Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

| x | Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended June 30, 2011

or

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission file number 1-14760

RAIT FINANCIAL TRUST

(Exact name of registrant as specified in its charter)

| Maryland | 23-2919819 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 2929 Arch Street, 17th Floor, Philadelphia, PA | 19104 | |

| (Address of principal executive offices) | (Zip Code) | |

(215) 243-9000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

A total of 38,425,188 common shares of beneficial interest, par value $0.03 per share, of the registrant were outstanding as of August 3, 2011.

Table of Contents

TABLE OF CONTENTS

| Page | ||||||

| PART I—FINANCIAL INFORMATION | ||||||

| Item 1. |

||||||

| Consolidated Balance Sheets as of June 30, 2011 and December 31, 2010 |

1 | |||||

| 2 | ||||||

| 3 | ||||||

| Consolidated Statements of Cash Flows for the Six-Month Periods Ended June 30, 2011 and 2010 |

4 | |||||

| 5 | ||||||

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

24 | ||||

| Item 3. |

41 | |||||

| Item 4. |

41 | |||||

| PART II—OTHER INFORMATION | ||||||

| Item 1. |

42 | |||||

| Item 1A. |

42 | |||||

| Item 6. |

42 | |||||

| 43 | ||||||

Table of Contents

| Item 1. | Financial Statements |

Consolidated Balance Sheets

(Unaudited and dollars in thousands, except share and per share information)

| As of June 30, 2011 |

As of December 31, 2010 |

|||||||

| Assets |

||||||||

| Investments in mortgages and loans, at amortized cost: |

||||||||

| Commercial mortgages, mezzanine loans, other loans and preferred equity interests |

$ | 1,165,163 | $ | 1,219,110 | ||||

| Allowance for losses |

(57,866 | ) | (69,691 | ) | ||||

|

|

|

|

|

|||||

| Total investments in mortgages and loans |

1,107,297 | 1,149,419 | ||||||

| Investments in real estate |

861,810 | 841,488 | ||||||

| Investments in securities and security-related receivables, at fair value |

717,975 | 705,451 | ||||||

| Cash and cash equivalents |

24,639 | 27,230 | ||||||

| Restricted cash |

188,688 | 176,723 | ||||||

| Accrued interest receivable |

39,582 | 37,138 | ||||||

| Other assets |

42,362 | 32,840 | ||||||

| Deferred financing costs, net of accumulated amortization of $11,154 and $9,943, respectively |

22,430 | 19,954 | ||||||

| Intangible assets, net of accumulated amortization of $2,057 and $1,777, respectively |

2,909 | 3,189 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 3,007,692 | $ | 2,993,432 | ||||

|

|

|

|

|

|||||

| Liabilities and Equity |

||||||||

| Indebtedness (including $145,041 and $152,494 at fair value, respectively) |

$ | 1,816,225 | $ | 1,838,177 | ||||

| Accrued interest payable |

21,715 | 19,925 | ||||||

| Accounts payable and accrued expenses |

24,620 | 25,089 | ||||||

| Derivative liabilities |

177,353 | 184,878 | ||||||

| Deferred taxes, borrowers’ escrows and other liabilities |

25,304 | 6,833 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

2,065,217 | 2,074,902 | ||||||

| Equity: |

||||||||

| Shareholders’ equity: |

||||||||

| Preferred shares, $0.01 par value per share, 25,000,000 shares authorized; |

||||||||

| 7.75% Series A cumulative redeemable preferred shares, liquidation preference $25.00 per share, 2,760,000 shares issued and outstanding |

28 | 28 | ||||||

| 8.375% Series B cumulative redeemable preferred shares, liquidation preference $25.00 per share, 2,258,300 shares issued and outstanding |

23 | 23 | ||||||

| 8.875% Series C cumulative redeemable preferred shares, liquidation preference $25.00 per share, 1,600,000 shares issued and outstanding |

16 | 16 | ||||||

| Common shares, $0.03 par value per share, 200,000,000 shares authorized, 38,197,648 and 35,300,190 issued and outstanding |

1,149 | 1,060 | ||||||

| Additional paid in capital |

1,722,797 | 1,691,681 | ||||||

| Accumulated other comprehensive income (loss) |

(118,485 | ) | (127,602 | ) | ||||

| Retained earnings (deficit) |

(666,952 | ) | (647,110 | ) | ||||

|

|

|

|

|

|||||

| Total shareholders’ equity |

938,576 | 918,096 | ||||||

| Noncontrolling interests |

3,899 | 434 | ||||||

|

|

|

|

|

|||||

| Total equity |

942,475 | 918,530 | ||||||

|

|

|

|

|

|||||

| Total liabilities and equity |

$ | 3,007,692 | $ | 2,993,432 | ||||

|

|

|

|

|

|||||

The accompanying notes are an integral part of these consolidated financial statements.

1

Table of Contents

Consolidated Statements of Operations

(Unaudited and dollars in thousands, except share and per share information)

| For the Three-Month Periods Ended June 30 |

For the Six-Month Periods Ended June 30 |

|||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Revenue: |

||||||||||||||||

| Interest income |

$ | 34,483 | $ | 39,173 | $ | 68,041 | $ | 80,503 | ||||||||

| Rental income |

22,138 | 17,685 | 43,428 | 33,760 | ||||||||||||

| Fee and other income |

2,242 | 3,512 | 5,673 | 12,351 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

58,863 | 60,370 | 117,142 | 126,614 | ||||||||||||

| Expenses: |

||||||||||||||||

| Interest expense |

22,328 | 24,662 | 45,695 | 50,132 | ||||||||||||

| Real estate operating expense |

13,791 | 13,399 | 26,408 | 23,921 | ||||||||||||

| Compensation expense |

5,737 | 6,886 | 12,281 | 14,938 | ||||||||||||

| General and administrative expense |

4,431 | 5,367 | 9,399 | 10,257 | ||||||||||||

| Provision for losses |

950 | 7,644 | 2,900 | 24,994 | ||||||||||||

| Depreciation and amortization expense |

7,249 | 7,013 | 14,368 | 13,196 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

54,486 | 64,971 | 111,051 | 137,438 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating Income |

4,377 | (4,601 | ) | 6,091 | (10,824 | ) | ||||||||||

| Interest and other income (expense) |

67 | 277 | 150 | 359 | ||||||||||||

| Gains (losses) on sale of assets |

564 | 7,692 | 1,979 | 11,616 | ||||||||||||

| Gains (losses) on extinguishment of debt |

3,706 | 17,202 | 3,169 | 37,012 | ||||||||||||

| Change in fair value of financial instruments |

(25,727 | ) | 4,446 | (20,116 | ) | 20,883 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before taxes and discontinued operations |

(17,013 | ) | 25,016 | (8,727 | ) | 59,046 | ||||||||||

| Income tax benefit (provision) |

256 | (96 | ) | 310 | (143 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from continuing operations |

(16,757 | ) | 24,920 | (8,417 | ) | 58,903 | ||||||||||

| Income (loss) from discontinued operations |

6 | 456 | 797 | 926 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

(16,751 | ) | 25,376 | (7,620 | ) | 59,829 | ||||||||||

| (Income) loss allocated to preferred shares |

(3,414 | ) | (3,415 | ) | (6,828 | ) | (6,821 | ) | ||||||||

| (Income) loss allocated to noncontrolling interests |

67 | 358 | 117 | 593 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) allocable to common shares |

$ | (20,098 | ) | $ | 22,319 | $ | (14,331 | ) | $ | 53,601 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings (loss) per share—Basic: |

||||||||||||||||

| Continuing operations |

$ | (0.53 | ) | $ | 0.81 | $ | (0.40 | ) | $ | 2.03 | ||||||

| Discontinued operations |

0.00 | 0.02 | 0.02 | 0.04 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total earnings (loss) per share—Basic |

$ | (0.53 | ) | $ | 0.83 | $ | (0.38 | ) | $ | 2.07 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average shares outstanding—Basic |

38,055,234 | 26,780,234 | 37,340,755 | 25,887,140 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings (loss) per share—Diluted: |

||||||||||||||||

| Continuing operations |

$ | (0.53 | ) | $ | 0.79 | $ | (0.40 | ) | $ | 2.00 | ||||||

| Discontinued operations |

0.00 | 0.02 | 0.02 | 0.04 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total earnings (loss) per share—Diluted |

$ | (0.53 | ) | $ | 0.81 | $ | (0.38 | ) | $ | 2.04 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average shares outstanding—Diluted |

38,055,234 | 27,420,302 | 37,340,755 | 26,261,594 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Distributions declared per common share |

$ | 0.06 | $ | 0.00 | $ | 0.15 | $ | 0.00 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of these consolidated financial statements.

