Attached files

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

———————

FORM 10-K

———————

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2019

OR

☐ TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

For the

transition period from _____

to _____

Commission

File Number: 001-36498

———————

CELLULAR BIOMEDICINE GROUP, INC.

(Exact name of registrant as specified in its charter)

———————

|

Delaware

|

|

86-1032927

|

|

State of Incorporation

|

|

IRS Employer Identification No.

|

1345 Avenue of Americas, 15th Floor

New York, New York 10105

(Address of principal executive offices)

(347) 905 5663

(Registrant’s telephone number)

Securities registered pursuant to Section 12(b) of the Exchange

Act:

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which Registered

|

|

Common

Stock, par value $0.001

|

CBMG

|

Nasdaq

Global Select Market

|

Securities registered pursuant to Section 12(g) of the Exchange

Act:

None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as

defined in Rule 405 of the Securities Act. ☑

No

Indicate

by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act. ☑

No

Indicate

by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such

reports) and (2) has been subject to such filing requirements for

the past 90 days. Yes ☑

Indicate

by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to

Rule 405 of Regulation S-T during the preceding 12 months (or for

such shorter period that the registrant was required to submit such

files). Yes ☑

Indicate

by check mark if disclosure of delinquent filers pursuant to Item

405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant’s knowledge, in

definitive proxy or information statements incorporated by

reference in Part III of this Form 10-K or any amendment to this

Form 10-K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See definitions of

“large accelerated filer,” “accelerated

filer” and “smaller reporting company” in Rule

12b-2 of the Exchange Act.:

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☒

|

|

Non-accelerated

filer

|

☐

|

Smaller reporting company

|

☐

|

|

|

|

Emerging

growth company

|

☐

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Act). ☑ No

State

the aggregate market value of the voting and non-voting common

equity held by non-affiliates computed by reference to the price at

which the common equity was last sold, or the average bid and asked

price of such common equity, as of the last business day of the

registrant’s most recently completed second fiscal quarter

– $200,634,545 as of June 30, 2019.

Indicate

the number of shares outstanding of each of the registrant’s

classes of common stock, as of the latest practicable date: As of

February 24, 2020, there were 19,355,292 shares of common stock

outstanding.

Documents

Incorporated By Reference – Portions of the

Registrant’s definitive Proxy Statement for its 2020 Annual

Meeting of Stockholders are incorporated by reference into Part III

of this Form 10-K.

THE

INFORMATION REQUIRED BY PART III OF THIS ANNUAL REPORT ON FORM

10-K, TO THE EXTENT NOT SET FORTH HEREIN, IS INCORPORATED BY

REFERENCE FROM THE REGISTRANT’S DEFINITIVE PROXY STATEMENT

RELATING TO THE ANNUAL MEETING OF STOCKHOLDERS, WHICH DEFINITIVE

PROXY STATEMENT SHALL BE FILED WITH THE SECURITIES AND EXCHANGE

COMMISSION WITHIN 120 DAYS AFTER THE END OF THE FISCAL YEAR TO

WHICH THIS ANNUAL REPORT ON FORM 10-K RELATES.

CELLULAR BIOMEDICINE GROUP, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED December 31, 2019

TABLE OF CONTENTS

|

|

|

|

Page

|

||

|

PART

I

|

|

|

|

||

|

|

|

|

|

||

|

|

4

|

||||

|

|

|

|

|

||

|

|

25

|

||||

|

|

|

|

|

||

|

|

53

|

||||

|

|

|

|

|

||

|

|

53

|

||||

|

|

|

|

|

||

|

|

53

|

||||

|

|

|

|

|

||

|

|

53

|

||||

|

|

|

|

|

||

|

PART

II

|

|

|

|

||

|

|

|

|

|

||

|

|

54

|

||||

|

|

|

|

|

||

|

|

59

|

||||

|

|

|

|

|

||

|

|

60

|

||||

|

|

|

|

|

||

|

|

75

|

||||

|

|

|

|

|

||

|

|

77

|

||||

|

|

|

|

|

||

|

|

77

|

||||

|

|

|

|

|

||

|

|

78

|

||||

|

|

|

|

|

||

|

|

78

|

||||

|

|

|

|

|

||

|

PART

III

|

|

|

|

||

|

|

|

|

|

||

|

|

79

|

||||

|

|

|

|

|

||

|

|

79

|

||||

|

|

|

|

|

||

|

|

79

|

||||

|

|

|

|

|

||

|

|

79

|

||||

|

|

|

|

|

||

|

|

79

|

||||

|

|

|

|

|

||

|

PART

IV

|

|

|

|

||

|

|

|

|

|

||

|

|

80

|

||||

|

|

|

|

|

||

|

|

81

|

||||

|

|

|

|

|

||

|

|

|

82

|

|||

2

Cautionary Note Regarding Forward-Looking Statements and Risk

Factors

This Annual Report on Form 10-K (“Annual Report”), may

contain “forward-looking statements” within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended, or

the Exchange Act and the Private Securities Litigation Reform Act

of 1995, which are subject to the “safe harbor” created

by those sections. Our actual results could differ materially from

those anticipated in these forward-looking statements. This annual

report on Form 10-K of the Company may contain forward-looking

statements which reflect the Company’s current views with

respect to future events and financial performance. The words

“believe,” “expect,”

“anticipate,” “intends,”

“estimate,” “forecast,”

“project” and similar expressions identify

forward-looking statements. All statements other than statements of

historical fact are statements that could be deemed to be

forward-looking statements, including plans, strategies and

objectives of management for future operations; proposed new

products, services, developments or industry rankings; future

economic conditions or performance; belief; and assumptions

underlying any of the foregoing. Although we believe that we have a

reasonable basis for each forward-looking statement contained in

this report, we caution you that these statements are based on a

combination of facts and factors currently known by us and our

projections of the future, about which we cannot be certain. Such

“forward-looking statements” are subject to risks and

uncertainties set forth from time to time in the Company’s

SEC reports and include, among others, the Risk Factors set forth

under Item 1A below.

The risks included herein are not exhaustive. This annual report on

Form 10-K filed with the SEC includes additional factors which

could impact the Company’s business and financial

performance. Moreover, the Company operates in a rapidly changing

and competitive environment. New risk factors emerge from time to

time and it is not possible for management to predict all such risk

factors. Further, it is not possible to assess the impact of all

risk factors on the Company’s business or the extent to which

any factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking

statements. Forward-looking statements in this report include, but

are not limited to, statements about:

●

the success, cost

and timing of our product development activities and clinical

trials;

●

our ability and the

potential to successfully advance our technology platform to

improve the safety and effectiveness of our existing product

candidates;

●

the potential for

our identified research priorities to advance our cancer and

degenerative disease technologies;

●

our ability to

obtain drug designation or breakthrough status for our product

candidates and any other product candidates, or to obtain and

maintain regulatory approval of our product candidates, and any

related restrictions, limitations and/or warnings in the label of

an approved product candidate;

●

public health

crises, such as the coronavirus outbreak at the beginning of

2020;

●

the ability to

generate or license additional intellectual property relating to

our product candidates;

●

regulatory

developments in China, the United States and other foreign

countries;

●

the potential of

the technologies we are developing (each as defined

below);

●

fluctuations in the

exchange rate between the U.S. dollar and the Chinese Yuan;

and

●

our plans to

continue to develop our manufacturing facilities.

Readers are cautioned not to place undue reliance on such

forward-looking statements as they speak only of the

Company’s views as of the date the statement was made. The

Company undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Note Regarding Third-Party Information

This Annual Report includes data that we obtained from industry

publications and third-party research, surveys and studies.

Industry publications and third-party research, surveys and studies

generally indicate that their information has been obtained from

sources believed to be reliable, although they do not guarantee the

accuracy or completeness of such information. This Annual Report

also includes data based on our own internal estimates and

research. Our internal estimates and research have not been

verified by any independent source, and, while we believe the

industry publications and third-party research, surveys and studies

are reliable, we have not independently verified such data. Such

third-party data and our internal estimates and research are

necessarily subject to a high degree of uncertainty and risk due to

a variety of factors, including those described in Item

1A—Risk Factors in this Annual Report. These and other

factors could cause results to differ materially from those

expressed in this Annual Report.

