Attached files

| file | filename |

|---|---|

| 8-K - 8-K - UNIVERSAL BIOSENSORS INC | d891810d8k.htm |

Exhibit 99.1 Annual General Meeting 24 July 2020Exhibit 99.1 Annual General Meeting 24 July 2020

Important Disclaimer • This presentation is intended to provide a general outline only and is not intended to be a definitive statement on the subject matter. This presentation is not financial advice and has been prepared without taking into account the objectives, financial situation or needs of a particular person. • Neither the Company, nor its officers or advisors or any other person warrants the accuracy of the analysis herein or guarantees the investment performance of the Company. Investors must make their own independent assessment of the Company and undertake such additional enquiries as they deem necessary or appropriate for their own investment purposes. • The statements contained in this presentation that are not purely historical are forward-looking statements within the meaning of the United States Exchange Act. Forward-looking statements in this presentation include statements regarding our expectations, beliefs, hopes, intentions or strategies. All forward-looking statements included in this presentation are based upon information available to us as of the date hereof, and we assume no obligation to update any such forward-looking statement as a result of new information, future events or otherwise. Our actual results could differ materially from our current expectations. • The Company is subject to a number of risks. For a summary of key risks, refer to the Company’s most recent Form 10-K filed with the United States Securities and Exchange Commission and the Australian Securities Exchange. • Under applicable United States securities laws all of the shares of our common stock are “restricted securities” as that term is defined in Rule 144 under the Securities Act of 1933, as amended. Restricted securities may be resold in the public market to United States persons as defined in Regulation S only if registered for resale or if they qualify for an exemption from registration under the Securities Act. We have not agreed to register any of our common stock for resale by security holders. 2Important Disclaimer • This presentation is intended to provide a general outline only and is not intended to be a definitive statement on the subject matter. This presentation is not financial advice and has been prepared without taking into account the objectives, financial situation or needs of a particular person. • Neither the Company, nor its officers or advisors or any other person warrants the accuracy of the analysis herein or guarantees the investment performance of the Company. Investors must make their own independent assessment of the Company and undertake such additional enquiries as they deem necessary or appropriate for their own investment purposes. • The statements contained in this presentation that are not purely historical are forward-looking statements within the meaning of the United States Exchange Act. Forward-looking statements in this presentation include statements regarding our expectations, beliefs, hopes, intentions or strategies. All forward-looking statements included in this presentation are based upon information available to us as of the date hereof, and we assume no obligation to update any such forward-looking statement as a result of new information, future events or otherwise. Our actual results could differ materially from our current expectations. • The Company is subject to a number of risks. For a summary of key risks, refer to the Company’s most recent Form 10-K filed with the United States Securities and Exchange Commission and the Australian Securities Exchange. • Under applicable United States securities laws all of the shares of our common stock are “restricted securities” as that term is defined in Rule 144 under the Securities Act of 1933, as amended. Restricted securities may be resold in the public market to United States persons as defined in Regulation S only if registered for resale or if they qualify for an exemption from registration under the Securities Act. We have not agreed to register any of our common stock for resale by security holders. 2

