Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RAIT Financial Trust | d258574d8k.htm |

1

RAIT Financial Trust

Third Quarter 2011

Exhibit 99.1 |

2

Forward Looking Statements &

Non-GAAP Financial Measures

This document and the related presentation may contain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, but are not limited to, statements about RAIT

Financial Trust’s (“RAIT”) plans, objectives, expectations and intentions with respect

to future operations, products and services and other statements that are not historical

facts. These forward- looking statements are based upon the current beliefs and

expectations of RAIT's management and are inherently subject to significant business,

economic and competitive uncertainties and contingencies, many of which are difficult

to predict and generally not within RAIT’s control. In addition, these forward-looking

statements are subject to assumptions with respect to future business strategies and decisions

that are subject to change. Actual results may differ materially from the anticipated

results discussed in these forward-looking statements. The

following factors, among others, could cause actual results to differ materially from the anticipated results

or other expectations expressed in the forward-looking statements: the risk factors

discussed and identified in filings by RAIT with the Securities and Exchange Commission

(“SEC”), including, without limitation, RAIT’s most recent annual and

quarterly reports filed with SEC.

You are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this presentation. All subsequent written and oral

forward-looking statements attributable to RAIT or any person acting on its behalf

are expressly qualified in their entirety by the cautionary statements contained or

referred to in this document and the related presentation. Except to the extent required by applicable law or

regulation, RAIT undertakes no obligation to update these forward-looking statements to

reflect events or circumstances after the date of this presentation or to reflect the

occurrence of unanticipated events.

The related presentation may contain non-U.S. generally accepted accounting principles

(“GAAP”) financial measures. A reconciliation of these non-GAAP

financial measures to the most directly comparable GAAP financial measure is included

in the Appendix to this document and RAIT’s most recent annual and quarterly

reports.

RAIT’s SEC filings are available on RAIT’s website at www.raitft.com. |

3

About RAIT

RAIT,

(NYSE:

RAS),

is

a

diversified

full

service

commercial

real

estate

company organized as an internally-managed REIT

$3.6 billion of real estate assets under management

Philadelphia

headquarters

with

offices

in

New

York

City,

Chicago

and

Minneapolis

Scalable commercial real estate platform with over 400 employees

Seasoned commercial real estate Lender

Origination platform for bridge, mezzanine and CMBS Loans

Owner –

commercial real estate properties

Sophisticated asset management

Captive property management for multi-family and office properties

Non-traded REIT sponsor

Experienced management team that has invested through multiple cycles

|

4

Recent Performance

Positioned

for

Growth

Improving

Cash Flow

Improved

Asset

Performance

Reduced debt to equity ratio to 2.3x at 9/30/11 from a peak of 7.4x

at 6/30/09

At 9/30/11, $4.6 million in recourse debt obligations that are

redeemable or maturing prior to October 2015

Recourse debt reductions through 10/29/11 expected to reduce

related interest expense

At 9/30/11, CRE securitizations remain fully cash-flowing and

performance test coverage ratios have improved

Increasing loan repayments, in prior quarters, creates opportunities

to increase spreads on new loans

Expiring interest rate hedges expected to reduce related interest

expense

Loans on non-accrual decreased to $91.8 million at 9/30/11 from

$143.2 million at 9/30/10

Increasing occupancy and rental rates across all property types at

9/30/11 from 9/30/10

Increased net operating income from owned real estate from

9/30/10 to 9/30/11

Reduced

Leverage &

Operating

Costs |

5

Synergistic Business Lines

Commercial Real Estate Lending

Directly Owned Commercial Real Estate

Scalable Non-Traded REIT Platform

Asset and Property Management |

6

Commercial Real Estate Lending

Commercial Real Estate Lending

$1.1 billion of CRE loans at September 30, 2011

Capitalize

on

existing,

scalable

platform

and

internal

expertise

to

originate

bridge,

mezzanine

and

CMBS

loans

of

$5

million

to

$30

million

on

multi-family,

office, retail and light industrial properties

Growing pipeline

Spread expansion opportunities

Fee

income

opportunities

–

originating,

managing

and

servicing

Capital

sources

–

repayments,

warehouse

facilities

&

other

sources

Citibank $100 million facility for CMBS eligible collateral

$77.9 million in loan repayments during quarter ended September 30, 2011

$90.7 million in capacity for reinvestment in RAIT’s CRE securitizations at

October 28, 2011 |

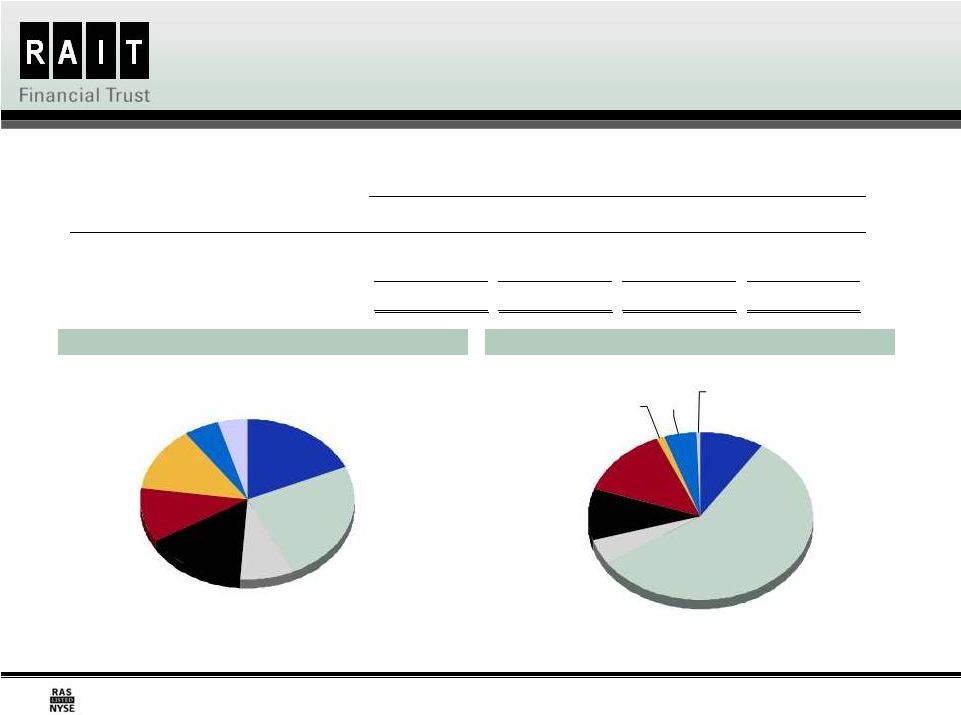

7

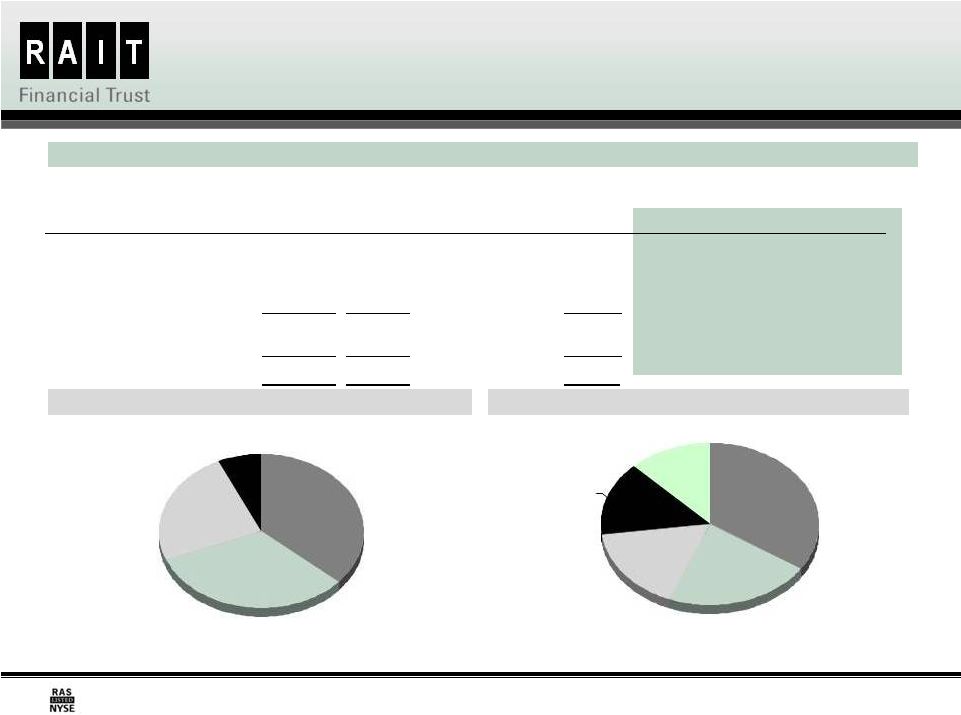

CRE Loan Portfolio Statistics

By Property Type

(1)

(1) Based on book value at 9/30/2011.

