Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington DC 20549

FORM 10-K

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended May 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-09061

ELECTRO RENT CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| CALIFORNIA | 95-2412961 | |

| (State or Other Jurisdiction | (I.R.S. Employer | |

| of Incorporation or Organization) | Identification No.) |

6060 Sepulveda Boulevard

Van Nuys, California 91411-2512

(Address of Principal Executive Offices and Zip Code)

(818) 786-2525

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock without par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

| Large Accelerated Filer ¨ | Accelerated Filer þ | Non-Accelerated Filer ¨ | Smaller Reporting Company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the registrant’s stock held by non-affiliates of the registrant as of November 30, 2010, was $290,782,316.

Number of shares of shares of the registrant’s common stock outstanding as of August 5, 2011: 23,980,581.

DOCUMENTS INCORPORATED BY REFERENCE

The information contained in the Proxy Statement for the Annual Shareholders Meeting of Shareholders to be held on October 13, 2011 that is required by Part III of this Form 10-K is incorporated herein by reference.

EXPLANATORY NOTE

Unless otherwise noted, (1) the terms “we”, “us” and “our” refer to Electro Rent Corporation and its subsidiaries, and (2) the terms “Common Stock” and “shareholder(s)” refer to our common stock and the holders of that stock, respectively.

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You can find many (but not all) of these statements by looking for words such as “approximates,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “would,” “may” or other similar expressions in this Report. We claim the protection of the safe harbor contained in the Private Securities Litigation Reform Act of 1995. We caution investors that any forward-looking statements presented in this Report, or that we may make orally or in writing from time to time, are based on the beliefs of, assumptions made by, and information currently available to, us. Such statements are based on assumptions, and the actual outcome will be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control or ability to predict. Although we believe that our assumptions are reasonable, they are not guarantees of future performance and some will inevitably prove to be incorrect. As a result, our actual future results can be expected to differ from our expectations, and those differences may be material. Accordingly, investors should use caution in relying on past forward-looking statements, which are based on known results and trends at the time they are made, to anticipate future results or trends.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include the following: common stock price fluctuations, fluctuations in operating results (including as a result of changing economic conditions), risks associated with technology changes, risks associated with customer solvency, competition, risks associated with international operations, risks associated with our manufacturers and suppliers, dependence on key personnel, control by management and others, risks associated with possible acquisitions and new business ventures and anti-takeover provisions. For further discussion of these and other factors, see Item 1A. “Risk Factors”; Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; and Item 7A. “Quantitative and Qualitative Disclosure About Interest Rates and Currency Rates,” in this Report, and our other filings with the Securities and Exchange Commission.

This Report and all subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date of this Report.

2

PART I

Item 1. Business.

We are one of the largest global organizations devoted to the rental, lease and sale of new and used electronic test and measurement (“T&M”) equipment. We purchase that equipment from leading manufacturers such as Agilent Technologies, Inc. (“Agilent”) and Tektronix primarily for use by our customers in the aerospace, defense, telecommunications, electronics, industrial and semiconductor industries. Although it represented only approximately 8% of our revenues in fiscal 2011, we believe our data products (“DP”) division is one of the largest rental companies in the United States for personal computers and servers from manufacturers including Dell, HP/Compaq, IBM and Toshiba. We have also recently expanded our efforts in the rental, lease and sale of industrial equipment such as electrical test equipment and inspection equipment.

The Electro Rent Approach. For the most part, customers who purchase or lease equipment from us place orders through our inside sales force, which has access to our proprietary computer system that is updated in real time for equipment availability and pricing. In the case of rentals and some leases, we generally use a pool of equipment we have previously purchased for that purpose or we may add equipment to that pool to fill a lease or rental order if the addition makes economic sense. Our equipment fulfillment team typically can arrange delivery of equipment from our pool to our customers within one or two days of a request. Most of our equipment is technically complex and must be calibrated and serviced when returned to us. We do most of that calibration in house, using a team of experienced technicians and our state of the art calibration laboratory.

Although our customers respond to equipment pricing and availabilities in making their decisions to choose to work with us, we believe that our success also depends on other factors:

| • | Customer Responsiveness. Our customer service, responsiveness and expert technical staff provide us a key competitive advantage. Our resale agreement with Agilent, for the United States and Canada, has enabled us to substantially expand the number and technical expertise of our T&M sales force, which at approximately 90 persons is the largest among our principal competitors. We believe our management team is the most experienced and stable in the industry, averaging 26 years at Electro Rent. In 2008 and 2009, Forbes magazine named us as one of their “100 Most Trustworthy Companies” out of the more than 8,000 publicly traded companies for what Forbes termed “transparent and conservative accounting practices and solid corporate governance and management.” |

| • | Global Platform. Although our customers represent a cross-section of the economy, much of our business is conducted with large companies in the aerospace and defense, semiconductor, electronics and telecommunications industries. As the largest T&M rental, leasing and sales company in North America, and one of the only rental companies in the world with a global platform and key locations in the US, Canada, China and Europe, our size and reach appeals to our multinational customers and assists us in maximizing our equipment utilization and inventory management across different geographic markets. |

| • | Multichannel Offerings. In the last two years, we have expanded our business to offer customers a single source for their equipment acquisitions, whether they want to rent, lease or buy new or used equipment. We believe that we offer the greatest breadth of acquisition options in the industry, allowing our customers to match the appropriate option to their usage and capital needs, budget and other factors, such as accounting rules and regulatory requirements. In addition, spreading costs over multiple channels allows us to maintain the largest sales force among our principal competitors, which in turn broadens and deepens our customer contacts and provides them more technical strength and assistance. |

3

| • | Deep Vendor Relationships. We have worked to develop and maintain strong relationships with the major manufacturers of equipment, who are our principal suppliers. We build these relationships not only through our rental and leasing activities, which make us one of the largest customers of these manufacturers, but also through partnerships with our vendors to sell their products. By maintaining close relationships with multiple vendors, we can help our customers select the right equipment for their needs, better fill customer orders for equipment with long lead-times, and understand product development trends which tend to shape the nature of the demands of our rental and leasing customers and the prices for our used equipment. |

| • | Dynamic Inventory Management Systems. To maximize our overall profit from the rental, leasing, and sales of equipment, we manage our equipment pool on an on-going basis by controlling the timing, pricing and mix of our purchases and sales. We acquire new and used equipment to meet current technological standards and current and anticipated customer demand, and we sell our used equipment when we believe that is the most lucrative option. We employ a complex equipment management strategy and our proprietary PERFECT™ software to adjust our inventory and pricing on a dynamic basis in order to maximize equipment availability, utilization and profitability. We manage each specific equipment class based on a separate assessment of that equipment’s historical and projected life cycle and numerous other factors, including the U.S. and global economy, interest rates and new product launches. |

Our Strategic Growth Initiatives. We believe that our resources and financial infrastructure remain capable of handling a significantly greater volume of business activity without a proportionate increase in expenses. Based on this belief, we have been seeking ways to increase revenues to leverage that infrastructure through internal growth and external acquisitions. These strategies include:

| • | Sales and Distribution Channel Initiative. Beginning in fiscal 2007, we have been expanding our business by adding new equipment sales channels to our rental, leasing and used equipment sales offerings. In addition to adding revenue and expanding our sales organization, we can capture related rental and lease opportunities and provide customers with a full range of equipment acquisition options. Our resale agreement with Agilent, commencing in fiscal 2010, gives us the exclusive right to sell Agilent’s more complex T&M equipment to small and medium size customers (who previously purchased directly from Agilent) in the United States and Canada. |

| • | Equipment Pool Expansion Initiatives. Despite the global economic downturn, we have used our strong balance sheet to make significant equipment purchases to meet T&M rental demand, support areas of potential growth and keep our equipment pool technologically up-to-date. In response to increasing customer demand, we increased our purchases of equipment during fiscal 2011 by 15% compared to fiscal 2010, which included $22.9 million of equipment acquired from Telogy, LLC (“Telogy”) in March 2010. As a result, we have been able to expand and upgrade our equipment base with equipment that is limited in supply but growing in demand, enhancing our ability to meet the needs of a wide range of customers, as well as expand our equipment pool offerings in some related areas such as telecom and industrial products. |

| • | Vendor Leasing Initiative. In fiscal 2009, we began an initiative to develop a substantial worldwide T&M leasing program by partnering with Agilent, Ixia, JDSU and other major manufacturers. These relationships have expanded our leasing program and enhanced our ability to meet the needs of our customers by offering competitive finance and operating leases. |

