Attached files

| file | filename |

|---|---|

| EX-99.1 - KNIGHT-SWIFT HOLDINGS INC ANNOUNCES FINANCIAL RESULTS FOR FOURTH QUARTER 2019 - Knight-Swift Transportation Holdings Inc. | exhibit99112312019.htm |

| 8-K - 8-K - Knight-Swift Transportation Holdings Inc. | knx-12312019x8k.htm |

Exhibit 99.2 KNX 4Q19 Earnings Presentation

Disclosure This presentation, including documents incorporated herein by reference, will contain forward- looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements. Please review our disclosures in filings with the United States Securities and Exchange Commission. Non-GAAP Financial Data This presentation includes the use of adjusted operating income, operating ratio, adjusted operating ratio, adjusted net income, adjusted earnings per share, adjusted pre-tax income, return on net tangible assets and free cash flow, which are financial measures that are not in accordance with United States generally accepted accounting principles (“GAAP”). Each such measure is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors and lenders. While management believes such measures are useful for investors, they should not be used as a replacement for financial measures that are in accordance with GAAP. In addition, our use of these non-GAAP measures should not be interpreted as indicating that these or similar items could not occur in future periods. In addition, adjusted operating ratio excludes trucking segment fuel surcharges from revenue and nets these surcharges against fuel expense. 2

Disclosure On September 8, 2017, pursuant to the Agreement and Plan of Merger, dated as of April 9, 2017, by Swift Transportation Company (“Swift”), Bishop Merger Sub, Inc., a direct wholly owned subsidiary of Swift, (“Merger Sub”), and Knight Transportation, Inc. (“Knight”), Merger Sub merged with and into Knight, with Knight surviving as a direct wholly owned subsidiary of Swift (the “2017 Merger”). Knight was the accounting acquirer and Swift was the legal acquirer in the 2017 Merger. In accordance with the accounting treatment applicable to the 2017 Merger, throughout this presentation, the reported results do not include the results of operations of Swift and its subsidiaries on and prior to the 2017 Merger date of September 8, 2017 (the “2017 Merger Date”). However, where indicated, certain historical information of Swift and its subsidiaries on and prior to the 2017 Merger Date, including their results of operations and certain operational statistics (collectively, the “Swift Historical Information”), has been provided. Management believes that presentation of the Swift Historical Information will be useful to investors. The Swift Historical Information has not been prepared in accordance with the rules of the Securities and Exchange Commission, including Article 11 of Regulation S-X, and it therefore does not reflect any of the pro forma adjustments that would be required by Article 11 of Regulation S-X. The Swift Historical Information does not purport to indicate the results that would have been obtained had the Swift and Knight businesses been operated together during the periods presented, or which may be realized in the future. 3

KNX Overview Q4 '19 YTD 2019 Revenue (ex. fuel surcharge and intersegment transactions) $ 861M $ 3,504M Trucking Adjusted Operating Ratio (1) 86.2% 86.5% • 13,348 irregular route tractors, 5,347 dedicated tractors, and 57,857 combined trailers • Dry Van, Refrigerated, Dedicated, Flatbed, Drayage, and Expedited service offerings Q4 '19 YTD 2019 Revenue (ex intersegment transactions) $ 112M $ 454M Intermodal Adjusted Operating Ratio (1) 99.5% 99.0% • 605 tractors and 9,858 containers Q4 '19 YTD 2019 Logistics Revenue (ex intersegment transactions) $ 93M $ 344M Adjusted Operating Ratio (1) 93.0% 93.5% YTD 2019 • Free Cash Flow of $270M (3) Shareholder • Return on Net Tangible Assets of 12.8% (1) Value • Reduced Net Debt by $88M (2) • Adjusted Leverage Ratio of 1.18 (1) • $41M paid out in Dividends 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation 2 Face value of debt, net of unrestricted cash 3 Net cash provided by operating activities, less net capital expenditures 4

Fourth Quarter 2019 Comparative Results Knight-Swift Consolidated Q4 '19 Q4 '18 Change (Dollars in thousands, except per share data) Total revenue $ 1,196,810 $ 1,394,640 (14.2 %) Revenue xTrucking FSC $ 1,085,412 $ 1,264,585 (14.2 %) Operating income $ 99,593 $ 206,777 (51.8 %) Adj. Operating Income ¹ $ 131,969 $ 221,658 (40.5 %) Net income attributable to Knight-Swift $ 67,444 $ 151,696 (55.5 %) Adj. Net income Attributable to Knight Swift ¹ $ 93,472 $ 162,856 (42.6 %) Earnings per diluted share $ 0.39 $ 0.86 (54.7 %) Adj. EPS ¹ $ 0.55 $ 0.93 (40.9 %) Adjustments 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation • $10.7 million in Q4 2019 and $10.7 million in Q4 2018 of amortization expense from mergers and acquisitions • $1.3 million in Q4 2019 and $2.8 million in Q4 2018 of impairments • $20.3 million in Q4 2019 and $1.0 million in Q4 2018 of legal accruals • $0.4 million in Q4 2018 of severance agreements • An effective tax rate of 25.3% was applied in our fourth quarter 2019 Adjusted EPS calculation to normalize permanent differences pertaining to a Value Added Tax ("VAT") adjustment within Swift's Mexico operations. 5

