Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Knight-Swift Transportation Holdings Inc. | d474415d8k.htm |

| EX-99.2 - EX-99.2 - Knight-Swift Transportation Holdings Inc. | d474415dex992.htm |

| EX-99.3 - EX-99.3 - Knight-Swift Transportation Holdings Inc. | d474415dex993.htm |

| EX-99.4 - EX-99.4 - Knight-Swift Transportation Holdings Inc. | d474415dex994.htm |

Exhibit 99.1

January 23, 2013

Dear Fellow Stockholders of Swift Transportation Company (NYSE: SWFT),

A summary of our key results for the three and twelve months ended December 31st is shown below:

| Three Months Ended December 31, | Full Year Ended December 31, | |||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 | 2011 | 2010 | |||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||

| ($ in millions, except per share data) | ||||||||||||||||||||||||

| Operating Revenue |

$ | 922.6 | $ | 860.7 | $ | 780.4 | $ | 3,493.2 | $ | 3,333.9 | $ | 2,929.7 | ||||||||||||

| Revenue xFSR1 |

$ | 739.9 | $ | 695.3 | $ | 661.6 | $ | 2,803.0 | $ | 2,679.8 | $ | 2,500.6 | ||||||||||||

| Operating Ratio |

88.4 | % | 88.7 | % | 90.2 | % | 90.8 | % | 90.8 | % | 91.7 | % | ||||||||||||

| Adjusted Operating Ratio2 |

84.7 | % | 85.5 | % | 84.3 | % | 87.8 | % | 87.9 | % | 88.3 | % | ||||||||||||

| EBITDA |

$ | 155.7 | $ | 153.0 | $ | 37.0 | $ | 513.5 | $ | 530.4 | $ | 378.1 | ||||||||||||

| Adjusted EBITDA2 |

$ | 164.5 | $ | 154.3 | $ | 155.4 | $ | 549.7 | $ | 537.2 | $ | 497.7 | ||||||||||||

| Diluted EPS |

$ | 0.34 | $ | 0.26 | $ | (0.66 | ) | $ | 0.82 | $ | 0.65 | $ | (1.98 | ) | ||||||||||

| Adjusted EPS2 |

$ | 0.38 | $ | 0.29 | $ | 0.28 | $ | 1.00 | $ | 0.79 | $ | 0.02 | ||||||||||||

| 1 | Revenue xFSR is Operating Revenue excluding fuel surcharge revenue |

| 2 | See GAAP to Non-GAAP reconciliation in the schedules following this letter |

Quarterly Highlights (discussed in more detail below, including GAAP to non-GAAP reconciliations):

| • | Record quarterly Operating Revenue, Revenue xFSR and Operating Income |

| • | Fourth quarter 2012 Adjusted EPS increased 31% to $0.38 versus $0.29 in the fourth quarter of 2011 |

| • | Adjusted Operating Ratio of 84.7% improved 80 basis points over the prior year |

| • | Reportable Segment information for Truckload, Dedicated and Intermodal are now provided |

| • | Truckload Weekly Revenue xFSR per Tractor grew 9.8% helping to drive the Truckload segment Adjusted Operating Ratio to 83.3%, a 170 basis point improvement over the prior year |

| • | Intermodal segment Revenue xFSR growth continues, increasing 32.4% in the fourth quarter over the prior year |

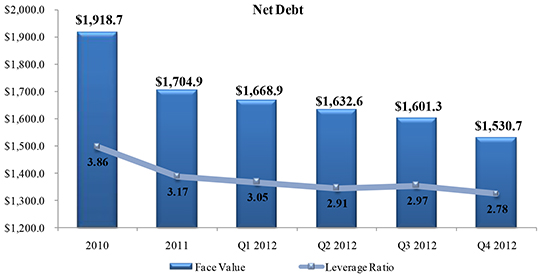

| • | Reduction in Net Debt of $70.6 million during the quarter |

Full Year Highlights (discussed in more detail below, including GAAP to non-GAAP reconciliations):

| • | Record results with the highest annual Operating Revenue and Operating Income in Swift’s history, at $3.5 billion and $322 million, respectively. |

| • | Full year 2012 Adjusted EPS increased 27% to $1.00 compared to $0.79 in 2011 |

| • | Intermodal business continues expansion with 40.2% Revenue xFSR growth for the full year |

| • | Dedicated Revenue xFSR grew 14.9%, achieving a third consecutive year of double digit growth |

| • | Truckload segment Adjusted Operating Ratio of 86.3%, showing continued improvement for the third straight year |

| • | Reduction in Net Debt of $174 million for the full year; exceeding our annual target of $50—$100 million |

| • | Leverage Ratio improved to 2.78:1.00, down from 3.86:1:00 at the end of 2010 |

|

Segment Reporting

In anticipation that our intermodal service offering would eventually constitute a reportable segment in accordance with U.S. GAAP, we analyzed our various service offerings, and the detail we provide to you, our shareholders. Although our trucking businesses are similar in nature and related, we felt it would be useful for you to have the information on our Dedicated and Truckload services separated. Therefore, we have identified the following three reportable segments: Truckload, Dedicated and Intermodal. We will present the revenue, operating income and key metrics for each reportable segment from this point forward. Additionally, we have provided a three year historical quarterly summary for each reportable segment, which will be available on our investor relations website at ir.swifttrans.com.

Fourth Quarter Overview

For the fourth quarter ended December 31, 2012, we generated record Operating Revenue of $922.6 million compared to $860.7 million in the fourth quarter of 2011. Our Revenue xFSR grew 6.4% to $739.9 million which is also a record high. Diluted earnings per share, in accordance with GAAP, grew 30.8% for the fourth quarter of 2012 to $0.34 compared to $0.26 in the fourth quarter of 2011. Adjusted diluted earnings per share, or Adjusted EPS, was $0.38 compared to $0.29 in the same quarter of 2011; a 31.0% increase. A reconciliation of GAAP results to non-GAAP results, as adjusted to exclude certain non-cash or special items, is provided in the schedules following this letter.

We continue to see positive year over year trends in our operational metrics, which are helping to drive our results. We increased the total loaded miles for our Truckload and Dedicated segments by approximately 1.0% year over year in the fourth quarter, despite a 4.4% decrease in our average operational trucks as we continue to focus on improving our asset utilization and Return on Net Assets (RONA). In the fourth quarter of 2012, our combined loaded miles per truck per week improved by 5.6% when compared to the fourth quarter of 2011, and our average Revenue xFSR per loaded mile increased 2.6% in the same period. We also realized sequential and year over year earnings improvements associated with the various seasonal contracts and project business we have with several of our large customers. Furthermore, we continued our focus on expanding our Intermodal segment, realizing 32.4% growth in Revenue xFSR in the fourth quarter of 2012 when compared with the same quarter of 2011, stemming from improvements in both load volumes as well as yield. The driver market remains challenging, but we are seeing success with our retention efforts as our driver turnover remains well below industry average. The initiatives we have implemented are having a positive impact, and as the market strengthens, these initiatives should enable us to continue to build on our results.

Fourth Quarter Results by Reportable Segment

A summary of our year over year fourth quarter revenue trends and key metrics for our reportable segments are as follows:

Truckload Segment:

Our Truckload segment consists of one-way movements over irregular routes throughout the United States, Mexico, and Canada. This service uses both company and owner-operator tractors with dry van, flatbed, and other specialized trailing equipment.

|

2 |

| Three Months Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Operating Revenue(1) |

$ | 591.1 | $ | 573.2 | $ | 548.2 | ||||||

| Revenue xFSR(1)(2) |

$ | 465.7 | $ | 453.8 | $ | 457.0 | ||||||

| Operating Ratio |

86.9 | % | 88.1 | % | 87.6 | % | ||||||

| Adjusted Operating Ratio (3) |

83.3 | % | 85.0 | % | 85.2 | % | ||||||

| Weekly Revenue xFSR per Tractor |

$ | 3,292 | $ | 2,999 | $ | 2,897 | ||||||

| Average Operational Truck Count |

10,765 | 11,514 | 12,003 | |||||||||

| Deadhead Percentage |

11.3 | % | 11.1 | % | 12.0 | % | ||||||

| 1 | In Millions |

| 2 | Revenue xFSR is operating revenue, excluding fuel surcharge revenue. |

| 3 | See GAAP to Non-GAAP reconciliation in the schedules following this letter. |

Revenue xFSR for our Truckload segment, increased 2.6% year over year during the fourth quarter of 2012. Although we had 749 fewer trucks in the fourth quarter of 2012 when compared to the fourth quarter of 2011, we were able to generate stronger revenue by delivering more with less as we continue to focus on our asset utilization. Our Weekly Revenue xFSR per Tractor increased 9.8% year over year driven by a 112 mile per truck per week increase in our loaded utilization. Additionally, customer rate increases throughout the year, combined with increased seasonal project business in the fourth quarter, drove our Revenue xFSR per loaded mile 3.3% higher compared to the fourth quarter of 2011.