2

Table of Contents

Consolidated Statements of Comprehensive Income (Loss)

(Unaudited and dollars in thousands)

| For the Three-Month Periods Ended June 30 |

For the Six-Month Periods Ended June 30 |

|||||||||||||||

| 2011 | 2010 | 2011 | 2010 | |||||||||||||

| Net income (loss) |

$ | (16,751 | ) | $ | 25,376 | $ | (7,620 | ) | $ | 59,829 | ||||||

| Other comprehensive income (loss): |

||||||||||||||||

| Change in fair value of interest rate hedges |

(15,246 | ) | (27,473 | ) | (13,194 | ) | (42,703 | ) | ||||||||

| Reclassification adjustments associated with unrealized losses (gains) from interest rate hedges included in net income (loss) |

(8 | ) | (51 | ) | (8 | ) | (38 | ) | ||||||||

| Realized (gains) losses on interest rate hedges reclassified to earnings |

11,247 | 11,546 | 22,136 | 23,271 | ||||||||||||

| Change in fair value of available-for-sale securities |

36 | (841 | ) | 183 | (4,975 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other comprehensive income (loss) |

(3,971 | ) | (16,819 | ) | 9,117 | (24,445 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income (loss) before allocation to noncontrolling interests |

(20,722 | ) | 8,557 | 1,497 | 35,384 | |||||||||||

| Allocation to noncontrolling interests |

67 | 358 | 117 | 593 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income (loss) |

$ | (20,655 | ) | $ | 8,915 | $ | 1,614 | $ | 35,977 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

The accompanying notes are an integral part of these consolidated financial statements.

3

Table of Contents

Consolidated Statements of Cash Flows

(Unaudited and dollars in thousands)

| For the Six-Month Periods Ended June 30 |

||||||||

| 2011 | 2010 | |||||||

| Operating activities: |

||||||||

| Net income (loss) |

$ | (7,620 | ) | $ | 59,829 | |||

| Adjustments to reconcile net income (loss) to cash flow from operating activities: |

||||||||

| Provision for losses |

2,900 | 24,994 | ||||||

| Share-based compensation expense |

317 | 2,292 | ||||||

| Depreciation and amortization |

14,368 | 14,421 | ||||||

| Amortization of deferred financing costs and debt discounts |

2,191 | 1,191 | ||||||

| Accretion of discounts on investments |

(1,276 | ) | (2,732 | ) | ||||

| (Gains) losses on sales of assets |

(1,979 | ) | (11,882 | ) | ||||

| (Gains) losses on extinguishment of debt |

(3,169 | ) | (37,012 | ) | ||||

| Change in fair value of financial instruments |

20,116 | (20,883 | ) | |||||

| Unrealized gains (losses) on interest rate hedges |

(8 | ) | (38 | ) | ||||

| Equity in (income) loss of equity method investments |

0 | (4 | ) | |||||

| Unrealized foreign currency (gains) losses on investments |

0 | (189 | ) | |||||

| Changes in assets and liabilities: |

||||||||

| Accrued interest receivable |

(2,736 | ) | 1,554 | |||||

| Other assets |

(7,724 | ) | 1,947 | |||||

| Accrued interest payable |

(20,965 | ) | (20,363 | ) | ||||

| Accounts payable and accrued expenses |

264 | (4,645 | ) | |||||

| Deferred taxes, borrowers’ escrows and other liabilities |

5,283 | (5,641 | ) | |||||

|

|

|

|

|

|||||

| Cash flow from operating activities |

(38 | ) | 2,839 | |||||

| Investing activities: |

||||||||

| Proceeds from sales of other securities |

9,985 | 14,626 | ||||||

| Purchase and origination of loans for investment |

(57,553 | ) | (17,574 | ) | ||||

| Principal repayments on loans |

50,814 | 22,465 | ||||||

| Investments in real estate |

(24,808 | ) | (9,161 | ) | ||||

| Proceeds from dispositions of real estate |

65,750 | 5,124 | ||||||

| Acquisition of Independence Realty Trust, Inc. and associated entities |

(2,578 | ) | 0 | |||||

| Proceeds from sale of collateral management rights |

0 | 14,106 | ||||||

| (Increase) Decrease in restricted cash |

(31,310 | ) | 4,438 | |||||

|

|

|

|

|

|||||

| Cash flow from investing activities |

10,300 | 34,024 | ||||||

| Financing activities: |

||||||||

| Repayments on secured credit facilities and loans payable on real estate |

(29,719 | ) | (11,599 | ) | ||||

| Proceeds from loans payable on real estate |

37,400 | 0 | ||||||

| Repayments and repurchase of CDO notes payable |

(20,913 | ) | (8,172 | ) | ||||

| Proceeds from issuance of 7.0% convertible senior notes |

115,000 | 0 | ||||||

| Repayments and repurchase of 6.875% convertible senior notes |

(119,320 | ) | (10,512 | ) | ||||

| Issuance (acquisition) of noncontrolling interests |

3,582 | (46 | ) | |||||

| Payments for deferred costs |

(6,710 | ) | (187 | ) | ||||

| Common share issuance, net of costs incurred |

17,874 | 4,384 | ||||||

| Distributions paid to preferred shares |

(6,828 | ) | (6,821 | ) | ||||

| Distributions paid to common shares |

(3,219 | ) | 0 | |||||

|

|

|

|

|

|||||

| Cash flow from financing activities |

(12,853 | ) | (32,953 | ) | ||||

|

|

|

|

|

|||||

| Net change in cash and cash equivalents |

(2,591 | ) | 3,910 | |||||

| Cash and cash equivalents at the beginning of the period |

27,230 | 25,034 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at the end of the period |

$ | 24,639 | $ | 28,944 | ||||

|

|

|

|

|

|||||

| Supplemental cash flow information: |

||||||||

| Cash paid for interest |

$ | 18,624 | $ | 23,084 | ||||

| Cash paid (refunds received) for taxes |

51 | (1,781 | ) | |||||

| Non-cash increase in investments in real estate from the conversion of loans |

78,300 | 52,687 | ||||||

| Non-cash decrease in indebtedness from conversion to shares or debt extinguishments |

(5,788 | ) | (24,530 | ) | ||||

The accompanying notes are an integral part of these consolidated financial statements.

4

Table of Contents

Notes to Consolidated Financial Statements

As of June 30, 2011

(Unaudited and dollars in thousands, except share and per share amounts)

NOTE 1: THE COMPANY

RAIT Financial Trust invests in and manages a portfolio of real-estate related assets, including direct ownership of real estate properties, and provides a comprehensive set of debt financing options to the real estate industry. References to “RAIT”, “we”, “us”, and “our” refer to RAIT Financial Trust and its subsidiaries, unless the context otherwise requires. We conduct our business through our subsidiaries, RAIT Partnership, L.P. and Taberna Realty Finance Trust, or Taberna, as well as through their respective subsidiaries. RAIT is a self-managed and self-advised Maryland real estate investment trust, or REIT. Taberna is also a Maryland REIT.

We finance a substantial portion of our investments through borrowing and securitization strategies seeking to match the maturities and terms of our financings with the maturities and terms of those investments, and to mitigate interest rate risk through derivative instruments.

We are subject to significant competition in all aspects of our business. Existing industry participants and potential new entrants compete with us for the available supply of investments suitable for origination or acquisition, as well as for debt and equity capital. We compete with many third parties engaged in real estate finance and investment activities, including other REITs, specialty finance companies, savings and loan associations, banks, mortgage bankers, insurance companies, mutual funds, institutional investors, investment banking firms, lenders, governmental bodies and other entities.

