Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Corvus Gold Inc. | exh_322.htm |

| EX-32.1 - EXHIBIT 32.1 - Corvus Gold Inc. | exh_321.htm |

| EX-31.2 - EXHIBIT 31.2 - Corvus Gold Inc. | exh_312.htm |

| EX-31.1 - EXHIBIT 31.1 - Corvus Gold Inc. | exh_311.htm |

| EX-23.2 - EXHIBIT 23.2 - Corvus Gold Inc. | exh_232.htm |

| EX-23.1 - EXHIBIT 23.1 - Corvus Gold Inc. | exh_231.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the quarterly period ended February 28, 2017 | ||

| OR | ||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

| Commission file number: 000-55447 | ||

CORVUS GOLD INC.

(Exact Name of Registrant as Specified in its Charter)

| British Columbia, Canada | 98-0668473 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 1750-700 West Pender Street | ||

| Vancouver, British Columbia, Canada, | V6C 1G8 | |

| (Address of Principal Executive Offices) | (Zip code) | |

Registrant’s telephone number, including area code: (604) 638-3246

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

|

Non-accelerated filer ☐ |

Small reporting company ☒ |

| (Do not check if a smaller reporting company) | |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of April 11, 2017, the registrant had 92,369,582 Common Shares outstanding.

Table of Contents

CORVUS GOLD INC.

CONDENSED INTERIM CONSOLIDATED BALANCE SHEETS

(Expressed in Canadian dollars)

| February

28, 2017 | May

31, 2016 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 2,981,212 | $ | 4,783,519 | ||||

| Accounts receivable | 30,144 | 28,810 | ||||||

| Prepaid expenses | 279,816 | 166,853 | ||||||

| Total current assets | 3,291,172 | 4,979,182 | ||||||

| Property and equipment (note 3) | 74,096 | 82,051 | ||||||

| Capitalized acquisition costs (note 4) | 4,424,364 | 4,261,680 | ||||||

| Total assets | $ | 7,789,632 | $ | 9,322,913 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued liabilities (note 6) | $ | 288,742 | $ | 236,861 | ||||

| Total current liabilities | 288,742 | 236,861 | ||||||

| Asset retirement obligations (note 4) | 304,732 | 293,578 | ||||||

| Total liabilities | 593,474 | 530,439 | ||||||

| Shareholders’ equity | ||||||||

| Share capital (note 5) | 72,670,170 | 69,890,670 | ||||||

| Contributed surplus (note 5) | 12,353,193 | 11,977,459 | ||||||

| Accumulated other comprehensive income - cumulative translation differences | 1,246,263 | 1,168,386 | ||||||

| Deficit accumulated during the exploration stage | (79,073,468 | ) | (74,244,041 | ) | ||||

| Total shareholders’ equity | 7,196,158 | 8,792,474 | ||||||

| Total liabilities and shareholders’ equity | $ | 7,789,632 | $ | 9,322,913 | ||||

Nature and continuance of operations (note 1)

Approved on behalf of the Directors:

| “Jeffrey Pontius” | Director | |

| “Anton Drescher” | Director | |

These accompanying notes form an integral part of these condensed

interim consolidated financial statements

| 3 |

CORVUS GOLD INC.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited)

(Expressed in Canadian dollars)

| Three months ended, | Nine months ended | |||||||||||||||

| February 28, 2017 | February 29, 2016 | February 28, 2017 | February 29, 2016 | |||||||||||||

| Expenses | ||||||||||||||||

| Administration | $ | 92 | $ | 1,832 | $ | 545 | $ | 6,457 | ||||||||

| Consulting fees (notes 5 and 6) | 164,869 | 193,492 | 456,531 | 536,111 | ||||||||||||

| Depreciation (note 3) | 5,537 | 6,831 | 16,544 | 19,629 | ||||||||||||

| Exploration expenditures (notes 4 and 5) | 877,567 | 405,701 | 2,107,236 | 2,300,159 | ||||||||||||

| Insurance | 47,597 | 30,918 | 105,913 | 93,107 | ||||||||||||

| Investor relations (notes 5 and 6) | 224,332 | 206,153 | 564,355 | 568,189 | ||||||||||||

| Office and miscellaneous | 27,818 | 35,161 | 89,931 | 103,847 | ||||||||||||

| Professional fees (notes 5 and 6) | 82,433 | 89,826 | 206,356 | 254,556 | ||||||||||||

| Regulatory | 35,954 | 41,901 | 67,809 | 81,886 | ||||||||||||

| Rent | 27,961 | 32,128 | 80,309 | 86,560 | ||||||||||||

| Travel | 23,097 | 11,075 | 107,415 | 79,545 | ||||||||||||

| Wages and benefits (notes 5 and 6) | 482,674 | 572,979 | 1,045,682 | 1,421,694 | ||||||||||||

| Total operating expenses | (1,999,931 | ) | (1,627,997 | ) | (4,848,626 | ) | (5,551,740 | ) | ||||||||

| Other income (expense) | ||||||||||||||||

| Interest income | 5,729 | 2,017 | 24,059 | 11,685 | ||||||||||||

| Gain on sale of capitalized acquisition costs (note 4(b)) | - | 66,669 | - | 92,397 | ||||||||||||

| Write-off of capitalized acquisition costs (note 4(a)) | - | - | - | (677,695 | ) | |||||||||||

| Foreign exchange gain (loss) | (1,065 | ) | 22,573 | (4,860 | ) | 144,223 | ||||||||||

| Total other income (loss) | 4,664 | 91,259 | 19,199 | (429,390 | ) | |||||||||||

| Net loss for the period | (1,995,267 | ) | (1,536,738 | ) | (4,829,427 | ) | (5,981,130 | ) | ||||||||

| Other comprehensive income | ||||||||||||||||

| Exchange difference on translating foreign operations | (65,148 | ) | 90,414 | 77,877 | 493,642 | |||||||||||

| Comprehensive loss for the period | $ | (2,060,415 | ) | $ | (1,446,324 | ) | $ | (4,751,550 | ) | $ | (5,487,488 | ) | ||||

| Basic and diluted loss per share | $ | (0.02 | ) | $ | (0.02 | ) | $ | (0.05 | ) | $ | (0.07 | ) | ||||

| Weighted average number of shares outstanding | 92,369,582 | 84,449,248 | 91,936,432 | 82,989,413 | ||||||||||||

These accompanying notes form an integral part of these condensed interim consolidated financial statements

| 4 |

CORVUS GOLD INC.

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(Expressed in Canadian dollars)

NINE MONTHS ENDED,

| February 28, 2017 | February 29, 2016 | |||||||

| Operating activities | ||||||||

| Net loss for the period | $ | (4,829,427 | ) | $ | (5,981,130 | ) | ||

| Add items not affecting cash: | ||||||||

| Depreciation | 16,544 | 19,629 | ||||||

| Stock-based compensation (note 5) | 453,788 | 639,350 | ||||||

| Write-off of capitalized acquisition costs (note 4(a)) | - | 677,695 | ||||||

| Gain on sale of capitalized acquisition costs (note 4(b)) | - | (92,397 | ) | |||||

| Loss (gain) on foreign exchange | 4,860 | (144,223 | ) | |||||

| Changes in non-cash items: | ||||||||

| Accounts receivable | (1,334 | ) | 7,506 | |||||

| Prepaid expenses | (112,963 | ) | 21,620 | |||||

| Accounts payable and accrued liabilities | 51,881 | (318,509 | ) | |||||

| Cash used in operating activities | (4,416,651 | ) | (5,170,459 | ) | ||||

| Financing activities | ||||||||

| Cash received from issuance of shares | 2,701,000 | 2,000,000 | ||||||

| Share issuance costs | (17,554 | ) | (13,401 | ) | ||||

| Repayment of promissory note | - | (298,488 | ) | |||||

| Cash provided by financing activities | 2,683,446 | 1,688,111 | ||||||

| Investing activities | ||||||||

| Expenditures on property and equipment | (7,739 | ) | - | |||||

| Cash received from sale of capitalized acquisition costs (note 4(b)) | - | 25,728 | ||||||

| Capitalized acquisition costs | (66,876 | ) | (32,594 | ) | ||||

| Cash used in investing activities | (74,615 | ) | (6,866 | ) | ||||

| Effect of foreign exchange on cash | 5,513 | 231,169 | ||||||

| Decrease in cash and cash equivalents | (1,802,307 | ) | (3,258,045 | ) | ||||

| Cash and cash equivalents, beginning of the period | 4,783,519 | 5,159,962 | ||||||

| Cash and cash equivalents, end of the period | $ | 2,981,212 | $ | 1,901,917 | ||||

Supplemental cash flow information (note 9)

These accompanying notes form an integral part of these condensed interim consolidated financial statements

| 5 |

CORVUS GOLD INC.

