Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REX ENERGY CORP | d565393d8k.htm |

| EX-99.6 - EX-99.6 - REX ENERGY CORP | d565393dex996.htm |

| EX-99.5 - EX-99.5 - REX ENERGY CORP | d565393dex995.htm |

| EX-99.4 - EX-99.4 - REX ENERGY CORP | d565393dex994.htm |

| EX-99.3 - EX-99.3 - REX ENERGY CORP | d565393dex993.htm |

| EX-99.2 - EX-99.2 - REX ENERGY CORP | d565393dex992.htm |

| EX-99.1 - EX-99.1 - REX ENERGY CORP | d565393dex991.htm |

Exhibit 99.7

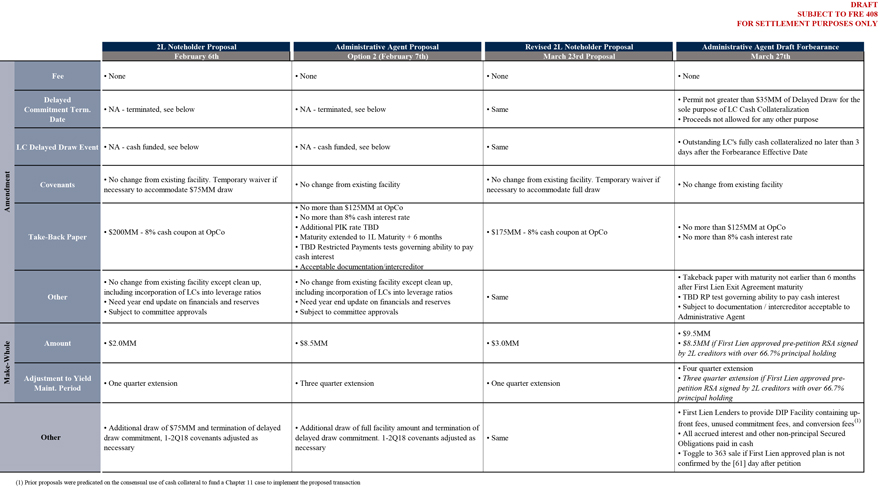

SUBJECT TO FRE 408 FOR SETTLEMENT PURPOSES ONLY 2L Noteholder Proposal Administrative Agent Proposal Revised 2L Noteholder Proposal Administrative Agent Draft Forbearance February 6th Option 2 (February 7th) March 23rd Proposal March 27th Fee • None • None • None • None Delayed Commitment Term. Date • NA - terminated, see below • NA - terminated, see below • Same • Permit not greater than $35MM of Delayed Draw for the sole purpose of LC Cash Collateralization • Proceeds not allowed for any other purpose LC Delayed Draw Event • NA - cash funded, see below • NA - cash funded, see below • Same • Outstanding LC’s fully cash collateralized no later than 3 days after the Forbearance Effective Date Amendment Covenants • No change from existing facility. Temporary waiver if necessary to accommodate $75MM draw • No change from existing facility • No change from existing facility. Temporary waiver if necessary to accommodate full draw • No change from existing facility Take-Back Paper • $200MM - 8% cash coupon at OpCo • No more than $125MM at OpCo • No more than 8% cash interest rate • Additional PIK rate TBD • Maturity extended to 1L Maturity + 6 months • TBD Restricted Payments tests governing ability to pay cash interest • Acceptable documentation/intercreditor • $175MM - 8% cash coupon at OpCo • No more than $125MM at OpCo • No more than 8% cash interest rate Other • No change from existing facility except clean up, including incorporation of LCs into leverage ratios • Need year end update on financials and reserves • Subject to committee approvals • No change from existing facility except clean up, including incorporation of LCs into leverage ratios • Need year end update on financials and reserves • Subject to committee approvals • Same • Takeback paper with maturity not earlier than 6 months after First Lien Exit Agreement maturity • TBD RP test governing ability to pay cash interest • Subject to documentation / intercreditor acceptable to Administrative Agent Amount • $2.0MM • $8.5MM • $3.0MM • $9.5MM • $8.5MM if First Lien approved pre-petition RSA signed by 2L creditors with over 66.7% principal holding Make-Whole Adjustment to Yield Maint. Period • One quarter extension • Three quarter extension • One quarter extension • Four quarter extension • Three quarter extension if First Lien approved pre-petition RSA signed by 2L creditors with over 66.7% principal holding Other • Additional draw of $75MM and termination of delayed draw commitment, 1-2Q18 covenants adjusted as necessary • Additional draw of full facility amount and termination of delayed draw commitment. 1-2Q18 covenants adjusted as necessary • Same • First Lien Lenders to provide DIP Facility containing up-front fees, unused commitment fees, and conversion fees(1) • All accrued interest and other non-principal Secured Obligations paid in cash • Toggle to 363 sale if First Lien approved plan is not confirmed by the [61] day after petition (1) Prior proposals were predicated on the consensual use of cash collateral to fund a Chapter 11 case to implement the proposed transaction