NOTE 2: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a. Basis of Presentation

The accompanying unaudited interim consolidated financial statements have been prepared by management in accordance with U.S. generally accepted accounting principles, or GAAP. Certain information and footnote disclosures normally included in annual consolidated financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations, although we believe that the included disclosures are adequate to make the information presented not misleading. The unaudited interim consolidated financial statements should be read in conjunction with our audited financial statements as of and for the year ended December 31, 2010 included in our Annual Report on Form 10-K. In the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary to present fairly our consolidated financial position and consolidated results of operations and cash flows are included. The results of operations for the interim periods presented are not necessarily indicative of the results for the full year.

Certain prior period amounts have been reclassified to conform with the current period presentation. Previously, interest expense was included as part of net interest margin within total revenue. We have now classified interest expense as a component of expenses. Additionally, interest expense associated with third party financing provided on our owned real estate is included in interest expense whereas previously it was reflected within property operating expenses.

b. Principles of Consolidation

The consolidated financial statements reflect our accounts and the accounts of our majority-owned and/or controlled subsidiaries. We also consolidate entities that are variable interest entities, or VIEs, where we have determined that we are the primary beneficiary of such entities. The portions of these entities that we do not own are presented as noncontrolling interest as of the dates and for the periods presented in the consolidated financial statements. All intercompany accounts and transactions have been eliminated in consolidation.

Under Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 810, “Consolidation”, the determination of whether to consolidate a VIE is based on the power to direct the activities of the VIE that most significantly impact the VIE’s economic performance together with either the obligation to absorb losses or the right to receive benefits that could be significant to the VIE. We define the power to direct the activities that most significantly impact the VIE’s economic performance as the ability to buy, sell, refinance, or recapitalize assets or entities, and solely control other material operating events or items of the respective entity. For our commercial mortgages, mezzanine loans, and preferred equity investments, certain rights we hold are protective in nature and would preclude us from having the power to direct the activities that most significantly impact the VIE’s economic performance. Assuming both criteria are met, we would be considered the primary beneficiary and would consolidate the VIE. We will continually assess our involvement with VIEs and consolidated the VIEs when we are the primary beneficiary. See Note 9 for additional disclosures pertaining to VIEs.

5

Table of Contents

c. Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates.

d. Investments in Loans

We invest in commercial mortgages, mezzanine loans, debt securities and other loans. We account for our investments in commercial mortgages, mezzanine loans and other loans at amortized cost. The carrying value of these investments is adjusted for origination discounts/premiums, nonrefundable fees and direct costs for originating loans which are amortized into income on a level yield basis over the terms of the loans.

e. Allowance for Losses, Impaired Loans and Non-accrual Status

We maintain an allowance for losses on our investments in commercial mortgages, mezzanine loans and other loans. Management’s periodic evaluation of the adequacy of the allowance is based upon expected and inherent risks in the portfolio, the estimated value of underlying collateral, and current economic conditions. Management reviews loans for impairment and establishes specific reserves when a loss is probable and reasonably estimable under the provisions of FASB ASC Topic 310, “Receivables.” As part of the detailed loan review, we consider many factors about the specific loan, including payment history, asset performance, borrower’s financial capability and other characteristics. If any trends or characteristics indicate that it is probable that other loans, with similar characteristics to those of impaired loans, have incurred a loss, we consider whether an allowance for loss is needed pursuant to FASB ASC Topic 450, “Contingencies.” Management evaluates loans for non-accrual status each reporting period. A loan is placed on non-accrual status when the loan payment deficiencies exceed 90 days. Payments received for non-accrual or impaired loans are applied to principal until the loan is removed from non-accrual status or no longer impaired. Past due interest is recognized on non-accrual loans when they are removed from non-accrual status and are making current interest payments. The allowance for losses is increased by charges to operations and decreased by charge-offs (net of recoveries). Management charges off impaired loans when the investment is no longer realizable and legally discharged.

f. Investments in Real Estate

Investments in real estate are shown net of accumulated depreciation. We capitalize all costs related to the improvement of the real property and depreciate those costs on a straight-line basis over the useful life of the asset. We depreciate real property using the following useful lives: buildings and improvements – 30 years; furniture, fixtures, and equipment – 5 to 10 years; and tenant improvements—shorter of the lease term or the life of the asset. Costs for ordinary maintenance and repairs are charged to expense as incurred.

We acquire real estate assets either directly or through the conversion of our investments in loans into owned real estate. Acquisitions of real estate assets and any related intangible assets are recorded initially at fair value under FASB ASC Topic 805, “Business Combinations.” Fair value is determined by management based on market conditions and inputs at the time the asset is acquired. All expenses incurred to acquire a real estate asset are expensed as incurred.

Management reviews our investments in real estate for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. The review of recoverability is based on an estimate of the future undiscounted cash flows (excluding interest charges) expected to result from the long-lived asset’s use and eventual disposition. These cash flows consider factors such as expected future operating income, trends and prospects, as well as the effects of leasing demand, competition and other factors. If impairment exists due to the inability to recover the carrying value of a long-lived asset, an impairment loss is recorded to the extent that the carrying value exceeds the estimated fair value of the property.

g. Investments in Securities

We account for our investments in securities under FASB ASC Topic 320, “Investments—Debt and Equity Securities”, and designate each investment security as a trading security, an available-for-sale security, or a held-to-maturity security based on our intent at the time of acquisition. Trading securities are recorded at their fair value each reporting period with fluctuations in fair value reported as a component of earnings. Available-for-sale securities are recorded at fair value with changes in fair value reported as a component of other comprehensive income (loss). We classify certain available-for-sale securities as trading securities when we elect to record them under the fair value option in accordance with FASB ASC Topic 825, “Financial Instruments.” See “i. Fair Value of Financial Instruments.” Upon the sale of an available-for-sale security, the realized gain or loss on the sale will be recorded as a component of earnings in the respective period. Held-to-maturity investments are carried at amortized cost at each reporting period.

6

Table of Contents

We account for investments in securities where the transfer meets the criteria as a financing under FASB ASC Topic 860, “Transfers and Servicing”, at amortized cost. Our investments in security-related receivables represent securities that were transferred to issuers of collateralized debt obligations, or CDOs, in which the transferors maintained some level of continuing involvement.

We use our judgment to determine whether an investment in securities has sustained an other-than-temporary decline in value. If management determines that an investment in securities has sustained an other-than-temporary decline in its value, the investment is written down to its fair value by a charge to earnings, and we establish a new cost basis for the investment. Our evaluation of an other-than-temporary decline is dependent on the specific facts and circumstances. Factors that we consider in determining whether an other-than-temporary decline in value has occurred include: the estimated fair value of the investment in relation to our cost basis; the financial condition of the related entity; and the intent and ability to retain the investment for a sufficient period of time to allow for recovery of the fair value of the investment.

h. Revenue Recognition

| 1) | Interest income—We recognize interest income from investments in commercial mortgages, mezzanine loans, and other securities on a yield to maturity basis. Upon the acquisition of a loan at a discount, we assess the portions of the discount that constitute accretable yields and non-accretable differences. The accretable yield represents the excess of our expected cash flows from the loan over the amount we paid for the loan. That amount, the accretable yield, is accreted to interest income over the remaining life of the loan. Many of our commercial mortgages and mezzanine loans provide for the accrual of interest at specified rates which differ from current payment terms. Interest income is recognized on such loans at the accrual rate subject to management’s determination that accrued interest and outstanding principal are ultimately collectible. |

For investments that we did not elect to record at fair value under FASB ASC Topic 825, “Financial Instruments”, origination fees and direct loan origination costs are deferred and amortized to net investment income, using the effective interest method, over the contractual life of the underlying loan security or loan, in accordance with FASB ASC Topic 310, “Receivables.”

For investments that we elected to record at fair value under FASB ASC Topic 825, origination fees and direct loan costs are recorded in income and are not deferred.