Operating Performance – Trucking Trucking Financial Metrics • 86.2% Adjusted Operating Ratio in Q4 '19 Q4 '18 Change Q4 2019 compared to 80.9% in the (Dollars in thousands) same quarter last year Revenue xFSC $861,428 $969,942 (11.2 %) Operating income $118,393 $183,318 (35.4 %) • 84.2% Swift Truckload Adjusted Operating Ratio Adjusted Operating Income ¹ $118,952 $185,307 (35.8 %) Operating ratio 87.8% 83.3% 450 bps • 88.2% Knight Trucking Adjusted Operating Ratio Adjusted Operating Ratio ¹ 86.2% 80.9% 530 bps • 6.3% reduction in revenue excluding fsc per loaded mile from Trucking Operating Statistics Q4 2018 Q4 '19 Q4 '18 Change • 5.4% reduction in miles per tractor Average revenue per tractor $46,078 $51,516 (10.6 %) from Q4 2018 Average tractors 18,695 18,828 (0.7 %) Average trailers 57,857 58,863 (1.7 %) Miles per tractor 22,776 24,065 (5.4 %) 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation. 6

Historical Knight and Swift Adj. O.R. Trend Rolling 4 Qtr Difference in Knight Trucking and Swift Truckload Adjusted Operating Ratios ¹ 9.0% R O j 8.0% d A t h g 7.0% i n K - 6.0% R O j d A 5.0% t f i w S 4.0% = e c n 3.0% e r e f f i D 2.0% % 1.0% 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 Rolling 4 Qtr Ending The average difference has moved from 700 bps pre-merger to less than 200 bps 1 Historical information prior to the Swift merger in September 2017 has not been prepared in accordance with the rules of the United States Securities and Exchange Commission, including Article 11 of Regulation S-X, and it therefore does not reflect any of the pro forma adjustments that would be required by Article 11 of Regulation S-X. The Swift Historical Information does not purport to indicate the results that would have been obtained had the Swift and Knight businesses been operated together during the period presented, or which may be realized in the future. 7

Operating Performance – Logistics Logistics Financial Metrics Q4 '19 Q4 '18 Change (Dollars in thousands) • 93.0% Adjusted Operating Ratio Revenue ex intersegment $92,757 $132,821 (30.2 %) during Q4 2019 Operating income $5,873 $13,266 (55.7 %) • 15.5% Brokerage Gross Margin Adjusted Operating Income ¹ $6,494 $14,060 (53.8 %) during the quarter compared with 18.3% in Q4 2018 Operating ratio 93.8% 90.1% 370 bps • 9.0% reduction in Brokerage Adjusted Operating Ratio ¹ 93.0% 89.4% 360 bps revenue per load • 23.9% reduction in Brokerage Brokerage Only Operating Statistics loads Q4 '19 Q4 '18 Change Revenue per load $1,429 $1,570 (9.0 %) Gross margin 15.5% 18.3% (280 bps) 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation. 8

Operating Performance – Intermodal Intermodal Financial Metrics Q4 '19 Q4 '18 Change • Market conditions continuing to (Dollars in thousands) pressure rate and volume Revenue ex intersegment $111,816 $137,472 (18.7 %) • 10.2% reduction in revenue per Operating income $600 $13,156 (95.4 %) load Adjusted Operating Income ¹ $600 $13,201 (95.5 %) • 9.4% reduction in load count Operating ratio 99.5% 90.5% 900 bps • Sequential load count growth of Adjusted Operating Ratio ¹ 99.5% 90.4% 910 bps 1.9% • Sequential Adjusted Operating Intermodal Operating Statistics Ratio improvement of 290 bps Q4 '19 Q4 '18 Change Average revenue per load $2,416 $2,690 (10.2 %) Load count 46,287 51,113 (9.4 %) Average tractors 605 714 (15.3 %) Average containers 9,858 9,706 1.6 % 1 See GAAP to non-GAAP reconciliation in the schedules following this presentation. 9

Significant Value Creation Current Adjusted Pretax Income ¹ ² Year (in millions) $700 $599M • Knight-Swift $600 $535M $479M $495M $500 continues to $392M generate $400 $313M $300 meaningful $200 income 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 • 12.8% TTM Return on Net Return on Tangible Net Assets ¹ ² Tangible Assets 20% 17.0% 15% 12.8% 11.4% 11.8% 9.4% 10% 7.5% 5% 0% 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 1 See GAAP to non-GAAP reconciliation in the schedules following this release. 2 Historical information prior to the Swift merger in September 2017 has not been prepared in accordance with the rules of the United States Securities and Exchange Commission, including Article 11 of Regulation S-X, and it therefore does not reflect any of the pro forma adjustments that would be required by Article 11 of Regulation S-X. The Swift Historical Information does not purport to indicate the results that would have been obtained had the Swift and Knight businesses been operated together during the period presented, or which may be realized in the future. 10

