Attached files

| file | filename |

|---|---|

| EX-23.2 - EXHIBIT 23.2 - Corvus Gold Inc. | v416707_ex23-2.htm |

| EX-10.5 - EXHIBIT 10.5 - Corvus Gold Inc. | v416707_ex10-5.htm |

| EX-23.7 - EXHIBIT 23.7 - Corvus Gold Inc. | v416707_ex23-7.htm |

| EX-23.6 - EXHIBIT 23.6 - Corvus Gold Inc. | v416707_ex23-6.htm |

| EX-23.4 - EXHIBIT 23.4 - Corvus Gold Inc. | v416707_ex23-4.htm |

| EX-21.1 - EXHIBIT 21.1 - Corvus Gold Inc. | v416707_ex21-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Corvus Gold Inc. | v416707_ex23-1.htm |

| EX-23.5 - EXHIBIT 23.5 - Corvus Gold Inc. | v416707_ex23-5.htm |

| EX-23.3 - EXHIBIT 23.3 - Corvus Gold Inc. | v416707_ex23-3.htm |

| EX-31.1 - EXHIBIT 31.1 - Corvus Gold Inc. | v416707_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Corvus Gold Inc. | v416707_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Corvus Gold Inc. | v416707_ex31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - Corvus Gold Inc. | v416707_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| FORM 10-K |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended May 31, 2015 | ||

| OR | ||

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

| Commission file number: 000-55447 |

| CORVUS GOLD INC. |

(Exact Name of Registrant as Specified in its Charter)

| British Columbia, Canada | 98-0668473 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

2300-1177 West Hastings Street (Address of Principal Executive Offices) |

V6E 2K3 (Zip code) |

Registrant’s telephone number, including area code: (604) 638-3246

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Shares, no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large Accelerated Filer ¨ | Accelerated Filer ¨ |

|

Non-Accelerated Filer ¨ (Do not check if a smaller reporting company) |

Small Reporting Company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $45,548,439

As of August 24, 2015, the registrant had 80,168,928 Common Shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

To the extent specifically referenced in Part III, portions of the registrant’s definitive Proxy Statement on Schedule 14A to be filed with the Securities and Exchange Commission in connection with the registrant’s 2015 Annual Meeting of Shareholders are incorporated by reference into this report. See Part III.

Table of Contents

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES AND PROVEN AND PROBABLE RESERVES

The mineral estimates in this Annual Report on Form 10-K have been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. As used in this Annual Report on Form 10-K, the terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 “Standards of Disclosure for Mineral Projects” (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in the United States Securities and Exchange Commission (“SEC”) Industry Guide 7 (“SEC Industry Guide 7”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves, and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part of a mineral deposit in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Guide 7 standards as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this report and the documents incorporated by reference herein contain descriptions of our mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

The term “mineralized material” as used in this Annual Report on Form 10-K, although permissible under SEC Industry Guide 7, does not indicate “reserves” by SEC Industry Guide 7 standards. We cannot be certain that any part of the mineralized material will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves”. Investors are cautioned not to assume that all or any part of the mineralized material will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted.

CAUTIONARY NOTE TO ALL INVESTORS CONCERNING ECONOMIC ASSESSMENTS THAT INCLUDE INFERRED RESOURCES

The Company currently holds or has the right to acquire interests in an advanced stage exploration project in Nye County, Nevada referred to as the North Bullfrog Project (the “NBP”). Mineral resources that are not mineral reserves have no demonstrated economic viability. The preliminary assessments on the NBP and the Company’s LMS Project are preliminary in nature and include “inferred mineral resources” that have a great amount of uncertainty as to their existence, and are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. It cannot be assumed that all, or any part, of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies. There is no certainty that such inferred mineral resources at the NBP or the LMS Project will ever be realized. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable.

| 1 |

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the exhibits attached hereto contain “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995, as amended, and “forward-looking information” within the meaning of applicable Canadian securities legislation, collectively “forward-looking statements”. Such forward-looking statements concern our anticipated results and developments in the operations of the Company in future periods, planned exploration activities, the adequacy of the Company’s financial resources and other events or conditions that may occur in the future. Forward-looking statements are frequently, but not always, identified by words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,” “potential,” “possible” and similar expressions, or statements that events, conditions or results “will,” “may,” “could” or “should” (or the negative and grammatical variations of any of these terms) occur or be achieved. These forward looking statements may include, but are not limited to, statements concerning:

| · | the Company’s strategies and objectives, both generally and in respect of its specific mineral properties; |

| · | the timing of decisions regarding the timing and costs of exploration programs with respect to, and the issuance of the necessary permits and authorizations required for, the Company’s exploration programs, including for the NBP; |

| · | the Company’s estimates of the quality and quantity of the mineral resources at its mineral properties; |

| · | the timing and cost of planned exploration programs of the Company and its joint venture partners (as applicable), and the timing of the receipt of results therefrom; |

| · | the planned use of proceeds from the Company’s private placements completed in February 2015, and from the exercises of stock options and warrants; |

| · | the Company’s future cash requirements; |

| · | general business and economic conditions; |

| · | the Company’s ability to meet its financial obligations as they come due, and to be able to raise the necessary funds to continue operations; |

| · | the Company’s expectation that its joint venture partners will contribute the required expenditures, and make the required payments and share issuances (if applicable) as necessary to earn an interest in certain of the Company’s mineral properties in accordance with existing option/joint venture agreements; |

| · | the Company’s expectation that it will be able to add additional mineral projects of merit to its assets; |

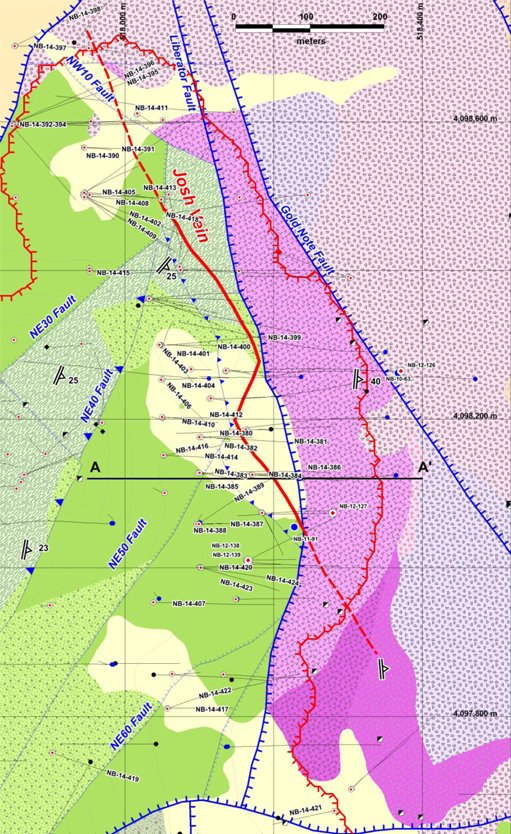

| · | the potential for the existence or location of additional high-grade veins at the NBP; |

