Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Resolute Forest Products Inc. | d8k.htm |

| EX-10.1 - EXHIBIT 10.1 - Resolute Forest Products Inc. | dex101.htm |

| EX-99.2 - EXHIBIT 99.2 - Resolute Forest Products Inc. | dex992.htm |

Exhibit 99.1

| CANADA | SUPERIOR COURT | |

| PROVINCE OF QUÉBEC DISTRICT OF MONTRÉAL

No.: 500-11-036133-094 |

Commercial Division Sitting as a court designated pursuant to the Companies’ Creditors Arrangement Act, R.S.C., c. C-36, as amended

| |

| IN THE MATTER OF THE PLAN OF COMPROMISE OR ARRANGEMENT OF: | ||

| ABITIBIBOWATER INC., a legal person incorporated under the laws of the State of Delaware, having its principal executive offices at 1155 Metcalfe Street, in the City and District of Montréal, Province of Quebec, H3B 5H2; | ||

| And | ||

| ABITIBI-CONSOLIDATED INC., a legal person incorporated under the laws of Canada, having its principal executive offices at 1155 Metcalfe Street, in the City and District of Montréal, Province of Quebec, H3B 5H2; | ||

| And | ||

| BOWATER CANADIAN HOLDINGS INC., a legal person incorporated under the laws of the Province of Nova Scotia, having its principal executive offices at 1155 Metcalfe Street, in the City and District of Montréal, Province of Quebec, H3B 5H2; | ||

| And | ||

| the other Petitioners listed on Appendices “A”, “B” and “C”; | ||

| Petitioners | ||

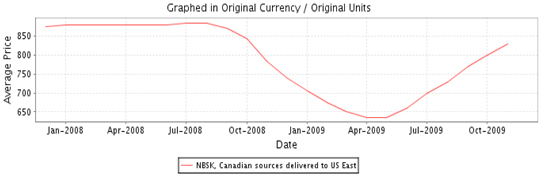

| And | ||

| ERNST & YOUNG INC., a legal person under the laws of Canada, having a place of business at 800 René-Lévesque Blvd. West, Suite 1900, in the City and District of Montréal, Province of Quebec, H3B 1X9; | ||

| Monitor | ||

TWENTY-FIFTH REPORT OF THE MONITOR

DECEMBER 9, 2009

INTRODUCTION

| 1. | On April 17, 2009, Abitibi-Consolidated Inc. (“ACI”) and its subsidiaries listed in Appendix “A” hereto (collectively with ACI, the “ACI Petitioners”) and Bowater Canadian Holdings Incorporated (“BCHI”) and its subsidiaries listed in Appendix “B” hereto (collectively with BCHI, the “Bowater Petitioners”) (the ACI Petitioners and the Bowater Petitioners are collectively referred to herein as the “Petitioners”) filed for and obtained protection from their creditors under the Companies’ Creditors Arrangement Act (the “CCAA” and the “CCAA Proceedings”) pursuant to an Order of this Honourable Court, as amended on May 6, 2009 (the “Initial Order”). Pursuant to an Order of this Honourable Court dated November 10, 2009, Abitibi-Consolidated (U.K.) Inc., a subsidiary of ACI, was added to the list of the ACI Petitioners. |

| 2. | Pursuant to the Initial Order, Ernst & Young Inc. (“EYI”) was appointed as monitor of the Petitioners (the “Monitor”) under the CCAA and a stay of proceedings in favour of the Petitioners was granted until May 14, 2009 (the “Stay Period”). The Stay Period has been subsequently extended to December 15, 2009 pursuant to further Orders of this Honourable Court. |

| 3. | On April 16, 2009, AbitibiBowater Inc. (“ABH”), Bowater Inc. (“BI”), and certain of their direct and indirect U.S. and Canadian subsidiaries, including BCHI and Bowater Canadian Forest Products Inc. (“BCFPI”) (collectively referred to herein as “U.S. Debtors”), filed voluntary petitions (collectively, the “Chapter 11 Proceedings”) for relief under Chapter 11 of the U.S. Bankruptcy Code, 11 U.S.C. §§ 101 et seq. (the “U.S. Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “U.S. Bankruptcy Court”). |

| 4. | The Petitioners are all subsidiaries of ABH (ABH, collectively with its subsidiaries, are referred to as the “ABH Group”). |

- 2 -

| 5. | On April 17, 2009, ABH and the petitioners listed on Appendix “C” hereto (collectively with ABH, the “18.6 Petitioners”) obtained Orders under Section 18.6 of the CCAA in respect of voluntary proceedings initiated under Chapter 11 and EYI was appointed as the information officer in respect of the 18.6 Petitioners. |

| 6. | On April 16, 2009, ACI and ACCC filed petitions for recognition under Chapter 15 of the U.S. Bankruptcy Code. On April 21, 2009, the U.S. Bankruptcy Court granted the recognition orders under Chapter 15 of the U.S. Bankruptcy Code. |

| 7. | On April 22, 2009, the Court amended the Initial Order to extend the stay of proceedings to the partnerships (the “Partnerships”) listed in Appendix “D” hereto. |

BACKGROUND

| 8. | ABH is one of the world’s largest publicly traded pulp and paper manufacturers. It produces a wide range of newsprint and commercial printing papers, market pulp and wood products. The ABH Group owns interests in or operates pulp and paper facilities, wood products facilities and recycling facilities located in Canada, the United States, the United Kingdom and South Korea. |

| 9. | Incorporated in Delaware and headquartered in Montreal, Quebec, ABH functions as a holding company and its business is conducted principally through four direct subsidiaries: BI, Bowater Newsprint South LLC (“Newsprint South”) (BI, Newsprint South and their respective subsidiaries are collectively referred to as the “BI Group”), ACI (ACI and its subsidiaries are collectively referred to as the “ACI Group”) and AbitibiBowater US Holding LLC (“ABUSH”) (ABUSH and its respective subsidiaries are collectively referred to as the “DCorp Group”). |

- 3 -

| 10. | ACI is a direct and indirect wholly-owned subsidiary of ABH. ABH wholly owns BI which in turn, wholly owns BCHI which, in turn, indirectly owns BCFPI which carries on the main Canadian operations of BI. |

| 11. | ACCC, a wholly-owned subsidiary of ACI, and BCFPI hold the majority of ABH’s Canadian assets and operations. |

PURPOSE

| 12. | This is the twenty-fifth report of the Monitor (the “Twenty-Fifth Report”) in these CCAA Proceedings, the purpose of which is to report to this Honourable Court with respect to the following: |

| (i) | the Petitioners’ five-week cash flow results for the period from October 19, 2009 to November 22, 2009 (the “Reporting Period”), in accordance with the first stay extension order of this Honourable Court (the “First Stay Extension Order”), and to provide details with respect to the following: |

| (a) | an update regarding the overview of the current market conditions in the forest products industry provided in the twentieth report of the Monitor dated November 4, 2009 (the “Twentieth Report”); |

| (b) | the receipts and disbursements of the ACI Group and BCFPI for the Reporting Period with a discussion of the variances from the respective forecasts (the “ACI Forecast” and the “BCFPI Forecast”) set forth in the Twentieth Report; |

| (c) | the current liquidity and revised cash flow forecasts of the ACI Group and BCFPI for the 17-week period ending March 21, 2010; |

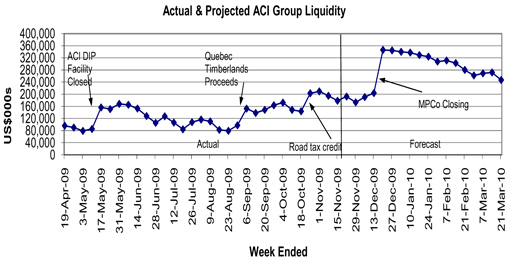

| (d) | an update with respect to certain key performance indicators (“KPIs”); and |

- 4 -

| (ii) | an update on an agreement between ACH LP (“ACH”), which is a non-filed subsidiary of ACCC, and the Ontario Power Authority (the “OPA”) guaranteeing the price ACH is to receive for power sold to the OPA (the “ACH Power Purchase Agreement”). |

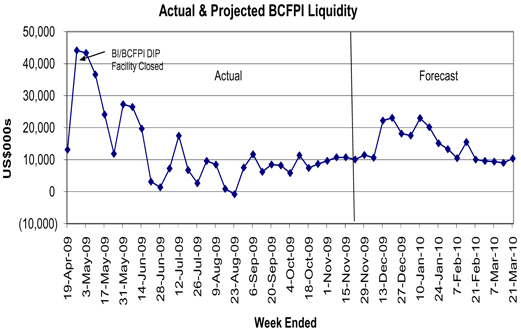

TERMS OF REFERENCE

| 13. | In preparing this Twenty-Fifth Report, the Monitor has been provided with and, in making comments herein, has relied upon unaudited financial information, the ABH Group’s books and records, financial information and projections prepared by the ABH Group and discussions with management of the ABH Group (the “Management”). The Monitor has not audited, reviewed or otherwise attempted to verify the accuracy or completeness of such information and, accordingly, the Monitor expresses no opinion or other form of assurance in respect of such information contained in this Twenty-Fifth Report. Some of the information referred to in this Twenty-Fifth Report consists of forecasts and projections. An examination or review of the financial forecast and projections, as outlined in the Canadian Institute of Chartered Accountants Handbook, has not been performed. Future-oriented financial information referred to in this Twenty-Fifth Report was prepared by the ABH Group based on Management’s estimates and assumptions. Readers are cautioned that, since these projections are based upon assumptions about future events and conditions, the actual results will vary from the projections, even if the assumptions materialize, and the variations could be significant. |

| 14. | Capitalized terms not defined in this Twenty-Fifth Report are as defined in the previous reports of the Monitor and the Initial Order. All references to dollars are in U.S. currency and are translated at a rate of CDN$1.00=US$0.90 unless otherwise noted. |

- 5 -

| 15. | Copies of all of the Monitor’s Reports, in both English and French, including a copy of this Twenty-Fifth Report, and all motion records and Orders in the CCAA Proceedings will be available on the Monitor’s website at www.ey.com/ca/abitibibowater. The Monitor has also established a bilingual toll-free telephone number that is referenced on the Monitor’s website so that parties may contact the Monitor if they have questions with respect to the CCAA Proceedings. |

| 16. | Copies of all of the U.S. Bankruptcy Court’s orders are posted on the website for Epiq Bankruptcy Solutions LCC (“Epiq”) at http://chapter11.epiqsystems.com/abitibibowater. The Monitor has included a link to Epiq’s website from the Monitor’s website. |

CURRENT MARKET CONDITIONS IN THE FOREST PRODUCTS INDUSTRY

| 17. | Pursuant to the First Stay Extension Order, the Monitor has provided this Honourable Court with regular reports on the Petitioners’ cash flows for each four-week period following the date of the First Stay Extension Order. These regular reports have included details with respect to the market conditions in the forest products industry. |

| 18. | While the forest products industry has faced significant challenges with respect to pricing and demand as indicated in previous reports of the Monitor, the Petitioners have advised the Monitor that the market has shown signs of rebounding. |

