Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Forbes Energy Services Ltd. | a2015q2fes-ex311.htm |

| EX-32.2 - EXHIBIT 32.2 - Forbes Energy Services Ltd. | a2015q2fes-ex322.htm |

| EX-32.1 - EXHIBIT 32.1 - Forbes Energy Services Ltd. | a2015q2fes-ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Forbes Energy Services Ltd. | a2015q2fes-ex312.htm |

| EX-10.3 - EXHIBIT 10.3 - Forbes Energy Services Ltd. | a2015q2fes-ex103.htm |

| EX-10.2 - EXHIBIT 10.2 - Forbes Energy Services Ltd. | a2015q2fes-ex102.htm |

| EX-10.1 - EXHIBIT 10.1 - Forbes Energy Services Ltd. | a2015q2fes-ex101.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________________________________________

Form 10-Q

__________________________________________________________

(Mark One)

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2015

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-35281

__________________________________________________________

Forbes Energy Services Ltd.

(Exact name of registrant as specified in its charter)

__________________________________________________________

Texas | 98-0581100 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

3000 South Business Highway 281 Alice, Texas | 78332 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(361) 664-0549

__________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). ¨ Yes x No

Shares outstanding of each of the registrant’s classes of common stock as of August 5, 2015:

Class | Outstanding as of August 5, 2015 | ||

Common Stock, $.04 par value | 22,157,435 | ||

FORBES ENERGY SERVICES LTD.

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | Other Information | |

Item 6. | Exhibits | |

Signature | ||

2

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q and any oral statements made in connection with it include certain forward-looking statements within the meaning of the federal securities laws. You can generally identify forward-looking statements by the appearance in such a statement of words like “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project” or “should” or other comparable words or the negative of these words. When you consider our forward-looking statements, you should keep in mind the risk factors we describe and other cautionary statements we make in this Quarterly Report on Form 10-Q. Our forward-looking statements are only predictions based on expectations that we believe are reasonable. Our actual results could differ materially from those anticipated in, or implied by, these forward-looking statements as a result of known risks and uncertainties set forth below and elsewhere in this Quarterly Report on Form 10-Q. These factors include or relate to the following:

• | oil and natural gas commodity prices; |

• | market response to global demands to curtail use of oil and natural gas; |

• | spending by the oil and natural gas industry; |

• | supply and demand for oilfield services and industry activity levels; |

• | our ability to maintain stable pricing; |

• | our level of indebtedness; |

• | possible impairment of our long-lived assets; |

• | potential for excess capacity; |

• | competition; |

• | substantial capital requirements; |

• | significant operating and financial restrictions under our indenture and revolving credit facility; |

• | technological obsolescence of operating equipment; |

• | dependence on certain key employees; |

• | concentration of customers; |

• | substantial additional costs of compliance with reporting obligations, the Sarbanes-Oxley Act and indenture covenants; |

• | seasonality of oilfield services activity; |

• | collection of accounts receivable; |

• | environmental and other governmental regulation, including potential climate change legislation; |

• | the potential disruption of business activities caused by the physical effects, if any, of climate change; |

• | risks inherent in our operations; |

• | ability to fully integrate future acquisitions; |

• | variation from projected operating and financial data; |

• | variation from budgeted and projected capital expenditures; |

• | volatility of global financial markets; and |

• | the other factors discussed under “Risk Factors” beginning on page 10 of the Annual Report on Form 10-K for the year ended December 31, 2014. |

We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. To the extent these risks, uncertainties and assumptions give rise to events that vary from our expectations, the forward-looking events discussed in this Quarterly Report on Form 10-Q may not occur. All forward-looking statements attributable to us are qualified in their entirety by this cautionary statement.

3

PART I—FINANCIAL INFORMATION

Item 1. Unaudited Condensed Consolidated Financial Statements

Forbes Energy Services Ltd.

Condensed Consolidated Balance Sheets (unaudited)

(in thousands, except per share amounts)

June 30, 2015 | December 31, 2014 | ||||||

Assets | |||||||

Current assets | |||||||

Cash and cash equivalents | $ | 75,179 | $ | 34,918 | |||

Accounts receivable - trade, net | 43,891 | 83,644 | |||||

Accounts receivable - related parties | 60 | 342 | |||||

Accounts receivable - other | 877 | 455 | |||||

Prepaid expenses and other | 6,973 | 10,537 | |||||

Total current assets | 126,980 | 129,896 | |||||

Property and equipment, net | 300,910 | 322,663 | |||||

Intangible assets, net | 20,862 | 22,292 | |||||

Deferred financing costs, net of accumulated amortization of $6.2 million and $5.5 million as of June 30, 2015 and December 31, 2014, respectively | 4,324 | 5,053 | |||||

Restricted cash | 452 | 1,381 | |||||

Other assets | 1,836 | 2,328 | |||||

Total assets | $ | 455,364 | $ | 483,613 | |||

Liabilities and Shareholders’ Equity | |||||||

Current liabilities | |||||||

Current portions of long-term debt | $ | 21,809 | $ | 11,204 | |||

Accounts payable - trade | 7,710 | 19,119 | |||||

Accounts payable - related parties | 91 | 186 | |||||

Accrued dividends | 61 | 61 | |||||

Accrued interest payable | 1,255 | 1,364 | |||||

Accrued expenses | 13,576 | 18,848 | |||||

Total current liabilities | 44,502 | 50,782 | |||||

Long-term debt, net of current portion | 285,027 | 286,687 | |||||

Deferred tax liability | 10,636 | 17,653 | |||||

Total liabilities | 340,165 | 355,122 | |||||

Commitments and contingencies (Note 10) | — | — | |||||

Temporary equity | |||||||

Series B senior convertible preferred shares | 14,622 | 14,602 | |||||

Shareholders’ equity | |||||||

Common stock, $.04 par value, 112,500 shares authorized, 22,104 and 21,845 shares issued and outstanding at June 30, 2015 and December 31, 2014, respectively | 884 | 874 | |||||

Additional paid-in capital | 194,564 | 194,704 | |||||

Accumulated deficit | (94,871 | ) | (81,689 | ) | |||

Total shareholders’ equity | 100,577 | 113,889 | |||||

Total liabilities and shareholders’ equity | $ | 455,364 | $ | 483,613 | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Forbes Energy Services Ltd.

Condensed Consolidated Statements of Operations (unaudited)

(in thousands, except per share amounts)

Three months ended June 30, | Six months ended June 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Revenues | |||||||||||||||

Well servicing | $ | 39,030 | $ | 70,356 | $ | 90,216 | $ | 139,449 | |||||||

Fluid logistics | 23,780 | 42,819 | 56,927 | 83,637 | |||||||||||

Total revenues | 62,810 | 113,175 | 147,143 | 223,086 | |||||||||||

Expenses | |||||||||||||||

Well servicing | 29,236 | 54,046 | 65,610 | 106,449 | |||||||||||

Fluid logistics | 17,876 | 31,582 | 42,036 | 61,943 | |||||||||||

General and administrative | 8,797 | 9,096 | 18,077 | 17,571 | |||||||||||

Depreciation and amortization | 13,759 | 13,555 | 27,922 | 26,806 | |||||||||||

Total expenses | 69,668 | 108,279 | 153,645 | 212,769 | |||||||||||

Operating income (loss) | (6,858 | ) | 4,896 | (6,502 | ) | 10,317 | |||||||||

Other income (expense) | |||||||||||||||

Interest income | 140 | 5 | 145 | 6 | |||||||||||

Interest expense | (6,911 | ) | (6,953 | ) | (13,781 | ) | (14,200 | ) | |||||||

Pre-tax loss | (13,629 | ) | (2,052 | ) | (20,138 | ) | (3,877 | ) | |||||||

Income tax benefit | (4,881 | ) | (559 | ) | (6,956 | ) | (1,090 | ) | |||||||

Net loss | (8,748 | ) | (1,493 | ) | (13,182 | ) | (2,787 | ) | |||||||

Preferred stock dividends | (194 | ) | (194 | ) | (388 | ) | (388 | ) | |||||||

Net loss attributable to common shareholders | $ | (8,942 | ) | $ | (1,687 | ) | $ | (13,570 | ) | $ | (3,175 | ) | |||

Loss per share of common stock | |||||||||||||||

Basic and diluted loss per share | $ | (0.41 | ) | $ | (0.08 | ) | $ | (0.62 | ) | $ | (0.15 | ) | |||

Weighted average number of shares outstanding | |||||||||||||||

Basic and diluted | 21,987 | 21,753 | 21,948 | 21,678 | |||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Forbes Energy Services Ltd.

