Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Forbes Energy Services Ltd. | ex322201910k.htm |

| EX-32.1 - EXHIBIT 32.1 - Forbes Energy Services Ltd. | ex321201910k.htm |

| EX-31.2 - EXHIBIT 31.2 - Forbes Energy Services Ltd. | ex312201910k.htm |

| EX-31.1 - EXHIBIT 31.1 - Forbes Energy Services Ltd. | ex311201910k.htm |

| EX-23.1 - EXHIBIT 23.1 - Forbes Energy Services Ltd. | ex231201910k.htm |

| EX-21.1 - EXHIBIT 21.1 - Forbes Energy Services Ltd. | ex211201910k.htm |

| EX-10.22 - EXHIBIT 10 - Forbes Energy Services Ltd. | ex1022201910k.htm |

| EX-10.21 - EXHIBIT 10.21 - Forbes Energy Services Ltd. | ex1021201910k.htm |

| EX-10.20 - EXHIBIT 10.20 - Forbes Energy Services Ltd. | ex1020201910k.htm |

| EX-10.19 - EXHIBIT 10.19 - Forbes Energy Services Ltd. | ex1019201910k.htm |

| EX-10.18 - EXHIBIT 10.18 - Forbes Energy Services Ltd. | ex1018201910k.htm |

| EX-4.3 - EXHIBIT 4.3 - Forbes Energy Services Ltd. | ex43201910k.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________________________

Form 10-K

____________________________________________________________

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-35281

____________________________________________________________

Forbes Energy Services Ltd.

(Exact name of registrant as specified in its charter)

____________________________________________________________

Texas | 98-0581100 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

3000 South Business Highway 281 Alice, Texas | 78332 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (361) 664-0549

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

None | ||

Securities registered pursuant to Section 12(g) of the Act:

Title of Each Class

Common Stock, $0.01 par value

____________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ¨ | Accelerated Filer | ¨ |

Non-Accelerated Filer | ¨ | Smaller Reporting Company | ý |

Emerging Growth Company | ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). ¨ Yes ý No

The aggregate market value of the stock held by non-affiliates of the registrant as of June 28, 2019, the last business day of the most recently completed second fiscal quarter, was approximately $2.5 million (based on a closing price of $2.25 per share and approximately 1.1 million shares held by non-affiliates).

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court ý Yes ¨ No

As of March 16, 2020, there were 5,522,822 shares outstanding of the registrant’s common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive 2020 proxy statement, anticipated to be filed with the Securities and Exchange Commission within 120 days after the close of the Registrant's fiscal year are incorporated by reference into Part III of this Annual Report on Form 10-K.

FORBES ENERGY SERVICES LTD. AND SUBSIDIARIES

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

Item 16. | ||

i

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes certain forward-looking statements within the meaning of the federal securities laws. You can generally identify forward-looking statements by the appearance in such a statement of words like “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project” or “should” or other comparable words or the negative of these words. When you consider our forward-looking statements, you should keep in mind the risk factors we describe and other cautionary statements we make in this Annual Report on Form 10-K. Our forward-looking statements are only predictions based on expectations that we believe are reasonable. Our actual results could differ materially from those anticipated in, or implied by, these forward-looking statements as a result of known risks and uncertainties set forth below and elsewhere in this Annual Report on Form 10-K. These factors include or relate to the following:

• | the outcome of a vote by our stockholders on the merger proposal described in Note 20 to the consolidated financial statements; |

• | satisfaction of the conditions required and successful completion of the merger proposal; |

• | the effect of the continuing industry-wide downturn in and the cyclical nature of, energy exploration and development activities; |

• | continuing incurrence of operating losses due to such downturn; |

• | oil and natural gas commodity prices; |

• | market response to global demands to curtail use of oil and natural gas; |

• | capital budgets and spending by the oil and natural gas industry; |

• | the ability or willingness of the Organization of Petroleum Exporting Countries, or OPEC, to set and maintain production levels for oil; |

• | oil and natural gas production levels by non-OPEC countries; |

• | supply and demand for oilfield services and industry activity levels; |

• | our ability to maintain stable pricing; |

• | the impact on our markets of the outbreak of epidemic or pandemic disease, including COVID-19 |

• | possible impairment of our long-lived assets; |

• | potential for excess capacity; |

• | competition; |

• | substantial capital requirements; |

• | significant operating and financial restrictions under our loan and security agreement which provides for a term loan, or the Term Loan Agreement, excluding paid-in-kind interest; |

• | technological obsolescence of operating equipment; |

• | dependence on certain key employees; |

• | concentration of customers; |

• | substantial additional costs of compliance with reporting obligations, the Sarbanes-Oxley Act, Term Loan Agreement, Revolving Loan Agreement and the 5% Subordinated Convertible PIK Notes covenants; |

• | seasonality of oilfield services activity; |

• | collection of accounts receivable; |

• | environmental and other governmental regulation; |

• | the potential disruption of business activities caused by the physical effects, if any, of climate change; |

• | risks inherent in our operations; |

• | ability to fully integrate future acquisitions; |

• | variation from projected operating and financial data; |

• | variation from budgeted and projected capital expenditures; |

ii

• | volatility of global financial markets; and |

• | the other factors discussed under “Risk Factors” beginning on page 10 of this Annual Report on Form 10-K. |

We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. To the extent these risks, uncertainties and assumptions give rise to events that vary from our expectations, the forward-looking events discussed in this Annual Report on Form 10-K may not occur. All forward-looking statements attributable to us are qualified in their entirety by this cautionary statement.

iii

PART I

Item 1.Business

Overview

Forbes Energy Services Ltd., or FES Ltd., is an independent oilfield services contractor that provides a wide range of well site services to oil and natural gas drilling and producing companies to help develop and enhance the production of oil and natural gas. These services include well maintenance, completion services, workovers and recompletions, plugging and abandonment, tubing testing, fluid hauling and fluid disposal. Our operations are concentrated in the major onshore oil and natural gas producing regions of Texas, with an additional location in Pennsylvania. We believe that our broad range of services, which extends from initial drilling, through production, to eventual abandonment, is fundamental to establishing and maintaining the flow of oil and natural gas throughout the life cycle of our customers’ wells. Our headquarters and executive offices are located at 3000 South Business Highway 281, Alice, Texas 78332. We can be reached by phone at (361) 664-0549.

As used in this Annual Report on Form 10-K, the “Company,” “we,” and “our” mean FES Ltd. and its subsidiaries, except as otherwise indicated.

On January 22, 2017, FES Ltd. and its then domestic subsidiaries (collectively, the "Debtors"), as predecessors to the Company, filed voluntary petitions, or the Bankruptcy Petitions, for reorganization under chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the Southern District of Texas-Corpus Christi Division, or the Bankruptcy Court, pursuant to the terms of a restructuring support agreement that contemplated the reorganization of the Debtors pursuant to a prepackaged plan of reorganization, as amended and supplemented, the Plan. On March 29, 2017, the Bankruptcy Court entered an order confirming the Plan. On April 13, 2017, or the Effective Date, the Plan became effective pursuant to its terms and the Debtors emerged from their chapter 11 cases. We applied fresh start accounting upon emergence from bankruptcy on the Effective Date, which resulted in the Company becoming a new entity for financial reporting purposes. The effects of the Plan and the application of fresh start accounting are reflected in our consolidated financial statements from and after the Effective Date.