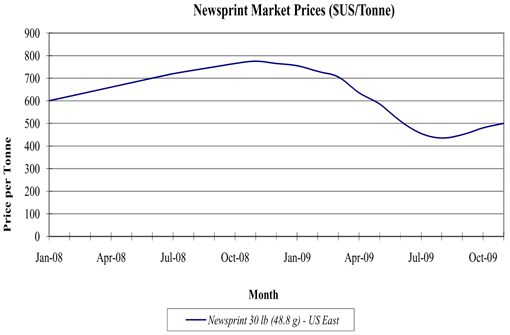

| 19. | As noted in previous reports of the Monitor, pricing in the North American newsprint market has been increasing over the last several months. According to a release on RISI.com on November 20, 2009 (the “RISI Report”), one of the Petitioners’ competitors, Kruger Inc. (“Kruger”), has announced a price increase of $25 per tonne for January and February, 2010. The Petitioners have advised the Monitor that they will also be increasing prices in two $25 per tonne |

- 6 -

| increments, which has also been reported by RISI.com. Such increases are effective January 1, 2010 and February 1, 2010 for customers in North America. The chart below from RISI.com details prices for newsprint over the last several months. |

| 20. | Despite recent price increases and the resulting cash flow impact, the debt rating for White Birch Paper Inc. (“White Birch”) was recently downgraded by Standard & Poors (“S&P”). S&P notes that the White Birch downgrade is primarily due to “elevated debt levels and continued weak market conditions for newsprint”. |

| 21. | Although not a significant producer of pulp, both BCFPI and the ACI Group produce pulp for sale to third parties. As noted in previous reports of the Monitor, the price for pulp has been increasing over the last several months. According to a report on RISI.com dated November 20, 2009, pulp prices have increased approximately $200 per tonne since April, 2009, as detailed in the graph from RISI.com below. |

- 7 -

| 22. | The Ontario Ministry of Northern Development, Mines and Forestry has recently announced that it has put into place a tender process to re-allocate cutting rights to Crown timberlands in Ontario that are currently not being used (the “Provincial Wood Supply Competitive Process”). The Provincial Wood Supply Competitive Process involves the possible cancellation of current Crown fibre supply agreements (some of which may be held by the Petitioners) and the re-bidding of such licenses. |

RECEIPTS AND DISBURSEMENTS FROM OCTOBER 19, 2009 TO NOVEMBER 22, 2009 FOR THE ACI GROUP AND BCFPI

The ACI Group

| 23. | The table below summarizes the ACI Group’s (including DCorp) actual receipts and disbursements for the Reporting Period, which is detailed in Appendix “E” of this Twenty-Fifth Report, with a comparison to the ACI Forecast amounts provided in the Twentieth Report. |

- 8 -

| US$000 | |||||||||||||||

| Actual | Forecast | Variance | |||||||||||||

| Opening Cash |

$ | 110,746 | $ | 110,746 | $ | — | — | ||||||||

| Receipts |

310,343 | 271,387 | 38,956 | 14 | % | ||||||||||

| Disbursements |

|||||||||||||||

| Net Trade Disbursements |

(156,006 | ) | (137,573 | ) | (18,433 | ) | (13 | %) | |||||||

| Intercompany |

(16,890 | ) | — | (16,890 | ) | N/A | |||||||||

| Other |

(85,999 | ) | (87,808 | ) | 1,809 | 2 | % | ||||||||

| (258,895 | ) | (225,381 | ) | (33,514 | ) | (15 | %) | ||||||||

| Financing |

|||||||||||||||

| Securitization Inflows / (Outflows) |

10,712 | (1,334 | ) | 12,046 | 903 | % | |||||||||

| Adequate Protection by DCorp to ACCC Term Lenders |

(3,180 | ) | (3,537 | ) | 357 | 10 | % | ||||||||

| DIP Interest & Fees |

(1,814 | ) | (245 | ) | (1,569 | ) | (640 | %) | |||||||

| Restructuring & Other Items |

(4,268 | ) | (5,000 | ) | 732 | 15 | % | ||||||||

| Foreign Exchange Translation |

(4,272 | ) | — | (4,272 | ) | N/A | |||||||||

| (2,822 | ) | (10,116 | ) | 7,294 | 72 | % | |||||||||

| Net Cash Flow |

48,626 | 35,890 | 12,736 | 35 | % | ||||||||||

| Ending Cash |

$ | 159,372 | $ | 146,636 | $ | 12,736 | 9 | % | |||||||

| DIP Availability (net of minimum undrawn balance) |

32,700 | 32,700 | — | — | |||||||||||

| Available Liquidity |

$ | 192,072 | $ | 179,336 | $ | 12,736 | 7 | % | |||||||

| 24. | As shown in the table above, the ACI Group’s total receipts for the Reporting Period, net of joint venture remittances, were approximately $39.0 million higher than projected in the ACI Forecast. Disbursements were $33.5 million higher than projected in the ACI Forecast and Financing cash flow was approximately $7.3 million greater than projected in the ACI Forecast. Overall, the ending cash balance and available liquidity were each approximately $12.7 million higher than the ACI Forecast. |

- 9 -

Receipts

| 25. | A breakdown of the receipts for the Reporting Period are outlined in the table below: |

| $US 000 | |||||||||||||||||

| Receipts |

Para. | Actual | Forecast | Variance | Variance % | ||||||||||||

| A/R Collections |

26(i) | $ | 214,113 | $ | 212,052 | $ | 2,061 | 1 | % | ||||||||

| Intercompany A/R Settlement |

26(i) | 43,551 | — | 43,551 | N/A | ||||||||||||

| Joint Venture Remittances, Net |

26(i) | (19,574 | ) | (17,417 | ) | (2,157 | ) | (12 | %) | ||||||||

| Collections on Behalf of Joint Ventures |

26(ii) | 3,804 | 20,466 | (16,662 | ) | (81 | %) | ||||||||||

| Net A/R Collections |

241,894 | 215,101 | 26,793 | 12 | % | ||||||||||||

| Other Inflows |

26(iii) | 68,449 | 56,286 | 12,163 | 22 | % | |||||||||||

| Total Receipts |

$ | 310,343 | $ | 271,387 | $ | 38,956 | 14 | % | |||||||||

| 26. | The variance analysis has been compiled based on discussions with Management and the following represents the more significant reasons for the variances: |

| (i) | A/R Collections, inclusive of receipts related to Intercompany A/R Settlements, net Joint Venture Remittances, and Collections on Behalf of Joint Ventures, were approximately $241.9 million during the Reporting Period compared to a forecast amount of $215.1 million resulting in a positive variance of approximately 12%. |

Intercompany A/R Settlements represent payments to the ACI Group from an affiliated ABH Group entity for ACI Group accounts receivable that were collected by the affiliated entity, such as BI or BCFPI.

| (ii) | Collections on Behalf of Joint Ventures totalled approximately $3.8 million during the Reporting Period. This amount represents amounts collected by the ACI Group for accounts receivable that belong to a joint venture partner. Such amounts will be paid to the joint venture partner on a monthly basis or in accordance with the joint venture agreement. The collections on behalf of joint ventures were $3.8 million for the Reporting Period as compared to a forecast amount of $20.5 million resulting in a negative variance of approximately $16.7 million. |

This variance is partly due to the fact that certain portions of amounts collected on behalf of joint ventures are also included in the “A/R Collections” line and have not yet been specifically allocated to “Collections on Behalf of Joint Ventures” as these amounts are allocated on a monthly basis.

- 10 -

During the Reporting Period, disbursements related to Joint Venture Remittances totalled approximately $19.6 million resulting in a negative variance of $2.2 million. This is primarily due the remittance of funds to one of the ACI Group’s joint ventures, Donohue Malbaie, for funds received from customers of the Donohue Malbaie joint venture by the ACI Group. The chart below summarizes collections by the ACI Group from customers of its most significant joint venture partners (Augusta and Donohue Malbaie) and subsequent remittances to joint ventures since April 17, 2009:

| US$000 | |||||||||

| Augusta | Donohue Malbaie |

Total | |||||||

| Collections by the ACI Group |

100,231 | 17,923 | 118,154 | ||||||

| Remittances to JVs by the ACI Group |

(96,454 | ) | (11,674 | ) | (108,128 | ) | |||

| 3,777 | 6,249 | 10,026 | |||||||

| (iii) | Other Inflows, which includes tax refunds and other miscellaneous receipts, totalled $68.4 million during the Reporting Period. The ACI Forecast included projected receipts of $56.3 million. The difference is primarily due to higher than forecast receipts related to road tax credits (approximately $2.3 million), receipts related to reforestation work (approximately $1.3 million) and receipts related to energy credits received from the Province of Ontario (approximately $1.3 million). The balance of this variance is due to a number of miscellaneous mill level deposits such as benefit reimbursements and tax refunds. |

- 11 -

Disbursements

| 27. | A breakdown of the disbursements related to Net Trade Disbursements for the Reporting Period is outlined below: |

| $US 000 | |||||||||||||||||

| Para. | Actual | Forecast | Variance | Variance % | |||||||||||||

| Trade Payables |

28(i) | $ | (168,079 | ) | $ | (129,936 | ) | $ | (38,143 | ) | (29 | %) | |||||

| Intercompany A/P Settlement |

28(i)(b) | 13,385 | — | 13,385 | N/A | ||||||||||||

| Payments on Behalf of Affiliates |

28(ii) | (1,312 | ) | — | (1,312 | ) | N/A | ||||||||||

| Capital Expenditures |

28(iii) | — | (7,637 | ) | 7,637 | 100 | % | ||||||||||

| Net Trade Disbursements |

$ | (156,006 | ) | $ | (137,573 | ) | $ | (18,433 | ) | (13 | %) | ||||||

| 28. | The variance analysis with respect to the disbursements for the more significant variances has been compiled based on discussions with Management and the following represents a summary of the reasons for the variances: |

| (i) | Disbursements related to Trade Payables were approximately $168.1 million during the Reporting Period, which was $38.1 million greater than the ACI Forecast. Management has advised that the variance is primarily due to the following: |

| (a) | Capital Expenditures have been included in the actual amount for Trade Payables disbursements until such time as the ACI Group identifies and allocates the disbursements which are capital in nature; |

| (b) | the ACI Group regularly disburses amounts on behalf of other affiliated entities which are included in Trade Payables (as noted above, the ACI Group was reimbursed by affiliates for approximately $13.4 million of such amounts, detailed on the Intercompany A/P Settlements line, during the Reporting Period). The quantum of amounts disbursed on behalf of other entities is not known until such time as the Petitioners reconcile their intercompany accounts, which is done on a regular basis; and |

