Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Jones Lang LaSalle Income Property Trust, Inc. | exhibit991.htm |

| EX-32.2 - EXHIBIT 32.2 - Jones Lang LaSalle Income Property Trust, Inc. | exhibit322123119.htm |

| EX-32.1 - EXHIBIT 32.1 - Jones Lang LaSalle Income Property Trust, Inc. | exhibit321123119.htm |

| EX-31.2 - EXHIBIT 31.2 - Jones Lang LaSalle Income Property Trust, Inc. | exhibit312123119.htm |

| EX-31.1 - EXHIBIT 31.1 - Jones Lang LaSalle Income Property Trust, Inc. | exhibit311123119.htm |

| EX-21.1 - EXHIBIT 21.1 - Jones Lang LaSalle Income Property Trust, Inc. | a123119subsidiarylisting.htm |

| EX-10.7 - EXHIBIT 10.7 - Jones Lang LaSalle Income Property Trust, Inc. | exhibit107.htm |

| EX-4.2 - EXHIBIT 4.2 - Jones Lang LaSalle Income Property Trust, Inc. | exhibit42.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

FORM 10-K

_________________________________

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-51948

Jones Lang LaSalle Income Property Trust, Inc.

(Exact name of registrant as specified in its charter)

_________________________________

Maryland | 20-1432284 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

333 West Wacker Drive, Chicago, IL, 60606

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including area code: (312) 897-4000

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Title of each class

Class A Common Stock, $.01 par value

Class M Common Stock, $.01 par value

Class A-I Common Stock, $.01 par value

Class M-I Common Stock, $.01 par value

Class D Common Stock, $.01 par value

_________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ | |

Non-accelerated filer | ý | Smaller reporting company | ¨ | |

Emerging growth company | ¨ | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

As of June 28, 2019, the aggregate market value of the 77,598,812 shares of Class A common stock, 40,802,153 shares of Class M common stock, 10,954,810 shares of Class A-I common stock, 14,329,536 shares of Class M-I common stock and 5,448,111 shares of Class D common stock held by non-affiliates of the registrant was $943,602, $496,970, $133,539, $174,534, and $66,249 for Class A, Class M, Class A-I, Class M-I and Class D shares, respectively, based upon the last net asset value of $12.16, $12.18, $12.19, $12.18 and $12.16 per share for Class A, Class M, Class A-I, Class M-I and Class D shares, respectively.

As of March 10, 2020, there were 94,210,815 shares of Class A common stock, 38,801,355 shares of Class M common stock, 11,122,334 shares of Class A-I common stock, 28,021,881 shares of Class M-I common stock and 4,957,915 shares of Class D common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Specified portions of the registrant’s proxy statement, which will be filed with the Commission pursuant to Regulation 14A in connection with the registrant’s 2020 Annual Meeting of Stockholders, are incorporated by reference into Part III of this annual report.

TABLE OF CONTENTS

Page | ||

PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

Item 16. | ||

1

Cautionary Note Regarding Forward-Looking Statements

This Form 10-K may contain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding, among other things, our plans, strategies and prospects, both business and financial. Forward-looking statements include, but are not limited to, statements that represent our beliefs concerning future operations, strategies, financial results or other developments. Forward-looking statements can be identified by the use of forward-looking terminology such as, but not limited to, “may,” “should,” “expect,” “anticipate,” “estimate,” “would be,” “believe,” or “continue” or the negative or other variations of comparable terminology. Because these forward-looking statements are based on estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond our control or are subject to change, actual results could be materially different. Although we believe that our plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, we cannot assure you that we will achieve or realize these plans, intentions or expectations. Forward-looking statements are inherently subject to risks, uncertainties and assumptions. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date this Form 10-K is filed with the Securities and Exchange Commission (“SEC”). Except as required by law, we do not undertake any obligation to update or revise any forward-looking statements contained in this Form 10-K. Important factors that could cause actual results to differ materially from the forward-looking statements are disclosed in “Item 1A. Risk Factors,” “Item 1. Business” and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Presentation of Dollar Amounts

Unless otherwise noted, all dollar amounts, except per share dollar amounts, reported in this Form 10-K are in thousands.

2

PART I

Item 1. | Business. |

GENERAL

Except where the context suggests otherwise, the terms “we,” “us,” “our,” the “Company” and "JLL Income Property Trust" refer to Jones Lang LaSalle Income Property Trust, Inc. The terms “Advisor” and “LaSalle” refer to LaSalle Investment Management, Inc.

Jones Lang LaSalle Income Property Trust, Inc. is an externally advised, daily valued perpetual-life real estate investment trust ("REIT") that owns and manages a diversified portfolio of apartment, industrial, office, retail and other properties located in the United States. Over time our real estate portfolio may be further diversified on a global basis through the acquisition of properties outside of the United States and will be complemented by investments in real estate-related debt and equity securities. We were incorporated on May 28, 2004 under the laws of the State of Maryland. We believe that we have operated in such a manner to qualify to be taxed as a REIT for federal income tax purposes commencing with the taxable year ended December 31, 2004, when we first elected REIT status. As of December 31, 2019, we owned interests in a total of 77 properties, located in 20 states.

We own, and plan to continue to own, all or substantially all of our assets through JLLIPT Holdings LP, a Delaware limited partnership (our “operating partnership”), of which we are the initial limited partner and JLLIPT Holdings GP, LLC, our wholly owned subsidiary is the sole general partner. The use of our operating partnership to hold all or substantially all of our assets is referred to as an Umbrella Partnership Real Estate Investment Trust ("UPREIT"). This structure is intended to facilitate tax deferred contributions of properties to our operating partnership in exchange for limited partnership interests in our operating partnership. A transfer of property directly to a REIT in exchange for shares of common stock of a REIT is generally a taxable transaction to the transferring property owner. In an UPREIT structure, a property owner who desires to defer taxable gain on the disposition of his property may transfer the property to our operating partnership in exchange for limited partnership interests in the operating partnership and defer taxation of gain until the limited partnership interests are disposed of in a taxable transaction.

From our inception to January 15, 2015, we raised equity proceeds through various public and private offerings of shares of our common stock. On January 16, 2015, our follow-on Registration Statement on Form S-11 was declared effective by the SEC with respect to our continuous public offering of up to $2,700,000 in any combination of shares of our Class A, Class M, Class A-I and Class M-I common stock, consisting of up to $2,400,000 of shares offered in our primary offering and up to $300,000 in shares offered pursuant to our distribution reinvestment plan (the “First Extended Public Offering”). As of July 6, 2018, the date our First Extended Public Offering terminated, we had raised aggregate gross proceeds from the sale of shares of our common stock in our First Extended Public Offering of $1,138,053.

On July 6, 2018, the SEC declared our second follow-on Registration Statement on Form S-11 (the "Second Extended Public Offering") effective (Commission File No. 333-222533) to offer up to $3,000,000 in any combination of shares of our Class A, Class M, Class A-I and Class M-I common stock, consisting of up to $2,700,000 of shares offered in our primary offering and up to $300,000 in shares offered pursuant to our distribution reinvestment plan. We reserve the right to terminate the Second Extended Public Offering at any time and to extend the Second Extended Public Offering term to the extent permissible under applicable law. As of December 31, 2019, we have raised aggregate gross proceeds from the sale of shares of our common stock in our Second Extended Public Offering of $542,060.