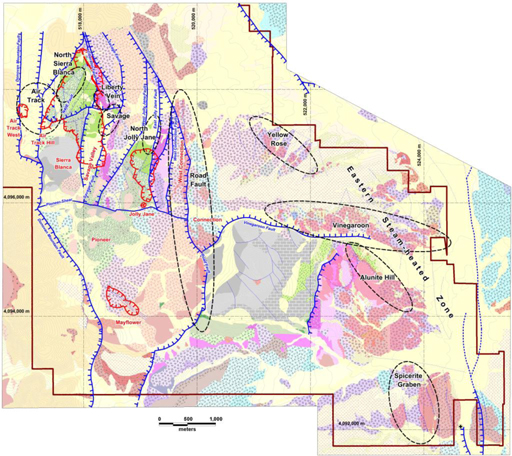

| · | the potential to expand the high grade gold and silver at the Yellowjacket target, and the potential to expand the higher grade bulk tonnage at the Sierra Blanca target, at the NBP; |

| · | the potential for any delineation of higher grade mineralization at the NBP; |

| · | the potential for there to be one or more additional vein zone(s) to the west and northeast of the current Yellowjacket high grade zone; |

| · | the potential discovery and delineation of mineral deposits/resources/reserves and any expansion thereof beyond the current estimate; |

| · | the potential for the NBP mineralization system to continue to grow and/or to develop into a major new higher-grade, bulk tonnage, Nevada gold discovery; and |

| · | the Company’s expectation that it will be able to build itself into a non-operator gold producer with significant carried interests and royalty exposure. |

Such forward-looking statements reflect the Company’s current views with respect to future events and are subject to certain known and unknown risks, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others, risks related to:

| 2 |

| · | to our requirement of significant additional capital; |

| · | to our limited operating history; |

| · | to our history of losses; |

| · | to cost increases for our exploration and, if warranted, development projects; |

| · | to our properties being in the exploration stage; |

| · | to mineral exploration and production activities; |

| · | to our lack of mineral production from our properties; |

| · | to estimates of mineral resources; |

| · | to changes in mineral resource estimates; |

| · | to differences in United States and Canadian mineral reserve and mineral resource reporting; |

| · | to our exploration activities being unsuccessful; |

| · | to fluctuations in gold, silver and other metal prices; |

| · | to our ability to obtain permits and licenses for production; |

| · | government and environmental regulations that may increase our costs of doing business or restrict our operations; |

| · | proposed legislation that may significantly affect the mining industry; |

| · | land reclamation requirements; |

| · | competition in the mining industry; |

| · | equipment and supply shortages; |

| · | current and future joint ventures and partnerships; |

| · | our ability to attract qualified management; |

| · | the ability to enforce judgment against certain of our Directors; |

| · | currency fluctuations; |

| · | claims on the title to our properties; |

| · | surface access on our properties; |

| · | potential future litigation; |

| · | our lack of insurance covering all our operations; |

| · | our status as a “passive foreign investment company” under US federal tax code; and |

| · | the Common Shares. |

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein. This list is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including without limitation those discussed in Part I, Item 1A, Risk Factors, of this Annual Report on Form 10-K, which are incorporated herein by reference, as well as other factors described elsewhere in this report and the Company’s other reports filed with the SEC.

The Company’s forward-looking statements contained in this Annual Report on Form 10-K are based on the beliefs, expectations and opinions of management as of the date of this Annual Report. The Company does not assume any obligation to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change, except as required by law. For the reasons set forth above, investors should not attribute undue certainty to or place undue reliance on forward-looking statements.

| 3 |

GLOSSARY OF TERMS

|

“Ag” |

Silver | |

| “alteration” | Changes in the chemical or mineralogical composition of a rock, generally produced by weathering or hydrothermal solutions | |

| “Arrangement” | The corporate spin-out of Corvus from ITH by way of a plan of arrangement among ITH, the shareholders of ITH and Corvus under the BCBCA, effective August 26, 2010 | |

| “Au” | Gold | |

| “Board” | The board of directors of Corvus | |

| “BCBCA” | Business Corporations Act (British Columbia), Corvus’ governing statute | |

| “Corvus Nevada” | Corvus Gold Nevada Inc., a wholly owned subsidiary of Corvus USA subsisting under the laws of Nevada | |

| “Corvus USA” | Corvus Gold (USA) Inc., a wholly owned subsidiary of Corvus subsisting under the laws of Nevada | |

| “Common Shares” | The Common Shares without par value in the capital stock of Corvus as the same are constituted on the date hereof | |

| “Corvus” | Corvus Gold Inc., a company organized under the laws of British Columbia | |

| “cut-off grade” | The lowest grade of mineralized material that qualifies as ore in a given deposit, that is, material of the lowest assay value that is included in a resource/reserve estimate | |

| “deposit” | A mineralized body which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures. Such a deposit does not qualify as a commercially mineable ore body or as containing reserves or ore, unless final legal, technical and economic factors are resolved | |

| “Director” | A member of the Board of Directors of Corvus | |

| “disseminated” | Fine particles of mineral dispersed throughout the enclosing rock | |

| “epigenetic” | Said of a mineral deposit of origin later than that of the enclosing rocks | |

| “executive officer” | When used in relation to any issuer (including the Company) means an individual who is: | |

| (a) | a chair, vice chair or president; | |

| (b) | a vice-president in charge of a principal business unit, division or function, including sales, finance or production; or | |

| (c) | performing a policy-making function in respect of the issuer | |

| “g/t” | Grams per metric tonne | |

| “grade” | To contain a particular quantity of ore or mineral, relative to other constituents, in a specified quantity of rock | |

| “heap leaching” | A method of recovering minerals from ore whereby crushed rock is stacked on a non-porous liner and an appropriate chemical solution is sprayed on the top of the pile (the “heap”) and allowed to percolate down through the crushed rock, dissolving the desired minerals(s) as it does so. The chemical solution is then collected from the base of the heap and is treated to remove the dissolved mineral(s) | |

| “host” | A rock or mineral that is older than rocks or minerals introduced into it or formed within it | |

| “host rock” | A body of rock serving as a host for other rocks or for mineral deposits, or any rock in which ore deposits occur | |

| 4 |

| “hydrothermal” | A term pertaining to hot aqueous solutions of magmatic origin which may transport metals and minerals in solution |

