Attached files

Exhibit 99.2

Summary

The following summary does not contain all of the information that you should consider before investing in the notes. You should read this entire offering memorandum carefully, including the matters discussed in the section titled “Risk factors” and the detailed information and financial information included in this offering memorandum.

Our Company

We are a leading global forest products company with a significant regional and global market presence in newsprint, coated mechanical and specialty papers, pulp and wood products. We are also one of world’s largest recyclers of newspapers and magazines. We were formed through the October 2007 combination of Abitibi and Bowater, which we refer to as the “combination.”

Through our subsidiaries, we currently own or operate 18 pulp and paper manufacturing facilities located in Canada, the United States and South Korea and 24 wood products facilities located in Canada. Excluding currently idled facilities, we have annual production capacity of approximately 6.0 million metric tons of a broad range of printing and writing papers such as newsprint, coated mechanical and specialty papers, which are sold to leading publishers, commercial printers and advertisers. In addition, we sell approximately 1.0 million metric tons of market pulp to paper, tissue and toweling manufacturers. Our sawmills, engineered wood products facilities and remanufacturing locations produce products primarily for new residential construction, and we either use the wood fiber residuals from this business to produce pulp and paper or sell the residuals on the open market.

For the last twelve months ended June 30, 2010, we generated revenues and Adjusted EBITDA of $4.5 billion and $196 million, respectively, and we generated revenue and Adjusted EBITDA of $4.5 billion and $242 million, respectively, for the last twelve months ended July 31, 2010 (see “Reconciliation of non-GAAP information” for information regarding our Adjusted EBITDA).

Our products

We manage our business along the following key business segments—newsprint, coated paper, specialty papers, market pulp and wood products. In general, our products are globally-traded commodities and are marketed in more than 70 countries.

Newsprint

We are among the largest producers of newsprint in the world by capacity, with operating capacity of approximately 3.3 million metric tons, or 9% of total worldwide capacity as of June 30, 2010. In addition, we are the largest North American producer of newsprint and have capacity of approximately 3.1 million metric tons or approximately 37% of total North American capacity. As of June 30, 2010, we owned or operated 12 newsprint facilities in North America and South Korea. We supply leading publishers with top-quality newsprint, including eco-friendly products made with 100% recycled fiber. For the six months ended June 30, 2010, approximately 50% of our total newsprint shipments were to markets outside of North America. These markets have exhibited better demand trends than North America. For the twelve months ended June 30, 2010, our newsprint segment had revenues of approximately $1.8 billion, or approximately 39% of our total revenues for such period.

1

Coated papers

We produce coated papers at our Catawba, South Carolina facility. With capacity of approximately 658,000 metric tons, or 14% of total North American capacity, as of June 30, 2010, we are one of the largest producers of coated mechanical paper in North America. Our coated papers are used in magazines, catalogs, books, retail advertising, direct mail and coupons. We sell coated papers to major commercial printers, publishers, catalogers and retailers. For the twelve months ended June, 30, 2010, our coated papers segment had revenues of approximately $428 million, or approximately 9% of our total revenues for such period.

Specialty papers

We produce specialty papers at nine facilities in North America. With operating capacity of approximately 1.8 million metric tons as of June 30, 2010, or 35% of total North American capacity, we are one of the largest producers of specialty papers in North America, including super-calendared, super-bright, high bright, bulky book and directory papers and kraft papers. Our specialty papers are used in books, retail advertising, direct mail, coupons and other commercial printing and packaging applications. For the twelve months ended June 30, 2010, our specialty papers segment had revenues of approximately $1.3 billion, or approximately 29% of our total revenues for such period.

Market pulp

Wood pulp is the most common material used to make paper. Pulp shipped and sold as pulp, as opposed to being processed into paper in the same facility, is commonly referred to as market pulp. As of June 30, 2010, we had capacity of approximately 1.1 million metric tons of market pulp at five facilities in North America, which represented approximately 7% of total North American capacity. Market pulp is used to make a range of consumer products including tissue, packaging, specialty paper products, diapers and other absorbent products. For the twelve months ended June 30, 2010, our market pulp segment had revenues of approximately $634 million, or approximately 14% of our total revenues for such period.

Wood products

We operate 18 sawmills in Canada that produce construction grade lumber sold in North America. We also operate two engineered wood products facilities in Canada that produce products for specialized applications, such as wood i-joists for beam replacement, and four remanufacturing facilities in Canada that produce roofing and flooring material and other products. We sell pulpwood, saw timber and woodchips to customers located in Canada and the United States. For the twelve months ended June 30, 2010, our wood products segment had revenues of approximately $391 million, or approximately 9% of our total revenues for such period.

Competitive strengths

We believe that the following are competitive strengths that provide us with a strong foundation to execute on our strategy and earn an acceptable return on capital:

2

Global leader in the forest products industry

We are a global leading manufacturer of newsprint, coated mechanical paper, specialty papers and market pulp, with locations in the U.S., Canada and Korea. According to RISI, we have established a global leadership position in newsprint and leading North American positions in our key segments based on annual manufacturing capacity, including: #1 in newsprint, #3 in coated paper, #1 in mechanical specialty papers and #6 in market pulp. We believe our leading positions provide us and our customers with competitive advantages, including significant economies of scale, extensive sales and marketing coverage in over 70 countries and what we believe to be best-in-class product offerings.

