Attached files

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-Q

Quarterly Report Under

the Securities Exchange Act of 1934

For Quarter Ended: March

31, 2018

Commission File Number: 000-52898

SUNSHINE BIOPHARMA INC.

(Exact name of small business issuer as specified in its

charter)

|

Colorado

|

|

20-5566275

|

|

(State

of other jurisdiction of incorporation)

|

|

(IRS

Employer ID No.)

|

6500 Trans-Canada Highway

4th Floor

Pointe-Claire, Quebec, Canada H9R 0A5

(Address of principal executive offices)

514) 426-6161

(Issuer’s Telephone

Number)

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file

such reports), and (2) has been subject to such filing requirements

for the past 90 days: Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every

Interactive Data File required to be submitted and posted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter)

during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

Yes ☑

No ☐

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated

filer”, “smaller reporting company”, and

“emerging growth company” in Rule 12b-2 of the Exchange

Act. (Check one)

|

|

Large

accelerated filer ☐

|

Accelerated

filer ☐

|

|

|

Non-accelerated

filer ☐

|

Smaller

reporting company ☒

|

|

|

Emerging

growth company ☒

|

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange

Act). ☐ Yes ☑ No

The number of shares of the registrant’s only class of common

stock issued and outstanding as of May 21, 2018, was 968,512,658

shares.

TABLE OF CONTENTS

|

|

PART I.

FINANCIAL INFORMATION

|

|

Page No.

|

|

|

|

|

|

|

|

|

Item

1. Financial

Statements

|

|

3

|

||

|

|

|

|

|

|

|

Unaudited

Consolidated Balance Sheet as of March 31, 2018

|

|

3

|

||

|

|

|

|

|

|

|

Unaudited

Consolidated Statement of Operations for the Three Month Periods

Ended March 31, 2018 and 2017

|

|

4

|

||

|

|

|

|

|

|

|

Unaudited

Consolidated Statement of Cash Flows for the Three Month Periods

Ended March 31, 2018 and 2017

|

|

5

|

||

|

|

|

|

|

|

|

Notes

to Consolidated Financial Statements

|

|

6

|

||

|

|

|

|

|

|

|

Item

2. Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

|

11

|

||

|

|

|

|

|

|

|

Item

3. Quantitative and

Qualitative Disclosures About Market Risk.

|

|

16

|

||

|

|

|

|

|

|

|

Item

4. Controls and

Procedures.

|

|

16

|

||

|

|

|

|

|

|

|

|

PART II. OTHER

INFORMATION

|

|

|

|

|

|

|

|

|

|

|

Item

1. Legal

Proceedings

|

|

18

|

||

|

|

|

|

|

|

|

Item 1A.

Risk

Factors

|

|

18

|

||

|

|

|

|

|

|

|

Item

2. Unregistered

Sales of Equity Securities and Use of Proceeds

|

|

18

|

||

|

|

|

|

|

|

|

Item

3. Defaults Upon

Senior Securities

|

|

18

|

||

|

|

|

|

|

|

|

Item

4. Mine Safety

Disclosures

|

|

18

|

||

|

|

|

|

|

|

|

Item

5. Other

Information

|

|

18

|

||

|

|

|

|

|

|

|

Item

6. Exhibits

|

|

18

|

||

|

|

|

|

|

|

|

Signatures

|

|

19

|

||

2

PART I.

|

|

Unaudited

|

Audited

|

|

|

March

31,

|

December

31,

|

|

|

2018

|

2017

|

|

ASSETS

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

Cash and cash

equivalents

|

$104,763

|

$107,532

|

|

Accounts

receivable

|

$92,390

|

$-

|

|

Prepaid

expenses

|

5,336

|

9,667

|

|

|

|

|

|

Total Current

Assets

|

202,489

|

117,199

|

|

|

|

|

|

Equipment (net of

$16,295 and $9,132 depreciation, resepctively)

|

118,444

|

59,996

|

|

Patents (net of

$58,918 amortization and $556,120 impairment)

|

-

|

-

|

|

|

|

|

|

Non-current

Assets:

|

|

|

|

Deposits

|

7,756

|

80,290

|

|

Goodwill

|

673,646

|

-

|

|

|

|

|

|

|

|

|

|

TOTAL

ASSETS

|

$1,002,335

|

$257,485

|

|

|

|

|

|

LIABILITIES AND

SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

Notes

payable

|

785,137

|

516,867

|

|

Notes payable -

Related party

|

256,665

|

205,742

|

|

Bank

overdraft

|

3,915

|

-

|

|

Accounts

payable

|

113,358

|

19,314

|

|

Interest

payable

|

21,924

|

9,215

|

|

|

|

|

|

Total Current

Liabilities

|

1,180,999

|

751,138

|

|

|

|

|

|

Long-term

Liabilities:

|

|

|

|

Note

payable

|

-

|

79,710

|

|

Note payable -

Related party

|

322,021

|

-

|

|

|

|

|

|

TOTAL

LIABILITIES

|

1,503,020

|

830,848

|

|

|

|

|

|

COMMITMENTS AND

CONTINGENCIES

|

|

|

|

|

|

|

|

SHAREHOLDERS'

EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

Preferred stock,

Series A $0.10 par value per share; Authorized 850,000

Shares;

Issued

and

outstanding -0- shares.

|

-

|

-

|

|

|

|

|

|

Preferred stock,

Series B $0.10 par value per share; Authorized 500,000

Shares;

Issued

and

outstanding 500,000 shares.

|

50,000

|

50,000

|

|

|

|

|

|

Common

Stock, $0.001 par value per share; Authorized

3,000,000,000 Shares; Issued and

outstanding

949,019,532 and 918,736,498 at March 31, 2018 and

December 31, 2017, respectively

|

948,020

|

918,737

|

|

Reserved for

issuance 474,779,621 at Martch 31, 2018

|

|

|

|

|

|

|

|

Capital paid in

excess of par value

|

12,387,355

|

12,075,586

|

|

|

|

|

|

Accumulated

comprehensive income

|

(2,234)

|

504

|

|

|

|

|

|

Accumulated

(Deficit)

|

(13,883,826)

|

(13,618,190)

|

|

|

|

|

|

TOTAL SHAREHOLDERS'

EQUITY (DEFICIT)

|

(500,685)

|

(573,363)

|

|

|

|

|

|

TOTAL LIABILITIES

AND SHAREHOLDERS' EQUITY (DEFICIT)

|

$1,002,335

|

$257,485

|

See

Accompanying Notes To These Financial Statements.