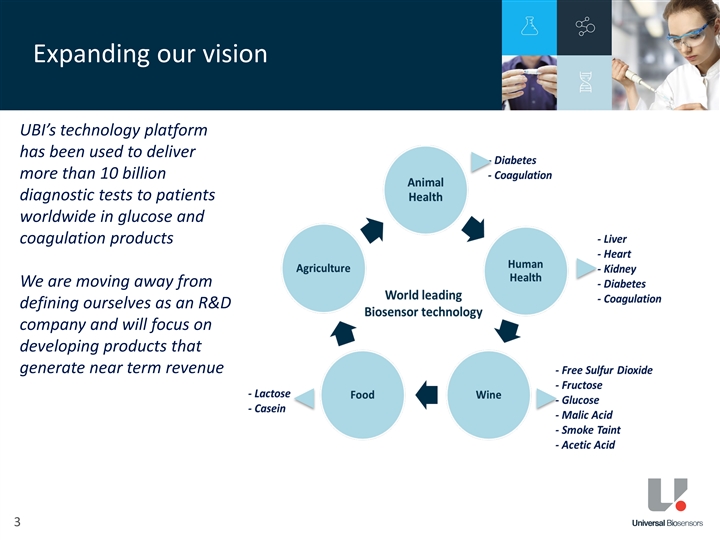

Expanding our vision UBI’s technology platform has been used to deliver more than 10 billion diagnostic tests to patients worldwide in glucose and coagulation products We are moving away from defining ourselves as an R&D company and will focus on developing products that generate near term revenue 3Expanding our vision UBI’s technology platform has been used to deliver more than 10 billion diagnostic tests to patients worldwide in glucose and coagulation products We are moving away from defining ourselves as an R&D company and will focus on developing products that generate near term revenue 3

New product launch SENTIA for the Wine Industry 4New product launch SENTIA for the Wine Industry 4

SENTIA Global opportunity SENTIA is UBI’s first new product launch in more than 6 years. SENTIA is a hand held, portable testing device which will change the nature of laboratory testing in the wine industry SENTIA delivers to the wine industry • medtech biosensor technology • gold-standard specificity and sensitivity for • Free SO2 testing • Glucose • Fructose • Malic acid testing (during 2021) • Smoke taint acetic acid testing to follow during 2022 • significant cost savings • productivity gains. 5SENTIA Global opportunity SENTIA is UBI’s first new product launch in more than 6 years. SENTIA is a hand held, portable testing device which will change the nature of laboratory testing in the wine industry SENTIA delivers to the wine industry • medtech biosensor technology • gold-standard specificity and sensitivity for • Free SO2 testing • Glucose • Fructose • Malic acid testing (during 2021) • Smoke taint acetic acid testing to follow during 2022 • significant cost savings • productivity gains. 5

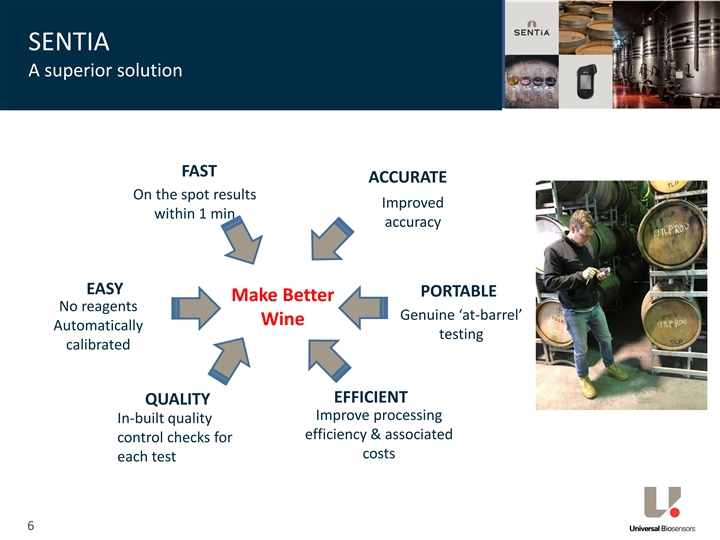

SENTIA A superior solution FAST ACCURATE On the spot results Improved within 1 min accuracy EASY PORTABLE Make Better No reagents Genuine ‘at-barrel’ Wine Automatically testing calibrated EFFICIENT QUALITY Improve processing In-built quality efficiency & associated control checks for costs each test 6SENTIA A superior solution FAST ACCURATE On the spot results Improved within 1 min accuracy EASY PORTABLE Make Better No reagents Genuine ‘at-barrel’ Wine Automatically testing calibrated EFFICIENT QUALITY Improve processing In-built quality efficiency & associated control checks for costs each test 6