By Geographic Region

(1)

Improved credit performance of the loan portfolio

As of September 30, 2011 unless otherwise Indicated ($ in 000s)

Multi-family

33%

Retail

24%

Other

7%

Office

36%

Mid Atlantic

22%

Southeast

17%

Northeast

12%

Central

34%

West

15%

Book Value

Weighted-

Average

Coupon

Range of Maturities

Number

of Loans

Key Statistics

Q3

2011

Q3

2010

Commercial Real Estate (CRE) Loans

Non-accrual loans

$91,833

$143,212

Commercial mortgages

$654,497

6.7%

Nov.

2011 to May 2021

39

% change

(36%)

Mezzanine loans

339,843

8.9%

Nov.

2011 to Nov. 2038

93

Reserve for losses

50,609

73,029

Preferred equity interests

60,070

10.5%

Nov. 2011 to Aug. 2025

21

% change

(31%)

Total CRE Loans

$1,054,410

7.6%

153

Provision for losses

500

10,813

Other loans

54,226

6.4%

Nov.

2011 to Oct. 2016

4

% change

(95%)

Total investments in loans

$1,108,636

7.6%

157 |

8

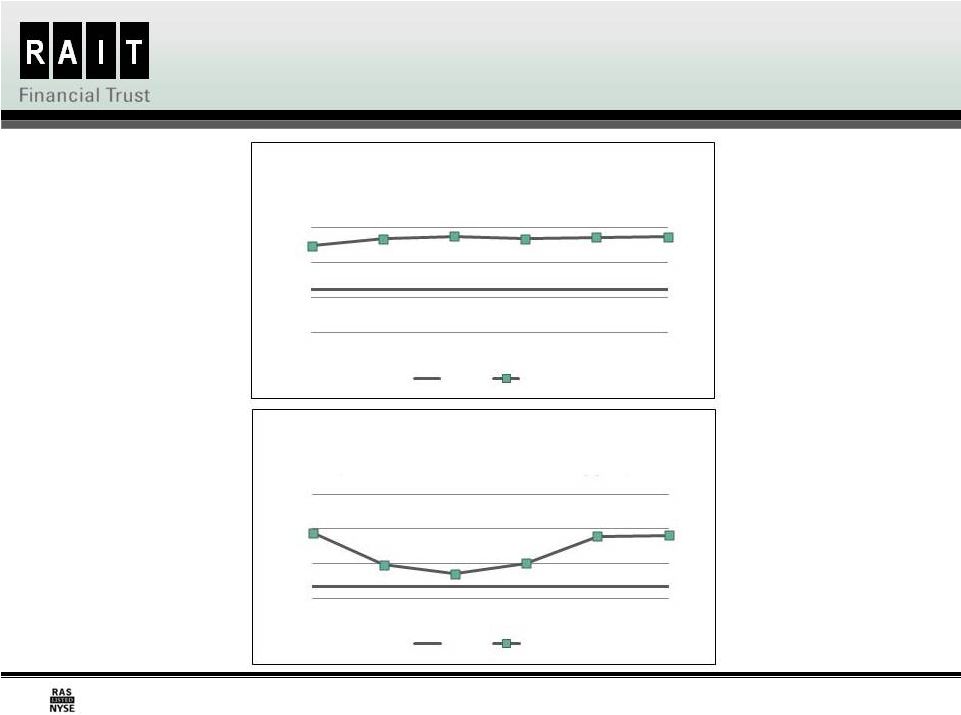

CRE Portfolio Securitization Performance

110.0%

115.0%

120.0%

125.0%

Inception

9/30/2010

12/31/2010

3/31/2011

6/30/2011

10/28/2011

RAIT CRE CDO I Performance

(Overcollateralization Trigger)

Trigger

Actual

110.0%

115.0%

120.0%

125.0%

Inception

9/30/2010

12/31/2010

3/31/2011

6/30/2011

10/28/2011

RAIT CRE CDO II Performance

(Overcollateralization Trigger)

Trigger

Actual |

9

Directly Owned Commercial Real Estate

Directly Owned Real Estate Portfolio

$850 million of CRE properties at September 30, 2011

Strategy to maximize value over time through increasing occupancy and higher

rental rates

Assets acquired below borrower’s cost upon loan conversions

Asset value creation opportunity

Increasing rental income from September 30, 2010 through September 30,

2011

Jupiter Communities –

internal multi-family property manager

CRP Commercial Services –

internal office property manager |

10

Directly Owned Commercial Real Estate

Portfolio Statistics

Net Real Estate Operating Income

Occupancy Rates by Property Type

(a) Based on operating performance for the three-month period ended

September 30, 2011 and September 30, 2010. (b) Average effective rent is

rent per unit per month. (c) Average effective rent is rent per

square foot per year. Improved Occupancy and Net Operating Income

As of September 30, 2011 unless otherwise Indicated ($ in 000s)