3

|

|

Unaudited

|

Unaudited

|

|

|

3

Months

|

3

Months

|

|

|

Ended

|

Ended

|

|

|

March

31,

|

March

31,

|

|

|

2018

|

2017

|

|

|

|

|

|

Revenue:

|

$91,168

|

$-

|

|

|

|

|

|

General &

Administrative Expenses

|

|

|

|

|

|

|

|

Accounting

|

28,000

|

15,600

|

|

Consulting

|

4,118

|

25,937

|

|

Legal

|

27,485

|

14,904

|

|

Office

|

19,048

|

9,066

|

|

Officer &

director remuneration

|

77,787

|

42,965

|

|

Rent

|

23,059

|

-

|

|

Salaries

|

57,558

|

-

|

|

Supplies

|

14,070

|

-

|

|

Depreciation

|

6,740

|

518

|

|

|

|

|

|

Total G &

A

|

257,865

|

108,990

|

|

|

|

|

|

(Loss) from

operations

|

(166,697)

|

(108,990)

|

|

|

|

|

|

Other Income

(expense):

|

|

|

|

Foreign exchange

(loss)

|

14,868

|

(639)

|

|

Interest

expense

|

(75,467)

|

(9,144)

|

|

Loss on debt

conversions

|

(38,340)

|

(76,929)

|

|

|

|

|

|

Total Other

(Expense)

|

(98,939)

|

(86,712)

|

|

|

|

|

|

Net

(loss)

|

$(265,636)

|

$(195,702)

|

|

|

|

|

|

Basic (Loss) per

common share

|

$0.00

|

$0.00

|

|

|

|

|

|

Weighted Average

Common Shares Outstanding

|

941,606,571

|

805,604,089

|

|

|

|

|

|

Net Income

(Loss)

|

$(265,636)

|

$(195,702)

|

|

Other comprehensive

income:

|

|

|

|

Gain (Loss) from

foreign exchange translation

|

(2,738)

|

1,509

|

|

Comprehensive

(Loss)

|

(268,374)

|

(194,193)

|

|

|

|

|

|

Basic (Loss) per

common share

|

$0.00

|

$0.00

|

|

|

|

|

|

Weighted Average

Common Shares Outstanding

|

941,606,571

|

805,604,089

|

4

|

|

Unaudited

|

Unaudited

|

|

|

3

Months

|

3

Months

|

|

|

Ended

|

Ended

|

|

|

March

31,

|

March

31,

|

|

|

2018

|

2017

|

|

|

|

|

|

Cash

Flows From Operating Activities:

|

|

|

|

|

|

|

|

Net

Loss

|

$(265,636)

|

$(195,702)

|

|

Depreciation and

amortization

|

6,740

|

525

|

|

Foreign exchange

loss

|

(14,868)

|

639

|

|

Stock issued for

licenses, services, and other assets

|

-

|

-

|

|

Stock issued for

payment interest

|

1,712

|

3,022

|

|

Loss on debt

conversion

|

38,340

|

76,929

|

|

Stock issued for

payment of expenses

|

-

|

14,400

|

|

(Increase) decrease

in accounts receivable

|

(12,882)

|

-

|

|

(Increase) decrease

in prepaid expenses

|

4,331

|

161

|

|

(Increase) decrease

in deposits

|

72,534

|

-

|

|

Increase (decrease)

in Accounts Payable & accrued expenses

|

(11,435)

|

(171)

|

|

Increase (decrease)

in interest payable

|

12,709

|

(7,840)

|

|

|

|

|

|

Net

Cash Flows Used in Operations

|

(168,455)

|

(108,037)

|

|

|

|

|

|

Cash

Flows From Investing Activities:

|

|

|

|

|

|

|

|

Cash paid for

Acquisition of Subsidiary

|

(80,289)

|

|

|

Cash received from

acquisition of subsidiary

|

4,942

|

|

|

Purchase of

equipment

|

(4,783)

|

-

|

|

|

|

|

|

Net

Cash Flows Used in Investing Activities

|

(80,130)

|

-

|

|

|

|

|

|

Cash

Flows From Financing Activities:

|

|

|

|

|

|

|

|

Proceed from notes

payables

|

356,885

|

50,256

|

|

Payment of notes

payable

|

(130,908)

|

-

|

|

Advances from

related parties

|

12,240

|

|

|

Payments to related

parties

|

(1,163)

|

|

|

Note payable used

to pay expenses

|

|

13,962

|

|

Note payable used

to pay origionation fees & interest

|

11,500

|

2,000

|

|

|

|

|

|

Net

Cash Flows Provided by Financing Activities

|

248,554

|

66,218

|

|

|

|

|

|

Net Increase

(Decrease) In Cash and cash equivalents

|

(31)

|

(41,819)

|

|

Foreign currency

translation adjustment

|

(2,738)

|

1,509

|

|

Cash and cash

equivalents at beginning of period

|

107,532

|

57,453

|

|

|

|

|

|

Cash and cash

equivalents at end of period

|

$104,763

|

$17,143

|

|

|

|

|

|

Supplementary

Disclosure Of Cash Flow Information:

|

|

|

|

|

|

|

|

Stock issued for

services, licenses and other assets

|

$-

|

$14,400

|

|

Stock issued for

note conversions including interest

|

$95,052

|

$128,451

|

|

Stock issued to pay

expenses and acquisition

|

$246,000

|

$-

|

|

Cash paid for

interest

|

$9,428

|

$-

|

|

Cash paid for

income taxes

|

$-

|

$-

|

See

Accompanying Notes To These Financial Statements.

5

Sunshine

Biopharma, Inc.

Notes

To Unaudited Consolidated Financial Statements

For The

Three Month Interim Period Ended March 31, 2018

Note 1 – Nature of Business and Basis of

Presentation

The

Company was originally incorporated under the name Mountain West

Business Solutions, Inc. (“MWBS”) on August 31, 2006 in

the State of Colorado. Until October 2009, the Company was

operating as a business consultancy firm. Effective October 15,

2009, the Company acquired Sunshine Biopharma, Inc. in a

transaction classified as a reverse acquisition. Sunshine

Biopharma, Inc. was holding an exclusive license to a new

anticancer drug bearing the laboratory name, Adva-27a. Upon

completion of the reverse acquisition transaction, the Company

changed its name to Sunshine Biopharma, Inc. and began operating as

a pharmaceutical company focusing on the development of the

licensed Adva-27a anticancer drug.

In July

2014, the Company formed a wholly owned Canadian subsidiary,

Sunshine Biopharma Canada Inc. (“Sunshine Canada”) for

the purposes of offering generic pharmaceutical products in Canada

and elsewhere around the world. Sunshine Canada has signed

licensing agreements for four (4) generic prescription drugs for

treatment of breast cancer, prostate cancer and BPH (Benign

Prostatic Hyperplasia). Sunshine Canada is currently evaluating

several other generic products for in-licensing and is working on

securing a Drug Establishment License (“DEL”) and a

Drug Identification Number (“DIN”) per product from

Health Canada. Once the DEL and the DIN’s are secured,

Sunshine Canada will begin its generic pharmaceuticals marketing

and sales program in Canada and overseas.