The Adjusted Operating Ratio in our Truckload segment improved 170 basis points over the fourth quarter of 2011. This improvement was driven by the utilization and Revenue xFSR per loaded mile increases discussed above, improved fuel efficiency, a slight benefit in fuel surcharge recovery and lower insurance costs. These improvements were partially offset by the driver incentive bonus initiated in the third quarter of 2012 and higher equipment costs.

We continue to monitor the freight environment and expect to adjust our truck count to match market conditions. As a result, we expect our first quarter truck count in our Truckload segment to be relatively flat from the fourth quarter of 2012.

Dedicated Segment:

Through our Dedicated segment, we devote exclusive use of equipment and offer tailored solutions under long-term contracts. This dedicated business utilizes refrigerated, dry van, flatbed and other specialized trailing equipment.

| Three Months Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Operating Revenue(1) |

$ | 188.2 | $ | 174.6 | $ | 135.3 | ||||||

| Revenue xFSR(1)(2) |

$ | 152.2 | $ | 143.0 | $ | 117.3 | ||||||

| Operating Ratio |

87.3 | % | 87.8 | % | 85.3 | % | ||||||

| Adjusted Operating Ratio (3) |

84.3 | % | 85.1 | % | 83.0 | % | ||||||

| Weekly Revenue xFSR per Tractor |

$ | 3,366 | $ | 3,256 | $ | 3,285 | ||||||

| Average Operational Truck Count |

3,439 | 3,343 | 2,716 | |||||||||

| 1 | In Millions |

| 2 | Revenue xFSR is operating revenue, excluding fuel surcharge revenue. |

| 3 | See GAAP to Non-GAAP reconciliation in the schedules following this letter. |

|

3 |

Revenue xFSR for our Dedicated segment increased 6.4% during the fourth quarter of 2012, largely due to the addition of a few large customer accounts during 2012. This additional business along with increased operational efficiencies drove our Weekly Revenue xFSR per Tractor up 3.4% over the prior year.

The Adjusted Operating Ratio in our Dedicated segment improved to 84.3% in the fourth quarter of 2012 from 85.1% in the fourth quarter of 2011. The key drivers behind this year over year improvement include increased utilization, higher Revenue xFSR per total mile, improved fuel efficiency, and volume growth.

Intermodal Segment:

Our Intermodal segment includes revenue generated by freight moving over the rail in our containers and other trailing equipment, combined with revenue for drayage to transport loads between the railheads and customer locations.

| Three Months Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Operating Revenue(1) |

$ | 97.7 | $ | 72.8 | $ | 57.7 | ||||||

| Revenue xFSR(1)(2) |

$ | 76.8 | $ | 58.0 | $ | 48.2 | ||||||

| Operating Ratio(4) |

100.5 | % | 96.0 | % | 95.9 | % | ||||||

| Adjusted Operating Ratio (3)(4) |

100.6 | % | 95.0 | % | 95.1 | % | ||||||

| Load Counts |

40,862 | 31,452 | 27,468 | |||||||||

| Average Container Counts |

8,628 | 5,955 | 4,713 | |||||||||

| 1 | In Millions |

| 2 | Revenue xFSR is operating revenue, excluding fuel surcharge revenue. |

| 3 | See GAAP to Non-GAAP reconciliation in the schedules following this letter. |

| 4 | During 2012 our Intermodal reportable segment incurred an increase in its insurance and claims expense primarily related to one claim associated with a dray truck accident, which increased the Intermodal Operating Ratio by approximately 430 to 520 basis points and the Adjusted Operating Ratio Ratio by approximately 550 to 660 basis points for the three months ended December 31, 2012, as compared to the two preceding years. |

During the fourth quarter of 2012 our Intermodal segment continued its expansion with Revenue xFSR growth of 32.4% over the fourth quarter of 2011. This increase in Revenue xFSR was driven by a 29.9% increase in the number of loads hauled, combined with a 1.9% increase in Revenue xFSR per load.

Our average container count grew by 44.9% to 8,628 in the fourth quarter of 2012 when compared to the same period in 2011. We added nearly 2,000 containers during the last six months of 2012 to take advantage of fourth quarter seasonal freight as well as 2013 projected growth.

For the fourth quarter, Intermodal Adjusted Operating Ratio increased from 95.0% in 2011 to 100.6% in 2012 due primarily to one claim associated with a dray truck accident, which increased the Intermodal Operating Ratio by approximately 430 to 520 basis points, and the Adjusted Operating Ratio by approximately 550 to 660 basis points compared to the two preceding years. This large claim was partially offset by increased volumes and revenue per load during the period, as previously discussed.

|

4 |

Other Revenue

Other Revenue includes revenue generated by our logistics and brokerage services as well as revenue generated by our subsidiaries offering support services to customers and owner-operators, including shop maintenance, equipment leasing, and insurance. In the fourth quarter of 2012, combined revenue from these services increased 9.7% compared to the same quarter in 2011, driven primarily by an increase in our fourth quarter seasonal project business, an increase in leasing revenue, and an increase in brokerage revenue.

Fourth Quarter Consolidated Operating Expenses

| Q4 ‘12 |

Q4 ‘11 | YOY Variance1 |

($ in millions) | Q4 ‘12 | Q3 ‘12 | QOQ Variance1 |

||||||||||||||||||

| $ | 922.6 | $ | 860.7 | 7.2 | % | Total Revenue | $ | 922.6 | $ | 871.1 | 5.9 | % | ||||||||||||

| (182.7 | ) | (165.4 | ) | 10.4 | % | Less: Fuel Surcharge Revenue | (182.7 | ) | (168.7 | ) | 8.3 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| $ | 739.9 | $ | 695.3 | 6.4 | % | Revenue xFSR | $ | 739.9 | $ | 702.4 | 5.3 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| $ | 205.3 | $ | 194.8 | -5.4 | % | Salaries, Wages & Benefits | $ | 205.3 | $ | 200.0 | -2.7 | % | ||||||||||||

| 27.7 | % | 28.0 | % | 30 | bps | % of Revenue xFSR | 27.7 | % | 28.5 | % | 80 | bps | ||||||||||||

| $ | 62.9 | $ | 60.5 | -3.9 | % | Operating Supplies & Expenses | $ | 62.9 | $ | 63.8 | 1.4 | % | ||||||||||||

| 8.5 | % | 8.7 | % | 20 | bps | % of Revenue xFSR | 8.5 | % | 9.1 | % | 60 | bps | ||||||||||||

| $ | 25.0 | $ | 23.2 | -7.7 | % | Insurance & Claims | $ | 25.0 | $ | 25.7 | 2.7 | % | ||||||||||||

| 3.4 | % | 3.3 | % | -10 | bps | % of Revenue xFSR | 3.4 | % | 3.7 | % | 30 | bps | ||||||||||||

| $ | 6.2 | $ | 6.4 | 2.5 | % | Communication & Utilities | $ | 6.2 | $ | 6.2 | -1.2 | % | ||||||||||||

| 0.8 | % | 0.9 | % | 10 | bps | % of Revenue xFSR | 0.8 | % | 0.9 | % | 10 | bps | ||||||||||||

| $ | 15.8 | $ | 14.8 | -7.0 | % | Operating Taxes & Licenses | $ | 15.8 | $ | 14.9 | -5.8 | % | ||||||||||||

| 2.1 | % | 2.1 | % | 0 | bps | % of Revenue xFSR | 2.1 | % | 2.1 | % | 0 | bps | ||||||||||||

| 1 | Positive numbers represent favorable variances, negative numbers represent unfavorable variances |

The table above highlights some of our cost categories for the fourth quarter of 2012, compared to the fourth quarter of 2011 and the third quarter of 2012, showing each as a percent of Revenue xFSR. Fuel surcharge revenue can be volatile and is primarily dependent upon the cost of fuel and not specifically related to our non-fuel operational expenses. Therefore, we believe that Revenue xFSR is a better measure for analyzing our expenses and operating metrics.

Salaries wages and benefits increased $10.5 million year over year due to the company driver pay increase implemented in July 2012, an increase in the number of non-driving employees to support business growth, and an increase in the employee bonus accrual reflecting our better than expected operating results for the year.

