Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - WESTERN CAPITAL RESOURCES, INC. | s102138_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - WESTERN CAPITAL RESOURCES, INC. | s102138_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - WESTERN CAPITAL RESOURCES, INC. | s102138_ex31-2.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

x Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended September 30, 2015

o Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission File Number: 000-52015

Western Capital Resources, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Minnesota | 47-0848102 | |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification Number) |

11550 “I” Street, Suite 150, Omaha, Nebraska 68137

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (402) 551-8888

N/A

(Former name, former address and former fiscal year, if changed since last report)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

APPLICABLE ONLY TO CORPORATE ISSUERS

As of November 13, 2015, the registrant had outstanding 9,497,689 shares of common stock, no par value per share.

Western Capital Resources, Inc.

Index

| 2 |

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES

CONTENTS

| Page | |

| CONDENSED CONSOLIDATED FINANCIAL STATEMENTS | |

| Condensed Consolidated Balance Sheets | 4 |

| Condensed Consolidated Statements of Income | 5 |

| Condensed Consolidated Statements of Cash Flows | 6 |

| Notes to Condensed Consolidated Financial Statements | 7 |

| 3 |

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| September 30, 2015 (Unaudited) | December 31, 2014 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS | ||||||||

| Cash | $ | 3,548,728 | $ | 4,273,350 | ||||

| Loans receivable (less allowance for losses of $1,301,000 and $1,219,000, respectively) | 5,097,418 | 5,331,266 | ||||||

| Accounts receivable (less allowance for losses of $266,000 and $59,405, respectively) | 2,155,177 | 1,135,127 | ||||||

| Inventory | 7,583,661 | 2,340,824 | ||||||

| Prepaid expenses and other | 2,756,249 | 1,435,918 | ||||||

| Deferred income taxes | 600,000 | 644,000 | ||||||

| TOTAL CURRENT ASSETS | 21,741,233 | 15,160,485 | ||||||

| PROPERTY AND EQUIPMENT, net | 8,518,038 | 1,197,710 | ||||||

| GOODWILL | 13,788,612 | 12,956,868 | ||||||

| INTANGIBLE ASSETS, net | 8,126,180 | 7,248,793 | ||||||

| OTHER | 439,402 | 198,408 | ||||||

| TOTAL ASSETS | $ | 52,613,465 | $ | 36,762,264 | ||||

| LIABILITIES AND EQUITY | ||||||||

| CURRENT LIABILITIES | ||||||||

| Accounts payable and accrued liabilities | $ | 9,381,954 | $ | 6,025,920 | ||||

| Income taxes payable | 923,827 | 755,615 | ||||||

| Current portion notes payable | 4,900,008 | 3,500,000 | ||||||

| Current portion capital lease obligations | 27,128 | 42,240 | ||||||

| Deferred revenue and other | 960,604 | 638,068 | ||||||

| TOTAL CURRENT LIABILITIES | 16,193,521 | 10,961,843 | ||||||

| LONG-TERM LIABILITIES | ||||||||

| Notes payable, net of current portion | 3,571,454 | 1,625,000 | ||||||

| Capital lease obligations, net of current portion | 48,922 | 31,481 | ||||||

| Deferred income taxes | 4,268,000 | 3,939,000 | ||||||

| Other | 93,262 | 114,514 | ||||||

| TOTAL LONG-TERM LIABILITIES | 7,981,638 | 5,709,995 | ||||||

| TOTAL LIABILITIES | 24,175,159 | 16,671,838 | ||||||

| COMMITMENTS AND CONTINGENCIES (Note 16) | ||||||||

| EQUITY | ||||||||

| WESTERN SHAREHOLDERS’ EQUITY | ||||||||

| Common stock, no par value, 12,500,000 shares authorized, 9,497,689 and 5,997,588 issued and outstanding. | - | - | ||||||

| Additional paid-in capital | 28,903,681 | 22,703,745 | ||||||

| Accumulated deficit | (486,233 | ) | (2,621,692 | ) | ||||

| TOTAL WESTERN SHAREHOLDERS’ EQUITY | 28,417,448 | 20,082,053 | ||||||

| NONCONTROLLING INTERESTS | 20,858 | 8,373 | ||||||

| TOTAL EQUITY | 28,438,306 | 20,090,426 | ||||||

| TOTAL LIABILITIES AND EQUITY | $ | 52,613,465 | $ | 36,762,264 | ||||

See notes to condensed consolidated financial statements.

| 4 |

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

| Three months ended | Nine months ended | |||||||||||||||

| September 30, 2015 | September 30, 2014 | September 30, 2015 | September 30, 2014 | |||||||||||||

| REVENUES | ||||||||||||||||

| Sales and associated fees | $ | 13,403,791 | $ | 5,710,322 | $ | 27,039,059 | $ | 15,680,700 | ||||||||

| Financing fees and interest | 2,865,842 | 2,919,822 | 8,007,438 | 8,229,216 | ||||||||||||

| Royalty and franchise fees, net | 2,803,405 | - | 7,883,214 | - | ||||||||||||

| Other revenue | 2,878,430 | 928,600 | 6,259,541 | 2,901,385 | ||||||||||||

| 21,951,468 | 9,558,744 | 49,189,252 | 26,811,301 | |||||||||||||

| COST OF REVENUES | ||||||||||||||||

| Cost of sales | 7,324,815 | 2,982,059 | 15,329,353 | 8,841,356 | ||||||||||||

| Provisions for loans receivable losses | 572,959 | 514,763 | 1,351,427 | 1,268,330 | ||||||||||||

| Other | 200,303 | - | 730,143 | - | ||||||||||||

| Total Cost of Revenues | 8,098,077 | 3,496,822 | 17,410,923 | 10,109,686 | ||||||||||||

| GROSS PROFIT | 13,853,391 | 6,061,922 | 31,778,329 | 16,701,615 | ||||||||||||

| OPERATING EXPENSES | ||||||||||||||||

| Salaries, wages and benefits | 6,236,073 | 2,706,386 | 14,733,576 | 7,702,265 | ||||||||||||

| Occupancy | 2,016,406 | 1,122,669 | 4,729,718 | 3,409,951 | ||||||||||||

| Selling, marketing and development | 1,142,751 | 91,164 | 1,513,578 | 260,831 | ||||||||||||

| Depreciation | 234,122 | 87,150 | 444,814 | 258,644 | ||||||||||||

| Amortization | 141,783 | 28,373 | 359,133 | 82,962 | ||||||||||||

| Other | 2,280,809 | 1,053,371 | 5,754,519 | 2,972,548 | ||||||||||||

| 12,051,944 | 5,089,113 | 27,535,338 | 14,687,201 | |||||||||||||

| OPERATING INCOME | 1,801,447 | 972,809 | 4,242,991 | 2,014,414 | ||||||||||||

| OTHER INCOME (EXPENSES): | ||||||||||||||||

| Interest income | 995 | - | 3,065 | - | ||||||||||||

| Interest expense | (198,048 | ) | (60,493 | ) | (401,299 | ) | (191,823 | ) | ||||||||

| (197,053 | ) | (60,493 | ) | (398,234 | ) | (191,823 | ) | |||||||||

| INCOME BEFORE INCOME TAXES | 1,604,394 | 912,316 | 3,844,757 | 1,822,591 | ||||||||||||

| INCOME TAX EXPENSE | 724,293 | 347,000 | 1,696,813 | 686,000 | ||||||||||||

| NET INCOME | 880,101 | 565,316 | 2,147,944 | 1,136,591 | ||||||||||||

| Less net income attributable to noncontrolling interests | (6,498 | ) | - | (12,485 | ) | - | ||||||||||

| NET INCOME ATTRIBUTABLE TO WESTERN SHAREHOLDERS | $ | 873,603 | $ | 565,316 | $ | 2,135,459 | $ | 1,136,591 | ||||||||

| EARNINGS PER SHARE ATTRIBUTABLE TO WESTERN COMMON SHAREHOLDERS | ||||||||||||||||

| Basic and diluted | $ | 0.09 | $ | 0.19 | $ | 0.30 | $ | 0.38 | ||||||||

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING | ||||||||||||||||

| Basic and diluted | 9,497,689 | 3,010,765 | 7,177,176 | 3,010,922 | ||||||||||||

See notes to condensed consolidated financial statements.