CONDENSED INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(Unaudited)

(Expressed in Canadian dollars)

| Number of shares | Amount | Contributed Surplus | Accumulated Other Comprehensive Income (Loss) – Cumulative Translation Differences | Deficit | Total | |||||||||||||||||||

| Balance, May 31, 2016 | 89,594,582 | $ | 69,890,670 | $ | 11,977,459 | $ | 1,168,386 | $ | (74,244,041 | ) | $ | 8,792,474 | ||||||||||||

| Net loss for the period | - | - | - | - | (4,829,427 | ) | (4,829,427 | ) | ||||||||||||||||

| Shares issued for cash | ||||||||||||||||||||||||

| Private placement | 2,550,000 | 2,601,000 | - | - | - | 2,601,000 | ||||||||||||||||||

| Exercise of stock options | 200,000 | 100,000 | - | - | - | 100,000 | ||||||||||||||||||

| Shares issued for capitalized acquisition costs | 25,000 | 18,000 | - | - | - | 18,000 | ||||||||||||||||||

| Other comprehensive income | ||||||||||||||||||||||||

| Exchange difference on translating foreign operations | - | - | - | 77,877 | - | 77,877 | ||||||||||||||||||

| Share issuance costs | - | (17,554 | ) | - | - | - | (17,554 | ) | ||||||||||||||||

| Reclassification of contributed surplus on exercise of stock options | - | 78,054 | (78,054 | ) | - | - | - | |||||||||||||||||

| Stock-based compensation | - | - | 453,788 | - | - | 453,788 | ||||||||||||||||||

| Balance, February 28, 2017 | 92,369,582 | $ | 72,670,170 | $ | 12,353,193 | $ | 1,246,263 | $ | (79,073,468 | ) | $ | 7,196,158 | ||||||||||||

These accompanying notes form an integral part of these condensed interim consolidated financial statements

| 6 |

| 1. | NATURE AND CONTINUANCE OF OPERATIONS |

On August 25, 2010, International Tower Hill Mines Ltd. (“ITH”) completed a Plan of Arrangement (the “Arrangement”) whereby its existing Alaska mineral properties (other than the Livengood project) and related assets and the North Bullfrog mineral property and related assets in Nevada (collectively, the “Nevada and Other Alaska Business”) were indirectly spun out into a new public company, being Corvus Gold Inc. (“Corvus” or the “Company”). As part of the Arrangement, ITH transferred its wholly-owned subsidiary Corvus Gold Nevada Inc. (“Corvus Nevada”) (which held the North Bullfrog property), to Corvus and a wholly-owned Alaskan subsidiary of ITH, Talon Gold Alaska, Inc. sold to Raven Gold Alaska Inc. (“Raven Gold”), a wholly-owned Alaskan subsidiary of Corvus, the Terra, Chisna, LMS and West Pogo properties. As a consequence of the completion of the Arrangement, the Terra, Chisna, LMS, West Pogo and North Bullfrog properties were transferred to Corvus.

The Company was incorporated on April 13, 2010 under the Business Corporations Act (British Columbia). These consolidated financial statements reflect the cumulative operating results of the predecessor, as related to the mineral properties that were transferred to the Company from June 1, 2006.

The Company is engaged in the business of acquiring, exploring and evaluating mineral properties, and either joint venturing or developing these properties further or disposing of them when the evaluation is completed. At February 28, 2017, the Company had interests in a property in Nevada, U.S.A.

The business of mining and exploration involves a high degree of risk and there can be no assurance that current exploration programs will result in profitable mining operations. The Company has no source of revenue, and has significant cash requirements to meet its administrative overhead and maintain its mineral property interests. The recoverability of amounts shown for mineral properties is dependent on several factors. These include the discovery of economically recoverable reserves, the ability of the Company to obtain the necessary financing to complete the development of these properties, and future profitable production or proceeds from disposition of mineral properties. The carrying value of the Company’s mineral properties does not reflect current or future values.

These condensed interim consolidated financial statements have been prepared on a going concern basis, which presume the realization of assets and discharge of liabilities in the normal course of business for the foreseeable future.

In assessing whether the going concern assumption is appropriate, management takes into account all available information about the future within one year from the date the condensed interim consolidated financial statements are issued.

The Company has sustained losses from operations, has negative cash flows, and has an ongoing requirement for capital investment to explore its mineral properties. As at February 28, 2017, the Company had working capital of $3,002,430 compared to working capital of $4,742,321 as at May 31, 2016. On July 15, 2016, the Company closed a non-brokered private placement equity financing and issued 2,550,000 common shares at a price of $1.02 per common share for gross proceeds of $2,601,000. Based on its current plans, budgeted expenditures, and cash requirements, the Company does not have sufficient cash to finance its current plans for the 12 months from the date the condensed interim consolidated financial statement are issued.

The Company expects that it will need to raise substantial additional capital to accomplish its business plan over the next several years. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favourable to the Company as those previously obtained, or at all. Should such financing not be available in that time-frame, the Company will be required to reduce its activities and will not be able to carry out all of its presently planned exploration and development activities on its currently anticipated scheduling.

These condensed interim consolidated financial statements do not include any adjustments to the amounts and classification of assets and liabilities that might be necessary should the Company be unable to continue in business.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

Basis of presentation

These unaudited condensed consolidated interim financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X under the Securities Exchange Act of 1934, as amended. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for annual financial statements. These unaudited condensed interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements for the year ended May 31, 2016 as filed in our Annual Report on Form 10-K. In the opinion of the Company’s management these financial statements reflect all adjustments, consisting of normal recurring adjustments, necessary to present fairly the Company’s financial position at February 28, 2017 and the results of its operations for the nine months then ended. Operating results for the nine months ended February 28, 2017 are not necessarily indicative of the results that may be expected for the year ending May 31, 2017. The 2016 year-end balance sheet data was derived from audited financial statements but does not include all disclosures required by U.S. GAAP.

| 7 |

The preparation of financial statements in conformity with US GAAP requires management to make judgments, estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the period. These judgments, estimates and assumptions are continuously evaluated and are based on management’s experience and knowledge of the relevant facts and circumstances. While management believes the estimates to be reasonable, actual results could differ from those estimates and could impact future results of operations and cash flows.

Basis of consolidation

These unaudited condensed interim consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries (collectively, the “Group”), Corvus Gold (USA) Inc. (“Corvus USA”) (a Nevada corporation), Corvus Nevada (a Nevada corporation), Raven Gold (an Alaska corporation) and SoN Land and Water LLC (“SoN”) (a Nevada limited liability company). All intercompany transactions and balances were eliminated upon consolidation.

Earnings (loss) per share

Basic loss per share is calculated using the weighted average number of common shares outstanding during the period. The Company uses the treasury stock method to compute the dilutive effect of options, warrants and similar instruments. Under this method, the dilutive effect on earnings (loss) per share is calculated presuming the exercise of outstanding options, warrants and similar instruments. It assumes that the proceeds of such exercise would be used to repurchase common shares at the average market price during the period. However, the calculation of diluted loss per share excludes the effects of various conversions and exercise of options and warrants that would be anti-dilutive. For the period ended February 28, 2017, 8,846,900 outstanding stock options (2016 – 8,226,334) were not included in the calculation of diluted earnings (loss) per share as their inclusion was anti-dilutive.

| 3. | PROPERTY AND EQUIPMENT |

| Computer Equipment | Vehicles | Tent | Total | |||||||||||||

| Cost | ||||||||||||||||

| Balance, May 31, 2016 | $ | 68,885 | $ | 89,434 | $ | 65,550 | $ | 223,869 | ||||||||

| Additions | 7,739 | - | - | 7,739 | ||||||||||||

| Currency translation adjustments | 733 | 1,167 | 855 | 2,755 | ||||||||||||

| Balance, February 28, 2017 | $ | 77,357 | $ | 90,601 | $ | 66,405 | $ | 234,363 | ||||||||

| Depreciation | ||||||||||||||||

| Balance, May 31, 2016 | $ | 43,495 | $ | 70,529 | $ | 27,794 | $ | 141,818 | ||||||||

| Depreciation for the period | 6,597 | 4,266 | 5,681 | 16,544 | ||||||||||||

| Currency translation adjustments | 525 | 962 | 418 | 1,905 | ||||||||||||

| Balance, February 28, 2017 | $ | 50,617 | $ | 75,757 | $ | 33,893 | $ | 160,267 | ||||||||

| Carrying amounts | ||||||||||||||||

| Balance, May 31, 2016 | $ | 25,390 | $ | 18,905 | $ | 37,756 | $ | 82,051 | ||||||||