2019 Capital Deployment • $269.8 million of YTD Free Cash Flow (Cash from Operations less Net Cash Capex) • $111.9 million reduction in operating lease liabilities $840 million Cash From Operations Investments in the Business Shareholder Returns $570 million Net Cash CapEx $87 million Share Repurchases $88 million Net Debt reduction $41 million Cash Dividends 11

2020 Market Outlook Signs of industry capacity reductions • Significantly less new truck and trailer orders • Increased new truck order cancellations • Weak used equipment market • Transportation failures on the rise • Driver employment trending negative 1st Half of 2020 • Freight market continues to be pressured • Fewer and less attractive non-contract opportunities • Acquisition opportunities 2nd Half of 2020 • Freight market to inflect positively • Increased spot and non-contract opportunities 12

2020 Guidance • Expected Adjusted EPS for the full year 2020 of $2.00 - $2.15 • Expected Adjusted EPS for the first quarter 2020 of $.35 - $.38 Guidance Assumptions • Revenue per loaded mile will be negative year over year in Q1 and Q2 and inflect positive with low single digit increases in the second half of the year • Year-over-year percent changes in miles per tractor will improve in the second half of the year • Limited cost inflation in key areas • Tax rate of 25.5% - 27.0% • Full year expected 2020 net cash capex of $550M - $575M These estimates represent Management’s best estimates based on current information available. Actual results may differ materially from these estimates. We would refer you to the Risk Factors section of the Company’s annual report for a discussion of the risks that may affect results. 13

Appendix 14

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio 1 2 Quarter-to-Date December 31, Year-to-Date December 31, 2019 2018 (recast) 2019 2018 (recast) GAAP Presentation (Dollars in thousands) Total revenue $ 1,196,810 $ 1,394,640 $ 4,843,950 $ 5,344,066 Total operating expenses (1,097,217) (1,187,863) (4,416,512) (4,775,023) Operating income $ 99,593 $ 206,777 $ 427,438 $ 569,043 Operating ratio 91.7% 85.2% 91.2% 89.4% Non-GAAP Presentation Total revenue $ 1,196,810 $ 1,394,640 $ 4,843,950 $ 5,344,066 Trucking fuel surcharge (111,398) (130,055) (448,618) (534,398) Revenue, excluding trucking fuel surcharge 1,085,412 1,264,585 4,395,332 4,809,668 Total operating expenses 1,097,217 1,187,863 4,416,512 4,775,023 Adjusted for: Trucking fuel surcharge (111,398) (130,055) (448,618) (534,398) Amortization of intangibles ³ (10,732) (10,693) (42,876) (42,584) Impairments ⁴ (1,304) (2,798) (3,486) (2,798) Legal accruals ⁵ (20,340) (1,000) (35,840) (1,000) Severance expense ⁶ — (390) — (1,958) Adjusted Operating Expenses 953,443 1,042,927 3,885,692 4,192,285 Adjusted Operating Income $ 131,969 $ 221,658 $ 509,640 $ 617,383 Adjusted Operating Ratio 87.8% 82.5% 88.4% 87.2% 1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio. 2 The reported results do not include the results of operations of Abilene and its subsidiaries on and prior to its acquisition by Knight on March 16, 2018 in accordance with the accounting treatment applicable to the transaction. 3 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the 2017 Merger, Abilene Acquisition, and other acquisitions. 4 We incurred $1.3 million of impairment charges in the fourth quarter of 2019, which were associated with certain revenue equipment technology, warehousing equipment no longer in use, and certain Swift legacy trailer models as a result of a softer used equipment market. The impairments were recorded across various segments, depending on the nature of the impairment. In addition to these fourth quarter 2019 impairment charges, full-year 2019 includes $2.2 million of impaired leasehold improvements from an early termination of a lease of one of our operating properties. During the fourth quarter of 2018, the Company incurred impairment charges related to the Company airplane of $2.2 million and incurred impairment charges related to replaced software systems of $0.6 million. 5 "Legal accruals" in the fourth quarter of 2019 include additional legal costs within the non-reportable segments, reflecting revised estimates for various pre-2017 Merger legal matters which were previously disclosed by Swift. During the fourth quarter of 2018 we incurred expenses related to certain class action action lawsuits involving employment-related claims. The amounts are included in "Miscellaneous operating expenses" in the condensed consolidated statements of comprehensive income. 6 Severance expenses were incurred during the third and fourth quarters of 2018 in relation to certain organizational changes at Swift. 15