| “ITH” | International Tower Hill Mines Ltd., a company subsisting under the laws of British Columbia |

| “massive” | Said of a mineral deposit, especially of sulphides, characterized by a great concentration of ore in one place, as opposed to a disseminated or veinlike deposit |

| “Moz” | Million ounces |

| “mineral reserve” | The economically mineable part of a Measured and/or Indicated Mineral Resource. It includes diluting materials and allowances for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility level as appropriate that include application of Modifying Factors. Such studies demonstrate that, at the time of reporting, extraction could reasonably be justified. The reference point at which Mineral Reserves are defined, usually the point where the ore is delivered to the processing plant, must be stated. The public disclosure of a Mineral Reserve must be demonstrated by a pre-feasibility study or feasibility study. See Cautionary Note to U.S. Investors Regarding Estimates of Measured, Indicated, and Inferred Resources and Proven and Probable Reserves above. |

| “mineral resource” | A mineral resource is a concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or quality, continuity and other geological characteristics of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge, including sampling. Material of economic interest refers to diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories. The term Mineral Resource covers mineralization and natural material of intrinsic economic interest which has been identified and estimated through exploration and sampling and within which Mineral Reserves may subsequently be defined by the consideration and application of Modifying Factors See Cautionary Note to U.S. Investors Regarding Estimates of Measured, Indicated, and Inferred Resources and Proven and Probable Reserves above. |

| “mineralization” | The concentration of metals and their chemical compounds within a body of rock |

| “modifying factors” | Considerations used to convert Mineral Resources to Mineral Reserves. These include, but are not restricted to, mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social and governmental factors |

| “National Instrument 43-101”/ “NI 43-101” | National Instrument 43-101 of the Canadian Securities Administrators entitled “Standards of Disclosure for Mineral Projects” |

| “NBP” | The North Bullfrog Project in Nevada held by Corvus Nevada, as more particularly described under “Properties” |

| “NSR” | Net smelter return |

| “Raven Gold” | Raven Gold Alaska Inc., a wholly owned subsidiary of Corvus USA subsisting under the laws of Alaska |

| “SEC” | United States Securities and Exchange Commission |

| “SoN” | SoN Land and Water, LLC, a limited liability company subsisting under the laws of Nevada, of which Corvus Nevada is the sole member |

| “tabular” | Said of a feature having two dimensions that are much larger or longer than the third, or of a geomorphic feature having a flat surface, such as a plateau |

| 5 |

| “TSX” | Toronto Stock Exchange |

| “vein” | An epigenetic mineral filling of a fault or other fracture, in tabular or sheetlike form, often with the associated replacement of the host rock; also, a mineral deposit of this form and origin |

| SEC Industry Guide 7 Definitions: | |

| exploration stage | An “exploration stage” prospect is one which is not in either the development or production stage |

| development stage | A “development stage” project is one which is undergoing preparation of an established commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study |

| mineralized material | The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction |

| probable reserve | The term “probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation |

| production stage | A “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product |

| proven reserve | The term “proven reserve” refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established |

| reserve | The term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. “Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing. A reserve includes adjustments to the in-situ tonnes and grade to include diluting materials and allowances for losses that might occur when the material is mined |

1 For SEC Industry Guide 7 purposes this study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

2 SEC Industry Guide 7 does not require designation of a qualified person.

USE OF NAMES

In this Annual Report on Form 10-K, unless the context otherwise requires, the terms "we", "us", "our", "Corvus", "Corvus Gold Inc.", the "Company" or the "Corporation" refer to Corvus Gold Inc. and its subsidiaries.

CURRENCY AND EXCHANGE RATES

All dollar amounts in this Annual Report are expressed in Canadian dollars unless otherwise indicated. The Company’s accounts are maintained in Canadian dollars and the Company’s financial statements are prepared in accordance with United States Generally Accepted Accounting Principles. All references to “U.S. dollars”, “USD” or to “US$” are to United States dollars.

The following table sets forth the rate of exchange for the Canadian dollar, expressed in United States dollars in effect at the end of the periods indicated, the average of exchange rates in effect during such periods, and the high and low exchange rates during such periods based on the noon rate of exchange as reported by the Bank of Canada for conversion of Canadian dollars into United States dollars.

| 6 |

| Year Ended May 31 | ||||||||||||

| Canadian Dollars to U.S. Dollars | 2015 | 2014 | 2013 | |||||||||

| Rate at end of period | 0.8022 | 0.9202 | 0.9672 | |||||||||

| Average rate for period | 0.8617 | 0.9379 | 0.9956 | |||||||||

| High for period | 0.9404 | 0.9833 | 1.0299 | |||||||||

| Low for period | 0.7811 | 0.8888 | 0.9599 | |||||||||

Metric Equivalents

For ease of reference, the following factors for converting Imperial measurements into metric equivalents are provided:

| To convert from Imperial | To metric | Multiply by | ||||

| Acres | Hectares | 0.404686 | ||||

| Feet | Metres | 0.30480 | ||||

| Miles | Kilometres | 1.609344 | ||||

| Tons | Tonnes | 0.907185 | ||||

| Ounces (troy)/ton | Grams/Tonne | 34.2857 | ||||

| 1 mile = 1.609 kilometres 1 acre = 0.405 hectares 2,204.62 pounds = 1 metric ton = 1 tonne |

2000 pounds (1 short ton) = 0.907 tonnes 1 ounce (troy) = 31.103 grams 1 ounce (troy)/ton = 34.2857 grams/tonne |

| 7 |

General Corporate Information

We were incorporated under the BCBCA with the name “Corvus Gold Inc.” on April 13, 2010 as a wholly-owned subsidiary of ITH, with an authorized capital consisting of an unlimited number of Common Shares. Pursuant to the corporate spin-out of Corvus from ITH by way of a plan of arrangement among ITH, the shareholders of ITH and Corvus under the BCBCA, effective August 26, 2010, Corvus was spun out as a separate and independent public company, and each shareholder of ITH received one-half of a Common Share.

We are a reporting issuer in the Canadian Provinces of British Columbia, Alberta and Ontario and the Common Shares are listed for trading on the TSX under the trading symbol “KOR” and are quoted on the OTCQX under the symbol “CORVF”.

Our head office is located at Suite 2300 – 1177 West Hastings Street, Vancouver, British Columbia, Canada V6E 2K3, and our registered and records office is located at Suite 2200, HSBC Building, 885 West Georgia Street, Vancouver, British Columbia V6C 3E8.

