Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Resolute Forest Products Inc. | rfp-2017331xex322.htm |

| EX-32.1 - EXHIBIT 32.1 - Resolute Forest Products Inc. | rfp-2017331xex321.htm |

| EX-31.2 - EXHIBIT 31.2 - Resolute Forest Products Inc. | rfp-2017331xex312.htm |

| EX-31.1 - EXHIBIT 31.1 - Resolute Forest Products Inc. | rfp-2017331xex311.htm |

| EX-10.2 - EXHIBIT 10.2 - Resolute Forest Products Inc. | rfp-2017331xex102.htm |

| EX-10.1 - EXHIBIT 10.1 - Resolute Forest Products Inc. | rfp-2017331xex101.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2017

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

FOR THE TRANSITION PERIOD FROM TO

COMMISSION FILE NUMBER: 001-33776

RESOLUTE FOREST PRODUCTS INC.

(Exact name of registrant as specified in its charter)

Delaware | 98-0526415 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. employer identification number) |

111 Duke Street, Suite 5000; Montréal, Quebec; Canada H3C 2M1 |

(Address of principal executive offices) (Zip Code) |

(514) 875-2160 |

(Registrant’s telephone number, including area code) |

(Former name, former address and former fiscal year, if changed since last report) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer þ | |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ | |

Emerging growth company ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes þ No ¨

As of April 28, 2017, there were 89,750,964 shares of Resolute Forest Products Inc. common stock, $0.001 par value, outstanding.

RESOLUTE FOREST PRODUCTS INC.

TABLE OF CONTENTS

Page Number | ||

PART I. FINANCIAL INFORMATION | ||

Item 1. Financial Statements: | ||

PART II. OTHER INFORMATION | ||

PART I. | FINANCIAL INFORMATION |

ITEM 1. | FINANCIAL STATEMENTS |

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in millions, except per share amounts)

Three Months Ended March 31, | ||||||||

2017 | 2016 | |||||||

Sales | $ | 872 | $ | 877 | ||||

Costs and expenses: | ||||||||

Cost of sales, excluding depreciation, amortization and distribution costs | 667 | 677 | ||||||

Depreciation and amortization | 51 | 52 | ||||||

Distribution costs | 110 | 112 | ||||||

Selling, general and administrative expenses | 43 | 38 | ||||||

Closure costs, impairment and other related charges | 7 | — | ||||||

Net gain on disposition of assets | — | (2 | ) | |||||

Operating loss | (6 | ) | — | |||||

Interest expense | (11 | ) | (10 | ) | ||||

Other income, net | — | 13 | ||||||

(Loss) income before income taxes | (17 | ) | 3 | |||||

Income tax provision | (29 | ) | (10 | ) | ||||

Net loss including noncontrolling interests | (46 | ) | (7 | ) | ||||

Net income attributable to noncontrolling interests | (1 | ) | (1 | ) | ||||

Net loss attributable to Resolute Forest Products Inc. | $ | (47 | ) | $ | (8 | ) | ||

Net loss per share attributable to Resolute Forest Products Inc. common shareholders: | ||||||||

Basic | $ | (0.52 | ) | $ | (0.09 | ) | ||

Diluted | (0.52 | ) | (0.09 | ) | ||||

Weighted-average number of Resolute Forest Products Inc. common shares outstanding: | ||||||||

Basic | 90.2 | 89.6 | ||||||

Diluted | 90.2 | 89.6 | ||||||

See accompanying notes to unaudited interim Consolidated Financial Statements.

1

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited, in millions)

Three Months Ended March 31, | ||||||||

2017 | 2016 | |||||||

Net loss including noncontrolling interests | $ | (46 | ) | $ | (7 | ) | ||

Other comprehensive income: | ||||||||

Unamortized prior service credits | ||||||||

Change in unamortized prior service credits | (4 | ) | (4 | ) | ||||

Income tax provision | — | — | ||||||

Change in unamortized prior service credits, net of tax | (4 | ) | (4 | ) | ||||

Unamortized actuarial losses | ||||||||

Change in unamortized actuarial losses | 14 | 12 | ||||||

Income tax provision | (2 | ) | (3 | ) | ||||

Change in unamortized actuarial losses, net of tax | 12 | 9 | ||||||

Foreign currency translation | 1 | — | ||||||

Other comprehensive income, net of tax | 9 | 5 | ||||||

Comprehensive loss including noncontrolling interests | (37 | ) | (2 | ) | ||||

Comprehensive income attributable to noncontrolling interests | (1 | ) | (1 | ) | ||||

Comprehensive loss attributable to Resolute Forest Products Inc. | $ | (38 | ) | $ | (3 | ) | ||

See accompanying notes to unaudited interim Consolidated Financial Statements.

2

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited, in millions, except per share amount)

March 31, 2017 | December 31, 2016 | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | $ | 39 | $ | 35 | ||||

Accounts receivable, net: | ||||||||

Trade | 370 | 358 | ||||||

Other | 84 | 83 | ||||||

Inventories, net | 608 | 570 | ||||||

Other current assets | 36 | 35 | ||||||

Total current assets | 1,137 | 1,081 | ||||||

Fixed assets, less accumulated depreciation of $1,464 and $1,415 as of March 31, 2017 and December 31, 2016, respectively | 1,866 | 1,842 | ||||||

Amortizable intangible assets, less accumulated amortization of $18 and $16 as of March 31, 2017 and December 31, 2016, respectively | 68 | 70 | ||||||

Goodwill | 81 | 81 | ||||||

Deferred income tax assets | 1,054 | 1,039 | ||||||

Other assets | 129 | 164 | ||||||

Total assets | $ | 4,335 | $ | 4,277 | ||||

Liabilities and equity | ||||||||

Current liabilities: | ||||||||

Accounts payable and accrued liabilities | $ | 468 | $ | 466 | ||||

Current portion of long-term debt | 1 | 1 | ||||||

Total current liabilities | 469 | 467 | ||||||

Long-term debt, net of current portion | 880 | 761 | ||||||

Pension and other postretirement benefit obligations | 1,251 | 1,281 | ||||||

Deferred income tax liabilities | 5 | 2 | ||||||

Other liabilities | 56 | 55 | ||||||

Total liabilities | 2,661 | 2,566 | ||||||

Commitments and contingencies | ||||||||

Equity: | ||||||||

Resolute Forest Products Inc. shareholders’ equity: | ||||||||

Common stock, $0.001 par value. 117.8 shares issued and 89.8 shares outstanding as of March 31, 2017 and December 31, 2016 | — | — | ||||||

Additional paid-in capital | 3,778 | 3,775 | ||||||

Deficit | (1,257 | ) | (1,207 | ) | ||||

Accumulated other comprehensive loss | (746 | ) | (755 | ) | ||||

Treasury stock at cost, 28.0 shares as of March 31, 2017 and December 31, 2016 | (120 | ) | (120 | ) | ||||

Total Resolute Forest Products Inc. shareholders’ equity | 1,655 | 1,693 | ||||||

Noncontrolling interests | 19 | 18 | ||||||

Total equity | 1,674 | 1,711 | ||||||

Total liabilities and equity | $ | 4,335 | $ | 4,277 | ||||

See accompanying notes to unaudited interim Consolidated Financial Statements.

3

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(Unaudited, in millions)

Three Months Ended March 31, 2017 | ||||||||||||||||||||||||||||

Resolute Forest Products Inc. Shareholders’ Equity | ||||||||||||||||||||||||||||

Common Stock | Additional Paid-In Capital | Deficit | Accumulated Other Comprehensive Loss | Treasury Stock | Non-controlling Interests | Total Equity | ||||||||||||||||||||||

Balance as of December 31, 2016 | $ | — | $ | 3,775 | $ | (1,207 | ) | $ | (755 | ) | $ | (120 | ) | $ | 18 | $ | 1,711 | |||||||||||

Share-based compensation costs for equity-classified awards | — | 3 | — | — | — | — | 3 | |||||||||||||||||||||

Net (loss) income | — | — | (47 | ) | — | — | 1 | (46 | ) | |||||||||||||||||||

Cumulative-effect adjustment upon deferred tax charge elimination (Note 9) | — | — | (3 | ) | — | — | — | (3 | ) | |||||||||||||||||||

Other comprehensive income, net of tax | — | — | — | 9 | — | — | 9 | |||||||||||||||||||||

Balance as of March 31, 2017 | $ | — | $ | 3,778 | $ | (1,257 | ) | $ | (746 | ) | $ | (120 | ) | $ | 19 | $ | 1,674 | |||||||||||

Three Months Ended March 31, 2016 | ||||||||||||||||||||||||||||

Resolute Forest Products Inc. Shareholders’ Equity | ||||||||||||||||||||||||||||

Common Stock | Additional Paid-In Capital | Deficit | Accumulated Other Comprehensive Loss | Treasury Stock | Non- controlling Interests | Total Equity | ||||||||||||||||||||||

Balance as of December 31, 2015 | $ | — | $ | 3,765 | $ | (1,126 | ) | $ | (587 | ) | $ | (120 | ) | $ | 13 | $ | 1,945 | |||||||||||

Share-based compensation costs for equity-classified awards | — | 3 | — | — | — | — | 3 | |||||||||||||||||||||

Net (loss) income | — | — | (8 | ) | — | — | 1 | (7 | ) | |||||||||||||||||||

Other comprehensive income, net of tax | — | — | — | 5 | — | — | 5 | |||||||||||||||||||||

Balance as of March 31, 2016 | $ | — | $ | 3,768 | $ | (1,134 | ) | $ | (582 | ) | $ | (120 | ) | $ | 14 | $ | 1,946 | |||||||||||

See accompanying notes to unaudited interim Consolidated Financial Statements.

4

RESOLUTE FOREST PRODUCTS INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in millions)

Three Months Ended March 31, | ||||||||

2017 | 2016 | |||||||

Cash flows from operating activities: | ||||||||

Net loss including noncontrolling interests | $ | (46 | ) | $ | (7 | ) | ||

Adjustments to reconcile net loss including noncontrolling interests to net cash (used in) provided by operating activities: | ||||||||

Share-based compensation | 4 | 3 | ||||||

Depreciation and amortization | 51 | 52 | ||||||

Inventory write-downs related to closures | 4 | — | ||||||

Deferred income taxes | 28 | 10 | ||||||

Net pension contributions and other postretirement benefit payments | (30 | ) | (21 | ) | ||||

Net gain on disposition of assets | — | (2 | ) | |||||

Gain on translation of foreign currency denominated deferred income taxes | (10 | ) | (63 | ) | ||||

Loss on translation of foreign currency denominated pension and other postretirement benefit obligations | 9 | 52 | ||||||

Gain on disposition of equity method investment | — | (5 | ) | |||||

Net planned major maintenance amortization | 1 | — | ||||||

Changes in working capital: | ||||||||

Accounts receivable | (11 | ) | (12 | ) | ||||

Inventories | (40 | ) | (20 | ) | ||||

Accounts payable and accrued liabilities | 1 | 22 | ||||||

Other, net | — | (3 | ) | |||||

Net cash (used in) provided by operating activities | (39 | ) | 6 | |||||

Cash flows from investing activities: | ||||||||

Cash invested in fixed assets | (69 | ) | (47 | ) | ||||

Disposition of assets | — | 5 | ||||||

Increase in countervailing duty cash deposits | (5 | ) | (6 | ) | ||||

Increase in restricted cash | (2 | ) | — | |||||

Decrease in deposit requirements for letters of credit, net | 1 | — | ||||||

Net cash used in investing activities | (75 | ) | (48 | ) | ||||

Cash flows from financing activities: | ||||||||

Net borrowings under revolving credit facilities | 118 | 20 | ||||||

Net cash provided by financing activities | 118 | 20 | ||||||

Effect of exchange rate changes on cash and cash equivalents | — | 1 | ||||||

Net increase (decrease) in cash and cash equivalents | 4 | (21 | ) | |||||

Cash and cash equivalents: | ||||||||

Beginning of period | 35 | 58 | ||||||

End of period | $ | 39 | $ | 37 | ||||

See accompanying notes to unaudited interim Consolidated Financial Statements.