Highly competitive cost structure

Due to the aggressive cost reduction and mill rationalization actions we have taken since the combination, we believe we are among the lowest cost producers in our paper grades in the North American forest products industry. We believe that our mills have significant cost advantages as a result of their high efficiency levels, strong economies of scale and access to low cost sources of energy and fiber furnish. In addition, based on PPPC data, our restructuring actions have resulted in ten of our 12 newsprint mills now being in the lower half of the cost curve for all North American newsprint mills. Our Catawba mill is also consistently ranked as one of the lowest cost producers of coated mechanical paper in North America. Our restructuring process (discussed below under “—Plans of Reorganization”) also has provided us with the ability to reject and repudiate a number of burdensome and disadvantageous contracts and unexpired leases, negotiate labor cost reductions and obtain funding relief in respect of the solvency deficit in our Canadian pension plans. Since the time of the combination, we have lowered our workforce by 6,800 employees or 38%. Our workforce reduction efforts, in addition to improved plant efficiencies and increased scalability, have enabled us to reduce our selling, general and administrative expense (“SG&A”) by approximately 50% since 2007.

Diversified product mix and end markets

We offer a diverse range of products to various end markets that help us mitigate the impact of volatility in any particular product category or end market, which we believe reduces our operating risk. For the twelve months ended June 30, 2010, our sales percentage by category was newsprint at 39%, coated paper at 9%, specialty papers at 29%, market pulp at 14% and wood products at 9%. Our international sales have grown to 31% of our revenues for the twelve month period ended June 30, 2010, including 12% and 10% sold into Latin America and Asia, respectively. Importantly, with newsprint in a long-term decline in North America, given our leading global position, we have focused our efforts on selling production into the export market and for the six months ended June 30, 2010, approximately 50% of our total newsprint shipments were to the export market.

Capital structure flexibility

We expect to emerge from the restructuring process with a realigned capital structure and healthier balance sheet, with approximately $1.1 billion in debt. Our liquidity (cash position plus committed but undrawn lines of credit under our borrowing base for our asset-based revolving credit facility) is expected to be approximately $600 million at emergence, and our asset based revolving credit facility is not expected to have any financial maintenance covenants unless our

3

liquidity drops below a minimum threshold level. See “Description of certain indebtedness—ABL Credit Facility.” We believe our realigned capital structure will provide us with greater financial flexibility, which will enable us to better react to changing market conditions and potential opportunities.

Experienced leadership team

We have a highly experienced management team. During our restructuring, we have streamlined our management structure and have successfully retained our key management talent. We believe this has provided us with the established leadership and functional experience necessary to help us execute our strategy, further reduce costs, enhance our competitive position and continue to help us improve our competitive position.

Our strategy

Key elements of our strategy to capitalize on our competitive position and enhance our returns on capital deployed are to:

Improve business mix

We plan to improve our business mix by focusing on grades that have and are expected to offer higher returns on capital. We believe we have cost effective opportunities to grow or convert newsprint capacity into coated and specialty papers and light-weight containerboard, which generally offer better demand characteristics, margins and returns compared to other, more commodity-like paper grades. In the second quarter of 2010, we converted our Coosa Pines newsprint mill to produce light-weight containerboard and other packaging grades. We are evaluating additional opportunities to convert some of our production capacity from less attractive grades to more attractive ones. By converting or closing some of our mills that were producing newsprint and other lower return grades, we believe that we can increase the capacity utilization across our mill system, improve the supply dynamics in these lower returning grades and enhance our return on capital.

Reduce our cost and increase operational flexibility

We continue to explore a variety of capital investment projects to significantly reduce our costs and increase operational flexibility similar to the recent streamlining of production at our Thunder Bay mill. At Thunder Bay, we idled paper machines for six months and restarted only the larger, more modern machine; renegotiated labor agreements; resized the workforce; rolled out a wage reduction across the woodlands operations; and renegotiated the power agreement. The combined changes resulted in a cash cost savings at the mill of over $150 per ton and we believe Thunder Bay is now one of the lowest cash cost mills in the industry. We believe additional initiatives of this nature would further improve our cost position, enhance our earnings potential and improve the cost competitiveness of our facilities. Furthermore, we expect that, following emergence and as a result of new labor agreements we have entered into during the first half of 2010 and management wage reductions, we will realize labor cost savings of approximately $95 million annually. In addition, we plan to further leverage our recycling system to provide low cost furnish to our mills system, giving us greater potential either to reduce furnish costs or offer higher margin products.

4

Target export markets with better newsprint demand

Although North American newsprint demand is expected to decline, RISI has projected that world newsprint demand will increase by about 1.6% per year from 2009 to 2012, with growth being strongest in Asia at 4.7%, Latin America at 4.9% and the Middle East at 5.6%. The growth in many of our international markets is primarily the result of increased urbanization trends, a rapidly growing middle class, lower Internet penetration rates per capita versus developed countries, economic growth and rising literacy rates. Accordingly, we will continue to focus on capitalizing on the growth of these markets. The location of our Eastern Canadian mills, which are on or near deep sea ports, allows us the flexibility to serve these higher growth markets. In addition, our Mokpo, South Korea newsprint mill will continue to focus on Southeast Asian markets, where demand for the first six months of the year increased approximately 10% compared to the same period in 2009. For the six months ended June 30, 2010, approximately 50% of our total newsprint shipments were to markets outside of North America.

Explore strategic opportunities

We believe there will be continued consolidation in the paper and forest products sector as we and our competitors continue to explore ways to increase efficiencies and diversify customer offerings. We believe this consolidation has been and will continue to be a benefit to our industry and our customers. Accordingly, from time to time, we expect to explore strategic opportunities to enhance our business and provide a good return on capital for our stakeholders. Additionally, we will continue to execute on our non-core asset sales program and use the proceeds to continue to improve our balance sheet or reinvest in our business.

Recent developments

July 2010 financial results

In the third quarter of 2010 our financial results continued to improve significantly. Sales in the month of July 2010 were approximately $374 million as compared to July 2009 sales of $339 million. July 2010 consolidated operating income was approximately $9 million as compared to a July 2009 consolidated operating loss of $45 million. EBITDA and Adjusted EBITDA for July 2010 was $12 million and $47 million, respectively, compared to July 2009 EBITDA of $47 million and Adjusted EBITDA of $0 million (which included $28 million of alternative fuel tax credits) (see “Reconciliation of non-GAAP information” for additional information regarding our calculation of EBITDA and Adjusted EBITDA). Product line contribution, which is before depreciation and SG&A, continued to improve in July 2010.