We are a mineral exploration company engaged in the acquisition, exploration and development of mineral properties. We currently hold or have the right to acquire interests in a number of mineral properties in Alaska and Nevada, USA, including the NBP, which is our sole material mineral property. We are in the exploration stage as our properties have not yet reached commercial production and none of our properties is beyond the preliminary exploration stage. All work presently planned by us is directed at defining mineralization and increasing understanding of the characteristics of, and economics of, that mineralization.

Emerging Growth Company Status

We qualify as an “emerging growth company” as defined in Section 101 of the Jumpstart our Business Startups Act (“JOBS Act”) as we do not have more than $1,000,000,000 in annual gross revenue and did not have such amount as of May 31, 2015, being the last day of our last fiscal year.

We may lose our status as an emerging growth company on the last day of our fiscal year during which (i) our annual gross revenue exceeds $1,000,000,000 or (ii) we issue more than $1,000,000,000 in non-convertible debt in a three-year period. We will lose our status as an emerging growth company if at any time we are deemed to be a large accelerated filer. We will lose our status as an emerging growth company on the last day of our fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement (August 28, 2019).

As an emerging growth company, we are exempt from Section 404(b) of the Sarbanes-Oxley Act of 2002 and Section 14A (a) and (b) of the Securities Exchange Act of 1934. Such sections are provided below:

| · | Section 404(b) of the Sarbanes-Oxley Act of 2002 requires a public company’s auditor to attest to, and report on, management's assessment of its internal controls. |

| · | Sections 14A(a) and (b) of the Securities and Exchange Act, implemented by Section 951 of the Dodd-Frank Act, require companies to hold shareholder advisory votes on executive compensation and golden parachute compensation. |

As long as we qualify as an emerging growth company, we will not be required to comply with the requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002 and Section 14A(a) and (b) of the Securities Exchange Act of 1934.

Geographic and Segment Information

We have one reportable segment, consisting of evaluation, acquisition and exploration activities which are focused principally in Nevada and Alaska, U.S.A. We reported no material revenues during 2015 and 2014.

| 8 |

Intercorporate Relationships

We have four material subsidiaries:

| (a) | Corvus Nevada, a corporation incorporated in Nevada on April 9, 2007, which holds all of our properties in Nevada and is 100% owned by Corvus USA; |

| (b) | Raven Gold, a corporation incorporated in Alaska on July 2, 2009, which holds all of our properties in Alaska and is 100% owned by Corvus USA; |

| (c) | SoN Land & Water, LLC, a limited liability company incorporated in Nevada on July 25, 2013, of which Corvus Nevada is the sole member; and |

| (d) | Corvus USA, a corporation incorporated in Nevada on February 25, 2013, which holds all of the shares of Corvus Nevada and Raven Gold and is 100% owned by Corvus. |

The following corporate chart sets forth all of our material subsidiaries:

Recent History

In May 2010, the board of directors of ITH approved a proposal to undertake a spin-out transaction to segregate its then existing assets into two separate and highly focused companies. The transaction was intended to maximize value for ITH shareholders by creating Corvus as a new exploration focused company that would work to advance ITH’s existing advanced to early stage exploration properties (at that time, four in Alaska and one in Nevada) and acquire additional exploration properties of merit, while allowing ITH to concentrate on moving its Livengood advanced exploration project towards feasibility and a potential production decision.

The spin-out transaction pursuant to the Arrangement was approved by the shareholders of ITH on August 12, 2010, and the final order of the Supreme Court of British Columbia approving the plan of arrangement necessary to implement the transaction was received on August 20, 2010. The effective date of the Arrangement was August 26, 2010 and the Common Shares commenced trading on the TSX on August 30, 2010. Under the terms of the Arrangement, ITH retained all assets relating to the Livengood gold project in Alaska, together with approximately $33 million in working capital, while Corvus received all of ITH’s other existing Alaska and Nevada assets (including the shares of Corvus Nevada), together with approximately $3.3 million in working capital.

Following the completion of the Arrangement, Corvus held four advanced to early stage exploration projects in Alaska (Chisna, Terra, LMS and West Pogo) and the advanced exploration stage NBP in Nevada. Our primary focus is to leverage our exploration expertise to discover major new gold deposits. Furthermore, we intend to try and build ourselves into a non-operator gold producer with significant carried interests and royalty exposure. To meet this objective, certain of the Alaskan projects received by us in the Arrangement have been made subject to option/joint ventures. For joint ventures arranged by us subsequent to the Arrangement, we will receive not only the benefit of all exploration expenditures required to be made by such partners in order to earn their respective interests in our properties, but also any option payment(s) in cash or shares. At the present time, we do not have any such joint ventures, as Corvus sold its interest in the Terra joint venture in February, 2014 and sold its interest in the West Pogo property in July, 2015. Due to the inability of the joint venture partners in our other joint ventures to complete their earn-in obligations, the remaining two joint ventures have been terminated (Chisna, and LMS).

| 9 |

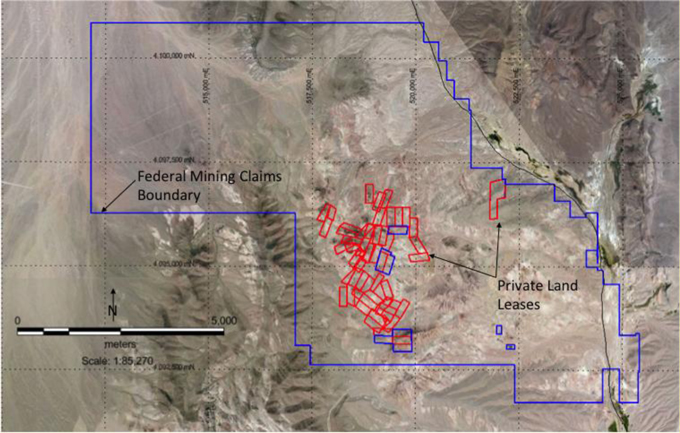

We also received from ITH a 100% interest in the NBP, which is Corvus’ sole material mineral property at this time and the primary focus of our exploration activities. Since the acquisition of the NBP from ITH, we have expanded the NBP by entering into additional leases of patented lode mining claims and staking additional unpatented lode mining claims.

Business Operations

Summary

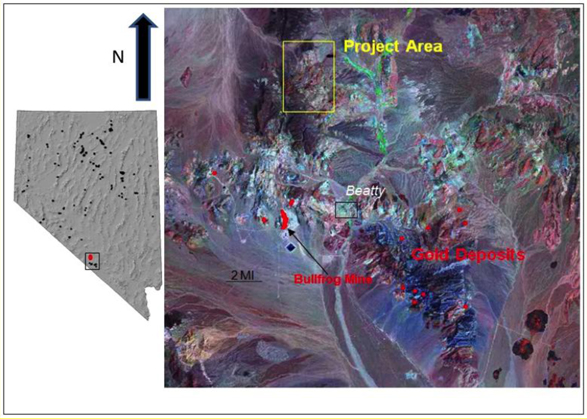

We currently hold, or have rights to acquire, interests in several mineral properties (subject, in certain cases, to NSR royalties payable to the original property vendors/lessors) in Alaska (3) and Nevada (1), USA. In all cases, the Company’s objective with respect to such properties is to evaluate the potential of the property and to determine if spending additional funds is warranted (in which case, an appropriate program to advance the property to the next decision point will be formulated and, depending upon available funds, implemented by us) or not (in which case the property may be returned by us to the optionor/lessor or, in respect of properties in which we are earning an interest, be returned to the optionor thereof). Our present primary focus is on the exploration and, if warranted, development of the NBP, located 15 kilometres north of Beatty, Nevada, which we consider as our only material mineral property at this time. The progress on, and results of, the work programs on our material mineral property is set out under Part I, Item 2, Properties in this Annual Report. We continue to assess additional mineral property acquisitions but do not presently contemplate entering into any such agreements, other than in connection with the NBP.

We are in the exploration stage and do not mine, produce or sell any mineral products at this time, nor do any of our current properties (with the exception of the NBP, which has measured, indicated and inferred estimated mineral resources and the LMS Project which has an inferred mineral resource) have any known or identified mineral resources or mineral reserves. We do not propose any method of production with respect to any of our Alaskan properties at this time. With respect to the NBP, our present preliminary studies indicate that any production would be through a combination of heap leaching some of the mineralization (and treatment of the leaching solution to recover gold and silver) and processing other portions of the mineralization through a gravity concentration-cyanide leach milling process.

Availability of Raw Materials

All of the raw materials we require to carry on our business are readily available through normal supply or business contracting channels in Canada and the United States. Since commencing current operations in August 2010, we have been able to secure the appropriate personnel, equipment and supplies required to conduct our contemplated programs. As a result, we do not believe that we will experience any shortages of required personnel, equipment or supplies in the foreseeable future.

Dependence on a Few Contracts

Our business is not substantially dependent on any contract such as a contract to sell the major part of the Company’s products or services or to purchase the major part of its requirements for goods, services or raw materials, or on any franchise or license or other agreement to use a patent, formula, trade secret, process or trade name upon which its business depends. Rather, our ability to continue making the holding, assessment, lease and option payments necessary to maintain our interest in our mineral projects is of primary concern. We do not presently anticipate any difficulties in this regard in the current financial year.

Competitive Conditions

There is aggressive competition within the minerals industry to discover and acquire mineral properties considered to have commercial potential. We compete for the opportunity to participate in promising exploration projects with other entities. In addition, we compete with others in efforts to obtain financing to acquire and explore mineral properties, acquire and utilize mineral exploration equipment and hire qualified mineral exploration personnel. We may compete with other junior mining companies for mining claims in regions adjacent to our existing claims, or in other parts of the world should we dedicate resources to doing so in the future. These companies may be better capitalized than us and we may have difficulty in expanding our holdings through the staking or acquisition of additional mining claims or other mineral tenures.

In competing for qualified mineral exploration personnel, we may be required to pay compensation or benefits relatively higher than those paid in the past, and the availability of qualified personnel may be limited in high-demand mining periods, such as was in past years when the price of gold was higher than it is now.

| 10 |

Government Regulation

The exploration and development of a mining prospect is subject to regulation by a number of federal and state government authorities. These include the United States Environmental Protection Agency (“EPA”) and the United States Bureau of Land Management (“BLM”) as well as the various state environmental protection agencies. The regulations address many environmental issues relating to air, soil and water contamination and apply to many mining related activities including exploration, mine construction, mineral extraction, ore milling, water use, waste disposal and use of toxic substances. In addition, we are subject to regulations relating to labor standards, occupational health and safety, mine safety, general land use, export of minerals and taxation. Many of the regulations require permits or licenses to be obtained and the filing of Notices of Intent and Plans of Operations, the absence of which or inability to obtain will adversely affect the ability for us to conduct our exploration, development and operation activities. The failure to comply with the regulations and terms of permits and licenses may result in fines or other penalties or in revocation of a permit or license or loss of a prospect.

Federal

On lands owned by the United States, mining rights are governed by the General Mining Law of 1872, as amended, which allows the location of mining claims on certain federal lands upon the discovery of a valuable mineral deposit and compliance with location requirements. The exploration of mining properties and development and operation of mines is governed by both federal and state laws. Federal laws that govern mining claim location and maintenance and mining operations on federal lands are generally administered by the BLM. Additional federal laws, governing mine safety and health, also apply. State laws also require various permits and approvals before exploration, development or production operations can begin. Among other things, a reclamation plan must typically be prepared and approved, with bonding in the amount of projected reclamation costs. The bond is used to ensure that proper reclamation takes place, and the bond will not be released until that time. Local jurisdictions may also impose permitting requirements (such as conditional use permits or zoning approvals).

Alaska

In Alaska, low impact, initial stage surface exploration such as stream sediment, soil and rock chip sampling do not require any permits. The State of Alaska requires an Alaska Placer Mining Application (“APMA”) exploration permit for all substantial surface disturbances such as trenching, road building and drilling. These permits are also reviewed by related state and federal agencies that can comment and require specific changes to the proposed work plans to minimize impacts on the environment. The permitting process for significant disturbances generally requires 30 days for processing and all work must be bonded. The Company understands that its joint venture partners/operators have, in the past, obtained all necessary permits with respect to their exploration activities on the Company’s properties in Alaska. Although the Company has never had, and understands that none of its joint venture partners/operators have had, an issue with the timely processing of APMA permits there can be no assurances that delays in permit approval will not occur. Due to the northern climate, exploration work in some areas of Alaska can be limited due to excessive snow cover and cold temperatures. In general, surface sampling work is limited to May through September and surface drilling from March through November, although some locations afford opportunities for year round exploration operations and others, such as wetland areas, may only be explored while frozen in the winter. Mining is conducted in a number of locations in Alaska on a year round basis, both open pit and underground.

Currently, there are no environmental regulations in Alaska that impact the Company because it is still in the exploration stage. Reclamation work, that is, work done to restore the property to its original state, is minimal because the Company’s operations (and those of its joint venture partners/operators on the Company’s Alaskan properties), have virtually no environmental impact. The required remedial environmental reclamation work typically consists of slashing underbrush so that wildlife movement is not hampered and basic re-seeding operations.