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Adjusted Net Income Attributable to Knight-Swift 1 2 Quarter-to-Date December 31, Year-to-Date December 31, 2019 2018 2019 2018 (Dollars in thousands, except per share data) GAAP: Net income attributable to Knight-Swift $ 67,444 $ 151,696 $ 309,206 $ 419,264 Adjusted for: Income tax expense attributable to Knight-Swift 25,275 50,573 103,798 131,389 Income before income taxes attributable to Knight-Swift 92,719 202,269 413,004 550,653 Amortization of intangibles ³ 10,732 10,693 42,876 42,584 Impairments ⁴ 1,304 2,798 3,486 2,798 Legal accruals ⁵ 20,340 1,000 35,840 1,000 Severance expense ⁶ — 390 — 1,958 Adjusted income before income taxes 125,095 217,150 495,206 598,993 Provision for income tax expense at effective rate 7 (31,623) (54,294) (122,124) (142,923) Non-GAAP: Adjusted Net Income Attributable to Knight-Swift $ 93,472 $ 162,856 $ 373,082 $ 456,070 1 Pursuant to the requirements of Regulation G, these tables reconcile consolidated GAAP net income attributable to Knight-Swift to non-GAAP consolidated Adjusted Net Income Attributable to Knight-Swift. 2 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 2. 3 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 3. 4 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4. 5 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 5. 6 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 6. 7 An effective tax rate of 25.3% was applied in our fourth quarter 2019 Adjusted EPS calculation to normalize permanent differences pertaining to a Value Added Tax ("VAT") adjustment within Swift's Mexico operations. The adjustment was the result of regulatory changes in Mexico and pertains to pre-2017 Merger VAT receivables from 2016 and prior years that have been deemed unrecoverable as of December 31, 2019. 16

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Adjusted EPS 1 2 Quarter-to-Date December 31, Year-to-Date December 31, 2019 2018 2019 2018 GAAP: Earnings per diluted share $ 0.39 $ 0.86 $ 1.80 $ 2.36 Adjusted for: Income tax expense attributable to Knight-Swift 0.15 0.29 0.60 0.74 Income before income taxes attributable to Knight-Swift 0.54 1.15 2.40 3.09 Amortization of intangibles ³ 0.06 0.06 0.25 0.24 Impairments ⁴ 0.01 0.02 0.02 0.02 Legal accruals ⁵ 0.12 0.01 0.21 0.01 Severance expense ⁶ — — — 0.01 Adjusted income before income taxes 0.73 1.24 2.88 3.37 Provision for income tax expense at effective rate 7 (0.18) (0.31) (0.71) (0.80) Non-GAAP: Adjusted EPS $ 0.55 $ 0.93 $ 2.17 $ 2.56 Note: Because the numbers reflected in the table above are calculated on a per share basis, they may not foot due to rounding. 1 Pursuant to the requirements of Regulation G, these tables reconcile consolidated GAAP diluted earnings per share to non-GAAP consolidated Adjusted EPS. 2 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 2. 3 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 3. 4 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4. 5 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 5. 6 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 6. 7 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Net Income Attributable to Knight-Swift – footnote 7. 17

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Segment Adjusted Operating Income and Adjusted Operating Ratio ¹ ² Quarter-to-Date December 31, Year-to-Date December 31, Trucking Segment 2019 2018 (recast) 2019 2018 (recast) GAAP Presentation (Dollars in thousands) Total revenue $ 972,826 $ 1,100,080 $ 3,952,866 $ 4,290,254 Total operating expenses (854,433) (916,762) (3,484,117) (3,739,436) Operating income $ 118,393 $ 183,318 $ 468,749 $ 550,818 Operating ratio 87.8% 83.3% 88.1% 87.2% Non-GAAP Presentation Total revenue $ 972,826 $ 1,100,080 $ 3,952,866 $ 4,290,254 Fuel surcharge (111,398) (130,055) (448,618) (534,398) Intersegment transactions — (83) (157) (242) Revenue, excluding fuel surcharge and intersegment transactions 861,428 969,942 3,504,091 3,755,614 Total operating expenses 854,433 916,762 3,484,117 3,739,436 Adjusted for: Fuel surcharge (111,398) (130,055) (448,618) (534,398) Intersegment transactions — (83) (157) (242) Amortization of intangibles ³ (324) (349) (1,371) (1,209) Impairments ⁴ (235) (1,640) (2,417) (1,640) Adjusted Operating Expenses 742,476 784,635 3,031,554 3,201,947 Adjusted Operating Income $ 118,952 $ 185,307 $ 472,537 $ 553,667 Adjusted Operating Ratio 86.2% 80.9% 86.5% 85.3% 1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio. 2 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 2. 3 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the Abilene Acquisition and historical Knight acquisitions. 4 Impairment charges incurred in the fourth quarter of 2019 were associated with certain revenue equipment technology. In addition to these fourth quarter 2019 impairment charges, full-year 2019 includes $2.2 million of impaired leasehold improvements from an early termination of a lease of one of our operating properties. Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 2 for a description of fourth quarter 2018 impairment charges of which the Trucking segment incurred a ratable share. 18