| 5 |

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited)

| Nine Months Ended | ||||||||

| September 30, 2015 | September 30, 2014 | |||||||

| OPERATING ACTIVITIES | ||||||||

| Net Income | $ | 2,147,944 | $ | 1,136,591 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation | 444,814 | 258,644 | ||||||

| Amortization | 359,133 | 82,962 | ||||||

| Stock based compensation | 76,538 | - | ||||||

| Deferred income taxes | 390,000 | 275,000 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Loans receivable | 233,848 | 344,103 | ||||||

| Accounts receivable | (492,684 | ) | - | |||||

| Inventory | (1,645,395 | ) | (445,191 | ) | ||||

| Prepaid expenses and other assets | (612,532 | ) | 345,883 | |||||

| Accounts payable and accrued liabilities | (468,720 | ) | 327,633 | |||||

| Deferred revenue and other current liabilities | (137,896 | ) | - | |||||

| Accrued liabilities and other | (21,252 | ) | (26,401 | ) | ||||

| Net cash provided by operating activities | 273,798 | 2,299,224 | ||||||

| INVESTING ACTIVITIES | ||||||||

| Purchase of property and equipment | (507,075 | ) | (211,106 | ) | ||||

| Purchase of intangible assets | - | (250,000 | ) | |||||

| Acquisition of stores | (2,608,500 | ) | - | |||||

| Cash acquired through acquisition | 2,470,930 | - | ||||||

| Net cash used by investing activities | (644,645 | ) | (461,106 | ) | ||||

| FINANCING ACTIVITIES | ||||||||

| Payments on notes payable – short-term | (120,000 | ) | - | |||||

| Payments on notes payable – long-term, net | (191,668 | ) | (750,000 | ) | ||||

| Common stock redemption | - | (388 | ) | |||||

| Payments on capital leases | (42,107 | ) | - | |||||

| Net cash used by financing activities | (353,775 | ) | (750,388 | ) | ||||

| NET (DECREASE) INCREASE IN CASH | (724,622 | ) | 1,087,730 | |||||

| CASH | ||||||||

| Beginning of period | 4,273,350 | 1,983,835 | ||||||

| End of period | $ | 3,548,728 | $ | 3,071,565 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | ||||||||

| Income taxes paid | $ | 1,759,171 | $ | 164,838 | ||||

| Interest paid | $ | 392,751 | $ | 200,124 | ||||

| Noncash investing and financing activities: | ||||||||

| Net assets acquired in JPPA/RAI/JPRE acquisition (see Note 13) | $ | 6,123,398 | $ | - | ||||

| Deposit applied to purchase of intangibles | $ | 50,000 | $ | - | ||||

See notes to condensed consolidated financial statements.

| 6 |

WESTERN CAPITAL RESOURCES, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

| 1. | Basis of Presentation, Nature of Business and Summary of Significant Accounting Policies – |

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared according to the instructions to Form 10-Q and Section 210.8-03(b) of Regulation S-X of the Securities and Exchange Commission (SEC) and, therefore, certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) have been omitted.

In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three- and nine-month periods ended September 30, 2015 are not necessarily indicative of the results that may be expected for the year ending December 31, 2015.

For further information, refer to the Consolidated Financial Statements and footnotes thereto included in our Form 10-K for the year ended December 31, 2014. The condensed consolidated balance sheet at December 31, 2014, has been derived from the audited consolidated financial statements at that date, but does not include all of the information and footnotes required by GAAP.

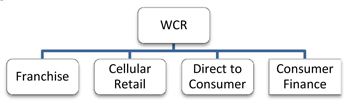

Nature of Business

References in these financial statement notes to the “Company” or “we” refer to Western Capital Resources, Inc. and its subsidiaries. References to specific companies within our enterprise, such as “PQH,” “WFL,” “EPI”, “AGI,”, “JPPA”, “RAI” or “JPRE” are references only to those companies. Western Capital Resources, Inc. (“WCR”) is a holding company owning operating subsidiaries, with the percentages owned by WCR of each subsidiary shown parenthetically, as summarized below.

| · | Franchise |

| o | AlphaGraphics, Inc. (AGI) (99.2%) – franchisor of 252 domestic and 26 international AlphaGraphics Business Centers, as of September 30, 2015, specializing in the planning, production and management of visual communications for businesses and individuals throughout the world. |

| · | Cellular Retail |

| o | PQH Wireless, Inc. and subsidiaries (PQH) (100%) – owns and operates 102 cellular retail stores, as of September 30, 2015, as an exclusive dealer of the Cricket brand in 15 states—Arizona, Colorado, Idaho, Illinois, Indiana, Iowa, Kansas, Missouri, Nebraska, Ohio, Oklahoma, Oregon, Texas, Washington and Wisconsin. |

| · | Direct to Consumer |

| o | J & P Park Acquisitions, Inc. (JPPA) (100%) – a multi-channel retailer of live plants, seeds, holiday gifts and garden accessories selling its products under Park Seed, Jackson & Perkins, and Wayside Gardens brand names as well as a wholesaler under the Park Wholesale brand. JPPA sells over the internet and through direct mail catalogs. |

| o | Restorers Acquisition, Inc. (RAI) (100%) – operates primarily as a retail seller of home improvement and restoration products. The company sells over the internet through the domain name www.Vandykes.com and through direct mail catalogs. |

| o | J & P Real Estate, LLC (JPRE) (100%) – owns real estate utilized as JPPA’s distribution and warehouse facility and the corporate offices of JPPA and RAI. |

| · | Consumer Finance |

| o | Wyoming Financial Lenders, Inc. (WFL) (100%) – owns and operates 50 “payday” stores, as of September 30, 2015, in nine states (Colorado, Iowa, Kansas, Nebraska, North Dakota, South Dakota, Utah, Wisconsin and Wyoming) providing sub-prime short-term uncollateralized non-recourse “cash advance” or “payday” loans typically ranging from $100 to $500 with a maturity of generally two to four weeks, “installment” loans typically ranging from $300 to $800 with a maturity of six months, check cashing and other money services to individuals. |

| o | Express Pawn, Inc. (EPI) (100%) – owns and operates three retail pawn stores, as of September 30, 2015, in Nebraska and Iowa, providing collateralized non-recourse pawn loans and retail sales of merchandise obtained from forfeited pawn loans or purchased from customers. |

| 7 |

Basis of Consolidation

The consolidated financial statements include the accounts of WCR, its wholly owned subsidiaries and other entities in which the Company owns a controlling financial interest. For financial interests in which the Company owns a controlling financial interest, the Company applies the guidance of ASC 810 applicable to reporting the equity and net income or loss attributable to noncontrolling interests. All significant intercompany balances and transactions of the Company have been eliminated in consolidation.

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that may affect certain reported amounts and disclosures in the consolidated financial statements and accompanying notes. Management bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances. Actual results could differ from those estimates. Significant management estimates relate to the notes and loans receivable allowance, carrying value and impairment of long-lived goodwill and intangible assets, inventory valuation and obsolescence, estimated useful lives of property and equipment, gift certificate liabilities and deferred taxes and tax uncertainties.

Receivables and Loss Allowance

Direct to Consumer

Receivables are recorded when billed or accrued and represent claims against third parties that will be settled in cash. The carrying value of receivables, net of the allowance for doubtful accounts, represents their estimated net realizable value. The allowance for doubtful accounts is estimated based on historical collection trends, type of customer, the age of outstanding receivables and existing economic conditions. If events or changes in circumstances indicate that specific receivable balances may be impaired, further consideration is given to the collectability of those balances and the allowance is adjusted accordingly. Past due receivable balances are written-off when internal collection efforts have been unsuccessful in collecting the amount due.

Inventory

Direct to Consumer

Inventory is valued at the lower of cost or market using the weighted-average method of determining cost.

Property and Equipment

Direct to Consumer

Property and equipment are recorded at cost less accumulated depreciation. Depreciation is provided on the straight-line method over the estimated useful lives of the related assets as follows:

| Ÿ | Computer equipment and software | 3 – 10 years |

| Ÿ | Warehouse improvements and equipment | 3 – 15 years |

| Ÿ | Building | 39 years |

The cost of maintenance and repairs is charged to operations as incurred while renewals and betterments are capitalized.

The Company capitalizes certain internal costs, including payroll costs, incurred in connection with the development of software for internal use. These costs are capitalized beginning when the Company has entered the application development stage. The capitalization of these costs ceases when the software is substantially complete and ready for its intended use. Costs incurred for enhancements that are expected to result in additional features or functionality are capitalized and expensed over the estimated useful life of the enhancements.

Deferred Revenue

Direct to Consumer

Sales billed or cash received in advance of actual delivery are deferred and recorded as income in the period in which the related deliveries are made.

| 8 |

Merchandise Credits and Gift Card Liabilities

Direct to Consumer

The Company maintains a liability for unredeemed gift cards, gift certificates and merchandise credits until the earlier of redemption, escheatment or a maximum of two years. The Company has concluded that the likelihood of these liabilities being redeemed beyond two years from the date of issuance is remote.

Advertising

Direct to Consumer

The Company expenses advertising costs as they are incurred, except for direct-response advertising, which is capitalized and amortized over its expected period of future benefits, not to exceed six months. Direct-response advertising consists primarily of catalog book production, printing, and postage costs.

Shipping and Handling Costs

Direct to Consumer

The Company includes shipping and handling fees billed to customers in net sales. Shipping and handling costs are expensed as incurred and included in cost of sales.

Stock-based Compensation

The Company accounts for its employee stock-based compensation plans using the fair value method. The fair value method requires the Company to estimate the grant-date fair value of its stock-based awards and amortize this fair value to compensation expense over the requisite service period or vesting term.

The Company uses the Black-Scholes option-pricing model to estimate the fair value of the Company’s stock option awards. The determination of the fair value of stock-based payment awards on the date of grant using an option-pricing model is affected by the Company’s stock price as well as assumptions regarding a number of complex and subjective variables. These variables include the expected stock price volatility over the term of the awards, actual and projected employee stock option exercise behaviors, the risk-free interest rate and expected dividends. Due to the inherent limitations of option-valuation models, future events that are unpredictable and the estimation process utilized in determining the valuation of the stock-based awards, the ultimate value realized by award holders may vary significantly from the amounts expensed in the Company’s financial statements.