July 2010 newsprint sales volumes were approximately 219,000 metric tons compared to 255,000 metric tons for July 2009. Although our July 2010 newsprint sales volumes were below July 2009 levels, our newsprint product line contribution was approximately $14 million in July 2010 compared to a negative contribution of $16 million in July 2009, reflecting improved average transaction prices and lower cash costs per metric ton. Newsprint sales in July 2010 were approximately $135 million as compared to sales of $129 million for July 2009. Our newsprint average transaction price (international and North America) for July 2010 was approximately $616 per metric ton as compared to a June 2010 average of $595 per metric ton and July 2009 average of $506 per metric ton. Our newsprint average cash cost was approximately $473 per

5

metric ton in July 2010 as compared to $506 per metric ton in June 2010. The improvement in our newsprint average transaction price increase is a result of continued implementation of the North American and international newsprint price increases.

July 2010 coated papers sales volumes were 58,000 short tons as compared to sales volumes of 56,000 short tons in July 2009. Coated papers sales in July 2010 were approximately $42 million as compared to sales of $39 million in July 2009. Our coated papers product line contribution for July 2010 was approximately $9 million, as compared to $4 million in July 2009. Our coated papers average transaction price for July 2010 was approximately $731 per short ton, as compared to $684 per short ton for June 2010 and $708 per short ton for July 2009. On August 10, 2010 we announced a price increase of $60 per short ton effective for all North American shipments on or after September 15, 2010.

July 2010 specialty papers sales volumes were 157,000 short tons compared to July 2009 sales volumes of 151,000 short tons. Specialty papers sales in July 2010 were approximately $108 million as compared to sales of $105 million for July 2009. Our specialty papers product line contribution for July 2010 was approximately $10 million as compared to $10 million in July 2009. Our specialty papers average transaction price for July 2010 was approximately $687 per short ton as compared to $668 per short ton for June 2010 and $698 per short ton in July 2009. Our specialty papers July 2010 cash cost was $552 per short ton compared to $532 per short ton in July 2009. On August 10, 2010 we announced a price increase of $60 per short ton on super-calendered grades effective for all North American shipments on or after September 15, 2010.

July 2010 market pulp sales volumes were 76,000 metric tons, compared to sales volumes of 103,000 metric tons in July 2009. The July 2010 volumes were affected by the significant maintenance outages in June 2010 and July 2009 sales volumes were higher than normal due to timing of international shipments and inventory stocking by our customers. However, our market pulp product line contribution of $25 million significantly exceeded product line contribution of $1 million in July 2009. Market pulp sales in July 2010 were approximately $62 million as compared to $52 million in July 2009. Our market pulp average transaction price (all grades) for July 2010 was approximately $805 per metric ton as compared to $508 per metric ton in July 2009. Our July market pulp average cash cost per metric ton was $424 compared to a cash cost per metric ton of $414 for July 2009. In June 2010 we performed our annual kraft pulp mill outages at our Thunder Bay and Coosa Pines facilities. All of our 2010 annual kraft pulp mill maintenance outages have now been completed.

July 2010 wood product sales volumes were 114,000 mbf compared to sales volumes of 105,000 mbf in July 2009. Wood product sales in July 2010 were approximately $32 million as compared to sales of $29 million for July 2009. Our wood products division continued to perform well in July 2010 and again provided positive contribution of $3 million as compared to $2 million for July 2009. Average lumber transaction prices per unit declined in July 2010 to $266 per mbf, or approximately 7% from June 2010 ($287 per mbf) and were approximately 5% lower than July 2009 transaction prices of $281 per mbf. The decline in average transaction prices was offset by increased sales volumes in July 2010 and the continued maintenance of a low operating cash cost per unit business.

The results of operations for the month of July 2010 discussed above are not necessarily indicative of the operating results to be expected for any other month or for the full year.

6

NAFTA settlement

On August 24, 2010, we announced a formal settlement agreement with the government of Canada regarding the December 2008 expropriation of certain of our assets and rights in the province of Newfoundland and Labrador (Canada) by the provincial government pursuant to the Abitibi-Consolidated Rights and Assets Act, S.N.L. 2008, c.A-1.01 (“Bill 75”). Under the agreement, the government of Canada has agreed to pay our new Canadian operating entity Cdn$130 million (approximately US$125 million) following our emergence from the Creditor Protection Proceedings (as defined below under “—Plans of Reorganization”). Such proceeds would be used to reduce the principal amount of the Convertible Notes to be issued in the Rights Offering (as such terms are defined under “—Plans of Reorganization”). As part of the settlement agreement, we have agreed to waive our legal actions and claims against the government of Canada under the North American Free Trade Agreement (“NAFTA”). The settlement agreement is subject to the approval of its terms by each of the Courts (as defined below under “—Plans of Reorganization”), as well as the Courts’ approval of the Plans of Reorganization. A hearing to consider the agreement is scheduled for September 15, 2010.

Permanent mill closures

Also on August 24, 2010, we confirmed the permanent closure of our Gatineau and Dolbeau paper mills, located in the province of Quebec, representing approximately 360,000 metric tons of newsprint (approximately 10% of our current newsprint capacity) and 244,000 metric tons of commercial printing paper capacity (approximately 10% of our current commercial printing paper capacity), respectively. The Gatineau mill has been indefinitely idled since April 15, 2010 and the Dolbeau mill since June 20, 2009.