We recognize interest income from interests in certain securitized financial assets on an estimated effective yield to maturity basis. Management estimates the current yield on the amortized cost of the investment based on estimated cash flows after considering prepayment and credit loss experience.

| 2) | Rental income—We generate rental income from tenant rent and other tenant-related activities at our consolidated real estate properties. For multi-family real estate properties, rental income is recorded when due from residents and recognized monthly as it is earned and realizable, under lease terms which are generally for periods of one year or less. For retail and office real estate properties, rental income is recognized on a straight-line basis from the later of the date of the commencement of the lease or the date of acquisition of the property subject to existing leases, which averages minimum rents over the terms of the leases. Leases also typically provide for tenant reimbursement of a portion of common area maintenance and other operating expenses to the extent that a tenant’s pro rata share of expenses exceeds a base year level set in the lease. |

| 3) | Fee and other income—We generate fee and other income through our various subsidiaries by (a) providing ongoing asset management services to investment portfolios under cancelable management agreements, (b) providing or arranging to provide financing to our borrowers, (c) providing property management services to third parties, and (d) providing fixed income trading and advisory services to our customers. We recognize revenue for these activities when the fees are fixed or determinable, are evidenced by an arrangement, collection is reasonably assured and the services under the arrangement have been provided. While we may receive asset management fees when they are earned, we eliminate earned asset management fee income from CDOs while such CDOs are consolidated. |

During the three-month periods ended June 30, 2011 and 2010, we received $1,302 and $1,432, respectively, of earned asset management fees associated with consolidated CDOs, of which we eliminated $924 and $967, respectively, of management fee income.

During the six-month periods ended June 30, 2011 and 2010, we received $2,600 and $5,104, respectively, of earned asset management fees associated with consolidated CDOs, of which we eliminated $1,883 and $1,983, respectively, of management fee income.

i. Fair Value of Financial Instruments

In accordance with FASB ASC Topic 820, “Fair Value Measurements and Disclosures”, fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Where available, fair value is based on observable market prices or parameters or derived from such prices or parameters. Where

7

Table of Contents

observable prices or inputs are not available, valuation models are applied. These valuation techniques involve management estimation and judgment, the degree of which is dependent on the price transparency for the instruments or market and the instruments’ complexity for disclosure purposes. Assets and liabilities recorded at fair value in the consolidated balance sheets are categorized based upon the level of judgment associated with the inputs used to measure their value. Hierarchical levels, as defined in FASB ASC Topic 820, “Fair Value Measurements and Disclosures” and directly related to the amount of subjectivity associated with the inputs to fair valuations of these assets and liabilities, are as follows:

| • | Level 1: Valuations are based on unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date. The types of assets carried at level 1 fair value generally are equity securities listed in active markets. As such, valuations of these investments do not entail a significant degree of judgment. |

| • | Level 2: Valuations are based on quoted prices for similar instruments in active markets or quoted prices for identical or similar instruments in markets that are not active or for which all significant inputs are observable, either directly or indirectly. |

Fair value assets and liabilities that are generally included in this category are unsecured REIT note receivables, commercial mortgage-backed securities, or CMBS, receivables and certain financial instruments classified as derivatives where the fair value is based on observable market inputs.

| • | Level 3: Inputs are unobservable inputs for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the level in the fair value hierarchy within which the fair value measurement in its entirety falls has been determined based on the lowest level input that is significant to the fair value measurement in its entirety. Our assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the asset. Generally, assets and liabilities carried at fair value and included in this category are trust preferred securities, or TruPS, and subordinated debentures, trust preferred obligations and CDO notes payable where observable market inputs do not exist. |

The availability of observable inputs can vary depending on the financial asset or liability and is affected by a wide variety of factors, including, for example, the type of investment, whether the investment is new, whether the investment is traded on an active exchange or in the secondary market, and the current market condition. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised by us in determining fair value is greatest for instruments categorized in level 3.

Fair value is a market-based measure considered from the perspective of a market participant who holds the asset or owes the liability rather than an entity-specific measure. Therefore, even when market assumptions are not readily available, our own assumptions are set to reflect those that management believes market participants would use in pricing the asset or liability at the measurement date. We use prices and inputs that management believes are current as of the measurement date, including during periods of market dislocation. In periods of market dislocation, the observability of prices and inputs may be reduced for many instruments. This condition could cause an instrument to be transferred from Level 1 to Level 2 or Level 2 to Level 3.

Many financial instruments have bid and ask prices that can be observed in the marketplace. Bid prices reflect the highest price that we and others are willing to pay for an asset. Ask prices represent the lowest price that we and others are willing to accept for an asset. For financial instruments whose inputs are based on bid-ask prices, we do not require that fair value always be a predetermined point in the bid-ask range. Our policy is to allow for mid-market pricing and adjusting to the point within the bid-ask range that results in our best estimate of fair value.

Fair value for certain of our Level 3 financial instruments is derived using internal valuation models. These internal valuation models include discounted cash flow analyses developed by management using current interest rates, estimates of the term of the particular instrument, specific issuer information and other market data for securities without an active market. In accordance with FASB ASC Topic 820, “Fair Value Measurements and Disclosures”, the impact of our own credit spreads is also considered when measuring the fair value of financial assets or liabilities, including derivative contracts. Where appropriate, valuation adjustments are made to account for various factors, including bid-ask spreads, credit quality and market liquidity. These adjustments are applied on a consistent basis and are based on observable inputs where available. Management’s estimate of fair value requires significant management judgment and is subject to a high degree of variability based upon market conditions, the availability of specific issuer information and management’s assumptions.

j. Income Taxes

RAIT and Taberna have each elected to be taxed as a REIT and to comply with the related provisions of the Internal Revenue Code of 1986, as amended, or the Internal Revenue Code. Accordingly, we generally will not be subject to U.S. federal income tax to the extent of our distributions to shareholders and as long as certain asset, income and share ownership tests are met. If we were to fail

8

Table of Contents

to meet these requirements, we would be subject to U.S. federal income tax, which could have a material adverse impact on our results of operations and amounts available for distributions to our shareholders. Management believes that all of the criteria to maintain RAIT’s and Taberna’s REIT qualification have been met for the applicable periods, but there can be no assurance that these criteria will continue to be met in subsequent periods.

We maintain various taxable REIT subsidiaries, or TRSs, which may be subject to U.S. federal, state and local income taxes and foreign taxes. Current and deferred taxes are provided on the portion of earnings (losses) recognized by us with respect to our interest in domestic TRSs. Deferred income tax assets and liabilities are computed based on temporary differences between our GAAP consolidated financial statements and the federal and state income tax basis of assets and liabilities as of the consolidated balance sheet date. We evaluate the realizability of our deferred tax assets (e.g., net operating loss and capital loss carryforwards) and recognize a valuation allowance if, based on the available evidence, it is more likely than not that some portion or all of our deferred tax assets will not be realized. When evaluating the realizability of our deferred tax assets, we consider estimates of expected future taxable income, existing and projected book/tax differences, tax planning strategies available, and the general and industry specific economic outlook. This realizability analysis is inherently subjective, as it requires management to forecast our business and general economic environment in future periods. Changes in estimate of deferred tax asset realizability, if any, are included in income tax expense on the consolidated statements of operations.

From time to time, our TRSs generate taxable income from intercompany transactions. The TRS entities generate taxable revenue from fees for services provided to CDO entities. Some of these fees paid to the TRS entities are capitalized as deferred financing costs by the CDO entities. Certain CDO entities may be consolidated in our financial statements pursuant to FASB ASC Topic 810, “Consolidation.” In consolidation, these fees are eliminated when the CDO entity is included in the consolidated group. Nonetheless, all income taxes are accrued by the TRSs in the year in which the taxable revenue is received. These income taxes are not eliminated when the related revenue is eliminated in consolidation.

Certain TRS entities are domiciled in the Cayman Islands and, accordingly, taxable income generated by these entities may not be subject to local income taxation, but generally will be included in our taxable income on a current basis, whether or not distributed. Upon distribution of any previously included income, no incremental U.S. federal, state, or local income taxes would be payable by us.