Stock-based compensation expense is recognized net of estimated forfeitures such that expense is recognized only for those stock-based awards that are expected to vest. A forfeiture rate is estimated at the time of grant and revised, if necessary, in subsequent periods if actual forfeitures differ from initial estimate.

Net Income Per Common Share

Basic net income per common share is computed by dividing the income available to common shareholders by the weighted average number of common shares outstanding for the period. Diluted earnings per share gives effect to all dilutive potential common shares outstanding during the period, including stock options, using the treasury stock method. Options to purchase 65,000 shares granted under the 2015 Stock Incentive Plan effective February 6, 2015 (see Note 18) were outstanding at September 30, 2015. These options have a strike price in excess of the market price as of September 30, 2015, were antidilutive and therefore not included in the computation of diluted earnings per share. Thus, there were no dilutive common shares as of September 30, 2015 and 2014.

Segment Reporting

The Company has grouped its operations into five segments – Franchise, Cellular Retail, Direct to Consumer, Consumer Finance, and Corporate. The Franchise segment specializes in the planning, production and management of visual communications for businesses and individuals. The Cellular Retail segment is an authorized Cricket premier dealer selling cellular phones and accessories, providing ancillary services and accepting service payments from customers. The Direct to Consumer segment consists primarily of online and mail order catalog retailers’ sales of product offerings including seeds, live goods, holiday gifts, garden accessories and home improvement and restoration products. The Consumer Finance segment provides financial and ancillary services and also sells used merchandise at retail pawn stores. The Corporate segment consists of Company activities related to acquisitions and subsequent management of acquired businesses.

| 9 |

Reclassifications

Certain Statement of Income reclassifications have been made in the presentation of our prior financial statements and accompanying notes, including pro forma presentation, to conform to the presentation as of and for the three and nine months ended September 30, 2015.

Recent Accounting Pronouncements

No new accounting pronouncement issued or effective during the fiscal quarter has had or is expected to have a material impact on our condensed consolidated financial statements.

| 2. | Risks Inherent in the Operating Environment – |

Regulatory

Consumer Finance

The Company’s Consumer Finance segment activities are highly regulated under numerous local, state and federal laws and regulations, which are subject to change. New laws or regulations could be enacted or issued, interpretations of existing laws or regulations may change, and enforcement action by regulatory agencies may intensify. Over the past several years, consumer advocacy groups and certain media reports have advocated governmental and regulatory action to prohibit or severely restrict sub-prime lending activities of the kind conducted by WFL and EPI. The federal Consumer Financial Protection Bureau has indicated that it will use its authority to further regulate the payday lending industry.

Any adverse change in present local, state or federal laws or regulations that govern or otherwise affect lending could result in the Consumer Finance segment’s curtailment or cessation of operations in certain or all jurisdictions or locations. Furthermore, any actual or perceived failure to comply with applicable local, state or federal laws or regulations could result in fines, litigation, closure of one or more store locations, or negative publicity. Any such outcome would have a corresponding impact on the Company’s results of operations and financial condition, primarily through a decrease in revenues, non-cash charges from the write-down of the carrying value of goodwill and intangible assets resulting from the cessation or curtailment of operations, and increased legal expenditures or fines, and could also negatively affect the Company’s general business prospects if the Company is unable to effectively replace such revenues in a timely and efficient manner or if negative publicity effects its ability to obtain additional financing as needed.

In addition, the passage of federal or state laws and regulations or changes in interpretations of them could, at any point, essentially prohibit WFL or EPI from conducting its lending business in its current form. Any such legal or regulatory change would certainly have a material and adverse effect on the Company, its operating results and its financial condition and prospects.

Franchise

In August 2015, the National Labor Relations Board (NLRB) changed its long-standing joint-employer standard in a widely discussed decision, Browning Ferris Industries of California, Inc. In that decision, the NLRB asserted that two or more entities are joint employers of a single workforce if they share or co-determine, even indirectly, those matters governing the essential terms and conditions of employment. In terms of franchise business models, the NLRB has to date refused to dismiss various labor and wage-violation complaints alleging that McDonalds is a joint employer together with its franchisees. In the past, courts determining whether a franchisor and franchisee are joint employers of a single workforce have generally examined whether the franchisor exercises direct (as opposed to indirect) and significant control over the franchisees' employment-related decisions-i.e., the hiring, firing or discipline of franchisee employees, payment of their wages, or setting of their work schedules. It is presently uncertain what the ultimate outcome will be of attempts by plaintiffs and regulatory authorities to impose employment-related liabilities upon franchisors under the theory that they are joint employers of their franchisees' employees. Nevertheless, the extension of the Browning Ferris principles to franchise business models, and their application to our AlphaGraphics business, could have material and adverse consequences to the operating results, financial condition and prospects of that business and our Company.

Vendor Concentration

Direct to Consumer

RAI has an agreement with a third-party fulfillment provider that is in effect through January 31, 2016. The fulfillment provider receives and stores inventory, performs periodic cycle counts, picks, packs and ships customer orders. Additional services such as, order taking, processing of customer payments, personalization, customer services, and order processing are also performed by the fulfillment provider. RAI is currently in negotiations to extend the agreement.

| 10 |

JPPA has an agreement with a third party wholesale grower that is in effect until 2019. The grower has agreed to perform research for JPPA and maintain JPPA's research crop in exchange for a reduction in royalties to be paid to JPPA for growing JPPA's patented roses. There is an option to renew the agreement for consecutive two year terms and the agreement calls for a 24 month notice prior to termination.

| 3. | Loans Receivable – |

At September 30, 2015 and December 31, 2014, the Company’s outstanding loans receivable aging was as follows:

| September 30, 2015 | ||||||||||||||||

| Payday | Installment | Pawn & Title | Total | |||||||||||||

| Current | $ | 4,234,640 | $ | 263,313 | $ | 326,968 | $ | 4,824,921 | ||||||||

| 1-30 | 369,269 | 43,826 | - | 413,095 | ||||||||||||

| 31-60 | 278,035 | 21,511 | - | 299,546 | ||||||||||||

| 61-90 | 250,381 | 13,988 | - | 264,369 | ||||||||||||

| 91-120 | 249,758 | 5,757 | - | 255,515 | ||||||||||||

| 121-150 | 168,596 | 1,815 | - | 170,411 | ||||||||||||

| 151-180 | 170,475 | 86 | - | 170,561 | ||||||||||||

| 5,721,154 | 350,296 | 326,968 | 6,398,418 | |||||||||||||

| Less Allowance | (1,204,000 | ) | (97,000 | ) | - | (1,301,000 | ) | |||||||||

| $ | 4,517,154 | $ | 253,296 | $ | 326,968 | $ | 5,097,418 | |||||||||

| December 31, 2014 | ||||||||||||||||

| Payday | Installment | Pawn & Title | Total | |||||||||||||

| Current | $ | 4,387,393 | $ | 321,634 | $ | 372,805 | $ | 5,081,832 | ||||||||

| 1-30 | 305,382 | 47,321 | - | 352,703 | ||||||||||||

| 31-60 | 223,465 | 24,791 | - | 248,256 | ||||||||||||

| 61-90 | 236,072 | 11,799 | - | 247,871 | ||||||||||||

| 91-120 | 206,705 | 5,438 | - | 212,143 | ||||||||||||

| 121-150 | 200,101 | 1,984 | - | 202,085 | ||||||||||||

| 151-180 | 204,804 | 572 | - | 205,376 | ||||||||||||

| 5,763,922 | 413,539 | 372,805 | 6,550,266 | |||||||||||||

| Less Allowance | (1,147,000 | ) | (72,000 | ) | - | (1,219,000 | ) | |||||||||

| $ | 4,616,922 | $ | 341,539 | $ | 372,805 | $ | 5,331,266 | |||||||||

| 4. | Loans Receivable Allowance – |

As a result of the Company’s collection efforts, it historically writes off approximately 43% of returned payday items. Based on days past the check return date, write-offs of payday returned items historically have tracked at the following approximate percentages: 1 to 30 days – 43%; 31 to 60 days – 65%; 61 to 90 days – 83%; 91 to 120 days – 88%; 121 to 150 days – 91%; and 151 to 180 days – 93%.