- 12 -

| (c) | Production levels are higher (approximately 11% or 24,000 tonnes for the month of November) than forecast in the ACI Forecast which has necessitated increased investments in working capital to support the increased sales to customers. |

| (ii) | Payments on Behalf of Affiliates represent amounts disbursed on behalf of ACH. Such amounts were reimbursed by ACH in the week ended November 29, 2009. |

| (iii) | As noted above, Capital Expenditures are not tracked on a weekly basis. The disbursements related to capital disbursements have been included in the Trade Payables disbursement line. Management has advised the Monitor that capital expenditures for the month of October, 2009 totalled approximately $0.9 million. |

| 29. | The net disbursements related to intercompany collections are detailed in the chart below: |

| $US 000 | |||||||||||||||

| Para. | Actual | Forecast | Variance | Variance % | |||||||||||

| A/R Collections - Affiliates |

29(i) | $ | 16,621 | $ | — | $ | 16,621 | N/A | |||||||

| Intercompany A/R Settlements |

29(ii) | (33,511 | ) | — | (33,511 | ) | N/A | ||||||||

| $ | (16,890 | ) | $ | — | $ | (16,890 | ) | N/A | |||||||

| (i) | A/R Collections – Affiliates totalled approximately $16.6 million during the Reporting Period. As part of its normal Cash Management System, the ACI Group regularly collects accounts receivable on behalf of other ABH Group entities. As it is not possible to forecast which customers will incorrectly pay the ACI Group on behalf of the other entities, collections on behalf of affiliates are not forecast by the Petitioners. The funds are paid on a regular basis by the ACI Group to the appropriate ABH Group entity, which payments are reflected in the Intercompany A/R Settlements line of the “Intercompany” section of the cash flow statement. As discussed in the next section, an amount of approximately $33.5 million was paid out to affiliates during the Reporting Period by the ACI Group to reimburse affiliates for collections made on their behalf by the ACI Group. |

- 13 -

| (ii) | The ACI Group does not forecast the disbursement of Intercompany A/R Settlements as it is not possible to predict which customers will pay the incorrect ABH Group entity for accounts receivable. The corresponding receipt of these amounts collected from affiliate customers is included in the A/R Collections – Affiliates line included in the “Intercompany” section of the cash flow statement. |

| (iii) | The reason for the negative variance noted above is that certain accounts receivable are not identified as belonging to affiliated entities due to a delay in the receipt of remittance advices from customers. As remittance advices are received from customers the required funds are transferred to the relevant entity. |

| 30. | Disbursements related to “Other” items are summarized in the chart below: |

| $US 000 | |||||||||||||||||

| Para. | Actual | Forecast | Variance | Variance % | |||||||||||||

| Marine Freight Payments |

30(i) | $ | (8,128 | ) | $ | (6,500 | ) | $ | (1,628 | ) | (25 | %) | |||||

| Utility Payments |

30(ii) | (28,025 | ) | (34,779 | ) | 6,754 | 19 | % | |||||||||

| Payroll & Benefits |

30(iii) | (49,846 | ) | (46,529 | ) | (3,317 | ) | (7 | %) | ||||||||

| Net Other Disbursements |

$ | (85,999 | ) | $ | (87,808 | ) | $ | 1,809 | 2 | % | |||||||

| (i) | Marine Freight Payments totalled $8.1 million during the Reporting Period. This compares to an amount of $6.5 million in the ACI Forecast. The reason for this variance is due to an increase in international shipments that require the use of marine freight. As an example, international shipments between August and October increased by approximately 47%, necessitating greater use of Marine Freight during the Reporting Period. |

- 14 -

| (ii) | Utility Payments were approximately $6.8 million less than forecast. Under the agreement the ACI Group has with its various power suppliers, it is required to pay a certain fixed amount on a weekly basis. The ACI Forecast contemplates that all such payments to utility suppliers will be made; however, based on monthly reconciliations of actual consumption, the relevant invoices and payments and the consent of the utility, certain payments were not required to be made. |

| (iii) | Total payments for Payroll & Benefits were $49.8 million during the Reporting Period compared to an amount of approximately $46.5 million in the ACI Forecast. This variance is primarily a timing variance due to the payment of payroll withholding taxes that were forecast to be paid outside of the Reporting Period. |

Financing

| 31. | Details regarding the ACI Group’s financing activities are summarized in the following table: |

| $US 000 | |||||||||||||||||

| Financing |

Para. | Actual | Forecast | Variance | Variance % | ||||||||||||

| Securitization Inflows / (Outflows) |

32(i) | $ | 10,712 | $ | (1,334 | ) | $ | 12,046 | 903 | % | |||||||

| Adequate Protection by DCorp to ACCC Term Lenders |

32(ii) | (3,180 | ) | (3,537 | ) | 357 | 10 | % | |||||||||

| DIP Interest & Fees |

32(iii) | (1,814 | ) | (245 | ) | (1,569 | ) | (640 | %) | ||||||||

| Restructuring & Other Items |

32(iv) | (4,268 | ) | (5,000 | ) | 732 | 15 | % | |||||||||

| Foreign Exchange Translation |

32(v) | (4,272 | ) | — | (4,272 | ) | N/A | ||||||||||

| $ | (2,822 | ) | $ | (10,116 | ) | $ | 7,294 | 72 | % | ||||||||

| 32. | The variance analysis with respect to the ACI Group’s financing activities has been compiled based on discussions with Management and the following represents a summary of the reasons for the variances: |

| (i) | Securitization Inflows/(Outflows) totalled an inflow of approximately $10.7 million compared to a projected outflow of approximately $1.3 million during the Reporting Period due to higher than forecast sales and a more favourable accounts receivable aging profile. |

- 15 -

| (ii) | Adequate Protection by DCorp to ACCC Term Lenders totalled approximately $3.2 million compared to a forecast amount of $3.5 million. The reason for the difference is due to the fact that certain professional fees originally forecast as part of Adequate Protection by DCorp to ACCC Term Lenders were included in the Restructuring & Other Items line. |

| (iii) | DIP Interest & Fees were greater than forecast due to the fact that approximately $1.5 million was paid during the Reporting Period to Bank of Montreal and Investissement Quebec to extend the ACI DIP Facility to December 15, 2009. This payment was not contemplated by the ACI Forecast. |

| (iv) | Payments for Restructuring & Other Items totalled approximately $4.3 million compared to a forecast of $5.0 million. The difference is primarily due to the timing of receipt of invoices from various professional service firms. |

| (v) | Amounts on the Foreign Exchange Translation line represent the difference between the actual exchange rate between Canadian and U.S. dollars at the time of conversion as compared to the forecast rate of CDN$1.00=US$0.90. During the Reporting Period the value of the Canadian dollar fluctuated between US$0.9243 and US$0.9715. |

- 16 -

BCFPI

| 33. | The following table summarizes the receipts and disbursements of BCFPI for the Reporting Period, which is detailed in Appendix “F” of this Twenty-Fifth Report: |

| US$000 | |||||||||||||||

| Actual | Forecast | Variance | |||||||||||||

| Receipts |

$ | 78,830 | $ | 61,204 | $ | 17,626 | 29 | % | |||||||

| Disbursements |

|||||||||||||||

| Net Trade Disbursements |

(50,607 | ) | (41,642 | ) | (8,965 | ) | (22 | %) | |||||||

| Intercompany |

(2,465 | ) | — | (2,465 | ) | N/A | |||||||||

| Other |

(18,068 | ) | (13,022 | ) | (5,046 | ) | (39 | %) | |||||||

| (71,140 | ) | (54,664 | ) | (16,476 | ) | (30 | %) | ||||||||

| Financing |

|||||||||||||||

| Interest |

(1,415 | ) | (1,502 | ) | 87 | 6 | % | ||||||||

| Restructuring Costs |

(1,391 | ) | (1,465 | ) | 74 | 5 | % | ||||||||

| Foreign Exchange Translation |

(2,243 | ) | — | (2,243 | ) | N/A | |||||||||

| (5,049 | ) | (2,967 | ) | (2,082 | ) | 70 | % | ||||||||

| Net Cash Flows |

2,641 | 3,573 | (932 | ) | (26 | %) | |||||||||

| Opening Cash |

7,401 | 7,401 | — | — | |||||||||||

| Ending Cash |

$ | 10,042 | $ | 10,974 | $ | (932 | ) | (8 | %) | ||||||

| 34. | As detailed in the table above, BCFPI’s total receipts for the Reporting Period were approximately $17.6 million higher than the BCFPI Forecast. Disbursements were $16.5 million higher than the BCFPI Forecast and Financing disbursements were $2.1 million greater than forecast. BCFPI had cash on hand of $10.0 million at November 22, 2009. Overall, the ending cash balance was approximately $0.9 million lower than the BCFPI Forecast. |

Receipts

| 35. | A breakdown of the BCFPI receipts are summarized in the table below: |

| US$000 | |||||||||||||||

| Receipts |

Para. | Actual | Forecast | Variance | Variance % | ||||||||||

| A/R Collections |

36(i) | $ | 13,505 | $ | 54,204 | $ | (40,699 | ) | (75 | %) | |||||

| Intercompany A/R Settlements |

36(i) | 41,909 | — | 41,909 | N/A | ||||||||||

| Total A/R Collections |

55,414 | 54,204 | 1,210 | 2 | % | ||||||||||

| Advances from Bowater Inc. |

36(ii) | 9,000 | 7,000 | 2,000 | 29 | % | |||||||||

| Other Inflows |

36(iii) | 14,416 | — | 14,416 | N/A | ||||||||||

| Total Receipts |

$ | 78,830 | $ | 61,204 | $ | 17,626 | 29 | % | |||||||

- 17 -

| 36. | The variance analysis with respect to the receipts has been compiled based on discussions with Management and the following represents a summary of the reasons for the significant variances: |

| (i) | Total A/R Collections were approximately $55.4 million resulting in a positive variance of approximately $1.2 million. |

Pursuant to BCFPI’s normal practice and the Cash Management System, sales which are made to customers domiciled in the United States are sold through an affiliate, Bowater America Inc. (“BAI”). BAI, which is a subsidiary of BI, collects the accounts receivable from the third party customers and then remits these funds via an Intercompany A/R Settlement to BCFPI. BCFPI continues to reconcile its intercompany trade receivables on a regular basis.