Condensed Consolidated Statements of Changes in Shareholders’ Equity (unaudited)

(in thousands)

Temporary Equity | |||||||||||||||||||||||||

Preferred Shares | Common Stock | Additional Paid-In Capital | Accumulated Deficit | Total Shareholders’ Equity | |||||||||||||||||||||

Shares | Amount | Shares | Amount | ||||||||||||||||||||||

Balance: December 31, 2014 | 588 | $ | 14,602 | 21,845 | $ | 874 | $ | 194,704 | $ | (81,689 | ) | $ | 113,889 | ||||||||||||

Net loss | — | — | — | — | — | (13,182 | ) | (13,182 | ) | ||||||||||||||||

Common shares issued under stock plan: | |||||||||||||||||||||||||

Share - based compensation | — | — | 259 | 10 | 248 | — | 258 | ||||||||||||||||||

Preferred shares dividends and accretion | — | 20 | — | — | (388 | ) | — | (388 | ) | ||||||||||||||||

Balance: | 588 | $ | 14,622 | 22,104 | $ | 884 | $ | 194,564 | $ | (94,871 | ) | $ | 100,577 | ||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

Forbes Energy Services Ltd.

Condensed Consolidated Statements of Cash Flows (unaudited)

(in thousands)

Six months ended June 30, | |||||||

2015 | 2014 | ||||||

Cash flows from operating activities: | |||||||

Net loss | $ | (13,182 | ) | $ | (2,787 | ) | |

Adjustments to reconcile net loss to net cash provided by operating activities: | |||||||

Depreciation and amortization expense | 27,922 | 26,806 | |||||

Share-based compensation | 629 | 1,980 | |||||

Deferred tax benefit | (7,017 | ) | (1,472 | ) | |||

Gain on disposal of assets, net | (342 | ) | (27 | ) | |||

Bad debt expense | 507 | 336 | |||||

Amortization of deferred financing cost | 729 | 1,070 | |||||

Changes in operating assets and liabilities: | |||||||

Accounts receivable | 39,175 | (13,086 | ) | ||||

Accounts receivable - related party | 282 | (158 | ) | ||||

Prepaid expenses and other assets | 256 | 2,197 | |||||

Accounts payable - trade | (12,875 | ) | (9,586 | ) | |||

Accounts payable - related party | (94 | ) | (395 | ) | |||

Accrued expenses | (5,232 | ) | 2,250 | ||||

Net cash provided by operating activities | 30,758 | 7,128 | |||||

Cash flows from investing activities: | |||||||

Proceeds from sale of property and equipment | 1,040 | 190 | |||||

Purchases of property and equipment | (5,402 | ) | (13,682 | ) | |||

Insurance proceeds | 1,262 | — | |||||

Change in restricted cash | 929 | (1 | ) | ||||

Net cash used in investing activities | (2,171 | ) | (13,493 | ) | |||

Cash flows from financing activities: | |||||||

Payments of debt | (2,816 | ) | (2,447 | ) | |||

Payment of tax withholding obligations related to restricted stock | (142 | ) | (467 | ) | |||

Proceeds from revolving credit facility | 15,000 | — | |||||

Dividends paid on Series B senior convertible preferred shares | (368 | ) | (368 | ) | |||

Net cash provided by (used in) financing activities | 11,674 | (3,282 | ) | ||||

Net increase (decrease) in cash and cash equivalents | 40,261 | (9,647 | ) | ||||

Cash and cash equivalents: | |||||||

Beginning of period | 34,918 | 26,409 | |||||

End of period | $ | 75,179 | $ | 16,762 | |||

The accompanying notes are an integral part of these condensed consolidated financial statements.

7

Forbes Energy Services Ltd.

Notes to Condensed Consolidated Financial Statements

1. Organization and Nature of Operations

Nature of Business

Forbes Energy Services Ltd., or FES Ltd, is an independent oilfield services contractor that provides a wide range of well site services to oil and natural gas drilling and producing companies to help develop and enhance the production of oil and natural gas. These services include fluid hauling, fluid disposal, well maintenance, completion services, workovers and re-completions, plugging and abandonment, and tubing testing. Our operations are concentrated in the major onshore oil and natural gas producing regions of Texas, with additional locations in Mississippi and Pennsylvania. We believe that our broad range of services, which extends from initial drilling, through production, to eventual abandonment, is fundamental to establishing and maintaining the flow of oil and natural gas throughout the life cycle of our customers' wells. Our headquarters and executive offices are located at 3000 South Business Highway 281, Alice, Texas 78332. We can be reached by phone at (361) 664-0549.

As used in these Consolidated Financial Statements, the “Company,” the “Forbes Group,” “we,” and “our” mean FES Ltd and its direct and indirect subsidiaries, except as otherwise indicated.

2. Risk and Uncertainties

As an independent oilfield services contractor that provides a broad range of drilling-related and production-related services to oil and natural gas companies, primarily onshore in Texas, our revenue, profitability, cash flows and future rate of growth are substantially dependent on our ability to (1) maintain adequate equipment utilization, (2) maintain adequate pricing for the services we provide, and (3) maintain a trained work force. Failure to do so could adversely affect our financial position, results of operations, and cash flows.

Because our revenues are generated primarily from customers who are subject to the same factors generally impacting the oil and natural gas industry, our operations are also susceptible to market volatility resulting from economic, cyclical, weather related, or other factors related to such industry. Changes in the level of operating and capital spending in the industry, decreases in oil and natural gas prices, or industry perception about future oil and natural gas prices could materially decrease the demand for our services, adversely affecting our financial position, results of operations and cash flows.

3. Basis of Presentation

Interim Financial Information

The unaudited condensed consolidated financial statements of the Forbes Group are prepared in conformity with accounting principles generally accepted in the United States of America, or GAAP, for interim financial reporting. Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to the rules and regulations of the Securities and Exchange Commission. Therefore, these condensed consolidated financial statements should be read along with the annual audited consolidated financial statements and notes thereto included in Forbes Group’s Annual Report on Form 10-K for the year ended December 31, 2014. In management’s opinion, all adjustments necessary for a fair statement are reflected in the interim periods presented. Interim results for the three and six months ended June 30, 2015 may not be indicative of results that will be realized for the full year ending December 31, 2015. All significant intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated balance sheets and the reported amounts of revenues and expenses during the reporting period. Actual results could materially differ from those estimates. Management believes that these estimates and assumptions provide a reasonable basis for the fair presentation of the condensed consolidated financial statements.

Recent Accounting Pronouncements

In April 2015, the Financial Accounting Standards Board, or the FASB, issued ASU 2015-03, “Simplifying the Presentation of Debt Issuance Costs.” ASU 2015-03 requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt

8

discounts. ASU 2015-03 is effective for annual periods beginning after December 15, 2015, and interim periods within those annual periods. The Company is in the process of determining if this pronouncement will have a material impact on its consolidated financial statements.

4. Intangible Assets

Our major classes of intangible assets consist of our customer relationships, trade names, safety training program and dispatch software. The Company expenses costs associated with extensions or renewals of intangible assets. There were no such extensions or renewals in the three or six months ended June 30, 2015 or June 30, 2014. Amortization expense is calculated using the straight-line method over the period indicated. Amortization expense for each of the three months ended June 30, 2015 and 2014 was $0.7 million and for each of the six months ended June 30, 2015 and 2014 was $1.4 million. Estimated amortization expense for the years 2015 through 2017 is $2.9 million per year and in 2018 is $2.7 million. The weighted average amortization period remaining for intangible assets is 7.3 years.

The following sets forth the identified intangible assets by major asset class:

As of June 30, 2015 | As of December 31, 2014 | ||||||||||||||||||||||||

Useful Life (years) | Gross Carrying Value | Accumulated Amortization | Net Book Value | Gross Carrying Value | Accumulated Amortization | Net Book Value | |||||||||||||||||||

(in thousands) | |||||||||||||||||||||||||

Customer relationships | 15 | $ | 31,896 | $ | (15,948 | ) | $ | 15,948 | $ | 31,896 | $ | (14,885 | ) | $ | 17,011 | ||||||||||

Trade names | 15 | 8,050 | (4,025 | ) | 4,025 | 8,050 | (3,756 | ) | 4,294 | ||||||||||||||||

Safety training program | 15 | 1,182 | (591 | ) | 591 | 1,182 | (552 | ) | 630 | ||||||||||||||||

Dispatch software | 10 | 1,135 | (851 | ) | 284 | 1,135 | (795 | ) | 340 | ||||||||||||||||

Other | 10 | 58 | (44 | ) | 14 | 58 | (41 | ) | 17 | ||||||||||||||||

$ | 42,321 | $ | (21,459 | ) | $ | 20,862 | $ | 42,321 | $ | (20,029 | ) | $ | 22,292 | ||||||||||||

5. Share-Based Compensation

Incentive Compensation Plans

From time to time, the Company grants stock options, restricted stock units, or other awards to its employees, including executive officers, and directors. After taking into account the restricted stock units granted through June 30, 2015 (as discussed in the Restricted Stock Units paragraph below), there were 656,372 shares available for future grants under the 2012 Incentive Compensation Plan. There have been no stock option awards issued under the 2012 Plan.

