Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Sunshine Biopharma, Inc | Financial_Report.xls |

| EX-32.1 - CERTIFICATE - Sunshine Biopharma, Inc | sbfm_exh321.htm |

| EX-31.2 - CERTIFICATE - Sunshine Biopharma, Inc | sbfm_exh312.htm |

| EX-31.1 - CERTIFICATE - Sunshine Biopharma, Inc | sbfm_exh311.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________

FORM 10-K

__________________

(Mark one)

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

|

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from ________________ to__________________.

|

Commission File Number 000-52898

SUNSHINE BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

Colorado

|

20-5566275

|

|

|

(State or other jurisdiction of Incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

469 Jean-Talon West

3rd Floor

Montreal, Quebec, Canada H3N 1R4

(Address of principal executive offices)

(514) 764-9698

(Issuer’s Telephone Number)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes o No þ

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesþ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | ||

| Non-accelerated filer o | Smaller reporting company þ | ||

| (Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the shares of voting stock held by non-affiliates of the Registrant as of March 9, 2015 was $1,160,838.

As of March 9, 2015, the Registrant had 77,051,041 shares of Common Stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE - None

TABLE OF CONTENTS

|

Facing Page

|

Page No.

|

||

|

Index

|

|||

|

PART I

|

|||

|

Item 1.

|

Business

|

3

|

|

|

Item 1A.

|

Risk Factors

|

8

|

|

|

Item 1B.

|

Unresolved Staff Comments

|

8

|

|

|

Item 2

|

Properties

|

9

|

|

|

Item 3.

|

Legal Proceedings

|

9

|

|

|

Item 4.

|

Mine Safety Disclosures

|

9

|

|

|

PART II

|

|||

|

Item 5.

|

Market for the Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

|

9

|

|

|

Item 6.

|

Selected Financial Data

|

11

|

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

11

|

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

14

|

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

15

|

|

|

Item 9.

|

Changes in and Disagreements on Accounting and Financial Disclosure

|

16

|

|

|

Item 9A.

|

Controls and Procedures

|

16

|

|

|

Item 9B.

|

Other Information

|

17

|

|

|

PART III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

17

|

|

|

Item 11.

|

Executive Compensation

|

19

|

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

19

|

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

20

|

|

|

Item 14.

|

Principal Accounting Fees and Services

|

21

|

|

|

PART IV

|

|||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

21

|

|

|

Signatures

|

23

|

||

2

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934. The statements regarding Sunshine Biopharma Inc. contained in this Report that are not historical in nature, particularly those that utilize terminology such as “may,” “will,” “should,” “likely,” “expects,” “anticipates,” “estimates,” “believes” or “plans,” or comparable terminology, are forward-looking statements based on current expectations and assumptions, and entail various risks and uncertainties that could cause actual results to differ materially from those expressed in such forward-looking statements.

Important factors known to us that could cause such material differences are identified in this Report and in our “Risk Factors” in Item 1A. We undertake no obligation to correct or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any future disclosures we make on related subjects in future reports to the SEC.

PART I

ITEM 1. BUSINESS

History

We were incorporated in the State of Colorado on August 31, 2006 under the name “Mountain West Business Solutions, Inc.” Until October 2009 our business was to provide management consulting with regard to accounting, computer and general business issues for small and home-office based companies.

Effective October 15, 2009, we executed an agreement to acquire Sunshine Biopharma, Inc., a Colorado corporation, in exchange for the issuance of 21,962,000 shares of our Common Stock and 850,000 shares of Convertible Preferred Stock, each convertible into twenty (20) shares of our Common Stock (the “Agreement”). As a result of this transaction we changed our name to “Sunshine Biopharma, Inc.” On December 21, 2011, Advanomics Corporation, a privately held Canadian company (“Advanomics”), and our licensor, exercised its right to convert the 850,000 shares of Series “A” Preferred Stock it held in our Company into 17,000,000 shares of Common Stock.

Description of Current Business

We are currently a pharmaceutical company focused on the research, development and commercialization of drugs for the treatment of various forms of cancer. The preclinical studies for our lead compound, Adva-27a, a multi-purpose antitumor compound, were successfully completed in late 2011. We are now continuing our clinical development of Adva-27a by conducting the next sequence of steps comprised of Good Manufacturing Practice (“GMP”) manufacturing of a 2 kilogram quantity, Investigational New Drug (“IND”)-enabling studies, regulatory filing and Phase I clinical trials. We plan to conduct our Phase I clinical trials for Adva-27a at the Jewish General Hospital, Montreal, Canada, one of McGill University’s Hospital Centers. The planned indication will be pancreatic cancer in parallel to multidrug resistant breast cancer as Adva-27a has shown a positive effect on both of these cancer types for which there is currently little or no treatment options available. See “Clinical Trials” below.

We have licensed our technology on an exclusive basis from Advanomics Corporation, and we are planning to initiate our own research and development program as soon as practicable once financing is in place. There are no assurances that we will obtain the financing necessary to allow us to implement this aspect of our business plan, or to enter clinical trials. See "Part I, Item 2, Management's Discussion and Analysis of Financial Condition -- Liquidity and Capital Resources," below.

3

Carbon-Difluoride Platform Technology

Many therapeutically important compounds contain diester bonds that link different parts of the molecule together. Diester bonds are naturally unstable often leading to suboptimal performance when the molecule is administered to patients. Diester bonds have specific nine-dimensional, as well as electrostatic properties that cannot be easily mimicked by other bonds. Bonds that do not mimic the diester bond correctly invariably render the compound inactive. In collaboration with Institut National des Sciences Appliquées de Rouen in France (“INSA”), Advanomics has developed a way to replace the diester bond with a Carbon-Difluoride bond which acts as a diester isostere. An isostere is a different chemical structure that mimics the properties of the original. In the body, Carbon-Difluoride compounds are resistant to metabolic degradation but recognized similarly to the diester compounds (see Figure 1).

Figure 1

Our Lead Compound (Adva-27a)

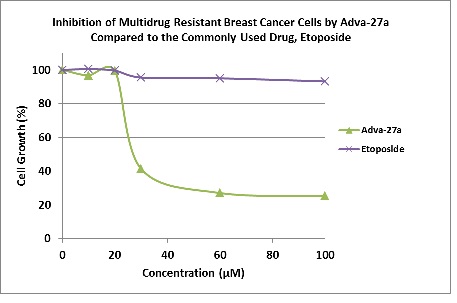

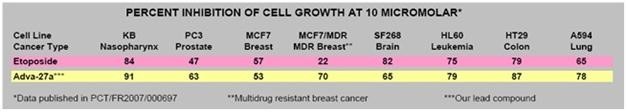

Our initial drug candidate is Adva-27a, a GEM-difluorinated C-glycoside derivative of Podophyllotoxin, targeted for various forms of cancer. If we are successful in our current financing efforts, Adva-27a is expected to enter Phase I clinical trials for pancreatic cancer and multidrug resistant breast cancer in mid to late 2016 (see “Clinical Development Path” and “Clinical Trials” below). Etoposide, which is also a derivative of Podophyllotoxin, is currently on the market and is used to treat various types of cancer including leukemia, lymphoma, testicular cancer, lung cancer, brain cancer, prostate cancer, bladder cancer, colon cancer, ovarian cancer, liver cancer and several other forms of cancer. Like Etoposide, Adva-27a is a Topoisomerase II inhibitor; however, unlike Etoposide and other anti-tumor drugs currently in use, Adva-27a is able to destroy multidrug resistant cancer cells. Adva-27a is a new chemical entity and has been shown to have distinct and more desirable biological properties compared to Etoposide. Most notably, Adva-27a is very effective against multidrug resistant breast cancer cells while Etoposide has no activity against this aggressive form of cancer (see Figure 2). In other side-by-side studies against Etoposide as a reference, Adva-27a showed markedly improved cell killing activity in various other cancer types, particularly prostate, colon and lung cancer (see Table 1). Our preclinical studies to date have shown that:

