Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________________

FORM 10-Q

_____________________________________________________________________

ý QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2016

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-35007

_____________________________________________________________________

Swift Transportation Company

(Exact name of registrant as specified in its charter)

_____________________________________________________________________

Delaware | 20-5589597 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

2200 South 75th Avenue

Phoenix, AZ 85043

(Address of principal executive offices and zip code)

(602) 269-9700

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

______________________________________________________________________

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | o | |||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The number of outstanding shares of the registrant’s Class A common stock as of October 25, 2016 was 82,629,985 and the number of outstanding shares of the registrant’s Class B common stock as of October 25, 2016 was 49,741,938.

QUARTERLY REPORT ON FORM 10-Q | |

TABLE OF CONTENTS | |

PART I FINANCIAL INFORMATION | PAGE |

PART II OTHER INFORMATION | |

2

QUARTERLY REPORT ON FORM 10-Q | ||

GLOSSARY OF TERMS | ||

The following glossary provides definitions for certain acronyms and terms used in this Quarterly Report on Form 10-Q. These acronyms and terms are specific to our company, commonly used in our industry, or are otherwise frequently used throughout our document. | ||

Term | Definition | |

Swift/the Company/Management/We/Us/Our | Unless otherwise indicated or the context otherwise requires, these terms represent Swift Transportation Company and its subsidiaries. Swift Transportation Company is the holding company for Swift Transportation Co., LLC (a Delaware limited liability company) and Interstate Equipment Leasing, LLC. | |

2007 Transactions | In April 2007, Jerry Moyes and his wife contributed their ownership of all of the issued and outstanding shares of IEL to Swift Corporation in exchange for additional Swift Corporation shares. In May 2007, the Moyes Affiliates (defined below), contributed their shares of Swift Transportation Co., Inc. common stock to Swift Corporation in exchange for additional Swift Corporation shares. Swift Corporation then completed its acquisition of Swift Transportation Co., Inc. through a merger on May 10, 2007, thereby acquiring the remaining outstanding shares of Swift Transportation Co., Inc. common stock. Upon completion of the 2007 Transactions, Swift Transportation Co., Inc. became a wholly-owned subsidiary of Swift Corporation. At the close of the market on May 10, 2007, the common stock of Swift Transportation Co., Inc. ceased trading on NASDAQ. | |

2010 METS | Mandatory Common Exchange Securities issued by Jerry Moyes and the Moyes Affiliates in 2010. | |

2013 RSA | Second Amended and Restated Receivables Sale Agreement, entered into in 2013 by SRCII (defined below), with unrelated financial entities, "The Purchasers." The 2013 RSA was later replaced by the 2015 RSA. | |

2015 RSA | Third Amendment to Amended and Restated Receivables Sale Agreement, entered into in 2015 by SRCII (defined below), with unrelated financial entities, "The Purchasers" | |

2014 Agreement | The Company's Third Amended and Restated Credit Agreement, replaced by the 2015 Agreement | |

2015 Agreement | The Company's Fourth Amended and Restated Credit Agreement | |

AOCI | Accumulated Other Comprehensive Income (Loss) | |

ASC | Accounting Standards Codification | |

ASU | Accounting Standards Update | |

Board | Swift's Board of Directors | |

COFC | Container on Flat Car | |

CSA | Compliance Safety Accountability | |

Deadhead | Tractor movement without hauling freight (unpaid miles driven) | |

DLC | Deferred Loan Cost | |

DOE | United States Department of Energy | |

EBITDA | Earnings Before Interest, Taxes, Depreciation, and Amortization (a non-GAAP measure) | |

EPS | Earnings Per Share | |

FASB | Financial Accounting Standards Board | |

FLSA | Fair Labor Standards Act | |

GAAP | United States Generally Accepted Accounting Principles | |

IEL | Interstate Equipment Leasing, LLC (formerly Interstate Equipment Leasing, Inc.) | |

IPO | Initial Public Offering | |

3

GLOSSARY OF TERMS — CONTINUED | ||

The following glossary provides definitions for certain acronyms and terms used in this Quarterly Report on Form 10-Q. These acronyms and terms are specific to our company, commonly used in our industry, or are otherwise frequently used throughout our document. | ||

Term | Definition | |

LIBOR | London InterBank Offered Rate | |

Moyes Affiliates | Jerry Moyes, The Jerry and Vickie Moyes Family Trust dated December 11, 1987, and various Moyes children’s trusts | |

NASDAQ | National Association of Securities Dealers Automated Quotations | |

New Revolver | Revolving line of credit under the 2015 Agreement | |

New Term Loan A | The Company's first lien term loan A under the 2015 Agreement | |

NLRB | National Labor Relations Board | |

OID | Original Issue Discount | |

Old Revolver | Revolving line of credit under the 2014 Agreement | |

Old Term Loan A | The Company's first lien term loan A under the 2014 Agreement | |

QTD | Quarter-to-date, or three months ended | |

Revenue xFSR | Revenue, Excluding Fuel Surcharge Revenue | |

SEC | United States Securities and Exchange Commission | |

SRCII | Swift Receivables Company II, LLC | |

The Purchasers | Unrelated financial entities in the 2013 RSA and 2015 RSA, which were accounts receivable securitization agreements entered into by SRCII | |

Term Loan B | The Company's first lien term loan B under the 2014 Agreement | |

TOFC | Trailer on Flat Car | |

VPF | Variable Prepaid Forward (contract) | |

YTD | Year-to-date, or nine months ended | |

4

PART I FINANCIAL INFORMATION | ||||

ITEM 1. | FINANCIAL STATEMENTS |

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

September 30, 2016 | December 31, 2015 | ||||||

(In thousands, except share data) | |||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 71,258 | $ | 107,590 | |||

Cash and cash equivalents – restricted | 59,487 | 55,241 | |||||

Restricted investments, held to maturity, amortized cost | 22,864 | 23,215 | |||||

Accounts receivable, net | 403,895 | 422,421 | |||||

Income tax refund receivable | 9,987 | 11,664 | |||||

Inventories and supplies | 16,264 | 18,426 | |||||

Assets held for sale | 11,830 | 9,084 | |||||

Prepaid taxes, licenses, insurance, and other | 50,669 | 48,149 | |||||

Current portion of notes receivable | 7,668 | 9,817 | |||||

Total current assets | 653,922 | 705,607 | |||||

Property and equipment, at cost: | |||||||

Revenue and service equipment | 2,233,507 | 2,278,618 | |||||

Land | 131,693 | 131,693 | |||||

Facilities and improvements | 278,291 | 269,769 | |||||

Furniture and office equipment | 110,996 | 99,519 | |||||

Total property and equipment | 2,754,487 | 2,779,599 | |||||

Less: accumulated depreciation and amortization | (1,200,613 | ) | (1,128,499 | ) | |||

Net property and equipment | 1,553,874 | 1,651,100 | |||||

Other assets | 22,664 | 26,585 | |||||

Intangible assets, net | 270,508 | 283,119 | |||||

Goodwill | 253,256 | 253,256 | |||||

Total assets | $ | 2,754,224 | $ | 2,919,667 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 138,087 | $ | 121,827 | |||

Accrued liabilities | 132,918 | 97,313 | |||||

Current portion of claims accruals | 78,478 | 84,429 | |||||

Current portion of long-term debt | 799 | 35,514 | |||||

Current portion of capital lease obligations | 71,988 | 59,794 | |||||

Total current liabilities | 422,270 | 398,877 | |||||

Revolving line of credit | 50,000 | 200,000 | |||||

Long-term debt, less current portion | 593,263 | 643,663 | |||||

Capital lease obligations, less current portion | 176,871 | 222,001 | |||||

Claims accruals, less current portion | 155,317 | 149,281 | |||||

Deferred income taxes | 438,369 | 463,832 | |||||

Accounts receivable securitization | 299,196 | 223,927 | |||||

Other liabilities | 6,699 | 959 | |||||

Total liabilities | 2,141,985 | 2,302,540 | |||||

Commitments and Contingencies (Notes 9 and 10) | |||||||

Stockholders’ equity: | |||||||

Preferred stock, par value $0.01 per share; authorized 10,000,000 shares; none issued | — | — | |||||

Class A common stock, par value $0.01 per share; authorized 500,000,000 shares; 82,615,248 and 87,808,801 shares issued and outstanding as of September 30, 2016 and December 31, 2015, respectively | 826 | 878 | |||||

Class B common stock, par value $0.01 per share; authorized 250,000,000 shares; 49,741,938 and 50,991,938 shares issued and outstanding as of September 30, 2016 and December 31, 2015, respectively | 497 | 510 | |||||

Additional paid-in capital | 690,317 | 754,589 | |||||

Accumulated deficit | (79,503 | ) | (139,033 | ) | |||

Accumulated other comprehensive income | — | 81 | |||||

Noncontrolling interest | 102 | 102 | |||||

Total stockholders’ equity | 612,239 | 617,127 | |||||

Total liabilities and stockholders’ equity | $ | 2,754,224 | $ | 2,919,667 | |||

See accompanying notes to consolidated financial statements.

