Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REX ENERGY CORP | d565393d8k.htm |

| EX-99.7 - EX-99.7 - REX ENERGY CORP | d565393dex997.htm |

| EX-99.6 - EX-99.6 - REX ENERGY CORP | d565393dex996.htm |

| EX-99.5 - EX-99.5 - REX ENERGY CORP | d565393dex995.htm |

| EX-99.4 - EX-99.4 - REX ENERGY CORP | d565393dex994.htm |

| EX-99.3 - EX-99.3 - REX ENERGY CORP | d565393dex993.htm |

| EX-99.2 - EX-99.2 - REX ENERGY CORP | d565393dex992.htm |

Second Lien Noteholder Discussion Materials March 21, 2018 Exhibit 99.1

Table of Contents Update on Financials / Liquidity Settlement Construct Next Steps Appendix

Update on Financials / Liquidity

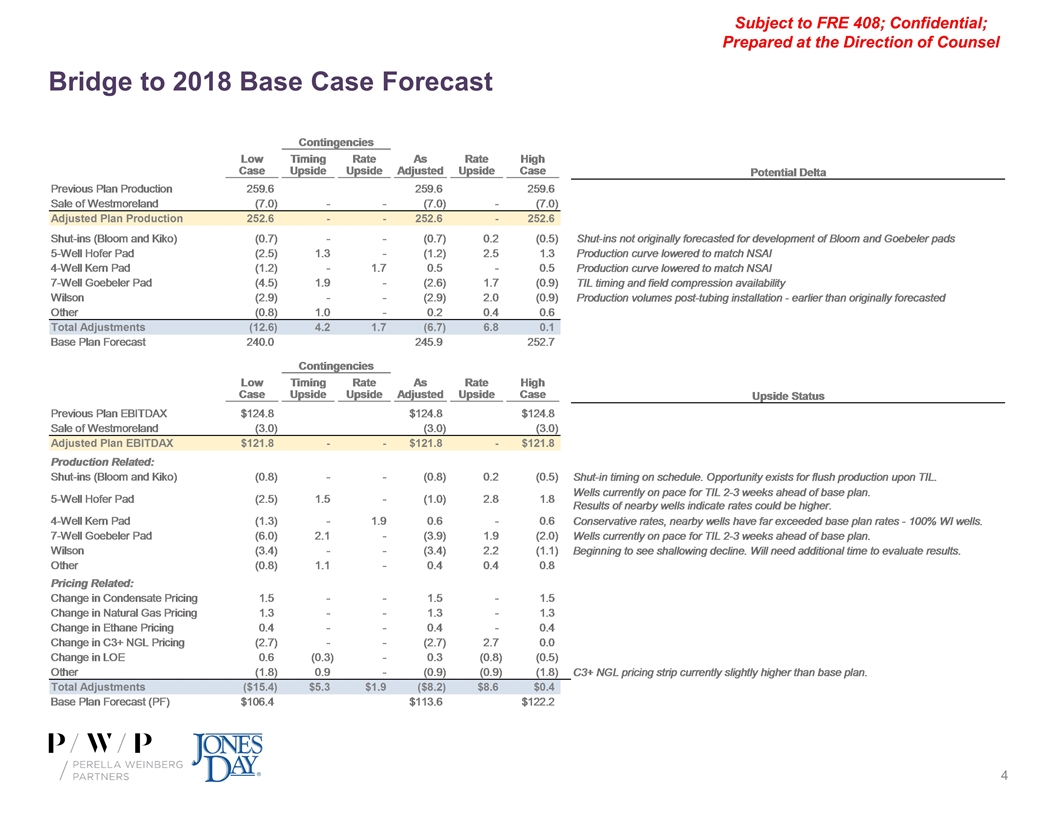

Bridge to 2018 Base Case Forecast

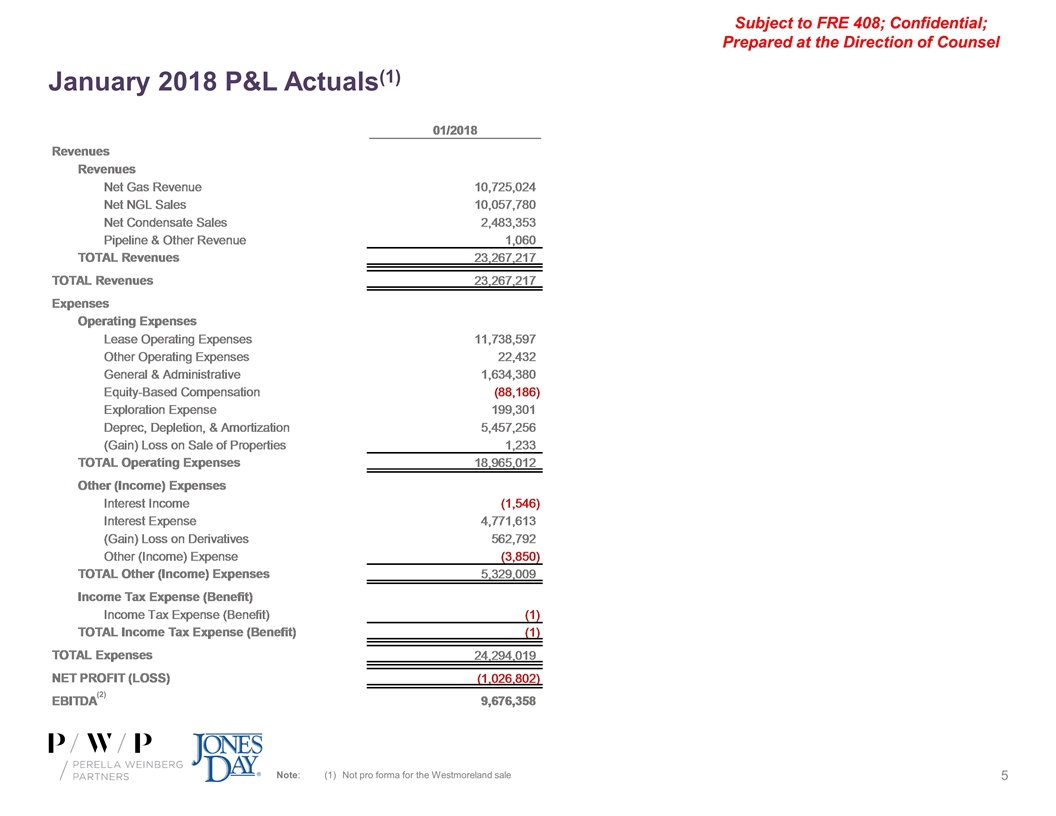

January 2018 P&L Actuals(1) Note:(1)Not pro forma for the Westmoreland sale (2)