On

January 1, 2018 the Company acquired all of the issued and

outstanding shares of Atlas Pharma Inc. (“Atlas”), a

Canadian privately held company. The purchase price for the shares

was Eight Hundred Forty Eight Thousand Dollars ($848,000) Canadian

($684,697 US). The purchase price included a cash payment of

$100,500 Canadian ($80,289 US), plus the issuance of 20,000,000

shares of the Company’s Common Stock valued at $246,000 or

$0.0123 per share, and a promissory note in the principal amount of

$450,000 Canadian ($358,407 US), with interest payable at the rate

of 3% per annum. Atlas is a certified company dedicated to chemical

analysis of pharmaceutical and other industrial samples.

Atlas’ operations are authorized by a Drug Establishment

License issued by Health Canada. Atlas is also registered with the

FDA.

While the agreement to acquire Atlas

Pharma Inc. was signed effective January 1, 2018, there are several

matters which are yet to be

completed. In addition, as of the date of this report, the audit of

Atlas Pharma Inc. has not been completed. As a result, various disclosures in this report

may have to be updated. The updated information may differ and

the difference may be

material.

In

March 2018, the Company formed NOX Pharmaceuticals, Inc., a wholly

owned Colorado corporation and assigned all of the Company’s

interest in the Adva27a anticancer drug to that company. NOX

Pharmaceuticals Inc.’s mission is to research, develop and

commercialize proprietary drugs including Adva-27a.

The

financial statements represent the consolidated activity of

Sunshine Biopharma, Inc., Sunshine Biopharma Canada Inc., Atlas

Pharma Inc. and NOX Pharmaceuticals, Inc. (herein collectively

referred to as the "Company").

The

Company has been and continues to work on the development of its

proprietary anticancer drug, Adva-27a. The next series of steps in

the development of Adva-27a include (i) GMP-manufacturing of a

2-kilogram quantity of the drug, (ii) completing the requisite

IND-enabling studies, and (iii) conducting Phase I clinical trials.

In the preclinical studies, Adva-27a was shown to be effective at

destroying multidrug resistant cancer cells including Pancreatic

Cancer, Breast Cancer, Lung Cancer and Uterine Sarcoma,

cells.

During

the last three month period the Company has continued to raise

money through stock sales and borrowings.

The

Company’s activities are subject to significant risks and

uncertainties, including failing to secure additional funding to

operationalize the Company’s generics business and

proprietary drug development program.

6

Sunshine

Biopharma, Inc.

Notes

To Unaudited Consolidated Financial Statements

For The

Three Month Interim Period Ended March 31, 2018

Basis of Presentation of Unaudited Condensed Financial

Information

The

unaudited condensed financial statements of the Company for the

three month periods ended March 31, 2018 and 2017 have been

prepared in accordance with accounting principles generally

accepted in the United States of America for interim financial

information and pursuant to the requirements for reporting on Form

10-Q and Regulation S-K. Accordingly, they do not include all the

information and footnotes required by accounting principles

generally accepted in the United States of America for complete

financial statements. However, such information reflects all

adjustments (consisting solely of normal recurring adjustments),

which are, in the opinion of management, necessary for the fair

presentation of the financial position and the results of

operations. Results shown for interim periods are not necessarily

indicative of the results to be obtained for a full fiscal year.

The balance sheet information as of March 31, 2018 was derived from

the audited financial statements included in the Company's

financial statements as of and for the year ended December 31, 2017

included in the Company’s Annual Report on Form 10-K filed

with the Securities and Exchange Commission (the “SEC”)

on April 2, 2018. These financial statements should be read in

conjunction with that report.

Between May 2014 and December

2016, the FASB issued several ASU’s on Revenue from Contracts

with Customers (Topic 606). These updates will supersede nearly all

existing revenue recognition guidance under current U.S. generally

accepted accounting principles (GAAP). The core principle is to

recognize revenues when promised goods or services are transferred

to customers in an amount that reflects the consideration to which

an entity expects to be entitled for those goods or

services.

A

five-step process has been defined to achieve this core principle,

and, in doing so, more judgment and estimates may be required

within the revenue recognition process than are required under

existing U.S. GAAP. The standards are effective for annual periods

beginning after December 15, 2017, and interim periods therein,

using either of the following transition methods: (i) a full

retrospective approach reflecting the application of the standards

in each prior reporting period with the option to elect certain

practical expedients, or (ii) a retrospective approach with the

cumulative effect of initially adopting the standards recognized at

the date of adoption (which includes additional footnote

disclosures). The Company is currently evaluating the impact of its

pending adoption of these standards on its financial statements and

has not yet determined the method by which it will adopt the

standard in 2018.

Recently Issued Accounting Pronouncements

The

amendments are effective for fiscal years beginning after December

15, 2017, and should be applied prospectively to an award modified

on or after the adoption date. Early adoption is permitted,

including adoption in an interim period. The Company does not

expect this amendment to have a material impact on its financial

statements.

7

Sunshine

Biopharma, Inc.

Notes

To Unaudited Consolidated Financial Statements

For The

Three Month Interim Period Ended March 31, 2018

Note 2 – Going Concern

The

accompanying financial statements have been prepared on a going

concern basis, which contemplates the realization of assets and the

satisfaction of liabilities in the normal course of business. Since

inception, the Company has had recurring operating losses and

negative operating cash flows. These factors raise substantial

doubt about the Company’s ability to continue as a going

concern.

The

Company’s continuation as a going concern is dependent on its

ability to obtain additional financing to fund operations,

implement its business model, and ultimately, attain profitable

operations. The Company will need to secure additional funds

through various means, including equity and debt financing or any

similar financing. There can be no assurance that the Company will

be able to obtain additional equity or debt financing, if and when

needed, on terms acceptable to the Company, or at all. Any

additional equity or debt financing may involve substantial

dilution to the Company’s stockholders, restrictive covenants

or high interest costs. The Company’s long-term liquidity

also depends upon its ability to generate revenues and achieve

profitability.

Note 3 – Notes Payable

During

the three months period ended March 31, 2018, the Company entered

into the following new debt arrangements:

●

On January 12,

2018, the Company received net proceeds of $100,000 in exchange for

a note payable having a face value of $102,000 and accruing

interest at the rate of 8% per annum. The note, due on October 30,

2018, is convertible after 180 days from issuance into $0.001 par

value Common Stock at a price 35% below market value. The Company

estimates that the fair value of this convertible debt approximates

the face value, so no value has been assigned to the beneficial

conversion feature.

8

Sunshine

Biopharma, Inc.

Notes

To Unaudited Consolidated Financial Statements

For The

Three Month Interim Period Ended March 31, 2018

●

On February 7,

2018, the Company received net proceeds of $143,000 in exchange for

a note payable having a face value of $150,000 and accruing

interest at the rate of 8% per annum. The note, due on February 7,

2019, is convertible after 180 days from issuance into $0.001 par

value Common Stock at a price 35% below market value. The Company

estimates that the fair value of this convertible debt approximates

the face value, so no value has been assigned to the beneficial

conversion feature.