9

Stock Options

The following table presents a summary of the Company’s stock option activity for the six months ended June 30, 2015:

Shares | Weighted- Average Exercise Price | Weighted-Average Remaining Contractual Term | Aggregate Intrinsic Value | |||||||||

Options outstanding at December 31, 2014 | 1,148,625 | $ | 7.94 | 5.44 | $ | — | ||||||

Granted | — | |||||||||||

Exercised | — | |||||||||||

Forfeited/cancelled | (534,500 | ) | 9.26 | $ | — | |||||||

Options outstanding at June 30, 2015 | 614,125 | $ | 6.80 | 5.37 years | $ | — | ||||||

Vested and expected to vest at June 30, 2015 | 614,125 | $ | 6.80 | 5.37 years | $ | — | ||||||

Exercisable at June 30, 2015 | 614,125 | $ | 6.80 | 5.37 years | $ | — | ||||||

During the three and six months ended June 30, 2015, the Company recorded no expenses for share-based compensation expense related to stock options as all outstanding options are fully vested. During the three and six three months ended June 30, 2014, the Company recorded total share-based compensation expense related to stock options of $0.4 million and $0.9 million, respectively. There was no share-based compensation cost capitalized for the three or six months ended June 30, 2015 or 2014. As of June 30, 2015, there was no unrecognized share-based compensation cost for stock options. During the three months ended June 30, 2015, the Company's executive officers, and members of its board of directors canceled, and Janet Forbes forfeited, an aggregate of 534,500 stock options, which were issued in August 2011 with exercise prices of $9.32 or $9.16. No consideration was paid to the Company's executive officers or members of its board of directors with respect to the cancellation of their stock options.

Restricted Stock Units

The following table presents a summary of restricted stock unit grant activity for the period ended June 30, 2015:

Number of Units | Grant Date Average Fair Value Per Unit | |||||||

Outstanding at December 31, 2014 | 637,495 | $ | 3.47 | |||||

Granted | 1,318,712 | 1.19 | ||||||

Vested | (397,875 | ) | 2.73 | |||||

Forfeited | — | |||||||

Nonvested at June 30, 2015 | 1,558,332 | $ | 1.73 | |||||

In the six months ended June 30, 2015, participants utilized a net withholding exercise method, in which restricted stock units were surrendered to cover payroll withholding tax. The cumulative net shares issued to the participants were 258,939 out of 397,875 vested shares of restricted stock units. The total pretax cash outflow, as included in withholding tax payments in our condensed consolidated statements of cash flows, for this net withholding exercise for the six months ended June 30, 2015 and June 30, 2014 was $0.1 million and $0.5 million, respectively.

Share-based compensation expense for the restricted stock units granted for the three months ended June 30, 2015 and June 30, 2014 was $0.5 million and $0.7 million, respectively. Share-based compensation expense for the restricted stock units granted for the six months ended June 30, 2015 and June 30, 2014 was $0.6 million and $1.1 million, respectively. The remaining share-based compensation expense of $2.3 million related to restricted stock units granted will be recognized over a weighted-average period of 2.20 years.

10

The following table summarizes the Company's share-based compensation expense for equity awards and liability awards (in thousands):

Three months ended June 30, | Six months ended June 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Awards classified as equity: | |||||||||||||||

Restricted stock unit expense | $ | 287 | $ | 458 | $ | 400 | $ | 748 | |||||||

Stock option expense | — | 448 | — | 895 | |||||||||||

Awards classified as liability: | |||||||||||||||

Restricted stock unit expense | 223 | 233 | 229 | 337 | |||||||||||

Total share-based compensation expense | $ | 510 | $ | 1,139 | $ | 629 | $ | 1,980 | |||||||

6. Property and Equipment

Property and equipment consisted of the following:

Estimated Life in Years | June 30, 2015 | December 31, 2014 | |||||||

(in thousands) | |||||||||

Well servicing equipment | 3-15 years | $ | 417,773 | $ | 417,561 | ||||

Autos and trucks | 5-10 years | 126,645 | 124,338 | ||||||

Disposal wells | 5-15 years | 38,255 | 38,167 | ||||||

Building and improvements | 5-30 years | 14,107 | 14,423 | ||||||

Furniture and fixtures | 3-15 years | 6,474 | 6,157 | ||||||

Land | 1,524 | 1,452 | |||||||

604,778 | 602,098 | ||||||||

Accumulated depreciation | (303,868 | ) | (279,435 | ) | |||||

$ | 300,910 | $ | 322,663 | ||||||

Depreciation expense was $13.1 million and $26.5 million for the three and six months ended June 30, 2015, respectively, and $12.9 million and $25.4 million for the three and six months ended June 30, 2014, respectively.

7. Long-Term Debt

Long-term debt at June 30, 2015 and December 31, 2014 consisted of the following:

June 30, 2015 | December 31, 2014 | ||||||

(in thousands) | |||||||

9% Senior Notes | $ | 280,000 | $ | 280,000 | |||

Revolving credit facility | 15,000 | — | |||||

Third party equipment notes and capital leases | 9,915 | 12,170 | |||||

Insurance notes | 1,921 | 5,721 | |||||

306,836 | 297,891 | ||||||

Less: Current portion | (21,809 | ) | (11,204 | ) | |||

$ | 285,027 | $ | 286,687 | ||||

11

9% Senior Notes

On June 7, 2011, FES Ltd issued $280.0 million in principal amount of 9% Senior Notes due 2019 (the “9% Senior Notes”). The 9% Senior Notes mature on June 15, 2019, and require semi-annual interest payments, in arrears, at an annual rate of 9% on June 15 and December 15 of each year, until maturity. No principal payments are due until maturity.

The 9% Senior Notes are guaranteed by the current domestic subsidiaries (the “Guarantor Subs”) of FES Ltd, which include Forbes Energy Services, LLC (“FES LLC”), C.C. Forbes, LLC (“CCF”), TX Energy Services, LLC (“TES”) and Forbes Energy International, LLC (“FEI LLC”). All of the Guarantor Subs are 100% owned and each guarantees the securities on a full and unconditional and joint and several basis, subject to customary release provisions which include: (i) the transfer, sale or other disposition (by merger or otherwise) of all or substantially all of the assets of the applicable Guarantor, or all of its capital stock; (ii) the proper designation of a Guarantor as an "Unrestricted Subsidiary"; (iii) the legal defeasance or satisfaction and discharge of the Indenture; and (iv) as may be provided in any intercreditor agreement entered into in connection with any current and future credit facilities, in each such case specified in clauses (i) through (iii) above in accordance with the requirements therefor set forth in the indenture governing the 9% Senior Notes (the "9% Senior Indenture"). The Forbes Group may, at its option, redeem all or part of the 9% Senior Notes from time to time at specified redemption prices and subject to certain conditions required by the 9% Senior Indenture. The Forbes Group is required to make an offer to purchase the notes and to repurchase any notes for which the offer is accepted at 101% of their principal amount, plus accrued and unpaid interest, if there is a change of control. The Forbes Group is required to make an offer to repurchase the notes and to repurchase any notes for which the offer is accepted at 100% of their principal amount, plus accrued and unpaid interest, following certain asset sales.

The Forbes Group is permitted under the terms of the 9% Senior Indenture to incur additional indebtedness in the future, provided that certain financial conditions set forth in the 9% Senior Indenture are satisfied. The Forbes Group is subject to certain covenants contained in the 9% Senior Indenture, including provisions that limit or restrict the Forbes Group's and certain future subsidiaries' abilities to incur additional debt, to create, incur or permit to exist certain liens on assets, to make certain dispositions of assets, to make payments on certain subordinated indebtedness, to pay dividends or certain other payments to equity holders, to engage in mergers, consolidations or other fundamental changes, to change the nature of its business or to engage in transactions with affiliates. Due to cross-default provisions in the 9% Senior Indenture and the loan agreement governing our revolving credit facility, with certain exceptions, a default and acceleration of outstanding debt under one debt agreement would result in the default and possible acceleration of outstanding debt under the other debt agreement. Accordingly, an event of default could result in all or a portion of our outstanding debt under our debt agreements becoming immediately due and payable. If this occurred, we might not be able to obtain waivers or secure alternative financing to satisfy all of our obligations simultaneously, which would adversely affect our business and operations.