In addition to the above, BI collects substantially all accounts receivable related to BCFPI’s sale of pulp. Such amounts are reconciled and transferred from BI to BCFPI on a monthly basis. Transfers of pulp receipts through the end of October have been paid to BCFPI.

| (ii) | On a net basis, Advances from Bowater Inc. totalled $9.0 million during the Reporting Period. Advances of $7.0 million were forecast in the BCFPI Forecast. The higher than forecast advances were required to maintain BCFPI’s liquidity at approximately $10 million. |

| (iii) | Amounts received related to Other Inflows were approximately $14.4 million during the Reporting Period. Such receipts primarily represent various sales tax refunds (approximately $5.6 million), amounts received in respect of reforestation work (approximately $3.1 million) and deposits made at the mill level. BCFPI does not typically forecast the receipt of such amounts. |

- 18 -

Disbursements

| 37. | Details regarding disbursements related to Net Trade Disbursements are summarized in the following table: |

| US$000 | |||||||||||||||||

| Para. | Actual | Forecast | Variance | Variance % | |||||||||||||

| Trade Payables |

38(i) | $ | (37,208 | ) | $ | (39,335 | ) | $ | 2,127 | 5 | % | ||||||

| Intercompany A/P Settlements - Disbursements |

38(ii) | (1,646 | ) | — | (1,646 | ) | N/A | ||||||||||

| Capital Expenditures |

38(iii) | — | (2,307 | ) | 2,307 | 100 | % | ||||||||||

| Payments on Behalf of Affiliates |

38(iv) | (11,753 | ) | — | (11,753 | ) | N/A | ||||||||||

| Net Trade Disbursements |

$ | (50,607 | ) | $ | (41,642 | ) | $ | (8,965 | ) | (22 | %) | ||||||

| 38. | The variance analysis with respect to BCFPI’s disbursements has been compiled based on discussions with Management and the following represents a summary of the reasons provided for these variances: |

| (i) | Disbursements related to Trade Payables were approximately $2.1 million less than projected during the Reporting Period. Included in the Trade Payables line in the BCFPI Forecast is approximately $3.1 million in respect of disbursements related to Freight. If this amount is removed from the forecast the negative variance is approximately $1.0 million. |

Receipts related to Intercompany A/P Settlements - Receipts were nil during the Reporting Period. Such amounts typically represent reimbursement for amounts disbursed on behalf of Mersey, which is a joint venture partially owned by BI. The actual amount transferred was nil due to a delay in the settlement of certain amounts due to BCFPI. The revised forecast in Appendix “H” contemplates that these amounts will be settled in the week ended November 29, 2009.

| (ii) | Intercompany A/P Settlements - Disbursements represent BCFPI reimbursing related entities for payments made on its behalf. During the Reporting Period, such payments totalled approximately $1.6 million and are primarily reimbursements to the ACI Group for freight costs. |

- 19 -

| (iii) | Capital Expenditures are not tracked on a weekly basis. As such, disbursements for this line item have been included in Trade Payables. The Monitor has been advised that capital expenditures for October, 2009 were approximately $0.8 million. |

| (iv) | Payments on Behalf of Affiliates were $11.8 million during the Reporting Period. These payments primarily represent disbursements made by BCFPI on behalf of Mersey. Due to the integrated nature of the operations of the Petitioners and the Cash Management System, such payments occur on a regular basis. BCFPI does not typically forecast such payments, nor does it typically forecast the repayment of these items. During the Reporting Period BCFPI was not directly reimbursed for all amounts disbursed on behalf of Mersey since the date of filing (as detailed in the table below). As noted above, a settlement in respect of this item is forecast to occur in the week ended November 29, 2009. |

| US$000 | |||

| Cash Receipts on Behalf of Mersey |

36,637 | ||

| Reimbursements for Payments Made |

30,968 | ||

| Amounts Disbursed on Behalf of Mersey |

(73,489 | ) | |

| Net Cash Flow |

(5,884 | ) | |

| 39. | Actual receipts and disbursements related to intercompany accounts receivable transactions are summarized in the table below: |

| US$000 | |||||||||||||||

| Para. | Actual | Forecast | Variance | Variance % | |||||||||||

| A/R Collections - Affiliates |

39(i) | $ | 5,049 | $ | — | $ | 5,049 | N/A | |||||||

| Intercompany A/R Settlements |

39(ii) | (7,514 | ) | — | (7,514 | ) | N/A | ||||||||

| $ | (2,465 | ) | $ | — | $ | (2,465 | ) | N/A | |||||||

| (i) | Receipts related to A/R Collections – Affiliates totalled approximately $5.0 million during the Reporting Period. Such amounts are regularly collected by BCFPI as part of the operation of the Cash Management System. |

- 20 -

| (ii) | Payments for Intercompany A/R Settlements totalled approximately $7.5 million during the Reporting Period. Intercompany A/R Settlements represent payments made by BCFPI to reimburse related entities for accounts receivable incorrectly paid to BCFPI by ABH-affiliated customers. |

| (iii) | The quantum of Intercompany A/R Settlements is greater than A/R Collections – Affiliates due to the fact that unapplied cash is occasionally identified as belonging to an affiliated ABH Group entity after it has been reported on a weekly basis as belonging to BCFPI. |

| 40. | Disbursements for “Other” items are as follows and are summarized in the table below: |

| US$000 | |||||||||||||||||

| Para. | Actual | Forecast | Variance | Variance % | |||||||||||||

| Freight |

40(i) | $ | (3,666 | ) | $ | (932 | ) | $ | (2,734 | ) | (293 | %) | |||||

| Intercompany SG&A Allocation |

40(ii) | — | (400 | ) | 400 | 100 | % | ||||||||||

| Payroll and Benefits |

40(iii) | (14,402 | ) | $ | (11,690 | ) | (2,712 | ) | (23 | %) | |||||||

| $ | (18,068 | ) | $ | (13,022 | ) | $ | (5,046 | ) | (39 | %) | |||||||

| (i) | Disbursements for Freight totalled $3.7 million during the Reporting Period. This compares to an amount of approximately $0.9 million in the BCFPI Forecast. As noted above, a portion of freight costs were forecast as part of the Trade Payables line. The quantum of this portion is approximately $3.1 million. Taking this reclassification into account, the variance related to Freight is approximately $0.4 million positive. |

| (ii) | Amounts related to the Intercompany SG&A Allocation were not settled during the Reporting Period. Such amounts are now forecast to be paid in December, 2009. |

- 21 -

| (iii) | During the Reporting Period, payments in respect of Payroll and Benefits totalled $14.4 million. The BCFPI Forecast projected disbursements in the amount of $11.7 million. The reason for this variance is primarily due to the early payment of benefits which was forecast to be paid in the week ended December 6, 2009. |

Financing

| 41. | Details regarding financing are summarized in the following table: |

| US$000 | |||||||||||||||||

| Financing |

Para. | Actual | Forecast | Variance | Variance % | ||||||||||||

| Interest |

42 | $ | (1,415 | ) | $ | (1,502 | ) | $ | 87 | 6 | % | ||||||

| Restructuring Costs |

43 | (1,391 | ) | (1,465 | ) | 74 | 5 | % | |||||||||

| Foreign Exchange Translation |

44 | (2,243 | ) | — | (2,243 | ) | N/A | ||||||||||

| Cash Flow from Financing/Restructuring |

$ | (5,049 | ) | $ | (2,967 | ) | $ | (2,082 | ) | (70 | %) | ||||||

| 42. | Disbursements related to Interest, which were forecast to be approximately $1.5 million, were approximately $1.4 million. |

| 43. | Restructuring Costs were approximately $1.4 million compared to a forecast amount of $1.5 million. |

| 44. | Amounts on the Foreign Exchange Translation line represent the difference between the actual exchange rate at the time of conversion between Canadian and U.S. dollars as compared to the forecast rate of CDN$1.00=US$0.90. |

CURRENT LIQUIDITY POSITION AND THE 17-WEEK CASH FLOW FORECASTS

| 45. | Attached as Appendices “G” and “H”, respectively, are the updated 17-week cash flow forecasts of the ACI Group (including DCorp) and BCFPI through March 21, 2009. |

- 22 -

| 46. | As at November 22, 2009, the ACI Group had cash on hand of approximately $159.4 million. In addition to this amount, the undrawn portion of the ACI DIP Facility was $45.2 million. However, pursuant to the ACI DIP Facility, $12.5 million of this amount must remain undrawn, thereby resulting in net available liquidity under the ACI DIP Facility of $32.7 million. Accordingly, the total liquidity of the ACI Group was $192.1 million ($159.4 million cash plus $32.7 million of the ACI DIP Facility) as at November 22, 2009. |

| 47. | The ACI Group’s actual liquidity to November 22, 2009 and forecast total liquidity for the 17 weeks ending March 21, 2010 is set forth in Appendix “G” and is summarized in the graph below: |

| 48. | The ACI Group’s total available liquidity at March 21, 2010, which is the end of the 17-week period in the forecast in Appendix “G”, is projected to be approximately $246.7 million. The primary reason for the difference in forecast liquidity at March 21, 2010 and the liquidity at the end of the ACI Forecast is the fact that the proceeds from the sale of ACCC’s interest in the Manicouagan Power Company (“MPCo”) are now included in the updated cash flow forecast in Appendix “G”. The ACI Forecast did not previously include any proceeds from the sale of MPCo. |

- 23 -

| 49. | The ACI Group cash flow forecast included in Appendix “G” reflects the repayment of the ACI DIP Facility on December 15, 2009, which is the revised date by which it must be repaid. Amounts outstanding under the ACI DIP Facility will be repaid with proceeds of the sale of the ACI Group’s 60% interest in MPCo. Although the cash flow forecast in Appendix “G” reflects the closing of the sale of MPCo in the week ended December 20, 2009, the actual closing is currently scheduled for December 9, 2009. A summary of the projected sources and uses of cash from the sale of MPCo is below: |

| CDN $000 | US $000 | |||||

| Proceeds from the Sale of ACCC MPCo Interest (Net of Certain Deductions) |

517,100 | 465,390 | ||||

| Payment to ULC Reserve |

(282,300 | ) | (254,070 | ) | ||

| ULC DIP Facility Drawing on Closing of MPCo Transaction |

130,000 | 117,000 | ||||

| ACI DIP Facility Repayment |

(60,889 | ) | (54,800 | ) | ||

| Distribution to Senior Secured Noteholders |

(200,000 | ) | (180,000 | ) | ||

| Net Cash Flow |

103,911 | 93,520 | ||||

| ULC Reserve |

||||||

| ULC DIP Available Upon Notice |

50,000 | 45,000 | ||||

| ULC DIP Available Subject to Court Approval |

50,000 | 45,000 | ||||

| Restricted ULC Reserve |

52,300 | 47,070 | ||||

| 152,300 | 137,070 | |||||

| ULC DIP Facility Drawing on Closing of MPCo Transaction |

130,000 | 117,000 | ||||

| 282,300 | 254,070 | |||||

Note: The above amounts are as estimated in the Nineteenth Report of the Monitor dated October 27, 2009, and are subject to adjustment for actual closing amounts.

| 50. | Actual results since the date of the issuance of the Initial Order and BCFPI’s forecast liquidity for the 17 weeks ended March 21, 2010, which includes the projected repayment of intercompany funding from BI in the amount of $2.0 million, is set forth in Appendix “H” and is summarized in the graph below. The estimate of liquidity in the following graph assumes that a minimum cash balance of $10.0 million will be maintained and funds will be transferred from BI, as necessary, on that basis. |

