Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - CURO Group Holdings Corp. | ex-322cfo906cert1q.htm |

| EX-32.1 - EXHIBIT 32.1 - CURO Group Holdings Corp. | ex-321ceo906cert1q.htm |

| EX-31.2 - EXHIBIT 31.2 - CURO Group Holdings Corp. | ex-312cfo302cert1q.htm |

| EX-31.1 - EXHIBIT 31.1 - CURO Group Holdings Corp. | ex-311ceo302cert1q.htm |

| EX-10.69 - EXHIBIT 10.69 - CURO Group Holdings Corp. | firstamendmenttorevolvin.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2018

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________to__________

Commission File Number 1-38315

CURO GROUP HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

Delaware | 90-0934597 | |

(State or other jurisdiction Of incorporation or organization) | (I.R.S. Employer Identification No.) | |

3527 North Ridge Road, Wichita, KS | 67205 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (316) 425-1410

Former name, former address and former fiscal year, if changed since last report: No Changes

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ | |

Non-accelerated filer | ☒ | (Do not check if a smaller reporting company) | ||

Smaller reporting company | ☐ | Emerging growth company | ☒ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

At May 1, 2018 there were 45,561,419 shares of the registrant’s Common Stock, $0.001 par value per share, outstanding.

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

FORM 10-Q

FIRST QUARTER ENDED MARCH 31, 2018

INDEX

Page | |||||||

Item 1. | Financial Statements (unaudited) | ||||||

March 31, 2018 and December 31, 2017 | |||||||

Three months ended March 31, 2018 and 2017 | |||||||

Three months ended March 31, 2018 and 2017 | |||||||

Three months ended March 31, 2018 and 2017 | |||||||

Item 2. | |||||||

Item 3. | |||||||

Item 4. | |||||||

Item 1. | |||||||

Item 1A. | |||||||

Item 2. | |||||||

Item 3. | |||||||

Item 4. | |||||||

Item 5. | |||||||

Item 6. | |||||||

2

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

March 31, 2018 | December 31, 2017 | ||||||

(Unaudited) | |||||||

ASSETS | |||||||

Cash | $ | 130,739 | $ | 162,374 | |||

Restricted cash (includes restricted cash of consolidated VIEs of $12,268 and $6,871 as of March 31, 2018 and December 31, 2017, respectively) | 17,656 | 12,117 | |||||

Gross loans receivable (includes loans of consolidated VIEs of $186,492 and $213,846 as of March 31, 2018 and December 31, 2017, respectively) | 389,838 | 432,837 | |||||

Less: allowance for loan losses (includes loans of consolidated VIEs of $36,619 and $46,140 as of March 31, 2018 and December 31, 2017, respectively) | (60,886 | ) | (69,568 | ) | |||

Loans receivable, net | 328,952 | 363,269 | |||||

Deferred income taxes | 1,817 | 772 | |||||

Income taxes receivable | — | 3,455 | |||||

Prepaid expenses and other | 32,753 | 42,512 | |||||

Property and equipment, net | 83,522 | 87,086 | |||||

Goodwill | 145,764 | 145,607 | |||||

Other intangibles, net of accumulated amortization of $42,540 and $41,156 as of March 31, 2018 and December 31, 2017, respectively) | 31,961 | 32,769 | |||||

Other | 12,217 | 9,770 | |||||

Total Assets | $ | 785,381 | $ | 859,731 | |||

LIABILITIES AND STOCKHOLDER’S EQUITY | |||||||

Accounts payable and accrued liabilities | $ | 52,860 | $ | 55,792 | |||

Deferred revenue | 10,152 | 11,984 | |||||

Income taxes payable | 8,734 | 4,120 | |||||

Accrued interest (includes accrued interest of consolidated VIEs of $1,263 and $1,266 as of March 31, 2018 and December 31, 2017, respectively) | 6,384 | 25,467 | |||||

Credit services organization guarantee liability | 10,412 | 17,795 | |||||

Deferred rent | 11,732 | 11,577 | |||||

Long-term debt (includes long-term debt and issuance costs of consolidated VIEs of $115,071 and $3,921 as of March 31, 2018 and $124,590 and $4,188 as of December 31, 2017, respectively) | 622,644 | 706,225 | |||||

Subordinated shareholder debt | 2,322 | 2,381 | |||||

Other long-term liabilities | 6,199 | 5,768 | |||||

Deferred tax liabilities | 11,393 | 11,486 | |||||

Total Liabilities | 742,832 | 852,595 | |||||

Commitments and contingencies | |||||||

Stockholder's Equity | |||||||

Preferred stock - $0.001 par value, 25,000,000 shares authorized and no shares were issued at either period end | — | — | |||||

Class A common stock - $0.001 par value; 225,000,000 shares authorized; issued and outstanding of 45,561,419 and 44,561,419 as of March 31, 2018 and December 31, 2017, respectively) | 9 | 8 | |||||

Paid-in capital | 61,056 | 46,079 | |||||

Retained earnings | 27,279 | 3,988 | |||||

Accumulated other comprehensive loss | (45,795 | ) | (42,939 | ) | |||

Total Stockholder’s Equity | 42,549 | 7,136 | |||||

Total Liabilities and Stockholder’s Equity | $ | 785,381 | $ | 859,731 | |||

See accompanying Notes to Condensed Consolidated Financial Statements.

3

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in thousands)

(unaudited)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Revenue | $ | 261,758 | $ | 224,580 | |||

Provision for losses | 81,031 | 61,736 | |||||

Net revenue | 180,727 | 162,844 | |||||

Cost of providing services | |||||||

Salaries and benefits | 26,918 | 26,433 | |||||

Occupancy | 13,427 | 14,095 | |||||

Office | 6,981 | 4,868 | |||||

Other costs of providing services | 14,400 | 14,855 | |||||

Advertising | 9,756 | 7,688 | |||||

Total cost of providing services | 71,482 | 67,939 | |||||

Gross margin | 109,245 | 94,905 | |||||

Operating expense | |||||||

Corporate, district and other | 40,454 | 32,993 | |||||

Interest expense | 22,349 | 23,366 | |||||

Loss on extinguishment of debt | 11,683 | 12,458 | |||||

Total operating expense | 74,486 | 68,817 | |||||

Net income before income taxes | 34,759 | 26,088 | |||||

Provision for income taxes | 11,467 | 9,450 | |||||

Net income | $ | 23,292 | $ | 16,638 | |||

Weighted average common shares outstanding: | |||||||

Basic | 45,506 | 37,895 | |||||

Diluted | 47,416 | 38,959 | |||||

Net income per common share: | |||||||

Basic earnings per share | $ | 0.51 | $ | 0.44 | |||

Diluted earnings per share: | $ | 0.49 | $ | 0.43 | |||

See accompanying Notes to Condensed Consolidated Financial Statements.

4

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands)

(unaudited)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Net income | $ | 23,292 | $ | 16,638 | |||

Other comprehensive income (loss): | |||||||

Cash flow hedges, net of $0 tax in all periods | 54 | (42 | ) | ||||

Foreign currency translation adjustment, net of $0 tax in all periods | (2,910 | ) | 2,790 | ||||

Other comprehensive income (loss) | (2,856 | ) | 2,748 | ||||

Comprehensive income | $ | 20,436 | $ | 19,386 | |||

See accompanying Notes to Condensed Consolidated Financial Statements.

5

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Cash flows from operating activities | |||||||

Net income | $ | 23,292 | $ | 16,638 | |||

Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

Depreciation and amortization | 4,660 | 4,654 | |||||

Provision for loan losses | 81,031 | 61,736 | |||||

Amortization of debt issuance costs | (34 | ) | 770 | ||||

Amortization of bond discount/(premium) | 1,163 | 14 | |||||

Deferred income tax benefit | (1,094 | ) | (504 | ) | |||

Loss on disposal of property and equipment | 478 | 10 | |||||

Loss on extinguishment of debt | 11,683 | 12,458 | |||||

Call premium payment from debt extinguishment | (9,300 | ) | — | ||||

Increase in cash surrender value of life insurance | (1,482 | ) | (502 | ) | |||

Share-based compensation expense | 1,842 | 126 | |||||

Changes in operating assets and liabilities: | |||||||

Loans receivable | (55,975 | ) | (34,818 | ) | |||

Prepaid expenses and other assets | 9,739 | 4,792 | |||||

Accounts payable and accrued liabilities | (3,239 | ) | (9,345 | ) | |||

Deferred revenue | (1,734 | ) | (1,715 | ) | |||

Income taxes payable | 19,629 | (841 | ) | ||||

Income taxes receivable | (7,411 | ) | 3,816 | ||||

Deferred rent | 180 | 194 | |||||

Accrued Interest | (19,084 | ) | (292 | ) | |||

Other liabilities | 443 | (266 | ) | ||||

Net cash provided by operating activities | 54,787 | 56,925 | |||||

Cash flows from investing activities | |||||||

Purchase of property, equipment and software | (1,609 | ) | (3,093 | ) | |||

Cash paid for Cognical Holdings preferred shares | (958 | ) | — | ||||

Changes in restricted cash | (5,403 | ) | (6,993 | ) | |||

Net cash (used in) investing activities | (7,970 | ) | (10,086 | ) | |||

Cash flows from financing activities | |||||||

Net proceeds from issuance of common stock | 13,135 | — | |||||

Proceeds from Non-Recourse U.S. SPV facility and ABL facility | 3,000 | 19,802 | |||||