Insurance and claims expense increased to $25.0 million for the fourth quarter of 2012 compared to $23.2 million in the prior year. In the fourth quarter of 2011, we experienced favorable actuarial adjustments related to the prior year loss layers as the development of liability claims from the prior years was better than the actuarial models had previously projected. In the fourth quarter of 2012, we experienced a similar but smaller reduction in the claims associated with the insurance products sold by our captive insurance company to our owner-operators. For the full year 2013, we expect insurance and claims expense to be between 3.6%—3.8% of Revenue xFSR.

|

5 |

Fuel Expense

| Q4 ‘12 |

Q4 ‘11 | ($ in millions, except D.O.E Diesel Fuel Index) | Q4 ‘12 | Q3 ‘12 | ||||||||||||

| $ | 152.1 | $ | 153.0 | Fuel Expense | $ | 152.1 | $ | 151.7 | ||||||||

| 16.5 | % | 17.8 | % | % of Total Revenue | 16.5 | % | 17.4 | % | ||||||||

| $ | 182.7 | $ | 165.4 | Fuel Surcharge Revenue (FSR) | $ | 182.7 | $ | 168.7 | ||||||||

| (77.6 | ) | (67.0 | ) | Less: FSR Reimbursed to Third Parties | (77.6 | ) | (73.7 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 105.1 | $ | 98.5 | Company FSR | $ | 105.1 | $ | 95.0 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 152.1 | $ | 153.0 | Fuel Expense | $ | 152.1 | $ | 151.7 | ||||||||

| (105.1 | ) | (98.5 | ) | Less: Company FSR | (105.1 | ) | (95.0 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 47.0 | $ | 54.6 | Net Fuel Expense | $ | 47.0 | $ | 56.7 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 6.3 | % | 7.8 | % | % of Revenue xFSR | 6.3 | % | 8.1 | % | ||||||||

| $ | 4.020 | $ | 3.868 | Average D.O.E. Diesel Fuel Index | $ | 4.020 | $ | 3.924 | ||||||||

| 3.9 | % | 23.0 | % | Year over Year % Change | 3.9 | % | 1.5 | % | ||||||||

Fuel expense for the fourth quarter of 2012, noted in the chart above, was $152.1 million, representing a slight decrease from the fourth quarter of 2011. We collect fuel surcharge revenue from our customers to help mitigate increases in fuel prices. The surcharges are primarily based on the Department of Energy (D.O.E.) Diesel Fuel Index, which is set each week based on retail prices at various truck stops around the country. We utilize a portion of our fuel surcharge revenue to reimburse owner-operators and other third parties, such as the railroads, who also must pay for fuel. To evaluate the effectiveness of our fuel surcharges, we deduct the portion of the revenue we pay to third parties, and then subtract the remaining company-related fuel surcharge revenue from our fuel expense. This calculation of Net Fuel Expense is shown above.

Net Fuel Expense decreased to $47.0 million in the fourth quarter of 2012 compared to $54.6 million in 2011, driven by improved fuel efficiency with our newer equipment as well as a reduction in the amount of driver idle time.

Sequentially, Net Fuel Expense decreased $9.7 million for the fourth quarter compared with the third quarter of 2012. This decrease can be attributed to the increase in fuel prices throughout the third quarter of 2012 and the associated fuel surcharge recovery lag compared to relatively flat fuel prices in the fourth quarter.

Purchased Transportation

Purchased transportation includes payments to owner-operators, railroads and other third parties we use for intermodal drayage and other brokered business. In the fourth quarter of 2012, this expense increased $28.4 million over the fourth quarter of 2011. A portion of the payments made to our partners is for fuel reimbursements. Fuel reimbursements increased $10.6 million year over year, primarily associated with the growth in our intermodal business and an increase in reimbursements to owner-operators.

| Q4 ‘12 |

Q4 ‘11 | ($ in millions) | Q4 ‘12 | Q3 ‘12 | ||||||||||||

| $ | 265.4 | $ | 237.0 | Purchased Transportation | $ | 265.4 | $ | 258.9 | ||||||||

| 28.8 | % | 27.5 | % | % of Total Revenue | 28.8 | % | 29.7 | % | ||||||||

| (77.6 | ) | (67.0 | ) | Less: FSR Reimbursed to Third Parties | (77.6 | ) | (73.7 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 187.8 | $ | 170.0 | Net Purchased Transportation | $ | 187.8 | $ | 185.2 | ||||||||

| 25.4 | % | 24.4 | % | % of Revenue xFSR | 25.4 | % | 26.4 | % | ||||||||

|

6 |

During the fourth quarter of 2012, excluding fuel reimbursements, Net Purchased Transportation increased $17.8 million year over year and $2.7 million sequentially. Both the year over year and sequential increases are predominantly associated with increased intermodal volumes. As a percent of Revenue xFSR, Net Purchased Transportation increased 100 bps year over year due to intermodal volumes growing faster than truckload volumes. Sequentially, Net Purchased Transportation as a percentage of Revenue xFSR decreased from 26.4% in the third quarter of 2012 to 25.4% in the fourth quarter. This decrease is primarily due to the increase in revenue generated by our fourth quarter seasonal project business.

Rental Expense and Depreciation & Amortization of Property and Equipment

Due to fluctuations in the amount of tractors leased versus owned, we combine our rental expense with depreciation and amortization of property and equipment for analytical purposes as shown in the table below:

| Q4 ‘12 |

Q4 ‘11 | ($ in millions) | Q4 ‘12 | Q3 ‘12 | ||||||||||||

| $ | 30.0 | $ | 20.9 | Rental Expense | $ | 30.0 | $ | 28.9 | ||||||||

| 4.1 | % | 3.0 | % | % of Revenue xFSR | 4.1 | % | 4.1 | % | ||||||||

| $ | 49.8 | $ | 51.2 | Depreciation & Amortization of Property and Equipment | $ | 49.8 | $ | 49.3 | ||||||||

| 6.7 | % | 7.4 | % | % of Revenue xFSR | 6.7 | % | 7.0 | % | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 79.7 | $ | 72.1 | Combined Rental Expense and Depreciation | $ | 79.7 | $ | 78.2 | ||||||||

| 10.8 | % | 10.4 | % | % of Revenue xFSR | 10.8 | % | 11.1 | % | ||||||||

Combined rental and depreciation expense in the fourth quarter of 2012 increased $7.6 million to $79.7 million from the fourth quarter of 2011. This increase is due to the rising costs of new equipment, growth in the number of trailers and intermodal containers and a higher percentage of leased assets which drive rent expense higher due to the inclusion of financing costs. These expenses were partially offset by a reduction in the total number of tractors.

Gain on Disposal of Property and Equipment

Gain on disposal of property and equipment was $3.5 million in the fourth quarter of 2012 compared to $2.6 million in the fourth quarter of 2011 and was higher than the guidance of $1.0—$2.0 million given in our third quarter 2012 Letter to Stockholders due to an increase in equipment sales through our IEL subsidiary. Future gains and losses will depend on the used truck market, our contracts with manufacturers, and our disposition volumes for tractors and trailers, all of which can vary depending on freight demand.

Interest Expense and Debt Balances

Interest expense, comprised of debt interest expense, the amortization of deferred financing costs and original issue discount, and excluding amortization of previous losses on our terminated interest rate swaps, decreased by $7.6 million in the fourth quarter of 2012 to $27.6 million, compared with $35.2 for the fourth quarter of 2011. The decrease was largely due to lower interest rates from refinancing our senior credit facility in the first quarter of 2012 as well as the continued reduction of our debt balances that has been an area of focus since our initial public offering in December 2010. During the fourth quarter of 2012, we made a $20.2 million voluntary payment on our Term Loan B-1 and a $41.4 million voluntary payment on our Term Loan B-2. These payments, combined with an increase in our unrestricted cash and other changes, resulted in a Net Debt reduction of $70.6 million in the fourth quarter.

|

7 |

Income Taxes

The income tax provisions in accordance with GAAP for the fourth quarter and full year 2012 were $27.9 million (resulting in an effective tax rate of 37.3%) and $61.1 million (resulting in an effective tax rate of 34.8%), respectively. As discussed in previous quarterly earnings releases, the lower effective rate was primarily due to tax benefits realized from favorable changes in effective state tax rates as well as additional employment tax credits claimed on our 2011 tax return. Since our IPO, we have used a normalized tax rate of 39% for calculating Adjusted EPS. If we used the GAAP tax rate in the calculation, our Adjusted EPS would have been $.01 higher in the fourth quarter of 2012 and $.07 higher for the full year of 2012.

We used a normalized rate of 39% in our Adjusted EPS calculation due to the amortization of deferred tax assets related to our pre-IPO interest rate swap amortization and other items that we knew would cause fluctuations in our GAAP effective tax rate. Going forward, these items should no longer cause large variations, therefore we will be using our GAAP effective tax rate for our Adjusted EPS calculation beginning in 2013. We expect our 2013 full year effective tax rate, in accordance with GAAP, to be approximately 38.5%.