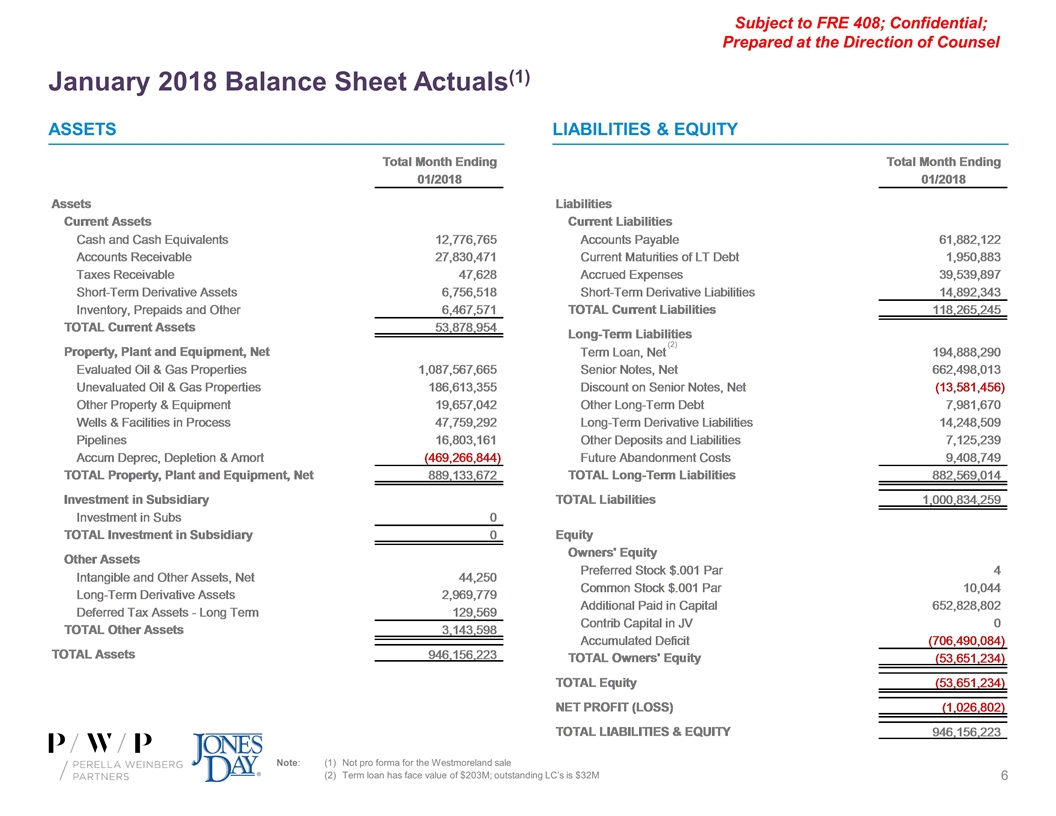

January 2018 Balance Sheet Actuals(1) Assets Liabilities & Equity Note:(1)Not pro forma for the Westmoreland sale (2)Term loan has face value of $203M; outstanding LC’s is $32M (2)