4

| ● |

Adva-27a is effective at killing different types of multidrug resistant cancer cells, including:

|

||

| o | Breast Cancer Cells (MCF-7/MDR) | ||

| o |

Small Cell Lung Cancer Cells (H69AR)

|

||

| o | Uterine Cancer (MES-SA/Dx5) | ||

| o | Pancreatic Cancer (Panc-1) | ||

| ● |

Adva-27a is unaffected by P-Glycoprotein, the enzyme responsible for making cancer cells resistant to anti-tumor drugs.

|

||

| ● |

Adva-27a has excellent clearance time (half-life = 54 minutes) as indicated by human microsomes stability studies and pharmacokinetics data in rats.

|

||

| ● |

Adva-27a clearance is independent of Cytochrome P450, a mechanism that is less likely to produce toxic intermediates.

|

||

| ● |

Adva-27a is an excellent inhibitor of Topoisomerase II with an IC50 of only 13.7 micromolar (this number has recently been reduce to 1.44 micromolar as a result of resolving the two isomeric forms of Adva-27a).

|

||

| ● |

Adva-27a has shown excellent pharmacokinetics profile as indicated by studies done in rats.

|

||

| ● |

Adva-27a does not inhibit tubulin assembly.

|

||

These and other preclinical data have been published in ANTICANCER RESEARCH, a peer-reviewed International Journal of Cancer Research and Treatment. The manuscript entitled “Adva-27a, a Novel Podophyllotoxin Derivative Found to Be Effective Against Multidrug Resistant Human Cancer Cells” appeared in print in the October 2012 issue of the journal [ANTICANCER RESEARCH 32: 4423-4432 (2012)]. A copy of the full manuscript as it appeared in the journal is available on our website at www.sunshinebiopharma.com.

Figure 2

Table 1

5

Clinical Development Path

The early stage preclinical studies for our lead compound, Adva-27a, were successfully completed in late 2011 and the results have been published [ANTICANCER RESEARCH 32: 4423-4432 (2012)]. We have been delayed in our implementation of our clinical development program due to lack of funding, but, while there are no assurances, we now believe we may have secured this funding. If we do receive this funding, we will continue our clinical development program of Adva-27a by conducting the next sequence of steps comprised of the following:

| ● |

GMP Manufacturing of 2 kilogram for use in IND-Enabling Studies and Phase I Clinical Trials

|

||

| ● |

IND-Enabling Studies

|

||

| ● |

Regulatory Filing (Fast-Track Status Anticipated)

|

||

| ● |

Phase I Clinical Trials (Multidrug Resistant Breast Cancer Indication)

|

||

GMP Manufacturing

On November 14, 2014, we entered into a Manufacturing Services Agreement with Lonza Ltd. and Lonza Sales Ltd. (hereinafter jointly referred to as “Lonza”), whereby we engaged Lonza to be the manufacturer of our Adva-27a anticancer drug (the “Lonza Agreement”). Lonza is one of the world’s leading and most-trusted manufacturers of pharmaceutical ingredients. Headquartered in Basel, Switzerland, Lonza has more than 40 major manufacturing facilities worldwide and is currently manufacturing 2 kilograms of our Adva-27a for clinical trials. The Lonza Agreement was effective November 10, 2014, has a term of 5 years, and may be extended or terminated earlier as provided in the Lonza Agreement. On November 30, 2014, we placed a Purchase Order for the manufacturing of 2 kilograms of our Adva-27a at an initial cost of $385,000 for the purchase of raw material and delivery of samples for process validation. Lonza has deferred the $385,000 payment until the samples for process validation are delivered, which is expected to occur in the third calendar quarter of 2015.

Pursuant to the terms of the Lonza Agreement, Lonza will manufacture our drug in accordance with current Good Manufacturing Practices (“cGMP”) in compliance with the regulations applicable in the U.S., Canada, Europe and other countries around the world relating to the manufacturing of medicinal products for human use. Lonza will build a master drug file for our Adva-27a drug and will have it ready for filing with regulatory authorities as may be required to secure ultimate drug approval. Kilogram level cGMP manufacturing for clinical trials shall commence following completion and testing of the process validation samples. Lonza is also responsible for procuring all required raw materials to prepare the batches, at our cost. The Agreement provides for us to maintain one representative of our Company at their facility during the manufacturing process. Quality assurance and control is the responsibility of both Lonza and us during the process.

We have the right to inspect, test and approve all batches to insure compliance with the manufacturing specifications, which is required to be completed within 30 days after release of a batch. In the event of a dispute regarding compliance with the manufacturing specifications, the dispute will be resolved ultimately by independent analysis and testing.

The Lonza Agreement contains customary warranties and disclaimers, confidentiality provisions as well as mutual indemnifications common in agreements of this type.

Clinical Trials

Adva-27a’s initial indication will be pancreatic cancer and multidrug resistant breast cancer for which there are currently little or no treatment options available. In June 2011 we concluded an agreement with McGill University’s Jewish General Hospital in Montreal, Canada to conduct Phase I clinical trials for these two indications. All aspects of the planned clinical trials in Canada will employ U.S. Food and Drug Administration (“FDA”) standards at all levels. As a result of the Dutchess Agreement and other financing opportunities described below, we now anticipate that Phase I clinical trials will commence in mid to late 2016 and we estimate that it will take 18 months to complete, at which time we expect to file for limited marketing approval with the regulatory authorities in Canada and the FDA in the U.S. See “Marketing,” below.

6

Marketing

According to the American Cancer Society, nearly 1.5 million new cases of cancer are diagnosed in the U.S. each year. Given the terminal and limited treatment options available for the pancreatic cancer and multidrug resistant breast cancer indications we are planning to study, we anticipate being granted limited marketing approval (“compassionate-use”) for our Adva-27a following receipt of funding and a successful Phase I clinical trial. There are no assurances that either will occur. Such limited approval will allow us to make the drug available to various hospitals and health care centers for experimental therapy and/or “compassionate-use”, thereby generating some revenues in the near-term.

We believe that upon successful completion of Phase I Clinical Trials we may receive one or more offers from large pharmaceutical companies to buyout or license our drug. However, there are no assurances that our Phase I Trials will be successful, or if successful, that any pharmaceutical companies will make an acceptable offer to us. In the event we do not consummate such a transaction, we will require significant capital in order to manufacture and market our new drug.

Intellectual Property

We are the exclusive licensee for the U.S. territory of Advanomics Corporation’s Adva-27a which is covered by international patent applications filed on April 27, 2007 (PCT/FR2007/000697). These patent applications, which are now issued in Europe, Canada and the United States (US 8,236,935) and are still pending elsewhere around the world, were originally owned by Institut National des Sciences Appliquées de Rouen (France) and have recently been purchased by Advanomics Corporation. On January 14, 2013, Advanomics Corporation filed a new patent application covering Adva-27a manufacturing processes as well as new Adva-27a derivatives and compositions.