On March 3, 2015, we commenced a private offering (the "Follow-on Private Offering") of up to $350,000 in shares of our Class D common stock with an indefinite duration. As of December 31, 2019, we have raised aggregate gross proceeds from the sale of shares of our Class D shares in our Follow-on Private Offering of $68,591.

On October 16, 2019, through our operating partnership, we initiated a program (the “DST Program”) to raise up to $500,000, which our board of directors may increase in its sole discretion, in private placements exempt from registration under the Securities Act of 1933, as amended (the "Securities Act"), through the sale of beneficial interests to accredited investors in specific Delaware statutory trusts holding real properties ("DST Properties"), which may be sourced from our real properties or from third parties. As of December 31, 2019, we have not raised any proceeds from our DST Program.

As of December 31, 2019, 88,007,721 shares of Class A common stock, 39,036,770 shares of Class M common stock, 11,153,567 shares of Class A-I common stock, 22,589,599 shares of Class M-I common stock, and 4,957,915 shares of Class D common stock were outstanding and held by a total of 17,246 stockholders.

3

LaSalle acts as our advisor pursuant to the advisory agreement among us, our operating partnership and LaSalle (the "Advisory Agreement"). The term of our Advisory Agreement expires June 5, 2020, subject to an unlimited number of successive one-year renewals. Our Advisor, a registered investment advisor with the SEC, has broad discretion with respect to our investment decisions and is responsible for selecting our investments and for managing our investment portfolio pursuant to the terms of the Advisory Agreement. Our executive officers are employees of and compensated by our Advisor. We have no employees, as all operations are managed by our Advisor.

LaSalle is a wholly-owned, but operationally independent subsidiary of Jones Lang LaSalle Incorporated ("JLL" or our "Sponsor"), a New York Stock Exchange-listed leading professional services firm that specializes in real estate and investment management. As of December 31, 2019, JLL and its affiliates owned an aggregate of 2,521,801 Class M shares, which were issued for cash at a price equal to the most recently reported net asset value ("NAV") per share as of the purchase date and have a current value of $30,867.

INVESTMENT OBJECTIVES AND STRATEGY

Investment Objectives

Our primary investment objectives are:

• | to generate an attractive level of current income for distribution to our stockholders; |

• | to preserve and protect our stockholders' capital investments; |

• | to achieve appreciation of our NAV over time; and |

• | to enable stockholders to utilize real estate as an asset class in diversified, long-term investment portfolios. |

We cannot assure that we will achieve our investment objectives. Our charter places numerous limitations on us with respect to the manner in which we may invest our funds. In most cases, these limitations cannot be changed unless our charter is amended, which may require the approval of our stockholders.

Investment Strategy

The cornerstone of our investment strategy is to acquire and manage income-producing commercial real estate properties and real estate-related assets around the world. We believe this strategy will enable us to provide stockholders with a portfolio that is well-diversified across property type, geographic region and industry, both in the United States and internationally. It is our belief that adding international investments to our portfolio over time will serve as an effective tool to construct a well-diversified portfolio designed to provide our stockholders with stable distributions and attractive long-term risk-adjusted returns.

We believe that our broadly diversified portfolio will benefit our stockholders by providing:

• | diversification of sources of income; |

• | access to attractive real estate opportunities currently in the United States and, over time, around the world; |

and

• | exposure to a return profile that should have lower correlations with other investments. |

Since real estate markets are often cyclical in nature, our strategy will allow us to more effectively deploy capital into property types and geographic regions where the underlying investment fundamentals are relatively strong or strengthening and away from those property types and geographic regions where such fundamentals are relatively weak or weakening. We intend to meet our investment objectives by selecting investments across multiple property types and geographic regions to achieve portfolio stability, diversification, current income and favorable risk-adjusted returns. To a lesser degree, we also intend to invest in debt and equity interests backed principally by real estate, which we refer to collectively as “real estate-related assets.”

4

We will leverage LaSalle's broad commercial real estate research and strategy platform and capabilities to employ a research-based investment philosophy focused on building a portfolio of commercial properties and real estate-related assets that we believe have the potential to provide stable income streams and outperform market averages over an extended holding period. Furthermore, we believe that having access to LaSalle and JLL's international organization and platform, with real estate professionals living and working full time throughout our global target markets, will be a valuable resource to us when considering and executing upon international investment opportunities.

Investment Portfolio Allocation Targets

Our board of directors has adopted investment guidelines for our Advisor to implement and actively monitor in order to allow us to achieve and maintain diversification in our overall investment portfolio. Our board of directors formally reviews our investment guidelines on an annual basis and our investment portfolio on a quarterly basis or, in each case, more often as they deem appropriate. Our board of directors will review the investment guidelines to ensure that the guidelines are being followed and are in the best interests of our stockholders. Each such determination and the basis therefor shall be set forth in the minutes of the meetings of our board of directors. Changes to our investment guidelines must be approved by our board of directors and do not require notice to or the vote of our stockholders.

We will seek to invest:

• up to 95% of our assets in properties;

• up to 25% of our assets in real estate-related assets; and

• up to 15% of our assets in cash, cash equivalents and other short-term investments.

Notwithstanding the above, the actual percentage of our portfolio that is invested in each investment type may from time to time be outside the target levels provided above due to factors such as a large inflow of capital over a short period of time, a lack of attractive investment opportunities or an increase in anticipated cash requirements for repurchase requests.

INVESTMENT POLICIES

We may invest in real estate directly or indirectly through interests in corporations, limited liability companies, partnerships and joint ventures having an equity interest in real property, real estate investment trusts, ground leases, tenant in common interests, mortgages, participating mortgages, convertible mortgages, second mortgages, mezzanine loans or other debt interests convertible into equity interests in real property, options to purchase real estate, real property purchase-and-leaseback transactions and other transactions and investments with respect to real estate.

We intend to use financial leverage to provide additional funds to support our investment activities. We expect to maintain a targeted Company leverage ratio (calculated as our share of total liabilities (excluding future dealer manager fees) divided by our share of the fair value of total assets) of between approximately 30% and 50%. Our Company leverage ratio was 33% and 39% at December 31, 2019 and 2018, respectively. We intend to continue to use portions of the proceeds from our offerings to retire certain borrowings as they mature or become available for repayment or when doing so is beneficial to achieving our investment objectives. We are precluded from borrowing more than approximately 75% of the sum of the cost of our investments (before non-cash reserves and depreciation), which is based upon the limit specified in our charter that borrowing may not exceed 300% of the cost of our net assets. “Net assets” is defined as our total assets, other than intangibles, valued at cost (prior to deducting depreciation and amortization, reserves for bad debts and other non-cash reserves) less total liabilities. However, we may temporarily borrow in excess of these amounts if such excess is approved by a majority of our board, including a majority of our independent directors, and disclosed to stockholders in our next quarterly report, along with justification for such excess. In such event, we will review our debt levels at that time and take action to reduce any such excess as soon as practicable. We are currently in compliance with the charter limitations on our indebtedness.