- 24 -

| 51. | On August 26, 2009 and September 1, 2009, this Honourable Court and the U.S. Bankruptcy Court, respectively, approved certain agreements between the ACI Group, BCFPI and Smurfit-Stone Container Canada Inc. (“Smurfit”) relating to the sale of certain timberlands by Smurfit, which will result in BCFPI receiving net proceeds in the amount of approximately $25.9 million (the “Smurfit Timberland Proceeds”). The Smurfit Timberland Proceeds were paid to the Monitor’s trust account in the week ended October 25, 2009 and are to be held in trust by the Monitor pending further order of this Honourable Court. For purposes of the forecast, the proceeds are reflected as being held in trust by the Monitor and are not used for operating purposes due to the uncertainty regarding the timing of the release of these funds. |

| 52. | BCFPI’s liquidity as at March 21, 2010 is projected to be approximately $9.6 million, not including the Smurfit Timberland Proceeds. |

| 53. | Management has informed the Monitor that BCFPI’s forecast cash requirements will be supported by BI through intercompany advances, if necessary. |

- 25 -

KEY PERFORMANCE INDICATORS

| 54. | As first reported in the Seventh Report the Petitioners track certain key performance indicators in the course of managing their business. Appendix “I” contains certain key performance indicators which have been updated through October 31, 2009, the most current data available as at the date of this Twenty-Fifth Report. |

ACH POWER PURCHASE AGREEMENT

| 55. | ACH is a non-filing partnership owned 75% by Abitibi-Consolidated Hydro Inc. (which is owned 75% by ACCC) and 25% by CDP Investissements Inc. ACH operates a number of power facilities in Ontario. It sells its power to the Independent Electricity System Operator and certain ABH mills based on market pricing. |

| 56. | The Monitor has been advised that, as part of a greater initiative to preserve certain independent power producers and to encourage clean energy, the OPA has recently begun to enter into fixed pricing agreements with independent power producers. |

| 57. | ACH has negotiated a long term agreement with the OPA, whereby the OPA will fix the price it pays to ACH for power purchased. The guaranteed price will increase every year based on the consumer price index. ABH advised that the average historical price has been approximately $50 per megawatt per hour so there is currently a premium over this historic average based on the ACH Power Purchase Agreement. If prices were to increase beyond the agreed upon per megawatt hour price, ACH would not realize this increase as its price would remain capped at the agreed level. |

- 26 -

| 58. | As part of the ACH Power Purchase Agreement, there exist certain events that would enable the OPA to cancel this contract. Such events primarily deal with any change in control of ACH and the ability of the OPA to cancel the ACH Power Purchase Agreement if it does not approve of any future purchaser. The OPA has the right to reject any purchaser in the first three years of the ACH Power Purchase Agreement and thereafter the OPA must consent to any purchaser, such consent not to be unreasonably withheld. |

All of which is respectfully submitted.

ERNST & YOUNG INC.

in its capacity as the Court Appointed Monitor

of the Petitioners

Per:

Alex Morrison, CA, CIRP

Senior Vice President

John Barrett, CA, CIRP

Vice President

Todd Ambachtsheer, CA, CIRP

Vice President

- 27 -

APPENDIX “A”

ABITIBI PETITIONERS

| 1. | Abitibi-Consolidated Company of Canada |

| 2. | Abitibi-Consolidated Inc. |

| 3. | 3224112 Nova Scotia Limited |

| 4. | Marketing Donohue Inc. |

| 5. | Abitibi-Consolidated Canadian Office Products Holding Inc. |

| 6. | 3834328 Canada Inc. |

| 7. | 6169678 Canada Inc. |

| 8. | 4042140 Canada Inc. |

| 9. | Donohue Recycling Inc. |

| 10. | 1508756 Ontario Inc. |

| 11. | 3217925 Nova Scotia Company |

| 12. | La Tuque Forest Products Inc. |

| 13. | Abitibi-Consolidated Nova Scotia Incorporated |

| 14. | Saguenay Forest Products Inc. |

| 15. | Terra Nova Explorations Ltd. |

| 16. | The Jonquière Pulp Company |

| 17. | The International Bridge and Terminal Company |

| 18. | Scramble Mining Ltd. |

| 19. | 9150-3383 Québec Inc. |

| 20. | Abitibi-Consolidated (U.K.) Inc. |

- 28 -

APPENDIX “B”

BOWATER PETITIONERS

| 1. | Bowater Canada Finance Corporation |

| 2. | Bowater Canadian Limited |

| 3. | Bowater Canadian Holdings. Inc. |

| 4. | 3231378 Nova Scotia Company |

| 5. | AbitibiBowater Canada Inc. |

| 6. | Bowater Canada Treasury Corporation |

| 7. | Bowater Canadian Forest Products Inc. |

| 8. | Bowater Shelburne Corporation |

| 9. | Bowater LaHave Corporation |

| 10. | St-Maurice River Drive Company Limited |

| 11. | Bowater Treated Wood Inc. |

| 12. | Canexel Hardboard Inc. |

| 13. | 9068-9050 Québec Inc. |

| 14. | Alliance Forest Products Inc. (2001) |

| 15. | Bowater Belledune Sawmill Inc. |

| 16. | Bowater Maritimes Inc. |

| 17. | Bowater Mitis Inc. |

| 18. | Bowater Guérette Inc. |

| 19. | Bowater Couturier Inc. |

- 29 -

APPENDIX “C”

18.6 PETITIONERS

| 1. | AbitibiBowater US Holding 1 Corp. |

| 2. | AbitibiBowater Inc. |

| 3. | Bowater Ventures Inc. |

| 4. | Bowater Incorporated |

| 5. | Bowater Nuway Inc. |

| 6. | Bowater Nuway Mid-States Inc. |

| 7. | Catawba Property Holdings LLC |

| 8. | Bowater Finance Company Inc. |

| 9. | Bowater South American Holdings Incorporated |

| 10. | Bowater America Inc. |

| 11. | Lake Superior Forest Products Inc. |

| 12. | Bowater Newsprint South LLC |

| 13. | Bowater Newsprint South Operations LLC |

| 14. | Bowater Finance II, LLC |

| 15. | Bowater Alabama LLC |

| 16. | Coosa Pines Golf Club Holdings, LLC |

- 30 -

APPENDIX “D”

PARTNERSHIPS

| 1. | Bowater Canada Finance Limited Partnership |

| 2. | Bowater Pulp and Paper Canada Holdings Limited Partnership |

| 3. | Abitibi-Consolidated Finance LP |

- 31 -

APPENDIX “E”

ACI GROUP ACTUAL RECEIPTS AND DISBURSEMENTS

Abitibi-Consolidated Inc. and its Subsidiaries (the “ACI Group”)

Actual to Forecast Comparison

5 Weeks Ended November 22, 2009

US$000

| Actual | ||||||||||||||||||

| Week Ended |

25-Oct-09 | 1-Nov-09 | 8-Nov-09 | 15-Nov-09 | 22-Nov-09 | Total | ||||||||||||

| Opening Cash |

110,746 | 170,074 | 176,323 | 161,826 | 145,496 | 110,746 | ||||||||||||

| Receipts |

||||||||||||||||||

| A/R Collections |

52,384 | 42,270 | 37,845 | 30,773 | 50,841 | 214,113 | ||||||||||||

| Intercompany A/R Settlement |

9,421 | 13,896 | 2,901 | 4,655 | 12,678 | 43,551 | ||||||||||||

| Joint Venture Remittances, Net |

— | (3,217 | ) | — | (16,357 | ) | — | (19,574 | ) | |||||||||

| Collections on Behalf of Joint Ventures |

3,128 | 10 | — | — | 666 | 3,804 | ||||||||||||

| Net A/R Collections |

64,933 | 52,959 | 40,746 | 19,071 | 64,185 | 241,894 | ||||||||||||

| Other Inflows |

44,233 | 8,799 | 3,214 | 8,657 | 3,546 | 68,449 | ||||||||||||

| Total Receipts |

109,166 | 61,758 | 43,960 | 27,728 | 67,731 | 310,343 | ||||||||||||

| Disbursements |

||||||||||||||||||

| Trade Payables |

(36,692 | ) | (32,960 | ) | (34,541 | ) | (30,927 | ) | (32,959 | ) | (168,079 | ) | ||||||

| Intercompany A/P Settlement |

1,148 | 6,705 | 2,362 | 2,740 | 430 | 13,385 | ||||||||||||

| Payment on Behalf of Affiliates |

— | — | — | — | (1,312 | ) | (1,312 | ) | ||||||||||

| Capital Expenditures |

— | — | — | — | — | — | ||||||||||||

| Net A/P Variance |

(35,544 | ) | (26,255 | ) | (32,179 | ) | (28,187 | ) | (33,841 | ) | (156,006 | ) | ||||||

| A/R Collections—Affiliates |

1,480 | 6,187 | 2,930 | 3,377 | 2,647 | 16,621 | ||||||||||||

| Intercompany A/R Settlements |

(6,781 | ) | (7,993 | ) | (7,396 | ) | (4,199 | ) | (7,142 | ) | (33,511 | ) | ||||||

| (5,301 | ) | (1,806 | ) | (4,466 | ) | (822 | ) | (4,495 | ) | (16,890 | ) | |||||||

| Marine Freight Payments |

(1,063 | ) | (792 | ) | (1,980 | ) | (1,581 | ) | (2,712 | ) | (8,128 | ) | ||||||

| Utility Payments |

(7,961 | ) | (5,470 | ) | (2,044 | ) | (2,134 | ) | (10,416 | ) | (28,025 | ) | ||||||

| Payroll & Benefits |

(10,821 | ) | (11,986 | ) | (10,311 | ) | (8,693 | ) | (8,035 | ) | (49,846 | ) | ||||||

| Net Other Disbursements |

(19,845 | ) | (18,248 | ) | (14,335 | ) | (12,408 | ) | (21,163 | ) | (85,999 | ) | ||||||

| Total Disbursements |

(60,690 | ) | (46,309 | ) | (50,980 | ) | (41,417 | ) | (59,499 | ) | (258,895 | ) | ||||||

| Financing |

||||||||||||||||||

| Securitization Inflows / (Outflows) |

12,691 | (5,282 | ) | (4,125 | ) | (1,286 | ) | 8,714 | 10,712 | |||||||||

| Adequate Protection by DCorp to ACCC Term Lenders |

— | (3,180 | ) | — | — | — | (3,180 | ) | ||||||||||

| DIP Interest & Fees |

— | — | (1,814 | ) | — | — | (1,814 | ) | ||||||||||

| Restructuring & Other Items |

(772 | ) | (738 | ) | (1,023 | ) | (321 | ) | (1,414 | ) | (4,268 | ) | ||||||

| Foreign Exchange Translation |

(1,067 | ) | — | (515 | ) | (1,034 | ) | (1,656 | ) | (4,272 | ) | |||||||

| 10,852 | (9,200 | ) | (7,477 | ) | (2,641 | ) | 5,644 | (2,822 | ) | |||||||||

| Cash Flow From Operations |

59,328 | 6,249 | (14,497 | ) | (16,330 | ) | 13,876 | 48,626 | ||||||||||

| Opening Cash Balance |

110,746 | 170,074 | 176,323 | 161,826 | 145,496 | 110,746 | ||||||||||||

| Cash Flow From Operations |

59,328 | 6,249 | (14,497 | ) | (16,330 | ) | 13,876 | 48,626 | ||||||||||

| Ending Cash Balance |

170,074 | 176,323 | 161,826 | 145,496 | 159,372 | 159,372 | ||||||||||||

Note: The above totals are subject to rounding adjustments

- 32 -

Abitibi-Consolidated Inc. and its Subsidiaries (the “ACI Group”)

