Attached files

| file | filename |

|---|---|

| 10-Q - 10-Q - Jones Lang LaSalle Income Property Trust, Inc. | jllipt-20140630x10q.htm |

| EX-32.1 - EX-32.1 - Jones Lang LaSalle Income Property Trust, Inc. | exhibit321.htm |

| EX-32.2 - EX-32.2 - Jones Lang LaSalle Income Property Trust, Inc. | exhibit322.htm |

| EX-31.2 - EX-31.2 - Jones Lang LaSalle Income Property Trust, Inc. | exhibit312.htm |

| EX-31.1 - EX-31.1 - Jones Lang LaSalle Income Property Trust, Inc. | exhibit311.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Jones Lang LaSalle Income Property Trust, Inc. | Financial_Report.xls |

Exhibit 4.2

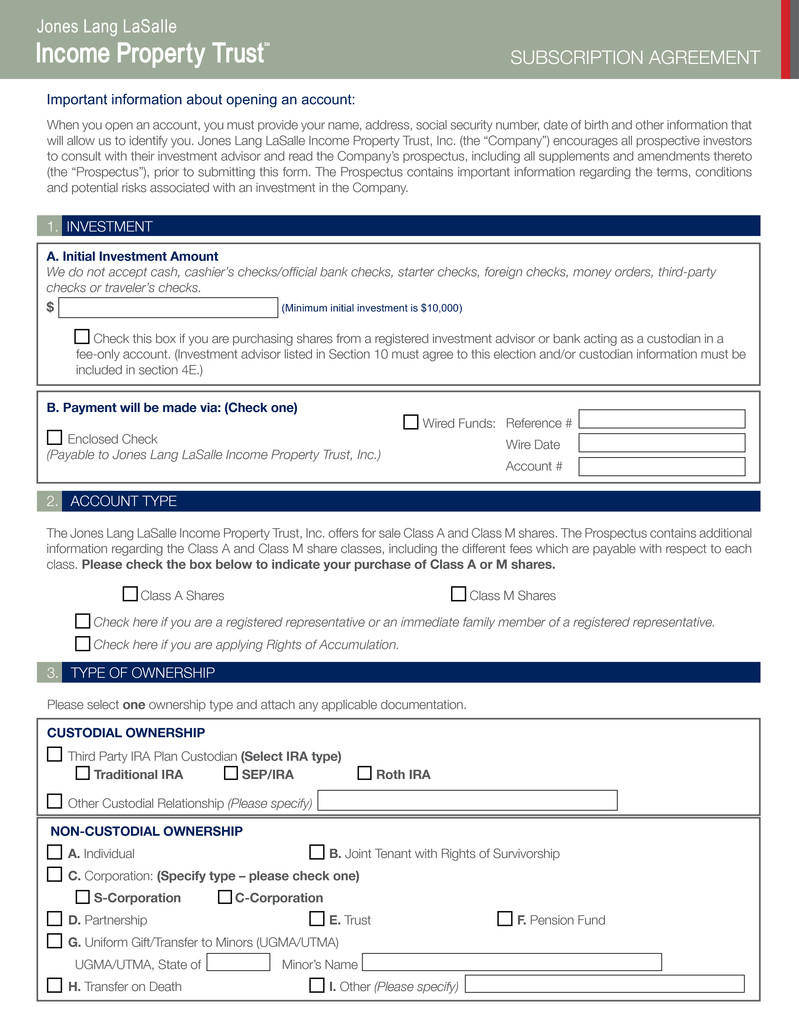

3. TYPE OF OWNERSHIP Please select one ownership type and attach any applicable documentation. CUSTODIAL OWNERSHIP Third Party IRA Plan Custodian (Select IRA type) Traditional IRA SEP/IRA Roth IRA Other Custodial Relationship (Please specify) NON-CUSTODIAL OWNERSHIP A. Individual B. Joint Tenant with Rights of Survivorship C. Corporation: (Specify type – please check one) S-Corporation C-Corporation D. Partnership E. Trust F. Pension Fund G. Uniform Gift/Transfer to Minors (UGMA/UTMA) UGMA/UTMA, State of Minor’s Name H. Transfer on Death I. Other (Please specify) When you open an account, you must provide your name, address, social security number, date of birth and other information that will allow us to identify you. Jones Lang LaSalle Income Property Trust, Inc. (the “Company”) encourages all prospective investors to consult with their investment advisor and read the Company’s prospectus, including all supplements and amendments thereto (the “Prospectus”), prior to submitting this form. The Prospectus contains important information regarding the terms, conditions and potential risks associated with an investment in the Company. Reference # Wire Date Account # Important information about opening an account: 1. INVESTMENT A. Initial Investment Amount We do not accept cash, cashier’s checks/official bank checks, starter checks, foreign checks, money orders, third-party checks or traveler’s checks. $ (Minimum initial investment is $10,000) Check this box if you are purchasing shares from a registered investment advisor or bank acting as a custodian in a fee-only account. (Investment advisor listed in Section 10 must agree to this election and/or custodian information must be included in section 4E.) B. Payment will be made via: (Check one) Wired Funds: Enclosed Check (Payable to Jones Lang LaSalle Income Property Trust, Inc.) 2. ACCOUNT TYPE The Jones Lang LaSalle Income Property Trust, Inc. offers for sale Class A and Class M shares. The Prospectus contains additional information regarding the Class A and Class M share classes, including the different fees which are payable with respect to each class. Please check the box below to indicate your purchase of Class A or M shares. Class A Shares Class M Shares Check here if you are a registered representative or an immediate family member of a registered representative. Check here if you are applying Rights of Accumulation.