Investments in Properties

We generally invest in properties located in large metropolitan areas that are well-leased with a stable tenant base and that are expected to generate predictable income. However, we may make investments in properties with other characteristics if we believe that the investments have the potential to enhance portfolio diversification or investment returns, as further described below under “Value Creation Opportunities.” There is no limitation on the amount we may invest in any single property.

5

We intend to manage risk through constructing and managing a broadly diversified portfolio of properties in developed markets around the world. We believe that a broadly diversified investment portfolio may offer stockholders significant benefits for a given level of risk relative to a more concentrated investment portfolio. In addition, we believe that assembling a diversified tenant base by investing in multiple properties and property types across multiple markets and geographic regions may mitigate the economic impacts associated with releasing properties or tenants potentially defaulting under their leases, since lease revenues represent the primary source of income from our real estate investments.

We will focus on acquiring and managing a portfolio of properties that provides tenants and residents with modern functionality and location desirability in order to avoid near-term obsolescence. We will generally invest in well-designed buildings that we believe present an attractive appearance, have been and are properly maintained and require minimal capital improvements in the near term. We generally do not intend to acquire higher risk properties in need of significant renovation, development or new construction; however, we may invest in these types of properties if we believe attractive risk-adjusted investment returns can be achieved through proactive management techniques or value-add programs, as further described below under “Value Creation Opportunities.”

Our board of directors is responsible for determining the consideration we pay for each property we acquire. However, our board has adopted investment guidelines that delegate this authority to our Advisor, so long as our Advisor complies with these investment guidelines. The investment guidelines limit the types of properties and investment amounts that may be acquired or disposed of without the specific approval of our board. Our board may change from time to time the scope of authority delegated to our Advisor.

Subject to limitations contained in our charter, we may issue, or cause to be issued, shares of our stock or limited partnership units in our operating partnership in any manner (and on such terms and for such consideration) in exchange for real estate. Our existing stockholders have no preemptive rights to purchase any such shares of our stock or limited partnership units, and any such issuance might cause a dilution of a stockholder’s initial investment. We may enter into additional contractual arrangements with contributors of property under which we would agree to repurchase a contributor’s units for shares of our common stock or cash, at the option of the contributor, at specified times. Although we may enter into such transactions, we do not currently intend to do so in the near term.

Global Target Markets

In general, we seek to invest in properties in well-established locations within larger metropolitan areas and with the potential for above average population or employment growth. Although we have and expect to continue to focus on investing primarily in developed markets throughout the United States, we may also invest a substantial portion of the proceeds of our offerings in markets outside of the United States. We believe that an allocation to international investments that meet our investment objectives and guidelines will contribute meaningfully to the diversification of our portfolio, the ability for us to identify favorable income-generating investments and the potential for achieving attractive long-term risk-adjusted returns. We believe that opportunities for attractive risk-adjusted returns exist both within the United States and globally. Most of our investments outside of the United States will be in core properties in stabilized, well-developed markets within Europe and the Asia Pacific region. We believe that our long-term strategy to acquire properties on a global basis will provide for a well-diversified portfolio that will generate attractive current returns and optimize long-term value for our stockholders.

Value Creation Opportunities

We may periodically seek to enhance investment returns through various value creation opportunities. While there are no specific limitations on the nature or amount of these types of investments, in the aggregate they are not expected to materially change the risk profile of our overall portfolio. Examples of likely value creation investments include properties with significant leasing risk, forward purchase commitments, redevelopment or repositioning opportunities and nontraditional or mixed-use property types. These investments generally have a higher risk and higher return profile than our primarily core strategy.

6

Disposition Policies

We anticipate that we will hold most of our properties for an extended period. However, we may determine to sell a property before the end of its anticipated holding period. We will monitor each investment within the portfolio and the overall portfolio composition for appropriateness in meeting our investment objectives. Our Advisor may determine to sell a property if:

• | an opportunity has arisen to enhance overall investment returns by reallocating capital; |

• | there are diversification benefits associated with disposing of the property and rebalancing our investment portfolio; |

• | in the judgment of our Advisor, the value of the property might decline or underperform as compared to our investment strategy; |

• | an opportunity has arisen to pursue a more attractive investment; |

• | the property was acquired as part of a portfolio acquisition and does not meet our investment guidelines; |

• | there exists a need to generate liquidity to satisfy repurchase requests, to pay distributions to our stockholders or for working capital; or |

• | in the judgment of our Advisor, the sale of the property is in the best interests of our stockholders. |

Generally, we intend to reinvest proceeds from the sale, financing or other disposition of properties in a manner consistent with our investment strategy and guidelines, although we may be required to distribute such proceeds to stockholders in order to comply with REIT requirements or we may make distributions for other reasons.

Investments in Real Estate-Related Assets

We may invest a portion of our portfolio in real estate-related assets other than properties. These assets may include the common and preferred stock of publicly-traded real estate-related companies, preferred equity interests, mortgage loans and other real estate-related equity and debt instruments. Up to 25% of our overall portfolio may be invested in real estate-related assets. We believe that our Advisor’s ability to acquire real estate-related assets in conjunction with acquiring a portfolio of properties may provide us with additional liquidity and further diversification, which provides greater financial flexibility and discretion to construct an investment portfolio designed to achieve our investment objectives. Our charter requires that any investment in equity securities (other than equity securities traded on a national securities exchange or included for quotation on an inter-dealer quotation system) not within the specific parameters of our investment guidelines adopted by our board of directors must be approved by a majority of our directors (including a majority of our independent directors) not otherwise interested in the transaction as being fair, competitive and commercially reasonable.

We may invest in mortgage loans consistent with the requirements for qualification as a REIT. We may originate or acquire interests in mortgage loans, generally on the same types of properties we might otherwise buy. These mortgage loans may pay fixed or variable interest rates or have “participating” features described below. Normally, mortgage loans will be secured by income-producing properties. They typically will be nonrecourse, which means they will not be the borrower’s personal obligations. We expect that most will be first mortgage loans, with first priority liens on the property. These loans may provide for payments of principal and interest or may provide for interest-only payments, with a balloon payment at maturity.

We may make mortgage loans that permit us to participate in the revenues from or appreciation of the underlying property consistent with the rules applicable for qualification as a REIT. These participations may entitle us to receive additional interest, usually calculated as a percentage of the gross income the borrower receives from operating, selling or refinancing the property. We may also receive an option to buy an interest in the property securing the participating loan.

7

Subject to the percentage of ownership limitations and gross income and asset requirements required for REIT qualification, we may invest in equity securities of companies engaged in real estate activities, including for the purpose of exercising control over such entities. Companies engaged in real estate activities may include, for example, REITs that either own properties or make real estate loans, real estate developers, entities with substantial real estate holdings such as limited partnerships, funds and other commingled investment vehicles, and other companies whose products and services are related to the real estate industry, such as mortgage lenders or mortgage servicing companies. We may acquire all or substantially all of the securities or assets of companies engaged in real estate activities where such investment would be consistent with our investment policies and our status as a REIT. We may also acquire exchange traded funds and mutual funds focused on REITs and real estate companies. In any event, we do not intend that our investments in securities will require us to register as an investment company under the Investment Company Act of 1940, as amended (the "Investment Company Act"), and we intend to generally divest appropriate securities before any such registration would be required.