●

On February 22,

2018, the Company received net proceeds of $80,000 in exchange for

a note payable having a face value of $85,000 and accruing interest

at the rate of 8% per annum. The note, due on November 30, 2018, is

convertible after 180 days from issuance into $0.001 par value

Common Stock at a price 35% below market value. The Company

estimates that the fair value of this convertible debt approximates

the face value, so no value has been assigned to the beneficial

conversion feature.

At March 31, 2018, the Company had advances from private

individuals totaling $40,651 Canadian (approximately $32,520 US).

These advances were made on an interest free basis and are

repayable on demand.

At

March 31, 2018 and December 31, 2017, accrued interest on Notes

Payable was $21,924 and $9,481, respectively.

Note 4 – Notes Payable - Related Party

On

January 1, 2018 as part of an acquisition the Company has a note

payable in the amount of $450,000 Canadian ($358,407 US) and

accruing interest at the rate of 3% per annum. The note is due on

December 31, 2023. Payments on this note are $10,000 Canadian

(approximately $8,000 US) per quarter. The outstanding principal

balance at March 31, 2018 is $353,058.

In

addition to the above, on March 31, 2018 the Company had notes

payable from related parties amounting to $256,665 and accrued

interest of $6,088.

Note 5 – Issuance of Common Stock

During

the three months ended March 31, 2018, the Company issued a total

of 29,283,034 shares of $0.001 par value Common Stock. Of these

9,283,034 shares valued at $95,052 were issued upon conversion of

outstanding notes payable, reducing the debt by $55,000 and

interest payable by $1,712 and generating a loss on conversion of

$38,340.

In

addition, 20,000,000 shares valued at $246,000 or $0.0123 per share

were issued as part of the acquisition of Atlas Pharma

Inc.

The

Company declared no dividends through March 31, 2018.

Note 6 – Commitments

The Company’s subsidiary, Atlas Pharma Inc., has entered into

long-term lease agreements for the rental of buildings which call

for minimum lease payments of $228,113 and additional lease

payments based on operating expenses. The lease expires on May 21,

2021. Minimum lease payments for the next four years are $62,213 in

2018, $62,213 in 2019, $62,213 in 2020, and $41,474 in

2021.

Note 7 – Earnings (Loss) Per Share

Earnings

(loss) per share is computed using the weighted average number of

Common Shares outstanding during the period. The Company has

adopted ASC 260 (formerly SFAS128), “Earnings per

Share”.

9

Sunshine

Biopharma, Inc.

Notes

To Unaudited Consolidated Financial Statements

For The

Three Month Interim Period Ended March 31, 2018

Note 8 – Goodwill

On January 1, 2018, the Company acquired all of the issued and

outstanding shares of Atlas Pharma Inc. ("Atlas"), a Canadian

privately held company. The purchase price for the shares was Eight

Hundred Forty Eight Thousand Dollars ($848,000) Canadian ($684,697

US). The book value of the fixed assets acquired was $11,051. The

remainder of the purchase price ($673,646) was applied to

Goodwill.

Note 9 – Income Taxes

Deferred

income taxes arise from the temporary differences between financial

statement and income tax recognition of net operating losses and

other items. Loss carryovers are limited under the Internal Revenue

Code should a significant change in ownership occur.

A

deferred tax asset at each date has been offset by a 100% valuation

allowance.

Note 10 – Royalties Payable

As part

of a subscription agreement entered into in 2016, the Company has

an obligation to pay a royalty of 5% of net sales on one of its

generic products (Anastrozole) for a period of three (3) years from

the date of the first sale of that product.

Note 11 – Related Party Transactions

In

addition to the related party transactions detailed in Note 5

above, during the three month period ended March 31, 2018 and 2017,

the Company paid its Officers and Directors cash compensation

totaling $77,787 and $42,965, respectively.

Note 12 - Revenue Recognition

As of January 1, 2018, we adopted ASU No. 2014-09, “Revenue

from Contracts with Customers” (ASU 2014-09). Under

the new guidance, an entity will

recognize revenue to depict the transfer of promised goods or

services to customers at an

amount that the entity expects to be entitled to in exchange for

those goods or services. Leasing revenue recognition is

specifically excluded and therefore

the new standard is only applicable to service fee and consulting

revenue. A five-step model has

been introduced for an entity to apply when recognizing revenue.

The new guidance also includes enhanced disclosure requirements. The guidance was

effective January 1, 2018 and was applied on a modified basis. The

adoption did not have an

impact on the Company's financial statements.

Note 13 - Accounts Receivable

Accounts receivable consist of trade accounts arising in the normal

course of business and are classified as current assets

and carried at original invoice

amounts less an estimate for doubtful receivables based on a review

of outstanding balances on a

monthly basis. The estimate of allowance for doubtful accounts is

based on the Company's bad debt experience, market

conditions, and aging of accounts

receivable, among other factors. If the financial condition of the

Company's customers deteriorates resulting in the customer's

inability to pay the Company's receivables as they come due,

additional allowances for doubtful accounts will be

required.

Note 14 – Subsequent Events

During

April 2018, the holder of a note payable dated September 22, 2017

elected to convert $47,000 in principal and $2,480 in accrued

interest into 13,084,511 shares of Common Stock leaving a principal

balance of -0-.

On

April 30, 2018, the holder of a note payable dated October 26, 2017

elected to convert $23,000 in principal and $917 in accrued

interest into 7,408,615 shares of Common Stock leaving a principal

balance of $92,000.

On May

3, 2018, we signed an agreement with Jitney Trade Inc. whereby the

parties agreed to extend the equity financing that was previously

announced of up to $10,000,000 Canadian (approximately $8,000,000

US) until August 31, 2018. The terms and conditions of the

financing remained unchanged at up to 400,000,000 shares of the

Company’s Common Stock at $0.025 Canadian (approximately

$0.02 US) per share.

10

ITEM 2. MANAGEMENT’S DISCUSSION AND

ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

The following discussion should be read in conjunction with our

consolidated financial statements and notes thereto included

herein. In connection with, and because we desire to take advantage

of, the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, we caution readers

regarding certain forward looking statements in the following

discussion and elsewhere in this report and in any other statement

made by, or on our behalf, whether or not in future filings with

the Securities and Exchange Commission. Forward looking statements

are statements not based on historical information and which relate

to future operations, strategies, financial results or other

developments. Forward looking statements are necessarily based upon

estimates and assumptions that are inherently subject to

significant business, economic and competitive uncertainties and

contingencies, many of which are beyond our control and many of

which, with respect to future business decisions, are subject to

change. These uncertainties and contingencies can affect actual

results and could cause actual results to differ materially from

those expressed in any forward looking statements made by, or on

our behalf. We disclaim any obligation to update forward looking

statements.

Overview and History

We were

incorporated in the State of Colorado on August 31, 2006 under the

name “Mountain West Business Solutions, Inc.” Until

October 2009, our business was to provide management consulting

with regard to accounting, computer and general business issues for

small and home-office based companies.