A rollforward of the Company’s loans receivable allowance is as follows:

| Nine Months Ended September 30, 2015 | Year Ended December 31, 2014 | |||||||

| Loans receivable allowance, beginning of period | $ | 1,219,000 | $ | 1,215,000 | ||||

| Provision for loan losses charged to expense | 1,351,427 | 1,817,822 | ||||||

| Charge-offs, net | (1,269,427 | ) | (1,813,822 | ) | ||||

| Loans receivable allowance, end of period | $ | 1,301,000 | $ | 1,219,000 | ||||

| 11 |

| 5. | Accounts Receivable – |

A breakdown of accounts receivables by segment as of September 30, 2015 and December 31, 2014 are as follows:

| September 30, 2015 | ||||||||||||||||

| Franchise | Cellular Retail | Direct to Consumer | Total | |||||||||||||

| Accounts receivable | $ | 1,423,267 | $ | 103,738 | $ | 894,172 | $ | 2,421,177 | ||||||||

| Less allowance | (150,000 | ) | - | (116,000 | ) | (266,000 | ) | |||||||||

| Net account receivable | $ | 1,273,267 | $ | 103,738 | $ | 778,172 | $ | 2,155,177 | ||||||||

December 31, 2014 | ||||||||||||||||

| Franchise | Cellular Retail | Direct to Consumer | Total | |||||||||||||

| Accounts receivable | $ | 1,164,532 | $ | - | $ | - | $ | 1,164,532 | ||||||||

| Less allowance | (59,405 | ) | - | - | (59,405 | ) | ||||||||||

| Net account receivable | $ | 1,135,127 | $ | - | $ | - | $ | 1,135,127 | ||||||||

| 6. | Property and Equipment – |

A rollforward of the Company’s property and equipment is as follows:

| December 31, 2014 | Merger Transaction | Additions | Deletions | September 30, 2015 | ||||||||||||||||

| Furniture and equipment | $ | 2,853,603 | $ | 492,435 | $ | 1,042,617 | $ | (730,468 | ) | $ | 3,658,187 | |||||||||

| Leasehold improvements | 787,188 | - | 22,766 | (9,117 | ) | 800,837 | ||||||||||||||

| Software | 504,967 | 1,197,839 | 81,243 | (108,081 | ) | 1,675,968 | ||||||||||||||

| Building | 85,906 | 5,034,348 | 28,449 | - | 5,148,703 | |||||||||||||||

| Land | 9,500 | 1,200,000 | - | - | 1,209,500 | |||||||||||||||

| Other | 96,311 | - | - | - | 96,311 | |||||||||||||||

| 4,337,475 | 7,924,622 | 1,175,075 | (847,666 | ) | 12,589,506 | |||||||||||||||

| Accumulated depreciation | (3,139,765 | ) | (1,334,555 | ) | (444,814 | ) | 847,666 | (4,071,468 | ) | |||||||||||

| $ | 1,197,710 | $ | 6,590,067 | $ | 730,261 | $ | - | $ | 8,518,038 | |||||||||||

| 7. | Intangible Assets – |

A rollforward of the Company’s intangible assets consisted of the follows:

| December 31, 2014 | Merger Transaction | Additions | Deletions | September 30, 2015 | ||||||||||||||||

| Customer relationships | $ | 4,924,912 | $ | - | $ | 1,115,000 | $ | - | $ | 6,039,912 | ||||||||||

| Acquired franchise agreements | 5,227,112 | - | - | - | 5,227,112 | |||||||||||||||

| Other | - | 227,000 | - | - | 227,000 | |||||||||||||||

| Amortizable Intangible assets | 10,152,024 | 227,000 | 1,115,000 | - | 11,494,024 | |||||||||||||||

| Less accumulated amortization | (5,685,523 | ) | (105,480 | ) | (359,133 | ) | - | (6,150,136 | ) | |||||||||||

| Net Amortizable Intangible Assets | 4,466,501 | 121,520 | 755,867 | - | 5,343,888 | |||||||||||||||

| Non-amortizable trademarks | 2,782,292 | - | - | - | 2,782,292 | |||||||||||||||

| Intangible Assets, net | $ | 7,248,793 | $ | 121,520 | $ | 755,867 | $ | - | $ | 8,126,180 | ||||||||||

As of September 30, 2015, estimated future amortization expense for the amortizable intangible assets is as follows:

| 2015 (remainder) | $ | 139,720 | ||

| 2016 | 550,796 | |||

| 2017 | 537,740 | |||

| 2018 | 525,991 | |||

| 2019 | 515,416 | |||

| 2020 | 499,165 | |||

| Thereafter | 2,575,060 | |||

| $ | 5,343,888 |

| 12 |

| 8. | Other Non-Current Assets – |

Other Non-Current Assets include $145,800 for a note receivable. Our agreement with the borrower includes an approximate 50% forgiveness of principal if, among other terms and conditions, required payments under the agreement are received. The agreement provides for monthly payments of principal over a five-year term ending March 2020.

| 9. | Deferred Revenue and Other Liabilities – |

Deferred revenue and other liabilities consist of the following:

| September 30, 2015 | December 31, 2014 | |||||||

| Deferred financing fees | $ | 269,526 | $ | 284,231 | ||||

| Deferred franchise fees | 49,579 | 281,837 | ||||||

| Merchandise credits and gift card liability | 447,499 | - | ||||||

| Other | 194,000 | 72,000 | ||||||

| Total | $ | 960,604 | $ | 638,068 | ||||

| 10. | Notes Payable – Long Term – |

| September 30, 2015 | December 31, 2014 | |||||||

| Note payable (with a credit limit of $3,000,000) to River City Equity, Inc., a related party, with interest payable monthly at 12% per annum, due June 30, 2016 and upon certain events can be collateralized by substantially all assets of WCR, excluding any equity interest in AGI | $ | 3,000,000 | $ | 2,000,000 | ||||

| Subsidiary note payable to a financial institution with quarterly principal payments of $375,000 plus interest at prime rate plus 2.5% per annum (5.75% as of September 30, 2015), secured by AGI’s assets, due June 2017 | 2,000,000 | 3,125,000 | ||||||

| Subsidiary note payable to a financial institution with monthly principal payments of $33,334 plus annual paydowns equal to JPRE’s net cash flow from operations due within 120 days of the calendar year end plus interest at LIBOR plus 3.5% per annum (3.75% as of September 30, 2015), secured by JPRE assets, due June 2019 | 3,471,462 | - | ||||||

| Total | 8,471,462 | 5,125,000 | ||||||

| Less current maturities | (4,900,008 | ) | (3,500,000 | ) | ||||

| $ | 3,571,454 | $ | 1,625,000 | |||||

As part of their lending agreement, AGI may draw on a $1,000,000 line of credit (LOC). The LOC bears interest at the greater of (a) the prime rate plus 2.50% per annum or (b) the LIBOR rate plus 5.50% per annum. The LOC matures in August 2017. There was no activity on this LOC during the period ended September 30, 2015 and there was no balance outstanding as of September 30, 2015.

As part of their lending agreement, JPPA may draw on a $4,250,000 LOC. The LOC bears interest at the LIBOR rate plus 2.75% per annum (3.00% as of September 30, 2015). The LOC matures on July, 2016. There was no activity on this LOC during the period ended September 30, 2015 and there was no balance outstanding as of September 30, 2015.

RAI is party to a $2,000,000 revolving LOC from a financial institution. This revolving LOC is collateralized by substantially all the assets of the RAI and matures in November 2015. Interest is payable monthly at LIBOR plus 3.50% per annum (3.75% as of September 30, 2015). There was no outstanding balance at September 30, 2015.

The Company’s notes payable with financial institutions includes certain financial covenants. Management has determined that the Company borrowers were in compliance with these financial covenants as of September 30, 2015.

| 13 |

| 11. | Other Operating Expense – |

A breakout of other operating expense is as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Bank fees | $ | 310,419 | $ | 114,391 | $ | 595,164 | $ | 334,069 | ||||||||

| Collection costs | 99,587 | 102,653 | 319,890 | 324,635 | ||||||||||||

| Conferences | 460,602 | - | 671,287 | - | ||||||||||||

| Insurance | 110,788 | 79,339 | 286,783 | 177,003 | ||||||||||||

| Management and advisory fees | 125,754 | 126,163 | 400,057 | 364,148 | ||||||||||||

| Professional and consulting fees | 483,575 | 106,113 | 1,401,683 | 422,515 | ||||||||||||

| Supplies | 167,480 | 150,058 | 496,116 | 474,571 | ||||||||||||

| Other | 522,604 | 374,654 | 1,583,539 | 875,607 | ||||||||||||

| $ | 2,280,809 | $ | 1,053,371 | $ | 5,754,519 | $ | 2,972,548 | |||||||||

| 12. | Income Tax Provision – |

Income tax expense, as a percentage of Income Before Income Taxes, was 45% and 38% for the three months ended September 30, 2015 and 2014, respectively, and 44% and 38% for the nine months ended September 30, 2015 and 2014, respectively. Nondeductible portion of meal and entertainment expense and nondeductible transaction costs contributed to the higher effective tax rates.

| 13. | Acquisitions – |

Cellular Retail

Effective June 1, 2015, PQH consummated the acquisition of all outstanding membership interests in four separate limited liability companies. The entities acquired, when combined, do not meet the 20% significant subsidiaries thresholds under Rule 210.1-02 as modified by Rule 210.3-05(b) of SEC Reg. S-X. Under the equity method of accounting, the assets acquired and liabilities assumed were recorded at their estimated fair values as of the purchase date as follows:

| June 1, 2015 | ||||

| Cash | $ | 389,000 | ||

| Inventory | 427,000 | |||

| Other receivables | 405,000 | |||

| Property and equipment | 612,000 | |||

| Goodwill | 578,000 | |||

| Intangible assets | 903,000 | |||

| Other assets | 69,000 | |||

| Accounts payable and accrued liabilities | (826,000 | ) | ||

| $ | 2,557,000 | |||

JPPA, RAI and JPRE Transaction

Effective July 1, 2015, the Company acquired the businesses of JPPA, RAI and JPRE by completing a merger and contribution transaction. In consideration for the acquisition of these businesses, the Company issued to the former owners an aggregate of 3.5 million shares of the Company’s common stock representing approximately 37% of the total issued and outstanding common stock after consummation of the acquisition.