Resolution of Quebec Pension Situation

The Company’s principal Canadian operating subsidiaries, Abitibi-Consolidated Company of Canada and Bowater Canadian Forest Products Inc., entered into an agreement on September 13, 2010 with the Quebec provincial government related to funding relief in respect of the material aggregate solvency deficits in the registered pension plans they sponsor in the province. The agreement includes a number of undertakings on behalf of the Company’s post-emergence Canadian operating subsidiary, whom we refer to as “AbiBow Canada,” that would become effective upon our emergence from the Creditor Protection Proceedings and apply for five years. AbiBow Canada’s undertakings are a condition to the government adopting the necessary funding relief regulations in Quebec.

Consistent with our previously disclosed agreement in principle with the Quebec pension authorities, the funding relief regulations are expected to provide, among other things, that AbiBow Canada’s aggregate annual contribution in respect of the solvency deficits in its material Canadian registered pension plans for each year from 2011 through 2020 will be limited to the following: (i) a $50 million basic contribution; (ii) beginning in 2013, if the plans’ aggregate solvency ratio falls below a specified target for a year, an additional contribution equal to 15% of free cash flow up to $15 million per year; and (iii) beginning in 2016, if the amount payable for benefits in a year exceeds a specified threshold and the plans’ aggregate solvency ratio is more than 2% below the target for that year, a supplementary contribution equal to such excess (such supplementary contribution being capped at $25 million on the first occurrence only of

7

such an excess). Should a plan move into surplus during the 2011-2020 period, it will cease to be subject to this funding relief. After 2020, the funding rules in place at the time will apply to any remaining deficit.

In addition to our agreement not to terminate voluntarily any of our pension plans in Quebec before the Emergence Date, AbiBow Canada’s has undertaken to:

| • | Not pay a dividend at any time when the weighted average solvency ratio of its pension plans in Quebec is less than 80%; |

| • | Abide by the compensation plan detailed in the Plans of Reorganization with respect to salaries, bonuses and severance; |

| • | Direct at least 60% of the maintenance and value-creation investments earmarked for the Company’s Canadian pulp and paper operations to projects in Quebec; |

| • | Invest at least $75 million in strategic projects in Quebec over a five-year period; |

| • | Maintain the Company’s head office and the current related functions in Quebec; |

| • | Make a $75 additional solvency deficit reduction contribution to its pension plans over four years for each metric ton of capacity reduced in the event of downtime of more than 6 consecutive months or 9 cumulative months over a period of 18 months; and |

| • | Create a diversification fund by contributing $2 million per year for five years for the benefit of the municipalities and workers in the Company’s Quebec operating regions. |

The adoption of satisfactory funding relief regulations in the provinces of Quebec and Ontario in respect of the material aggregate solvency deficits in the registered pension plans is a condition precedent to the implementation of the Plans of Reorganization. The province of Quebec’s enactment of the funding relief regulations described above is conditional upon the province of Ontario taking equivalent measures for the Company pension plans under its jurisdiction. We are now moving forward with similar discussions with the province of Ontario’s pension and finance authorities. There can be no assurance that those discussions will be successful.

ACH Limited Partnership

We are currently in the process of evaluating the potential sale of ACH Limited Partnership (“ACH”), in which we own a 75% interest. ACH operates three hydroelectric facilities in the province of Ontario. ACH was not a debtor in the Creditor Protection Proceedings (as defined below under “—Plans of Reorganization”), and ACH’s Cdn$255 million of debt (approximately US$239 million) is expected to be assumed by the buyer in any sale. No final determinations have been made with respect to the sale of ACH and we expect any such sale will not be consummated until after we have emerged from the Creditor Protection Proceedings. If any sale is completed within six months of the Emergence Date, we will use the cash proceeds from any such sale to reduce the principal amount of the Convertible Notes to be issued in the Rights Offering (as such terms are defined below under “—Plans of Reorganization”).

8

Escrow offering

This offering is occurring in connection with our emergence from the Creditor Protection Proceedings. The Plans of Reorganization (as defined below under “—Plans of Reorganization”) have not yet been confirmed. Confirmation hearings with respect to the Plans of Reorganization are scheduled with the U.S. Court (as defined below under “—Plans of Reorganization”) and Canadian Court (as defined below under “—Plans of Reorganization”) for September 24, 2010 and September 20, 2010, respectively.

The notes will be issued by the Escrow Issuer, a wholly-owned subsidiary of AbitibiBowater created solely to issue the notes. The Escrow Issuer will deposit the net proceeds of this offering into a segregated escrow account until the date that the Escrow Conditions are satisfied. The net proceeds of the notes, together with cash necessary to fund any required special mandatory redemption, will be pledged as security for the benefit of the noteholders and upon satisfaction of the Escrow Conditions, the net proceeds will be released to AbitibiBowater and used as set forth under “Use of proceeds.”

If the Escrow Conditions are satisfied, the Escrow Issuer will merge with and into AbitibiBowater, with AbitibiBowater as the surviving entity. Upon the consummation of the merger, AbitibiBowater will assume all of the obligations of the Escrow Issuer, the guarantees of the guarantors will become effective and the notes and the guarantees will be secured as provided under “Description of notes—Security.” If the Escrow Conditions are not fulfilled on or prior to December 31, 2010, the notes will be redeemed at 101% of the issue price of the notes (as set forth on the cover of this offering memorandum) plus accrued and unpaid interest to, but excluding the date of redemption. Upon consummation of this offering, the escrow account will be funded with the net proceeds of the offering and cash provided by AbitibiBowater in an amount sufficient to fund the redemption of the notes and accrued and unpaid interest to, but excluding the date of the redemption. The net proceeds from the sale of the notes, together with cash to fund the redemption, will be pledged as security for the benefit of the noteholders and upon satisfaction of the Escrow Conditions, the net proceeds from the sale of the notes will be used as described under “Use of Proceeds.”