Payments on Non-Recourse U.S. SPV facility and ABL facility | (12,519 | ) | (11,797 | ) | |||

Proceeds from issuance of 12.00% Senior Secured Notes | — | 461,329 | |||||

Payments on 10.75% Senior Secured Notes | — | (426,034 | ) | ||||

Payments on 12.00% Senior Secured Notes | (77,500 | ) | — | ||||

Payments on 12.00% Senior Cash Pay Notes | — | (125,000 | ) | ||||

Debt issuance costs paid | (71 | ) | (13,690 | ) | |||

Proceeds from credit facilities | 10,000 | — | |||||

Payments on credit facilities | (10,000 | ) | — | ||||

Net cash (used in) financing activities | (73,955 | ) | (95,390 | ) | |||

Effect of exchange rate changes on cash | (4,497 | ) | 829 | ||||

Net (decrease) in cash | (31,635 | ) | (47,722 | ) | |||

Cash at beginning of period | 162,374 | 193,525 | |||||

Cash at end of period | $ | 130,739 | $ | 145,803 | |||

6

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND NATURE OF OPERATIONS

Basis of Presentation

The terms “CURO," "CGHC," "we,” “our,” “us,” and the “Company,” refer to CURO Group Holdings Corp. and its directly and indirectly owned subsidiaries as a combined entity, except where otherwise stated. The term "CFTC" refers to CURO Financial Technologies Corp., a subsidiary of CURO, and its directly and indirectly owned subsidiaries as a consolidated entity, except where otherwise stated.

The accompanying unaudited Condensed Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”), and with the accounting policies described in our 2017 Annual Report on Form 10-K. Certain information and note disclosures normally included in our annual financial statements prepared in accordance with US GAAP have been condensed or omitted, although we believe that the disclosures are adequate to enable a reasonable understanding of the information presented.

The unaudited Condensed Consolidated Financial Statements and the accompanying notes (the “Interim Statements”) reflect all adjustments, which are, in the opinion of management, necessary to present fairly our results of operations, financial position and cash flows for the periods presented. The adjustments consist solely of normal recurring adjustments. The Interim Statements should be read in conjunction with the Consolidated Financial Statements and related Notes included in our 2017 Annual Report on Form 10-K. Interim results of operations are not necessarily indicative of results that may be expected for future interim periods or for the entire year ending December 31, 2018.

We completed our initial public offering ("IPO") in December 2017. Prior to our IPO we filed a certificate of amendment to our certificate of incorporation that effected a 36-for-1 split of our common stock. All share and per share data have been retroactively adjusted for all periods presented to reflect the stock split as if the stock split had occurred at the beginning of the earliest period presented.

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other requirements that are otherwise generally applicable to public companies. We have elected to take advantage of these reduced reporting and other requirements available to us.

Principles of Consolidation

The Condensed Consolidated Financial Statements include the accounts of CURO and its wholly-owned subsidiaries. Intercompany transactions and balances have been eliminated in consolidation.

Use of Estimates

The preparation of Condensed Consolidated Financial Statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements. Estimates also affect the reported amounts of revenues and expenses during the periods reported. Some of the significant estimates that we have made in the accompanying Condensed Consolidated Financial Statements include allowances for loan losses, certain assumptions related to goodwill and intangibles, accruals related to self-insurance, Credit Services Organization ("CSO") guarantee liability and estimated tax liabilities. Actual results may differ from those estimates.

Nature of Operations

We are a growth-oriented, technology-enabled, highly-diversified consumer finance company serving a wide range of underbanked consumers in the United States, the United Kingdom and Canada.

7

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

Recently Adopted Accounting Pronouncements

In May 2017, the Financial Accounting Standards Board ("FASB") issued ASU 2017-09, Compensation - Stock Compensation (Topic 718): Scope of Modification Accounting ("ASU 2017-09"). Under modification accounting, an entity is required to re-value its equity awards each time there is a modification to the terms of the awards. The provisions in ASU 2017-09 provide guidance about which changes to the terms or conditions of a share-based payment award require an entity to account for the effects of a modification, unless certain conditions are met. The amendments in this update were effective for all entities for annual periods, and interim periods within those annual periods, beginning after December 15, 2017. ASU 2017-09 was effective for us as of January 1, 2018. The adoption of this amendment did not have a material impact on our Consolidated Financial Statements.

Recently Issued Accounting Pronouncements Not Yet Adopted

In February 2018, the FASB issued ASU 2018-02, Income Statement - Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive income ("ASU 2018-02"). Current US GAAP requires deferred tax liabilities and assets to be adjusted for the effect of a change in tax laws or rates with the effect included in income from continuing operations in the period the change is enacted, including items of other comprehensive income for which the related tax effects are presented in other comprehensive income (“stranded tax effects”). ASU 2018-02 allows, but does not require, companies to reclassify stranded tax effects caused by the 2017 Tax Cuts and Jobs Act from accumulated other comprehensive income to retained earnings. Additionally, ASU 2018-02 requires new disclosures by all companies, whether they opt to do the reclassification or not. The provisions of ASU 2018-02 are effective for all entities for fiscal years beginning after December 15, 2018, and interim periods within those fiscal years. Early adoption is permitted. Companies should apply the proposed amendments either in the period of adoption or retrospectively to each period (or periods) in which the effect of the change in the U.S. federal corporate income tax rate in the Tax Cuts and Jobs Act is recognized. We are currently assessing the impact adoption of ASU 2018-02 will have on our Consolidated Financial Statements.

In September 2017, the FASB issued ASU 2017-13, Revenue Recognition (Topic 605), Revenue from Contracts with Customers (Topic 606), Leases (Topic 840), and Leases (Topic 842): Amendments to SEC Paragraphs Pursuant to the Staff Announcement at the July 20, 2017 EITF Meeting and Rescission of Prior SEC Staff Announcements and Observer Comments ("ASU 2017-13"). ASU 2017-13 amends the early adoption date option for public business entities related to the adoption of ASU No. 2014-09 and ASU No. 2016-02. We are currently assessing the impact adoption of Topic 606 and Topic 842 will have on our Consolidated Financial Statements.

In January 2017, the FASB issued ASU 2017-04, Intangibles - Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment ("ASU 2017-04"). The amendments in ASU 2017-04 simplified the goodwill impairment test by eliminating Step 2 of the test which requires an entity to compute the implied fair value of goodwill. Instead, an entity should recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit's fair value, and is limited to the amount of total goodwill allocated to that reporting unit. Under ASU 2017-04, an entity still has the option to perform the qualitative assessment for a reporting unit to determine if the quantitative impairment test is necessary. The provisions of ASU 2017-04 are effective for a public entity's annual or interim goodwill impairment tests in fiscal years beginning after December 15, 2019 and effective for us, as an emerging growth company, in fiscal years beginning after December 15, 2021. We are currently assessing the impact adoption of ASU 2017-04 will have on our Consolidated Financial Statements.

In January 2017, the FASB issued ASU 2017-01, Business Combinations (Topic 805): Clarifying the definition of a Business ("ASU 2017-01"). The amendments in ASU 2017-01 narrow the definition of a business and provide a framework that gives an entity a basis for making reasonable judgments about whether a transaction involves an asset or a business and provide a screen to determine when a set (an integrated set of assets and activities) is not a business. The screen requires a determination that when substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets, the set is not a business. If the screen is not met, the amendments in ASU 2017-01 (i) require that to be considered a business, a set must include, at a minimum, an input and a substantive process that together significantly contribute to the ability to create

8

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

output and (ii) remove the evaluation of whether a market participant could replace missing elements. The amendments provide a framework to assist entities in evaluating whether both an input and a substantive process are present. ASU 2017-01 is effective prospectively for public companies for annual periods beginning after December 15, 2017 including interim periods therein, and it will be effective for us, as an emerging growth company, for annual periods beginning after December 15, 2018 and interim periods beginning after December 15, 2019. We are currently assessing the impact adoption of ASU 2017-01 will have on our Consolidated Financial Statements.