Cash, Cash Equivalents and Other Short-Term Investments

We may invest up to 15% of our assets in cash, cash equivalents and other short-term investments. These types of investments may include the following, to the extent consistent with our qualification as a REIT:

• | money market instruments, cash and other cash equivalents (such as high-quality short-term debt instruments, including commercial paper, certificates of deposit, bankers' acceptances, repurchase agreements, interest- bearing time deposits and credit rated corporate debt securities); |

• | U.S. government or government agency securities; and |

• | credit rated corporate debt or asset-backed securities of U.S. or foreign entities, or credit rated debt securities of foreign governments or multi-national organizations. |

Other Investments

We may, but do not presently intend to, make investments other than as previously described. At all times, we intend to make investments in such a manner consistent with maintaining our qualification as a REIT under the Internal Revenue Code of 1986, as amended (the "Code"). We do not intend to underwrite securities of other issuers.

COMPETITION

We face competition when attempting to make real estate investments, including competition from domestic and foreign financial institutions, other REITs, life insurance companies, pension funds, partnerships and individual investors. The leasing of real estate is also highly competitive. Our properties compete for tenants with similar properties primarily on the basis of location, total occupancy costs (including base rent and operating expenses), services provided and the design and condition of the improvements.

SEASONALITY

Our investments are not materially impacted by seasonality, despite certain of our retail tenants being impacted by seasonality. Percentage rents (rents computed as a percentage of tenant sales) that we earn from investments in retail properties may, in the future, be impacted by seasonality.

ENVIRONMENTAL STRATEGIES

As an owner and operator of real estate, we are subject to various environmental laws. Compliance with existing laws has not had a material adverse effect on our financial condition and results of operations, and we do not believe it will have such an impact in the future. However, we cannot predict the impact of unforeseen environmental contingencies or new or changed environmental laws or regulations applicable to our current investments in properties or investments in properties we may make in the future. During our due diligence prior to making investments in properties, we retain qualified environmental consultants to assist us in identifying and quantifying environmental risks associated with such investments.

8

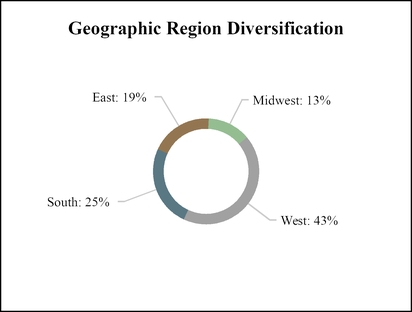

GEOGRAPHIC CONCENTRATION

The following table provides information regarding the geographic concentration of our real estate portfolio as of December 31, 2019:

Real Estate Portfolio | ||||||||

Number of Properties | Net Rentable Square Feet | Estimated Percent of Fair Value | ||||||

South | 18 | 5,001,000 | 25 | % | ||||

West | 29 | 4,176,000 | 43 | |||||

East | 17 | 3,462,000 | 19 | |||||

Midwest | 13 | 2,370,000 | 13 | |||||

Total | 77 | 15,009,000 | 100 | % | ||||

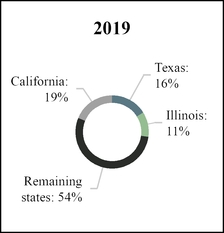

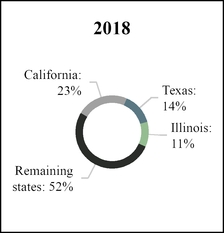

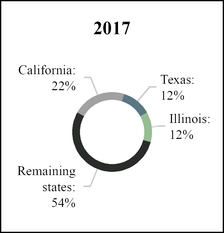

The following charts sets forth the percentage of our consolidated revenues derived from properties owned in each state that accounted for more than 10% of our consolidated revenues during 2019, 2018 and 2017:

FOREIGN OPERATIONS

We previously owned one property outside the United States, a multi-tenant office building located in Calgary, Canada. We were subject to currency risk and general Canadian economy risks associated with this investment. This property accounted for approximately 7% of our consolidated office revenues for the year ended December 31, 2017 and approximately 1% of our consolidated revenues for the year ended December 31, 2017. The Canadian property was disposed of on July 26, 2017.

9

DEPENDENCE ON SIGNIFICANT TENANTS

Our significant tenants that accounted for more than 10% of the consolidated revenues from their respective segments during the years ending December 31, 2019, 2018 and 2017 were as follows:

For the year ended December 31, | |||||

2019 | 2018 | 2017 | |||

Office | |||||

Amazon(1) | 45% | 30% | 30% | ||

Summit Medical Group | 15% | 12% | 11% | ||

Sugar Publishing (2) | 3% | 11% | 9% | ||

________

(1) | Amazon, including Whole Foods, also accounted for 4%, 4%, and 5% of the consolidated revenues in the retail segment in 2019, 2018 and 2017, respectively, and 5%, 6% and 6% of the consolidated revenues in the industrial segment in 2019, 2018 and 2017, respectively. |

(2) | The property leasing to this tenant was sold on February 7, 2019. |

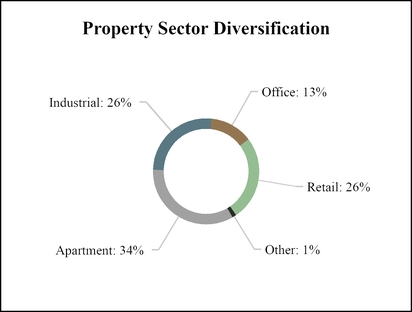

REPORTABLE SEGMENTS

We align our internal operations along the primary property types we are targeting for investments, resulting in five operating segments: apartment properties, industrial properties, office properties, retail properties and other properties. See Item 7, “Management's Discussion and Analysis of Financial Condition and Results of Operations” and Item 8, “Financial Statements and Supplementary Data” for financial information related to our reportable segments.

Apartment Properties

Apartment properties are generally defined as having five or more dwelling units that are part of a single complex and offered for rental use as opposed to detached single-family residential properties. There are three main types of apartment properties: garden-style (mostly one-story apartments), low-rise and high-rise. Apartments generally have the lowest vacancy rates of any property type, with the better performing properties typically located in markets or locations with strong employment and demographic dynamics. We plan to invest in apartment properties that are located in or near employment centers with favorable potential for employment growth and conveniently situated with access to transportation and retail and service amenities. Traditional apartment properties are generally leased by apartment unit to individual tenants for one year terms.

Industrial Properties

Industrial properties are generally categorized as warehouse/distribution centers, research and development facilities, flex space or manufacturing. The performance of industrial properties is typically dependent on the proximity to economic centers and the movement of global trade and goods. Industrial properties typically utilize a triple-net lease structure pursuant to which the tenant is generally responsible for property operating expenses in addition to base rent which can help mitigate the risks associated with rising expenses. We intend to invest in industrial properties that are located in major distribution hubs and near transportation modes such as port facilities, airports, rail lines and major highway systems.