5

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 1. Organization and Basis of Presentation

Nature of operations

Resolute Forest Products Inc. (with its subsidiaries and affiliates, either individually or collectively, unless otherwise indicated, referred to as “Resolute Forest Products,” “we,” “our,” “us,” “Parent” or the “Company”) is incorporated in Delaware. We are a global leader in the forest products industry with a diverse range of products, including market pulp, tissue, wood products, newsprint and specialty papers, which are marketed in over 70 countries. We own or operate over 40 pulp, paper, tissue and wood products facilities, as well as power generation assets in the United States and Canada.

Financial statements

Our interim Consolidated Financial Statements are unaudited and have been prepared in accordance with the requirements of the U.S. Securities and Exchange Commission (the “SEC”) for interim reporting. Under those rules, certain footnotes and other financial information that are normally required by U.S. generally accepted accounting principles may be condensed or omitted. In our opinion, all adjustments (consisting of normal recurring adjustments) necessary for the fair statement of the unaudited interim Consolidated Financial Statements have been made. All amounts are expressed in U.S. dollars, unless otherwise indicated. The results for the interim period ended March 31, 2017, are not necessarily indicative of the results to be expected for the full year. These unaudited interim Consolidated Financial Statements should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2016, filed with the SEC on March 1, 2017. Certain prior period amounts in our footnotes have been reclassified to conform to the 2017 presentation. For additional information, see Note 11, “Segment Information.”

New accounting pronouncements adopted

In October 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2016-16, “Intra-Entity Transfers of Assets Other Than Inventory,” which eliminates the deferral of the tax effects of intra-entity asset transfers other than inventory until the transferred assets are sold to a third party or recovered through use. This update is effective on a modified retrospective approach for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. As early adoption is permitted as of the beginning of an annual period, we adopted this ASU on January 1, 2017. For additional information, see Note 9, “Income Taxes.”

Accounting pronouncements not yet adopted

In March 2017, the FASB issued ASU 2017-07, “Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost,” which requires employers that present a measure of operating income in their statements of earnings to disaggregate and present only the service cost component of net periodic benefit cost and net periodic postretirement benefit cost in operating expenses (together with other employee compensation costs arising during the period). The other components of the net periodic benefit cost are to be reported separately outside any subtotal of operating income. This update is effective retrospectively for fiscal years beginning after December 15, 2017, including interim periods within those fiscal years, with early adoption permitted for fiscal years beginning after December 31, 2016. We plan to adopt this ASU on January 1, 2018. The adoption of this accounting guidance will impact the presentation of our results of operations, the effect of which cannot be reasonably estimated due to the inherent uncertainties with respect to the variations in assumptions used to determine the net periodic benefit cost, and could be material.

Note 2. Closure Costs, Impairment and Other Related Charges

During the three months ended March 31, 2017, we recorded severance and other costs of $7 million, as a result of the permanent closure of our Mokpo, South Korea, paper mill on March 9, 2017.

6

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 3. Other Income, Net

Other income, net for the three months ended March 31, 2017 and 2016, was comprised of the following:

Three Months Ended March 31, | ||||||||

(Unaudited, in millions) | 2017 | 2016 | ||||||

Foreign exchange gain | $ | — | $ | 6 | ||||

Gain on disposition of equity method investment (1) | — | 5 | ||||||

Miscellaneous income | — | 2 | ||||||

$ | — | $ | 13 | |||||

(1) | On February 1, 2016, we sold for total consideration of $5 million our interest in Produits Forestiers Petit-Paris Inc., an unconsolidated entity located in Saint-Ludger-de-Milot, Quebec, in which we had a 50% interest, resulting in a gain on disposition of $5 million. |

Note 4. Accumulated Other Comprehensive Loss

The change in our accumulated other comprehensive loss by component (net of tax) for the three months ended March 31, 2017, was as follows:

(Unaudited, in millions) | Unamortized Prior Service Credits | Unamortized Actuarial Losses | Foreign Currency Translation | Total | ||||||||||||

Balance as of December 31, 2016 | $ | 67 | $ | (819 | ) | $ | (3 | ) | $ | (755 | ) | |||||

Other comprehensive income before reclassifications | — | 1 | 1 | 2 | ||||||||||||

Amounts reclassified from accumulated other comprehensive loss (1) | (4 | ) | 11 | — | 7 | |||||||||||

Net current period other comprehensive (loss) income | (4 | ) | 12 | 1 | 9 | |||||||||||

Balance as of March 31, 2017 | $ | 63 | $ | (807 | ) | $ | (2 | ) | $ | (746 | ) | |||||

(1) | See the table below for details about these reclassifications. |

The reclassifications out of accumulated other comprehensive loss for the three months ended March 31, 2017, were comprised of the following:

(Unaudited, in millions) | Amounts Reclassified From Accumulated Other Comprehensive Loss | Affected Line in the Consolidated Statements of Operations | |||

Unamortized Prior Service Credits | |||||

Amortization of prior service credits | $ | (4 | ) | Cost of sales, excluding depreciation, amortization and distribution costs (1) | |

— | Income tax provision | ||||

$ | (4 | ) | Net of tax | ||

Unamortized Actuarial Losses | |||||

Amortization of actuarial losses | $ | 13 | Cost of sales, excluding depreciation, amortization and distribution costs (1) | ||

(2 | ) | Income tax provision | |||

$ | 11 | Net of tax | |||

Total Reclassifications | $ | 7 | Net of tax | ||

(1) | These items are included in the computation of net periodic benefit cost related to our pension and other postretirement benefit (“OPEB”) plans summarized in Note 8, “Employee Benefit Plans.” |

7

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 5. Net Loss Per Share

The weighted-average number of outstanding stock options and nonvested equity-classified restricted stock units, deferred stock units and performance stock units (collectively, “stock unit awards”), for the three months ended March 31, 2017 and 2016, was as follows:

Three Months Ended March 31, | ||||||

(Unaudited, in millions) | 2017 | 2016 | ||||

Stock options | 1.4 | 1.5 | ||||

Stock unit awards (1) | 4.6 | 2.5 | ||||

(1) | Excludes contingently issuable shares that are included in the basic weighted-average number of common shares outstanding, given that all the necessary conditions have been satisfied. |

These stock options and stock unit awards were excluded from the calculation of diluted net loss per share as the impact would have been antidilutive.

Note 6. Inventories, Net

Inventories, net as of March 31, 2017 and December 31, 2016, were comprised of the following:

(Unaudited, in millions) | March 31, 2017 | December 31, 2016 | ||||||

Raw materials and work in process | $ | 184 | $ | 171 | ||||

Finished goods | 201 | 183 | ||||||

Mill stores and other supplies | 223 | 216 | ||||||

$ | 608 | $ | 570 | |||||

During the three months ended March 31, 2017, we recorded charges of $4 million for write-downs of mill stores and other supplies primarily as a result of the permanent closure of our Mokpo paper mill. These charges were included in “Cost of sales, excluding depreciation, amortization and distribution costs” in our Consolidated Statements of Operations.

Note 7. Long-Term Debt

Overview

Long-term debt, including current portion, as of March 31, 2017 and December 31, 2016, was comprised of the following:

(Unaudited, in millions) | March 31, 2017 | December 31, 2016 | ||||||

5.875% senior notes due 2023: | ||||||||

Principal amount | $ | 600 | $ | 600 | ||||

Deferred financing costs | (5 | ) | (6 | ) | ||||

Unamortized discount | (4 | ) | (4 | ) | ||||

Total senior notes due 2023 | 591 | 590 | ||||||

Term loan due 2025 | 46 | 46 | ||||||

Borrowings under revolving credit facilities | 243 | 125 | ||||||

Capital lease obligation | 1 | 1 | ||||||

Total debt | 881 | 762 | ||||||

Less: Current portion of long-term debt | (1 | ) | (1 | ) | ||||

Long-term debt, net of current portion | $ | 880 | $ | 761 | ||||

8

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

2023 Notes

We issued $600 million in aggregate principal amount of 5.875% senior notes due 2023 (the “2023 Notes”) on May 8, 2013. Upon their issuance, the notes were recorded at their fair value of $594 million, which reflected a discount of $6 million that is being amortized to “Interest expense” in our Consolidated Statements of Operations using the interest method over the term of the notes, resulting in an effective interest rate of 6%. Interest on the notes is payable semi-annually on May 15 and November 15, until their maturity date of May 15, 2023. In connection with the issuance of the notes, we incurred financing costs of approximately $9 million, which were deferred and recorded as a reduction of the notes. These deferred financing costs are being amortized to “Interest expense” in our Consolidated Statements of Operations using the interest method over the term of the notes. The fair value of the 2023 Notes was $550 million and $543 million as of March 31, 2017 and December 31, 2016, respectively, and was determined by reference to over-the-counter prices (Level 1).

Senior Secured Credit Facility

On September 7, 2016, we entered into a senior secured credit facility (the “Senior Secured Credit Facility”) for up to $185 million. The Senior Secured Credit Facility provides a term loan of $46 million with a maturity date of September 7, 2025 (“Term Loan”), and a revolving credit facility of up to $139 million with a maturity date of September 7, 2022 (“Revolving Credit Facility”). As of March 31, 2017, we had fully borrowed the $139 million available under the Revolving Credit Facility. The fair values of the Term Loan and Revolving Credit Facility approximated their carrying values as of March 31, 2017, as the variable interest rates reflect current interest rates for financial instruments with similar characteristics and maturities (Level 2).

ABL Credit Facility

On May 22, 2015, we entered into a senior secured asset-based revolving credit facility (the “ABL Credit Facility”), with an aggregate lender commitment of up to $600 million at any time outstanding, subject to borrowing base availability based on specified advance rates, eligibility criteria and customary reserves. The ABL Credit Facility will mature on May 22, 2020. As of March 31, 2017, we had $341 million of availability under the ABL Credit Facility, net of $104 million of borrowings and $31 million of ordinary course letters of credit outstanding. The fair value of the ABL Credit Facility approximated its carrying value as of March 31, 2017, as the variable interest rates reflect current interest rates for financial instruments with similar characteristics and maturities (Level 2).

Capital lease obligation

We have a capital lease obligation for a warehouse with a maturity date of December 1, 2017, which can be renewed for 20 years at our option. Minimum monthly payments are determined by an escalatory price clause.

Note 8. Employee Benefit Plans

Pension and OPEB plans

The components of net periodic benefit cost relating to our pension and OPEB plans for the three months ended March 31, 2017 and 2016, were as follows:

Pension Plans:

Three Months Ended March 31, | ||||||||

(Unaudited, in millions) | 2017 | 2016 | ||||||

Service cost | $ | 5 | $ | 5 | ||||

Interest cost | 49 | 52 | ||||||

Expected return on plan assets | (63 | ) | (60 | ) | ||||

Amortization of actuarial losses | 14 | 13 | ||||||

$ | 5 | $ | 10 | |||||

9

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

OPEB Plans:

Three Months Ended March 31, | ||||||||

(Unaudited, in millions) | 2017 | 2016 | ||||||

Interest cost | 2 | 2 | ||||||

Amortization of actuarial gains | (1 | ) | (1 | ) | ||||

Amortization of prior service credits | (4 | ) | (4 | ) | ||||

$ | (3 | ) | $ | (3 | ) | |||

Defined contribution plans

Our expense for the defined contribution plans totaled $5 million for both the three months ended March 31, 2017 and 2016.