Our Markets and Competition. We believe the North American general purpose test equipment rental market generates in excess of $300 million of annual rental and lease revenue, and is characterized by intense competition from several large competitors. Although no single competitor holds a dominant market share in North America, our primary competitors in the T&M rental area include McGrath Rent Corp., Continental Resources, Test Equity, and Microlease plc. We compete for rental business with Microlease plc and Livingston Group Ltd. in Europe, and Orix Corporation and a number of local operators in Asia. These entities also compete with us in leasing T&M equipment, as do banks, vendors and other financing sources. In addition, in selling our equipment, we may also compete with sales of

4

new equipment by our suppliers, including Agilent and Tektronix, and their other distributors. Our competitors engage in aggressive pricing for both rentals and sales, as well as offer customers extended warranties that exceed the underlying manufacturers’ warranties and other services. In order to maintain or increase our market share, we may choose to lower our prices, resulting in lower revenues and decreased profitability.

The market for the lease and rental of computers and servers is highly fragmented, although our principal competitors include SmartSource Computer & Audio Visual Rentals, Source One Rentals, Rentex and CRE Rentals. The computer rental market has been characterized by intense competition that has led to industry consolidation. We acquired two competitors during the last fifteen years and SmartSource, our largest competitor, has expanded primarily due to its nineteen acquisitions. While we have focused on the rental of large quantities of computers to unique customers, SmartSource concentrates more on audio visual and trade show technology rentals and is thus not a direct competitor.

Our Backlog. As of May 31, 2011, we had an order backlog of $17.0 million, compared to $9.7 million as of May 31, 2010, the result of sales in connection with our resale agreement with Agilent. There was no such backlog in fiscal 2009. We expect that a majority of the backlog will be delivered to customers within six months of our fiscal year end.

Backlog represents the cumulative balance, at a given point in time, of recorded customer sales orders that have not yet been shipped or recognized as sales. Backlog is increased when an order is received, and backlog is decreased when we recognize sales. Although backlog consists of firm orders for which goods and services are yet to be provided, customers can, and sometimes do, terminate or modify these orders. Backlog, on any particular date, while indicative of short-term revenue performance, is not necessarily a reliable indicator of medium or long-term revenue performance.

International Operations. We have sales and leasing activity in foreign countries, which in the aggregate accounted for approximately 12.6% of our revenues in 2011, 14.6% in 2010 and 14.8% in 2009. Selected financial information regarding our international operations is presented below:

| Year ended May 31, (in thousands) |

2011 | 2010 | 2009 | |||||||||

|

|

||||||||||||

| Revenues: 1 |

||||||||||||

| U.S. |

$ | 199,861 | $ | 124,618 | $ | 111,184 | ||||||

| Other 2 |

28,868 | 21,249 | 19,297 | |||||||||

|

|

||||||||||||

| Total |

$ | 228,729 | $ | 145,867 | $ | 130,481 | ||||||

|

|

||||||||||||

| As of May 31, (in thousands) |

2011 | 2010 | 2009 | |||||||||

|

|

||||||||||||

| Net Long Lived Assets: 3 |

||||||||||||

| U.S. |

$ | 180,591 | $ | 166,533 | $ | 151,204 | ||||||

| Other 2 |

33,491 | 25,206 | 24,672 | |||||||||

|

|

||||||||||||

| Total |

$ | 214,082 | $ | 191,739 | $ | 175,876 | ||||||

|

|

||||||||||||

| 1 | Revenues by country are based on the location of shipping destination, whether the order originates in the U.S. parent or a foreign subsidiary. |

| 2 | Other consists of other foreign countries that each individually accounts for less that 10% of the total revenues or assets. |

| 3 | Net long-lived assets include rental and lease equipment, other property, goodwill and intangibles, net of accumulated depreciation and amortization. |

For risks relating to our international operations, see “Item 1A. Risk Factors – Risks Associated with International Operations.”

5

Other Information about Us. The following table shows, for each of the last three fiscal years, revenues from rentals and leases and sales of equipment and other revenues for our T&M and DP operating segments:

| Years ended May 31, (in thousands) |

T&M | DP | Total | |||||||||

|

|

||||||||||||

| 2011 |

||||||||||||

| Rentals and leases |

$ | 101,273 | $ | 16,789 | $ | 118,062 | ||||||

| Sales of equipment and other revenues |

108,450 | 2,217 | 110,667 | |||||||||

|

|

||||||||||||

| $ | 209,723 | $ | 19,006 | $ | 228,729 | |||||||

|

|

||||||||||||

| 2010 |

||||||||||||

| Rentals and leases |

$ | 77,874 | $ | 16,327 | $ | 94,201 | ||||||

| Sales of equipment and other revenues |

49,282 | 2,384 | 51,666 | |||||||||

|

|

||||||||||||

| $ | 127,156 | $ | 18,711 | $ | 145,867 | |||||||

|

|

||||||||||||

| 2009 |

||||||||||||

| Rentals and leases |

$ | 77,430 | $ | 20,965 | $ | 98,395 | ||||||

| Sales of equipment and other revenues |

29,054 | 3,032 | 32,086 | |||||||||

|

|

||||||||||||

| $ | 106,484 | $ | 23,997 | $ | 130,481 | |||||||

|

|

||||||||||||

The majority of our rental equipment inventory is located at our Van Nuys, California warehouse and is serviced by an ISO9001:2000 and AS9100 Revision B registered and compliant laboratory. We also service our customers through sales offices and calibration and service centers in the United States, Canada, China and Europe, which are linked by a proprietary on-line computer system. These centers also function as depots for the sale of used equipment.

For additional financial information about our segments, see Note 15 to our consolidated financial statements included in this Form 10-K.

Our business is non-seasonal, except for the third quarter months of December, January and February, when rental activity declines due to extended holiday closings by a number of customers. In addition, because February is a short month, rental billing is reduced.

No single customer accounted for more than 10% of our total revenues during fiscal 2011, 2010 or 2009. We do not derive any significant portion of our revenues from direct United States Government contracts.

We have no material patents, trademarks, licenses, franchises or concessions.

At May 31, 2011, we employed approximately 371 individuals. None of these employees is a member of a labor union. We believe that our employee relations are satisfactory.

Electro Rent Corporation was incorporated in California in 1965 and became a publicly held corporation in 1980.

Obtaining Additional Information. Our Internet address is www.electrorent.com. Copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge on our website via links to the Securities and Exchange Commission’s website as soon as reasonably practicable after we electronically file those materials with the Securities and Exchange Commission. We provide paper copies of these reports to shareholders upon written request to Shareholder Relations, Electro Rent Corporation, 6060 Sepulveda Boulevard, Van Nuys, California 91411-2512.

Item 1A. Risk Factors.