Office Properties

Office sector properties are generally categorized based upon location and quality. Buildings may be located in Central Business Districts ("CBDs") or suburbs. Buildings may also be classified by general quality and size, ranging from Class A properties, which are generally large-scale buildings of the highest-quality, to Class C buildings which are below investment grade. We intend to invest in Class A or B office properties that are near areas of dense population, have sufficient transportation access or are located within well-established suburban office/business parks or CBDs. We also anticipate that a portion of the office properties in which we invest will be medical office and healthcare related facilities. We expect the duration of our office leases to be generally between five to ten years, which can help mitigate the volatility of our portfolio's income.

10

Retail Properties

The retail sector is comprised of five main formats: neighborhood retail, community centers, regional centers, super-regional centers and single-tenant stores. Location, convenience, accessibility and tenant mix are generally considered to be among the key criteria for successful retail investments. Retail leases tend to range from three to five years for small tenants and ten to 15 years for large anchor tenants. Leases, particularly for anchor tenants, may include a base payment plus a percentage of retail sales. Household incomes and population density are generally considered to be key drivers of local retail demand. We will seek investments in retail properties that are located within densely populated residential areas with favorable demographic characteristics and near other retail and service amenities.

Other Properties

The other property sector is currently comprised of parking facilities. The parking industry is large and fragmented and includes facilities that provide short-term parking spaces for vehicles on an hourly, daily, weekly or monthly basis. Parking structures can range from surface lots to larger multi-level buildings. Location and the local trade area are critically important to the performance of parking facilities. In addition to location, parking rates offered at a facility have a significant influence on a driver’s decision to use a particular facility. We will seek to invest principally in parking facilities in densely populated urban areas with high barriers to entry for new competition and multiple demand drivers.

AVAILABLE INFORMATION

We are subject to the information requirements of the Exchange Act. Therefore, we file periodic reports, proxy statements and other information with the SEC. The SEC maintains a website (www.sec.gov) where the reports, proxy and information statements, and other information that we file electronically with the SEC can be accessed free of charge. Our website is www.JLLIPT.com. We may use our website as a distribution channel for material information about our Company. Our reports on Forms 10-K, 10-Q and 8-K, and all amendments to those reports are posted on our website as soon as reasonably practicable after the reports are electronically filed with or furnished to the SEC. The contents of our website are not incorporated by reference.

INSURANCE

Although we believe our investments are currently adequately covered by insurance consistent with the terms and levels of coverage that are standard in our industry, we cannot predict at this time if we will be able to obtain adequate coverage at a reasonable cost in the future.

EMPLOYEES

We have no paid employees. The employees of our Advisor or its affiliates provide management, acquisition, advisory and certain other administrative services for us.

On November 4, 2014, as contemplated in our Advisory Agreement, we agreed to reimburse LaSalle for a portion of certain of our executive officers’ compensation associated with work performed on the First Extended Public Offering prior to the effective date. Under this arrangement a total of $125 was reimbursed over a four-year period beginning on January 16, 2015.

11

Item 1A. | Risk Factors. |

You should consider carefully the risks described below and the other information in this Form 10-K, including our consolidated financial statements and the related notes included elsewhere in this Form 10-K. If any of the following risks actually occur, they may materially harm our business and our financial condition and results of operations and cause the NAV to decline.

Risks Related to Investing in Shares of Our Common Stock

There is no public trading market for shares of our common stock; therefore, the ability of our stockholders to dispose of their shares will likely be limited to the repurchase of shares by us which generally will not be available during the first year after the purchase. If stockholders do sell their shares to us, they may receive less than the price paid.

There is no current public trading market for shares of our common stock, and we do not expect that such a public market will ever develop. Therefore, the repurchase of shares by us will likely be the only way for stockholders to dispose of their shares. We will repurchase shares at a price equal to our NAV per share of the class of shares being repurchased on the date of repurchase, and not based on the price at which the shares were purchased. Shares are not eligible for repurchase for the first year after purchase except upon death or disability of a stockholder; provided, however, that shares issued pursuant to our distribution reinvestment plan are not subject to the one-year holding period. In addition, we may repurchase shares if a stockholder fails to maintain a minimum balance of $5 in shares, even if the failure to meet the minimum balance is caused solely by a decline in our NAV. As a result of these terms of our share repurchase plan, stockholders may receive less than the price they paid for their shares when they sell them to us pursuant to our share repurchase plan.

Our ability to repurchase shares may be limited, and our board of directors may modify or suspend our share repurchase plan at any time.

Our share repurchase plan limits the funds we may use to purchase shares each calendar quarter to 5% of the combined NAV of all classes of shares as of the last day of the previous calendar quarter, which means that in any 12-month period, we limit repurchases to approximately 20% of our total NAV. The vast majority of our assets consist of properties that cannot generally be liquidated quickly. Therefore, we may not always have a sufficient amount of cash to immediately satisfy repurchase requests. Our board of directors may modify or suspend for any period of time or indefinitely our share repurchase plan should repurchase requests, in the business judgment of our board of directors, place an undue burden on our liquidity, adversely affect our investment operations or pose a risk of having a material adverse impact on stockholders whose shares are not repurchased. Because our board of directors is not required to authorize the recommencement of the share repurchase plan within any specified period of time, our board of directors may effectively terminate the plan by suspending it indefinitely. As a result, our stockholders’ ability to have their shares repurchased by us may be limited and at times no liquidity may be available for our stockholders’ investment in us.

We have a history of operating losses and cannot assure you that we will sustain profitability.

As a consequence of recognizing depreciation in connection with the properties we own, we have a history of operating losses and cannot assure you that we will sustain profitability. As a result, since our inception in 2004, we have experienced net losses (calculated in accordance with U.S. generally accepted accounting principles ("GAAP")) over a number of years. The extent of our future operating losses are highly uncertain, and we may not sustain profitability.

The availability, timing and amount of cash distributions to you is uncertain.

Our board of directors declared quarterly distributions for our stockholders beginning in the first quarterly period following the initial closing of our first offering on December 23, 2004 through March 31, 2009. We did not pay distributions for the nine quarterly periods from March 2009 to September 30, 2011, but we have declared quarterly distributions for our stockholders every quarter since. Most recently, on March 3, 2020, our board of directors declared a quarterly distribution of $0.135 per share for the first quarter of 2020. We bear all expenses incurred in our operations, which are deducted from cash funds generated from operations prior to computing the amount of cash for distribution to stockholders. In addition, our board of directors, in its discretion, may retain any portion of such funds for working capital or other purposes, which was the policy of our board of directors between March 2009 through September 2011 when we suspended our distributions as a part of our cash conservation strategy adopted in response to the uncertain economic climate and extraordinary conditions in the commercial real estate industry.

12

Your overall return may be reduced if we pay distributions from sources other than our cash from operations.