In November 2016, the FASB issued ASU 2016-18, Statement of Cash Flows (Topic 230): Restricted Cash ("ASU 2016-18"). The amendments in ASU 2016-18 require that a statement of cash flows explain the change during the period in the total of cash, cash equivalents, and amounts generally described as restricted cash or restricted cash equivalents. As a result, amounts generally described as restricted cash and restricted cash equivalents should be included with cash and cash equivalents when reconciling the beginning-of-period and end-of-period total amounts shown on the statement of cash flows. ASU 2016-18 is effective for public companies for fiscal years beginning after December 15, 2017 and interim periods therein, and it will be effective for us, as an emerging growth company, for fiscal years beginning after December 15, 2018 and interim periods beginning after December 15, 2019. The amendments should be applied using a retrospective transition method to each period presented. We are currently assessing the impact adoption of ASU 2016-18 will have on our Consolidated Financial Statements.

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments (a consensus of the Emerging Issues Task Force) (“ASU 2016-15”). The amendments in ASU 2016-15 provide guidance on eight specific cash flow issues, including debt prepayment or debt extinguishment costs, contingent consideration payments made after a business combination, distributions received from equity method investees and beneficial interests in securitization transactions. ASU 2016-15 is effective for public companies for fiscal years beginning after December 15, 2017 and interim periods within those fiscal years, and it will be effective for us, as an emerging growth company, for fiscal years beginning after December 15, 2018 and interim periods within fiscal years beginning after December 15, 2019. We are currently assessing the potential impact ASU 2016-15 will have on our Consolidated Statements of Cash Flows.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments” ("ASU 2016-13"). This ASU modifies the impairment model to utilize an expected loss methodology in place of the currently used incurred loss methodology, which will result in the more timely recognition of losses. ASU 2016-13 will be effective for public companies for fiscal years beginning after December 15, 2019 and interim periods within those fiscal years, and it will be effective for us, as an emerging growth company, for fiscal years beginning after December 15, 2020 and interim periods within fiscal years beginning after December 15, 2021. We are currently assessing the impact ASU 2016-13 will have on our Consolidated Financial Statements.

In February 2016, the FASB issued its new lease accounting guidance in ASU No. 2016-02, Leases (Topic 842) (“ASU 2016-02”). ASU 2016-02 requires lessees to recognize the following for all leases (with the exception of short-term leases) at the commencement date: (i) a lease liability, which is a lessee’s obligation to make lease payment arising from a lease, measured on a discounted basis; and (ii) a right-of-use asset, which is an asset that represents the lessee’s right to use, or control the use of, a specified asset for the lease term. Under the new guidance, lessor accounting is largely unchanged and lessees will no longer be provided with a source of off-balance sheet financing. ASU 2016-02 will be effective for public companies for fiscal years beginning after December 15, 2018 and interim periods within those fiscal years, and it will be effective for us, as an emerging growth company, for fiscal years beginning after December 15, 2019 and interim periods within fiscal years beginning after December 15, 2020. Early adoption is permitted. Lessees (for capital and operating leases) and lessors (for sales-type, direct financing, and operating leases) must apply a modified retrospective transition approach for leases existing at, or entered into after, the beginning of the earliest comparative period presented in the financial statements. The modified retrospective approach would not require any transition accounting for leases that expired before the earliest comparative period presented. Lessees and lessors may not apply a full retrospective transition approach. We are currently assessing the impact ASU 2016-02 will have on our Consolidated Financial Statements.

9

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

In January 2016, the FASB issued ASU No. 2016-01, Financial Instruments-Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities (“ASU 2016-01”) which requires (i) equity investments (except those accounted for under the equity method of accounting, or those that result in consolidation of the investee) to be measured at fair value with changes in fair value recognized in net income, (ii) public business entities to use the exit price notion when measuring the fair value of financial instruments for disclosure purposes and (iii) separate presentation of financial assets and financial liabilities by measurement category and form of financial asset (i.e., securities or loans and receivables). ASU 2016-01 eliminates the requirement to disclose the method(s) and significant assumptions used to estimate the fair value that is required to be disclosed for financial instruments measured at amortized cost. ASU 2016-01 is effective for public companies for fiscal years beginning after December 15, 2017 and interim periods within those fiscal years, and it will be effective for us, as an emerging growth company, for fiscal years beginning after December 15, 2018 and interim periods within fiscal years beginning after December 15, 2019. We are currently assessing the impact this ASU will have on our Consolidated Financial Statements.

In November 2015, the FASB issued ASU No. 2015-17, Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes (“ASU 2015-17”). ASU 2015-07 eliminates the requirement for organizations to present deferred tax liabilities and assets as current and noncurrent in a classified balance sheet. Instead, organizations will be required to classify all deferred tax assets and liabilities as noncurrent. ASU 2015-17 was effective for public companies for fiscal years beginning after December 15, 2016 and interim periods within those fiscal years, and it will be effective for us, as an emerging growth company, for fiscal years beginning after December 15, 2017 and interim periods within fiscal years beginning after December 15, 2018. We do not expect that adoption of this amendment will have a material impact on our Consolidated Financial Statements.

In August 2015, the FASB issued ASU 2015-14, Revenue from Contracts with Customers (Topic 606) (“ASU 2015-14”), which deferred the effect date of ASU 2014-09, Revenue from Contracts with Customers (Topic 606) (“ASU 2014-09”), for public companies to fiscal years beginning after December 15, 2017 and interim periods within those fiscal years, and it will be effective for us, as an emerging growth company, for fiscal years beginning after December 15, 2018 and interim periods within fiscal years beginning after December 15, 2019. If we are no longer an emerging growth company as of December 31, 2018, we will be required to adopt the provision of this standard retroactively as of January 1, 2018. In May 2014, the FASB issued ASU 2014-09 which amended the existing accounting standards for revenue recognition. ASU 2014-09 establishes principles for recognizing revenue upon the transfer of promised goods or services to customers, in an amount that reflects the expected consideration received in exchange for those goods or services. We do not expect that adoption of ASU 2014-09 will have a material impact on our Consolidated Financial Statements.

NOTE 2 - VARIABLE INTEREST ENTITIES

We hold a credit facility whereby certain loan receivables are sold to wholly-owned, bankruptcy-remote special purpose subsidiaries (VIEs) and additional debt is incurred through the Non-Recourse U.S. SPV facility (See Note 5, "Long-Term Debt," for further discussion) that is collateralized by these underlying loan receivables.

We have determined that we are the primary beneficiary of the VIEs and are required to consolidate them. We include the assets and liabilities related to the VIEs in our Consolidated Financial Statements and we account for them as secured borrowings. We parenthetically disclose on our Consolidated Balance Sheets the VIEs’ assets that can only be used to settle the VIEs' obligations and liabilities if the VIEs’ creditors have no recourse against our general credit.

10

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

The carrying amounts of consolidated VIEs' assets and liabilities associated with our special purpose subsidiaries were as follows:

(in thousands) | March 31, 2018 | December 31, 2017 | |||||

Assets | |||||||

Restricted Cash | $ | 12,268 | $ | 6,871 | |||

Loans receivable less allowance for loan losses | 149,873 | 167,706 | |||||

Total Assets | $ | 162,141 | $ | 174,577 | |||

Liabilities | |||||||

Accounts payable and accrued liabilities | $ | 15 | $ | 12 | |||

Accrued interest | 1,263 | 1,266 | |||||

Long-term debt | 111,150 | 120,402 | |||||

Total Liabilities | $ | 112,428 | $ | 121,680 | |||

NOTE 3 – LOANS RECEIVABLE AND REVENUE

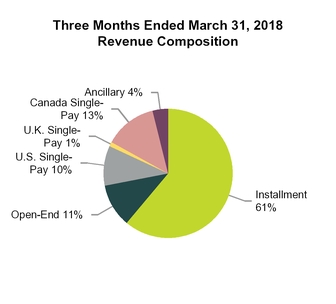

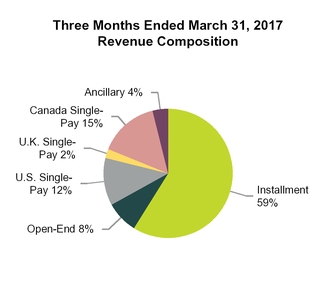

The following table summarizes revenue by product for the periods indicated:

Three Months Ended March 31, | |||||||

(in thousands) | 2018 | 2017 | |||||

Unsecured Installment | $ | 132,946 | $ | 109,431 | |||

Secured Installment | 26,856 | 23,669 | |||||

Open-End | 27,223 | 17,907 | |||||

Single-Pay | 63,705 | 63,790 | |||||

Ancillary | 11,028 | 9,783 | |||||

Total revenue | $ | 261,758 | $ | 224,580 | |||

The following tables summarize Loans receivable by product and the related delinquent loans receivable at March 31, 2018:

March 31, 2018 | ||||||||||||||||

(in thousands) | Single-Pay | Unsecured Installment | Secured Installment | Open-End | Total | |||||||||||

Current loans receivable | $ | 87,075 | $ | 132,159 | $ | 65,448 | $ | 51,564 | $ | 336,246 | ||||||

Delinquent loans receivable | — | 39,273 | 14,319 | — | 53,592 | |||||||||||

Total loans receivable | 87,075 | 171,432 | 79,767 | 51,564 | 389,838 | |||||||||||

Less: allowance for losses | (4,485 | ) | (37,916 | ) | (11,639 | ) | (6,846 | ) | (60,886 | ) | ||||||

Loans receivable, net | $ | 82,590 | $ | 133,516 | $ | 68,128 | $ | 44,718 | $ | 328,952 | ||||||

11

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

March 31, 2018 | ||||||||||

(in thousands) | Unsecured Installment | Secured Installment | Total | |||||||

Delinquent loans receivable | ||||||||||

0-30 days past due | $ | 13,133 | $ | 6,274 | $ | 19,407 | ||||

31-60 days past due | 12,500 | 4,366 | 16,866 | |||||||

61-90 days past due | 13,640 | 3,679 | 17,319 | |||||||

Total delinquent loans receivable | $ | 39,273 | $ | 14,319 | $ | 53,592 | ||||

The following tables summarize Loans receivable by product and the related delinquent loans receivable at December 31, 2017:

December 31, 2017 | ||||||||||||||||

(in thousands) | Single-Pay | Unsecured Installment | Secured Installment | Open-End | Total | |||||||||||

Current loans receivable | $ | 99,400 | $ | 151,343 | $ | 73,165 | $ | 47,949 | $ | 371,857 | ||||||

Delinquent loans receivable | — | 44,963 | 16,017 | — | 60,980 | |||||||||||

Total consumer loans receivable | 99,400 | 196,306 | 89,182 | 47,949 | 432,837 | |||||||||||

Less: allowance for losses | (5,916 | ) | (43,754 | ) | (13,472 | ) | (6,426 | ) | (69,568 | ) | ||||||

Consumer loans receivable, net | $ | 93,484 | $ | 152,552 | $ | 75,710 | $ | 41,523 | $ | 363,269 | ||||||

December 31, 2017 | ||||||||||

(in thousands) | Unsecured Installment | Secured Installment | Total | |||||||

Delinquent loans receivable | ||||||||||

0-30 days past due | $ | 18,358 | $ | 8,116 | $ | 26,474 | ||||

31-60 days past due | 12,836 | 3,628 | 16,464 | |||||||

61-90 days past due | 13,769 | 4,273 | 18,042 | |||||||

Total delinquent loans receivable | $ | 44,963 | $ | 16,017 | $ | 60,980 | ||||

The following tables summarize loans guaranteed by us under our CSO programs and the related delinquent receivables at March 31, 2018:

March 31, 2018 | ||||||||||

(in thousands) | Unsecured Installment | Secured Installment | Total | |||||||

Current loans receivable guaranteed by the Company | $ | 45,922 | $ | 2,329 | $ | 48,251 | ||||

Delinquent loans receivable guaranteed by the Company | 8,410 | 437 | 8,847 | |||||||

Total loans receivable guaranteed by the Company | 54,332 | 2,766 | 57,098 | |||||||

Less: CSO guarantee liability | (9,886 | ) | (526 | ) | (10,412 | ) | ||||

Loans receivable guaranteed by the Company, net | $ | 44,446 | $ | 2,240 | $ | 46,686 | ||||

12

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

March 31, 2018 | ||||||||||

(in thousands) | Unsecured Installment | Secured Installment | Total | |||||||

Delinquent loans receivable | ||||||||||

0-30 days past due | $ | 6,358 | $ | 379 | $ | 6,737 | ||||

31-60 days past due | 1,078 | 30 | 1,108 | |||||||

61-90 days past due | 974 | 28 | 1,002 | |||||||

Total delinquent loans receivable | $ | 8,410 | $ | 437 | $ | 8,847 | ||||

The following tables summarize loans guaranteed by us under our CSO programs and the related delinquent receivables at December 31, 2017:

December 31, 2017 | ||||||||||

(in thousands) | Unsecured Installment | Secured Installment | Total | |||||||

Current loans receivable guaranteed by the Company | $ | 62,676 | $ | 3,098 | $ | 65,774 | ||||

Delinquent loans receivable guaranteed by the Company | 12,480 | 537 | 13,017 | |||||||

Total loans receivable guaranteed by the Company | 75,156 | 3,635 | 78,791 | |||||||

Less: CSO guarantee liability | (17,073 | ) | (722 | ) | (17,795 | ) | ||||

Loans receivable guaranteed by the Company, net | $ | 58,083 | $ | 2,913 | $ | 60,996 | ||||

December 31, 2017 | ||||||||||

(in thousands) | Unsecured Installment | Secured Installment | Total | |||||||

Delinquent loans receivable | ||||||||||

0-30 days past due | $ | 10,477 | $ | 459 | $ | 10,936 | ||||

31-60 days past due | 1,364 | 41 | 1,405 | |||||||

61-90 days past due | 639 | 37 | 676 | |||||||

Total delinquent loans receivable | $ | 12,480 | $ | 537 | $ | 13,017 | ||||

The following table summarizes activity in the allowance for loan losses during the three months ended March 31, 2018:

Three Months Ended March 31, 2018 | ||||||||||||||||||

(in thousands) | Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | ||||||||||||

Balance, beginning of period | $ | 5,916 | $ | 43,754 | $ | 13,472 | $ | 6,426 | $ | — | $ | 69,568 | ||||||

Charge-offs | (47,707 | ) | (39,377 | ) | (11,485 | ) | (20,349 | ) | (675 | ) | (119,593 | ) | ||||||

Recoveries | 35,009 | 5,967 | 2,866 | 9,377 | 47 | 53,266 | ||||||||||||

Net charge-offs | (12,698 | ) | (33,410 | ) | (8,619 | ) | (10,972 | ) | (628 | ) | (66,327 | ) | ||||||

Provision for losses | 11,302 | 27,477 | 6,786 | 11,428 | 628 | 57,621 | ||||||||||||

Effect of foreign currency translation | (35 | ) | 95 | — | (36 | ) | — | 24 | ||||||||||

Balance, end of period | $ | 4,485 | $ | 37,916 | $ | 11,639 | $ | 6,846 | $ | — | $ | 60,886 | ||||||

Allowance for loan losses as a percentage of gross loan receivables | 5.2 | % | 22.1 | % | 14.6 | % | 13.3 | % | N/A | 15.6 | % | |||||||

13

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

The following table summarizes activity in the CSO guarantee liability during the three months ended March 31, 2018:

Three Months Ended March 31, 2018 | |||||||||

(in thousands) | Unsecured Installment | Secured Installment | Total | ||||||

Balance, beginning of period | $ | 17,073 | $ | 722 | $ | 17,795 | |||

Charge-offs | (41,719 | ) | (1,219 | ) | (42,938 | ) | |||

Recoveries | 10,976 | 1,169 | 12,145 | ||||||

Net charge-offs | (30,743 | ) | (50 | ) | (30,793 | ) | |||

Provision for losses | 23,556 | (146 | ) | 23,410 | |||||

Balance, end of period | $ | 9,886 | $ | 526 | $ | 10,412 | |||

The following table summarizes activity in the allowance for loan losses and the CSO guarantee liability, in total, during the three months ended March 31, 2018:

Three Months Ended March 31, 2018 | ||||||||||||||||||

(in thousands) | Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | ||||||||||||

Balance, beginning of period | $ | 5,916 | $ | 60,827 | $ | 14,194 | $ | 6,426 | $ | — | $ | 87,363 | ||||||

Charge-offs | (47,707 | ) | (81,096 | ) | (12,704 | ) | (20,349 | ) | (675 | ) | (162,531 | ) | ||||||

Recoveries | 35,009 | 16,943 | 4,035 | 9,377 | 47 | 65,411 | ||||||||||||

Net charge-offs | (12,698 | ) | (64,153 | ) | (8,669 | ) | (10,972 | ) | (628 | ) | (97,120 | ) | ||||||

Provision for losses | 11,302 | 51,033 | 6,640 | 11,428 | 628 | 81,031 | ||||||||||||

Effect of foreign currency translation | (35 | ) | 95 | — | (36 | ) | — | 24 | ||||||||||

Balance, end of period | $ | 4,485 | $ | 47,802 | $ | 12,165 | $ | 6,846 | $ | — | $ | 71,298 | ||||||