The indenture governing the notes will restrict the activities of the Escrow Issuer and AbitibiBowater prior to the Assumption. See “Description of notes—Escrow of proceeds; release conditions.”

9

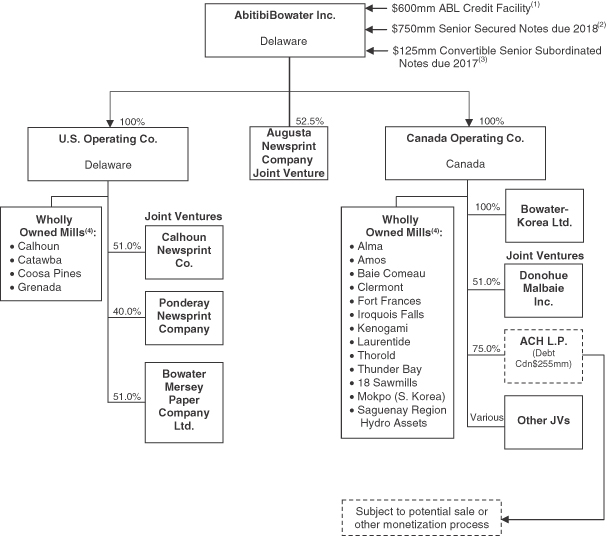

Our corporate structure

The chart below provides a simplified chart of our expected corporate and debt structure upon completion of the Transactions (as defined below in “—Plans of Reorganization”) and the application of the use of proceeds as described under “Use of proceeds.” Not all of our subsidiaries will be guarantors of the notes. For more information see “Description of the notes—Note guarantees.”

| (1) | On the Emergence Date (as defined below in “—Plans of Reorganization”), we do not expect that there will be any amounts outstanding under the ABL Credit Facility, but expect to have issued approximately $52 million in letters of credit under such facility. |

| (2) | ABI Escrow Corporation, a wholly-owned subsidiary of AbitibiBowater Inc., will be the issuer of the notes prior to the Assumption. |

| (3) | Estimated amount based on our projected liquidity on the Emergence Date as described under “Use of proceeds.” See “Description of certain indebtedness—Convertible Notes” for a description of how changes in our liquidity will impact the principal amount of the Convertible Notes issued. |

| (4) | Does not reflect closed or currently idled mills. |

10

Plans of Reorganization

On April 16, 2009 and December 21, 2009, AbitibiBowater Inc. and certain of its U.S. and Canadian subsidiaries filed voluntary petitions (collectively, the “Chapter 11 Cases”) in the United States Bankruptcy Court for the District of Delaware (the “U.S. Court”) for relief under the provisions of Chapter 11 (“Chapter 11”) of the United States Bankruptcy Code, as amended (the “Bankruptcy Code”). In addition, on April 17, 2009, certain of AbitibiBowater Inc.’s Canadian subsidiaries sought creditor protection (the “CCAA Proceedings”) under the Companies’ Creditors Arrangement Act (the “CCAA”) with the Superior Court of Quebec in Canada (the “Canadian Court”). On April 17, 2009, Abitibi and its wholly-owned subsidiary, Abitibi-Consolidated Company of Canada (“ACCC”), each filed a voluntary petition for provisional and final relief (the “Chapter 15 Cases”) in the U.S. Court under the provisions of Chapter 15 of the United States Bankruptcy Code, as amended, to obtain recognition and enforcement in the United States of certain relief granted in the CCAA Proceedings and also on that date, AbitibiBowater Inc. and certain of its subsidiaries in the Chapter 11 Cases obtained orders under Section 18.6 of the CCAA in respect thereof (the “18.6 Proceedings”). The Chapter 11 Cases, the Chapter 15 Cases, the CCAA Proceedings and the 18.6 Proceedings are collectively referred to as the “Creditor Protection Proceedings.” For a discussion of the events leading up to the commencement of the Creditor Protection Proceedings, see “Management’s discussion and analysis of financial condition and results of operations—Events leading to our creditor protection filings.” The entities subject to the Creditor Protection Proceedings are referred to herein as the “Debtors.” The U.S. Court and the Canadian Court are collectively referred to as the “Courts.” On February 2, 2010, our wholly-owned subsidiary that operates the Bridgewater, United Kingdom operations filed for administration in the United Kingdom pursuant to the United Kingdom Insolvency Act. Our subsidiary that operates the Mokpo, South Korea operations and almost all of our less than wholly-owned subsidiaries continue to operate outside of the Creditor Protection Proceedings.

We initiated the Creditor Protection Proceedings in order to enable us to pursue reorganization efforts under the protection of Chapter 11 and the CCAA, as applicable. The Creditor Protection Proceedings have allowed us to reassess our business strategy with a view to developing a comprehensive financial and business restructuring plan. We remain in possession of our assets and properties and continue to operate our business and manage our properties as “debtors in possession” under the jurisdiction of the Courts and in accordance with the applicable provisions of Chapter 11 and the CCAA.