Settlement Construct

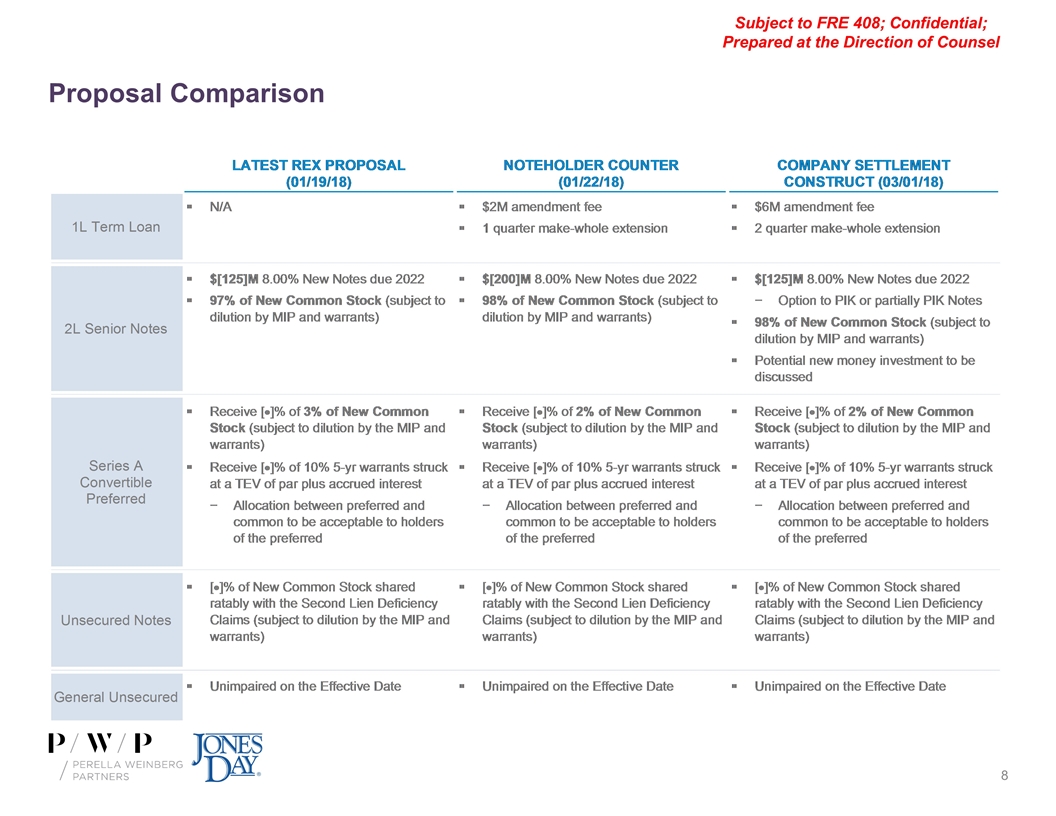

Proposal Comparison

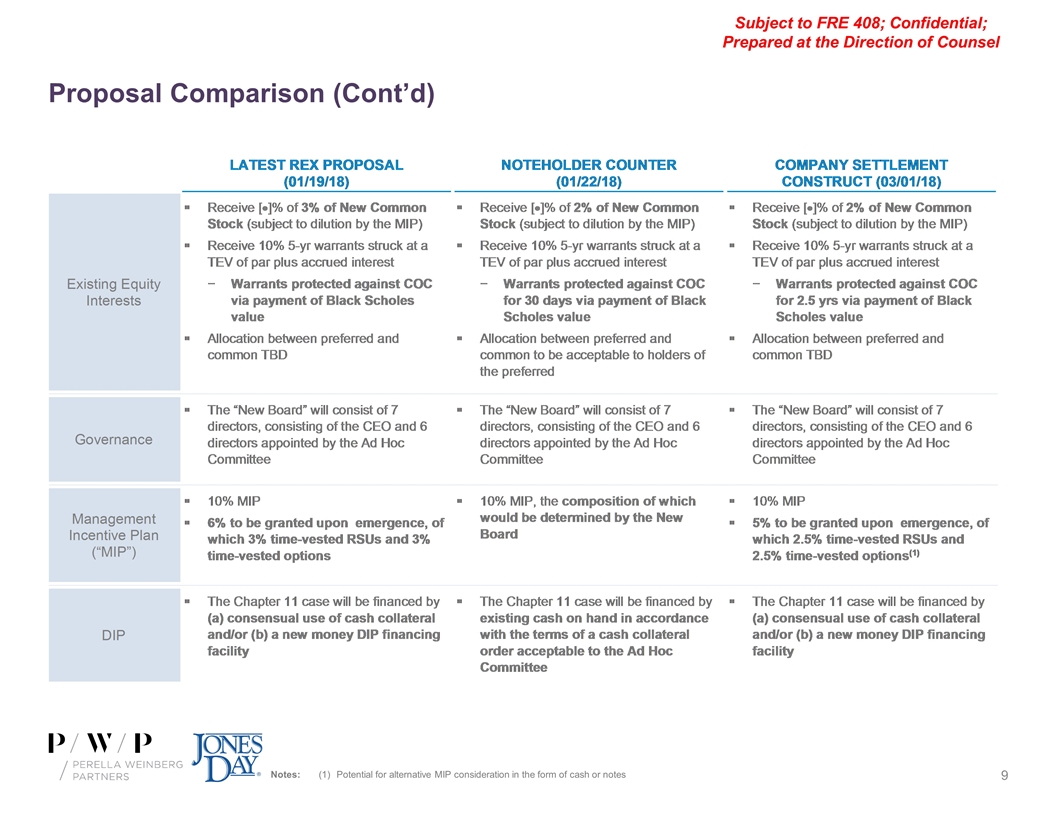

Proposal Comparison (Cont’d) Notes:(1)Potential for alternative MIP consideration in the form of cash or notes