14

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

The following table summarizes activity in the allowance for loan losses during the three months ended March 31, 2017:

Three Months Ended March 31, 2017 | ||||||||||||||||||

(in thousands) | Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | ||||||||||||

Balance, beginning of period | $ | 5,425 | $ | 17,853 | $ | 10,737 | $ | 5,179 | $ | — | $ | 39,194 | ||||||

Charge-offs | (44,885 | ) | — | — | (9,229 | ) | (1,139 | ) | (55,253 | ) | ||||||||

Recoveries | 33,227 | 4,840 | 3,028 | 5,353 | 752 | 47,200 | ||||||||||||

Net charge-offs | (11,658 | ) | 4,840 | 3,028 | (3,876 | ) | (387 | ) | (8,053 | ) | ||||||||

Provision for losses | 10,894 | 19,309 | 6,504 | 3,265 | 387 | 40,359 | ||||||||||||

Effect of foreign currency translation | 58 | 38 | 1 | 4 | — | 101 | ||||||||||||

Balance, end of period | $ | 4,719 | $ | 42,040 | $ | 20,270 | $ | 4,572 | $ | — | $ | 71,601 | ||||||

Allowance for loan losses as a percentage of gross loan receivables | 5.9 | % | 32.0 | % | 30.0 | % | 17.8 | % | N/A | 23.5 | % | |||||||

The following table summarizes activity in the CSO guarantee liability during the three months ended March 31, 2017:

Three Months Ended March 31, 2017 | ||||||||||||

(in thousands) | Single-Pay | Unsecured Installment | Secured Installment | Total | ||||||||

Balance, beginning of period | $ | 274 | $ | 15,630 | $ | 1,148 | $ | 17,052 | ||||

Charge-offs | (1,821 | ) | (27,647 | ) | (3,163 | ) | (32,631 | ) | ||||

Recoveries | 659 | 10,957 | 2,371 | 13,987 | ||||||||

Net charge-offs | (1,162 | ) | (16,690 | ) | (792 | ) | (18,644 | ) | ||||

Provision for losses | 904 | 19,542 | 931 | 21,377 | ||||||||

Balance, end of period | $ | 16 | $ | 18,482 | $ | 1,287 | $ | 19,785 | ||||

The following table summarizes activity in the allowance for loan losses and the CSO guarantee liability, in total, during the three months ended March 31, 2017:

Three Months Ended March 31, 2017 | ||||||||||||||||||

(in thousands) | Single-Pay | Unsecured Installment | Secured Installment | Open-End | Other | Total | ||||||||||||

Balance, beginning of period | $ | 5,699 | $ | 33,483 | $ | 11,885 | $ | 5,179 | $ | — | $ | 56,246 | ||||||

Charge-offs | (46,706 | ) | (27,647 | ) | (3,163 | ) | (9,229 | ) | (1,139 | ) | (87,884 | ) | ||||||

Recoveries | 33,886 | 15,797 | 5,399 | 5,353 | 752 | 61,187 | ||||||||||||

Net charge-offs | (12,820 | ) | (11,850 | ) | 2,236 | (3,876 | ) | (387 | ) | (26,697 | ) | |||||||

Provision for losses | 11,798 | 38,851 | 7,435 | 3,265 | 387 | 61,736 | ||||||||||||

Effect of foreign currency translation | 58 | 38 | 1 | 4 | — | 101 | ||||||||||||

Balance, end of period | $ | 4,735 | $ | 60,522 | $ | 21,557 | $ | 4,572 | $ | — | $ | 91,386 | ||||||

NOTE 4 – CREDIT SERVICES ORGANIZATION

The CSO fee receivable amounts under our CSO programs were $9.9 million and $14.5 million at March 31, 2018 and December 31, 2017, respectively. As noted, we bear the risk of loss through our guarantee to purchase any defaulted customer loans from the lenders. The terms of these loans range from three to eighteen months. This guarantee represents an obligation to purchase specific loans that go into default. As of March 31, 2018 and December 31, 2017, the maximum amount payable under all such guarantees was $48.0 million and $65.2 million,

15

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

respectively. Our guarantee liability was $10.4 million and $17.8 million at March 31, 2018 and December 31, 2017, respectively.

We have placed $13.3 million and $17.9 million in collateral accounts for the lenders at March 31, 2018 and December 31, 2017, respectively, which is reflected in "Prepaid expenses and other" in the Condensed Consolidated Balance Sheets. The balances required to be maintained in these collateral accounts vary based upon lender but are typically based on a percentage of the outstanding loan balances held by the lender. The percentage of outstanding loan balances required for collateral is defined within the terms agreed to between us and each such lender.

NOTE 5 – LONG-TERM DEBT

Long-term debt consisted of the following:

(in thousands) | March 31, 2018 | December 31, 2017 | ||||||

2017 Senior secured notes (due 2022) | $ | 511,493 | $ | 585,823 | ||||

Non-Recourse U.S. SPV Facility | 111,151 | 120,402 | ||||||

Senior Revolver | — | — | ||||||

Long-term debt | $ | 622,644 | $ | 706,225 | ||||

Senior Secured Notes

In February and November 2017, CFTC issued $470.0 million and $135.0 million, respectively, of 12.00% Senior Secured Notes due March 1, 2022 ("Senior Secured Notes"). The February issuance refinanced similar notes that were nearing maturity, and the extinguishment of the existing notes resulted in a pretax loss of $12.5 million in the three months ended March 31, 2017. In connection with these 2017 debt issuances we capitalized financing costs of approximately $18.3 million, the balance of which is included in the Interim Consolidated Balance Sheets as a component of “Long-term debt,” and is being amortized over the term of the Senior Secured Notes and included as a component of interest expense.

On February 5, 2018 CFTC issued a notice of redemption for $77.5 million of its Senior Secured Notes (the transaction whereby the Senior Secured Notes were partially redeemed, the “Redemption”) that were issued by CFTC. The Redemption occurred on March 7, 2018 at a price equal to 112.00% of the principal amount of the Notes redeemed, plus accrued and unpaid interest paid thereon, to the date of Redemption. The Redemption price and the amortization of a corresponding portion of the capitalized financing costs resulted in a loss on Redemption of $11.7 million. Following the Redemption, $527.5 million of the original outstanding principal amount of the Senior Secured Notes remain outstanding. CFTC conducted the Redemption pursuant to the Indenture governing the Senior Secured Notes (the “Indenture”), dated as of February 15, 2017, by and among CFTC, the guarantors party thereto and TMI Trust Company, as trustee and collateral agent. Consistent with the terms of the Indenture, CFTC used a portion of the cash proceeds from our IPO, completed in December 2017, to redeem such Senior Secured Notes.

As of March 31, 2018, CFTC was in full compliance with the covenants and other provisions of the Senior Secured Notes.

Non-Recourse U.S. SPV Facility

In November 2016, CURO Receivables Finance I, LLC, a Delaware limited liability company (the “SPV Borrower”) and a wholly-owned subsidiary, entered into a five-year revolving credit facility with Victory Park Management, LLC and certain other lenders that provides an $80.0 million term loan and $70.0 million revolving borrowing capacity that can expand over time (“Non-Recourse U.S. SPV Facility”). As of March 31, 2018, the SPV Borrower was in full compliance with the covenants and other provisions of the Non-Recourse U.S. SPV Facility.

16

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

Senior Revolver

In September 2017, CFTC and CURO Intermediate Holdings Corp. entered into a $25.0 million Senior Secured Revolving Loan Facility with BayCoast Bank (the “Senior Revolver”). The terms of the Senior Revolver generally conform to the related provisions in the Indenture dated February 15, 2017 for our Senior Secured Notes and complements our other financing sources, while providing seasonal short-term liquidity. In February 2018, the Senior Revolver capacity was increased to $29.0 million as permitted by the Indenture to the Senior Secured Notes based upon consolidated tangible assets. The Senior Revolver is now syndicated with participation by a second bank.

There is $29.0 million maximum availability under the Senior Revolver, including up to $5.0 million of standby letters of credit, for a one-year term, renewable for successive terms following annual review. The Senior Revolver was undrawn at March 31, 2018 and December 31, 2017. As of March 31, 2018, CFTC and CURO Intermediate Holdings Corp. were in full compliance with the covenants and other provisions of the Senior Revolver.

NOTE 6 – SHARE-BASED COMPENSATION

On November 8, 2017, the Company’s shareholders approved a new incentive plan (“2017 Incentive Plan”). The 2017 Incentive Plan provides for the issuance of up to 5.0 million shares, subject to certain adjustment provisions described in the 2017 Incentive Plan, for the granting of stock options, restricted stock awards, restricted stock units (“RSUs”), stock appreciation rights, performance awards and other awards that may be settled in or based upon our common stock. Awards may be granted to certain of our officers, employees, consultants and directors. The 2017 Incentive Plan provides that shares of common stock subject to awards granted become available for issuance if such awards expire, terminate, are canceled for any reason, or are forfeited by the recipient.