The entities are affiliated entities under common control and in accordance with Accounting Standards Codification Topic 805, “Business Combinations,” and the Company, as the acquirer, recognized the assets and liabilities of the target entities at their historical values as of the date of merger as follows:

| 14 |

| July 1, 2015 | ||||

| Cash | $ | 2,082,000 | ||

| Accounts Receivables, net | 527,000 | |||

| Inventory | 3,170,000 | |||

| Deferred income tax asset | 186,000 | |||

| Prepaid expense and other current assets | 525,000 | |||

| Property and equipment, net | 6,590,000 | |||

| Goodwill | 31,000 | |||

| Intangible assets, net | 122,000 | |||

| Accounts payable and accrued liabilities | (2,231,000 | ) | ||

| Short-term notes payable | (120,000 | ) | ||

| Income taxes payable | (547,000 | ) | ||

| Deferred revenue and other | (460,000 | ) | ||

| Notes payable and capital leases | (3,583,000 | ) | ||

| Deferred income tax liability | (169,000 | ) | ||

| $ | 6,123,000 | |||

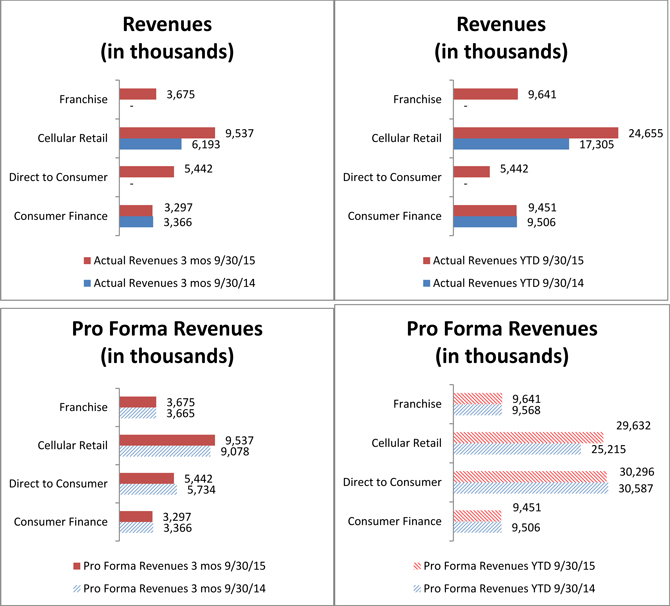

The results of the operations for the acquired businesses, as well as the acquisition of AGI (see Note 13 to the Company’s December 31, 2014 Notes to Consolidated Financial Statements) on October 1, 2014 have been included in the consolidated financial statements since the respective dates of acquisition. The following table presents the unaudited pro forma results of operations for the three and nine months ended September 30, 2015 and 2014, as if these acquisitions had been consummated at the beginning of 2014. The pro forma net income below excludes the expenses of the transactions and includes a reduction in management and advisory fees that resulted from the AGI transaction. The pro forma results of operations are prepared for comparative purposes only and do not necessarily reflect the results that would have occurred had the acquisitions been consummated at the beginning of the 2014, or the results that may occur in the future.

| For the Three Months Ended September 30, 2015 (in thousands except earnings per share) | ||||||||||||||||||||||||

| Franchise | Cellular Retail | Direct to Consumer | Consumer Finance | Corporate | Total | |||||||||||||||||||

| Pro forma revenue | $ | 3,675 | $ | 9,537 | $ | 5,442 | $ | 3,297 | $ | - | $ | 21,951 | ||||||||||||

| Pro forma net income (loss) | $ | 829 | $ | 443 | $ | (569 | ) | $ | 390 | $ | (167 | ) | $ | 926 | ||||||||||

| Pro forma net income attributable to noncontrolling interests | $ | 6 | $ | - | $ | - | $ | - | $ | - | $ | 6 | ||||||||||||

| Pro forma net income (loss) available to Western shareholders | $ | 823 | $ | 443 | $ | (569 | ) | $ | 390 | $ | (167 | ) | $ | 920 | ||||||||||

| Pro forma earnings (loss) per share available to Western common shareholders – basic and diluted | $ | 0.087 | $ | 0.047 | $ | (0.060 | ) | $ | 0.041 | $ | (0.018 | ) | $ | 0.097 | ||||||||||

| For the Three Months Ended September 30, 2014 (in thousands except earnings per share) | ||||||||||||||||||||||||

| Franchise | Cellular Retail | Direct to Consumer | Consumer Finance | Corporate | Total | |||||||||||||||||||

| Pro forma revenue | $ | 3,665 | $ | 9,078 | $ | 5,734 | $ | 3,366 | $ | - | $ | 21,843 | ||||||||||||

| Pro forma net income (loss) | $ | 648 | $ | 393 | $ | (606 | ) | $ | 364 | $ | - | $ | 799 | |||||||||||

| Pro forma net income attributable to noncontrolling interests | $ | 5 | $ | - | $ | - | $ | - | $ | - | $ | 5 | ||||||||||||

| Pro forma net income (loss) available to Western shareholders | $ | 643 | $ | 393 | $ | (606 | ) | $ | 364 | $ | - | $ | 794 | |||||||||||

| Pro forma earnings (loss) per share available to Western common shareholders – basic and diluted | $ | 0.068 | $ | 0.041 | $ | (0.064 | ) | $ | 0.039 | $ | - | $ | 0.084 | |||||||||||

| 15 |

| For the Nine Months Ended September 30, 2015 (in thousands except earnings per share) | ||||||||||||||||||||||||

| Franchise | Cellular Retail | Direct to Consumer | Consumer Finance | Corporate | Total | |||||||||||||||||||

| Pro forma revenue | $ | 9,641 | $ | 29,632 | $ | 30,296 | $ | 9,451 | $ | - | $ | 79,020 | ||||||||||||

| Pro forma net income (loss) | $ | 1,585 | $ | 967 | $ | 1,365 | $ | 932 | $ | (408 | ) | $ | 4,441 | |||||||||||

| Pro forma net income attributable to noncontrolling interests | $ | 13 | $ | - | $ | - | $ | - | $ | - | $ | 13 | ||||||||||||

| Pro forma net income (loss) available to Western shareholders | $ | 1,572 | $ | 967 | $ | 1,365 | $ | 932 | $ | (408 | ) | $ | 4,428 | |||||||||||

| Pro forma earnings (loss) per share available to Western common shareholders – basic and diluted | $ | 0.165 | $ | 0.102 | $ | 0.144 | $ | 0.098 | $ | (0.043 | ) | $ | 0.466 | |||||||||||

| For the Nine Months Ended September 30, 2014 (in thousands except earnings per share) | ||||||||||||||||||||||||

| Franchise | Cellular Retail | Direct to Consumer | Consumer Finance | Corporate | Total | |||||||||||||||||||

| Pro forma revenue | $ | 9,568 | $ | 25,215 | $ | 30,587 | $ | 9,506 | $ | - | $ | 74,876 | ||||||||||||

| Pro forma net income (loss) | $ | 1,165 | $ | 526 | $ | 480 | $ | 1,076 | $ | - | $ | 3,247 | ||||||||||||

| Pro forma net income attributable to noncontrolling interests | $ | 5 | $ | - | $ | - | $ | - | $ | - | $ | 5 | ||||||||||||

| Pro forma net income (loss) available to Western shareholders | $ | 1,160 | $ | 526 | $ | 480 | $ | 1,076 | $ | - | $ | 3,242 | ||||||||||||

| Pro forma earnings (loss) per share available to Western common shareholders – basic and diluted | $ | 0.122 | $ | 0.055 | $ | 0.051 | $ | 0.113 | $ | - | $ | 0.341 | ||||||||||||

| 14. | Segment Information – |

Segment information related to the three and nine months ended September 30, 2015 and 2014, is presented below:

| For the Three Months Ended September 30, 2015 (in thousands) | ||||||||||||||||||||||||

| Franchise | Cellular Retail | Direct to Consumer | Consumer Finance | Corporate | Total | |||||||||||||||||||

| Revenues from external customers | $ | 3,675 | $ | 9,537 | 5,442 | $ | 3,297 | $ | - | $ | 21,951 | |||||||||||||

| Depreciation and amortization | $ | 109 | $ | 136 | 102 | $ | 29 | $ | - | $ | 376 | |||||||||||||

| Interest expense | $ | 57 | $ | 91 | 50 | $ | - | $ | - | $ | 198 | |||||||||||||

| Income tax expense (benefit) | $ | 534 | $ | 221 | (177 | ) | $ | 221 | $ | (75 | ) | $ | 724 | |||||||||||

| Net income (loss) | $ | 829 | $ | 443 | (569 | ) | $ | 390 | $ | (213 | ) | $ | 880 | |||||||||||

| Expenditures for segmented assets | $ | - | $ | - | 186 | $ | 29 | $ | - | $ | 215 | |||||||||||||

| For the Three Months Ended September 30, 2014 (in thousands) | ||||||||||||||||||||||||