The Company is in compliance with the covenants in the indenture governing the 9% Senior Notes at June 30, 2015.

Revolving Credit Facility

On September 9, 2011, FES Ltd. and its current domestic subsidiaries entered into a loan and security agreement with certain lenders, and Regions Bank, as agent for the secured parties, or the Agent. This loan and security agreement was amended in December 2011, July 2012 and July 2013. The loan and security agreement, as amended, provides for an asset based revolving credit facility with a maximum borrowing credit of $90.0 million, subject to borrowing base availability, any reserves established by the facility agent in its discretion, compliance with a fixed charge coverage ratio covenant if availability under the facility falls below certain thresholds and, for borrowings above $75.0 million, compliance with the debt incurrence covenant in the 9% Senior Indenture that prohibits the incurrence of debt except for certain limited exceptions, including indebtedness incurred under the permitted credit facility debt basket to the greater of $75.0 million or 18% of our Consolidated Tangible Assets (as defined in the 9% Senior Indenture) reported for the last fiscal quarter for which financial statements are available. As of June 30, 2015, 18% of our Consolidated Tangible Assets was approximately $77.4 million. Under the loan and security agreement, our borrowing base at any time is equal to (i) 85% of eligible accounts, which are determined by Agent in its reasonable discretion, plus (ii) the lesser of 85% of the appraised value, subject to certain adjustments, of our well services equipment that has been properly pledged and appraised, is in good operating condition and is located in the United States, or 100% of the net book value of such equipment, minus (iii) any reserves established by the Agent in its reasonable discretion. As of June 30, 2015, the borrowing base was $90.0 million and borrowing availability was $54.8 million.

As amended, the loan and security agreement has a stated maturity of July 26, 2018. In June 2015, the Company, for the first time since the July 2013 amendment, drew down $15.0 million under the facility, which is reflected in the current portion of long term debt since the Company plans to repay the revolving loan balance in the next twelve months. As of June 30, 2015, the facility had a revolving loan balance outstanding of $15.0 million and $7.6 million in letters of credit outstanding against the facility.

12

Borrowings bear interest at a rate equal to either (a) the LIBOR rate plus an applicable margin of between 2.00% to 2.50% based on borrowing availability or (b) a base rate plus an applicable margin of between 1.00% to 1.50% based on borrowing availability, where the base rate is equal to the greater of the prime rate established by Regions Bank, the overnight federal funds rate plus 0.5% or the LIBOR rate for a one month period plus 1%.

In addition to paying interest on outstanding principal under the facility, a fee of 0.375% per annum will accrue on unutilized availability under the credit facility. We are required to pay a fee of between 2.25% to 2.75%, based on borrowing availability, with respect to the principal amount of any letters of credit outstanding under the facility. We are also responsible for certain other administrative fees and expenses.

FES LLC, FEI LLC, TES, and CCF are the borrowers under the loan and security agreement. Their obligations have been guaranteed by one another and by FES Ltd. Subject to certain exceptions and permitted encumbrances, including the exemption of real property interests from the collateral package, the obligations under this facility are secured by a first priority security interest in all of our assets.

We are able to voluntarily repay outstanding loans at any time without premium or penalty (subject to the fees discussed above). If at any time our outstanding loans under the credit facility exceed the availability under our borrowing base, we may be required to repay the excess. Further, we are required to use the net proceeds from certain events, including certain judgments, tax refunds or insurance awards to repay outstanding loans, however, we may reborrow following such repayments if the conditions to borrowing are met.

The loan and security agreement contains customary covenants for an asset-based credit facility, which include (i) restrictions on certain mergers, consolidations and sales of assets; (ii) restrictions on the creation or existence of liens; (iii) restrictions on making certain investments; (iv) restrictions on the incurrence or existence of indebtedness; (v) restrictions on transactions with affiliates; (vi) requirements to deliver financial statements, report and notices to the Agent and (vii) a springing requirement to maintain a consolidated Fixed Charge Coverage Ratio (which is defined in the loan and security agreement) of 1.1:1.0 in the event that our excess availability under the credit facility falls below the greater of $8.2 million or 15.0% of our maximum credit under the facility for sixty consecutive days; provided that, the restrictions described in (i)-(v) above are subject to certain exceptions and permissions limited in scope and dollar value. The loan and security agreement also contains customary representations and warranties and event of default provisions. As of June 30, 2015, we are in compliance with all applicable covenants in the loan and security agreement.

Third Party Equipment Notes and Capital Leases

The Forbes Group financed the purchase of certain vehicles and equipment through commercial loans and capital leases with aggregate principal amounts outstanding as of June 30, 2015 and December 31, 2014 of approximately $9.9 million and $12.2 million, respectively. These loans are repayable in a range of 42 to 60 monthly installments with the maturity dates ranging from July 2015 to July 2018. Interest accrues at rates ranging from 3.1% to 8.4% and is payable monthly. The loans are collateralized by equipment purchased with the proceeds of such loans. The Forbes Group paid total principal payments of approximately $1.4 million and $1.2 million for three months ended June 30, 2015 and 2014, respectively, and $2.8 million and $2.4 million for the six months ended June 30, 2015 and 2014, respectively.

Following are required principal payments due on notes and capital leases (other than the 9% Senior Notes) existing as of June 30, 2015:

July - December 2015 | 2016 | 2017 | 2018 | 2019 | |||||||||||||||

(in thousands) | |||||||||||||||||||

Notes and capital lease principal payments | $ | 2,686 | $ | 4,149 | $ | 2,837 | $ | 243 | $ | — | |||||||||

Management currently acquires all light duty trucks (pick up trucks) through capital leases and uses capital leases or cash to purchase equipment held under operating leases that has reached the end of the lease term. See Note 10 - Commitments and Contingencies.

Insurance Notes

During October of 2014, the Forbes Group entered into promissory notes for the payment of insurance premiums at an interest rate of 2.9% with an aggregate principal amount outstanding as of June 30, 2015 and December 31, 2014 of

13

approximately $1.9 million and $5.7 million, respectively. The amount outstanding could be substantially offset by the cancellation of the related insurance coverage which is classified as prepaid insurance.

8. Fair Value of Financial Instruments

Fair value is defined as the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The carrying amounts of cash and cash equivalents, accounts receivable-trade, accounts receivable – other, accounts payable – trade, and insurance notes, approximate fair value because of the short maturity of these instruments. The fair values of third party notes and equipment notes approximate their carrying values, based on current market rates at which the company could borrow funds with similar maturities (Level 2 in the fair value hierarchy).

June 30, 2015 | December 31, 2014 | ||||||||||||||

Carrying Amount | Fair Value | Carrying Amount | Fair Value | ||||||||||||

(in thousands) | |||||||||||||||

9.0% Senior Notes | $ | 280,000 | $ | 224,000 | $ | 280,000 | $ | 165,200 | |||||||

The fair value of our 9% Senior Notes is a level one input within the fair value hierarchy and is based on the dealer quoted market prices at June 30, 2015 and December 31, 2014, respectively.

14

9. Related Party Transactions

The Forbes Group enters into transactions with related parties in the normal course of conducting business. The following tables represent related party transactions.

