Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Forbes Energy Services Ltd. | a201710qq3fes-ex322.htm |

| EX-32.1 - EXHIBIT 32.1 - Forbes Energy Services Ltd. | a201710qq3fes-ex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Forbes Energy Services Ltd. | a201710qq3fes-ex312.htm |

| EX-31.1 - EXHIBIT 31.1 - Forbes Energy Services Ltd. | a201710qq3fes-ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________________________________________

Form 10-Q

__________________________________________________________

(Mark One)

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2017

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-35281

__________________________________________________________

Forbes Energy Services Ltd.

(Exact name of registrant as specified in its charter)

__________________________________________________________

Delaware | 98-0581100 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

3000 South Business Highway 281 Alice, Texas | 78332 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(361) 664-0549

__________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x |

Emerging growth company | ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). ¨ Yes x No

The number of shares of common stock, par value $0.01 per share, of Forbes Energy Services Ltd. outstanding as of November 1, 2017 was 5,336,397.

FORBES ENERGY SERVICES LTD.

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | Other Information | |

Item 6. | Exhibits | |

Signatures | ||

2

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q and any oral statements made in connection with it include certain forward-looking statements within the meaning of the federal securities laws. You can generally identify forward-looking statements by the appearance in such a statement of words like “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project” or “should” or other comparable words or the negative of these words. When you consider our forward-looking statements, you should keep in mind the risk factors we describe and other cautionary statements we make in this Quarterly Report on Form 10-Q. Our forward-looking statements are only predictions based on expectations that we believe are reasonable. Our actual results could differ materially from those anticipated in, or implied by, these forward-looking statements as a result of known risks and uncertainties set forth below and elsewhere in this Quarterly Report on Form 10-Q. These factors include or relate to the following:

• | the effect of the industry-wide downturn in energy exploration and development activities; |

• | continuing incurrence of operating losses due to such downturn; |

• | oil and natural gas commodity prices; |

• | market response to global demands to curtail use of oil and natural gas; |

• | capital budgets and spending by the oil and natural gas industry; |

• | the ability or willingness of the Organization of Petroleum Exporting Countries, or OPEC, to set and maintain production levels for oil; |

• | oil and natural gas production levels by non-OPEC countries; |

• | supply and demand for oilfield services and industry activity levels; |

• | our ability to maintain stable pricing; |

• | possible impairment of our long-lived assets; |

• | potential for excess capacity; |

• | competition; |

• | substantial capital requirements; |

• | significant operating and financial restrictions under our loan and security agreement which provides for a term loan of $50.0 million, or the New Loan Agreement; |

• | technological obsolescence of operating equipment; |

• | dependence on certain key employees; |

• | concentration of customers; |

• | substantial additional costs of compliance with reporting obligations, the Sarbanes-Oxley Act and New Loan Agreement covenants; |

• | seasonality of oilfield services activity; |

• | collection of accounts receivable; |

• | environmental and other governmental regulation; |

• | the potential disruption of business activities caused by the physical effects, if any, of climate change; |

• | risks inherent in our operations; |

• | ability to fully integrate future acquisitions; |

• | variation from projected operating and financial data; |

• | variation from budgeted and projected capital expenditures; |

• | volatility of global financial markets; and |

• | the other factors discussed under “Risk Factors” beginning on page 11 of the Annual Report on Form 10-K for the year ended December 31, 2016, as amended. |

3

We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. To the extent these risks, uncertainties and assumptions give rise to events that vary from our expectations, the forward-looking events discussed in this Quarterly Report on Form 10-Q may not occur. All forward-looking statements attributable to us are qualified in their entirety by this cautionary statement.

4

PART I—FINANCIAL INFORMATION

Item 1. Unaudited Condensed Consolidated Financial Statements

Forbes Energy Services Ltd.

(Debtor-in-Possession January 22, 2017 through April 12, 2017)

Condensed Consolidated Balance Sheets (unaudited)

(in thousands, except par value amounts)

Successor | Predecessor | |||||||

September 30, 2017 | December 31, 2016 | |||||||

Assets | ||||||||

Current assets | ||||||||

Cash and cash equivalents | $ | 7,568 | $ | 20,437 | ||||

Cash - restricted | 34,052 | 27,563 | ||||||

Accounts receivable - trade, net of allowance for doubtful accounts of $1.7 million and $1.4 million as of September 30, 2017 and December 31, 2016, respectively | 25,547 | 16,962 | ||||||

Accounts receivable - other | 543 | 290 | ||||||

Prepaid expenses and other current assets | 2,421 | 8,778 | ||||||

Total current assets | 70,131 | 74,030 | ||||||

Property and equipment, net | 118,669 | 233,362 | ||||||

Intangible assets, net | 12,132 | 3,220 | ||||||

Other assets | 1,191 | 2,269 | ||||||

Total assets | $ | 202,123 | $ | 312,881 | ||||

Liabilities, Temporary Equity and Stockholders’ Equity (Deficit) | ||||||||

Current liabilities | ||||||||

Current portions of long-term debt | 1,550 | $ | 298,932 | |||||

Accounts payable - trade | 6,656 | 4,505 | ||||||

Accounts payable - related parties | 12 | 18 | ||||||

Accrued interest payable | 76 | 26,578 | ||||||

Accrued expenses | 9,635 | 8,740 | ||||||

Total current liabilities | 17,929 | 338,773 | ||||||

Long-term debt, net of current portion and issuance costs | 51,129 | 240 | ||||||

Deferred tax liability | 379 | 1,096 | ||||||

Total liabilities | 69,437 | 340,109 | ||||||

Commitments and contingencies (Note 9) | ||||||||

Temporary equity | ||||||||

Predecessor Series B senior convertible preferred shares, 588 shares outstanding at December 31, 2016 | — | 15,298 | ||||||

Stockholders’ equity (deficit) | ||||||||

Predecessor common stock, $0.04 par value, 112,500 shares authorized, 22,215 shares outstanding at December 31, 2016 | — | 889 | ||||||

Predecessor additional paid-in capital | — | 193,477 | ||||||

Successor common stock, $0.01 par value, 40,000 shares authorized, 5,336 shares issued and outstanding at September 30, 2017 | 53 | — | ||||||

Successor additional paid-in capital | 148,612 | — | ||||||

Accumulated deficit | (15,979 | ) | (236,892 | ) | ||||

Total stockholders’ equity (deficit) | 132,686 | (42,526 | ) | |||||

Total liabilities, temporary equity and stockholders’ equity (deficit) | $ | 202,123 | $ | 312,881 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

Forbes Energy Services Ltd.

(Debtor-in-Possession January 22, 2017 through April 12, 2017)

Condensed Consolidated Statements of Operations (unaudited)

(in thousands, except per share amounts)

Successor | Predecessor | ||||||||

Three months ended September 30, 2017 | Three months ended September 30, 2016 | ||||||||

Revenues | |||||||||

Well servicing | $ | 23,513 | $ | 17,739 | |||||

Fluid logistics | 10,782 | 10,118 | |||||||

Total revenues | 34,295 | 27,857 | |||||||

Expenses | |||||||||

Well servicing | 16,883 | 14,685 | |||||||

Fluid logistics | 10,371 | 9,678 | |||||||

General and administrative | 6,458 | 4,182 | |||||||

Depreciation and amortization | 7,134 | 12,501 | |||||||

Restructuring costs | — | 3,084 | |||||||

Total expenses | 40,846 | 44,130 | |||||||

Operating loss | (6,551 | ) | (16,273 | ) | |||||

Other income (expense) | |||||||||

Interest income | 5 | 1 | |||||||

Interest expense | (2,170 | ) | (6,939 | ) | |||||

Pre-tax loss | (8,716 | ) | (23,211 | ) | |||||

Income tax expense (benefit) | 260 | (2 | ) | ||||||

Net loss | (8,976 | ) | (23,209 | ) | |||||

Preferred stock dividends | — | (194 | ) | ||||||

Net loss attributable to common stockholders | $ | (8,976 | ) | $ | (23,403 | ) | |||

Loss per share of common stock | |||||||||

Basic and diluted loss per share | $ | (1.70 | ) | $ | (1.05 | ) | |||

Weighted average number of shares outstanding | |||||||||

Basic and diluted | 5,279 | 22,214 | |||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

Forbes Energy Services Ltd.