| Franchise | Cellular Retail | Direct to Consumer | Consumer Finance | Corporate | Total | |||||||||||||||||||

| Revenues from external customers | $ | - | $ | 6,193 | $ | - | $ | 3,366 | $ | - | $ | 9,559 | ||||||||||||

| Depreciation and amortization | $ | - | $ | 85 | $ | - | $ | 31 | $ | - | $ | 116 | ||||||||||||

| Interest expense | $ | - | $ | 42 | $ | - | $ | 18 | $ | - | $ | 60 | ||||||||||||

| Income tax expense (benefit) | $ | - | $ | 164 | $ | - | $ | 183 | $ | - | $ | 347 | ||||||||||||

| Net income (loss) | $ | - | $ | 266 | $ | - | $ | 299 | $ | - | $ | 565 | ||||||||||||

| Expenditures for segmented assets | $ | - | $ | 34 | $ | - | $ | 9 | $ | - | $ | 43 | ||||||||||||

| 16 |

| For the Nine Months Ended September 30, 2015 (in thousands) | ||||||||||||||||||||||||

| Franchise | Cellular Retail | Direct to Consumer | Consumer Finance | Corporate | Total | |||||||||||||||||||

| Revenues from external customers | $ | 9,641 | $ | 24,655 | $ | 5,442 | $ | 9,451 | $ | - | $ | 49,189 | ||||||||||||

| Depreciation and amortization | $ | 325 | $ | 292 | $ | 102 | $ | 85 | $ | - | $ | 804 | ||||||||||||

| Interest expense | $ | 156 | $ | 195 | $ | 50 | $ | - | $ | - | $ | 401 | ||||||||||||

| Income tax expense (benefit) | $ | 1,015 | $ | 503 | $ | (177 | ) | $ | 553 | $ | (197 | ) | $ | 1,697 | ||||||||||

| Net income (loss) | $ | 1,585 | $ | 910 | $ | (569 | ) | $ | 932 | $ | (710 | ) | $ | 2,148 | ||||||||||

| Total segment assets | $ | 9,379 | $ | 12,823 | $ | 13,568 | $ | 16,299 | $ | 544 | $ | 52,613 | ||||||||||||

| Expenditures for segmented assets | $ | 91 | $ | 3,656 | $ | 186 | $ | 45 | $ | 14 | $ | 3,992 | ||||||||||||

| For the Nine Months Ended September 30, 2014 (in thousands) | ||||||||||||||||||||||||

| Franchise | Cellular Retail | Direct to Consumer | Consumer Finance | Corporate | Total | |||||||||||||||||||

| Revenues from external customers | $ | - | $ | 17,305 | $ | - | $ | 9,506 | $ | - | $ | 26,811 | ||||||||||||

| Depreciation and amortization | $ | - | $ | 256 | $ | - | $ | 86 | $ | - | $ | 342 | ||||||||||||

| Interest expense | $ | - | $ | 130 | $ | - | $ | 62 | $ | - | $ | 192 | ||||||||||||

| Income tax expense (benefit) | $ | - | $ | 119 | $ | - | $ | 567 | $ | - | $ | 686 | ||||||||||||

| Net income (loss) | $ | - | $ | 199 | $ | - | $ | 938 | $ | - | $ | 1,137 | ||||||||||||

| Total segment assets | $ | - | $ | 8,625 | $ | - | $ | 16,749 | $ | - | $ | 25,374 | ||||||||||||

| Expenditures for segmented assets | $ | - | $ | 401 | $ | - | $ | 60 | $ | - | $ | 461 | ||||||||||||

| 15. | Leases – |

The Company leases retail and office facilities under operating leases with terms ranging from month to month to six years, with rights to extend for additional periods. Future minimum base lease payments (in thousands) are approximately as follows:

| Year Ending December 31, | Operating Leases | |||

| 2015 (remainder) | $ | 938 | ||

| 2016 | 2,920 | |||

| 2017 | 2,110 | |||

| 2018 | 998 | |||

| 2019 | 554 | |||

| 2020 | 90 | |||

| Thereafter | - | |||

| Total minimum base lease payments | $ | 7,610 | ||

| 16. | Commitments and Contingencies – |

Employment Agreements

On April 11, 2013, the Company entered into an Amended and Restated Employment Agreement with its Chief Executive Officer, Mr. John Quandahl. This agreement has a term of three years and contains, among other terms and conditions, provisions for an annual performance-based cash bonus pool for management.

Effective February 9, 2015, the Company entered into a three-year employment agreement with its Chief Investment Officer (CIO). Pursuant to that agreement, the CIO is eligible for a discretionary annual performance-based bonus up to $200,000. To date no performance-based bonus has been accrued.

| 17 |

The Company has also entered into several employment agreements with certain members of subsidiary management. The terms of each agreement are different, but may ordinarily include stipulated base salary and bonus potential.

Pursuant to the numerous employment agreements, bonuses of approximately $353,000 and $655,000 were accrued for the three and nine months ended September 30, 2015, respectively.

Vendor Service Agreement

In September 2015, AGI entered into a service agreement with a vendor for approximately $680,000. The vendor will provide services over a three year period.

| 17. | Management and Advisory Agreement – |

The Company is party to an Amended and Restated Management and Advisory Agreement with Blackstreet Capital Management, LLC, (“Blackstreet”) under which Blackstreet provides certain financial, managerial, strategic and operating advice and assistance to the Company (see Note 17 to the Company’s December 31, 2014 Notes to Consolidated Financial Statements).

The amended and restated agreement requires the Company to pay Blackstreet a fee in an amount equal to $400,000 upon the closing of an acquisition in consideration for Blackstreet’s referral to the Company of such acquisition opportunity, and Blackstreet’s assistance in the performance of due diligence services relating thereto. Any fees which may have been payable per these terms related to the JPPA, RAI and JPRE acquisition (see Note 12) were waived by Blackstreet.

Effective July 1, 2015 the agreement with Blackstreet was amended. The annual fees under the amended and restated contract will be the greater of (i) $612,100 (subject to annual increases of five percent) or (ii) five percent of Western Capital’s “EBITDA” as defined under the agreement. All other terms and provisions remain unmodified.

| 18. | Equity – |

Common Stock Issued

As further explained in Note 13, on July 1, 2015, WCR issued an aggregate of 3.5 million shares of common stock for the acquisition of JPPA, RAI and JPRE. This represented approximately 37% of the total issued and outstanding common stock of the Company after the issuance.

WCR 2015 Stock Incentive Plan

The Board of Directors of WCR adopted WCR’s new 2015 Stock Incentive Plan effective February 6, 2015. The plan replaces the Company’s earlier adopted 2008 Stock Incentive Plan, which the board terminated effective February 6, 2015. There were no incentives issued or outstanding under the terminated plan.

WCR’s Board of Directors, or a committee of the board, will administer the 2015 Stock Incentive Plan and have complete authority to award incentives, interpret the plan and make any other determination it believes necessary and advisable for the proper administration of the plan. A total of 100,000 shares of WCR common stock were reserved in connection with the adoption of the 2015 Stock Incentive Plan.

The new plan permits the granting of incentives in any one or a combination of the following forms:

| Ÿ | stock options, including options intended to qualify under Section 422 of the Internal Revenue Code of 1986, as amended, as “qualified” or “incentive” stock options; |

| Ÿ | stock appreciation rights (often referred to as “SARs”) payable in cash or shares of common stock; |

| Ÿ | restricted stock and restricted stock units; |

| Ÿ | performance awards of cash, stock or property; and |

| Ÿ | stock awards. |

| 18 |

The following table summarizes nonvested stock option awards outstanding at September 30, 2015 and the changes for the nine months then ended:

| Number of Shares | Weighted- Average Exercise Price Per Share | Weighted- Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value | |||||||||||||

| Outstanding and nonvested at December 31, 2014 | - | $ | - | $ | - | |||||||||||

| Granted | 65,000 | 6.00 | 9.37 | - | ||||||||||||

| Vested | - | - | - | |||||||||||||

| Forfeited | - | - | - | |||||||||||||

| Outstanding and nonvested at September 30, 2015 | 65,000 | $ | 6.00 | 9.37 | $ | - | ||||||||||

| Exercisable at September 30, 2015 | - | |||||||||||||||

The option vests in three annual and near-equal installments on each of February 8, 2016, 2017 and 2018, and has a contract life of ten years. There were no vested options at September 30, 2015, and thus no intrinsic value in outstanding vested options at September 30, 2015. As of September 30, 2015, total unrecognized stock-based compensation expense related to nonvested stock options was approximately $119,000, which is expected to be recognized over a weighted-average period of approximately 1.4 years.

JPPA Stock Incentive Plan

The following table summarizes nonvested stock option awards outstanding at September 30, 2015 and the changes for the three months then ended:

| Number of Shares | Weighted- Average Exercise Price Per Share | Weighted- Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value | |||||||||||||

| Outstanding and nonvested at June 30, 2015 | 35.1 | $ | 3403.37 | $ | - | |||||||||||

| Granted | - | - | 9.4 | - | ||||||||||||

| Vested | - | - | - | |||||||||||||

| Forfeited | - | - | - | |||||||||||||

| Outstanding and nonvested at September 30, 2015 | 35.1 | $ | 3403.37 | 9.4 | $ | - | ||||||||||

| Exercisable at September 30, 2015 | - | |||||||||||||||

Subject to the provisions of the J&P Park Acquisitions, Inc. 2010 Stock Option Plan, the options vest 10% annually beginning on the one year anniversary of the grant until 50% of the options have vested. The remaining options vest upon a sale of the company (as defined in the agreement). The options have a contract life of ten years. There were no vested options at September 30, 2015, and thus no intrinsic value in outstanding vested options at September 30, 2015. As of September 30, 2015, total unrecognized stock-based compensation expense related to nonvested stock options was approximately $108,000. At September 30, 2015 JPPA had 4,645 shares issued and outstanding.