Nevada

In Nevada, as in Alaska, initial stage surface exploration does not require any permits. Notice-level exploration permits (less than 5 acres of disturbance) are required (through the BLM) for the NBP to allow for drilling. More extensive disturbance required the application for a receipt of a “Plan of Operations” from the BLM. In May 2013, Corvus obtained an amended Plan of Operations allowing 100 acres of surface disturbance in the public lands portion of the NBP, which is considered sufficient by us for our currently proposed 2015-2016 drilling and characterization program. We also applied for, and received in August 2013, a Notice of Intent for disturbance of an additional 1.3 acres outside the currently defined NBP area in order to allow us to drill water monitor wells and geotechnical soil investigations outside the NBP area. In June of 2015, the Company applied for, and received a Notice of Intent which allows an additional 2.1 acres of disturbance for exploration of the Eastern Steam-heated Alteration zone, outside of the NBP permit area. As of May 31, 2015, the Company had posted with the BLM, as security for the reclamation obligations, a Surety Bond of US$341,341. In general, exploration activities in Nevada can be carried out on a year-round basis. Mining is conducted in Nevada on a year round basis, both open pit and underground.

| 11 |

In Nevada, we are also required to post bonds with the State of Nevada to secure our environmental and reclamation obligations on private land, with amount of such bonds reflecting the level of rehabilitation anticipated by the then proposed activities. As at May 31, 2015, the Company had posted with Nevada Division of Minerals in the State of Nevada, as security for these reclamation obligations, a Surety Bond of US$209,070.

In June 2013, formal meetings were held with officials of both the Nevada Department of Environmental Protection (“NDEP”) and the BLM to discuss the design criteria for the environmental baseline studies that will be required to support the development of a Plan of Operation and other permit applications necessary to enable any mining at or production from the NBP. In January 2014, Corvus Nevada executed a Memorandum of Understanding (“MOU”) with the Tonopah Office of the BLM for definition of baseline characterization requirements and development of a mining plan of operations at the NBP. Characterization plans for hydro-geologic modeling studies, rock geochemical studies and biologic/wildlife studies have been developed and have been reviewed by BLM specialists. We are in the process of responding to comments and additional requirements received from the BLM with respect to such plans.

If we are successful in the future at discovering a commercially viable mineral deposit on our property interests, then if and when we commence any mineral production, we will also need to comply with laws that regulate or propose to regulate our mining activities, including the management and handling of raw materials, disposal, storage and management of hazardous and solid waste, the safety of our employees and post-mining land reclamation.

We cannot predict the impact of new or changed laws, regulations or permitting requirements, or changes in the ways that such laws, regulations or permitting requirements are enforced, interpreted or administered. Health, safety and environmental laws and regulations are complex, are subject to change and have become more stringent over time. It is possible that greater than anticipated health, safety and environmental capital expenditures or reclamation and closure expenditures will be required in the future. We expect continued government and public emphasis on environmental issues will result in increased future investments for environmental controls at our operations.

Environmental Regulation

Our mineral projects are subject to various federal, state and local laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. The development, operation, closure, and reclamation of mining projects in the United States requires numerous notifications, permits, authorizations, and public agency decisions. Compliance with environmental and related laws and regulations requires us to obtain permits issued by regulatory agencies, and to file various reports and keep records of our operations. Certain of these permits require periodic renewal or review of their conditions and may be subject to a public review process during which opposition to our proposed operations may be encountered. We are currently operating under various permits for activities connected to mineral exploration, reclamation, and environmental considerations. Our policy is to conduct business in a way that safeguards public health and the environment. We believe that our operations are conducted in material compliance with applicable laws and regulations.

Changes to current local, state or federal laws and regulations in the jurisdictions where we operate could require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could impact the economics of our projects.

U.S. Federal Laws

The Comprehensive Environmental, Response, Compensation, and Liability Act (“CERCLA”), and comparable state statutes, impose strict, joint and several liability on current and former owners and operators of sites and on persons who disposed of or arranged for the disposal of hazardous substances found at such sites. It is not uncommon for the government to file claims requiring cleanup actions, demands for reimbursement for government-incurred cleanup costs, or natural resource damages, or for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by hazardous substances released into the environment. The Federal Resource Conservation and Recovery Act (“RCRA”), and comparable state statutes, govern the disposal of solid waste and hazardous waste and authorize the imposition of substantial fines and penalties for noncompliance, as well as requirements for corrective actions. CERCLA, RCRA and comparable state statutes can impose liability for clean-up of sites and disposal of substances found on exploration, mining and processing sites long after activities on such sites have been completed.

| 12 |

The Clean Air Act (“CAA”), as amended, restricts the emission of air pollutants from many sources, including mining and processing activities. Any future mining operations by the Company may produce air emissions, including fugitive dust and other air pollutants from stationary equipment, storage facilities and the use of mobile sources such as trucks and heavy construction equipment, which are subject to review, monitoring and/or control requirements under the CAA and state air quality laws. New facilities may be required to obtain permits before work can begin, and existing facilities may be required to incur capital costs in order to remain in compliance. In addition, permitting rules may impose limitations on our production levels or result in additional capital expenditures in order to comply with the rules.

The National Environmental Policy Act (“NEPA”) requires federal agencies to integrate environmental considerations into their decision-making processes by evaluating the environmental impacts of their proposed actions, including issuance of permits to mining facilities, and assessing alternatives to those actions. If a proposed action could significantly affect the environment, the agency must prepare a detailed statement known as an Environmental Impact Statement (“EIS”). The United States Environmental Protection Agency (“EPA”), other federal agencies, and any interested third parties will review and comment on the scoping of the EIS and the adequacy of and findings set forth in the draft and final EIS. This process can cause delays in issuance of required permits or result in changes to a project to mitigate its potential environmental impacts, which can in turn impact the economic feasibility of a proposed project.

The Clean Water Act (“CWA”), and comparable state statutes, impose restrictions and controls on the discharge of pollutants into waters of the United States. The discharge of pollutants into regulated waters is prohibited, except in accordance with the terms of a permit issued by the EPA or an analogous state agency. The CWA regulates storm water mining facilities and requires a storm water discharge permit for certain activities. Such a permit requires the regulated facility to monitor and sample storm water run-off from its operations. The CWA and regulations implemented thereunder also prohibit discharges of dredged and fill material in wetlands and other waters of the United States unless authorized by an appropriately issued permit. The CWA and comparable state statutes provide for civil, criminal and administrative penalties for unauthorized discharges of pollutants and impose liability on parties responsible for those discharges for the costs of cleaning up any environmental damage caused by the release and for natural resource damages resulting from the release.