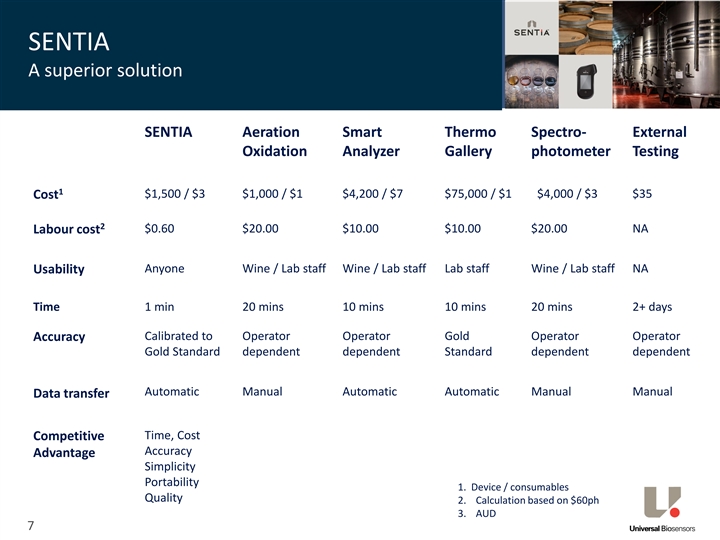

SENTIA A superior solution SENTIA Aeration Smart Thermo Spectro- External Oxidation Analyzer Gallery photometer Testing 1 $1,500 / $3 $1,000 / $1 $4,200 / $7 $75,000 / $1 $4,000 / $3 $35 Cost 2 $0.60 $20.00 $10.00 $10.00 $20.00 NA Labour cost Usability Anyone Wine / Lab staff Wine / Lab staff Lab staff Wine / Lab staff NA Time 1 min 20 mins 10 mins 10 mins 20 mins 2+ days Calibrated to Operator Operator Gold Operator Operator Accuracy Gold Standard dependent dependent Standard dependent dependent Automatic Manual Automatic Automatic Manual Manual Data transfer Time, Cost Competitive Accuracy Advantage Simplicity Portability 1. Device / consumables Quality 2. Calculation based on $60ph 3. AUD 7SENTIA A superior solution SENTIA Aeration Smart Thermo Spectro- External Oxidation Analyzer Gallery photometer Testing 1 $1,500 / $3 $1,000 / $1 $4,200 / $7 $75,000 / $1 $4,000 / $3 $35 Cost 2 $0.60 $20.00 $10.00 $10.00 $20.00 NA Labour cost Usability Anyone Wine / Lab staff Wine / Lab staff Lab staff Wine / Lab staff NA Time 1 min 20 mins 10 mins 10 mins 20 mins 2+ days Calibrated to Operator Operator Gold Operator Operator Accuracy Gold Standard dependent dependent Standard dependent dependent Automatic Manual Automatic Automatic Manual Manual Data transfer Time, Cost Competitive Accuracy Advantage Simplicity Portability 1. Device / consumables Quality 2. Calculation based on $60ph 3. AUD 7

SENTIA Product Roadmap Smoke Taint Acetic Acid Malic Acid H2 2021 Launch Q1 Glucose & Fructose 2020 Mid 2021 Free SO2 Q1 2021 Product Launch 8SENTIA Product Roadmap Smoke Taint Acetic Acid Malic Acid H2 2021 Launch Q1 Glucose & Fructose 2020 Mid 2021 Free SO2 Q1 2021 Product Launch 8