Canadian pension funding

On March 31, 2017, we reached an agreement with the province of Ontario with respect to the additional solvency deficit reduction contributions required for past capacity reductions in Ontario, stipulating that we are no longer required to make additional contributions for capacity reductions that occurred in Ontario after April 15, 2014. As a result, our requirement to make additional contributions to our material Canadian registered pension plans will be reduced by Cdn $16 million in 2017 and Cdn $8 million in 2018. The expiration of the original 2010 undertaking in December 2015 did not eliminate the obligations already incurred under the terms of that undertaking prior to its expiration.

Note 9. Income Taxes

The income tax provision attributable to (loss) income before income taxes differs from the amounts computed by applying the U.S. federal statutory income tax rate of 35% for the three months ended March 31, 2017 and 2016, as a result of the following:

Three Months Ended March 31, | ||||||||

(Unaudited, in millions) | 2017 | 2016 | ||||||

(Loss) income before income taxes | $ | (17 | ) | $ | 3 | |||

Income tax provision: | ||||||||

Expected income tax benefit (provision) | 6 | (1 | ) | |||||

Changes resulting from: | ||||||||

Valuation allowance (1) | (26 | ) | (18 | ) | ||||

Enactment of change in foreign tax rate | (12 | ) | — | |||||

Foreign exchange | (1 | ) | 3 | |||||

State income taxes, net of federal income tax benefit | 2 | 2 | ||||||

Foreign tax rate differences | 3 | 4 | ||||||

Other, net | (1 | ) | — | |||||

$ | (29 | ) | $ | (10 | ) | |||

(1) | We recorded a valuation allowance of $26 million and $18 million for the three months ended March 31, 2017 and 2016, respectively, primarily related to our U.S. operations where we recognize a full valuation allowance against our net deferred income tax assets. |

Deferred tax charge

On January 1, 2017, we adopted ASU 2016-16, “Intra-Entity Transfers of Assets Other Than Inventory,” which eliminates the deferral of the tax effects of intra-entity asset transfers other than inventory until the transferred assets are sold to a third party or recovered through use. Accordingly, the deferred tax charge recognized in 2015 as a result of a gain on an intercompany asset transfer in connection with an operating company realignment was eliminated, resulting in a decrease in “Other assets” of $35 million and an increase in deferred tax assets of $32 million, with a cumulative-effect adjustment of $3 million to “Deficit” in our Consolidated Balance Sheet as of January 1, 2017.

10

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 10. Commitments and Contingencies

Legal matters

We become involved in various legal proceedings and other disputes in the normal course of business, including matters related to contracts, commercial disputes, taxes, environmental issues, activists’ damages, employment and workers’ compensation claims, Aboriginal claims and other matters. Although the final outcome is subject to many variables and cannot be predicted with any degree of certainty, we regularly assess the status of the matters and establish provisions (including legal costs expected to be incurred) when we believe an adverse outcome is probable, and the amount can be reasonably estimated. Except as described below and for claims that cannot be assessed due to their preliminary nature, we believe that the ultimate disposition of these matters outstanding or pending as of March 31, 2017, will not have a material adverse effect on our Consolidated Financial Statements.

On April 24, 2017, the U.S. Department of Commerce (“Commerce”) announced its preliminary determinations in its countervailing duty investigation of Canadian-origin softwood lumber products exported to the U.S., and, as a result, since April 28, 2017, we have been required to pay cash deposits to the U.S. at a rate of 12.82% for estimated countervailing duties on our imports to the U.S. of the majority of softwood lumber products produced at our Canadian sawmills. For additional information, see Note 13, “Subsequent Event.”

Effective January 1, 2015, we modified our U.S. OPEB plan so that unionized participants, upon reaching Medicare eligibility, are provided Medicare coverage via a Medicare Exchange program rather than via a Company-sponsored medical plan. On March 2, 2016, a proposed class action lawsuit (Reynolds, et al v. Resolute Forest Products Inc., Resolute FP US Inc., Resolute FP US Health and Resolute Welfare Benefit Plan) was filed in the United States District Court for the Eastern District of Tennessee (“District Court”) on behalf of certain Medicare-eligible retirees who were previously unionized employees of our Calhoun, Tennessee; Catawba, South Carolina; and Coosa Pines, Alabama, mills, and their spouses and dependents. The plaintiffs allege that the modifications described above breach the collective bargaining agreements and plan covering the members of the proposed class in the lawsuit. Plaintiffs seek reinstatement of the health care benefits as in effect before January 1, 2015, for the proposed class in the lawsuit. The Company disputes the allegations in the complaint and intends to defend the action. On May 23, 2016, the Company filed a motion to dismiss the complaint. The motion to dismiss was denied by the District Court on March 1, 2017. The proposed class action lawsuit is at a preliminary stage and no class has been certified. Accordingly, we are not presently able to determine the ultimate resolution of this matter or to reasonably estimate the potential impact on our Consolidated Financial Statements.

On February 26, 2015, a countervailing duty petition was filed with Commerce and the U.S. International Trade Commission by certain U.S. supercalendered (“SC”) paper producers requesting that the U.S. government impose countervailing duties on Canadian-origin SC paper exported to the U.S. market. One of our subsidiaries was identified in the petition as being a Canadian exporting producer of SC paper to the U.S. and was selected as a mandatory respondent to be investigated by Commerce. As a result of that investigation, since August 3, 2015, we have been required to pay cash deposits to the U.S. for estimated countervailing duties on our imports to the U.S. of SC paper produced at our Canadian mills. Between August 3, 2015 and October 15, 2015, we were required to make cash deposits at a rate of 2.04%. On October 15, 2015, that rate increased to 17.87%, 17.10% of which was not based on any countervailable subsidy we received, but rather on a punitive application of “adverse facts available.” We are required to continue making cash deposits at the 17.87% rate until Commerce sets a countervailing duty rate in an administrative review, which Commerce commenced on February 13, 2017. Commerce has not yet announced whether we will be a mandatory respondent in that review. If we are a mandatory respondent, our countervailing duty rate, if any, will be based on Commerce’s determination as to whether we receive countervailable subsidies that benefit our Canadian production of SC paper. Following the initial administrative review, which may not be finalized in 2017, we may remain subject to annual administrative reviews until December 2020, or possibly later. The decision in each administrative review is subject to appeal. If we are not selected as a mandatory respondent, we would be required to pay duties at an “all others” rate, which would be calculated as a weighted average of the rates determined by Commerce for companies that are selected as mandatory respondents.

Following Commerce’s rate determination in 2015, we appealed that determination to a bi-national panel under the North American Free Trade Agreement (the “Panel”). On April 13, 2017, the Panel issued its decision, remanding the matter to Commerce and upholding several of Commerce’s determinations, including among others its application of adverse facts available in setting our 17.87% subsidy rate. Notwithstanding the Panel’s decision, Commerce’s prior determination of adverse facts available does not apply in an administrative review. In addition, the Panel’s decision can be challenged by the Canadian government, although not until the conclusion of the remand process. The Canadian government has already filed a separate World Trade Organization challenge to Commerce’s countervailing duty determination in the SC paper investigation, including Commerce’s use of adverse facts available against us.

11

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Through March 31, 2017, our cash deposits totaled $32 million, and based on our current operating parameters, could be as high as $25 million in 2017. To the extent the countervailing duty rate set by Commerce is lower than 17.87%, we will recover excess deposits, plus interest. If the countervailing duty rate set by Commerce is at or above 17.87%, the deposits and any deficiency will be converted into actual countervailing duties. We are not presently able to determine the ultimate resolution of this matter, but we believe it is not probable that we will ultimately be assessed with significant countervailing duties on our Canadian-produced SC paper. Accordingly, no contingent loss was recorded in respect of this petition in our Consolidated Statement of Operations for the three months ended March 31, 2017.

Effective July 31, 2012, we completed the final step of the transaction pursuant to which we acquired the remaining 25.4% of the outstanding Fibrek Inc. (“Fibrek”) shares, following the approval of Fibrek’s shareholders on July 23, 2012, and the issuance of a final order of the Quebec Superior Court in Canada approving the arrangement on July 27, 2012. Certain former shareholders of Fibrek exercised (or purported to exercise) rights of dissent in respect of the transaction, asking for a judicial determination of the fair value of their claim under the Canada Business Corporations Act. No consideration has to date been paid to the former Fibrek shareholders who exercised (or purported to exercise) rights of dissent. Any such consideration will only be paid out upon settlement or judicial determination of the fair value of their claims and will be paid entirely in cash. Accordingly, we cannot presently determine the amount that ultimately will be paid to former holders of Fibrek shares in connection with the proceedings, but we have accrued approximately Cdn $14 million ($11 million, based on the exchange rate in effect on March 31, 2017) for the eventual payment of those claims. The hearing in this matter is expected to begin in 2019.

On June 12, 2012, we filed a motion for directives with the Quebec Superior Court, the court with jurisdiction in the creditor protection proceedings under the Companies’ Creditors Arrangement Act (Canada) (the “CCAA Creditor Protection Proceedings”), seeking an order to prevent pension regulators in each of Quebec, New Brunswick, and Newfoundland and Labrador from declaring partial wind-ups of pension plans relating to employees of former operations in New Brunswick, and Newfoundland and Labrador, or a declaration that any claim for accelerated reimbursements of deficits arising from a partial wind-up is a barred claim under the CCAA Creditor Protection Proceedings. We contend, among other things, that any such declaration, if issued, would be inconsistent with the Quebec Superior Court’s sanction order confirming the CCAA debtors’ CCAA Plan of Reorganization and Compromise, as amended, and the terms of our emergence from the CCAA Creditor Protection Proceedings. A partial wind-up would likely shorten the period in which any deficit within those plans, which could reach up to Cdn $150 million ($115 million, based on the exchange rate in effect on March 31, 2017), would have to be funded if we do not obtain the relief sought. No hearing date has been set to date.

Environmental matters

We are subject to a variety of federal or national, state, provincial and local environmental laws and regulations in the jurisdictions in which we operate. We believe our operations are in material compliance with current applicable environmental laws and regulations. Environmental regulations promulgated in the future could require substantial additional expenditures for compliance and could have a material impact on us, in particular, and the industry in general.

We may be a “potentially responsible party” with respect to four hazardous waste sites that are being addressed pursuant to the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (commonly known as Superfund) or the Resource Conservation and Recovery Act corrective action authority. We believe we will not be liable for any significant amounts at any of these sites.

We have recorded $8 million of environmental liabilities as of both March 31, 2017 and December 31, 2016, primarily related to environmental remediation related to closed sites. The amount of these liabilities represents management’s estimate of the ultimate settlement based on an assessment of relevant factors and assumptions and could be affected by changes in facts or assumptions not currently known to management for which the outcome cannot be reasonably estimated at this time. These liabilities are included in “Accounts payable and accrued liabilities” or “Other liabilities” in our Consolidated Balance Sheets.

We have also recorded $22 million and $23 million of asset retirement obligations as of March 31, 2017 and December 31, 2016, respectively, primarily consisting of liabilities associated with landfills, sludge basins and the dismantling of retired assets. These liabilities are included in “Accounts payable and accrued liabilities” or “Other liabilities” in our Consolidated Balance Sheets.

12

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Other matters

On October 30, 2014, we received a notice from the Ministry of Natural Resources and Forestry of Ontario (the “MNRF”) directing us to repay a conditional incentive of Cdn $23 million ($17 million, based on the exchange rate in effect on March 31, 2017) offered to us in 2007 toward the construction of an electricity-producing turbine, should we fail to restart our Fort Frances, Ontario, pulp and paper mill or otherwise implement an alternative remedy acceptable to the MNRF. Several extensions of the deadline to implement an alternative remedy were granted to us by the MNRF, the last of which extended the remedy date to June 30, 2017. We continue to believe that we will reach an acceptable outcome. Accordingly, no contingent liability was recorded in respect of this notice in our Consolidated Balance Sheet as of March 31, 2017.