On November 16, 2018, we completed our acquisition of Cretic Energy Services, LLC (Cretic). Cretic provides coiled tubing services to E&P companies in the United States, primarily in the Permian Basin in Texas. The total consideration we paid for this acquisition was approximately $69.1 million in cash. We funded the Cretic acquisition with $50.0 million in proceeds from our Bridge Loan, $10.0 million addition to our Term Loan Agreement and cash on hand. We believe this acquisition has significantly enhanced our coiled tubing services and our position in the Permian Basin. See Note 5 - Acquisition of Cretic Energy Services, LLC to our Consolidated Financial Statements included in this Annual Report on Form 10-K for further discussion regarding the acquisition of Cretic.

On December 18, 2019, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Superior Energy Services, Inc., a Delaware corporation (“Superior”), New NAM, Inc., a Delaware corporation and a newly formed, wholly owned subsidiary of Superior (“NAM”), Spieth Newco, Inc., a Delaware corporation and a newly formed, wholly owned subsidiary of the Company (“Newco”), Spieth Merger Sub, Inc., a Delaware corporation and a newly formed, wholly owned subsidiary of Newco (“NAM Merger Sub”), and Fowler Merger Sub, Inc., a Delaware corporation and a newly formed, wholly owned subsidiary of Newco (“Fowler Merger Sub”). Upon the terms and subject to the conditions set forth in the Merger Agreement, at the effective time of the transactions contemplated in the Merger Agreement, NAM Merger Sub will merge with and into NAM (the “NAM Merger”) and Forbes Merger Sub will merge with and into the Company (the Forbes Merger, and together with the NAM Merger, the “Mergers”), with each of NAM and the Company continuing as surviving entities and wholly owned subsidiaries of Newco.

The Merger Agreement, and the transactions contemplated thereby, have been approved by the Company’s board of directors, the special committee of the Company’s board of directors, and the Superior board of directors. Newco filed a preliminary proxy statement/prospectus on February 13, 2020. In connection with the Merger Agreement, certain stockholders of the Company, including Ascribe Capital LLC and its affiliates (the “Ascribe Entities”) and Solace Capital Partners, L.P. (“Solace”), entered into voting and support agreements. The Company stockholders that are party to the voting agreements have committed to vote the shares of the Company’s common stock they beneficially own in favor of the adoption of the Merger Agreement and any other matters necessary for the consummation of the transaction contemplated by the Merger Agreement. The Ascribe Entities and Solace will beneficially own approximately 51% of the outstanding common stock of the Company as of the record date for the special meeting of the Company’s stockholders. As a result, the Ascribe Entities and Solace will have the ability to approve the Merger Agreement without the vote of any other stockholder.

The Mergers are expected to close in the second quarter of 2020, subject to the satisfaction or waiver of customary closing conditions, including approval of the Merger Agreement by the Company’s stockholders and satisfaction of certain financing conditions.

1

We provide a wide range of services to a diverse group of companies. For the year ended December 31, 2019, we provided services to 504 companies. John E. Crisp, Steve Macek and our senior management team have cultivated deep and ongoing relationships with these customers during their average experience of over 35 years in the oilfield services industry.

We conduct our operations through the following three business segments:

• | Well Servicing. Our well servicing segment comprised 48.5% and 45.9% of our consolidated revenues for the years ended December 31, 2019 and 2018, respectively. Our well servicing segment utilizes our fleet of well servicing rigs, which at December 31, 2019 was comprised of 134 workover rigs and 7 swabbing rigs and other related assets and equipment. These assets are used to provide (i) well maintenance, including remedial repairs and removal and replacement of downhole production equipment, (ii) well workovers, including significant downhole repairs, re-completions and re-perforations, (iii) completion and swabbing activities, (iv) plugging and abandonment services, and (v) pressure testing of oil and natural gas production tubing and scanning tubing for pitting and wall thickness using tubing testing units. |

• | Coiled Tubing. Our coiled tubing segment comprised 27.8% and 21.9% of our consolidated revenues for the years ended December 31, 2019 and 2018, respectively. This segment utilizes our fleet of 14 coiled tubing units, of which 11 are large diameter units (2 3/8” or larger). These units provide a range of services accomplishing a wide variety of goals including horizontal completions, well bore clean-outs and maintenance, nitrogen services, thru-tubing services, formation stimulation using acid and other chemicals, and other pre- and post-hydraulic fracturing well preparation services. |

• | Fluid Logistics. Our fluid logistics segment comprised 23.7% and 32.2% of our consolidated revenues for the years ended December 31, 2019 and 2018, respectively. Our fluid logistics segment utilizes our fleet of owned or leased fluid transport trucks and related assets, including specialized vacuum, high-pressure pump and tank trucks, hot oil trucks, frac tanks, fluid mixing tanks, salt water disposal wells and facilities, and related equipment. These assets are used to provide, transport, store, and dispose of a variety of drilling and produced fluids used in, and generated by, oil and natural gas production. These services are required in most workover and completion projects and are routinely used in daily operations of producing wells. |

We believe that our three business segments are complementary and create synergies in terms of selling opportunities. Our multiple lines of service are designed to capitalize on our existing customer base to grow it within existing markets, generate more business from existing customers, and increase our operating performance. By offering our customers the ability to reduce the number of vendors they use, we believe that we help improve our customers’ efficiency. Further, by having multiple service offerings that span the life cycle of the well, we believe that we have a competitive advantage over smaller competitors offering more limited services.

The following table summarizes the number of locations and major components of our equipment fleet at December 31, 2019:

December 31, 2019 | ||

Locations | 22 | |

Well Servicing Segment: | ||

Workover rigs | 134 | |

Swabbing rigs | 7 | |

Other heavy trucks | 12 | |

Tubing testing units | 7 | |

Coiled Tubing Segment: | ||

Coiled tubing units | 14 | |

Fluid Logistics Segment: | ||

Vacuum trucks | 103 | |

Other heavy trucks | 53 | |

Frac and fluid mixing tanks | 2,534 | |

Salt water disposal wells (1) | 11 | |

(1) | At December 31, 2019, the 11 salt water disposal wells were subject to verbal or written ground leases or other operating arrangements with third parties. The above well count does not include one well that has been permitted and drilled but has not been completed. |

2

Corporate Structure

FES Ltd. was initially organized as a Bermuda exempt company on April 9, 2008. On August 12, 2011, FES Ltd. discontinued its existence as a Bermuda entity and converted into a Texas corporation, or the Texas Conversion. FES Ltd. has been and is the holding company for all of our operations. Forbes Energy Services LLC, or FES LLC, a Delaware limited liability company, is a wholly-owned subsidiary of FES Ltd. that acts as an intermediate holding company for our direct and indirect wholly-owned operating companies that have conducted our business historically: C.C. Forbes, LLC, or CCF, TX Energy Services, LLC, or TES, Forbes Energy International, LLC, or FEI, and since its acquisition effective November 16, 2018, Cretic Energy Services LLC, or CES.