As of | ||||||||||||||||

June 30, 2015 | December 31, 2014 | |||||||||||||||

(in thousands) | ||||||||||||||||

Related parties cash and cash equivalents balances: | ||||||||||||||||

Balance at Texas Champion Bank (1) | $ | 1,414 | $ | 1,040 | ||||||||||||

Balance at Brush Country Bank (2) | 649 | 644 | ||||||||||||||

Related parties receivable: | ||||||||||||||||

Dorsal Services, Inc. (3) | 60 | 60 | ||||||||||||||

Wolverine Construction, Inc. (4) | — | 282 | ||||||||||||||

$ | 60 | $ | 342 | |||||||||||||

Related parties payable: | ||||||||||||||||

Alice Environmental Services, LP/Alice Environmental Holding LLC (5) | $ | 78 | $ | 83 | ||||||||||||

Dorsal Services, Inc. (3) | 2 | 25 | ||||||||||||||

Tasco Tool Service Ltd. (6) | — | 59 | ||||||||||||||

Texas Quality Gate Guard Services, LLC (7) | 11 | 11 | ||||||||||||||

Texas Water Disposal Services, LLC (8) | — | 8 | ||||||||||||||

$ | 91 | $ | 186 | |||||||||||||

Three months ended June 30, | Six months ended June 30, | |||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||

(in thousands) | ||||||||||||||||

Related parties capital expenditures: | ||||||||||||||||

Alice Environmental West Texas, LLC (9) | $ | — | $ | — | $ | 455 | $ | — | ||||||||

$ | — | $ | — | $ | 455 | $ | — | |||||||||

Related parties revenue activity: | ||||||||||||||||

Alice Environmental Services, LP/Alice Environmental Holding LLC (5) | $ | — | $ | — | $ | — | $ | 1 | ||||||||

Dorsal Services, Inc. (3) | 6 | — | — | 1 | ||||||||||||

Tasco Tool Service Ltd. (6) | 1 | 1 | 1 | 1 | ||||||||||||

Wolverine Construction, Inc. (4) | — | 248 | — | 308 | ||||||||||||

Texas Water Disposal Services, LLC (8) | — | — | — | 57 | ||||||||||||

$ | 7 | $ | 249 | $ | 1 | $ | 368 | |||||||||

Related parties expense activity: | ||||||||||||||||

Alice Environmental Services, LP/Alice Environmental Holding LLC (5) | $ | 559 | $ | 344 | $ | 1,135 | $ | 966 | ||||||||

Dorsal Services, Inc. (3) | — | 113 | 19 | 306 | ||||||||||||

Tasco Tool Service Ltd. (6) | 68 | 68 | 135 | 138 | ||||||||||||

FCJ Management, LLC (10) | 5 | 9 | 14 | 18 | ||||||||||||

JITSU Services, LLC (11) | — | 92 | — | 152 | ||||||||||||

Texas Quality Gate Guard Services, LLC (7) | 61 | — | 114 | — | ||||||||||||

Animas Holdings, LLC (12) | 73 | 115 | 149 | 203 | ||||||||||||

Texas Water Disposal Services, LLC (8) | — | 1 | — | 3 | ||||||||||||

CJW Group, LLC (13) | 10 | — | 19 | — | ||||||||||||

$ | 776 | $ | 742 | $ | 1,585 | $ | 1,786 | |||||||||

15

(1)The Company has a deposit relationship with Texas Champion Bank. Travis Burris, one of the directors of FES Ltd., is also the President, Chief Executive Officer, and director of Texas Champion Bank. Mr. Crisp, our President and Chief Executive Officer, serves on the board of directors.

(2)Messrs. Crisp and Forbes are directors and shareholders of Brush Country Bank, an institution with which the Company conducts business and has deposits.

(3)Dorsal Services, Inc. is a trucking service company. Mr. Crisp, an executive officer and director, is a partial owner of Dorsal Services, Inc. The company uses Dorsal Services from time to time.

(4)Wolverine Construction, Inc., or Wolverine, is an entity that was owned by two sons and a brother of Mr. Crisp, an executive officer and director of FES Ltd., and a son of Mr. Forbes, an executive officer and director of FES Ltd. Wolverine provided construction and site preparation services to certain customers of the Company. The interests in Wolverine were sold in 2014.

(5)Messrs. John E. Crisp and Charles C. Forbes, Jr., executive officers and directors of FES Ltd., are also owners and managers of Alice Environmental Holdings, LLC, or AEH, and indirect owners and managers of Alice Environmental Services, LP, or AES. The Company leases or rents land and buildings, disposal wells, aircraft, and other equipment from AES.

(6)Tasco Tool Service Ltd. is a down-hole tool company that is partially owned and managed by a company that is owned by Mr. Forbes, both an executive officer and director of FES Ltd., along with Robert Jenkins a manager of one of the subsidiaries of FES Ltd. Tasco rents and sells tools to the Company from time to time.

(7)Texas Quality Gate Guard Services, LLC, or Texas Quality Gate Guard Services, is an entity owned by Messrs. Crisp and Forbes and a son of Mr. Crisp, an executive officer and director of FES Ltd. Texas Quality Gate Guard Services has provided security services to the Company.

(8) Texas Water Disposal Services, LLC. is partially owned by a brother of Mr. Crisp, an executive officer and director of FES Ltd. Texas Water Disposal is a company that owns a salt water disposal well that is used by the Company.

(9) Alice Environmental West Texas, LLC, or AEWT, is an entity owned by Messrs. Crisp and Forbes, executive officers and directors of FES Ltd. The Company purchased land previously leased for a new well service location from AEWT.

(10) FCJ Management, LLC or FCJ, is an entity that leases land and facilities to the Company and is owned by Messrs. Crisp and Forbes, and Robert Jenkins, a manager of one of the subsidiaries of FES Ltd.

(11)JITSU Services, LLC, or JITSU, is a financial leasing company owned by Janet Forbes and Mr. Crisp, an executive officer and director of FES Ltd. The Company previously leased ten vacuum trucks from JITSU.

(12)Animas Holdings, LLC, or Animas, is a property and disposal company that is owned by the two sons of Mr. Crisp and three children of Mr. Forbes and Ms. Forbes. Messrs. Crisp and Forbes are executive officers and directors of FES Ltd. and Ms. Forbes served as a director of FES Ltd. until June 11, 2014. The Company pays Animas for waste water disposal and lease facilities.

(13) CJW Group, LLC is an entity that leases facilities to the Company and is partially owned by Messrs. Crisp and Forbes, executive officers and directors of FES Ltd.

10. Commitments and Contingencies

Concentrations of Credit Risk

FDIC insurance coverage is currently $250,000 per depositor at each financial institution, and our non-interest bearing cash balances typically exceed federally insured limits. The Company restricts investment of temporary cash investments to financial institutions with high credit standings. The Company's customer base consists primarily of multi-national and independent oil and natural gas producers. The Company does not require collateral on its trade receivables. For the three months ended June 30, 2015, the Company's largest customer, five largest customers, and ten largest customers constituted 16.0%, 45.3%, and 64.5% of consolidated revenues, respectively. For the six months ended June 30, 2015 the Company's largest customer, five largest customers, and ten largest customers constituted 16.5%, 46.3%, and 66.4% of consolidated revenues, respectively. The loss of any one of our top five customers would have a materially adverse effect on the revenues and profits of the Company. Further, our trade accounts receivable are from companies within the oil and natural gas industry and as such the Company is exposed to normal industry credit risks. As of June 30, 2015, the Company's largest customer, five largest customers, and ten largest customers constituted 12.3%, 39.9%, and 57.4% of accounts receivable, respectively. The Company continually evaluates its reserves for potential credit losses and establishes reserves for such losses.

Self-Insurance

The Company is self-insured under its Employee Group Medical Plan for the first $0.3 million per individual. The Company is also self-insured for the first $0.5 million and $1.0 million under its insurance policies for auto liability and general liability, respectively. The Company has accrued a liability of approximately $5.9 million and $5.8 million as of June 30, 2015 and December 31, 2014, respectively, for insurance claims as of such dates. In addition to accruals for the self-insured portion of the Employee Group Medical Benefits Plan, the liability for incurred but not received claims also includes estimated “run off” liabilities payable at future dates related to the worker’s compensation, general liability and automobile liability self-insurance program that was eliminated in October 2009.

16

Litigation

The Company is subject to various other claims and legal actions that arise in the ordinary course of business. We do not believe that any of these claims and actions, separately or in the aggregate, will have a material adverse effect on our business, financial condition, results of operations, or cash flows, although we cannot guarantee that a material adverse effect will not occur.

Off-Balance Sheet Arrangements

We are often party to certain transactions that require off-balance sheet arrangements such as performance bonds, guarantees, operating leases for equipment, and bank guarantees that are not reflected in our condensed consolidated balance sheets. These arrangements are made in our normal course of business and they are not reasonably likely to have a current or future material adverse effect on our financial condition, results of operations, liquidity or cash flows.