Please carefully consider the following discussion of various risks and uncertainties. We believe these risk factors are the most relevant to our business and could cause our results to differ materially from the

6

forward-looking statements made by us. The following risk factors are not the only risk factors that we face. Additional risks that we do not consider material, or of which we are not currently aware, may also have an adverse impact on us. Our business, financial condition and results of operations could be seriously harmed if any of these risks or uncertainties actually occur or materialize. In that event, the market price for our common stock could decline, and our shareholders may lose all or part of their investment.

COMMON STOCK PRICE FLUCTUATIONS

Our Common Stock price has fluctuated significantly and may continue to do so in the future.

General Factors. We believe some of the reasons for past fluctuations in the price of our stock have included:

| • | announcements of developments related to our business; |

| • | announcements concerning new products or enhancements in the equipment that we rent, or developments in our relationships with our customers; |

| • | variations in our revenues, gross margins, earnings or other financial results from investors’ expectations; and |

| • | fluctuations in results of our operations and general conditions in the economy, our market, and the markets served by our customers. |

In addition, prices in the stock market have been volatile in recent years. In many cases, the fluctuations have been unrelated to the operating performance of the affected companies. As a result, the price of our Common Stock could fluctuate in the future without regard to our operating performance.

Future Sales of our Common Stock. Sales of our Common Stock by our officers, directors and employees could adversely and unpredictably affect the price of our shares. Additionally, the price could be affected even by the potential for sales by these persons. In addition to the 23,980,581 shares outstanding as of August 5, 2011, as of such date, we are authorized to issue up to 303,501 shares of Common Stock upon exercise of stock options and conversion of our stock units previously granted under our equity incentive plan.

We cannot predict the effect that any future sales of our Common Stock, or the potential for those sales, will have on our share price.

FLUCTUATIONS IN OPERATING RESULTS

Historically, our operating results have fluctuated, and we expect that fluctuations could continue in the future. The fluctuations in our past results have resulted from many factors, some of which are beyond our control. In the future, these or other factors could have a material adverse impact on our operating results and cause our stock price to decrease.

Timing of Equipment Purchases and Sales and Equipment Pool Management. The profitability of our business depends in part on controlling the timing, pricing and mix of purchases and sales of equipment and on managing our equipment pool. We seek to acquire new and used equipment at attractive prices, from which we feel we can make a profit as a result of a combination of renting and/or selling that equipment. We base expenditures for equipment purchases, sales and marketing and other items on our expectations of future customer demand. In order to maximize overall profit from the rental, leasing, and sales of equipment, we manage our equipment pool on an on-going basis by analyzing our product strategy for each specific equipment class in light of that equipment’s historical and projected lifecycle. In doing so, we compare our estimate of potential profit from rental with the potential profit from the product’s immediate sale and replacement with new or other equipment.

7

Our overall equipment management is complex and our equipment strategy can change during the equipment’s lifetime based upon numerous factors, including the U.S. and global economy, interest rates and new product launches. Our strategic equipment decisions are based on the following fundamentals:

| • | our acquisition cost; |

| • | our estimates of current and future market demand for rentals; |

| • | our estimates of current and future supply of equipment; |

| • | the book value of the equipment after depreciation and other impairment; |

| • | our estimates of the effect of interest rates on rental and leasing fees as well as capital financing; and |

| • | our estimates of the potential current and future sale prices of equipment. |

However, historical trends are not necessarily indicative of future trends. If our assumptions prove to be wrong, not only may our revenues fall short of our expectations, but we may not be able to adjust our inventory quickly enough to compensate for lower demand for one or more products in our inventory. In addition, as demand for a product falls, we may have difficulty in selling any of our excess equipment at a favorable price or at all. Both of these factors can compound the impact of any revenue shortfall and further affect our operating results and the price of our stock.

Risks Associated with Changing Economic Conditions. The U.S. economy and international markets that we serve have been impacted by a severe recession, which has resulted in more stringent credit requirements and reduced access to capital, and which may deepen and continue for the foreseeable future. Our customers historically have reduced their expenditures for electronic equipment during economic downturns. Accordingly, when the domestic and/or international economy weakens, demand for our services declines. A large part of our equipment pool is rented or leased to customers in the aerospace, defense, electronics and telecommunications industries. Continued slowdowns in the U.S. and global economy, or one or more of these specific industries, may result in lower demand and price pressure and could have a material adverse effect on our operating results and stock price. In fact, in fiscal 2002 and fiscal 2003, the U.S. economy experienced a downturn and the core industries we serve were negatively impacted. As a result, we experienced a decline in revenues, and we recorded a loss on impairment of goodwill and intangibles. Beginning in fiscal 2009, the recession in the U.S. and global economy resulted in reduced revenues and a decline in our operating results for fiscal 2009 and 2010. Although we experienced growth in revenues and operating profit in fiscal 2011, there can be no assurances that this trend will continue.

Seasonal and Quarterly Fluctuations. Regardless of the overall economic outlook domestically and globally, December, January and February typically reflect lower rental activity. In addition, because February is a short month, revenue billing in that month is reduced. We cannot predict whether these seasonal factors or their effects will change in the future. The seasonal spending patterns of our customers are affected by factors such as:

| • | weather, holiday and vacation considerations; and |

| • | budgetary considerations. |

Additionally, our operating results are subject to quarterly fluctuations resulting from a variety of factors, including remarketing activities, product announcements by manufacturers, economic conditions and

8

variations in the financial mix of new rentals and leases. The financial mix of new rentals and leases is a result of a combination of factors such as:

| • | changes in customer demands and/or requirements; |

| • | new product announcements; |

| • | price changes; |

| • | changes in delivery dates; |

| • | changes in maintenance policies and the pricing policies of equipment manufacturers; and |

| • | price competition from other rental, leasing and finance companies. |

Other Factors. Other factors that may affect our operating results include:

| • | competitive forces within our current and anticipated future markets; |

| • | changes in interest rates; |

| • | our ability to attract customers and meet their expectations; |

| • | currency fluctuations and other risks of international operations; |

| • | general economic conditions; and |

| • | differences in the timing of our spending on acquiring equipment, renting or leasing that equipment and receiving revenues from our customers. |

All or any of these and similar factors could result in our operating results differing substantially from the expectations of public market analysts and investors, which would likely have a material adverse impact on our stock price.

RISKS ASSOCIATED WITH TECHNOLOGY CHANGES

If we do not adequately anticipate or respond to changes in technology, it could have a material adverse effect on our operating results and stock price.

Technological Advancements. We must anticipate and keep pace with the introduction of new hardware, software and networking technologies and acquire equipment that will be marketable to our current and prospective customers. The equipment we rent can be the subject of rapid technological developments, evolving customer demands and frequent new product announcements and enhancements. If we fail to adequately anticipate or adapt to new technological developments or to recognize changing market conditions, our operating results and stock price could be materially and adversely affected.

Expenses Resulting from Technological Advancements. As a result of technology developments, we may have to make substantial and unanticipated expenditures to acquire new equipment or invest in further staff education on operating and servicing the equipment we deliver to our customers. Further, we may not adequately anticipate or respond successfully to technological changes for many reasons, including misjudging the impact of technological changes as well as financial, technological or other constraints. If we do not adequately anticipate or respond to changes in technological advancements or

9

customer preferences, it would likely have a material adverse impact on our operating results and stock price.

Introduction of New Products and Services. The markets in which we operate are characterized by rapidly changing technology, evolving industry standards and declining prices of certain products. Our operating results will depend to a significant extent on our ability to continue to introduce new services and to control and/or reduce costs on existing services. Whether we succeed in our new offerings depends on several factors such as:

| • | proper identification of customer needs; |

| • | our costs; |

| • | timely completion and introduction of products and services as compared to our competitors; |

| • | our ability to differentiate our equipment and services from our competitors; and |

| • | market acceptance of our business. |

RISKS ASSOCIATED WITH CUSTOMER SOLVENCY

If we do not collect on contracts with customers, it could have a material adverse effect on our operating results and stock price.