Our Lead Anti-Cancer Compound, Adva-27a, in 3D

Development of New Business

On July 25, 2014, we formed Sunshine Biopharma Canada Inc., a Canadian wholly owned subsidiary for the purposes of conducting pharmaceutical business in Canada and elsewhere around the globe. While no assurances can be provided and subject to the availability of adequate financing, of which there is no assurance, we anticipate that Sunshine Biopharma Canada will soon secure a Drug Establishment License (DEL) from Health Canada and proceed to signing manufacturing, marketing, sales and distribution contracts for various generic pharmaceuticals and biomedical products. This new effort broadens our business scope and provides us with the opportunity to generate revenues in the near to mid-term. We anticipate revenues to be generated through the export of generic pharmaceuticals overseas. There are no assurances that we will be able to sign applicable contracts or generate profits from these anticipated new operations. In addition to revenue generation, we anticipate that as a result of these activities, Sunshine Biopharma Canada will then be well positioned for the marketing and distribution of Adva-27a, our flagship oncology drug candidate currently being developed for the treatment of pancreatic cancer and multidrug resistant breast cancer, provided that Adva-27a is approved for such marketing and distribution, of which there can be no assurance.

While no assurances can be provided, we are also planning to expand our product line through acquisitions and/or in-licensing as well as in-house research and development.

7

Government Regulations

Our existing and proposed business operations are subject to extensive and frequently changing federal, state, provincial and local laws and regulations. We will be subject to significant regulations in the U.S. in order to obtain the approval of the FDA to offer our product on the market. The approximate procedure for obtaining FDA approval involves an initial filing of an IND application following which the FDA would give the go ahead with Phase I clinical (human) trials. As a result of the Dutchess Agreement and other financing opportunities described below, we now anticipate that this process will commence in mid to late 2016 and we estimate that this procedure will take 18 months to complete. Following completion of Phase I, the results are filed with the FDA and a request is made to proceed to Phase II. Similarly, following completion of Phase II the data are filed with the FDA and a request is made to proceed to Phase III. Following completion of Phase III, a request is made for marketing approval. Depending on various issues and considerations, the FDA could provide limited marketing approval on a humanitarian basis if the drug treats terminally ill patients with limited treatment options available. As of the date of this Report we have not made any filings with the FDA or other regulatory bodies in other jurisdictions. We have however had extensive discussions with clinicians at the McGill University’s Jewish General Hospital in Montreal where we plan to undertake our Phase I study for pancreatic cancer and multidrug resistant breast cancer they believe that Health Canada is likely to grant us a so-called fast-track process on the basis of the terminal nature of the cancer types which we will be treating. There are no assurances this will occur.

Employees

As of the date of this Report we have three (3) employees, our management. We anticipate that if we receive financing we will hire additional employees in the areas of accounting, regulatory affairs, marketing and laboratory personnel.

Competition

We will be competing with publicly and privately held companies engaged in developing cancer therapies. There are numerous other entities engaged in this business that have greater resources, both financial and otherwise, than the resources presently available to us. Nearly all major pharmaceutical companies including Amgen, Roche, Pfizer, Bristol-Myers Squibb and Novartis, to name just a few, have on-going anti-cancer drug development programs and some of the drug they may develop could be in direct competition with our drug. Also, a number of small companies are also working in the area of cancer and could develop drugs that may be in competition with ours. However, none of these competitor companies can use molecules similar to ours as they would be infringing our patents.

Trademarks-Tradenames

We are the exclusive licensee for the U.S. territory of Advanomics’ Adva-27a which is covered by international patent applications filed on April 27, 2007 (PCT/FR2007/000697). These patent applications, which are now issued in Europe, Canada and the United States (US 8,236,935) and which are still pending elsewhere around the world, were originally owned by Institut National des Sciences Appliquées de Rouen (France) and have recently been purchased by Advanomics.

ITEM 1A. RISK FACTORS

We are a smaller reporting company and not required to include this disclosure in our Form 10-K annual report.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

8

ITEM 2. PROPERTIES

Since June 2012 our principal place of business has been located at 469 Jean-Talon West, 3rd Floor, Montreal, Quebec, Canada, H3N 1R4. This is also the location of our licensor, Advanomics Corporation, who is providing this space to us on a rent free basis as of the date of this Report. If and when we are able to secure financing we expect that we will lease our own office and laboratory space. Our current space consists of approximately 1,000 square feet of shared executive office space. We anticipate that this will be sufficient for our needs until financing is in place, of which there is no assurance.

ITEM 3. LEGAL PROCEEDINGS

In February 2015 we filed an action in the Circuit Court of the 11th Judicial Circuit for Miami-Date County, Florida against Justin Keener, d/b/a JMJ Financial, arising out of a convertible note that we issued to the defendant. The complaint alleges among other things, claims of usury, fraudulent inducement, breach of contract, and injunctive and declaratory relief. As of the date of this report we are awaiting receipt of an answer to our complaint, which is due on or before March 9, 2015.

To the best of our management’s knowledge and belief, there are no other material claims that have been brought against us nor have there been any claims threatened.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Trading of our Common Stock commenced on the OTCBB in September 2007 under the symbol “MWBN.” Effective November 30, 2009, the trading symbol for our Common Stock was changed to “SBFM” as a result of our name change discussed above.

The table below sets forth the reported high and low bid prices for the periods indicated. The bid prices shown reflect quotations between dealers, without adjustment for markups, markdowns or commissions, and may not represent actual transactions in our Common Stock.

|

Quarter Ended

|

High

|

Low

|

||||||

|

March 31, 2013

|

$ | 0.44 | $ | 0.24 | ||||

|

June 30, 2013

|

$ | 0.28 | $ | 0.19 | ||||

|

September 31, 2013

|

$ | 0.23 | $ | 0.16 | ||||

|

December 31, 2013

|

$ | 0.21 | $ | 0.13 | ||||

|

March 31, 2014

|

$ | 0.20 | $ | 0.125 | ||||

|

June 30, 2014

|

$ | 0.22 | $ | 0.125 | ||||

|

September 31, 2014

|

$ | 0.13 | $ | 0.055 | ||||

|

December 31, 2014

|

$ | 0.08 | $ | 0.161 |

As of March 9, 2015, the closing bid price of our Common Stock was $0.02.

9

Trading volume in our Common Stock is very limited. As a result, the trading price of our Common Stock is subject to significant fluctuations.

The Securities Enforcement and Penny Stock Reform Act of 1990

The Securities and Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

As of the date of this Report, our Common Stock is defined as a “penny stock” under the Securities and Exchange Act. It is anticipated that our Common Stock will remain a penny stock for the foreseeable future. The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his/her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares in us will be subject to Rules 15g-1 through 15g-10 of the Securities and Exchange Act. Rather than creating a need to comply with those rules, some broker-dealers will refuse to attempt to sell penny stock.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the Commission, which:

|

●

|

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

|

|

|

●

|

contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of the Securities Act of 1934, as amended;

|

|

|

●

|

contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask price;

|

|

|

●

|

contains a toll-free telephone number for inquiries on disciplinary actions;

|

|

|

●

|

defines significant terms in the disclosure document or in the conduct of trading penny stocks; and

|

|

|

●

|

contains such other information and is in such form (including language, type, size and format) as the Securities and Exchange Commission shall require by rule or regulation;

|

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, to the customer:

|

●

|

the bid and offer quotations for the penny stock;

|

|

|

●

|

the compensation of the broker-dealer and its salesperson in the transaction;

|

|

|

●

|

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and

|

|

|

●

|

monthly account statements showing the market value of each penny stock held in the customer's account.

|

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling their securities.