Q3 2011

Q4 2010

Rental income

$23,635

$20,170

Real estate operating expenses

(14,563)

(13,404)

Net Real Estate Operating Income

$9,072

$6,766

Number of owned properties

48

47

Average Occupancy

84.5%

79.2%

Investments

in Real

Estate

Quantity

Number of

Properties

Average Physical Occupancy

Average Effective Rent

(a)

9/30/2011

12/31/2010

Q3 2011

Q3

2010

Multi-family real estate properties

(b)

$555,916

8,014

units

33

89.8%

85.5%

$671

$646

Office real estate properties

(c)

224,981

1,786,860

sq. ft.

10

68.5%

67.8%

20.50

19.54

Retail real estate properties

(c)

46,127

1,114,250

sq. ft.

2

68.9%

58.8%

9.55

7.75

Parcels of land

22,208

7.3 acres

3

–

–

–

–

Total

$849,232

48

84.5%

79.2%

78%

84%

85%

86%

88%

89%

90%

54%

56%

53%

68%

71%

69%

69%

60%

59%

58%

59%

56%

62%

69%

71%

74%

75%

79%

82%

83%

85%

40%

50%

60%

70%

80%

90%

100%

Q12010

Q32010

Q12011

Q32011

Multi-family

Office

Retail

Total |

11

Non-Traded REIT Platform

Scalable Non-Traded REIT Platform

Independence Realty Trust, Inc. (“IRT”)

RAIT’s subsidiaries serve as dealer manager, external manager & advisor

Target asset class: multi-family

RAIT equity investment of $40 million paripassu with returns to IRT equity

investors »

RAIT contributed six properties to IRT

Fee stream to RAIT

»

.75 bps on average invested assets (excludes fee on initial portfolio for two

years) »

Up to 3% dealer manager fee

»

1%

3

party

financing

coordination

fee

»

4% of revenue property management fee (Jupiter Communities)

»

Expense reimbursement

»

Back-end promote structure

Monthly dividend –

6% current run rate based on $10 initial offering price

Target maximum equity raise: $1.1 billion

Raise capital through retail Broker/Dealer & financial advisor networks

Recently signed first selling agreement

Any disclosure relating to IRT is neither an offer nor a solicitation to purchase securities

