Attached files

| file | filename |

|---|---|

| EX-32 - CERTIFICATION - Cellular Biomedicine Group, Inc. | cbmg_ex32.htm |

| EX-31 - CERTIFICATION - Cellular Biomedicine Group, Inc. | cbmg_ex31.htm |

| EX-21 - SUBSIDIARIES - Cellular Biomedicine Group, Inc. | cbmg_ex21.htm |

| EX-23.1 - CONSENT - Cellular Biomedicine Group, Inc. | cbmg_ex231.htm |

| EX-23.2 - CONSENT - Cellular Biomedicine Group, Inc. | cbmg_ex232.htm |

| EX-10.39 - CONSULTING AGREEMENT - Cellular Biomedicine Group, Inc. | cbmg_ex1039.htm |

| EX-10.46 - CLINICAL TRIAL AGREEMENT - Cellular Biomedicine Group, Inc. | cbmg_ex1046.htm |

| EX-10.45 - PATENT TRANSFER AGREEMENT - Cellular Biomedicine Group, Inc. | cbmg_ex1045.htm |

| EX-10.43 - TECHNOLOGY TRANSFER CONTRACT - Cellular Biomedicine Group, Inc. | cbmg_ex1043.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

———————

FORM 10-K

———————

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2015

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number: 001-36498

———————

CELLULAR BIOMEDICINE GROUP, INC.

(Exact name of registrant as specified in its charter)

———————

|

Delaware

|

86-1032927

|

|

|

State of Incorporation

|

IRS Employer Identification No.

|

19925 Stevens Creek Blvd., Suite 100

Cupertino, California 95014

(Address of principal executive offices)

(408) 973-7884

(Registrant's telephone number)

Securities registered pursuant to Section 12(b) of the Exchange Act:

Common Stock, par value $.001 per share

Securities registered pursuant to Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

þ

|

||

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes þ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter – $296,012,116 as of June 30, 2015.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date: As of February 29, 2016, there were 11,983,688 shares of common stock, par value $.001 per share issued and outstanding.

Documents Incorporated By Reference –None

CELLULAR BIOMEDICINE GROUP, INC.

FORM 10-K ANNUAL REPORT

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2015

TABLE OF CONTENTS

|

Page

|

|||||

|

ITEM 1.

|

BUSINESS

|

4

|

|||

|

ITEM 1A.

|

RISK FACTORS

|

32

|

|||

|

ITEM 2.

|

PROPERTIE

|

68

|

|||

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

68

|

|||

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

68

|

|||

|

ITEM 5.

|

MARKET FOR REGISTRANT'S COMMON STOCK, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

69

|

|||

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

74

|

|||

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

76

|

|||

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

92

|

|||

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

93

|

|||

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

93

|

|||

|

ITEM 9A.

|

CONTROLS AND PROCEDURES

|

94

|

|||

|

ITEM 9B.

|

OTHER INFORMATION

|

95

|

|||

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

96

|

|||

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

106

|

|||

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

116

|

|||

|

ITEM 13.

|

CERTAIN RELATIONSHIPS, RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

119

|

|||

|

ITEM 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

120

|

|||

|

ITEM 15.

|

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

122

|

|||

|

SIGNATURES

|

125

|

||||

3

Cautionary Note Regarding Forward-looking Statements and Risk Factors

This annual report on Form 10-K of the Company may contain forward-looking statements which reflect the Company's current views with respect to future events and financial performance. The words "believe," "expect," "anticipate," "intends," "estimate," "forecast," "project," and similar expressions identify forward-looking statements. All statements other than statements of historical fact are statements that could be deemed to be forward-looking statements, including plans, strategies and objectives of management for future operations; proposed new products, services, developments or industry rankings; future economic conditions or performance; belief; and assumptions underlying any of the foregoing. Such "forward-looking statements" are subject to risks and uncertainties set forth from time to time in the Company's SEC reports and include, among others, the Risk Factors set forth under Item 1A below.

The risks included herein are not exhaustive. This annual report on Form 10-K filed with the SEC include additional factors which could impact the Company's business and financial performance. Moreover, the Company operates in a rapidly changing and competitive environment. New risk factors emerge from time to time and it is not possible for management to predict all such risk factors. Further, it is not possible to assess the impact of all risk factors on the Company's business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Readers are cautioned not to place undue reliance on such forward-looking statements as they speak only of the Company's views as of the date the statement was made. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

|

ITEM 1. BUSINESS.

|

As used in this annual report, "we", "us", "our", "CBMG", "Company" or "our company" refers to Cellular Biomedicine Group, Inc. and, unless the context otherwise requires, all of its subsidiaries.

Overview

Cellular Biomedicine Group, Inc. is a biomedicine company, principally engaged in the development of new treatments for cancerous and degenerative diseases utilizing proprietary cell-based technologies. Our technology includes two major cell platforms: (i) Immune Cell therapy for treatment of a broad range of cancers using Vaccine, T Cells Receptor ("TCR") clonality analysis technology, and T Central Memory Cell ("Tcm") preparation methodologies, Chimeric Antigen Receptor T cell (“CAR-T”), and (ii) human adipose-derived mesenchymal progenitor cells (“haMPC”) for treatment of joint and autoimmune diseases, with primary research and manufacturing facilities in China.

We are focused on developing and marketing safe and effective cell-based therapies based on our cellular platforms, to treat serious chronic and degenerative diseases such as cancer, orthopedic diseases (including osteoarthritis and tissue damage), various inflammatory diseases and metabolic diseases. We have developed proprietary practical knowledge in the use of cell-based therapeutics that we believe could be used to help a great number of people suffering from cancer and other serious chronic diseases. We are conducting clinical studies in China for two stem cell based therapies to treat knee osteoarthritis (“KOA”) and Cartilage Defect (“CD”). We have completed Phase IIb autologous haMPC KOA clinical study and published its promising results. Led by Shanghai Renji Hospital, one of the largest teaching hospitals in China, we have launched Phase I clinical trial of an off-the-shelf allogeneic haMPC (AlloJoinTM) therapy for KOA .We have also initiated preclinical studies in Asthma and Chronic Obstructive Pulmonary Disease ("COPD").

4

Our primary target market is Greater China. We believe that the results of our research studies and the acquired knowhow and clinical data will support expanded preclinical and clinical trials with a larger population of patients, which we expect to carry out through authorized treatment centers throughout Greater China. With the recent acquisition of the University of South Florida’s license on the next generation GVAX vaccine’s (“CD40LGVAX”) and its related technologies and technical knowledge, we have expanded our comprehensive immuno-oncology cell therapy portfolio with cancer immunotherapy vaccine and vaccine combination technology platform and broadened our potential treatment options for patients. We plan to evaluate a return of investment on any U.S. sponsorship of the phase l/ll clinical study to support a U.S. New Drug Application (NDA) for the combination of CD40LGVAX, a next generation cancer vaccine, with nivolumab, an anti-PD1 checkpoint inhibitor, to treat unresectable stage IV non-small cell lung cancer (“NSCLC”), (collectively “U.S. CD40LGVAX Trial”). We may also seek approval to conduct clinical trials with leading non-U.S. medical centers or seek partnership for CD40LGVAX sub-license opportunities.

With our 2014 acquisition of Agreen Biotech Co. Ltd. ("AG"), we are generating an increasing amount of technical services revenue comprised of TCR clonality analysis technology and Tcm and Dendritic Cell ("DC") preparation methodologies. AG is a biotech company with operations in China, engaged in the development of treatments for cancerous diseases utilizing proprietary cell technologies, which include preparation of subset T Cell and clonality assay platform technology for treatment of a broad range of cancers by AG’s primary hospital partner, Jilin Hospital. We are expanding the hospital partnerships business model to a few additional hospitals in the densely populated northeast China region in Beijing, Shanxi, Shandong and Anhui Province. With recent build-up of our Vaccine, Tcm, TCR clonality, CAR-T and anti-PD-1 technologies we are evaluating and prioritizing our cancer clinical trial indications for commercialization using safe and most effective therapy or combination therapies. We are integrating CBMG's state-of-the art infrastructure and clinical platform with the aforementioned acquired technologies to boost the Company's Immuno-Oncology presence, and pave the way for future partnerships. We plan to initiate certain cancer clinical trials in China upon receiving acceptance of the clinical trial designs with the principal investigator and obtaining the requisite approvals. We have yet to derive revenue from our CAR-T technologies.