| Balance, February 28, 2017 | $ | 26,740 | $ | 14,844 | $ | 32,512 | $ | 74,096 | ||||||||

| 8 |

| 4. | MINERAL PROPERTIES |

The Company had the following activity related to capitalized acquisition costs:

| North Bullfrog | Total | |||||||

| (note 4(d)) | ||||||||

| Balance, May 31, 2016 | $ | 4,261,680 | $ | 4,261,680 | ||||

| Acquisition costs | 84,876 | 84,876 | ||||||

| Asset retirement obligations | 7,325 | 7,325 | ||||||

| Currency translation adjustments | 70,483 | 70,483 | ||||||

| Balance, February 28, 2017 | $ | 4,424,364 | $ | 4,424,364 | ||||

The following table presents costs incurred for exploration and evaluation activities for the nine months ended February 28, 2017:

| North Bullfrog | Total | |||||||

| (note 4(d)) | ||||||||

| Exploration costs: | ||||||||

| Assay | $ | 453,955 | $ | 453,955 | ||||

| Drilling | 757,628 | 757,628 | ||||||

| Equipment rental | 51,543 | 51,543 | ||||||

| Field costs | 119,438 | 119,438 | ||||||

| Geological/ Geophysical | 231,923 | 231,923 | ||||||

| Land maintenance & tenure | 282,104 | 282,104 | ||||||

| Permits | 26,928 | 26,928 | ||||||

| Studies | 129,356 | 129,356 | ||||||

| Travel | 54,361 | 54,361 | ||||||

| Total expenditures for the period | $ | 2,107,236 | $ | 2,107,236 | ||||

The following table presents costs incurred for exploration and evaluation activities for the nine months ended February 29, 2016:

| West Pogo | Chisna | North Bullfrog | LMS | Total | ||||||||||||||||

| (note 4(b)) | (note 4(a)) | (note 4(d)) | (note 4(c)) | |||||||||||||||||

| Exploration costs: | ||||||||||||||||||||

| Assay | $ | - | $ | - | $ | 666,700 | $ | - | $ | 666,700 | ||||||||||

| Drilling | - | - | 655,117 | - | 655,117 | |||||||||||||||

| Equipment rental | - | - | 33,256 | - | 33,256 | |||||||||||||||

| Field costs | 181 | 247 | 86,757 | 534 | 87,719 | |||||||||||||||

| Geological/ Geophysical | - | 6,210 | 265,454 | 2,154 | 273,818 | |||||||||||||||

| Land maintenance & tenure | - | 13,534 | 306,954 | 32,900 | 353,388 | |||||||||||||||

| Permits | - | - | 632 | - | 632 | |||||||||||||||

| Studies | - | - | 310,893 | - | 310,893 | |||||||||||||||

| Transportation | - | - | - | 2,131 | 2,131 | |||||||||||||||

| Travel | - | 913 | 51,650 | - | 52,563 | |||||||||||||||

| 181 | 20,904 | 2,377,413 | 37,719 | 2,436,217 | ||||||||||||||||

| Cost recovery | (23,802 | ) | (7,418 | ) | - | (104,838 | ) | (136,058 | ) | |||||||||||

| Total expenditures (recovery) for the period | $ | (23,621 | ) | $ | 13,486 | $ | 2,377,413 | $ | (67,119 | ) | $ | 2,300,159 | ||||||||

| a) | Chisna Property, Alaska |

The Chisna property is located in the eastern Alaska Range, Alaska, and is comprised of unpatented mineral claims owned 100% by the Company and fee simple lands leased from Ahtna Incorporated (“Ahtna”).

On November 2, 2009, ITH and Talon Gold Alaska, Inc. (ITH’s wholly-owned Alaskan subsidiary) entered into an agreement (as amended) with Ocean Park Ventures Corp. (“OPV”). Pursuant to the agreement, an Alaskan subsidiary of OPV and Raven Gold formed a joint venture for the purpose of exploring and developing the Chisna property.

| 9 |

On November 7, 2012, OPV withdrew from the joint venture and thereby returned 100% of the Chisna Project to the Company.

On March 24, 2010, Raven Gold entered into a Mineral Exploration Agreement with Option to Lease with Ahtna, an Alaska Native Regional Corporation, concerning approximately 26,516 hectares of fee simple lands in the Athell Area of Alaska surrounding or adjacent to some of the blocks of mineral claims owned by Raven Gold.

During the year ended May 31, 2015, the Company gave notification and terminated the Ahtna lease.

During the year ended May 31, 2016, the Company wrote off the Chisna property as the Company, at the time, had reduced the Chisna property to 36 core claims. On April 5, 2016, Raven Gold completed a transaction with Millrock Resources Inc. (“Millrock”) on the Chisna property. The ownership of the property was sold for USD 25,000 and a retained net smelter return (“NSR”) royalty of 1% on precious metals and 1% on base metals.

| b) | West Pogo Property, Alaska |

The West Pogo property is located approximately 50 kilometres north of Delta Junction, Alaska, and consists of unpatented mineral claims owned 100% by the Company.

During the year ended May 31, 2014, the Company wrote off the West Pogo property, as there had been a delay in exploration work on the property for an extended period of time.

During the year ended May 31, 2016, Raven Gold completed a transaction with Millrock Resources Inc. (“Millrock”) on the West Pogo and Goodpaster database projects in Alaska. The ownership position was sold for $25,728 (USD 20,000) and the Goodpaster database project was sold for $136,058 (USD 100,000) and reflected as cost recovery for the West Pogo and LMS project. For the West Pogo project, the Company retained net smelter return (“NSR”) royalties of 3% on precious metals and 1% on base metals with 1% of the precious metal royalty buy down for USD 2 million and a further 1% for an additional USD 5 million. For the Goodpaster database, the Company retained NSR royalty of 1% on all new claims acquired within the defined Area of Interest which totals some 1,500 square kilometres covering the largest gold producing District in Alaska. One half of the royalty can be purchased for USD 2 million.

| c) | LMS Property, Alaska |

The LMS property consists of unpatented mineral claims owned 100% by the Company. During the year ended May 31, 2016, the Company sold the LMS property for a consideration of $473,585 (USD 350,000) and was granted a retained NSR royalty of 3% on precious metals and 1% on base metals with a 1% on buy down of the precious metal royalty for USD$4,000,000.

| d) | North Bullfrog Project, Nevada |

The Company’s North Bullfrog project consists of certain leased patented lode mining claims and federal unpatented mining claims owned 100% by the Company.

| (i) | Interests acquired from Redstar Gold Corp. |

On October 9, 2009, a US subsidiary of ITH at the time (Corvus Nevada) completed the acquisition of all of the interests of Redstar Gold Corp. (“Redstar”) and Redstar Gold U.S.A. Inc. (“Redstar US”) in the North Bullfrog project, which consisted of the following leases:

| (1) | Pursuant to a mining lease and option to purchase agreement made effective October 27, 2008 between Redstar and an arm’s length limited liability company, Redstar has leased (and has the option to purchase) 12 patented mining claims referred to as the “Connection” property. The ten-year, renewable mining lease requires advance minimum royalty payments (recoupable from production royalties, but not applicable to the purchase price if the option to purchase is exercised) of USD 10,800 (paid) on signing and annual payments for the first three anniversaries of USD 10,800 (paid) and USD 16,200 for every year thereafter (paid to October 27, 2016). Redstar has an option to purchase the property (subject to the NSR royalty below) for USD 1,000,000 at any time during the life of the lease. Production is subject to a 4% NSR royalty, which may be purchased by the lessee for USD 1,250,000 per 1% (USD 5,000,000 for the entire royalty). |

| 10 |

| (2) | Pursuant to a mining lease made and entered into as of May 8, 2006 between Redstar and two arm’s length individuals, Redstar has leased 3 patented mining claims which form part of the North Bullfrog project holdings. The lease is for an initial term of 10 years, and for so long thereafter as mining activities continue on the claims or contiguous claims held by the lessee. The lessee is required to pay advance minimum royalty payments (recoupable from production royalties) of USD 4,000 on execution, USD 3,500 on each of May 8, 2007, 2008 and 2009 (paid), USD 4,500 on May 8, 2010 and each anniversary thereafter, adjusted for inflation (paid to May 8, 2016). The lessor is entitled to receive a 2% NSR royalty on all production, which may be purchased by the lessee for USD 1,000,000 per 1% (USD 2,000,000 for the entire royalty). |