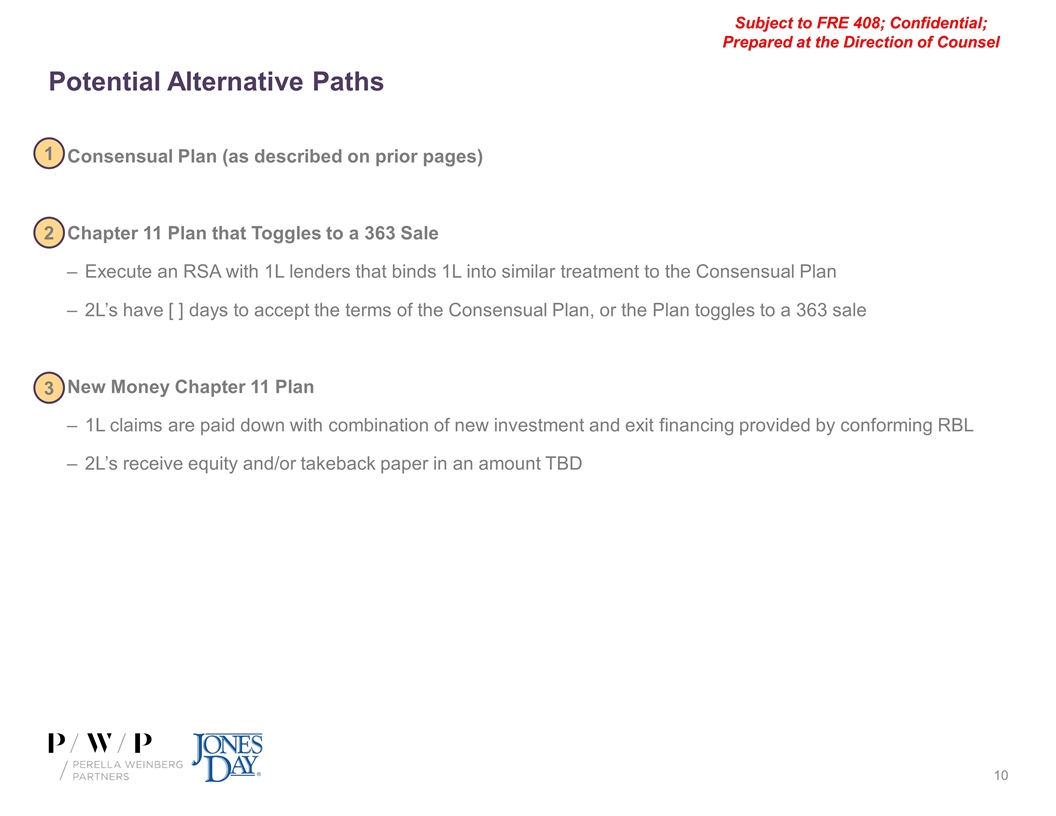

Potential Alternative Paths Consensual Plan (as described on prior pages) Chapter 11 Plan that Toggles to a 363 Sale Execute an RSA with 1L lenders that binds 1L into similar treatment to the Consensual Plan 2L’s have [ ] days to accept the terms of the Consensual Plan, or the Plan toggles to a 363 sale New Money Chapter 11 Plan 1L claims are paid down with combination of new investment and exit financing provided by conforming RBL 2L’s receive equity and/or takeback paper in an amount TBD 1 2 3

Next Steps

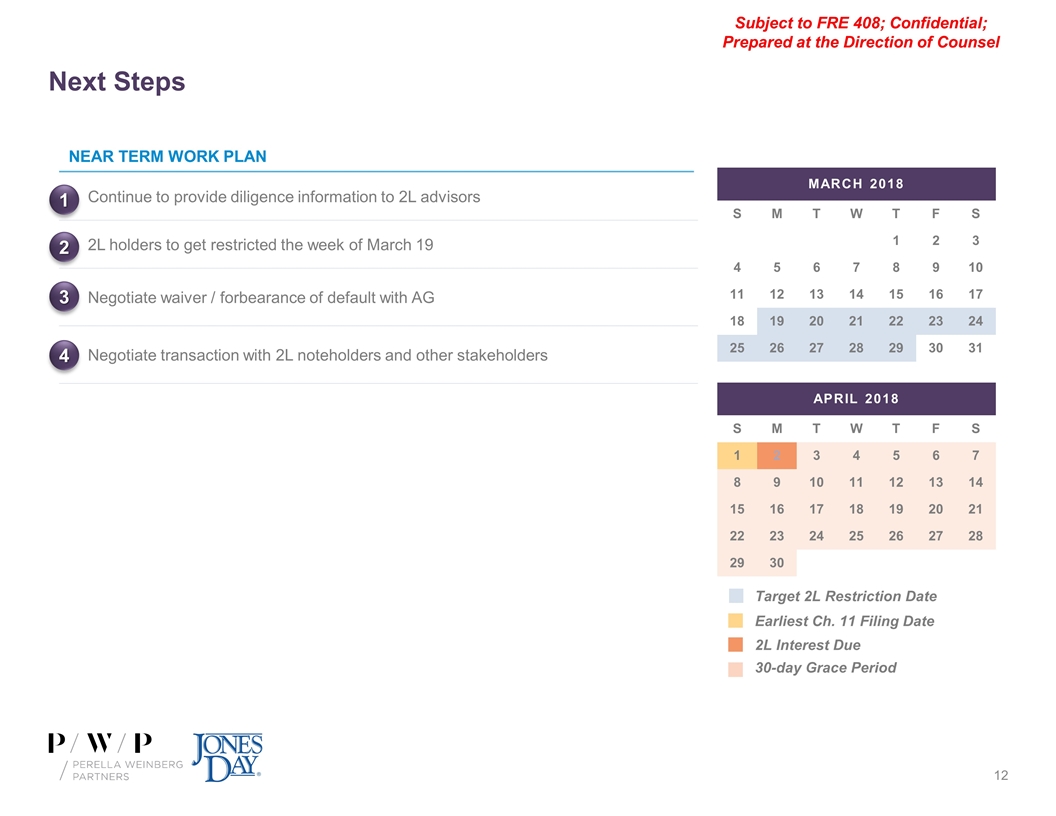

Next Steps MARCH 2018 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 APRIL 2018 S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 NEAR TERM WORK PLAN Continue to provide diligence information to 2L advisors 2L holders to get restricted the week of March 19 Negotiate waiver / forbearance of default with AG Negotiate transaction with 2L noteholders and other stakeholders 1 3 4 30-day Grace Period 2L Interest Due Target 2L Restriction Date Earliest Ch. 11 Filing Date 2