Under the Plan, all of FES Ltd.’s previously outstanding equity interests, which included FES Ltd.’s prior common stock, par value $0.04 per share, or the Old Common Stock, FES Ltd.’s prior preferred stock, awards under FES Ltd.’s prior incentive compensation plans, and the preferred stock purchase rights under the rights agreement dated as of May 19, 2008, as subsequently amended on July 8, 2013, between FES Ltd. and CIBC Mellon Trust Company, as rights agent, in FES Ltd. were extinguished without recovery, FES Ltd. was "converted" to a Delaware corporation and FES Ltd. created a new class of common stock, par value $0.01 per share, or the New Common Stock.

On May 18, 2017, shares of the New Common Stock were authorized for trading on the Over-The-Counter Pink Market. On May 19, 2017, OTC Markets Group Inc. announced that the New Common Stock was qualified to trade on the OTCQX Best Market. On May 19, 2017, the New Common Stock began trading on the OTCQX Best Market under the symbol “FLSS.”

Our Competitive Position

We believe that the following competitive strengths position us well within the oilfield services industry:

• | Exposure to Revenue Streams Throughout the Life Cycle of the Well. Our maintenance and workover services give us exposure to demand from our customers throughout the life cycle of a well, from drilling through production and eventual abandonment. Each new well that is drilled provides us a potential multi-year stream of well servicing revenue, as our customers attempt to maximize and maintain a well’s productivity. Accordingly, demand for our production services is generally driven by the total number of producing wells in a region and is generally less volatile than demand for new well drilling services. |

• | High Level of Customer Retention. Our top customers include many of the largest integrated and independent oil and natural gas companies operating onshore in the United States. We believe that our success comes from growing in our existing markets with existing customers due to the quality of our well servicing rigs, our personnel, and our safety record. We believe members of our senior management team have maintained excellent working relationships with our top customers in the United States with their combined experience in the oilfield services industry. We believe the complementary nature of our three business segments also helps us to retain customers because of the efficiency we offer a customer with multiple needs at the wellsite. Notably, approximately 69% of our total revenues for the year ended December 31, 2019 were from customers that utilize services in at least two of our business segments. Further, by having multiple service offerings that span the life cycle of the well, we believe that we have a competitive advantage over smaller competitors offering more limited services. |

• | Industry-Leading Safety Record. During the year ended December 31, 2019, we had approximately 2.2% fewer reported incidents than the industry average as published by the Bureau of Labor Statistics. We believe that our safety record and reputation are critical factors to purchasing and operations managers in their decision-making process. We have a strong safety culture based on our training programs and safety seminars for our employees and customers. For example, for several years, members of our senior management have played an integral part in joint safety training meetings with customer personnel. |

• | Experienced Senior Management Team and Operations Staff. Our executive operations management team of John E. Crisp and Steve Macek have an average of 35 years each of experience within the oilfield services industry. In addition, our next level of management, which includes our division, regional and location managers, has an average of over 25 years of experience in the industry. |

Our Business Strategy

Our strategy in this rapidly changing market:

• | Maintain Maximum Asset Utilization. We constantly monitor asset usage and industry trends as we strive to maximize utilization. We accomplish this through moving assets from regions with less activity to those with more activity or that are increasing in activity. We are focusing on basins that are either predominantly oil or contain natural gas with high liquids content, such as the Permian Basin in West Texas and the Eagle Ford Basin in South Texas. Drilling techniques have resulted in the need for less equipment for well completions or fewer hours for the equipment being |

3

used. This has directly impacted our utilization. In response, we continue to minimize costs by concentrating utilization in as few active assets as possible while eliminating or substantially reducing our operating expenses on the inactive assets.

• | Maintain a Presence in Proven and Established Oil and Liquids Rich Basins. We focus our operations on customers that operate in well-established basins which have proven production histories and that have maintained a high level of activity throughout various oil and natural gas pricing environments. While a substantial amount of our business is in the completion area, the majority of our business is production-related. We believe production-related services help create a more stable revenue stream, as these services are tied more to producing wells and less to drilling activity. Our experience shows that historically, production-related services tend to withstand depressed economic or industry conditions better than completion services. |

• | Establish and Maintain Leadership Position in Core Operating Areas. Based on our estimates, we believe that we have a significant market share in well servicing and fluid logistics in South Texas. We strive to establish and maintain significant positions within each of our core operating areas. To achieve this goal, we maintain close customer relationships and offer high-quality services to our customers. In addition, our significant presence in our core operating areas facilitates employee retention, hiring and brand recognition. |

• | Maintain a Disciplined Growth Strategy. We strategically evaluate opportunities for growth and expansion when customer demand dictates and dedicate the capital and staffing to respond. Conversely, we continually evaluate the viability and economics of our existing locations to ensure an efficient use of our management time and working capital. In some cases, this may result in closing a location or locations, reducing middle management, and reducing headcount. We believe both of these initiatives are necessary in order for the Company to be competitive in the current market environment. |

Description of Business Segments

Well Servicing Segment

Our fleet of 141 well servicing rigs was comprised of 134 workover rigs and 7 swabbing rigs, as of December 31, 2019 and located in 9 areas across Texas plus 1 in Pennsylvania. This fleet allows us to provide a comprehensive offering of well services to oil and natural gas companies, including completions of newly drilled oil and natural gas wells, wellbore maintenance, workovers and recompletions, tubing testing, and plugging and abandonment services. As a result of the downturn, 28 and 81 rigs were stacked at December 31, 2019 and 2018, respectively.

Our well servicing rig fleet has an average age of less than twelve years. As part of our operational strategy, we enhanced our design specifications to improve the operational and safety characteristics of our well servicing rigs compared with some of the older well servicing rigs operated by others in the industry. These include increased derrick height and weight ratings and increased mud pump horsepower. We believe these enhanced features translate into increased demand for our equipment and services along with better pricing for our equipment and personnel. In addition, we augment our well servicing rig fleet with auxiliary equipment, such as mud pumps, power swivels, mud plants, mud tanks, blow-out preventers, lighting plants, generators, pipe racks, and tongs, which results in incremental rental revenue and increases financial performance of a typical well servicing job.

We provide the following services in our well servicing segment:

• | Completions. Utilizing our well servicing rig fleet, we perform completion services, which involve wellbore cleanout, well prepping for fracturing, drilling, setting and retrieving plugs, fishing operations, tool conveyance and logging, cementing, well unloading, casing and packer testing, pump-down plug, velocity strings, perforating, acidizing and/or stimulating a wellbore, along with swabbing operations that are utilized to clean a wellbore prior to production. Completion services are generally shorter term in nature and involve our equipment operating on a site for a period of two to three days, although some fishing jobs, which involve the recovery of equipment lost or stuck in the wellbore, can take longer. |

• | Maintenance. Through our fleet of well servicing rigs, we provide for the removal and repair of sucker rods, downhole pumps, and other production equipment, repair of failed production tubing, and removal of sand, paraffin, and other downhole production-related byproducts that impair well performance. These operations typically involve our well servicing rigs operating on a wellsite for five to seven days. |

• | Workovers and Recompletions. We provide workover and re-completion services for existing wellbores. These services are designed to significantly enhance production by re-perforating to initiate or re-establish productivity from an oil or natural gas wellbore. In addition, we provide major downhole repairs such as casing repair, production tubing replacement, and deepening and sidetracking operations used to extend a wellbore laterally or vertically. These operations are typically longer term in nature and involve our well servicing rigs operating on a wellsite for one to two weeks at a time. |