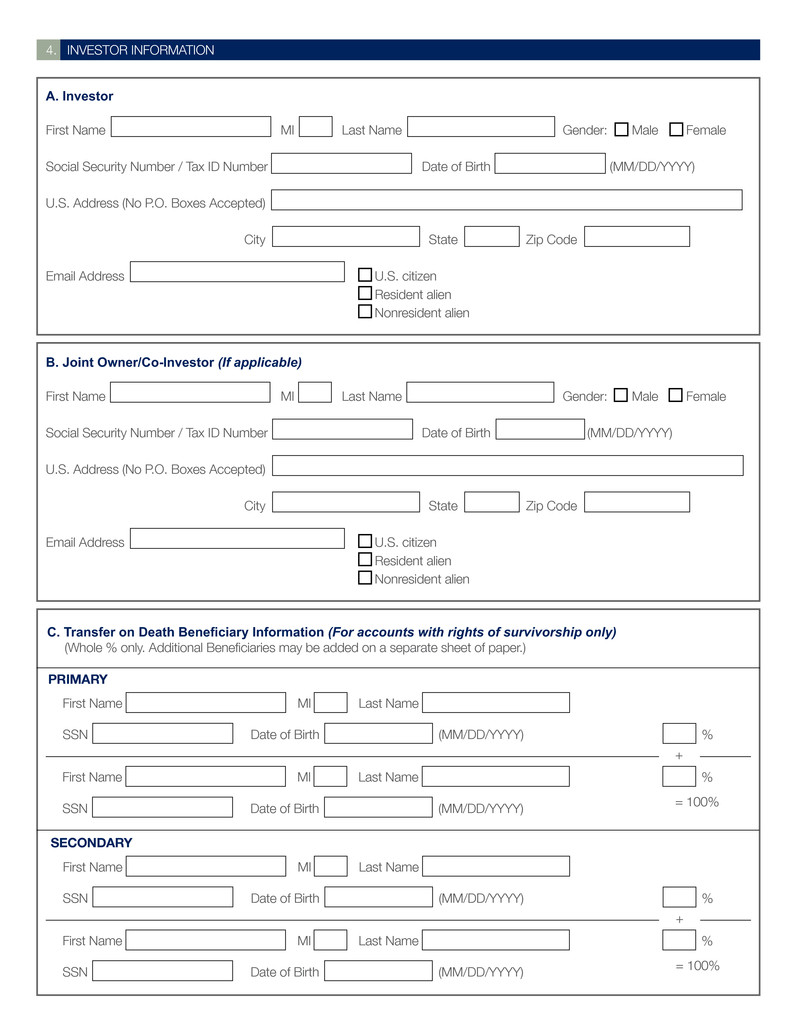

B. Joint Owner/Co-Investor (If applicable) First Name MI Last Name Gender: Male Female Social Security Number / Tax ID Number Date of Birth (MM/DD/YYYY) U.S. Address (No P.O. Boxes Accepted) City State Zip Code Email Address U.S. citizen Resident alien Nonresident alien A. Investor First Name MI Last Name Gender: Male Female Social Security Number / Tax ID Number Date of Birth (MM/DD/YYYY) U.S. Address (No P.O. Boxes Accepted) City State Zip Code Email Address U.S. citizen Resident alien Nonresident alien 4. INVESTOR INFORMATION C. Transfer on Death Beneficiary Information (For accounts with rights of survivorship only) (Whole % only. Additional Beneficiaries may be added on a separate sheet of paper.) First Name MI Last Name SSN Date of Birth (MM/DD/YYYY) % PRIMARY First Name MI Last Name % SSN Date of Birth (MM/DD/YYYY) First Name MI Last Name SSN Date of Birth (MM/DD/YYYY) % SECONDARY First Name MI Last Name % SSN Date of Birth (MM/DD/YYYY) + = 100% + = 100%