Other Items

In the fourth quarter of 2012, a deposit related to the purchase of certain fuel technology equipment and a related asset were written off as the supplier ceased operations, resulting in a pre-tax impairment of $2.3 million recorded in the Impairments line item. Additionally, Swift Power Services, LLC (“SPS”), an entity in which we own a minority interest, failed to make its first scheduled principal payment and quarterly interest payment to us on December 31, 2012 due to a decline in its financial performance, resulting from a legal dispute with the former owners and its primary customer. This caused us to evaluate the secured promissory note due from SPS for impairment, which resulted in a $6.0 million pre-tax adjustment recorded in Impairments of non-operational assets in the fourth quarter of 2012.

Full Year 2012 Results by Reportable Segment

A summary of our full year 2012 revenue trends and key metrics for our individual segments are as follows:

Truckload Segment:

| Years Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Operating Revenue(1) |

$ | 2,282.3 | $ | 2,336.1 | $ | 2,078.7 | ||||||

| Revenue xFSR(1)(2) |

$ | 1,798.7 | $ | 1,844.2 | $ | 1,748.4 | ||||||

| Operating Ratio |

89.2 | % | 90.5 | % | 90.7 | % | ||||||

| Adjusted Operating Ratio (3) |

86.3 | % | 87.9 | % | 88.9 | % | ||||||

| Weekly Revenue xFSR per Tractor |

$ | 3,165 | $ | 2,968 | $ | 2,862 | ||||||

| Average Operational Truck Count |

10,869 | 11,915 | 11,714 | |||||||||

| Deadhead Percentage |

11.1 | % | 11.0 | % | 11.8 | % | ||||||

| 1 | In Millions |

| 2 | Revenue xFSR is operating revenue, excluding fuel surcharge revenue. |

| 3 | See GAAP to Non-GAAP reconciliation in the schedules following this letter. |

|

8 |

Truckload Revenue xFSR, decreased 2.5% during 2012, largely due to an 8.8% reduction in the size of our average operational fleet. Although we had 1,046 fewer trucks during 2012 when compared to 2011, we were able to generate relatively consistent revenue figures by improving the Weekly Revenue xFSR per Tractor, which is a combination of Revenue xFSR per loaded mile and loaded miles per truck per week (loaded utilization). Our loaded utilization continued its upward momentum, improving 64 miles per truck per week during 2012, when compared to the prior year. For the full year, growth in Truckload Revenue xFSR per loaded miles was 3.0% when compared to the full year 2011.

Our Truckload Adjusted Operating Ratio improved 160 basis points to 86.3% in 2012 compared with 87.9% in 2011. This was in addition to a 100 basis point improvement from 2010 to 2011, a trend for which we are very proud. The 2012 Adjusted Operating Ratio improvement was driven by increased Revenue xFSR per loaded mile, fuel efficiency, fuel surcharge recovery and loaded utilization, partially offset by driver and owner-operator pay increases, and higher equipment costs.

For the full year 2013, we expect to grow approximately 200 – 300 tractors in our Truckload segment, but may adjust as we evaluate freight volumes, the strength of the economic recovery, and the opportunity for improvement on the return on our net assets.

Dedicated Segment:

| Years Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Operating Revenue(1) |

$ | 724.4 | $ | 625.3 | $ | 514.0 | ||||||

| Revenue xFSR(1)(2) |

$ | 589.9 | $ | 513.4 | $ | 450.1 | ||||||

| Operating Ratio |

89.8 | % | 88.8 | % | 87.0 | % | ||||||

| Adjusted Operating Ratio (3) |

87.5 | % | 86.4 | % | 85.2 | % | ||||||

| Weekly Revenue xFSR per Tractor |

$ | 3,357 | $ | 3,305 | $ | 3,314 | ||||||

| Average Operational Truck Count |

3,361 | 2,979 | 2,605 | |||||||||

| 1 | In Millions |

| 2 | Revenue xFSR is operating revenue, excluding fuel surcharge revenue. |

| 3 | See GAAP to Non-GAAP reconciliation in the schedules following this letter. |

Dedicated Revenue xFSR increased 14.9% during 2012, largely due to the addition of new business with several large customers late in 2011 and throughout 2012. On a full year basis, our Weekly Dedicated Revenue xFSR per Tractor increased 1.6% to $3,357 as we continue to focus on the efficient utilization of our assets.

The Adjusted Operating Ratio increased to 87.5% in 2012 from 86.4% in 2011. This increase was primarily due to an increase in insurance and workers compensation claims for the year partially offset by an increase in Revenue xFSR per total mile, improved fuel efficiency and improved fuel surcharge recovery. In many cases, we have been growing dedicated business with customers who provide their own trailing equipment which reduces our capital investment, and therefore reduces our required margins to achieve our targeted Return on Net Assets. For the full year 2013, we expect continued growth in revenue and as such plan to grow the fleet 100 – 200 trucks.

|

9 |

Intermodal Segment:

| Years Ended December 31, | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| Operating Revenue(1) |

$ | 333.9 | $ | 237.9 | $ | 212.3 | ||||||

| Revenue xFSR(1)(2) |

$ | 263.2 | $ | 187.7 | $ | 177.3 | ||||||

| Operating Ratio(4) |

102.1 | % | 98.7 | % | 97.3 | % | ||||||

| Adjusted Operating Ratio (3)(4) |

102.6 | % | 98.3 | % | 96.7 | % | ||||||

| Load Counts |

145,144 | 106,419 | 106,126 | |||||||||

| Average Container Counts |

7,209 | 5,527 | 4,341 | |||||||||

| 1 | In Millions |

| 2 | Revenue xFSR is operating revenue, excluding fuel surcharge revenue. |

| 3 | See GAAP to Non-GAAP reconciliation in the schedules following this letter. |

| 4 | During 2012 our Intermodal reportable segment incurred an increase in its insurance and claims expense primarily related to one claim associated with a dray truck accident, which increased the Intermodal Operating Ratio by approximately 310 to 350 basis points and the Adjusted Operating Ratio by approximately 400 to 440 basis points for the year ended December 31, 2012, as compared to the two preceding years. |

Our intermodal business continued its positive trend with Revenue xFSR growth of 40.2% in 2012 when compared to the full year 2011. The increase in revenue was driven by a 36.4% increase in the number of loads and a 2.8% increase in Revenue xFSR per load.

Our full year average container count grew by 1,682 containers, or 30.4%. In 2012, we added a total of 2,507 containers to end the year with a fleet of 8,717. We are targeting Intermodal revenue growth of 20-25% in 2013 by increasing the utilization of our current fleet.

For the full year of 2012, the Adjusted Operating Ratio in our Intermodal segment increased from 98.3% in 2011 to 102.6% in 2012. This increase is primarily due to the previously discussed insurance costs which increased the full year Operating Ratio by approximately 310 to 350 basis points and the Adjusted Operating Ratio by approximately 400 to 440 basis points compared to the two preceding years. In addition, the Adjusted Operating Ratio was impacted by higher purchased transportation costs, partially offset by higher revenue per load and improved management of chassis expenses. As we have discussed in the past, our Intermodal profitability even excluding insurance, is not at an acceptable level. With the foundation we have established and the new management we have put in place, we have identified and are working on several areas to help drive improvement in our profitability.

Other Revenue

Revenue from other services includes revenue generated by logistics and brokerage services, and revenue generated by our subsidiaries offering support services to customers and owner-operators, including shop maintenance, equipment leasing, and insurance. For the full year 2012, revenue from these services increased 9.4% compared to the full year 2011, driven primarily by modest growth in each of the aforementioned areas.

|

10 |

Interest Expense and Debt Balances

| Dec 31, 2011 Actual |

Q1 Refinance |

Full Year Changes |

Dec 31, 2012 Actual |

|||||||||||||

| Unrestricted Cash |

$ | 82.1 | $ | (28.5 | ) | $ | 53.6 | |||||||||

| A/R Securitization |

$ | 180.0 | $ | — | $ | 24.0 | $ | 204.0 | ||||||||

| Revolver ($400mm) |

— | $ | — | $ | — | $ | — | |||||||||

| Old Term Loan B |

934.4 | $ | (874.0 | ) | $ | (60.4 | ) | $ | — | |||||||

| Term Loan B-1 (a) |

— | $ | 200.0 | $ | (42.5 | ) | $ | 157.5 | ||||||||

| Term Loan B-2 (a) |

— | $ | 674.0 | $ | (97.0 | ) | $ | 577.0 | ||||||||

| Senior Secured 2nd Lien Notes (a) |

500.0 | $ | — | $ | — | $ | 500.0 | |||||||||

| Capital Leases & Other Debt |

157.0 | $ | — | $ | (11.2 | ) | $ | 145.8 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Secured Debt |

$ | 1,771.4 | $ | — | ($ | 187.1 | ) | $ | 1,584.3 | |||||||

| Fixed Rate Notes |

15.6 | $ | (15.6 | ) | $ | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Debt |

$ | 1,787.0 | $ | — | $ | (202.7 | ) | $ | 1,584.3 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Debt |

$ | 1,704.9 | $ | — | $ | (174.2 | ) | $ | 1,530.7 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Amounts presented represent face value |

Interest expense, comprised of debt interest expense, the amortization of deferred financing costs and original issue discount, and excluding amortization of previous losses on our terminated interest rate swaps, decreased by $27.9 million in the full year 2012 to $118.1 million, compared with $146.0 for the full year of 2011. The decrease was largely due to lower interest rates from refinancing our senior credit facility in the first quarter of 2012 as well as the continued reduction of our debt balances that has been an area of focus since our initial public offering in December 2010.