The TRS entities may be subject to tax laws that are complex and potentially subject to different interpretations by the taxpayer and the relevant governmental taxing authorities. In establishing a provision for income tax expense, we must make judgments and interpretations about the application of these inherently complex tax laws. Actual income taxes paid may vary from estimates depending upon changes in income tax laws, actual results of operations, and the final audit of tax returns by taxing authorities. Tax assessments may arise several years after tax returns have been filed. We review the tax balances of our TRS entities quarterly and as new information becomes available, the balances are adjusted as appropriate.

k. Recent Accounting Pronouncements

On January 1, 2010, we adopted Accounting Standards Update (ASU) No. 2010-06, “Fair Value Measurements and Disclosures (Topic 820): Improving Disclosures about Fair Value Measurements.” This accounting standard requires new disclosures for significant transfers in and out of Level 1 and 2 fair value measurements and a description of the reasons for the transfer. This accounting standard also updates existing disclosures by providing fair value measurement disclosures for each class of assets and liabilities and provides disclosures about the valuation techniques and inputs used to measure fair value for both recurring and nonrecurring fair value measurements. For Level 3 fair value measurements, new disclosures will require entities to present information separately for purchases, sales, issuances, and settlements. These disclosures are effective for fiscal years beginning after December 15, 2010, and for interim periods within those fiscal years. The adoption of this standard did not have a material effect on our consolidated financial.

On January 1, 2011, we adopted ASU No. 2010-29, “Disclosure of Supplementary Pro Forma Information for Business Combinations.” This accounting standard requires that if a public entity presents comparative financial statements, the entity should disclose revenue and earnings of the combined entity as though the business combination(s) that occurred during the current year had occurred as of the beginning of the comparable prior annual reporting period only. This accounting standard also expands the supplemental pro forma disclosures under FASB ASU Topic 805, “Business Combinations” to include a description of the nature and amount of material, nonrecurring pro forma adjustments directly attributable to the business combination included in the reported pro forma revenue and earnings. The adoption of this standard did not have a material effect on our consolidated financial statements.

In April 2011, the FASB issued accounting standards classified under FASB ASC Topic 310, “Receivables”. This accounting standard amends existing guidance to provide additional guidance on the determination of whether a creditor has granted a concession and whether a debtor is experiencing financial difficulties for purposes of determining whether a restructuring constitutes a troubled debt restructuring. This standard is effective for the first interim or annual period beginning on or after June 15, 2011, and should be applied retrospectively to the beginning of the annual period of adoption. Management is currently evaluating the impact that this standard may have on our consolidated financial statements.

9

Table of Contents

NOTE 3: INVESTMENTS IN LOANS

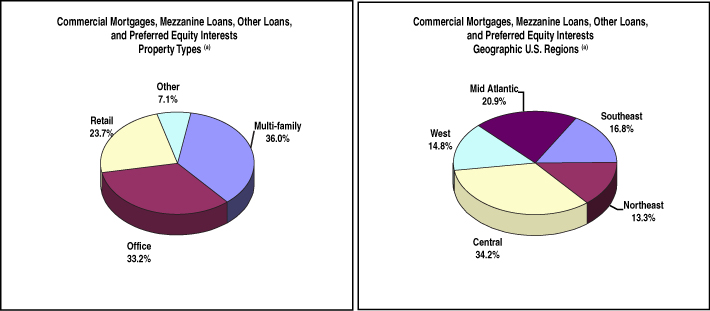

Investments in Commercial Mortgages, Mezzanine Loans, Other Loans and Preferred Equity Interests

The following table summarizes our investments in commercial mortgages, mezzanine loans, other loans and preferred equity interests as of June 30, 2011:

| Unpaid Principal Balance |

Unamortized (Discounts) Premiums |

Carrying Amount |

Number of Loans |

Weighted- Average Coupon (1) |

Range of Maturity Dates | |||||||||||||||||

| Commercial Real Estate (CRE) Loans |

||||||||||||||||||||||

| Commercial mortgages |

$ | 689,624 | $ | (4,021 | ) | $ | 685,603 | 42 | 6.7 | % | Aug. 2011 to May 2021 | |||||||||||

| Mezzanine loans |

358,797 | (5,292 | ) | 353,505 | 99 | 9.2 | % | Aug. 2011 to Nov. 2038 | ||||||||||||||

| Preferred equity interests |

74,477 | (1,148 | ) | 73,329 | 22 | 10.3 | % | Nov. 2011 to Aug. 2025 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total CRE Loans |

1,122,898 | (10,461 | ) | 1,112,437 | 163 | 7.7 | % | |||||||||||||||

| Other loans |

54,842 | (707 | ) | 54,135 | 4 | 6.4 | % | Aug. 2011 to Oct. 2016 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total Loans |

$ | 1,177,740 | $ | (11,168 | ) | $ | 1,166,572 | 167 | 7.7 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Deferred fees |

(1,409 | ) | 0 | (1,409 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| Total investments in loans |

$ | 1,176,331 | $ | (11,168 | ) | $ | 1,165,163 | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Weighted-average coupon is calculated on the unpaid principal amount of the underlying instruments, which does not necessarily correspond to the carrying amount. |

In July 2011, we negotiated an agreement to sell $60.9 million in principal amount commercial mortgages to a CMBS securitization. We expect the sale to close during the three month period ended September 30, 2011.

During the six-month periods ended June 30, 2011 and 2010, we completed the conversion of three and five commercial real estate loans with a carrying value of $85,388 and $64,048 to real estate owned properties. During the six-month periods ended June 30, 2011 and 2010, we charged off $7,088 and $11,361, respectively, related to the conversion of commercial real estate loans to owned properties. See Note 5.

The following table summarizes the delinquency statistics of our commercial real estate loans as of June 30, 2011 and December 31, 2010:

| Delinquency Status |

As of June 30, 2011 |

As of December 31, 2010 |

||||||

| 30 to 59 days |

$ | 1,230 | $ | 27,978 | ||||

| 60 to 89 days |

0 | 0 | ||||||

| 90 days or more |

52,434 | 55,450 | ||||||

| In foreclosure or bankruptcy proceedings |

41,084 | 46,578 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 94,748 | $ | 130,006 | ||||

|

|

|

|

|

|||||

As of June 30, 2011 and December 31, 2010, approximately $94,117 and $122,306, respectively, of our commercial real estate loans were on non-accrual status and had a weighted-average interest rate of 9.7% and 8.8%, respectively. As of June 30, 2011 and December 31, 2010, approximately $19,500 and $20,908 of other loans were on non-accrual status and had a weighted-average interest rate of 7.2%.

Allowance For Losses And Impaired Loans

The following table provides a roll-forward of our allowance for losses for our commercial mortgages, mezzanine loans, and other loans for the three-month periods ended June 30, 2011 and 2010:

| For the Three-Month Period Ended June 30, 2011 |

For the Three-Month Period Ended June 30, 2010 |

|||||||

| Beginning balance |

$ | 66,769 | $ | 76,823 | ||||

| Provision |

950 | 7,644 | ||||||

| Charge-offs, net of recoveries |

(9,853 | ) | (5,795 | ) | ||||

|

|

|

|

|

|||||

| Ending balance |

$ | 57,866 | $ | 78,672 | ||||

|

|

|

|

|

|||||

10

Table of Contents

The following table provides a roll-forward of our allowance for losses for our commercial mortgages, mezzanine loans, and other loans for the six-month periods ended June 30, 2011 and 2010:

| For the Six-Month Period Ended June 30, 2011 |

For the Six-Month Period Ended June 30, 2010 |

|||||||

| Beginning balance |

$ | 69,691 | $ | 86,609 | ||||

| Provision |

2,900 | 24,994 | ||||||

| Charge-offs, net of recoveries |

(14,725 | ) | (32,931 | ) | ||||

|

|

|

|

|

|||||

| Ending balance |

$ | 57,866 | $ | 78,672 | ||||

|

|

|

|

|

|||||

As of June 30, 2011 and December 31, 2010, we identified 22 and 27 commercial mortgages, mezzanine loans and other loans with unpaid principal balances of $115,857 and $157,746 as impaired.