In

October 2009, we acquired Sunshine Biopharma, Inc., a Colorado

corporation holding an exclusive license to a new anticancer drug

bearing the laboratory name, Adva-27a. As a result of this

transaction we changed our name to “Sunshine Biopharma,

Inc.” and our officers and directors resigned their positions

with us and were replaced by Sunshine Biopharma, Inc.’s

management at the time, including our current CEO, Dr. Steve N.

Slilaty, and our current CFO, Camille Sebaaly each of whom remain

part of our current management. Our principal business became that

of a pharmaceutical company focusing on the development of our

licensed Adva-27a anticancer compound. In December 2015 we acquired

all issued and pending patents pertaining to our Adva-27a

technology and terminated the license.

In July

2014, we formed a wholly owned Canadian subsidiary, Sunshine

Biopharma Canada Inc. (“Sunshine Canada”), for the

purposes of offering generic pharmaceutical products in Canada and

elsewhere around the world. Sunshine Canada has signed licensing

agreements for four (4) generic prescription drugs for the

treatment of breast cancer, prostate cancer and BPH (Benign

Prostatic Hyperplasia). We have applied for and are currently

awaiting the issuance by Health Canada of a Drug Establishment

License and a Drug Identification Number for each of our four (4)

generic products in order to begin marketing of the

same.

In

January 2018, we acquired Atlas Pharma Inc. (“Atlas”),

a certified company dedicated to chemical analysis of

pharmaceutical and other industrial samples whose operations are

authorized by a Drug Establishment License issued by Health Canada.

Atlas has been generating revenues since its inception in September

2013. The revenues reported in our consolidated financial

statements for the first calendar quarter of 2018 are a result of

the Atlas operations.

In

March 2018, we formed NOX Pharmaceuticals, Inc., a Colorado

corporation, and assigned all of our interest in our Adva-27a

anticancer compound to that company. NOX Pharmaceuticals

Inc.’s mission is to research, develop and commercialize

proprietary drugs including Adva-27a.

As a

result, we are now a holding company operating through these three

wholly owned subsidiaries.

Our

principal place of business is located at 6500 Trans-Canada Highway, 4th Floor,

Pointe-Claire, Quebec, Canada H9R 0A5. Our phone number is

(514) 426-6161and our website address is

www.sunshinebiopharma.com.

We have

not been subject to any bankruptcy, receivership or similar

proceeding.

Operations

Proprietary Drug Development Operations

Since

inception, our proprietary drug development activities have been

focused on the development of a small molecule called Adva-27a for

the treatment of aggressive forms of cancer. A Topoisomerase II

inhibitor, Adva-27a has been shown to be effective at destroying

Multidrug Resistant Cancer cells including Pancreatic Cancer cells,

Breast Cancer cells, Small-Cell Lung Cancer cells and Uterine

Sarcoma cells (Published in ANTICANCER RESEARCH, Volume 32, Pages

4423-4432, October 2012). Sunshine Biopharma Inc. owns all of the

rights, as well as, all of the issued and pending worldwide patents

pertaining to Adva-27a, including U.S. Patent Number

8,236,935.

11

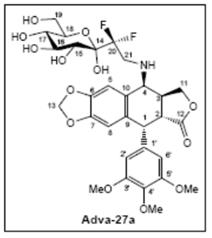

Adva-27a is a

GEM-difluorinated C-glycoside derivative of Podophyllotoxin.

Another derivative of Podophyllotoxin called Etoposide is currently

on the market and is used to treat various types of cancer

including leukemia, lymphoma, testicular cancer, lung cancer, brain

cancer, prostate cancer, bladder cancer, colon cancer, ovarian

cancer, liver cancer and several other forms of cancer. Etoposide

is one of the most widely used anticancer drugs. Adva-27a and

Etoposide are similar in that they both attack the same target in

cancer cells, namely the DNA unwinding enzyme, Topoisomerase II.

Unlike Etoposide, and other anti-tumor drugs currently in use,

Adva-27a is able to destroy Multidrug Resistant Cancer cells.

Adva-27a is the only compound known today that is capable of

destroying Multidrug Resistant Cancer. In addition, Adva-27a has

been shown to have distinct and more desirable biological and

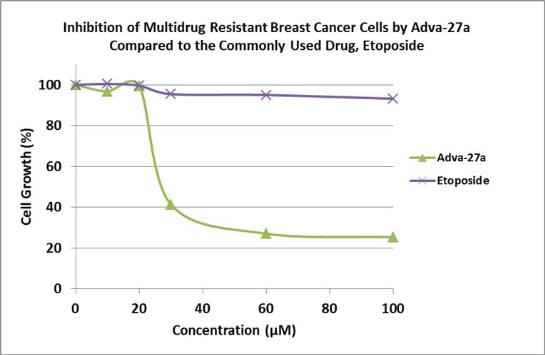

pharmacological properties compared to Etoposide. In side-by-side

studies using Multidrug Resistant Breast Cancer cells and Etoposide

as a reference, Adva-27a showed markedly improved cell killing

activity (see Figure below). Our preclinical studies to date have

shown that:

●

Adva-27a is

effective at killing different types of Multidrug Resistant cancer

cells, including Pancreatic Cancer Cells (Panc-1), Breast Cancer

Cells (MCF-7/MDR), Small-Cell Lung Cancer Cells (H69AR), and

Uterine Sarcoma Cells (MES-SA/Dx5).

●

Adva-27a is

unaffected by P-Glycoprotein, the enzyme responsible for making

cancer cells resistant to anti-tumor drugs.

●

Adva-27a has

excellent clearance time (half-life = 54 minutes) as indicated by

human microsomes stability studies and pharmacokinetics data in

rats.

●

Adva-27a clearance

is independent of Cytochrome P450, a mechanism that is less likely

to produce toxic intermediates.

●

Adva-27a is an

excellent inhibitor of Topoisomerase II with an IC50 of only 13.7

micromolar (this number has recently been reduce to 1.44 micromolar

as a result of resolving the two isomeric forms of

Adva-27a).

●

Adva-27a has shown

excellent pharmacokinetics profile as indicated by studies done in

rats.

●

Adva-27a does not

inhibit tubulin assembly.

These

and other preclinical data have been published in ANTICANCER

RESEARCH, a peer-reviewed International Journal of Cancer Research

and Treatment. The publication which is entitled “Adva-27a, a

Novel Podophyllotoxin Derivative Found to Be Effective Against

Multidrug Resistant Human Cancer Cells” [ANTICANCER RESEARCH

32: 4423-4432 (2012)] is available on our website at www.sunshinebiopharma.com.