As we have stated previously, our goal is to continue to reduce our leverage ratio through EBITDA growth and debt repayments. In the fourth quarter of 2012, we reduced our net debt by an additional $70.6 million to $1.53 billion. This brings our total reduction in net debt for 2012 to $174.2 million, which is above our $50-$100 million per year target due to better than expected earnings, less equipment purchases and more operating lease financing due to attractive terms. As a result of our various voluntary prepayments, our next required principal payment on our Term Loan B-1 is June 30, 2014, and we have no additional required principal payments on our Term Loan B-2 until its maturity in December of 2017.

|

11 |

The debt repayments, combined with the improvement in earnings in the fourth quarter, enabled us to reduce our leverage ratio to 2.78:1.00 as of December 31, 2012, which is better than we expected. We continue to maintain compliance with all of the covenants in our credit agreement as of December 31, 2012.

Cash Flow and Capital Expenditures

We continue to generate positive cash flows from operations. For the full year of 2012, we generated $406.6 million of cash from operations compared with $323.9 million in 2011. Our 2012 Net Cash Capital Expenditures were $174.6 million. Currently, we are projecting our Net Cash Capital Expenditures to be approximately $250 million for the full year 2013 as we anticipate trading more equipment in 2013 and growing the fleet by 300 – 500 tractors. We may adjust that amount in order to match market conditions and maximize return on our assets. Cash used in financing activities through December 31, 2012 was $262.5 million, primarily driven by the voluntary repayments of our debt.

| ($ Millions) | Q4 2012 | Q4 2011 | YTD 2012 | YTD 2011 | ||||||||||||

| Net Cash Capital Expenditures |

61.7 | 51.3 | 174.6 | 172.5 | ||||||||||||

| Addback: Proceeds from Sales |

29.0 | 20.2 | 118.6 | 67.1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross Cash Capital Expenditures |

$ | 90.7 | $ | 71.5 | $ | 293.2 | $ | 239.6 | ||||||||

| Capital Leases |

— | 9.9 | 38.5 | 10.6 | ||||||||||||

| Operating Leases |

53.4 | 68.0 | 271.7 | 264.9 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Capital & Operating Lease Total |

$ | 53.4 | $ | 77.9 | $ | 310.2 | $ | 275.5 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross Investment in Equipment & Facilities |

$ | 144.1 | $ | 149.4 | $ | 603.4 | $ | 515.1 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Original Value of Expired Leases

| ($ Millions) | Q4 2012 | Q4 2011 | YTD 2012 | YTD 2011 | ||||||||||||

| Capital Leases |

14.5 | 21.3 | 44.9 | 69.0 | ||||||||||||

| Operating Leases |

56.2 | 114.3 | 138.1 | 159.7 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 70.7 | $ | 135.6 | $ | 183.0 | $ | 228.7 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Liquidity Summary

Our liquidity position, at December 31, 2012, remains strong with a total of $433.1 million available, including $53.6 million of unrestricted cash and $74.0 million of restricted cash and investments in our captive insurance companies that are reserved for the future payment of outstanding claims. Our $400.0 million revolving credit facility remains undrawn, and we had $159.1 million of letters of credit outstanding primarily for insurance collateral purposes, leaving $240.9 million available. We also had $64.6 million available on our accounts receivable securitization facility.

Summary

Although the overall economic environment, as well as the general freight market was not what many predicted at the outset of 2012, we are very pleased with the results our organization has been able to deliver, both in the fourth quarter, and for the full year. Our key trucking metrics are trending favorably, despite economic uncertainty, and we have seen strong growth in our Intermodal and Dedicated segments. We continue to deliver on our commitment to pay down our debt, with a $174.2 million Net Debt reduction this year. We are proud of each of our team members, who meet weekly to discuss progress on their individual and team goals, which are all aligned with our organization-wide goal of improving our return on net assets. As a result of this alignment and focus, we were able to achieve record Operating Revenue, as well as record Operating Income, both for the fourth quarter and the full year, a trend we will strive to repeat in 2013.

|

12 |

Sincerely,

| Jerry Moyes | Richard Stocking | Ginnie Henkels | ||

| Chief Executive Officer | Chief Operating Officer | Chief Financial Officer |

Guidance Contained in the Letter

| • | Growth of 300-500 tractors expected for 2013 with 200 – 300 growth in Truckload and 100 – 200 growth in Dedicated |

| • | Intermodal Revenue xFSR growth targeted to be between 20-25% |

| • | Full year 2013 Net Cash Capital Expenditures expected to be approximately $250 million |

| • | Insurance and claims expense expected to be between 3.6%—3.8% of Revenue xFSR |

| • | Reduction in Net Debt in 2013 expected to be between $50—$100 million |

| • | 2013 full year effective tax rate, in accordance with GAAP, expected to be approximately 38.5%; GAAP tax rate will be used to calculate Adjusted EPS going forward |

|

13 |

Conference Call Q&A Session

Swift Transportation management will host a Q&A session at 10:00 a.m. Eastern Standard Time on Thursday, January 24th to answer questions about the Company’s financial results. Please email your questions to Investor_Relations@swifttrans.com prior to 7:00 p.m. Eastern Standard Time on Wednesday, January 23rd.

Participants may access the call using the following dial-in numbers:

U.S./Canada: (877) 897-8479

International/Local: (706) 501-7951

Conference ID: 88635091

The live webcast, letter to stockholders, transcript of the Q&A, and the replay of the earnings Q&A session can be accessed via our investor relations website at ir.swifttrans.com.

IR Contact:

Jason Bates

Vice President of Finance &

Investor Relations Officer

623.907.7335

Forward Looking Statements & Use of Non-GAAP Measures

This letter contains statements that may constitute forward-looking statements, which are based on information currently available, usually identified by words such as “anticipates,” “believes,” “estimates”, “plans,” “projects,” “expects,” “hopes,” “intends,” “will,” “could,” “should” “may,” or similar expressions which speak only as of the date the statement was made. Such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements concerning: trends relating to our operations, freight volumes, leverage, utilization, revenue, expenses, seasonal freight fluctuations and demand patterns, fleet size and composition between company and owner-operator trucks, profitability and related metrics; the timing and level of fleet size and equipment count; expectations of property and equipment dispositions and anticipated gains relative thereto during 2013; impact of reduction or increases in fuel prices; expected insurance claims expense as a percentage of Revenue xFSR; our expected effective tax rate; growth in dedicated segment revenue in 2013; estimated net cash capital expenditures for 2013; our expectations of intermodal growth; our intentions to use excess cash flows to repay debt; increasing returns on net assets; the impact of operating initiatives we have undertaken and the ability to generate returns for shareholders. Such forward-looking statements are inherently uncertain, are based upon the current beliefs, assumptions and expectations of Company management and current market conditions, which are subject to significant risks and uncertainties as set forth in the Risk Factor Section of our Annual Report Form 10-K for the year ended December 31, 2011. As to the Company’s business and financial performance, the following factors, among others, could cause actual results to differ materially from those in forward-looking statements: the amount and velocity of changes in fuel prices and our ability to recover fuel prices through our fuel surcharge program; the direction and duration of any trends, in pricing and volumes; assumptions regarding demand; any future recessionary economic cycles and downturns in customers’ business cycles, particularly in market segments and industries in which we have a significant concentration of customers; increasing competition from trucking, rail, intermodal, and brokerage competitors; a significant reduction in, or termination of, our trucking services by a key customer; our ability to achieve our strategy of growing our revenue; volatility in the price or availability of fuel; increases in new equipment prices or replacement costs; our significant ongoing capital requirements; the regulatory environment in which we operate, including existing regulations and changes in existing regulations, or violations by us of existing or future regulations; the costs of environmental and safety compliance and/or the imposition of liabilities under environmental and safety laws and regulations; difficulties in driver recruitment and retention; increases in driver compensation to the extent not offset by increases in freight rates; changes in rules or legislation by the National Labor Relations Board or Congress and/or union organizing efforts; potential volatility or decrease in the amount of earnings as a result of our claims exposure through our wholly-owned captive insurance companies; risks relating to our captive insurance companies; uncertainties associated with our operations in Mexico; our ability to attract and maintain relationships with owner-operators; the possible re-classification of our owner-operators as employees; adverse results from litigation; our ability to retain or replace key personnel; conflicts of interest or potential litigation that may arise from other businesses owned by Jerry Moyes, including pledges of Swift stock by Jerry Moyes; our dependence on third parties for intermodal and brokerage business; potential