Note 11. Segment Information

We manage our business based on the products we manufacture. Accordingly, our reportable segments correspond to our principal product lines: market pulp, tissue, wood products, newsprint and specialty papers.

None of the income or loss items following “Operating loss” in our Consolidated Statements of Operations are allocated to our segments, since those items are reviewed separately by management. For the same reason, closure costs, impairment and other related charges, inventory write-downs related to closures, start-up costs, gains and losses on disposition of assets, certain components of pension and OPEB costs and credits as well as other discretionary charges or credits are not allocated to our segments. We allocate depreciation and amortization expense to our segments, although the related fixed assets and amortizable intangible assets are not allocated to segment assets. Additionally, all selling, general and administrative expenses are allocated to our segments, with the exception of certain discretionary charges and credits, which we present under “corporate and other.”

In the first quarter of 2017, we changed our presentation of segment operating income to reallocate the amortization of prior service credits component of pension and OPEB costs from the reportable segments to “corporate and other.” Current service costs will continue to be allocated to the reportable segments. This approach is consistent with the indicators management uses internally to evaluate performance, including those used by the chief operating decision maker. Prior period amounts have been reclassified to conform to the 2017 presentation.

Information about certain segment data for the three months ended March 31, 2017 and 2016, was as follows:

(Unaudited, in millions) | Market Pulp (1) | Tissue | Wood Products (2) | Newsprint | Specialty Papers | Segment Total | Corporate and Other | Total | ||||||||||||||||||||||||

Sales | ||||||||||||||||||||||||||||||||

First three months | ||||||||||||||||||||||||||||||||

2017 | $ | 209 | $ | 20 | $ | 177 | $ | 226 | $ | 240 | $ | 872 | $ | — | $ | 872 | ||||||||||||||||

2016 | 211 | 23 | 119 | 257 | 267 | 877 | — | 877 | ||||||||||||||||||||||||

Depreciation and amortization | ||||||||||||||||||||||||||||||||

First three months | ||||||||||||||||||||||||||||||||

2017 | $ | 8 | $ | 1 | $ | 9 | $ | 16 | $ | 12 | $ | 46 | $ | 5 | $ | 51 | ||||||||||||||||

2016 | 7 | 2 | 7 | 20 | 13 | 49 | 3 | 52 | ||||||||||||||||||||||||

Operating income (loss) | ||||||||||||||||||||||||||||||||

First three months | ||||||||||||||||||||||||||||||||

2017 | $ | 7 | $ | — | $ | 20 | $ | (4 | ) | $ | 4 | $ | 27 | $ | (33 | ) | $ | (6 | ) | |||||||||||||

2016 | 19 | (2 | ) | (4 | ) | (5 | ) | 5 | 13 | (13 | ) | — | ||||||||||||||||||||

(1) | Inter-segment sales of $9 million and $5 million, which are transacted at cost, were excluded from market pulp sales for the three months ended March 31, 2017 and 2016, respectively. |

(2) | Wood products sales to our joint ventures, which are transacted at arm’s length negotiated prices, were $4 million and $5 million for the three months ended March 31, 2017 and 2016, respectively. |

13

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 12. Condensed Consolidating Financial Information

The following information is presented in accordance with Rule 3-10 of Regulation S-X and the public information requirements of Rule 144 promulgated pursuant to the Securities Act of 1933, as amended, in connection with Resolute Forest Products Inc.’s 2023 Notes that are fully and unconditionally guaranteed, on a joint and several basis, by all of our 100% owned material U.S. subsidiaries (the “Guarantor Subsidiaries”). The 2023 Notes are not guaranteed by our foreign subsidiaries (the “Non-guarantor Subsidiaries”).

The following condensed consolidating financial information sets forth the Statements of Operations and Comprehensive (Loss) Income for the three months ended March 31, 2017 and 2016, the Balance Sheets as of March 31, 2017 and December 31, 2016, and the Statements of Cash Flows for the three months ended March 31, 2017 and 2016 for the Parent, the Guarantor Subsidiaries on a combined basis, and the Non-guarantor Subsidiaries also on a combined basis. The condensed consolidating financial information reflects the investments of the Parent in the Guarantor Subsidiaries and Non-guarantor Subsidiaries, as well as the investments of the Guarantor Subsidiaries in the Non-guarantor Subsidiaries, using the equity method of accounting. The principal consolidating adjustments are entries to eliminate the investments in subsidiaries and intercompany balances and transactions.

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME | ||||||||||||||||||||

For the Three Months Ended March 31, 2017 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Sales | $ | — | $ | 709 | $ | 550 | $ | (387 | ) | $ | 872 | |||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of sales, excluding depreciation, amortization and distribution costs | — | 677 | 378 | (388 | ) | 667 | ||||||||||||||

Depreciation and amortization | — | 19 | 32 | — | 51 | |||||||||||||||

Distribution costs | — | 41 | 69 | — | 110 | |||||||||||||||

Selling, general and administrative expenses | 9 | 17 | 17 | — | 43 | |||||||||||||||

Closure costs, impairment and other related charges | — | — | 7 | — | 7 | |||||||||||||||

Operating (loss) income | (9 | ) | (45 | ) | 47 | 1 | (6 | ) | ||||||||||||

Interest expense | (20 | ) | (1 | ) | (3 | ) | 13 | (11 | ) | |||||||||||

Other income, net | — | 13 | — | (13 | ) | — | ||||||||||||||

Equity in (loss) income of subsidiaries | (18 | ) | 1 | — | 17 | — | ||||||||||||||

(Loss) income before income taxes | (47 | ) | (32 | ) | 44 | 18 | (17 | ) | ||||||||||||

Income tax provision | — | — | (29 | ) | — | (29 | ) | |||||||||||||

Net (loss) income including noncontrolling interests | (47 | ) | (32 | ) | 15 | 18 | (46 | ) | ||||||||||||

Net income attributable to noncontrolling interests | — | — | (1 | ) | — | (1 | ) | |||||||||||||

Net (loss) income attributable to Resolute Forest Products Inc. | $ | (47 | ) | $ | (32 | ) | $ | 14 | $ | 18 | $ | (47 | ) | |||||||

Comprehensive (loss) income attributable to Resolute Forest Products Inc. | $ | (38 | ) | $ | (33 | ) | $ | 24 | $ | 9 | $ | (38 | ) | |||||||

14

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME | ||||||||||||||||||||

For the Three Months Ended March 31, 2016 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Sales | $ | — | $ | 741 | $ | 516 | $ | (380 | ) | $ | 877 | |||||||||

Costs and expenses: | ||||||||||||||||||||

Cost of sales, excluding depreciation, amortization and distribution costs | — | 705 | 353 | (381 | ) | 677 | ||||||||||||||

Depreciation and amortization | — | 22 | 30 | — | 52 | |||||||||||||||

Distribution costs | — | 43 | 69 | — | 112 | |||||||||||||||

Selling, general and administrative expenses | 5 | 16 | 17 | — | 38 | |||||||||||||||

Net gain on disposition of assets | — | — | (2 | ) | — | (2 | ) | |||||||||||||

Operating (loss) income | (5 | ) | (45 | ) | 49 | 1 | — | |||||||||||||

Interest expense | (18 | ) | — | (4 | ) | 12 | (10 | ) | ||||||||||||

Other income, net | — | 19 | 6 | (12 | ) | 13 | ||||||||||||||

Equity in income (loss) of subsidiaries | 15 | (13 | ) | — | (2 | ) | — | |||||||||||||

(Loss) income before income taxes | (8 | ) | (39 | ) | 51 | (1 | ) | 3 | ||||||||||||

Income tax provision | — | — | (10 | ) | — | (10 | ) | |||||||||||||

Net (loss) income including noncontrolling interests | (8 | ) | (39 | ) | 41 | (1 | ) | (7 | ) | |||||||||||

Net income attributable to noncontrolling interests | — | — | (1 | ) | — | (1 | ) | |||||||||||||

Net (loss) income attributable to Resolute Forest Products Inc. | $ | (8 | ) | $ | (39 | ) | $ | 40 | $ | (1 | ) | $ | (8 | ) | ||||||

Comprehensive (loss) income attributable to Resolute Forest Products Inc. | $ | (3 | ) | $ | (42 | ) | $ | 48 | $ | (6 | ) | $ | (3 | ) | ||||||

15

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING BALANCE SHEET | ||||||||||||||||||||

As of March 31, 2017 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Assets | ||||||||||||||||||||

Current assets: | ||||||||||||||||||||

Cash and cash equivalents | $ | — | $ | 2 | $ | 37 | $ | — | $ | 39 | ||||||||||

Accounts receivable, net | — | 285 | 169 | — | 454 | |||||||||||||||

Accounts receivable from affiliates | 1 | 484 | 403 | (888 | ) | — | ||||||||||||||

Inventories, net | — | 273 | 346 | (11 | ) | 608 | ||||||||||||||

Note, advance and interest receivable from parent | — | 66 | — | (66 | ) | — | ||||||||||||||

Notes and interest receivable from affiliates | — | 59 | — | (59 | ) | — | ||||||||||||||

Other current assets | — | 15 | 21 | — | 36 | |||||||||||||||

Total current assets | 1 | 1,184 | 976 | (1,024 | ) | 1,137 | ||||||||||||||

Fixed assets, net | — | 778 | 1,088 | — | 1,866 | |||||||||||||||

Amortizable intangible assets, net | — | 14 | 54 | — | 68 | |||||||||||||||

Goodwill | — | 81 | — | — | 81 | |||||||||||||||

Deferred income tax assets | — | — | 1,051 | 3 | 1,054 | |||||||||||||||

Notes receivable from parent | — | 761 | — | (761 | ) | — | ||||||||||||||

Note receivable from affiliate | — | 110 | — | (110 | ) | — | ||||||||||||||

Investments in consolidated subsidiaries and affiliates | 3,909 | 2,069 | — | (5,978 | ) | — | ||||||||||||||

Other assets | — | 63 | 66 | — | 129 | |||||||||||||||

Total assets | $ | 3,910 | $ | 5,060 | $ | 3,235 | $ | (7,870 | ) | $ | 4,335 | |||||||||

Liabilities and equity | ||||||||||||||||||||

Current liabilities: | ||||||||||||||||||||

Accounts payable and accrued liabilities | $ | 14 | $ | 221 | $ | 233 | $ | — | $ | 468 | ||||||||||

Current portion of long-term debt | — | 1 | — | — | 1 | |||||||||||||||

Accounts payable to affiliates | 484 | 403 | 1 | (888 | ) | — | ||||||||||||||

Note, advance and interest payable to subsidiaries | 66 | — | — | (66 | ) | — | ||||||||||||||

Notes and interest payable to affiliate | — | — | 59 | (59 | ) | — | ||||||||||||||

Total current liabilities | 564 | 625 | 293 | (1,013 | ) | 469 | ||||||||||||||

Long-term debt, net of current portion | 591 | 289 | — | — | 880 | |||||||||||||||

Note payable to subsidiaries | 761 | — | — | (761 | ) | — | ||||||||||||||

Note payable to affiliate | — | — | 110 | (110 | ) | — | ||||||||||||||

Pension and other postretirement benefit obligations | — | 389 | 862 | — | 1,251 | |||||||||||||||

Deferred income tax liabilities | — | 1 | 4 | — | 5 | |||||||||||||||

Other liabilities | 1 | 24 | 31 | — | 56 | |||||||||||||||

Total liabilities | 1,917 | 1,328 | 1,300 | (1,884 | ) | 2,661 | ||||||||||||||

Total equity | 1,993 | 3,732 | 1,935 | (5,986 | ) | 1,674 | ||||||||||||||

Total liabilities and equity | $ | 3,910 | $ | 5,060 | $ | 3,235 | $ | (7,870 | ) | $ | 4,335 | |||||||||