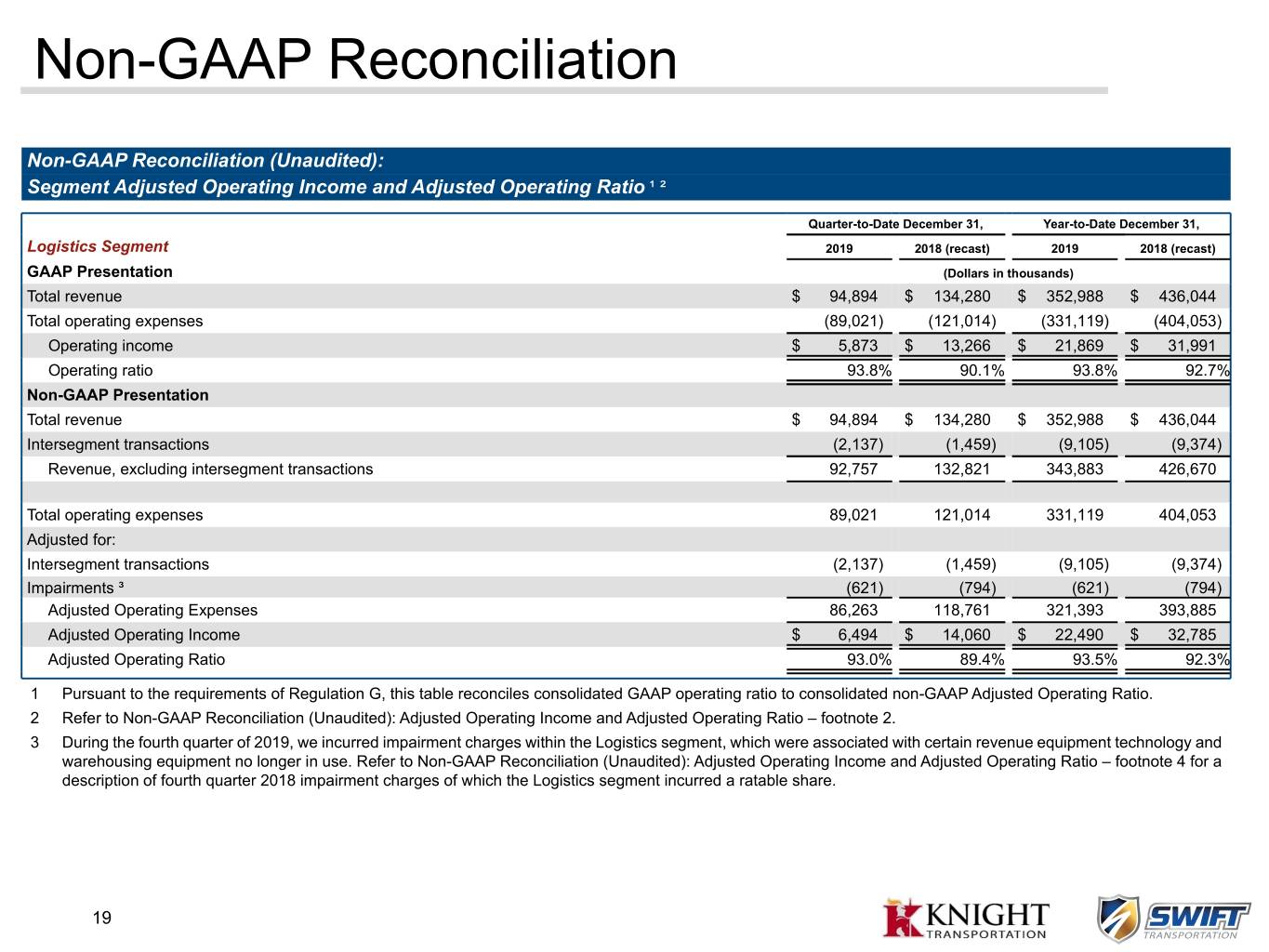

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Segment Adjusted Operating Income and Adjusted Operating Ratio ¹ ² Quarter-to-Date December 31, Year-to-Date December 31, Logistics Segment 2019 2018 (recast) 2019 2018 (recast) GAAP Presentation (Dollars in thousands) Total revenue $ 94,894 $ 134,280 $ 352,988 $ 436,044 Total operating expenses (89,021) (121,014) (331,119) (404,053) Operating income $ 5,873 $ 13,266 $ 21,869 $ 31,991 Operating ratio 93.8% 90.1% 93.8% 92.7% Non-GAAP Presentation Total revenue $ 94,894 $ 134,280 $ 352,988 $ 436,044 Intersegment transactions (2,137) (1,459) (9,105) (9,374) Revenue, excluding intersegment transactions 92,757 132,821 343,883 426,670 Total operating expenses 89,021 121,014 331,119 404,053 Adjusted for: Intersegment transactions (2,137) (1,459) (9,105) (9,374) Impairments ³ (621) (794) (621) (794) Adjusted Operating Expenses 86,263 118,761 321,393 393,885 Adjusted Operating Income $ 6,494 $ 14,060 $ 22,490 $ 32,785 Adjusted Operating Ratio 93.0% 89.4% 93.5% 92.3% 1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio. 2 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 2. 3 During the fourth quarter of 2019, we incurred impairment charges within the Logistics segment, which were associated with certain revenue equipment technology and warehousing equipment no longer in use. Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4 for a description of fourth quarter 2018 impairment charges of which the Logistics segment incurred a ratable share. 19