issued by IRT rd |

12

Asset and Property Management

Asset Management

Management fees

CDOs

$1.9 billion of commercial real estate loans

$1.7 billion of U.S. real estate debt securities

Non-traded

REIT

–

IRT

targeting

over

$1.5

billion

of

assets

upon

full

ramp

up

S & P rated loan servicer and special servicer

Property Management

Property management fees

Jupiter Communities

Multi-family focused

49 properties and 11,500 units

CRP Commercial Services

Office focused

2 million square feet

As of September 30, 2011 |

13

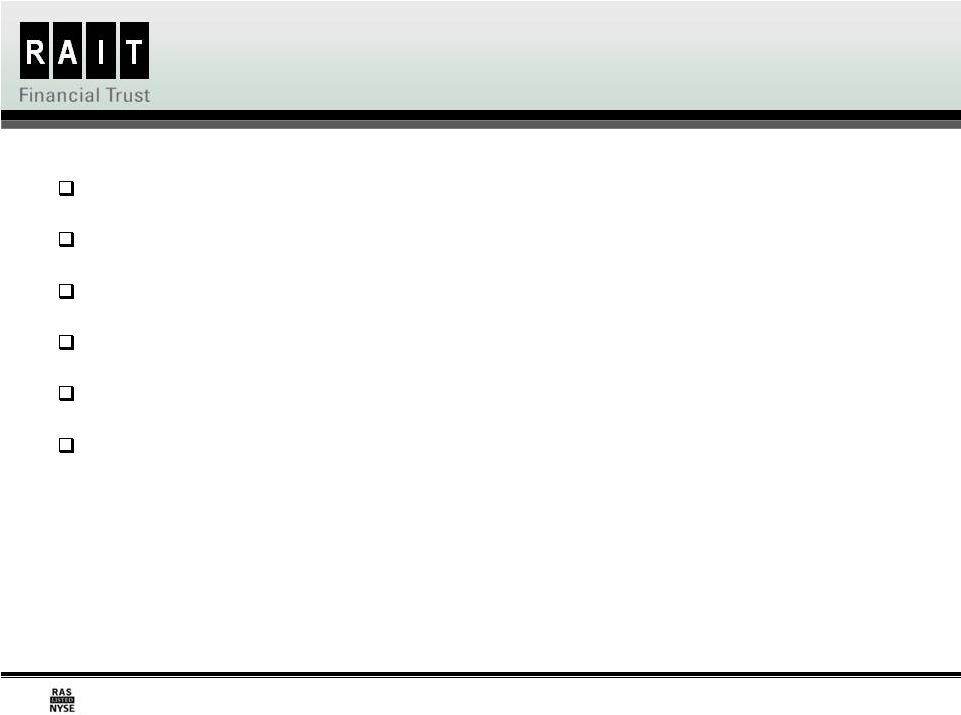

Recourse Debt Summary

Only $4.6 million of Redeemable Recourse Indebtedness and No Debt

Maturities Prior to October 2015 Description

Unpaid Principal

Balance

Weighted-

Average

Interest Rate

Contractual Maturity

Recourse Indebtedness:

7.0% convertible senior notes (1)

115,000

$

7.0%

Apr. 2031

6.75% senior secured note (2)

25,000

6.8%

Apr. 2017

6.85% senior secured note (2)

25,000

6.9%

Oct. 2017

7.15% senior secured note (2)

25,000

7.2%

Oct. 2018

7.25% senior secured note (2)

25,000

7.3%

Apr. 2019

Junior subordinated notes

38,052

5.2%

Oct. 2015 to Mar. 2035

Junior subordinated notes

25,100

7.7%

Apr. 2037

Secured credit facility

10,554

3.0%

Dec. 2016

6.875% convertible senior notes (3)

4,582

6.9%

Apr. 2031

Toal recourse indebtedness

293,288

$

6.7%

$-

$4,582

$-

$-

$19,381

$269,325

$-

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

2011

2012 (4)

2013

2014

2015

Thereafter (5)

Recourse Debt Maturities and Redemption Dates

(in 000's)

Debt Breakdown

Recourse

10%

Non-

recourse

90%

As of October 28, 2011 ($ in 000s)

(1) Our 7.0% convertible senior notes are redeemable, at par at the option of the holder, in April

2016, April 2021, and April 2026. (2) Eliminated in consolidation

(3) Our 6.875% convertible senior notes are redeemable, at par at the option of the holder, in April

2012, April 2017, and April 2022. (4) Assumes full exercise of holders’ 6.875% convertible senior notes redemption right in April

2012. (5) Assumes full exercise of holders’ 7.0% convertible senior notes redemption right in April

2016. |

14

Resourceful and Disciplined Investment

Approach

RAIT kept its core commercial real estate platform in place throughout the recession

and was opportunistic in managing its assets and liabilities

Focused on originating, underwriting and managing commercial real estate

investments directly utilizing RAIT’s internal capabilities

Opportunistically invested in discounted RAIT liabilities including CDO debt and

convertible debt

Generated new investments from restructuring investments in our $3.6 billion of

assets under management

Maintained

adequate

liquidity

with

only

$4.6

million

in

recourse

debt

obligations

at

October 28, 2011 that are redeemable or maturing prior to October 2015

Funding capacity in RAIT CRE securitizations

New $100 million CMBS facility to fund CMBS eligible loans and in discussion

with other capital providers

Leverage RAIT’s capabilities through creation of non-traded REIT platform

Reinstated quarterly common dividend in second quarter 2011 |

15

Experienced Management Team

Officer

Position

Years of

Experience

Comments

Scott F. Schaeffer

Chairman of the Board, CEO

and President

26

Chairman of the Board since December 2010

CEO of RAIT since February 2009

President since September 2000

Jack E. Salmon

CFO and Treasurer

35

CFO and Treasurer of RAIT since December 2006

President of Independence Realty Trust since January 2011

Joined RAIT in 2006

Raphael Licht

COO and Secretary

18

COO of RAIT since February 2009

Chief Legal Officer and Chief Administrative Officer from

December 2006 to February 2009

Joined RAIT in 2006

Ken Frappier

Executive Vice President –

Portfolio and Risk

Management

37

Executive Vice President of RAIT since February 2008

Chief Credit Officer of RAIT from December 2006 to February

2008

Senior Vice President of Portfolio and Risk Management of RAIT

from April 2002 to December 2006

Jim Sebra

Senior Vice President

and CAO

14

SVP and CAO since May 2007

Joined RAIT in 2006

Andres Viroslav

Vice President, Director of

Corporate Communications

16

Vice President of RAIT since 2002

Joined RAIT in September 2001 |

16

RAIT Highlights

Experienced management team

Integrated platform with synergistic business lines

Pipeline of new investment opportunities

Access to new sources of capital

Adequate liquidity with no near term debt maturities

Reinstated quarterly common dividend in second quarter 2011 |

17

Appendix |

18

Key Statistics

(1)