The Safe Drinking Water Act (“SDWA”) and the Underground Injection Control (“UIC”) program promulgated thereunder, regulate the drilling and operation of subsurface injection wells. The EPA directly administers the UIC program in some states and in others the responsibility for the program has been delegated to the state. The program requires that a permit be obtained before drilling a disposal or injection well. Violation of these regulations and/or contamination of groundwater by mining related activities may result in fines, penalties, and remediation costs, among other sanctions and liabilities under the SWDA and state laws. In addition, third party claims may be filed by landowners and other parties claiming damages for alternative water supplies, property damages, and bodily injury.

Nevada and Alaska

Other Nevada and Alaska regulations govern operating and design standards for the construction and operation of any source of air contamination and landfill operations. Any changes to these laws and regulations could have an adverse impact on our financial performance and results of operations by, for example, requiring changes to operating constraints, technical criteria, fees or surety requirements.

Employees

As at August 24, 2015, we have 3 full time employees. Our operations are managed by our officers with oversight by the Directors. We engage geological, metallurgical, and engineering consultants from time to time as required to assist in evaluating our property interests and recommending and conducting work programs.

Gold Price History

The price of gold is volatile and is affected by numerous factors all of which are beyond our control, such as the sale or purchase of gold by various central banks and financial institutions, inflation, recession, fluctuation in the relative values of the U.S. dollar and foreign currencies, changes in global and regional gold demand and the political and economic conditions.

The following table presents the high, low and average afternoon fixed prices in U.S. dollars for an ounce of gold on the London Bullion Market over the past five calendar years:

| 13 |

| Year | High | Low | Average | |||||||||

| US$ | US$ | US$ | ||||||||||

| 2010 | 1,421 | 1,058 | 1,225 | |||||||||

| 2011 | 1,895 | 1,319 | 1,571 | |||||||||

| 2012 | 1,792 | 1,540 | 1,669 | |||||||||

| 2013 | 1,693 | 1,192 | 1,411 | |||||||||

| 2014 | 1,385 | 1,142 | 1,267 | |||||||||

Data Source: www.kitco.com

Seasonality

The NBP is not subject to material restrictions on our operations due to seasonality. However, due to the northern climate, exploration work in some areas of Alaska can be limited due to excessive snow cover and cold temperatures. In general, surface sampling work is limited to May through September and surface drilling from March through November, although some locations afford opportunities for year round exploration operations and others, such as wetland areas, may only be explored while frozen in the winter. Mining is conducted in a number of locations in Alaska on a year round basis, both open pit and underground.

Available Information

We make available, free of charge, on or through our Internet website, at www.corvusgold.com, our Annual Report on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the U.S. Securities Exchange Act of 1934, as amended. Our Internet website and the information contained therein or connected thereto are not intended to be, and are not incorporated into this Annual Report on Form 10-K.

You should carefully consider the following risk factors in addition to the other information included in this Annual Report on Form 10-K. Each of these risk factors could materially and adversely affect our business, operating results and financial condition, as well as materially and adversely affect the value of an investment in our Common Shares. The risks described below are not the only ones facing the Company. Additional risks that we are not presently aware of, or that we currently believe are immaterial, may also adversely affect our business, operating results and financial condition. We cannot assure you that we will successfully address these risks or that other unknown risks exist that may affect our business.

Risks Related To Our Company

We will require significant additional capital to fund our business plan.

We will be required to expend significant funds to determine if proven and probable mineral reserves exist at our properties, to continue exploration and if warranted, develop our existing properties and to identify and acquire additional properties to diversify our property portfolio. We have spent and will be required to continue to expend significant amounts of capital for drilling, geological and geochemical analysis, assaying and feasibility studies with regard to the results of our exploration. We may not benefit from some of these investments if we are unable to identify commercially exploitable mineralized material.

Our ability to obtain necessary funding for these purposes, in turn, depends upon a number of factors, including the status of the national and worldwide economy and the price of gold and silver. Capital markets worldwide have been adversely affected by substantial losses by financial institutions, caused by investments in asset-backed securities. We may not be successful in obtaining the required financing or, if we can obtain such financing, such financing may not be on terms that are favorable to us. Failure to obtain such additional financing could result in delay or indefinite postponement of further mining operations or exploration and development and the possible partial or total loss of our potential interest in our properties.

We have a limited operating history on which to base an evaluation of our business and prospects.

Since our inception we have had no revenue from operations. We have no history of producing metals from any of our properties. All of our properties are exploration stage properties in various stages of exploration. Advancing properties from exploration into the development stage requires significant capital and time, and successful commercial production from a property, if any, will be subject to completing feasibility studies, permitting and construction of the mine, processing plants, roads, and other related works and infrastructure. As a result, we are subject to all of the risks associated with developing and establishing new mining operations and business enterprises including:

| 14 |

| · | completion of feasibility studies to verify reserves and commercial viability, including the ability to find sufficient gold/silver mineral reserves to support a commercial mining operation; |

| · | the timing and cost, which can be considerable, of further exploration, preparing feasibility studies, permitting and construction of infrastructure, mining and processing facilities; |

| · | the availability and costs of drill equipment, exploration personnel, skilled labor and mining and processing equipment, if required; |

| · | the availability and cost of appropriate smelting and/or refining arrangements, if required; |

| · | compliance with environmental and other governmental approval and permit requirements; |

| · | the availability of funds to finance exploration, development and construction activities, as warranted; |

| · | potential opposition from non-governmental organizations, environmental groups, local groups or local inhabitants which may delay or prevent development activities; |

| · | potential increases in exploration, construction and operating costs due to changes in the cost of fuel, power, materials and supplies; and |

| · | potential shortages of mineral processing, construction and other facilities related supplies. |

The costs, timing and complexities of exploration, development and construction activities may be increased by the location of our properties and demand by other mineral exploration and mining companies. It is common in exploration programs to experience unexpected problems and delays during drill programs and, if commenced, development, construction and mine start-up. Accordingly, our activities may not result in profitable mining operations and we may not succeed in establishing mining operations or profitably producing metals at any of our properties.

We have a history of losses and expect to continue to incur losses in the future.

We have incurred losses since inception, have negative cash flow from operating activities and expect to continue to incur losses in the future. We incurred the following losses from operations during each of the following periods:

| · | $(10,536,611) for the year ended May 31, 2015; and |

| · | $(13,117,477) for the year ended May 31, 2014. |

We expect to continue to incur losses unless and until such time as one of our properties enters into commercial production and generate sufficient revenues to fund continuing operations. We recognize that if we are unable to generate significant revenues from mining operations and dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition.

Increased costs could affect our financial condition.

We anticipate that costs at our projects that we may explore or develop, will frequently be subject to variation from one year to the next due to a number of factors, such as changing grade, metallurgy and revisions to mine plans, if any, in response to the physical shape and location of the body. In addition, costs are affected by the price of commodities such as fuel, steel, rubber, and electricity. Such commodities are at times subject to volatile price movements, including increases that could make production at certain operations less profitable. A material increase in costs at any significant location could have a significant effect on our profitability.