5

CONSOLIDATED INCOME STATEMENTS

(UNAUDITED)

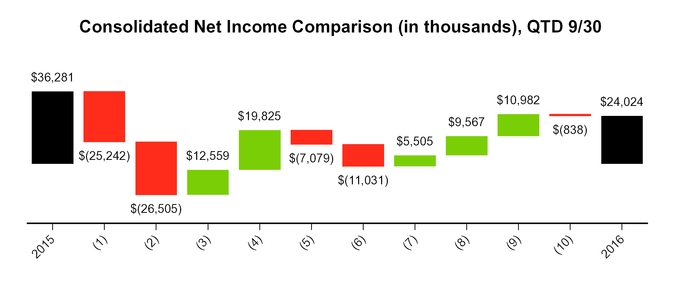

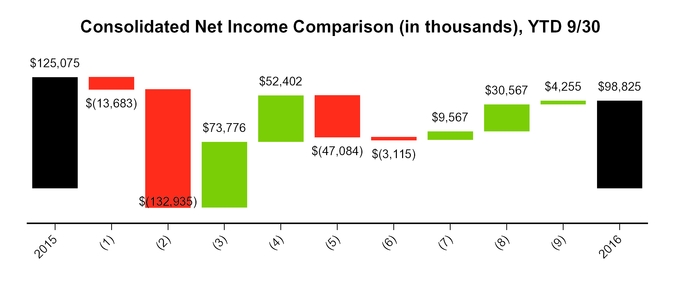

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

(In thousands, except per share data) | |||||||||||||||

Operating revenue: | |||||||||||||||

Revenue, excluding fuel surcharge revenue | $ | 929,732 | $ | 954,974 | $ | 2,772,054 | $ | 2,785,737 | |||||||

Fuel surcharge revenue | 83,494 | 109,999 | 220,849 | 353,784 | |||||||||||

Operating revenue | 1,013,226 | 1,064,973 | 2,992,903 | 3,139,521 | |||||||||||

Operating expenses: | |||||||||||||||

Salaries, wages, and employee benefits | 293,098 | 283,767 | 868,831 | 821,747 | |||||||||||

Operating supplies and expenses | 113,750 | 102,719 | 291,185 | 288,070 | |||||||||||

Fuel | 90,464 | 103,023 | 252,822 | 326,598 | |||||||||||

Purchased transportation | 280,041 | 299,866 | 830,952 | 883,354 | |||||||||||

Rental expense | 57,004 | 59,088 | 170,326 | 180,909 | |||||||||||

Insurance and claims | 47,372 | 52,877 | 140,888 | 139,390 | |||||||||||

Depreciation and amortization of property and equipment | 67,245 | 66,852 | 198,884 | 184,194 | |||||||||||

Amortization of intangibles | 4,204 | 4,204 | 12,611 | 12,611 | |||||||||||

Gain on disposal of property and equipment | (5,620 | ) | (9,825 | ) | (16,909 | ) | (23,987 | ) | |||||||

Communication and utilities | 7,130 | 8,236 | 20,977 | 23,134 | |||||||||||

Operating taxes and licenses | 18,685 | 19,245 | 55,795 | 55,104 | |||||||||||

Total operating expenses | 973,373 | 990,052 | 2,826,362 | 2,891,124 | |||||||||||

Operating income | 39,853 | 74,921 | 166,541 | 248,397 | |||||||||||

Other expenses (income): | |||||||||||||||

Interest expense | 7,384 | 9,130 | 23,545 | 29,627 | |||||||||||

Derivative interest expense | — | 68 | — | 3,972 | |||||||||||

Interest income | (624 | ) | (647 | ) | (2,011 | ) | (1,825 | ) | |||||||

Loss on debt extinguishment | — | 9,567 | — | 9,567 | |||||||||||

Non-cash impairments of non-operating assets | — | — | — | 1,480 | |||||||||||

Legal settlements and reserves | — | — | 3,000 | 6,000 | |||||||||||

Other income, net | (1,223 | ) | (752 | ) | (3,093 | ) | (2,341 | ) | |||||||

Total other expenses (income), net | 5,537 | 17,366 | 21,441 | 46,480 | |||||||||||

Income before income taxes | 34,316 | 57,555 | 145,100 | 201,917 | |||||||||||

Income tax expense | 10,292 | 21,274 | 46,275 | 76,842 | |||||||||||

Net income | $ | 24,024 | $ | 36,281 | $ | 98,825 | $ | 125,075 | |||||||

Basic earnings per share | $ | 0.18 | $ | 0.25 | $ | 0.73 | $ | 0.88 | |||||||

Diluted earnings per share | $ | 0.18 | $ | 0.25 | $ | 0.73 | $ | 0.87 | |||||||

Shares used in per share calculations: | |||||||||||||||

Basic | 132,930 | 142,801 | 134,622 | 142,535 | |||||||||||

Diluted | 134,462 | 144,132 | 136,227 | 144,238 | |||||||||||

See accompanying notes to consolidated financial statements.

6

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

(In thousands) | |||||||||||||||

Net income | $ | 24,024 | $ | 36,281 | $ | 98,825 | $ | 125,075 | |||||||

Accumulated losses on derivatives reclassified to derivative interest expense | — | 69 | — | 3,886 | |||||||||||

Other | — | — | (81 | ) | — | ||||||||||

Other comprehensive income (loss) before income taxes | — | 69 | (81 | ) | 3,886 | ||||||||||

Income tax effect of items within other comprehensive income (loss) | — | — | — | (1,469 | ) | ||||||||||

Other comprehensive income (loss), net of income taxes | — | 69 | (81 | ) | 2,417 | ||||||||||

Total comprehensive income | $ | 24,024 | $ | 36,350 | $ | 98,744 | $ | 127,492 | |||||||

See accompanying notes to consolidated financial statements.

7

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

(UNAUDITED)

Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Accumulated Deficit | Accumulated Other Comprehensive Income | Noncontrolling Interest | Total Stockholders’ Equity | |||||||||||||||||||||||||||

Shares | Par Value | Shares | Par Value | ||||||||||||||||||||||||||||||

(In thousands, except share data) | |||||||||||||||||||||||||||||||||

Balances, December 31, 2015 | 87,808,801 | $ | 878 | 50,991,938 | $ | 510 | $ | 754,589 | $ | (139,033 | ) | $ | 81 | $ | 102 | $ | 617,127 | ||||||||||||||||

Common stock issued under stock plans | 785,416 | 8 | 5,167 | 5,175 | |||||||||||||||||||||||||||||

Stock-based compensation expense | 4,691 | 4,691 | |||||||||||||||||||||||||||||||

Excess tax benefit from stock-based compensation | 547 | 547 | |||||||||||||||||||||||||||||||

Shares issued under employee stock purchase plan | 63,941 | — | 955 | 955 | |||||||||||||||||||||||||||||

Repurchase and cancellation of Class A common stock | (7,292,910 | ) | (73 | ) | (75,632 | ) | (39,295 | ) | (115,000 | ) | |||||||||||||||||||||||

Conversion of Class B common stock to Class A common stock | 1,250,000 | 13 | (1,250,000 | ) | (13 | ) | — | ||||||||||||||||||||||||||

Net income | 98,825 | 98,825 | |||||||||||||||||||||||||||||||

Other comprehensive income (loss), net of income taxes | (81 | ) | (81 | ) | |||||||||||||||||||||||||||||

Balances, September 30, 2016 | 82,615,248 | $ | 826 | 49,741,938 | $ | 497 | $ | 690,317 | $ | (79,503 | ) | $ | — | $ | 102 | $ | 612,239 | ||||||||||||||||

See accompanying notes to consolidated financial statements.