In order to successfully exit from Chapter 11 and the CCAA, we are required to propose and obtain approval from certain affected or impaired creditors and confirmation by the Courts of a plan or plans of reorganization that satisfy the requirements of Chapter 11 (the “Chapter 11 Plan of Reorganization”) and the CCAA (the “CCAA Plan of Reorganization”) (the Chapter 11 Plan of Reorganization and the CCAA Plan of Reorganization are referred to collectively as the “Plans of Reorganization”). Hearings to consider confirmation of the Plans of Reorganization are currently scheduled to be held before the U.S. Courts on September 24, 2010 and before the Canadian Court on September 20, 2010. In order for the Chapter 11 Plan of Reorganization to be confirmed by the U.S. Court pursuant to section 1129 of the Bankruptcy Code, among other things, at least one class of impaired claims must accept the Chapter 11 Plan of Reorganization, determined without including votes to accept the Plans of Reorganization cast by “insiders,” as that term is defined in section 101(31) of the Bankruptcy Code. A class of claims has accepted a Chapter 11

11

plan of reorganization if such plan of reorganization has been accepted by creditors that hold at least two-thirds in amount and more than one-half in number of the allowed claims of such class held by creditors that have voted to accept or reject such plan of reorganization. In order for the CCAA Plan of Reorganization to be approved by the Canadian Court pursuant to the CCAA, among other things, such CCAA Plan of Reorganization must be approved by the affirmative vote of a majority in number, representing not less than two-thirds in value of the voting claims, of the creditors of each class of creditors that will be affected by the CCAA Plan of Reorganization and must be determined as being fair, reasonable and equitable. Following confirmation, the Plans of Reorganization will be consummated upon the satisfaction of certain conditions. The date of such consummation is referred to as the “Emergence Date.”

The Plans of Reorganization would, among other things, provide for a coordinated restructuring and compromise of our prepetition obligations, set forth the revised capital structure of the newly reorganized entities and certain elements of our corporate governance following our exit from the Creditor Protection Proceedings.

As currently proposed, the Plans of Reorganization include, in addition to the issuance of the notes in this offering, the following key elements:

| • | each of the Debtors will continue to operate its business in substantially its current form; |

| • | all amounts outstanding under the Senior Secured Superpriority Debtor-in-Possession Credit Agreement dated as of April 21, 2009 among the Company, Bowater and certain other subsidiaries of the Company and the lenders party thereto (the “DIP Facility”) will be paid in full in cash (approximately $40 million as of August 31, 2010) and the facility will be terminated; |

| • | all outstanding receivables interests purchased under the Second Amended and Restated Receivables Purchase Agreement, dated as of June 16, 2009 among Abitibi and certain of its affiliates and Citibank, N.A. as agent (the “Securitization Facility”) will be repurchased in cash for a price equal to the par amount thereof and the Securitization Facility will be terminated (approximately $120 million as of August 31, 2010); |

| • | the prepetition Bowater U.S. and Canadian secured credit facilities (which consist of separate credit agreements entered into by Bowater and separately by its subsidiary Bowater Canadian Forest Products, Inc.) will be paid in full in cash (aggregate of approximately $354 million, comprised of approximately $216 million under the U.S. facility and approximately $138 million under the Canadian facility); both facility amounts include principal, accrued interest and professional fees assuming an Emergence Date of October 14, 2010, while the Canadian facility amount assumes Canadian dollar borrowings are converted to U.S. dollars at an exchange rate of Cdn$1.0309 to US$1.00; |

| • | the prepetition ACCC term loan (the “ACCC Term Loan”) will be repaid in full in cash (approximately $363 million), including principal, accrued interest and professional fees and assuming an Emergence Date of October 14, 2010; |

| • | the outstanding ACCC 13.75% Senior Secured Notes due 2011 will be paid in full in cash (approximately $347 million), including principal, accrued interest and professional fees and assuming an Emergence Date of October 14, 2010; |

12

| • | the outstanding Bowater floating rate industrial revenue bonds due 2029 will be repaid in full in cash (approximately $34 million as of August 31, 2010); |

| • | certain holders of allowed claims arising from the Debtors’ prepetition unsecured indebtedness will receive their pro rata share of the new common stock to be issued by the reorganized Company upon emergence and will be entitled, to the extent eligible, to participate in the Rights Offering (as defined below); |

| • | pension and post retirement obligations related to prior service costs, which had been classified as liabilities subject to compromise, will be reclassified, subject to resolution of funding relief; |

| • | holders of the prepetition unsecured claims with individual claim amounts of $5,000 or less (or reduced to such amount) may be paid in cash in an amount equal to 50% of their claim amount (approximately $15 million as of August 31, 2010), but under certain circumstances, these claim holders may be treated instead like all other holders of claims arising from prepetition unsecured indebtedness; |

| • | all equity interests in the Company existing immediately prior to the Emergence Date will be discharged, cancelled, released and extinguished; |

| • | the Debtors will conduct a rights offering (the “Rights Offering”) for the issuance of 10% convertible senior subordinated notes (the “Convertible Notes”). Under the Rights Offering, each eligible unsecured creditor will receive a non-transferable right entitling such creditor to purchase its proportionate share of up to $500 million of Convertible Notes to be issued by the reorganized Company on the Emergence Date. Under certain circumstances, the amount of Convertible Notes may thereafter be increased by up to an additional $110 million (the “Escrow Notes”). The amount of Escrow Notes that we may issue will be reduced on a pro rata basis to the extent we issue less than $500 million of Convertible Notes in the Rights Offering. Based on our current expected liquidity on the Emergence Date, we currently expect to issue approximately $125 million of Convertible Notes (excluding the Escrow Notes). The Convertible Notes are expected to bear interest at the rate of 10% per annum (11% per annum if we elect to pay a portion of the interest through the issuance of additional Convertible Notes). We have entered into a backstop commitment agreement that has been approved by the Courts and which provides for the purchase by certain investors (including the Initial Purchasers and/or their affiliates) of Convertible Notes to the extent that the Rights Offering is under-subscribed; and |

| • | the reorganized Company will enter into a senior secured asset-based revolving credit facility in an amount of $600 million (the “ABL Credit Facility”) under which the Company will have issued $52 million in letters of credit. |

On the Emergence Date, the terms of the Plans of Reorganization confirmed by the Courts will be binding upon the Debtors and all other parties affected by the Plans of Reorganization. Parties will have 14 days to file a notice of appeal following entry of a confirmation order by the U.S. Court, and 21 days to file a notice of appeal with respect to a sanction order entered by the Canadian Court. Even if a notice of appeal is timely filed, the Debtors expect to proceed to consummate the Plans of Reorganization confirmed by the Courts in accordance with its terms,

13

unless the party seeking the appeal also obtains a stay of implementation of the Plans of Reorganization pending appeal of the confirmation or sanction order, in which event the Debtors will not be able to implement the terms of the Plans of Reorganization confirmed by the Courts unless and until the stay is lifted. An appeal of the confirmation or sanction order may be initiated even if there is no stay pending appeal of the confirmation order and, in such circumstances, the appeal may be dismissed as moot if the Debtors have implemented the Plans of Reorganization to the point of “substantial consummation.”