Corporate History

Cellular Biomedicine Group, Inc., a Delaware corporation (formerly known as EastBridge Investment Group Corporation), was originally incorporated in the State of Arizona on June 25, 2001. The Company's principal activity through June 30, 2005 was to manufacture mobile entertainment products.

In 2005, the Company decided to exit the mobile entertainment market and dedicate its activities to providing investment related services in Asia, with a strong focus on high GDP growth countries, such as China. The Company concentrated its efforts in the Far East (Hong Kong, mainland China, Australia) and in the United States and sought to provide consulting services necessary for small to medium-size companies to obtain capital to grow their business, either to become public companies in the United States or to find joint venture partners or raise capital to expand their businesses

On February 6, 2013, and as further described below, we completed a merger to acquire Cellular Biomedicine Group Ltd.:

In connection with the Merger, effective on March 5, 2013, the Company (formerly named “EastBridge Investment Group Corporation”) changed its name to “Cellular Biomedicine Group, Inc.” In addition in March 2013 we changed our corporate headquarters to 530 University Avenue, #17, Palo Alto, California 94301.

5

From February 6, 2013 to June 23, 2014, we operated the Company in two separate reportable segments: (i) Biomedicine Cell Therapy (“Biomedicine”); and (ii) Financial Consulting (“Consulting”). The Consulting segment was conducted through EastBridge Sub. On June 23, 2014, the Company announced the discontinuation of the Consulting segment as it no longer fit into management’s long-term strategy and vision. The Company is continuing to focus its resources on becoming a biotechnology company bringing therapies to improve the health of patients in China.

On September 26, 2014, the Company completed its acquisition of Beijing Agreen Biotechnology Co. Ltd. ("AG") and the U.S. patent held by AG’s founder. AG is a biotech company with operations in China, engaged in the development of treatments for cancerous diseases utilizing proprietary cell technologies, which include without limitation, preparation of subset T Cell and clonality assay platform technology for treatment of a broad range of cancers at AG’s served hospital, Jilin Hospital.

At the end of September 2015, the Company moved its corporate headquarters to 19925 Stevens Creek Blvd., Suite 100 in Cupertino, California.

Merger with Cellular Biomedicine Group Ltd.

On November 13, 2012, EastBridge Investment Group Corporation (“EastBridge” or “Parent”) and CBMG Acquisition Limited, a British Virgin Islands company and the Company’s wholly-owned subsidiary (“Merger Sub”) entered into an Agreement and Plan of Merger (“Merger Agreement”) by and among EastBridge, Merger Sub and Cellular Biomedicine Group Ltd., a British Virgin Islands company (“CBMG BVI”), as amended on January 15, 2013, January 31, 2013 and February 6, 2013, pursuant to which the parties agreed that Merger Sub shall merge with and into CBMG BVI, with CBMG BVI as the surviving entity. The transactions under the Merger Agreement as amended are referred to as the “Merger”. The Merger was subject to customary closing conditions, including, among other things, (a) approval by the shareholders of CBMG BVI, (b) resignations of the departing directors and officers of EastBridge, Merger Sub and CBMG BVI, and (c) execution of certain ancillary agreements, including, but not limited to, executive employment agreements with EastBridge, compliance certificates, lock up agreement and opinions of counsel, as referenced in Article VII of the Merger Agreement.

On December 20, 2012 CBMG BVI obtained shareholder approval by holding an extraordinary general meeting of the shareholders, in which holders of a majority of its capital stock approved the merger pursuant to British Virgin Islands law. Since the Merger was structured as a triangular merger in which a wholly owned merger subsidiary of EastBridge merged with CBMG BVI, no stockholder approval on the part of the EastBridge stockholders was required under Delaware law. We note that although EastBridge issued in excess of 20% of its shares in the merger, since its shares are not listed on a national exchange, no stockholder approval requirement applied to this transaction under any exchange rules.”

On February 5, 2013, the registrant formed a new Delaware subsidiary named EastBridge Investment Corp. (“EastBridge Sub”). Pursuant to a Contribution Agreement by and between the registrant and EastBridge Sub dated February 5, 2013 (the “Contribution Agreement”), the registrant contributed all assets and liabilities related to its consulting services business, to its newly formed subsidiary, EastBridge Investment Corp., from and after which it continued to conduct the consulting services business and operations of EastBridge at the subsidiary level.

On February 6, 2013 (the “Effective Date”), the Parties executed all documents and filed the Plan of Merger with the registrar of the British Virgin Islands. Upon consummation of the Merger on the Effective Date, CBMG BVI shareholders were issued 3,638,932 shares of common stock, par value $0.001 per share, of EastBridge (the “EastBridge Common Stock”) constituting approximately 70% of the outstanding stock of EastBridge on a fully-diluted basis and the EastBridge stockholders retained 30% of the Company on a fully-diluted basis. Specifically, each of CBMG BVI’s ordinary shares (“CBMG Ordinary Shares”) was converted into the right to receive 0.020019 of a share of EastBridge Common Stock.

6

Reorganization and Share Exchange

Effective January 18, 2013, the Company completed its reincorporation from the State of Arizona to the State of Delaware (the “Reincorporation”). In connection with the Reincorporation, the Company exchanged every 100 shares of the Arizona entity for 1 share of the successor Delaware entity, with the same effect as a 1:100 reverse stock split, which became effective on January 31, 2013. All share and per share information in this Annual Report (including in the above paragraph), unless otherwise specified, reflects this reverse split.

Recent Developments

In January 2015, we initiated patient recruitment to support a phase II clinical study, in China, of ReJoinTM human adipose derived mesenchymal progenitor cell (“haMPC”) therapy for Cartilage Damage (“CD”) resulting from osteoarthritis (“OA”) or sports injury. The study is based on the same science that has shown significant progress in the treatment of Knee Osteoarthritis (“KOA”). Both arthroscopy and the use of magnetic resonance imaging (“MRI”) will be deployed to further demonstrate the regenerative efficacy of ReJoinTM on CD.

On February 4, 2015, the Company announced its agreement related to the acquisition of Chinese PLA General Hospital's ("PLAGH", Beijing, also known as "301 Hospital") Chimeric Antigen Receptor T cell (“CAR-T”) therapy, its recombinant expression vector CD19, CD20, CD30 and Human Epidermal Growth Factor Receptor's (EGFR or HER1) Immuno-Oncology patents applications, and Phase I clinical data of the aforementioned therapies and manufacturing knowledge. The 301 Hospital team has conducted several preliminary clinical studies of various CAR-T constructs targeting CD19-positive acute lymphocytic leukemia, CD20-positive advanced B-cell Non-Hodgkin’s lymphoma, CD30-positive Hodgkin's lymphoma and EGFR-HER1-positive advanced lung cancer, cholangiocarcinoma, pancreatic cancer, and renal cell carcinoma. Pursuant to the terms of the Transfer Agreement, PLAGH agreed to transfer to the Company all of its right, title and interest in and to certain technologies currently owned by PLAGH (including, without limitation, four technologies and their pending patent applications) that relate to genetic engineering of chimeric antigen receptor (CAR)-modified T cells and its applications (collectively, the “Technology”). In addition, PLAGH is responsible for obtaining governmental approval for the clinical trial related to the Technology.

We announced interim Phase IIb trial results for our ReJoinTM haMPC therapy for KOA on March 25, 2015, which confirmed that the primary and secondary endpoints of ReJoin TM therapy groups have all improved significantly compared to their baseline. We released positive 48-week follow-up data in January 2016.

In January 2016, we launched a Phase I clinical trial of an off-the-shelf allogeneic haMPC AlloJoin™ therapy for KOA.