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Segment Adjusted Operating Income and Adjusted Operating Ratio ¹ ² Quarter-to-Date December 31, Year-to-Date December 31, Intermodal Segment 2019 2018 (recast) 2019 2018 (recast) GAAP Presentation (Dollars in thousands) Total revenue $ 111,967 $ 138,138 $ 455,466 $ 498,821 Total operating expenses (111,367) (124,982) (450,965) (467,549) Operating income $ 600 $ 13,156 $ 4,501 $ 31,272 Operating ratio 99.5% 90.5% 99.0% 93.7% Non-GAAP Presentation Total revenue $ 111,967 $ 138,138 $ 455,466 $ 498,821 Intersegment transactions (151) (666) (1,488) (1,223) Revenue, excluding intersegment transactions 111,816 137,472 453,978 497,598 Total operating expenses 111,367 124,982 450,965 467,549 Adjusted for: Intersegment transactions (151) (666) (1,488) (1,223) Impairments ³ — (45) — (45) Adjusted Operating Expenses 111,216 124,271 449,477 466,281 Adjusted Operating Income $ 600 $ 13,201 $ 4,501 $ 31,317 Adjusted Operating Ratio 99.5% 90.4% 99.0% 93.7% 1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio. 2 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 2. 3 Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income and Adjusted Operating Ratio – footnote 4 for a description of fourth quarter 2018 impairment charges of which the Intermodal segment incurred a ratable share. 20

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Return on Net Tangible Assets 1 2 December 31, 2019 2018 2017 2016 2015 2014 2013 (Dollars in thousands) Total Assets Consolidated: Post-merger $ 8,281,732 $ 7,911,885 $ 7,683,442 $ — $ — $ — $ — Knight: Pre-merger — — — 1,078,525 1,120,232 1,082,285 807,121 Swift: Pre-merger — — — 2,745,666 2,919,667 2,892,721 2,809,008 Adjusted for: Deferred income tax assets Consolidated: Post-merger — — — — — — — Knight: Pre-merger — — — — — (3,187) (3,359) Swift: Pre-merger — — — — — — (46,833) Intangible assets, net Consolidated: Post-merger (1,379,459) (1,420,919) (1,440,903) — — — — Knight: Pre-merger — — — (2,575) (3,075) (3,575) — Swift: Pre-merger — — — (266,305) (283,119) (299,933) (316,747) Goodwill Consolidated: Post-merger (2,918,992) (2,919,176) (2,887,867) — — — — Knight: Pre-merger — — — (47,031) (47,050) (47,067) (10,257) Swift: Pre-merger — — — (253,256) (253,256) (253,256) (253,256) Tangible Assets $ 3,983,281 $ 3,571,790 $ 3,354,672 $ 3,255,024 $ 3,453,399 $ 3,367,988 $ 2,985,677 1 Pursuant to the requirements of Regulation G, this table reconciles Total Assets and Total Liabilities to Average Net Tangible Assets. 2 The Swift Historical Information has not been prepared in accordance with the rules of the Securities and Exchange Commission, including Article 11 of Regulation S- X, and it therefore does not reflect any of the pro forma adjustments that would be required by Article 11 of Regulation S-X. The Swift Historical Information does not purport to indicate the result that would have been obtained had the Swift and Knight businesses been operated together during the period presented, or which may be realized in the future. 21

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Return on Net Tangible Assets 1 2 December 31, 2019 2018 2017 2016 2015 2014 2013 (Dollars in thousands) Total Liabilities Consolidated: Post-merger $ 2,613,429 $ 2,449,166 $ 2,443,072 $ — $ — $ — $ — Knight: Pre-merger — — — 289,794 379,860 403,010 252,588 Swift: Pre-merger — — — 2,073,411 2,302,540 2,422,427 2,525,421 Adjusted for: Revolving line of credit, capital lease obligations, long- term debt and fair value of interest rate swaps Consolidated: Post-merger (714,034) (689,510) (665,905) — — — — Knight: Pre-merger — — — (18,000) (112,000) (134,400) (38,000) Swift: Pre-merger — — — (865,741) (1,160,972) (1,167,175) (1,350,588) Accounts receivable securitization Consolidated: Post-merger (204,762) (239,606) (305,000) — — — — Knight: Pre-merger — — — — — — — Swift: Pre-merger — — — (279,285) (223,927) (334,000) (264,000) Deferred income tax liabilities Consolidated: Post-merger (771,719) (739,538) (679,077) — — — — Knight: Pre-merger — — — (178,000) (174,165) (162,007) (140,149) Swift: Pre-merger — — — (427,722) (463,832) (437,389) (484,200) Non-Interest Bearing Liabilities, excluding deferred income tax liabilities 922,914 780,512 793,090 594,457 547,504 590,466 501,072 Net Tangible Assets 3,060,367 2,791,278 2,561,582 2,660,567 2,905,895 2,777,522 2,484,605 Average Net Tangible Assets 2,925,823 2,676,430 2,611,075 2,783,231 2,841,709 2,631,064 Adjusted Net Income $ 373,082 $ 456,070 $ 195,545 $ 260,894 $ 335,340 $ 301,221 Return on Net Tangible Assets 12.8% 17.0% 7.5% 9.4% 11.8% 11.4% 1 Pursuant to the requirements of Regulation G, this table reconciles Total Assets and Total Liabilities to Average Net Tangible Assets. 2 The Swift Historical Information has not been prepared in accordance with the rules of the Securities and Exchange Commission, including Article 11 of Regulation S-X, and it therefore does not reflect any of the pro forma adjustments that would be required by Article 11 of Regulation S-X. The Swift Historical Information does not purport to indicate the result that would have been obtained had the Swift and Knight businesses been operated together during the period presented, or which may be realized in the future. 22