In this offering memorandum unless otherwise indicated, the “Transactions” refer, collectively, to the consummation of the Plans of Reorganization and related transactions, including the application of Fresh Start Accounting principles, the completion of certain intercompany reorganization transactions to simplify our corporate structure as contemplated by the Plans of Reorganization, the entry into the ABL Credit Facility, the issuance of the notes offered hereby and the Convertible Notes and the application of the net proceeds thereof as further described under “Use of proceeds.” The Transactions will significantly de-lever the Debtors’ capital structure, leaving the Company with approximately $1.1 billion (excluding the Escrow Notes) in outstanding debt on the Emergence Date.

Impact of emergence from Creditor Protection Proceedings—Fresh Start Accounting

As discussed in detail in the section titled “Unaudited pro forma consolidated financial information,” our emergence from the Creditor Protection Proceedings, the implementation of the Plans of Reorganization and our application of Fresh Start Accounting principles will affect our future reported results of operations and make it difficult to compare our historical, pre-emergence results of operations with those that we report in the future.

As noted in the unaudited pro forma consolidated financial information, initial Fresh Start Accounting valuations are preliminary and have been made solely for purposes of developing the unaudited pro forma consolidated financial information. Updates to such preliminary valuations will be completed as of the Emergence Date and, to the extent such updates reflect a valuation different than those used in the unaudited pro forma consolidated financial information, there may be adjustments in the carrying values of certain assets and liabilities. To the extent actual valuations and allocations differ from those used in calculating the unaudited pro forma consolidated financial information, these differences will be reflected on our balance sheet upon emergence under Fresh Start Accounting and may also affect the amount of expenses which would be recognized in the statement of operations post-emergence from the Creditor Protection Proceedings. Any such differences could be material.

14

Summary unaudited pro forma and historical consolidated financial information

The following tables set forth our summary unaudited pro forma and historical consolidated financial information for the periods ended and as of the dates set forth below. The summary historical financial data as of and for the fiscal years ended December 31, 2009 and 2008 have been derived from our audited consolidated financial statements and related notes and management’s discussion and analysis, which are included elsewhere in this offering memorandum. The summary historical financial information as of June 30, 2010 and for the six month periods ended June 30, 2010 and 2009 have been derived from our unaudited interim consolidated financial statements and related notes and management’s discussion and analysis, included elsewhere in this offering memorandum. In the opinion of management, our unaudited interim consolidated financial statements contain all adjustments, consisting only of normal recurring adjustments necessary for a fair presentation of our financial position, results of operations and cash flows. The results of operations for the six month period ended June 30, 2010 are not necessarily indicative of the operating results to be expected for the full year.

The unaudited consolidated statement of operations data for the twelve months ended June 30, 2010 have been derived by adding the unaudited interim consolidated statement of operations for the six months ended June 30, 2010 to the audited consolidated statement of operations for the year ended December 31, 2009, then deducting the unaudited interim consolidated statement of operations for the six months ended June 30, 2009.

The unaudited pro forma consolidated financial data set forth in the table below has been derived by applying the pro forma adjustments described under “Unaudited pro forma consolidated financial information” to our unaudited interim consolidated financial statements as of June 30, 2010 and to our unaudited consolidated statement of operations data for the twelve months ended June 30, 2010, as derived in the manner described above. The summary unaudited pro forma consolidated statement of operations data has been prepared to give effect to the consummation of the Plans of Reorganization and related transactions, including the application of Fresh Start Accounting principles, the entry into the ABL Credit Facility, and the issuance of the notes offered hereby and the application of the net proceeds thereof in each case as if they had occurred on the first day of each period presented. The summary unaudited pro forma consolidated balance sheet data has been prepared to give effect to the Transactions as if they had occurred on June 30, 2010.

The summary unaudited pro forma consolidated financial data is presented for illustrative purposes only and is not necessarily indicative of the results of operations or financial position that would have actually been reported had such Transactions been completed at the beginning of each period presented or as of June 30, 2010, respectively, nor is it indicative of our future results of operations or financial position.

The pro forma consolidated financial data should be read in conjunction with “Use of proceeds,” “Capitalization,” “Unaudited pro forma consolidated financial information,” “Selected historical financial information” and our historical consolidated financial statements and related notes which are included elsewhere in this offering memorandum.

15

| Historical year ended December 31, |

Historical six months ended June 30, |

Historical ended June 30, |

Pro forma ended June 30, |

|||||||||||||||

| (dollars in millions) | 2008 | 2009 | 2009 | 2010 | ||||||||||||||

| Statement of operations data: |

||||||||||||||||||

| Sales |

$6,771 | $4,366 | $2,149 | $2,282 | $4,499 | $4,499 | ||||||||||||

| Cost of sales, excluding depreciation, amortization and cost of timber harvested |