On March 25, 2015, the Company announced results of the Phase I clinical studies on CAR-CD19 (CBM-C19.1) and CAR-CD20 (CBM-C20.1). The Phase I trial data showed an optimistic response rate under controllable toxicities. In comparison with leading clinical research reports on CAR-CD19 therapies by peers, we believe that the efficacy profile of both CBM-C19.1 and CBM-C20.1 therapies are distinguished for the following reasons:

|

I.

|

The patient selection criteria of this study is highly selective. The participants enrolled in the studies were advanced, relapsed, and refractory to other standard-of-care therapies. This selection criterion is highly distinguishable from other studies, which avoided higher risk patients. Most of these high severity patients would not have been eligible for other entities’ studies because of extramedullary involvement or because the presence of bulky tumors were deemed too risky for their trials.

|

7

|

II.

|

The treatment program design of this study is very stringent.

|

|

a.

|

Our higher risk patients did not receive conditioning chemotherapy, which is known as a beneficial facilitator of adoptive T cell therapies.

|

|

b.

|

Moreover, our higher risk patients did not receive subsequent Hematopoietic Stem Cell transplantation (HSCT), which is also known as a beneficial facilitator of adoptive T cell therapies.

|

From April 2015, the Company commenced cooperation with agents/hospitals through which it started to provide immune-cell therapy technology consulting services to hospitals located in Beijing, Shandong, Anhui and Shanghai. For the year ended December 31, 2015, revenue of $0.5 million was derived from this service.

On May 27, 2015, the Company announced the appointment of Richard L. Wang, Ph.D., MBA, PMP as Chief Operating Officer. Dr. Wang, a seasoned and accomplished scientist and industry professional, brings operational, project management, and R&D governance experience from multinational pharmaceutical companies, to support the Company’s research of osteoarthritis and oncology therapeutics. Dr. Wang oversees the Company’s research collaborations, technology transfers, drug development clinical trials, regulatory affairs, production, and oversight of the Company’s multicenter operations.

At the 10th Annual World Stem Cells & Regenerative Medicine Congress in London, UK on May 21, 2015, the Company announced results of the Phase I clinical studies of CD30-directed CAR-T therapy on CD30-positive Stage III and IV Hodgkin's lymphoma patients. The results of this trial demonstrated that five out of seven patients responded to the treatment, and the therapy was demonstrated in this trial to be safe, feasible and efficacious.

On June 26, 2015, the Company completed the acquisition of Blackbird BioFinance, LLC (“Blackbird”)’s license from University of South Florida (“USF”) on the next generation cancer immunotherapy vaccine CD40LGVAX, its related technologies and technical knowledge. Of the total consideration to be delivered to Blackbird for the purchased assets, $2,500,000 was delivered in cash and 28,120 shares of Company common stock (the "Closing Shares"), representing $1,050,000 of the purchase consideration (based on the 20-day volume-weighted average price of the Company’s stock on the closing date), was issued and delivered to Blackbird. Another 18,747 shares (the “Holdback Shares”), representing $700,000 of the purchase consideration (based on the 20-day volume-weighted average price of the Company’s stock on the closing date), was issued and delivered to Blackbird in November 2015. Based on the terms of the license, we believe the Company will pay potentially more than $25 million in future milestones and royalty payments.

We believe this technological addition may address meaningful and sizable unmet medical needs. Based on the latest data available from NCCN Clinical Practice Guidelines in Oncology Non-Small Cell Lung Cancer (“NSCLC”) (Version 4. 2014), an estimated 224,210 people in the United States were diagnosed with lung cancer in 2014, with an estimated 159,260 deaths occurring because of the disease. In China, 728,552 individuals were diagnosed with lung cancer in 2012, and 592,410 individuals in China died of lung cancer in 2012 (source: Chinese Cancer Registry Annual Report 2012 & GMCD40L Study Synopsis).

Despite the advances of targeted therapies and recent breakthroughs with immune checkpoint inhibitors, such as anti-PD1 or PDL1 monoclonal antibody treatments, there are still significant unmet medical needs in NSCLC, and the disease remains largely incurable. We believe the CD40LGVAX vaccine, in combination with an anti-PD1 monoclonal antibody, may provide synergistic and improved clinical benefits in both PDL1 positive and negative patients. We previously anticipated a phase I/II clinical trial for the CD40LGVAX vaccine combined with PD-1 antibody to commence in the second half of 2015. We are currently evaluating both U.S. and non-U.S. options for furthering clinical trials for the CD40LGVAX vaccine following Moffitt Cancer Center’s notification to us that it will not be continuing its sponsorship of the U.S. CD40LGVAX Trial. In the third quarter of 2015, we reviewed and modified the design of CD40LGVAX trial by expanding the number of patient recruitment, changing from single site to multi-sites trial and adding stratification to the trial. We are converting the CD40LGVAX Investigator Sponsor Research (“ISR”) to a CBMG IND trial.

8

On June 26, 2015, the Russell Investments Group reconstituted its comprehensive set of U.S. indexes, the Company was selected to be included in the broad-market Russell 3000® Index. The Russell 3000® Index encompasses the 3,000 largest U.S.-traded stocks by objective, market-capitalization rankings and style attributes. This weighted index by market capitalization was constructed to provide a comprehensive barometer of the broad market and it now represents approximately 98% of the investable U.S. equity market. Membership in this index, which remains in place for one year, means automatic inclusion in the small-cap Russell 2000® Index as well as the appropriate growth and value style indexes. Russell indexes are widely used by investment managers and institutional investors for index funds and as benchmarks for active investment strategies.

In July 2015, the Company has received two new certifications from the China Food and Drug Administration (the “CFDA”) for its proprietary cell and tissue preservation media kits, in accordance with the CFDA’s new regulations announced on June 1, 2015. These certified kits enable long-term preservation and long distance shipment of cells and tissue, without freezing them down, from and to the point of care for ready applications by physicians. The latest certifications further strengthen our Vertically Integrated Cell Manufacturing System (VICMS) to centralize the processing and supplying of autologous cell therapies, and reinforce our potential to be a world-class biotechnology company, serving large unmet medical needs.

On August 26, 2015 the Company filed new patents - “Preparation of HER1 chimeric antigen receptor and NKT cells and application” for China patent and PCT and “Preparation of CD19 chimeric antigen receptor and NKT cells and application” for China patent.

On September 26, 2015, the Company presented at the 2015 European Cancer Congress’ (“ECCO”) annual meeting held in Vienna, Austria results from the first 11 NSCLC patients in the trial outlined in the abstract, entitled Chimeric Antigen Receptor-Modified T-Cells for the Immunotherapy of Patients with HER-1 Expressing Advanced Relapsed/Refractory Non-Small Cell Lung Cancer.

On September 28, 2015, the Company announced results of the Phase I clinical studies of CAR-T EGFR-HER1 (“CBM-EGFR.1”) for the treatment of patients with EGFR expressing advanced relapsed/refractory solid tumors. Based on the results from 24 patients treated with CBM-EGFR.1 (17 patients with non-small cell lung cancer, 5 patients with cholangiocarcinoma, 1 patient with pancreatic cancer and 1 patient with renal cell carcinoma (“RCC”)), the early results showed that CBM-EGFR.1 immunotherapy was safe, well tolerated, and had positive signal of clinical activity in several indications. The data was selected for a late-breaking oral presentation entitled EGFR-Targeted Chimeric Antigen Receptor-Modified T Cells Immunotherapy for Patients With EGFR-Expressing Advanced or Relapsed/Refractory Solid Tumors at the 5th World Congress on Cancer Therapy in Atlanta, Georgia. Highlight of Phase I/II clinical trial for CBMG CAR-T products in multiple advanced, refractory/relapsing solid tumors is as follow:

|

●

|

First known report of positive safety and signal of clinical activity of EGFR CAR-T in multiple solid tumor indications,

|

|

●

|

Most NSCLC patients treated with CBM-EGFR.1 failed EGFR-TKI therapy prior to CBM-EGFR.1 treatment,

|

|

●

|

Overall disease control rate (DCR) is 79% (19 of 24). 100% DCR in cholangiocarcinoma (5/5), 71% DCR in NSCLC (12/17),

|

|

●

|

Objective response rate (ORR) of 25% in combined indications: 2 complete response (CR) and 1 partial response (PR) in cholangiocarcinoma, 2 PR in NSCLC and 1 PR in pancreatic cancer.

|

9

The September 2015 reports on CBM-EGFR.1 therapy for late stage solid tumors have demonstrated our ability to innovate, advance boundaries between basic research and translational medicine and streamline the production of CAR-T and clinical treatment. With the talent addition of our COO and CSO, and the maturing of working relationship with PLAGH cancer immune cell therapy resources, we plan to evaluate and prioritize our cancer clinical trial indications for commercialization using safe and most effective therapy or combination therapies. The Company believes that, when integrated with CBMG's state-of-the-art infrastructure and clinical platform, the aforementioned acquired AG, 301 Hospital and USF technologies will improve our cancer immune cell therapies clinical pathway and pave the way for collaboration with renowned institutions. We plan to initiate certain cancer clinical trials upon receiving acceptance of the clinical trial designs with principal investigators and obtaining the requisite approvals.