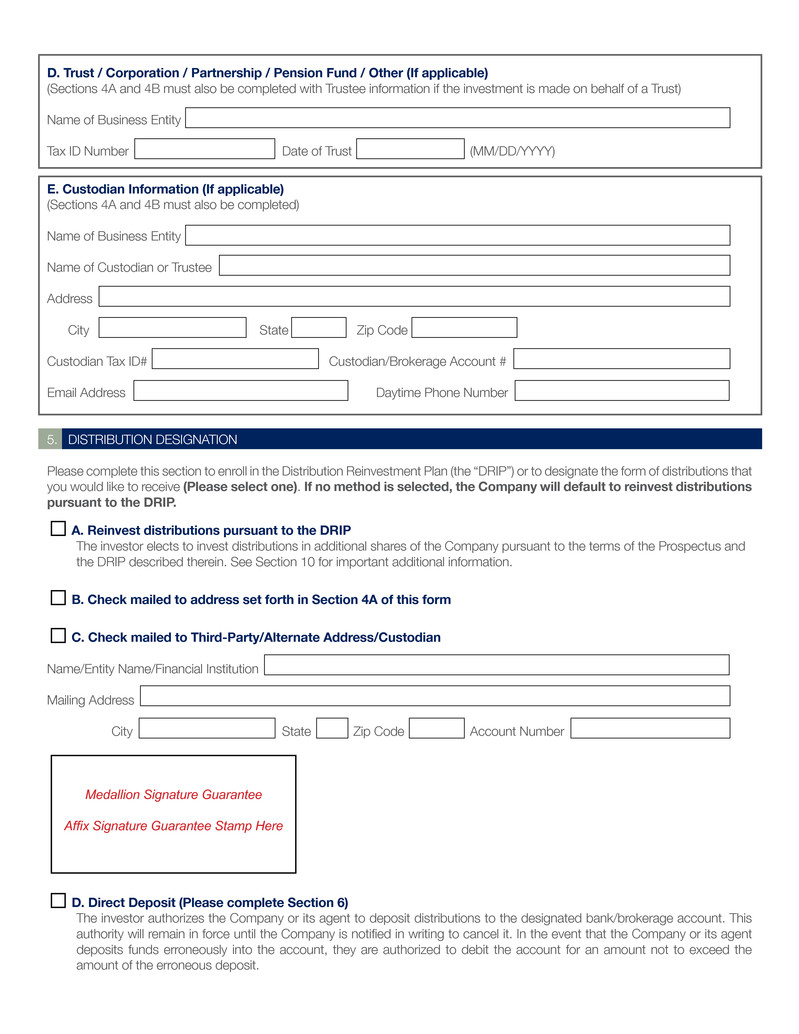

D. Trust / Corporation / Partnership / Pension Fund / Other (If applicable) (Sections 4A and 4B must also be completed with Trustee information if the investment is made on behalf of a Trust) Name of Business Entity Tax ID Number Date of Trust (MM/DD/YYYY) E. Custodian Information (If applicable) (Sections 4A and 4B must also be completed) Name of Business Entity Name of Custodian or Trustee Address City State Zip Code Custodian Tax ID# Custodian/Brokerage Account # Email Address Daytime Phone Number 5. DISTRIBUTION DESIGNATION Please complete this section to enroll in the Distribution Reinvestment Plan (the “DRIP”) or to designate the form of distributions that you would like to receive (Please select one). If no method is selected, the Company will default to reinvest distributions pursuant to the DRIP. A. Reinvest distributions pursuant to the DRIP The investor elects to invest distributions in additional shares of the Company pursuant to the terms of the Prospectus and the DRIP described therein. See Section 10 for important additional information. B. Check mailed to address set forth in Section 4A of this form C. Check mailed to Third-Party/Alternate Address/Custodian Name/Entity Name/Financial Institution Mailing Address City State Zip Code Account Number D. Direct Deposit (Please complete Section 6) The investor authorizes the Company or its agent to deposit distributions to the designated bank/brokerage account. This authority will remain in force until the Company is notified in writing to cancel it. In the event that the Company or its agent deposits funds erroneously into the account, they are authorized to debit the account for an amount not to exceed the amount of the erroneous deposit. Medallion Signature Guarantee Affix Signature Guarantee Stamp Here