8

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

Nine Months Ended September 30, | |||||||

2016 | 2015 | ||||||

(In thousands) | |||||||

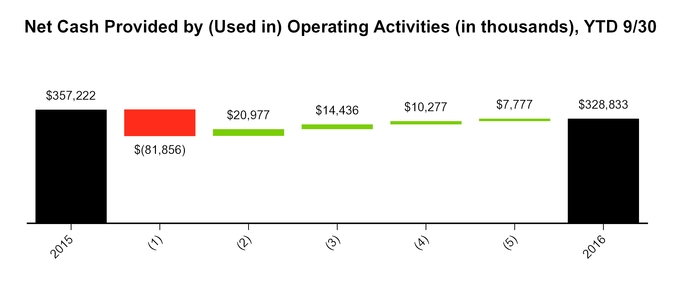

Cash flows from operating activities: | |||||||

Net income | $ | 98,825 | $ | 125,075 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization of property, equipment, and intangibles | 211,495 | 196,805 | |||||

Amortization of debt issuance costs, original issue discount, and other | 996 | 5,574 | |||||

Gain on disposal of property and equipment, less write-off of totaled tractors | (14,797 | ) | (21,974 | ) | |||

Impairments | — | 1,480 | |||||

Deferred income taxes | (25,670 | ) | (8,106 | ) | |||

Provision for (reduction of) losses on accounts receivable | (2,626 | ) | 5,348 | ||||

Non-cash loss on debt extinguishment and write-offs of deferred financing costs and original issue discount | — | 9,567 | |||||

Stock-based compensation expense | 4,691 | 4,618 | |||||

Excess tax benefit from stock-based compensation | (547 | ) | (2,200 | ) | |||

Income effect of mark-to-market adjustment of interest rate swaps | — | 87 | |||||

Increase (decrease) in cash resulting from changes in: | |||||||

Accounts receivable | 21,152 | 25,328 | |||||

Inventories and supplies | 2,162 | (102 | ) | ||||

Prepaid expenses and other current assets | (843 | ) | (1,197 | ) | |||

Other assets | 2,682 | 6,583 | |||||

Accounts payable, and accrued and other liabilities | 31,313 | 10,336 | |||||

Net cash provided by operating activities | 328,833 | 357,222 | |||||

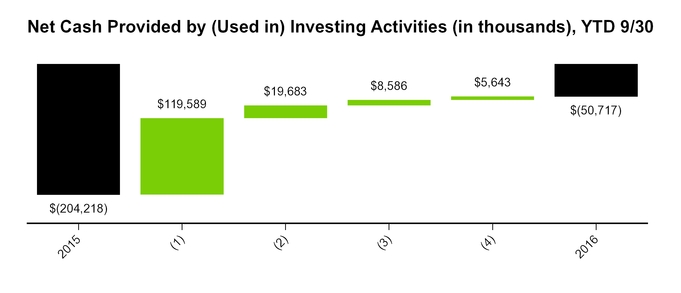

Cash flows from investing activities: | |||||||

Increase in cash and cash equivalents – restricted | (4,246 | ) | (12,832 | ) | |||

Proceeds from maturities of investments | 23,869 | 23,965 | |||||

Purchases of investments | (23,737 | ) | (22,710 | ) | |||

Proceeds from sale of property and equipment | 96,228 | 76,545 | |||||

Capital expenditures | (141,269 | ) | (260,858 | ) | |||

Payments received on notes receivable | 4,763 | 3,137 | |||||

Expenditures on assets held for sale | (24,784 | ) | (19,777 | ) | |||

Payments received on assets held for sale | 18,459 | 8,019 | |||||

Payments received on equipment sale receivables | — | 293 | |||||

Net cash used in investing activities | (50,717 | ) | (204,218 | ) | |||

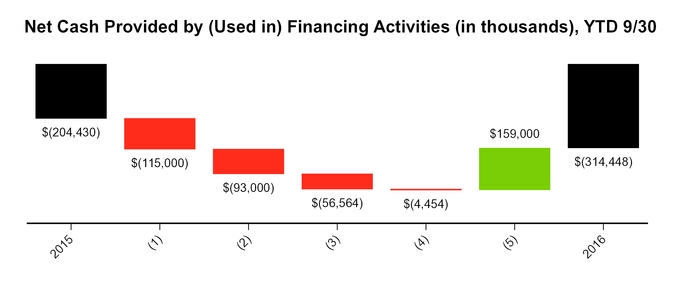

Cash flows from financing activities: | |||||||

Repayment of long-term debt and capital leases | (131,125 | ) | (954,561 | ) | |||

Proceeds from long-term debt | — | 684,504 | |||||

Net (repayments) borrowings on revolving line of credit | (150,000 | ) | 143,000 | ||||

Borrowings under accounts receivable securitization | 100,000 | 65,000 | |||||

Repayment of accounts receivable securitization | (25,000 | ) | (149,000 | ) | |||

Payment of deferred loan costs | — | (3,240 | ) | ||||

Proceeds from common stock issued | 6,130 | 7,667 | |||||

Repurchases of Class A common stock | (115,000 | ) | — | ||||

Excess tax benefit from stock-based compensation | 547 | 2,200 | |||||

Net cash used in financing activities | (314,448 | ) | (204,430 | ) | |||

Net decrease in cash and cash equivalents | (36,332 | ) | (51,426 | ) | |||

Cash and cash equivalents at beginning of period | 107,590 | 105,132 | |||||

Cash and cash equivalents at end of period | $ | 71,258 | $ | 53,706 | |||

See accompanying notes to consolidated financial statements.

9

CONSOLIDATED STATEMENTS OF CASH FLOWS — CONTINUED

(UNAUDITED)

Nine Months Ended September 30, | |||||||

2016 | 2015 | ||||||

(In thousands) | |||||||

Supplemental disclosures of cash flow information: | |||||||

Cash paid during the period for: | |||||||

Interest | $ | 22,818 | $ | 37,254 | |||

Income taxes | 67,058 | 77,335 | |||||

Non-cash investing activities: | |||||||

Equipment purchase accrual | $ | 29,813 | $ | 11,801 | |||

Notes receivable from sale of assets | 1,416 | 5,618 | |||||

Equipment sales receivables | — | 5 | |||||

Non-cash financing activities: | |||||||

Capital lease additions | $ | 12,811 | $ | 142,937 | |||

Accrued deferred loan costs | — | 250 | |||||

See accompanying notes to consolidated financial statements.

10

Notes to Consolidated Financial Statements (Unaudited) |

Note 1 — Introduction and Basis of Presentation

Certain acronyms and terms used throughout this Quarterly Report on Form 10-Q are specific to our company, commonly used in our industry, or are otherwise frequently used throughout our document. Definitions for these acronyms and terms are provided in the "Glossary of Terms," available in the front of this document.

Description of Business

Swift is a transportation solutions provider, headquartered in Phoenix, Arizona. As of September 30, 2016, the Company's fleet of revenue equipment included 19,157 tractors (comprised of 14,380 company tractors and 4,777 owner-operator tractors), 62,727 trailers, and 9,131 intermodal containers. The Company’s four reportable segments are Truckload, Dedicated, Swift Refrigerated, and Intermodal.

Seasonality

In the truckload industry, results of operations generally show a seasonal pattern. As customers ramp up for the year-end holiday season, the late third quarter and fourth quarter have historically been the Company's strongest volume periods. As customers reduce shipments after the winter holiday season, the first quarter has historically been a lower-volume quarter than the other three quarters. In recent years, the macro consumer buying patterns combined with shippers’ supply chain management, which historically contributed to the fourth quarter "peak" season, continued to evolve. As a result, the Company's fourth quarter 2015, 2014, and 2013 volumes were more evenly distributed throughout the quarter, rather than peaking early in the quarter. In the eastern and mid-western United States, and to a lesser extent in the western United States, the Company's equipment utilization typically declines and operating expenses generally increase during the winter season. This tends to be attributed to declines in fuel efficiency from engine idling and increases in accident frequency, claims, and equipment repairs from severe weather. The Company's revenue is directly related to shippers' available working days. As such, curtailed operations and vacation shutdowns around the holidays may affect the Company's revenue. From time to time, the Company also suffers short-term impacts from severe weather and similar events, such as tornadoes, hurricanes, blizzards, ice storms, floods, fires, earthquakes, and explosions that could add volatility to, or harm, the Company's results of operations.

Basis of Presentation

The consolidated financial statements and footnotes included in this Quarterly Report on Form 10-Q should be read in conjunction with the consolidated financial statements and footnotes included in the Company's Annual Report on Form 10-K for the year ended December 31, 2015. The consolidated financial statements include the accounts of Swift Transportation Company and its wholly-owned subsidiaries. In management's opinion, these consolidated financial statements were prepared in accordance with GAAP and include all adjustments necessary for the fair presentation of the periods presented.

Change in Accounting Estimate

In August 2016, the Company decreased the estimated residual values of a certain group of its tractors, given recent trends in the used tractor market. Management prospectively accounted for this as a change in accounting estimate. This increased "Depreciation and amortization of property and equipment" in the consolidated income statements by approximately $3.6 million for the three and nine months ended September 30, 2016, which immaterially affected basic and diluted earnings per share.