On November 9, 2015, the Company announced the opening of its new state-of-the-art facility in the PKUCare Industrial Park, Changping District, Beijing, China. Eight hundred square meters of the 1,400 square meter site has been equipped with four independent production lines to support clinical batch production and commercial scale manufacturing. Designed and built to GMP standards, the facility has been certified by the Beijing Institute for Drug Control, accredited bodies of the China National Accreditation Service (CNAS) and China Metrology Accreditation (CMA). With this expansion into Beijing, the Company now operates three GMP facilities in China that will house nine independent production lines with the capacity to host more than 200,000 individual cell sources.

In the next 12 months, we aim to accomplish the following, though there can be no assurances that we will be able to accomplish any of these goals:

| ● | Confirm the safety and tolerability profile of CBM-EGFR.1 in cholangiocarcinoma and NSCLC; |

| ● | Explore the CBM-EGFR.1 opportunities in other solid tumor indications; |

| ● | Seek early possibilities of conducting multi-center Phase IIb trials to validate the clinical activity from early CBM-EGFR.1 observation; |

| ● | Confirm the safety and tolerability profile of CBM-CD20.1 targeting CD20 for NHL; |

| ● | Explore the CBM-CD20.1 opportunities in other cancer indications; |

| ● | Seek early possibilities of conducting multi-center Phase IIb trials to validate the clinical activity from early CBM-CD20.1 observation; |

| ● | Evaluate potential partners to develop an immunohistochemistry based diagnostic assay to aid in the patient selection whenever needed; |

| ● | Launch Phase II trials to explore the efficacy and safety of CD19 or CD20 CAR-T mono or combination therapies in chemo refractory/relapsing patients with hematological malignancies; |

| ● | File new CAR-T and other patents; |

| ● | Obtain approval for pending patents; |

| ● | Evaluate the feasibility of sponsoring a multi-sites Phase I/II clinical study to support the New Drug Application (NDA) for the U.S. CD40LGVAX trial; |

| ● | Evaluate feasibility of sponsoring a registration trial-like clinical study to support the New Drug Application (NDA) for an allogeneic haMPC Knee Osteoarthritis therapy (“Allo KOA”) study in the United States; |

| ● | Complete preclinical GLP safety evaluation studies of haMPC for Asthma and Chronic Obstructive Pulmonary Disease (COPD); |

| ● | Provide update on Cartilage Damage clinical study; |

| ● | Develop preclinical package for allogeneic haMPC therapy for COPD/Asthma clinical trial; |

| ● | Continue to seek advanced technologies to bolster our CAR-T China market position; |

| ● | Bolster R&D resources to fortify our intellectual properties portfolio and scientific development; |

| ● | File registration for our 2014 Stock Option Plan; and |

| ● | Improve liquidity by registering the shares sold in previous private placements and further fortify our balance sheet by courting institutional investors. |

For the years ended December 31, 2015, 2014 and 2013, we generated $2.5 million, $0.6 million and $0.2 million in revenue, respectively. The revenue since July 2014 is all from our technology consulting service. Before July 2014, our revenue was mainly from sales of A-Stromal™ enzyme reagent kits. We expect our biomedicine business to generate revenues primarily from immune therapy and the development of therapies for the treatment of KOA in the next three to four years.

Our operating expenses for year ended December 31, 2015 were in line with management’s plans and expectations. We incurred an increase in total operating expenses of approximately $10 million for the year ended December 31, 2015, as compared to the year ended December 31, 2014, which is primarily attributable to an increase in cost of sales in line with the revenue, option awards costs, professional service costs and increased input into expenditures for R&D projects.

10

Corporate Structure

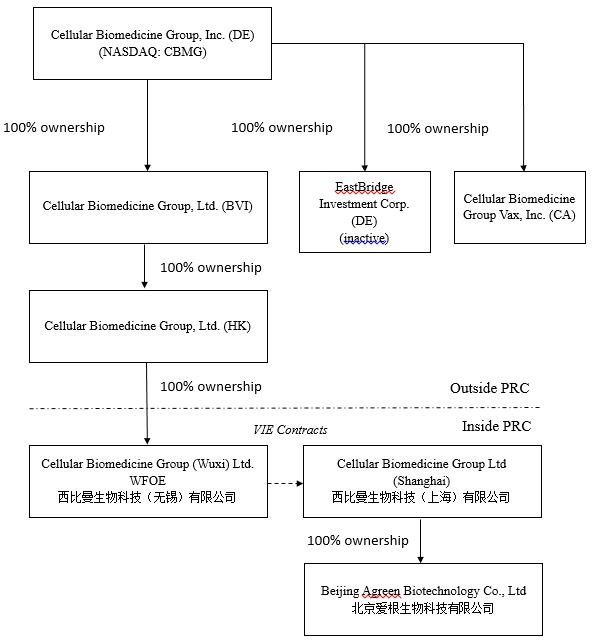

Our current corporate structure is illustrated in the following diagram:

Following the completion of our merger on February 6, 2013, we had the following subsidiaries (including a controlled VIE entity):

CBMG BVI, a British Virgin Islands corporation, is a holding company and a wholly-owned subsidiary of Cellular Biomedicine Group, Inc. (NASDAQ: CBMG), a Delaware corporation. We operate our biomedicine business through CBMG BVI and its subsidiary and controlled (VIE) company.

Cellular Biomedicine Group HK Limited, a Hong Kong company limited by shares, is a holding company and wholly owned subsidiary of CBMG BVI.

11

Cellular Biomedicine Group Ltd. (Wuxi), license number 320200400034410 (the “WFOE”) is a wholly foreign-owned entity that is 100% owned by Cellular Biomedicine Group HK Limited. This entity’s legal name in China is西比曼生物科技(无锡)有限公司, which directly translates to “Xi Biman Biological Technology (Wuxi) Co. Ltd.” WFOE controls and holds ownership rights in the business, assets and operations of Cellular Biomedicine Group Ltd. (Shanghai) (“CBMG Shanghai”) through variable interest entity (VIE) agreements. We conduct certain biomedicine business activities through WFOE, including lab kit production and research.

Cellular Biomedicine Group Ltd. (Shanghai) license number 310104000501869 (“CBMG Shanghai”), is a PRC domestic corporation, which we control and hold ownership rights in, through WFOE and the above-mentioned VIE agreements. This entity’s legal name in China is 西比曼生物科技(上海)有限公司, which directly translates to “Xi Biman Biotech (Shanghai) Co., Ltd.” We conduct certain biomedicine business activities through our controlled VIE entity, CBMG Shanghai, including clinical trials and certain other activities requiring a domestic license in the PRC. Mr. Chen Mingzhe and Mr. Cao Wei (our President, Chief Operating Officer and director) together are the record holders of all of the outstanding registered capital of CBMG Shanghai. Mr. Chen and Mr. Cao are also directors of CBMG Shanghai constituting the entire management of the same. Mr. Chen and Mr. Cao receive no compensation for their roles as managers of CBMG Shanghai.

Beijing Agreen Biotechnology Co., Ltd is a PRC domestic corporation and wholly owned subsidiary of CBMG Shanghai.

Eastbridge Investment Corporation (“Eastbridge Sub”), a Delaware corporation, is a wholly owned subsidiary of the Company.

Cellular Biomedicine Group VAX, Inc. (“CBMG VAX”), a California corporation, is a wholly owned subsidiary of the Company.