12

We have

been delayed in our clinical development program due to lack of

funding. Our fund raising efforts are continuing and as soon as

adequate financing is in place we will continue our clinical

development program of Adva-27a by conducting the following next

sequence of steps:

●

GMP Manufacturing

of 2 kilogram for use in IND-Enabling Studies and Phase I Clinical

Trials

●

IND-Enabling

Studies

●

Regulatory Filing

(Fast-Track Status Anticipated)

●

Phase I Clinical

Trials (Pancreatic Cancer Indication)

Adva-27a’s

initial indication will be Pancreatic Cancer for which there are

currently little or no treatment options available. We are planning

to conduct our clinical trials at McGill University’s Jewish

General Hospital in Montreal, Canada. All aspects of the clinical

trials in Canada will employ FDA standards at all levels. We

estimate that the Pancreatic Cancer clinical trials will take

approximately 18 to 24 months from start to finish. Given the

terminal and limited treatment options available for the Pancreatic

Cancer, we anticipate being granted limited marketing approval

(“compassionate-use”) for our Adva-27a following a

successful Phase I clinical trial. It is likely that following such

events, we will begin to receive offers from large pharmaceutical

companies to buyout or license our drug. Alternatively, it may be

more advisable for us to continue our own development of the drug

by proceeding to Phase II clinical trials and attending to other

requirements for full marketing approval.

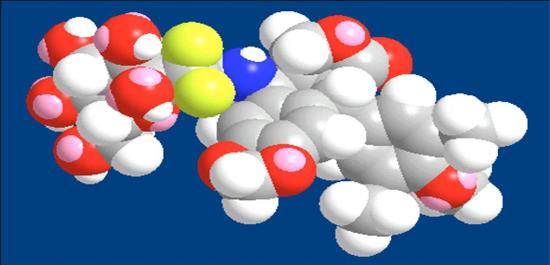

Our Lead Anti-Cancer Compound, Adva-27a, in 3D

Generic Pharmaceuticals Operations

In

2016, our Canadian wholly owned subsidiary, Sunshine Biopharma

Canada Inc. (“Sunshine Canada”), signed Cross

Referencing Agreements with a major pharmaceutical company for four

prescription generic drugs for the treatment of Breast Cancer,

Prostate Cancer and Enlarged Prostate. Following this acquisition

we have been working towards commencement of marketing of these

pharmaceutical products under our own Sunshine Biopharma label.

These four generic products are as follows:

●

Anastrozole (brand

name Arimidex® by AstraZeneca) for treatment of Breast

Cancer;

●

Letrozole (brand

name Femara® by Novartis) for treatment of Breast

Cancer;

●

Bicalutamide (brand

name Casodex® by AstraZeneca) for treatment of Prostate

Cancer;

●

Finasteride (brand

name Propecia® by Merck) for treatment of BPH (Benign

Prostatic Hyperplasia)

Worldwide sales of

the brand name version of these products as reported by the

respective pharmaceutical company, owner of the registered

trademark are as follows:

●

Arimidex®

$232M in 2016

●

Femara® $380M

in 2014

●

Casodex® $247M

in 2016

●

Propecia®

$183M in 2015

In June

2017, Sunshine Canada submitted an application to Health Canada for

the procurement of a Drug Establishment License

(“DEL”), a requirement for the Company’s drug

handling and pharmaceutical operations. Health Canada has assigned

the Company DEL Application No. 3002475 and File No. 17938. We are

currently awaiting Health Canada to set a date for physical

inspection of our warehouse and drug management operations. In

addition, we are currently in the process of filing applications

for a Drug Identification Number (“DIN”) for each of

its four (4) generic products, Anastrozole, Letrozole, Bicalutamide

and Finasteride. The Figure below shows our 30-Pill blister pack of

Anastrozole.

13

We

currently have twenty three (23) additional Generic Pharmaceuticals

under review for in-licensing. We believe that a larger product

portfolio will provide us with more opportunities and a greater

reach into the marketplace. Our plan is to fund our Proprietary

Drug Development Program, including Adva-27a, through the sales of

Generic Drugs. In addition to near-term revenue generation,

building the generics business infrastructure and securing the

proper permits will render us appropriately positioned for the

marketing and distribution of our own proprietary drugs as they

become available.

Analytical Chemistry Services Operations

On

January 1, 2018, we entered into an agreement (the “Atlas

Agreement”) to acquire Atlas Pharma Inc.

(“Atlas”). The purchase price was $848,000 Canadian

($684,697 US). Payment of the purchase price was comprised of (i) a

cash payment of $100,500 Canadian ($80,289 US), (ii) the issuance

of 20,000,000 shares of our Common Stock valued at $246,000, and

(iii) a promissory note in the principal amount of $450,000

Canadian ($358,407 US), with interest payable at the rate of 3% per

annum. We are required to make payments of $10,000 Canadian

(approximately $8,000 US) per calendar quarter, due and payable on

or before the end of each such calendar quarter through December

31, 2023.

Atlas

is a certified company dedicated to chemical analysis of

pharmaceutical and other industrial samples. Atlas has 9 full-time

employees and generated revenues of approximately $500,000 Canadian

(approximately $400,000 US) in 2017. Housed in a 5,250 square foot

facility, Atlas’s operations are authorized by a Drug

Establishment License (DEL) issued by Health Canada and are fully

compliant with the requirements of Good Manufacturing Practices

(GMP). Atlas is also registered with the FDA.

Atlas

is the owner of a relatively large portfolio of analytical

chemistry methodology and Standard Operating Procedure. This

intellectual property is protected as company secrets and

controlled through employee and management confidentiality

agreements.

We

intend to expand Atlas’ business operations by purchasing

additional equipment and hiring more technical and sales personnel.

Part of the expansion will include the development and addition of

new tests and new sample testing capabilities.

Results Of Operations

Comparison of Results of Operations for the three months ended

March 31, 2018 and 2017

For

the three months ended March 31, 2018, we generated $91,168 in

revenues compared to no revenues for the same three months of 2017.

All of these revenues were generated from the operations of our

newly acquired wholly owned subsidiary, Atlas Pharma Inc.

(“Atlas”), which we acquired on December 31,

2017.

General

and administrative expenses during the three month period ended

March 31, 2018 were $257,865, compared to general and

administrative expense of $108,990 incurred during the three month

period ended March 31, 2017, an increase of $148,875. This increase

is attributable to increases in the following expense

categories:

●

Accounting

Fees increased by $12,400 due to accounting expenses associated

with the acquisition of Atlas.

●

Legal

Fees increased by $12,581 as a result of legal expenses in

connection with the acquisition of Atlas.

●

Office

Expenses increased by $9,982 due the consolidation of Atlas office

expenses.

●

Rent

increased by $23,059 which is the rent for the space occupied by

Atlas.

●

Salaries increased by $57,558 which is entirely for the

full-time employees of Atlas.

●

Supplies increased by $14,070 which are largely laboratory

supplies used in the analytical testing services provided by

Atlas.

In

addition, we saw an increase of $34,822 in Officer & Director

Compensation as well as an increase of $6,222 in Depreciation, the

latter being a result of depreciation associated with the

analytical chemistry equipment of Atlas. The only expense category

that decreased was Consulting Fees by $21,819 as most of the

required work was performed by salaried Atlas

personnel.