16

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING BALANCE SHEET | ||||||||||||||||||||

As of December 31, 2016 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Assets | ||||||||||||||||||||

Current assets: | ||||||||||||||||||||

Cash and cash equivalents | $ | — | $ | 2 | $ | 33 | $ | — | $ | 35 | ||||||||||

Accounts receivable, net | — | 283 | 158 | — | 441 | |||||||||||||||

Accounts receivable from affiliates | — | 479 | 395 | (874 | ) | — | ||||||||||||||

Inventories, net | — | 259 | 323 | (12 | ) | 570 | ||||||||||||||

Note, advance and interest receivable from parent | — | 373 | — | (373 | ) | — | ||||||||||||||

Notes and interest receivable from affiliates | — | 54 | — | (54 | ) | — | ||||||||||||||

Other current assets | — | 16 | 19 | — | 35 | |||||||||||||||

Total current assets | — | 1,466 | 928 | (1,313 | ) | 1,081 | ||||||||||||||

Fixed assets, net | — | 733 | 1,109 | — | 1,842 | |||||||||||||||

Amortizable intangible assets, net | — | 14 | 56 | — | 70 | |||||||||||||||

Goodwill | — | 81 | — | — | 81 | |||||||||||||||

Deferred income tax assets | — | — | 1,036 | 3 | 1,039 | |||||||||||||||

Note receivable from parent | — | 443 | — | (443 | ) | — | ||||||||||||||

Note receivable from affiliate | — | 109 | — | (109 | ) | — | ||||||||||||||

Investments in consolidated subsidiaries and affiliates | 3,918 | 2,068 | — | (5,986 | ) | — | ||||||||||||||

Other assets | — | 62 | 102 | — | 164 | |||||||||||||||

Total assets | $ | 3,918 | $ | 4,976 | $ | 3,231 | $ | (7,848 | ) | $ | 4,277 | |||||||||

Liabilities and equity | ||||||||||||||||||||

Current liabilities: | ||||||||||||||||||||

Accounts payable and accrued liabilities | $ | 5 | $ | 222 | $ | 239 | $ | — | $ | 466 | ||||||||||

Current portion of long-term debt | — | 1 | — | — | 1 | |||||||||||||||

Accounts payable to affiliates | 479 | 395 | — | (874 | ) | — | ||||||||||||||

Note, advance and interest payable to subsidiaries | 373 | — | — | (373 | ) | — | ||||||||||||||

Notes and interest payable to affiliate | — | — | 54 | (54 | ) | — | ||||||||||||||

Total current liabilities | 857 | 618 | 293 | (1,301 | ) | 467 | ||||||||||||||

Long-term debt, net of current portion | 590 | 171 | — | — | 761 | |||||||||||||||

Note payable to subsidiary | 443 | — | — | (443 | ) | — | ||||||||||||||

Note payable to affiliate | — | — | 109 | (109 | ) | — | ||||||||||||||

Pension and other postretirement benefit obligations | — | 397 | 884 | — | 1,281 | |||||||||||||||

Deferred income tax liabilities | — | 1 | 1 | — | 2 | |||||||||||||||

Other liabilities | — | 24 | 31 | — | 55 | |||||||||||||||

Total liabilities | 1,890 | 1,211 | 1,318 | (1,853 | ) | 2,566 | ||||||||||||||

Total equity | 2,028 | 3,765 | 1,913 | (5,995 | ) | 1,711 | ||||||||||||||

Total liabilities and equity | $ | 3,918 | $ | 4,976 | $ | 3,231 | $ | (7,848 | ) | $ | 4,277 | |||||||||

17

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS | ||||||||||||||||||||

For the Three Months Ended March 31, 2017 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Net cash (used in) provided by operating activities | $ | — | $ | (47 | ) | $ | 8 | $ | — | $ | (39 | ) | ||||||||

Cash flows from investing activities: | ||||||||||||||||||||

Cash invested in fixed assets | — | (59 | ) | (10 | ) | — | (69 | ) | ||||||||||||

Increase in countervailing duty cash deposits | — | (5 | ) | — | — | (5 | ) | |||||||||||||

Increase in restricted cash | — | — | (2 | ) | — | (2 | ) | |||||||||||||

Decrease in deposit requirements for letters of credit, net | — | — | 1 | — | 1 | |||||||||||||||

Increase in notes receivable from affiliate | — | (7 | ) | — | 7 | — | ||||||||||||||

Net cash used in investing activities | — | (71 | ) | (11 | ) | 7 | (75 | ) | ||||||||||||

Cash flows from financing activities: | ||||||||||||||||||||

Net borrowings under revolving credit facilities | — | 118 | — | — | 118 | |||||||||||||||

Increase in notes payable to affiliate | — | — | 7 | (7 | ) | — | ||||||||||||||

Net cash provided by financing activities | — | 118 | 7 | (7 | ) | 118 | ||||||||||||||

Net increase in cash and cash equivalents | — | — | 4 | — | 4 | |||||||||||||||

Cash and cash equivalents: | ||||||||||||||||||||

Beginning of period | — | 2 | 33 | — | 35 | |||||||||||||||

End of period | $ | — | $ | 2 | $ | 37 | $ | — | $ | 39 | ||||||||||

CONDENSED CONSOLIDATING STATEMENT OF CASH FLOWS | ||||||||||||||||||||

For the Three Months Ended March 31, 2016 | ||||||||||||||||||||

(Unaudited, in millions) | Parent | Guarantor Subsidiaries | Non-guarantor Subsidiaries | Consolidating Adjustments | Consolidated | |||||||||||||||

Net cash provided by (used in) operating activities | $ | — | $ | 17 | $ | (11 | ) | $ | — | $ | 6 | |||||||||

Cash flows from investing activities: | ||||||||||||||||||||

Cash invested in fixed assets | — | (31 | ) | (16 | ) | — | (47 | ) | ||||||||||||

Disposition of assets | — | — | 5 | — | 5 | |||||||||||||||

Increase in countervailing duties cash deposits | — | (6 | ) | — | — | (6 | ) | |||||||||||||

Increase in notes receivable from affiliate | — | (3 | ) | — | 3 | — | ||||||||||||||

Net cash used in investing activities | — | (40 | ) | (11 | ) | 3 | (48 | ) | ||||||||||||

Cash flows from financing activities: | ||||||||||||||||||||

Borrowings under revolving credit facility | — | 20 | — | — | 20 | |||||||||||||||

Increase in notes payable to affiliate | — | — | 3 | (3 | ) | — | ||||||||||||||

Net cash provided by financing activities | — | 20 | 3 | (3 | ) | 20 | ||||||||||||||

Effect of exchange rate changes on cash and cash equivalents | — | — | 1 | — | 1 | |||||||||||||||

Net decrease in cash and cash equivalents | — | (3 | ) | (18 | ) | — | (21 | ) | ||||||||||||

Cash and cash equivalents: | ||||||||||||||||||||

Beginning of period | — | 13 | 45 | — | 58 | |||||||||||||||

End of period | $ | — | $ | 10 | $ | 27 | $ | — | $ | 37 | ||||||||||

18

RESOLUTE FOREST PRODUCTS INC.

Notes to Unaudited Interim Consolidated Financial Statements

Note 13. Subsequent Event

The following significant event occurred subsequent to March 31, 2017:

• | On November 25, 2016, countervailing duty and anti-dumping petitions were filed with Commerce and the U.S. International Trade Commission by certain U.S. softwood lumber producers requesting that the U.S. government impose countervailing and anti-dumping duties on Canadian-origin softwood lumber products exported to the U.S. One of our subsidiaries was identified in the petition as being a Canadian exporting producer of softwood lumber products to the U.S. and was selected as a mandatory respondent to be investigated by Commerce in both the countervailing and anti-dumping duty investigations. On April 24, 2017, Commerce announced its preliminary determinations in the countervailing duty investigation, and, as a result, since April 28, 2017, we have been required to pay cash deposits to the U.S. at a rate of 12.82% for estimated countervailing duties on our imports to the U.S. of the majority of the softwood lumber products produced at our Canadian sawmills. The rate and the requirement to pay cash deposits do not have retroactive effect. Commerce has not yet issued its preliminary determination in the anti-dumping investigation. |

The preliminary 12.82% rate can remain in effect for up to four months. If Commerce does not issue a countervailing duty order before the four-month period lapses, then we would not be required to pay deposits for countervailing duties on our softwood lumber imports until Commerce issues its countervailing duty order. If as a result of such a countervailing duty order we are subject to a countervailing duty deposit requirement on any of our softwood lumber product imports to the U.S., then we would be required to resume making cash deposits at the rate set in the order until Commerce sets a countervailing duty rate in a subsequent administrative review. Based on the 12.82% rate and our current operating parameters, cash deposits on our imports of the affected softwood lumber products to the U.S. would be approximately $17 million for the initial four-month period, and as high as $50 million per year if the rate were to remain in effect continuously. We are not presently able to determine the ultimate resolution of this matter and we are presently evaluating the impact of this announcement on our Consolidated Financial Statements.

19

ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

The following management’s discussion and analysis is intended to help the reader understand Resolute Forest Products, our results of operations, cash flows and financial condition. The discussion is provided as a supplement to, and should be read in conjunction with, our consolidated financial statements and the accompanying notes (or the “Consolidated Financial Statements”) contained in Item 1 – Financial Statements of this Quarterly Report on Form 10-Q (or “Form 10-Q”).

When we refer to “Resolute Forest Products,” “we,” “our,” “us” or the “Company,” we mean Resolute Forest Products Inc. with its subsidiaries and affiliates, either individually or collectively, unless otherwise indicated.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING INFORMATION AND USE OF THIRD-PARTY DATA

Statements in this Form 10-Q that are not reported financial results or other historical information of Resolute Forest Products are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. They include, for example, statements relating to our: efforts and initiatives to reduce costs and increase revenues and profitability; business and operating outlook; future pension funding obligations; assessment of market conditions; growth strategies and prospects, and the growth potential of the Company and the industry in which we operate; liquidity; future cash flows, including as a result of changes to our pension funding obligations; and strategies for achieving our goals generally. Forward-looking statements may be identified by the use of forward-looking terminology such as the words “should,” “would,” “could,” “will,” “may,” “expect,” “believe,” “anticipate,” “attempt,” “project” and other terms with similar meaning indicating possible future events or potential impact on our business or Resolute Forest Products’ shareholders.

The reader is cautioned not to place undue reliance on these forward-looking statements, which are not guarantees of future performance. These statements are based on management’s current assumptions, beliefs and expectations, all of which involve a number of business risks and uncertainties that could cause actual results to differ materially. The potential risks and uncertainties that could cause our actual future financial condition, results of operations and performance to differ materially from those expressed or implied in this Form 10-Q include, but are not limited to, the impact of: developments in non-print media, and the effectiveness of our responses to these developments; the highly cyclical nature of the forest products industry; intense competition in the forest products industry; any inability to offer products certified to globally recognized forestry management and chain of custody standards; any inability to successfully implement our strategies to increase our earnings power; the possible failure to successfully integrate acquired businesses with ours or to realize the anticipated benefits of acquisitions, such as Atlas Paper Holdings, Inc. and its subsidiaries (or “Atlas Tissue”), or divestitures or other strategic transactions or projects, such as our Calhoun, Tennessee, tissue project; uncertainty or changes in political or economic conditions in the U.S., Canada or other countries in which we manufacture or sell our products; global economic conditions; any difficulties in obtaining wood fiber at favorable prices, or at all; changes in the cost of purchased energy and other raw materials; physical and financial risks associated with global, regional and local climate conditions and change; any disruption in operations or increased labor costs due to labor disputes; disruptions to our supply chain, operations or the delivery of our products; cybersecurity risks; negative publicity, even if unjustified; currency fluctuations; contributions to our pension plans at levels higher than expected; the terms of our outstanding indebtedness, which could restrict our current and future operations; our ability to maintain adequate capital resources to provide for all of our substantial capital requirements; losses that are not covered by insurance; any additional closure costs and long-lived asset or goodwill impairment or accelerated depreciation charges; any need to record additional valuation allowances against our recorded deferred income tax assets; our exports from one country to another country becoming or remaining subject to countervailing duties, cash deposit requirements, border taxes, quotas or other trade remedies or restrictions; the future regulation of our Canadian exports to the U.S., including softwood lumber and supercalendered (or “SC”) paper; any failure to comply with laws or regulations generally; any additional environmental or health and safety liabilities; any violation of trade laws, export controls or other laws relating to our international sales and operations; unanticipated outcomes of legal proceedings or disputes in which we are involved; the actions of holders of a significant percentage of our common stock; and the potential risks and uncertainties set forth under Part I, Item 1A, “Risk Factors,” of our annual report on Form 10-K for the year ended December 31, 2016, filed with the U.S. Securities and Exchange Commission, or the “SEC”, on March 1, 2017 (the “2016 Annual Report”).