On February 5, 2018, the Company issued additional RSUs under the 2017 Incentive Plan. RSUs are typically valued at the date of grant based on the value of our common stock and are expensed using the straight-line method over the service period. Grants of RSUs do not confer full stockholder rights such as voting rights and cash dividends, but provide for additional dividend equivalent RSU awards in lieu of cash dividends. Unvested shares of restricted stock may be forfeited upon termination of employment with the Company depending on the circumstances of the termination, or failure to achieve the required performance condition, if applicable.

A summary of the status of non-vested restricted stock as of March 31, 2018, and changes during the period, is presented in the following table:

Non-vested Restricted Stock | Shares | Weighted Average Grant Date Fair Value | ||||

December 31, 2017 | 1,516,241 | $ | 14.00 | |||

Granted | 32,857 | $ | 17.14 | |||

Vested | — | — | ||||

Forfeited | — | — | ||||

March 31, 2018 | 1,549,098 | $ | 14.07 | |||

Share-based compensation expense for the three months ended March 31, 2018 and 2017, which includes compensation costs from stock options and RSUs, was $1.8 million and $0.1 million, respectively, and is included in the Interim Consolidated Statements of Income as a component of "Corporate, district and other" expense. The increased expense in the three months ended March 31, 2018 is primarily due to grants of RSUs in 2017, as further disclosed in our 2017 Annual Report on Form 10-K.

As of March 31, 2018, there was $20.2 million of unrecognized compensation cost, net of estimated forfeitures, related to share-based awards, which we will recognize over a weighted-average period of 2.7 years.

17

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

NOTE 7 – INCOME TAXES

Our effective tax rate was 33.0% and 36.2% for the three months ended March 31, 2018 and 2017, respectively. On December 22, 2017, H.R. 1, commonly referred to as the Tax Cuts and Jobs Act of 2017 (“the 2017 Tax Act”) was signed by the U.S. President, which enacted various changes to the U.S. corporate tax law. Some of the most significant provisions affecting us include a reduced U.S. corporate income tax rate from 35% to 21% effective in 2018, a one-time “deemed repatriation” tax on unremitted earnings accumulated in non-U.S. jurisdictions and reported on the 2017 corporate income tax return, and a 2018 and forward minimum tax on global intangible low-taxed income ("GILTI"). At 2017 year-end, we recorded an estimated provisional deemed repatriation tax of $8.1 million. Subsequently, the IRS issued additional guidance regarding the calculation of the deemed repatriation tax and we recorded an additional accrual of $1.2 million increasing the effective tax rate by 3.5%. In 2018, we recorded an estimated GILTI tax of $0.6 million increasing the effective tax rate by 1.7%. Additionally, we have not recorded a tax benefit for losses in the UK resulting in an increase of 1.6% and 2.3% to the effective tax rate for the three months ended March 31, 2018 and March 31, 2017, respectively.

As of March 31, 2018, we estimated and provided U.S. net tax of $9.9 million on our cumulative undistributed non-US earnings as part of the 2017 repatriation tax provision and the 2018 GILTI tax in the 2017 Tax Act. We intend to reinvest our foreign earnings indefinitely in our non-U.S. operations and therefore have not provided for any non-U.S. withholding tax that would be assessed on dividend distributions. If the earnings of $160.0 million were distributed to the U.S., we would be subject to estimated Canadian withholding taxes of approximately $8.0 million. In the event the earnings were distributed to the U.S., we would adjust our income tax provision for the period and would determine the amount of foreign tax credit that would be available.

NOTE 8 – FINANCIAL INSTRUMENTS

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. We are required to use valuation techniques that are consistent with the market approach, income approach, and/or cost approach. Inputs to valuation techniques refer to the assumptions that market participants would use in pricing the asset or liability based on market data obtained from independent sources, or unobservable, meaning those that reflect our own estimate about the assumptions market participants would use in pricing the asset or liability based on the best information available in the circumstances. Accounting standards establish a three-level fair value hierarchy based upon the assumptions (inputs) used to price assets or liabilities. The hierarchy requires us to maximize the use of observable inputs and minimize the use of unobservable inputs.

The three levels of inputs used to measure fair value are listed below.

Level 1 – Inputs are unadjusted quoted prices in active markets for identical assets or liabilities that we have access to at the measurement date.

Level 2 – Inputs include quoted market prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability and inputs that are derived principally from or corroborated by observable market data by correlation or other means (market corroborated inputs).

Level 3 – Unobservable inputs reflecting our own judgments about the assumptions market participants would use in pricing the asset or liability since limited market data exists. We develop these inputs based on the best information available, including our own data.

18

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

Financial Assets and Liabilities Not Measured at Fair Value

The table below presents the assets and liabilities that were not measured at fair value at March 31, 2018.

Estimated Fair Value | |||||||||||||||

(dollars in thousands) | Carrying Value March 31, 2018 | Level 1 | Level 2 | Level 3 | March 31, 2018 | ||||||||||

Financial assets: | |||||||||||||||

Cash | $ | 130,739 | $ | 130,739 | $ | — | $ | — | $ | 130,739 | |||||

Restricted cash | 17,656 | 17,656 | — | — | 17,656 | ||||||||||

Loans receivable, net | 328,952 | — | — | 328,952 | 328,952 | ||||||||||

Investment | 6,600 | — | — | 6,600 | 6,600 | ||||||||||

Financial liabilities: | |||||||||||||||

Credit services organization guarantee liability | $ | 10,412 | $ | — | $ | — | $ | 10,412 | $ | 10,412 | |||||

Senior secured notes | 511,493 | — | — | 583,406 | 583,406 | ||||||||||

Non-Recourse U.S. SPV facility | 111,151 | — | — | 115,071 | 115,071 | ||||||||||

Senior Revolver | — | — | — | — | — | ||||||||||

The table below presents the assets and liabilities that were not measured at fair value at December 31, 2017.

Estimated Fair Value | |||||||||||||||

(dollars in thousands) | Carrying Value December 31, 2017 | Level 1 | Level 2 | Level 3 | December 31, 2017 | ||||||||||

Financial assets: | |||||||||||||||

Cash | $ | 162,374 | $ | 162,374 | $ | — | $ | — | $ | 162,374 | |||||

Restricted cash | 12,117 | 12,117 | — | — | 12,117 | ||||||||||

Loans receivable, net | 363,269 | — | — | 363,269 | 363,269 | ||||||||||

Investment | 5,600 | — | — | 5,600 | 5,600 | ||||||||||

Financial liabilities: | |||||||||||||||

Credit services organization guarantee liability | 17,795 | — | — | 17,795 | 17,795 | ||||||||||

2017 Senior Secured notes | 585,823 | — | — | 663,472 | 663,472 | ||||||||||

Non-Recourse U.S. SPV facility | 120,402 | — | — | 124,590 | 124,590 | ||||||||||

Loans receivable are carried on the Interim Consolidated Balance Sheets net of the allowance for estimated loan losses, which we calculate primarily based upon models that back-test subsequent collections history for each type of loan product. The unobservable inputs used to calculate the carrying value include additional quantitative factors, such as current default trends and changes to the portfolio mix are also considered in evaluating the accuracy of the models, as well as additional qualitative factors such as the impact of new loan products, changes to underwriting criteria or lending policies, new store development or entrance into new markets, changes in jurisdictional regulations or laws, recent credit trends and general economic conditions. Loans have terms ranging up to 60 months. The carrying value of loans receivable approximates the fair value.

In connection with our CSO programs, we guarantee consumer loan payment obligations to unrelated third-party lenders for loans that we arrange for consumers on the third-party lenders’ behalf. We are required to purchase from the lender defaulted loans we have guaranteed. The estimated fair value of the guarantee liability related to CSO loans we have guaranteed was $10.4 million and $17.8 million as of March 31, 2018 and December 31, 2017, respectively. We record the initial measurement of this guarantee liability at fair value using Level 3 inputs with subsequent measurement of the liability measured as a contingent loss. The unobservable inputs used to calculate

19

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

fair value include the nature of the loan products, the creditworthiness of the borrowers in the customer base, our historical loan default history for similar loans, industry loan default history, historical collection rates on similar products, current default trends, past-due account roll rates, changes to underwriting criteria or lending policies, new store development or entrance into new markets, changes in jurisdictional regulations or laws, recent credit trends and general economic conditions.

The fair value of our Senior Secured Notes was based on broker quotations. The fair value of the Non-Recourse U.S. SPV facility was based on the cash needed for final settlement.