RAI Stock Incentive Plan

The following table summarizes nonvested stock option awards outstanding at September 30, 2015 and the changes for the three months then ended:

| Number of Shares | Weighted- Average Exercise Price Per Share | Weighted- Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value | |||||||||||||

| Outstanding and nonvested at June 30, 2015 | - | $ | - | $ | - | |||||||||||

| Granted | 73.76 | 3,765.90 | 9.16 | - | ||||||||||||

| Vested | - | - | - | |||||||||||||

| Forfeited | - | - | - | |||||||||||||

| Outstanding and nonvested at September 30, 2015 | 73.76 | $ | 3,765.90 | 9.16 | $ | - | ||||||||||

| Exercisable at September 30, 2015 | 2.96 | 6,471.00 | 6.45 | - | ||||||||||||

| 19 |

Subject to the provisions of the Restorers Acquisition, Inc. 2011 Stock Option Plan, the options vest 10% annually beginning on the one year anniversary of the grant until 50% of the options have vested. The remaining options vest upon a sale of the company (as defined in the agreement). The options have a contract life of 10 years. There were no vested options at September 30, 2015 and thus no intrinsic value in outstanding vested options at September 30, 2015. As of September 30, 2015, total unrecognized stock-based compensation expense related to nonvested stock options was approximately $230,000. At September 30, 2015 RAI had 573 shares issued and outstanding.

| 19. | Subsequent Events – |

On October 1, 2015, the Consumer Finance segment disposed of all four of its locations in an underperforming Utah market for $167,500 in cash, resulting in a loss of approximately $450,000.

On November 10, 2015 PQH executed an Asset Purchase Agreement to acquire 10 Cricket Retail Locations for approximately $450,000. The purchase is expected to close on December 1, 2015.

The Company evaluated all other events or transactions that occurred after September 30, 2015 up through November 16, 2015, the date on which these financial statements were issued. During this period, the Company did not have any other material subsequent events that impacted its financial statements.

| 20 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Some of the statements made in this report are “forward-looking statements,” as that term is defined under Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based upon our current expectations and projections about future events. Whenever used in this report, the words “believe,” “anticipate,” “intend,” “estimate,” “expect” and similar expressions, or the negative of such words and expressions, are intended to identify forward-looking statements, although not all forward-looking statements contain such words or expressions. The forward-looking statements in this report are primarily located in the material set forth under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (Part I, Item 2), but may be found in other parts of this report as well. These forward-looking statements generally relate to our plans, objectives and expectations for future operations and are based upon management’s current estimates and projections of future results or trends. Although we believe that our plans and objectives reflected in or suggested by these forward-looking statements are reasonable, we may not achieve these plans or objectives. You should read this report completely and with the understanding that actual future results may be materially different from what we expect. We will not necessarily update forward-looking statements even though our situation may change in the future.

Specific factors that might cause actual results to differ from our expectations embodied in our forward-looking statements, or that might affect the value of the common stock, include but are not limited to:

| · | changes in local, state or federal laws and regulations governing lending practices, or changes in the interpretation of such laws and regulations; |

| · | litigation and regulatory actions directed toward us or the industries in which we operate, particularly in certain key states or nationally; |

| · | our need for additional financing; |

| · | unpredictability or uncertainty in financing markets which could impair our ability to grow our business through acquisitions; |

| · | changes in Cricket dealer compensation; |

| · | the impact on us, as a Cricket dealer, of the AT&T acquisition of the Cricket Wireless business; |

| · | failure of or disruption caused by a significant vendor; and |

| · | our ability to successfully integrate our recently acquired businesses. |

Other factors that could cause actual results to differ from those implied by the forward-looking statements in this report are more fully described in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014.

Industry data and other statistical information used in this report are based on independent publications, government publications, reports by market research firms or other published independent sources. Some data are also based on our good faith estimates, derived from our review of internal surveys and the independent sources listed above. Although we believe these sources are reliable, we have not independently verified the information.

OVERVIEW

Western Capital Resources, Inc. (“we”, “WCR” or “Western Capital”) is a holding company that operates, through its subsidiaries, in the following industries and operating segments:

| 21 |

Our “Franchise” segment involves the franchising of AlphaGraphics® customized print and marketing solutions offered through our majority owned subsidiary AlphaGraphics, Inc. (99.2% owned) (“AlphaGraphics” or “AGI”). Our “Cellular Retail” segment is an authorized Cricket Wireless dealer and involves the retail sale of cellular phones and accessories to consumers through our wholly owned subsidiary PQH Wireless, Inc. and its subsidiaries (“PQH”). On July 1, 2015, we acquired our “Direct to Consumer” segment, which consists of an online and direct marketing distribution retailer with product offerings including seeds, live goods and garden accessories operating in the retail market under Park Seed, Jackson & Perkins and Wayside Gardens, and in the wholesale market under Park Wholesale, and an online retail seller of home improvement and restoration products operating over the internet through the domain name of www.Vandykes.com and through direct mail catalogs. Our “Consumer Finance” segment consists of retail financial services conducted through our wholly owned subsidiaries Wyoming Financial Lenders, Inc. (“WFL”) and Express Pawn, Inc. (“EPI”). On January 1, 2015, our “Corporate” segment was formed which includes the corporate acquisition and due-diligence team and management of acquired subsidiaries. Throughout this report, we collectively refer to WCR and its consolidated subsidiaries as “we,” the “Company,” and “us.” References to specific companies within our enterprise, such as “PQH,” “WFL,” “EPI”, “AGI”, “JPPA”, “RAI”, or “JPRE” are references only to those companies.

Key actual and pro forma financial data for the three and nine months ended September 30, 2015 and 2014 were as follows:

Discussion of Critical Accounting Policies

Our condensed consolidated financial statements and accompanying notes have been prepared in accordance with accounting principles generally accepted in the United States of America applied on a consistent basis. The preparation of these financial statements requires us to make a number of estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting periods. We evaluate these estimates and assumptions on an ongoing basis. We base these estimates on the information currently available to us and on various other assumptions that we believe are reasonable under the circumstances. Actual results could vary materially from these estimates under different assumptions or conditions.

| 22 |

Our significant accounting policies are discussed in Note 1, “Basis of Presentation, Nature of Business and Summary of Significant Accounting Policies,” of the notes to our condensed consolidated financial statements included in this report. We believe that the following critical accounting policies affect the more significant estimates and assumptions used in the preparation of our condensed consolidated financial statements.

Loan Loss Allowance

Included in loans receivable are unpaid principal, interest and fee balances of payday, installment, pawn and title loans that have not reached their maturity date, and “late” payday loans that have reached maturity within the last 180 days and have remaining outstanding balances. Late payday loans generally are unpaid loans where a customer’s personal check has been deposited and the check has been returned due to non-sufficient funds in the customer’s account, a closed account, or other reasons. All returned items are charged-off after 180 days, as collections after that date have not been significant. Loans are carried at cost plus accrued interest or fees less payments made and a loans receivable allowance.

We do not specifically reserve for any individual payday, installment or title loan. We aggregate loan types for purposes of estimating the loss allowance using a methodology that analyzes historical portfolio statistics and management’s judgment regarding recent trends noted in the portfolio. This methodology takes into account several factors, including (1) the amount of loan principal, interest and fee outstanding, (2) historical charge offs from loans that originated during the last 24 months, (3) current and expected collection patterns and (4) current economic trends. We utilize a software program to assist with the tracking of our historical portfolio statistics. A loan loss allowance is maintained for anticipated losses for payday and installment loans based primarily on our historical percentages of net charge offs, applied against the applicable balance of loan principal, interest and fees outstanding. We also periodically perform a look-back analysis on our loan loss allowance to verify the historical allowance established tracks with the actual subsequent loan write-offs and recoveries. We are aware that as conditions change, we may need to make additional allowances in future periods. Loan losses or charge-offs of pawn or title loans are not recorded because the value of the collateral exceeds the loan amount.

A rollforward of our loans receivable allowance (in thousands) is as follows:

| Nine Months Ended September 30, 2015 | Year Ended December 31, 2014 | |||||||

| Loans receivable allowance, beginning of period | $ | 1,219 | $ | 1,215 | ||||

| Provision for loan losses charged to expense | 1,351 | 1,818 | ||||||

| Charge-offs, net | (1,269 | ) | (1,814 | ) | ||||

| Loans receivable allowance, end of period | $ | 1,301 | $ | 1,219 | ||||

Valuation of Long-lived and Intangible Assets

We assess the impairment of long-lived and intangible assets whenever events or changes in circumstances indicate that the carrying value may not be recoverable. Goodwill is analyzed on an annual basis. Factors that could trigger an impairment review include significant underperformance relative to expected historical or projected future cash flows, significant changes in the manner of use of acquired assets or the strategy for the overall business, and significant negative industry trends. When management determines that the carrying value of long-lived and intangible assets may not be recoverable, impairment is measured based on the excess of the assets’ carrying value over the estimated fair value.