One of the reasons some of our customers find it more attractive to rent or lease electronic equipment than owning that equipment is the need to deploy their capital elsewhere. This can be particularly true in industries with high growth rates such as the telecommunications industry. However, some of our customers have liquidity issues, which have been compounded by the current economic recession, and ultimately cannot fulfill the terms of their agreements with us. If we are not able to manage credit risk issues, or if a large number of customers should have financial difficulties at the same time, our credit losses would increase above historical levels. If this should occur, our results of operations and stock price may be materially and adversely affected.

COMPETITION

If we do not effectively compete in our market, our operating results and stock price will be materially and adversely affected.

Our industry is characterized by intense competition from several large competitors, some of which have access to greater financial and other resources than we do. Although no single competitor holds a dominant market share, we face competition from both established entities and new entries in the market. Our primary competitors in the North American T&M rental area include McGrath Rent Corp., Continental Resources, Test Equity and Microlease plc. We compete for rental business with Microlease plc and Livingston Group Ltd. in Europe and Orix Corporation in Asia. These entities also compete with us in leasing T&M equipment, as do banks, vendors and other financing sources. In addition, in selling our equipment, we may also compete with sales of new equipment by our suppliers, including Agilent and Tektronix, and their other distributors.

The market for the lease and rental of computers and servers is highly fragmented, although our principal competitors include SmartSource Computer & Audio Visual Rentals, Source One Rentals, Rentex and CRE Rentals. The computer rental market has been characterized by intense competition that has lead to industry consolidation. We acquired two competitors during the last sixteen years and SmartSource, our largest competitor, has expanded primarily due to its nineteen acquisitions.

10

Our competitors engage in aggressive pricing for both rentals and sales, as well as offer customers extended warranties in excess of the underlying manufacturers’ warranties and other services. In order to maintain or increase our market share, we may choose to lower our prices, resulting in lower revenues and decreased profitability.

RISKS ASSOCIATED WITH INTERNATIONAL OPERATIONS

If we do not adequately anticipate and respond to the risks inherent in international operations, it could have a material adverse effect on our operating results and stock price.

Currency Risks. We generated approximately 12.6% of our revenues from international operations during the past fiscal year. Our contracts to supply equipment outside of the U.S. are generally priced in local currency. However, our consolidated financial statements are prepared in U.S. dollars. Consequently, changes in exchange rates can unpredictably and adversely affect our consolidated operating results, and could result in exchange losses. Although we use foreign currency forward contracts to mitigate the risks associated with fluctuations in exchange rates, we may not be able to eliminate or reduce the effects of currency fluctuations. Thus, exchange rate fluctuations could have a material adverse impact on our operating results and stock price.

Other Risks Associated with International Operations. Additionally, our financial results may be adversely affected by other international risks, such as:

| • | international political and economic conditions; |

| • | changes in government regulation in various countries; |

| • | trade barriers; |

| • | difficulty in staffing our foreign sales and service centers, and in training and retaining foreign employees; |

| • | issues relating to the repatriation of any profits; |

| • | adverse tax consequences; and |

| • | costs associated with expansion into new territories. |

We expect to continue our international operations and that the revenues we derive from these activities will continue to be a meaningful portion of our total revenues. If we do not anticipate and respond to the risks associated with international operations, it could have a material adverse effect on our operating results and stock price.

RISKS ASSOCIATED WITH OUR MANUFACTURERS AND SUPPLIERS

If we are not able to obtain equipment at favorable rates, it could have a material adverse effect on our operating results and stock price.

About 90% of our equipment portfolio at acquisition cost consists of general purpose T&M instruments purchased from leading manufacturers such as Agilent and Tektronix. The remainder of our equipment pool consists of personal computers and workstations, which include personal computers from Compaq, Dell, IBM, Apple, and Toshiba and workstations primarily from Sun Microsystems and Hewlett Packard. We depend on these manufacturers and suppliers to contract for our equipment. If, in the future, we are not able to purchase necessary equipment from one or more of these suppliers on favorable terms, we may not be able to meet our customers’ demands in a timely manner or for a price that generates a profit. If this should occur, we can make no assurance that we will be able to secure necessary equipment from

11

an alternative source on acceptable terms and our business and stock price may be materially and adversely affected.

DEPENDENCE ON KEY PERSONNEL

If we are unable to recruit and retain qualified personnel, it could have a material adverse effect on our operating results and stock price.

Our success depends in large part on the continued services of our executive officers, our senior managers and other key personnel, including, among others, our Chief Executive Officer, Daniel Greenberg, our President, Steven Markheim, and our Chief Financial Officer, Craig Jones. The loss of these people, especially without advance notice, could materially and adversely impact our results of operations. It is also very important that we attract and retain highly skilled personnel to accommodate growth and to replace personnel who leave. Competition for qualified personnel can be intense, especially in technology industries, and there are a limited number of people with the requisite knowledge and experience to market, sell and service our equipment. Under these conditions, we could be unable to recruit, train, and retain employees. If we cannot attract and retain qualified personnel, it could have a material adverse impact on our operating results and stock price.

CONTROL BY MANAGEMENT AND OTHERS

Senior management has significant influence over our policies and affairs and may be in a position to determine the outcome of corporate actions.

As of August 5, 2011, our executive officers and directors collectively own approximately 21.4% of our Common Stock.

As of that date, (i) Mr. Daniel Greenberg, our Chairman and Chief Executive Officer, beneficially owns approximately 20.1% of our outstanding shares of Common Stock, and (ii) one other shareholder controls 16.1% of our outstanding shares of Common Stock. Consequently, these shareholders may have significant influence over our policies and affairs and may be in a position to determine the outcome of corporate actions requiring shareholder approval. These may include, for example, the election of directors, the adoption of amendments to our corporate documents and the approval of mergers and sales of our assets.

RISKS ASSOCIATED WITH POSSIBLE ACQUISITIONS AND NEW BUSINESS VENTURES

If we cannot successfully implement any recent or future acquisitions or new business ventures, it could have a material adverse effect on our operating results and stock price.

On occasion, we evaluate business opportunities that appear to fit within our overall business strategy. In fiscal 2006, we acquired Rush Computer Rentals, Inc., a private company based in Wallingford, Connecticut that rents and sells a wide range of DP equipment. In fiscal 2010, we acquired certain assets and select post-closing liabilities of Telogy, a private company headquartered in Union City, California, and a leading provider of electronic T&M equipment. In fiscal 2010, we entered into a resale agreement with Agilent to sell new T&M equipment in the U.S. and Canada, resulting in the hiring of additional sales and support staff. We could decide to pursue one or more other opportunities by acquisition or internal development. Acquisitions and new business ventures, both domestic and foreign, involve many risks, including:

| • | the difficulty of integrating acquired operations and personnel with our existing operations; |

| • | the difficulty of developing and marketing new products and services; |

12

| • | the diversion of our management’s attention as a result of evaluating, negotiating and integrating acquisitions or new business ventures; |

| • | our exposure to unforeseen liabilities of acquired companies; and |

| • | the loss of key employees of an acquired operation. |

In addition, an acquisition or new business venture could adversely impact cash flows and/or operating results, and dilute shareholder interests, for many reasons, including:

| • | charges to our income to reflect the impairment of acquired intangible assets, including goodwill; |

| • | interest costs and debt service requirements for any debt incurred in connection with an acquisition or new business venture; and |

| • | any issuance of securities in connection with an acquisition or new business venture that dilutes or lessens the rights of our current shareholders. |

Additionally, we have implemented various new business ventures in the past, and not all of such ventures have been successful. The risks associated with acquisitions and new business ventures could have a material adverse impact on our operating results and stock price.