| (3) | Pursuant to a mining lease made and entered into as of May 8, 2006 between Redstar and an arm’s length private Nevada corporation, Redstar has leased 2 patented mining claims which form part of the North Bullfrog project holdings. The lease is for an initial term of 10 years, and for so long thereafter as mining activities continue on the claims or contiguous claims held by the lessee. The lessee is required to pay advance minimum royalty payments (recoupable from production royalties) of USD 2,000 on execution, USD 2,000 on each of May 8, 2007, 2008 and 2009 (paid), USD 3,000 on May 8, 2010 and each anniversary thereafter, adjusted for inflation (paid to May 8, 2016). The lessor is entitled to receive a 3% NSR royalty on all production, which may be purchased by the lessee for USD 850,000 per 1% (USD 2,550,000 for the entire royalty). On May 29, 2014, the parties signed a First Amendment Agreement whereby the Lease is amended to provide that in addition to the Advance Minimum Royalty payments payable in respect of the Original Claims, the lessee will now pay to the lessor Advance Minimum Royalty payments in respect of the Yellow Rose Claims of USD 2,400 on execution, USD 2,400 on each of May 29, 2015, 2016 and 2017 (paid to May 29, 2016), USD 3,600 on May 29, 2018 and each anniversary thereafter. The Lessor is entitled to receive a 3% NSR royalty on all production from the Yellow Rose claims, which may be purchased by the lessee for USD 770,000 per 1% (USD 2,310,000 for the entire royalty). |

| (4) | Pursuant to a mining lease made and entered into as of May 16, 2006 between Redstar and an arm’s length individual, Redstar has leased 12 patented mineral claims which form part of the North Bullfrog project holdings. The lease is for an initial term of 10 years, and for so long thereafter as mining activities continue on the claims or contiguous claims held by the lessee. The lessee is required to pay advance minimum royalty payments (recoupable from production royalties) of USD 20,500 on execution and USD 20,000 on each anniversary thereafter (paid to May 16, 2016). The lessor is entitled to receive a 4% NSR royalty on all production, which may be purchased by the lessee for USD 1,000,000 per 1% (USD 4,000,000 for the entire royalty). |

| (5) | Pursuant to a mining lease made and entered into as of May 22, 2006 between Redstar and two arm’s length individuals, Redstar has leased 3 patented mineral claims which form part of the North Bullfrog project holdings. The lease is for an initial term of 10 years, and for so long thereafter as mining activities continue on the claims or contiguous claims held by the lessee. The lessee is required to pay advance minimum royalty payments (recoupable from production royalties) of USD 8,000 on execution, USD 4,800 on each of May 22, 2007, 2008 and 2009 (paid), USD 7,200 on May 22, 2010 and each anniversary thereafter, adjusted for inflation (paid to May 22, 2016). The lessor is entitled to receive a 2% NSR royalty on all production, which may be purchased by the lessee for USD 1,000,000 per 1% (USD 2,000,000 for the entire royalty). |

| (6) | Pursuant to a mining lease made and entered into as of June 16, 2006 between Redstar and an arm’s length individual, Redstar has leased one patented mineral claims which form part of the North Bullfrog project holdings. The lease is for an initial term of 10 years, and for so long thereafter as mining activities continue on the claims or contiguous claims held by the lessee. The lessee is required to pay advance minimum royalty payments (recoupable from production royalties) of USD 2,000 on execution, USD 2,000 on each of June 16, 2007, 2008 and 2009 (paid), USD 3,000 on June 16, 2010 and each anniversary thereafter, adjusted for inflation (paid to June 16, 2016). The lessor is entitled to receive a 2% NSR royalty on all production, which may be purchased by the lessee for USD 1,000,000 per 1% (USD 2,000,000 for the entire royalty). |

As a consequence of the acquisition of Redstar and Redstar US’s interest in the foregoing leases, Corvus Nevada is now the lessee under all of such leases.

| 11 |

| (i) | Interests acquired directly by Corvus Nevada |

| (1) | Pursuant to a mining lease and option to purchase agreement made effective December 1, 2007 between Corvus Nevada and a group of arm’s length limited partnerships, Corvus Nevada has leased (and has the option to purchase) patented mining claims referred to as the “Mayflower” claims which form part of the North Bullfrog project. The terms of the lease/option are as follows: |

| ☐ | Terms: Initial term of five years, commencing December 1, 2007, with the option to extend the lease for an additional five years. The lease will continue for as long thereafter as the property is in commercial production or, alternatively, for an additional three years if Corvus Nevada makes advance minimum royalty payments of USD 100,000 per year (which are recoupable against actual production royalties). |

| ☐ | Lease Payments: USD 5,000 (paid) and 25,000 common shares of ITH (delivered) following regulatory acceptance of the transaction; and an additional USD 5,000 and 20,000 common shares on each of the first through fourth lease anniversaries (paid and issued). Pursuant to an agreement with the lessors, in lieu of the 20,000 ITH shares due December 1, 2010, Corvus Nevada paid USD 108,750 on November 10, 2010 and delivered 46,250 common shares of the Company on December 2, 2010. If Corvus Nevada elects to extend the lease for a second five-year term, it will pay USD 10,000 and deliver 50,000 common shares of ITH upon election being made, and an additional 50,000 common shares of ITH on each of the fifth through ninth anniversaries (USD 10,000 paid on October 31, 2012 and 50,000 common shares of ITH delivered on October 25, 2012 paid with cash of $126,924; and USD 10,000 paid on November 13, 2013 and 50,000 common shares of ITH delivered on November 25, 2013 paid with cash of $35,871; and USD 10,000 paid on November 17, 2014 and 50,000 common shares of ITH delivered on November 7, 2014 paid with cash of $21,200; and USD 10,000 paid on November 23, 2015 and 50,000 common shares of ITH delivered on November 5, 2015 paid with cash of $19,237; and USD 10,000 paid on November 17, 2016 and 50,000 common shares of ITH, purchased for $53,447 in the market by the Company, were delivered on November 10, 2016). |

| ☐ | Anti-Dilution: Pursuant to an amended agreement agreed to by the lessors in March 2015, the Company shall deliver a total of 85,000 common shares (issued) of the Company for the years 2011 to 2014 (2011: 10,000 common shares; 2012 to 2014: 25,000 common shares each year). All future payments will be satisfied by the delivery of an additional ½ common shares of the Company for each of the ITH shares due per the original agreement (issued 25,000 shares of the Company on November 18, 2015 and 25,000 shares of the Company on November 18, 2016). |

| ☐ | Work Commitments: USD 100,000 per year for the first three years (incurred), USD 200,000 per year for the years 4 – 6 (incurred) and USD 300,000 for the years 7 – 10 (incurred to year 9). Excess expenditures in any year may be carried forward. If Corvus Nevada does not incur the required expenditures in year one, the deficiency is required to be paid to the lessors. |

| ☐ | Retained Royalty: Corvus Nevada will pay the lessors a NSR royalty of 2% if the average gold price is USD 400 per ounce or less, 3% if the average gold price is between USD 401 and USD 500 per ounce and 4% if the average gold price is greater than USD 500 per ounce. |

| (2) | Pursuant to a mining lease and option to purchase made effective March 1, 2011 between Corvus Nevada and an arm’s length individual, Corvus Nevada has leased, and has the option to purchase, 2 patented mineral claims which form part of the North Bullfrog project holdings. The lease is for an initial term of 10 years, subject to extension for an additional 10 years (provided advance minimum royalties are timely paid), and for so long thereafter as mining activities continue on the claims. The lessee is required to pay advance minimum royalty payments (recoupable from production royalties, but not applicable to the purchase price if the option to purchase is exercised) of USD 20,000 on execution (paid), USD 25,000 on each of March 1, 2012 (paid), 2013 (paid) and 2014 (paid), USD 30,000 on March 1, 2015 and each anniversary thereafter (paid to March 1, 2017), adjusted for inflation. The lessor is entitled to receive a 2% NSR royalty on all production. The lessee may purchase the royalty for USD 1,000,000 per 1%. If the lessee purchases the entire royalty (USD 2,000,000) the lessee will also acquire all interest of the lessor in the subject property. |

| 12 |

| (3) | Pursuant to a purchase agreement made effective March 28, 2013, Corvus Nevada agreed to purchase the surface rights of five patented mining claims owned by two arm’s length individuals for USD 160,000 paid on closing (March 28, 2013). The terms include payment by Corvus Nevada of a fee of USD 0.02 per ton of overburden to be stored on the property, subject to payment for a minimum of 12 million short tons. The minimum tonnage fee (USD 240,000) bears interest at 4.77% per annum from closing and is evidenced by a promissory note due on the sooner of the commencing of use of the property for waste materials storage or December 31, 2015 (balance paid December 17, 2015). As a result, the Company recorded $406,240 (USD 400,000) in acquisition costs with $157,408 paid in cash and the remaining $248,832 (USD 240,000) in promissory note payable during the year ended May 31, 2013. |

| (4) | In December 2013, SoN completed the purchase of a parcel of land approximately 30 km north of the North Bullfrog project which carries with it 1,600 acre feet of irrigation water rights. The cost of the land and associated water rights was cash payment of $1,100,118 (USD 1,034,626). |

| (5) | On March 30, 2015, Lunar Landing, LLC signed a lease agreement with Corvus Nevada to lease private property containing the three patented Sunflower claims to Corvus Nevada, which are adjacent to the Yellow Rose claims leased in 2014. The term of the lease is 3 years with provision to extend the lease for an additional 7 years, and an advance minimum royalty payment of USD 5,000 per year with USD 5,000 paid upon signing (paid to March 2017). The lease includes a 4% NSR royalty on production, with an option to purchase the royalty for USD 500,000 per 1% or USD 2,000,000 for the entire 4% royalty. The lease also includes the option to purchase the property for USD 300,000. |

Acquisitions

The acquisition of title to mineral properties is a detailed and time-consuming process. The Company has taken steps, in accordance with industry norms, to verify title to mineral properties in which it has an interest. Although the Company has taken every reasonable precaution to ensure that legal title to its properties is properly recorded in the name of the Company (or, in the case of an option, in the name of the relevant optionor), there can be no assurance that such title will ultimately be secured.