Risks Related to Mining and Exploration

All of our properties are in the exploration stage. Other than the NBP and our LMS Project, which have estimated inferred and/or measured and indicated mineral resources identified, there are no known mineral resources, and there are no known mineral reserves, on any of our other properties. There is no assurance that we can establish the existence of any mineral reserve on any of our properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from these properties and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral reserve in a commercially exploitable quantity, the exploration component of our business could fail.

| 15 |

We have not established that any of our mineral properties contain any mineral reserve according to recognized reserve guidelines, nor can there be any assurance that we will be able to do so. A mineral reserve is defined by the SEC in its Industry Guide 7 as that part of a mineral deposit, which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a “reserve” that meets the requirements of the SEC’s Industry Guide 7 is extremely remote; in all probability our mineral properties do not contain any “reserves” and any funds that we spend on exploration could be lost. Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that they can be developed into producing mines and extract those minerals. Both mineral exploration and development involve a high degree of risk and few mineral properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the mineral deposit to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral deposit unprofitable.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses.

Exploration for and the production of minerals is highly speculative and involves much greater risk than many other businesses. Most exploration programs do not result in the discovery of mineralization, and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Our operations are, and any future development or mining operations we may conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and development of mineral properties, such as, but not limited to:

| · | economically insufficient mineralized material; |

| · | fluctuation in production costs that make mining uneconomical; |

| · | labor disputes; |

| · | unanticipated variations in grade and other geologic problems; |

| · | environmental hazards; |

| · | water conditions; |

| · | difficult surface or underground conditions; |

| · | industrial accidents; |

| · | metallurgic and other processing problems; |

| · | mechanical and equipment performance problems; |

| · | failure of pit walls or dams; |

| · | unusual or unexpected rock formations; |

| · | personal injury, fire, flooding, cave-ins and landslides; and |

| · | decrease in the value of mineralized material due to lower gold and/or silver prices. |

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures, potential revenues and production dates. We currently have very limited insurance to guard against some of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable, or result in additional expenses.

| 16 |

We have no history of producing metals from our current mineral properties and there can be no assurance that we will successfully establish mining operations or profitably produce precious metals.

We have no history of producing metals from our current mineral properties. We do not produce gold or silver and do not currently generate operating earnings. While we seek to move our projects into production, such efforts will be subject to all of the risks associated with establishing new mining operations and business enterprises, including:

| · | the timing and cost, which are considerable, of the construction of mining and processing facilities; |

| · | the ability to find sufficient gold/silver reserves to support a profitable mining operation; |

| · | the availability and costs of skilled labor and mining equipment; |

| · | compliance with environmental and other governmental approval and permit requirements; |

| · | the availability of funds to finance construction and development activities; |

| · | potential opposition from non-governmental organizations, environmental groups, local groups or local inhabitants that may delay or prevent development activities; and |

| · | potential increases in construction and operating costs due to changes in the cost of labor, fuel, power, materials and supplies. |

The costs, timing and complexities of mine construction and development may be increased by the remote location of some of our properties. It is common in new mining operations to experience unexpected problems and delays during construction, development and mine start-up. In addition, our management will need to be expanded. This could result in delays in the commencement of mineral production and increased costs of production. Accordingly, we cannot assure you that our activities will result in profitable mining operations or that we will successfully establish mining operations.

Estimates of mineral resources are subject to evaluation uncertainties that could result in project failure.

Our exploration and future mining operations, if any, are and would be faced with risks associated with being able to accurately predict the quantity and quality of mineral resources/reserves within the earth using statistical sampling techniques. Estimates of mineral resource/reserve on any of our properties would be made using samples obtained from appropriately placed trenches, test pits and underground workings and intelligently designed drilling. There is an inherent variability of assays between check and duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. Additionally, there also may be unknown geologic details that have not been identified or correctly appreciated at the current level of accumulated knowledge about our properties. This could result in uncertainties that cannot be reasonably eliminated from the process of estimating mineral resources/reserves. If these estimates were to prove to be unreliable, we could implement an exploitation plan that may not lead to commercially viable operations in the future.

Any material changes in mineral resource/reserve estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital.

As we have not completed feasibility studies on any of our properties and have not commenced actual production, mineral resource estimates may require adjustments or downward revisions. In addition, the grade ultimately mined, if any, may differ from that indicated by our feasibility studies and drill results. Minerals recovered in small scale tests may not be duplicated in large scale tests under on-site conditions or in production scale.

The mineral resource estimates contained in this Annual Report have been determined based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for gold or silver may render portions of our mineralization and resource estimates uneconomic and result in reduced reported mineralization or adversely affect any commercial viability determinations we may reach. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our share price and the value of our properties.

There are differences in U.S. and Canadian practices for reporting reserves and resources.

Our mineral reserve and mineral resource estimates are not directly comparable to those made in filings subject to SEC reporting and disclosure requirements, as we generally report mineral reserves and mineral resources in accordance with Canadian requirements. These requirements are different from the practices used to report mineral reserve and mineral resource estimates in reports and other materials filed with the SEC. It is Canadian practice to report measured, indicated and inferred mineral resources, which are generally not permitted in disclosure filed with the SEC by United States issuers. In the United States, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into reserves.

Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations; however, the SEC only permits issuers to report “resources” as in place, tonnage and grade without reference to unit measures.

| 17 |

Accordingly, information concerning descriptions of mineralization, mineral reserves and mineral resources contained in this Annual Report, or in the documents incorporated herein by reference, may not be comparable to information made public by other United States companies subject to the reporting and disclosure requirements of the SEC.

Our exploration activities on our properties may not be commercially successful, which could lead us to abandon our plans to develop our properties and our investments in exploration.

Our long-term success depends on our ability to identify mineral deposits on our existing properties and other properties we may acquire, if any, that we can then develop into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of gold, silver and other commodity exploration is determined in part by the following factors:

| · | the identification of potential mineralization based on surficial analysis; |

| · | availability of government-granted exploration permits; |

| · | the quality of our management and our geological and technical expertise; and |

| · | the capital available for exploration and development work. |

Substantial expenditures are required to establish proven and probable mineral reserves through drilling and analysis, to develop metallurgical processes to extract metal, and to develop the mining and processing facilities and infrastructure at any site chosen for mining. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if we are unable to identify commercially exploitable mineral reserves. The decision to abandon a project may have an adverse effect on the market value of our securities and the ability to raise future financing.

The volatility of the price of gold could adversely affect our future operations and, if warranted, our ability to develop our properties.