Derivative Financial Instrument

The Company seeks to minimize risks from foreign currency rate fluctuations on anticipated transactions in the ordinary course of business through the use of cash flow hedges. As of March 31, 2018, we entered into a series of cash flow hedges in which the hedging instruments were forwards to purchase GBP £6.4 million. These contracts will complete in the third quarter of 2018.

We performed an assessment that determined all critical terms of the hedging instrument and the hedged transaction match and, as such, have qualitatively concluded that changes in the hedge instrument’s intrinsic value will completely offset the change in the expected cash flows based on changes in the spot rate. Since the effectiveness of this hedge is assessed based on changes in the hedge instrument’s intrinsic value, the change in the time value of the contract would be excluded from the assessment of hedge effectiveness. We recorded changes in the hedge instrument’s intrinsic value, to the extent that they were effective as a hedge, in "Other comprehensive income." As of March 31, 2018 we have recorded an unrealized gain of $0.1 million in "Other comprehensive income" associated with this hedge.

Purchase of Cognical Holdings Inc. Preferred Shares

During the first quarter of 2018, we purchased 560,872 additional preferred shares of Cognical Holdings, Inc. ("Cognical") for $1.0 million. As a result of this transaction, along with share purchases during 2017, we currently own 10.4% of the equity of Cognical. We record these purchases in "Other assets' on our Consolidated Balance Sheets.

NOTE 9 – STOCKHOLDERS EQUITY

In connection with our IPO in December 2017, the underwriters had a 30-day option to purchase up to an additional 1.0 million shares at the initial public offering prices, less the underwriting discount to over-allotments, if any. The underwriters exercised this option and purchased 1.0 million shares on January 5, 2018. The exercise of this option provided additional proceeds to us of $13.1 million.

NOTE 10 – EARNINGS PER SHARE

The following presents the computation of basic earnings per share (in thousands, except per share amounts):

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Basic: (1) | |||||||

Net income | $ | 23,292 | $ | 16,638 | |||

Weight average common shares | 45,506 | 37,895 | |||||

Basic earnings per share | $ | 0.51 | $ | 0.44 | |||

(1) The share and per share information have been adjusted to reflect the 36-to-1 stock split of our common stock, which occurred during the fourth quarter of 2017. | |||||||

20

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

The following computation reconciles the differences between the basic and diluted earnings per share presentations (in thousands, except per share amounts):

Three Months Ended March 31, | |||||||

2018 | 2017 | ||||||

Diluted: (1) | |||||||

Net income | $ | 23,292 | $ | 16,638 | |||

Weighted average common shares - basic | 45,506 | 37,895 | |||||

Dilutive effect of stock options and restricted stock units | 1,910 | 1,064 | |||||

Weighted average common shares - diluted | 47,416 | 38,959 | |||||

Diluted earnings per share | $ | 0.49 | $ | 0.43 | |||

(1) The share and per share information have been adjusted to reflect the 36-to-1 stock split of our common stock, which occurred during the fourth quarter of 2017. | |||||||

Potential common shares that would have the effect of increasing diluted earnings per share or decreasing diluted loss per share are considered to be anti-dilutive and as such, we do not include these shares in calculating "Diluted earnings per share." For the three months ended March 31, 2018 and 2017, there were no potential common shares excluded from the calculation of diluted earnings per share because their effect was anti-dilutive.

NOTE 11 – SUPPLEMENTAL CASH FLOW INFORMATION

The following table provides supplemental cash flow information:

Three Months Ended March 31, | |||||||

(dollars in thousands) | 2018 | 2017 | |||||

Cash paid for: | |||||||

Interest | $ | 40,225 | $ | 22,824 | |||

Income taxes | 4,431 | 7,700 | |||||

Non-cash investing activities: | |||||||

Property and equipment accrued in accounts payable | $ | 317 | $ | 126 | |||

NOTE 12 – SEGMENT REPORTING

We prepare segment information on the same basis that our chief operating decision maker reviews financial information for operational decision making purposes. We have three reportable operating segments: the U.S., Canada and the U.K.

The segment performance measure below is based on gross margin. In management’s evaluation of performance, certain costs, such as corporate expenses, district expenses and interest expense, are not allocated by segment, and accordingly the following reporting segment results do not include such allocated costs. There are no intersegment revenues, and we determined the amounts below in accordance with the same accounting principles used in our Consolidated Financial Statements.

21

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

The following table illustrates summarized financial information concerning our reportable segments.

Three Months Ended March 31, | |||||||

(dollars in thousands) | 2018 | 2017 | |||||

Revenues by segment: | |||||||

U.S. | $ | 204,593 | $ | 174,322 | |||

Canada | 46,250 | 41,566 | |||||

U.K. | 10,915 | 8,692 | |||||

Consolidated revenue | $ | 261,758 | $ | 224,580 | |||

Gross margin by segment: | |||||||

U.S. | $ | 91,344 | $ | 77,133 | |||

Canada | 14,502 | 14,300 | |||||

U.K. | 3,399 | 3,472 | |||||

Consolidated gross margin | $ | 109,245 | $ | 94,905 | |||

Expenditures for long-lived assets by segment: | |||||||

U.S. | $ | 788 | $ | 1,672 | |||

Canada | 754 | 1,291 | |||||

U.K. | 67 | 130 | |||||

Consolidated expenditures for long-lived assets | $ | 1,609 | $ | 3,093 | |||

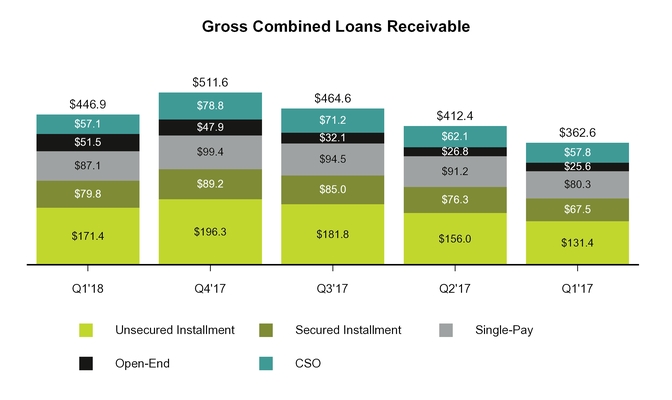

The following table provides the proportion of gross loans receivable by segment:

(dollars in thousands) | March 31, 2018 | December 31, 2017 | |||||

U.S. | $ | 266,731 | $ | 308,696 | |||

Canada | 102,597 | 104,551 | |||||

U.K. | 20,510 | 19,590 | |||||

Total gross loans receivable | $ | 389,838 | $ | 432,837 | |||

The following table illustrates our net long-lived assets, comprised of property and equipment by geographic region. These amounts are aggregated on a legal entity basis and do not necessarily reflect where the asset is physically located:

(dollars in thousands) | March 31, 2018 | December 31, 2017 | |||||

U.S. | $ | 50,614 | $ | 52,627 | |||

Canada | 31,390 | 32,924 | |||||

U.K. | 1,518 | 1,535 | |||||

Total net long-lived assets | $ | 83,522 | $ | 87,086 | |||

Our chief operating decision maker does not review assets by segment for purposes of allocating resources or

decision-making purposes; therefore, total assets by segment are not disclosed.

NOTE 13 – CONTINGENT LIABILITIES

Harrison, et al v. Principal Investments, Inc. et al

During the period relevant to this class action litigation, we pursued in excess of 16,000 claims in the limited actions and jurisdiction court in Clark County, Nevada, seeking payment of loans on which customers had defaulted. We utilized outside counsel to file these debt collection lawsuits. On Scene Mediations, a process serving company, was employed to serve the summons and petitions in the majority of these cases. In an unrelated matter, the principal of On Scene Mediations was convicted of multiple accounts of perjury and filing false affidavits to obtain judgments

22

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

on behalf of a Las Vegas collection agency. In September 2010, we were sued by four former customers in a proposed class action suit filed in the District Court in Clark County, Nevada. The plaintiffs in this case claimed that they, and others in the proposed class, were not properly served notice of the debt collection lawsuits by the Company.

On June 7, 2017, the parties reached a settlement in this matter and we accrued approximately $2.3 million as a result of this settlement. At a July 24, 2017 hearing before the District Court in Clark County, Nevada, the court granted preliminary approval of the settlement, and on October 30, 2017, the court issued final approval of the class settlement. We paid the approved settlement amount and released the related liability.