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Adjusted Income Before Income Taxes and Adjusted Net Income - Knight, Swift and Combined 1 2 Knight Swift Combined Year-to-Date December 31, Year-to-Date December 31, Year-to-Date December 31, 2017 2016 2015 2014 2017 2016 2015 2014 2017 2016 2015 2014 (Dollars in thousands) GAAP: Net income $ 130,453 $ 93,863 $ 116,718 $ 102,862 $ 365,135 $ 149,267 $ 197,577 $ 161,152 $ 495,588 $ 243,130 $ 314,295 $ 264,014 attributable to Adjusted for: ³ Income tax (benefit) (25,314) 57,592 68,047 67,809 (263,506) 65,702 119,209 89,474 (288,820) 123,294 187,256 157,283 expense Income before income taxes 105,139 151,455 184,765 170,671 101,629 214,969 316,786 250,626 206,768 366,424 501,551 421,297 attributable to Amortization of — — — — 23,652 15,648 15,648 15,648 23,652 15,648 15,648 15,648 intangibles ⁴ Impairments ⁵ — — — — 22,318 807 1,480 2,308 22,318 807 1,480 2,308 Legal Accruals ⁶ 1,900 2,450 7,163 — — — — — 1,900 2,450 7,163 — Moyes retirement — — — — — 7,079 — — — 7,079 — — package Loss on debt — — — — — — 9,567 39,909 — — 9,567 39,909 extinguishment Merger and acquisition related 23,112 — — — 35,123 — — — 58,235 — — — expenses ⁷ Adjusted income 130,151 153,905 191,928 170,671 182,722 238,503 343,481 308,491 312,873 392,408 535,409 479,162 before income taxes Provision (48,807) (58,532) (70,815) (67,809) (68,521) (72,982) (129,254) (110,132) (117,328) (131,514) (200,069) (177,941) Adjusted net income $ 81,344 $ 95,373 $ 121,113 $ 102,862 $ 114,201 $ 165,521 $ 214,227 $ 198,359 $ 195,545 $ 260,894 $ 335,340 $ 301,221 1 Pursuant to the requirements of Regulation G, this table reconciles GAAP net income to Adjusted Income before Income Taxes and Adjusted Net Income. 2 The Swift Historical Information has not been prepared in accordance with the rules of the Securities and Exchange Commission, including Article 11 of Regulation S-X, and it therefore does not reflect any of the pro forma adjustments that would be required by Article 11 of Regulation S-X. The Combined Historical Information does not purport to indicate the result that would have been obtained had the Swift and Knight businesses been operated together during the period presented, or which may be realized in the future. 3 For explanation of Swift's Adjustments prior to 2017, see Swift's GAAP to Non-GAAP reconciliation to consolidated Adjusted EPS under "Non-GAAP Financial Measures" included in Part II, Item 7 in Swift's 2016 Annual Report on Form 10-K. 4 "Amortization of intangibles" in Swift's post-merger results primarily reflects the non-cash amortization expense relating to certain intangible assets identified in the 2017 Merger. "Amortization of intangibles" in Swift's pre-merger 2017 results reflects the non-cash amortization expense relating to certain intangible assets identified in the 2007 going-private transaction through which Swift Corporation acquired Swift Transportation Co. 5 During 2017, Swift terminated the implementation of it's enterprise resource planning system, resulting in an impairment loss. 6 In 2017, 2016 and 2015, Knight incurred expenses related to certain class action lawsuits involving employment-related claims. 7 In 2017, both Knight and Swift incurred certain merger-related expenses associated with the 2017 Merger. 23