Following are future lease payments on operating leases existing as of June 30, 2015:

July - December 2015 | 2016 | 2017 | 2018 | 2019 | |||||||||||||||

(in thousands) | |||||||||||||||||||

Lease payments | $ | 4,721 | $ | 4,617 | $ | 296 | $ | — | $ | — | |||||||||

11. Supplemental Cash Flow Information

Six months ended June 30, | |||||||

2015 | 2014 | ||||||

(in thousands) | |||||||

Cash paid for | |||||||

Interest | $ | 13,089 | $ | 13,153 | |||

Income tax | 60 | 70 | |||||

Supplemental schedule of non-cash investing and financing activities | |||||||

Changes in accounts payable related to capital expenditures | $ | 1,466 | $ | 3,360 | |||

Capital leases on equipment | 562 | 856 | |||||

Preferred stock dividends and accretion costs | 20 | 20 | |||||

12. Earnings per Share

Basic earnings (loss) per share (“EPS”) is computed by dividing net income (loss) available to common shareholders by the weighted average common stock outstanding during the period. Diluted earnings (loss) per share takes into account the potential dilution that could occur if securities or other contracts to issue common stock, such as options and convertible preferred stock, were exercised and converted into common stock. Potential common stock equivalents that have been issued by the Forbes Group relate to outstanding stock options and unvested restricted stock units which are determined using the treasury stock method, and the Series B Senior Convertible Preferred Stock (the "Series B Preferred Stock"), which are determined using the "if-converted" method. In applying the if-converted method, conversion is not assumed for purposes of computing diluted EPS if the effect would be antidilutive. As of June 30, 2015 and June 30, 2014, there were 614,125 and 1,148,625 options to purchase common stock outstanding, respectively, and 588,059 Series B Preferred Stock. The Series B Preferred Stock is convertible at a rate of nine shares of common stock to one share of Series B Preferred Stock, or 5,292,531 shares of common stock.

The shares of Series B Preferred Stock are participating securities as they participate in undistributed earnings with common stock, whether that participation is conditioned upon the occurrence of a specified event or not. A participating security is included in the computation of basic EPS using the two-class method. Under the two-class method, basic EPS for the Company’s common stock is computed by dividing net income applicable to common shares by the weighted-average common stock outstanding during the period. Under the certificate of designation for our Series B Preferred Stock (the “Series B Certificate of Designation”), if at any time the Company declares a dividend in cash which is greater in value than five

17

percent on a cumulative basis over the previous twelve month period of the then current “Common Share Fair Market Value,” as that term is defined in the Series B Certificate of Designation, the Series B Preferred Stock will be entitled to receive a dividend payable in cash equal to the amount in excess of five percent of the then Common Share Fair Market Value per common share they would have received if all outstanding Series B Preferred Stock had been converted into common shares. There were no earnings allocated to the Series B Preferred Stock for the quarters ended June 30, 2015 and 2014 since there was a net loss for those periods and earnings for the quarter were not in excess of amounts prescribed by the Series B Certificate of Designation for our Series B Preferred Stock. Diluted EPS for the Company’s common stock is computed using the more dilutive of the two-class method or the if-converted method. The following table sets forth the reconciliation of weighted average shares outstanding and diluted weighted average shares outstanding:

Three months ended June 30, | Six months ended June 30, | ||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||

(in thousands) | (in thousands) | ||||||||||

Weighted average shares outstanding | 21,987 | 21,753 | 21,948 | 21,678 | |||||||

Dilutive effect of stock options and restricted stock | — | — | — | — | |||||||

Dilutive effect of preferred stock | — | — | — | — | |||||||

Diluted weighted average shares outstanding | 21,987 | 21,753 | 21,948 | 21,678 | |||||||

There were 614,125 stock options, 1,558,332 units of unvested restricted stock, and 5,292,531 shares of common stock equivalents underlying the Series B Preferred Stock outstanding as of June 30, 2015 that were not included in the calculation of diluted EPS for the six months ended June 30, 2015 because their effect would have been antidilutive. There were 1,148,625 stock options, 685,448 units of unvested restricted stock, and 5,292,531 shares of common stock equivalents underlying the Series B Preferred Stock outstanding as of June 30, 2014 that were not included in the calculation of diluted EPS for the six months ending June 30, 2014 because their effect would have been antidilutive.

The following table sets forth the computation of basic and diluted loss per share:

Three months ended June 30, | Six months ended June 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

(in thousands, except per share amounts) | |||||||||||||||

Basic and diluted: | |||||||||||||||

Net loss | $ | (8,748 | ) | $ | (1,493 | ) | $ | (13,182 | ) | $ | (2,787 | ) | |||

Preferred stock dividends and accretion | (194 | ) | (194 | ) | (388 | ) | (388 | ) | |||||||

Net loss attributable to common shareholders | $ | (8,942 | ) | $ | (1,687 | ) | $ | (13,570 | ) | $ | (3,175 | ) | |||

Weighted-average common shares | 21,987 | 21,753 | 21,948 | 21,678 | |||||||||||

Basic and diluted net loss per share | $ | (0.41 | ) | $ | (0.08 | ) | $ | (0.62 | ) | $ | (0.15 | ) | |||

13. Income Taxes

The Company’s tax benefit from application of the effective tax rate for the six months ended June 30, 2015 was estimated to be 34.5% based on pre-tax loss of $20.1 million. For the six months ended June 30, 2014, the Company's effective tax rate was a benefit of 28.1%. The difference between the effective rate and 35.0% statutory rate is mainly due to Texas Margins Tax and non-deductible expenses.

14. Business Segment Information

The Forbes Group has determined that it has two reportable segments organized based on its products and services—well servicing and fluid logistics. The accounting policies of the segments are the same as those described in the summary of significant accounting policies.

Well Servicing

At June 30, 2015, our well servicing segment utilized our fleet of 172 owned well servicing rigs, which was comprised of 159 workover rigs and 13 swabbing rigs, as well as nine tubing testing units, six coiled tubing spreads, four electromagnetic scan trucks and related assets and equipment. These assets are used to provide (i) well maintenance, including remedial repairs and removal and replacement of downhole production equipment, (ii) well workovers, including significant downhole repairs, re-completions and re-perforations, (iii) completion and swabbing activities, (iv) plugging and abandonment services, and (v)

18

pressure testing of oil and natural gas production tubing and scanning tubing for pitting and wall thickness using tubing testing units.

Fluid Logistics

The fluid logistics segment utilizes our fleet of owned or leased fluid transport trucks and related assets, including specialized vacuum, high pressure pump and tank trucks, frac tanks, salt water disposal wells and facilities, and related equipment. These assets are used to provide transport, store and dispose of a variety of drilling and produced fluids used in and generated by oil and natural gas production activities. These services are required in most workover and completion projects and are routinely used in the daily operation of producing wells.

The following tables set forth certain financial information with respect to the Company’s reportable segments for the three and six months ended June 30, 2015 and June 30, 2014:

Three months ended June 30, | Six months ended June 30, | ||||||||||||||||||||||

Well Servicing | Fluid Logistics | Consolidated | Well Servicing | Fluid Logistics | Consolidated | ||||||||||||||||||

2015 | (in thousands) | (in thousands) | |||||||||||||||||||||

Operating revenues | $ | 39,030 | $ | 23,780 | $ | 62,810 | $ | 90,216 | $ | 56,927 | $ | 147,143 | |||||||||||

Direct operating costs | 29,236 | 17,876 | 47,112 | 65,610 | 42,036 | 107,646 | |||||||||||||||||

Segment profits | $ | 9,794 | $ | 5,904 | $ | 15,698 | $ | 24,606 | $ | 14,891 | $ | 39,497 | |||||||||||

Depreciation and amortization | $ | 6,393 | $ | 7,366 | $ | 13,759 | $ | 12,934 | $ | 14,988 | $ | 27,922 | |||||||||||

Capital expenditures | 722 | 2,715 | 3,437 | 4,026 | 3,404 | 7,430 | |||||||||||||||||

Total assets | 653,685 | 478,252 | 1,131,937 | 653,685 | 478,252 | 1,131,937 | |||||||||||||||||

Long lived assets | 178,373 | 123,198 | 301,571 | 178,373 | 123,198 | 301,571 | |||||||||||||||||

2014 | |||||||||||||||||||||||

Operating revenues | $ | 70,356 | $ | 42,819 | $ | 113,175 | $ | 139,449 | $ | 83,637 | $ | 223,086 | |||||||||||

Direct operating costs | 54,046 | 31,582 | 85,628 | 106,449 | 61,943 | 168,392 | |||||||||||||||||

Segment profits | $ | 16,310 | $ | 11,237 | $ | 27,547 | $ | 33,000 | $ | 21,694 | $ | 54,694 | |||||||||||

Depreciation and amortization | $ | 6,070 | $ | 7,485 | $ | 13,555 | $ | 11,955 | $ | 14,851 | $ | 26,806 | |||||||||||

Capital expenditures | 6,572 | 5,182 | 11,754 | 8,917 | 8,981 | 17,898 | |||||||||||||||||

Total assets | 612,256 | 485,889 | 1,098,145 | 612,256 | 485,889 | 1,098,145 | |||||||||||||||||