The average unpaid principal balance of total impaired loans was $130,062 and $184,925 during the three-month periods ended June 30, 2011 and 2010 and $139,290 and $180,654 during the six-month periods ended June 30, 2011 and 2010. We recorded interest income from impaired loans of $18 and $1,178 for the three-month periods ended June 30, 2011 and 2010 and $524 and $2,492 for the six-month periods ended June 30, 2011 and 2010.

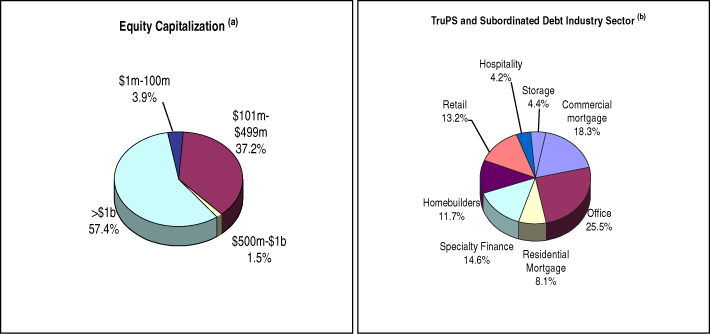

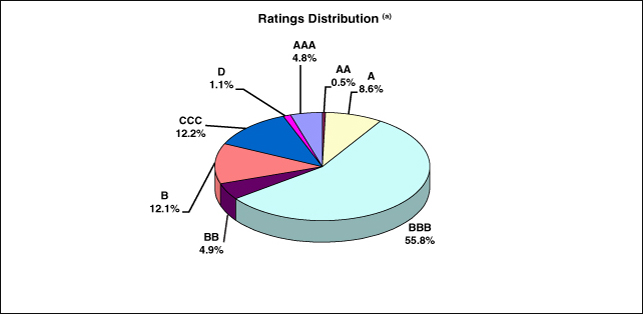

NOTE 4: INVESTMENTS IN SECURITIES

Our investments in securities and security-related receivables are accounted for at fair value. The following table summarizes our investments in securities as of June 30, 2011:

| Investment Description |

Amortized Cost |

Net Fair Value Adjustments |

Estimated Fair Value |

Weighted Average Coupon (1) |

Weighted Average Years to Maturity |

|||||||||||||||

| Trading securities |

||||||||||||||||||||

| TruPS |

$ | 690,501 | $ | (222,129 | ) | $ | 468,372 | 4.8 | % | 23.3 | ||||||||||

| Other securities |

10,000 | (10,000 | ) | 0 | 4.8 | % | 41.4 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total trading securities |

700,501 | (232,129 | ) | 468,372 | 4.8 | % | 23.5 | |||||||||||||

| Available-for-sale securities |

3,600 | (3,598 | ) | 2 | 2.1 | % | 31.4 | |||||||||||||

| Security-related receivables |

||||||||||||||||||||

| TruPS receivables |

111,199 | (28,310 | ) | 82,889 | 6.9 | % | 11.5 | |||||||||||||

| Unsecured REIT note receivables |

61,000 | 4,323 | 65,323 | 6.6 | % | 6.2 | ||||||||||||||

| CMBS receivables (2) |

153,868 | (75,891 | ) | 77,977 | 5.7 | % | 32.5 | |||||||||||||

| Other securities |

75,767 | (52,355 | ) | 23,412 | 3.3 | % | 30.7 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total security-related receivables |

401,834 | (152,233 | ) | 249,601 | 5.7 | % | 22.3 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total investments in securities |

$ | 1,105,935 | $ | (387,960 | ) | $ | 717,975 | 5.1 | % | 23.2 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Weighted-average coupon is calculated on the unpaid principal amount of the underlying instruments which does not necessarily correspond to the carrying amount. |

| (2) | CMBS receivables include securities with a fair value totaling $22,142 that are rated between “AAA” and “A-” by Standard & Poor’s, securities with a fair value totaling $45,297 that are rated “BBB+” and “B-” by Standard & Poor’s, securities with a fair value totaling $8,647 that are rated “CCC” by Standard & Poor’s and securities with a fair value totaling $1,891 that are rated “D” by Standard & Poor’s. |

A substantial portion of our gross unrealized losses is greater than 12 months.

11

Table of Contents

TruPS included above as trading securities include (a) investments in TruPS issued by VIEs of which we are not the primary beneficiary and which we do not consolidate and (b) transfers of investments in TruPS securities to us that were accounted for as a sale pursuant to FASB ASC Topic 860, “Transfers and Servicing.”

The following table summarizes the non-accrual status of our investments in securities:

| As of June 30, 2011 | As of December 31, 2010 | |||||||||||||||||||||||

| Principal /Par Amount on Non-accrual |

Weighted Average Coupon |

Fair Value | Principal /Par Amount on Non-accrual |

Weighted Average Coupon |

Fair Value | |||||||||||||||||||

| TruPS and TruPS receivables |

$ | 128,682 | 3.9 | % | $ | 2,935 | $ | 133,682 | 4.1 | % | $ | 5,581 | ||||||||||||

| Other securities |

32,335 | 3.2 | % | 2 | 42,754 | 2.8 | % | 976 | ||||||||||||||||

| CMBS receivables |

24,408 | 5.9 | % | 5,393 | 29,204 | 5.9 | % | 975 | ||||||||||||||||

The assets of our consolidated CDOs collateralize the debt of such entities and are not available to our creditors. As of June 30, 2011 and December 31, 2010, investment in securities of $801,700 and $806,700, respectively, in principal amount of TruPS and subordinated debentures, and $214,868 and $219,868, respectively, in principal amount of unsecured REIT note receivables and CMBS receivables, collateralized the consolidated CDO notes payable of such entities.

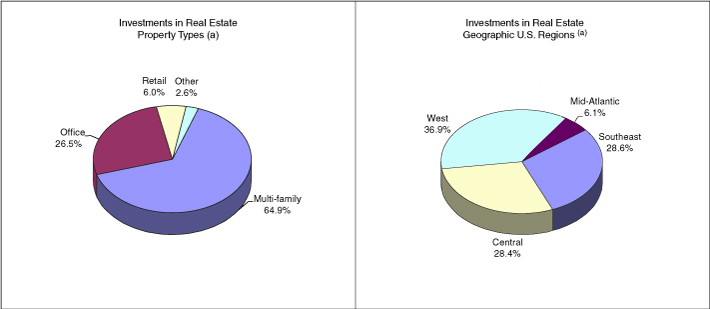

NOTE 5: INVESTMENTS IN REAL ESTATE

The table below summarizes our investments in real estate:

| As of June 30, 2011 | As of December 31, 2010 | |||||||||||||||

| Book Value | Number of Properties |

Book Value | Number of Properties |

|||||||||||||

| Multi-family real estate properties |

$ | 590,280 | 33 | $ | 602,183 | 33 | ||||||||||

| Office real estate properties |

247,413 | 10 | 219,567 | 9 | ||||||||||||

| Retail real estate properties |

48,243 | 2 | 41,838 | 2 | ||||||||||||

| Parcels of land |

22,208 | 3 | 22,208 | 3 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Subtotal |

908,144 | 48 | 885,796 | 47 | ||||||||||||

| Plus: Escrows and reserves |

9,894 | 2,296 | ||||||||||||||

| Less: Accumulated depreciation and amortization |

(56,228 | ) | (46,604 | ) | ||||||||||||

|

|

|

|

|

|||||||||||||

| Investments in real estate |

$ | 861,810 | $ | 841,488 | ||||||||||||

|

|

|

|

|

|||||||||||||

As of June 30, 2011, our investments in real estate of $908,144 are financed through $99,305 of mortgages held by third parties and $767,598 of mortgages held by our consolidated securitizations. Together, along with commercial real estate loans held by these securitizations, these mortgages serve as collateral for the CDO notes payable issued by our consolidated securitizations. All intercompany balances and interest charges are eliminated in consolidation.

Acquisitions:

During the six-month period ended June 30, 2011, we converted three loans with a carrying value of $85,388, relating to one office property and two multi-family properties, to owned real estate. Upon conversion, we recorded the investment in real estate acquired including any related working capital at fair value of $78,167.