Variable Interest Entity (VIE) Agreements

Through our wholly foreign-owned entity and 100% subsidiary, Cellular Biomedicine Group Ltd. (Wuxi), we control and have ownership rights by means of a series of VIE agreements with CBMG Shanghai. The following is a description of each of these VIE agreements:

Exclusive Business Cooperation Agreement. Through the WFOE, we are a party to an exclusive business cooperation agreement dated September 17, 2012 with CBMG Shanghai, which provides that (i) the WFOE shall exclusively provide CBMG Shanghai with complete technical support, business support and related consulting services; (ii) without prior written consent of the WFOE, CBMG Shanghai may not accept the same or similar consultancy and/or services from any third party, nor establish any similar cooperation relationship with any third party regarding same matters during the term of the agreement; (iii) CBMG Shanghai shall pay the WFOE service fees as calculated based on the time of service rendered by the WFOE multiplying the corresponding rate, plus an adjusted amount decided by the board of the WFOE; and (iv) CBMG Shanghai grants to the WFOE an irrevocable and exclusive option to purchase, at its sole discretion, any or all of CBMG Shanghai’s assets at the lowest purchase price permissible under PRC laws. The term of the agreement is 10 years, provided however the agreement may extended at the option of the WFOE. Since this agreement permits the WFOE to determine the service fee at its sole discretion, the agreement in effect provides the WFOE with rights to all earnings of the VIE.

Loan Agreement. Through the WFOE, we are a party to a loan agreement with CBMG Shanghai, Cao Wei and Chen Mingzhe dated September 17, 2012, in accordance with which the WFOE agreed to provide an interest-free loan to CBMG Shanghai. The term of the loan is 10 years, which may be extended upon written consent of the parties. The method of repayment of CBMG Shanghai shall be at the sole discretion of the WFOE, including but not limited to an acquisition of CBMG Shanghai in satisfaction of its loan obligations.

12

Exclusive Option Agreement with Cao Wei. Through the WFOE, we are a party to an option agreement with CBMG Shanghai and Cao Wei dated May 28, 2012, in accordance with which: (i) Cao Wei irrevocably granted the WFOE an irrevocable and exclusive right to purchase, or designate another person to purchase the entire equity interest in CBMG Shanghai as then held by him, at an aggregate purchase price to be determined; and (ii) any proceeds obtained by Cao Wei through the above equity transfer in CBMG Shanghai shall be used for the payment of the loan provided by the WFOE under the aforementioned Loan Agreement.

Exclusive Option Agreement with Chen Mingzhe. Through the WFOE, we are a party to an exclusive option agreement with CBMG Shanghai and Chen Mingzhe dated May 28, 2012, under which: (i) Chen Mingzhe irrevocably granted the WFOE an irrevocable and exclusive right to purchase, or designate another person to purchase the entire equity interest in CBMG Shanghai for an aggregate purchase price to be determined; and (ii) any proceeds obtained by Chen Mingzhe through the above equity transfer in CBMG Shanghai shall be used for the payment of the loan provided by the WFOE under the aforementioned Loan Agreement.

Power of Attorney from Cao Wei. Through the WFOE we are the recipient of a power of attorney executed by Cao Wei on October 10, 2012, in accordance with which Cao Wei authorized the WFOE to act on his behalf as his exclusive agent with respect to all matters concerning his equity interest in CBMG Shanghai, including without limitation to attending the shareholder meetings of CBMG Shanghai, exercising voting rights and designating and appointing senior executives of CBMG Shanghai.

Power of Attorney from Chen Mingzhe. Through the WFOE we are the recipient of a power of attorney executed by Chen Mingzhe on September 17, 2012, in accordance with which Chen Mingzhe authorized the WFOE to act on his behalf as his exclusive agent with respect to all matters concerning his equity interest in CBMG Shanghai, including without limitation to attending the shareholders meetings of CBMG Shanghai, exercising voting rights and designating and appointing senior executives of CBMG Shanghai.

Equity Interest Pledge Agreement with Cao Wei. Through the WFOE, we are a party to an equity interest pledge agreement with CBMG Shanghai and Cao Wei dated May 28, 2012, in accordance with which: (i) Cao Wei pledged to the WFOE the entire equity interest he holds in CBMG Shanghai as security for payment of the consulting and service fees by CBMG Shanghai under the Exclusive Business Cooperation Agreement; (ii) Cao Wei and CBMG Shanghai submitted all necessary documents to ensure the registration of the Pledge of the Equity Interest with the State Administration for Industry and Commerce (“SAIC”), and the pledge became effective on January 24, 2013; (iii) on the occurrence of any event of default, unless it has been successfully resolved within 20 days after the delivery of a rectification notice by the WFOE, the WFOE may exercise its pledge rights at any time by a written notice to Cao Wei.

Equity Interest Pledge Agreement with Chen Mingzhe. Through the WFOE we are a party to an equity interest pledge agreement with CBMG Shanghai and Chen Mingzhe dated May 28, 2012, in accordance with which: (i) Chen Mingzhe pledged to the WFOE the entire equity interest he holds in CBMG Shanghai as security for payment of the consulting and service fees by CBMG Shanghai under the Exclusive Business Cooperation Agreement; (ii) Chen Mingzhe and CBMG Shanghai submitted all necessary documents to ensure the registration of the Pledge of the Equity Interest with SAIC, and the pledge became effective on January 24, 2013; (iii) on the occurrence of any event of default, unless it has been successfully resolved within 20 days after the delivery of a rectification notice by the WFOE, the WFOE may exercise its pledge rights at any time by a written notice to Chen Mingzhe.

13

Our relationship with our controlled VIE entity, CBMG Shanghai, through the VIE agreements, is subject to various operational and legal risks. Management believes the Mr. Chen and Mr. Cao as record holders of the VIE’s registered capital have no interest in acting contrary to the VIE agreements. However, if Mr. Chen and Cao as shareholders of the VIE entity were to reduce or eliminate their ownership of the registered capital of the VIE entity, or if Mr. Cao ceases to serve as a director and/or officer of the other CBMG entities, their interests may diverge from that of CBMG and they may seek to act in a manner contrary to the VIE agreements (for example by controlling the VIE entity in such a way that is inconsistent with the directives of CBMG management and the board; or causing non-payment by the VIE entity of services fees). If such circumstances were to occur the WFOE would have to assert control rights through the powers of attorney and other VIE agreements, which would require legal action through the PRC judicial system. While we believe the VIE agreements are legally enforceable in the PRC, there is a risk that enforcement of these agreements may involve more extensive procedures and costs to enforce, in comparison to direct equity ownership of the VIE entity. We believe based on the advice of local counsel that the VIE agreements are valid and in compliance with PRC laws presently in effect. Notwithstanding the foregoing, if the applicable PRC laws were to change or are interpreted by authorities in the future in a manner which challenges or renders the VIE agreements ineffective, the WFOE’s ability to control and obtain all benefits (economic or otherwise) of ownership of the VIE entity could be impaired or eliminated. In the event of such future changes or new interpretations of PRC law, in an effort to substantially preserve our rights we may have to either amend our VIE agreements or enter into alternative arrangements which comply with PRC laws as interpreted and then in effect.

For further discussion of risks associated with the above, please see the section below titled “Risks Related to Our Structure.”

BIOMEDICINE BUSINESS

Our biomedicine business was founded in 2009 as a newly formed specialty biomedicine company by a team of seasoned Chinese-American executives, scientists and doctors. In 2010, we established a GMP facility in Wuxi, and in 2012 we established a U.S. Food and Drug Administration (“FDA”) GMP standard protocol-compliant manufacturing facility in Shanghai. In October 2015 , we opened a GMP facility in Beijing. Our focus has been to monetize the rapidly growing health care market in China by marketing and commercializing stem cell and immune cell therapeutics, related tools and products from our patent-protected homegrown and acquired cell technology, as well as by utilizing exclusively in-licensed and other acquired intellectual properties.

Our current treatment focal points are cancer and other degenerative diseases such as KOA, Asthma, COPD and Cartilage Defects.