Appendix

Defaults and Forbearance Rex failed to timely deliver its fourth quarter 2017 financial statements, which resulted in a Financial Statement Default Subsequent to the Financial Statement Default, on February 26, 2018, Rex presented a certificate to request a Delayed Draw Loan, in which it represented and warranted that no Defaults or Events of Default existed, and that as of such date all representations and warranties in the Credit Agreement were true and correct Rex has now delivered its fourth quarter 2017 financial statements Rex is currently in negotiations with its first lien lenders on a forbearance agreement that would cover the previously alleged defaults and an Event of Default that would result from a failure to make the Second Lien interest payment on April 2, 2018

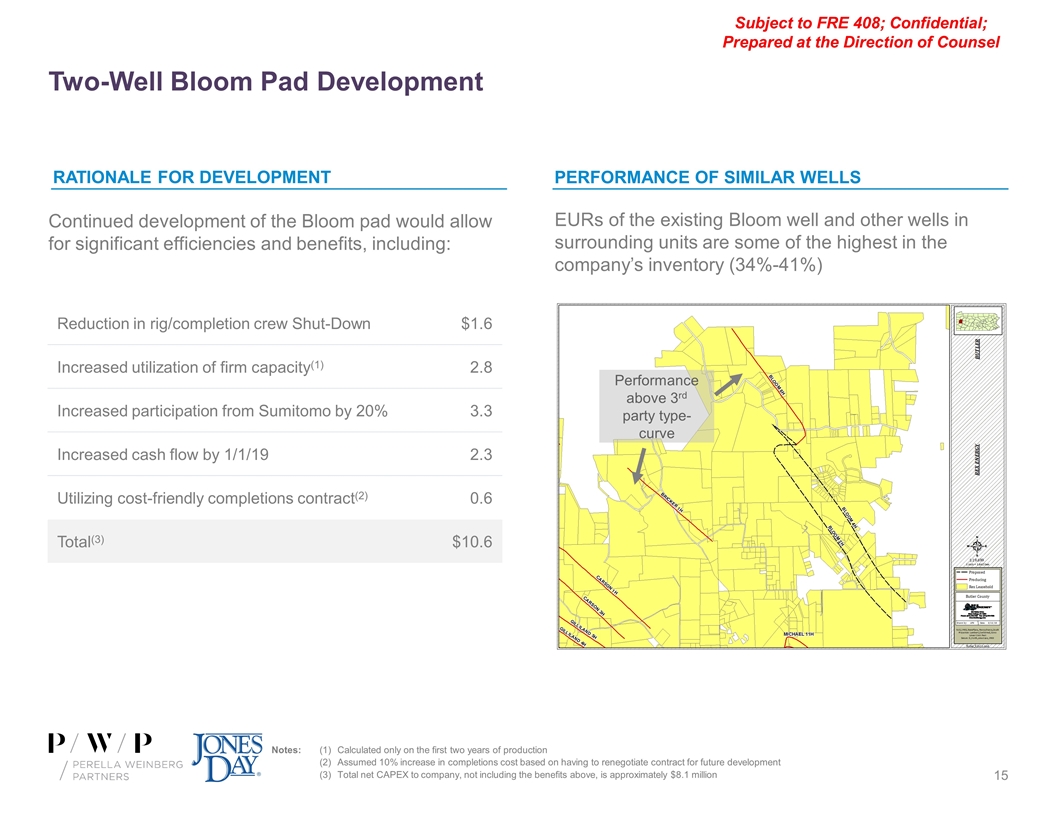

Two-Well Bloom Pad Development Continued development of the Bloom pad would allow for significant efficiencies and benefits, including: Notes:(1) Calculated only on the first two years of production (2)Assumed 10% increase in completions cost based on having to renegotiate contract for future development (3)Total net CAPEX to company, not including the benefits above, is approximately $8.1 million Reduction in rig/completion crew Shut-Down $1.6 Increased utilization of firm capacity(1) 2.8 Increased participation from Sumitomo by 20% 3.3 Increased cash flow by 1/1/19 2.3 Utilizing cost-friendly completions contract(2) 0.6 Total(3) $10.6 Performance above 3rd party type-curve Performance of Similar Wells EURs of the existing Bloom well and other wells in surrounding units are some of the highest in the company’s inventory (34%-41%) Rationale for Development