Environmental Expenditures

The operations of the Company may in the future be affected from time to time in varying degrees by changes in environmental regulations, including those for future removal and site restoration costs. Both the likelihood of new regulations and their overall effect upon the Company vary greatly and are not predictable. The Company’s policy is to meet or, if possible, surpass standards set by relevant legislation by application of technically proven and economically feasible measures.

Environmental expenditures that relate to ongoing environmental and reclamation programs are charged against earnings as incurred or capitalized and amortized depending on their future economic benefits. Estimated future removal and site restoration costs, when the ultimate liability is reasonably determinable, are charged against earnings over the estimated remaining life of the related business operation, net of expected recoveries.

The Company has estimated the fair value of the liability for asset retirement that arose as a result of exploration activities to be $304,732 (USD 229,000) (May 31, 2016 - $293,578 (USD 224,000)). The fair value of the liability was determined to be equal to the estimated remediation costs. Due to the early stages of the project, and that extractive activities have not yet begun, the Company is unable to predict with any precision the timing of the cash flow related to the reclamation activities.

| 5. | SHARE CAPITAL |

Authorized

Unlimited common shares without par value.

| 13 |

Share issuances

During the nine months ended February 28, 2017, the Company had the following share issuances:

| a) | On November 18, 2016, the Company issued 25,000 common shares in connection with the lease on the Mayflower property (note 4d)(ii)(1), with a fair value of $18,000. |

| b) | On July 15, 2016, the Company closed a non-brokered private placement equity financing and issued 2,550,000 common shares at a price of $1.02 per share for gross proceeds of $2,601,000. In connection with the financing, the Company paid an additional $17,554 in share issuance costs. |

| c) | An aggregate of 200,000 shares were issued on exercise of 200,000 stock options for gross proceeds of $100,000. |

Stock options

Stock options awarded to employees and non-employees by the Company are measured and recognized in the Condensed Interim Consolidated Statement of Operations and Comprehensive Loss over the vesting period.

The Company has adopted an incentive stock option plan, first adopted in 2010 and then amended in 2013 (the “Amended 2010 Plan”). The essential elements of the Amended 2010 Plan provide that the aggregate number of common shares of the Company’s share capital that may be made issuable pursuant to options granted under the Amended 2010 Plan (together with any other shares which may be issued under other share compensation plans of the Company) may not exceed 10% of the number of issued shares of the Company at the time of the granting of the options. Options granted under the Amended 2010 Plan will have a maximum term of ten years. The exercise price of options granted under the Amended 2010 Plan will not be less than the greater of the market price of the common shares (as defined by TSX, currently defined as the 5 day volume weighted average price for the 5 trading days immediately preceding the date of grant) or the closing market price of the Company’s common shares for the trading day immediately preceding the date of grant), or such other price as may be agreed to by the Company and accepted by the TSX. Options granted under the Amended 2010 Plan vest immediately, unless otherwise determined by the directors at the date of grant.

A summary of the status of the stock option plan as of February 28, 2017, and May 31, 2016, and changes during the periods are presented below:

| Nine months ended February 28, 2017 | Year ended May 31, 2016 | |||||||||||||||

| Number of Options | Weighted Average Exercise Price | Number of Options | Weighted Average Exercise Price | |||||||||||||

| Balance, beginning of the period | 7,981,000 | $ | 0.85 | 7,396,334 | $ | 0.94 | ||||||||||

| Granted | 1,135,000 | 1.02 | 1,650,000 | 0.48 | ||||||||||||

| Exercised | (200,000 | ) | (0.50 | ) | (245,334 | ) | (0.50 | ) | ||||||||

| Expired | (69,100 | ) | (0.93 | ) | (820,000 | ) | (0.94 | ) | ||||||||

| Balance, end of the period | 8,846,900 | $ | 0.87 | 7,981,000 | $ | 0.85 | ||||||||||

The weighted average remaining contractual life of options outstanding at February 28, 2017 was 2.10 years (May 31, 2016 – 2.42 years).

| 14 |

Stock options outstanding are as follows:

| February 28, 2017 | May 31, 2016 | |||||||||||||||||||||||

| Expiry Date | Exercise Price | Number of Options | Exercisable at Period- End | Exercise Price | Number of Options | Exercisable at Year- End | ||||||||||||||||||

| September 19, 2016 | $ | - | - | - | $ | 0.50 | 219,100 | 219,100 | ||||||||||||||||

| November 17, 2016* | $ | 0.67 | 210,000 | 210,000 | $ | 0.67 | 210,000 | 210,000 | ||||||||||||||||

| January 23, 2017 | $ | - | - | - | $ | 1.10 | 50,000 | 50,000 | ||||||||||||||||

| May 1, 2017 | $ | 0.73 | 50,000 | 50,000 | $ | 0.73 | 50,000 | 50,000 | ||||||||||||||||

| May 29, 2017 | $ | 0.92 | 300,000 | 300,000 | $ | 0.92 | 300,000 | 300,000 | ||||||||||||||||

| September 19, 2017 | $ | 0.96 | 2,016,900 | 2,016,900 | $ | 0.96 | 2,016,900 | 2,016,900 | ||||||||||||||||

| October 29, 2017 | $ | 0.96 | 100,000 | 100,000 | $ | 0.96 | 100,000 | 100,000 | ||||||||||||||||

| August 16, 2018 | $ | 0.76 | 2,120,000 | 2,120,000 | $ | 0.76 | 2,120,000 | 2,120,000 | ||||||||||||||||

| September 8, 2019 | $ | 1.40 | 1,265,000 | 1,265,000 | $ | 1.40 | 1,265,000 | 842,490 | ||||||||||||||||

| September 9, 2020 | $ | 0.46 | 640,000 | 426,240 | $ | 0.46 | 640,000 | 213,120 | ||||||||||||||||

| November 13, 2020 | $ | 0.49 | 1,010,000 | 672,660 | $ | 0.49 | 1,010,000 | 336,330 | ||||||||||||||||

| June 22, 2018 | $ | 1.02 | 50,000 | 33,300 | $ | - | - | - | ||||||||||||||||

| September 15, 2021 | $ | 0.91 | 1,085,000 | 361,305 | $ | - | - | - | ||||||||||||||||

| 8,846,900 | 7,555,405 | 7,981,000 | 6,457,940 | |||||||||||||||||||||

*The Company’s share trading policy (the “Policy”) requires that all restricted persons and others who are subject to the Policy refrain from conducting any transactions involving the purchase or sale of the Company’s securities, during the period in any quarter commencing 30 days prior to the scheduled issuance of the next quarter or year-end public disclosure of the financial results as well as when there is material data on hand. In accordance with the terms of the Amended 2010 Plan, if stock options are set to expire during a restricted period and are not exercised prior to any such restriction, they will not expire but instead will be available for exercise for 10 days after such restrictions are lifted.

The Company uses the fair value method for determining stock-based compensation for all options granted during the periods. The fair value of options granted was $691,819 (2016 - $420,866), determined using the Black-Scholes option pricing model based on the following weighted average assumptions:

| For the nine months ended | February 28, 2017 | February 29, 2016 | ||||||

| Risk-free interest rate | 0.71 | % | 0.88 | % | ||||

| Expected life of options (years) | 4.87 | 5 | ||||||

| Annualized volatility | 85.96 | % | 72.33 | % | ||||

| Dividend yield | 0 | % | 0 | % | ||||

| Exercise price | $ | 0.91 | $ | 0.48 | ||||

| Fair value per share | $ | 0.61 | $ | 0.26 | ||||

Annualized volatility was determined by reference to historic volatility of the Company.