Long lived assets | 195,790 | 137,576 | 333,366 | 195,790 | 137,576 | 333,366 | |||||||||||||||||

Three months ended June 30, | Six months ended June 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

Reconciliation of the Forbes Group Operating Income (Loss) As Reported: | (in thousands) | (in thousands) | |||||||||||||

Segment profits | $ | 15,698 | $ | 27,547 | $ | 39,497 | $ | 54,694 | |||||||

General and administrative expense | 8,797 | 9,096 | 18,077 | 17,571 | |||||||||||

Depreciation and amortization | 13,759 | 13,555 | 27,922 | 26,806 | |||||||||||

Operating income (loss) | (6,858 | ) | 4,896 | (6,502 | ) | 10,317 | |||||||||

Other income and expenses, net | (6,771 | ) | (6,948 | ) | (13,636 | ) | (14,194 | ) | |||||||

Pre-tax loss | $ | (13,629 | ) | $ | (2,052 | ) | $ | (20,138 | ) | $ | (3,877 | ) | |||

19

June 30, 2015 | December 31, 2014 | ||||||

Reconciliation of the Forbes Group Assets As Reported: | (in thousands) | ||||||

Total reportable segments | $ | 1,131,937 | $ | 1,132,856 | |||

Elimination of internal transactions | (1,840,924 | ) | (1,784,404 | ) | |||

Parent | 1,164,351 | 1,135,161 | |||||

Total assets | $ | 455,364 | $ | 483,613 | |||

15. Equity Securities

Common Stock

Holders of common stock have no pre-emptive, redemption, conversion, or sinking fund rights. Holders of common stock are entitled to one vote per share on all matters submitted to a vote of holders of common stock. Unless a different majority is required by law or by the bylaws, resolutions to be approved by holders of common stock require approval by a simple majority of votes cast at a meeting at which a quorum is present. In the event of the liquidation, dissolution, or winding up of the Company, the holders of common stock are entitled to share equally and ratably in the Company's assets, if any, remaining after the payment of all of its debts and liabilities, subject to any liquidation preference on any issued and outstanding preferred stock.

Series B Preferred Stock

Under our Series B Certificate of Designation, we are authorized to issue 825,000 shares of Series B Preferred Stock, par value $0.01 per share. On May 28, 2010, the Company completed a private placement of 580,800 shares of Series B Preferred Stock at a price per share of CAD $26.37 for an aggregate purchase price in the amount of approximately USD $14.5 million based on the exchange rate between U.S. dollars and Canadian dollars then in effect of $1.00 to CDN $1.0547. The Company received net proceeds of USD $13.8 million after closing fee paid to investors of USD $0.3 million and legal fees and other offering costs of USD $0.4 million. This is presented as temporary equity on the balance sheet. The common stock into which the Series B Preferred Stock is convertible has certain demand and “piggyback” registration rights.

The value of the Series B Preferred Stock, for accounting purposes, is being accreted up to redemption value from the date of issuance to the earliest redemption date of the instrument using the effective interest rate method. If the Series B Preferred Stock had been redeemed as of June 30, 2015 and December 31, 2014, the redemption amount applicable at each date would have been approximately $14.6 million.

Dividends

The Series B Preferred Stock is entitled to receive preferential dividends equal to five percent (5.0%) per annum of the original issue price per share, payable quarterly in February, May, August and November of each year. Such dividends may be paid by the Company in cash or in kind (in the form of additional shares of Series B Preferred Stock). As shares of the Series B Preferred Stock are convertible into shares of our common stock, any dividend paid in kind would have a dilutive effect on our shares of common stock.

Preferred stock dividends are recorded at their fair value. If paid in cash, the amount paid represents fair value. If paid in kind, the fair value of the preferred stock dividends would be determined using valuation techniques that include a component representing the intrinsic value of the dividends (which represents the fair value of the common stock into which the preferred stock could be converted) and an option component (which is determined using a Black-Scholes Option Pricing Model). Dividends and accretion for the three and six months ended June 30, 2015 and June 30, 2014 was $0.2 million in each period. The Company has paid in cash all required quarterly dividends on the Series B Preferred Stock through June 30, 2015.

16. Subsequent Events

In July 2015, we closed our current well servicing location in Mississippi and combined our current well servicing location in Kilgore, Texas with our yard in Carthage, Texas. Our Carthage location will continue to service customers formerly serviced by our Kilgore location. The Company does not expect this to have any material effects on operations or financial results.

20

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the accompanying condensed consolidated financial statements and related notes included elsewhere in this Quarterly Report on Form 10-Q and with the audited consolidated financial statements for the year ended December 31, 2014 included in our Annual Report on Form 10-K. Any forward-looking statements made by or on our behalf are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Readers are cautioned that such forward-looking statements involve risks and uncertainties in that the actual results may differ materially from those projected in the forward-looking statements. Important factors that could cause actual results to differ include risks set forth in the Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2014.

Overview

Forbes Energy Services Ltd., or FES Ltd., is an independent oilfield services contractor that provides a wide range of well site services to oil and natural gas drilling and producing companies to help develop and enhance the production of oil and natural gas. These services include fluid hauling, fluid disposal, well maintenance, completion services, workovers and re-completions, plugging and abandonment, and tubing testing. Our operations are concentrated in the major onshore oil and natural gas producing regions of Texas, with additional locations in Mississippi and Pennsylvania. We believe that our broad range of services, which extends from initial drilling, through production, to eventual abandonment, is fundamental to establishing and maintaining the flow of oil and natural gas throughout the life cycle of our customers’ wells. Our headquarters and executive offices are located at 3000 South Business Highway 281, Alice, Texas 78332. We can be reached by phone at (361) 664-0549.

As used in this Quarterly Report on Form 10-Q, the “Company,” the “Forbes Group,” “we,” and “our” mean FES Ltd. and its subsidiaries, except as otherwise indicated.

We currently provide a wide range of services to a diverse group of companies. Through the six months ended June 30, 2015, we provided services to over 500 companies. Our blue-chip customer base includes Anadarko Petroleum Corporation, ConocoPhillips Company, and Pioneer Natural Resources Company, among others. John E. Crisp, Charles C. Forbes, Jr. and our senior management team, have cultivated deep and ongoing relationships with these customers during their average of over 38 years of experience in the oilfield services industry. For the three and six months ended June 30, 2015, we generated consolidated revenues of approximately $62.8 million and $147.1 million, respectively.

We currently conduct our operations through the following two business segments:

• | Well Servicing. Our well servicing segment comprised 62.1% and 61.3% of consolidated revenues for the three and six months ended June 30, 2015. At June 30, 2015, our well servicing segment utilized our modern fleet of 172 well servicing rigs, which was comprised of 159 workover rigs and 13 swabbing rigs, as well as six coiled tubing spreads, nine tubing testing units, four electromagnetic scan units, and related assets and equipment. These assets are used to provide (i) well maintenance, including remedial repairs and removal and replacement of downhole production equipment, (ii) well workovers, including significant downhole repairs, re-completions and re-perforations, (iii) completion and swabbing activities, (iv) plugging and abandonment services, and (v) pressure testing of oil and natural gas production tubing and scanning tubing for pitting and wall thickness using tubing testing units. |

• | Fluid Logistics. Our fluid logistics segment comprised 37.9% and 38.7% of consolidated revenues for the three and six months ended June 30, 2015. Our fluid logistics segment utilized our fleet of owned or leased fluid transport trucks and related assets, including specialized vacuum, high-pressure pump and tank trucks, hot oil trucks, frac tanks, fluid mixing tanks, salt water disposal wells and facilities, and related equipment. These assets are used to provide, transport, store, and dispose of a variety of drilling and produced fluids used in, and generated by, oil and natural gas production. These services are required in most workover and completion projects and are routinely used in daily operations of producing wells. |

We believe that our two business segments are complementary and create synergies in terms of selling opportunities. Our multiple lines of service are designed to capitalize on our existing customer base to grow it within existing markets, generate more business from existing customers, and increase our operating performance. By offering our customers the ability to reduce the number of vendors they use, we believe that we help improve our customers’ efficiency. This is demonstrated by the fact that 77.9% of our revenues for both the three and six months ended June 30, 2015 were from customers that utilized

21

services of both of our business segments. Further, by having multiple service offerings that span the life cycle of the well, we believe that we have a competitive advantage over smaller competitors offering more limited services.