All forward-looking statements in this Form 10-Q are expressly qualified by the cautionary statements contained or referred to in this section and in our other filings with the SEC and the Canadian securities regulatory authorities. We disclaim any obligation to publicly update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

20

Market and industry data

The information on industry and general economic conditions in this Form 10-Q was derived from third-party sources and trade publications we believe to be widely accepted and accurate. We have not independently verified the information and cannot assure you of its accuracy.

OVERVIEW

Resolute Forest Products is a global leader in the forest products industry with a diverse range of products, including market pulp, tissue, wood products, newsprint and specialty papers, which are marketed in over 70 countries. The company owns or operates over 40 pulp, paper, tissue and wood products facilities, as well as power generation assets in the U.S. and Canada. We are the largest Canadian producer of wood products east of the Canadian Rockies and one of the most significant pulp producers in North America. By capacity, we are the number one producer of newsprint in the world and the largest producer of uncoated mechanical papers in North America. We are also an emerging tissue producer.

We report our activities in five business segments: market pulp, tissue, wood products, newsprint and specialty papers.

We are guided by our vision and values, focusing on safety, profitability, accountability, sustainability and teamwork. These are the elements that we believe best define us:

• | Competitive cost structure and diversified asset base - Through our large-scale, efficient and integrated operations, competitive sources of energy and fiber, strategically located mills, and cost-effective management structure, we believe we are well positioned to compete in the global marketplace. We maintain a rigorous focus on reducing costs, optimizing production across our network, adjusting to market dynamics, as well as capitalizing on our access to international markets. |

• | Conservative capital structure - Our low debt and solid liquidity levels are key to our continued transformation to a more sustainable company. In order to maintain financial strength and flexibility, we continue to spend our capital in a disciplined, strategic and focused manner, concentrating on our most successful sites. |

• | Strategic perspectives - We pursue initiatives that improve our cost position, advance diversification, provide synergies or position us to expand into future growth markets. All are key to our long-term success. To that end, we take an opportunistic approach that aligns with our strategic plan and that we believe positions us favorably for the long-term evolution of the paper and forest products industry. |

Our Business

For information relating to our business, including our products, strategy, capital management, sustainable performance and development, and power generation assets, refer to our 2016 Annual Report.

First Quarter Overview

In the first quarter of 2017, we changed our presentation of segment operating income to reallocate the amortization of prior service credits component of pension and other postretirement benefit (or “OPEB”) costs from the reportable segments to “corporate and other.” Current service costs will continue to be allocated to the reportable segments. We now also treat the amortization of prior service credits component of pension and OPEB costs as a special item to be adjusted for purposes of establishing our non-GAAP performance measures, as further described below in note 1 under “First Quarter Overview,” and in note 1 under “Results of Operations – Consolidated Results – Selected Financial Information,” together with our non-operating pension and OPEB costs and credits. This approach is consistent with the indicators management uses internally to evaluate performance, including those used by the chief operating decision maker. Prior period amounts have been reclassified to conform to the 2017 presentation.

Three months ended March 31, 2017 vs. March 31, 2016

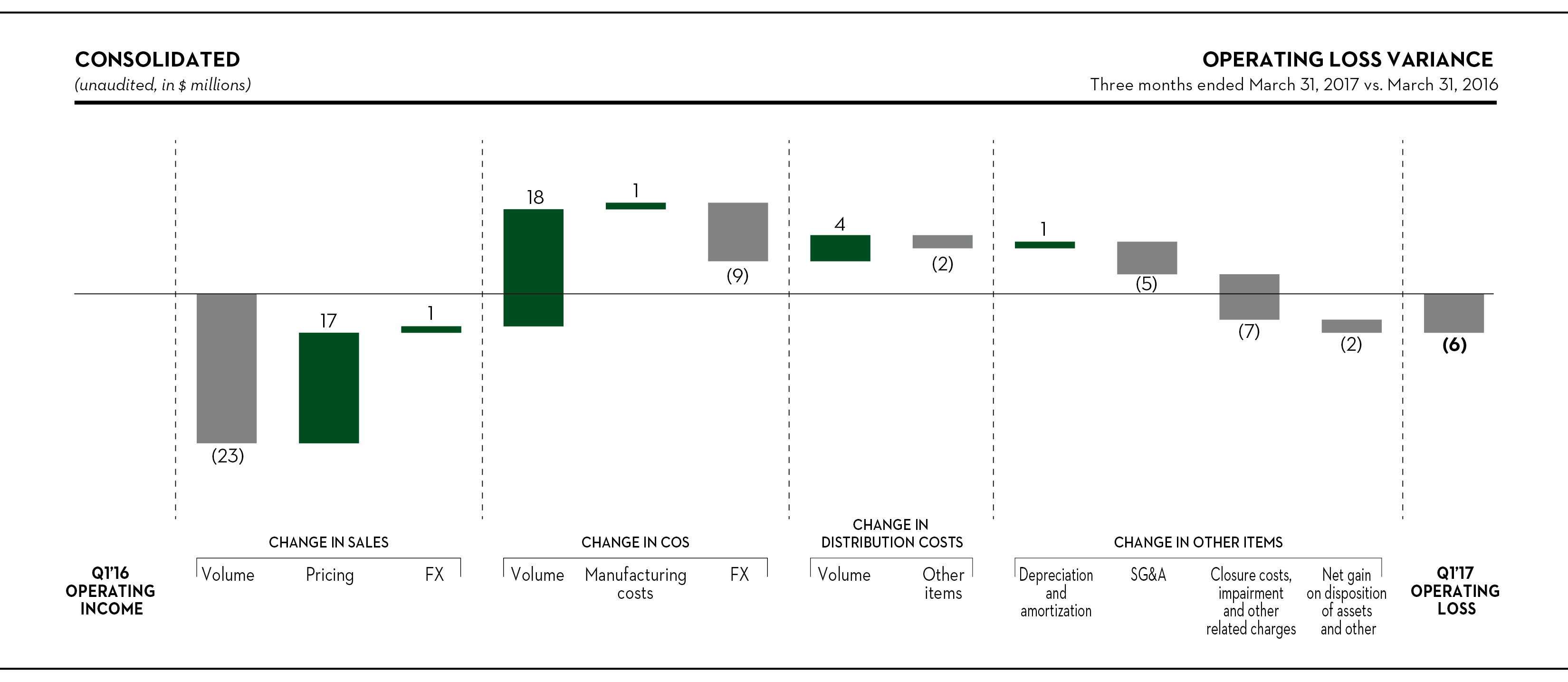

Our operating loss was $6 million in the quarter, compared to a break-even position in the first quarter of 2016. Excluding special items, we generated an operating income of $10 million, compared to $3 million in the year-ago period. Special items are described below.

Our net loss in the quarter was $47 million, or $0.52 per share, compared to $8 million, or $0.09 per share, in the first quarter of 2016. Our net loss in the quarter, excluding special items, was $30 million, or $0.33 per share, compared to $22 million, or $0.25 per share, in the year-ago period.

21

Three Months Ended March 31, 2017 | Operating Income (Loss) | Net Income (Loss) | EPS | |||||||||

(Unaudited, in millions, except per share amounts) | ||||||||||||

GAAP, as reported | $ | (6 | ) | $ | (47 | ) | $ | (0.52 | ) | |||

Adjustments for special items: | ||||||||||||

Closure costs, impairment and other related charges | 7 | 7 | 0.08 | |||||||||

Inventory write-downs related to closures | 4 | 4 | 0.04 | |||||||||

Start-up costs | 8 | 8 | 0.09 | |||||||||

Non-operating pension and OPEB credits | (3 | ) | (3 | ) | (0.03 | ) | ||||||

Income tax effect of special items | — | 1 | 0.01 | |||||||||

Adjusted for special items (1) | $ | 10 | $ | (30 | ) | $ | (0.33 | ) | ||||

Three Months Ended March 31, 2016 | Operating Income (Loss) | Net Income (Loss) | EPS | |||||||||

(Unaudited, in millions, except per share amounts) | ||||||||||||

GAAP, as reported | $ | — | $ | (8 | ) | $ | (0.09 | ) | ||||

Adjustments for special items: | ||||||||||||

Foreign exchange translation gain | — | (6 | ) | (0.07 | ) | |||||||

Start-up costs | 3 | 3 | 0.03 | |||||||||

Net gain on disposition of assets | (2 | ) | (2 | ) | (0.02 | ) | ||||||

Non-operating pension and OPEB costs | 2 | 2 | 0.02 | |||||||||

Other income, net | — | (7 | ) | (0.08 | ) | |||||||

Income tax effect of special items | — | (4 | ) | (0.04 | ) | |||||||

Adjusted for special items (1) | $ | 3 | $ | (22 | ) | $ | (0.25 | ) | ||||

(1) | Operating income (loss), net income (loss) and net income (loss) per share (or “EPS”), in each case as adjusted for special items, are not financial measures recognized under generally accepted accounting principles (or “GAAP”). We calculate operating income (loss), as adjusted for special items, as operating income (loss) from our Consolidated Statements of Operations, adjusted for items such as closure costs, impairment and other related charges, inventory write-downs related to closures, start-up costs, gains and losses on disposition of assets, non-operating pension and OPEB costs and credits, and other charges or credits that are excluded from our segment’s performance from GAAP operating income (loss). We calculate net income (loss), as adjusted for special items, as net income (loss) from our Consolidated Statements of Operations, adjusted for the same special items applied to operating income (loss), in addition to foreign exchange translation gains and losses, other income (expense), net, and the income tax effect of the special items. EPS, as adjusted for special items, is calculated as net income (loss), as adjusted for special items, per diluted share. We believe that using these non-GAAP measures is useful because they are consistent with the indicators management uses internally to measure the Company’s performance, and it allows the reader to more easily compare our operations and financial performance from period to period. Operating income (loss), net income (loss) and EPS, in each case as adjusted for special items, are internal measures, and therefore may not be comparable to those of other companies. These non-GAAP measures should not be viewed as substitutes to financial measures determined under GAAP. |