3

PART I

ITEM 1. BUSINESS.

As used

in this annual report, “we,” “us,”

“our,” “CBMG,” “Company” or

“our company” refers to Cellular Biomedicine Group,

Inc. and, unless the context otherwise requires, all of its

subsidiaries or deemed controlled companies.

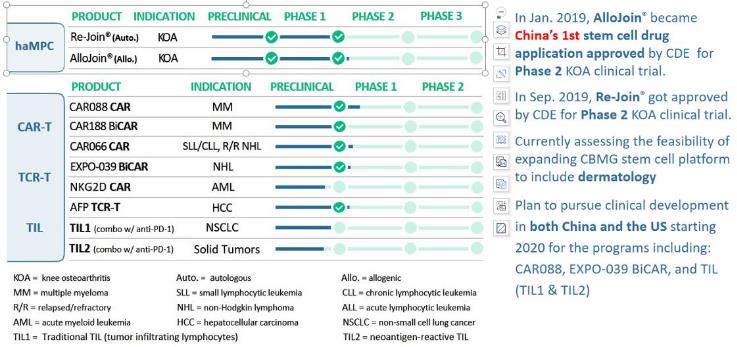

Overview

We

are a clinical-stage biopharmaceutical company committed to using

our proprietary cell-based technologies to develop immunotherapies

for the treatment of cancer and stem cell therapies for the

treatment of degenerative diseases. We view ourselves as a leader

in cell therapy industry through our diverse, multi-target, broad

pipeline ranging from immuno-oncology, featuring CAR-T, TCR-T and

TIL to regenerative medicine. Our focus is to bring our potentially

best-in-class products to market while also aiming to reduce

manufacturing cycle time and aggregate cost while striving to

ensure quality products of cell therapies. We provide comprehensive

and integrated research and manufacturing services throughout the

discovery, development and manufacturing spectrum for cell-based

technologies. We have two major components to our global strategy.

First, we intend on developing our own internal pipeline, focusing

on immune cell therapy, regenerative medicine, as well as other

innovative biotechnology modalities that can leverage our

infrastructure, human capital and intellectual property. Second, we

plan to partner with leading companies to monetize our innovative

technologies in markets where we do not currently have a presence

and may also seek to bring their technologies to markets where we

have infrastructure.

Our

end-to-end platform enables discovery, development and

manufacturing of cell-based therapies from concept to commercial

manufacturing in a cost-efficient manner. The manufacturing and

delivery of T cell therapies involve complex, integrated processes,

comprised of isolating T-cells from patients, T cell enrichment,

activation, viral vector transduction, expansion, harvest and

fill-finish. Our in-house cell therapy manufacturing is comprised

of a semi-automated, fully closed system and can manufacture high

quality plasmids, and serum-free reagents as well as viral vectors

for our immuno-oncology cell therapy products. Because we are

vertically integrated, we are able to reduce the aggregate cost of

cell therapies. We plan to build out our manufacturing capacity to

scale for commercial supply at an economical cost. We hone our

manufacturing process in our good manufacturing practice (GMP)

facilities in China to achieve cycle time reduction, improve

quality assurance and control and increase efficiency and early

development to understand our therapies’ efficacy. Our other

objective on institutionalizing our manufacturing process is

portability and ease of tech transfer to other facilities and ease

of deployment in future locations.

Our

technologies include two major cell platforms:

A. Immune

cell therapy for treatment of a broad range of cancer

indications.

a. Hematological

Cancer

i.

Chimeric Antigen Receptor modified T-cells (CAR-T);

and

b.

Solid Tumors

i.

T-cells with genetically modified, tumor antigen-specific T-Cell

Receptors (TCRs); and

ii.

Next-generation neoantigen-reactive, bio-markers based Tumor

Infiltrating lymphocytes (TILs).

B. Regenerative

Medicines using human adipose-derived mesenchymal progenitor cells

(haMPC) for treatment of joint diseases.

a. Knee

Osteoarthritis (Autologous & Allogeneic); and

b. Other

degenerative and dermatologic diseases (assessing the

feasibility).

4

Our

initial target market is China, where we believe that our

cell-based therapies will be able to help patients with significant

unmet medical needs. For hematological cancer we have:

●

Finished

enrolling patients for the second cohort in a Phase I dose

escalation clinical study for our anti-B cell maturation

antigen(“anti-BCMA”) CAR-T therapy for the treatment of

multiple myeloma in China. Currently we are enrolling patients for

the third cohort in China. The Phase Ia clinical study will enroll

22 patients in several stratified cohorts and has been expanded

into multiple clinical sites. We have submitted our Investigational

New Drug (IND) dossier to the New Medical Products Administration

(NMPA) for approval for the Phase Ib study and are waiting for

feedback.

●

Initiated

first-in-human non-Hodgkin lymphoma clinical trials in China for

our CD19 and CD20 bi-specific CAR-T products.

●

Achieved

the first-in-human milestone and continued patient recruitment in

China for our Phase I investigator initiated clinical trial of

anti-CD20 CAR-T targeting anti-CD19 antibody or CAR-T treated,

relapsed diffuse large B-cell lymphoma (DLBCL) and small B-cell

lymphoma patients.

For

solid tumors:

●

The clinical trial of Alpha-fetoprotein

T-cell receptor (AFP-TCR-T) targeting hepatocellular carcinoma (HCC) has been

approved by Zhongshan Hospital in Shanghai and our first HCC

patient has been infused with our AFP TCR-T-cells in December 2019;

and

●

We

plan to launch non-small cell lung cancer (NSCLC) TIL clinical

trials in the U.S. in the first half of 2021.

If the data from certain of our China-based,

immuno-oncology clinical trials proves to be positive, we intend to

submit IND applications with the U.S. FDA in order to conduct clinical trials in the

United States.

On regenerative medicine development we have been

approved by the NMPA in China to initiate a Phase II clinical trial

of AlloJoin®,

our allogenic haMPC therapy for the treatment of knee

osteoarthritis, which is the first stem cell drug application

approved by the NMPA for a Phase II clinical trial in knee

osteoarthritis since the NMPA clarified its cell therapy

regulations in December 2017. We launched our Phase II AlloJoin®

clinical trial on September 12, 2019. Using data from our Phase IIb

clinical studies before the NMPA clarified its cell therapy

regulations, we have submitted our IND application with the NMPA

for our autologous knee osteoarthritis. We have also been approved

by the NMPA in China to initiate a Phase II clinical trial of

ReJoin®,

our autologous haMPC therapy for the treatment of knee

osteoarthritis.

In

addition to our own internal clinical pipelines, we have formed and

plan to continue to seek partnerships with other cell therapy

focused companies to expand their technology in the Chinese market.

Our comprehensive capabilities have attracted inbound inquiries

from global pharmaceutical companies seeking to improve the

efficiency of their drug development process and/or to co-develop

their therapeutic products by initially conducting investigator

initiated trials in China, and upon verification on

proof-of-concept (POC) to launch clinical trials in the U.S. and in

China. We believe that we are positioned to capture opportunities

from the rapid expansion of global pharmaceutical companies by

leveraging our focus on cell manufacturing process improvement,

which offers the benefits of improving product quality and creates

cost savings. Positioned at the forefront of science, we believe

our established clinical network in China will enable us to

collaborate with these global firms as they seek to enter the

Chinese market to develop in-house capabilities and infrastructure

and to improve efficiency throughout the drug development

process.