Stock-based compensation has been allocated as follows:

| For the period ended, | February 28, 2017 | February 29, 2016 | ||||||

| Consulting fees | $ | 233,281 | $ | 317,528 | ||||

| Exploration expenditures – Geological/geophysical | 23,366 | 13,809 | ||||||

| Investor relations | 55,431 | 75,621 | ||||||

| Professional fees | 5,112 | 13,802 | ||||||

| Wages and benefits | 136,598 | 218,590 | ||||||

| $ | 453,788 | $ | 639,350 | |||||

| 15 |

| 6. | RELATED PARTY TRANSACTIONS |

During the period ended February 28, 2017, the Company entered into the following transactions with related parties:

| For the period ended, | February 28, 2017 | February 29, 2016 | ||||||

| Consulting fees to CFO | $ | 90,000 | $ | 85,333 | ||||

| Wages and benefits to CEO and COO | 638,564 | 659,906 | ||||||

| Wages and benefits to former President | - | 234,997 | ||||||

| Directors fees (included in consulting fees) | 101,250 | 101,250 | ||||||

| Fees to Vice President of Corporate Communications (included in investor relations) | 137,500 | 152,500 | ||||||

| Stock-based compensation to related parties | 372,155 | 500,941 | ||||||

| $ | 1,339,469 | $ | 1,734,927 | |||||

As at February 28, 2017, included in accounts payable and accrued liabilities was $7,677 (May 31, 2016 – $7,628) in expenses owing to companies related to officers and officers of the Company.

These amounts were unsecured, non-interest bearing and had no fixed terms or terms of repayment. Accordingly, fair value could not be readily determined.

The Company has also entered into change of control agreements with officers of the Company. In the case of termination, the officers are entitled to an amount equal to a multiple (ranging from two times to three times) of the sum of the annual base salary then payable to the officer, the aggregate amount of bonus(es) (if any) paid to the officer within the calendar year immediately preceding the Effective Date of Termination, and an amount equal to the vacation pay which would otherwise be payable for the one year period next following the Effective Date of Termination.

| 7. | GEOGRAPHIC SEGMENTED INFORMATION |

The Company operates in one industry segment, the mineral resources industry, and in two geographical segments, Canada and the United States. All current exploration activities are conducted in the United States and Canada. The significant asset categories identifiable with these geographical areas are as follows:

| Canada | United States | Total | ||||||||||

| February 28, 2017 | ||||||||||||

| Capitalized acquisition costs | $ | - | $ | 4,424,364 | $ | 4,424,364 | ||||||

| Property and equipment | $ | 9,092 | $ | 65,004 | $ | 74,096 | ||||||

| May 31, 2016 | ||||||||||||

| Capitalized acquisition costs | $ | - | $ | 4,261,680 | $ | 4,261,680 | ||||||

| Property and equipment | $ | 8,068 | $ | 73,983 | $ | 82,051 | ||||||

| For the period ended | February 28, 2017 | February 29, 2016 | ||||||

| Net loss for the period – Canada | $ | (1,582,642 | ) | $ | (1,587,624 | ) | ||

| Net loss for the period – United States | (3,246,785 | ) | (4,393,506 | ) | ||||

| Net loss for the period | $ | (4,829,427 | ) | $ | (5,981,130 | ) | ||

| 16 |

| 8. | SUBSIDIARIES |

Significant subsidiaries for the nine months ended February 28, 2017 and February 28, 2016 are:

| Country of Incorporation | Principal Activity | The Company’s effective interest for 2017 | The Company’s effective interest for 2016 | |||||||||||||

| Corvus Gold (USA) Inc. | USA | Holding company | 100 | % | 100 | % | ||||||||||

| Raven Gold Alaska Inc. | USA | Exploration company | 100 | % | 100 | % | ||||||||||

| Corvus Gold Nevada Inc. | USA | Exploration company | 100 | % | 100 | % | ||||||||||

| SoN Land & Water LLC | USA | Exploration company | 100 | % | 100 | % | ||||||||||

| 9. | SUPPLEMENTAL CASH FLOW INFORMATION |

| For the nine months ended | February 28, 2017 | February 29, 2016 | ||||||

| Non-cash financing and investing transactions | ||||||||

| Shares issued to acquire mineral properties | $ | 18,000 | $ | 11,250 | ||||

| 17 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with our unaudited condensed interim consolidated financial statements for the nine months ended February 28, 2017, and the related notes thereto, which have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). This discussion and analysis contains forward-looking statements and forward-looking information that involve risks, uncertainties and assumptions. Our actual results may differ materially from those anticipated in these forward-looking statements and information as a result of many factors. See section heading “Note Regarding Forward-Looking Statements” below. All currency amounts are stated in Canadian dollars unless noted otherwise.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES AND PROVEN AND PROBABLE RESERVES

Corvus Gold Inc. (“we”, “us”, “our,” “Corvus” or the “Company”) is a mineral exploration company engaged in the acquisition and exploration of mineral properties. The mineral estimates in the Technical Report (as defined below) referenced in this Quarterly Report on Form 10-Q have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. As used in the Technical Report referenced in this Quarterly Report on Form 10-Q, the terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 “Standards of Disclosure for Mineral Projects” (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ materially from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7 (“SEC Industry Guide 7”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part of a mineral deposit in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in the Technical Report referenced in this report contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

CAUTIONARY NOTE TO ALL INVESTORS CONCERNING ECONOMIC ASSESSMENTS THAT INCLUDE INFERRED RESOURCES

The Company currently holds or has the right to acquire interests in an advanced stage exploration project in Nye County, Nevada referred to as the North Bullfrog Project (the “NBP”). Mineral resources that are not mineral reserves have no demonstrated economic viability. The preliminary economic assessment included in the Technical Report on the NBP is preliminary in nature and includes “inferred mineral resources” that have a great amount of uncertainty as to their existence, and are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies. There is no certainty that such inferred mineral resources at the NBP will ever be realized. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Readers should refer to the Technical Report for additional information.

| 18 |

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q and the exhibits attached hereto contain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, as amended, and “forward-looking information” within the meaning of applicable Canadian securities legislation, collectively “forward-looking statements”. Such forward-looking statements concern our anticipated results and developments in the operations of the Company in future periods, planned exploration activities, the adequacy of the Company’s financial resources and other events or conditions that may occur in the future. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible” and similar expressions, or statements that events, conditions or results “will,” “may,” “could” or “should” (or the negative and grammatical variations of any of these terms) occur or be achieved. These forward-looking statements may include, but are not limited to, statements concerning:

| · | the Company’s strategies and objectives, both generally and in respect of its specific mineral properties; |

| · | the timing of decisions regarding the timing and costs of exploration programs with respect to, and the issuance of the necessary permits and authorizations required for, the Company’s exploration programs, including for the NBP; |

| · | the Company’s estimates of the quality and quantity of the mineral resources at its mineral properties; |

| · | the timing and cost of planned exploration programs of the Company and its joint venture partners (as applicable), and the timing of the receipt of results therefrom; |

| · | the Company’s future cash requirements and use of proceeds of sales of non-core assets; |

| · | general business and economic conditions; |

| · | the Company’s ability to meet its financial obligations as they come due, and to be able to raise the necessary funds to continue operations; |

| · | the Company’s expectation that it will be able to add additional mineral projects of merit to its assets; |

| · | the potential for the existence or location of additional high-grade veins at the NBP; |

| · | the potential to expand the high-grade gold and silver at the YellowJacket target, and the potential to expand the higher-grade bulk tonnage at the Sierra Blanca target, at the NBP; |

| · | the potential for any delineation of higher grade mineralization at the NBP; |

| · | the potential for there to be one or more additional vein zone(s) to the west and northeast of the current YellowJacket high grade zone; |

| · | the potential discovery and delineation of mineral deposits/resources/reserves and any expansion thereof beyond the current estimate; |

| · | the potential for the NBP mineralization system to continue to grow and/or to develop into a major new higher-grade, bulk tonnage, Nevada gold discovery; and |

| · | the Company’s expectation that it will be able to build itself into a non-operator gold producer with significant carried interests and royalty exposure. |

Such forward-looking statements reflect the Company’s current views with respect to future events and are subject to certain known and unknown risks, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others, risks related to:

| · | our requirement of significant additional capital; |

| · | our limited operating history; |

| · | our history of losses; |

| · | cost increases for our exploration and, if warranted, development projects; |

| · | our property being in the exploration stage; |

| · | mineral exploration and production activities; |

| · | our lack of mineral production from our property; |

| · | estimates of mineral resources; |

| · | changes in mineral resource estimates; |

| · | differences in United States and Canadian mineral reserve and mineral resource reporting; |

| · | our exploration activities being unsuccessful; |

| · | fluctuations in gold, silver and other metal prices; |

| · | our ability to obtain permits and licenses for production; |

| · | government and environmental regulations that may increase our costs of doing business or restrict our operations; |

| · | proposed legislation that may significantly affect the mining industry; |

| · | land reclamation requirements; |

| · | competition in the mining industry; |

| · | equipment and supply shortages; |

| · | current and future joint ventures and partnerships; |

| · | our ability to attract qualified management; | |

| 19 |

| · | the ability to enforce judgment against certain of our Directors; |

| · | currency fluctuations; |

| · | claims on the title to our property; |

| · | surface access on our property; |

| · | potential future litigation; |

| · | our lack of insurance covering all our operations; |

| · | our status as a “passive foreign investment company” under US federal tax code; and |

| · | the Common Shares. |

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including without limitation those discussed in Part I, Item 1A, Risk Factors, of our Annual Report on Form 10-K, as filed with the SEC on August 22, 2016, which are incorporated herein by reference, as well as other factors described elsewhere in this report and the Company’s other reports filed with the SEC.