Change in Presentation

In April 2015, FASB issued ASU 2015-03, Simplifying the Presentation of Debt Issuance Costs, which amended ASC Subtopic 835-30, Interest – Imputation of Interest. The amendments in this ASU simplify the presentation of debt issuance costs and align the presentation with debt discounts. Entities are required to present debt issuance costs within liabilities as a direct deduction from the face amount of the related debt, rather than as a deferred charge within assets. In August 2015, FASB issued ASU 2015-15, Presentation and Subsequent Measurement of Debt Issuance Costs Associated with Line-of-Credit Arrangements – Amendments to SEC Paragraphs Pursuant to Staff Announcement at June 18, 2015 EITF Meeting (SEC Update), which also amended ASC Subtopic 835-30, Interest – Imputation of Interest. The SEC determined that ASU 2015-03 (discussed above) did not address costs related to line-of-credit arrangements. The amendments in ASU 2015-15 clarify that entities may defer and present debt issuance costs as an asset, and subsequently amortize the deferred debt issuance costs ratably over the term of the line-of-credit arrangement, regardless of whether there are any outstanding borrowings on the line-of-credit arrangement. The amendments in these ASUs require retrospective application, with related disclosures for a change in accounting principle. For public business entities, the amendments in these ASUs are effective for financial statements issued for fiscal years beginning after December 15, 2015, and the interim periods within those fiscal years, with early adoption permitted.

11

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

The Company adopted this guidance at the beginning of 2016. Accordingly, DLCs, except for those associated with the Company’s New Revolver, are presented as direct deductions from the face amount of the related debt. The Company retrospectively adjusted the December 31, 2015 consolidated balance sheet to align with the current period presentation, as follows:

December 31, 2015 | ||||||||||||

Financial Statement Caption | Unadjusted Consolidated Balance Sheet | Reclassification Adjustments | Adjusted Consolidated Balance Sheet | |||||||||

(In thousands) | ||||||||||||

ASSETS: | ||||||||||||

Other assets | $ | 29,353 | $ | (2,768 | ) | $ | 26,585 | |||||

LIABILITIES: | ||||||||||||

Current portion of long-term debt | $ | 35,582 | $ | (68 | ) | $ | 35,514 | |||||

Long-term debt, less current portion | 645,290 | (1,627 | ) | 643,663 | ||||||||

Accounts receivable securitization | 225,000 | (1,073 | ) | 223,927 | ||||||||

Note 2 — Recently Issued Accounting Pronouncements

The following table presents accounting pronouncements recently issued by FASB, but not yet adopted by the Company.

Date Issued | Reference | Description | Expected Adoption Date and Method | Financial Statement Impact | ||||

August 2016 | 2016-15: Statement of Cash Flows (Topic 230) – Classification of Certain Cash Receipts and Cash Payments | This ASU has several amendments, which are designed to reduce existing diversity in practice of how certain cash receipts and cash payments are presented and classified in the statement of cash flows. The ASU addresses eight specific cash flow issues, of which the following are expected to be applicable to Swift: 1) debt prepayment and extinguishment costs, 2) proceeds from settlement of insurance claims, 3) proceeds from settlement of corporate-owned life insurance policies, 4) beneficial interests in securitization transactions, and 5) separately identifiable cash flows and application of the predominance principle. | January 2018, Retrospective | Currently under evaluation; not expected to be material. | ||||

June 2016 | 2016-13: Financial Instruments – Credit Losses (Topic 326) – Measurement of Credit Losses on Financial Instruments | The purpose of this ASU is to amend the current incurred loss impairment methodology with a new methodology that reflects expected credit losses and requires a broader range of reasonable and supportable information to inform credit loss estimates. This is the final credit accounting standard, out of a series, with detailed guidance on the new loss reserve model, Current Expected Credit Loss ("CECL"). Among other provisions, the amendments in the ASU require a financial asset (or group of assets) measured at amortized cost basis to be presented at the net amount expected to be collected. Entities are no longer required to wait until a loss is probable to record it. | January 2020, Adoption method varies by amendment | Currently under evaluation; not expected to be material. | ||||

May 2016 | 2016-12: Revenue from Contracts with Customers (Topic 606) – Narrow-scope Improvements and Practical Expedients | The amendments in this ASU clarify certain aspects regarding the collectibility criterion, sales taxes collected from customers, noncash consideration, contract modifications, and completed contracts at transition. It additionally clarifies that retrospective application only requires disclosure of the accounting change effect on prior periods presented, not on the period of adoption. | January 2018, Modified retrospective | Impact of ASC Topic 606 overall is currently under evaluation; may be material, but not yet quantifiable. | ||||

12

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Date Issued | Reference | Description | Expected Adoption Date and Method | Financial Statement Impact | ||||

April 2016 | 2016-10: Revenue from Contracts with Customers (Topic 606) – Identifying Performance Obligations and Licensing | The amendments in this ASU clarify the following two aspects of Topic 606: identifying performance obligations and the licensing implementation guidance, while retaining the related principles for those areas. The amendments do not change the core principle of the guidance. | January 2018, Modified retrospective | Impact of ASC Topic 606 overall is currently under evaluation; may be material, but not yet quantifiable. | ||||

March 2016 | 2016-08: Revenue from Contracts with Customers (Topic 606) – Principal versus Agent Considerations (Reporting Revenue Gross versus Net) | The amendments in this ASU are intended to improve the operability and understandability of the implementation guidance on principal versus agent considerations, but do not change the core principle of the guidance. | January 2018, Modified retrospective | Impact of ASC Topic 606 overall is currently under evaluation; may be material, but not yet quantifiable. | ||||

March 2016 | 2016-09: Compensation – Stock Compensation (Topic 718) – Improvements to Employee Share-based Payment Accounting | The amendments in this ASU are intended to simplify various aspects of accounting for stock-based compensation, including income tax consequences, classification of awards as equity or liability, as well as classification of activities within the statement of cash flows. | January 2017, Adoption method varies by amendment | Currently under evaluation; not yet quantifiable. | ||||

February 2016 | 2016-02: Leases (Topic 842) | The new standard requires lessees to recognize assets and liabilities arising from both operating and financing leases on the balance sheet. Lessor accounting for leases is largely unaffected by the new guidance. | January 2019, Modified retrospective | Currently under evaluation; expected to be material, but not yet quantifiable. | ||||

January 2016 | 2016-01: Financial Instruments – Overall (Subtopic 825-10) – Recognition and Measurement of Financial Assets and Financial Liabilities | The amendments in this ASU address various aspects of recognition, measurement, presentation, and disclosure of financial instruments. They additionally establish ASC Topic 321 – Investments – Equity Securities, which applies to investments in equity securities and other ownership interests in an entity, including investments in partnerships, unincorporated joint ventures, and limited liability companies. | January 2018, Modified retrospective | Not expected to be material. | ||||

Note 3 — Restricted Investments

The following table presents the cost or amortized cost, gross unrealized gains and temporary losses, and estimated fair value of the Company’s restricted investments:

September 30, 2016 | |||||||||||||||

Gross Unrealized | |||||||||||||||

Cost or Amortized Cost | Gains | Temporary Losses | Estimated Fair Value | ||||||||||||

(In thousands) | |||||||||||||||

United States corporate securities | $ | 16,483 | $ | 1 | $ | (8 | ) | $ | 16,476 | ||||||

Municipal bonds | 4,956 | — | (6 | ) | 4,950 | ||||||||||

Negotiable certificate of deposits | 1,425 | — | — | 1,425 | |||||||||||

Restricted investments, held to maturity | $ | 22,864 | $ | 1 | $ | (14 | ) | $ | 22,851 | ||||||

13

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

December 31, 2015 | |||||||||||||||

Gross Unrealized | |||||||||||||||

Cost or Amortized Cost | Gains | Temporary Losses | Estimated Fair Value | ||||||||||||

(In thousands) | |||||||||||||||

United States corporate securities | $ | 16,686 | $ | 2 | $ | (27 | ) | $ | 16,661 | ||||||

Municipal bonds | 4,904 | 1 | (1 | ) | 4,904 | ||||||||||

Negotiable certificate of deposits | 1,625 | — | — | 1,625 | |||||||||||

Restricted investments, held to maturity | $ | 23,215 | $ | 3 | $ | (28 | ) | $ | 23,190 | ||||||

Refer to Note 15 for additional information regarding fair value measurements of restricted investments.

As of September 30, 2016, the contractual maturities of the restricted investments were one year or less. There were 44 securities and 36 securities that were in an unrealized loss position for less than twelve months as of September 30, 2016 and December 31, 2015, respectively. The Company did not recognize any impairment losses for the three or nine months ended September 30, 2016 or 2015.