In September 2018, we executed a License and

Collaboration Agreement (hereinafter Novartis LCA) with Novartis AG

(Novartis) to manufacture and supply their U.S. FDA-approved CD19 CAR-T cell therapy product

Kymriah®

in China. Pursuant to the Novartis LCA

agreement, we also granted Novartis a worldwide license to certain

of our CAR-T intellectual property for the development, manufacture

and commercialization of CAR-T products. We are entitled to an

escalating single-digit percentage royalty of

Kymriah®’s

net sales in China. CBMG is responsible for the cost of

bi-directional technology transfers between the two companies. We

will receive collaboration payments equal to a single-digit

escalating percentage of net sales of Kymriah®

in China, subject to certain caps set

forth under the Novartis LCA, for sales in diffuse large B-cell

lymphoma and pediatric acute lymphoblastic leukemia indications and

up to a maximum amount to be agreed upon for sales in other

indications. We are also obligated to assist Novartis with the

development of Kymriah®

in China as Novartis may request and

are responsible for a certain percentage of the total development

cost for the development of Kymriah®

in China for indications other than

diffuse large B-cell lymphoma and pediatric acute lymphoblastic

leukemia indications. As of December 31, 2019, we have achieved

three major milestones on the technology transfer and collaboration

with Novartis on commercialization of Kymriah®,

specifically: process and analytical training, feasibility runs and

an export license for

feasibility/comparability.

On October 2, 2018, we executed a non-exclusive

license agreement with the U.S. National Cancer Institute

(“NCI”) for ten

tumor infiltrating lymphocytes patents, pursuant to which we

acquired rights to the worldwide development, manufacture and

commercialization of autologous, tumor-reactive lymphocyte adoptive

cell therapy products, isolated from tumor infiltrating lymphocytes

for the treatment of non-small cell lung, stomach, esophagus,

colorectal and head and neck cancer(s) in humans. We agreed to pay

certain license fees for such license, including (i) an initial

up-front cash payment; (ii) a de minimis non-refundable annual

royalty that may be credited against any earned royalties due from

net sales; (iii) a small single-digit percentage of net sales of

the licensed products, payable on a semi-annual basis, which may be

adjusted downward in the event that the Company must pay a license

fee to a third party; (iv) an additional small single-digit

sublicense fee on the fair market value of any consideration

received for granting a sublicense; and (v) a milestone payment

component tied to certain clinical and commercial developments. We

have a unilateral right to terminate the license agreement.

Th

e NCI has the right

to terminate the license agreement if CBMG (i) commits a material

breach; (ii) fails to use commercially reasonable effort in

developing the licensed products or processes; (iii) fails to

achieve certain performance benchmarks; (iv) willfully makes a

false statement; (v) is not keeping licensed products or processes

reasonably available to the public after commercial use; (vi)

cannot reasonably satisfy unmet health and safety needs; or (vii)

cannot meet certain requirements by federal regulations. The

license agreement will expire upon the expiration of the last to

expire of the patent rights licensed pursuant thereto. Other than

an initial upfront payment and a de minimis annual royalty payment,

the Company has not paid any additional royalty under the license

agreement as of December 31, 2019.

5

In

order to expedite fulfillment of patient treatment, we have been

actively developing technologies and products with strong

intellectual property protection. CBMG’s worldwide exclusive

license to the T Cell patent rights owned by Augusta University

provides an opportunity to expand the application of CBMG’s

cancer therapy-enabling technologies and to initiate clinical

trials with leading cancer hospitals. On February 14, 2019, Augusta

University granted us an exclusive, worldwide license with

sublicense rights to its patent rights to Human Alpha

Fetoprotein-Specific T Cell Receptor modified T-cells (AFP TCR-T).

In consideration for the license granted, the Company agreed to pay

the university a one-time, non-refundable, non-creditable license

fee within 30 days of execution of the license agreement and a

single-digit percent of running royalty on net sales of the

licensed products. The Company also agreed to (a) use its

commercially reasonable efforts to develop and conduct such

research, development and validation studies as necessary or

desirable to obtain all regulatory approvals to manufacture and

market the licensed products in at least one country in certain

major markets listed in the license agreement, and (b) upon receipt

of such approvals, to use commercially reasonable efforts to market

each licensed product in such country. The Company, at its sole

expense, has the obligation to fund the costs of all research,

development, preclinical and clinical trials, regulatory approval

and commercialization of the licensed products. The license

agreement will expire upon the termination of the Company’s

obligation to pay royalty pursuant to the terms thereof. Upon

expiration of the term, the license granted the Company will

survive the expiration of the license agreement, and convert to a

perpetual, fully paid up license. The Company may terminate the

agreement, in its sole discretion, upon 30 days’ prior

written notice to Augusta University and either party may terminate

the license agreement upon or after the breach of a material

provision of the agreement that is not cured within 45 days after

notice thereof by the non-breaching party. The Company has not paid

any royalty since there have not been any sales of licensed

products as of the date of this report.

Corporate History

Headquartered

in New York, the Company is a Delaware biopharmaceutical company

focused on developing treatment for cancer and joint diseases for

patients in China. The Company was formerly known as EastBridge

Investment Group Corporation, originally incorporated in the State

of Arizona on June 25, 2011, and reincorporated as Cellular

Biomedicine Group, Inc. in the State of Delaware on January 18,

2013. The Company started its regenerative medicine business in

China in 2009 and expanded to CAR-T therapies in 2014.

Recent Developments

On

January 8, 2019, we initiated patient recruitment for CAR088

(anti-BCMA CAR-T) in China.

On

January 17, 2019, our AlloJoin® Therapy for KOA

got approved for Phase II trial in China.

On June

17, 2019, we initiated a Phase I clinical trial of CAR066

(anti-CD20 CAR-T) targeting previously anti-CD19 CAR-T treated,

relapsed diffuse large B-cell lymphoma (DLBCL) and small B-cell

lymphoma patients in China, and dosed the first CD19 CAR-T relapsed

DLBCL patient.

On July

4, 2019, we submitted our autologous haMPC (ReJoin®) KOA Phase II

IND filing with the NMPA under the new regulation.

On July

4, 2019, CD20-CD19 bi-specific CAR-Ts showed

desired in vitro and in vivo anti-tumor

activity. We plan to introduce an improved CAR-T manufacturing

process with reduced manufacturing duration and better product

quality controls for the bi-specific CD20-CD19 CAR-Ts targeting

NHL, and the same development strategy is also utilized for our

BCMA manufacturing platform. Based on scientific evidence known to

the public, CD20-CD19 bi-specific CAR-Ts have

shown reactivity against both single positive (CD20+ or CD19+)

and double positive (CD20+CD19+) tumor targets.

On July

5, 2019, we filed a shelf registration statement on Form S-3 to

offer and sell from time to time, in one or more series, any of the

securities of the Company, for total gross proceeds up to

$200,000,000, which was declared effective by the Securities and

Exchange Commission on July 16, 2019.

On

August 27, 2019, we entered into a Facility Improvement and Process

Validation Agreement with Duke University. Pursuant to this

agreement, the Company paid for improvement of Duke’s GMP

facility, Duke University agreed to conduct and the Company agreed

to fund a tumor infiltrating lymphocytes clinical

trial.

On

September 12, 2019, we launched our allogenic haMPC

AlloJoin® KOA Phase II

clinical trial.

As of

September 30, 2019, CBMG had a total of 11 labs (suites) that were

certified as Biosafety Level-2 (BSL-2) meeting the local regulatory

requirements for the handling of biological materials.

On

October 2, 2019, we entered into a lease agreement to build a

22,000 square foot facility in Rockville, Maryland to expand

R&D and to support clinical development in the

U.S.

6

On

December 7, 2019 we announced early data from our ongoing

investigator initiated trial at an oral presentation titled

“Novel Anti-BCMA CAR-T for Relapsed or Refractory Multiple

Myeloma” at the 61st American Society of Hematology

“ASH” annual meeting in Orlando, FL.

On

December 23, 2019, we dosed our first

patient in our clinical trial of AFP-TCR-T

targeting HCC.