10

Holders

We had 121 holders of record of our Common Stock as of the date of this Report, not including those persons who hold their shares in “street name.”

Stock Transfer Agent

The stock transfer agent for our securities is Corporate Stock Transfer, Inc., of Denver, Colorado. Their address is 3200 Cherry Creek South Drive, Suite 430, Denver, Colorado, 80209. Their phone number is (303) 282-4800.

Dividends

We have not paid any dividends since our incorporation and do not anticipate the payment of dividends in the foreseeable future. At present, our policy is to retain earnings, if any, to develop and market our products. The payment of dividends in the future will depend upon, among other factors, our earnings, capital requirements, and operating financial conditions.

Reports

We are subject to certain reporting requirements and furnish annual financial reports to our stockholders, certified by our independent accountants, and furnish unaudited quarterly financial reports in our quarterly reports filed electronically with the SEC. All reports and information filed by us can be found at the SEC website, www.sec.gov.

ITEM 6. SELECTED FINANCIAL DATA.

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our audited financial statements and notes thereto included herein. In connection with, and because we desire to take advantage of, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we caution readers regarding certain forward looking statements in the following discussion and elsewhere in this Report and in any other statement made by, or on our behalf, whether or not in future filings with the Securities and Exchange Commission. Forward looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by, or on our behalf. We disclaim any obligation to update forward looking statements.

Overview and History

We were incorporated in the State of Colorado on August 31, 2006 under the name “Mountain West Business Solutions, Inc.” During our fiscal year ended July 31, 2009 our business was to provide management consulting with regard to accounting, computer and general business issues for small and home-office based companies. Effective October 15, 2009, we executed an agreement to acquire Sunshine Biopharma, Inc., a Colorado corporation (“SBI”), in exchange for the issuance of 21,962,000 shares of our Common Stock and 850,000 shares of Convertible Preferred Stock, each convertible into twenty (20) shares of our Common Stock (the “Agreement”). As a result of this transaction our officers and directors resigned their positions with us and were replaced by our current management. See PART III, Item 10, below. As a result of this transaction we have changed our name to “Sunshine Biopharma, Inc.” On December 21, 2011, Advanomics Corporation, a privately held Canadian company (“Advanomics”), and our licensor, exercised its right to convert the 850,000 shares of Series “A” Preferred Stock it held in our Company into 17,000,000 shares of Common Stock.

11

Our principal place of business is located at 469 Jean-Talon West, 3rd Floor, Montreal, Quebec, Canada H3N 1R4. Our phone number is (514) 764-9698 and our website address is www.sunshinebiopharma.com.

We have not been subject to any bankruptcy, receivership or similar proceeding.

Results Of Operations

Comparison of Results of Operations for the fiscal years ended December 31, 2014 and 2013

Total expenses, including general and administrative expenses and research and development expenses for our fiscal year ended December 31, 2014 were $1,755,114, compared to $1,936,077 during our fiscal year ended December 31, 2013, a decrease of $180,963. During our fiscal year ended December 31, 2014, our principal expenses included $700,500 in financial consulting fees, compared to $1,186,610 during 2013, a decrease of $486,110. Other principal expenses included $263,333 in licensing fees compared to $475,000 incurred during 2013, $327,000 in research and development costs in 2014 compared to $137,400 in 2013 and increased professional fees, including an increase in accounting fees of approximately $17,000 in 2014 compared to 2013 and increased legal fees of approximately $180,000 in 2014 compared to 2013 as a result of increased litigation expenses. We also incurred $105,000 in public relation fees during 2014, compared to no related expenses during 2013.

In 2013 we incurred a loss of $548,951 which arose from the conversion of outstanding convertible notes. No loss was incurred in this category during 2014. On March 30, 2013 we issued 2,590,426 shares of our Common Stock upon the conversion of Convertible Notes payable on or before March 31, 2013 (“Convertible Notes”) valued at $621,703 representing principal of $513,000 and interest of $5,086. These Convertible Notes contained a beneficial conversion feature convertible at our option and were convertible at a fixed conversion price of $0.20. The market price on the issuance of these Convertible Notes varied from a low of $0.21 per share and a high of $0.46 per share with an average of $0.36 per share. Consequently, the Convertible Notes were considered to have a beneficial conversion feature and under ASC 470-20-25-10 the beneficial conversion feature was calculated to be $548,951 in total based on the issuance date and the share price on that date. This amount was booked to interest expense and Additional Paid in Capital.

As a result, we incurred a net loss of $1,934,210 (approximately $0.03 per share) for the fiscal year ended December 31, 2014, compared to a net loss of $2,491,483 during our fiscal year ended December 31, 2013 (approximately $0.04 per share).

Because we have not generated any revenues, following is our Plan of Operation.

Plan of Operation

As of the date of this Report we are a pharmaceutical company focused on the research, development and commercialization of drugs for the treatment of various forms of cancer. Our lead compound, Adva-27, a multi-purpose anti-tumor compound, is expected to enter Phase I clinical trials in 2016. We have licensed our technology on an exclusive basis from Advanomics Corporation, a privately held Canadian company (“Advanomics”), and we are planning to initiate our own research and development program as soon as practicable, once financing is in place. There are no assurances that we will obtain the financing necessary to allow us to implement this aspect of our business plan, or to enter clinical trials. More details about our Plan of Operations are provided above under "PART I, Item 1, Business," above.

12

Liquidity and Capital Resources

As of December 31, 2014, we had cash or cash equivalents of $143,423.

Net cash used in operating activities was $538,595 during our fiscal year ended December 31, 2014, compared to $564,398 during our fiscal year ended December 31, 2013. We anticipate that overhead costs in current operations will increase in the future once we enter Phase I clinical trials as discussed in "PART I, Item 1, Business," above.

Cash flows provided or used in investing activities were $0 for the period from August 17, 2009 (inception) through December 31, 2013, as well as during our fiscal year ended December 31, 2014. Net cash flows provided or used by financing activities was $650,778 during our fiscal year ended December 31, 2014, compared to $463,000 during our fiscal year ended December 31, 2013.

During the fiscal year ended December 31, 2014, we issued 1,900,000 shares of our Common Stock upon the conversion of $29,820 in debt. The fair market value of the 1,900,000 shares was $68,000. The difference of $38,180 went to loss on conversion of note payable on our Statement of Operations for December 31, 2014. We also sold 1,196,900 shares of our Common Stock for cash of $153,334 and issued 9,655,080 shares of our Common Stock in exchange for services valued at $1,258,006. During 2014 we issued 500,000 shares of our Common Stock in exchange for prepaid interest valued at $75,000.

During the fiscal year ended December 31, 2013, we issued 2,590,426 shares of our Common Stock for the conversion of $513,000 in debt and interest of $5,086. We sold 1,000,000 shares of common stock for cash of $195,000 and issued 5,292,543 shares of our Common Stock in exchange for services valued at $1,151,310.

We are not generating revenue from our operations, and our ability to implement our business plan for the future will depend on the future availability of financing. Such financing will be required to enable us to further develop our drug research and development capabilities and continue operations. We estimate that we will require approximately $5 million in debt and/or equity capital to fully implement our business plan in the future and there are no assurances that we will be able to raise this capital. During our fiscal year ended December 31, 2014, we did, on April 23, 2014, enter into an Investment Agreement (the “Investment Agreement”) with Dutchess Opportunity Fund, II, LP (“Dutchess”), for the sale of up to $2.5 million of shares of our Common Stock over a three-year commitment period. Under the terms of the Investment Agreement we may, from time to time and in our sole discretion, issue shares of our Common Stock to Dutchess at a price equal to ninety percent (90%) of the lowest daily volume weighted average price during a Trading Day of our Common Stock during the five (5) consecutive Trading Days immediately preceding the Put Notice Date, up to $2.5 million. In connection with the Investment Agreement, we also issued to Dutchess an engagement fee in the form of 400,000 “restricted” shares of our Common Stock.

