Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - CURO Group Holdings Corp. | ex-322cfo906cert1q.htm |

| EX-32.1 - EXHIBIT 32.1 - CURO Group Holdings Corp. | ex-321ceo906cert1q.htm |

| EX-31.2 - EXHIBIT 31.2 - CURO Group Holdings Corp. | ex-312cfo302cert1q.htm |

| EX-31.1 - EXHIBIT 31.1 - CURO Group Holdings Corp. | ex-311ceo302cert1q.htm |

| 10-Q - 10-Q - CURO Group Holdings Corp. | a2018q1groupdoc.htm |

ACTIVE/93980810.5

FIRST AMENDMENT TO REVOLVING LOAN AGREEMENT

THIS FIRST AMENDMENT TO REVOLVING LOAN AGREEMENT (this

“Amendment”), dated as of February 26, 2018, is by and among CURO FINANCIAL

TECHNOLOGIES CORP., a Delaware corporation (“CFTC”), CURO INTERMEDIATE

HOLDINGS CORP., a Delaware corporation (“Holdings” and, together with CFTC, the

“Borrower”), the Guarantors party to the Loan Agreement (as defined below), each Lender party

to the Loan Agreement (as defined below) and BAY COAST BANK, as administrative agent (in

such capacity, the “Administrative Agent”). Capitalized terms used herein and not otherwise

defined herein shall have the meanings ascribed thereto in the Loan Agreement.

W I T N E S S E T H

WHEREAS, the Borrower, the Lenders, the Guarantors and the Administrative Agent

are parties to that certain Revolving Loan Agreement dated as of September 1, 2017, (as

amended, modified, extended, restated, replaced, or supplemented from time to time, the “Loan

Agreement”);

WHEREAS, the Borrower has requested that the Lenders amend certain provisions of

the Loan Agreement to increase the Commitments thereunder in order to permit the Borrower to

incur Indebtedness under the Loan Agreement in an amount permitted under the Senior Notes

Indenture on the date hereof; and

WHEREAS, Section 5.09(b)(i) of the Senior Notes Indenture permits the Borrower to

incur Indebtedness under the Loan Agreement not to exceed $29.04 million.

NOW, THEREFORE, in consideration of the agreements hereinafter set forth, and for

other good and valuable consideration, the receipt and adequacy of which are hereby

acknowledged, the parties hereto agree as follows:

ARTICLE I

AMENDMENTS

1.1 Amendments to Section 1.01.

(a) Section 1.01 of the Loan Agreement is hereby amended by amended and

restating the definitions of “Commitment” and “Commitment Termination Date” in their

entirety as follows:

“Commitment” means the commitment of a Lender to make or otherwise fund a

Loan and to acquire participations in Letters of Credit hereunder, and

“Commitments” means such commitments of all Lenders in the aggregate. The

amount of each Lender’s Commitment, if any, is set forth opposite such Lender’s

name on Schedule 1.01(a) or in the applicable Assignment Agreement, subject to

any adjustment or reduction pursuant to the terms and conditions hereof. The

aggregate amount of the Commitments as of the First Amendment Effective Date

is $29,000,000.

2

ACTIVE/93980810.5

“Commitment Termination Date” means the earliest to occur of (i) June 30, 2019,

(ii) the date the Commitments are permanently reduced to zero pursuant to

Section 2.13(b), or (iii) the date of the termination of the Commitments pursuant

to Section 6.01 including upon any demand for payment.

(b) Section 1.01 of the Loan Agreement is hereby further amended adding the

following new definitions in alphabetical order:

“Debt Limitation” means the greater of (i) $25.0 million and (ii) 5% of

Consolidated Tangible Assets.

“Consolidated Tangible Assets” means with respect to CFTC as of any date, the

aggregate of the assets of CFTC and its Restricted Subsidiaries, excluding

goodwill and any other assets properly classified as intangible assets in

accordance with GAAP, shown on the balance sheet for the most recently ended

fiscal quarter for which financial statements are available, determined on a

consolidated basis in accordance with GAAP.

“First Amendment” means that certain First Amendment to Revolving Loan

Agreement, dated as of February 26, 2018, by and among the Borrower, the

Guarantors party thereto, the Lenders party thereto and the Administrative Agent.