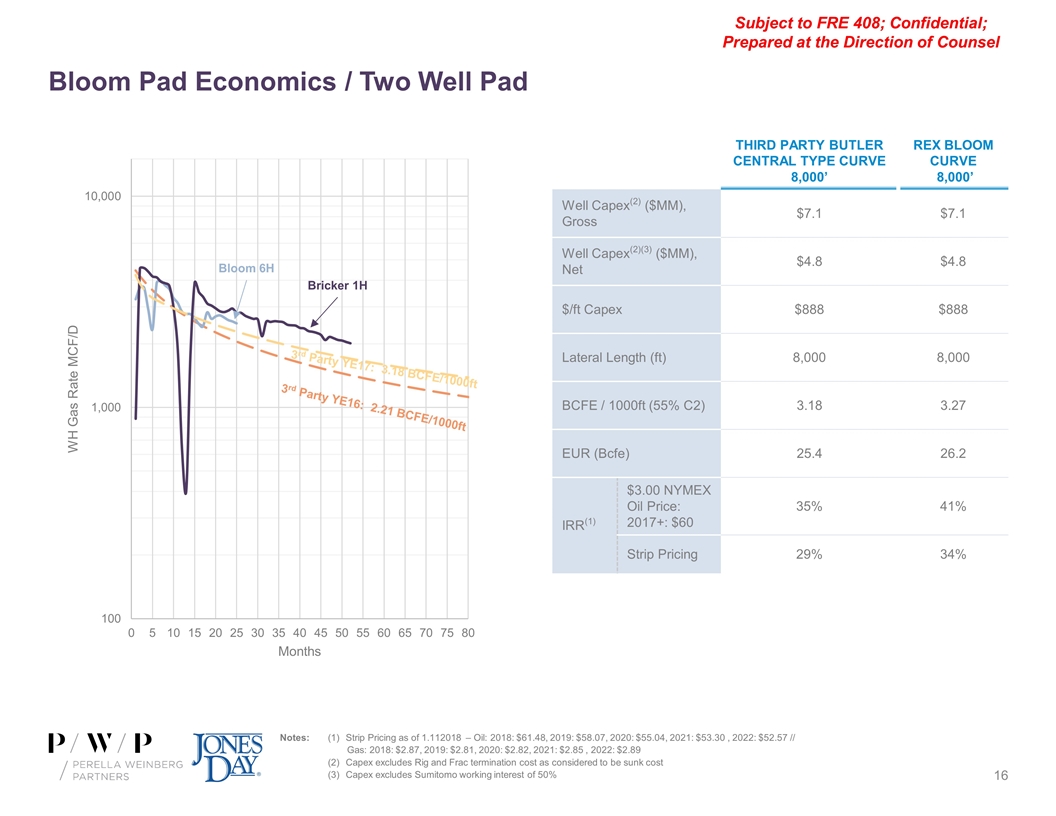

Bloom Pad Economics / Two Well Pad THIRD PARTY BUTLER CENTRAL TYPE CURVE 8,000’ REX BLOOM CURVE 8,000’ Well Capex(2) ($MM), Gross $7.1 $7.1 Well Capex(2)(3) ($MM), Net $4.8 $4.8 $/ft Capex $888 $888 Lateral Length (ft) 8,000 8,000 BCFE / 1000ft (55% C2) 3.18 3.27 EUR (Bcfe) 25.4 26.2 IRR(1) $3.00 NYMEX Oil Price: 2017+: $60 35% 41% Strip Pricing 29% 34% Notes:(1)Strip Pricing as of 1.112018 – Oil: 2018: $61.48, 2019: $58.07, 2020: $55.04, 2021: $53.30 , 2022: $52.57 // Gas: 2018: $2.87, 2019: $2.81, 2020: $2.82, 2021: $2.85 , 2022: $2.89 (2)Capex excludes Rig and Frac termination cost as considered to be sunk cost (3)Capex excludes Sumitomo working interest of 50% 3rd Party YE16: 2.21 BCFE/1000ft 3rd Party YE17: 3.18 BCFE/1000ft Bloom 6H Bricker 1H