4

• | Tubing Testing. Our downhole tubing testing services allow operators to verify tubing integrity. Tubing testing services are performed as production tubing is run into a new wellbore or on older wellbores as production tubing is replaced during a workover operation. In addition to our downhole testing units, our electromagnetic scan trucks scan tubing while out of the wellbore. This scanning function provides key operational information related to corrosion pitting, holes and splits, and wall loss on tubing. Tubing testing services complement our other service offerings and provide a significant opportunity for cross-selling. |

• | Plugging and Abandonment. Our well servicing rigs are also used in the process of permanently closing oil and natural gas wells that are no longer capable of producing in economic quantities, become mechanically impaired or are dry holes. Plugging and abandonment work can be performed with a well servicing rig along with wireline and cementing equipment; however, this service is typically provided by companies that specialize in plugging and abandonment work. Many well operators bid this work on a “lump sum” basis to include the sale or disposal of equipment salvaged from the well as part of the compensation received. |

Coiled Tubing Segment

Our fleet of 14 coiled tubing units is comprised of 11 large diameter units (2 3/8” and larger) and three smaller diameter units. Seven of the large diameter units were acquired with the acquisition of Cretic as disclosed in Note 5 - Acquisition of Cretic Energy Services, LLC. Our high capacity fleet can accommodate optimally designed work strings that are the size and length to efficiently meet the long lateral requirements in the most challenging well bores. The units are utilized in a wide range of well completion and intervention operations. The services offered are customized to the customer's job specific requirements. Our coiled tubing fleet has an average age of less than 8 years.

We provide the following services in our coiled tubing segment:

• | Completions. Utilizing our coiled tubing fleet, we perform completion services, which involve wellbore cleanout, well prepping for fracturing, fishing operations, tool conveyance and logging, cementing, well unloading, casing and packer testing, pump-down plug, velocity strings, perforating, acidizing and/or stimulating a wellbore. Completion services are generally shorter term in nature and involve our equipment operating on a site for a period of two to three days, although some fishing jobs, which involve the recovery of equipment lost or stuck in the wellbore, can take longer. |

• | Maintenance. Through our fleet of coiled tubing units, we provide for removal of scale, sand, paraffin, and other downhole production-related byproducts that impair well performance. These operations typically involve our coiled tubing equipment operating on a wellsite for five to seven days. |

• | Workovers and Recompletions. We provide workover and recompletion services for existing wellbores. These services are designed to significantly enhance production by re-perforating to initiate or re-establish productivity from an oil or natural gas wellbore. These operations are typically longer term in nature and involve our coiled tubing units operating on a wellsite for one to two weeks at a time. |

Fluid Logistics Segment

Our fluid logistics segment provides an integrated array of oilfield fluid sales, transportation, storage, and disposal services that are required on most workover, drilling, and completion projects and are routinely used in daily operations of producing wells by oil and natural gas producers. We have a substantial operational footprint with 12 fluid logistics locations across Texas as of December 31, 2019, and an extensive fleet of transportation trucks, high-pressure pump trucks, hot oil trucks, frac tanks, fluid mixing tanks and salt water disposal wells. This combination of services enables us to provide a one-stop source for oil and natural gas companies. Although there are some large operators in our areas with whom we compete, we believe that the vast majority of our smaller competitors in this segment can provide some, but not all, of the equipment and services required by customers, thereby requiring our customers to use several companies to meet their requirements and increasing their administrative burden. In addition, by pursuing an integrated approach to service, we experience increased asset utilization rates, as multiple assets are usually required to service a customer.

We provide the following services in our fluid logistics segment:

• | Fluid Hauling. As of December 31, 2019, we owned 103 fluid service vacuum trucks, trailers, and other hauling trucks equipped with a fluid hauling capacity of up to 150 barrels per unit, with most of the units having a capacity of 130 barrels. As a result of the industry downturn, 17 trucks and trailers were stacked at December 31, 2019. Each fluid service truck unit is equipped to pump fluids from or into wells, pits, tanks, and other on-site storage facilities. The majority of our fluid service truck units are also used to transport water to fill frac tanks on well locations, including frac tanks provided by us and others, to transport produced salt water to disposal wells, including injection wells owned and/or operated by us, and to transport drilling and completion fluids to and from well locations. In conjunction with frac tank rentals, we use fluid service trucks to transport water for use by our customers in fracturing operations. Following completion of fracturing operations by our customers, our fluid service trucks are used to transport the |

5

flowback produced as a result of the fracturing operations from the wellsite to disposal wells. We also operate several hot oil trucks which are capable of providing heated water and oil for use in well and pipe maintenance.

• | Disposal Services. Most oil and natural gas wells produce varying amounts of salt water throughout their productive lives. Under Texas law, oil and natural gas waste and salt water produced from oil and natural gas wells are required to be disposed of in authorized facilities, including permitted salt water disposal wells. Disposal, or injection, wells are licensed by state authorities and are completed in permeable formations below the fresh water table. As of December 31, 2019, we operated 11 disposal wells in 10 locations across Texas, with an aggregate injection capacity of approximately 101,000 barrels per day. The wells are permitted to dispose of salt water and incidental non-hazardous oil and natural gas wastes throughout our operational bases in Texas. It is our intent to locate salt water disposal wells in close proximity to the producing wells of our customers. Although, in the normal course of production development, it is not uncommon for drilling and production activity to migrate closer to or farther away from our disposal wells. We maintain separators at all of our disposal wells that permit us to reclaim residual crude oil that we sell. |

• | Equipment Rental. As of December 31, 2019, we owned a fleet of 2,534 fluid storage tanks that can store up to 500 barrels of fluid each. This equipment is used by oilfield operators to store various fluids at the wellsite, including fresh water, brine and acid for frac jobs, flowback, temporary production, and drilling fluids. We transport the tanks with our trucks to well locations that are usually within a 75-mile radius of our nearest location. Frac tanks are used during all phases of the life of a producing well. A typical fracturing operation conducted by a customer can be completed within four days using five to 40 or more frac tanks. Average age of our equipment is approximately eight years. |

• | Fluid Sales. We sell and transport a variety of chemicals and fluids used in drilling, completion, and workover operations for oil and natural gas wells. Although this is a relatively small percentage of our overall business, the provision of these chemicals and fluids increases utilization of and enhances revenues from the associated equipment. Through these services, we provide fresh water used in fracturing fluid, completion fluids, cement, and drilling mud. In addition, we provide potassium chloride for completion fluids, brine water, and water-based drilling mud. |

Financial Information about Segments and Geographic Areas

See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 15 to our Consolidated Financial Statements included in this Annual Report on Form 10-K for further discussion regarding financial information by segment and geographic location.

Seasonality and Cyclical Trends

Our operations are impacted by seasonal factors. Historically, our business has been negatively impacted during the winter months due to inclement weather, fewer daylight hours, and holidays. We also typically experience a significant slowdown during the Thanksgiving and Christmas holiday seasons. Our well servicing rigs are mobile and we operate a significant number of oilfield vehicles. During periods of heavy snow, ice or rain, we may not be able to move our equipment between locations, thereby reducing our ability to generate rig or truck hours. In addition, the majority of our well servicing rigs work only during daylight hours. In the winter months, as daylight time becomes shorter, the amount of time that the well servicing rigs work is shortened, which has a negative impact on total hours worked.

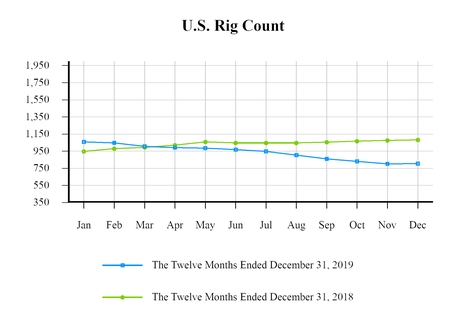

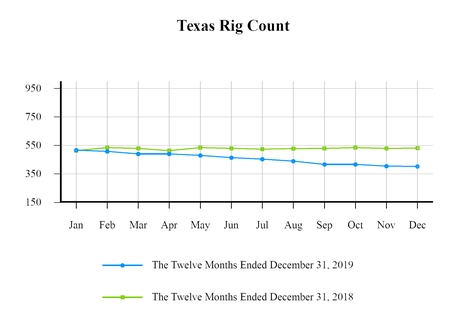

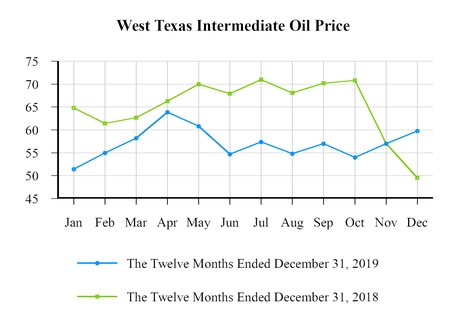

In addition, the oil and natural gas industry has traditionally been volatile and is influenced by a combination of long-term, short-term and cyclical trends, including the domestic and international supply and demand for oil and natural gas, current and expected future prices for oil and natural gas and the perceived stability and sustainability of those prices. This volatility has increased in recent periods, including the recent outbreak of COVID-19. Such cyclical trends also include the resultant levels of cash flows generated and allocated by exploration and production companies to their drilling, completion and workover budget.

Sales Organization

Our sales structure is primarily decentralized where each of our business regions cultivates and maintains relationships with customer representatives who manage operations in their respective regions. At the regional level, management maintains relationships with key personnel in the operators' branch or division offices and in each business unit function. In the field, regional managers, yard managers and supervisors are the primary point of contact for sales to operator field representatives. At the corporate level, our Chief Executive Officer and Director of Business Development work with account managers who are assigned to our larger customers, act as liaison between customer contacts, including purchasing managers and the appropriate contacts within each function of the Forbes organization. Sales representatives typically serve multiple roles and in that way are involved in most aspects of the sales cycle, from order fulfillment to billing. Our customers represent both large and small independent oil and natural gas companies that are largely managed at the field level, and depending on the structure, have corporate procurement groups also coordinating supply chain decisions. These corporate procurement groups are the primary focus of our designated sales personnel. We cross-market our well servicing rigs, coiled tubing units and our fluid logistics services, thereby offering our customers the ability to minimize vendors, which we believe improves the efficiency of our customers. This is demonstrated by

6

the fact that approximately 69% of our revenues for the year ended December 31, 2019 were from customers that utilized services of two or more of our business segments.

Employees

As of December 31, 2019, we had 786 employees.

We provide comprehensive employee training and implement recognized standards for health and safety. None of our employees are represented by a union or employed pursuant to a collective bargaining agreement or similar arrangement. We have not experienced any strikes or work stoppages, and we believe we have good relations with our employees.

Continued retention of existing qualified management and field employees and availability of additional qualified management and field employees will be a critical factor in our continued success as we work to ensure that we have adequate levels of experienced personnel to service our customers.

Competition

Our competition includes small regional service providers as well as larger companies with operations throughout the continental United States and internationally. Our larger competitors are Basic Energy Services, Inc., Superior Energy Services, Inc., Key Energy Services, Inc., C&J Energy Services, Inc., and Stallion Oilfield Services, Ltd. Because of their size, we believe these companies market a large portion of their work to the major oil and natural gas companies. In addition to rates, we compete primarily on the basis of the age and quality of our equipment, our safety record, the quality and expertise of our employees, and our responsiveness to customer needs.

Customers

We served 504 customers for the year ended December 31, 2019. For the year ended December 31, 2019, our largest customer comprised approximately 10% of our total revenues; our five largest customers comprised approximately 36% of our total revenues; and our ten largest customers comprised approximately 45% of our total revenues. During the year ended December 31, 2019, our largest customer Chesapeake Energy comprised approximately 10% of our total revenues, respectively. The loss of our largest customer or of several of the customers in the top ten would materially adversely affect our revenues and results of operations. There can be no assurance that lost revenues could be replaced in a timely manner or at all.

We have master service agreements in place with most of our customers, under which jobs or projects are awarded on the basis of price, type of service, location of equipment, and the experience level of work crews. Our business segments charge customers by the hour, by the day, or by the project for the services, equipment, and personnel we provide.

Suppliers

We purchase well servicing chemicals, drilling fluids, and related supplies from various third-party suppliers. Although we do not have written agreements with any of our suppliers (other than leases with respect to certain equipment), we have not historically suffered from an inability to purchase or lease equipment or purchase raw materials.

Insurance

Our operations are subject to risks inherent in the oilfield services industry, such as equipment defects, malfunctions, failures and natural disasters. In addition, hazards such as unusual or unexpected geological formations, pressures, blow-outs, fires or other conditions may be encountered in drilling and servicing wells, as well as the transportation of fluids and our assets between locations. We have obtained insurance coverage against certain of these risks which we believe is customary in the industry. We have $100 million of liability coverage. Our general liability policy is self-insured up to $2 million for each occurrence. We also make estimates and accrue for amounts related to deductibles or self-insured retentions. Such insurance is subject to coverage limits and exclusions and may not be available for all of the risks and hazards to which we are exposed. In addition, no assurance can be given that such insurance will be adequate to cover our liabilities or will be generally available in the future or, if available, that premiums will be commercially justifiable. If we incur substantial liability and such damages are not covered by insurance or are in excess of policy limits, or if we incur such liability at a time when we are not able to obtain liability insurance, our business, results of operations, and financial condition could be materially and adversely affected.

Environmental Regulations

Our operations are subject to various federal, state and local laws and regulations in the United States pertaining to health, safety, and the environment. Laws and regulations protecting the environment have become more stringent over the years, and in certain circumstances may impose strict, joint and several liability, rendering us potentially liable for environmental damage without regard to negligence or fault on our part and for environmental response costs for which others have contributed. Moreover, cleanup costs, penalties, and other damages arising as a result of new, or changes to existing environmental laws and regulations could be substantial and could have a material adverse effect on our financial condition, results of operations, and cash flows. We

7

believe that we conduct our operations in substantial compliance with current federal, state, and local requirements related to health, safety and the environment. There were no known material environmental liabilities at December 31, 2019 and 2018.

The following is a summary of the more significant existing environmental, health, and safety laws and regulations to which our operations are subject and for which compliance may have a material adverse effect on our results of operation or financial position. See Item 1A of this Annual Report for further details on the following: Risk Factors— Due to the nature of our business, we may be subject to environmental liability.

Hazardous Substances and Waste

The Comprehensive Environmental Response, Compensation, and Liability Act, as amended, or CERCLA, and comparable state laws in the United States impose liability without regard to fault or the legality of the original conduct on certain defined persons, including current and prior owners or operators of the site where a release of hazardous substances occurred and entities that disposed or arranged for the disposal of the hazardous substances found at the site and entities that selected and transported the hazardous substances to the site. Under CERCLA, these responsible persons may be assigned strict joint and severed liability for the costs of cleaning up the hazardous substances, for damages to natural resources, and for the costs of certain health studies. In the course of our operations, we handle materials that are regulated as hazardous substances and, as a result, may incur CERCLA liability for cleanup costs. Because of the expansive definition of "responsible parties" under CERCLA, we could be held liable for releases of hazardous substances that resulted from third party operations not under our control or for releases related to practices performed by us or others that were industry standard and in compliance with existing laws and regulations. Also, claims may be filed for personal injury and property damage allegedly caused by the release of or exposure to hazardous substances or other pollutants.

We also handle solid wastes that are subject to the requirements of the Resource Conservation and Recovery Act, as amended, or RCRA, and comparable state statutes. Certain materials generated in the exploration, development, or production of crude oil and natural gas are excluded from RCRA’s hazardous waste regulation under RCRA Subtitle C, but may be subject to regulation as a solid waste under RCRA Subtitle D. Moreover, these wastes, which include wastes currently generated during our operations, could be designated as “hazardous wastes” in the future and become subject to more rigorous and costly disposal requirements. Any such changes in the laws and regulations could have a material adverse effect on our operating expenses.

Although we have used operating and disposal practices that were standard in the industry at the time, hydrocarbons or other wastes may have been released at properties owned or leased by us now or in the past, or at other locations where these hydrocarbons and wastes were taken for treatment or disposal. Under CERCLA, RCRA and analogous state laws, we could be required to clean up contaminated property (including contaminated groundwater), perform remedial activities to prevent future contamination, pay for associated natural resource damages, or pay significant monetary penalties for such releases.

Water Discharges

We operate facilities that are subject to requirements of the Clean Water Act, as amended, or CWA, and analogous state laws that impose restrictions and controls on the discharge of pollutants into navigable waters. Pursuant to these laws, permits must be obtained to discharge pollutants into state waters or waters of the United States, including to discharge storm water runoff from certain types of facilities. Spill prevention, control, and countermeasure requirements under the CWA require implementation of measures to help prevent the contamination of navigable waters in the event of a hydrocarbon spill. The CWA can impose substantial civil and criminal penalties for non-compliance. We believe that our disposal and equipment cleaning facilities are in substantial compliance with CWA requirements.

Air Emissions

Our facilities and operations are also subject to regulation under the Clean Air Act (CAA) and analogous state and local laws and regulations for air emissions. Changes in and scheduled implementation of these laws could lead to the imposition of new air pollution control requirements for our operations. Therefore, we may incur future capital expenditures to upgrade or modify air pollution control equipment or come into compliance where needed. The EPA promulgated new source performance standards regulating methane emissions from the oil and gas sector in June 2016. These regulations require a reduction in methane emissions from new and modified infrastructure and equipment in the oil and gas sector, including the drilling of new wells, by up to 45% from 2012 levels by the year 2025. The Trump Administration has rolled back the methane standards in 2019. We believe that our operations are in substantial compliance with CAA requirements.

Employee Health and Safety

We are subject to the requirements of the federal Occupational Safety and Health Act, as amended, or OSHA, and comparable state laws that regulate the protection of employee health and safety. OSHA’s hazard communication standard requires that information about hazardous materials used or produced in our operations be maintained and provided to employees, state and local government authorities, and citizens. In addition, OSHA requires that certain safety measures such as hazard controls and

8

employee training be implemented to prevent employee exposure to safety and health hazards and dangerous conditions at oil and gas sites. We believe that our operations are in substantial compliance with OSHA requirements.

Climate Change Regulation

Continued political attention to issues concerning climate change, the role of human activity in it, and potential mitigation through regulation could have a material impact on our operations and financial results. International agreements and national or regional legislation and regulatory measures to limit greenhouse emissions are currently in various stages of discussion or implementation. These and other greenhouse gas emissions-related laws, policies, and regulations may result in substantial capital, compliance, operating and maintenance costs. Material price increases or incentives to conserve or use alternative energy sources could reduce demand for services that we currently provide and adversely affect our operations and financial results. The ultimate financial impact associated with compliance with these laws and regulations is uncertain and is expected to vary depending on the laws enacted in each jurisdiction, our activities in those jurisdictions and market conditions.

Other Laws and Regulations

We operate salt water disposal wells that are subject to the CWA, Safe Drinking Water Act, and state and local laws and regulations, including those established by the EPA’s Underground Injection Control Program which establishes the minimum program requirements. Our salt water disposal wells are located in Texas, which requires us to obtain a permit to operate each of these wells. We have such permits for each of our operating salt water disposal wells. The Texas regulatory agency may suspend, modify, or terminate any of these permits if such well operation is likely to result in pollution of fresh water, substantial violation of permit conditions or applicable rules, contributes to seismic activity or leaks to the environment. We maintain insurance against some risks associated with our well service activities, but there can be no assurance that this insurance will continue to be commercially available or available at premium levels that justify its purchase by us. The occurrence of a significant event that is not fully insured or indemnified could have a materially adverse effect on our financial condition and operations. In addition, hydraulic fracturing practices have come under increased scrutiny in recent years as various regulatory bodies and public interest groups investigate the potential impacts of hydraulic fracturing on fresh water sources. Risks associated with potential regulation of hydraulic fracturing are discussed in more detail under Item 1A. Risk Factors: Federal and state legislative and regulatory initiatives relating to hydraulic fracturing could result in increased cost and additional operating restrictions or delays.

Available Information

Information regarding Forbes Energy Services Ltd. and its subsidiaries can be found on our website at http://www.forbesenergyservices.com. We make available on our website, free of charge, access to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, and amendments to the foregoing, as well as other documents that we file or furnish to the Securities and Exchange Commission, or the SEC, in accordance with Sections 13 or 15(d) of the Exchange Act as soon as reasonably practicable after these reports have been electronically filed with, or furnished to, the SEC. We also post copies of any press releases we issue on our website. We intend to use our website as a means of disclosing material non-public information and for complying with disclosure obligations under Regulation FD. Such disclosures will be included on our website under the heading “Investor Relations.” Accordingly, investors should monitor such portion of our website, in addition to following our press releases, SEC filings and public conference calls and webcasts. Information filed with the SEC may be read or copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an internet website (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically. Our Third Amended and Restated Employee Code of Business Conduct and Ethics (which applies to all employees, including our Chief Executive Officer and Chief Financial Officer), Second Amended and Restated Code of Business Conduct and Ethics for Members of the Board of Directors (the "Board") and the charters for our Audit, Nominating/Corporate Governance and Compensation Committees, can all be found on the Investor Relations page of our website under “Corporate Governance.” We intend to disclose any changes to or waivers from the Third Amended and Restated Employee Code of Business Conduct and Ethics that would otherwise be required to be disclosed under Item 5.05 of Form 8-K on our website. We will also provide printed copies of these materials to any shareholder upon request to Forbes Energy Services Ltd., Attn: Chief Financial Officer, 3000 South Business Highway 281, Alice, Texas 78332. The information on our website is not, and shall not be deemed to be, a part of this report or incorporated into any other filings we make with the Commission.

9

Item 1A. | Risk Factors |

The following information describes certain significant risks and uncertainties inherent in our business. You should take these risks into account when evaluating us. This section does not describe all risks applicable to us, our industry or our business, and it is intended only as a summary of known material risks that are specific to the Company. You should carefully consider such risks and uncertainties together with the other information contained in this Form 10-K. If any of such risks or uncertainties actually occurs, our business, financial condition or operating results could be harmed substantially and could differ materially from the plans and other forward-looking statements included in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report on Form 10-K and elsewhere herein.

RISKS RELATING TO THE FORBES MERGER

There can be no assurances when or if the Mergers will be completed.

Although we expect to complete the Mergers in the second quarter of 2020, there can be no assurances as to the exact timing of completion of the Mergers or that the Mergers will be completed at all. The completion of the Mergers is subject to customary approvals and conditions, many of which are outside of our control. Furthermore, there can be no assurance that the conditions required to complete the Mergers will be satisfied or waived on the anticipated schedule, or at all. If the Merger Agreement is terminated under certain circumstances, we may be obligated to pay Superior a termination fee.

Company stockholders will experience a reduction in percentage ownership and voting power in Newco as a result of the Mergers.

Company stockholders will experience a substantial reduction in their percentage ownership interests and effective voting power in respect of Newco relative to their percentage ownership interests in the Company prior to the Mergers. Consequently, Company stockholders should expect to exercise less influence over the management and policies of Newco following the Mergers than they currently exercise over the management and policies of the Company.

The Forbes Merger may trigger certain “change of control” provisions and other restrictions in contracts of the Company and the failure to obtain any required consents or waivers could adversely impact Newco.

Certain agreements of the Company will or may require the consent or waiver of one or more counterparties in connection with the Forbes Merger. The failure to obtain any such consent or waiver may permit such counterparties to terminate, or otherwise increase their rights or the Company’s obligations under, any such agreement because the Forbes Merger may violate an anti-assignment, change of control or similar provision relating to any of such transactions. If this occurs, the Company may have to seek to replace that agreement with a new agreement or seek an amendment to such agreement. The Company cannot assure you that it will be able to replace or amend any such agreement on comparable terms or at all. If any such agreement is material, the failure to obtain consents, amendments or waivers under, or to replace on similar terms or at all, any of these agreements could adversely affect the financial performance or results of operations of Newco following the Mergers.

If the Mergers do not close, Forbes will not benefit from the expenses incurred in its pursuit.

The Mergers may not be completed. If the Mergers are not completed, the Company will have incurred substantial expenses for which no ultimate benefit will have been received. The Company has incurred out-of-pocket expenses in connection with the Mergers for investment banking, legal and accounting fees and other related charges, much of which will be incurred even if the Mergers are not completed.

The termination of the Merger Agreement, or failure to otherwise complete the Mergers, could negatively impact the Company, including impairing its ability to continue as a going concern.

If the Merger Agreement is terminated, or the Company fails to complete the Mergers, there may be various consequences, including that the Company’s business may have been adversely impacted by the failure to pursue other beneficial opportunities due to the focus of management on the Mergers, without realizing any of the anticipated benefits of completing the transaction.

The Company has incurred substantial net losses and losses from operations for the years ended December 31, 2019 and 2018. As of December 31, 2019, the Company had cash and cash equivalents of approximately $5.2 million and positive working capital of approximately $9.2 million, after taking into account that the mandatorily convertible notes of $58.6 million will not result in a cash settlement. While the Company has access to a working capital facility that is based on the Company’s accounts receivable, as of December 31, 2019, only $4.1 million was available to borrow under such facility. The Company’s Revolving Loan is also due January 2021. Recent negotiations to extend the maturity date have not been successful and there can be no assurance that the Company will be able to negotiate an extension on the current Revolving Loan or have sufficient funds to repay such obligations when they come due. In addition, the Company has outstanding $58.6 million of mandatorily convertible PIK notes due November 30, 2020 (the “PIK Notes”), but does not at present have sufficient authorized common share capital to fully convert the PIK Notes upon maturity or other mandatory conversion event, such as change in control. In addition, the Company may not have access to other sources of external capital on reasonable terms or at all. We also expect to experience continued volatility in market demand

10

which create normal oil and gas price fluctuations as well as external market pressures due to effects of global health concerns such as the recent outbreak of COVID-19 and the precipitous decline in oil prices that are not within our control. As a result of these and other factors, there is substantial doubt that the Company will be able to continue as a going concern. If the Mergers are not completed, these concerns will be heightened, and there can be no assurance that alternative strategic plans will provide sufficient liquidity for the Company to continue its operations.

In addition, a termination of the Merger Agreement or any failure to otherwise complete the Mergers may result in various consequences, including the following:

• | our business may have been adversely impacted by the failure to pursue other beneficial opportunities due to the focus of management on the Mergers, without realizing any of the anticipated benefits of completing the Mergers. |

• | our management has and will continue to expend a significant amount of capital and time and resources on the Mergers, and a failure to consummate the Mergers as currently contemplated could have a material adverse effect on our business and results of operations; |

• | the market price of our common stock may decline to the extent that the market price prior to the closing of the Mergers reflects a market assumption that the Mergers will be completed; |

• | we may be required, under certain circumstances, to pay Superior a termination fee equal to $1.0 million under the Merger Agreement, which could adversely affect our financial condition and liquidity; and |

• | negative reactions from the financial markets may occur if the anticipated return on our investment in Newco is not realized. |

If the Mergers are not consummated, we cannot assure our stockholders that the risks described above will not negatively impact our business or financial results.

We are subject to business uncertainties with respect to our operations until the Mergers close.

In connection with the pendency of the Mergers, it is possible that some customers, suppliers and other persons with whom we have a business relationship may delay or defer certain business decisions or might decide to seek to terminate, change or renegotiate their relationships with us, as the case may be, as a result of the Mergers, which could negatively affect our revenues, earnings and cash flows, as well as the market price of our common stock, regardless of whether the Mergers are completed. Such risks may be exacerbated by delays or other adverse developments with respect to the completion of the Mergers.

Uncertainties associated with the Mergers may distract management personnel and other key employees and divert their attention away from growing our business, which could adversely affect our future business and operations.

We are dependent on the experience and industry knowledge of our officers and other key employees to execute our business plans. Prior to completion of the Mergers, as a result of our expected management changes, our current and prospective employees may experience uncertainty about their roles following the completion of the Mergers, which may have an adverse effect on our ability to attract or retain key management and other key personnel.

Potential litigation against us or Superior could result in an injunction preventing the completion of the Mergers or a judgment resulting in the payment of damages.

Stockholders of our company and/or Superior may file lawsuits against us or Superior, respectively, and/or the directors and officers of such companies in connection with the Mergers. As of the date of this filing, there have been no such lawsuits filed against either Superior or us. However, if filed in the future, these lawsuits could prevent or delay the completion of the Mergers and result in significant costs to us, including any costs associated with the indemnification of directors and officers. The defense or settlement of any lawsuit or claim against us that remains unresolved at the time the Mergers is completed may adversely affect our business, financial condition, results of operations and cash flows.