“First Amendment Effective Date” has the meaning set forth in the First

Amendment.

1.2 Amendment to Section 2.01. Section 2.01 of the Loan Agreement is hereby

amended by deleting the first sentence thereof in its entirety and substituting therefor the

following:

During the Commitment Period, subject to the terms and conditions hereof, each

Lender severally agrees to make Loans to the Borrower in an aggregate amount

up to but not exceeding such Lender’s Commitment; provided that after giving

effect to the making of any Loans in no event shall the Total Utilization of

Commitments exceed the lesser of (a) the Commitments then in effect and (b) the

Debt Limitation then in effect; and provided further that in each calendar year,

commencing with 2018, there shall be a period of thirty (30) consecutive days

when there are no Loans outstanding hereunder.

1.3 Amendment to Section 2.14. Section 2.14 of the Loan Agreement is hereby

amended by deleting the text “[Reserved]” therein and substituting therefor the following”

In the Event the Total Utilization at any time exceeds the Debt Limitation, the

Borrower will immediately repay an amount equal to such excess to be applied to

prepay Loans, together with any additional amounts required to be paid pursuant

to Section 2.18(c).

3

ACTIVE/93980810.5

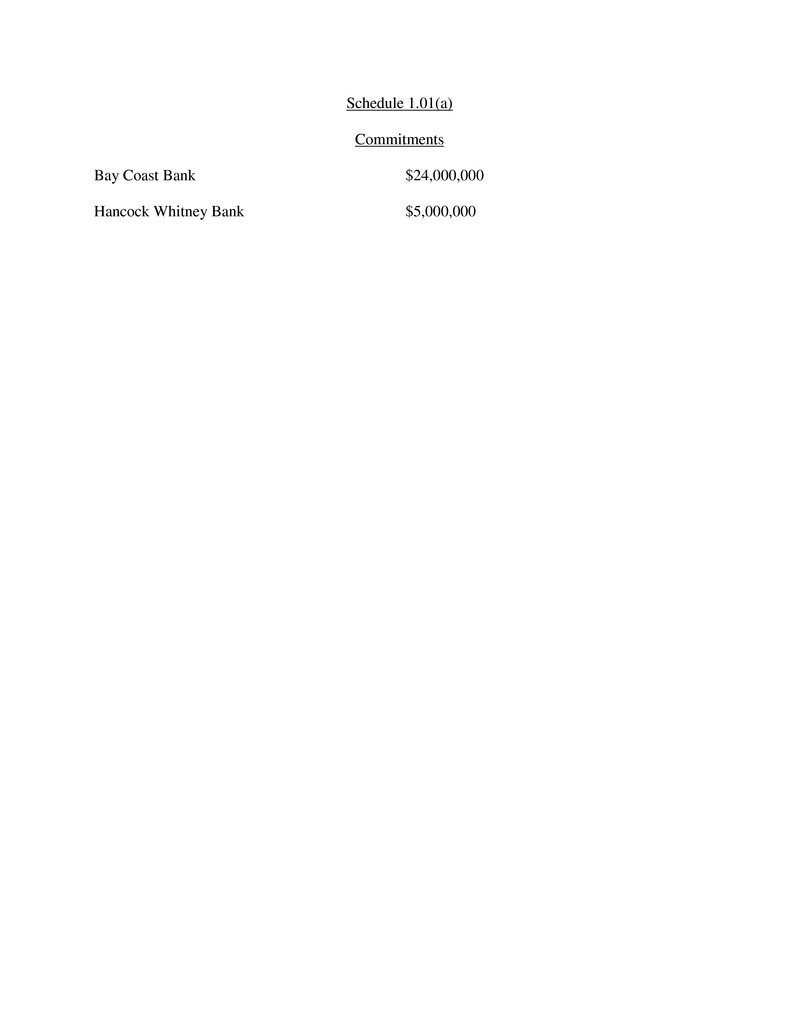

1.4 Amendment to Schedule 1.01(a). Schedule 1.01(a) of the Loan Agreement is

hereby amended by substituting therefor the Schedule 1.01(a) attached hereto.

1.5 Amendment of Exhibit A-1. Exhibit A-1 of the Loan Agreement is hereby

amended by substituting therefor the Exhibit A-1 attached hereto.