RISKS ASSOCIATED WITH FLUCTUATING INTEREST RATES

Interest rate fluctuations could have a material adverse effect on our operating results and stock price.

Our leasing yields tend to correlate with market interest rates. When interest rates are higher, our leasing terms incorporate a higher financing charge. However, in times of relatively lower interest rates our financing charges also decrease, and some of our customers choose to purchase new equipment, rather than leasing equipment at all. Lower leasing yields are reflected in lower rental and lease revenues.

ANTI-TAKEOVER PROVISIONS

The anti-takeover provisions contained in our Articles of Incorporation and Bylaws and in California law could materially and adversely impact the value of our Common Stock.

Certain provisions of our Articles of Incorporation, our Bylaws and California law could, together or separately, discourage, delay or prevent a third party from acquiring us, even if doing so might benefit our shareholders. This may adversely impact the interests of our shareholders with respect to a potential acquisition and may also affect the price investors would receive for their shares of Common Stock. Some examples of these provisions in our Articles of Incorporation and Bylaws are:

| • | the right of our board of directors to issue preferred stock with rights and privileges that are senior to the Common Stock, without prior shareholder approval; and |

| • | certain limitations of the rights of shareholders to call a special meeting of shareholders. |

Item 1B. Unresolved Staff Comments.

None.

13

Item 2. Properties.

We own a building that houses our corporate headquarters and Los Angeles sales office located at 6060 Sepulveda Boulevard, Van Nuys, California. The building contains approximately 84,500 square feet of office space. Approximately 40,500 square feet are currently leased to others. These tenant arrangements provide for all of the leased property to be available for our future needs.

We own a building at 15385 Oxnard Street, Van Nuys, California, which contains approximately 68,200 square feet. We use all of this space, except for 1,000 square feet that are currently being leased to others. This building houses our California warehouse and equipment calibration center.

We own a facility in Wood Dale, Illinois, containing approximately 30,750 square feet. This facility houses our Illinois warehouse and service center.

As of May 31, 2011, we had sales offices in the metropolitan areas of Atlanta and Los Angeles. We also have service centers in Chicago, Dallas, Los Angeles, New York/Newark, San Francisco, Charlotte, Orlando, Toronto and Washington/Baltimore. We have foreign sales offices and warehouses in Mechelen, Belgium, and in Beijing and Tianjin, China.

Our facilities aggregate approximately 269,000 square feet as of May 31, 2011. Except for the corporate headquarters, the Wood Dale, Illinois facilities and the Oxnard Street building, each of which we own, all of our facilities are rented pursuant to leases for up to seven years for aggregate annual rentals of approximately $1.1 million in fiscal 2011. We do not consider any rented facility essential to our operations. We consider our facilities to be in good condition, well maintained and adequate for our needs.

Item 3. Legal Proceedings.

From time to time, we may be involved in litigation relating to claims arising out of our operations in the normal course of business, including claims of alleged infringement, misuse or misappropriation of intellectual property rights of third parties. As of the date of this report, we are not a party to any litigation which we believe would have a material adverse effect on our business operations or financial condition.

Item 4. (Removed and Reserved).

None.

PART II

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market for Common Stock; Holders.

Our common stock is quoted on the NASDAQ stock market under the symbol ELRC. There were approximately 332 shareholders of record at August 5, 2011. The following table sets forth, for the period shown, the high and low sale prices of our Common Stock as reported by NASDAQ.

| Fiscal Year 2011 | Fiscal Year 2010 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter |

$ | 14.36 | $ | 11.09 | $ | 10.61 | $ | 8.76 | ||||||||

| Second Quarter |

15.68 | 11.99 | 11.95 | 9.90 | ||||||||||||

| Third Quarter |

17.19 | 14.56 | 12.26 | 10.22 | ||||||||||||

| Fourth Quarter |

17.80 | 13.76 | 15.50 | 11.62 | ||||||||||||

14

Sales of Unregistered Securities.

We did not make any unregistered sales of our securities during the quarter ended May 31, 2011.

Securities Authorized for Issuance Under Equity Compensation Plans.

The following table provides information as of May 31, 2011 with respect to shares of our Common Stock that may be issued under our existing stock incentive plans, all of which were approved by our shareholders:

EQUITY COMPENSATION PLAN INFORMATION

| Number of shares of common stock to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted-average exercise price of outstanding options, warrants and rights (b) |

Number of shares of common stock remaining available for future issuance under equity compensation plans (excluding shares reflected in column (a)) (c) | ||

| 36,000 |

$17.69 | 669,099 |

Stock Repurchases.

We have from time to time repurchased shares of our common stock under an authorization from our Board of Directors. Shares repurchased by us are retired and returned to the status of authorized but unissued stock.

We did not repurchase any shares in fiscal 2011. During fiscal 2010 and 2009, we repurchased 44,114 and 2,138,057 shares of our common stock, respectively. We may choose to make additional open market or other purchases of our common stock in the future, but we have no commitment to do so.

Dividends.

Since July 2007, we have been paying quarterly dividends in each January, April, July and October. The total amount of cash dividends we paid in fiscal 2011, 2010 and 2009 is discussed under “Item 7. Management’s Discussion and Analysis and Results of Operations-Liquidity and Capital Resources.” We expect to continue paying a quarterly dividend in future quarters, although the amount and timing of dividends, if any, will be made by our Board of Directors in each quarter, subject to compliance with applicable law.

15

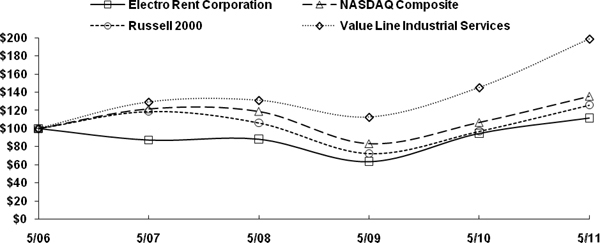

Performance Graph.

This graph compares our total shareholder return with (1) the NASDAQ (US) Index, (2) the Russell 2000 Index, and (3) the composite prices of the companies listed by Value Line, Inc. in its Industrial Services Industry Group. Our Common Stock is listed in both the Russell 2000 Index and the Industrial Services Industry Group. The comparison is over a five year period, beginning May 31, 2006 and ending May 31, 2011. The total shareholder return assumes $100 invested at the beginning of the period in our Common Stock and in each index. It also assumes reinvestment of all dividends.

Cumulative Five Year Total Return

Value of $100 Invested on May 31, 2006

Fiscal Years Ended May 31

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |||||||||||||||||||

| Electro Rent Corporation |

100 | 87 | 88 | 64 | 95 | 111 | ||||||||||||||||||

| NASDAQ Composite |

100 | 122 | 119 | 84 | 107 | 135 | ||||||||||||||||||

| Russell 2000 |

100 | 119 | 106 | 73 | 97 | 126 | ||||||||||||||||||

| Value Line Industrial Services |

100 | 129 | 131 | 113 | 145 | 199 | ||||||||||||||||||

16

Item 6. Selected Financial Data.