The amount of each tranche under the Investment Agreement is limited to maximum $100,000 and we may only issue a Put Notice (as defined under the Investment Agreement) ten (10) Trading Days after each prior Put Notice Date and if the trading price of our Common Stock is $0.10 or greater. We are not obligated to utilize any of the $2.5 million available under the Investment Agreement and there are no minimum commitments or minimum use penalties.

The Investment Agreement does not impose any restrictions on our operating activities. During the term of the Investment Agreement, Dutchess is prohibited from engaging in any short selling or hedging transactions, either directly or indirectly, related to our Common Stock.

As a material term of the Dutchess Agreement, we were required to register the 400,000 shares of our Common Stock already issued to Dutchess, as well as 13,000,000 additional shares of our Common Stock reserved for issuance upon our drawing down funds pursuant to the Investment Agreement. We filed the registration statement with the SEC on May 22, 2014 and it became effective July 23, 2014. On August 7, 2014, we elected to issue our initial put notice to Dutchess, wherein we requested that Dutchess purchase 930,233 shares of our Common Stock for $100,000. We utilized the proceeds from the sale of these shares to repay debt. We anticipate that the proceeds from the next put notice shall be utilized to commence IND studies on our Adva-27a drug.

Despite the Dutchess Agreement there can be no assurances that we will have sufficient capital to complete the implementation of our business plan, as we currently estimate we will need up to $5 million to do so. We expect to raise the additional capital necessary to fully implement our business plan either by the sale of our securities, or through generating revenues as described in Plan of Operation above. There are no assurances that either scenario will be successfully implemented. As of the date of this report we have not reached any agreement with any party that has agreed to provide us with the additional capital we think may be necessary to fully implement our business plan, or whether we will generate sufficient revenues to allow us to do so. Our inability to obtain additional sufficient funds from external sources if and when needed may have a material adverse effect on our plan of operation, results of operations and financial condition.

Our cost to continue operations as they are now conducted is nominal, but these are expected to increase once we commence Phase I clinical trials. We do not have sufficient funds to cover the anticipated increase in these expenses. We need to raise additional funds in order to continue our existing operations, to initiate research and development activities, and to finance our plans to expand our operations for the next year. If we are successful in raising additional funds, our research and development efforts will continue and expand.

13

Subsequent Events

On February 20, 2015, we entered into an agreement with Belair Capital Markets Inc. (“Belair”) and Villette Capital Inc. ("Villette") pursuant to which Belair and Villette have agreed to provide us with advice on corporate structure and operations as well as aid us in our efforts to raise $5 million in debt and/or equity financing to fund our Adva-27a drug development program and for working capital.

In January and February 2015, the holder of the $94,624 convertible note elected to convert a total of $30,090 into 3,500,000 shares of $0.001 par value common stock leaving a note balance of $64,534.

Inflation

Although our operations are influenced by general economic conditions, we do not believe that inflation had a material effect on our results of operations during our fiscal year ended December 31, 2014.

Critical Accounting Policies and Estimates

Critical Accounting Estimates

The discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities. On an on-going basis, we evaluate our estimates based on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions. The following represents a summary of our critical accounting policies, defined as those policies that we believe are the most important to the portrayal of our financial condition and results of operations and that require management’s most difficult, subjective or complex judgments, often as a result of the need to make estimates about the effects of matters that are inherently uncertain.

Leases – We follow the guidance in SFAS No. 13 “Accounting for Leases,” as amended, which requires us to evaluate the lease agreements we enter into to determine whether they represent operating or capital leases at the inception of the lease.

Recently Adopted Accounting Standards – In May 2014, FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606), which amends the existing accounting standards for revenue recognition.

In June 2014 FASB issued Accounting Standards Update (ASU), ASU 2014-10 regarding development stage entities. The ASU removes the definition of development stage entity, as was previously defined under generally accepted accounting principles in the United States (U.S. GAAP), from the accounting standards codification, thereby removing the financial reporting distinction between development stage entities and other reporting entities from U.S. GAAP. In addition, the ASU eliminates the requirements for development stage entities to (i) present inception-to-date information in the statement of income, cash flow and stockholders' equity, (ii) label the financial statements as those of a development stage entity, (iii) disclose a description of the development stage activities in which the entity is engaged, and (iv) disclose in the first year in which the entity is no longer a development stage entity that in prior years it had been in the development stage.

We have chosen to adopt the ASU early for our financial statements as of September 30, 2014. The adoption of this pronouncement impacted us by eliminating the requirement to report inception to date financial information previously required.

There were various other accounting standards and interpretations issued during 2014 and 2013, none of which are expected to have a material impact on our consolidated financial position, operations or cash flows.

Off-Balance Sheet Arrangements

We have not entered into any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources and would be considered material to investors.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

14

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

TABLE OF CONTENTS

|

Page No.

|

||

|

Independent Accountant’s Audit Report

|

F-1

|

|

|

Consolidated Balance Sheet

|

F-2

|

|

|

Consolidated Statement of Operations

|

F-3

|

|

|

Consolidated Statement of Cash Flow

|

F-4

|

|

|

Statement of Shareholders’ Equity

|

F-5-F-6

|

|

|

Notes to the Consolidated Financial Statements

|

F-7-F-13

|

15

Independent Auditor Report

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of Sunshine Biopharma, Inc.:

We have audited the accompanying consolidated balance sheet of Sunshine Biopharma, Inc. (“the Company”) as of December 31, 2014 and 2013 and the related statement of operations, stockholders’ equity (deficit) and cash flows for the years then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statement referred to above present fairly, in all material respects, the financial position of Sunshine Biopharma, Inc., as of December 31, 2014 and 2013, and the results of its operations and its cash flows for the years then ended, in conformity with generally accepted accounting principles in the United States of America.

The company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the Company's internal control over financial reporting. Accordingly, we express no such opinion.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company’s significant operating losses raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ B F Borgers CPA PC

B F Borgers CPA PC

Lakewood, CO

March 9, 2015

F-1

Sunshine Biopharma, Inc.

Balance Sheet

|

December 31,

|

December 31,

|

|||||||

|

2014

|

2013

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets:

|

||||||||

|

Cash and cash equivalents

|

$ | 143,423 | $ | 31,240 | ||||

|

Total Current Assets

|

143,423 | 31,240 | ||||||

|

TOTAL ASSETS

|

$ | 143,423 | $ | 31,240 | ||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

Current Liabilities:

|

||||||||

|

Current portion of note payable

|

480,124 | 12,500 | ||||||

|

Accounts payable

|

34,766 | 23,809 | ||||||

|

Interest payable

|

16,113 | 2,641 | ||||||

|

Total Curent Liabilities

|

||||||||

|

TOTAL LIABILITIES

|

531,003 | 38,950 | ||||||

|

SHAREHOLDERS' EQUITY

|

||||||||

|

Preferred stock, $0.10 par value per share;

|

||||||||

|

Authorized 5,000,000 Shares; Issued

|

||||||||

|

and outstanding -0- shares.

|

- | - | ||||||

|

Common Stock, $0.001 per share;

|

||||||||

|

Authorized 200,000,000 Shares; Issued

|

||||||||

|

and outstanding 73,551,041and 60,299,061 at

|

||||||||

|

December 31, 2014 and December 31, 2013 respectively

|

73,551 | 60,299 | ||||||

|

Capital paid in excess of par value

|

6,967,228 | 5,426,140 | ||||||

|

Accumulated other comprehesive (Loss)

|

- | - | ||||||

|

Accumulated (Deficit)

|

(7,428,359 | ) | (5,494,149 | ) | ||||

|

TOTAL SHAREHOLDERS' EQUITY

|

(387,580 | ) | (7,710 | ) | ||||

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

$ | 143,423 | $ | 31,240 | ||||

See Accompanying Notes To These Financial Statements.