The following table summarizes the aggregate estimated fair value of the assets and liabilities associated with the three properties acquired during the six-month period ended June 30, 2011, on the respective date of each conversion, for the real estate accounted for under FASB ASC Topic 805.

| Description |

Estimated Fair Value |

|||

| Assets acquired: |

||||

| Investments in real estate |

$ | 78,300 | ||

| Cash and cash equivalents |

402 | |||

| Restricted cash |

582 | |||

| Other assets |

137 | |||

|

|

|

|||

| Total assets acquired |

79,421 | |||

12

Table of Contents

| Description |

Estimated Fair Value |

|||

| Liabilities assumed: |

||||

| Accounts payable and accrued expenses |

775 | |||

| Other liabilities |

479 | |||

|

|

|

|||

| Total liabilities assumed |

1,254 | |||

|

|

|

|||

| Estimated fair value of net assets acquired |

$ | 78,167 | ||

|

|

|

|||

The following table summarizes the consideration transferred to acquire the real estate properties and the amounts of identified assets acquired and liabilities assumed at the respective conversion date:

| Description |

Estimated Fair Value |

|||

| Fair value of consideration transferred: |

||||

| Commercial real estate loans |

$ | 78,300 | ||

| Other considerations |

(133 | ) | ||

|

|

|

|||

| Total fair value of consideration transferred |

$ | 78,167 | ||

|

|

|

|||

During the six-month period ended June 30, 2011, these investments contributed revenue of $1,620 and a net income allocable to common shares of $751. During the six-month period ended June 30, 2011, we did not incur any third-party acquisition-related costs.

Our consolidated unaudited pro forma information, after including the acquisition of real estate properties, is presented below as if the acquisition occurred on January 1, 2010. These pro forma results are not necessarily indicative of the results which actually would have occurred if the acquisition had occurred on the first day of the periods presented, nor does the pro forma financial information purport to represent the results of operations for future periods:

| Description |

For the Six-Month Period Ended June 30, 2011 |

For the Six-Month Period Ended June 30, 2010 |

||||||

| Total revenue, as reported |

$ | 117,142 | $ | 126,614 | ||||

| Pro forma revenue |

119,922 | 130,960 | ||||||

| Net income (loss) allocable to common shares, as reported |

(14,331 | ) | 53,601 | |||||

| Pro forma net income (loss) allocable to common shares |

(13,536 | ) | 54,741 | |||||

These amounts have been calculated after adjusting the results of the acquired businesses to reflect the additional depreciation that would have been charged assuming the fair value adjustments to our investments in real estate had been applied from January 1, 2010 together with the consequential tax effects.

We have not yet completed the process of estimating the fair value of assets acquired and liabilities assumed. Accordingly, our preliminary estimates and the allocation of the purchase price to the assets acquired and liabilities assumed may change as we complete the process. In accordance with FASB ASC Topic 805, changes, if any, to the preliminary estimates and allocation will be reported in our financial statements retrospectively.

Dispositions:

During the six-month period ended June 30, 2011, we sold two multi-family properties for a total purchase price of $67,550. We recorded losses on the sale of these assets of $168.

13

Table of Contents

NOTE 6: INDEBTEDNESS

We maintain various forms of short-term and long-term financing arrangements. Generally, these financing agreements are collateralized by assets within securitizations. The following table summarizes our total recourse and non-recourse indebtedness as of June 30, 2011:

| Description |

Unpaid Principal Balance |

Carrying Amount |

Weighted- Average Interest Rate |

Contractual Maturity | ||||||||||

| Recourse indebtedness: |

||||||||||||||

| 7.0% convertible senior notes (1) |

$ | 115,000 | $ | 107,064 | 7.0 | % | Apr. 2031 | |||||||

| 6.875% convertible senior notes (2) |

38,813 | 38,943 | 6.9 | % | Apr. 2027 | |||||||||

| Secured credit facilities |

19,745 | 19,745 | 4.5 | % | Dec. 2011 | |||||||||

| Senior secured notes |

43,000 | 43,000 | 12.5 | % | Apr. 2014 | |||||||||

| Loans payable on real estate |

7,183 | 7,183 | 5.0 | % | Sept. 2013 | |||||||||

| Junior subordinated notes, at fair value (3) |

38,052 | 4,422 | 5.2 | % | Oct. 2015 to Mar. 2035 | |||||||||

| Junior subordinated notes, at amortized cost |

25,100 | 25,100 | 7.7 | % | Apr. 2037 | |||||||||

|

|

|

|

|

|

|

|||||||||

| Total recourse indebtedness |

286,893 | 245,457 | 7.4 | % | ||||||||||

| Non-recourse indebtedness: |

||||||||||||||

| CDO notes payable, at amortized cost (4)(5) |

1,337,987 | 1,337,987 | 0.6 | % | 2045 to 2046 | |||||||||

| CDO notes payable, at fair value (3)(4)(6) |

1,134,643 | 140,619 | 0.9 | % | 2037 to 2038 | |||||||||

| Loans payable on real estate |

92,144 | 92,162 | 5.9 | % | Sept. 2011 to Mar. 2018 | |||||||||

|

|

|

|

|

|

|

|||||||||

| Total non-recourse indebtedness |

2,564,774 | 1,570,768 | 0.9 | % | ||||||||||

|

|

|

|

|

|

|

|||||||||

| Total indebtedness |

$ | 2,851,667 | $ | 1,816,225 | 1.6 | % | ||||||||

|

|

|

|

|

|

|

|||||||||

| (1) | Our 7.0% convertible senior notes are redeemable, at par at the option of the holder, in April 2016, April 2021, and April 2026. |

| (2) | Our 6.875% convertible senior notes are redeemable, at par at the option of the holder, in April 2012, April 2017, and April 2022. |

| (3) | Relates to liabilities which we elected to record at fair value under FASB ASC Topic 825. |

| (4) | Excludes CDO notes payable purchased by us which are eliminated in consolidation. |

| (5) | Collateralized by $1,774,581 principal amount of commercial mortgages, mezzanine loans, other loans and preferred equity interests. These obligations were issued by separate legal entities and consequently the assets of the special purpose entities that collateralize these obligations are not available to our creditors. |

| (6) | Collateralized by $1,279,735 principal amount of investments in securities and security-related receivables and loans, before fair value adjustments. The fair value of these investments as of June 30, 2011 was $875,526. These obligations were issued by separate legal entities and consequently the assets of the special purpose entities that collateralize these obligations are not available to our creditors. |

Recourse indebtedness refers to indebtedness that is recourse to our general assets, including the loans payable on real estate that are guaranteed by us. Non-recourse indebtedness consists of indebtedness of consolidated VIEs (i.e. CDOs and other securitization vehicles) and loans payable on real estate which is recourse only to specific assets pledged as collateral to the lenders. The creditors of each consolidated VIE have no recourse to our general credit.

The current status or activity in our financing arrangements occurring as of or during the six-month period ended June 30, 2011 is as follows:

Recourse Indebtedness

6.875% convertible senior notes. During the six-month period ended June 30, 2011, we repurchased $104,800 in aggregate principal amount of our 6.875% Convertible Senior Notes due 2027, or the 6.875% convertible senior notes, for an aggregate purchase price of $103,213. As a result of these transactions, we recorded losses on extinguishment of debt of $1,033, net of deferred financing costs and unamortized discounts that were written off.

Our 6.875% convertible senior notes are redeemable, at the option of the holder, in April 2012. We expect to acquire, redeem, refinance or otherwise enter into transactions to satisfy our 6.875% convertible senior notes which may include any combination of payments of cash, issuances of our debt and/or equity securities, sales or exchanges of our assets or other methods.

7.0% convertible senior notes. On March 21, 2011, we issued and sold in a public offering $115,000 aggregate principal amount of our 7.0% Convertible Senior Notes due 2031, or the 7.0% convertible senior notes. After deducting the underwriting discount and the estimated offering costs, we received approximately $109,000 of net proceeds. Interest on the 7.0% convertible senior notes is paid semi-annually and the 7.0% convertible senior notes mature on April 1, 2031.