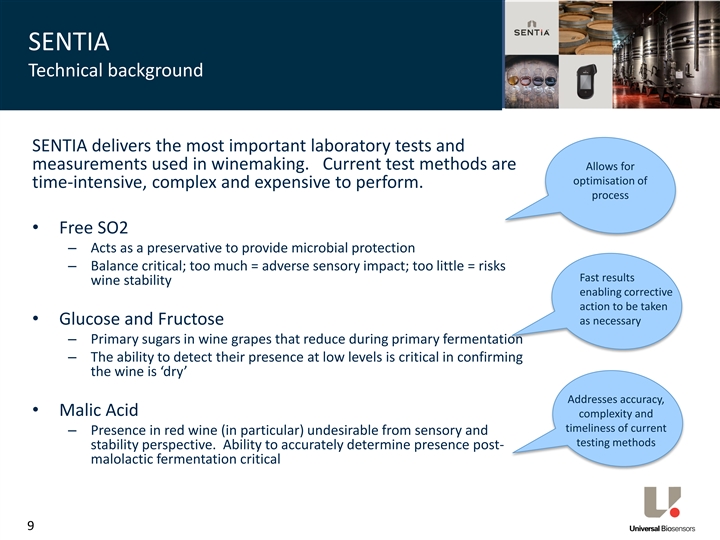

SENTIA Technical background SENTIA delivers the most important laboratory tests and measurements used in winemaking. Current test methods are Allows for optimisation of time-intensive, complex and expensive to perform. process • Free SO2 – Acts as a preservative to provide microbial protection – Balance critical; too much = adverse sensory impact; too little = risks Fast results wine stability enabling corrective action to be taken • Glucose and Fructose as necessary – Primary sugars in wine grapes that reduce during primary fermentation – The ability to detect their presence at low levels is critical in confirming the wine is ‘dry’ Addresses accuracy, • Malic Acid complexity and timeliness of current – Presence in red wine (in particular) undesirable from sensory and testing methods stability perspective. Ability to accurately determine presence post- malolactic fermentation critical 9SENTIA Technical background SENTIA delivers the most important laboratory tests and measurements used in winemaking. Current test methods are Allows for optimisation of time-intensive, complex and expensive to perform. process • Free SO2 – Acts as a preservative to provide microbial protection – Balance critical; too much = adverse sensory impact; too little = risks Fast results wine stability enabling corrective action to be taken • Glucose and Fructose as necessary – Primary sugars in wine grapes that reduce during primary fermentation – The ability to detect their presence at low levels is critical in confirming the wine is ‘dry’ Addresses accuracy, • Malic Acid complexity and timeliness of current – Presence in red wine (in particular) undesirable from sensory and testing methods stability perspective. Ability to accurately determine presence post- malolactic fermentation critical 9

SENTIA Launch Strategy In discussion with global distribution partners. eDM UBI will create and support an Key opinion leaders Published Papers environment of information and & influencers communication to ensure the success of SENTIA. Early Sales Adopter Support Incentives Awareness Campaign 10SENTIA Launch Strategy In discussion with global distribution partners. eDM UBI will create and support an Key opinion leaders Published Papers environment of information and & influencers communication to ensure the success of SENTIA. Early Sales Adopter Support Incentives Awareness Campaign 10

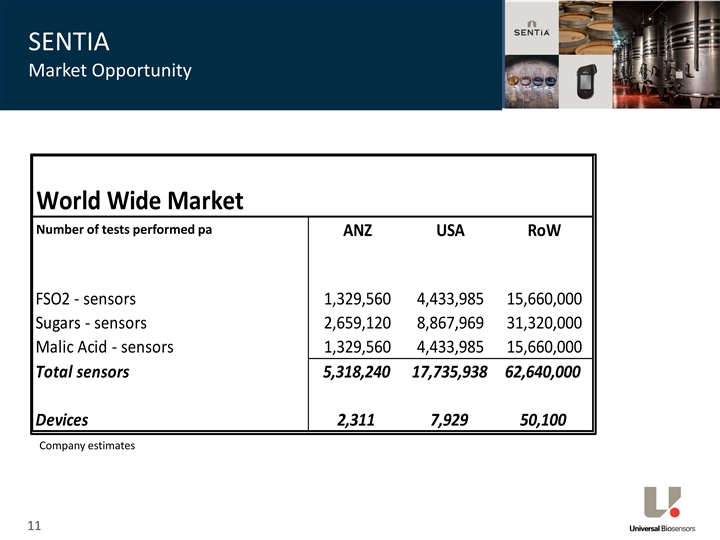

SENTIA Market Opportunity World Wide Market Number of tests performed pa ANZ USA RoW FSO2 - sensors 1,329,560 4,433,985 15,660,000 Sugars - sensors 2,659,120 8,867,969 31,320,000 Malic Acid - sensors 1,329,560 4,433,985 15,660,000 Total sensors 5,318,240 17,735,938 62,640,000 Devices 2,311 7,929 50,100 Company estimates 11SENTIA Market Opportunity World Wide Market Number of tests performed pa ANZ USA RoW FSO2 - sensors 1,329,560 4,433,985 15,660,000 Sugars - sensors 2,659,120 8,867,969 31,320,000 Malic Acid - sensors 1,329,560 4,433,985 15,660,000 Total sensors 5,318,240 17,735,938 62,640,000 Devices 2,311 7,929 50,100 Company estimates 11

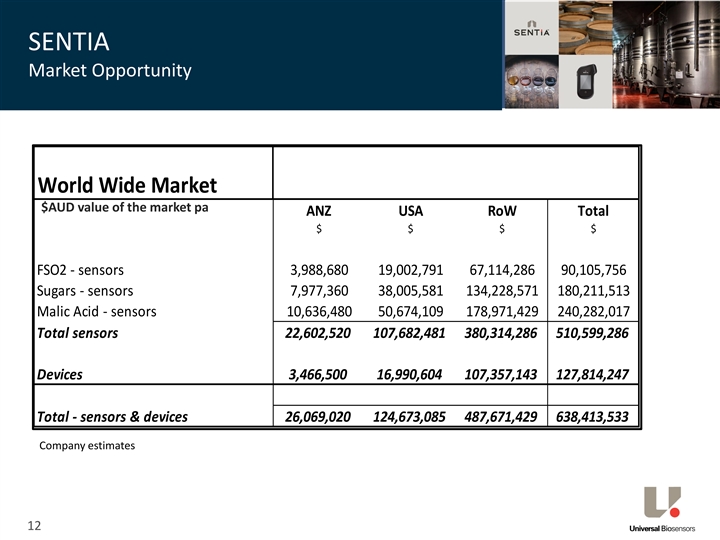

SENTIA Market Opportunity World Wide Market $AUD value of the market pa ANZ USA RoW Total $ $ $ $ FSO2 - sensors 3,988,680 19,002,791 67,114,286 90,105,756 Sugars - sensors 7,977,360 38,005,581 134,228,571 180,211,513 Malic Acid - sensors 10,636,480 50,674,109 178,971,429 240,282,017 Total sensors 22,602,520 107,682,481 380,314,286 510,599,286 Devices 3,466,500 16,990,604 107,357,143 127,814,247 Total - sensors & devices 26,069,020 124,673,085 487,671,429 638,413,533 Company estimates 12SENTIA Market Opportunity World Wide Market $AUD value of the market pa ANZ USA RoW Total $ $ $ $ FSO2 - sensors 3,988,680 19,002,791 67,114,286 90,105,756 Sugars - sensors 7,977,360 38,005,581 134,228,571 180,211,513 Malic Acid - sensors 10,636,480 50,674,109 178,971,429 240,282,017 Total sensors 22,602,520 107,682,481 380,314,286 510,599,286 Devices 3,466,500 16,990,604 107,357,143 127,814,247 Total - sensors & devices 26,069,020 124,673,085 487,671,429 638,413,533 Company estimates 12

Coagulation UBI is developing a new coagulation product and has purchased the global distribution rights to its existing coagulation products 13Coagulation UBI is developing a new coagulation product and has purchased the global distribution rights to its existing coagulation products 13

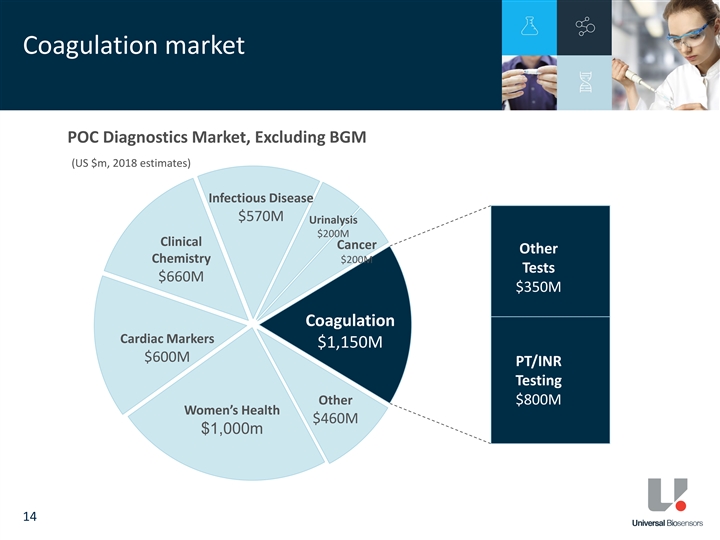

Coagulation market POC Diagnostics Market, Excluding BGM (US $m, 2018 estimates) Infectious Disease $570M Urinalysis $200M Clinical Cancer Other Chemistry $200M Tests $660M $350M Coagulation Cardiac Markers $1,150M $600M PT/INR Testing Other $800M Women’s Health $460M $1,000m 14Coagulation market POC Diagnostics Market, Excluding BGM (US $m, 2018 estimates) Infectious Disease $570M Urinalysis $200M Clinical Cancer Other Chemistry $200M Tests $660M $350M Coagulation Cardiac Markers $1,150M $600M PT/INR Testing Other $800M Women’s Health $460M $1,000m 14

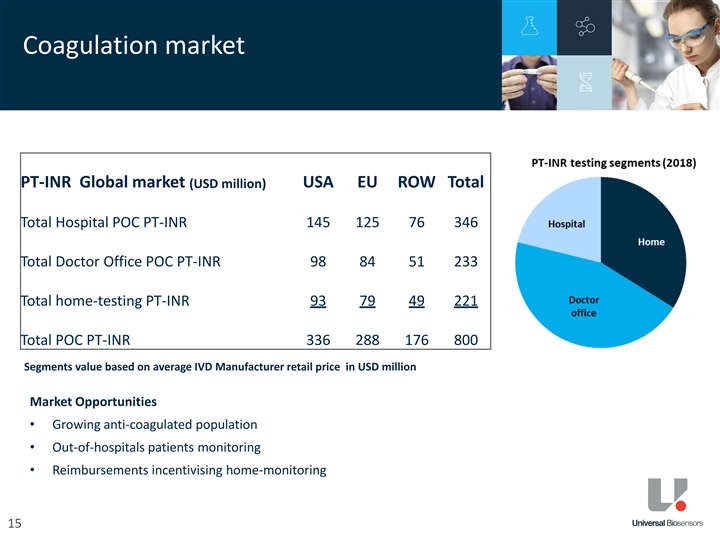

Coagulation market PT-INR Global market (USD million) USA EU ROW Total Total Hospital POC PT-INR 145 125 76 346 Total Doctor Office POC PT-INR 98 84 51 233 Total home-testing PT-INR 93 79 49 221 Total POC PT-INR 336 288 176 800 Segments value based on average IVD Manufacturer retail price in USD million Market Opportunities • Growing anti-coagulated population • Out-of-hospitals patients monitoring • Reimbursements incentivising home-monitoring 15Coagulation market PT-INR Global market (USD million) USA EU ROW Total Total Hospital POC PT-INR 145 125 76 346 Total Doctor Office POC PT-INR 98 84 51 233 Total home-testing PT-INR 93 79 49 221 Total POC PT-INR 336 288 176 800 Segments value based on average IVD Manufacturer retail price in USD million Market Opportunities • Growing anti-coagulated population • Out-of-hospitals patients monitoring • Reimbursements incentivising home-monitoring 15