22

RESULTS OF OPERATIONS

Consolidated Results

Selected financial information

Three Months Ended March 31, | ||||||||

(Unaudited, in millions, except per share amounts) | 2017 | 2016 | ||||||

Sales | $ | 872 | $ | 877 | ||||

Operating income (loss) per segment: | ||||||||

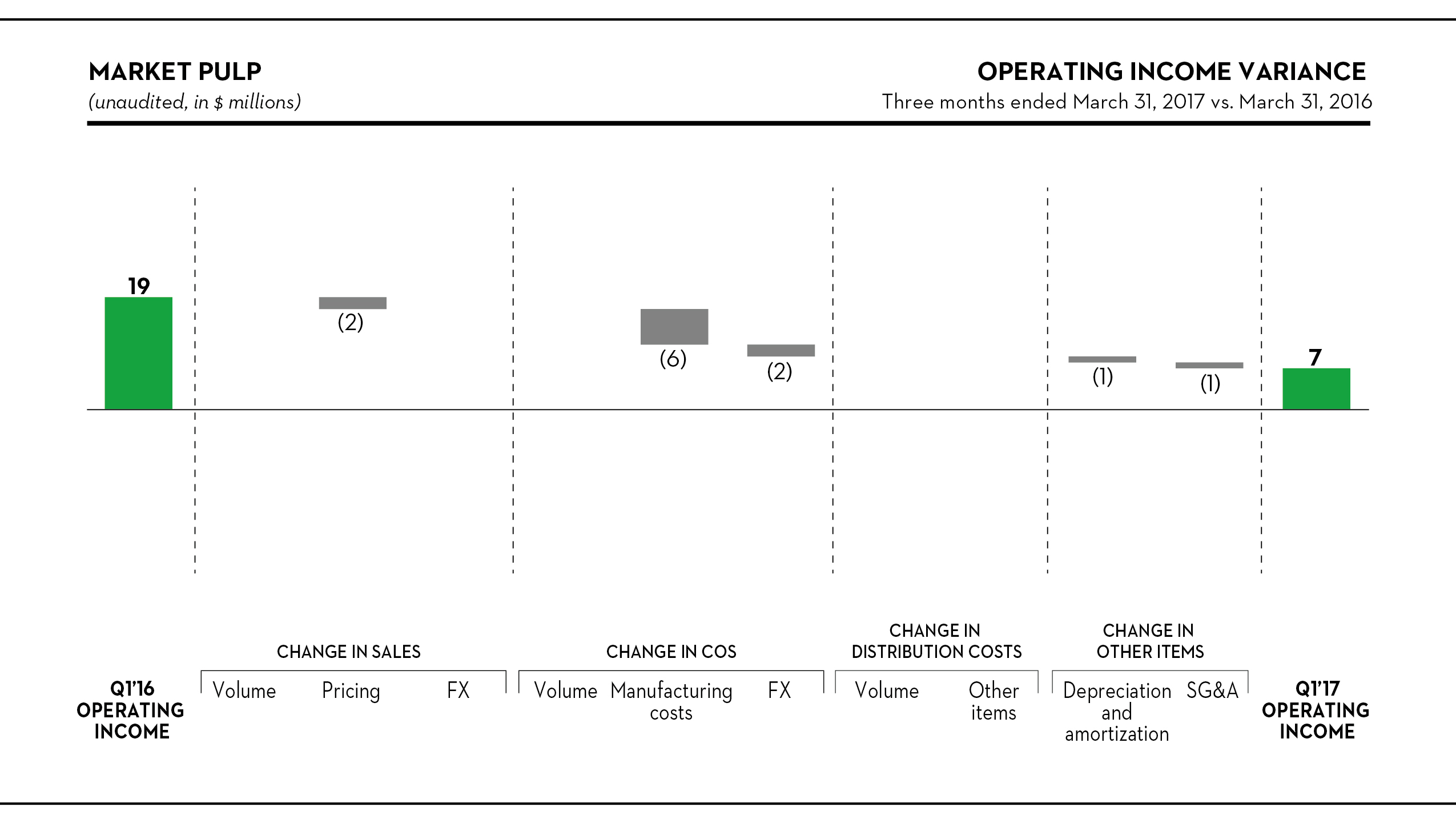

Market pulp | 7 | 19 | ||||||

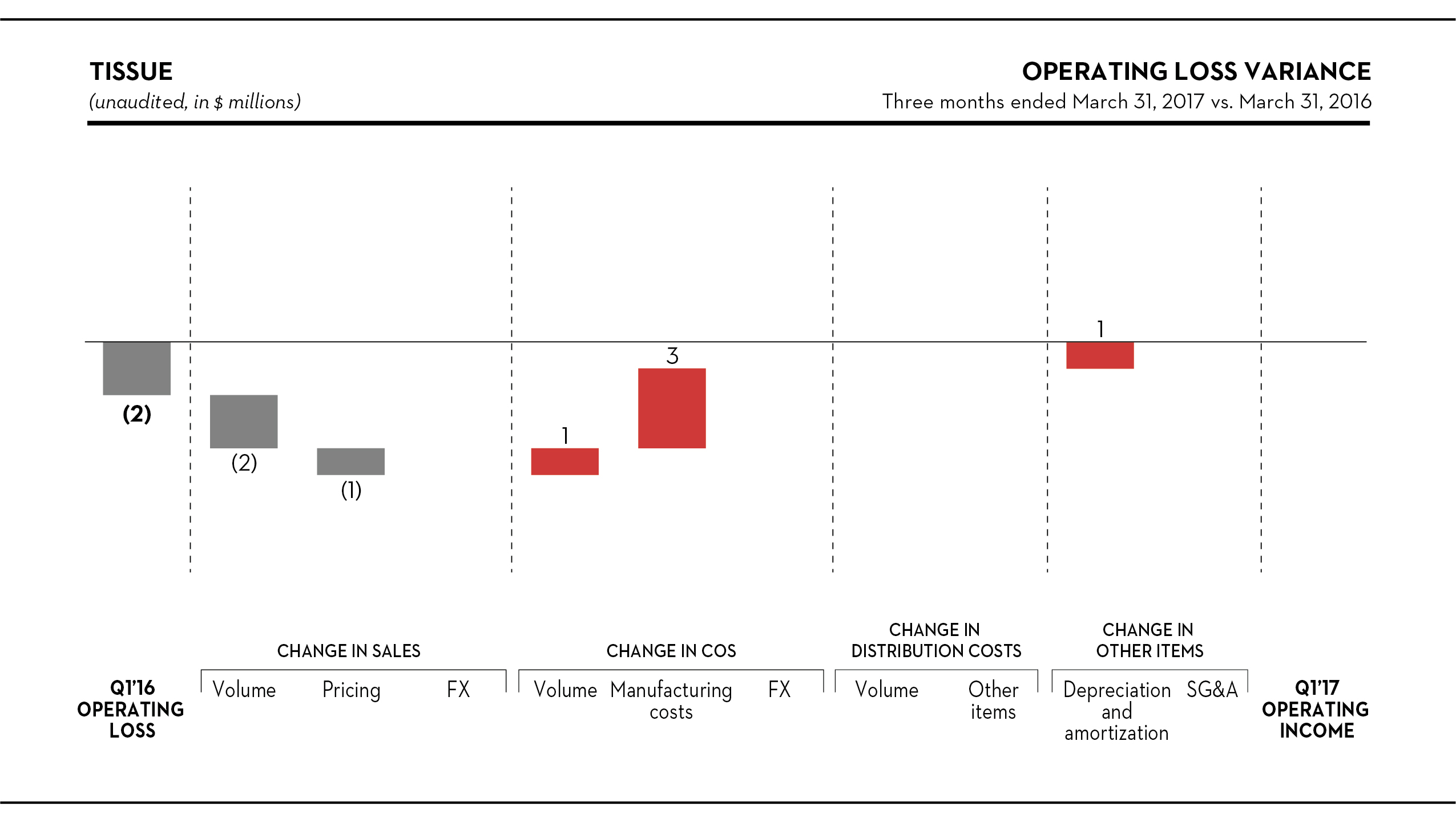

Tissue | — | (2 | ) | |||||

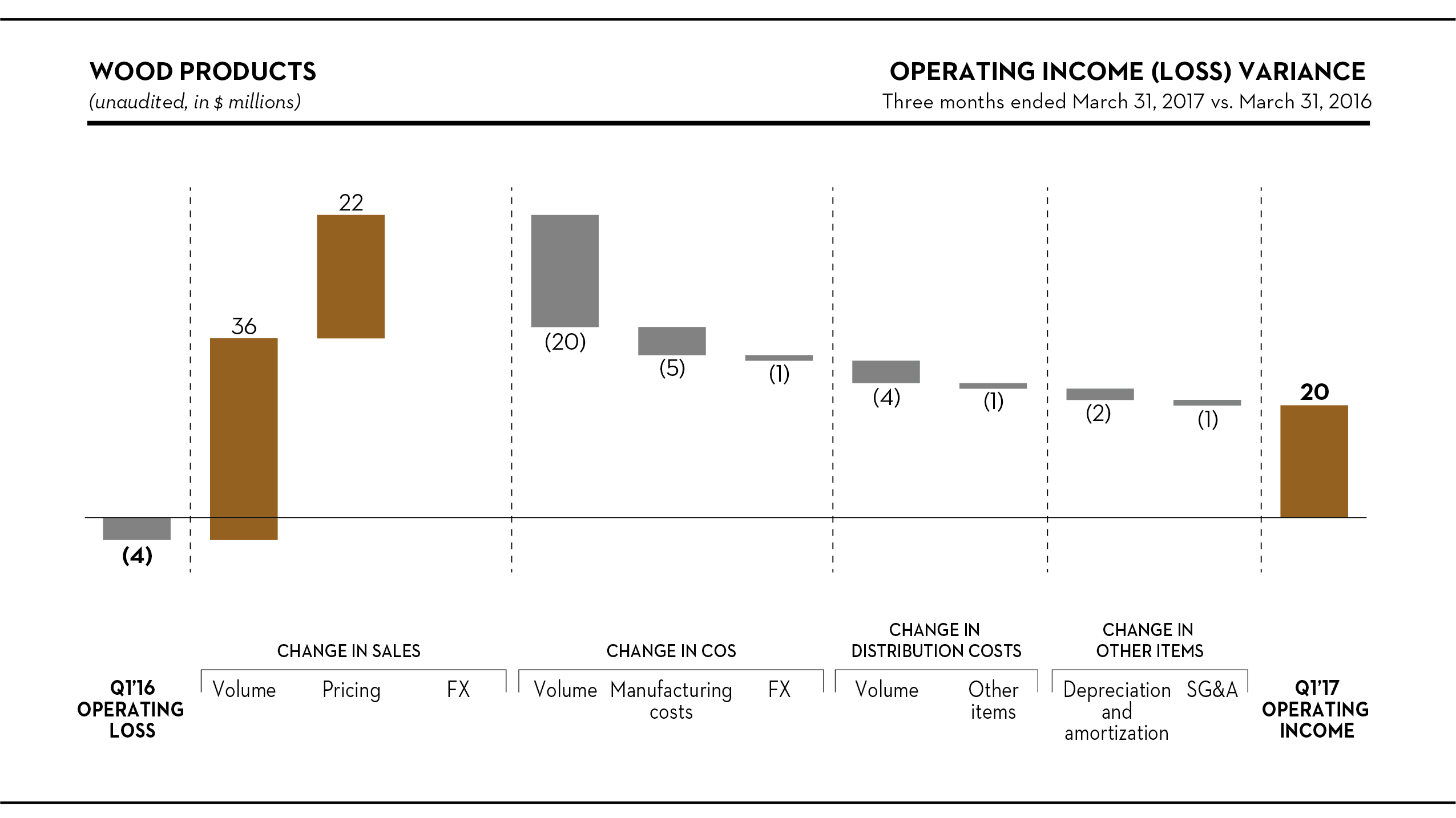

Wood products | 20 | (4 | ) | |||||

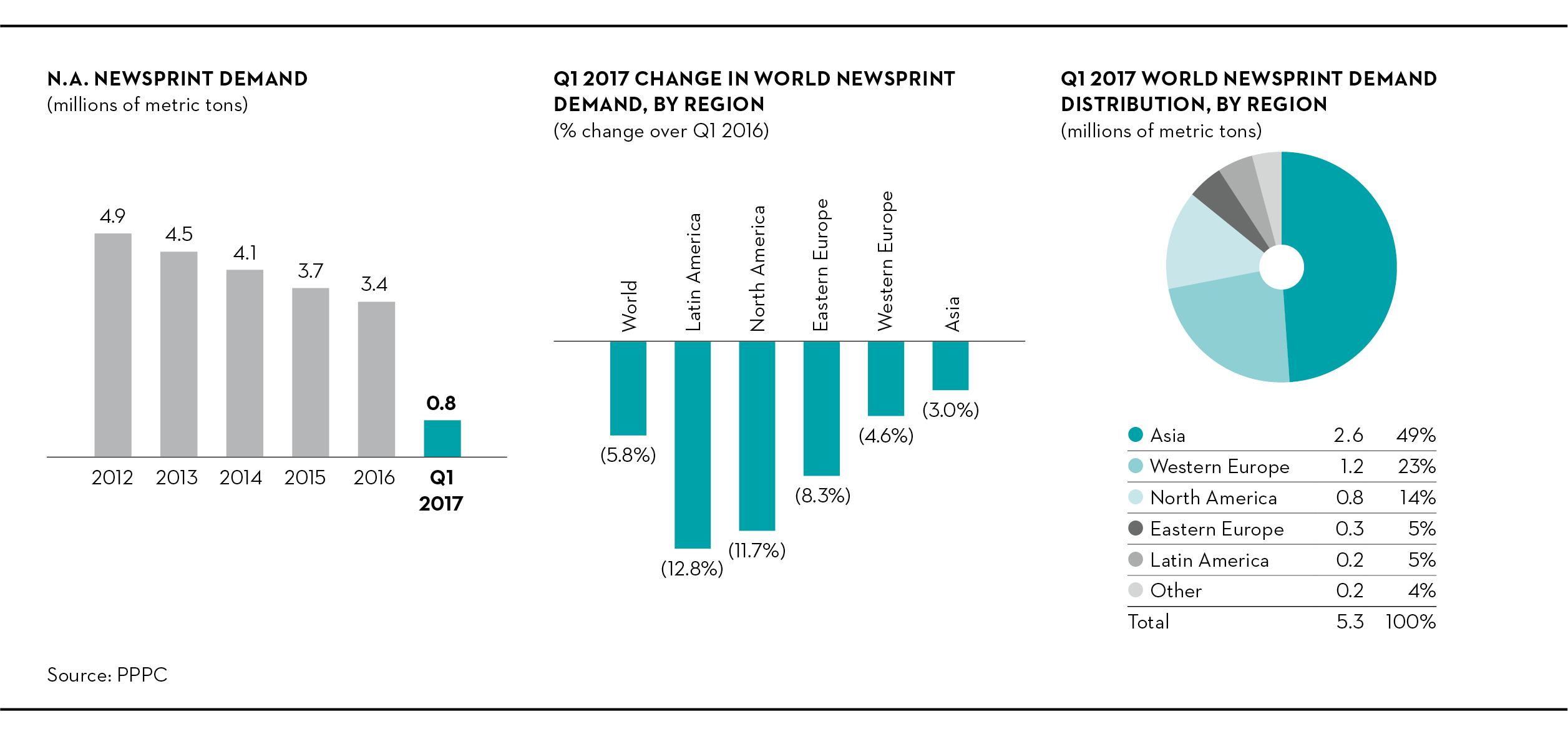

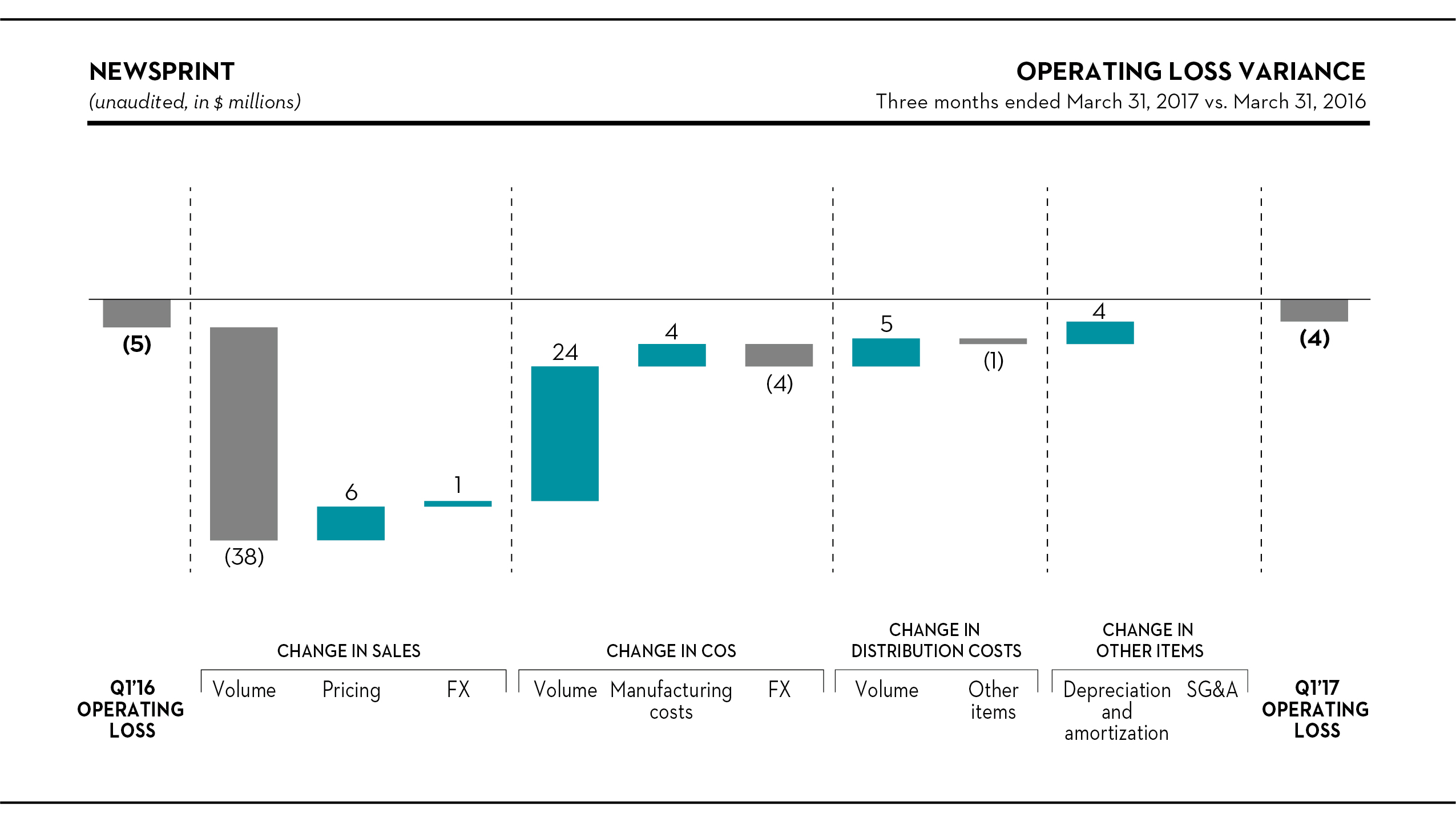

Newsprint | (4 | ) | (5 | ) | ||||

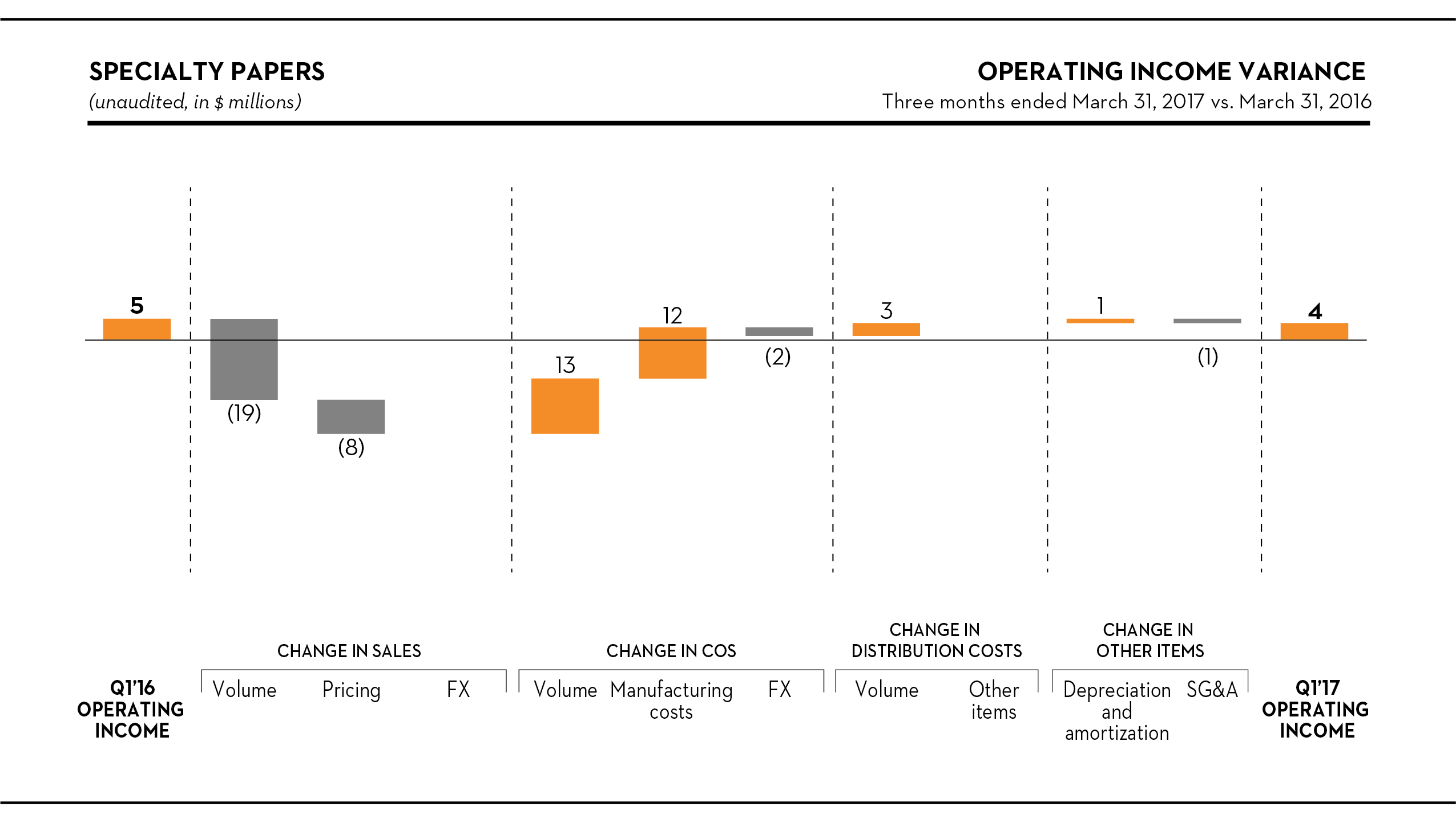

Specialty papers | 4 | 5 | ||||||

Segment total | 27 | 13 | ||||||

Corporate and other | (33 | ) | (13 | ) | ||||

Operating loss | (6 | ) | — | |||||

Net loss attributable to Resolute Forest Products Inc. | (47 | ) | (8 | ) | ||||

Net loss per common share attributable to Resolute Forest Products Inc. common shareholders: | ||||||||

Basic | $ | (0.52 | ) | $ | (0.09 | ) | ||

Diluted | (0.52 | ) | (0.09 | ) | ||||

Adjusted EBITDA (1) | $ | 61 | $ | 55 | ||||

(Unaudited, in millions) | March 31, 2017 | December 31, 2016 | ||||||

Cash and cash equivalents | $ | 39 | $ | 35 | ||||

Total assets | 4,335 | 4,277 | ||||||