Actual to Forecast Comparison

5 Weeks Ended November 22, 2009

US$000

| Forecast | ||||||||||||||||||

| Week Ended |

25-Oct-09 | 1-Nov-09 | 8-Nov-09 | 15-Nov-09 | 22-Nov-09 | Total | ||||||||||||

| Opening Cash |

110,746 | 160,567 | 151,869 | 162,255 | 142,859 | 110,746 | ||||||||||||

| Receipts |

||||||||||||||||||

| A/R Collections |

38,015 | 45,031 | 41,751 | 41,080 | 46,175 | 212,052 | ||||||||||||

| Intercompany A/R Settlement |

— | — | — | — | — | — | ||||||||||||

| Joint Venture Remittances, Net |

(844 | ) | — | — | (16,573 | ) | — | (17,417 | ) | |||||||||

| Collections on Behalf of Joint Ventures |

3,757 | 3,833 | 4,292 | 4,292 | 4,292 | 20,466 | ||||||||||||

| Net A/R Collections |

40,928 | 48,864 | 46,043 | 28,799 | 50,467 | 215,101 | ||||||||||||

| Other Inflows |

40,427 | 5,437 | 6,008 | 2,175 | 2,239 | 56,286 | ||||||||||||

| Total Receipts |

81,355 | 54,301 | 52,051 | 30,974 | 52,706 | 271,387 | ||||||||||||

| Disbursements |

||||||||||||||||||

| Trade Payables |

(27,052 | ) | (25,865 | ) | (26,933 | ) | (25,043 | ) | (25,043 | ) | (129,936 | ) | ||||||

| Intercompany A/P Settlement |

— | — | — | — | — | — | ||||||||||||

| Payment on Behalf of Affiliates |

— | — | — | — | — | — | ||||||||||||

| Capital Expenditures |

(1,496 | ) | (1,503 | ) | (1,546 | ) | (1,546 | ) | (1,546 | ) | (7,637 | ) | ||||||

| Net A/P Variance |

(28,548 | ) | (27,368 | ) | (28,479 | ) | (26,589 | ) | (26,589 | ) | (137,573 | ) | ||||||

| A/R Collections—Affiliates |

— | — | — | — | — | |||||||||||||

| Intercompany A/R Settlements |

— | — | — | — | — | |||||||||||||

| — | — | — | — | — | — | |||||||||||||

| Marine Freight Payments |

(1,300 | ) | (1,300 | ) | (1,300 | ) | (1,300 | ) | (1,300 | ) | (6,500 | ) | ||||||

| Utility Payments |

(7,870 | ) | (7,299 | ) | (3,870 | ) | (7,870 | ) | (7,870 | ) | (34,779 | ) | ||||||

| Payroll & Benefits |

(5,507 | ) | (18,848 | ) | (5,397 | ) | (11,380 | ) | (5,397 | ) | (46,529 | ) | ||||||

| Net Other Disbursements |

(14,677 | ) | (27,447 | ) | (10,567 | ) | (20,550 | ) | (14,567 | ) | (87,808 | ) | ||||||

| Total Disbursements |

(43,225 | ) | (54,815 | ) | (39,046 | ) | (47,139 | ) | (41,156 | ) | (225,381 | ) | ||||||

| Financing |

||||||||||||||||||

| Securitization Inflows / (Outflows) |

12,691 | (3,402 | ) | (1,619 | ) | (2,231 | ) | (6,773 | ) | (1,334 | ) | |||||||

| Adequate Protection by DCorp to ACCC Term Lenders |

— | (3,537 | ) | — | — | — | (3,537 | ) | ||||||||||

| DIP Interest & Fees |

— | (245 | ) | — | — | — | (245 | ) | ||||||||||

| Restructuring & Other Items |

(1,000 | ) | (1,000 | ) | (1,000 | ) | (1,000 | ) | (1,000 | ) | (5,000 | ) | ||||||

| Foreign Exchange Translation |

— | — | — | — | — | — | ||||||||||||

| 11,691 | (8,184 | ) | (2,619 | ) | (3,231 | ) | (7,773 | ) | (10,116 | ) | ||||||||

| Cash Flow From Operations |

49,821 | (8,698 | ) | 10,386 | (19,396 | ) | 3,777 | 35,890 | ||||||||||

| Opening Cash Balance |

110,746 | 160,567 | 151,869 | 162,255 | 142,859 | 110,746 | ||||||||||||

| Cash Flow From Operations |

49,821 | (8,698 | ) | 10,386 | (19,396 | ) | 3,777 | 35,890 | ||||||||||

| Ending Cash Balance |

160,567 | 151,869 | 162,255 | 142,859 | 146,636 | 146,636 | ||||||||||||

Note: The above totals are subject to rounding adjustments

- 33 -

Abitibi-Consolidated Inc. and its Subsidiaries (the “ACI Group”)

Actual to Forecast Comparison

5 Weeks Ended November 22, 2009

US$000

| Variance | ||||||||||||||||||

| Week Ended |

25-Oct-09 | 1-Nov-09 | 8-Nov-09 | 15-Nov-09 | 22-Nov-09 | Total | ||||||||||||

| Opening Cash |

— | 9,507 | 24,454 | (429 | ) | 2,637 | — | |||||||||||

| Receipts |

||||||||||||||||||

| A/R Collections |

14,369 | (2,761 | ) | (3,906 | ) | (10,307 | ) | 4,666 | 2,061 | |||||||||

| Intercompany A/R Settlement |

9,421 | 13,896 | 2,901 | 4,655 | 12,678 | 43,551 | ||||||||||||

| Joint Venture Remittances, Net |

844 | (3,217 | ) | — | 216 | — | (2,157 | ) | ||||||||||

| Collections on Behalf of Joint Ventures |

(629 | ) | (3,823 | ) | (4,292 | ) | (4,292 | ) | (3,626 | ) | (16,662 | ) | ||||||

| Net A/R Collections |

24,005 | 4,095 | (5,297 | ) | (9,728 | ) | 13,718 | 26,793 | ||||||||||

| Other Inflows |

3,806 | 3,362 | (2,794 | ) | 6,482 | 1,307 | 12,163 | |||||||||||

| Total Receipts |

27,811 | 7,457 | (8,091 | ) | (3,246 | ) | 15,025 | 38,956 | ||||||||||

| Disbursements |

||||||||||||||||||

| Trade Payables |

(9,640 | ) | (7,095 | ) | (7,608 | ) | (5,884 | ) | (7,916 | ) | (38,143 | ) | ||||||

| Intercompany A/P Settlement |

1,148 | 6,705 | 2,362 | 2,740 | 430 | 13,385 | ||||||||||||

| Payment on Behalf of Affiliates |

— | — | — | — | (1,312 | ) | (1,312 | ) | ||||||||||

| Capital Expenditures |

1,496 | 1,503 | 1,546 | 1,546 | 1,546 | 7,637 | ||||||||||||

| Net A/P Variance |

(6,996 | ) | 1,113 | (3,700 | ) | (1,598 | ) | (7,252 | ) | (18,433 | ) | |||||||

| A/R Collections—Affiliates |

1,480 | 6,187 | 2,930 | 3,377 | 2,647 | 16,621 | ||||||||||||

| Intercompany A/R Settlements |

(6,781 | ) | (7,993 | ) | (7,396 | ) | (4,199 | ) | (7,142 | ) | (33,511 | ) | ||||||

| (5,301 | ) | (1,806 | ) | (4,466 | ) | (822 | ) | (4,495 | ) | (16,890 | ) | |||||||

| Marine Freight Payments |

237 | 508 | (680 | ) | (281 | ) | (1,412 | ) | (1,628 | ) | ||||||||

| Utility Payments |

(91 | ) | 1,829 | 1,826 | 5,736 | (2,546 | ) | 6,754 | ||||||||||

| Payroll & Benefits |

(5,314 | ) | 6,862 | (4,914 | ) | 2,687 | (2,638 | ) | (3,317 | ) | ||||||||

| Net Other Disbursements |

(5,168 | ) | 9,199 | (3,768 | ) | 8,142 | (6,596 | ) | 1,809 | |||||||||

| Total Disbursements |

(17,465 | ) | 8,506 | (11,934 | ) | 5,722 | (18,343 | ) | (33,514 | ) | ||||||||

| Financing |

||||||||||||||||||

| Securitization Inflows / (Outflows) |

— | (1,880 | ) | (2,506 | ) | 945 | 15,487 | 12,046 | ||||||||||

| Adequate Protection by DCorp to ACCC Term Lenders |

— | 357 | — | — | — | 357 | ||||||||||||

| DIP Interest & Fees |

— | 245 | (1,814 | ) | — | — | (1,569 | ) | ||||||||||

| Restructuring & Other Items |

228 | 262 | (23 | ) | 679 | (414 | ) | 732 | ||||||||||

| Foreign Exchange Translation |

(1,067 | ) | — | (515 | ) | (1,034 | ) | (1,656 | ) | (4,272 | ) | |||||||

| (839 | ) | (1,016 | ) | (4,858 | ) | 590 | 13,417 | 7,294 | ||||||||||

| Cash Flow From Operations |

9,507 | 14,947 | (24,883 | ) | 3,066 | 10,099 | 12,736 | |||||||||||

| Opening Cash Balance |

— | 9,507 | 24,454 | (429 | ) | 2,637 | — | |||||||||||

| Cash Flow From Operations |

9,507 | 14,947 | (24,883 | ) | 3,066 | 10,099 | 12,736 | |||||||||||

| Ending Cash Balance |

9,507 | 24,454 | (429 | ) | 2,637 | 12,736 | 12,736 | |||||||||||

Note: The above totals are subject to rounding adjustments

- 34 -

APPENDIX “F”

BCFPI ACTUAL RECEIPTS AND DISBURSEMENTS

Bowater Canadian Forest Products Inc. (“BCFPI”)