Cancer. In the cancer field, our in-licensed Tumor Cell Target Dendritic Cell (“TC-DC”) therapy utilizes dendritic cells that have been taught the unique "signature" of the patient's’ cancer, in order to trigger an effective immune response against cancer stem cells, the root cause of cancer metastasis and recurrence. Our TC-DC product candidate has successfully completed a U.S. FDA Phase II clinical trial for the treatment of Metastatic Melanoma at the Hoag Medical Center in California. We have a process to develop human embryo-derived motor neuronal precursor cells and human embryo-derived neuronal precursor cells with high purity levels, validated by synapse formation, and have shown functional innervation with human muscle cells. Under applicable international reciprocity procedures we are utilizing data generated in a U.S. Phase II clinical trial in an analogous China-based Phase I/II Clinical Trial for the treatment of Hepatocellular Carcinoma (“HCC”), a major type of Liver Cancer. Management believes we will be able to leverage skin cancer data produced in ongoing trials in the U.S., and apply it toward advancing our product candidate for the treatment of liver cancer and other cancer-related indications. As of December 31, 2013, we have completed the HCC Phase I trial. With the advent of more advanced technologies in our portfolio, at present we do not plan on continuing the HCC trial. And with the recent build-up of our Vaccine, Tcm, TCR clonality, CAR-T and anti-PD-1 technologies we plan to evaluate and prioritize our cancer clinical trial indications for commercialization using safe and most effective therapy or combination therapies. We announced results from our Phase I trial for certain of CAR-T cancer immunotherapy programs on March 25, May 21, and late September 2015. The Phase I trial data for the CD19, CD20 and CD30 and EGFR HER 1 constructs showed a positive response rate under controllable toxicities.

14

KOA. In 2013, we completed a Phase I/IIa clinical trial, in China, for our Knee Osteoarthritis (“KOA”) therapy named ReJoinTM . The trial tested the safety and efficacy of intra-articular injections of autologous haMPCs in order to reduce inflammation and repair damaged joint cartilage. The 6-month follow-up clinical data showed ReJoinTM therapy to be both safe and effective.

In Q2 of 2014, we completed patient enrollment for the Phase IIb clinical trial of ReJoin™ for KOA. The multi-center study has enrolled 53 patients to participate in a randomized, single blind trial. We published 48 weeks follow-up data of Phase I/IIa on December 5, 2014. The 48 weeks data indicated that patients have reported a decrease in pain and a significant improvement in mobility and flexibility, while the clinical data shows our ReJoinTM regenerative medicine treatment to be safe. We announced interim 24 week results for ReJoinTM on March 25, 2015 and released positive Phase IIb 48 week follow-up data in January 2016, which shows the primary and secondary endpoints of ReJoin® therapy group having all improved significantly compared to their baseline, which has confirmed some of the Company’s Phase I/IIa results. . Our ReJoinTM human adipose-derived mesenchymal progenitor cell (haMPC) therapy for KOA is an interventional therapy using proprietary device, process, culture and medium:

|

●

|

Obtain adipose (fat) tissue from the patient using our CFDA approved medical device, the A-StromalTM Kit; and

|

|

●

|

Expand haMPCs using our proprietary culture medium (serum-free and antibiotics-free); and

|

|

●

|

formulated for ReJoinTM therapy using our proprietary formulation.

|

Our process is distinguishable from sole Stromal Vascular Fraction (SVF) therapy. The immunophenotype of our haMPCs exhibited multiple biomarkers such as CD29+, CD73+, CD90+, CD49d+, HLA-I+, HLA-DR-, Actin-, CD14-, CD34-, and CD45-. In contrast, SVF is merely a heterogeneous fraction including preadipocytes, endothelial cells, smooth muscle cells, pericytes, macrophages, fibroblasts, and adipose-derived stem cells (ASCs).

Cartilage Damage. In January 2015, we initiated patient recruitment to support a study, in China, of ReJoinTM human adipose derived mesenchymal progenitor cell (“haMPC”) therapy for Cartilage Damage (“CD”) resulting from osteoarthritis (“OA”) or sports injury. The study is based on the same science that has shown significant progress in the treatment of KOA. Both arthroscopy and the use of magnetic resonance imaging (“MRI”) will be deployed to further demonstrate the regenerative efficacy of ReJoinTM on CD. We announced interim Phase IIb trial results for our ReJoinTM haMPC therapy for KOA on March 25, 2015, which confirmed that the primary and secondary endpoints of ReJoin TM therapy groups have all improved significantly compared to their baseline. We released positive 48-week follow-up data in January 2016.

Asthma. In Q1 of 2014, we began a pre-clinical study on haMPC therapy for asthma. The pre-clinical study, conducted by Shanghai First People’s Hospital, a leading teaching hospital affiliated with Shanghai Jiaotong University, will evaluate the safety and efficacy of haMPCs to treat severe asthma.

COPD. COPD refers to a group of diseases that block airflow to the lungs and make it difficult to breathe. The two most common conditions that make up COPD are chronic bronchitis and emphysema, which gradually destroys the smallest air passages (bronchioles) in the lungs. Currently the common treatments for COPD, such as use of steroids, inhalers and bronchodilator drugs, aim to control the symptoms and minimize further damage, but do not reverse the tissue damage. The major causes of COPD in China are tobacco smoking, biomass fuel use and genetic susceptibility.

Our pre-clinical COPD study is being conducted by Shanghai First People's Hospital, a leading teaching hospital affiliated with Shanghai Jiaotong University. Professor Zhou Xin, director of the hospital's respiratory department and chairperson of Respiratory Diseases Division of Shanghai Medical Association, will lead the study as Principal Investigator.

15

The unique lines of adult adipose-derived stem cells and the immune cell therapies enable us to create multiple cell formulations in treating specific medical conditions and diseases, as well as applying single cell types in a specific treatment protocol. Management believes that our adult adipose-derived line will become commercially viable and market-ready in China within three to four years, and will continue to grow the budding immune cell technical service revenue. In addition, we plan to assess and initiate cancer clinical trials leading to commercialization using safe and most effective therapy or combination therapies. Our facilities are certified to meet the international standards NSF/ANSI 49, ISO-14644 (or equivalent), ANSI/NCSL Z-540-1 and 10CFR21, as well as Chinese CFDA standards CNAS L0221. In addition to standard protocols, we use proprietary processes and procedures for manufacturing our cell lines, comprised of:

| ● |

Banking processes that ensure cell preservation and viability;

|

|

●

|

DNA identification for stem cell ownership; and

|

|

●

|

Bio-safety testing at independently certified laboratories.

|

Regenerative Medicine and Cell Therapy

Regenerative medicine is the “process of replacing or regenerating human cells, tissues or organs to restore or establish normal function”. Cell therapy as applied to regenerative medicine holds the promise of regenerating damaged tissues and organs in the body by rejuvenating damaged tissue and by stimulating the body’s own repair mechanisms to heal previously irreparable tissues and organs. Medical cell therapies are classified into two types: allogeneic (cells from a third-party donor) or autologous (cells from one’s own body), with each offering its own distinct advantages. Allogeneic cells are beneficial when the patient’s own cells, whether due to disease or degeneration, are not as viable as those from a healthy donor. Similarly, in cases such as cancer, where the disease is so unique to the individual, autologous cells can offer true personalized medicine.