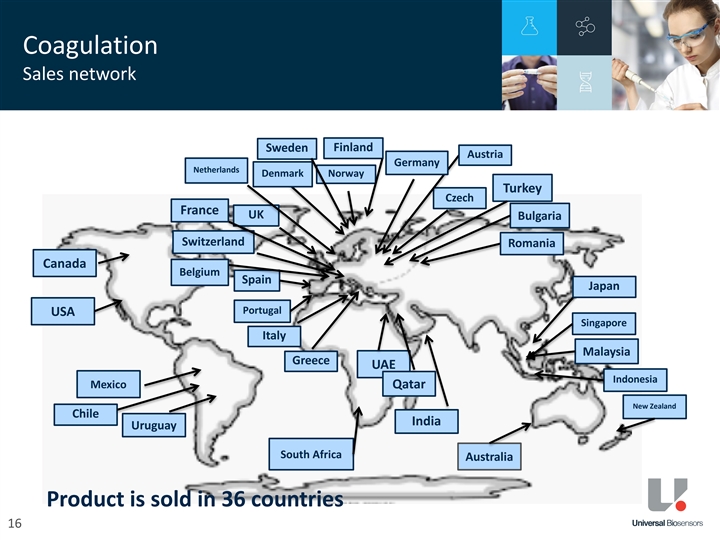

Coagulation Sales network Finland Sweden Austria Germany Netherlands Denmark Norway Turkey Czech France UK Bulgaria Switzerland Romania Canada Belgium Spain Japan Portugal USA Singapore Italy Malaysia Greece UAE Indonesia Mexico Qatar New Zealand Chile India Uruguay South Africa Australia Product is sold in 36 countries 16Coagulation Sales network Finland Sweden Austria Germany Netherlands Denmark Norway Turkey Czech France UK Bulgaria Switzerland Romania Canada Belgium Spain Japan Portugal USA Singapore Italy Malaysia Greece UAE Indonesia Mexico Qatar New Zealand Chile India Uruguay South Africa Australia Product is sold in 36 countries 16

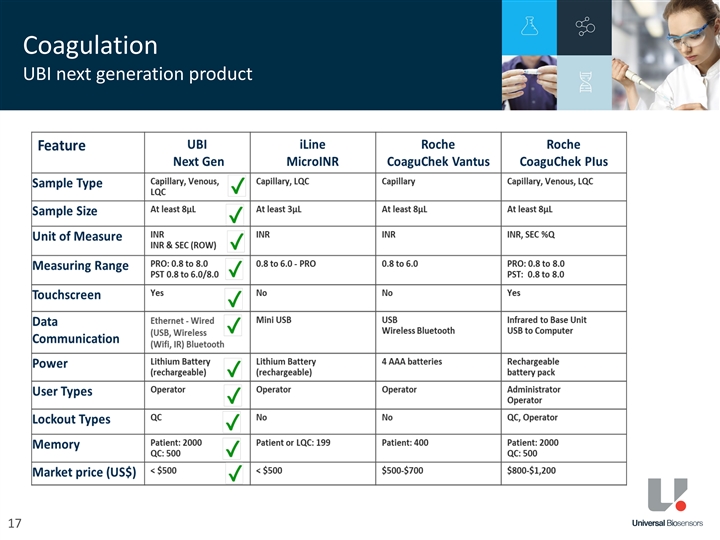

Coagulation UBI next generation product 17Coagulation UBI next generation product 17