Actual to Forecast Comparison

5 Weeks Ended November 22, 2009

US$000

| Actual | ||||||||||||||||||

| Week Ended |

25-Oct-09 | 1-Nov-09 | 8-Nov-09 | 15-Nov-09 | 22-Nov-09 | Total | ||||||||||||

| Opening Cash |

7,401 | 8,647 | 9,612 | 10,729 | 10,726 | 7,401 | ||||||||||||

| Receipts |

||||||||||||||||||

| A/R Collections |

1,578 | 2,973 | 4,480 | 1,712 | 2,762 | 13,505 | ||||||||||||

| Intercompany A/R Settlements |

7,082 | 4,217 | 3,482 | 21,195 | 5,933 | 41,909 | ||||||||||||

| Total A/R Collections |

8,660 | 7,190 | 7,962 | 22,907 | 8,695 | 55,414 | ||||||||||||

| Advances from Bowater Inc. |

6,000 | 7,000 | — | (9,000 | ) | 5,000 | 9,000 | |||||||||||

| Other Inflows |

2,054 | 1,471 | 8,896 | 1,493 | 502 | 14,416 | ||||||||||||

| Total Receipts |

16,714 | 15,661 | 16,858 | 15,400 | 14,197 | 78,830 | ||||||||||||

| Disbursements |

||||||||||||||||||

| Trade Payables |

(6,434 | ) | (7,574 | ) | (9,523 | ) | (8,028 | ) | (5,649 | ) | (37,208 | ) | ||||||

| Intercompany A/P Settlements—Disbursements |

(344 | ) | (394 | ) | (455 | ) | (269 | ) | (184 | ) | (1,646 | ) | ||||||

| Capital Expenditures |

— | — | — | — | — | — | ||||||||||||

| Payments on Behalf of Affiliates |

(2,633 | ) | (1,462 | ) | (1,960 | ) | (1,603 | ) | (4,095 | ) | (11,753 | ) | ||||||

| Net A/P |

(9,411 | ) | (9,430 | ) | (11,938 | ) | (9,900 | ) | (9,928 | ) | (50,607 | ) | ||||||

| A/R Collections—Affiliates |

881 | 1,564 | 834 | 629 | 1,141 | 5,049 | ||||||||||||

| Intercompany A/R Settlements |

(2,827 | ) | (1,066 | ) | (1,220 | ) | (1,062 | ) | (1,339 | ) | (7,514 | ) | ||||||

| (1,946 | ) | 498 | (386 | ) | (433 | ) | (198 | ) | (2,465 | ) | ||||||||

| Intercompany SG&A Allocation |

— | — | — | — | — | — | ||||||||||||

| Freight |

(500 | ) | (858 | ) | (372 | ) | (998 | ) | (938 | ) | (3,666 | ) | ||||||

| Payroll and Benefits |

(2,046 | ) | (4,141 | ) | (1,676 | ) | (3,362 | ) | (3,177 | ) | (14,402 | ) | ||||||

| Total Disbursements |

(13,903 | ) | (13,931 | ) | (14,372 | ) | (14,693 | ) | (14,241 | ) | (71,140 | ) | ||||||

| Cash Flow From Operations |

2,811 | 1,730 | 2,486 | 707 | (44 | ) | 7,690 | |||||||||||

| Financing |

||||||||||||||||||

| Settlement Proceeds—Receipt |

25,868 | — | — | — | — | 25,868 | ||||||||||||

| Settlement Proceeds—Disbursement |

(25,868 | ) | — | — | — | — | (25,868 | ) | ||||||||||

| Interest |

(386 | ) | — | (1,029 | ) | — | — | (1,415 | ) | |||||||||

| Restructuring Costs |

(410 | ) | (342 | ) | (157 | ) | (209 | ) | (273 | ) | (1,391 | ) | ||||||

| Foreign Exchange Translation |

(769 | ) | (423 | ) | (183 | ) | (501 | ) | (367 | ) | (2,243 | ) | ||||||

| Cash Flow from Financing/Restructuring |

(1,565 | ) | (765 | ) | (1,369 | ) | (710 | ) | (640 | ) | (5,049 | ) | ||||||

| Net Cash Flows |

1,246 | 965 | 1,117 | (3 | ) | (684 | ) | 2,641 | ||||||||||

| Opening Cash Balance |

7,401 | 8,647 | 9,612 | 10,729 | 10,726 | 7,401 | ||||||||||||

| Cash Flow From Operations |

1,246 | 965 | 1,117 | (3 | ) | (684 | ) | 2,641 | ||||||||||

| Ending Cash Balance |

8,647 | 9,612 | 10,729 | 10,726 | 10,042 | 10,042 | ||||||||||||

Note: The above totals are subject to rounding adjustments

- 35 -

Bowater Canadian Forest Products Inc. (“BCFPI”)

Actual to Forecast Comparison

5 Weeks Ended November 22, 2009

US$000

| Forecast | ||||||||||||||||||

| Week Ended |

25-Oct-09 | 1-Nov-09 | 8-Nov-09 | 15-Nov-09 | 22-Nov-09 | Total | ||||||||||||

| Opening Cash |

7,401 | 10,053 | 9,097 | 10,541 | 10,188 | 7,401 | ||||||||||||

| Receipts |

||||||||||||||||||

| A/R Collections |

7,365 | 12,419 | 8,475 | 20,190 | 5,755 | 54,204 | ||||||||||||

| Intercompany A/R Settlements |

— | — | — | — | — | — | ||||||||||||

| Total A/R Collections |

7,365 | 12,419 | 8,475 | 20,190 | 5,755 | 54,204 | ||||||||||||

| Advances from Bowater Inc. |

6,000 | — | 4,000 | (9,000 | ) | 6,000 | 7,000 | |||||||||||

| Other Inflows |

— | — | — | — | — | — | ||||||||||||

| Total Receipts |

13,365 | 12,419 | 12,475 | 11,190 | 11,755 | 61,204 | ||||||||||||

| Disbursements |

||||||||||||||||||

| Trade Payables |

(7,684 | ) | (7,726 | ) | (7,975 | ) | (7,975 | ) | (7,975 | ) | (39,335 | ) | ||||||

| Intercompany A/P Settlements—Disbursements |

— | — | — | — | — | — | ||||||||||||

| Capital Expenditures |

(452 | ) | (454 | ) | (467 | ) | (467 | ) | (467 | ) | (2,307 | ) | ||||||

| Payments on Behalf of Affiliates |

— | — | — | — | — | — | ||||||||||||

| Net A/P |

(8,136 | ) | (8,180 | ) | (8,442 | ) | (8,442 | ) | (8,442 | ) | (41,642 | ) | ||||||

| A/R Collections—Affiliates |

— | — | — | — | — | — | ||||||||||||

| Intercompany A/R Settlements |

— | — | — | — | — | — | ||||||||||||

| — | — | — | — | — | — | |||||||||||||

| Intercompany SG&A Allocation |

— | — | (400 | ) | — | — | (400 | ) | ||||||||||

| Freight |

(226 | ) | (217 | ) | (163 | ) | (163 | ) | (163 | ) | (932 | ) | ||||||

| Payroll and Benefits |

(1,733 | ) | (3,846 | ) | (1,733 | ) | (2,645 | ) | (1,733 | ) | (11,690 | ) | ||||||

| Total Disbursements |

(10,095 | ) | (12,243 | ) | (10,738 | ) | (11,250 | ) | (10,338 | ) | (54,664 | ) | ||||||

| Cash Flow From Operations |

3,270 | 176 | 1,737 | (60 | ) | 1,417 | 6,540 | |||||||||||

| Financing |

||||||||||||||||||

| Settlement Proceeds—Receipt |

25,868 | — | — | — | — | 25,868 | ||||||||||||

| Settlement Proceeds—Disbursement |

(25,868 | ) | — | — | — | — | (25,868 | ) | ||||||||||

| Interest |

(325 | ) | (839 | ) | — | — | (338 | ) | (1,502 | ) | ||||||||

| Restructuring Costs |

(293 | ) | (293 | ) | (293 | ) | (293 | ) | (293 | ) | (1,465 | ) | ||||||

| Foreign Exchange Translation |

— | — | — | — | — | — | ||||||||||||

| Cash Flow from Financing/Restructuring |

(618 | ) | (1,132 | ) | (293 | ) | (293 | ) | (631 | ) | (2,967 | ) | ||||||

| Net Cash Flows |

2,652 | (956 | ) | 1,444 | (353 | ) | 786 | 3,573 | ||||||||||

| Opening Cash Balance |

7,401 | 10,053 | 9,097 | 10,541 | 10,188 | 7,401 | ||||||||||||

| Cash Flow From Operations |

2,652 | (956 | ) | 1,444 | (353 | ) | 786 | 3,573 | ||||||||||

| Ending Cash Balance |

10,053 | 9,097 | 10,541 | 10,188 | 10,974 | 10,974 | ||||||||||||

Note: The above totals are subject to rounding adjustments

- 36 -

Bowater Canadian Forest Products Inc. (“BCFPI”)

Actual to Forecast Comparison

5 Weeks Ended November 22, 2009

US$000

| Variance | ||||||||||||||||||

| Week Ended |

25-Oct-09 | 1-Nov-09 | 8-Nov-09 | 15-Nov-09 | 22-Nov-09 | Total | ||||||||||||

| Opening Cash |

— | (1,406 | ) | 515 | 188 | 538 | — | |||||||||||

| Receipts |

||||||||||||||||||

| A/R Collections |

(5,787 | ) | (9,446 | ) | (3,995 | ) | (18,478 | ) | (2,993 | ) | (40,699 | ) | ||||||

| Intercompany A/R Settlements |

7,082 | 4,217 | 3,482 | 21,195 | 5,933 | 41,909 | ||||||||||||

| Total A/R Collections |

1,295 | (5,229 | ) | (513 | ) | 2,717 | 2,940 | 1,210 | ||||||||||

| Advances from Bowater Inc. |

— | 7,000 | (4,000 | ) | — | (1,000 | ) | 2,000 | ||||||||||

| Other Inflows |

2,054 | 1,471 | 8,896 | 1,493 | 502 | 14,416 | ||||||||||||

| Total Receipts |

3,349 | 3,242 | 4,383 | 4,210 | 2,442 | 17,626 | ||||||||||||

| Disbursements |

||||||||||||||||||

| Trade Payables |

1,250 | 152 | (1,548 | ) | (53 | ) | 2,326 | 2,127 | ||||||||||

| Intercompany A/P Settlements—Disbursements |

(344 | ) | (394 | ) | (455 | ) | (269 | ) | (184 | ) | (1,646 | ) | ||||||

| Capital Expenditures |

452 | 454 | 467 | 467 | 467 | 2,307 | ||||||||||||

| Payments on Behalf of Affiliates |

(2,633 | ) | (1,462 | ) | (1,960 | ) | (1,603 | ) | (4,095 | ) | (11,753 | ) | ||||||

| Net A/P |

(1,275 | ) | (1,250 | ) | (3,496 | ) | (1,458 | ) | (1,486 | ) | (8,965 | ) | ||||||

| A/R Collections—Affiliates |

881 | 1,564 | 834 | 629 | 1,141 | 5,049 | ||||||||||||

| Intercompany A/R Settlements |

(2,827 | ) | (1,066 | ) | (1,220 | ) | (1,062 | ) | (1,339 | ) | (7,514 | ) | ||||||

| (1,946 | ) | 498 | (386 | ) | (433 | ) | (198 | ) | (2,465 | ) | ||||||||

| Intercompany SG&A Allocation |

— | — | 400 | — | — | 400 | ||||||||||||

| Freight |

(274 | ) | (641 | ) | (209 | ) | (835 | ) | (775 | ) | (2,734 | ) | ||||||

| Payroll and Benefits |

(313 | ) | (295 | ) | 57 | (717 | ) | (1,444 | ) | (2,712 | ) | |||||||

| Total Disbursements |

(3,808 | ) | (1,688 | ) | (3,634 | ) | (3,443 | ) | (3,903 | ) | (16,476 | ) | ||||||

| Cash Flow From Operations |

(459 | ) | 1,554 | 749 | 767 | (1,461 | ) | 1,150 | ||||||||||

| Financing |

||||||||||||||||||

| Settlement Proceeds—Receipt |

— | — | — | — | — | — | ||||||||||||

| Settlement Proceeds—Disbursement |

— | — | — | — | — | — | ||||||||||||

| Interest |

(61 | ) | 839 | (1,029 | ) | — | 338 | 87 | ||||||||||

| Restructuring Costs |

(117 | ) | (49 | ) | 136 | 84 | 20 | 74 | ||||||||||

| Foreign Exchange Translation |

(769 | ) | (423 | ) | (183 | ) | (501 | ) | (367 | ) | (2,243 | ) | ||||||

| Cash Flow from Financing/Restructuring |

(947 | ) | 367 | (1,076 | ) | (417 | ) | (9 | ) | (2,082 | ) | |||||||

| Net Cash Flows |

(1,406 | ) | 1,921 | (327 | ) | 350 | (1,470 | ) | (932 | ) | ||||||||

| Opening Cash Balance |

— | (1,406 | ) | 515 | 188 | 538 | — | |||||||||||

| Cash Flow From Operations |

(1,406 | ) | 1,921 | (327 | ) | 350 | (1,470 | ) | (932 | ) | ||||||||

| Ending Cash Balance |

(1,406 | ) | 515 | 188 | 538 | (932 | ) | (932 | ) | |||||||||

Note: The above totals are subject to rounding adjustments

- 37 -

APPENDIX “G”