Note 4 — Goodwill and Other Intangible Assets

There were no goodwill impairments recorded during the three or nine months ended September 30, 2016 or 2015. Other intangible asset balances were as follows:

September 30, 2016 | December 31, 2015 | ||||||

(In thousands) | |||||||

Customer Relationships: | |||||||

Gross carrying value | $ | 275,324 | $ | 275,324 | |||

Accumulated amortization | (185,853 | ) | (173,242 | ) | |||

Customer relationships, net | 89,471 | 102,082 | |||||

Trade Name: | |||||||

Gross carrying value | 181,037 | 181,037 | |||||

Intangible assets, net | $ | 270,508 | $ | 283,119 | |||

The following table presents amortization of intangible assets related to the 2007 Transactions and intangible assets existing prior to the 2007 Transactions:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2016 | 2015 | 2016 | 2015 | ||||||||||||

(In thousands) | |||||||||||||||

Amortization of intangible assets related to the 2007 Transactions | $ | 3,912 | $ | 3,912 | $ | 11,736 | $ | 11,736 | |||||||

Amortization related to intangible assets existing prior to the 2007 Transactions | 292 | 292 | 875 | 875 | |||||||||||

Amortization of intangibles | $ | 4,204 | $ | 4,204 | $ | 12,611 | $ | 12,611 | |||||||

14

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

On December 10, 2015, SRCII, a wholly-owned subsidiary of the Company, entered into the 2015 RSA, which further amended the 2013 RSA. The parties to the 2015 RSA include SRCII as the seller, Swift Transportation Services, LLC as the servicer, the various conduit purchasers, the various related committed purchasers, the various purchaser agents, the various letters of credit participants, and PNC Bank, National Association as the issuing bank of letters of credit and as administrator. Pursuant to the 2015 RSA, the Company's receivable originator subsidiaries sell, on a revolving basis, undivided interests in all of their eligible accounts receivable to SRCII. In turn, SRCII sells a variable percentage ownership interest in the eligible accounts receivable to the various purchasers. The facility qualifies for treatment as a secured borrowing under ASC Topic 860, Transfers and Servicing. As such, outstanding amounts are classified as liabilities on the Company’s consolidated balance sheets. Refer to Note 15 for information regarding the fair value of the 2015 RSA.

As of September 30, 2016 and December 31, 2015, interest accrued on the aggregate principal balance at a rate of 1.1% and 1.0%, respectively. Program fees and unused commitment fees are recorded in interest expense in the Company's consolidated income statements. The Company incurred program fees of $1.2 million related to the 2015 RSA and $0.8 million related to the 2013 RSA, during the three months ended September 30, 2016 and 2015, respectively. The Company incurred program fees of $3.1 million related to the 2015 RSA and $2.7 million related to the 2013 RSA, during the nine months ended September 30, 2016 and 2015, respectively.

The 2015 RSA is subject to customary fees and contains various customary affirmative and negative covenants, representations and warranties, and default and termination provisions. Collections on the underlying receivables by the Company are held for the benefit of SRCII and the Purchasers in the facility and are unavailable to satisfy claims of the Company and its subsidiaries.

Note 6 — Debt and Financing

Other than the Company’s accounts receivable securitization, as discussed in Note 5, and its outstanding capital lease obligations as discussed in Note 8, the Company's long-term debt consisted of the following:

September 30, 2016 | December 31, 2015 | ||||||

(In thousands) | |||||||

2015 Agreement: New Term Loan A, due July 2020, net of $1,431 and $1,695 DLCs as of September 30, 2016 and December 31, 2015, respectively (1) | $ | 592,819 | $ | 668,055 | |||

Other | 1,243 | 11,122 | |||||

Long-term debt | 594,062 | 679,177 | |||||

Less: current portion of long-term debt, net of $0 and $68 DLCs as of September 30, 2016 and December 31, 2015, respectively | (799 | ) | (35,514 | ) | |||

Long-term debt, less current portion | $ | 593,263 | $ | 643,663 | |||

September 30, 2016 | December 31, 2015 | ||||||

(In thousands) | |||||||

Long-term debt | $ | 594,062 | $ | 679,177 | |||

Revolving line of credit, due July 2020 (1) (2) | 50,000 | 200,000 | |||||

Long-term debt, including revolving line of credit | $ | 644,062 | $ | 879,177 | |||

____________

(1) | Refer to Note 15 for information regarding the fair value of long-term debt. |

(2) | The Company additionally had outstanding letters of credit, primarily related to workers' compensation and self-insurance liabilities of $97.0 million and $95.0 million under the New Revolver at September 30, 2016 and December 31, 2015, respectively. |

15

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Credit Agreement

On July 27, 2015, the Company entered into the 2015 Agreement, which replaced the 2014 Agreement, including the $450.0 million Old Revolver (zero outstanding at closing), $500.0 million Old Term Loan A ($485.0 million outstanding at closing), and $400.0 million Term Loan B ($395.0 million outstanding at closing). The 2015 Agreement includes a New Revolver and a New Term Loan A. Upon closing, the $680.0 million in proceeds from the New Term Loan A, a $200.0 million draw on the New Revolver, and $4.9 million cash on hand were used to pay off the then-outstanding balances of the Old Term Loan A and Term Loan B, including accrued interest and fees under the 2014 Agreement, as well as certain transactional fees associated with the 2015 Agreement.

The following table presents the key terms of the 2015 Agreement:

Description | New Term Loan A | New Revolver (2) | ||

(Dollars in thousands) | ||||

Maximum borrowing capacity | $680,000 | $600,000 | ||

Final maturity date | July 27, 2020 | July 27, 2020 | ||

Interest rate base | LIBOR | LIBOR | ||

LIBOR floor | —% | —% | ||

Interest rate minimum margin (1) | 1.50% | 1.50% | ||

Interest rate maximum margin (1) | 2.25% | 2.25% | ||

Minimum principal payment – amount (3) | $6,625 | $— | ||

Minimum principal payment – frequency | Quarterly | Once | ||

Minimum principal payment – commencement date (3) | December 31, 2015 | July 27, 2020 | ||

____________

(1) | The interest rate margin for the New Term Loan A and New Revolver is based on the Company's consolidated leverage ratio. As of September 30, 2016, interest accrued at 2.03% on the New Term Loan A and 2.03% on the New Revolver. As of December 31, 2015, interest accrued at 2.12% on the New Term Loan A and 2.08% on the New Revolver. |

(2) | The commitment fee for the unused portion of the New Revolver is based on the Company's consolidated leverage ratio and ranges from 0.25% to 0.35%. As of September 30, 2016, commitment fees on the unused portion of the New Revolver accrued at 0.25% and outstanding letter of credit fees accrued at 1.50%. As of December 31, 2015, commitment fees on the unused portion of the New Revolver accrued at 0.25% and outstanding letter of credit fees accrued at 1.75%. |

(3) | Commencing in March 2017, the minimum quarterly payment amount on the New Term Loan A is $12.3 million, at which it remains until final maturity. |

The New Revolver and New Term Loan A of the 2015 Agreement contain certain financial covenants with respect to a maximum leverage ratio and a minimum consolidated interest coverage ratio. The 2015 Agreement provides flexibility regarding the use of proceeds from asset sales, payment of dividends, stock repurchases, and equipment financing. In addition to the financial covenants, the 2015 Agreement includes customary events of default, including a change in control default and certain affirmative and negative covenants, including, but not limited to, restrictions, subject to certain exceptions, on incremental indebtedness, asset sales, certain restricted payments (including dividends and stock repurchases), certain incremental investments or advances, transactions with affiliates, engagement in additional business activities, and prepayment of certain other indebtedness.

Borrowings under the 2015 Agreement are secured by substantially all of the assets of the Company and are guaranteed by Swift Transportation Company, IEL, Central Refrigerated Transportation, LLC and its subsidiaries, Swift Transportation Co., LLC and its domestic subsidiaries (other than its captive insurance subsidiaries, driver academy subsidiary, and its bankruptcy-remote special purpose subsidiary).

Loss on Debt Extinguishment

The Company incurred no losses on debt extinguishment during the three and nine months ended September 30, 2016. During the three and nine months ended September 30, 2015, the Company incurred $9.6 million in losses on debt extinguishment reflecting the write-off of the unamortized OID and deferred financing fees related to the 2014 Agreement, which was replaced by the 2015 Agreement.