Regenerative medicine can be categorized into major subfields as follows:

|

●

|

Cell Therapy. Cell therapy involves the use of cells, whether derived from adults, third party donors or patients, from various parts of the body, for the treatment of diseases or injuries. Therapeutic applications may include cancer vaccines, cell based immune-therapy, arthritis, heart disease, diabetes, Parkinson’s and Alzheimer’s diseases, vision impairments, orthopedic diseases and brain or spinal cord injuries. This subfield also includes the development of growth factors and serums and natural reagents that promote and guide cell development.

|

|

●

|

Tissue Engineering. This subfield involves using a combination of cells with biomaterials (also called “scaffolds”) to generate partially or fully functional tissues and organs, or using a mixture of technology in a bioprinting process. Some natural materials, like collagen, can be used as biomaterial, but advances in materials science have resulted in a variety of synthetic polymers with attributes that would make them uniquely attractive for certain applications. Therapeutic applications may include heart patch, bone re-growth, wound repair, replacement neo-urinary conduits, saphenous arterial grafts, inter-vertebral disc and spinal cord repair.

|

|

●

|

Diagnostics and Lab Services. This subfield involves the production and derivation of cell lines that may be used for the development of drugs and treatments for diseases or genetic defects. This sector also includes companies developing devices that are designed and optimized for regenerative medicine techniques, such as specialized catheters for the delivery of cells, tools for the extraction of stem cells and cell-based diagnostic tools.

|

16

All living complex organisms start as a single cell that replicates, differentiates (matures) and perpetuates in an adult through its lifetime. Cell therapy is aimed at tapping into the power of cells to prevent and treat disease, regenerate damaged or aged tissue and provide cosmetic applications. The most common type of cell therapy has been the replacement of mature, functioning cells such as through blood and platelet transfusions. Since the 1970s, bone marrow and then blood and umbilical cord-derived stem cells have been used to restore bone marrow and blood and immune system cells damaged by chemotherapy and radiation used to treat many cancers. These types of cell therapies have been approved for use world-wide and are typically reimbursed by insurance.

Over the past number of years, cell therapies have been in clinical development to attempt to treat an array of human diseases. The use of autologous (self-derived) cells to create vaccines directed against tumor cells in the body has been demonstrated to be effective and safe in clinical trials. Researchers around the globe are evaluating the effectiveness of cell therapy as a form of replacement or regeneration of cells for the treatment of numerous organ diseases or injuries, including those of the brain and spinal cord. Cell therapies are also being evaluated for safety and effectiveness to treat heart disease, autoimmune diseases such as diabetes, inflammatory bowel disease, joint diseases and cancerous diseases. While no assurances can be given regarding future medical developments, we believe that the field of cell therapy is a subset of biotechnology that holds promise to improve human health, help eliminate disease and minimize or ameliorate the pain and suffering from many common degenerative diseases relating to aging.

Recent Developments in Cancer Cell Therapy

According to the U.S. National Cancer Institute’s 2013 cancer topics research update on CAR-T-Cells, excitement is growing for immunotherapy—therapies that harness the power of a patient’s immune system to combat their disease, or what some in the research community are calling the “fifth pillar” of cancer treatment.

One approach to immunotherapy involves engineering patients’ own immune cells to recognize and attack their tumors. And although this approach, called adoptive cell transfer ("ACT"), has been restricted to small clinical trials so far, treatments using these engineered immune cells have generated some remarkable responses in patients with advanced cancer. For example, in several early-stage trials testing ACT in patients with advanced acute lymphoblastic leukemia ("ALL") who had few if any remaining treatment options, many patients’ cancers have disappeared entirely. Several of these patients have remained cancer free for extended periods.

Equally promising results have been reported in several small clinical trials involving patients with lymphoma. Although the lead investigators cautioned that much more research is needed, the results from the trials performed thus far indicate that researchers can successfully alter patients’ T cells so that they attack their cancer cells. As an example, we look to Spectrum Pharmaceutical’s Folotyn approved in September 2009 for treatment of R/R peripheral T-cell lymphoma with approval supported by a single arm trial observing an overall response rate of 27% and median duration of response of 9.4 months. In addition, CTI Therapeutics Pixuvri received a complete response letter in April 2010 in R/R aggressive NHL in which a 37% overall response rate and 5.5 month duration of response was observed.

ACT’s building blocks are T cells, a type of immune cell collected from the patient’s own blood. After collection, the T cells are genetically engineered to produce special receptors on their surface called chimeric antigen receptors ("CARs"). CARs are proteins that allow the T cells to recognize a specific protein (antigen) on tumor cells. These engineered CAR T cells are then grown in the laboratory until they number in the billions. The expanded population of CAR T cells is then infused into the patient. After the infusion, if all goes as planned, the T cells multiply in the patient’s body and, with guidance from their engineered receptor, recognize and kill cancer cells that harbor the antigen on their surfaces. This process builds on a similar form of ACT pioneered from NCI’s Surgery Branch for patients with advanced melanoma. According to www.cancer.gov/.../research-updates/2013/CAR-T-Cells, in 2013 NCI’s Pediatric Oncology Branch commented that the CAR T cells are much more potent than anything they can achieve with other immune-based treatments being studied. Although investigators working in this field caution that there is still much to learn about CAR T-cell therapy, the early results from trials like these have generated considerable optimism. Researchers opined that CAR T-cell therapy eventually may become a standard therapy for some B-cell malignancies like ALL and chronic lymphocytic leukemia.

17

The traditional cancer treatment includes surgery, chemotherapy, and radiation therapy. In the last decade, we witnessed a boom in targeted therapies including monoclonal antibody and small molecule therapies, such as Iressa and Tarciva that targets EGFR activating mutations in the NSCLC, Herceptin that treats breast cancer patients with HER2 overexpression, Crizotinib that targets NSCLC patients with positive ALK fusion gene.

So far, chimeric antigen receptor T cell therapy (“CAR-T”) such as CD19 CAR-T, have been tested in many hematological indications on patients that are refractory/replapsing to chemotherapy, and many of them have relapsed after stem cell transplantation. Basically these patients have very limited treatment option. CAR-T has shown good efficacy in these patients and many have lived for years.

Market for Cell-Based Therapies

In 2013, U.S. sales of products which contain stem cells or progenitor cells or which are used to concentrate autologous blood, bone marrow or adipose tissues to yield concentrations of stem cells for therapeutic use were, conservatively, valued at $236 million at the hospital level. It is estimated that the orthopedics industry used approximately 92% of the stem cell products.

The forecast is that in the United States, shipments of treatments with stem cells or instruments which concentrate stem cell preparations for injection into painful joints will fuel an overall increase in the use of stem cell based treatments and an increase to $5.7 billion in 2020, with key growth areas being Spinal Fusion, Sports Medicine and Osteoarthritis of the joints.

According to data published in the executive summary of the 2014 New York Stem Cell Summit Report, the U.S. specific addressable market in KOA is $83 million, estimated to grow to $1.84 billion by 2020. It is forecast that within the Orthopedic Stem Cell Market, cartilage repair in 2014 will be 23% ($77 million) and will rise to 56% ($1.7 billion) by 2020. According to International Journal of Rheumatic Diseases, 2011 there are over 57 million people with KOA in China. There are about 1,000 newborns with Spinal Muscular Atrophy Type I (“SMA-I”) disease in China annually. The median life span of these children is less than 6 months. Adult incidence is approximately 2 million in China.

There over 30 million people in China suffering from asthma without effective therapies. Respiratory diseases account for 15% of deaths in China. China has the largest asthmatic population in the world and is one of the countries with the highest asthma mortality rate (Source: Respirology 2013, Asian Pacific Society of Respirology).

According to Respirology 2013, Asian Pacific Society of Respirology, COPD account for 15% of deaths in China and poses a high economic and social burden on families and communities in China, due to the expense of prescription drugs and the impact on quality of life, with many patients deteriorating to the point of being unable to work and a shortened life span. Based on estimates by World Health Organization (WHO) of 2.5% prevalence of COPD in China. Over 32 million people in China suffer from COPD, so the need for innovative solutions is pressing as this disease represents a significant unmet medical need.

18

The current data on CAR T-cell therapies, presented from various institutions including MSKCC, University of Pennsylvania, National Cancer Institute, and Fred Hutchinson Cancer Center, has been extremely positive. Recently, T cell checkpoint manipulation has brought hope to the struggling battle against cancer using immune cell therapy technologies. Merck has received fast approval for its PD-1 antibody therapy for Melanoma. Novartis CAR-T technology has made breakthroughs in treating B cell lymphoma using genetically modified T cell technology.

Approved cell therapies have been appearing on the market in recent years. In 2011, however, the industry was dealt two setbacks when Geron Corporation discontinued its embryonic program, and when Sanofi-Aventis acquired Genzyme Corporation and did not acquire the product rights relating to the allogeneic cell technology of Osiris Therapeutics, Inc., a partner of Genzyme and a leader in the field. In both cases there were difficulties navigating the U.S. regulatory requirements for product approval. Inadequate trial designs were cited in the executive summary of the 2012 New York Stem Cell Summit Report as contributing to these failures.