|

14 |

failure in computer or communications systems; our ability to execute or integrate any future acquisitions successfully; seasonal factors such as harsh weather conditions that increase operating costs; our ability to sustain cost savings realized as part of recent cost reduction initiatives; our history of net losses; goodwill impairment; our level of indebtedness and our ability to service our outstanding indebtedness, including compliance with our indebtedness covenants, and the impact such indebtedness may have on the way we operate our business. You should understand that many important factors, in addition to those listed above and in our filings with the SEC, could impact us financially. As a result of these and other factors, actual results may differ from those set forth in the forward-looking statements and the prices of the Company’s securities may fluctuate dramatically. The Company makes no commitment, and disclaims any duty, to update or revise any forward-looking statements to reflect future events, new information or changes in these expectations. In addition to our GAAP results, this Letter to Stockholders also includes certain non-GAAP financial measures as defined by the SEC. The calculation of each measure, including a reconciliation to the most closely related GAAP measure and the reasons management believes each non-GAAP measure is useful, are included in the attached schedules.

|

15 |

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

THREE MONTHS AND YEARS ENDED DECEMBER 31, 2012 AND 2011

| Three Months Ended December 31, |

Years Ended December 31, |

|||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||

| (Unaudited) | ||||||||||||||||

| (Amounts in thousands, except per share data) | ||||||||||||||||

| Operating revenue |

$ | 922,619 | $ | 860,723 | $ | 3,493,182 | $ | 3,333,908 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating expenses: |

||||||||||||||||

| Salaries, wages and employee benefits |

205,278 | 194,810 | 803,996 | 789,888 | ||||||||||||

| Operating supplies and expenses |

62,898 | 60,542 | 245,085 | 238,206 | ||||||||||||

| Fuel |

152,060 | 153,015 | 602,615 | 631,552 | ||||||||||||

| Purchased transportation |

265,443 | 236,972 | 1,010,185 | 889,432 | ||||||||||||

| Rental expense |

29,973 | 20,943 | 108,921 | 81,841 | ||||||||||||

| Insurance and claims |

25,004 | 23,224 | 107,569 | 95,077 | ||||||||||||

| Depreciation and amortization of property and equipment |

49,758 | 51,204 | 199,829 | 204,173 | ||||||||||||

| Amortization of intangibles |

4,204 | 4,405 | 16,925 | 18,258 | ||||||||||||

| Impairments |

2,322 | — | 3,387 | — | ||||||||||||

| Gain on disposal of property and equipment |

(3,466 | ) | (2,573 | ) | (14,080 | ) | (8,474 | ) | ||||||||

| Communication and utilities |

6,226 | 6,385 | 24,601 | 25,999 | ||||||||||||

| Operating taxes and licenses |

15,809 | 14,776 | 62,103 | 61,943 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating expenses |

815,509 | 763,703 | 3,171,136 | 3,027,895 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

107,110 | 97,020 | 322,046 | 306,013 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other (income) expenses: |

||||||||||||||||

| Interest expense |

27,613 | 35,212 | 118,091 | 145,973 | ||||||||||||

| Derivative interest expense |

— | 2,990 | 5,101 | 15,057 | ||||||||||||

| Interest income |

(595 | ) | (400 | ) | (2,098 | ) | (1,900 | ) | ||||||||

| Loss on debt extinguishment |

— | — | 22,219 | — | ||||||||||||

| Impairments of non-operating assets |

5,979 | — | 5,979 | — | ||||||||||||

| Other |

(609 | ) | (394 | ) | (2,895 | ) | (1,949 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other (income) expenses, net |

32,388 | 37,408 | 146,397 | 157,181 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income taxes |

74,722 | 59,612 | 175,649 | 148,832 | ||||||||||||

| Income tax expense |

27,872 | 22,800 | 61,060 | 58,282 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 46,850 | $ | 36,812 | $ | 114,589 | $ | 90,550 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic earnings per share |

$ | 0.34 | $ | 0.26 | $ | 0.82 | $ | 0.65 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted earnings per share |

$ | 0.34 | $ | 0.26 | $ | 0.82 | $ | 0.65 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Shares used in per share calculations |

||||||||||||||||

| Basic |

139,551 | 139,499 | 139,532 | 139,155 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

139,618 | 139,528 | 139,619 | 139,663 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

|

16 |

ADJUSTED EPS RECONCILIATION (UNAUDITED) (a)

THREE MONTHS AND YEARS ENDED DECEMBER 31, 2012, 2011 AND 2010

| Three Months Ended December 31, |

Years Ended December 31, |

|||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 | 2011 | 2010 | |||||||||||||||||||

| Diluted earnings (loss) per share |

$ | 0.34 | $ | 0.26 | $ | (0.66 | ) | $ | 0.82 | $ | 0.65 | $ | (1.98 | ) | ||||||||||

| Adjusted for: |

||||||||||||||||||||||||

| Income tax expense (benefit) |

0.20 | 0.16 | (0.57 | ) | 0.44 | 0.42 | (0.69 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) before income taxes |

0.54 | 0.43 | (1.24 | ) | 1.26 | 1.07 | (2.67 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-cash impairments (b) |

0.02 | — | — | 0.02 | — | 0.02 | ||||||||||||||||||

| Non-cash impairments of non-operating assets (c) |

0.04 | — | — | 0.04 | — | — | ||||||||||||||||||

| Acceleration of non-cash stock options (d) |

— | — | 0.31 | — | — | 0.36 | ||||||||||||||||||

| Loss on debt extinguishment (e) |

— | — | 1.31 | 0.16 | — | 1.51 | ||||||||||||||||||

| Other special non-cash items (f) |

— | — | — | — | — | 0.12 | ||||||||||||||||||

| Mark-to-market adjustment of interest rate swaps (g) |

— | — | 0.01 | — | — | 0.39 | ||||||||||||||||||

| Amortization of certain intangibles (h) |

0.03 | 0.03 | 0.06 | 0.11 | 0.12 | 0.30 | ||||||||||||||||||

| Amortization of unrealized losses on interest rate swaps (i) |

— | 0.02 | — | 0.04 | 0.11 | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted income (loss) before income taxes |

0.62 | 0.48 | 0.46 | 1.63 | 1.30 | 0.03 | ||||||||||||||||||

| Provision for income tax (benefit) expense at normalized effective rate |

0.24 | 0.19 | 0.18 | 0.63 | 0.51 | 0.01 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EPS |

$ | 0.38 | $ | 0.29 | $ | 0.28 | $ | 1.00 | $ | 0.79 | $ | 0.02 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | We define Adjusted EPS as (1) income (loss) before income taxes plus (i) amortization of the intangibles from our 2007 going-private transaction, (ii) non-cash impairments, (iii) other special non-cash items, (iv) excludable transaction costs, (v) the mark-to-market adjustment on our interest rate swaps that is recognized in the statement of operations in a given period, and (vi) the amortization of previous losses recorded in accumulated other comprehensive income (loss) (“OCI”) related to the interest rate swaps we terminated upon our IPO and refinancing transactions in December 2010; (2) reduced by income taxes at 39%, our normalized effective tax rate; (3) divided by weighted average diluted shares outstanding. We believe the presentation of financial results excluding the impact of the items noted above provides a consistent basis for comparing our results from period to period and to those of our peers due to the non-comparable nature of the intangibles from our going-private transaction, the historical volatility of the interest rate derivative agreements and the non-operating nature of the impairment charges, transaction costs and other adjustment items. Adjusted EPS is not presented in accordance with GAAP and should be considered in addition to, not as a substitute for, or superior to, measures of financial performance in accordance with GAAP. The numbers reflected in the above table are calculated on a per share basis and may not foot due to rounding. |

| (b) | In the fourth quarter of 2012, a deposit related to the purchase of certain fuel technology equipment and a related asset were written off as the supplier ceased operations, resulting in a pre-tax impairment of $2.3 million. In the first quarter of 2012, real property with a carrying amount of $1.7 million was written down to its fair value of $0.6 million, resulting in a pre-tax impairment charge of $1.1 million. In the first quarter of 2010, revenue equipment with a carrying value of $3.6 million was written down to its fair value of $2.3 million, resulting in a pre-tax impairment charge of $1.3 million. |