1.6 Amendment of Exhibit C. Exhibit C of the Loan Agreement is hereby amended

by substituting therefor the Exhibit C attached hereto.

ARTICLE II

CONDITIONS TO EFFECTIVENESS

2.1 Closing Conditions. This Amendment shall become effective as of the day and

year set forth above (the “First Amendment Effective Date”) upon satisfaction of the following

conditions (in each case, in form and substance reasonably acceptable to the Administrative

Agent) on or prior to the date hereof.

(a) Executed Amendment. The Administrative Agent shall have received a

copy of this Amendment duly executed by the Borrower, the Required Lenders and the

Administrative Agent.

(b) Assignment and Assumption Agreement. The Administrative Agent shall

have received an Assignment and Assumption Agreement, dated the Amendment Effective Date,

in form reasonably satisfactory to the Administrative Agent, duly executed by the Borrower, Bay

Coast Bank, as assignor and Administrative Agent, and Hancock Whitney Bank, as assignee,

which has become effective immediately prior to the effectiveness of this Amendment.

(c) Certificate of Responsible Officer. The Administrative Agent shall have

received a certificate of a Responsible Officer of the Borrower certifying that the Commitments,

as amended by this Amendment, comply with Section 5.09(b) of the Senior Notes Indenture.

(d) Legal Opinion. The Administrative Agent shall have received opinions of

counsel to the Loan Parties addressed to the Administrative Agent and the Lenders, in form and

substance reasonably satisfactory to the Administrative Agent.

(e) Miscellaneous. All other documents and legal matters in connection with

the transactions contemplated by this Amendment shall be reasonably satisfactory in form and

substance to the Administrative Agent and its counsel.

ARTICLE III

MISCELLANEOUS

3.1 Amended Terms. On and after the Amendment Effective Date, all references to

the Loan Agreement in each of the Loan Documents shall hereafter mean the Loan Agreement as

amended by this Amendment. Except as specifically amended hereby or otherwise agreed, the

Loan Agreement is hereby ratified and confirmed and shall remain in full force and effect

according to its terms.

4

ACTIVE/93980810.5

3.2 Representations and Warranties of Loan Parties. The Borrower represents and

warrants as follows:

(a) It has taken all necessary action to authorize the execution, delivery and

performance of this Amendment.

(b) This Amendment has been duly executed and delivered by such Person

and constitutes such Person’s legal, valid and binding obligation, enforceable in accordance with

its terms, except as such enforceability may be subject to (i) bankruptcy, insolvency,

reorganization, fraudulent conveyance or transfer, moratorium or similar laws affecting

creditors’ rights generally and (ii) general principles of equity (regardless of whether such

enforceability is considered in a proceeding at law or in equity).

(c) No consent, approval, authorization or order of, or filing, registration or

qualification with, any court or governmental authority or third party is required in connection

with the execution, delivery or performance by such Person of this Amendment.

(d) Any and all notices required to be delivered by the Borrower, including

but not limited to any notices required to be delivered by the Borrower pursuant to the Indenture

Documents, have been duly given.

(e) The representations and warranties set forth in Article IV of the Loan

Agreement are true and correct as of the date hereof in all material respects (except for those

which expressly relate to an earlier date).

(f) After giving effect to this Amendment, no event has occurred and is

continuing which constitutes a Default or an Event of Default.

(g) The Collateral Documents continue to create a valid security interest in,

and Lien upon, the Collateral, in favor of the Administrative Agent, for the benefit of the

Lenders to secure all Obligations (including the principal amount of all Loans up to the

maximum amount of the Commitments as increased under this Amendment), which security

interests and Liens are perfected in accordance with the terms of the Collateral Documents and

prior to all Liens other than Permitted Liens.