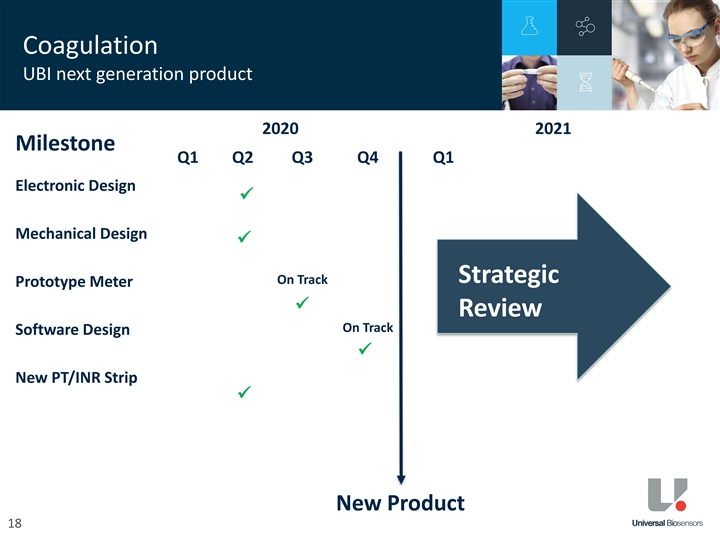

Coagulation UBI next generation product 2020 2021 Milestone Q1 Q2 Q3 Q4 Q1 Electronic Design üü Mechanical Design üü Strategic On Track Prototype Meter üü Review On Track Software Design üü New PT/INR Strip üü New Product 18Coagulation UBI next generation product 2020 2021 Milestone Q1 Q2 Q3 Q4 Q1 Electronic Design üü Mechanical Design üü Strategic On Track Prototype Meter üü Review On Track Software Design üü New PT/INR Strip üü New Product 18

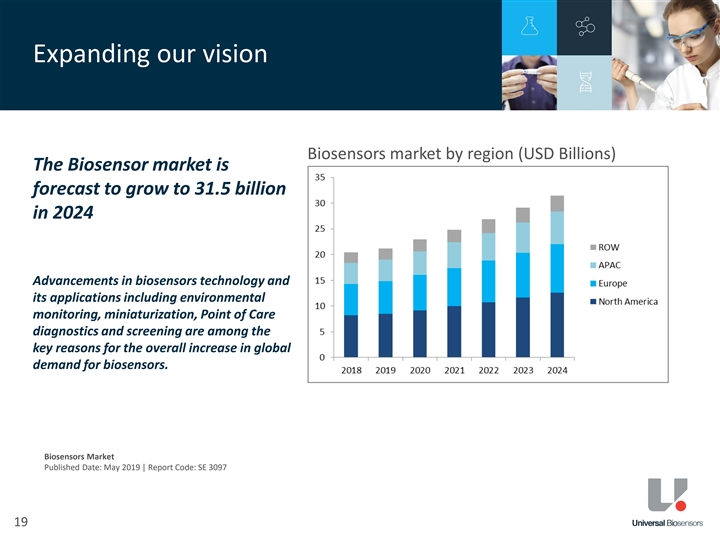

Expanding our vision Biosensors market by region (USD Billions) The Biosensor market is forecast to grow to 31.5 billion in 2024 Advancements in biosensors technology and its applications including environmental monitoring, miniaturization, Point of Care diagnostics and screening are among the key reasons for the overall increase in global demand for biosensors. Biosensors Market Published Date: May 2019 | Report Code: SE 3097 19Expanding our vision Biosensors market by region (USD Billions) The Biosensor market is forecast to grow to 31.5 billion in 2024 Advancements in biosensors technology and its applications including environmental monitoring, miniaturization, Point of Care diagnostics and screening are among the key reasons for the overall increase in global demand for biosensors. Biosensors Market Published Date: May 2019 | Report Code: SE 3097 19

Expanding our vision UBI intend to leverage its • Biosensor technology platform • Strong balance sheet, and • Newly acquired access to a global distribution network to: 1. Commercialise biosensor, detection and diagnostic products in large global markets that will deliver near term revenue 2. Strategic review of existing coagulation opportunities 3. Aggressively pursue M&A transactions; to Maximise shareholder value 20Expanding our vision UBI intend to leverage its • Biosensor technology platform • Strong balance sheet, and • Newly acquired access to a global distribution network to: 1. Commercialise biosensor, detection and diagnostic products in large global markets that will deliver near term revenue 2. Strategic review of existing coagulation opportunities 3. Aggressively pursue M&A transactions; to Maximise shareholder value 20

Universal Biosensors For further details please contact John Sharman Chief Executive Officer Universal Biosensors, Inc END 21Universal Biosensors For further details please contact John Sharman Chief Executive Officer Universal Biosensors, Inc END 21