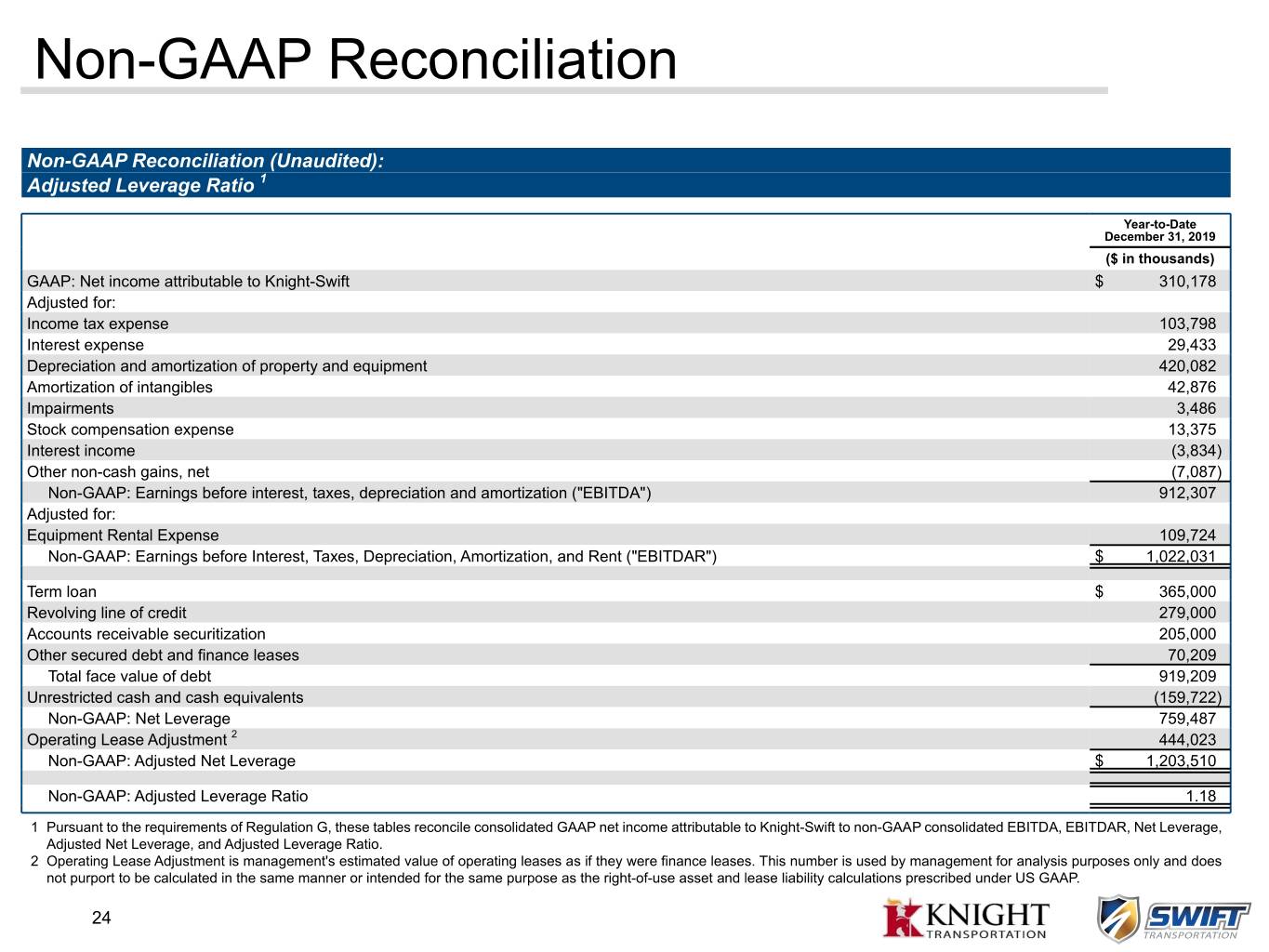

Non-GAAP Reconciliation Non-GAAP Reconciliation (Unaudited): Adjusted Leverage Ratio 1 Year-to-Date December 31, 2019 ($ in thousands) GAAP: Net income attributable to Knight-Swift $ 310,178 Adjusted for: Income tax expense 103,798 Interest expense 29,433 Depreciation and amortization of property and equipment 420,082 Amortization of intangibles 42,876 Impairments 3,486 Stock compensation expense 13,375 Interest income (3,834) Other non-cash gains, net (7,087) Non-GAAP: Earnings before interest, taxes, depreciation and amortization ("EBITDA") 912,307 Adjusted for: Equipment Rental Expense 109,724 Non-GAAP: Earnings before Interest, Taxes, Depreciation, Amortization, and Rent ("EBITDAR") $ 1,022,031 Term loan $ 365,000 Revolving line of credit 279,000 Accounts receivable securitization 205,000 Other secured debt and finance leases 70,209 Total face value of debt 919,209 Unrestricted cash and cash equivalents (159,722) Non-GAAP: Net Leverage 759,487 Operating Lease Adjustment 2 444,023 Non-GAAP: Adjusted Net Leverage $ 1,203,510 Non-GAAP: Adjusted Leverage Ratio 1.18 1 Pursuant to the requirements of Regulation G, these tables reconcile consolidated GAAP net income attributable to Knight-Swift to non-GAAP consolidated EBITDA, EBITDAR, Net Leverage, Adjusted Net Leverage, and Adjusted Leverage Ratio. 2 Operating Lease Adjustment is management's estimated value of operating leases as if they were finance leases. This number is used by management for analysis purposes only and does not purport to be calculated in the same manner or intended for the same purpose as the right-of-use asset and lease liability calculations prescribed under US GAAP. 24