(in thousands, except per share amounts)

The following selected consolidated financial data should be read in conjunction with our audited consolidated financial statements and the accompanying notes included in Item 8. Financial Statements and Supplementary Data below and other financial and statistical information included in this Form 10-K.

| Fiscal year ended May 31, | ||||||||||||||||||||

| 2011 | 2010 (1) | 2009 | 2008 | 2007 | ||||||||||||||||

|

|

||||||||||||||||||||

| Operations data: |

||||||||||||||||||||

| Revenues |

$ | 228,729 | $ | 145,867 | $ | 130,481 | $ | 144,536 | $ | 126,859 | ||||||||||

|

|

||||||||||||||||||||

| Costs of revenues and depreciation |

134,571 | 81,666 | 68,630 | 69,901 | 55,848 | |||||||||||||||

| Selling, general and administrative expenses |

57,423 | 46,447 | 44,456 | 43,940 | 42,000 | |||||||||||||||

| Bargain purchase gain (2) |

(202 | ) | (679 | ) | — | — | — | |||||||||||||

| Interest and other, net |

(352 | ) | (1,599 | ) | (1,507 | ) | (3,292 | ) | (5,440 | ) | ||||||||||

|

|

||||||||||||||||||||

| Income before income taxes |

37,289 | 20,032 | 18,902 | 33,987 | 34,451 | |||||||||||||||

| Income tax provision |

13,533 | 8,435 | 7,150 | 12,883 | 13,402 | |||||||||||||||

|

|

||||||||||||||||||||

| Net income |

$ | 23,756 | $ | 11,597 | $ | 11,752 | $ | 21,104 | $ | 21,049 | ||||||||||

|

|

||||||||||||||||||||

| Earnings per share: |

||||||||||||||||||||

| Basic |

$ | 0.99 | $ | 0.48 | $ | 0.47 | $ | 0.81 | $ | 0.82 | ||||||||||

| Diluted |

$ | 0.99 | $ | 0.48 | $ | 0.47 | $ | 0.81 | $ | 0.81 | ||||||||||

| Shares used in per share calculation: |

||||||||||||||||||||

| Basic |

23,974 | 23,932 | 24,899 | 25,910 | 25,716 | |||||||||||||||

| Diluted |

24,072 | 24,004 | 24,980 | 26,079 | 26,053 | |||||||||||||||

| Balance sheet data (at end of year): |

||||||||||||||||||||

| Total assets |

$ | 305,927 | $ | 276,068 | $ | 271,334 | $ | 293,082 | $ | 284,819 | ||||||||||

| Shareholders’ equity |

$ | 240,375 | $ | 229,962 | $ | 228,753 | $ | 256,108 | $ | 243,479 | ||||||||||

| Shareholders’ equity per common share |

$ | 10.02 | $ | 9.60 | $ | 9.55 | $ | 9.87 | $ | 9.43 | ||||||||||

| Cash dividends declared per common share |

$ | 0.60 | $ | 0.45 | $ | 0.75 | $ | 0.35 | $ | 0.10 | ||||||||||

| (1) | Includes the operating results and balance sheet information of the assets acquired from Telogy from March 31, 2010, the closing date of the acquisition (see Note 4 to the consolidated financial statements included in this Form 10-K). |

| (2) | The estimated fair value of the net assets acquired from Telogy exceeded the acquisition cost, resulting in a bargain purchase gain with respect to this transaction. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

(in thousands, except per share amounts)

The following discussion of our financial condition and results of operations should be read in conjunction with the consolidated financial statements and the notes thereto and the other financial and statistical information appearing elsewhere in this Form 10-K.

Overview

We are one of the largest global organizations devoted to the rental, lease and sale of new and used electronic T&M equipment. We purchase that equipment from leading manufacturers such as Agilent and Tektronix primarily for use by our customers in the aerospace, defense, telecommunications, electronics, industrial and semiconductor industries. Although it represents only approximately 8%, 13% and 18% of our revenues in fiscal 2011, 2010 and 2009, respectively, we believe our DP division is one of the largest

17

rental businesses in the United States for personal computers and servers from manufacturers including Dell, HP/Compaq, IBM and Toshiba.

We have also recently expanded our efforts in the rental, lease and sale of industrial equipment such as electrical test equipment and inspection equipment. Our resale agreement with Agilent gives us the exclusive right to sell Agilent’s more complex T&M equipment to small and medium size customers (who previously purchased directly from Agilent) in the United States and Canada. We began selling T&M equipment under the resale agreement during our third quarter of fiscal 2010. We have added approximately 58 people to our sales and support staff to serve these customers, and this agreement is material to our operations.

On March 31, 2010, we completed the acquisition of certain assets (including accounts receivable and rental equipment but excluding certain designated assets) and select liabilities of Telogy, LLC (“Telogy”), for $24.7 million in cash, subject to post-closing adjustments. The purchase price was reduced by $0.3 million in fiscal 2011 reflecting the final determination of assets acquired and other components of the purchase price in accordance with specific provisions of the asset purchase agreement with Telogy. Telogy, headquartered in Union City, California, was a leading provider of electronic T&M equipment in North America. We accounted for the acquisition under Accounting Standards Codification (“ASC”) 805, Business Combinations. (See Note 4 to the consolidated financial statements included in this Form 10-K.)

Our financial results for fiscal 2010 were impacted by competitive pressure on rental rates due in large part to the recession in the U.S. and our major international markets. However, our utilization rates improved due to an increase in demand and equipment on rent. During fiscal 2011, we have seen a modest improvement in our T&M and DP rental rates and a significant increase in our equipment on rent, while maintaining a high utilization rate, in particular in our North American and European operations. As a result of these improvements, our recent acquisition of Telogy, and sales of T&M equipment in connection with our Agilent resale agreement, we have experienced substantial growth in revenues and operating profit for fiscal 2011. Despite this growth, our customers and competitors continue to be affected by the recent recession in the U.S. and global economy, resulting in more stringent credit requirements and reduced access to capital. We must continue to be focused on remaining profitable in the current conditions, as well as being prepared for the possibility that recessionary trends may continue in future periods.

In fiscal 2011, 86% of our rental and lease revenues was derived from T&M equipment, compared to 83% for fiscal 2010. We have experienced growth in both our T&M and DP rental revenues, due to increased rental activity and a modest increase in our T&M and DP rental rates. Our T&M rental revenues for fiscal 2011 and the fourth quarter of fiscal 2010 include the rental revenues acquired from Telogy.

For fiscal 2011, rental revenues were 90% of our rental and lease revenues, compared to 86% for the fiscal 2010. The increase is the result of an increase in our T&M and DP rental activity, including the rental revenues associated with assets acquired from Telogy, while our lease revenues declined due to a decrease in demand for DP leases.

To maximize our overall profit from the rental, leasing, and sales of equipment, we manage our equipment pool on an on-going basis by controlling the timing, pricing and mix of our purchases and sales of equipment. We acquire new and used equipment to meet current technological standards and current and anticipated customer demand, and we sell our used equipment where we believe that is the most lucrative option. We employ a complex equipment management strategy and our proprietary PERFECT™ software to adjust our inventory and pricing on a dynamic basis in order to maximize equipment availability, utilization and profitability. We manage each specific equipment class based on a separate assessment of that equipment’s historical and projected life cycle and numerous other factors, including the U.S. and global economy, interest rates and new product launches. If we do not accurately predict market trends, or if demand for the equipment we supply declines, we can be left with inventory that we are unable to rent or sell for a profit. We assess the carrying value of the equipment pool on a quarterly basis or more frequently when factors indicating potential impairment are present.

18

Profitability and key business trends

Comparing fiscal 2011 to fiscal 2010, our revenues increased by 56.8% from $145.9 million to $228.7 million, our operating profit increased 100.4% from $18.4 million to $36.9 million and our net income increased by 104.8% from $11.6 million to $23.8 million.

Our rental and lease revenues increased 25.3% from $94.2 million to $118.0 million. The increase in our rental and lease revenues reflects increased rental activity and T&M and DP rental rates in our North American and European operations, which are attributable to improved market conditions and the T&M rental revenues acquired from Telogy.