Results of Operations – Three Months Ended September 30, 2015 Compared to Three Months Ended September 30, 2014

On July 1, 2015, we acquired our newest segment, Direct to Consumer. In the acquisition, we acquired the assets and businesses of J&P Park Acquisitions, Inc. (“JPPA”), Restorers Acquisition, Inc. (“RAI”), and J&P Real Estate, LLC (“JPRE”) in exchange for our issuance to the former owners of those businesses of an aggregate of 3.5 million shares of our common stock, representing approximately 37% of our total issued and outstanding common stock on a post-acquisition basis. The Direct to Consumer segment is seasonal and historically experiences a loss in the quarter ending September 30 due to a slowdown in sales of the seasonal products it sells (seeds and live goods) and the period ending prior to the start of holiday gift sales. For the current quarter the Direct to Consumer segment had a loss of ($0.57) million or $0.06 cents per share, which was in line with managements’ expectations, resulting in a drag on consolidated earnings and earnings per share period over period. In addition, our Corporate segment, which was created at the beginning of the 2015, contributed a loss of $0.02 cents per share, which management views as investment in future growth. Net income attributable to our common shareholders was $0.87 million, or $0.09 per share (basic and diluted), for the three months ended September 30, 2015, compared to $0.57 million, or $0.19 per share (basic and diluted), for the three months ended September 30, 2014. For the current quarter, the Franchise segment, acquired on October 1, 2014, contributed $0.82 million in net income while the Cellular Retail segment contributed $0.44 million in net income and the Consumer Finance segment contributed $0.39 million in net income. We expect segment contribution to earnings per share to further change in the fourth quarter due, at least in part, to the seasonality of the Direct to Consumer segment, higher holiday sales activity in the Cellular Retail segment and fluctuating levels of mergers and acquisitions expenditures.

| 23 |

The following table provides quarter-over-quarter revenues and net income (in thousands) attributable to WCR common shareholders by operating segment:

| Franchise | Cellular Retail | Direct to Consumer | Consumer Finance | Corporate | Total | |||||||||||||||||||

| Three Months Ended September 30, 2015 | ||||||||||||||||||||||||

| Revenues | $ | 3,675 | $ | 9,537 | $ | 5,442 | $ | 3,297 | $ | - | $ | 21,951 | ||||||||||||

| % of total revenue | 16.7 | % | 43.5 | % | 24.8 | % | 15.0 | % | - | 100.0 | % | |||||||||||||

| Net income (loss) | $ | 829 | $ | 443 | $ | (569 | ) | $ | 390 | $ | (213 | ) | $ | 880 | ||||||||||

| Net income (loss) attributable to WCR common shareholders | $ | 823 | $ | 443 | $ | (569 | ) | $ | 390 | $ | (213 | ) | $ | 874 | ||||||||||

| Three Months Ended September 30, 2014 | ||||||||||||||||||||||||

| Revenues | $ | - | $ | 6,193 | $ | - | $ | 3,366 | $ | - | $ | 9,559 | ||||||||||||

| % of total revenue | - | 64.8 | % | - | 35.2 | % | - | 100.0 | % | |||||||||||||||

| Net income (loss) | $ | - | $ | 266 | $ | - | $ | 299 | $ | - | $ | 565 | ||||||||||||

| Net income (loss) attributable to WCR common shareholders | $ | - | $ | 266 | $ | - | $ | 299 | $ | - | $ | 565 | ||||||||||||

| 24 |

Franchise

Three Months Ended September 30, (in thousands) | 2015 % of | 2014 % of | ||||||||||||||

| 2015 | 2014 | Revenues | Revenues | |||||||||||||

| Revenues | $ | 3,675 | $ | - | 100.0 | % | - | % | ||||||||

| Less: | ||||||||||||||||

| Cost of revenues | 200 | - | 5.5 | % | - | % | ||||||||||

| Expenses | 2,646 | - | 71.8 | % | - | % | ||||||||||

| Net income | $ | 829 | $ | - | 22.7 | % | - | % | ||||||||

Our U.S. franchisees reported center sales for the three months ended September 30 as follows:

| 2015 | 2014 | |||||||

| Total gross U.S. network-wide center sales | $ | 67,194,000 | $ | 63,641,000 | ||||

The table below summarizes the number of AlphaGraphics business centers owned and operated by franchisees during the three-month periods ended September 30, 2015 and 2014:

| Beginning | New | Closed | Ending | |||||||||||||

| 2015 | ||||||||||||||||

| US Centers | 250 | 4 | 2 | 252 | ||||||||||||

| International Centers | 26 | - | - | 26 | ||||||||||||

| Total | 276 | 4 | 2 | 278 | ||||||||||||

| 2014 | ||||||||||||||||

| US Centers | 245 | - | 1 | 244 | ||||||||||||

| International Centers | 33 | - | 1 | 32 | ||||||||||||

| Total | 278 | - | 2 | 276 | ||||||||||||

Revenues and net income for the three months ended September 30, 2015 were $3.68 million and $0.83 million, respectively, compared to pro forma revenues and net income for the comparable period in 2014 of $3.67 million and $0.65 million, respectively. Gross U.S. network-wide center sales as provided by franchisees increased 5.6% over the comparable periods.

Cellular Retail

The following table summarizes our Cellular Retail segment operating results:

Three Months Ended September 30, (in thousands) | 2015 % of | 2014 % of | ||||||||||||||

| 2015 | 2014 | Revenues | Revenues | |||||||||||||

| Revenues | $ | 9,537 | $ | 6,193 | 100.0 | % | 100.0 | % | ||||||||

| Less: | ||||||||||||||||

| Cost of revenues | 4,461 | 2,839 | 46.8 | % | 45.9 | % | ||||||||||

| Expenses | 4,633 | 3,088 | 48.6 | % | 49.8 | % | ||||||||||

| Net income (loss) | $ | 443 | $ | 266 | 4.6 | % | 4.3 | % | ||||||||

A summary table of the number of Cricket cellular retail stores we operated during the three-month periods ended September 30, 2015 and 2014 follows:

| 2015 | 2014 | |||||||

| Beginning | 110 | 58 | ||||||

| Acquired/ Launched | - | - | ||||||

| Closed | (8 | ) | - | |||||

| Ending | 102 | 58 | ||||||

| 25 |

On June 1, 2015 we acquired 41 Cricket retail stores, seven of which we subsequently closed. We closed one additional underperforming store bringing the number of Cricket retail stores we operated at September 30, 2015 to 102.

Revenues in the Cellular Retail segment increased $3.35 million, or 54.0%, to $9.54 million for the three months ended September 30, 2015, compared to $6.19 million for the three months ended September 30, 2014. This increase is due to a several factors that contributed to an approximate 52% increase in units activated period over period, including our acquisition of additional stores, relocation of underperforming locations, and the effects of AT&T’s acquisition of Cricket Wireless.

Our expenses increased $1.54 million from $3.09 million for the three-month period ended September 30, 2014 to $4.63 million for the three-month period ended September 30, 2015, primarily as a result of adding the new store locations. Stated as a percentage of Cellular Retail revenues, our period-over-period expenses were 48.6% compared to 49.8% the prior period, a decrease of 1.2%.

Direct to Consumer

The following table summarizes our Direct to Consumer segment operating results:

| Three Months Ended September 30, (in thousands) | 2015 % of | 2014 % of | ||||||||||||||

| 2015 | 2014 | Revenues | Revenues | |||||||||||||

| Revenues | $ | 5,442 | $ | - | 100.0 | % | - | % | ||||||||

| Less: | ||||||||||||||||

| Cost of revenues | 2,703 | - | 49.7 | % | - | % | ||||||||||

| Expenses | 3,308 | - | 60.7 | % | - | % | ||||||||||

| Net loss | $ | (569 | ) | $ | - | (10.4 | )% | - | % | |||||||

Revenues and net loss for the three months ended September 30, 2015 were $5.44 million and ($0.57) million, respectively, compared to pro forma revenues and net loss for the comparable period in 2014 of $5.73 million and ($0.61) million, respectively.

Consumer Finance

The following table summarizes our Consumer Finance segment operating results:

| Three Months Ended September 30, (in thousands) | 2015 % of | 2014 % of | ||||||||||||||

| 2015 | 2014 | Revenues | Revenues | |||||||||||||

| Revenues | $ | 3,297 | $ | 3,366 | 100.0 | % | 100.0 | % | ||||||||

| Less: | ||||||||||||||||

| Cost of revenues | 734 | 657 | 22.3 | % | 19.5 | % | ||||||||||

| Expenses | 2,173 | 2,410 | 65.9 | % | 71.6 | % | ||||||||||

| Net income | $ | 390 | $ | 299 | 11.8 | % | 8.9 | % | ||||||||

A summary table of the number of consumer finance locations we operated during the three month periods ended September 30, 2015 and 2014 follows:

| 2015 | 2014 | |||||||

| Beginning | 51 | 51 | ||||||