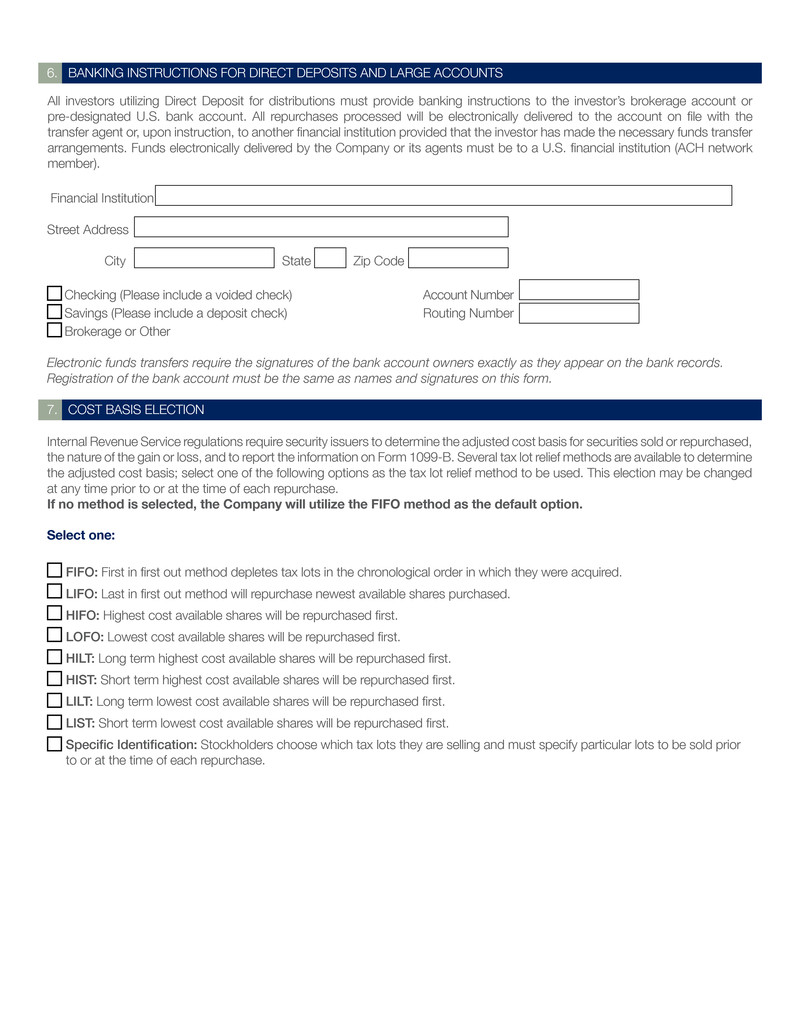

6. BANKING INSTRUCTIONS FOR DIRECT DEPOSITS AND LARGE ACCOUNTS Financial Institution Street Address City State Zip Code Checking (Please include a voided check) Account Number Savings (Please include a deposit check) Routing Number Brokerage or Other Electronic funds transfers require the signatures of the bank account owners exactly as they appear on the bank records. Registration of the bank account must be the same as names and signatures on this form. 7. COST BASIS ELECTION Select one: FIFO: First in first out method depletes tax lots in the chronological order in which they were acquired. LIFO: Last in first out method will repurchase newest available shares purchased. HIFO: Highest cost available shares will be repurchased first. LOFO: Lowest cost available shares will be repurchased first. HILT: Long term highest cost available shares will be repurchased first. HIST: Short term highest cost available shares will be repurchased first. LILT: Long term lowest cost available shares will be repurchased first. LIST: Short term lowest cost available shares will be repurchased first. Specific Identification: Stockholders choose which tax lots they are selling and must specify particular lots to be sold prior to or at the time of each repurchase. All investors utilizing Direct Deposit for distributions must provide banking instructions to the investor’s brokerage account or pre-designated U.S. bank account. All repurchases processed will be electronically delivered to the account on file with the transfer agent or, upon instruction, to another financial institution provided that the investor has made the necessary funds transfer arrangements. Funds electronically delivered by the Company or its agents must be to a U.S. financial institution (ACH network member). Internal Revenue Service regulations require security issuers to determine the adjusted cost basis for securities sold or repurchased, the nature of the gain or loss, and to report the information on Form 1099-B. Several tax lot relief methods are available to determine the adjusted cost basis; select one of the following options as the tax lot relief method to be used. This election may be changed at any time prior to or at the time of each repurchase. If no method is selected, the Company will utilize the FIFO method as the default option.