F-2

Sunshine Biopharma, Inc.

Statement Of Operations

|

December 31,

|

December 31,

|

|||||||

|

2014

|

2013

|

|||||||

|

Revenue:

|

$ | - | $ | - | ||||

|

General & Administrative Expenses

|

||||||||

|

Research and Development

|

327,000 | 137,400 | ||||||

|

Accounting

|

40,440 | 23,640 | ||||||

|

Consulting

|

700,500 | 1,186,610 | ||||||

|

Director fees

|

15,000 | - | ||||||

|

Legal

|

268,335 | 88,381 | ||||||

|

Licenses

|

263,333 | 475,000 | ||||||

|

Office

|

25,738 | 18,963 | ||||||

|

Merger Cost

|

- | - | ||||||

|

Public Relations

|

105,000 | - | ||||||

|

Stock Transfer Fee

|

9,768 | 6,083 | ||||||

|

Writedown of intangible assets

|

- | - | ||||||

|

Total G & A

|

1,755,114 | 1,936,077 | ||||||

|

(Loss) from operations

|

(1,755,114 | ) | (1,936,077 | ) | ||||

|

Other (expense):

|

||||||||

|

Interest expense

|

(179,096 | ) | (6,455 | ) | ||||

|

Beneficial conversion feature

|

- | (548,951 | ) | |||||

|

Total Other (Expense)

|

(179,096 | ) | (555,406 | ) | ||||

|

Net (loss)

|

$ | (1,934,210 | ) | $ | (2,491,483 | ) | ||

|

Basic (Loss) per common share

|

$ | (0.03 | ) | $ | (0.04 | ) | ||

|

Weighted Average Common Shares Outstanding

|

66,131,657 | 55,395,819 | ||||||

See Accompanying Notes To These Financial Statements.

F-3

Sunshine Biopharma, Inc.

Statement Of Cash Flows

|

December 31,

|

December 31,

|

|||||||

|

2014

|

2013

|

|||||||

|

Cash Flows From Operating Activities:

|

||||||||

|

Net (Loss)

|

$ | (1,934,210 | ) | $ | (2,491,483 | ) | ||

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

||||||||

|

Stock issued for licenses, services, and other assets

|

1,258,006 | 1,246,310 | ||||||

|

Stock issued for payment interest on notes payable

|

113,180 | 100,000 | ||||||

|

Stock issued for payment of expenses

|

- | 5,086 | ||||||

|

Beneficial conversion feature on note conversion

|

- | 548,951 | ||||||

|

Decrease in prepaid expenses

|

- | 2,155 | ||||||

|

Increase in Accounts Payable

|

10,957 | 23,214 | ||||||

|

Increase in interest payable

|

13,472 | 1,369 | ||||||

|

Net Cash Flows (used) in operations

|

(538,595 | ) | (564,398 | ) | ||||

|

Cash Flows From Investing Activities:

|

||||||||

|

Net Cash Flows (used) in Investing activities

|

- | - | ||||||

|

Cash Flows From Financing Activities:

|

||||||||

|

Proceed from note payable

|

395,000 | 463,000 | ||||||

|

Note payable used to pay expenses

|

63,333 | |||||||

|

Note payable used to pay origionation fees & interest

|

39,111 | |||||||

|

Sale of common stock

|

153,334 | - | ||||||

|

Net Cash Flows provided by financing activities

|

650,778 | 463,000 | ||||||

|

Net Increase (Decrease) In Cash and cash equivalents

|

112,183 | (101,398 | ) | |||||

|

Cash and cash equivalents at beginning of period

|

31,240 | 132,638 | ||||||

|

Supplementary Disclosure Of Cash Flow Information:

|

$ | 143,423 | $ | 31,240 | ||||

|

Stock issued for services, licenses and other assets

|

$ | 1,258,006 | $ | 1,237,310 | ||||

|

Stock issued for note conversions

|

$ | 68,000 | $ | 513,000 | ||||

|

Stock issued for interest

|

$ | 75,000 | $ | - | ||||

|

Stock issued for payment of expenses

|

$ | - | $ | 100,000 | ||||

|

Loan proceeds used to pay expenses

|

$ | 50,000 | $ | - | ||||

|

Cash paid for interest

|

$ | - | $ | - | ||||

|

Cash paid for income taxes

|

$ | - | $ | - | ||||

See Accompanying Notes To These Financial Statements.

F-4

Sunshine Biopharma, Inc.

Statement of Shareholders' Equity

|

Number Of

|

Capital Paid

|

Number Of

|

Stock

|

During the

|

||||||||||||||||||||||||||||||||

|

Common

|

Common

|

in Excess

|

Preferred

|

Preferred

|

Subscription

|

Comprehensive

|

development

|

|||||||||||||||||||||||||||||

|

Shares Issued

|

Stock

|

of Par Value

|

Shares Issued

|

Stock

|

Receivable

|

Income

|

stage

|

Total

|

||||||||||||||||||||||||||||

|

Balance at December 31, 2012

|

51,416,092 | $ | 51,416 | $ | 3,021,676 | - | $ | - | $ | - | $ | - | $ | (3,002,666 | ) | $ | 70,426 | |||||||||||||||||||

|

March 30, 2013 issued 2,590,428 shares of par value $0.001 common stock for conversion of debt in the amount of $513,000 and interest of $5,086 or $0.24 per share

|

2,590,426 | 2,590 | 515,496 | 518,086 | ||||||||||||||||||||||||||||||||

|

Common stock issued for cash

|

1,000,000 | 1,000 | 194,000 | 195,000 | ||||||||||||||||||||||||||||||||

|

Common stock issued for services

|

5,292,543 | 5,293 | 1,146,017 | 1,151,310 | ||||||||||||||||||||||||||||||||

|

Beneficial conversion feature

|

548,951 | 548,951 | ||||||||||||||||||||||||||||||||||

|

Net (Loss)

|

- | - | - | (2,491,483 | ) | (2,491,483 | ) | |||||||||||||||||||||||||||||

|

Balance at December 31, 2013

|

60,299,061 | $ | 60,299 | $ | 5,426,140 | - | $ | - | $ | - | $ | - | $ | (5,494,149 | ) | $ | (7,710 | ) | ||||||||||||||||||

|

Common stock issued for cash

|

1,196,900 | 1,197 | 152,137 | 153,334 | ||||||||||||||||||||||||||||||||

|

Common stock issued for services

|

9,655,080 | 9,655 | 1,248,351 | 1,258,006 | ||||||||||||||||||||||||||||||||

|

Common stock issued for the reduction of note payable

|

1,900,000 | 1,900 | 66,100 | 68,000 | ||||||||||||||||||||||||||||||||

|

Common stock issued for prepaid interest

|

500,000 | 500 | 74,500 | 75,000 | ||||||||||||||||||||||||||||||||

|

Net (Loss)

|

- | - | - | (1,934,210 | ) | (1,934,210 | ) | |||||||||||||||||||||||||||||

|

Balance at December 31, 2014

|

73,551,041 | $ | 73,551 | $ | 6,967,228 | - | $ | - | $ | - | $ | - | $ | (7,428,359 | ) | $ | (387,580 | ) | ||||||||||||||||||

See Accompanying Notes To These Audited Financial Statements.