14

We

also incurred $75,467 in interest expense during the three months

ended March 31, 2018, compared to $9,144 in interest expense during

the similar period in 2017 as a result of increased

borrowings. However, we incurred $38,340 in losses

arising from debt conversion during the three months ended March

31, 2018, compared to $76,929 in losses from debt conversion during

the similar period in 2017, a difference of $38,589 as a result of

some convertible notes having been paid off prior to

maturity.

As

a result, we incurred a net loss of $265,636 ($0.00 per share) for

the three month period ended March 31, 2018, compared to a net loss

of $195,702 ($0.00 per share) during the three month period ended

March 31, 2017.

Liquidity and Capital Resources

As

of March 31, 2018, we had cash or cash equivalents of

$104,763.

Net cash used in operating activities was $168,455

during the three month period ended March 31, 2018, compared to

$108,037 for the three month period ended March 31,

2017. We anticipate that overhead costs and other

expenses will increase in the future as we move forward with our

proprietary drug development activities and expansion of our

generic pharmaceuticals operations as well as our newly acquired

analytical chemistry services operations as discussed above.

Cash

flows from financing activities were $248,462 for the three month

periods ended March 31, 2018, compared to $66,218 during the three

months ended March 31, 2017. Cash flows used by

investing activities were $106,101 for the three month period ended

March 31, 2018 compared to $0 during the same three months period

in 2017.

During

the three months period ended March 31, 2018, we issued a total of

29,283,034 shares of our Common Stock. Of these, 9,283,034 shares

valued at $95,052 were issued upon conversion of outstanding notes

payable, reducing debt by $55,000 and interest payable by $1,712

and generating a loss on conversion of $38,340. In addition, we

issued 20,000,000 shares of our Common Stock valued at $246,000 or

$0.0123 per share as part of the acquisition of Atlas Pharma

Inc.

During

the three months ended March 31, 2018, we entered into the

following new debt arrangements:

●

On January 12,

2018, we received net proceeds of $100,000 in exchange for a note

payable having a face value of $102,000 and accruing interest at

the rate of 8% per annum. The note, due on October 30, 2018, is

convertible after 180 days from issuance into $0.001 par value

Common Stock at a price 35% below market value. We estimate that

the fair value of this convertible debt approximates the face

value, so no value has been assigned to the beneficial conversion

feature.

●

On February 7,

2018, we received net proceeds of $143,000 in exchange for a note

payable having a face value of $150,000 and accruing interest at

the rate of 8% per annum. The note, due on February 7, 2019, is

convertible after 180 days from issuance into $0.001 par value

Common Stock at a price 39% below market value. We estimate that

the fair value of this convertible debt approximates the face

value, so no value has been assigned to the beneficial conversion

feature.

●

On February 22,

2018, we received net proceeds of $80,000 in exchange for a note

payable having a face value of $85,000 and accruing interest at the

rate of 8% per annum. The note, due on November 30, 2018, is

convertible after 180 days from issuance into $0.001 par value

Common Stock at a price 39% below market value. We estimate that

the fair value of this convertible debt approximates the face

value, so no value has been assigned to the beneficial conversion

feature.

In

August 2017 we signed an agreement with Jitney Trade Inc.

(“Jitney”), a Canadian broker-dealer, to raise up to

$10 million Canadian (approximately $8 million US) in a private

offering being undertaken only in Canada (the

“Offering”) in order to provide the funding we have

estimated we need to implement our business plan. The Offering

expired on February 28, 2018 without any funds having been raised.

Since February 28, 2018, we have been engaged in negotiations with

Jitney concerning the terms for extending the Offering. On May 3,

2018, we signed an agreement with Jitney whereby the parties agreed

to extend the Offering under the same terms and conditions until

August 31, 2018.

We are not generating adequate revenues from our

operations, and our ability to implement our business plan as set

forth herein will depend on the future availability of financing.

Such financing will be required to enable us to expand our

Analytical Chemistry Services business and further develop our

Generic Pharmaceuticals operations and Proprietary Drug Development

program. We intend to raise funds through private placements of our

Common Stock and/or debt financing. We estimate that we will

require approximately $7 million ($2 million for the Analytical

Chemistry and Generic Pharmaceuticals operations and $5 million for

the Proprietary Drug Development program) to fully implement our

business plan in the future and there are no assurances that we

will be able to raise this capital. Our inability to obtain

sufficient funds from external sources when needed will have a

material adverse effect on our plan of operation, results of

operations and financial condition. Our plan is to fund our

Proprietary Drug Development Program, including Adva-27a, through

the sales of Generic Drugs if we are unable to find any additional

financing. There are also no assurances that we will generate

sufficient revenues and profits from our Proprietary Drug

Development Program to accomplish these objectives.

15

Our

cost of operations is expected to increase as we move forward with

implementation of our business plan. We do not have sufficient

funds to cover the anticipated increase in the relevant expenses.

We need to raise additional capital in order to continue our

existing operations and finance our expansion plans for the next

year. If we are successful in raising additional funds, we expect

our operations and business efforts to continue and expand. There

are no assurances this will occur.

Subsequent Events

During

April 2018, the holder of a note payable dated September 22, 2017

elected to convert $47,000 in principal and $2,480 in accrued

interest into 13,084,511 shares of Common Stock leaving a principal

balance of $0.

On

April 30, 2018, the holder of a note payable dated October 26, 2017

elected to convert $23,000 in principal and $917 in accrued

interest into 7,408,615 shares of Common Stock leaving a principal

balance of $92,000.

On May

3, 2018, we signed an agreement with Jitney Trade Inc. whereby the

parties agreed to extend the proposed equity financing that was

previously announced of up to $10,000,000 Canadian (approximately

$8,000,000 US), until August 31, 2018. The terms and conditions of

the financing remained unchanged. We intend to offer at up to

400,000,000 shares of our Common Stock at a price of $0.025

Canadian (approximately $0.02 US) per share. There are no

assurances that Jitney will sell any shares of our Common Stock in

this proposed offering.

Off Balance Sheet Arrangements

None

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET

RISK.

We

are a smaller reporting company and are not required to provide the

information under this item pursuant to Regulation

S-K.

ITEM 4. CONTROLS AND PROCEDURES.

Disclosure

Controls and Procedures – Our

management, with the participation of our Chief Executive Officer

and Chief Financial Officer, has evaluated the effectiveness of our

disclosure controls and procedures (as such term is defined in

Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of

1934, as amended (the “Exchange Act”) as of the end of

the period covered by this Report.

These

controls are designed to ensure that information required to be

disclosed in the reports we file or submit pursuant to the

Securities Exchange Act of 1934 is recorded, processed, summarized

and reported within the time periods specified in the rules and

forms of the Securities and Exchange Commission, and that such

information is accumulated and communicated to our management,

including our CEO/CFO to allow timely decisions regarding required

disclosure.