16

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Note 7 — Deferred Loan Costs

As discussed in Note 1, DLCs related to the Company's New Term Loan A and accounts receivable securitization are now netted against the face amount of the debt, pursuant to the amendments in ASU 2015-03. DLCs related to the New Revolver are reported in "Other assets." The following table presents the classification of DLCs in the Company's consolidated balance sheets:

September 30, 2016 | December 31, 2015 | ||||||

(In thousands) | |||||||

ASSETS: | |||||||

Other assets | $ | 1,251 | $ | 1,496 | |||

LIABILITIES: | |||||||

Current portion of long-term debt | — | 68 | |||||

Long-term debt, less current portion | 1,431 | 1,627 | |||||

Accounts receivable securitization | 804 | 1,073 | |||||

Total DLCs | $ | 3,486 | $ | 4,264 | |||

The Company finances a portion of its revenue equipment under capital and operating leases and certain terminals under operating leases.

Capital Leases (as Lessee) — The Company’s capital leases are typically structured with balloon payments at the end of the lease term equal to the residual value the Company is contracted to receive from certain equipment manufacturers upon sale or trade back to the manufacturers. If the Company does not receive proceeds of the contracted residual value from the manufacturer, the Company is still obligated to make the balloon payment at the end of the lease term. Certain leases contain renewal or fixed price purchase options. The present value of obligations under capital leases is included under "Current portion of capital lease obligations" and "Capital lease obligations, less current portion" in the consolidated balance sheets. As of September 30, 2016, the leases were collateralized by revenue equipment with a cost of $326.2 million and accumulated amortization of $91.5 million. As of December 31, 2015, the leases were collateralized by revenue equipment with a cost of $357.8 million and accumulated amortization of $90.1 million. Amortization of the equipment under capital leases is included in "Depreciation and amortization of property and equipment" in the Company’s consolidated income statements.

Operating Leases (as Lessee) — Rent expense related to operating leases was $57.0 million and $59.1 million for the three months ended September 30, 2016 and 2015, respectively. Rent expense related to operating leases was $170.3 million and $180.9 million for the nine months ended September 30, 2016 and 2015, respectively.

As of September 30, 2016, the Company's outstanding commitments to acquire revenue equipment were as follows:

• | remainder of 2016: $174.3 million ($103.2 million of which were tractor commitments), |

• | year-ended December 31, 2017: $190.9 million ($190.9 million of which were tractor commitments), and |

• | thereafter: none. |

The Company has the option to cancel tractor purchase orders with 60 to 90 days' notice prior to the scheduled production, although the notice period has lapsed for 35.1% of the tractor commitments outstanding as of September 30, 2016. These purchases are expected to be financed by the combination of operating leases, capital leases, debt, proceeds from sales of existing equipment, and cash flows from operations.

As of September 30, 2016, the Company had $0.3 million in outstanding purchase commitments for non-revenue equipment and no purchase commitments for facilities. Factors such as costs and opportunities for future terminal expansions may change the amount of such expenditures.

17

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

The Company is involved in certain claims and pending litigation primarily arising in the normal course of business. The majority of these claims relate to workers' compensation, auto collision and liability, physical damage, and cargo damage. The Company expenses legal fees as incurred and accrues for the uninsured portion of contingent losses from these and other pending claims when it is both probable that a liability has been incurred and the amount of the loss can be reasonably estimated. Based on the knowledge of the facts and, in certain cases, advice of outside counsel, management believes the resolution of claims and pending litigation, taking into account existing reserves, will not have a material adverse effect on the Company. Moreover, the results of complex legal proceedings are difficult to predict and the Company’s view of these matters may change in the future as the litigation and events related thereto unfold.

For certain cases described below, management is unable to provide a meaningful estimate of the possible loss or range of loss because, among other reasons, (1) the proceedings are in various stages that do not allow for assessment; (2) damages have not been sought; (3) damages are unsupported and/or exaggerated; (4) there is uncertainty as to the outcome of pending appeals; and/or (5) there are significant factual issues to be resolved. For these cases, however, management does not believe, based on currently available information, that the outcomes of these proceedings will have a material adverse effect on our financial condition, though the outcomes could be material to our operating results for any particular period, depending, in part, upon the operating results for such period.

Arizona Owner-operator Class Action Litigation

On January 30, 2004, a class action lawsuit was filed by Leonel Garza on behalf of himself and all similarly-situated persons against Swift Transportation: Garza v. Swift Transportation Co., Inc., Case No. CV7-472 (the "Garza Complaint"). The putative class originally involved certain owner-operators who contracted with the Company under a 2001 Contractor Agreement that was in place for one year. The putative class is alleging that the Company should have reimbursed owner-operators for actual miles driven rather than the contracted and industry standard remuneration based upon dispatched miles. The trial court denied the plaintiff’s petition for class certification. The plaintiff appealed and on August 6, 2008, the Arizona Court of Appeals issued an unpublished Memorandum Decision reversing the trial court’s denial of class certification and remanding the case back to the trial court. On November 14, 2008, the Company filed a petition for review to the Arizona Supreme Court regarding the issue of class certification as a consequence of the denial of the Motion for Reconsideration by the Court of Appeals. On March 17, 2009, the Arizona Supreme Court granted the Company’s petition for review, and on July 31, 2009, the Arizona Supreme Court vacated the decision of the Court of Appeals, opining that the Court of Appeals lacked automatic appellate jurisdiction to reverse the trial court’s original denial of class certification and remanded the matter back to the trial court for further evaluation and determination. Thereafter, the plaintiff renewed the motion for class certification and expanded it to include all persons who were employed by Swift as employee drivers or who contracted with Swift as owner-operators on or after January 30, 1998, in each case who were compensated by reference to miles driven. On November 4, 2010, the Maricopa County trial court entered an order certifying a class of owner-operators and expanding the class to include employees. Upon certification, the Company filed a motion to compel arbitration, as well as filing numerous motions in the trial court urging dismissal on several other grounds including, but not limited to the lack of an employee as a class representative, and the named owner-operator class representative only contracted with the Company for a three-month period under a one-year contract that no longer exists. In addition to these trial court motions, the Company also filed a petition for special action with the Arizona Court of Appeals, arguing that the trial court erred in certifying the class because the trial court relied upon the Court of Appeals ruling that was previously overturned by the Arizona Supreme Court. On April 7, 2011, the Arizona Court of Appeals declined jurisdiction to hear this petition for special action and the Company filed a petition for review to the Arizona Supreme Court. On August 31, 2011, the Arizona Supreme Court declined to review the decision of the Arizona Court of Appeals. In April 2012, the trial court issued the following rulings with respect to certain motions filed by Swift: (1) denied Swift’s motion to compel arbitration; (2) denied Swift’s request to decertify the class; (3) granted Swift’s motion that there is no breach of contract; and (4) granted Swift’s motion to limit class size based on statute of limitations. On November 13, 2014, the court denied the plaintiff's motion to add new class representatives for the employee class and therefore the employee class remains without a plaintiff class representative. On March 18, 2015, the court denied Swift's two motions for summary judgment (1) to dismiss any claims related to the employee class since there is no class representative; and (2) to dismiss the plaintiff's claim of breach of a duty of good faith and fair dealing. On July 14, 2015, the court granted Swift's motion to decertify the entire class. On December 23, 2015, the plaintiff filed a petition for special action with the Arizona Court of Appeals. On July 12, 2016, the Court of Appeals reversed the lower court’s order decertifying the class. Swift filed a petition for review with the Arizona Supreme Court on August 12, 2016. A decision regarding the petition for review is forthcoming. The final disposition of this case and the impact of such disposition cannot be determined at this time.

Ninth Circuit Owner-operator Misclassification Class Action Litigation

On December 22, 2009, a class action lawsuit was filed against Swift Transportation and IEL: Virginia VanDusen, John Doe 1, and Joseph Sheer, individually and on behalf of all other similarly-situated persons v. Swift Transportation Co., Inc., Interstate Equipment Leasing, Inc., Jerry Moyes, and Chad Killebrew, Case No. 9-CIV-10376 filed in the United States District Court for the Southern District of New York (the "Sheer Complaint"). The putative class involves owner-operators alleging that Swift Transportation

18

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

misclassified owner-operators as independent contractors in violation of the federal FLSA, and various New York and California state laws and that such owner-operators should be considered employees. The lawsuit also raises certain related issues with respect to the lease agreements that certain owner-operators have entered into with IEL. At present, in addition to the named plaintiffs, approximately 450 other current or former owner-operators have joined this lawsuit. Upon Swift’s motion, the matter was transferred from the United States District Court for the Southern District of New York to the United States District Court in Arizona. On May 10, 2010, the plaintiffs filed a motion to conditionally certify an FLSA collective action and authorize notice to the potential class members. On September 23, 2010, the plaintiffs filed a motion for a preliminary injunction seeking to enjoin Swift and IEL from collecting payments from plaintiffs who are in default under their lease agreements and related relief. On September 30, 2010, the district court granted Swift’s motion to compel arbitration and ordered that the class action be stayed, pending the outcome of arbitration. The district court further denied the plaintiff’s motion for preliminary injunction and motion for conditional class certification. The district court also denied the plaintiff’s request to arbitrate the matter as a class.