14

Table of Contents

Prior to April 5, 2016, the 7.0% convertible senior notes are not redeemable at RAIT’s option, except to preserve RAIT’s status as a REIT. On or after April 5, 2016, RAIT may redeem all or a portion of the 7.0% convertible senior notes at a redemption price equal to the principal amount plus accrued and unpaid interest. Holders of 7.0% convertible senior notes may require RAIT to repurchase all or a portion of the 7.0% convertible senior notes at a purchase price equal to the principal amount plus accrued and unpaid interest on April 1, 2016, April 1, 2021, and April 1, 2026, or upon the occurrence of certain defined fundamental changes.

The 7.0% convertible senior notes are convertible at the option of the holder at an initial conversion rate of 130.0559 common shares per $1,000 principal amount of 7.0% convertible senior notes (equivalent to an initial conversion price of $7.69 per common share). Upon conversion of 7.0% convertible senior notes by a holder, the holder will receive cash, our common shares or a combination of cash and our common shares, at our election. The initial conversion rate is subject to adjustment in certain circumstances. We include the 7.0% convertible senior notes in earnings per share using the treasury stock method if the conversion value in excess of the par amount is considered in the money during the respective periods.

According to FASB ASC Topic 470, “Debt”, we recorded a discount on our issued and outstanding 7.0% convertible senior notes of $8,228. This discount reflects the fair value of the embedded conversion option within the 7.0% convertible senior notes and was recorded as an increase to additional paid in capital. The fair value was calculated by discounting the cash flows required in the indenture relating to the 7.0% convertible senior notes agreement by a discount rate that represents management’s estimate of our senior, unsecured, non-convertible debt borrowing rate at the time when the 7.0% convertible senior notes were issued. The discount will be amortized to interest expense through April 1, 2016, the date at which holders of our 7.0% convertible senior notes could require repayment.

Secured credit facility. During the six-month period ending June 30, 2011, we prepaid a $16,160 secured credit facility due to mature in October 2011.

As of June 30, 2011, we have $19,745 outstanding under our remaining secured credit facility, which is payable in December 2011 under the current terms of this facility. Our secured credit facility is secured by designated commercial mortgages and mezzanine loans.

Senior secured notes. During the six-month period ended June 30, 2011, the holder of the 10.0% senior secured convertible note, or the 10.0% senior note, converted $5,250 principal amount of the 10.0% senior note into 1,500,000 common shares. On April 26, 2011, we prepaid the remaining $15,700 principal amount of the 10.0% senior note.

Loans payable on real estate. During the six-month period ended June 30, 2011 we refinanced recourse financing consisting of a first mortgage of $12,500 principal amount with a fixed rate of 5.8%, due in April 2012, that was associated with one of our owned real estate properties with non-recourse financing provided by a consolidated securitization.

Non-Recourse Indebtedness

CDO notes payable, at amortized cost. CDO notes payable at amortized cost represent notes issued by consolidated CDO entities which are used to finance the acquisition of unsecured REIT notes, CMBS securities, commercial mortgages, mezzanine loans, and other loans in our commercial real estate portfolio. Generally, CDO notes payable are comprised of various classes of notes payable, with each class bearing interest at variable or fixed rates. Both of our CRE CDOs are meeting all of their overcollateralization, or OC, and interest coverage, or IC, trigger tests as of June 30, 2011.

During the six-month period ended June 30, 2011, we repurchased, from the market, a total of $6,700 in aggregate principal amount of CDO notes payable issued by our RAIT II CDO securitization. The aggregate purchase price was $2,499 and we recorded a gain on extinguishment of debt of $4,202, net of deferred financing costs that were written off.

CDO notes payable, at fair value. Both of our Taberna consolidated CDOs are failing OC trigger tests which cause a change to the priority of payments to the debt and equity holders of the respective securitizations. Upon the failure of an OC test, the indenture of each CDO requires cash flows that would otherwise have been distributed to us as equity distributions, or in some cases interest payments on our retained CDO notes payable, be used to pay down sequentially the outstanding principal balance of the most senior note holders. The OC tests failures are due to defaulted collateral assets and credit risk securities. During the six-month period ended June 30, 2011, $21,315 of cash flows were re-directed from our retained interests in these CDOs and were used to repay the most senior holders of our CDO notes payable.

Loans payable on real estate. During the six-month period ended June 30, 2011, we obtained a first mortgage on an investment in real estate from the Federal National Mortgage Association that has a principal balance of $13,400, 7 year term, and a 5.12% interest rate and a first mortgage on an investment in real estate from Bank of America that has a principal balance of $24,000, 10 year term, and a 6.09% interest rate.

15

Table of Contents

NOTE 7: DERIVATIVE FINANCIAL INSTRUMENTS

We may use derivative financial instruments to hedge all or a portion of the interest rate risk associated with our borrowings. The principal objective of such arrangements is to minimize the risks and/or costs associated with our operating and financial structure as well as to hedge specific anticipated transactions. The counterparties to these contractual arrangements are major financial institutions with which we and our affiliates may also have other financial relationships. In the event of nonperformance by the counterparties, we are potentially exposed to credit loss. However, because of the high credit ratings of the counterparties, we do not anticipate that any of the counterparties will fail to meet their obligations.

Cash Flow Hedges

We have entered into various interest rate swap contracts to hedge interest rate exposure on floating rate indebtedness. We designate interest rate hedge agreements at inception and determine whether or not the interest rate hedge agreement is highly effective in offsetting interest rate fluctuations associated with the identified indebtedness. At designation, certain of these interest rate swaps had a fair value not equal to zero. However, we concluded, at designation, that these hedging arrangements were highly effective during their term using regression analysis and determined that the hypothetical derivative method would be used in measuring any ineffectiveness. At each reporting period, we update our regression analysis and, as of June 30, 2011, we concluded that these hedging arrangements were highly effective during their remaining term and used the hypothetical derivative method in measuring the ineffective portions of these hedging arrangements.

The following table summarizes the aggregate notional amount and estimated net fair value of our derivative instruments as of June 30, 2011 and December 31, 2010:

| As of June 30, 2011 | As of December 31, 2010 | |||||||||||||||

| Notional | Fair Value | Notional | Fair Value | |||||||||||||

| Cash flow hedges: |

||||||||||||||||

| Interest rate swaps |

$ | 1,751,563 | $ | (177,353 | ) | $ | 1,786,698 | $ | (184,878 | ) | ||||||

| Interest rate caps |

36,000 | 1,189 | 36,000 | 1,496 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net fair value |

$ | 1,787,563 | $ | (176,164 | ) | $ | 1,822,698 | $ | (183,382 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

For interest rate swaps that are considered effective hedges, we reclassified realized losses of $11,247 and $11,546 to earnings for the three-month periods ended June 30, 2011 and 2010 and $22,136 and $23,271 for the six-month periods ended June 30, 2011 and 2010. For interest rate swaps that are considered ineffective hedges, we reclassified unrealized gains of $51 to earnings for the three-month period ended June 30, 2010 and $38 for the six-month period ended June 30, 2010.

On January 1, 2008, we adopted the fair value option, which has been classified under FASB ASC Topic 825, “Financial Instruments”, for certain of our CDO notes payable. Upon the adoption of this standard, hedge accounting for any previously designated cash flow hedges associated with these CDO notes payable was discontinued and all changes in fair value of these cash flow hedges are recorded in earnings. As of June 30, 2011, the notional value associated with these cash flow hedges where hedge accounting was discontinued was $967,276 and had a liability balance with a fair value of $88,913. See Note 8: “Fair Value of Financial Instruments” for the changes in value of these hedges during the three-month and six-month periods ended June 30, 2011 and 2010. The change in value of these hedges was recorded as a component of the change in fair value of financial instruments in our consolidated statement of operations.

Amounts reclassified to earnings associated with effective cash flow hedges are reported in interest expense and the fair value of these hedge agreements is included in other assets or derivative liabilities.

NOTE 8: FAIR VALUE OF FINANCIAL INSTRUMENTS

Fair Value of Financial Instruments