To date, all of the distributions we have paid to stockholders have been funded through a combination of cash flow from our operations and borrowings. We may not generate sufficient cash flow from operations to fully fund distributions to stockholders. Therefore, we may choose to use cash flows from financing activities, which include borrowings (including borrowings secured by our assets), net proceeds of our public and private offerings or other sources to fund distributions to our stockholders. We may be required to continue to fund our regular distributions from a combination of some of these sources if our investments fail to perform as anticipated, our expenses are greater than expected or due to numerous other factors. We have not established a limit on the amount of our distributions that may be paid from any of these sources. Using certain of these sources may result in a liability to us, which would require a future repayment. The use of these sources for distributions and the ultimate repayment of any liabilities incurred could adversely impact our ability to pay distributions in future periods, decrease our NAV, decrease the amount of cash we have available for operations and new investments and adversely impact the value of an investment in our shares of common stock.

Your purchase price may be more or less than the actual NAV if our NAV is incorrectly calculated.

If our NAV is calculated in a way that is not reflective of our actual NAV, then the purchase price of shares of our common stock or the price paid for the repurchase of your shares of common stock on a given date may not accurately reflect the value of our portfolio, and your shares may be worth more or less than the purchase or repurchase price.

Risks Related to Conflicts of Interest

Our Advisor will face a conflict of interest with respect to the allocation of investment opportunities and competition for tenants between us and other real estate programs that it advises.

Our Advisor’s officers and key real estate professionals will identify potential investments in properties and other real estate-related assets that are consistent with our investment guidelines for our possible acquisition. However, our Advisor may not acquire an investment in a property unless it has reviewed and approved presenting it to us in accordance with its allocation policies. LaSalle and its affiliates will advise other investment programs that invest in properties and real estate-related assets in which we may be interested, including the DST Program. LaSalle could face conflicts of interest in determining which programs will have the opportunity to acquire and participate in such investments as they become available. As a result, other investment programs advised by LaSalle may compete with us with respect to certain investments that we may want to acquire. Our Advisor also has discretion to choose which of our properties to syndicate in the DST Program, which presents conflicts because our Advisor and LaSalle Investment Management Distributors, LLC, an affiliate of our Advisor (the “Dealer Manager”), earn fees from the DST Program.

In addition, we may acquire properties in geographic areas where other investment programs advised by LaSalle own properties. Therefore, our properties may compete for tenants with other properties owned by such investment programs. If one of such investment programs attracts a tenant that we are competing for, we could suffer a loss of revenue due to delays locating another suitable tenant.

Our Advisor faces a conflict of interest because the fees it receives for services performed are based on our NAV, for which our Advisor is ultimately responsible.

Our Advisor is paid a fee for its services based on our NAV, which is calculated by ALPS Fund Services Inc. under the supervision of our Advisor. The calculation of our NAV includes certain subjective judgments of our Advisor and our independent valuation advisor, including estimates of fair value of particular assets, and therefore may not correspond to realizable value upon a sale of those assets.

Our Advisor’s management personnel face conflicts of interest relating to time management and there can be no assurance that our Advisor’s management personnel will devote adequate time to our business activities or that our Advisor will be able to hire adequate additional employees.

All of our Advisor’s management personnel, other employees, affiliates and related parties may also provide services to other affiliated entities of our Advisor. We are not able to estimate the amount of time that such management personnel will devote to our business. As a result, certain of our Advisor’s management personnel may have conflicts of interest in allocating their time between our business and their other activities which may include advising and managing various other real estate programs and ventures, which may be numerous and may change as programs are closed or new programs are formed. During times of significant activity in other programs and ventures, the time they devote to our business may decline and be less than we would require. There can be no assurance that our Advisor’s affiliates will devote adequate time to our business activities or that our Advisor will be able to hire adequate additional employees.

13

Our Advisor and its affiliates, including our officers and some of our directors, face conflicts of interest caused by compensation arrangements with us and other LaSalle affiliated entities, which could result in actions that are not in our stockholders’ best interests.

Our Advisor and its affiliates receive substantial fees from us in return for their services and these fees could influence our Advisor’s advice to us. Among other matters, the compensation arrangements could affect their judgment with respect to:

• | the continuation, renewal or enforcement of our agreements with our Advisor and its affiliates, including the Advisory Agreement; |

• | the decision to adjust the value of our real estate portfolio or the value of certain portions of our portfolio of other real estate-related assets, or the calculation of our NAV; |

• | public offerings of equity by us, which may result in increased advisory fees of the Advisor; |

• | competition for tenants from affiliated programs that own properties in the same geographic area as us; |

• | whether to sell interests in certain of our real properties through the DST Program and to select which properties to be sold through the DST Program; and |

• | asset sales, which may allow LaSalle or its affiliates to earn disposition fees and commissions. |

We currently have, and may enter into, agreements with subsidiaries of our Sponsor to perform certain services for our real estate portfolio.

Subsidiaries of our Sponsor provide property management, leasing and other services to property owners, and currently provides certain services to us with respect to a portion of our properties, and we may engage subsidiaries of our Sponsor to perform additional property or construction management, leasing and other services related to our real estate portfolio. The fees, commissions and expense reimbursements paid to our Sponsor in connection with these services have not and will not be determined with the benefit of arm’s-length negotiations of the type normally conducted between unrelated parties. Even though all such agreements will be subject to approval by our independent directors, they could be on terms not as favorable to us as those we could receive from a third party.

The time and resources that LaSalle affiliated entities devote to us may be diverted and we may face additional competition due to the fact that LaSalle affiliated entities are not prohibited from raising money for another entity that makes the same types of investments that we target.

LaSalle affiliated entities are not prohibited from raising money for another investment entity that makes the same types of investments as those we target. As a result, the time and resources they could devote to us may be diverted. In addition, we may compete with any such investment entity for the same investors and investment opportunities. We may also co-invest with any such investment entity. Even though all such co-investments will be subject to approval by our independent directors, they could be on terms not as favorable to us as those we could achieve co-investing with a third party.

Our Advisor may have conflicting fiduciary obligations if we acquire properties with its affiliates or other related entities; as a result, in any such transaction we may not have the benefit of arm’s-length negotiations of the type normally conducted between unrelated parties.

Our Advisor has in the past and may in the future cause us to acquire an interest in a property from its affiliates or through a joint venture with its affiliates or to dispose of an interest in a property to its affiliates. In these circumstances, our Advisor will have a conflict of interest when fulfilling its fiduciary obligation to us. In any such transaction we may not have the benefit of arm’s-length negotiations of the type normally conducted between unrelated parties. Even though all such transactions will be subject to approval by our independent directors, they could be on terms not as favorable to us as those we could receive from a third party.

14

Our executive officers, our affiliated directors and the key real estate professionals acting on behalf of our Advisor face conflicts of interest related to their positions or interests in affiliates of our Advisor, which could hinder our ability to implement our business strategy and to generate returns to our stockholders.

Our executive officers, our affiliated directors and the key real estate professionals acting on behalf of our Advisor may also be involved in the management of other real estate businesses, including other LaSalle affiliated entities, and separate accounts established for institutional investors, each of which invests in the real estate or real estate-related assets. As a result, they owe fiduciary duties to each of these entities and their investors, which fiduciary duties may from time to time conflict with the fiduciary duties that they owe to us and our stockholders. Their loyalties to these other entities and investors could result in action or inaction that is detrimental to our business, which could harm the implementation of our investment strategy. These individuals face conflicts of interest in allocating their time among us and such other funds, investors and activities. These conflicts of interest could cause these individuals to allocate less of their time to us than we may require, which may adversely impact our operations.

Risks Related to Adverse Changes in General Economic Conditions

Changes in global economic and capital markets conditions, including periods of generally deteriorating real estate industry fundamentals, may significantly affect our results of operations and returns to our stockholders.

We are subject to risks generally incident to the ownership of real estate-related assets, including changes in global, national, regional or local economic, demographic and real estate market conditions, as well as other factors particular to the locations of our investments. A recession could adversely impact our investments as a result of, among other items, increased tenant defaults under our leases, lower demand for rentable space, as well as potential oversupply of rentable space, each of which could lead to increased concessions, tenant improvement expenditures or reduced rental rates to maintain occupancies. These conditions could also adversely impact the financial condition of the tenants that occupy our real properties and, as a result, their ability to pay us rents.

We have recorded impairments of our real estate as a result of such conditions. To the extent that a general economic slowdown is prolonged or becomes more severe or real estate fundamentals deteriorate, it may have a significant and adverse impact on our revenues, results from operations, financial condition, liquidity, overall business prospects and ultimately our ability to pay distributions to our stockholders.

Any market deterioration may cause the value of our real estate investments to decline.

If the current economic or real estate environment were to worsen in the markets where our properties are located, the NAV per share of our common stock may experience more volatility or decline as a result. Volatility in the fair value and operating performance of commercial real estate has made estimating cash flows from our real estate investments difficult, since such estimates are dependent upon our judgment regarding numerous factors, including, but not limited to, current and potential future refinancing availability, fluctuations in regional or local real estate values and fluctuations in regional or local rental or occupancy rates, real estate tax rates and other operating expenses.

We cannot assure our stockholders that we will not have to realize or record impairment charges, or experience disruptions in cash flows and/or permanent losses related to our real estate investments or decreases in the NAV per share of our common stock in future periods. In addition, to the extent that volatile markets exist, these conditions could adversely impact our ability to potentially sell our real estate investments at a price and with terms acceptable to us or at all.

Inflation or deflation may adversely affect our financial condition and results of operations.

Although neither inflation nor deflation has materially impacted our operations in the recent past, increased inflation could have an adverse impact on our floating rate mortgages and interest rates and general and administrative expenses, as these costs could increase at a rate higher than our rental and other revenue. Inflation could also have an adverse effect on consumer spending which could impact our tenants’ revenues and, in turn, our percentage rents, where applicable. Conversely, deflation could lead to downward pressure on rents and other sources of income.

15

Risks Related to Our General Business Operations and Our Corporate Structure

We depend on our Advisor and the key personnel of our Advisor and we may not be able to secure suitable replacements in the event that we fail to retain their services.

Our success is dependent upon our relationships with, and the performance of, our Advisor and the key real estate professionals of our Advisor for the acquisition and management of our investment portfolio and our corporate operations. Any of these parties may suffer or become distracted by adverse financial or operational problems in connection with their business and activities unrelated to us and over which we have no control. Should any of these parties fail to allocate sufficient resources to perform their responsibilities to us for any reason, we may be unable to achieve our investment objectives. In the event that, for any reason, the Advisory Agreement is terminated, or our Advisor is unable to retain its key personnel, it may be difficult for us to secure suitable replacements on acceptable terms, which would adversely impact the value of your investment.

Our Advisor’s inability to retain the services of key real estate professionals could negatively impact our performance.

Our success depends to a significant degree upon the contributions of certain key real estate professionals employed by our Advisor, each of whom would be difficult to replace. Neither we nor our Advisor have employment agreements with these individuals and they may not remain associated with us or our Advisor. If any of these persons were to cease their association with us or our Advisor, our operating results could suffer. Our future success depends, in large part, upon our Advisor’s ability to attract and retain highly skilled managerial, operational and marketing professionals. If our Advisor loses or is unable to obtain the services of highly skilled professionals, our ability to implement our investment strategies could be delayed or hindered.

We may change our investment and operational policies without stockholder consent.

We may change our investment and operational policies, including our policies with respect to investments, operations, indebtedness, capitalization and distributions, at any time without the consent of our stockholders, which could result in our making investments that are different from, and possibly riskier or more highly leveraged than is currently contemplated. A change in our investment strategy may, among other things, increase our exposure to interest rate risk, default risk and real estate market fluctuations, all of which could materially affect our ability to achieve our investment objectives.

We are and may continue to be subject to litigation, which could have a material adverse effect on our financial condition.

We currently are, and are likely to continue to be, subject to litigation. Some of these claims may result in significant defense costs and potentially significant judgments against us. We cannot be certain of the ultimate outcomes of currently asserted claims or of those that arise in the future. Resolution of these types of matters against us may result in our having to pay significant fines, judgments, or settlements, which, if uninsured, or if the fines, judgments, and settlements exceed insured levels, would adversely impact our earnings and cash flows, thereby impacting our ability to service debt and make quarterly distributions to our stockholders. Certain litigation or the resolution of certain litigation may affect the availability or cost of some of our insurance coverage, which could adversely impact our results of operations and cash flows, expose us to increased risks that would be uninsured, and/or adversely impact our ability to attract officers and directors.

The limits on the percentage of shares of our common stock that any person may own may discourage a takeover or business combination that could otherwise benefit our stockholders.

Our charter, with certain exceptions, authorizes our board of directors to take such actions as are necessary and desirable to preserve our qualification as a REIT. Unless exempted by our board of directors, no person may own more than 9.8% in value of our outstanding capital stock or more than 9.8% in value or number of shares, whichever is more restrictive, of our outstanding common stock. A person that did not acquire more than 9.8% of our shares may become subject to our charter restrictions if repurchases by other stockholders cause such person’s holdings to exceed 9.8% of our outstanding shares. Any attempt to own or transfer shares of our common stock in excess of the ownership limit without the consent of our board of directors will be void, or will result in those shares being transferred by operation of law to a charitable trust, and the person who acquired such excess shares will not be entitled to any distributions thereon or to vote those excess shares. Our 9.8% ownership limitation may have the effect of delaying, deferring or preventing a change in control of us, including an extraordinary transaction (such as a merger, tender offer or sale of all or substantially all of our assets) that might provide a premium price for our stockholders.

16

Maryland law and our organizational documents limit our rights and the rights of our stockholders to recover claims against our directors and officers, which could reduce your and our recovery against them if they cause us to incur losses.