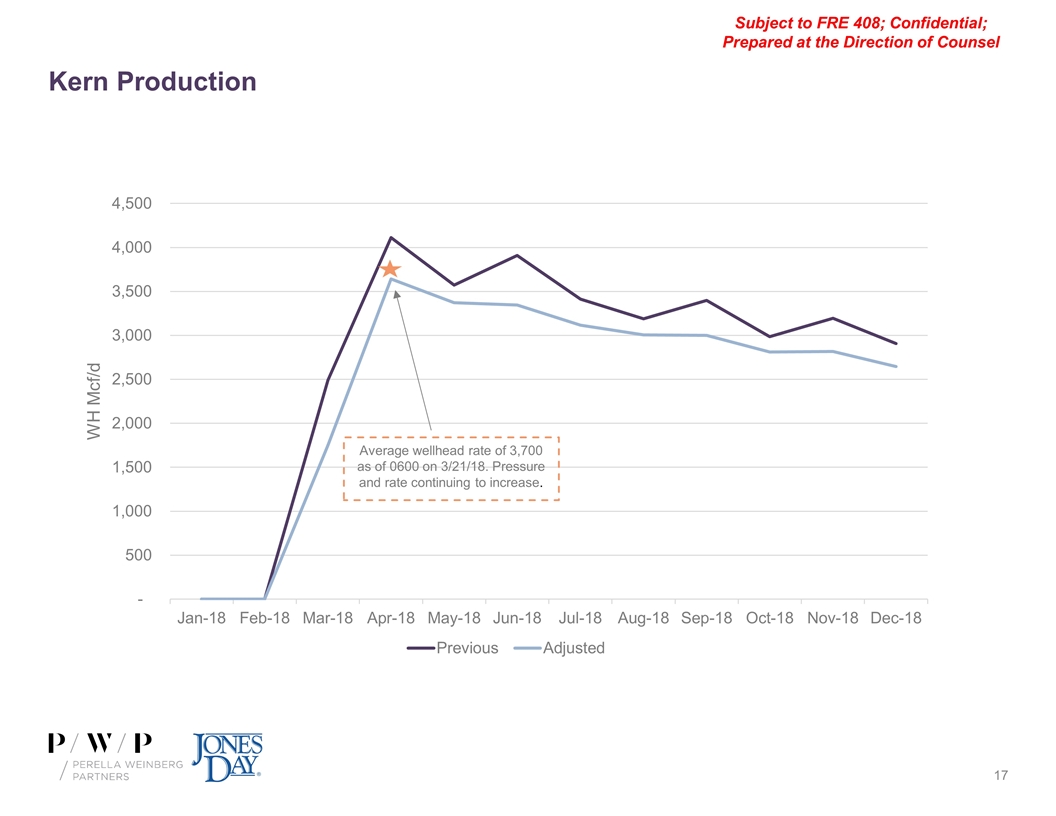

Kern Production Average wellhead rate of 3,700 as of 0600 on 3/21/18. Pressure and rate continuing to increase.

Legal Disclaimer This Presentation has been provided to you by Perella Weinberg Partners and its affiliates (collectively “Perella Weinberg Partners” or the “Firm”) and may not be used or relied upon for any purpose without the written consent of Perella Weinberg Partners. The information contained herein (the “Information”) is confidential. By accepting this Information, you agree that you and your directors, partners, officers, employees, attorney(s), agents and representatives agree to use it for informational purposes only and will not divulge any such Information to any other party. Reproduction of this Information, in whole or in part, is prohibited. These contents are proprietary and a product of Perella Weinberg Partners. The Information contained herein is not an offer to buy or sell or a solicitation of an offer to buy or sell any corporate advisory services or security or to participate in any corporate advisory services or trading strategy. Any decision regarding corporate advisory services or to invest in the investments described herein should be made after, as applicable, reviewing such definitive offering memorandum, conducting such investigations as you deem necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment or service. The information used in preparing these materials may have been obtained from or through you or your representatives or from public sources. Perella Weinberg Partners assumes no responsibility for independent verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and/or forecasts of future financial performance (including estimates of potential cost savings and synergies) prepared by or reviewed or discussed with the managements of your company and/or other potential transaction participants or obtained from public sources, we have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such managements (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). The Firm has no obligation (express or implied) to update any or all of the Information or to advise you of any changes; nor do we make any express or implied warranties or representations as to the completeness or accuracy or accept responsibility for errors. Nothing contained herein should be construed as tax, accounting or legal advice. You (and each of your employees, representatives or other agents) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the transactions contemplated by these materials and all materials of any kind (including opinions or other tax analyses) that are provided to you relating to such tax treatment and structure. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. federal income tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. federal income tax treatment of the transaction.