In the

next 12 months, we aim to accomplish the

following:

●

Bifurcate our

markets and launch clinical studies in the U.S. upon establishing

good POC from the clinical studies in China and transfer the

clinical assets from Shanghai to the U.S., including our quick

cycle-time, highly differentiated, proprietary manufacturing

process comprised of short cycle-time, semi-automation and closed

system;

●

Advance our

Rockville site’s research and development and manufacturing

to support our clinical development in the U.S.;

●

Assess the

feasibility of expanding our stem cell platform to include

dermatology;

●

Execute clinical

trial sponsorship with U.S.-based Principal Investigators (PI) to

develop our clinical assets in the U.S.;

●

Collaborate with

Duke University on TIL process development to improve cycle time

and institutionalized scalability;

●

Explore the

feasibility of establishing a new R&D and clinical

manufacturing site in China to adapt to our rapid business

expansion and explore the addition of Contract Development and

Manufacturing Organization (CDMO) business to support certain

specific market-oriented business strategies;

●

Evaluate our

strategy to further increase our enterprise value and expand our

capital market strategy;

●

Execute the

technology transfer and align the manufacturing processes with the

global CAR-T leader to support the development of the world’s

first CAR-T therapy in China;

●

Explore and

introduce a gene therapy technology platform, product development

and manufacturing for our current business to create synergy with

our cell therapy pipelines;

●

Bolster R&D

resources to fortify our intellectual property portfolio and

scientific development;

7

●

Evaluate and

implement a digital data tracking and storage technology system for

research and development, material management, GMP production and

integrated clinical data management;

●

Evaluate emerging

regenerative medicine technology platform for other indications and

review recent developments in the competitive

landscape;

●

Strengthen our

Quality Management System (QMS) centralized document control system

and electronic batch recording system for quality assurance, and

laboratory information management system (LMS) for quality

control;

●

Leverage our QMS

system and our strong scientific expertise in both the U.S. and

China;

●

Collaborate with

multinational pharmaceutical companies to co-develop cell therapy

products in China and possibly in the U.S.; and

●

Continue to

implement International Organization for Standardization (ISO)

27001 standard to fortify our information assets

security.

Key Anticipated 2020 Milestones

R&D

Milestones

●

Completing

construction of the Rockville R&D site to support our continued

effort for pipeline development

●

Continued effort to

support IIT and IND in China, and US IND for key CBMG clinical

assets

●

Continuing to

build a dynamic clinical pipeline for cell therapy, including new

assets for CAR-T and TCR-T, and allogeneic cell therapy

products

Manufacturing

Milestones

●

Completing

construction of the Rockville manufacturing site to support our

clinical development in the U.S.

●

Continuing to

assess the feasibility of expanding manufacturing capacity at new

site(s) in both the U.S. and China

Clinical

Milestones

●

Advancing haMPC

Phase II trials in China for both AlloJoin® and

ReJoin®

●

Continue enrollment

into I/O programs in China for CAR088, CAR188, CAR066, EXPO-039 and

AFP TCR-T

●

Advancing I/O

programs in the U.S. for TIL Therapy (TIL1)

Regulatory

Milestones

●

Filing an IND in

the U.S. for TIL Therapy CAR088 and EXPO-039

●

Seeking additional

INDs for other clinical programs in China

●

Expand clinical

research programs in the U.S.

Other

Milestones

●

Continuing

collaboration with current and new clinical sites and 3A hospitals

in China

●

Continuing

translation and clinical collaboration with Duke University on TIL

Therapy

●

Continuing

collaboration with current partners in manufacturing and process

development for next-generation cell therapies

●

Evaluating

co-development and/or strategic partnerships for both in-licensing

and out-licensing with high quality, multinational

partners

8

Our

operating expenses for year ended December 31, 2019 were in line

with management’s plans and expectations. We had an increase

in total operating expenses of approximately $10.6 million for the

year ended December 31, 2019, as compared to the year ended

December 31, 2018, which is primarily attributable to increased

R&D expenses and clinical developments in 2019.

9

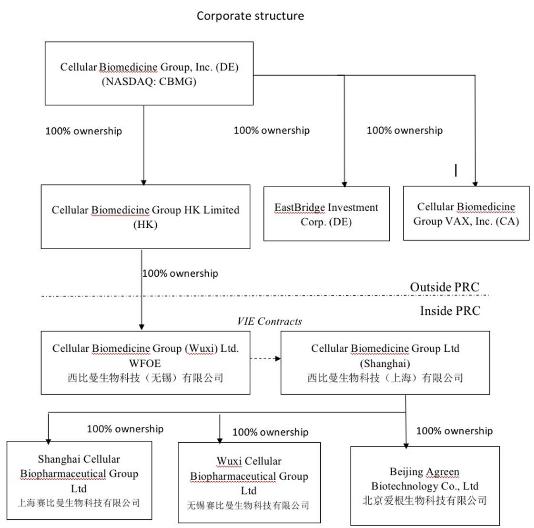

Corporate Structure

Our

current corporate structure is illustrated in the following

diagram:

Currently we have

the following subsidiaries (including a controlled VIE

entity):

Eastbridge Investment Corporation

("Eastbridge Sub"), a Delaware corporation, is a wholly owned

subsidiary of the Company.

Cellular Biomedicine Group VAX, Inc.

("CBMG VAX"), a California corporation, is a wholly owned

subsidiary of the Company.

Cellular Biomedicine Group HK Limited, a

Hong Kong company limited by shares, is a holding company and

wholly owned subsidiary of the Company.

Cellular Biomedicine Group Ltd. (Wuxi)

(“CBMG Wuxi”) license number 320200400034410 (the

“WFOE”) is a wholly foreign-owned entity that is 100%

owned by Cellular Biomedicine Group HK Limited. This entity’s

legal name in Chinese translates to “Xi Biman Biological

Technology (Wuxi) Co. Ltd.” The WFOE controls and

holds ownership rights in the business, assets and operations of

Cellular Biomedicine Group Ltd. (Shanghai) (“CBMG

Shanghai”) through variable interest entity (VIE) agreements.

We conduct certain biopharmaceutical business activities through

the WFOE, including research and development, technical support,

technical service, technology transfer in the biomedical technology

field, manufacturing of non-food, pharmaceutical polypeptides and

medical devices (in vitro diagnostic reagents) extracted by

biology; making

foreign investments with its own funds; and cosmetics, sanitary

products and biological agents wholesale and commission

agents.

Cellular Biomedicine Group Ltd.

(Shanghai) license number 310104000501869, is a PRC domestic

corporation, which we control and hold ownership rights in, through

the WFOE and the above-mentioned VIE agreements. This

entity’s legal name in Chinese translates to “Xi Biman

Biotech (Shanghai) Co., Ltd.” We conduct certain

biopharmaceutical business activities through our controlled VIE

entity, CBMG Shanghai, including clinical trials and certain other

activities requiring a domestic license in the PRC. Chen Mingzhe

and Lu Junfeng, together, are the record holders of all of the

outstanding registered capital of CBMG Shanghai. Chen and Lu are

also directors of CBMG Shanghai constituting the entire management

of the same.

Beijing Agreen Biotechnology Co., Ltd.

is a PRC domestic corporation and wholly owned subsidiary of CBMG

Shanghai.

Wuxi Cellular Biopharmaceutical Group

Ltd., established on January 17, 2017, is a PRC domestic

corporation and wholly owned subsidiary of CBMG Shanghai.

Shanghai Cellular Biopharmaceutical Group

Ltd., established on January 18, 2017, is a PRC domestic

corporation and wholly owned subsidiary of CBMG

Shanghai.