ACI GROUP CASH FLOW FORECAST

Abitibi Consolidated Inc. and its subsidiaries (the “ACI Group”)

Weekly Cash Flow Forecast

17 Weeks Ending March 21, 2010

US$000

| Week ended |

Notes |

29-Nov-09 | 6-Dec-09 | 13-Dec-09 | 20-Dec-09 | 27-Dec-09 | 3-Jan-10 | 10-Jan-10 | 17-Jan-10 | 24-Jan-10 | |||||||||||||||||||

| Opening Cash |

1 | 159,372 | 140,324 | 157,755 | 150,308 | 235,298 | 233,816 | 229,002 | 226,582 | 218,494 | |||||||||||||||||||

| Receipts |

|||||||||||||||||||||||||||||

| Total A/R Collections |

3 | 26,080 | 49,577 | 39,015 | 47,000 | 47,363 | 45,024 | 32,592 | 47,483 | 40,747 | |||||||||||||||||||

| Collections on Behalf of Joint Ventures |

4 | 4,116 | 4,156 | 4,163 | 4,163 | 4,163 | 4,251 | 4,370 | 4,370 | 4,370 | |||||||||||||||||||

| Other Inflows |

5 | 6,864 | 7,363 | 2,548 | 2,485 | 2,485 | 4,799 | 6,415 | 6,622 | 2,551 | |||||||||||||||||||

| Total Receipts |

37,061 | 61,096 | 45,726 | 53,648 | 54,012 | 54,074 | 43,376 | 58,475 | 47,668 | ||||||||||||||||||||

| Disbursements |

|||||||||||||||||||||||||||||

| Trade Payables |

6 | (26,631 | ) | (29,046 | ) | (27,980 | ) | (26,090 | ) | (26,090 | ) | (25,625 | ) | (28,205 | ) | (28,205 | ) | (28,205 | ) | ||||||||||

| Capital Expenditures |

7 | (933 | ) | (908 | ) | (903 | ) | (903 | ) | (903 | ) | (1,000 | ) | (1,129 | ) | (1,129 | ) | (1,129 | ) | ||||||||||

| Marine Freight Payments |

8 | (1,700 | ) | (1,700 | ) | (1,700 | ) | (1,700 | ) | (1,700 | ) | (1,700 | ) | (1,300 | ) | (1,300 | ) | (1,300 | ) | ||||||||||

| Utility Payments |

9 | (7,870 | ) | (4,441 | ) | (3,870 | ) | (7,870 | ) | (7,870 | ) | (6,156 | ) | (3,870 | ) | (7,870 | ) | (7,870 | ) | ||||||||||

| Payroll & Benefits |

10 | (14,136 | ) | (10,744 | ) | (10,892 | ) | (6,987 | ) | (9,637 | ) | (15,102 | ) | (6,932 | ) | (11,609 | ) | (6,932 | ) | ||||||||||

| Joint Venture Remittances, Net |

11 | (838 | ) | — | — | (17,577 | ) | (838 | ) | — | — | (18,369 | ) | — | |||||||||||||||

| Restructuring & Other Items |

12 | (1,000 | ) | (1,000 | ) | (1,000 | ) | (1,000 | ) | (1,000 | ) | (1,000 | ) | (1,000 | ) | (1,000 | ) | (1,000 | ) | ||||||||||

| Total Disbursements |

(53,108 | ) | (47,839 | ) | (46,345 | ) | (62,126 | ) | (48,037 | ) | (50,583 | ) | (42,436 | ) | (69,483 | ) | (46,436 | ) | |||||||||||

| Financing |

|||||||||||||||||||||||||||||

| Securitization Inflows / (Outflows) |

13 | (3,000 | ) | 7,842 | (6,829 | ) | 75 | (7,456 | ) | (4,770 | ) | (3,360 | ) | 2,920 | (6,506 | ) | |||||||||||||

| Adequate Protection and Fees by DCorp to ACCC Term Lenders |

14 | — | (3,431 | ) | — | — | — | (3,537 | ) | — | — | — | |||||||||||||||||

| Proceeds From the Sale of ACCC MPCo Interest |

15 | — | — | — | 465,390 | — | — | — | — | — | |||||||||||||||||||

| Payment to the ULC Reserve |

15 | — | — | — | (254,070 | ) | — | — | — | — | — | ||||||||||||||||||

| ACI DIP Facility Drawings / (Repayments) |

15, 16 | — | — | — | (54,800 | ) | — | — | — | — | — | ||||||||||||||||||

| ULC DIP Facility Drawings / (Repayments) |

15 | — | — | — | 117,000 | — | — | — | — | — | |||||||||||||||||||

| Payment to the Senior Secured Notes |

15 | — | — | — | (180,000 | ) | — | — | — | — | — | ||||||||||||||||||

| Lufkin Proceeds |

17 | — | — | — | — | — | — | — | — | — | |||||||||||||||||||

| DIP Interest & Fees |

16 | — | (237 | ) | — | (127 | ) | — | — | — | — | — | |||||||||||||||||

| Asset Sale |

— | — | — | — | — | — | — | — | — | ||||||||||||||||||||

| Securitization Closing Fees |

— | — | — | — | — | — | — | — | — | ||||||||||||||||||||

| Total Change in Cash |

(19,048 | ) | 17,431 | (7,447 | ) | 84,990 | (1,481 | ) | (4,815 | ) | (2,420 | ) | (8,088 | ) | (5,275 | ) | |||||||||||||

| Ending Cash Balance |

140,324 | 157,755 | 150,308 | 235,298 | 233,816 | 229,002 | 226,582 | 218,494 | 213,219 | ||||||||||||||||||||

| Ending Cash Balance |

140,324 | 157,755 | 150,308 | 235,298 | 233,816 | 229,002 | 226,582 | 218,494 | 213,219 | ||||||||||||||||||||

| Undrawn Portion of ACI DIP Facility |

18 | 32,700 | 32,700 | 32,700 | — | — | — | — | — | — | |||||||||||||||||||

| ULC DIP Available Upon Notice |

18 | — | — | — | 45,000 | 45,000 | 45,000 | 45,000 | 45,000 | 45,000 | |||||||||||||||||||

| Immediately Available Liquidity |

173,024 | 190,455 | 183,008 | 280,298 | 278,816 | 274,002 | 271,582 | 263,494 | 258,219 | ||||||||||||||||||||

| ULC Available Upon Court Approval |

18 | — | — | — | 45,000 | 45,000 | 45,000 | 45,000 | 45,000 | 45,000 | |||||||||||||||||||

| Lufkin Proceeds Held in Trust |

17 | — | — | 20,500 | 20,500 | 20,500 | 20,500 | 20,500 | 20,500 | 20,500 | |||||||||||||||||||

| Total Available Liquidity |

17, 18 | 173,024 | 190,455 | 203,508 | 345,798 | 344,316 | 339,502 | 337,082 | 328,994 | 323,719 | |||||||||||||||||||

| Securitization Schedule |

19 | ||||||||||||||||||||||||||||

| Allowable Receivable Pool Balance |

152,421 | 160,262 | 154,474 | 154,548 | 147,093 | 142,323 | 138,964 | 142,888 | 136,381 | ||||||||||||||||||||

| Interest, Fees and Adjustments |

20 | — | — | (1,040 | ) | — | — | — | — | (1,005 | ) | — | |||||||||||||||||

| Amount Drawn Under Facility |

155,421 | 152,421 | 160,262 | 154,474 | 154,548 | 147,093 | 142,323 | 138,964 | 142,888 | ||||||||||||||||||||

| Availability / (Required Repayment) |

(3,000 | ) | 7,842 | (6,829 | ) | 75 | (7,456 | ) | (4,770 | ) | (3,360 | ) | 2,920 | (6,506 | ) | ||||||||||||||

| ULC Reserve |

|||||||||||||||||||||||||||||

| Opening Balance |

— | — | — | — | 47,070 | 47,070 | 47,070 | 47,070 | 47,070 | ||||||||||||||||||||

| Initial Deposit |

21 | — | — | — | 254,070 | — | — | — | — | — | |||||||||||||||||||

| ULC DIP Facility Drawings—Liquidity |

21 | — | — | — | (117,000 | ) | — | — | — | — | — | ||||||||||||||||||

| Disbursement to ULC Trust—Available Upon Notice |

21 | — | — | — | (45,000 | ) | — | — | — | — | — | ||||||||||||||||||

| Disbursement to ULC Trust—Available Subject to Further Court Approval |

21 | — | — | — | (45,000 | ) | — | — | — | — | — | ||||||||||||||||||

| Ending Balance ULC Reserve—Available Liquidity |

21 | — | — | — | 47,070 | 47,070 | 47,070 | 47,070 | 47,070 | 47,070 | |||||||||||||||||||

| ULC DIP Availability Subject to Further Court Approval |

— | — | — | 45,000 | 45,000 | 45,000 | 45,000 | 45,000 | 45,000 | ||||||||||||||||||||

| Restricted ULC Reserve Deposit |

21 | — | — | — | 117,000 | 117,000 | 117,000 | 117,000 | 117,000 | 117,000 | |||||||||||||||||||

| Lufkin Proceeds Held in Trust |

17 | — | — | 20,500 | 20,500 | 20,500 | 20,500 | 20,500 | 20,500 | 20,500 | |||||||||||||||||||

The above forecast uses an exchange rate of CDN$1.00=US$ 0.90.

Note: The above totals are subject to rounding adjustments in the underlying balances.