(Debtor-in-Possession January 22, 2017 through April 12, 2017)

Condensed Consolidated Statements of Operations (unaudited)

(in thousands, except per share amounts)

Successor | Predecessor | |||||||||||

April 13 through September 30, 2017 | January 1 through April 12, 2017 | Nine Months Ended September 30, 2016 | ||||||||||

Revenues | ||||||||||||

Well servicing | $ | 41,652 | $ | 19,554 | $ | 53,248 | ||||||

Fluid logistics | 20,493 | 11,211 | 34,951 | |||||||||

Total revenues | 62,145 | 30,765 | 88,199 | |||||||||

Expenses | ||||||||||||

Well servicing | 30,698 | 15,952 | 47,074 | |||||||||

Fluid logistics | 19,425 | 11,207 | 33,770 | |||||||||

General and administrative | 9,588 | 5,012 | 15,307 | |||||||||

Depreciation and amortization | 12,815 | 13,601 | 39,660 | |||||||||

Impairment of assets | — | — | 14,512 | |||||||||

Restructuring costs | — | — | 3,435 | |||||||||

Total expenses | 72,526 | 45,772 | 153,758 | |||||||||

Operating loss | (10,381 | ) | (15,007 | ) | (65,559 | ) | ||||||

Other income (expense) | ||||||||||||

Interest income | 11 | 13 | 30 | |||||||||

Interest expense | (4,067 | ) | (2,254 | ) | (20,797 | ) | ||||||

Reorganization items, net | (1,299 | ) | 44,503 | — | ||||||||

Pre-tax income (loss) | (15,736 | ) | 27,255 | (86,326 | ) | |||||||

Income tax expense | 243 | 27 | 38 | |||||||||

Net income (loss) | (15,979 | ) | 27,228 | (86,364 | ) | |||||||

Preferred stock dividends | — | (46 | ) | (582 | ) | |||||||

Net income (loss) attributable to common stockholders | $ | (15,979 | ) | $ | 27,182 | $ | (86,946 | ) | ||||

Income (loss) per share of common stock | ||||||||||||

Basic and diluted income (loss) per share | $ | (3.04 | ) | $ | 0.99 | $ | (3.91 | ) | ||||

Weighted average number of shares outstanding | ||||||||||||

Basic and diluted | 5,262 | 27,508 | 22,214 | |||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

7

Forbes Energy Services Ltd.

(Debtor-in-Possession January 22, 2017 through April 12, 2017)

Condensed Consolidated Statement of Changes in Stockholders’ Equity (Deficit) (unaudited)

(in thousands)

Temporary Equity | Permanent Equity | ||||||||||||||||||||||||

Preferred Stock | Common Stock | Additional Paid-In Capital | Accumulated Deficit | Total Stockholders’ Equity (Deficit) | |||||||||||||||||||||

Shares | Amount | Shares | Amount | ||||||||||||||||||||||

Predecessor | |||||||||||||||||||||||||

Balance at December 31, 2016 | 588 | $ | 15,298 | 22,215 | $ | 889 | $ | 193,477 | $ | (236,892 | ) | $ | (42,526 | ) | |||||||||||

Net income, January 1, 2017 - April 12, 2017 | — | — | — | — | — | 27,228 | 27,228 | ||||||||||||||||||

Preferred stock dividends and accretion | — | 46 | — | — | (46 | ) | — | (46 | ) | ||||||||||||||||

Balance: April 12, 2017 | 588 | 15,344 | 22,215 | 889 | 193,431 | (209,664 | ) | (15,344 | ) | ||||||||||||||||

Cancellation of temporary equity and predecessor permanent equity | (588 | ) | (15,344 | ) | (22,215 | ) | (889 | ) | (193,431 | ) | 209,664 | 15,344 | |||||||||||||

Balance: April 12, 2017 | — | $ | — | — | $ | — | $ | — | $ | — | $ | — | |||||||||||||

Successor | |||||||||||||||||||||||||

Issuance of Successor common stock | 5,250 | $ | 53 | $ | 147,578 | $ | — | $ | 147,631 | ||||||||||||||||

Share-based compensation | 86 | — | 1,034 | — | 1,034 | ||||||||||||||||||||

Net loss, April 13, 2017 - September 30, 2017 | — | — | — | (15,979 | ) | (15,979 | ) | ||||||||||||||||||

Balance at September 30, 2017 | 5,336 | $ | 53 | $ | 148,612 | $ | (15,979 | ) | $ | 132,686 | |||||||||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

8

Forbes Energy Services Ltd.

(Debtor-in-Possession January 22, 2017 through April 12, 2017)

Condensed Consolidated Statements of Cash Flows (unaudited)

(in thousands)

Successor | Predecessor | |||||||||||

April 13, through September 30, 2017 | January 1 through April 12, 2017 | Nine months ended September 30, 2016 | ||||||||||

Cash flows from operating activities: | ||||||||||||

Net income (loss) | $ | (15,979 | ) | $ | 27,228 | $ | (86,364 | ) | ||||

Adjustments to reconcile net income (loss) to net cash by used in operating activities: | ||||||||||||

Depreciation and amortization | 12,815 | 13,601 | 39,660 | |||||||||

Share-based compensation | 1,034 | — | 180 | |||||||||

Reorganization items (non-cash) | — | (51,166 | ) | — | ||||||||

Deferred tax (benefit) expense | 15 | (47 | ) | 53 | ||||||||

(Gain) loss on disposal of assets | (338 | ) | (950 | ) | 654 | |||||||

Impairment of assets | — | — | 14,512 | |||||||||

Bad debt expense | 145 | 1 | 520 | |||||||||

Amortization of debt discount | 968 | 234 | 1,026 | |||||||||

Interest paid in kind | 1,676 | — | — | |||||||||

Changes in operating assets and liabilities: | ||||||||||||

Accounts receivable | (8,069 | ) | (916 | ) | 9,224 | |||||||

Prepaid expenses and other assets | 2,083 | (851 | ) | (593 | ) | |||||||

Other assets | 902 | 103 | — | |||||||||

Accounts payable - trade | (4,457 | ) | 6,608 | (1,804 | ) | |||||||

Accounts payable - related parties | (8 | ) | 2 | — | ||||||||

Accrued expenses | 549 | 324 | 1,471 | |||||||||

Accrued interest payable | (6 | ) | 1,575 | 18,919 | ||||||||

Net cash used in operating activities | (8,670 | ) | (4,254 | ) | (2,542 | ) | ||||||

Cash flows from investing activities: | ||||||||||||

Proceeds from sale of property and equipment | 1,086 | 937 | 946 | |||||||||

Purchases of property and equipment | (4,044 | ) | (400 | ) | (7,239 | ) | ||||||

Change in restricted cash | — | — | (9,453 | ) | ||||||||

Net cash provided by (used in) investing activities | (2,958 | ) | 537 | (15,746 | ) | |||||||

Cash flows from financing activities: | ||||||||||||

Change in restricted cash | — | (6,416 | ) | — | ||||||||

Payments for capital leases | (664 | ) | (444 | ) | (3,115 | ) | ||||||

Payments for debt issuance costs | — | (5,000 | ) | — | ||||||||

Payment of Prior Senior Notes | — | (20,000 | ) | — | ||||||||

Repayment of Prior Loan Agreement | — | (15,000 | ) | — | ||||||||

Proceeds from New Loan Agreement | — | 50,000 | — | |||||||||

Payment of tax withholding obligations related to restricted stock | — | — | (120 | ) | ||||||||

Dividends paid on Predecessor Series B senior convertible preferred shares | — | — | (61 | ) | ||||||||

Net cash provided by (used in) financing activities | (664 | ) | 3,140 | (3,296 | ) | |||||||

Net decrease in cash and cash equivalents | (12,292 | ) | (577 | ) | (21,584 | ) | ||||||

Cash and cash equivalents: | ||||||||||||

Beginning of period | 19,860 | 20,437 | 74,611 | |||||||||

End of period | $ | 7,568 | $ | 19,860 | $ | 53,027 | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

9

Forbes Energy Services Ltd.

(Debtor-in-Possession January 22, 2017 through April 12, 2017)

Notes to Condensed Consolidated Financial Statements

(unaudited)

1. Organization and Nature of Operations

Nature of Business

Forbes Energy Services Ltd., or FES Ltd., is an independent oilfield services contractor that provides a wide range of well site services to oil and natural gas drilling and producing companies to help develop and enhance the production of oil and natural gas. These services include fluid hauling, fluid disposal, well maintenance, completion services, workovers and re-completions and plugging and abandonment. The Company's operations are concentrated in the major onshore oil and natural gas producing regions of Texas, with an additional location in Pennsylvania. The Company believes that its broad range of services, which extends from initial drilling, through production, to eventual abandonment, is fundamental to establishing and maintaining the flow of oil and natural gas throughout the life cycle of its customers' wells.

As used in these Consolidated Financial Statements, the “Company,” “we,” and “our” mean FES Ltd. and its direct and indirect subsidiaries, except as otherwise indicated.

Chapter 11 Proceedings

On January 22, 2017, FES Ltd. and its domestic subsidiaries, or collectively, the Debtors, filed voluntary petitions, or the Bankruptcy Petitions, for reorganization under chapter 11 of the United States Bankruptcy Code, or the Bankruptcy Code, in the United States Bankruptcy Court for the Southern District of Texas-Corpus Christi Division, or the Bankruptcy Court, pursuant to the terms of a restructuring support agreement that contemplated the reorganization of the Debtors pursuant to a prepackaged plan of reorganization, as amended and supplemented, the Plan. On March 29, 2017, the Bankruptcy Court entered an order confirming the Plan. On April 13, 2017, or the Effective Date, the Plan became effective pursuant to its terms and the Debtors emerged from their chapter 11 cases.

Effect of the Bankruptcy Proceedings

During the bankruptcy proceedings, the Debtors conducted normal business activities and were authorized to pay certain vendor payments, wage payments and tax payments in the ordinary course. In addition, subject to certain specific exceptions under the Bankruptcy Code, the Bankruptcy Petitions automatically stayed most judicial or administrative actions against the Debtors or their property to recover, collect, or secure a prepetition claim. For example, the Bankruptcy Petitions prohibited lenders or note holders from pursuing claims for defaults under the Debtors’ debt agreements during the pendency of the chapter 11 cases.

The Plan

Under the Plan, which was approved by the Bankruptcy Court and became effective on the Effective Date,:

•FES Ltd. converted from a Texas corporation to a Delaware corporation;

•All prior equity interests (which included FES Ltd.’s prior common stock, par value $0.04 per share, or the Old Common Stock, FES Ltd.’s prior preferred stock, awards under FES Ltd.’s prior incentive compensation plans, or the Prior Compensation Plans, and the preferred stock purchase rights under the rights agreement dated as of May 19, 2008 as subsequently amended on July 8, 2013, or the Rights Agreement, between FES Ltd. and CIBC Mellon Trust Company, as rights agent) in FES Ltd. were extinguished without recovery;

•FES Ltd. created a new class of common stock, par value $0.01 per share, or the New Common Stock;

•Approximately $280 million in principal amount of FES Ltd.'s prior 9% senior notes due 2019, or the Prior Senior Notes, plus accrued interest of $28.1 million were canceled and each holder of the Prior Senior Notes received such holder’s pro rata share of (i) $20.0 million in cash and (ii) 100% of the New Common Stock, subject to dilution only as a result of the shares of New Common Stock issued or available for issuance in connection with a management incentive plan, or the Management Incentive Plan. A total of 5,249,997 shares of New Common Stock was issued to the holders of the Prior Senior Notes;

•The Debtors entered into the New Loan Agreement (see Note 6 - Long-Term Debt), with certain financial institutions party thereto from time to time as lenders, or the Lenders, and Wilmington Trust, National Association, as agent for the Lenders;

10

•FES Ltd. adopted the Management Incentive Plan, which provides for the issuance of equity-based awards with respect to, in the aggregate, up to 750,000 shares of New Common Stock;

•The Debtors’ loan and security agreement governing their revolving credit facility dated as of September 9, 2011 as subsequently amended, or the Prior Loan Agreement, with Regions Bank, or Regions, as the sole lender party thereto, or the Lender, was terminated and a new letter of credit facility was entered into with Regions, or the New Regions Letters of Credit Facility, which covers letters of credit and the Company's credit card program. Regions continues to hold the cash pledged to support the New Regions Letters of Credit Facility in the amount of $10.1 million as of November 6, 2017;

•The Debtors paid off the outstanding principal balance of $15 million plus outstanding interest and fees under the Prior Loan Agreement, and the Prior Loan Agreement was terminated in accordance with the Plan;

•Holders of allowed creditor claims, aside from holders of the Prior Senior Notes, received, on account of such claims, either payment in full in cash or otherwise had their rights reinstated; and

•FES Ltd. entered into a registration rights agreement with certain of its stockholders to provide registration rights with respect to the New Common Stock.

Fresh Start Accounting

Upon emergence from bankruptcy, the Company adopted fresh start accounting in accordance with the provisions of Accounting Standards Codification, or ASC, 852, “Reorganizations,” or ASC 852, as (i) the holders of Old Common Stock received none of the New Common Stock issued upon the Debtors' emergence from bankruptcy and (ii) the reorganization value of the Company's assets immediately prior to confirmation of the Plan was less than the post-petition liabilities and allowed claims. The Company applied fresh start accounting from and after the Effective Date. Fresh start accounting required the Company to present its assets, liabilities and equity as if it were a new entity upon emergence from bankruptcy, with no beginning retained earnings or deficit as of the fresh start reporting date. The cancellation of the Old Common Stock and the issuance of the New Common Stock on the Effective Date caused a change of control of FES Ltd. under ASC 852. As a result of the adoption of fresh start accounting, the Company’s unaudited condensed consolidated financial statements from and after April 13, 2017 will not be comparable to its financial statements prior to such date. References to “Successor” or “Successor Company” relate to the financial position and results of operations of the reorganized Company from and after April 13, 2017. References to “Predecessor” or “Predecessor Company” relate to the financial position and results of operations of the Company on or prior to April 12, 2017.

Upon the application of fresh start accounting, the Company allocated the reorganization value to its individual assets and liabilities in conformity with ASC 805, Business Combinations, or ASC 805. Reorganization value represents the fair value of the Successor Company’s assets before considering liabilities.

Under ASC 852, the Successor Company must determine a value to be assigned to the equity of the emerging company as of the date of adoption of fresh start accounting. Enterprise value represents the fair value of an entity’s interest-bearing debt and stockholders’ equity. In the updated valuation analysis submitted to (and confirmed by) the Bankruptcy Court, the Company estimated a range of enterprise values between $176 million and $210 million, with a midpoint of $193 million. The Company deemed it appropriate to use the low end of the range to determine the final enterprise value of $176 million for fresh-start accounting. The low end of the enterprise value range was selected based on significant market volatility around the emergence. The Company calculated an enterprise value for the Successor Company using a discounted cash flow, or DCF, analysis under the income approach.

Under our DCF analysis, the Company calculated an estimate of future cash flows for the period ranging from 2017 to 2021 and discounted estimated future cash flows to present value. The estimated cash flows for the period 2017 to 2021 were derived from earnings forecasts and assumptions regarding growth and margin projections, as applicable, and a tax rate of 35.0%. A terminal value was included based on the cash flows of the final year of the forecast period. The discount rate of 16.9% was estimated based on an after-tax weighted average cost of capital, or the WACC, reflecting the rate of return that would be expected by a market participant. The WACC also takes into consideration a company specific risk premium reflecting the risk associated with the overall uncertainty of the financial projections used to estimate future cash flows.

The estimated enterprise value and the equity value are highly dependent on the achievement of the future financial results contemplated in the projections that were set forth in the Plan. The estimates and assumptions made in the valuation are inherently subject to significant uncertainties. The primary assumptions for which there is a reasonable possibility of the occurrence of a variation that would have significantly affected the reorganization value include revenue growth, operating expenses, the amount and timing of capital expenditures and the discount rate utilized.

11

Fresh start accounting reflects the value of the Successor Company as determined in the confirmed Plan. Under fresh start accounting, asset values are remeasured and allocated based on their respective fair values in conformity with the acquisition method of accounting for business combinations in ASC 805. Liabilities existing as of the Effective Date, other than deferred taxes, were recorded at the present value of amounts expected to be paid using appropriate risk adjusted interest rates. Deferred taxes were determined in conformity with applicable accounting standards. Predecessor accumulated depreciation, accumulated amortization and retained deficit were eliminated.

Machinery and Equipment

To estimate the fair value of machinery and equipment, the Company considered the income approach, the cost approach, and the sales comparison (market) approach for each individual asset. The primary approaches that were relied upon to value these assets were the cost approach and the market approach. Although the income approach was not applied to value the machinery and equipment assets individually, the Company did consider the earnings of the enterprise of which these assets are a part. When more than one approach is used to develop a valuation, the various approaches are reconciled to determine a final value conclusion.

The typical starting point or basis of the valuation estimate is replacement cost new, or the RCN, reproduction cost new, or the CRN, or a combination of both. Once the RCN and CRN estimates are adjusted for physical and functional conditions, they are then compared to market data and other indications of value, where available, to confirm results obtained by the cost approach.

Where direct RCN estimates were not available or deemed inappropriate, the CRN for machinery and equipment was estimated using the indirect (trending) method, in which percentage changes in applicable price indices are applied to historical costs to convert them into indications of current costs. To estimate the CRN amounts, inflation indices from established external sources were then applied to historical costs to estimate the CRN for each asset.

The market approach measures the value of an asset through an analysis of recent sales or offerings of comparable property, and considers physical, functional and economic conditions. Where direct or comparable matches could not be reasonably obtained, the Company utilized the percent of cost technique of the market approach. This technique looks at general sales, sales listings, and auction data for each major asset category. This information is then used in conjunction with each asset’s effective age to develop ratios between the sales price and RCN or CRN of similar asset types. A market-based depreciation curve was developed and applied to asset categories where sufficient sales and auction information existed.

Where market information was not available or a market approach was deemed inappropriate, the Company developed a cost approach. In doing so, an indicated value is derived by deducting physical deterioration from the RCN or CRN of each identifiable asset or group of assets. Physical deterioration is the loss in value or usefulness of a property due to the using up or expiration of its useful life caused by wear and tear, deterioration, exposure to various elements, physical stresses, and similar factors.

Functional and economic obsolescence related to these was also considered. Any functional obsolescence due to excess capital costs was eliminated through the direct method of the cost approach to estimate the RCN. Economic obsolescence was also applied to stacked and underutilized assets based on the status of the asset. Economic obsolescence was also considered in situations in which the earnings of the applicable business segment in which the assets are employed suggest economic obsolescence. When penalizing assets for economic obsolescence, an additional economic obsolescence penalty was levied, while considering scrap value to be the floor value for an asset.

Intangible Assets

The financial information used to estimate the fair values of intangible assets was consistent with the information used in estimating the Company’s enterprise value.

Trademarks were valued utilizing the relief from royalty method of the income approach. Significant inputs and assumptions included remaining useful lives, the forecasted revenue streams, an applicable royalty rate, tax rate, and applicable discount rate.

Customer relationships were valued using a multi-period excess earnings method, and were split between well servicing relationships and fluid servicing relationships. There was no value attributed to the fluid servicing customer relationships. Significant inputs and assumptions for both relationship analyses included the expected attrition rate, forecasted revenue streams, contributory asset charges, and an applicable discount rate.

12

Covenants not to compete were valued using a with and without method under the income approach. Significant inputs and assumptions included the expected impact on revenues under competition, the forecasted revenue streams, the probability of competition if the non-compete were not in place, and an applicable discount rate.

The following table reconciles the enterprise value to the estimated reorganization value as of the Effective Date (in millions):

Enterprise value | $ | 176 | ||

Plus: Cash and cash equivalents | 20 | |||

Plus: Fair value on non-debt liabilities, net | 20 | |||

Reorganization value of Successor assets | $ | 216 | ||

Condensed Consolidated Balance Sheet

The adjustments set forth in the following condensed consolidated balance sheet as of the Effective Date reflect the effects of the transactions contemplated by the Plan and carried out by the Company, which are reflected in the column titled “Reorganization Adjustments,” as well as fair value adjustments as a result of the adoption of fresh start accounting, which are reflected in the column titled “Fresh Start Adjustments.”

13

The following table reflects the reorganization and application of ASC 852 on the Company's condensed consolidated balance sheet at April 12, 2017:

Predecessor Company | Reorganization Adjustments | Fresh Start Adjustments | Successor Company | ||||||||||||

(in thousands, except par value) | |||||||||||||||

Assets | |||||||||||||||

Current assets | |||||||||||||||

Cash and cash equivalents | $ | 17,500 | $ | 2,360 | (a) | $ | — | $ | 19,860 | ||||||

Cash - restricted | 27,579 | 6,400 | (a) | — | 33,979 | ||||||||||

Accounts receivable - trade | 17,237 | — | — | 17,237 | |||||||||||

Accounts receivable - other | 930 | — | — | 930 | |||||||||||

Prepaid expenses and other | 6,099 | 45 | (b) | — | 6,144 | ||||||||||

Other current assets | 567 | — | — | 567 | |||||||||||

Total current assets | 69,912 | 8,805 | — | 78,717 | |||||||||||

Property and equipment, net | 220,326 | — | (97,442 | ) | (g) | 122,884 | |||||||||

Intangible assets, net | 3,068 | — | 9,587 | (h) | 12,655 | ||||||||||

Other assets | 2,178 | (12 | ) | (b) | — | 2,166 | |||||||||

Total assets | $ | 295,484 | $ | 8,793 | $ | (87,855 | ) | $ | 216,422 | ||||||

Liabilities, Temporary Equity and Shareholders’ Equity (Deficit) | |||||||||||||||

Current liabilities | |||||||||||||||

Current portions of long-term debt | $ | 18,064 | $ | (15,000 | ) | (a) | $ | — | $ | 3,064 | |||||

Accounts payable - trade | 12,238 | (1,125 | ) | (b) | — | 11,113 | |||||||||

Accounts payable - related parties | 20 | — | — | 20 | |||||||||||

Accrued expenses | 9,293 | (82 | ) | (a) | (65 | ) | (i) | 9,146 | |||||||

Total current liabilities | 39,615 | (16,207 | ) | (65 | ) | 23,343 | |||||||||

Long-term debt, net of current portion | 84 | 45,000 | (c) | — | 45,084 | ||||||||||

Deferred tax liability | 1,049 | — | (685 | ) | (j) | 364 | |||||||||

Liabilities subject to compromise | 308,072 | (308,072 | ) | (d) | — | — | |||||||||

Total liabilities | 348,820 | (279,279 | ) | (750 | ) | 68,791 | |||||||||

Temporary equity | |||||||||||||||

Predecessor Series B senior convertible preferred shares, 588 shares outstanding at December 31, 2016 | 15,344 | (15,344 | ) | (e) | — | — | |||||||||

Stockholders’ equity (deficit) | |||||||||||||||

Predecessor common stock, $0.04 par value, 112,500 shares authorized; 22,215 shares outstanding at December 31, 2016 | 889 | (889 | ) | (e) | — | — | |||||||||

Predecessor additional paid-in capital | 193,431 | (193,431 | ) | (e) | — | — | |||||||||

Successor common stock, $0.01 par value, 40,000 shares authorized; 5,250 shares issued and outstanding | — | 53 | (f) | — | 53 | ||||||||||

Successor additional paid-in capital | — | 147,578 | (f) | — | 147,578 | ||||||||||

Accumulated retained earnings (deficit) | (263,000 | ) | 350,105 | (e) | (87,105 | ) | (k) | — | |||||||

Total stockholders’ equity (deficit) | (68,680 | ) | 303,416 | (87,105 | ) | 147,631 | |||||||||

Total liabilities, temporary equity and stockholders’ equity (deficit) | $ | 295,484 | $ | 8,793 | $ | (87,855 | ) | $ | 216,422 | ||||||

14

Reorganization Adjustments

Reorganization adjustments reflect amounts recorded on the Effective Date for the effect of implementation of the Plan. The significant reorganization adjustments are summarized as follows (in thousands):

(a) | Reflects the net sources of cash on the Effective Date from implementation of the Plan: |

Sources: | ||||

First Lien Term Loan | $ | 50,000 | ||

Uses: | ||||

Payment to Holders of the Prior Senior Notes | $ | (20,000 | ) | |

Payoff of Prior Loan Agreement | (15,000 | ) | ||

Payoff of Prior Loan Agreement accrued interest | (82 | ) | ||

Restricted cash | (6,400 | ) | ||

Debt issuance costs | (5,000 | ) | ||

Professional Fees | (1,158 | ) | ||

Total Uses | (47,640 | ) | ||

Net Sources | $ | 2,360 | ||

(b) Reflects the net payment of $1.1 million in professional fees.

(c) Represents the issuance of the new debt, net of loan costs, in connection with the Plan.

(d) Reflects the settlement of Liabilities Subject to Compromise in accordance with the Plan as follows:

Liabilities subject to compromise of the Predecessor Company: | ||||

Prior Senior Notes and accrued interest | $ | 308,072 | ||

Fair value of equity issued to Prior Senior Noteholders | (147,631 | ) | ||

Cash payments to Prior Senior Noteholders | (20,000 | ) | ||

Gain on settlement of liabilities subject to compromise | $ | 140,441 | ||

(e) Reflects the cumulative impact of reorganization adjustments discussed above:

Gain on settlement of liabilities subject to compromise | $ | 140,441 | ||

Cancellation of Predecessor temporary equity and permanent equity | 209,664 | |||

Net impact to retained earnings (deficit) | $ | 350,105 | ||

(f) Reflects the issuance of 5,249,997 shares, valued at $28.12 per share, of New Common Stock in accordance with the Plan.

15

Fresh start Accounting Adjustments

Fresh start accounting adjustments are necessary to reflect assets at their estimated fair values and to eliminate accumulated deficit.

(g) An adjustment of $97.4 million was recorded to decrease the net book value of property and equipment to estimated fair value. The components of property and equipment, net as of the Effective Date and the fair value at the Effective Date are summarized in the following table (in thousands).

Predecessor Company | Fresh start adjustments | Successor Company | |||||||||

Well servicing equipment | $ | 165,585 | $ | (88,033 | ) | $ | 77,552 | ||||

Autos and trucks | 26,660 | 7,392 | 34,052 | ||||||||

Disposal wells | 15,890 | (12,080 | ) | 3,810 | |||||||

Buildings and improvements | 9,766 | (4,424 | ) | 5,342 | |||||||

Furniture and fixtures | 901 | 359 | 1,260 | ||||||||

Land | 1,524 | (656 | ) | 868 | |||||||

$ | 220,326 | $ | (97,442 | ) | $ | 122,884 | |||||

(h) An adjustment of $9.6 million was recorded to increase the net book value of intangible assets to estimated fair value. The components of intangibles, net as of the Effective Date and the fair value at the Effective Date are summarized in the following table (in thousands).

Useful Life (years) | Predecessor Company | Fresh start adjustments | Successor Company | |||||||||

Trade Names | 15 | $ | 3,068 | $ | (596 | ) | $ | 2,472 | ||||

Covenants not to compete | 4 | — | 1,505 | 1,505 | ||||||||

Customer relationships | 15 | — | 8,678 | 8,678 | ||||||||

$ | 3,068 | $ | 9,587 | $ | 12,655 | |||||||

Estimated amortization expense of the intangible assets is as follows (in thousands):

Year ending December 31, | Amortization | ||

2017 | $ | 793 | |

2018 | 1,120 | ||

2019 | 1,120 | ||

2020 | 1,120 | ||

2021 | 853 | ||

2022 | 743 | ||

Thereafter | 6,906 | ||

$ | 12,655 | ||

(i) Reflects adjustment decreasing the Company's asset retirement obligation to estimated fair value.

(j) Reflects a reduction in deferred tax liabilities recorded as of the Effective Date as determined in accordance with ASC 740 - Income Taxes. The reduction in deferred tax liabilities was primarily the result of the revaluation of the Company’s property and equipment and intangible assets under fresh start accounting.

16

(k) Reflects the cumulative impact of fresh start adjustments discussed above (in thousands):

Intangible assets fair value adjustments | $ | 9,587 | ||

Property and equipment fair value adjustments | (97,442 | ) | ||

Asset retirement obligation adjustment | 65 | |||

Deferred tax liability adjustments | 685 | |||

Net impact to retained earnings (deficit) | $ | (87,105 | ) | |

Reorganization Items

Reorganization items represent amounts incurred subsequent to the filing of the Bankruptcy Petitions as a direct result of the filing of the Plan and are comprised of the following (in thousands):

Successor | Predecessor | |||||||||||

Three months ended September 30, 2017 | April 13 through September 30, 2017 | January 1 through April 12, 2017 | ||||||||||

Reorganization legal and professional fees | $ | — | $ | (1,299 | ) | $ | (6,729 | ) | ||||

Deferred loan costs expensed | — | — | (2,104 | ) | ||||||||

Gain on settlement of liabilities subject to compromise | — | — | 140,441 | |||||||||

Fresh start adjustments | — | — | (87,105 | ) | ||||||||

Reorganization items, net | $ | — | $ | (1,299 | ) | $ | 44,503 | |||||

2. Risk and Uncertainties

As an independent oilfield services contractor that provides a broad range of drilling-related and production-related services to oil and natural gas companies, primarily onshore in Texas, the Company's revenue, profitability, cash flows and future rate of growth are substantially dependent on it's ability to (1) maintain adequate equipment utilization, (2) maintain adequate pricing for the services it provides, and (3) maintain a trained workforce. Failure to do so could adversely affect the Company's financial position, results of operations, and cash flows.

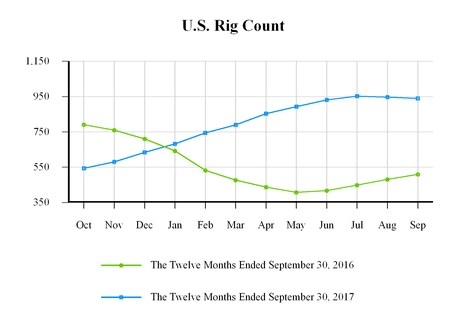

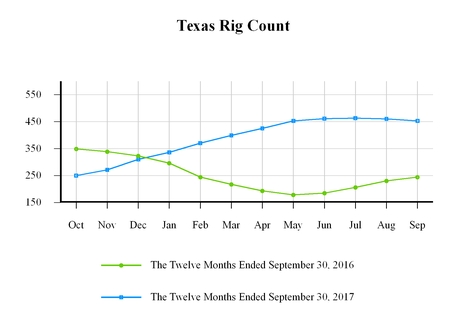

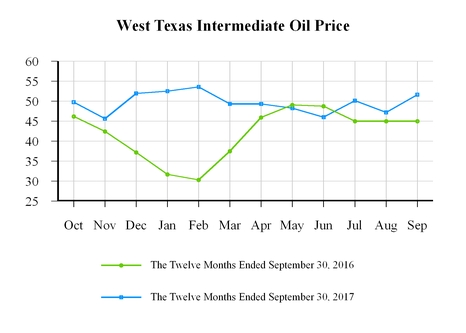

Because the Company's revenues are generated primarily from customers who are subject to the same factors as the Company that are generally impacting the oil and natural gas industry, the Company's operations are also susceptible to market volatility resulting from economic, cyclical, weather related, or other factors related to such industry. Changes experienced in the level of operating and capital spending in the industry, decreases in oil and natural gas prices, and/or industry perception about future oil and natural gas prices has materially decreased the demand for the Company's services, and has had an adverse effect on its financial position, results of operations and cash flows.

3. Basis of Presentation

Fresh Start Accounting

As discussed in Note 1 - Chapter 11 Proceedings, upon emergence from bankruptcy, the Company qualified for and adopted fresh start accounting in accordance with the provisions of ASC 852 as (i) the holders of Old Common Stock received none of the New Common Stock issued upon the Debtors' emergence from bankruptcy and (ii) the reorganization value of the Company's assets immediately prior to confirmation of the Plan was less than the post-petition liabilities and allowed claims. The Company applied fresh start accounting from and after the Effective Date. Fresh start accounting required the Company to present its assets, liabilities and equity as if it were a new entity upon emergence from bankruptcy, with no beginning retained earnings or deficit as of the fresh start reporting date. As a result of the adoption of fresh start accounting, the Company’s unaudited condensed consolidated financial statements from and after the Effective Date will not be comparable to its financial statements prior to such date.

17

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated balance sheets and the reported amounts of revenues and expenses during the reporting period. Actual results could materially differ from those estimates.

Interim Financial Information

The unaudited condensed consolidated financial statements of the Company are prepared in conformity with accounting principles generally accepted in the United States of America, or GAAP, for interim financial reporting. Certain information and footnote disclosures normally included in annual financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to the rules and regulations of the Securities and Exchange Commission. Therefore, these condensed consolidated financial statements should be read along with the annual audited consolidated financial statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 2016, as amended. Interim results for the periods presented may not be indicative of results that will be realized for future periods due to to the adoption of fresh start accounting during the second quarter of 2017. All significant intercompany accounts and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated balance sheets and the reported amounts of revenues and expenses during the reporting period. Actual results could materially differ from those estimates.

Restricted Cash

Restricted cash at September 30, 2017 (Successor) and December 31, 2016 (Predecessor) was $34.1 million and $27.6 million, respectively. The components of restricted cash at September 30, 2017 primarily included $23.9 million related to the New Loan Agreement, which is subject to satisfaction of certain release restrictions and $10.1 million in a cash collateral account related to letters of credit and the Company's corporate credit card program under the New Regions Letter of Credit Facility. The release conditions set forth in the New Loan Agreement include, among other things, (i) no default or event of default under the New Loan Agreement having occurred or being continuing as of the date of the requested release of proceeds of the New Loan Agreement, or that would exist after giving effect to the release requested to be made on such date, and (ii) the Company’s unrestricted cash and cash equivalents being less than $7 million after giving pro forma effect to the requested release.

Impairment

During the second quarter of 2016, the Company experienced a triggering event resulting from the continuing decline in operating revenues due to an industry-wide slowdown. An impairment loss of $14.5 million was recorded as a component of operating expenses based on the amount that the carrying value of certain intangibles exceeded the fair value of such intangibles during the second quarter of 2016.

Recent Accounting Pronouncements

In January 2017, the Financial Accounting Standards Board, or the FASB, issued Accounting Standards Update, or ASU, No. 2017-01, or ASU 2017-01, "Clarifying the Definition of a Business." ASU 2017-01 provides guidance on whether or not an integrated set of assets and activities constitutes a business. ASU 2017-01 is effective for periods beginning after December 15, 2017 including interim periods within those periods, with early adoption permitted in specific instances. The Company has determined the adoption of this pronouncement will not have a material impact on its consolidated financial statements and related disclosures.

In November 2016, the FASB issued ASU No. 2016-18, "Statement of Cash Flows (Topic 230), Restricted Cash," or ASU 2016-18. ASU 2016-18 provides guidance on the presentation of restricted cash and restricted cash equivalents in the statement of cash flows. Restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period amounts shown on the statement of cash flows. The amendments of ASU 2016-18 should be applied using a retrospective transition method and are effective for reporting periods beginning after December 15, 2017 with early adoption permitted. The Company believes the adoption of this pronouncement will only change the presentation of the statement of cash flows for restricted cash.

18

In August 2016, the FASB issued ASU No. 2016-15, “Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments,” or ASU 2016-15. ASU 2016-15 will make eight targeted changes to how cash receipts and cash payments are presented and classified in the statement of cash flows. ASU 2016-15 is effective for fiscal years beginning after December 15, 2017. The new standard will require adoption on a retrospective basis unless it is impracticable to apply, in which case, the new standard would apply the amendments prospectively as of the earliest date practicable. The Company is currently in the process of evaluating the impact of adoption on its consolidated financial statements.

In June 2016, the FASB issued ASU No. 2016-13, "Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments", or ASU 2016-13, which introduces a new impairment model for financial instruments that is based on expected credit losses rather than incurred credit losses. The new impairment model applies to most financial assets, including trade accounts receivable. The amendments in ASU 2016-13 are effective for interim and annual reporting periods beginning after December 15, 2019 with early adoption permitted for annual periods beginning after December 15, 2018. The Company is currently in the process of evaluating the impact of adoption on its consolidated financial statements.

In February 2016, the FASB issued ASU No. 2016-02, "Leases (Topic 842)," or ASU 2016-02, which increases the transparency and comparability about leases among entities. The new guidance requires lessees to recognize a lease liability and a corresponding lease asset for operating leases with lease terms greater than 12 months. It also requires additional disclosures about leasing arrangements to help users of financial statements better understand the amount, timing, and uncertainty of cash flows arising from leases. ASU 2016-02 becomes effective for interim and annual periods beginning after December 15, 2018 and requires a modified retrospective approach to adoption. Early adoption is permitted. The Company has engaged a third party to assist in evaluating the impact of this new standard on its consolidated financial statements and related disclosures. The Company expects to recognize additional lease assets and liabilities related to operating leases with terms longer than one year; however, the Company has not completed its analysis nor quantified the impact.

In May 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers (Topic 606),” or ASU 2014-09, which provides guidance for revenue recognition and which supersedes nearly all existing revenue recognition guidance under ASU 2014-09. This ASU provides guidance that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods and services. Additionally, the guidance permits two methods of transition upon adoption: full retrospective and modified retrospective. Under the full retrospective method, the standard would be applied to each prior reporting period presented. Under the modified retrospective method, the cumulative effect of applying the standard would be recognized at the date of initial application. In August 2015, the FASB issued final revised guidance that deferred the effective date of the revenue recognition standard to be for annual and interim periods beginning after December 15, 2017. The Company has engaged a third party to assist in evaluating the impact of this new standard on its consolidated financial statements and related disclosures. To date, the Company has 1) identified its major revenue streams, 2) completed a preliminary review of the key master services agreements for each of the revenue streams. We are in the process of analyzing the corresponding underlying transactions through a review of purchase orders, invoices, and our customary business practices and evaluating the applicability of the “as-invoiced” practical expedient. Based on our preliminary analysis, we do not anticipate a significant impact to the timing of the Company’s revenue recognition; however, the evaluation is not complete and these preliminary conclusions are subject to change. The Company also has started to accumulate information needed for the additional disclosures prescribed by the new standard. The Company expects to complete its analysis by December 31, 2017 and will adopt the new standard as of January 1, 2018.

19

4. Share-Based Compensation

As discussed in Note 1 - Chapter 11 Proceedings, on the Effective Date, all prior equity interests (which included the Old Common Stock, FES Ltd.’s prior preferred stock, awards under the Prior Compensation Plans and the preferred stock purchase rights under the Rights Agreement) in FES Ltd. were extinguished without recovery.

Management Incentive Plan

On the Effective Date, pursuant to the operation of the Plan, the Management Incentive Plan became effective.

The compensation committee, or the Compensation Committee, of the board of directors of the FES Ltd., or the Board, will administer the Management Incentive Plan. The Compensation Committee has broad authority under the Management Incentive Plan to, among other things: (i) select participants; (ii) determine the terms and conditions, not inconsistent with the Management Incentive Plan, of any award granted under the Management Incentive Plan; (iii) determine the number of shares to be covered by each award granted under the Management Incentive Plan; and (iv) determine the fair market value of awards granted under the Management Incentive Plan, subject to certain exceptions.

Persons eligible to receive awards under the Management Incentive Plan include officers and employees of the Company. The types of awards that may be granted under the Management Incentive Plan include stock options, stock appreciation rights, restricted stock, restricted stock units, performance units, performance shares and other forms of stock based awards.

The maximum number of shares of New Common Stock that may be issued or transferred pursuant to awards under the Management Incentive Plan is 750,000, which number may be increased with the approval of FES Ltd.’s stockholders. If any outstanding award granted under the Management Incentive Plan expires or is terminated or canceled without having been exercised or settled in full, or if shares of New Common Stock acquired pursuant to an award subject to forfeiture are forfeited, the shares of New Common Stock allocable to the terminated portion of such award or such forfeited shares will revert to the Management Incentive Plan and will be available for grant under the Management Incentive Plan as determined by the Compensation Committee in consultation with the Chairman of the Board, subject to certain restrictions.

As is customary in management incentive plans of this nature, in the event of any change in the outstanding shares of New Common Stock by reason of a stock split, stock dividend or other non-recurring dividends or distributions, recapitalization, merger, consolidation, spin-off, combination, repurchase or exchange of stock, reorganization, liquidation, dissolution or other similar corporate transaction, an equitable adjustment will be made in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Management Incentive Plan. Such adjustment may include an adjustment to the maximum number and kind of shares of stock or other securities or other equity interests as to which awards may be granted under the Management Incentive Plan, the number and kind of shares of stock or other securities or other equity interests subject to outstanding awards and the exercise price thereof, if applicable.

A summary of the Company's share-based compensation expense during the periods presented are as follows:

Successor | Predecessor | ||||||||||||||

(dollar amounts in thousands) | Three months ended September 30, 2017 | April 13 through September 30, 2017 | January 1, through April 12, 2017 | Nine months ended September 30, 2016 | |||||||||||

Share based compensation expense recognized | $ | 1,034 | $ | 1,034 | $ | — | $ | — | |||||||

Unrecognized compensation cost | $ | 3,916 | $ | 3,916 | $ | — | $ | — | |||||||

Remaining weighted-average service period (years) | 3.92 | 3.92 | — | — | |||||||||||

During the three months ended September 30, 2017, the Company issued 450,000 restricted stock units to officers and employees subject to the Management Incentive Plan. Below is a summary of the restricted stock units awarded.

20

Number of Shares | Weighted Average Fair Value | ||||||

Unvested as of April 13, 2017 | — | $ | — | ||||

Granted | 450,000 | $ | 11.00 | ||||

Vested | 86,400 | $ | 11.00 | ||||

Forfeited | — | $ | — | ||||

Unvested as of September 30, 2017 | 363,600 | $ | 11.00 | ||||

5. Property and Equipment

Property and equipment consisted of the following:

Successor | Predecessor | |||||||||

Estimated Life in Years | September 30, 2017 | December 31, 2016 | ||||||||

(in thousands) | ||||||||||

Well servicing equipment | 9-15 years | $ | 78,738 | $ | 411,199 | |||||

Autos and trucks | 5-10 years | 39,994 | 126,580 | |||||||

Disposal wells | 5-15 years | 3,892 | 37,752 | |||||||

Building and improvements | 5-30 years | 5,396 | 14,125 | |||||||

Furniture and fixtures | 3-15 years | 1,809 | 6,779 | |||||||

Land | 868 | 1,524 | ||||||||

130,697 | 597,959 | |||||||||

Accumulated depreciation | (12,028 | ) | (364,597 | ) | ||||||

$ | 118,669 | $ | 233,362 | |||||||

Depreciation expense was $6.8 million for the three months ended September 30, 2017 (Successor), $12.3 million for the period April 13, 2017 through September 30, 2017 (Successor) and $13.4 million for the period January 1, 2017 through April 12, 2017 (Predecessor). Depreciation expense was $12.4 million and $38.1 million for the three and nine months ended September 30, 2016 (Predecessor), respectively.

21

6. Long-Term Debt

Long-term debt at September 30, 2017 (Successor) and December 31, 2016 (Predecessor) consisted of the following:

Successor | Predecessor | |||||||

September 30, 2017 | December 31, 2016 | |||||||

(in thousands) | ||||||||

Prior Senior Notes, net of deferred financing costs of $2.3 million as of December 31, 2016 | $ | — | $ | 277,662 | ||||

Prior Loan Agreement | — | 15,000 | ||||||

Third party equipment notes and capital leases | 5,035 | 1,386 | ||||||

Insurance notes | — | 5,124 | ||||||

New Loan Agreement of $50 million, including $1.7 million of accrued interest paid in kind and net of debt discount of $4.0 million as of September 30, 2017 | 47,644 | — | ||||||

Total debt | 52,679 | 299,172 | ||||||

Less: Current portion | (1,550 | ) | (298,932 | ) | ||||

Total long-term debt | $ | 51,129 | $ | 240 | ||||

Prior Senior Notes

On June 7, 2011, FES Ltd. issued $280.0 million in principal amount of the Prior Senior Notes, which were guaranteed by Forbes Energy Services LLC, or FES LLC, C.C. Forbes, LLC, or CCF, TX Energy Services, LLC, or TES, and Forbes Energy International, LLC, or FEI. FES Ltd.’s failure to make the semi-annual interest payments on the Prior Senior Notes on June 15, 2016 and December 15, 2016 after the cure periods provided for in the indenture governing the Prior Senior Notes, or the Prior Senior Indenture, and other events of default resulting from technical breaches of covenants under the Prior Senior Indenture, or collectively, the Prior Indenture Defaults, could have resulted in all outstanding indebtedness due under the Prior Senior Indenture immediately becoming due and payable. However, as discussed in Note 1 - Chapter 11 Proceedings, any efforts to enforce such payment obligations were automatically stayed as a result of the filing of the Bankruptcy Petitions, and the creditors' rights of enforcement in respect of the Prior Senior Indenture were subject to the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. As discussed in Note 1 - Chapter 11 Proceedings, on the Effective Date, the Prior Senior Notes were canceled and each holder of the Prior Senior Notes received such holder’s pro rata share of (i) $20 million in cash and (ii) 100% of the New Common Stock, subject to dilution only as a result of the shares of New Common Stock issued or available for issuance in connection with the Management Incentive Plan.

Prior Loan Agreement

On September 9, 2011, the Debtors entered into the Prior Loan Agreement. Under cross default provisions in the Prior Loan Agreement, an event of default under the Prior Senior Indenture constituted an event of default under the Prior Loan Agreement. As mentioned above, the Debtors experienced the Prior Indenture Defaults under the Prior Senior Indenture and, thus, constituted an event of default under the Prior Loan Agreement, or the Prior Loan Defaults. The Prior Indenture Defaults and the Prior Loan Defaults could have resulted in all outstanding indebtedness due under the Prior Senior Indenture and the Prior Loan Agreement becoming immediately due and payable. However, as discussed in Note 1 - Chapter 11 Proceedings, any efforts to enforce such payment obligations were automatically stayed as a result of the filing of the Bankruptcy Petitions, and the creditors' rights of enforcement in respect of the Prior Senior Indenture and the Prior Loan Agreement were subject to the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. As discussed in Note 1 - Chapter 11 Proceedings, on the Effective Date, the outstanding principal balance of $15.0 million plus outstanding interest and fees under the Prior Loan Agreement were paid off and the Prior Loan Agreement was terminated in accordance with the Plan. Additionally, on the Effective Date, the Debtors entered into the New Regions Letters of Credit Facility to cover letters of credit and certain bank product obligations.

22

New Loan Agreement

As discussed previously, on the Effective Date, the Company entered into the New Loan Agreement. FES LLC is the borrower, or the Borrower, under the New Loan Agreement. The Borrower’s obligations have been guaranteed by FES Ltd. and by TES, CCF and FEI, each direct subsidiaries of the Borrower and indirect subsidiaries of FES Ltd. The New Loan Agreement provides for a term loan of $50.0 million, which was fully funded on the Effective Date. Subject to certain exceptions and permitted encumbrances, the obligations under this loan are secured by a first priority security interest in substantially all the assets of the Company other than cash collateralizing the New Regions Letters of Credit Facility. Such term loan has a stated maturity date of April 13, 2021. The proceeds of such term loan are only permitted to be used for (i) the payment on account of the Prior Senior Notes in an amount equal to $20.0 million; (ii) the payment of costs, expenses and fees incurred on or prior to the Effective Date in connection with the preparation, negotiation, execution and delivery of the New Loan Agreement and documents related thereto; and (iii) subject to satisfaction of certain release conditions set forth in the New Loan Agreement, for general operating, working capital and other general corporate purposes of the Borrower not otherwise prohibited by the terms of the New Loan Agreement. The release conditions set forth in the New Loan Agreement include, among other things, (i) no default or event of default under the New Loan Agreement having occurred or being continuing as of the date of the requested release of proceeds of the New Loan Agreement, or that would exist after giving effect to the release requested to be made on such date, and (ii) the Company’s unrestricted cash and cash equivalents being less than $7 million after giving pro forma effect to the requested release. At September 30, 2017, $23.9 million included in restricted cash was subject to these release restrictions.

Borrowings under this term loan bear interest at a rate equal to five percent (5%) per annum payable quarterly in cash, or the Cash Interest Rate, plus (ii) an initial paid in kind interest rate of seven percent (7%) commencing April 13, 2017 to be capitalized and added to the principal amount of the term loan or, at the election of the Borrower, paid in cash. The paid in kind interest increases by two percent (2%) twelve months after the Effective Date and every twelve months thereafter until maturity. Upon and after the occurrence of an event of default, the Cash Interest Rate will increase by two percentage points per annum. During the period from April 13, 2017 through September 30, 2017, $1.7 million of interest was paid in kind.

The Borrower is also responsible for certain other administrative fees and expenses. In connection with the execution of the New Loan Agreement, the Borrower paid the Lenders a funding fee of $3.0 million and paid certain Lenders a backstop fee of $2.0 million. These amounts were recorded as debt issuance costs, as a reduction in the carrying amount of the New Loan Agreement. The $20.0 million payment referred to above and these fees were funded as draws under the New Loan Agreement.

The Company is able to voluntarily repay the outstanding term loan at any time without premium or penalty. The Company is required to use the net proceeds from certain events, including but not limited to, the disposition of assets, certain judgments, indemnity payments, tax refunds, pension plan refunds, insurance awards and certain incurrences of indebtedness to repay outstanding loans under the New Loan Agreement. The Company may also be required to use cash in excess of $20.0 million to repay outstanding loans under the New Loan Agreement.

The New Loan Agreement includes customary negative covenants for an asset-based term loan, including covenants limiting the ability of the Company to, among other things, (i) effect mergers and consolidations, (ii) sell assets, (iii) create or suffer to exist any lien, (iv) make certain investments, (v) incur debt and (vi) transact with affiliates. In addition, the New Loan Agreement includes customary affirmative covenants for an asset-based term loan, including covenants regarding the delivery of financial statements, reports and notices to the Agent. The New Loan Agreement also contains customary representations and warranties and event of default provisions for a secured term loan.

New Regions Letters of Credit Facility

As discussed previously, on the Effective Date the Company entered into the New Regions Letters of Credit Facility to cover letters of credit and certain bank product obligations existing on the Effective Date and pursuant to which Regions may issue, upon request by the Company, letters of credit and continue to provide charge cards for use by the Company. Amounts available under the New Regions Letters of Credit Facility are subject to customary fees and are secured by a first-priority lien on, and security interest in, a cash collateral account with Regions containing cash equal to at least (i) 105% of the sum of (a) all amounts owing for any drawings under letters of credit, including any reimbursement obligations, (b) the aggregate undrawn amount of all outstanding letters of credit, (c) all sums owing to Regions or any affiliate pursuant to any letter of credit document and (d) all obligations of the Company arising thereunder, including any indemnities and obligations for reimbursement of expenses and (ii) 120% of the aggregate line of credit for charge cards issued by Regions to the Company. The fees for each letter of credit for the period from and excluding the date of issuance of such letter of credit to and including the date of expiration or termination, are equal to (x) the average daily face amount of each outstanding letter of credit multiplied by (y) a per annum rate determined by Regions from time to time in its discretion based upon such factors as

23

Regions shall determine, including, without limitation, the credit quality and financial performance of the Company. As of the Effective Date, such rate was 3.00%. In the event the Company is unable to repay amounts due under the New Regions Letters of Credit Facility, Regions could proceed against such cash collateral account. Regions has no commitment under the New Regions Letters of Credit Facility to issue letters of credit. At September 30, 2017, the facility had $9.0 million in letters of credit outstanding.

Capital Leases

The Company financed the purchase of certain vehicles and equipment through commercial loans and capital leases with aggregate principal amounts outstanding as of September 30, 2017 and December 31, 2016 of approximately $5.0 million and $1.4 million, respectively. These loans are repayable in a range of 42 to 47 monthly installments with the maturity dates ranging from October 2017 to September 2021. Interest accrues at rates ranging from 3.4% to 5.7% and is payable monthly. The loans are collateralized by equipment purchased with the proceeds of such loans. The Company paid total principal payments of approximately $0.7 million during the period April 13, 2017 through September 30, 2017 (Successor), $0.4 million during the period January 1, 2017 through April 12, 2017 (Predecessor), and $1.0 million and $3.1 million during the three and nine months ended September 30, 2016 (Predecessor), respectively.

Following are required principal payments due on capital leases existing as of September 30, 2017:

October - December 2017 | 2018 | 2019 | 2020 | 2021 and thereafter | ||||||||||||||

(in thousands) | ||||||||||||||||||

Capital lease principal payments | $ | 464 | $ | 1,374 | $ | 1,181 | $ | 1,234 | $ | 782 | ||||||||

Management has historically acquired all light duty trucks (pickup trucks) through capital leases and may use capital leases or cash to purchase equipment held under operating leases that have reached the end of the lease term.

Insurance Notes

During October of 2016, the Company entered into an insurance promissory note for the payment of insurance premiums at an interest rate of 2.9% with an aggregate principal amount outstanding as of December 31, 2016, of approximately $5.1 million. As of September 30, 2017, the insurance promissory note had been paid in full.

7. Fair Value Measurements

Fair value is defined as the amount that would be received for the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Financial Assets and Liabilities

The carrying amounts of cash and cash equivalents, accounts receivable-trade, accounts receivable-other, accounts payable-trade, and insurance notes, approximate fair value because of the short maturity of these instruments. The fair values of third party notes and equipment notes approximate their carrying values, based on current market rates at which the Company could borrow funds with similar maturities (Level 2 in the fair value hierarchy). The fair values of the New Loan Agreement and the Prior Senior Notes as of the respective dates are set forth below:

Successor | Predecessor | |||||||||||||||

September 30, 2017 | December 31, 2016 | |||||||||||||||

Carrying Amount | Fair Value | Carrying Amount | Fair Value | |||||||||||||

(in thousands) | ||||||||||||||||

New Loan Agreement (1) | $ | 47,644 | $ | 57,600 | $ | — | $ | — | ||||||||

Prior Senior Notes | $ | — | $ | — | $ | 277,662 | $ | 98,570 | ||||||||

(1) New Loan Agreement includes $1.7 million of paid in kind interest less $4.0 million of debt issuance cost.

24

Non-Financial Assets and Liabilities

Non-financial assets and liabilities that are initially measured at fair value are comprised of property, plant and equipment and intangible assets and are not remeasured at fair value in subsequent periods. Such initial measurements are classified as Level 3 since certain significant unobservable inputs are utilized in their determination. These fair value calculations incorporate a market and a cost approach and the inputs include projected revenue, costs, equipment utilization and other assumptions. As discussed in Note 1 - Fresh Start Accounting, property, plant and equipment and intangible assets were remeasured as part of fresh start accounting.

8. Related Party Transactions

The Company enters into transactions with related parties in the normal course of conducting business. The following tables represent related party transactions (in thousands):

As of | |||||||||

Successor | Predecessor | ||||||||

September 30, 2017 | December 31, 2016 | ||||||||

Related parties cash and cash equivalents balances: | |||||||||

Balance at Texas Champion Bank (1) | $ | — | $ | 294 | |||||

Related parties payable: | |||||||||

Texas Quality Gate Guard Services, LLC (2) | $ | — | $ | 18 | |||||

There were no related party capital expenditures for the period ended September 30, 2017 (Successor), the period January 1, 2017 through April 12, 2017 (Predecessor), and the three and nine months ended September 30, 2016 (Predecessor).

Successor | Predecessor | |||||||||||||||||||||

Three months ended September 30, 2017 | April 13 through September 30, 2017 | January 1 through April 12, 2017 | Three months ended September 30, 2016 | Nine months ended September 30, 2016 | ||||||||||||||||||

Related parties expense activity: | ||||||||||||||||||||||

Alice Environmental Holdings, LLC Alice Environmental Services, LLC (5) | $ | 221 | $ | 369 | $ | 296 | $ | 227 | $ | 788 | ||||||||||||

Animas Holding, LLC (6) | 47 | 79 | 61 | 39 | 123 | |||||||||||||||||

CJW Group, LLC (7) | 9 | 15 | — | 13 | 9 | 28 | ||||||||||||||||

Dorsal Services, Inc. (3) | — | — | 2,890 | — | 8 | 8 | ||||||||||||||||

Tasco Tool Services, Inc. (4) | — | — | 11 | 9 | 25 | |||||||||||||||||

Texas Quality Gate Guard Services, LLC (2) | — | — | 58 | 51 | 116 | |||||||||||||||||

$ | 277 | $ | 463 | $ | 439 | $ | 343 | $ | 1,088 | |||||||||||||

Other payments to related parties: | |||||||||||||||||||||

SB Factoring, LLC (8) | $ | 27 | $ | 27 | $ | 65 | $ | 79 | $ | 296 | |||||||||||

(1) | The Company had a deposit relationship with Texas Champion Bank. Travis Burris is the President, Chief Executive Officer, and director of Texas Champion Bank and served as a Company director until the Effective Date. John E. Crisp, an executive officer and director of Forbes Energy Services, Ltd., serves on the board of directors of Texas Champion Bank. On September 30, 2017, the Company closed the account with Texas Champion Bank. |

(2) | Texas Quality Gate Guard Services, LLC, or Texas Quality Gate Guard Services, is an entity partially owned by Mr. Crisp and a son of Mr. Crisp. Texas Quality Gate Guard Services has provided security services to the Company. Since the Effective Date, Texas Quality Gate Guard Services has not provided services to our Company and we do not anticipate securing their services in the future. |

(3) | Dorsal Services, Inc., or Dorsal Services, is a trucking service company. Mr. Crisp was a partial owner of Dorsal Services in prior periods. The Company used Dorsal Services from time to time. |

25