10

Variable Interest Entity (VIE) Agreements

Through

our wholly foreign-owned entity and 100% subsidiary, Cellular

Biomedicine Group Ltd. (Wuxi), we control and have ownership rights

by means of a series of VIE agreements with CBMG Shanghai. The

shareholders of record for CBMG Shanghai were Cao Wei and Chen

Mingzhe, who together owned 100% of the equity interests in CBMG

Shanghai before October 26, 2016. On October 26, 2016, Cao Wei,

Chen Mingzhe and Lu Junfeng entered into an equity transfer

agreement and a supplementary agreement pursuant to which Cao Wei

transferred his equity interests in CBMG Shanghai to Chen Mingzhe

and Lu Junfeng. As a result of the transfer, each of Chen and Lu

now owns a 50% equity interest in CBMG Shanghai. On the same day,

WFOE, CBMG Shanghai, Cao Wei and Chen Mingzhe entered into a

termination agreement, pursuant to which the series of VIE

agreements executed among the WFOE, CBMG Shanghai, Chen Mingzhe and

Cao Wei were terminated and a new set of VIE agreements were

executed. The following is a description of each of these VIE

agreements:

Exclusive Business Cooperation

Agreement. Through the WFOE, we are a party to an exclusive

business cooperation agreement dated October 26, 2016 with CBMG

Shanghai, which provides that (i) the WFOE shall exclusively

provide CBMG Shanghai with complete technical support, business

support and related consulting services; (ii) without prior written

consent of the WFOE, CBMG Shanghai may not accept the same or

similar consultancy and/or services from any third party, nor

establish any similar cooperation relationship with any third party

regarding same matters during the term of the agreement; (iii) CBMG

Shanghai shall pay the WFOE service fees as calculated based on the

time of service rendered by the WFOE multiplying the corresponding

rate, plus an adjusted amount decided by the board of the WFOE; and

(iv) CBMG Shanghai grants to the WFOE an irrevocable and exclusive

option to purchase, at its sole discretion, any or all of CBMG

Shanghai’s assets at the lowest purchase price permissible

under PRC laws. The term of the agreement is 10 years, provided

however the agreement may extended at the option of the WFOE. Since

this agreement permits the WFOE to determine the service fee at its

sole discretion, the agreement in effect provides the WFOE

with rights to all earnings of the VIE.

Loan Agreement. Through the WFOE, we

are a party to a loan agreement with CBMG Shanghai, Lu Junfeng and

Chen Mingzhe dated October 26, 2016, in accordance with which the

WFOE agreed to provide an interest-free loan to CBMG Shanghai. The

term of the loan is 10 years, which may be extended upon written

consent of the parties. The method of repayment of CBMG Shanghai

shall be at the sole discretion of the WFOE, including but not

limited to an acquisition of CBMG Shanghai in satisfaction of its

loan obligations.

Exclusive Option Agreement with Lu

Junfeng. Through the WFOE, we are a party to an option

agreement with CBMG Shanghai and Lu Junfeng dated October 26, 2016,

in accordance with which: (i) Lu Junfeng granted the WFOE an

irrevocable and exclusive right to purchase, or designate another

person to purchase the entire equity interest in CBMG Shanghai as

then held by him, at an aggregate purchase price to be determined;

and (ii) any proceeds obtained by Lu Junfeng through the above

equity transfer in CBMG Shanghai shall be used for the payment of

the loan provided by the WFOE under the aforementioned Loan

Agreement.

Exclusive Option Agreement with Chen

Mingzhe. Through the WFOE, we are a party to an exclusive

option agreement with CBMG Shanghai and Chen Mingzhe dated October

26, 2016, under which: (i) Chen Mingzhe granted the WFOE an

irrevocable and exclusive right to purchase, or designate another

person to purchase the entire equity interest in CBMG Shanghai for

an aggregate purchase price to be determined; and (ii) any proceeds

obtained by Chen Mingzhe through the above equity transfer in CBMG

Shanghai shall be used for the payment of the loan provided by the

WFOE under the aforementioned Loan Agreement.

Power of Attorney from Lu Junfeng.

Through the WFOE, we are the recipient of a power of attorney

executed by Lu Junfeng on October 26, 2016, in accordance with

which Lu Junfeng authorized the WFOE to act on his behalf as his

exclusive agent with respect to all matters concerning his equity

interest in CBMG Shanghai, including without limitation attending

the shareholders’ meetings of CBMG Shanghai, exercising

voting rights and designating and appointing senior executives of

CBMG Shanghai.

Power of Attorney from Chen Mingzhe.

Through the WFOE, we are the recipient of a power of attorney

executed by Chen Mingzhe on October 26, 2016, in accordance with

which Chen Mingzhe authorized the WFOE to act on his behalf as his

exclusive agent with respect to all matters concerning his equity

interest in CBMG Shanghai, including without limitation attending

the shareholders’ meetings of CBMG Shanghai, exercising

voting rights and designating and appointing senior executives of

CBMG Shanghai.

Equity Interest Pledge Agreement with Lu

Junfeng. Through the WFOE, we are a party to an equity

interest pledge agreement with CBMG Shanghai and Lu Junfeng dated

October 26, 2016, in accordance with which: (i) Lu Junfeng pledged

to the WFOE the entire equity interest he holds in CBMG Shanghai as

security for payment of the consulting and service fees by CBMG

Shanghai under the Exclusive Business Cooperation Agreement; (ii)

Lu Junfeng and CBMG Shanghai submitted all necessary documents

to ensure the registration of the Pledge of the Equity Interest

with the State Administration for Industry and Commerce (SAIC) and

the pledge became effective on November 22, 2016; and (iii) on

the occurrence of any event of default, unless it has been

successfully resolved within 20 days after the delivery of a

rectification notice by the WFOE, the WFOE may exercise its pledge

rights at any time by a written notice to Lu Junfeng.

Equity Interest Pledge Agreement with Chen

Mingzhe. Through the WFOE we are a party to an equity

interest pledge agreement with CBMG Shanghai and Chen Mingzhe dated

October 26, 2016, in accordance with which: (i) Chen Mingzhe

pledged to the WFOE the entire equity interest he holds in CBMG

Shanghai as security for payment of the consulting and service fees

by CBMG Shanghai under the Exclusive Business Cooperation

Agreement; (ii) Chen Mingzhe and CBMG Shanghai submitted all

necessary documents to ensure the registration of the Pledge of the

Equity Interest with SAIC, and the pledge became effective

on November 22, 2016; and (iii) on the occurrence of any event

of default, unless it has been successfully resolved within 20 days

after the delivery of a rectification notice by the WFOE, the WFOE

may exercise its pledge rights at any time by a written notice to

Chen Mingzhe.

Our

relationship with our controlled VIE entity, CBMG Shanghai,

through the VIE agreements, is subject to various operational and

legal risks. Management believes that Chen and Lu, as record

holders of the VIE’s registered capital, have no interest in

acting contrary to the VIE agreements. However, if Chen and Lu as

shareholders of the VIE entity were to reduce or eliminate their

ownership of the registered capital of the VIE entity, their

interests may diverge from that of CBMG and they may seek to act in

a manner contrary to the VIE agreements (for example by controlling

the VIE entity in such a way that is inconsistent with the

directives of CBMG management and the board; or causing non-payment

by the VIE entity of services fees). If such circumstances were to

occur the WFOE would have to assert control rights through the

powers of attorney and other VIE agreements, which would require

legal action through the PRC judicial system. While we believe the

VIE agreements are legally enforceable in the PRC, there is a risk

that enforcement of these agreements may involve more extensive

procedures and costs to enforce, in comparison to direct equity

ownership of the VIE entity. We believe based on the advice of

local counsel that the VIE agreements are valid and in compliance

with PRC laws presently in effect. Notwithstanding the foregoing,

if the applicable PRC laws were to change or are interpreted by

authorities in the future in a manner which challenges or renders

the VIE agreements ineffective, the WFOE’s ability to control

and obtain all benefits (economic or otherwise) of ownership of the

VIE entity could be impaired or eliminated. In the event of such

future changes or new interpretations of PRC law, in an effort to

substantially preserve our rights we may have to either amend our

VIE agreements or enter into alternative arrangements which comply

with PRC laws as interpreted and then in effect.

For

further discussion of risks associated with the above, please see

Item 1A – Risk Factors under the subheading “Risks

Related to Our Structure.”