(h) No Conflict. The execution, delivery and performance by the Loan Parties

of this Amendment and the consummation of the transactions hereunder do not and will not (i)

violate (A) any provision of any Law or any governmental rule or regulation applicable to any

such Loan Party, (B) any of the Organizational Documents of any Loan Party or (C) any order,

judgment, or decree of any court or other agency of government binding on such Loan Party; (ii)

result in a breach of or constitute (with due notice or lapse of time or both) a default under any

Contractual Obligation of such Loan Party; (iii) result in or require the creation or imposition of

any Lien upon any of the properties or assets of such Loan Party (other than any Liens created

under any of the Facility Documents in favor of the Collateral Agent on behalf of the Secured

Parties); or (iv) require any approval of stockholders, members, or partners or any approval or

consent of any Person under any Contractual Obligation of any Loan Party, except for such

approvals or consents which have been obtained on or before the First Amendment Effective

Date and disclosed in writing to the Lenders.

5

ACTIVE/93980810.5

(i) Incurrence of Indebtedness. Pursuant to the terms of Section 5.09(b)(i) of

the Senior Notes Indenture, the Borrower is permitted to incur Indebtedness under the Loan

Agreement on the date hereof in an aggregate principal amount of $29,039,692, and the

Borrower is not required under the Senior Notes Indenture to take any further action or provide

any notice to any Person in connection with the incurrence of any such Indebtedness.

(j) First Priority Claims. The outstanding amount of all Obligations,

including without limitation the principal of and all interest on Loans and all Additional Secured

Obligations, constitute and at all times will constitute “First Priority Claims” under the Senior

Notes Indenture and “First Lien Obligations” under the Intercreditor Agreement.

(k) Collateral. All Obligations are secured by the “Collateral” under the

“Collateral Documents” (each as defined in the Senior Notes Indenture) and entitled to a senior

secured position with respect to such Collateral as First Priority Claims thereunder in accordance

with the terms thereof.

3.3 Reaffirmation of Obligations. The Borrower hereby ratifies the Loan Agreement

and acknowledges and reaffirms (a) that it is bound by all terms of the Loan Agreement

applicable to it and (b) that it is responsible for the observance and full performance of its

respective Obligations.

3.4 Loan Document. This Amendment shall constitute a Loan Document under the

terms of the Loan Agreement.

3.5 Expenses. The Borrower agrees to pay all reasonable costs and expenses of the

Administrative Agent in connection with the preparation, execution and delivery of this

Amendment, including without limitation the reasonable fees and expenses of Goodwin Procter

LLP, the Administrative Agent’s legal counsel.

3.6 Further Assurances. The Borrower agrees to promptly take such action, upon the

request of the Administrative Agent, as is necessary to carry out the intent of this Amendment.

3.7 Entirety. This Amendment and the other Loan Documents embody the entire

agreement among the parties hereto and supersede all prior agreements and understandings, oral

or written, if any, relating to the subject matter hereof.

3.8 Counterparts; Telecopy. This Amendment may be executed in any number of

counterparts, each of which when so executed and delivered shall be an original, but all of which

shall constitute one and the same instrument. Delivery of an executed counterpart of a signature

page of this Amendment or any other document required to be delivered hereunder, by fax

transmission or e-mail transmission (e.g. “pdf” or “tif”) shall be effective as delivery of a

manually executed counterpart of this Agreement. Without limiting the foregoing, upon the

request of any party, such fax transmission or e-mail transmission shall be promptly followed by

such manually executed counterpart.

3.9 GOVERNING LAW. THIS AMENDMENT SHALL BE GOVERNED BY,

AND SHALL BE CONSTRUED AND ENFORCED IN ACCORDANCE WITH THE

LAWS OF THE STATE OF NEW YORK.

6

ACTIVE/93980810.5

3.10 Successors and Assigns. This Amendment shall be binding upon and inure to the

benefit of the parties hereto and their respective successors and assigns.

3.11 Consent to Jurisdiction; Service of Process; Waiver of Jury Trial. The

jurisdiction, service of process and waiver of jury trial provisions set forth in Section 9.06 of the

Loan Agreement are hereby incorporated by reference, mutatis mutandis.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

Schedule 1.01(a)