The Company’s forward-looking statements contained in this Quarterly Report on Form 10-Q are based on the beliefs, expectations and opinions of management as of the date of this report. The Company does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change, except as required by law. For the reasons set forth above, investors should not attribute undue certainty to or place undue reliance on forward-looking statements.

Current Business Activities

General

The Company’s material mineral property is the NBP, an advanced exploration stage project in Nevada which has a number of high-priority, bulk tonnage and high-grade vein targets (held through Corvus Gold Nevada Inc. (“Corvus Nevada”), a Nevada subsidiary).

The primary focus of the Company will be to leverage its exploration expertise to expand its existing deposits and discover major new gold deposits. Other than with respect to the ongoing exploration of the NBP, the Company’s strategy is to leverage its other non-core assets by maintaining a retained royalty.

Highlights of activities during the period and to the date of this MD&A include:

| · | NBP Exploration: The 2016 Phase II drilling program began in mid-October 2016 with the initial drilling to the north and west of Sierra Blanca-YellowJacket resource in the Company’s new West Zone and to the east in the Liberator Zone. In addition, drilling of “new discovery” targets at North Jolly Jane, Connection, Cat Hill, Jim Dandy, East Savage Vein and the Deep Savage was conducted. A total of 11,000 metres of reverse circulation drilling is planned for Phase II, which is to be completed by mid-April 2017. |

| · | Results for 8 holes drilled in the Liberator Zone, immediately east of YellowJacket have outlined mineralization along an 800 metre strike length, with broad zones of higher grade mineralization along the Liberator Fault. |

| · | Nineteen holes have been drilled in the Company’s new Western Zone (previously described as the NWSB and Swale targets), which lies immediately west of the Sierra Blanca-YellowJacket resource. This drilling has outlined a zone of near surface gold mineralization with all holes returning broad intercepts near the currently defined open pit resource. | |

| · | Four holes have been drilled in the North Jolly Jane target and main Jolly Jane resource area. This drilling has indicated the potential of higher-grade zones in the North Jolly Jane target area, related to stockwork quartz veining along the West Jolly Jane fault zone. |

| · | Metallurgical tests have been initiated on mineralized samples from the YellowJacket and West Zones. These test programs include flotation concentration tests on 11 composites and five heap leach column tests. |

| · | Baseline characterization activities continued with re-completion of the NB-WW-04 water quality monitoring well, collection and reporting of meteorological data. |

| · | The Company’s Sarcobatus water well, originally developed in 1952, was re-completed and produced to begin to characterize the production capacity. |

Nevada Property

North Bullfrog Project

Our principal mineral property is the NBP, a gold exploration project located in northwestern Nye County, Nevada, in the Northern Bullfrog Hills about 15 km north of the town of Beatty. The NBP does not have any known proven or probable reserves under SEC Industry Guide 7 and the project is exploratory in nature. A NI 43-101 technical report entitled “Technical Report and Preliminary Economic Assessment for Combined Mill and Heap Leach Processing at the North Bullfrog Project Bullfrog Mining District, Nye County, Nevada” with an effective date of June 16, 2015, as amended and restated on May 18, 2016, (the “Technical Report”) is available under Corvus Gold’s SEDAR profile at www.sedar.com and EDGAR profile at www.sec.gov. The Technical Report is referred to herein for informational purposes only and is not incorporated herein by reference. The Technical Report contains disclosure regarding mineral resources that are not Guide 7 compliant proven or probable reserves, see “Cautionary Note to U.S. Investors Regarding Estimates of Measured, Indicated and Inferred Resources and Proven and Probable Reserves” above.

| 20 |

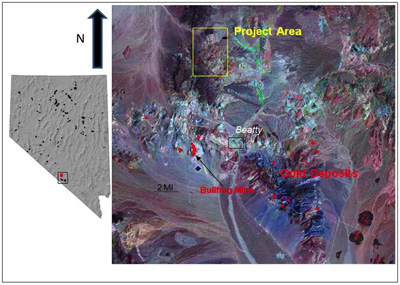

The NBP is located in the Bullfrog Hills of northwestern Nye County, Nevada (Figure 1). The NBP covers about 7,223 hectares of patented and unpatented mining claims in Sections 20, 21, 25, 26, 27, 28, 29, 32, 33, 34, 35, and 36 of T10S, R46E; sections 1, 2, 11, 12, 13, and 14 of T11S, R46E; section 31 of T10S, R47E; and sections 6, 9, 15, 16, and 17 T11S, R47E, MDBM. We have a total of nine option/lease agreements in place that give us control of an aggregate of 51 patented lode mining claims (Figure 2). Corvus Nevada owns an additional 5 patented claims (the Millman claims) and a 430 acre property with 1600 acre-feet of water rights located north of NBP in the Sacrobatus hydrographic basin (Basin 146).

|

||

| Figure 1. Property Map showing the Location of the North Bullfrog Project. |

|

||

| Figure 2. Property Map of the North Bullfrog Project, Blue

outline shows the NBP boundary and red areas are the Leased Private Land (UTm NAD 27 Zone 11). |

| 21 |

Phase II 2016 Drilling Results

A total of 10,132 metres of Reverse Circulation (RC) drilling have been completed during 2016 Phase II drilling program which began in October 2016 and is expected to be completed in April 2017. Drilling results, currently available, are from the Liberator Zone, and the new Western Zone (a combination of the previously described NWSB and Swale targets), which lie immediately to the east and west, respectively, of the Company’s Sierra Blanca-YellowJacket resource (Figure 3), and the North Jolly Jane Target (Figure 6). The Phase II drilling program has also included holes drilled to the north and south of the Jolly Jane resource (North Jolly Jane) and Jim Dandy), the Savage Vein and Deep Savage areas, Connection and Cat Hill. Results from that drilling are still pending the laboratory assay data.

|

||

| Figure 3. Drill hole locations map for Phase II 2016, North Bullfrog Project. |

Liberator Zone

Eight holes have been completed in the Liberator Zone (Table 1). Results outline a broad zone of gold mineralization as six of the eight holes returned wide mineralized intercepts. Drill Hole NB16-320 intercepted broad gold mineralization starting at a shallow depth below surface returning 108 metres @ 0.57 g/t Au including higher grade vein intercepts of 1.52 metres @ 8.3 g/t Au and 1.52 metres @ 4.96 g/t Au (Table 1) and ending in mineralization. This zone has now been intercepted over a strike length of over 800 metres, and is oriented sub-parallel to the YellowJacket Deposit, with several zones of higher grade mineralization along the trend.