The plaintiff filed a petition for a writ of mandamus to the Ninth Circuit Court of Appeals asking that the district court’s September 30, 2010 order be vacated. On July 27, 2011, the Ninth Circuit Court of Appeals denied the plaintiff’s petition for writ of mandamus and thereafter the district court denied the plaintiff’s motion for reconsideration and certified its September 30, 2010 order. The plaintiffs filed an interlocutory appeal to the Ninth Circuit Court of Appeals to overturn the district court’s September 30, 2010 order to compel arbitration, alleging that the agreement to arbitrate is exempt from arbitration under Section 1 of the Federal Arbitration Act ("FAA") because the class of plaintiffs allegedly consists of employees exempt from arbitration agreements. On November 6, 2013, the Ninth Circuit Court of Appeals reversed and remanded, stating its prior published decision, "expressly held that a district court must determine whether an agreement for arbitration is exempt from arbitration under Section 1 of the FAA as a threshold matter." As a consequence of this determination by the Ninth Circuit Court of Appeals being different from a decision of the Eighth Circuit Court of Appeals on a similar issue, on February 4, 2014, the Company filed a petition for writ of certiorari to the United States Supreme Court to address whether the district court or arbitrator should determine whether the contract is an employment contract exempt from Section 1 of the Federal Arbitration Act. On June 16, 2014, the United States Supreme Court denied the Company’s petition for writ of certiorari.

The matter remains pending in the district court and dispositive motion briefing was completed on September 30, 2016. The Company also filed a writ of mandamus and appeal from the district court's order that effectively denied the Company's motion to compel arbitration. The Ninth Circuit held oral argument on November 16, 2015, and after further briefing, dismissed the appeal on July 26, 2016, finding that it lacked jurisdiction. The Company has filed a motion for reconsideration of this decision. The Company intends to vigorously defend against any proceedings. The final disposition of this case and the impact of such final disposition cannot be determined at this time.

California Wage, Meal, and Rest Driver Class Actions

On March 22, 2010, a class action lawsuit was filed by John Burnell, individually and on behalf of all other similarly-situated persons against Swift Transportation: John Burnell and all others similarly-situated v. Swift Transportation Co., Inc., filed in the Superior Court of California, County of San Bernardino (the "Burnell Complaint"). On September 3, 2010, upon motion by Swift, the matter was removed to the United States District Court for the Central District of California (the "California Court"), Case No. EDCV10-809-VAP. The putative class includes drivers who worked for Swift during the four years preceding the date of filing and alleges that Swift failed to pay the California minimum wage, failed to provide proper meal and rest periods, and failed to timely pay wages upon separation from employment. On April 9, 2013, the Company filed a motion for judgment on the pleadings, requesting dismissal of the plaintiff's claims related to alleged meal and rest break violations under the California Labor Code alleging that such claims are preempted by the Federal Aviation Administration Authorization Act.

The issue of class certification must first be resolved before the California Court will address the merits of these cases, and the Company retains all of its defenses against liability and damages pending a determination of class certification. Class certification briefing is now complete and a class certification hearing was scheduled for April 25, 2016. The class certification hearing was held and argued as scheduled. In May 2016, the District Court issued an order denying class certification. The plaintiffs and petitioners sought leave from the Ninth Circuit Court of Appeals to appeal the class decertification order. On July 18, 2016, the court denied the plaintiffs' and petitioners' petition to appeal the decertification order. Therefore, at the present time and based upon the current procedural nature of the case, the final disposition and impact to the Company cannot be determined.

On April 5, 2012, the Company was served with an additional class action complaint, alleging facts similar to those as set forth in the Burnell Complaint: James R. Rudsell, on behalf of himself and all others similarly-situated v. Swift Transportation Co. of Arizona, LLC and Swift Transportation Company, in the Superior Court of California, County of San Bernardino (the "Rudsell Complaint"). On May 3, 2012, upon motion by Swift, the matter was removed to the California Court, Case No. EDCV12-00692-VAP. The Rudsell Complaint was stayed on April 29, 2013, pending a resolution of the Burnell Complaint.

On September 25, 2014, a class action lawsuit was filed by Lawrence Peck on behalf of himself and all other similarly-situated persons against Swift Transportation: Peck v. Swift Transportation Co. of Arizona, LLC in the Superior Court of California, County of Riverside (the "Peck Complaint"). The putative class, which includes current and former non-exempt employee truck drivers who performed services in California within the four-year statutory period, alleges that Swift failed to pay for all hours worked (specifically

19

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

that pay-per-mile fails to compensate drivers for non-driving related services), failed to pay overtime, failed to properly reimburse work-related expenses, failed to timely pay wages, and failed to provide accurate wage statements. On October 24, 2014, upon motion by Swift, the matter was removed to the California Court, Case No. 14-CV-02206-VAP. The Peck Complaint was stayed on April 6, 2015, pending a resolution of the earlier filed cases. On November 20, 2014, the plaintiff filed a Private Attorneys General Act class action lawsuit in the Superior Court of California, County of Riverside (the "Peck PAGA Complaint"). Upon motion by Swift, the Peck PAGA Complaint was stayed on March 19, 2015. On May 24, 2016, after the Burnell Court failed to certify the petitioner’s class, the plaintiff filed a motion to lift the stay regarding the Peck PAGA Complaint. On June 22, 2016, the court lifted the stay. The matter is in its initial stages and the parties are engaging in discovery.

On February 27, 2015, Sadashiv Mares filed a complaint alleging five Causes of Action arising under California state law on behalf of himself and a putative class against Swift Transportation Co. of Arizona, LLC in the Superior Court of California, County of Alameda (the "Mares Complaint"). On July 13, 2015, upon motion by Swift, the matter was removed to the United States District Court for the Northern District of California, Case No. 2:15-CV-03253-JSW. Upon the parties' stipulation, on October 17, 2015, the case was transferred to the California Court, Case No. 2:15-CV-07920-VAP. The Mares Complaint was stayed on February 24, 2016, pending a resolution of the earlier filed cases. On October 11, 2016, the court granted a motion filed by the plaintiffs to lift the stay. The matter is in its initial phases and is expected to move into discovery.

On or about April 15, 2015, a complaint was filed in the Superior Court of California, County of San Bernardino: Rafael McKinsty et al. v. Swift Transportation Co. of Arizona, LLC, et al., (the "McKinsty Complaint"). The McKinsty Complaint, a purported class action, alleges violation of California rest break laws and is similar to the Burnell, Rudsell, Peck, and Mares Complaints. On July 2, 2015, upon motion by Swift, the matter was removed to the California Court, Case No. 15-CV-1317-VAP. The McKinsty Complaint was stayed on August 19, 2015, pending a resolution of the earlier filed cases.

On October 15, 2015, a class action lawsuit was filed in the Superior Court of California, County of Riverside: Thor Nilsen v. Swift Transportation Co. of Arizona, LLC (the "Nilsen Complaint"). The Nilsen Complaint alleges violations of California law similar to the Burnell, Rudsell, Peck, Mares, and McKinsty Complaints. On December 9, 2015, upon motion by Swift, the matter was removed to the California Court, Case No. 15-CV-02504-VAP. The Nilsen Complaint was stayed January 29, 2016, pending resolution of the earlier filed cases.

California Private Attorney General Act Class Action

On July 8, 2016, a class action lawsuit was filed by Theron Christopher on behalf of himself and all other similarly-situated persons against Swift Transportation Co. of Arizona, LLC, in the Superior Court of California, County of Riverside (the "Christopher Complaint"). The plaintiff purports to represent all current and former employees employed by Swift in California and alleges that Swift violated California law by failing to timely pay wages and failing to reimburse employees for business expenses. The matter is in its initial phases and is expected to move into discovery. The Company retains all of its defenses against liability and damages. The Company intends to vigorously defend against the merits of these claims and to challenge certification. The final disposition of this case and the impact of such final disposition of this case cannot be determined at this time.