Excludes our 6.875% convertible senior notes that have a final maturity in April 2027 but are

redeemable in full in April 2012. Includes any principal amortization on recourse debt

that is required prior to the stated maturity.

(2)

On January

10, 2011, RAIT declared a 2010 annual cash dividend on its common shares of $0.09 per common

share, split adjusted. The dividends were paid on January 31, 2011 to holders

of record on January

21, 2011.

(Dollars in thousands, except share and per share amounts)

(1)

(2)

(2)

(2)

September

31, 2011

June 30,

2011

March 31,

2011

December

31, 2011

September

31, 2011

Financial Statistics:

Assets under management

$3,633,133

$3,763,184

$3,822,534

$3,837,526

$3,901,342

Total revenue

$60,089

$58,863

$58,279

$59,057

$58,899

Recourse debt maturing in one year

$1,833

$19,745

$20,040

$41,489

$7,919

Earnings per share – diluted

$(0.55)

$(0.53)

$0.16

$0.86

$0.49

Funds from Operations (“FFO”) per share

$(0.36)

$(0.34)

$0.33

$1.05

$0.82

Adjusted Funds from Operations

$0.23

$0.22

$0.19

$0.15

$(0.09)

(“AFFO”) per share

Common dividend declared

$0.06

$0.06

$0.09

-

-

Debt to equity ratio

2.3x

2.2x

2.1x

2.3x

2.6x

Commercial Real Estate (“CRE”) Loan

Portfolio:

CRE loans-- unpaid principal

$1,064,946

$1,122,898

$1,149,169

$1,173,141

$1,216,875

Non-accrual loans -- unpaid principal

$91,833

$94,117

$121,054

$122,306

$143,212

Non-accrual loans as a % of reported

8.6%

8.4%

10.5%

10.4%

11.8%

loans

Reserve for losses

$50,609

$49,906

$58,809

$61,731

$73,029

Reserves as a % of non-accrual loans

55.1%

53.0%

48.6%

50.5%

51.0%

Provision for losses

$500

$950

$1,950

$2,500

$10,813

CRE Property Portfolio:

Reported investments in real estate

$849,232

$851,916

$859,983

$839,192

$818,184

Number of properties owned

48

48

48

47

47

Multifamily units owned

8,014

8,014

8,311

8,311

8,231

Office square feet owned

1,786,860

1,786,908

1,786,908

1,632,978

1,634,997

Retail square feet owned

1,114,250

1,116,171

1,116,063

1,116,112

1,069,588

Average occupancy data:

Multifamily

89.8%

88.6%

88.0%

85.5%

84.6%

Office

68.5%

68.8%

70.7%

67.8%

52.5%

Retail

68.9%

62.0%

56.3%

58.8%

57.7%

Total

84.5%

83.1%

82.4%

79.2%

74.8%

|

19

Balance Sheet

(Dollars in thousands, except share and per share amounts)

As of

September 30,

2011

As of

December 31,

2010

Assets

Investments in mortgages and loans, at amortized cost:

Commercial mortgages, mezzanine loans, other loans and preferred

equity interests

Allowance for losses

(56,126)

Total investments in mortgages and loans

1,051,303

1,149,419

Investments in real estate

849,232

839,192

Investments in securities and security-related receivables, at fair value

719,546

705,451

Cash and cash equivalents

29,693

27,230

Restricted cash

179,019

Accrued interest receivable

37,138

Other assets

43,851

32,840

Deferred financing costs, net of accumulated amortization of $11,010

and 22,791

19,954

respectively

2,769

3,189

Total assets

3,048,172

Liabilities and Equity

Indebtedness:

Recourse indebtedness

247,564

Non-recourse indebtedness

1,545,686

Total indebtedness

1,793,250

1,838,177

Accrued interest payable

25,495

Accounts payable and accrued expenses

24,843

Derivative liabilities

184,878

91,499

Total liabilities

Equity:

Shareholders’

equity:

Preferred shares, $0.01 par value per share, 25,000,000 shares authorized;