F-5

Sunshine Biopharma, Inc.

Statement of Shareholders' Equity

|

Number Of

|

Capital Paid

|

Number Of

|

Stock

|

During the

|

||||||||||||||||||||||||||

|

Common

|

Common

|

in Excess

|

Preferred

|

Preferred

|

Subscription

|

Comprehensive

|

development

|

|||||||||||||||||||||||

|

Shares Issued

|

Stock

|

of Par Value

|

Shares Issued

|

Stock

|

Receivable

|

Income

|

stage

|

Total

|

||||||||||||||||||||||

|

Balance at December 31, 2012

|

51,416,092 | $ | 51,416 | $ | 3,021,676 | - | $ | - | $ | - | $ | - | $ | (3,002,666 | ) | $ | 70,426 | |||||||||||||

|

January 11, 2013 issued 350,000 sharesof par value $0.001 common stock for services valued at $ 136,500 or $0.39 per share

|

350,000 | 350 | 136,150 | 136,500 | ||||||||||||||||||||||||||

|

March 28, 2013 issued 918,500 shares of par value $0.001 common stock for services valued at $ 220,440 or $0.24 per share

|

918,500 | 919 | 219,522 | - | - | 220,440 | ||||||||||||||||||||||||

|

March 30, 2013 issued 259,043 shares of par value $0.001 common stock for services valued at $ 219,370 or $0.24 per share

|

914,043 | 914 | 218,456 | 219,370 | ||||||||||||||||||||||||||

|

March 30, 2013 issued 2,590,428 shares of par value $0.001 common stock for conversion of debt in the amount of $513,000 and interest of $5,086 or $0.24 per share

|

2,590,426 | 2,590 | 515,496 | 518,086 | ||||||||||||||||||||||||||

|

Beneficial conversion feature

|

548,951 | 548,951 | ||||||||||||||||||||||||||||

|

May 14, 2013 issued 250,000 shares of par value $0.001 common stock for services valued at $ 60,000 or $0.24 per share

|

250,000 | 250 | 59,750 | 60,000 | ||||||||||||||||||||||||||

|

August 1, 2013 issued 150,000 shares of par value $0.001 common stock for services valued at $ 30,000 or $0.20 per share

|

150,000 | 150 | 29,850 | 30,000 | ||||||||||||||||||||||||||

|

August 23, 2013 issued 250,000 shares of par value $0.001 common stock for services valued at $ 50,000 or $0.20 per share

|

250,000 | 250 | 49,750 | 50,000 | ||||||||||||||||||||||||||

|

October 4, 2013 issued 60,0000 shares of par value $0.001 common stock for services valued at $ 15,000 or $0.25 per share

|

60,000 | 60 | 14,940 | 15,000 | ||||||||||||||||||||||||||

|

November 4, 2013 issued 500,000 shares of par value $0.001 common stock for cash of $95,000 or $0.19 per share

|

500,000 | 500 | 94,500 | 95,000 | ||||||||||||||||||||||||||

|

November 20, 2013 issued 425,000 shares of par value $0.001 common stock for cash of $85,000 or $0.20 per share

|

425,000 | 425 | 84,575 | 85,000 | ||||||||||||||||||||||||||

|

November 20, 2013 issued 600,000 shares of par value $0.001 common stock for services valued at $ 114,000 or $0.19 per share

|

600,000 | 600 | 113,400 | 114,000 | ||||||||||||||||||||||||||

|

December 2, 2013 issued 75,000 shares of par value $0.001 common stock for cash of $15,000 or $0.20 per share

|

75,000 | 75 | 14,925 | 15,000 | ||||||||||||||||||||||||||

|

December 27, 2013 issued 1,800,000 shares of par value $0.001 common stock for services valued at $ 306,000 or $0.17 per share

|

1,800,000 | 1,800 | 304,200 | 306,000 | ||||||||||||||||||||||||||

|

Net (Loss)

|

- | - | - | (2,491,483 | ) | (2,491,483 | ) | |||||||||||||||||||||||

|

Balance at December 31, 2013

|

60,299,061 | $ | 60,299 | $ | 5,426,140 | - | $ | - | $ | - | $ | - | $ | (5,494,149 | ) | $ | (7,710 | ) | ||||||||||||

|

January 6, 2014 issued 200,000 shares of par value $0.001 common stock for cash of $40,000 or $0.20 per share

|

200,000 | 200 | 39,800 | 40,000 | ||||||||||||||||||||||||||

|

January 30, 2014 issued 600,000 shares of par value $0.001 common stock for services valued at $ 96,000 or $0.16 per share

|

600,000 | 600 | 95,400 | 96,000 | ||||||||||||||||||||||||||

|

February 14, 2014 issued 66,667 shares of par value $0.001 common stock for cash of $13,333 or $0.20 per share

|

66,667 | 67 | 13,267 | 13,334 | ||||||||||||||||||||||||||

| March 2, 2014 issued 10,000 shares of par value $0.001 common stock for services valued at $ 1,400 or $0.14 per share | 10,000 | 10 | 1,390 | 1,400 | ||||||||||||||||||||||||||

|

March 14, 2014 issued 1,000,000 shares of par value $0.001 common stock for services valued at $ 170,000 or $0.17 per share

|

1,000,000 | 1,000 | 169,000 | 170,000 | ||||||||||||||||||||||||||

|

March 27, 2014 issued 500,000 shares of par value $0.001 common stock for prepaid interest valued at $ 75,000 or $0.15 per share

|

500,000 | 500 | 74,500 | 75,000 | ||||||||||||||||||||||||||

|

April 14, 2014 issued 500,000 shares of par value $0.001 common stock for services valued at $ 100,000 or $0.20 per share

|

500,000 | 500 | 99,500 | 100,000 | ||||||||||||||||||||||||||

|

April 17, 2014 issued 1,700 000 shares of par value $0.001 common stock for services valued at $323,000 or $0.19 per share

|

1,700,000 | 1,700 | 321,300 | 323,000 | ||||||||||||||||||||||||||

|

April 25, 2014 issued 400,000 shares of par value $0.001 common stock for services valued at $ 60,000 or $0.15 per share

|

400,000 | 400 | 59,600 | 60,000 | ||||||||||||||||||||||||||

|

May 15, 2014 issued 500,0000 shares of par value $0.001 common stock for services valued at $ 80,000 or $0.16 per share

|

500,000 | 500 | 79,500 | 80,000 | ||||||||||||||||||||||||||

|

June 12, 2014 issued 190,000 shares of par value $0.001 common stock for services valued at $ 30,400 or $0.16 per share

|

190,000 | 190 | 30,210 | 30,400 | ||||||||||||||||||||||||||

|

July 7, 2014 issued 975,000 shares of par value $0.001 common stock for services

valued at $136,500 or $0.14 per share

|

975,000 | 975 | 135,525 | 136,500 | ||||||||||||||||||||||||||

| July 24, 2014 issued 400,000 shares of par value $0.001 common stock for services