California Wage, Meal, and Rest: Yard Hostler Class Actions

On January 28, 2016, a class action lawsuit was filed by Grant Fritsch, individually and on behalf of all other similarly-situated persons against Swift Transportation Services, LLC and Swift Transportation Company in the Superior Court of California, County of San Bernardino (the "Fritsch Complaint"). The plaintiff worked for Swift as a yard hostler and purports to represent a class of "non-exempt maintenance and service employees" of Swift Transportation Services, LLC and/or Swift Transportation Company. The Fritsch Complaint alleges that Swift failed to pay overtime and doubletime wages required by California law, failed to provide proper meal and rest periods, failed to provide accurate itemized wage statements, and failed to timely pay wages upon separation from employment. The Fritsch Complaint also includes a claim under the Private Attorneys General Act. The Company filed a motion to dismiss based upon the wrong party being named in the lawsuit, and the plaintiff agreed to amend the complaint, which was served June 17, 2016. On August 30, 2016, the plaintiff again amended his complaint to clarify the class he was seeking to represent a class of individuals employed by Swift as yard hostlers in California. The Company retains all of its defenses against liability and damages. The Company intends to vigorously defend against the merits of these claims and to challenge certification. The final disposition of this case and the impact of such final disposition of this case cannot be determined at this time.

On April 1, 2016, a class action lawsuit was filed by Bill Barker, Tab Bachman, and William Yingling, on behalf of all other similarly-situated persons against Swift Transportation Company of Arizona, LLC, in the Superior Court of California, County of Sacramento (the "Barker Complaint"). The Barker Complaint alleges that Swift failed to pay minimum wage and overtime, failed to reimburse for business expenses, failed to provide proper meal and rest periods, failed to provide accurate itemized wage statements, and failed to timely pay wages upon separation from employment. On July 5, 2016, upon motion by Swift, the matter was removed to the United States District Court for the Eastern District of California, Case No. 2:16-CV-01532-TLN-CKD. The matter is in its initial phases and is expected to move into discovery. The Company retains all of its defenses against liability and damages. The Company intends to vigorously defend against the merits of these claims and to challenge certification. The final disposition of this case and the impact of such final disposition of this case cannot be determined at this time.

20

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

National Customer Service Misclassification Class Action Litigation

On May 11, 2016, a collective and class action was filed by a former Swift customer service representative level four ("CSR IV"), Salvador Castro, individually and on behalf of herself and all similarly-situated persons against Swift Transportation Co. of Arizona, LLC in the United States District Court for the Central District of California, Case No. CV 16-3232 (the "Castro Complaint"). The operative complaint alleges failure to pay overtime under the FLSA, as well as California state law claims including failure to pay timely final wages, failure to provide meal and rest periods, failure to pay overtime, and violation of the unfair competition. So far five plaintiffs have opted in to the lawsuit. The matter is in its initial phases and the parties are conducting discovery. The Company retains all of its defenses against liability and damages. The Company intends to vigorously defend against the merits of these claims and to challenge certification. The final disposition of this case and the impact of such final disposition of this case cannot be determined at this time.

In addition to the Castro Complaint, fourteen former or current CSR IVs who signed arbitration agreements with Swift have filed individual arbitrations with the American Arbitration Association ("AAA"). The claims alleged in the individual arbitrations are the same claims asserted in the Castro Complaint.

Arizona Fair Labor Standards Act Class Action Litigation

On December 29, 2015, a class action lawsuit was filed by Pamela Julian, individually and on behalf of all other similarly-situated persons against Swift Transportation, Inc., et al. in the United States District Court for the District of Delaware, Case No. 1:15-CV-01212-UNA (the "Julian Compliant"). The Julian Complaint alleges that Swift violated the FLSA by failing to pay its trainee drivers minimum wage for all work performed and by failing to pay overtime. On February 29, 2016, upon Stipulation of the Parties, the court transferred the case to the United States District Court for the District of Arizona, Case No. 2:16-CV-00576-ROS. On March 9, 2016, Swift filed a motion to dismiss the plaintiffs' overtime claims, which was granted by the District Court on May 31, 2016. The Company retains all of its defenses against liability and damages for the remaining claims. The Company intends to vigorously defend against the merits of these claims and to challenge certification. The final disposition of this case and the impact of such final disposition of this case cannot be determined at this time.

Washington Overtime Class Actions

On September 9, 2011, a class action lawsuit was filed by Troy Slack and several other drivers on behalf of themselves, and all similarly-situated persons, against Swift Transportation: Troy Slack, et al. v. Swift Transportation Co. of Arizona, LLC and Swift Transportation Corporation in the State Court of Washington, Pierce County (the "Slack Complaint"). The Slack Complaint was removed to the United States District Court for the Western District of Washington (the "Court") on October 12, 2011, case number 11-2-114380. The putative class includes all current and former Washington state-based employee drivers during the three-year statutory period prior to the filing of the lawsuit, and through the present, and alleges that they were not paid minimum wage and overtime in accordance with Washington state law and that they suffered unlawful deductions from wages. On November 23, 2013, the court entered an order on the plaintiffs' motion to certify the class. The court only certified the class as it pertains to "dedicated" drivers and did not certify any other class, including any class related to over-the-road drivers. On September 2, 2015, new counsel was appointed for the plaintiffs and on November 16, 2015, new legal counsel was substituted for the Company. As a result of the substitution of counsel for both parties, the court extended all existing dates by ten months. On April 1, 2016, the court entered an order approving the plaintiffs' proposed class notice. The matter is now in discovery. The Company retains all of its defenses against liability and damages. The Company intends to vigorously defend against the merits of these claims and to challenge certification. The final disposition of this case and the impact of such final disposition of this case cannot be determined at this time.

On January 14, 2016, a class action lawsuit was filed by Julie Hedglin, individually and on behalf of all others similarly situated against Swift Transportation Co. of Arizona, LLC in the State Court of Washington, Pierce County (the "Hedglin Complaint"). The Hedglin Complaint was removed to the Court on February 18, 2016, 3:16-CV-05127-RJB. The putative class includes all current and former Washington heavy haul drivers and alleges the class was not paid for meal and rest periods, was not paid for overtime, was not paid all wages due at established pay periods, and was not provided accurate wage statements. The matter is in its initial phases and is expected to move into discovery. The Company retains all of its defenses against liability and damages. The Company intends to vigorously defend against the merits of these claims and to challenge certification. The final disposition of this case and the impact of such final disposition of this case cannot be determined at this time.

21

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Indiana Fair Credit Reporting Act Class Action Litigation

On March 18, 2015, a class action lawsuit was filed by Melvin Banks, individually and on behalf of all other similarly-situated persons against Central Refrigerated Service, Inc. in the United States District Court for the Northern District of Indiana, Case No. 2:15-CV-00105. The complaint alleges that Central Refrigerated Service, Inc. violated the Fair Credit Reporting Act by failing to provide job applicants with adverse action notices and copies of their consumer reports and statements of rights. At this time, the size of the potential class is unknown. The Company’s motion to have the case transferred from Indiana to the United States District Court for the District of Arizona has been granted. The first phase of discovery, regarding potential for identifying and certifying a class of affected job applicants, has been completed. The Company retains all of its defenses against liability and damages. The Company intends to vigorously defend against the merits of these claims and to challenge certification. The final disposition of this case, including the size of any affected class, and the impact of such final disposition of this case cannot be determined at this time.

Utah Collective and Individual Arbitration

On June 1, 2012, Gabriel Cilluffo, Kevin Shire, and Bryan Ratterree filed a putative class and collective action lawsuit against Central Refrigerated Service, Inc., Central Leasing, Inc., Jon Isaacson, and Jerry Moyes (collectively referred to herein as the "Central Parties"), Case No. ED CV 12-00886 in the United States District Court for the Central District of California. Through this action, the plaintiffs alleged that the Central Parties misclassified owner-operator drivers as independent contractors and were therefore liable to these drivers for minimum wages and other employee benefits under the FLSA. The complaint also alleged a federal forced labor claim under 18 U.S.C. § 1589 and 1595, as well as fraud and other state-law claims.

Pursuant to the plaintiffs' owner-operator agreements, the district court issued an order compelling arbitration and directed that the plaintiffs' causes of action under the FLSA should proceed to collective arbitration, while their forced labor, fraud, and state law claims would proceed as separate individual arbitrations. A collective arbitration was subsequently initiated with the AAA. Notice of the collective arbitration was sent to more than 3,000 owner-operators who worked for Central Refrigerated Service, Inc. and leased a vehicle from Central Leasing, Inc. on or after June 1, 2009. On October 26, 2016 the arbitrator assigned to the case ruled that approximately 1,300 Central Refrigerated drivers involved in the collective arbitration have been misclassified as independent contractors and that they should have been compensated as employees. The ruling left open the question of what damages, if any, are payable to these drivers. The arbitrator ruled that such damages could be assessed in a collective proceeding and declined to decertify the collective proceeding under the FLSA. No trial date on the claimant's damages has been set by the arbitrator.