7.75% Series A cumulative redeemable preferred shares, liquidation

preference $25.00 per share, 2,760,000 shares issued and outstanding

28

28

8.375% Series B cumulative redeemable preferred shares, liquidation

preference $25.00 per share, 2,258,300 shares issued and outstanding

23

23

8.875% Series C cumulative redeemable preferred shares, liquidation

preference $25.00 per share, 1,600,000 shares issued and outstanding

16

16

Common shares, $0.03 par value per share, 200,000,000 shares authorized,

1,205

1,060

Additional paid in capital

1,730,373

1,691,681

Accumulated other comprehensive income (loss)

Retained earnings (deficit)

Total shareholders’

equity

915,022

918,096

3,839

434

Total equity

918,861

918,530

Total liabilities and equity

3,048,172

2,993,432

$9,943, respectively

40,077,148 and 35,300,190 issued and outstanding

Noncontrolling interests

41,110

293,357

1,544,820

$

$

$

$

$

$

$

$

287,877

194,224

1,107,429

(69,691)

1,219,110

2,993,432

19,925

25,089

6,833

(127,602)

(126,081)

(690,542)

2,129,311

2,074,902

(647,110)

Intangible assets, net of accumulated amortization of $2,197 and $1,777, Deferred taxes, borrowers’ escrows and other

liabilities |

20

Consolidated Statements of Operations

(Dollars in thousands, except share and per share amounts)

For the Three-Month

Periods Ended

September 30

For the Nine-Month

Periods Ended

September 30

2011

2010

2011

2010

Revenue:

Interest income

$

33,549

$ 37,252

$

101,590

$

117,755

Rental income

23,635

18,443

67,063

52,203

Fee and other income

2,905

3,204

8,578

15,555

Total revenue

60,089

58,899

177,231

185,513

Expenses:

Interest expense

22,689

24,038

68,384

74,170

Real estate operating expense

14,563

13,951

40,971

37,872

Compensation expense

6,898

6,766

19,179

21,704

General and administrative expense

4,042

4,331

13,441

14,588

Provision for loan losses

500

10,813

3,400

35,807

Depreciation and amortization

7,300

7,380

21,668

20,576

Total expenses

55,992

67,279

167,043

204,717

Operating income

4,097

(8,380)

10,188

(19,204)

Interest and other income (expense)

145

42

295

401

Gains (losses) on sale of assets

1,455

-

3,434

11,616

Gains (losses) on extinguishment of debt

11,371

14,278

14,540

51,290

Change in fair value of financial instruments

(34,997)

14,237

(55,113)

35,120

Income (loss) before taxes and discontinued operations

(17,929)

20,177

(26,656)

79,223

Income tax benefit (provision)

158

627

468

484

Income (loss) from continuing operations

(17,771)

20,804

(26,188)

79,707

Income (loss) from discontinued operations

(50)

(2,556)

747

(1,630)

Net income (loss)

(17,821)

18,248

(25,441)

78,077

(Income) loss allocated to preferred shares

(3,407)

(3,406)

(10,235)

(10,227)

(Income) loss allocated to noncontrolling interests

59

210

176

803

Net income (loss) allocable to common shares

$

(21,169)

$ 15,052

$ (35,500)

$

68,653

Earnings (loss) per share—Basic:

Continuing operations

$

(0.55)

$

0.58

$ (0.96)

$ 2.57

Discontinued operations

0.00

(0.08)

0.02

(0.06)

Total earnings (loss) per share—Basic

$

(0.55)

$

0.50

$ (0.94)

$

2.51

Weighted-average shares outstanding—Basic

38,771,022

30,330,259

37,822,750

27,384,451

Earnings (loss) per share—Diluted:

Continuing operations

$

(0.55)

$

0.57

$ (0.96)

$ 2.53

Discontinued operations

0.00

(0.08)

0.02

(0.06)

Total earnings (loss) per share—Diluted

$

(0.55)

$ 0.49

$

(0.94)

$

2.47

Weighted-average shares outstanding—Diluted

38,771,022

30,887,145

37,822,750

27,800,648

|

21

Adjusted Funds From Operations

(Dollars in thousands, except share and per share amounts)