8. IMPORTANT INVESTOR INFORMATION All items on this form must be completed in order to process the application. Please note that the Company, its agents and participating broker-dealers are required by law to obtain, verify and record certain personal information obtained to establish this account. We may also ask for other identifying documents or financial information relevant to a suitability assessment. If that information is not provided, we may not be able to open the account. In order to invest in the Company, we only accept checks drawn from a U.S. bank account or wired funds from a U.S. financial institution (ACH network member). We do not accept money orders, traveler’s checks, starter checks, foreign checks, counter checks, third-party checks or cash. IMPORTANT INFORMATION FOR INVESTORS IN THE DISTRIBUTION REINVESTMENT PLAN: If you elect to participate in the Distribution Reinvestment Plan, you are requested to promptly notify the Company in writing if at any time you experience a material change in your financial condition, including the failure to meet the income, net worth and investment concentration standards imposed by your state of residence and as set forth in the Prospectus and this form relating to such investment or can no longer make the representations or warranties set forth in Section 9 of this form. This request in no way shifts the responsibility of the Company’s sponsor, or any other person selling shares on behalf of the Company to you, to make every reasonable effort to determine that the purchase of shares in this offering is a suitable and appropriate investment based on information provided by you. IMPORTANT INFORMATION FOR INVESTORS PURCHASING SHARES UNDER THE TERMS FOR UNIFORM GIFTS OR TRANSFERS TO MINORS (UGMA / UTMA): To the extent that shares of the Company are purchased for the benefit of a minor under UGMA /UTMA, the minor will be required to complete a Subscription Eligibility Form and Account Application at the time that he or she becomes of legal age as defined by the law of the minor’s state of residency. 9. CUSTODIAN SIGNATURE (For Custodian identified in Section 4E, as applicable) The undersigned, being the custodian of the IRA being invested in the Company by the investor, hereby accepts and agrees to this subscription. Name of Authorized Signatory Signature of Authorized Signatory Date If the custodian of the IRA being invested in the Company by the investor accepts and agrees to the investor’s election (if applicable) to invest distributions in additional shares of the Company pursuant to the terms of the Prospectus and the DRIP described therein, please initial here.

10. PARTICIPATING BROKER-DEALER / INVESTMENT ADVISOR OR REGISTERED INVESTMENT ADVISOR (“RIA”) INFORMATION Broker-Dealer Investment Advisor /RIA Name Investment Advisor/RIA Mailing Address City State Zip Code Investment Advisor/RIA Number Branch Number CRD Number Email Address Daytime Phone Number Fax Number The undersigned confirms by its signature, on behalf of the broker-dealer or the investment advisor/RIA, as applicable, that it (i) has reasonable grounds to believe that the information and representations concerning the investor identified herein are true, correct and complete in all respects; (ii) has verified that the form of ownership selected is accurate and, if other than individual ownership, has verified that the individual executing on behalf of the investor is properly authorized and identified; (iii) has discussed such investor’s prospective purchase of shares with such investor; (iv) has advised such investor of all pertinent facts with regard to the liquidity and marketability of the shares; (v) has delivered or made available a current Prospectus and related supplements, if any, to such investor; and (vi) has reasonable grounds to believe that the purchase of shares is a suitable investment for such investor, that such investor meets the suitability standards applicable to such investor set forth in the Prospectus and related supplements, if any, and that such investor is in a financial position to enable such investor to realize the benefits of such an investment and to suffer any loss that may occur with respect thereto. The broker-dealer or the Investment Advisor/RIA, as applicable, agrees to maintain records of the information used to determine that an investment in shares is suitable and appropriate for the investor for a period of six years. The undersigned further represents and certifies, on behalf of the broker-dealer or the Investment Advisor/ RIA, as applicable, that in connection with this subscription for shares, he or she has complied with and has followed all applicable policies and procedures under his or her firm’s existing Anti-Money Laundering Program and Customer Identification Program. The undersigned investment advisor/RIA further represents and certifies that the investor has granted said investment advisor/ RIA a power of attorney with the authority to execute this subscription agreement on the investor’s behalf, including all required representations. Investment Advisor/RIA Signature Date Broker-Dealer Signature Date Branch Manager Signature (If required by Participating Broker-Dealer) Date If applicable, the investment advisor/RIA must complete all fields in this section and sign below to complete this form. By signing this form, the investment advisor/RIA warrants that he or she is duly licensed and may sell shares of the Company in the state designated as the investor’s legal residence, as well as the state in which the sale was made. All sales of securities must be made through a broker-dealer that has a Participating Broker-Dealer Agreement in effect with LaSalle Investment Management Distributors, LLC, the Company’s dealer manager.