Factors Affecting Results of Operations

Market Conditions

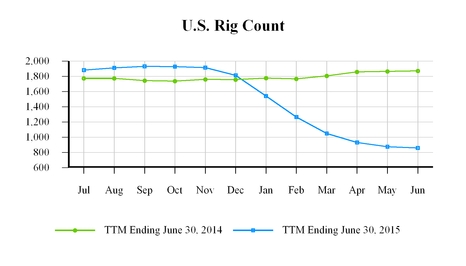

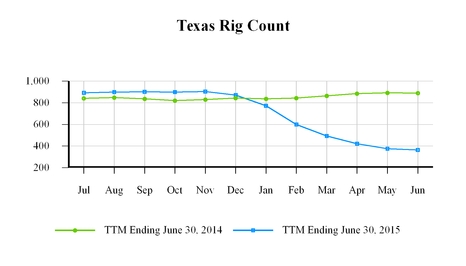

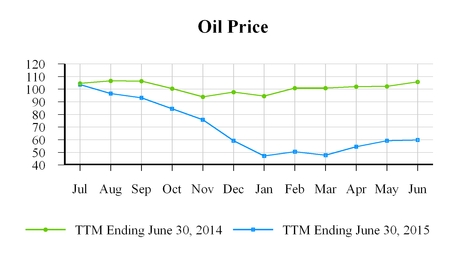

The oil and gas industry has experienced a significant decline in oil exploration and production activity that began in the fourth quarter of 2014 and has continued through the second quarter of 2015. The price of West Texas Intermediate (“WTI”) oil has fallen precipitously from a price of $103 per barrel as of June 30, 2014 to a trading range of $47-$60 per barrel for the latter half of 2014 and the first half of 2015, a decrease of approximately 51.5%. As of August 11, 2015, the price of WTI was approximately $44 per barrel. In response to this precipitous drop in WTI oil prices, exploration and production companies decreased the number of U.S. drilling rigs from 1,873 as of June 30, 2014 to 859 as of June 30, 2015, a decrease of 54.1%. During this period, Texas drilling rig count dropped from an average of 891 in June 2014 to an average of 363 in June 2015, a decrease of 59.3%.

Below, is a table that provides historical U.S. and Texas drilling activity, a chart that provides total U.S. and Texas rig counts, and WTI oil price trends.

Three months ended June 30, | Six months ended June 30, | ||||||||||||||||

2015 | 2014 | % Change | 2015 | 2014 | % Change | ||||||||||||

Texas average active drilling rigs: | |||||||||||||||||

Oil | 337 | 805 | (58.1 | )% | 444 | 778 | (42.9 | )% | |||||||||

Natural gas | 50 | 84 | (40.5 | )% | 60 | 91 | (34.1 | )% | |||||||||

Total | 387 | 889 | (56.5 | )% | 504 | 869 | (42.0 | )% | |||||||||

U.S. average active drilling rigs: | |||||||||||||||||

Oil | 681 | 1,530 | (55.5 | )% | 896 | 1,479 | (39.4 | )% | |||||||||

Natural gas | 223 | 319 | (30.1 | )% | 257 | 333 | (22.8 | )% | |||||||||

Total | 904 | 1,849 | (51.1 | )% | 1,153 | 1,812 | (36.4 | )% | |||||||||

Source: Rig counts are per Baker Hughes, Inc. (www.bakerhughes.com). Rig counts are the averages of the weekly rig count activity.

22

The declines in oil and natural gas prices and oil and exploration activity have created a more challenging market for the provision of our services. In response to the current market conditions, the Company has implemented certain cost reduction measures and will continue to analyze cost reduction opportunities while ensuring that appropriate functions and capacity are preserved to allow the Company to be opportunistic as market conditions improve. Cost reductions, which began in the fourth quarter of 2014 and continued through the first half of 2015, include reductions in headcount, labor rates, bonuses, over-time, travel and entertainment, vendor pricing, and other cost controls that contribute to earnings. The Company has also consolidated locations where levels of activity dictate greater efficiencies with operations performed out of a single location. Additionally, the Company has delayed completion of two salt water disposal wells until customer demand justifies their expenditures. Capital spending has largely been limited to capital commitments incurred before the market downturn, the replacement of existing equipment with new equipment, more efficient equipment demanded from our customers, and the purchase of equipment under operating leases nearing the end of their term.

As the Company expects pricing for its services to remain very competitive through the remainder of 2015 and utilization to remain challenging, costs and structure will be continually evaluated based on the changing market conditions with a focus on continuous process improvements.

Oil and Natural Gas Prices

Demand for well servicing and fluid logistics services is generally a function of the willingness of oil and natural gas companies to make operating and capital expenditures to explore for, develop and produce oil and natural gas, which in turn is affected by current and anticipated levels of oil and natural gas prices. Exploration and production spending is generally categorized as either operating expenditures or capital expenditures. Activities by oil and natural gas companies designed to

23

add oil and natural gas reserves are classified as capital expenditures, and those associated with maintaining or accelerating production, such as workover and fluid logistics services, are categorized as operating expenditures. Operating expenditures are typically more stable than capital expenditures and are less sensitive to oil and natural gas price volatility. In contrast, capital expenditures by oil and natural gas companies for drilling are more directly influenced by current and expected oil and natural gas prices and generally reflect the volatility of commodity prices including the precipitous decline in oil prices in late 2014 and early 2015.

Workover Rig Rates

Our well servicing segment revenues are dependent on the prevailing market rates for workover rigs. Composite rates declined 6.3% in the second quarter of 2015 when compared to the same period in the prior year due to the current market decline.

Fluid Logistics Rates

Our fluid logistics segment revenues are dependent on the prevailing market rates for fluid transport trucks and the related assets, including specialized vacuum, high-pressure pump and tank trucks, hot oil trucks, frac tanks, fluid mixing tanks and salt water disposal wells. Pricing and utilization decreased through 2014 and continued to decrease through the first half of of 2015 in response to changing market conditions.

Operating Expenses

During the first half of 2015, operating expenses have decreased at a slightly higher rate than the reduction in revenues in both the well servicing and fluid logistics segments. Expense decline was driven by reductions in headcount, along with mandated cost reduction measures. Future earnings and cash flows will be dependent on our ability to manage our overall cost structure as well as continued efforts to maintain or increase rates to customers and reduce costs with outside vendors.

Equipment rental and lease costs continue to be a significant component of our operating expenses. During the first quarter of 2015, we did not enter into any additional operating leases.

Capital Expenditures

During the first half of 2015, we received swabbing rigs, specialty fluid mixing tanks, and other well servicing equipment and incurred the associated costs of placing this equipment in service. In the second quarter of 2015, the Company purchased vacuum trucks, winch trucks, and trailers that had previously been on operating leases and were at the end of their respective terms. One swabbing rig is expected to be delivered in the third quarter of 2015 that was ordered in the fourth quarter of 2014.

Results of Operations

The following discussion, as well as the discussion found under "Liquidity and Capital Resources," compares our consolidated financial information for the three months ended June 30, 2015 to the three months ended June 30, 2014.

Three Months Ended June 30, 2015 Compared to Three Months Ended June 30, 2014

The following table compares our operating results for the three months ended June 30, 2015 and 2014 (in thousands, except percentages). Operating expenses exclude general and administrative expenses, depreciation, and amortization.

Revenue | Operating Expenses, excluding depreciation and amortization | |||||||||||||||||||||||||||

2015 | 2014 | 2015 | % of revenues | 2014 | % of revenue | Change | % Change | |||||||||||||||||||||

Well Servicing | $ | 39,030 | $ | 70,356 | $ | 29,236 | 74.9 | % | $ | 54,046 | 76.8 | % | $ | (24,810 | ) | (45.9 | )% | |||||||||||

Fluid Logistics | 23,780 | 42,819 | 17,876 | 75.2 | % | 31,582 | 73.8 | % | (13,706 | ) | (43.4 | )% | ||||||||||||||||

Total | $ | 62,810 | $ | 113,175 | $ | 47,112 | 75.0 | % | $ | 85,628 | 75.7 | % | $ | (38,516 | ) | (45.0 | )% | |||||||||||

The following table compares segment profits for the three months ended June 30, 2015 and 2014 (in thousands, except percentages).

24

2015 | 2014 | ||||||||||||

Amount | Gross margin % (1) | Amount | Gross margin % (1) | ||||||||||

Well servicing | $ | 9,794 | 25.1 | % | $ | 16,310 | 23.2 | % | |||||

Fluid logistics | 5,904 | 24.8 | % | 11,237 | 26.2 | % | |||||||

Total | $ | 15,698 | 25.0 | % | $ | 27,547 | 24.3 | % | |||||

(1) Excluding depreciation and amortization