Attached files

| file | filename |

|---|---|

| 8-K - 8-K - REX ENERGY CORP | d565393d8k.htm |

| EX-99.7 - EX-99.7 - REX ENERGY CORP | d565393dex997.htm |

| EX-99.6 - EX-99.6 - REX ENERGY CORP | d565393dex996.htm |

| EX-99.5 - EX-99.5 - REX ENERGY CORP | d565393dex995.htm |

| EX-99.4 - EX-99.4 - REX ENERGY CORP | d565393dex994.htm |

| EX-99.3 - EX-99.3 - REX ENERGY CORP | d565393dex993.htm |

| EX-99.1 - EX-99.1 - REX ENERGY CORP | d565393dex991.htm |

Discussion Materials March 28, 2018 Exhibit 99.2

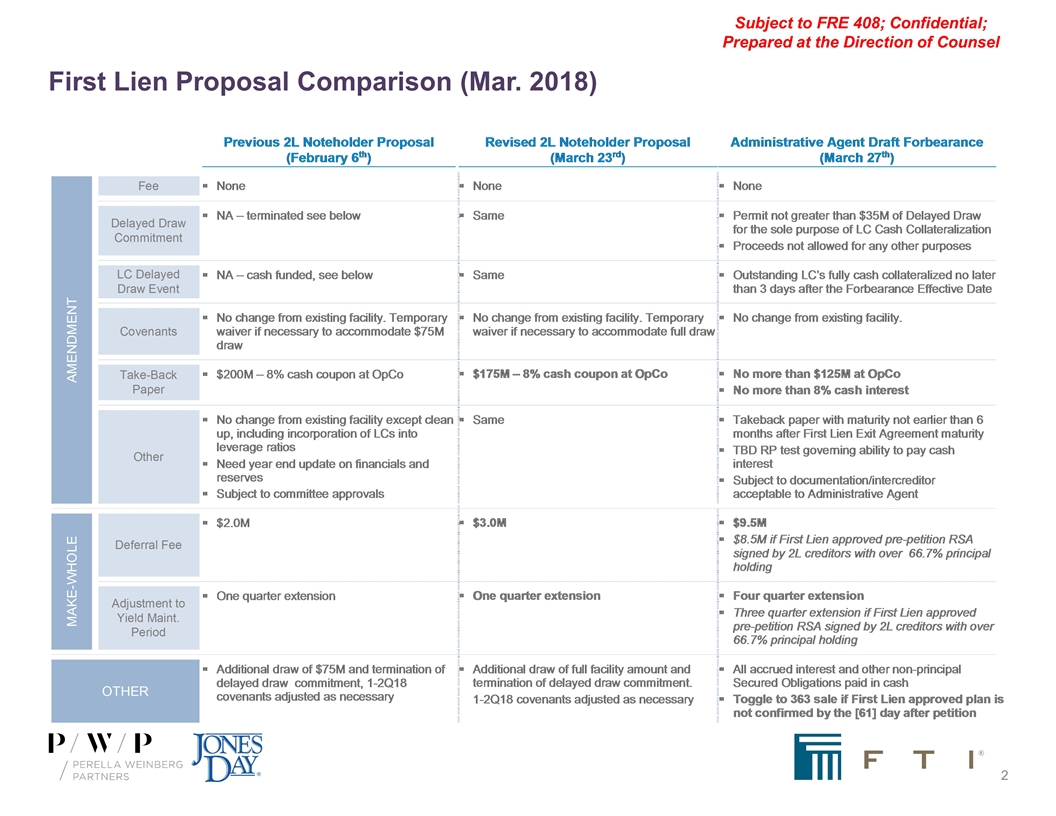

First Lien Proposal Comparison (Mar. 2018)