Commitments

Bay Coast Bank $24,000,000

Hancock Whitney Bank $5,000,000

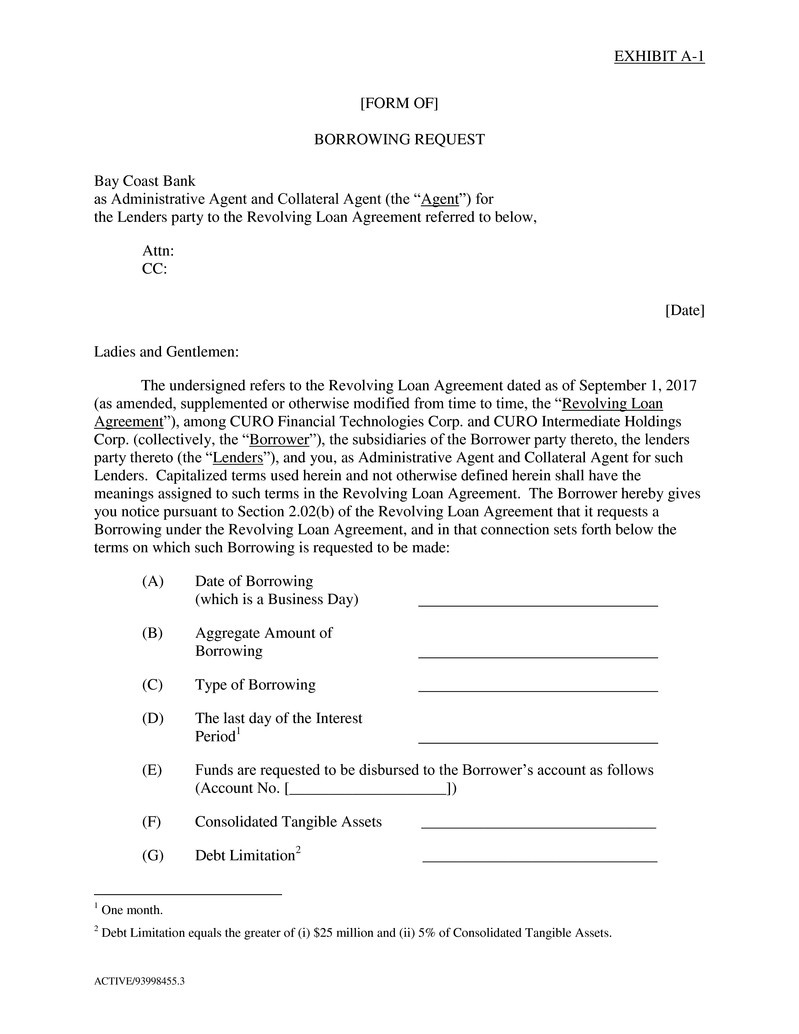

EXHIBIT A-1

ACTIVE/93998455.3

[FORM OF]

BORROWING REQUEST

Bay Coast Bank

as Administrative Agent and Collateral Agent (the “Agent”) for

the Lenders party to the Revolving Loan Agreement referred to below,

Attn:

CC:

[Date]

Ladies and Gentlemen:

The undersigned refers to the Revolving Loan Agreement dated as of September 1, 2017

(as amended, supplemented or otherwise modified from time to time, the “Revolving Loan

Agreement”), among CURO Financial Technologies Corp. and CURO Intermediate Holdings

Corp. (collectively, the “Borrower”), the subsidiaries of the Borrower party thereto, the lenders

party thereto (the “Lenders”), and you, as Administrative Agent and Collateral Agent for such

Lenders. Capitalized terms used herein and not otherwise defined herein shall have the

meanings assigned to such terms in the Revolving Loan Agreement. The Borrower hereby gives

you notice pursuant to Section 2.02(b) of the Revolving Loan Agreement that it requests a

Borrowing under the Revolving Loan Agreement, and in that connection sets forth below the

terms on which such Borrowing is requested to be made:

(A) Date of Borrowing

(which is a Business Day)

(B) Aggregate Amount of

Borrowing

(C) Type of Borrowing

(D) The last day of the Interest

Period1

(E) Funds are requested to be disbursed to the Borrower’s account as follows

(Account No. [____________________])

(F) Consolidated Tangible Assets ______________________________

(G) Debt Limitation2 ______________________________

1 One month.

2 Debt Limitation equals the greater of (i) $25 million and (ii) 5% of Consolidated Tangible Assets.

ACTIVE/93998455.3

The Borrower hereby represents and warrants to the Agent and the Lenders that, on the

date of this Borrowing Request and on the date of the related Borrowing, the Debt Limitation is

as set forth in item (G) above and that, after giving effect to the Borrowing hereunder, the Total

Utilization does not exceed the Debt Limitation.