Maryland law provides that a director will not have any liability as a director so long as he or she performs his or her duties in accordance with the applicable standard of conduct. In addition, Maryland law and our charter provide that no director or officer shall be liable to us or our stockholders for monetary damages unless the director or officer (1) actually received an improper benefit or profit in money, property or services or (2) was actively and deliberately dishonest as established by a final judgment. Moreover, our charter generally requires us to indemnify and advance expenses to our directors and officers for losses they may incur by reason of their service in those capacities unless their act or omission was material to the matter giving rise to the proceeding and was committed in bad faith or was the result of active and deliberate dishonesty, they actually received an improper personal benefit in money, property or services or, in the case of any criminal proceeding, they had reasonable cause to believe the act or omission was unlawful. As a result, you and we may have more limited rights against our directors or officers than might otherwise exist under common law, which could reduce your and our recovery from these persons if they act in a manner that causes us to incur losses. In addition, we are obligated to fund the defense costs incurred by these persons in some cases. However, our charter provides that we may not indemnify our directors, or our Advisor and its affiliates, for any liability or loss suffered by them or hold our directors, our Advisor and its affiliates harmless for any liability or loss suffered by us, unless they have determined that the course of conduct that caused the loss or liability was in our best interests, they were acting on our behalf or performing services for us, the liability or loss was not the result of negligence or misconduct by our non-independent directors, our Advisor and its affiliates, or gross negligence or willful misconduct by our independent directors, and the indemnification or agreement to hold harmless is recoverable only out of our net assets or the proceeds of insurance and not from the stockholders.

Certain provisions in our organizational documents and under Maryland law could inhibit transactions or changes of control under circumstances that could otherwise provide stockholders with the opportunity to realize a premium.

Our charter and bylaws contain provisions that could delay or prevent a change of control of our company or changes in our board of directors that our stockholders might consider favorable. For example, our charter authorizes the issuance of preferred stock which can be created and issued by our board of directors without prior stockholder approval, with rights senior to those of our common stock, and prohibits our stockholders from filling board vacancies. In addition, for so long as the advisory agreement is in effect, our Advisor has the right to nominate, subject to the approval of such nomination by our board of directors, three affiliated directors to the slate of directors to be voted on by the stockholders at our annual meeting of stockholders. Furthermore, our board of directors must also consult with our Advisor in connection with (i) its selection of each independent director for nomination to the slate of directors to be voted on at the annual meeting of stockholders, and (ii) filling any vacancies created by the removal, resignation, retirement or death of any director. These and other provisions in our charter and bylaws could make it more difficult for stockholders or potential acquirers to obtain control of our board of directors or initiate actions that are opposed by our then-current board of directors, including a merger, tender offer or proxy contest involving our company.

In addition, certain provisions of the Maryland General Corporation Law applicable to us prohibit business combinations with: (1) any person who beneficially owns 10% or more of the voting power of our outstanding voting stock, which we refer to as an “interested stockholder;” (2) an affiliate or associate of ours who, at any time within the two-year period prior to the date in question, was the beneficial owner of 10% or more of the voting power of our then outstanding stock, which we also refer to as an “interested stockholder;” or (3) an affiliate of an interested stockholder. These prohibitions last for five years after the most recent date on which the interested stockholder became an interested stockholder. Thereafter, any business combination with the interested stockholder or an affiliate of the interested stockholder must be recommended by our board of directors and approved by the affirmative vote of at least 80% of the votes entitled to be cast by holders of our outstanding voting stock, and two-thirds of the votes entitled to be cast by holders of our voting stock other than shares held by the interested stockholder or its affiliate with whom the business combination is to be effected or held by an affiliate or associate of the interested stockholder. These requirements could have the effect of inhibiting a change in control even if a change in control were in our stockholders’ best interest. These provisions of Maryland law do not apply, however, to business combinations that are approved or exempted by our board of directors prior to the time that someone becomes an interested stockholder. Pursuant to the business combination statute, our board of directors has exempted any business combination involving us and any person, provided that such business combination is first approved by a majority of our board of directors, including a majority of our independent directors.

17

Our UPREIT structure may result in potential conflicts of interest with our operating partnership or limited partners in our operating partnership whose interests may not be aligned with those of our stockholders.

Conflicts of interest exist or could arise in the future as a result of the relationships between us and our affiliates, on the one hand, and our operating partnership or any partner thereof, on the other. Our directors and officers have duties to our company under applicable Maryland law in connection with their direction of the management of our company. At the same time, we, as sole member, have duties to the general partner of our operating partnership which, in turn, as general partner of our operating partnership, has duties to our operating partnership and to the limited partners under Delaware law in connection with the management of our operating partnership.

Under Delaware law, the general partner of a Delaware limited partnership has fiduciary duties of care and loyalty, and an obligation of good faith, to the partnership and its partners. While these duties and obligations cannot be eliminated entirely in the limited partnership agreement, Delaware law permits the parties to a limited partnership agreement to specify certain types or categories of activities that do not violate the general partner’s duty of loyalty and to modify the duty of care and obligation of good faith, so long as such modifications are not unreasonable. These duties as general partner of our operating partnership to the partnership and its partners may come into conflict with the interests of our company. Under the partnership agreement of our operating partnership, upon the admission of a person other than one of our subsidiaries as a limited partner in our operating partnership, the limited partners of our operating partnership expressly agree that the general partner of our operating partnership is acting for the benefit of the operating partnership itself and our stockholders, collectively. The general partner is under no obligation to give priority to the separate interests of the limited partners in deciding whether to cause our operating partnership to take or decline to take any actions. If there is a conflict between the interests of us or our stockholders, on the one hand, and the interests of the limited partners of our operating partnership other than us or our subsidiaries, on the other, that cannot be resolved in a manner not adverse to either, the partnership agreement provides that such conflict will be resolved in favor of our stockholders and the general partner will not be liable for losses sustained by the limited partners in connection with such decisions provided the general partner acted in good faith. Additionally, the partnership agreement of our operating partnership expressly limits our liability by providing that we and our directors, officers, agents and employees, will not be liable or accountable to our operating partnership or its partners for money damages. In addition, our operating partnership is required to indemnify us, our directors, officers and employees, the general partner and its trustees, officers and employees, employees of our operating partnership and any other persons whom the general partner may designate from and against any and all claims arising from operations of our operating partnership in which any indemnitee may be involved, or is threatened to be involved, as a party or otherwise unless it is established that the act or omission of the indemnitee constituted fraud, intentional harm or gross negligence on the part of the indemnitee, the claim is brought by the indemnitee (other than to enforce the indemnitee’s rights to indemnification or advance of expenses) or the indemnitee is found to be liable to our operating partnership, and then only with respect to each such claim. The provisions of Delaware law that allow the fiduciary duties of a general partner to be modified by a partnership agreement have not been tested in a court of law, and we have not obtained an opinion of counsel covering the provisions set forth in the partnership agreement that purport to waive or restrict our fiduciary duties.

Tax protection agreements could limit our ability to sell or otherwise dispose of property contributed to our operating partnership.

In connection with a contribution of property to our operating partnership, our operating partnership may enter into a tax protection agreement with the contributor of such property that provides that if we dispose of any interest in the contributed property in a taxable transaction within a certain time period, subject to certain exceptions, we may be required to indemnify the contributor for its tax liabilities attributable to the built-in gain that exists with respect to such property interests, and the tax liabilities incurred as a result of such tax protection payment. Therefore, although it may be in our stockholders’ best interests that we sell the contributed property, it may be economically prohibitive for us to do so because of these obligations.