11. INVESTOR SIGNATURES Please read and separately initial each of the representations below in order to complete the application for purchasing and owning shares of the Company. If you have more questions about this offering or if you would like additional copies of the Prospectus, please visit the Company’s website at www.JLLIPT.com. Investment advisors can also contact their wholesale representatives. In the case of trust accounts, you may not grant any person a power of attorney to make the representations on your behalf. To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify and record information that identifies each person who opens an account. What this means for you is that when you open an account, we will ask for your name, address, social security number, date of birth and other information that will allow us to identify you. This will assist us in ensuring that your information is secure. PLEASE NOTE: ALL ITEMS MUSTS BE READ AND INITIALED I, the investor (or in the case of fiduciary accounts, the person authorized to sign on such subscriber’s behalf), hereby represent and warrant to the Company as follows: (a) I have received a copy of the final Prospectus (the Prospectus and all supplements and amendments thereto that were filed with the Securities and Exchange Commission) for Jones Lang LaSalle Income Property Trust, Inc. at least five business days before completing this form. (b) I understand that the Company files a supplement to its Prospectus following the end of each month disclosing daily pricing information for the preceding month, which I can access through the Company’s website at www.JLLIPT.com, the SEC’s website at www.sec.gov or from my investment advisor. I also understand that following each business day, I can access the Company’s daily pricing information for that day from any of these sources as well as through the Company’s toll-free automated telephone line at 855-652-0277. I have received the Company’s NAV per share from one or more of these sources before completing this form. (c) I have (i) a minimum net worth of at least $250,000, or (ii) a minimum net worth of at least $100,000 and a minimum annual gross income of at least $70,000, and, if applicable, I meet the higher suitability requirements imposed by my state of primary residence as set forth in the Prospectus under “Suitability Standards.” I acknowledge that these suitability requirements can be met by myself or the fiduciary acting on my behalf. For these purposes, “net worth” is calculated excluding the value of my home, home furnishings and automobiles. (d) With the purchase of shares of the Company, no more than 10% of my liquid net worth will be invested in shares of the Company and other similar programs, including direct participation programs, with liquid net worth being defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities. (e) I acknowledge that shares of the Company are not liquid, that there is no public market for the shares and that the Company may be unable to repurchase my shares at any particular time. (f) I am purchasing the shares for my own account or on behalf of a trust or other eligible entity. If I am purchasing shares on behalf of a trust or other eligible entity, I have due authority to sign this agreement and to legally bind the trust or other eligible entity to the terms and conditions for purchasing shares of the Company. Investor/ Owner Co-Investor/ Joint-Owner

By signing this subscription agreement, I agree to the terms and conditions for owning shares of the Company as outlined in this form, the Prospectus and any applicable supplements. I certify that I have received a copy of this prospectus and that I meet the net worth and gross annual income requirements described above. The Company will assert these representations and warranties in any proceeding in which a stockholder or a regulatory authority attempts to hold the Company liable because stockholders did not receive copies of this prospectus or because the Company failed to adhere to each state’s suitability requirements. I certify under penalties of perjury that I am not involved in any money laundering schemes and the source of any investment in the Company is not derived from any criminal activities. I further acknowledge that after an account is opened with the Company, I will receive account statements, a confirmation of my purchase and other correspondence which I must carefully review to ensure that my instructions have been properly acted upon. If any discrepancies are noted, I agree to notify the Company or the transfer agent in a timely manner. My failure to notify one of the above entities on a timely basis will relieve such entities of any liability with respect to any discrepancy. I certify that I am of legal age to sign this form. For joint accounts, all parties must sign. Except in the case of a fiduciary account, the investor may not grant any person a power of attorney to make the above representations on his, hers or its benefit. SUBSTITUTE W-9 The undersigned certifies, under penalties of perjury, (i) that the taxpayer identification number shown in this Subscription Agreement is true, correct and complete, (ii) that I am (we are) not subject to backup withholding either because I (we) have not been notified that I am (we are) subject to backup withholding as a result of a failure to report all interest or distributions, or the Internal Revenue Service has notified me (us) that I am (we are) no longer subject to backup withholding and (iii) I am (we are) a U.S. citizen or other U.S. person. NOTE: The Internal Revenue Service does not require your consent to any provision of this document other than the certification regarding backup withholding. Form W-9 instructions are available upon request. NOTE: By signing this form, you are not waiving any rights that you may have under federal and state securities laws. Name of Authorized Signatory Signature of Authorized Signatory Date Name of Co-Investor/Joint Owner Signature of Co-Investor/Joint Owner Date 12. SUBSCRIPTION CHECKLIST