In addition, our T&M sales activity increased 120.1% from $49.3 million to $108.5 million. The increase in our T&M sales activity is due to new equipment sales in connection with our Agilent resale agreement, and an increase in our used equipment sales attributable to improved demand and pricing. The increase in T&M sales more than offset declines in revenues from finance leases and distribution sales.

Some of our key profitability measurements are presented below:

| Fiscal 2011 | Fiscal 2010 | Fiscal 2009 | ||||||||||

|

|

||||||||||||

| Net income per diluted common share (EPS) |

$ | 0.99 | $ | 0.48 | $ | 0.47 | ||||||

| Net income as a percentage of average assets |

8.2 | % | 4.2 | % | 4.2 | % | ||||||

| Net income as a percentage of average equity |

10.3 | % | 5.2 | % | 4.9 | % | ||||||

|

|

||||||||||||

The increase in our operating profit is due primarily to a significant increase in rental revenues and sales of new equipment for fiscal 2011. The increase was partially offset by an increase in depreciation expense of $5.3 million, or 12.5%, as we have invested in additional rental equipment to support our growth, and an increase in selling, general and administrative expenses of $11.0 million, or 23.6%, primarily related to our hiring of sales and support staff in connection with our Agilent resale agreement.

The amount of our equipment on rent, based on acquisition cost, increased 7.5% to $214.5 million at May 31, 2011 from $199.5 million at May 31, 2010. Acquisition cost of equipment on lease decreased 2.8% to $27.8 million at May 31, 2011 from $28.6 million at May 31, 2010.

The average amount of our equipment on rent, based on average acquisition cost, increased 28.8% to $212.1 million for fiscal 2011 from $164.7 million for fiscal 2010. The average acquisition cost of equipment on lease increased 2.4% to $28.7 million for fiscal 2011 from $28.0 million for fiscal 2010.

Average rental rates for our T&M and DP segments increased by 2.4% for fiscal 2011 from fiscal 2010, while average lease rates declined by 9.4% for the same period. Average utilization for our T&M equipment pool, based on average acquisition cost of equipment on rent and lease compared to the total average equipment pool, was 70.0% for fiscal 2011 compared to 65.1% for fiscal 2010. Over the same period, the average utilization of our DP equipment pool decreased to 41.9% from 43.7%.

RESULTS OF OPERATIONS

Fiscal 2011 Compared with Fiscal 2010

Total Revenues: Total revenues for fiscal 2011 and 2010 were $228.7 million and $145.9 million, respectively. The 56.8% increase in total revenues was due to a 25.3% increase in rental and lease revenues and a 114.2% increase in sales of equipment and other revenues.

Rental and lease revenues for fiscal 2011 were $118.1 million, compared to $94.2 million for the same period of the prior fiscal year. This increase reflects an increase in our T&M and DP rental activity and rental rates in our North American and European operations, due to improved market conditions, the

19

acquisition of Telogy in the fourth quarter of fiscal 2010, and an increase in T&M leasing activity that was partially offset by a continued decline in DP leasing demand.

Sales of equipment and other revenues increased to $110.7 million for fiscal 2011 from $51.7 million in fiscal 2010. The increase is due to the full year effect of sales of new T&M equipment through our Agilent resale agreement and an increase in our sales of used equipment in our T&M business, due in part to a large sale to a customer, partially offset by a decline in finance lease activity and distribution sales. Our unfilled orders for T&M equipment relating to our resale agreement were $17.0 million at May 31, 2011, compared to $9.7 million at May 31, 2010. We terminated our distribution agreement with Agilent (which was replaced with the resale agreement) on January 31, 2010.

Depreciation of Rental and Lease Equipment: Depreciation of rental and lease equipment increased in fiscal 2011 to $47.9 million, or 40.6% of rental and lease revenues, from $42.6 million, or 45.2% of rental and lease revenues, in fiscal 2010. The increased depreciation expense in fiscal 2011 was due to a higher average rental and lease equipment pool, while the decreased ratio, as a percentage of rental and lease revenues, was due to higher average utilization for fiscal 2011.

Costs of Revenues Other Than Depreciation: Costs of revenues other than depreciation increased 121.8% to $86.6 million in fiscal 2011 from $39.1 million in fiscal 2010. Costs of revenues other than depreciation primarily includes the cost of equipment sales, which increased as a percentage of equipment sales to 77.0% in fiscal 2011 from 73.2% for fiscal 2010. This increase is due to an increase in sales of new T&M equipment through our Agilent resale agreement, which generally carry a lower margin than used equipment sales. Our sales margin is expected to continue to decline as a result of anticipated growth in connection with our resale agreement. Our sales margin is also impacted by competition, the global recession, and customer requirements and funding.

Selling, General and Administrative Expenses: Selling, general and administrative expenses increased 23.6% to $57.4 million in fiscal 2011 compared to $46.4 million in fiscal 2010. Our selling, general and administrative expenses increased primarily due to additional sales and support staff in connection with our Agilent resale agreement. As a percentage of total revenues, selling, general and administrative expenses decreased to 25.1% in fiscal 2011 from 31.8% in fiscal 2010, due to the increase in total revenues.

Operating Profit: As a result of significant growth in both our rental and lease revenues and our sales of equipment and other revenues, due to improved market conditions, the acquisition of Telogy in the fourth quarter of fiscal 2010, and sales of new T&M equipment in connection with our Agilent resale agreement, operating profit increased 100.4% to $36.9 million, or 16.1% of total revenues, in fiscal 2011, compared to an operating profit of $18.4 million, or 12.6% of total revenues, in fiscal 2010.

Interest Income, Net: Interest income, net, was $0.4 million in fiscal 2011, compared to $1.6 million in fiscal 2010, due to a lower cash balance, lower interest rates on our money market funds, and the redemption of our auction rate securities (“ARS”) (which carried a higher interest rate) in our first fiscal quarter of fiscal 2011.

Income Tax Provision: Our effective tax rate was 36.3% for fiscal 2011, compared to 42.1% for fiscal 2010. The decrease is due primarily to the derecognition of $1.4 million of interest and penalties resulting from the effective settlement of our uncertain tax positions in fiscal 2011. (See Note 7 to our consolidated financial statements included in this Form 10-K.)

Fiscal 2010 Compared with Fiscal 2009

Total Revenues: Total revenues for fiscal 2010 and 2009 were $145.9 million and $130.5 million, respectively. The 11.8% increase in total revenues was due to a 61.0% increase in sales of equipment and other revenues, partially offset by a decrease in rental and lease revenues of 4.3%.

Rental and lease revenues in fiscal 2010 were $94.2 million, compared to $98.4 million in fiscal 2009. This decrease reflected a decline in our DP lease revenues, primarily due to lower demand for leases,

20

and a decrease in DP rental revenues, while our T&M rental and lease revenues remained essentially unchanged from fiscal 2009. Rental rates decreased for both our DP and T&M businesses, reflecting increased competitive pressures and the global recession. This decrease was partially offset by an increase in our T&M rental and lease activity, due in part to the Telogy acquisition.

Sales of equipment and other revenues increased to $51.7 million for fiscal 2010 from $32.1 million in fiscal 2009. The increase was primarily due to an increase in used equipment sales in our T&M business, increased finance lease activity, resulting from a large sale to a customer and continued development of our vendor leasing program that provides customers with flexible financing alternatives, and sales of T&M equipment through our new Agilent resale agreement. Our unfilled orders for T&M equipment relating to our resale agreement were $9.7 million at May 31, 2010. Distribution sales in fiscal 2010 declined as a result of the termination of our Agilent distribution agreement on January 31, 2010.