Table 1

Phase II Drill Results - Liberator Zone

(Reported drill intercepts are not true widths. At this time, there is insufficient data with respect to the shape of the mineralization to calculate its true orientation in space.)

| From (m) | To (m) | Length (m)* | Gold (g/t) | Silver (g/t) | |

| NB-16-315 | 228.6 | 323.09 | 94.5 | 0.36 | 0.87 |

| AZ 265 dip-70 inc | 249.94 | 256.03 | 6.09 | 1.06 | 0.72 |

| inc | 269.75 | 275.84 | 6.09 | 1.14 | 1.43 |

| 329.18 | 338.33 | 9.15 | 0.15 | 0.51 | |

| 22 |

| NB-16-316 | 141.73 | 243.84 | 102.1 | 0.44 | 1.15 |

| AZ 265 dip-65 inc | 198.12 | 201.17 | 3.05 | 0.88 | 1.20 |

| inc | 228.6 | 231.65 | 3.05 | 0.94 | 2.12 |

| Hole ended in gold mineralization | |||||

| NB-16-319 | 97.54 | 100.58 | 3.05 | 1.56 | 14.17 |

| AZ 265 dip-75 | 106.68 | 117.35 | 10.7 | 0.15 | 1.01 |

| 132.59 | 164.59 | 32 | 0.25 | 0.79 | |

| 169.16 | 181.36 | 12.2 | 0.13 | 0.58 | |

| 188.98 | 220.98 | 32 | 0.16 | 0.34 | |

| NB-16-320 | 76.2 | 184.4 | 108.2 | 0.57 | 0.87 |

| AZ 270 dip -50 inc | 112.78 | 114.3 | 1.52 | 4.96 | 6.04 |

| inc | 118.87 | 120.4 | 1.52 | 8.25 | 1.52 |

| inc | 164.59 | 184.4 | 19.81 | 0.99 | 1.13 |

| Hole ended in gold mineralization | |||||

| NB-16-321 | 103.63 | 156.97 | 53.34 | 0.34 | 0.76 |

| AZ 270 dip -70 inc | 118.87 | 123.44 | 4.57 | 0.69 | 0.88 |

| inc | 143.26 | 155.45 | 12.19 | 0.60 | 0.84 |

| NB-16-317 | 33.53 | 132.59 | 99.06 | 0.25 | 0.64 |

| AZ 360 dip-90 inc | 115.82 | 121.92 | 6.1 | 0.50 | 0.71 |

| inc | 124.97 | 128.02 | 3.05 | 0.54 | 1.07 |

| 160.02 | 190.5 | 30.48 | 0.25 | 0.85 | |

| Hole ended in gold mineralization | |||||

| NB-16-318 | 82.3 | 88.39 | 6.09 | 0.14 | 0.82 |

| AZ 270 dip-65 | 146.3 | 213.36 | 67.06 | 0.44 | 0.88 |

| inc | 158.5 | 170.69 | 12.19 | 0.59 | 0.95 |

| inc | 175.26 | 195.07 | 19.81 | 0.58 | 0.78 |

| Hole ended in gold mineralization | |||||

| NB-16-322 | 118.87 | 121.92 | 3.05 | 0.31 | 3.41 |

| AZ 265 dip-65 | 134.11 | 175.26 | 41.15 | 0.46 | 0.85 |

| inc | 134.11 | 135.64 | 1.52 | 0.91 | 1.14 |

| inc | 152.4 | 166.12 | 13.72 | 0.74 | 0.86 |

|

* Mineralized thickness calculated @ 0.10 g/t Au cutoff with internal intervals calculated @ 1.0 g/t Au cutoff | |||||

The Liberator Zone is parallel to the YellowJacket deposit and has about the same strike length at nearly one kilometre. Although the Liberator and YellowJacket structural zones are parallel, they dip in opposite directions with the YellowJacket dipping to the west and the Liberator dipping to the east, which led to the Liberator not being effectively tested in the past during the east directed YellowJacket drilling programs. The new Liberator discovery like the YellowJacket has returned drill intersections of shallow, higher grade gold mineralization (NB-15-267, 11m @ 3.5 g/t Au, NR15-14, Oct. 15, 2015; NB-13-350, 6m @ 2.4 g/t Au, NR13-25, Oct. 10, 2013; NB-12-126, 5.7m @ 6 g/t Au, NR12-10, Mar. 22, 2012; NB-10-63, 14m @ 6 g/t Au, NR11-03, Feb. 1, 2011). In addition, the Liberator also hosts broad zones of lower grade mineralization highlighting the extensive fluid flow of gold and silver rich solutions in this large structural zone (NB-16-320, 108m @ 0.57 g/t Au; NB-16-303, 154m @ 0.54 g/t Au, NR16-11, Aug. 2, 2016; NB-15-267, 210m @ 0.47 g/t Au, NR15-14, Oct. 15, 2016; low grade halo around high-grade zone).

| 23 |

These infill holes that have added continuity to the overall Liberator mineralized zone and importantly, have now defined its northern extension (NB-16-315 6.1m @ 1.06 g/t Au and 6.1m @ 1.14 g/t Au) below the intercept in hole NB-16-300 with 18m @ 1.8 g/t Au. The higher-grade parts of the Liberator system are related to quartz stockwork and sulfidized zones at intersections with northeast structures, forming shoots within the very broad and extensive structurally controlled low-grade system. The Liberator Zone converges with the YellowJacket structural zone near surface at a depth of about 30 metres. These holes continue to outline the large Liberator structural zone which hosts broad low-grade mineralization and currently three higher grade chutes. Follow-up drilling on the zone is being planned.

Deep High-Grade Target

The refinement of the strike and dip of the Liberator Zone along with deep drilling success announced late last year at YellowJacket (NB-16-314, 10.7m @ 2.41 g/t Au & 9.7 g/t Ag, NR16-14, Nov. 29, 2016) has now outlined new deep target potential for the Sierra Blanca/YellowJacket deposit. The deep targets are located where the large YellowJacket and Liberator structural zones intersect the underlying low angle, West Jolly Jane Fault at depths of 400-500 metres (Figure 4). This geologic target is analogous to the Hishikari deposit in Japan which hosts large high-grade, gold-silver deposits along major structural zones at the contact between underlying basement sediments and overlying volcanic units. Follow-up core drilling of this target is planned for the next phase of North Bullfrog exploration later this year.

|

||

| Figure 4. District cross-section showing deep and other target areas for future exploration. |

Western Zone

During the Phase II 2016 drill program, 18 holes were drilled in the new Western Zone, which is a combination of the previously described NWSB and Swale targets, and lies immediately west of the Company’s Sierra Blanca-YellowJacket resource (Figure 3). Results (Table 2) continue to outline an extensive zone of near surface gold mineralization with all holes returning broad intercepts near the current open pit resource. Drill hole NB-17-329 intercepted 91.4 metres @ 0.52 g/t Au including a higher grade stockwork vein intercept of 38.1 metres @ 0.97 g/t Au (Table 2).

Table 2

Phase II Drill Results - Western Zone

(Reported drill intercepts are not true widths. At this time, there is insufficient data with respect to the shape of the mineralization to calculate its true orientation in space.)

| From (m) | To (m) | Length (m)* | Gold (g/t) | Silver (g/t) | |

| NB-16-323 | 70.1 | 135.64 | 65.54 | 0.64 | 1.11 |

| AZ 85 dip-75 inc | 73.15 | 91.44 | 18.29 | 0.91 | 1.57 |

| inc | 114.3 | 131.06 | 16.76 | 0.98 | 0.92 |

| NB-16-324 | 106.68 | 112.78 | 6.1 | 0.70 | 0.30 |

| AZ 135 dip-50 inc | 108.2 | 111.25 | 3.05 | 1.17 | 0.38 |

| 147.83 | 195.07 | 47.24 | 0.16 | 0.32 | |

| 225.55 | 242.32 | 16.77 | 0.18 | 0.42 | |

| 248.41 | 252.98 | 4.57 | 0.12 | 0.56 | |

| 262.13 | 291.08 | 28.95 | 0.24 | 1.06 | |

| 318.52 | 332.23 | 13.71 | 0.18 | 0.88 | |

| 24 |

| NB-16-325 | 120.4 | 228.6 | 108.2 | 0.41 | 0.81 |

| AZ 85 dip-55 inc | 140.21 | 144.78 | 4.57 | 0.61 | 0.87 |

| inc | 152.4 | 153.92 | 1.52 | 0.51 | 1.06 |

| inc | 179.83 | 185.93 | 6.1 | 0.69 | 0.79 |

| inc | 192.02 | 211.84 | 19.82 | 0.73 | 1.35 |

| inc | 216.41 | 219.46 | 3.05 | 0.57 | 0.74 |

| 233.17 | 239.27 | 6.1 | 0.12 | 0.41 | |

| 251.46 | 300.23 | 48.77 | 0.18 | 0.61 | |

| 307.85 | 316.99 | 9.14 | 0.16 | 0.48 | |

| 333.76 | 402.34 | 68.58 | 0.21 | 1.32 | |

| NB-16-326 | 114.3 | 243.84 | 129.54 | 0.37 | 0.69 |

| AZ 85 dip-55 inc | 143.26 | 149.35 | 6.09 | 0.61 | 0.96 |

| inc | 153.92 | 156.97 | 3.05 | 0.58 | 0.99 |

| inc | 163.07 | 166.12 | 3.05 | 0.53 | 0.67 |

| inc | 175.26 | 190.5 | 15.24 | 0.59 | 0.85 |

| inc | 231.65 | 237.74 | 6.09 | 0.71 | 0.94 |

| 263.65 | 313.94 | 50.29 | 0.22 | 0.83 | |

| 324.61 | 353.57 | 28.96 | 0.14 | 0.34 | |

| 409.96 | 432.82 | 22.86 | 0.12 | 0.32 | |