The Borrower hereby further represents and warrants to the Agent and the Lenders that,

on the date of this Borrowing Request and on the date of the related Borrowing, the conditions to

lending specified in Section 3.02 of the Revolving Loan Agreement have been satisfied. The

Borrower further represents and warrants to the Agent and the Lenders that, as of the date of this

Borrowing Request and on the date of the related Borrowing, the total amount of First Priority

Claims has not been and will not be required to be reduced pursuant to the provisions of Section

5.09(b)(i) of the Senior Notes Indenture.

EXHIBIT A-1

ACTIVE/93998455.3

CURO FINANCIAL TECHNOLOGIES CORP.

CURO INTERMEDIATE HOLDINGS CORP.

By:

Name:

[Responsible Officer]

EXHIBIT C

ACTIVE/93998455.3

[FORM OF]

COMPLIANCE CERTIFICATE

THE UNDERSIGNED HEREBY CERTIFIES AS FOLLOWS:

1. I am the [Chief Financial Officer/Treasurer] of CURO Financial Technologies

Corp. and CURO Intermediate Holdings Corp. (collectively, “Borrower”).

2. I have reviewed the terms of that certain Revolving Loan Agreement, dated as of

September 1, 2017, by and among Borrower, certain subsidiaries of Borrower, the Lenders party

thereto, and Bay Coast Bank, as Administrative Agent and Collateral Agent (as it may be

amended, supplemented or otherwise modified, the “Revolving Loan Agreement”), and I have

made, or have caused to be made under my supervision, a review in reasonable detail of the

transactions and condition of Borrower and its Subsidiaries during the accounting period covered

by the financial statements attached hereto as Annex A. All terms used but not defined herein

shall have their respective meanings in the Revolving Loan Agreement.

3. The examination described in paragraph 2 above did not disclose, and I have no

knowledge of, the existence of any condition or event which constitutes an Event of Default or

Default during or at the end of the accounting period covered by the attached financial

statements or as of the date of this Certificate [except as set forth in a separate attachment to this

Certificate, describing in detail, the nature of the condition or event, the period during which it

has existed and the action which Borrower has taken, is taking, or proposes to take with respect

to each such condition or event].

4. Set forth on Annex B attached hereto are the detailed information and calculations

showing compliance with the financial covenants set forth in Section 5.03 of the Revolving Loan

Agreement and calculating the Debt Limitation.

ACTIVE/93998455.3

The foregoing certifications, together with the computations set forth in Annex A and

Annex B hereto are made and delivered [________ __, 20__] pursuant to Section 5.01(a)(iii) of

the Revolving Loan Agreement.

CURO FINANCIAL TECHNOLOGIES CORP.

CURO INTERMEDIATE HOLDINGS CORP.

By:

Name:

[Responsible Officer]

ACTIVE/93998455.3

ANNEX A TO

COMPLIANCE CERTIFICATE

FINANCIAL STATEMENTS

ANNEX B TO

COMPLIANCE CERTIFICATE

ACTIVE/93998455.3

[_____], 20,[__] [_____], 20,[__] [_____], 20,[__] [_____], 20,[__]

Trailing Twelve

Months

Consolidated Cash Flow

Consolidated Interest Expense

Consolidated Interest Coverage Ratio

Cash

Loans Receivable, net

Property and Equipment, net

Eligible Collateral

Total Utilization

Minimum Eligible Collateral Value

February 2017 12.00% Senior Secured Notes (due 2022)

Senior Revolver

Other Indebtedness

Indebtedness

Consolidated Leverage Ratio

Consolidated Tangible Assets

Debt Limitation*

* The lesser of $25,000,000 and 5% of Consolidated Tangible Assets, less the aggregate amount of all Net Proceeds of Asset Sales applied to permanently repay any such

Indebtedness (and to correspondingly reduce commitments with respect thereto) pursuant to Section 5.10 of the Senior Notes Indenture.

Fiscal Quarter Ended

CURO FINANCIAL TECHNOLOGIES CORPORATION

FINANCIAL COVENANTS

for the Four Fiscal Quarters Ended [_____], 20[__]

(in thousands)