| (c) | Swift Power Services, LLC (“SPS”), an entity in which we own a minority interest, failed to make its first scheduled principal payment and quarterly interest payment to us on December 31, 2012 due to a decline in its financial performance resulting from a legal dispute with the former owners and its primary customer. This caused us to evaluate the secured promissory note due from SPS for impairment, which resulted in a $6.0 million pre-tax adjustment that was recorded in Impairments of non-operational assets in the fourth quarter of 2012. |

| (d) | In the fourth quarter of 2010, we incurred a $22.6 million one-time non-cash equity compensation charge for certain stock options that vested upon our IPO. |

| (e) | On May 21, 2012, we completed the call of our remaining $15.2 million face value 12.50% fixed rate notes due May 15, 2017, at a price of 106.25% of face value pursuant to the terms of the indenture governing the notes, resulting in a loss on debt extinguishment of $1.3 million, representing the call premium and write-off of the remaining unamortized deferred financing fees. On March 6, 2012, we entered into an Amended and Restated Credit Agreement (“New Agreement”). The New Agreement replaced the then-existing, remaining $874 million face value first lien term loan, which was scheduled to mature in December 2016. The replacement of the then-existing first lien term loan resulted in a loss on debt extinguishment of $20.9 million in the first quarter of 2012, representing the write-off of the unamortized original issue discount and deferred financing fees associated with the original term loan. In December 2010, we incurred a $95.5 million loss on debt extinguishment related to the termination of the previous senior secured credit facility and the tender offer and consent solicitation process for the fixed and floating rate notes comprised of the write-off of $50.3 million of existing deferred loan costs related to the debt extinguishment and $45.2 million of legal and advisory costs, tender premiums, and consent fees related to the cancelled fixed and floating rate notes. |

|

17 |

| (f) | Incremental pre-tax depreciation expense of $7.4 million reflecting management’s revised estimates regarding salvage value and useful lives for approximately 7,000 dry van trailers, which management decided during the first quarter of 2010 to scrap over the next few years. |

| (g) | Mark-to-market adjustment of interest rate swaps of $1.1 million and $24.5 million in the three months and year ended December 31, 2010, respectively, reflects the portion of the change in fair value of these financial instruments which was recorded in earnings and excludes any portion recorded in accumulated other OCI under cash flow hedge accounting. |

| (h) | Amortization of certain intangibles reflects the non-cash amortization expense of $3.9 million, $4.1 million and $4.5 million for the three months ended December 31, 2012, 2011 and 2010, respectively, and $15.8 million, $17.1 million and $19.3 million for the years ended December 31, 2012, 2011 and 2010, respectively, relating to certain intangible assets identified in the 2007 going-private transaction through which Swift Corporation acquired Swift Transportation Co. |

| (i) | Amortization of unrealized losses on interest rate swaps reflects the non-cash amortization expense of $3.0 million for the three months ended December 31, 2011 and $5.1 million and $15.1 million for the years ended December 31, 2012 and 2011, respectively, included in derivative interest expense in the consolidated statements of operations and is comprised of previous losses recorded in accumulated OCI related to the interest rate swaps we terminated upon our IPO and concurrent refinancing transactions in December 2010. Such losses were incurred in prior periods when hedge accounting applied to the swaps and were expensed in relation to the hedged interest payments through the original maturity of the swaps in August 2012. |

|

18 |

ADJUSTED OPERATING INCOME AND OPERATING RATIO RECONCILIATION (UNAUDITED) (a)

THREE MONTHS AND YEARS ENDED DECEMBER 31, 2012, 2011 AND 2010

| Three Months Ended December 31, |

Years

Ended, December 31, |

|||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 | 2011 | 2010 | |||||||||||||||||||

| (Amounts in thousands) | ||||||||||||||||||||||||

| Operating revenue |

$ | 922,619 | $ | 860,723 | $ | 780,427 | $ | 3,493,182 | $ | 3,333,908 | $ | 2,929,723 | ||||||||||||

| Less: Fuel surcharge revenue |

182,723 | 165,449 | 118,816 | 690,192 | 654,119 | 429,155 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Revenue xFSR |

739,896 | 695,274 | 661,611 | 2,802,990 | 2,679,789 | 2,500,568 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating expense |

815,509 | 763,703 | 703,854 | 3,171,136 | 3,027,895 | 2,686,668 | ||||||||||||||||||

| Adjusted for: |

||||||||||||||||||||||||

| Fuel surcharge revenue |

(182,723 | ) | (165,449 | ) | (118,816 | ) | (690,192 | ) | (654,119 | ) | (429,155 | ) | ||||||||||||

| Amortization of certain intangibles (b) |

(3,912 | ) | (4,113 | ) | (4,548 | ) | (15,758 | ) | (17,092 | ) | (19,305 | ) | ||||||||||||

| Non-cash impairments (c) |

(2,322 | ) | — | — | (3,387 | ) | — | (1,274 | ) | |||||||||||||||

| Other items (d) |

— | — | — | — | — | (7,382 | ) | |||||||||||||||||

| Acceleration on non-cash stock options (e) |

— | — | (22,605 | ) | — | — | (22,605 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted operating expense |

626,552 | 594,141 | 557,885 | 2,461,799 | 2,356,684 | 2,206,947 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted operating income |

$ | 113,344 | $ | 101,133 | $ | 103,726 | $ | 341,191 | $ | 323,105 | $ | 293,621 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted Operating Ratio |

84.7 | % | 85.5 | % | 84.3 | % | 87.8 | % | 87.9 | % | 88.3 | % | ||||||||||||

| Operating Ratio |

88.4 | % | 88.7 | % | 90.2 | % | 90.8 | % | 90.8 | % | 91.7 | % | ||||||||||||

| (a) | We define Adjusted Operating Ratio as (a) total operating expenses, less (i) fuel surcharges, (ii) amortization of the intangibles from our 2007 going-private transaction, (iii) non-cash impairment charges, (iv) other special non-cash items, and (v) excludable transaction costs, as a percentage of (b) total revenue excluding fuel surcharge revenue. We believe fuel surcharge is sometimes volatile and eliminating the impact of this source of revenue (by netting fuel surcharge revenue against fuel expense) affords a more consistent basis for comparing our results of operations. We also believe excluding impairments, non-comparable nature of the intangibles from our going-private transaction and other special items enhances the comparability of our performance from period to period. Adjusted Operating Ratio is not a recognized measure under GAAP. Adjusted Operating Ratio should be considered in addition to, not as a substitute for, or superior to, measures of financial performance in accordance with GAAP. |

| (b) | Amortization of certain intangibles reflects the non-cash amortization expense of $3.9 million, $4.1 million and $4.5 million for the three months ended December 31, 2012, 2011 and 2010, respectively, and $15.8 million, $17.1 million and $19.3 million for the years ended December 31, 2012, 2011 and 2010, respectively, relating to certain intangible assets identified in the 2007 going-private transaction through which Swift Corporation acquired Swift Transportation Co. |

| (c) | In the fourth quarter of 2012, a deposit related to the purchase of certain fuel technology equipment and a related asset were written off as the supplier ceased operations, resulting in a pre-tax impairment of $2.3 million. In the first quarter of 2012, real property with a carrying amount of $1.7 million was written down to its fair value of $0.6 million, resulting in a pre-tax impairment charge of $1.1 million. In the first quarter of 2010, revenue equipment with a carrying value of $3.6 million was written down to its fair value of $2.3 million, resulting in a pre-tax impairment charge of $1.3 million. |

| (d) | Incremental pre-tax depreciation expense of $7.4 million reflecting management’s revised estimates regarding salvage value and useful lives for approximately 7,000 dry van trailers, which management decided during the first quarter of 2010 to scrap over the next few years. |

| (e) | In the fourth quarter of 2010, we incurred a $22.6 million one-time non-cash equity compensation charge for certain stock options that vested upon our IPO. |

|

19 |

ADJUSTED EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION

AND AMORTIZATION (UNAUDITED) (a)