Some of our executive officers have interests in the Mergers that are different from the interests of our stockholders generally.

Some of our executive officers have interests in the Mergers that are different from, or are in addition to, the interests of our stockholders generally. These interests may include vesting of their equity awards in connection with the consummation of the Mergers.

If the Mergers are completed, we may not achieve the anticipated benefits.

The success of Newco, in its combination of the Superior U.S. Business with our business as a result of the Mergers, will depend, in part, on Newco’s ability to realize the anticipated benefits and cost savings from combining the Superior U.S. Business with the Company’s business. There can be no assurance that the Superior U.S. Business and the Company will be able to successfully integrate, which may negatively impact our combination with the Superior U.S. Business. Difficulties in integrating the Superior U.S. Business and the Company may result in Newco performing differently than expected, in operational challenges, or in the failure to realize anticipated expense-related efficiencies that may have a negative impact on integration of Newco.

11

RISKS RELATING TO OUR BUSINESS

The industry in which we operate is highly volatile and dependent on domestic spending by the oil and natural gas industry, and continued and prolonged reductions in oil and natural gas prices and in the overall level of exploration and development activities may further reduce our levels of utilization, demand for our services, or pricing for our services.

The levels of utilization, demand, pricing, and terms for oilfield services in our existing or future service areas largely depend upon the level of exploration and development activity for both crude oil and natural gas in the United States. Oil and natural gas industry conditions are influenced by numerous factors over which we have no control, including oil and natural gas prices, expectations about future oil and natural gas prices, levels of supply and consumer demand, the cost of exploring for, producing and delivering oil and natural gas, the expected rates of current production, the discovery rates of new oil and natural gas reserves, available pipeline and other oil and natural gas transportation capacity, political instability in oil and natural gas producing countries, merger and divestiture activity among oil and natural gas producers, political, regulatory and economic conditions, and the ability of oil and natural gas companies to raise equity capital or debt financing. Any addition to, or elimination or curtailment of, government incentives for companies involved in the exploration for and production of oil and natural gas could have a significant effect on the oilfield services industry in the United States.

Our operations may be materially affected by severe weather conditions, such as hurricanes, drought, or extreme temperatures. Such events could result in evacuation of personnel, suspension of operations or damage to equipment and facilities. Damage from adverse weather conditions could result in a material adverse effect on our financial condition, results of operations and cash flows.

Beginning in October 2014 and through the first half of 2017, oil prices worldwide dropped significantly. While market conditions generally improved somewhat in the second half of 2017 and continued through the beginning of 2019, oil prices dropped precipitously in the first quarter of 2020. Continued unusually low or significant further reduction in commodity prices could cause the cancellation or curtailment of additional drilling programs and the lowering of production spending on existing wells in the future. Lower oil and natural gas prices could also cause our customers to seek to terminate, renegotiate, or fail to honor our service contracts.

A continued and prolonged reduction in the overall level of exploration and development activities, whether resulting from changes in oil and natural gas prices or otherwise, could materially and adversely affect us by negatively impacting:

• | our revenues, cash flows and profitability; |

• | the fair market value of our equipment fleet; |

• | our ability to maintain or increase our borrowing capacity; |

• | our ability to obtain additional capital to finance our business and make acquisitions, and the cost of that capital; |

• | the collectability of our receivables; and |

• | our ability to retain skilled personnel whom we would need in the event of an upturn in the demand for our services. |

The ongoing decrease in utilization, demand for our services and pricing has had, and if it continues will continue to have a material adverse effect on our business, financial condition, results of operations, and cash flows.

Management has determined that certain factors raise substantial doubt about our ability to continue as a going concern, and our continued existence is dependent upon our ability to successfully execute our business plan.

The financial statements included with this report are presented under the assumption that we will continue as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business over a reasonable length of time. Management has determined that certain factors raise substantial doubt about our ability to continue as a going concern, such as incurring substantial net losses and losses from operations for the years ended December 31, 2019 and 2018. As of December 31, 2019, the Company had cash and cash equivalents of approximately $5.2 million. While the Company has access to a working capital facility that is based on the Company’s accounts receivable, as of December 31, 2019, $4.1 million was available to borrow under such facility. The Company’s Revolving Loan is due January 2021, which is within the 12-month going concern evaluation period. Current negotiations to extend the maturity date have not been successful and there can be no assurance that the Company will be able to negotiate an extension on the current Revolving Loan or have sufficient funds to repay such obligations when they come due. As of December 31, 2019, the outstanding balance on the Revolving Loan is $4.0 million. An additional uncertainty for the Company relates to the possibility, absent the approval by the Company’s stockholders of an amendment to its certificate of incorporation, that there will not be sufficient authorized common shares to fully convert the $58.6 million accrued amount of PIK notes. In addition, the Company may not have access to other sources of external capital on reasonable terms or at all. We also expect to continue to experience volatility in market demand which create normal oil and gas price fluctuations as well as external market pressures due to effects of global health concerns such as COVID-19 and the recent oil price war triggered by Russia and Saudi Arabia, that are not within our control. The financial statements do not include any adjustments that might result from the outcome of this uncertainties.

12

Our business may be adversely affected by a deterioration in general economic conditions or a weakening of the broader energy industry.

A prolonged economic slowdown or recession in the United States, adverse events relating to the energy industry or regional, national and global economic conditions and factors, particularly a further or renewed slowdown in the oil and gas industry, could negatively impact our operations and therefore adversely affect our results. The risks associated with our business are more acute during periods of economic slowdown or recession because such periods may be accompanied by decreased exploration and development spending by our customers, decreased demand for oil and gas and decreased prices for oil and gas. The recent outbreak of COVID-19 has also resulted in increased volatility in financial and commodity markets, as well as decreased prices for oil and gas as a result of suspension of certain travel and industrial activity.

We extend credit to our customers which presents a risk of non-payment.

A substantial portion of our accounts receivable are with customers involved in the oil and natural gas industry, whose revenues are also affected by fluctuations in oil and natural gas prices, including the substantial decline in oil prices in recent periods. Collection of some of these receivables will be more difficult, and due to economic factors affecting this industry, we may experience an increase in uncollectible accounts. Failure to collect a significant level of receivables from one or more customers could have a material adverse effect on our business, financial condition, results of operations, and cash flows.

The market for oil and natural gas may be adversely affected by global demands to curtail use of such fuels.

Fuel conservation measures, alternative fuel requirements, increasing consumer demand for alternatives to oil and natural gas and technological advances in fuel economy and energy generation devices could reduce the demand for oil and other liquid hydrocarbons. We cannot predict the effect of changing demand for oil and natural gas products, and any major changes may have a material adverse effect on our business, financial condition, results of operations and cash flows.

We may be unable to maintain or increase pricing on our core services.

We may periodically seek to increase the prices on our services to offset rising costs or to generate higher returns for our stockholders. However, we operate in a very competitive industry and, as a result, we are not always successful in raising or maintaining our existing prices. Additionally, during periods of increased market demand, a significant amount of new service capacity may enter the market, which also puts pressure on the pricing of our services and limits our ability to increase prices.