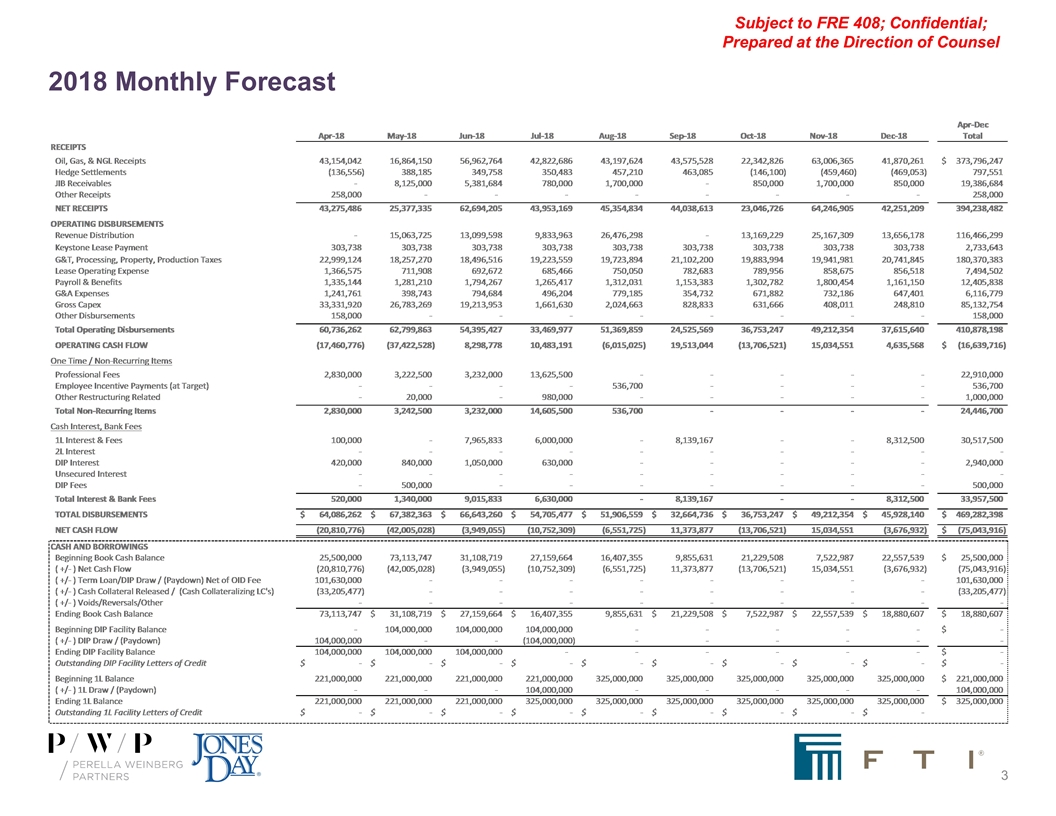

2018 Monthly Forecast

Legal Disclaimer This Presentation has been provided to you by Perella Weinberg Partners and its affiliates (collectively “Perella Weinberg Partners” or the “Firm”) and may not be used or relied upon for any purpose without the written consent of Perella Weinberg Partners. The information contained herein (the “Information”) is confidential. By accepting this Information, you agree that you and your directors, partners, officers, employees, attorney(s), agents and representatives agree to use it for informational purposes only and will not divulge any such Information to any other party. Reproduction of this Information, in whole or in part, is prohibited. These contents are proprietary and a product of Perella Weinberg Partners. The Information contained herein is not an offer to buy or sell or a solicitation of an offer to buy or sell any corporate advisory services or security or to participate in any corporate advisory services or trading strategy. Any decision regarding corporate advisory services or to invest in the investments described herein should be made after, as applicable, reviewing such definitive offering memorandum, conducting such investigations as you deem necessary and consulting the investor’s own investment, legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment or service. The information used in preparing these materials may have been obtained from or through you or your representatives or from public sources. Perella Weinberg Partners assumes no responsibility for independent verification of such information and has relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and/or forecasts of future financial performance (including estimates of potential cost savings and synergies) prepared by or reviewed or discussed with the managements of your company and/or other potential transaction participants or obtained from public sources, we have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such managements (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). The Firm has no obligation (express or implied) to update any or all of the Information or to advise you of any changes; nor do we make any express or implied warranties or representations as to the completeness or accuracy or accept responsibility for errors. Nothing contained herein should be construed as tax, accounting or legal advice. You (and each of your employees, representatives or other agents) may disclose to any and all persons, without limitation of any kind, the tax treatment and tax structure of the transactions contemplated by these materials and all materials of any kind (including opinions or other tax analyses) that are provided to you relating to such tax treatment and structure. For this purpose, the tax treatment of a transaction is the purported or claimed U.S. federal income tax treatment of the transaction and the tax structure of a transaction is any fact that may be relevant to understanding the purported or claimed U.S. federal income tax treatment of the transaction.