THREE MONTHS AND YEARS ENDED DECEMBER 31, 2012, 2011 AND 2010

| Three Months

Ended December 31, |

Years

Ended December 31, |

|||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 | 2011 | 2010 | |||||||||||||||||||

| (Amounts in thousands) | ||||||||||||||||||||||||

| Net income (loss) |

$ | 46,850 | $ | 36,812 | $ | (48,314 | ) | $ | 114,589 | $ | 90,550 | $ | (125,413 | ) | ||||||||||

| Adjusted for: |

||||||||||||||||||||||||

| Depreciation and amortization of property and equipment |

49,758 | 51,204 | 49,830 | 199,829 | 204,173 | 206,279 | ||||||||||||||||||

| Amortization of intangibles |

4,204 | 4,405 | 4,840 | 16,925 | 18,258 | 20,472 | ||||||||||||||||||

| Interest expense |

27,613 | 35,212 | 61,670 | 118,091 | 145,973 | 251,129 | ||||||||||||||||||

| Derivative interest expense |

— | 2,990 | 11,430 | 5,101 | 15,057 | 70,399 | ||||||||||||||||||

| Interest income |

(595 | ) | (400 | ) | (579 | ) | (2,098 | ) | (1,900 | ) | (1,379 | ) | ||||||||||||

| Income tax expense (benefit) |

27,872 | 22,800 | (41,837 | ) | 61,060 | 58,282 | (43,432 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings before interest, taxes, depreciation and amortization (EBITDA) |

$ | 155,702 | $ | 153,023 | $ | 37,040 | $ | 513,497 | $ | 530,393 | $ | 378,055 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-cash equity compensation (b) |

514 | 1,261 | 22,883 | 4,645 | 6,785 | 22,883 | ||||||||||||||||||

| Loss on debt extinguishment (c) |

— | — | 95,461 | 22,219 | — | 95,461 | ||||||||||||||||||

| Non-cash impairments (d) |

2,322 | — | — | 3,387 | — | 1,274 | ||||||||||||||||||

| Non-cash impairments of non-operating assets (e) |

5,979 | — | — | 5,979 | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) |

$ | 164,517 | $ | 154,284 | $ | 155,384 | $ | 549,727 | $ | 537,178 | $ | 497,673 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | We define Adjusted EBITDA as net income (loss) plus (i) depreciation and amortization, (ii) interest and derivative interest expense, including other fees and charges associated with indebtedness, net of interest income, (iii) income taxes, (iv) non-cash equity compensation expense, (v) non-cash impairments, (vi) other special non-cash items, and (vii) excludable transaction costs. We believe that Adjusted EBITDA is a relevant measure for estimating the cash generated by our operations that would be available to cover capital expenditures, taxes, interest and other investments and that it enhances an investor’s understanding of our financial performance. We use Adjusted EBITDA for business planning purposes and in measuring our performance relative to that of our competitors. Our method of computing Adjusted EBITDA is consistent with that used in our senior secured credit agreement for covenant compliance purposes and may differ from similarly titled measures of other companies. Adjusted EBITDA is not a recognized measure under GAAP. Adjusted EBITDA should be considered in addition to, not as a substitute for or superior to, net income, cash flow from operations, operating income or any other performance measures derived in accordance with GAAP as measures of operating performance or operating cash flows as a measure of liquidity. |

| (b) | Represents recurring non-cash equity compensation expense following our IPO, on a pre-tax basis. In accordance with the terms of our senior credit agreement, this expense is added back in the calculation of Adjusted EBITDA for covenant compliance purposes. |

| (c) | On May 21, 2012, we completed the call of our remaining $15.2 million face value 12.50% fixed rate notes due May 15, 2017, at a price of 106.25% of face value pursuant to the terms of the indenture governing the notes, resulting in a loss on debt extinguishment of $1.3 million, representing the call premium and write-off of the remaining unamortized deferred financing fees. On March 6, 2012, we entered into an Amended and Restated Credit Agreement (“New Agreement”). The New Agreement replaced the then-existing remaining $874 million face value first lien term loan, which was scheduled to mature in December 2016. The replacement of the then-existing first lien term loan resulted in a loss on debt extinguishment of $20.9 million in the first quarter of 2012, representing the write-off of the unamortized original issue discount and deferred financing fees associated with the original term loan. In December 2010, we incurred a $95.5 million loss on debt extinguishment related to the termination of the previous senior secured credit facility and the tender offer and consent solicitation process for the fixed and floating rate notes comprised of the write-off of $50.3 million of existing deferred loan costs related to the debt extinguishment and $45.2 million of legal and advisory costs, tender premiums, and consent fees related to the cancelled fixed and floating rate notes. |

| (d) | In the fourth quarter of 2012, a deposit related to the purchase of certain fuel technology equipment and a related asset were written off as the supplier ceased operations, resulting in a pre-tax impairment of $2.3 million. In the first quarter of 2012, real property with a carrying amount of $1.7 million was written down to its fair value of $0.6 million, resulting in a pre-tax impairment charge of $1.1 million. In the first quarter of 2010, revenue equipment with a carrying value of $3.6 million was written down to its fair value of $2.3 million, resulting in a pre-tax impairment charge of $1.3 million. |

| (e) | Swift Power Services, LLC (“SPS”), an entity in which we own a minority interest, failed to make its first scheduled principal payment and quarterly interest payment to us on December 31, 2012 due to a decline in its financial performance resulting from a legal dispute with the former owners and its primary customer. This caused us to evaluate the secured promissory note due from SPS for impairment, which resulted in a $6.0 million pre-tax adjustment that was recorded in Impairments of non-operational assets in the fourth quarter of 2012. |

|

20 |

FINANCIAL INFORMATION BY SEGMENT (UNAUDITED)

THREE MONTHS AND YEARS ENDED DECEMBER 31, 2012, 2011 AND 2010

| Three Months Ended December 31, |

Years

Ended, December 31, |

|||||||||||||||||||||||

| 2012 | 2011 | 2010 | 2012 | 2011 | 2010 | |||||||||||||||||||

| (Amounts in thousands) | ||||||||||||||||||||||||

| Operating revenue: |

||||||||||||||||||||||||

| Truckload |

$ | 591,100 | $ | 573,198 | $ | 548,198 | $ | 2,282,342 | $ | 2,336,056 | $ | 2,078,687 | ||||||||||||

| Dedicated |

188,150 | 174,636 | 135,341 | 724,405 | 625,268 | 514,005 | ||||||||||||||||||

| Intermodal |

97,710 | 72,830 | 57,666 | 333,938 | 237,875 | 212,285 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Subtotal |

876,960 | 820,664 | 741,205 | 3,340,685 | 3,199,199 | 2,804,977 | ||||||||||||||||||

| Nonreportable segments (a) |

58,791 | 53,602 | 45,863 | 211,112 | 192,987 | 142,974 | ||||||||||||||||||

| Intersegment eliminations |

(13,132 | ) | (13,543 | ) | (6,641 | ) | (58,615 | ) | (58,278 | ) | (18,228 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Consolidated operating revenue |

$ | 922,619 | $ | 860,723 | $ | 780,427 | $ | 3,493,182 | $ | 3,333,908 | $ | 2,929,723 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating income (loss): |

||||||||||||||||||||||||

| Truckload |

$ | 77,639 | $ | 68,295 | $ | 67,739 | $ | 246,005 | $ | 222,954 | $ | 193,489 | ||||||||||||

| Dedicated |

23,922 | 21,292 | 19,934 | 74,026 | 69,753 | 66,573 | ||||||||||||||||||

| Intermodal (b) |

(445 | ) (b) | 2,877 | 2,367 | (6,854 | ) (b) | 3,146 | 5,827 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Subtotal |

101,116 | 92,464 | 90,040 | 313,177 | 295,853 | 265,889 | ||||||||||||||||||

| Nonreportable segments (a) |

5,994 | 4,556 | (13,467 | ) | 8,869 | 10,160 | (22,834 | ) | ||||||||||||||||

| Intersegment eliminations |

— | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Consolidated operating income |

$ | 107,110 | $ | 97,020 | $ | 76,573 | $ | 322,046 | $ | 306,013 | $ | 243,055 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating Ratio: |

||||||||||||||||||||||||

| Truckload |

86.9 | % | 88.1 | % | 87.6 | % | 89.2 | % | 90.5 | % | 90.7 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Dedicated |

87.3 | % | 87.8 | % | 85.3 | % | 89.8 | % | 88.8 | % | 87.0 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Intermodal (b) |

100.5 | %(b) | 96.0 | % | 95.9 | % | 102.1 | %(b) | 98.7 | % | 97.3 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted Operating Ratio (c): |

||||||||||||||||||||||||

| Truckload |

83.3 | % | 85.0 | % | 85.2 | % | 86.3 | % | 87.9 | % | 88.9 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Dedicated |

84.3 | % | 85.1 | % | 83.0 | % | 87.5 | % | 86.4 | % | 85.2 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Intermodal (b) |

100.6 | %(b) | 95.0 | % | 95.1 | % | 102.6 | %(b) | 98.3 | % | 96.7 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (a) | Our nonreportable segments are comprised of our freight brokerage and logistics management services, IEL, insurance and shop activities. |