5,144 | 3,343 | 1,572 | 1,866 | 3,637 | 3,649 | ||||||||||||

| Depreciation, amortization and cost of timber harvested |

726 | 602 | 314 | 257 | 545 | 246 | ||||||||||||

| Distribution costs |

757 | 487 | 234 | 278 | 531 | 531 | ||||||||||||

| Selling, general and administrative expenses |

332 | 198 | 111 | 69 | 156 | 166 | ||||||||||||

| Impairment of goodwill |

810 | — | — | — | — | — | ||||||||||||

| Closure costs, impairment and other related charges |

481 | 202 | 270 | 8 | (60 | ) | (60 | ) | ||||||||||

| Net gain on disposition of assets |

(49 | ) | (91 | ) | (53 | ) | (13 | ) | (51 | ) | (51 | ) | ||||||

| Operating income (loss) |

(1,430 | ) | (375 | ) | (299 | ) | (183 | ) | (259 | ) | 18 | |||||||

| Interest expense |

(706 | ) | (597 | ) | (335 | ) | (318 | ) | (580 | ) | (118 | ) | ||||||

| Other (expense) income, net |

93 | (71 | ) | (31 | ) | 38 | (2 | ) | (10 | ) | ||||||||

| Loss before reorganization items and income taxes |

(2,043 | ) | (1,043 | ) | (665 | ) | (463 | ) | (841 | ) | (110 | ) | ||||||

| Reorganization items, net |

— | (639 | ) | (99 | ) | (353 | ) | (893 | ) | — | ||||||||

| Extraordinary loss on expropriation of assets |

(256 | ) | — | — | — | — | — | |||||||||||

| Net income (loss) including noncontrolling interests |

(2,207 | ) | (1,560 | ) | (723 | ) | (806 | ) | (1,643 | ) | (19 | ) | ||||||

| Net income (loss) attributable to AbitibiBowater Inc. |

(2,234 | ) | (1,553 | ) | (728 | ) | (797 | ) | (1,622 | ) | — | |||||||

| Other financial data: |

||||||||||||||||||

| EBITDA(1) |

(611 | ) | (483 | ) | (115 | ) | (241 | ) | (609 | ) | 254 | |||||||

| Adjusted EBITDA(1) |

589 | 343 | 217 | 70 | 196 | 184 | ||||||||||||

| Capital expenditures |

186 | 101 | 53 | 26 | 74 | 74 | ||||||||||||

| Historical selected operations data: |

||||||||||||||||||

| Newsprint volume sold (in thousands of metric tons) |

4,746 | 3,157 | 1,484 | 1,558 | 3,231 | — | ||||||||||||

| Newsprint revenue per metric ton ($) |

682 | 571 | 630 | 570 | 552 | — | ||||||||||||

| Coated papers volume sold (in thousands of short tons) |

748 | 571 | 274 | 325 | 622 | — | ||||||||||||

| Coated papers revenue per short ton ($) |

882 | 730 | 759 | 677 | 699 | — | ||||||||||||

| Specialty papers volume sold (in thousands of short tons) |

2,425 | 1,819 | 856 | 924 | 1,887 | — | ||||||||||||

| Specialty papers revenue per short ton ($) |

754 | 731 | 786 | 680 | 680 | — | ||||||||||||

| Market pulp volume sold (in thousands of metric tons) |

895 | 946 | 425 | 466 | 987 | — | ||||||||||||

| Market pulp revenue per metric ton ($) |

700 | 548 | 515 | 720 | 642 | — | ||||||||||||

| Wood products volume sold (in millions of board feet) |

1,556 | 1,143 | 524 | 665 | 1,284 | — | ||||||||||||

| Wood products revenue per thousand board feet ($) |

269 | 254 | 207 | 315 | 325 | — | ||||||||||||

16

| (dollars in millions) | Historical as of June 30, 2010 |

Pro forma as of June 30, 2010 | ||||

| Balance sheet data: |

||||||

| Cash and cash equivalents |

$ | 708 | $ | 203 | ||

| Working capital(2) |

1,451 | 1,194 | ||||

| Total current assets |

2,171 | 1,655 | ||||

| Total assets |

6,649 | 6,001 | ||||

| Total secured debt |

1,340 | 875 | ||||

| Total debt not subject to compromise |

1,579 | 1,114 | ||||

| Total current liabilities |

1,820 | 461 | ||||

| Total liabilities subject to compromise |

7,065 | — | ||||

| Total liabilities |

9,437 | 3,132 | ||||

| Pro forma June 30, 2010 | |||

| Credit statistics: |

|||

| Deficiency of earnings to fixed charges(3) |

$ | 111 | |

| Ratio of secured debt to Adjusted EBITDA(1) |

3.7x | ||

| Ratio of total debt to Adjusted EBITDA(1) |

5.0x | ||

| (1) | EBITDA is defined as net earnings (loss) before interest, taxes and depreciation, amortization and cost of timber harvested. Adjusted EBITDA is EBITDA plus certain elements primarily associated with gain or loss on foreign currency translation, reorganization related expenses, closure costs, impairment of goodwill and other related charges, asset write offs or inventory write downs, gains on disposition of assets and extraordinary loss on expropriation of assets. EBITDA and Adjusted EBITDA include alternative fuel mix tax credits of $0, $276 million, $118 million, $0 and $158 million for the years ended December 31, 2008 and 2009, the six months ended June 30, 2009 and 2010 and the pro forma twelve months ended June 30, 2010, respectively. See “Reconciliation of non-GAAP information” for a reconciliation of EBITDA and Adjusted EBITDA. Secured debt and total debt is net of cash and cash equivalents. |

| (2) | Working capital is defined as current assets less current liabilities, excluding short-term bank debt, secured borrowings and current portion of long-term debt, but including debtor in possession financing. |

| (3) | For purposes of determining the deficiency of earnings to fixed charges, earnings consist of loss before income taxes and noncontrolling interests plus fixed charges (excluding capitalized interest). Fixed charges consist of total interest expense (including capitalized interest) plus that portion of rental expense representative of the interest factor (deemed to be one-third of rental expense) plus amortized premium and discount related to indebtedness. For the pro forma twelve months ended June 30, 2010, earnings were inadequate to cover fixed charges. |

17