11

BIOPHARMACEUTICAL BUSINESS

The biopharmaceutical business was founded in 2009

by a team of seasoned Chinese-American executives, scientists and

doctors. In 2010, we established a facility designed and built to

comply with China’s GMP standards in Wuxi, China, and in

2012, we established a U.S. FDA

compliant manufacturing facility in Shanghai. In November 2017, we

opened our Zhangjiang facility in Shanghai, of which 40,000 square

feet, or 35% of the total facility, was designed and built to GMP

standards and dedicated to advanced cell manufacturing. Our focus

has been to serve the rapidly growing health care market initially

in China by marketing and commercializing immune cell and stem cell

therapeutics, related tools and products from our patent-protected

homegrown and acquired cell technology, as well as by utilizing

in-licensed and other acquired intellectual properties before

shifting our attention to serve the mature and highly competitive

health care market in the U.S. We continue to explore new

products and gene therapies that may require the investment of a

material amount of assets.

Our

current treatment focal points are cancer and KOA.

Cancer. We are focusing our clinical development

efforts on B-cell maturation antigen (BCMA)-specific, and CD20

CAR-T therapies, T-cells with genetically engineered T-cell

receptor (TCR-Ts) and tumor infiltrating lymphocytes (TILs)

technologies. As discussed above in Item 1 – Business, under

the subheading “Overview,” we entered into the Novartis

LCA in September of 2018. With the execution of the Novartis LCA,

we have prioritized our efforts on working with Novartis to bring

Kymriah®

to patients in China as soon as

practicable. In light of our collaboration with Novartis, we will

no longer pursue our own ALL and DLBCL biologics license

application submission with the NMPA.

On the research and development side, we seek to bring our CD22

CAR-T, CD20 CAR-T for CD19 CAR-T Relapsing NHL, CD19-CD20

bispecific CAR-T product, BCMA CAR-T for Multiple Myeloma (MM),

NKG2D CAR-T for acute myeloid leukemia (AML), AFP TCR-T for HCC and

neoantigen reactive TIL on solid tumors, respectively, in

first-in-human trial as soon as possible. We plan to continue

leveraging our cutting-edge Chemistry, Manufacturing and Control

(CMC) platform, as well as our Quality Management System and our

strong scientific expertise in the U.S and in China, to collaborate

with multinational pharmaceutical companies to co-develop cell

therapies in China.

KOA. In 2013, we completed a Phase I/IIa clinical

study, in China, for our KOA therapy named

ReJoin®.

The trial tested the safety and efficacy of intra-articular

injections of autologous haMPCs in order to reduce inflammation and

repair damaged joint cartilage. Since 2013, we have continued

clinical studies on ReJoin® and

our trial data has demonstrated positive results on the performance

of ReJoin®.

Our ReJoin® human

adipose-derived mesenchymal progenitor cell (haMPC) therapy for KOA

is an interventional therapy using our proprietary process, culture

and medium.

Our

process is distinguishable from sole Stromal Vascular Fraction

(SVF) therapy. The immunophenotype of our haMPCs exhibited a

homogenous population expressing multiple biomarkers such as CD73+,

CD90+, CD105+, HLA-DR-, CD14-, CD34- and CD45-. In contrast, SVF is

merely a heterogeneous fraction including preadipocytes,

endothelial cells, smooth muscle cells, pericytes, macrophages,

fibroblasts and adipose-derived stem cells.

In January 2016, we launched the Allogeneic KOA

Phase I Trial in China to evaluate the safety and efficacy of

AlloJoin®,

an off-the-shelf allogeneic adipose derived progenitor cell (haMPC)

therapy for the treatment of KOA. On August 5, 2016, we completed

patient treatment for the Allogeneic KOA Phase I trial, and on

December 9, 2016, we announced interim three-month safety data from

the Allogenic KOA Phase I Trial in China. The interim analysis of

the trial has demonstrated a preliminary safety and tolerability

profile of AlloJoin® in

the three doses tested, and no serious adverse events (SAE) have

been observed. On March 16, 2018, we announced a positive 48-week

AlloJoin® Phase

I data in China, which demonstrated good safety and early efficacy

for the slowing of cartilage deterioration. China finalized its

cell therapy regulatory pathway in December 2017. Our

AlloJoin®

IND application to conduct a Phase II

clinical trial with the NMPA was been approved in January 2019 and

we launched our Phase II AlloJoin®

clinical trial on September 12, 2019. On September 27, 2019, we received the

ReJoin®

therapy application acceptance for

Phase II clinical trials by the NMPA.

We

established adult adipose-derived progenitor cell and

immuno-oncology cellular therapy platforms in treating specific

medical conditions and diseases. Our Quality Management Systems

(QMS) have been assessed and certified to meet the requirements of

ISO 9001: 2015, and a quality manual based on GMP guidelines has

been finalized. The facilities, utilities and equipment in both

Zhangjiang and Wuxi Sites have been calibrated and/or qualified and

in compliance with requirements of local health authorities. We

installed an Enterprise Quality Management System (EQMS) in April

2019 to facilitate the quality activities. A document management

system and Laboratory Information Management System (LIMS) will be

installed and qualified in early 2020.

Our

proprietary manufacturing processes and procedures include (i)

banking of allogenic cellular product and intermediate product;

(ii) manufacturing process of GMP-grade viral vectors; (iii)

manufacturing process of GMP-grade cellular product; and (iv)

analytical testing to ensure the safety, identity, purity and

potency of cellular products.

Recent Developments in Adoptive Immune Cell Therapy

(ACT)

The

immune system plays an essential role in cancer development and

growth. In the past decade, immune checkpoint blockade has

demonstrated a major breakthrough in cancer treatment and has

currently been approved for the treatment of multiple tumor types.

Adoptive immune cell therapy (ACT) with tumor-infiltrating

lymphocytes (TIL) or gene-modified T-cells expressing novel T cell

receptors (TCR) or chimeric antigen receptors (CAR) is another

strategy to modify the immune system to recognize tumor cells and

thus carry out an anti-tumor effector function.

The

TILs consist of tumor-resident T-cells which are isolated and

expanded ex vivo after surgical resection of the tumor. Thereafter,

the TILs are further expanded in a rapid expansion protocol (REP).

Before intravenous adoptive transfer into the patient, the patient

is treated with a lymphodepleting conditioning regimen. TCR gene

therapy and CAR gene therapy are ACT with genetically modified

peripheral blood T-cells. For both treatment modalities, peripheral

blood T-cells are isolated via leukapheresis. These T-cells are

then transduced by viral vectors to either express a specific TCR

or CAR. These treatments have shown promising results in various

tumor types.

12

CAR-Ts

According to the

U.S. National Cancer Institute’s 2013 cancer topics research

update on CAR-T-Cells, excitement is growing for

immunotherapy—therapies that harness the power of a

patient’s immune system to combat their disease, or what some

in the research community are calling the “fifth

pillar” of cancer treatment.

One

approach to immunotherapy involves engineering patients’

own immune cells to recognize and attack their tumors. This

approach is called adoptive cell transfer (ACT). ACT’s

building blocks are T cells, a type of immune cell collected

from the patient’s own blood. One of the well-established ACT

approaches is CAR-T cancer therapy. After collection, the

T-cells are genetically engineered to produce special

receptors on their surface called chimeric antigen receptors

(CARs). CARs are proteins that allow the T-cells to recognize

a specific protein (antigen) on tumor cells. These engineered

CAR-T-cells are then grown until the number reaches dose level. The

expanded population of CAR-T-cells is then infused into the

patient. After the infusion, if all goes as planned, the

T-cells multiply in the patient’s body and, with

guidance from their engineered receptor, recognize and kill

cancer cells that harbor the antigen on their surfaces. This

process builds on a similar form of ACT pioneered from

NCI’s Surgery Branch for patients with advanced

melanoma. In 2013, NCI’s Pediatric Oncology Branch

commented that the CAR-T-cells are much more potent

than anything they can achieve with other immuno-based

treatments being studied. Although investigators working in

this field caution that there is still much to learn about CAR

T-cell therapy, the early results from trials like these have

generated considerable optimism.

CAR-T

cell therapies, such as anti-CD19 CAR-T and anti-BCMA CAR-T, have

been tested in several hematological indications on patients

that are refractory/relapsing to chemotherapy, and many of

them have relapsed after stem cell transplantation. All

of these patients had limited treatment options prior to

CAR-T therapy. CAR-T has shown encouraging clinical efficacy

in many of these patients, and some of them have had durable

clinical response for years. However, some adverse effects, such as

cytokine release syndrome (CRS) and neurological toxicity, have

been observed in patients treated with CAR-T-cells. For example, in

July 2016, Juno Therapeutics, Inc. reported the death of

patients enrolled in the U.S. Phase II clinical trial of

JCAR015 (anti-CD19 CAR-T) for the treatment of relapsed or

refractory B cell acute lymphoblastic leukemia (B-ALL). The

U.S. FDA put the trial on hold and lifted the hold within

a week after Juno provided a satisfactory explanation and

solution. Juno attributed the cause of patient deaths to the

use of Fludarabine preconditioning and they switched to use

only cyclophosphamide pre-conditioning in subsequent

enrollment.

In

August 2017, the U.S. FDA approved Novartis’

Kymriah®

(tisagenlecleucel) a CD19-targeted CAR-T therapy, for the treatment

of patients up to 25 years old for relapsed or refractory (r/r)

acute lymphoblastic leukemia (ALL), the most common cancer in

children. Current treatments show a rate of 80% remission

using intensive chemotherapy. However, there are almost

no conventional treatments to help patients who have

relapsed or are refractory to traditional treatment.

Kymriah® has shown

results of complete and long lasting remission, and was the

first U.S. FDA-approved CAR-T therapy. In October 2017, the

U.S. FDA approved Kite Pharmaceuticals’ (Gilead) CAR-T

therapy for diffuse large B-cell lymphoma (DLBCL) the most

common type of NHL in adults. The initial results

of axicabtagene ciloleucel (Yescarta), the prognosis of

high-grade chemo refractory NHL, is dismal with a medium

survival time of a few weeks. Yescarta is a therapy

for patients who have not responded to or who have relapsed

after at least two other kinds of treatment.

In May

2018, the U.S. FDA approved Novartis’ Kymriah® for intravenous

infusion for its second indication—the treatment of adult

patients with relapsed or refractory (r/r) large B-cell lymphoma

after two or more lines of systemic therapy including diffuse large

B-cell lymphoma (DLBCL) not otherwise specified, high grade B-cell

lymphoma and DLBCL arising from follicular lymphoma.

Kymriah® is now the only

CAR-T cell therapy to receive U.S. FDA approval for two distinct

indications in non-Hodgkin lymphoma (NHL) and B-cell ALL. On

September 25, 2018, we entered into the Novartis LCA with Novartis

to manufacture and supply Kymriah® to Novartis in

China.

Besides

anti-CD19 CAR-T, anti-BCMA CAR-T has shown promising clinical

efficacy in treatment of multiple myeloma. For example, bb2121, a

CAR-T therapy targeting BCMA, has been developed by Bluebird bio,

Inc. and Celgene for previously treated patients with multiple

myeloma. Based on preliminary clinical data from the ongoing Phase

I study CRB-401, bb2121 has been granted Breakthrough Therapy

Designation by the U.S. FDA and PRIME eligibility by the European

Medicines Agency (EMA) in November 2017. We plan to initiate our

anti-BCMA CAR-T investigator initiated trial in the near

future.

Recent

progress in Universal Chimeric Antigen Receptor (UCAR) T-cells

showed benefits such as ease of use, availability and the drug

pricing challenge. Currently, most therapeutic UCAR products are

being developed with gene editing platforms such as CRISPR or

TALEN. For example, UCART19 is an allogeneic CAR T-cell product

candidate developed by Cellectis for treatment of CD19-expressing

hematological malignancies. UCART19 Phase I clinical trials started

in adult and pediatric patients in Europe in June 2016 and in the

U.S. in 2017. The use of UCAR may has the potential to overcome the

limitation of the current autologous approach by providing an

allogeneic, frozen, “off-the-shelf” T-cell product for

cancer treatment.

TILs

While

CAR-T cell therapy has proven successful in treatment of several

hematological malignancies, other cell therapy approaches,

including Tumor Infiltrating Lymphocytes (TIL) are being developed

to treat solid tumors. For example, Iovance Biotherapeutics is

focused on the development of autologous tumor-directed TILs for

treatments of patients with various solid tumor indications.

Iovance is conducting several Phase II clinical trials to

assess the efficacy and safety of autologous TIL for treatment of

patients with Metastatic Melanoma, Squamous Cell Carcinoma of the

Head and Neck, Non-Small Cell Lung Cancer (NSCLC) and Cervical

Cancer in the U.S. and Europe.

13

TCRs

Adaptimmune is

partnering with GlaxoSmithKline to develop TCR-T

therapy targeting the NY-ESO-1 peptide, which is present across

multiple cancer types. Their NY-ESO SPEAR T-cell has been used in

multiple Phase I/II clinical trials in patients with solid tumors

and haematological malignancies, including synovial sarcoma, myxoid

round cell liposarcoma, multiple myeloma, melanoma, NSCLC and

ovarian cancer. The initial data suggested positive clinical

responses and evidence of tumor reduction in patients. NY-ESO

SPEART T-cell has been granted breakthrough therapy designation by

the U.S. FDA and PRIME regulatory access in Europe.

Adaptimmune’s other TCR-T product, AFP SPEAR T-cell targeting

AFP peptide, is aimed at the treatment of patients with

hepatocellular carcinoma (HCC). AFP SPEAR T-cell is in a Phase I

study and enrolling HCC patients in the U.S.

CBMG’s Adoptive Immune Cell Therapy (ACT)

Programs

In

December 2017, the Chinese government issued trial guidelines

concerning the development and testing of cell therapy products in

China. Although these trial guidelines are not yet codified as

mandatory regulation, we believe they provide a measure of clarity

and a preliminary regulatory pathway for our cell therapy

operations in an uncertain regulatory environment. On April 18 and

April 21, 2018, the Center for Drug

Evaluation (CDE) posted on its website acceptance of the IND

application for CAR-T cancer therapies in treating patients with

NHL and adult ALL submitted by the Company’s wholly-owned

subsidiaries, CBMG Shanghai and Shanghai Cellular Biopharmaceutical

Group Ltd. On September 25, 2018 we entered into Novartis LCA to

manufacture and supply Kymriah® in China. As

part of the deal, Novartis took approximately a 9% equity stake in

CBMG, and CBMG is discontinuing development of its own anti-CD19

CAR-T cell therapy. This collaboration with Novartis reflects our

shared commitment to bringing the first marketed CAR-T cell

therapy, Kymriah®, a

transformative treatment option currently approved in the U.S., EU

and Canada for two difficult-to-treat cancers, to China, where the

number of patients in need remains the highest in the world.

Together with Novartis, we plan to bring the first CAR-T cell

therapy to patients in China as soon as possible. We continue to

develop CAR-T therapies other than CD 19 on our own and Novartis

has the first right of negotiation on these CAR-T developments. The

CBMG oncology pipeline includes CAR-T targeting CD20-, CD22- and

B-cell maturation antigen (BCMA), AFP TCR-T, which could

specifically eradicate AFP positive HCC tumors and TIL

technologies. Our current priority is to collaborate with Novartis

to bring Kymriah® to China. At

the same time, we remain committed to developing our existing

pipeline of immunotherapy candidates for hematologic and solid

tumor cancers to help deliver potential new treatment options for

patients in China. We are striving to build a competitive research

and development function, a translational medicine unit, along with

a well-established cellular manufacturing capability and ample

capacity, to support Kymriah® in China and

our development of multiple assets in multiple indications. We

believe that these efforts will allow us to boost the

Company’s Immuno-Oncology presence. We initiated a clinical

trial to evaluate anti-BCMA CAR-T therapy in Multiple Myeloma

(“MM”) and started first in-human studies for multiple

CAR-T and TCR-T programs in 2019.