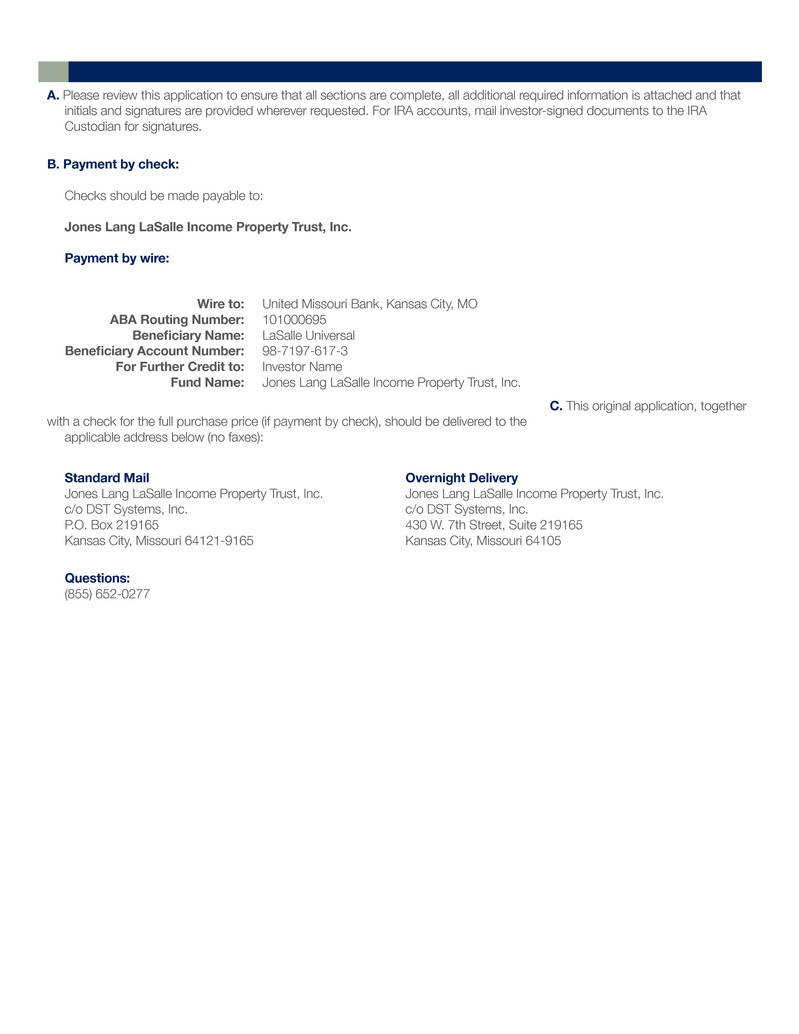

A. Please review this application to ensure that all sections are complete, all additional required information is attached and that initials and signatures are provided wherever requested. For IRA accounts, mail investor-signed documents to the IRA Custodian for signatures. B. Payment by check: Checks should be made payable to: Jones Lang LaSalle Income Property Trust, Inc. Payment by wire: C. This original application, together with a check for the full purchase price (if payment by check), should be delivered to the applicable address below (no faxes): Questions: (855) 652-0277 Standard Mail Jones Lang LaSalle Income Property Trust, Inc. c/o DST Systems, Inc. P.O. Box 219165 Kansas City, Missouri 64121-9165 Overnight Delivery Jones Lang LaSalle Income Property Trust, Inc. c/o DST Systems, Inc. 430 W. 7th Street, Suite 219165 Kansas City, Missouri 64105 Wire to: ABA Routing Number: Beneficiary Name: Beneficiary Account Number: For Further Credit to: Fund Name: United Missouri Bank, Kansas City, MO 101000695 LaSalle Universal 98-7197-617-3 Investor Name Jones Lang LaSalle Income Property Trust, Inc.