valued at $52,000 or $0.13 per share

|

400,000 | 400 | 51,600 | 52,000 | ||||||||||||||||||||||||||

|

August 7, 2014 issued 930,233 shares of par value $0.001 common stock for cash

of $100,000 or $0.1075 per share

|

930,233 | 930 | 99,070 | 100,000 | ||||||||||||||||||||||||||

|

September 8, 2014 issued 300,000 shares of par value $0.001 common stock for services valued at $27,000 or $0.09 per share

|

300,000 | 300 | 26,700 | 27,000 | ||||||||||||||||||||||||||

|

September 19, 2014 issued 340,080 shares of par value $0.001 common stock for services valued at $27,206 or $0.08 per share

|

340,080 | 340 | 26,866 | 27,206 | ||||||||||||||||||||||||||

| November 1, 2014 issued 500,000 shares of par value $0.001 common stock for services valued at $35,000 or $0.07 per share | 500,000 | 500 | 34,500 | 35,000 | ||||||||||||||||||||||||||

|

November 10, 2014 issued 250,000 shares of par value $0.001 common stock for services valued at $20,000 or $0.08 per share

|

250,000 | 250 | 19,750 | 20,000 | ||||||||||||||||||||||||||

|

November 11, 2014 issued 300,000 shares of par value $0.001 common stock for the reduction of a note payable of $9,000, valued at $18,000 or $.06 per share

|

300,000 | 300 | 17,700 | 18,000 | ||||||||||||||||||||||||||

|

November 24 2014 issued 600,000 shares of par value $0.001 common stock for the reduction of a note payable of $11,160, valued at $30,000 or $.05 per share

|

600,000 | 600 | 29,400 | 30,000 | ||||||||||||||||||||||||||

|

November 27, 2014 issued 640,000 shares of par value $0.001 common stock for services valued at $32,000 or $0.05 per share

|

640,000 | 640 | 31,360 | 32,000 | ||||||||||||||||||||||||||

| December 4, 2014 issued 1,350,000 shares of par value $0.001 common stock for services valued at $67,500 or $0.05 per share | 1,350,000 | 1,350 | 66,150 | 67,500 | ||||||||||||||||||||||||||

|

December 18, 2014 issued 1,000,000 shares of par value $0.001 common stock for the reduction of a note payable of $9,660, valued at $20,000 or $.02 per share

|

1,000,000 | 1,000 | 19,000 | 20,000 | ||||||||||||||||||||||||||

|

Beneficial conversion feature

|

- | - | ||||||||||||||||||||||||||||

|

Net (Loss)

|

- | - | - | (1,934,210 | ) | (1,934,210 | ) | |||||||||||||||||||||||

|

Balance at December 31, 2014

|

73,551,041 | $ | 73,551 | $ | 6,967,228 | - | $ | - | $ | - | $ | - | $ | (7,428,359 | ) | $ | (387,580 | ) | ||||||||||||

See Accompanying Notes To These Audited Financial Statements.

F-6

Sunshine Biopharma, Inc.

CONSOLIDATED FINANCIAL STATEMENTS

With Independent Accountant’s Audit Report

At December 31, 2014 and 2013

F-7

Sunshine Biopharma, Inc.

Notes to Consolidated Financial Statements

December 31, 2014 and 2013

Note 1. Organization and Basis of Presentation

Mountain West Business Solutions, Inc. (“MWBS”) was incorporated August 31, 2006 in the State of Colorado. Sunshine Etopo, Inc. (formerly Sunshine Biopharma, Inc.) was incorporated in the State of Colorado on August 17, 2009. Effective October 15, 2009 MWBS was acquired by Sunshine Etopo, Inc. in a transaction classified as a reverse acquisition. MWBS concurrently changed its name to Sunshine Biopharma, Inc. The financial statements represent the activity of Sunshine Etopo, Inc. from August 17, 2009 (inception) through October 15, 2009, and the consolidated activity of Sunshine Etopo, Inc. and Sunshine Biopharma Inc. from October 15, 2009 forward. Sunshine Etopo, Inc. and Sunshine Biopharma, Inc. are hereinafter referred to collectively as the "Company". The Company was formed for the purposes of conducting research, development and commercialization of drugs for the treatment of various forms of cancer. The Company may also engage in any other business that is permitted by law, as designated by the Board of Directors of the Company.

NOTE 2. Summary of Significant Accounting Policies

PRINCIPLES OF CONSOLIDATION

The accompanying consolidated financial statements include the accounts of the Company and its wholly owned subsidiary. All intercompany accounts and transactions have been eliminated in consolidation.

USE OF ESTIMATES

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

CASH AND CASH EQUIVALENTS

For the Balance Sheets and Statements of Cash Flows, all highly liquid investments with maturity of 90 days or less are considered to be cash equivalents. The Company had a cash balance of $143,423 and $31,240 as of December 31, 2014 and December 31, 2013, respectively. At times such cash balances may be in excess of the FDIC limit of $250,000.

F-8

Sunshine Biopharma, Inc.

Notes to Consolidated Financial Statements

December 31, 2014 and 2013

NOTE 2. Summary of Significant Accounting Policies (Continued)

INCOME TAXES

In accordance with ASC 740 - Income Taxes, the provision for income taxes is computed using the asset and liability method. The liability method measures deferred income taxes by applying enacted statutory rates in effect at the balance sheet date to the differences between the tax basis of assets and liabilities and their reported amounts on the financial statements. The resulting deferred tax assets or liabilities have been adjusted to reflect changes in tax laws as they occur. A valuation allowance is provided when it is more likely than not that a deferred tax asset will not be realized.

The Company expects to recognize the financial statement benefit of an uncertain tax position only after considering the probability that a tax authority would sustain the position in an examination. For tax positions meeting a "more-likely-than-not" threshold, the amount to be recognized in the financial statements will be the benefit expected to be realized upon settlement with the tax authority. For tax positions not meeting the threshold, no financial statement benefit is recognized. As of December 31, 2014, the Company had no uncertain tax positions. The Company recognizes interest and penalties, if any, related to uncertain tax positions as general and administrative expenses. The Company currently has no federal or state tax examinations nor has it had any federal or state examinations since its inception. To date, the Company has not incurred any interest or tax penalties.

For federal tax purposes, the Company’s 2011 through 2013 tax years remain open for examination by the tax authorities under the normal three-year statute of limitations.

CONCENTRATION OF CREDIT RISKS

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash equivalents, notes receivables, deposits, and trade receivables. The Company places its cash equivalents with high credit quality financial institutions. As of December 31, 2014 and 2013 there were no trade receivables.

F-9

Sunshine Biopharma, Inc.

Notes to Consolidated Financial Statements

December 31, 2014 and 2013

NOTE 2. Summary of Significant Accounting Policies (Continued)

FINANCIAL INSTRUMENTS AND FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company applies the provisions of Financial Accounting Standards Board (FASB) accounting guidance, FASB Topic ASC 825, Financial Instruments. ASC 825 requires all entities to disclose the fair value of financial instruments, both assets and liabilities recognized and not recognized on the balance sheet, for which it is practicable to estimate fair value, and defines fair value of a financial instrument as the amount at which the instrument could be exchanged in a current transaction between willing parties. As of December 31, 2014 and 2013, the fair value of cash, accounts receivable and notes receivable, accounts payable, accrued expenses, and other payables approximated carrying value due to the short maturity of the instruments, quoted market prices or interest rates which fluctuate with market rates.

The Company defines fair value as the price that would be received to sell an asset or be paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Company applies the following fair value hierarchy, which prioritizes the inputs used to measure fair value into three levels and bases the categorization within the hierarchy upon the lowest level of input that is available and significant to the fair value measurement. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).