Reimbursement Offer; Possible Changes in Payment Practices

During 2017, it was determined that a limited universe of borrowers may have incurred bank overdraft or non-sufficient funds fees because of possible confusion about certain electronic payments we initiated on their loans. As a result, we decided to reimburse such fees through payments or credits against outstanding loan balances, subject to per-customer dollar limitations, upon receipt of (1) claims from potentially affected borrowers stating that they were in fact confused by our practices and (2) bank statements from such borrowers showing that fees for which reimbursement is sought were incurred at a time that such borrowers might reasonably have been confused about our practices. We recorded a $2.0 million liability for this matter.

Additionally, we also decided that, in June 2018, we will discontinue the use of secondary payment cards for affected borrowers who do not explicitly reauthorize the use of secondary payment cards. For these borrowers, in the event we cannot obtain payment through the bank account or payment card listed on the borrower’s application, we will need to rely exclusively on other collection methods such as delinquency notices and/or collection calls. The discontinuation for affected borrowers of our current use of secondary cards will increase collections costs and reduce collections effectiveness.

City of Austin

We were cited on July 5, 2016 by the City of Austin, Texas for alleged violations of the Austin ordinance addressing products offered by CSOs. The Austin ordinance regulates aspects of products offered under our Credit Access Business programs, including loan sizes and repayment terms. We believe that: (i) the Austin ordinance (like its counterparts elsewhere in the state) conflicts with Texas state law and (ii) our product in any event complies with the ordinance, when the ordinance is properly construed. The Austin Municipal Court agreed with our position that the ordinance conflicts with Texas law and, accordingly, did not address our second argument. In September 2017, the Travis County Court reversed the Municipal Court’s decision and remanded the case for further proceedings. Subsequent to the denial of our appeal of the County Court's decision in October 2017, we were notified during the quarter ended March 31, 2018 that the case could potentially go to trial in the summer of 2018. We do not anticipate having a final determination of the lawfulness of our CAB program under the Austin ordinance (and similar ordinances in other Texas cities) in the near future. A final adverse decision could potentially result in material monetary liability in Austin and elsewhere in Texas, and would force us to restructure the loans we originate in Austin and elsewhere in Texas.

Other Legal Matters

We are also a defendant in certain routine litigation matters encountered in the ordinary course of our business. Certain of these matters may be covered to an extent by insurance. In the opinion of management, based upon the advice of legal counsel, the likelihood is remote that the impact of any pending legal proceedings and claims, either individually or in the aggregate, would have a material adverse effect on our Consolidated Financial Statements.

23

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

NOTE 14 – CONDENSED CONSOLIDATING FINANCIAL INFORMATION

In February 2017, CFTC issued $470.0 million aggregate principal amount Senior Secured Notes, the proceeds of which were used together with available cash, to (i) redeem the outstanding 10.75% Senior Secured Notes due 2018 of our wholly owned subsidiary, CURO Intermediate, (ii) redeem the outstanding 12.00% Senior Cash Pay Notes due 2017 and (iii) pay fees, expenses, premiums and accrued interest in connection with the offering. CFTC sold the Senior Secured Notes to qualified institutional buyers under Rule 144A of the Securities Act of 1933, as amended (the “Securities Act”); or outside the U.S. to non-U.S. persons in compliance with Regulation S of the Securities Act.

In November 2017, CFTC issued $135.0 million aggregate principal amount of additional Senior Secured Notes in a private offering exempt from the registration requirements of the Securities Act (the "Additional Notes Offering"). CFTC used the proceeds from the Additional Notes Offering, together with available cash, to (i) pay a cash dividend, in an amount of $140.0 million to us, CFTC’s sole stockholder, and ultimately our stockholders and (ii) pay fees, expenses, premiums and accrued interest in connection with the Additional Notes Offering. CFTC received the consent of the holders holding a majority in the outstanding principal amount outstanding of the current Senior Secured Notes to a one-time waiver with respect to the restrictions contained in Section 5.07(a) of the indenture governing the Senior Secured Notes to permit the dividend.

On March 7, 2018, CFTC redeemed $77.5 million of the Senior Secured Notes at a price equal to 112.00% of the principal amount plus accrued and unpaid interest to the date of redemption. Following the redemption, $527.5 million of the original outstanding principal amount of the Senior Secured Notes remain outstanding. The redemption was conducted pursuant to the indenture governing the Senior Secured Notes, dated as of February 15, 2017, by and among CFTC, the guarantors party thereto and TMI Trust Company, as trustee and collateral agent. Consistent with the terms of the indenture, CFTC used a portion of the cash proceeds from our IPO, completed in December 2017, to redeem such Senior Secured Notes. See Note 5, "Long-Term Debt," for additional details.

The following condensed consolidating financing information, which has been prepared in accordance with the requirements for presentation of Rule 3-10(d) of Regulation S-X promulgated under the Securities Act, presents the condensed consolidating financial information separately for:

(i) | CFTC as the issuer of the Senior Secured Notes; |

(ii) | CURO Intermediate as the issuer of the 10.75% senior secured notes that were redeemed in February 2017; |

(iii) | Our subsidiary guarantors, which are comprised of our domestic subsidiaries, excluding CFTC and CURO Intermediate (the “Subsidiary Guarantors”), on a consolidated basis, which are 100% owned by CURO, and which are guarantors of the Senior Secured Notes issued in February 2017 and the 10.75% senior secured notes redeemed in February 2017; |

(iv) | Our other subsidiaries on a consolidated basis, which are not guarantors of the Senior Secured Notes (the “Subsidiary Non-Guarantors”) |

(v) | Consolidating and eliminating entries representing adjustments to: |

a. | eliminate intercompany transactions between or among us, the Subsidiary Guarantors and the Subsidiary Non-Guarantors; and |

b. | eliminate the investments in our subsidiaries; |

(vi) | Us and our subsidiaries on a consolidated basis. |

24

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(unaudited)

Condensed Consolidating Balance Sheets

March 31, 2018 | ||||||||||||||||||||||||||||||

(dollars in thousands) | CFTC | CURO Intermediate | Subsidiary Guarantors | Subsidiary Non-Guarantors | SPV Subs | Eliminations | Consolidated | CURO | Eliminations | CURO Consolidated | ||||||||||||||||||||

Assets: | ||||||||||||||||||||||||||||||

Cash | $ | — | $ | — | $ | 82,358 | $ | 48,381 | $ | — | $ | — | $ | 130,739 | $ | — | $ | — | $ | 130,739 | ||||||||||

Restricted cash | — | — | 1,678 | 3,710 | 12,268 | — | 17,656 | — | — | 17,656 | ||||||||||||||||||||

Loans receivable, net | — | — | 68,304 | 110,775 | 149,873 | — | 328,952 | — | — | 328,952 | ||||||||||||||||||||

Deferred income taxes | — | 1,002 | (3,313 | ) | 4,128 | — | — | 1,817 | — | — | 1,817 | |||||||||||||||||||

Prepaid expenses and other | — | — | 29,304 | 3,449 | — | — | 32,753 | — | — | 32,753 | ||||||||||||||||||||

Property and equipment, net | — | — | 50,613 | 32,909 | — | — | 83,522 | — | — | 83,522 | ||||||||||||||||||||

Goodwill | — | — | 91,130 | 54,634 | — | — | 145,764 | — | — | 145,764 | ||||||||||||||||||||

Other intangibles, net | 16 | — | 5,024 | 26,921 | — | — | 31,961 | — | — | 31,961 | ||||||||||||||||||||

Intercompany receivable | — | 37,877 | 19,236 | (17,249 | ) | — | (39,864 | ) | — | — | — | — | ||||||||||||||||||

Investment in subsidiaries | 31,067 | 981,468 | — | — | — | (1,012,535 | ) | — | (62,855 | ) | 62,855 | — | ||||||||||||||||||

Other | 6,668 | — | 4,499 | 1,050 | — | — | 12,217 | — | — | 12,217 | ||||||||||||||||||||

Total assets | $ | 37,751 | $ | 1,020,347 | $ | 348,833 | $ | 268,708 | $ | 162,141 | $ | (1,052,399 | ) | $ | 785,381 | $ | (62,855 | ) | $ | 62,855 | $ | 785,381 | ||||||||

Liabilities and Stockholder's equity: | ||||||||||||||||||||||||||||||

Accounts payable and accrued liabilities | $ | 2,346 | $ | 16 | $ | 33,274 | $ | 17,176 | $ | 15 | $ | — | $ | 52,827 | $ | 33 | $ | — | $ | 52,860 | ||||||||||

Deferred revenue | — | — | 5,031 | 5,145 | (24 | ) | — | 10,152 | — | — | 10,152 | |||||||||||||||||||

Income taxes payable | (56,738 | ) | 87,519 | (18,566 | ) | 269 | — | — | 12,484 | (3,750 | ) | — | 8,734 | |||||||||||||||||

Accrued interest | 5,121 | — | — | — | 1,263 | — | 6,384 | — | — | 6,384 | ||||||||||||||||||||