Depreciation of Rental and Lease Equipment: Depreciation of rental and lease equipment decreased in fiscal 2010 to $42.6 million, or 45.2% of rental and lease revenues, from $46.1 million, or 46.8% of rental and lease revenues, in fiscal 2009. The decreased depreciation expense in fiscal 2010 was due to a sale of excess T&M equipment, while the decreased depreciation ratio, as a percentage of rental and lease revenues, reflected the lower equipment level during most of the year and higher utilization.

Costs of Revenues Other Than Depreciation: Costs of revenues other than depreciation increased 73.0% to $39.1 million in fiscal 2010 from $22.6 million in fiscal 2009. Costs of revenues other than depreciation primarily includes the cost of equipment sales, which increased as a percentage of equipment sales to 73.2% in fiscal 2010 from 67.3% in fiscal 2009. This increase reflected a decline in our used equipment sales margin, resulting from competitive pressures and the global recession, and an increase in our lower margin finance leases. In addition, fiscal 2010 includes sales of T&M equipment through the Agilent resale agreement, which generally carry a lower margin. Our sales margin is also impacted by competition, the global recession, and customer requirements and funding.

Selling, General and Administrative Expenses: Selling, general and administrative expenses increased 4.5% to $46.4 million in fiscal 2010 compared to $44.5 million in fiscal 2009. Our selling, general and administrative expenses increased primarily due to additional sales and support staff in connection with our new Agilent resale agreement, and $0.2 million in transition costs related to the Telogy acquisition, partially offset by several cost cutting measures that we introduced at the beginning of fiscal 2010 to control or reduce our selling, general and administrative expenses in response to the recession in the U.S. and our major international markets. As a percentage of total revenues, selling, general and administrative expenses decreased to 31.8% in fiscal 2010 from 34.1% in fiscal 2009, due to an increase in total revenues.

Operating Profit: As a result of significant growth in our sales of equipment and other revenues and a gain on bargain purchase of $0.7 million as a result of the Telogy acquisition, operating profit increased 6.0% to $18.4 million, or 12.6% of total revenues, in fiscal 2010, compared to an operating profit of $17.4 million, or 13.3% of total revenues, in fiscal 2009.

Interest Income, Net: Interest income, net, was $1.6 million in fiscal 2010, compared to $1.5 million in fiscal 2009. Interest income, net, includes $0.7 million of unrealized losses on our put option to UBS AG (“UBS”) which were offset by a related $0.7 million of unrealized gains on our investments, trading.

Income Tax Provision: Our effective tax rate was 42.1% for fiscal 2010, compared to 37.8% for fiscal 2009. The increase was due primarily to changes in tax estimates, a valuation allowance on tax benefits for certain foreign subsidiary losses and a reduction of the benefit from tax-advantaged investments.

Liquidity and Capital Resources

Capital Expenditures. During the last three fiscal years, our primary capital requirements have been purchases of rental and lease equipment. We generally purchase equipment throughout the year to replace equipment that has been sold and to maintain adequate levels of rental equipment to meet existing and expected customer demands. To meet T&M rental demand, support areas of potential

21

growth for both T&M and DP equipment and to keep our equipment pool technologically up-to-date, we made payments for purchases of $91.5 million of rental and lease equipment during fiscal 2011, $79.8 million in fiscal 2010, and $52.0 million in fiscal 2009. In response to increasing customer demand beginning in the second half of fiscal 2010 and continuing throughout fiscal 2011, purchases of equipment in fiscal 2011 were 14.7% higher than fiscal 2010. Capital expenditures for fiscal 2010 include $22.9 million of rental and lease equipment acquired from Telogy.

Share Repurchases and Dividends. We periodically repurchase shares of our common stock under an authorization from our board of directors. Shares we repurchase are retired and returned to the status of authorized but unissued stock. During fiscal 2010 and 2009, we repurchased 44 and 2,138 shares of our common stock, respectively, for $0.4 million and $22.8 million, respectively, at an average price per share of $8.94 and $10.67, respectively. There were no shares repurchased in fiscal 2011. We may make repurchases of our common stock in the future through open market transactions or otherwise, but we have no commitments to do so.

For fiscal 2011, 2010 and 2009, we paid aggregate dividends of $14.4 million, $14.4 million and $15.0 million, respectively. We expect to continue paying a quarterly dividend in future quarters, although the amount and timing of dividends, if any, will be made at the discretion of our board of directors in each quarter, subject to compliance with applicable law.

Dividend and Repurchase Summary

| Fiscal Year Ended May 31, | ||||||||||||||||

| (in thousands, except per share information) | Three Year Totals |

2011 | 2010 | 2009 | ||||||||||||

|

|

||||||||||||||||

| Cash dividends paid |

$ | 43,839 | $ | 14,449 | $ | 14,360 | $ | 15,030 | ||||||||

| Shares repurchased |

2,182 | — | 44 | 2,138 | ||||||||||||

| Average price per share repurchased |

$ | 10.64 | $ | — | $ | 8.94 | $ | 10.67 | ||||||||

| Aggregate purchase price |

$ | 23,208 | $ | — | $ | 395 | $ | 22,813 | ||||||||

| Total cash returned to shareholders |

$ | 67,047 | $ | 14,449 | $ | 14,755 | $ | 37,843 | ||||||||

|

|

||||||||||||||||

Cash and Cash Equivalents and Investments. Despite the $67.0 million in cash we have returned to our shareholders over the past three fiscal years, and the $24.7 million we paid in connection with the Telogy acquisition in fiscal 2010, we continue to maintain $41.4 million in cash and cash equivalents. We expect that the level of our cash and cash equivalents and investments may decrease as we pay dividends in future quarters, or if we decide to buy back additional shares of our common stock, increase equipment purchases in response to demand, finance another acquisition, or pursue other opportunities. We primarily invest our cash balance in money market funds, and corporate and government bond funds.

At May 31, 2010, we held $14.3 million, at cost, in ARS, which we classified as investments, trading.

On November 6, 2008, we accepted an offer from UBS providing us with rights related to our ARS (the “Rights”). The Rights permitted us to require UBS to purchase our ARS at par value, defined as the price equal to the liquidation preference of the ARS plus accrued but unpaid dividends or interest, at any time between June 30, 2010 and July 2, 2012. During the first quarter of fiscal 2011, UBS purchased our remaining ARS of $14.3 million at par value.

During the second quarter of fiscal 2010, we sold our investments available-for-sale, which consisted of corporate and government bond funds, for $28.8 million, including a realized gain of $0.8 million, included in interest income, net, in our consolidated statements of operations.

Cash Flows and Credit Facilities. We have three principal sources of liquidity: cash flows provided by our operating activities, proceeds from the sale of equipment from our portfolio, and external funds that historically have been provided by bank borrowings.

22

During fiscal 2011, 2010, and 2009 net cash provided by operating activities was $68.8 million, $34.2 million and $59.0 million, respectively. The increase in operating cash flow for fiscal 2011 compared to fiscal 2010 was due primarily to:

| • | an increase in net income to $23.8 million for fiscal 2011 from $11.6 million for fiscal 2010; and |

| • | an increase in our deferred tax liability of $23.5 million, due to the effective settlement of $4.5 million in unrecognized tax positions during fiscal 2011, and the enactment of bonus depreciation, which significantly increased our tax depreciation expense for fiscal 2011 and retroactively for our fiscal year ended May 31, 2010, resulting in deferral of payment of our current year tax expense of $13.5 million, and a refund of prior year taxes paid of $6.7 million. |

This increase was partially offset by an increase in other assets of $8.9 million for fiscal 2011 due to an increase in our demonstration pool inventory of $3.1 million and recording of an income tax receivable of $3.1 million.

The decrease in operating cash flow for fiscal 2010 compared to fiscal 2009 was due primarily to: