Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________________

Form 10-Q

_____________________________________________________________________

ý QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended September 30, 2015

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-35007

_____________________________________________________________________

Swift Transportation Company

(Exact name of registrant as specified in its charter)

_____________________________________________________________________

Delaware | 20-5589597 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

2200 South 75th Avenue

Phoenix, AZ 85043

(Address of principal executive offices and zip code)

(602) 269-9700

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

______________________________________________________________________

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | o | |||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The number of outstanding shares of the registrant’s Class A common stock as of 10/30/2015 was 91,966,463 and the number of outstanding shares of the registrant’s Class B common stock as of 10/30/2015 was 50,991,938.

SWIFT TRANSPORTATION COMPANY

TABLE OF CONTENTS

PAGE | |

2

GLOSSARY OF TERMS

The following glossary provides definitions for certain acronyms and terms used in this Quarterly Report on Form 10-Q. These acronyms and terms are specific to our company, commonly used in our industry, or are otherwise frequently used throughout our document. | ||

Term | Definition | |

Swift/the Company/Management/We/Us/Our | Unless otherwise indicated or the context otherwise requires, these terms represent Swift Transportation Company and its subsidiaries. Swift Transportation Company is the holding company for Swift Transportation Co., LLC (a Delaware limited liability company) and Interstate Equipment Leasing, LLC. | |

2007 Transactions | In April 2007, Jerry Moyes and his wife contributed their ownership of all of the issued and outstanding shares of IEL to Swift Corporation in exchange for additional Swift Corporation shares. In May 2007, the Moyes Affiliates, contributed their shares of Swift Transportation Co., Inc. common stock to Swift Corporation in exchange for additional Swift Corporation shares. Swift Corporation then completed its acquisition of Swift Transportation Co., Inc. through a merger on May 10, 2007, thereby acquiring the remaining outstanding shares of Swift Transportation Co., Inc. common stock. Upon completion of the 2007 Transactions, Swift Transportation Co., Inc. became a wholly-owned subsidiary of Swift Corporation. At the close of the market on May 10, 2007, the common stock of Swift Transportation Co, Inc. ceased trading on NASDAQ. | |

2011 RSA | The Company's previous Receivables Sale Agreement, entered into in 2011, with unrelated financial entities | |

2013 Agreement | The Company's Second Amended and Restated Credit Agreement, replaced by the 2014 Agreement | |

2013 RSA | Second Amended and Restated Receivables Sale Agreement, entered into in 2013 by SRCII, with unrelated financial entities, "The Purchasers" | |

2014 Agreement | The Company's Third Amended and Restated Credit Agreement | |

2015 Agreement | The Company's Fourth Amended and Restated Credit Agreement | |

AOCI | Accumulated Other Comprehensive Income (Loss) | |

ASC | Accounting Standards Codification | |

ASU | Accounting Standards Update | |

Central | Central Refrigerated Transportation, LLC (formerly Central Refrigerated Transportation, Inc.) | |

COFC | Container on Flat Car | |

CSA | Compliance Safety Accountability | |

Deadhead | Tractor movement without hauling freight (unpaid miles driven) | |

DOE | United States Department of Energy | |

EBITDA | Earnings Before Interest, Taxes, Depreciation and Amortization | |

EPS | Earnings Per Share | |

FASB | Financial Accounting Standards Board | |

GAAP | United States Generally Accepted Accounting Principles | |

IEL | Interstate Equipment Leasing, LLC (formerly Interstate Equipment Leasing, Inc.) | |

IPO | Initial Public Offering | |

LIBOR | London InterBank Offered Rate | |

Moyes Affiliates | Jerry Moyes, The Jerry and Vickie Moyes Family Trust dated December 11, 1987, and various Moyes children’s trusts | |

NASDAQ | National Association of Securities Dealers Automated Quotations | |

New Revolver | Revolving line of credit under the 2015 Agreement | |

New Term Loan A | The Company's first lien term loan A under the 2015 Agreement | |

NLRB | National Labor Relations Board | |

OID | Original Issue Discount | |

Old Revolver | Revolving line of credit under the 2014 Agreement | |

Old Term Loan A | The Company's first lien term loan A under the 2014 Agreement | |

Revenue xFSR | Revenue, Excluding Fuel Surcharge Revenue | |

SEC | United States Securities and Exchange Commission | |

Senior Notes | The Company's previously outstanding senior secured second priority notes | |

SRCII | Swift Receivables Company II, LLC | |

Swift Refrigerated | Swift Refrigerated Service, LLC (formerly Central Refrigerated Transportation, LLC) | |

The Purchasers | Unrelated financial entities in the 2013 RSA, which was entered into by SRCII | |

Term Loan B | The Company's first lien term loan B under the 2014 Agreement | |

TOFC | Trailer on Flat Car | |

VPF | Variable Prepaid Forward | |

3

PART I — FINANCIAL INFORMATION | ||||

ITEM 1. | FINANCIAL STATEMENTS |

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

September 30, 2015 | December 31, 2014 | ||||||

(In thousands, except share data) | |||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 53,706 | $ | 105,132 | |||

Restricted cash | 58,453 | 45,621 | |||||

Restricted investments, held to maturity, amortized cost | 23,134 | 24,510 | |||||

Accounts receivable, net | 448,323 | 478,999 | |||||

Equipment sales receivable | — | 288 | |||||

Income tax refund receivable | 17,369 | 18,455 | |||||

Inventories and supplies | 19,094 | 18,992 | |||||

Assets held for sale | 11,096 | 2,907 | |||||

Prepaid taxes, licenses, insurance and other | 53,724 | 51,441 | |||||

Deferred income taxes | 30,993 | 44,861 | |||||

Current portion of notes receivable | 9,523 | 9,202 | |||||

Total current assets | 725,415 | 800,408 | |||||

Property and equipment, at cost: | |||||||

Revenue and service equipment | 2,279,852 | 2,061,835 | |||||

Land | 127,865 | 122,835 | |||||

Facilities and improvements | 270,041 | 268,025 | |||||

Furniture and office equipment | 93,813 | 67,740 | |||||

Total property and equipment | 2,771,571 | 2,520,435 | |||||

Less: accumulated depreciation and amortization | 1,092,987 | 978,305 | |||||

Net property and equipment | 1,678,584 | 1,542,130 | |||||

Other assets | 29,597 | 41,855 | |||||

Intangible assets, net | 287,322 | 299,933 | |||||

Goodwill | 253,256 | 253,256 | |||||

Total assets | $ | 2,974,174 | $ | 2,937,582 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 136,551 | $ | 160,186 | |||

Accrued liabilities | 105,370 | 100,329 | |||||

Current portion of claims accruals | 79,103 | 81,251 | |||||

Current portion of long-term debt | 29,747 | 31,445 | |||||

Current portion of capital lease obligations | 63,223 | 42,902 | |||||

Fair value of interest rate swaps | — | 6,109 | |||||

Current portion of accounts receivable securitization | 250,000 | — | |||||

Total current liabilities | 663,994 | 422,222 | |||||

Revolving line of credit | 200,000 | 57,000 | |||||

Long-term debt, less current portion | 652,498 | 871,615 | |||||

Capital lease obligations, less current portion | 232,398 | 158,104 | |||||

Claims accruals, less current portion | 151,980 | 143,693 | |||||

Deferred income taxes | 460,504 | 480,640 | |||||

Accounts receivable securitization, less current portion | — | 334,000 | |||||

Other liabilities | 530 | 14 | |||||

Total liabilities | 2,361,904 | 2,467,288 | |||||

Commitments and Contingencies (Notes 8 and 9) | |||||||

Stockholders’ equity: | |||||||

Preferred stock, par value $0.01 per share; Authorized 10,000,000 shares; none issued | — | — | |||||

Class A common stock, par value $0.01 per share; Authorized 500,000,000 shares; 91,943,073 and 91,103,643 shares issued and outstanding as of September 30, 2015 and December 31, 2014, respectively | 919 | 911 | |||||

Class B common stock, par value $0.01 per share; Authorized 250,000,000 shares; 50,991,938 shares issued and outstanding as of September 30, 2015 and December 31, 2014 | 510 | 510 | |||||

Additional paid-in capital | 795,600 | 781,124 | |||||

Accumulated deficit | (184,942 | ) | (310,017 | ) | |||

Accumulated other comprehensive income (loss) | 81 | (2,336 | ) | ||||

Noncontrolling interest | 102 | 102 | |||||

Total stockholders’ equity | 612,270 | 470,294 | |||||

Total liabilities and stockholders’ equity | $ | 2,974,174 | $ | 2,937,582 | |||

See accompanying notes to consolidated financial statements.

4

CONSOLIDATED INCOME STATEMENTS

(UNAUDITED)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(In thousands, except per share data) | |||||||||||||||

Operating revenue: | |||||||||||||||

Revenue, excluding fuel surcharge revenue | $ | 954,974 | $ | 881,829 | $ | 2,785,737 | $ | 2,575,165 | |||||||

Fuel surcharge revenue | 109,999 | 193,051 | 353,784 | 584,059 | |||||||||||

Operating revenue | 1,064,973 | 1,074,880 | 3,139,521 | 3,159,224 | |||||||||||

Operating expenses: | |||||||||||||||

Salaries, wages and employee benefits | 283,767 | 240,005 | 821,747 | 707,464 | |||||||||||

Operating supplies and expenses | 102,719 | 88,459 | 288,070 | 253,361 | |||||||||||

Fuel | 103,023 | 149,099 | 326,598 | 458,798 | |||||||||||

Purchased transportation | 299,866 | 328,112 | 883,354 | 987,530 | |||||||||||

Rental expense | 59,088 | 59,655 | 180,909 | 167,509 | |||||||||||

Insurance and claims | 52,877 | 37,673 | 139,390 | 113,442 | |||||||||||

Depreciation and amortization of property and equipment | 66,852 | 54,369 | 184,194 | 165,335 | |||||||||||

Amortization of intangibles | 4,204 | 4,204 | 12,611 | 12,611 | |||||||||||

Impairments | — | 2,308 | — | 2,308 | |||||||||||

Gain on disposal of property and equipment | (9,825 | ) | (11,628 | ) | (23,987 | ) | (23,099 | ) | |||||||

Communication and utilities | 8,236 | 7,321 | 23,134 | 22,207 | |||||||||||

Operating taxes and licenses | 19,245 | 17,892 | 55,104 | 54,155 | |||||||||||

Total operating expenses | 990,052 | 977,469 | 2,891,124 | 2,921,621 | |||||||||||

Operating income | 74,921 | 97,411 | 248,397 | 237,603 | |||||||||||

Other expenses (income): | |||||||||||||||

Interest expense | 9,130 | 20,372 | 29,627 | 65,050 | |||||||||||

Derivative interest expense | 68 | 1,756 | 3,972 | 5,027 | |||||||||||

Interest income | (647 | ) | (777 | ) | (1,825 | ) | (2,235 | ) | |||||||

Loss on debt extinguishment | 9,567 | 2,854 | 9,567 | 12,757 | |||||||||||

Non-cash impairments of non-operating assets | — | — | 1,480 | — | |||||||||||

Legal settlement | — | — | 6,000 | — | |||||||||||

Other | (752 | ) | (842 | ) | (2,341 | ) | (2,416 | ) | |||||||

Total other expenses (income), net | 17,366 | 23,363 | 46,480 | 78,183 | |||||||||||

Income before income taxes | 57,555 | 74,048 | 201,917 | 159,420 | |||||||||||

Income tax expense | 21,274 | 23,890 | 76,842 | 56,759 | |||||||||||

Net income | $ | 36,281 | $ | 50,158 | $ | 125,075 | $ | 102,661 | |||||||

Basic earnings per share | $ | 0.25 | $ | 0.35 | $ | 0.88 | $ | 0.73 | |||||||

Diluted earnings per share | $ | 0.25 | $ | 0.35 | $ | 0.87 | $ | 0.72 | |||||||

Shares used in per share calculations: | |||||||||||||||

Basic | 142,801 | 141,557 | 142,535 | 141,282 | |||||||||||

Diluted | 144,132 | 143,322 | 144,238 | 143,338 | |||||||||||

See accompanying notes to consolidated financial statements.

5

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(UNAUDITED)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(In thousands) | |||||||||||||||

Net income | $ | 36,281 | $ | 50,158 | $ | 125,075 | $ | 102,661 | |||||||

Accumulated losses on derivatives reclassified to derivative interest expense | 69 | 1,642 | 3,886 | 4,438 | |||||||||||

Other comprehensive income before income taxes | 69 | 1,642 | 3,886 | 4,438 | |||||||||||

Income tax effect of items within other comprehensive income | — | (633 | ) | (1,469 | ) | (1,710 | ) | ||||||||

Other comprehensive income, net of income taxes | 69 | 1,009 | 2,417 | 2,728 | |||||||||||

Total comprehensive income | $ | 36,350 | $ | 51,167 | $ | 127,492 | $ | 105,389 | |||||||

See accompanying notes to consolidated financial statements.

6

CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

(UNAUDITED)

Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Accumulated Deficit | Accumulated Other Comprehensive (Loss) Income | Noncontrolling Interest | Total Stockholders’ Equity | ||||||||||||||||||||||||||||

Shares | Par Value | Shares | Par Value | |||||||||||||||||||||||||||||||

(In thousands, except per share data) | ||||||||||||||||||||||||||||||||||

Balances, December 31, 2014 | 91,103,643 | $ | 911 | 50,991,938 | $ | 510 | $ | 781,124 | $ | (310,017 | ) | $ | (2,336 | ) | $ | 102 | $ | 470,294 | ||||||||||||||||

Common stock issued under stock plans | 802,731 | 8 | 6,771 | 6,779 | ||||||||||||||||||||||||||||||

Stock-based compensation expense | 4,618 | 4,618 | ||||||||||||||||||||||||||||||||

Excess tax benefits from stock-based compensation | 2,200 | 2,200 | ||||||||||||||||||||||||||||||||

Shares issued under employee stock purchase plan | 36,699 | — | 887 | 887 | ||||||||||||||||||||||||||||||

Net income | 125,075 | 125,075 | ||||||||||||||||||||||||||||||||

Other comprehensive income, net of income taxes | 2,417 | 2,417 | ||||||||||||||||||||||||||||||||

Balances, September 30, 2015 | 91,943,073 | $ | 919 | 50,991,938 | $ | 510 | $ | 795,600 | $ | (184,942 | ) | $ | 81 | $ | 102 | $ | 612,270 | |||||||||||||||||

See accompanying notes to consolidated financial statements.

7

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

Nine Months Ended September 30, | |||||||

2015 | 2014 | ||||||

(In thousands) | |||||||

Cash flows from operating activities: | |||||||

Net income | $ | 125,075 | $ | 102,661 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization of property, equipment and intangibles | 196,805 | 177,946 | |||||

Amortization of debt issuance costs, original issue discount, and losses on terminated swaps | 5,574 | 7,794 | |||||

Gain on disposal of property and equipment less write-off of totaled tractors | (21,974 | ) | (21,784 | ) | |||

Impairments | 1,480 | 2,308 | |||||

Deferred income taxes | (8,106 | ) | (33,120 | ) | |||

Provision for losses on accounts receivable | 5,348 | 2,041 | |||||

Non-cash loss on debt extinguishment and write-offs of deferred financing costs and original issue discount | 9,567 | 12,757 | |||||

Non-cash equity compensation | 4,618 | 3,892 | |||||

Excess tax benefits from stock-based compensation | (2,200 | ) | (2,029 | ) | |||

Income effect of mark-to-market adjustment of interest rate swaps | 87 | (74 | ) | ||||

Increase (decrease) in cash resulting from changes in: | |||||||

Accounts receivable | 25,328 | (37,793 | ) | ||||

Inventories and supplies | (102 | ) | (2,307 | ) | |||

Prepaid expenses and other current assets | (1,197 | ) | 23,711 | ||||

Other assets | 6,583 | 6,014 | |||||

Accounts payable, accrued and other liabilities | 10,336 | 50,796 | |||||

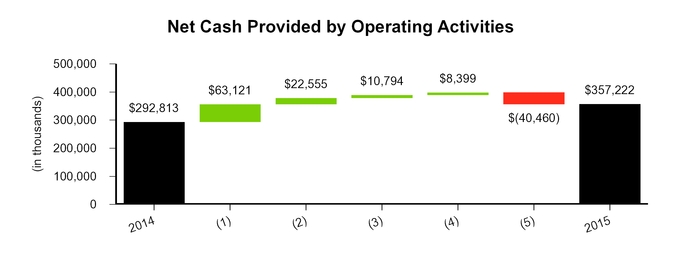

Net cash provided by operating activities | 357,222 | 292,813 | |||||

Cash flows from investing activities: | |||||||

Increase in restricted cash | (12,832 | ) | (678 | ) | |||

Proceeds from maturities of investments | 23,965 | 25,523 | |||||

Purchases of investments | (22,710 | ) | (25,159 | ) | |||

Proceeds from sale of property and equipment | 76,545 | 116,672 | |||||

Capital expenditures | (260,858 | ) | (211,113 | ) | |||

Payments received on notes receivable | 3,137 | 3,759 | |||||

Expenditures on assets held for sale | (19,777 | ) | (2,900 | ) | |||

Payments received on assets held for sale | 8,019 | 20,089 | |||||

Payments received on equipment sale receivables | 293 | 368 | |||||

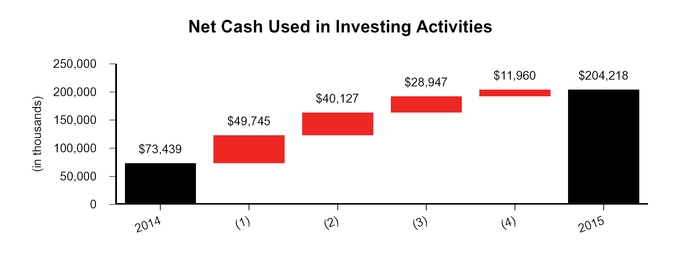

Net cash used in investing activities | (204,218 | ) | (73,439 | ) | |||

Cash flows from financing activities: | |||||||

Repayment of long-term debt and capital leases | (954,561 | ) | (772,088 | ) | |||

Proceeds from long-term debt | 684,504 | 450,000 | |||||

Net borrowings on revolving line of credit | 143,000 | 65,000 | |||||

Borrowings under accounts receivable securitization | 65,000 | 100,000 | |||||

Repayment of accounts receivable securitization | (149,000 | ) | (49,000 | ) | |||

Payment of deferred loan costs | (3,240 | ) | (11,784 | ) | |||

Proceeds from common stock issued | 7,667 | 7,587 | |||||

Excess tax benefits from stock-based compensation | 2,200 | 2,029 | |||||

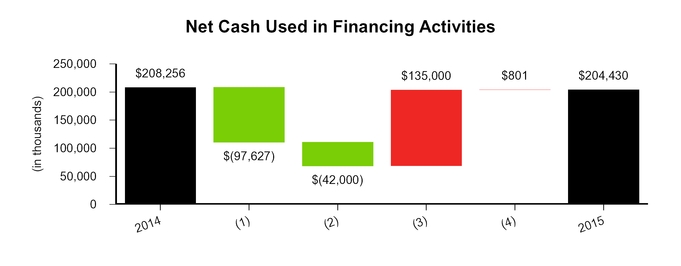

Net cash used in financing activities | (204,430 | ) | (208,256 | ) | |||

Net (decrease) increase in cash and cash equivalents | (51,426 | ) | 11,118 | ||||

Cash and cash equivalents at beginning of period | 105,132 | 59,178 | |||||

Cash and cash equivalents at end of period | $ | 53,706 | $ | 70,296 | |||

See accompanying notes to consolidated financial statements.

8

CONSOLIDATED STATEMENTS OF CASH FLOWS — CONTINUED

(UNAUDITED)

Nine Months Ended September 30, | |||||||

2015 | 2014 | ||||||

(In thousands) | |||||||

Supplemental disclosures of cash flow information: | |||||||

Cash paid during the period for: | |||||||

Interest | $ | 37,254 | $ | 59,809 | |||

Income taxes | 77,335 | 59,501 | |||||

Non-cash investing activities: | |||||||

Equipment purchase accrual | $ | 11,801 | $ | 40,379 | |||

Notes receivable from sale of assets | 5,618 | 4,524 | |||||

Equipment sales receivables | 5 | 878 | |||||

Non-cash financing activities: | |||||||

Capital lease additions | $ | 142,937 | $ | 64,351 | |||

Accrued deferred loan costs | 250 | 280 | |||||

See accompanying notes to consolidated financial statements.

9

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

Note 1 — Introduction and Basis of Presentation

Certain acronyms and terms used throughout this Quarterly Report on Form 10-Q are specific to our company, commonly used in our industry, or are otherwise frequently used throughout our document. Definitions for these acronyms and terms are provided in the "Glossary of Terms," available in the front of this document.

Description of Business

Swift is a transportation solutions provider, headquartered in Phoenix, Arizona. As of September 30, 2015, the Company's fleet of revenue equipment included 20,836 tractors (comprised of 15,824 company tractors and 5,012 owner-operator tractors), 64,528 trailers and 9,150 intermodal containers. The Company’s four reportable segments are Truckload, Dedicated, Swift Refrigerated (formally Central Refrigerated) and Intermodal.

Seasonality

In the truckload industry, results of operations generally show a seasonal pattern. As customers ramp up for the holiday season at year-end, the late third and fourth quarters have historically been the Company's strongest volume quarters. As customers reduce shipments after the winter holiday season, the first quarter has historically been a lower volume quarter than the other three quarters. In recent years, the macro consumer buying patterns combined with shippers’ supply chain management, which historically contributed to the fourth quarter "peak" season, continued to evolve. As a result, the Company's fourth quarter 2014, 2013 and 2012 volumes were more evenly disbursed throughout the quarter rather than peaking early in the quarter. In the eastern and mid-western United States, and to a lesser extent in the western United States, during the winter season the Company's equipment utilization typically declines and operating expenses generally increase, with fuel efficiency declining because of engine idling and severe weather sometimes creating higher accident frequency, increased claims, and more equipment repairs. Revenue may also be affected by holidays as a result of curtailed operations or vacation shutdowns, because the Company's revenue is directly related to available working days of shippers. From time to time, the Company also suffers short-term impacts from severe weather and similar events, such as tornadoes, hurricanes, blizzards, ice storms, floods, fires, earthquakes, and explosions that could add volatility to, or harm, the Company's results of operations.

Basis of Presentation

The consolidated financial statements and footnotes included in this Quarterly Report on Form 10-Q should be read in conjunction with the consolidated financial statements and footnotes included in the Company's Annual Report on Form 10-K for the year ended December 31, 2014. The consolidated financial statements include the accounts of Swift Transportation Company and its wholly-owned subsidiaries. In management's opinion, these consolidated financial statements were prepared in accordance with GAAP and include all adjustments necessary for the fair presentation of the periods presented.

Changes in Presentation

Beginning in 2015, the Company made the following changes in presentation:

• | Excess tax benefits from stock-based compensation are separately presented within "Net cash provided by operating activities" in the consolidated statements of cash flows. The prior period presentation has been retrospectively adjusted to reclassify the amount out of "Accounts payable, accrued and other liabilities" and into the new line item "Excess tax benefits from stock-based compensation." The change in presentation has no net impact on "Net cash provided by operating activities." |

• | Gross amounts of investment in securities activities are presented as "Proceeds from maturities of investments" and "Purchases of investments" in the consolidated statements of cash flows. The prior period presentation has been retrospectively adjusted to accommodate this gross presentation. The change in presentation has no net impact on "Net cash used in investing activities." |

• | "Operating revenue" in the consolidated income statements is disaggregated into the line items "Revenue, excluding fuel surcharge revenue" and "Fuel surcharge revenue." The change in presentation has no net impact on "Operating revenue." |

10

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Note 2 — Recently Issued Accounting Pronouncements

In August 2015, FASB issued ASU 2015-14, Deferral of the Effective Date, which amends ASC Topic 606, Revenue from Contracts with Customers. ASC Topic 606 was established by previously-issued ASU 2014-09. For public business entities, the amendments in ASU 2015-14 defer the effective date of ASU 2014-09 to annual reporting periods beginning after December 15, 2017. Early adoption of ASU 2014-09 is permitted. Management is currently evaluating the impact of adopting ASC Topic 606, as amended.

In July 2015, FASB issued ASU 2015-11, Simplifying the Measurement of Inventory, which amends ASC Topic 330, Inventory. The amendments in this ASU simplify subsequent measurement of inventory for all inventory measurement methods, except for last-in-first-out and retail inventory methods. Current guidance requires entities to measure inventory at the lower of cost or market. However, market could be the replacement cost, net realizable value, or net realizable value less an approximately normal profit margin. The new guidance requires entities to measure inventory at the lower of cost and net realizable value, instead of the previously issued guidance of lower of cost or market. FASB defines net realizable value as estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal and transportation. For public business entities, the amendments in this ASU are effective for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years. The amendments should be applied prospectively. Although early adoption is permitted, the Company expects to adopt this guidance at the beginning of 2017. However, due to the nature of the Company's inventory balances (spare parts, tires, fuel and supplies), inventory is predominantly stated at cost, which is consistently below net realizable value. As such, the amendments in this ASU are not expected to have a material impact on the Company's financial position or results of operations upon adoption.

In April 2015, FASB issued ASU 2015-03, Simplifying the Presentation of Debt Issuance Costs, which amends ASC Subtopic 835-30, Interest — Imputation of Interest. The amendments in this ASU simplify the presentation of debt issuance costs and align the presentation with debt discounts. Entities will be required to present debt issuance costs as a direct deduction from the face amount of the related note, rather than as a deferred charge. In August 2015, FASB issued ASU 2015-15, Presentation and Subsequent Measurement of Debt Issuance Costs Associated with Line-of-Credit Arrangements — Amendments to SEC Paragraphs Pursuant to Staff Announcement at June 18, 2015 EITF Meeting (SEC Update), which also amends ASC Subtopic 835-30, Interest — Imputation of Interest. The SEC determined that ASU 2015-03 (discussed above) did not address costs related to line-of-credit arrangements. The amendments in ASU 2015-15 clarify that entities may defer and present debt issuance costs as an asset, and subsequently amortize the deferred debt issuance costs ratably over the term of the line-of-credit arrangement, regardless of whether there are any outstanding borrowings on the line-of-credit arrangement. The amendments in these ASUs require retrospective application, with related disclosures for a change in accounting principle. Upon adoption, the Company will comply with these disclosure requirements by providing the nature and reason for the change, the transition method, a description of the adjusted prior period information and the effect of the change on the financial statement line items. For public business entities, the amendments in these ASUs will be effective for financial statements issued for fiscal years beginning after December 15, 2015, and the interim periods within those fiscal years. Early adoption is permitted; however, the Company expects to adopt this guidance at the beginning of 2016. Upon adoption, the amended guidance will affect Swift's classification of debt issuance costs, which are currently classified in "Other assets" in the consolidated balance sheets. In accordance with the amendments in ASU 2015-15, debt issuance costs associated with the our revolving line of credit will remain within "Other assets" in the consolidated balance sheets. All other debt issuance costs will be reclassified, in accordance with the amendments in ASU 2015-03. This reclassification of debt issuance costs will effectively decrease "Other assets" by approximately $2.5 million and correspondingly decrease the long-term debt balances by the same amount.

In February 2015, FASB issued ASU 2015-02, Amendments to the Consolidation Analysis, which amends ASC Topic 810, Consolidation, by changing the analysis that reporting entities are required to perform to determine whether certain types of legal entities should be consolidated. The amendments in this ASU focus on limited partnerships and similar legal entities (such as limited liability companies); however, all legal entities are subject to reevaluation under the revised consolidation model. The revised consolidation model modifies the evaluation of whether limited partnerships and similar legal entities are variable interest entities or voting interest entities, and eliminates the presumption that a general partner should consolidate a limited partnership. It also affects the consolidation analysis of reporting entities that are involved with variable interest entities, especially those that have fee arrangements and related-party relationships. The amendments in the ASU also affect certain investment funds. For public business entities, the amendments in this ASU are effective for fiscal years beginning after December 15, 2015, and the interim periods within those fiscal years. Early adoption is permitted. Entities may use a retrospective approach, or a modified retrospective approach by recording a cumulative-effect adjustment to equity as of the beginning of the year of adoption. The Company is currently evaluating the accounting, transition and disclosure requirements of the standard and cannot currently estimate the financial statement impact of adoption.

11

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Note 3 — Restricted Investments

September 30, 2015 | |||||||||||||||

Gross Unrealized | |||||||||||||||

Cost or Amortized Cost | Gains | Temporary Losses | Estimated Fair Value | ||||||||||||

United States corporate securities | $ | 16,664 | $ | 4 | $ | (2 | ) | $ | 16,666 | ||||||

Municipal bonds | 4,845 | 4 | (1 | ) | 4,848 | ||||||||||

Negotiable certificate of deposits | 1,625 | 1 | — | 1,626 | |||||||||||

Total restricted investments | $ | 23,134 | $ | 9 | $ | (3 | ) | $ | 23,140 | ||||||

December 31, 2014 | |||||||||||||||

Gross Unrealized | |||||||||||||||

Cost or Amortized Cost | Gains | Temporary Losses | Estimated Fair Value | ||||||||||||

United States corporate securities | $ | 20,892 | $ | 2 | $ | (10 | ) | $ | 20,884 | ||||||

Foreign corporate securities | 1,503 | — | — | 1,503 | |||||||||||

Negotiable certificate of deposits | 2,115 | — | — | 2,115 | |||||||||||

Total restricted investments | $ | 24,510 | $ | 2 | $ | (10 | ) | $ | 24,502 | ||||||

Refer to Note 11 for additional information regarding fair value measurements of restricted investments.

As of September 30, 2015, the contractual maturities of the restricted investments were one year or less. There were 14 securities and 24 securities that were in an unrealized loss position for less than twelve months as of September 30, 2015 and December 31, 2014, respectively. The Company did not recognize any impairment losses for the three or nine months ended September 30, 2015 or 2014.

Note 4 — Goodwill and Other Intangible Assets

September 30, 2015 | December 31, 2014 | ||||||

Customer Relationships: | |||||||

Gross carrying value | $ | 275,324 | $ | 275,324 | |||

Accumulated amortization | (169,039 | ) | (156,428 | ) | |||

Trade Name: | |||||||

Gross carrying value | 181,037 | 181,037 | |||||

Intangible assets, net | $ | 287,322 | $ | 299,933 | |||

The following table presents amortization of intangibles for the three and nine months ended September 30, 2015 and 2014, related to intangible assets recognized in conjunction with the 2007 Transactions and the intangible assets existing prior to the 2007 Transactions (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Amortization of intangible assets related to the 2007 Transactions | $ | 3,912 | $ | 3,912 | $ | 11,736 | $ | 11,736 | |||||||

Amortization related to intangible assets existing prior to the 2007 Transactions | 292 | 292 | 875 | 875 | |||||||||||

Amortization of intangibles | $ | 4,204 | $ | 4,204 | $ | 12,611 | $ | 12,611 | |||||||

12

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Note 5 — Accounts Receivable Securitization

In June 2013, SRCII entered into the 2013 RSA with the Purchasers to replace the Company's prior 2011 RSA, and to sell, on a revolving basis, undivided interests in the Company’s accounts receivable through the maturity of the facility in July 2016. Pursuant to the 2013 RSA, the Company’s receivable originator subsidiaries sell all of their eligible accounts receivable to SRCII, which in turn sells a variable percentage ownership interest in its accounts receivable to the Purchasers. On September 26, 2014, the Company exercised an accordion option, increasing the maximum borrowing capacity on the 2013 RSA from $325.0 million to $375.0 million. The Company entered into an amendment to the 2013 RSA, effective March 31, 2015, to clarify when the Company’s consent is required in conjunction with a Purchaser’s sale or assignment of any portion of its purchased interest in the receivables and to amend certain of the performance ratios to provide increased flexibility to the Company in managing its receivables.

The facility qualifies for treatment as a secured borrowing under ASC Topic 860, Transfers and Servicing. As such, outstanding amounts are classified as liabilities on the Company’s consolidated balance sheets in "Current portion of accounts receivable securitization" as of September 30, 2015 and "Accounts receivable securitization, less current portion" as of December 31, 2014.

As of September 30, 2015 and December 31, 2014, interest accrued on the aggregate principal balance at a rate of 0.8%. Program fees and unused commitment fees are recorded in interest expense in the Company's consolidated income statements. The Company incurred program fees of $0.8 million and $0.9 million, during the three months ended September 30, 2015 and 2014, respectively. The Company incurred program fees of $2.7 million and $2.5 million, during the nine months ended September 30, 2015 and 2014, respectively.

The 2013 RSA is subject to customary fees and contains various customary affirmative and negative covenants, representations and warranties, and default and termination provisions. Collections on the underlying receivables by the Company are held for the benefit of SRCII and the Purchasers in the facility and are unavailable to satisfy claims of the Company and its subsidiaries.

Note 6 — Debt and Financing

September 30, 2015 | December 31, 2014 | ||||||

2015 Agreement: New Term Loan A, due July 2020 | $ | 676,375 | $ | — | |||

2014 Agreement: Old Term Loan A, due June 2019 | — | 500,000 | |||||

2014 Agreement: Term Loan B, due June 2021, net of $920 OID | — | 396,080 | |||||

Other | 5,870 | 6,980 | |||||

Long-term debt | 682,245 | 903,060 | |||||

Less: current portion of long-term debt | (29,747 | ) | (31,445 | ) | |||

Long-term debt, less current portion | $ | 652,498 | $ | 871,615 | |||

September 30, 2015 | December 31, 2014 | ||||||

Long-term debt | 682,245 | 903,060 | |||||

Revolving line of credit (1) | 200,000 | $ | 57,000 | ||||

Long-term debt, including revolving line of credit | $ | 882,245 | $ | 960,060 | |||

____________

(1) | The Company had outstanding letters of credit, primarily related to workers' compensation and self-insurance liabilities of $95.5 million under the New Revolver at September 30, 2015 and $100.3 million under the Old Revolver at December 31, 2014. |

Credit Agreement

On July 27, 2015, the Company entered into the 2015 Agreement, which replaced the 2014 Agreement, including the $450.0 million Old Revolver (zero outstanding at closing), $500.0 million Old Term Loan A ($485.0 million outstanding at closing), and a $400.0 million Term Loan B ($395.0 million outstanding at closing). The 2015 Agreement includes a New Revolver and a New Term Loan A. Upon closing, the $680.0 million in proceeds from the New Term Loan A, a $200.0 million draw on the New Revolver and $4.9 million cash on hand were used to pay off the then-outstanding balances of the Old Term Loan A and Term Loan B, including accrued interest and fees under the 2014 Agreement, as well as certain transactional fees associated with the 2015 Agreement.

13

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

The following table presents the key terms of the 2015 Agreement (dollars in thousands):

Description | New Term Loan A | New Revolver (2) | ||

Maximum borrowing capacity | $680,000 | $600,000 | ||

Final maturity date | July 27, 2020 | July 27, 2020 | ||

Interest rate base | LIBOR | LIBOR | ||

LIBOR floor | —% | —% | ||

Interest rate minimum margin (1) | 1.50% | 1.50% | ||

Interest rate maximum margin (1) | 2.25% | 2.25% | ||

Minimum principal payment — amount (3) | $3,625 | $— | ||

Minimum principal payment — frequency | Quarterly | Once | ||

Minimum principal payment — commencement date (3) | September 30, 2015 | July 27, 2020 | ||

____________

(1) | The interest rate margin for the New Term Loan A and New Revolver is 1.75%, which is lower than the 2014 Agreement's Term Loan B. After December 31, 2015, the interest rate margin for the New Term Loan A and New Revolver will be based on the Company's consolidated leverage ratio. As of September 30, 2015, interest accrued at 1.95% on the New Term Loan A and 1.95% on the New Revolver. |

(2) | The commitment fee for the unused portion of the New Revolver is based on the Company's consolidated leverage ratio, and ranges from 0.25% to 0.35%. As of September 30, 2015, commitment fees on the unused portion of the New Revolver accrued at 0.25% and outstanding letter of credit fees accrued at 1.75%. |

(3) | Commencing in December 2015, the minimum quarterly payment amount on the New Term Loan A is $6.6 million, then increases to $12.3 million in March 2017, at which it remains until final maturity. |

Similar to the 2014 Agreement, the New Revolver and New Term Loan A of the 2015 Agreement contain certain financial covenants with respect to a maximum leverage ratio and a minimum consolidated interest coverage ratio. The 2015 Agreement provides flexibility regarding the use of proceeds from asset sales, payment of dividends, stock buybacks, and equipment financing. In addition to the financial covenants, the 2015 Agreement includes customary events of default, including a change in control default and certain affirmative and negative covenants, including, but not limited to, restrictions, subject to certain exceptions, on incremental indebtedness, asset sales, certain restricted payments (including dividends), certain incremental investments or advances, transactions with affiliates, engaging in additional business activities, and prepayments of certain other indebtedness.

Borrowings under the credit facility are secured by substantially all of the assets of the Company and are guaranteed by Swift Transportation Company, IEL, Swift Refrigerated Transportation, LLC and its subsidiaries, Swift Transportation Co., LLC and its domestic subsidiaries other than its captive insurance subsidiaries, driver academy subsidiary, and its bankruptcy-remote special purpose subsidiary.

Deferred Loan Costs and Loss on Debt Extinguishment

Deferred loan costs, reported in "Other assets" in the Company's consolidated balance sheets, were $3.7 million and $10.4 million as of September 30, 2015 and December 31, 2014, respectively.

The Company incurred $9.6 million in losses on debt extinguishment during the three and nine months ended September 30, 2015, reflecting the write-off of the unamortized OID and deferred financing fees related to the 2014 Agreement, which was replaced by the 2015 Agreement. During the three and nine months ended September 30, 2014, the Company incurred $2.9 million and $12.8 million in losses on debt extinguishment, respectively. During the nine months ended September 30, 2014, $5.2 million of the loss on debt extinguishment related to the replacement of the 2013 Agreement with the 2014 Agreement, and $7.6 million related to the Company's repurchase of its Senior Notes.

14

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Note 7 — Leases

Capital — The Company’s capital leases are typically structured with balloon payments at the end of the lease term equal to the residual value the Company is contracted to receive from certain equipment manufacturers upon sale or trade back to the manufacturers. If the Company does not receive proceeds of the contracted residual value from the manufacturer, the Company is still obligated to make the balloon payment at the end of the lease term. Certain leases contain renewal or fixed price purchase options. The present value of obligations under capital leases is included under "Current portion of capital lease obligations" and "Capital lease obligations, less current portion" in the consolidated balance sheets. As of September 30, 2015, the leases were collateralized by revenue equipment with a cost of $366.9 million and accumulated amortization of $83.6 million. As of December 31, 2014, the leases were collateralized by revenue equipment with a cost of $270.6 million and accumulated amortization of $68.0 million. Amortization of the equipment under capital leases is included in "Depreciation and amortization of property and equipment" in the Company’s consolidated income statements.

Operating — Rent expense related to operating leases was $59.1 million for the three months ended September 30, 2015 and $59.7 million for the three months ended September 30, 2014. Rent expense related to operating leases was $180.9 million for the nine months ended September 30, 2015 and $167.5 million for the nine months ended September 30, 2014.

Note 8 — Purchase Commitments

As of September 30, 2015, the Company had commitments outstanding to acquire revenue equipment for the remainder of 2015 of approximately $144.1 million ($108.3 million of which were tractor commitments) and in 2016 to 2017 for approximately $659.3 million ($571.8 million of which were tractor commitments). The Company has the option to cancel tractor purchase orders with 60 to 90 days' notice prior to the scheduled production, although the notice period has lapsed for 9.1% of the tractor commitments outstanding as of September 30, 2015. These purchases are expected to be financed by the combination of operating leases, capital leases, debt, proceeds from sales of existing equipment, and cash flows from operations.

On October 27, 2015, management announced that the Company will not further grow its tractor fleet in the remainder of 2015 and in 2016. As such, the Company canceled the purchase and trade of approximately 450 tractors. The impact of these cancellations is included in the outstanding purchase commitment amounts, discussed above. New tractors received under the remaining purchase commitments in 2015 and 2016 are intended to replace older tractors in our current fleet.

As of September 30, 2015, the Company had outstanding purchase commitments of approximately $1.1 million for facilities and non-revenue equipment. Factors such as costs and opportunities for future terminal expansions may change the amount of such expenditures.

Note 9 — Contingencies and Legal Proceedings

For certain cases described below, management is unable to provide a meaningful estimate of the possible loss or range of loss because, among other reasons, (1) the proceedings are in various stages; (2) damages have not been sought; (3) damages are unsupported and/or exaggerated; (4) there is uncertainty as to the outcome of pending appeals; and/or (5) there are significant factual issues to be resolved. For these cases, however, management does not believe, based on currently available information, that the outcomes of these proceedings will have a material adverse effect on our financial condition, though the outcomes could be material to our operating results for any particular period, depending, in part, upon the operating results for such period.

15

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Arizona Owner-operator Class Action Litigation

On January 30, 2004, a class action lawsuit was filed by Leonel Garza on behalf of himself and all similarly-situated persons against Swift Transportation: Garza v. Swift Transportation Co., Inc., Case No. CV7-472 (the "Garza Complaint"). The putative class originally involved certain owner-operators who contracted with the Company under a 2001 Contractor Agreement that was in place for one year. The putative class is alleging that the Company should have reimbursed owner-operators for actual miles driven rather than the contracted and industry standard remuneration based upon dispatched miles. The trial court denied plaintiff’s petition for class certification. The plaintiff appealed and on August 6, 2008, the Arizona Court of Appeals issued an unpublished Memorandum Decision reversing the trial court’s denial of class certification and remanding the case back to the trial court. On November 14, 2008, the Company filed a petition for review to the Arizona Supreme Court regarding the issue of class certification as a consequence of the denial of the Motion for Reconsideration by the Court of Appeals. On March 17, 2009, the Arizona Supreme Court granted the Company’s petition for review, and on July 31, 2009, the Arizona Supreme Court vacated the decision of the Court of Appeals, opining that the Court of Appeals lacked automatic appellate jurisdiction to reverse the trial court’s original denial of class certification and remanded the matter back to the trial court for further evaluation and determination. Thereafter, the plaintiff renewed the motion for class certification and expanded it to include all persons who were employed by Swift as employee drivers or who contracted with Swift as owner-operators on or after January 30, 1998, in each case who were compensated by reference to miles driven. On November 4, 2010, the Maricopa County trial court entered an order certifying a class of owner-operators and expanding the class to include employees. Upon certification, the Company filed a motion to compel arbitration, as well as filing numerous motions in the trial court urging dismissal on several other grounds including, but not limited to the lack of an employee as a class representative, and because the named owner-operator class representative only contracted with the Company for a three-month period under a one-year contract that no longer exists. In addition to these trial court motions, the Company also filed a petition for special action with the Arizona Court of Appeals, arguing that the trial court erred in certifying the class because the trial court relied upon the Court of Appeals ruling that was previously overturned by the Arizona Supreme Court. On April 7, 2011, the Arizona Court of Appeals declined jurisdiction to hear this petition for special action and the Company filed a petition for review to the Arizona Supreme Court. On August 31, 2011, the Arizona Supreme Court declined to review the decision of the Arizona Court of Appeals. In April 2012, the trial court issued the following rulings with respect to certain motions filed by Swift: (1) denied Swift’s motion to compel arbitration; (2) denied Swift’s request to decertify the class; (3) granted Swift’s motion that there is no breach of contract; and (4) granted Swift’s motion to limit class size based on statute of limitations. On November 13, 2014, the court denied plaintiff's motion to add new class representatives for the employee class and therefore the employee class remains without a plaintiff class representative. On March 18, 2015, the court denied Swift's two motions for summary judgment (1) to dismiss any claims related to the employee class since there is no class representative; and (2) to dismiss plaintiff's claim of breach of a duty of good faith and fair dealing. On July 14, 2015, the court granted Swift's motion to decertify the entire class. The Company intends to defend against any appeal pursued by the plaintiff.

Ninth Circuit Owner-operator Misclassification Class Action Litigation

On December 22, 2009, a class action lawsuit was filed against Swift Transportation and IEL: Virginia VanDusen, John Doe 1 and Joseph Sheer, individually and on behalf of all other similarly-situated persons v. Swift Transportation Co., Inc., Interstate Equipment Leasing, Inc., Jerry Moyes, and Chad Killebrew, Case No. 9-CIV-10376 filed in the United States District Court for the Southern District of New York (the "Sheer Complaint"). The putative class involves owner-operators alleging that Swift Transportation misclassified owner-operators as independent contractors in violation of the federal Fair Labor Standards Act ("FLSA"), and various New York and California state laws and that such owner-operators should be considered employees. The lawsuit also raises certain related issues with respect to the lease agreements that certain owner-operators have entered into with IEL. At present, in addition to the named plaintiffs, approximately 450 other current or former owner-operators have joined this lawsuit. Upon Swift’s motion, the matter was transferred from the United States District Court for the Southern District of New York to the United States District Court in Arizona. On May 10, 2010, the plaintiffs filed a motion to conditionally certify an FLSA collective action and authorize notice to the potential class members. On September 23, 2010, plaintiffs filed a motion for a preliminary injunction seeking to enjoin Swift and IEL from collecting payments from plaintiffs who are in default under their lease agreements and related relief. On September 30, 2010, the district court granted Swift’s motion to compel arbitration and ordered that the class action be stayed, pending the outcome of arbitration. The district court further denied plaintiff’s motion for preliminary injunction and motion for conditional class certification. The district court also denied plaintiff’s request to arbitrate the matter as a class.

The plaintiff filed a petition for a writ of mandamus to the Ninth Circuit Court of Appeals asking that the district court’s September 30, 2010 order be vacated. On July 27, 2011, the Ninth Circuit Court of Appeals denied the plaintiff’s petition for writ of mandamus and thereafter the district court denied plaintiff’s motion for reconsideration and certified its September 30, 2010 order. The plaintiffs filed an interlocutory appeal to the Ninth Circuit Court of Appeals to overturn the district court’s September 30, 2010 order to compel arbitration, alleging that the agreement to arbitrate is exempt from arbitration under Section 1 of the Federal Arbitration Act ("FAA") because the class of plaintiffs allegedly consists of employees exempt from arbitration agreements. On November 6, 2013, the Ninth Circuit Court of Appeals reversed and remanded, stating its prior published decision, "expressly held that a district court must determine whether an agreement for arbitration is exempt from arbitration under Section 1 of the FAA as a threshold matter." As a consequence of this determination by the Ninth Circuit Court of Appeals being different from a decision of the Eighth Circuit Court of Appeals on a similar issue, on February 4, 2014, the Company filed a petition for writ of certiorari to the United States Supreme

16

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Court to address whether the district court or arbitrator should determine whether the contract is an employment contract exempt from Section 1 of the Federal Arbitration Act. On June 16, 2014, the United States Supreme Court denied the Company’s petition for writ of certiorari. The matter remains pending in the district court and is currently in discovery. The Company has filed a writ of mandamus and appeal from the district court's order that effectively denies the Company's motion to compel arbitration. The Ninth Circuit has set oral argument on the matter for November 16, 2015. The Company intends to vigorously defend against any proceedings. The final disposition of this case and the impact of such final disposition cannot be determined at this time.

California Wage, Meal and Rest Employee Class Actions

On March 22, 2010, a class action lawsuit was filed by John Burnell, individually and on behalf of all other similarly-situated persons against Swift Transportation: John Burnell and all others similarly-situated v. Swift Transportation Co., Inc., Case No. CIVDS 1004377 filed in the Superior Court of the State of California, for the County of San Bernardino (the "Burnell Complaint"). On September 3, 2010, upon motion by Swift, the matter was removed to the United States District Court for the Central District of California, Case No. EDCV10-809-VAP. The putative class includes drivers who worked for Swift during the four years preceding the date of filing alleging that Swift failed to pay the California minimum wage, failed to provide proper meal and rest periods and failed to timely pay wages upon separation from employment. On April 9, 2013, the Company filed a motion for judgment on the pleadings, requesting dismissal of plaintiff's claims related to alleged meal and rest break violations under the California Labor Code alleging that such claims are preempted by the Federal Aviation Administration Authorization Act. On May 29, 2013, the United States District Court for the Central District of California granted the Company's motion for judgment on the pleadings and dismissed plaintiff's claims that are based on alleged violations of meal and rest periods set forth in the California Labor Code. Plaintiff appealed to the Ninth Circuit Court. Based on the Circuit Court's holding in a different case, it remanded the plaintiff's meal and rest break claims to the district court. The district court has not yet addressed the merits of those claims. Minimum wage claims (specifically that pay-per-mile fails to compensate drivers for non-driving-related services), timeliness of such pay and the issue of class certification remain pending.

On April 5, 2012, the Company was served with an additional class action complaint, alleging facts similar to those as set forth in the Burnell Complaint: James R. Rudsell, on behalf of himself and all others similarly-situated v. Swift Transportation Co. of Arizona, LLC and Swift Transportation Company, Case No. CIVDS 1200255, in the Superior Court of California for the County of San Bernardino (the "Rudsell Complaint"). The Rudsell Complaint was stayed, pending a resolution in the Burnell Complaint.

On September 25, 2014, a class action lawsuit was filed by Lawrence Peck on behalf of himself and all other similarly-situated persons against Swift Transportation: Peck v. Swift Transportation Co. of Arizona, LLC in the Superior Court of California, County of Riverside (the "Peck Complaint"). The putative class includes current and former non-exempt employee truck drivers who performed services in California within the four-year statutory period, alleging that Swift failed to pay for all hours worked (specifically that pay-per-mile fails to compensate drivers for non-driving related services), failed to pay overtime, failed to properly reimburse work-related expenses, failed to timely pay wages and failed to provide accurate wage statements.

Peck is currently stayed, pending a resolution in the Burnell and Rudsell cases, based on the similarity of the Peck claims to the claims in those earlier filed cases.

On February 27, 2015, Sadashiv Mares filed a complaint in the California Superior Court for the County of Alameda alleging five Causes of Action arising under California state law on behalf of himself and a putative class against Swift Transportation Co. of Arizona, LLC (the "Mares Complaint"). On June 19, 2015, Swift filed a demurrer because plaintiff’s complaint failed to state a claim under Cal. Code Civ. Proc. § 430.10(e) and was uncertain, ambiguous and unintelligible under Cal. Code Civ. Proc. § 430.10(f). On July 13, 2015, the case was removed to federal court under the Class Action Fairness Act. The case remains at the pleading stage. Management believes the case involves similar claims to those alleged in the Burnell, Rudsell and Peck Complaints.

On or about April 15, 2015, a complaint was filed in the Superior Court of the State of California in and for the County of San Bernardino: Rafael McKinsty et al. v. Swift Transportation Co. of Arizona, LLC, et al., Case No. CIVDS 1505599 (the "McKinsty Complaint"). The McKinsty Complaint, a purported class action, alleges violation of California rest break laws and is similar to the Burnell, Rudsell, Peck and Mares Complaints. The case was removed to federal court and was related to the Burnell, Rudsell and Peck actions.

The issue of class certification must first be resolved before the court will address the merits of these cases, and the Company retains all of its defenses against liability and damages, pending a determination of class certification. The Company intends to vigorously defend against certification of the class in all of these matters, as well as the merits of these matters, should the classes be certified. The final disposition of these cases and the impact of such final dispositions of these cases cannot be determined at this time.

National Customer Service Misclassification Class Action Litigation

On April 15, 2014, a collective and class action was filed by a former Swift Customer Service Representative level four ("CSR IV"), Lorraine Flores, individually and on behalf of herself and all similarly-situated persons against Swift Transportation Co. of Arizona, LLC in the United States District Court for the Central District of California, Case No. CV 14-2900-AB(Ex) (the "Flores Complaint").

17

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

The operative complaint alleges failure to pay overtime under the FLSA, as well as California state law claims including failure to pay timely final wages, failure to provide meal and rest periods, failure to pay overtime, and violation of the unfair competition law (four-year statute of limitations).

On October 3, 2014, the California District Court compelled, to individual arbitration, CSR IVs who signed Arbitration Agreements. On October 30, 2014, Flores’ overtime claim under the FLSA was conditionally certified and notice was issued to all CSR IVs. Thirty-three CSR IVs who signed valid Arbitration Agreements filed individual arbitrations with the American Arbitration Association ("AAA"). Approximately thirty-two CSR IVs who did not sign Arbitration Agreements opted into the collective action.

Pursuant to a mediation held on September 11, 2015, the parties have agreed to a global settlement of both the collective action and all of the individual arbitrations. The $5.1 million settlement and related costs are included in "Operating supplies and expenses" in the Company's consolidated income statements for the three and nine months ended September 30, 2015.

Washington Overtime Class Action

On September 9, 2011, a class action lawsuit was filed by Troy Slack and several other drivers on behalf of themselves, and all similarly-situated persons, against Swift Transportation: Troy Slack, et al. v. Swift Transportation Co. of Arizona, LLC and Swift Transportation Corporation in the State Court of Washington, Pierce County (the "Slack Complaint"). The Slack Complaint was removed to federal court on October 12, 2011, case number 11-2-114380. The putative class includes all current and former Washington state-based employee drivers during the three-year statutory period prior to the filing of the lawsuit, and through the present, and alleges that they were not paid minimum wage and overtime in accordance with Washington state law and that they suffered unlawful deductions from wages. On November 23, 2013, the court entered an order on plaintiffs' motion to certify the class. The court only certified the class as it pertains to "dedicated" drivers and did not certify any other class, including any class related to over-the-road drivers. The parties dispute the definition of "dedicated" as used by the court and a class notice has not yet been issued. On September 2, 2015, new counsel was appointed for Plaintiffs. As a result of substitution of counsel, the court has extended all existing dates by ten months. The matter is now anticipated to move into discovery. The Company retains all of its defenses against liability and damages. The Company intends to vigorously defend against the merits of these claims and to challenge certification. The final disposition of this case and the impact of such final disposition of this case cannot be determined at this time.

Indiana Fair Credit Reporting Act Class Action Litigation

On March 18, 2015, a class action lawsuit was filed by Melvin Banks, individually and on behalf of all other similarly-situated persons against Central Refrigerated Service, Inc. in the United States District Court for the Northern District of Indiana, Case No. 2:15-cv-00105. The complaint alleges that Central violated the Fair Credit Reporting Act by failing to provide job applicants with adverse action notices and copies of their consumer reports and rights. At this time, the size of the potential class is unknown. The matter is now anticipated to move into discovery. The Company retains all of its defenses against liability and damages. The Company intends to vigorously defend against the merits of these claims and to challenge certification. The final disposition of this case and the impact of such final disposition of this case cannot be determined at this time.

Utah Collective and Individual Arbitration

On June 1, 2012, Gabriel Cilluffo, Kevin Shire and Bryan Ratterree filed a putative class and collective action lawsuit against Central Refrigerated Service, Inc., Central Leasing, Inc., Jon Isaacson, and Jerry Moyes (collectively referred to herein as the "Central Parties"), Case No. ED CV 12-00886 in the United States District Court for the Central District of California. Through this action, the plaintiffs alleged that the Central Parties misclassified owner-operator drivers as independent contractors and were therefore liable to these drivers for minimum wages and other employee benefits under the FLSA. The complaint also alleged a federal forced labor claim under 18 U.S.C. § 1589 and 1595, as well as fraud and other state-law claims.

Pursuant to the plaintiffs' owner-operator agreements, the district court issued an Order compelling arbitration and directed that the plaintiffs' causes of action under the FLSA should proceed to collective arbitration, while their forced labor, fraud and state law claims would proceed as separate individual arbitrations. A collective arbitration was subsequently initiated with the American Arbitration Association ("AAA"). Notice of the collective arbitration was sent to more than 3,000 owner-operators who worked for Central Refrigerated Service, Inc. and leased a vehicle from Central Leasing, Inc. on or after June 1, 2009. The parties are currently conducting discovery. No trial date has been set by the arbitrator.

In addition to the collective arbitration that is pending before the AAA, the three named plaintiffs, along with approximately 400 other owner-operators, have initiated a series of individual, bilateral proceedings against the Central Parties with the AAA. Discovery is commencing in these individual cases, which are pending before approximately 30 separate arbitrators. Trial dates for these arbitrations are expected to begin in late 2016.

The Central Parties intend to vigorously defend against the merits of plaintiffs' claims in both the collective and individual arbitration proceedings. The final disposition of this case and the impact cannot be determined at this time.

18

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

California Class and Collective Action for Pre-employment Physical Testing

On October 6, 2014 Robin Anderson filed a putative class and collective action against Central Refrigerated Service, Inc., ("Central Refrigerated") Case No. 5:14-CV 02062 in the United States District Court for the Central District of California (the "Anderson Complaint"). In this action, plaintiff alleges that pre-employment tests of physical strength administered by a third party on behalf of Central Refrigerated, had an unlawfully discriminatory impact on female applicants and applicants over the age of 40. The suit seeks damages under Title VII of the Civil Rights Act of 1964, the Age Discrimination Act, and parallel California state law provisions, including the California Fair Employment and Housing Act.

Based on the acquisition of Central Refrigerated by Swift Transportation Company, Plaintiff was allowed to amend her complaint in October 2015 to include Swift Transportation Company and Workwell Systems, Inc. as additional defendants. Workwell Systems, Inc. is the company that provided the physical testing service used by Central Refrigerated. The litigation is still at a very preliminary stage and plaintiff has not yet effected service on the newly added defendants. Discovery has not yet commenced in the case and no trial date has been set. There is not currently any information available regarding the number of potential members of the putative class or collective actions.

Central Refrigerated and Swift intend to vigorously defend against the merits of plaintiff’s claims. The final disposition of this case and the impact cannot be determined at this time.

Environmental Notice

On April 17, 2009, the Company received a notice from the Lower Willamette Group ("LWG"), advising that there was a total of 250 potentially responsible parties ("PRPs"), with respect to alleged environmental contamination of the Lower Willamette River in Portland, Oregon, designated as the Portland Harbor Superfund site (the "Site"), and that as a previous landowner at the Site, the Company was asked to join a group of 60 PRPs and proportionately contribute to (1) reimbursement of funds expended by LWG to investigate environmental contamination at the Site and (2) remediation costs of the same, rather than be exposed to potential litigation. Although the Company does not believe it contributed any contaminants to the Site, the Company was at one time the owner of property at the Site and the Comprehensive Environmental Response, Compensation and Liability Act imposes a standard of strict liability on property owners with respect to environmental claims. Notwithstanding this standard of strict liability, management believes the Company's potential proportionate exposure to be minimal and not material. No formal complaint has been filed in this matter. The Company’s pollution liability insurer was notified of this potential claim. Since April 17, 2009, there have been no significant developments pertaining to this matter and, in management's opinion, the likelihood is remote that final disposition of this matter will result in a material loss.

Environmental

The Company's tractors and trailers are involved in motor vehicle accidents, and experience damage, mechanical failures and cargo issues as an incidental part of its ordinary course of operations. From time to time, these matters result in the discharge of diesel fuel, motor oil or other hazardous materials into the environment. Depending on local regulations and the party who is determined to be at fault, the Company is sometimes responsible for the clean-up costs associated with these discharges. As of September 30, 2015, the Company's estimate for its total legal liability for all such clean-up and remediation costs was approximately $0.9 million in the aggregate for all current and prior year claims.

Note 10 — Derivative Financial Instruments

The final settlement of the Company's interest rate swaps occurred in July 2015. The following table presents pre-tax losses (gains) from changes in fair value of the Company's interest rate swaps, included in earnings (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||

Loss reclassified from AOCI into net income from cash flow hedges (effective portion) | $ | 69 | $ | 1,642 | $ | 3,886 | $ | 4,438 | ||||||||

(Gain) loss recognized in income from de-designated derivative contracts | (1 | ) | 114 | 86 | 589 | |||||||||||

Derivative interest expense | $ | 68 | $ | 1,756 | $ | 3,972 | $ | 5,027 | ||||||||

19

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Losses (benefits) on cash flow hedging, reclassified out of AOCI into the consolidated income statements were as follows (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||

Reclassified to: | 2015 | 2014 | 2015 | 2014 | |||||||||||||

Interest rate swaps | Derivative interest expense | $ | 69 | $ | 1,642 | $ | 3,886 | $ | 4,438 | ||||||||

Income tax (benefit) expense | Income tax expense | — | (633 | ) | (1,469 | ) | (1,710 | ) | |||||||||

Net income | $ | 69 | $ | 1,009 | $ | 2,417 | $ | 2,728 | |||||||||

Activities related to AOCI, net of tax, are presented in the consolidated statement of stockholders' equity, and primarily pertain to derivative financial instruments. The tax effects are presented in the consolidated statements of comprehensive income.

Activities related to foreign currency transactions were immaterial for the three and nine months ended September 30, 2015 and 2014.

Note 11 — Fair Value Measurement

September 30, 2015 | December 31, 2014 | ||||||||||||||

Carrying Value | Estimated Fair Value | Carrying Value | Estimated Fair Value | ||||||||||||

Financial Assets: | |||||||||||||||

Restricted investments (1) | $ | 23,134 | $ | 23,140 | $ | 24,510 | $ | 24,502 | |||||||

Financial Liabilities: | |||||||||||||||

2015 Agreement: New Term Loan A, due July 2020 (2) | 676,375 | 676,375 | — | — | |||||||||||

2014 Agreement: Old Term Loan A, due June 2019 (2) | — | — | 500,000 | 500,000 | |||||||||||

2014 Agreement: Term Loan B, due June 2021, net of $920 OID (2) | — | — | 396,080 | 390,436 | |||||||||||

Accounts receivable securitization (3) | 250,000 | 250,000 | 334,000 | 334,000 | |||||||||||

Revolving line of credit (4) | 200,000 | 200,000 | 57,000 | 57,000 | |||||||||||

The carrying amounts of the final instruments shown in the table are included in the consolidated balance sheets, as follows:

(1) | Restricted investments are included in "Restricted investments, held to maturity, amortized cost." |

(2) | The New Term Loan A, Old Term Loan A and Term Loan B are included in "Current portion of long-term debt" and "Long-term debt, less current portion." |

(3) | The accounts receivable securitization is included in "Current portion of accounts receivable securitization" as of September 30, 2015 and "Accounts receivable securitization, less current portion" as of December 31, 2014. |

(4) | The New Revolver (due July 2020) and Old Revolver (due June 2019) are included in "Revolving line of credit," as of September 30, 2015 and December 31, 2014. |

Recurring Fair Value Measurements

As of September 30, 2015, no major categories of assets or liabilities included in the Company's consolidated balance sheets at estimated fair value were measured on a recurring basis.

20

SWIFT TRANSPORTATION COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) — CONTINUED

Nonrecurring Fair Value Measurements

The following table depicts the level in the fair value hierarchy of the inputs used to estimate fair value of assets measured on a nonrecurring basis (in thousands):

Fair Value Measurements at Reporting Date Using: | |||||||||||||||||||

Estimated Fair Value | Level 1 Inputs | Level 2 Inputs | Level 3 Inputs | Total Gains (Losses) | |||||||||||||||

As of September 30, 2015 | |||||||||||||||||||

Note receivable | $ | — | $ | — | $ | — | $ | — | $ | (1,480 | ) | ||||||||

As of December 31, 2014 | |||||||||||||||||||

Other assets | — | — | — | — | (2,308 | ) | |||||||||||||

In September 2013, the Company agreed to advance up to $2.3 million, pursuant to an unsecured promissory note, to an independent fleet contractor that transported freight on Swift's behalf. In March 2015, management became aware that the independent contractor violated various covenants outlined in the unsecured promissory note, which created an event of default that made the principal and accrued interest immediately due and payable. As a result of this event of default, as well as an overall decline in the independent contractor's financial condition, management re-evaluated the fair value of the unsecured promissory note. As of March 31, 2015, management determined that the remaining balance due from the independent contractor to the Company was not collectible, which resulted in a $1.5 million pre-tax adjustment that was recorded in "Non-cash impairments of non-operating assets" in the Company's consolidated income statements.

Fair value of assets measured on a nonrecurring basis as of December 31, 2014 represent certain operations software that was replaced, and for which the carrying value was determined to be fully impaired during the three months ended September 30, 2014.

Note 12 — Earnings per Share

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||

Basic weighted average common shares outstanding | 142,801 | 141,557 | 142,535 | 141,282 | |||||||

Dilutive effect of stock options | 1,331 | 1,765 | 1,703 | 2,056 | |||||||

Diluted weighted average common shares outstanding | 144,132 | 143,322 | 144,238 | 143,338 | |||||||

Anti-dilutive shares excluded from the dilutive-effect calculation (1) | 350 | 168 | 195 | 171 | |||||||

____________

(1) | Shares were excluded from the dilutive-effect calculation because the outstanding options' exercise prices were greater than the average market price of the Company's common shares during the period. |

Note 13 — Income Taxes

The effective tax rate for the three months ended September 30, 2015 was 37.0%, which was lower than management's expectation of 38.5%, primarily due to certain federal employment tax credits realized as discrete items. The effective tax rate for the three months ended September 30, 2014 was 32.3%, which was lower than management's expectation of 38.5%, primarily due to certain federal income tax credits realized as a discrete item in the third quarter of 2014.

The effective tax rate for the nine months ended September 30, 2015 was 38.1%, which was lower than management's expectation of 38.5%, primarily due to the federal employment tax credits mentioned above. The effective tax rate for the nine months ended September 30, 2014 was 35.6%, which was lower than management's expectation of 38.5%, primarily due to the federal income tax credits mentioned above.

Accrued interest and penalties included in income tax expense as of September 30, 2015 were approximately $1.3 million. The Company does not anticipate a decrease of unrecognized tax benefits during the next twelve months.

21