16

Based on this

evaluation, our CEO and CFO have concluded that our disclosure

controls and procedures were not effective as of March 31, 2018, at

reasonable assurance level, for the following reasons:

● Ineffective control

environment and lack of qualified full-time CFO who has SEC

experience to focus on our financial affairs;

● Lack of qualified

and sufficient personnel, and processes to adequately and timely

identify making any and all required public

disclosures;

● Deficiencies in the

period-end reporting process and accounting policies;

● Inadequate internal

controls over the application of new accounting principles or the

application of existing accounting principles to new

transactions;

● Inadequate internal

controls relating to the authorization, recognition, capture, and

review of transactions, facts, circumstances, and events that could

have a material impact on the company’s financial reporting

process;

● Deficient revenue

recognition policies;

● Inadequate internal

controls with respect to inventory transactions; and

● Improper and lack

of timely accounting for accruals such as prepaid expenses,

accounts payable and accrued liabilities.

Our

Board of Directors has assigned a priority to the short-term and

long-term improvement of our internal control over financial

reporting. We are reviewing various potential solutions to remedy

the processes that would eliminate the issues that may arise due to

the absence of separation of duties within the financial reporting

functions. Additionally, the Board of Directors will work with

management to continuously review controls and procedures to

identified deficiencies and implement remediation within our

internal controls over financial reporting and our disclosure

controls and procedures.

We

believe that our financial statements presented in this annual

report on Form 10-K fairly present, in all material respects, our

financial position, results of operations, and cash flows for all

periods presented herein.

Inherent

Limitations – Our management, including our Chief

Executive Officer and Chief Financial Officer, does not expect that

our disclosure controls and procedures will prevent all error and

all fraud. A control system, no matter how well

conceived and operated, can provide only reasonable, not absolute,

assurance that the objectives of the control system are

met. The design of any system of controls is based in

part upon certain assumptions about the likelihood of future

events, and there can be no assurance that any design will succeed

in achieving its stated goals under all potential future

conditions. Further, the design of a control system must

reflect the fact that there are resource constraints, and the

benefits of controls must be considered relative to their costs.

Because of the inherent limitations in all control systems, no

evaluation of controls can provide absolute assurance that all

control issues and instances of fraud, if any, within our company

have been detected. These inherent limitations include

the realities that judgments in decision-making can be faulty, and

that breakdown can occur because of simple error or mistake. In

particular, many of our current processes rely upon manual reviews

and processes to ensure that neither human error nor system

weakness has resulted in erroneous reporting of financial

data.

Changes in

Internal Control over Financial Reporting – There were

no changes in our internal control over financial reporting during

the three month period ended March 31, 2018, which were identified

in conjunction with management’s evaluation required by

paragraph (d) of Rules 13a-15 and 15d-15 under the Exchange Act,

that have materially affected, or are reasonably likely to

materially affect, our internal control over financial

reporting.

17

PART II. OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

On

November 14, 2014, we entered into a Manufacturing Services

Agreement with Lonza Ltd. and Lonza Sales Ltd. (hereinafter jointly

referred to as “Lonza”), whereby we engaged Lonza to be

the manufacturer of our Adva-27a anticancer drug. In June 2016 we

received a sample of the pilot manufacturing run for evaluation.

Our laboratory analyses showed that, while the sample meets all of

the required chemical, physical and biological specifications, the

amount of material generated (the “Yield”) by the pilot

run was found to be significantly lower than anticipated. We are

currently working towards finding possible solutions to increase

the Yield and define a path forward. During the course of our

discussions concerning the problem of the low Yield, Lonza informed

us that they required us to pay them $687,818 prior to moving

forward with any activity pertaining to the manufacturing agreement

we have with them. We have repeatedly indicated to Lonza that a

clear path defining exactly how the extremely low Yield issue would

be addressed is imperative prior to us making any payments. We

issued a letter to them in June 2017 advising of our position. As

of the date of this Report we have not received a response to our

letter and no further action has been taken by either

party.

To the

best of our management’s knowledge and belief, there are no

other material claims that have been brought against us nor have

there been any claims threatened.

ITEM 1A. RISK FACTORS

We

are a smaller reporting company and are not required to provide the

information under this item pursuant to Regulation

S-K.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF

PROCEEDS

During

the three months period ended March 31, 2018, we issued a total of

29,283,034 shares of our Common Stock. Of these, 9,283,034 shares

valued at $95,052 were issued upon conversion of outstanding notes

payable. In addition, we issued 20,000,000 shares of our Common

Stock as part of the consideration for the acquisition of Atlas

Pharma Inc.

We

relied upon the exemption from registration provided by Section

4(2) of the Securities Act of 1933, as amended, to issue these

shares.

Other

than reduction of debt from the conversion of the outstanding

convertible notes described above, we did not receive any direct

proceeds from the issuance of these shares. The proceeds from the

notes were used for working capital.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. MINE SAFETY DISCLOSURE

Not

Applicable.

ITEM 5. OTHER INFORMATION

None.

ITEM 6. EXHIBITS

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

Certification

of Chief Executive Officer Pursuant to Section 302 of the

Sarbanes-Oxley Act of 2002

|

|

|

|

|

|

|

|

Certification

of Chief Financial Officer Pursuant to Section 302 of the

Sarbanes-Oxley Act of 2002

|

|

|

|

|

|

|

|

Certification

of Chief Executive Officer and Chief Financial Officer Pursuant to

Section 906 of the Sarbanes-Oxley Act of 2002

|

|

101.INS

|

|

XBRL

Instance Document*

|

|

|

|

|

|

101.SCH

|

|

XBRL

Schema Document*

|

|

|

|

|

|

101.CAL

|

|

XBRL

Calculation Linkbase Document*

|

|

|

|

|

|

101.DEF

|

|

XBRL

Definition Linkbase Document*

|

|

|

|

|

|

101.LAB

|

|

XBRL

Label Linkbase Document*

|

|

|

|

|

|

101.PRE

|

|

XBRL

Presentation Linkbase Document*

|

______________________

*

Pursuant to Rule 406T of Regulation S-T, these interactive data

files are not deemed filed or part of a registration statement or

prospectus for purposes of Section 11 or 12 of the Securities Act

or Section 18 of the Securities Exchange Act and otherwise not

subject to liability.

18

SIGNATURES

Pursuant

to the requirements of Section 12 of the Securities and Exchange

Act of 1934, the Registrant has duly caused this Report to be

signed on its behalf by the undersigned, thereunto duly authorized

on May 21, 2018.

|

|

SUNSHINE BIOPHARMA, INC.

|

|

|

|

|

|

|

|

|

|

By:

|

s/ Dr.

Steve N. Slilaty

|

|

|

|

|

Dr.

Steve N. Slilaty,

|

|

|

|

|

Principal

Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

s/

Camille Sebaaly

|

|

|

|

|

Camille

Sebaaly,

Principal

Financial Officer and

|

|

|

|

|

Principal

Accounting Officer

|

|

19