The number of cell therapy companies that are currently in Phase 2 and Phase 3 trials has been gathering momentum, and we anticipate that new cellular therapy products will appear on the market within the next several years.

Management believes the remaining risk in monetizing cancer immune cell therapies is concentrated in late stage clinical studies, speed-to-approval, manufacturing and process optimization.

Our Strategy

The majority of our biomedicine business is in the development stage. We intend to concentrate our business on cell therapies and in the near-term, carrying our KOA stem cell therapy and cancer immune cell therapies to commercialization.

We are developing our business in cell therapeutics and capitalizing on the increasing importance and promise that adult stem cells have in regenerative medicine. Our most advanced candidate involves adipose-derived mesenchymal stem cells to treat KOA. Based on current estimates, aside from AG’s budding Tcm technical service revenue, we expect our biomedicine business to generate revenues primarily through the development of therapies for the treatment of KOA within the next three to four years.

Presently we have two autologous cell therapy candidates undergoing clinical trials in China, for the treatment of KOA and CD. If and when these therapies gain regulatory approval in the PRC, we will be able to market and offer them for clinical use. Although our biomedicine business is relatively new, our technologies have been in development for decades, and our focus is on the latest translational stages of product development, principally from the pre-clinical trial stage to regulatory approval and commercialization of new therapies.

Our strategy is to develop safe and effective cellular medicine therapies for indications that represent a large unmet need in China, based on technologies developed both in-house and obtained through acquisition, licensing and collaboration arrangements with other companies. Our near term objective is to pursue successful clinical trials in China for our KOA application, followed by our CD and Asthma therapies. We intend to utilize our comprehensive cell platform to support multiple cell lines to pursue multiple therapies, both allogeneic and autologous. We intend to apply U.S. Standard Operating Procedures ("SOPs") and protocols while complying with Chinese regulations, while owning, developing and executing our own clinical trial protocols. We plan to establish domestic and international joint ventures or partnerships to set up cell laboratories and/or research facilities, acquire technology or in-license technology from outside of China, and build affiliations with hospitals, to develop a commercialization path for our therapies, once approved. We intend to use our first-mover advantage in China, against a backdrop of enhanced regulation by the central government, to differentiate ourselves from the competition and establish a leading position in the China cell therapeutic market. We also intend to out-license our technologies to interested parties and are exploring the feasibility of a U.S. allogeneic KOA clinical study with the FDA.

19

CBMG initially plans to use its centralized manufacturing facility located in Shanghai to service multiple hospitals within 200 km of the facility. We aim to complete clinical trials for our KOA and CD therapy candidates as soon as practicable. Our goal is to first obtain regulatory permission for commercial use of the therapies for the respective hospitals in which the trials are being conducted. CBMG plans to scale up its customer base by qualifying multiple additional hospitals for the post-trial use of therapies, once approved, by following regulatory guidelines. Based on current regulation and estimates we expect our biomedicine business to generate revenues primarily from continuous expansion of Tcm technical services and the development of therapies for the treatment of KOA within the next three to four years.

With the AG acquisition we intend to monetize AG’s U.S. and Chinese intellectual property for immune cell therapy preparation methodologies and patient immunity assessment by engaging with prominent hospitals to conduct pre-clinical and clinical studies in specific cancer indications. The T Cell clonality analysis technology patent, together with AG’s other know-how for immunity analysis, will enable the Company to establish an immunoassay platform that is crucial for immunity evaluation of patients with immune disorders as well as cancerous diseases that are undergoing therapy.

We believe that few competitors in China are as well-equipped as we are in the clinical trial development, diversified U.S. FDA protocol compliant manufacturing facilities, regulatory compliance and policy making participation, as well as a long-term presence in the U.S. with U.S.-based management and investor base.

We intend to continue our business development efforts by adding other proven domestic and international biotechnology partners to monetize the China health care market.

In order to expedite fulfillment of patient treatment CBMG has been actively developing technologies and products with a strong intellectual properties protection, including haMPC, derived from fat tissue, for the treatment of KOA, CD, Asthma, COPD and other indications. CBMG’s acquisition of AG provides an enlarged opportunity to expand the application of its cancer therapy-enabling technologies and to initiate clinical trials with leading cancer hospitals. With the AG acquisition, we will continue to seek to empower hospitals' immune cell cancer therapy development programs that help patients improve their quality of life and improve their survival rate.

CBMG's proprietary and patent-protected production processes and clinical protocols enable us to produce raw material, manufacture cells, and conduct cell banking and distribution. Applying our proprietary intellectual property, we will be able to customize specialize formulations to address complex diseases and debilitating conditions.

CBMG has been developing disease-specific clinical treatment protocols. These protocols are designed for each of these proprietary cell lines to address patient-specific medical conditions. These protocols include medical assessment to qualify each patient for treatment, evaluation of each patient before and after a specific therapy, cell transplantation methodologies including dosage, frequency and the use of adjunct therapies, potential adverse effects and their proper management.

The protocols of haMPC therapy for KOA and CD have been approved by the hospitals’ Institutional Review Board for clinical trials. Once the trials are completed, the clinical data will be analyzed by a qualified third party statistician and reports will be filed by the hospitals to regulatory agencies for approval for use in treating patients.

20

CBMG has three cGMP facilities in Beijing, Shanghai and Wuxi, China that meet international standards and have been certified by the CFDA. In any precision setting, it is vital that all controlled-environment equipment meet certain design standards. To achieve this goal, our Shanghai cleanroom facility underwent an ISO-14644 cleanroom certification. Additionally, our facilities have been certified to meet the ISO-9001 Quality Management standard by SGS Group, and accredited by the American National Bureau of Accreditation (“ANBA”). These cGMP facilities make CBMG one of the few companies in China with facilities that have been certified by US- and European-based, FDA authorized ISO accreditation institutions.

In total, our cGMP facilities have over 23,000 sq. ft. of cleanroom space with the capacity for nine independent cell production lines.

Most importantly, our most experienced team members have more than 30 years of relevant experience in China, EU, and the United States. All of these factors make CBMG a high quality cell products manufacturer in China.

Our Targeted Indications and Potential Therapies

Knee Osteoarthritis (KOA)

We completed the Phase I/IIa clinical trial for the treatment of KOA. The trial tested the safety and efficacy of intra-articular injections of autologous haMPCs in order to reduce inflammation and repair damaged joint cartilage. The 6-month follow-up clinical data showed ReJoin TM therapy to be both safe and effective.

In the second quarter of 2014, we completed patient enrollment for the Phase IIb clinical trial of ReJoinTM for KOA. The multi-center study has enrolled 53 patients to participate in a randomized, single blind trial. We published 48 weeks follow-up data of Phase I/IIa on December 5, 2014. The 48 weeks data indicated that patients have reported a decrease in pain and a significant improvement in mobility and flexibility, while the clinical data shows our ReJoinTM regenerative medicine treatment to be safe. We announced positive Phase IIb 48-week follow-up data in January 2016.

Osteoarthritis is a degenerative disease of the joints. KOA is one of the most common types of osteoarthritis. Pathological manifestation of osteoarthritis is primarily local inflammation caused by immune response and subsequent damage of joints. Restoration of immune response and joint tissues are the objective of therapies.

According to International Journal of Rheumatic Diseases, 2011, 53% of KOA patients will degenerate to the point of disability. Conventional treatment usually involves invasive surgery with painful recovery and physical therapy. As drug-based methods of management are ineffective, the same journal estimates that some 1.5 million patients with this disability will degenerate to the point of requiring artificial joint replacement surgery every year. However, only 40,000 patients will actually be able to undergo replacement surgery, leaving the majority of patients to suffer from a life-long disability due to lack of effective treatment.

haMPCs are currently being considered as a new and effective treatment for osteoarthritis, with a huge potential market. Osteoarthritis is one of the ten most disabling diseases in developed countries. Worldwide estimates are that 9.6% of men and 18.0% of women aged over 60 years have symptomatic osteoarthritis. It is estimated that the global OA therapeutics market was worth $4.4 billion in 2010 and is forecast to grow at a compound annual growth rate (“CAGR”) of 3.8% to reach $5.9 billion by 2018.

21