Market for Immune Cell Therapies

Our immune cell therapies involve the genetic engineering of

T-cells to express either chimeric antigen receptors, or CARs, or T

cell receptors, or TCRs and TIL. These T-cells are designed to

recognize and attack cancer cells. Kymriah is a type of immune cell therapy that is made from

a patient’s own white blood cells and is a prescription

cancer treatment used in patients up to 25 years old who have acute

lymphoblastic leukemia that is either relapsing or is refractory.

It is also used in patients with non-Hodgkin lymphoma that has

relapsed or is refractory after having at least two other kinds of

treatment. On August 30, 2017, Kymriah was approved by the U.S. FDA

for the treatment of children and young adults with ALL. By October

18, 2017, the U.S. FDA granted

approval for Yescarta for treating patients with

relapsed/refractory diffuse large B-cell lymphoma (r/rDLBCL) and

other rare large B-cell lymphomas. On May 1, 2018, the

U.S.FDA approved Kymriah for a second

indication (diffuse large B-cell lymphoma). In August 2018, Kymriah

and Yescarta secured European Union approval for the treatment of

blood cancers, including B-cell acute lymphoblastic leukemia (ALL)

and relapsed or refractory diffuse large B-cell lymphoma (DLBCL).

Health Canada approved Kymriah as the first CAR-T therapy in Canada

and the Therapeutic Goods Administration (TGA) approved it as the

first CAR-T therapy in Australia.

In 2019, 1,762,450 new cancer cases and 606,880 cancer deaths are

projected to occur in the U.S. According to a 2018 International

Agency for Cancer publication, China, as the most populous country

in the world with an estimated population of nearly 1.42 billion,

is projected to have around 4.51 million cancer cases and 3.04

million cancer death by year 2020. A 2018 Global Cancer

Statistics Cancer Communications report states that compared (the

2018 Global Cancer Statistics Report) to the U.S. and UK, China has

a 30% and 40% higher cancer mortality among which 36.4% of the

cancer-related deaths were from the digestive tract cancers

(stomach, liver and esophagus cancer) and have relatively poorer

prognoses.

The

2018 Global Cancer Statistics Report also reported that in 2018,

lung cancer was the most diagnosed cancer type worldwide and in

China with 2,093,8761 and

733,3002

new cases respectively. HCC is the 4th most common cancer in

China and more than 50% of new HCC cases world-wide are in China.

About 466,000 new liver cancer cases each year and the mortality is

around 343,7003 annually in China.

Chen et al. In 2018, it was estimated about 510,000 new case of Non

Hopkins lymphoma (NHL) and 248,724 patients died from NHL

worldwide.4

Multiple

myeloma accounts for 1% of all cancers and approximately 10%

of all hematological malignancies.5 In 2016 there

were about 138,509 incident cases worldwide. The United States had

the most cases (about 24,407) and the most deaths (about 14,212),

China was the second in both measures which incident cases were

about 16,537 and deaths about 10,363. The global incidence of

multiple myeloma rose by 126% from 1990 to 2016. East Asia (China,

North Korea, and Taiwan) saw incident cases of multiple myeloma

jump by 262%, which was the largest increase among any of the 21

global regions.6

1 Chen et al. CA Cancer J Clin.

2016; 66:155-132

2 Bray F et al. CA Cancer J Clin.

2018: 68:394-424

3 Chen et al. CA Cancer J Clin.

2016; 66:155-132

4 Bray F et al. CA Cancer J Clin.

2018: 68:394-424

5 Moreau P et al., Annals of Oncol.

24 (Supplement 6): vi133–vi137, 2013)

6 Cowan AJ et al., JAMA

Oncol. 2018;4(9):1221-1227

14

Market for Stem Cell-Based Therapies

The U.S. forecast is that shipments of treatments with stem cells,

or instruments which concentrate stem cell preparations for

injection into painful joints, will fuel an overall increase in the

use of stem cell based treatments resulting in an increase to $5.7

billion in 2020, with key growth areas being Spinal Fusion, Sports

Medicine and Osteoarthritis of the joints. Osteoarthritis (OA) is a

chronic disease that is characterized by degeneration of the

articular cartilage, hyperosteogeny and, ultimately, joint

destruction that can affect all of the joints. According to a paper

published by Dillon CF, Rasch EK, Gu Q et

al. entitled, “Prevalence of knee

osteoarthritis in the United States: Arthritis Data from the Third

National Health and Nutrition Examination Survey,” the

incidence of OA is 50% among people over age 60 and 90% among

people over age 65. KOA accounts for the majority of total OA

conditions and in adults, OA is the second leading cause of work

disability and the disability incidence rate is high (53%). The

costs of OA management has grown exponentially over recent decades,

accounting for up to 1% to 2.5% of the gross national product of

countries with aging populations, including the U.S., Canada, the

UK, France and Australia. According to the American Academy of

Orthopedic Surgeons (AAOS), the only pharmacologic therapies

recommended for OA symptom management are non-steroidal

anti-inflammatory drugs (NSAIDs) and tramadol (for patients with

symptomatic osteoarthritis). Moreover, there is no approved disease

modification therapy for OA in the world. Disease progression is a

leading cause of hospitalization and ultimately requires joint

replacement surgery. According to an article published by the

Journal of the American Medical Association, approximately 505,000

hip replacements and 723,000 knee replacements were performed in

the United States in 2014, collectively costing more than $20

billion. International regulatory guidelines on clinical

investigation of medicinal products used in the treatment of OA

were updated in 2015, and clinical benefits (or trial outcomes) of

a disease modification therapy for KOA has been well defined and

recommended. Medicinal products used in the treatment of

osteoarthritis need to provide both a symptom relief effect for at

least six months and a structure modification effect to slow

cartilage degradation by at least 12 months. Symptom relief is

generally measured by a composite questionnaire, the Western

Ontario and McMaster Universities Osteoarthritis Index (WOMAC)

score, and structure modification is measured by MRI, or

radiographic image as accepted by international communities. The

Company uses the WOMAC as the primary end point to demonstrate

symptom relief, and MRI to assess structure and regeneration

benefits as a secondary endpoint.

According to the Foundation for the National Institutes of Health,

there are 27 million Americans with Osteoarthritis (OA), and

symptomatic Knee Osteoarthritis (KOA) occurs in 13% of persons aged

60 and older. According to a nationwide population-based

longitudinal survey among the Chinese retired population,

approximately 8.1% of participants were found to suffer from

symptomatic knee OA. Currently no treatment exists that can

effectively preserve knee joint cartilage or slow the progression

of KOA.

According to Alternative and Integrative

Medicine, 53% of KOA patients

will degenerate to the point of disability. Conventional treatment

usually involves invasive surgery with painful recovery and

physical therapy and replacement surgeries are typically only

suggested and performed on patients in the late stage of

KOA.

Our Global Strategy

CBMG is a drug development company focusing on developing cell

therapies first in China, to take advantage of cost efficiencies,

leveraging the expeditious Investigator Initiated Trials

(“IIT”) process in China, publish and share our data in

major conferences and scientific journals and then address the

rest-of-the-world market after safety and efficacy of those

programs are established. Our goal is to develop safe and effective

cellular therapies for indications that represent a large unmet

need in China. We intend to use our first-mover advantage in China,

against a backdrop of enhanced regulation by the central

government, to differentiate ourselves from the competition and

establish a leading position in the China cell therapeutic market.

We intend to invest and expand our clinical research capabilities

by building drug development and manufacturing infrastructure in

China and in the U.S., expanding our clinical research platform,

hiring new talent and enhancing our existing coverage. We believe

that few competitors in China are as well-equipped as we are in the

areas of clinical trial development, internationally compliant

manufacturing, quality assurance and control, as well as our

dedication to regulatory compliance and process

improvement.

The key issues with cell therapy as modality are drug

therapeutic index, institutionalized, scalable manufacturing and an