(1) We believe that funds from operations, or FFO, and adjusted funds from operations, or AFFO, each of

which are non-GAAP measures, are additional appropriate measures of the operating

performance of a REIT and us in particular. We compute FFO in accordance with the standards established

by the National Association of Real Estate Investment Trusts, or NAREIT, as net income or loss

allocated to common shares (computed in accordance with GAAP), excluding real estate-related depreciation and amortization expense, gains or losses on sales of real estate and the cumulative

effect of changes in accounting principles. AFFO is a computation made by analysts and investors

to measure a real estate company's cash flow generated by operations. We calculate AFFO by

adding to or subtracting from FFO: change in fair value of financial instruments; gains or losses on

debt extinguishment; capital expenditures, net of any direct financing associated with those capital

expenditures; straight-line rental effects; amortization of various deferred items and intangible

assets; and share-based compensation. Our calculation of AFFO differs from the methodology used for

calculating AFFO by certain other REITs and, accordingly, our AFFO may not be comparable to AFFO

reported by other REITs. Our management utilizes FFO and AFFO as measures of our operating

performance, and believes they are also useful to investors, because they facilitate an understanding

of our operating performance after adjustment for certain non-cash items, such as real estate

depreciation, share-based compensation and various other items required by GAAP that may not

necessarily be indicative of current operating performance and that may not accurately compare our

operating performance between periods. Furthermore, although FFO, AFFO and other supplemental

performance measures are defined in various ways throughout the REIT industry, we also believe

that FFO and AFFO may provide us and our investors with an additional useful measure to compare our

financial performance to certain other REITs. Neither FFO nor AFFO is equivalent to net

income or cash generated from operating activities determined in accordance with U.S. GAAP.

Furthermore, FFO and AFFO do not represent amounts available for management's discretionary use

because of needed capital replacement or expansion, debt service obligations or other commitments or

uncertainties. Neither FFO nor AFFO should be considered as an alternative to net income as an

indicator of our operating performance or as an alternative to cash flow from operating activities as a

measure of our liquidity. References to “we”, “us”, and “our” refer to RAIT Financial Trust and its

subsidiaries.

For the Three-

Month Periods

Ended September 30

For the Nine-

Month Periods

Ended September 30

2011

2010

2011

2010

$ (21,169)

$

15,052

$ (35,500)

$ 68,653

7,024

7,702

20,817

21,151

50

2,911

218

2,645

$ (14,095)

$ 25,665

$ (14,465)

$

92,449

$ (0.36)

$ 0.83

(0.38)

$

3.33

38,771,022

30,887,145

37,822,750

27,800,648

$ (14,095)

$

25,665

$ (14,465)

$ 92,449

34,997

(14,237)

55,113

(35,120)

(11,371)

(14,278)

(14,540)

(51,290)

(671)

(568)

(1,446)

(1,136)

(1,096)

75

(2,783)

40

1,046

371

2,482

(475)

79

583

396

2,877

$

8,889

$

(2,389)

$ 24,757

$

7,345

$ 0.

23

$ (0.08)

$

065

$

0.26

38,771,022

30,887,145

37,822,750

27,800,648

Funds From Operations (“FFO”):

Net income (loss) allocable to common shares ....................................

Adjustments:

Depreciation expense .................................................................

(Gains) Losses on sale of real estate

..........................................

Funds from operations

..........................................................................

Funds from Operations per share .........................................................

Weighted-average shares - diluted

Adjusted Funds From Operations (“AFFO”):

Funds from Operations .........................................................................

Adjustments:

Change in fair value of financial instruments ...............................

(Gains) Losses on debt extinguishment ......................................

Capital expenditures, net of direct financing ................................

Straight-line rental adjustments ...................................................

Amortization of deferred items and intangible assets ..................

Share-based compensation .........................................................

Adjusted Funds from Operations ..........................................................

Adjusted Funds from Operations per share ..........................................

Weighted-average shares - diluted

$ |

22

Investment in Debt Securities

TruPS and Subordinated Debentures by Industry Sector

(1)

(1) Based on estimated fair value.

(2) S&P Ratings as of September 31, 2011.

Other Securities by Ratings Distribution

(1)(2)

($ in 000s)

Office

25%

Residential

Mortgage

8%

Specialty

Finance

15%

Retail

13%

Hospitality

5%

Homebuilders

11%

Storage

5%

Commercial

Mortgage

18%

BBB

56%

BB

5%

B

10%

AAA

5%

D

1%

CCC

13%

AA

1%

A

9%

As of September 30, 2011

Investment Description

Estimated Fair

Value

Amortized Cost

Weighted-Average

Coupon

Weighted Average

Years to Maturity

TruPS and Subordinated Debentures

$564,769

$748,575

4.9%

21.1

Other securities

154,777

303,073

5.1%

27.3

Total

$719,546

$1,051,648

5.0%

22.9 |