Attached files

| file | filename |

|---|---|

| EX-32.2 - EX 32.2 - SUPERVALU INC | f17form10-kex322.htm |

| EX-32.1 - EX 32.1 - SUPERVALU INC | f17form10-kex321.htm |

| EX-31.2 - EX 31.2 - SUPERVALU INC | f17form10-kex312.htm |

| EX-31.1 - EX 31.1 - SUPERVALU INC | f17form10-kex311.htm |

| EX-24.1 - EX 24.1 - SUPERVALU INC | f17form10-kex241.htm |

| EX-23.1 - EX 23.1 - SUPERVALU INC | f17form10-kex231.htm |

| EX-21.1 - EX 21.1 - SUPERVALU INC | f17form10-kex211.htm |

| EX-12.1 - EX 12.1 - SUPERVALU INC | f17form10-kex121.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 25, 2017

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number: 1-5418

SUPERVALU INC.

(Exact name of registrant as specified in its charter)

DELAWARE | 41-0617000 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

11840 VALLEY VIEW ROAD EDEN PRAIRIE, MINNESOTA | 55344 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (952) 828-4000

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, par value $0.01 per share | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ | Emerging growth company ¨ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of September 9, 2016 was approximately $1,248,780,826 (based upon the closing price of registrant’s Common Stock on the New York Stock Exchange).

As of April 21, 2017, there were 267,676,000 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of registrant’s definitive Proxy Statement filed for the registrant’s 2017 Annual Meeting of Stockholders are incorporated by reference into Part III, as specifically set forth in Part III.

SUPERVALU INC.

Annual Report on Form 10-K

TABLE OF CONTENTS

Item | Page | |

1. | ||

1A. | ||

1B. | ||

2. | ||

3. | ||

4. | ||

5. | ||

6. | ||

7. | ||

7A. | ||

8. | ||

9. | ||

9A. | ||

9B. | ||

10. | ||

11. | ||

12. | ||

13. | ||

14. | ||

15. | ||

2

CAUTIONARY STATEMENTS FOR PURPOSES OF THE SAFE HARBOR PROVISIONS OF THE SECURITIES LITIGATION REFORM ACT

Any statements contained in this Annual Report on Form 10-K regarding the outlook for Supervalu’s businesses and their respective markets, such as projections of future performance, guidance, statements of Supervalu’s plans and objectives, forecasts of market trends and other matters, are forward-looking statements based on Supervalu’s assumptions and beliefs. Such statements may be identified by such words or phrases as “will likely result,” “are expected to,” “will continue,” “may continue,” “outlook,” “is anticipated,” “estimate,” “project,” “believes,” “intends” or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those discussed in such statements and no assurance can be given that the results in any forward-looking statement will be achieved. For these statements, Supervalu claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Any forward-looking statement speaks only as of the date on which it is made, and Supervalu disclaims any obligation to subsequently revise any forward-looking statement to reflect events or circumstances after such date or to reflect the occurrence of anticipated or unanticipated events.

Certain factors could cause Supervalu’s future results to differ materially from those expressed or implied in any forward-looking statements contained in this Annual Report on Form 10-K. These factors include the factors discussed in Part I, Item 1A of this Annual Report on Form 10-K under the heading “Risk Factors” and any other cautionary statements, written or oral, which may be made or referred to in connection with any such forward-looking statements. Since it is not possible to foresee all such factors, these factors should not be considered as complete or exhaustive.

PART I

ITEM 1. BUSINESS

Unless otherwise indicated, all references to “Supervalu,” “we,” “us,” “our” and the “Company” in this Annual Report on Form 10-K relate to SUPERVALU INC. and its wholly and majority-owned subsidiaries. All dollar and share amounts in this Annual Report on Form 10-K are in millions, except per share data and where otherwise noted.

Business Overview

Supervalu is the largest public company grocery distributor to wholesale customers across the United States through its Wholesale segment, operates five retail grocery banners in six geographic regions through its Retail segment and provides professional service solutions to retail operators and other entities, the results of which are included within Wholesale or Corporate depending on the customer type. Supervalu leverages its distribution operations by providing wholesale distribution and logistics service solutions to wholesale customers as well as wholesale distribution to Supervalu’s Retail stores. SUPERVALU INC., a Delaware corporation, was organized in 1925 as the successor to two wholesale grocery firms established in the 1870s.

Supervalu’s business is classified by management into two reportable segments: Wholesale and Retail. These reportable segments are two distinct businesses. The Wholesale reportable segment derives revenues from wholesale distribution of groceries and other products, logistics services and professional service solutions to retail stores and other customers (collectively referred to as “wholesale customers”). The Retail reportable segment derives revenues from the sale of groceries and other products at retail locations operated by Supervalu. Substantially all of Supervalu’s operations are domestic.

Supervalu operates on a 52/53 week fiscal year basis, with its fiscal year ending on the last Saturday in February. All references to fiscal 2017, 2016 and 2015 relate to the 52-week fiscal year ended February 25, 2017, the 52-week fiscal year ended February 27, 2016 and the 53-week fiscal year ended February 28, 2015, respectively.

Wholesale

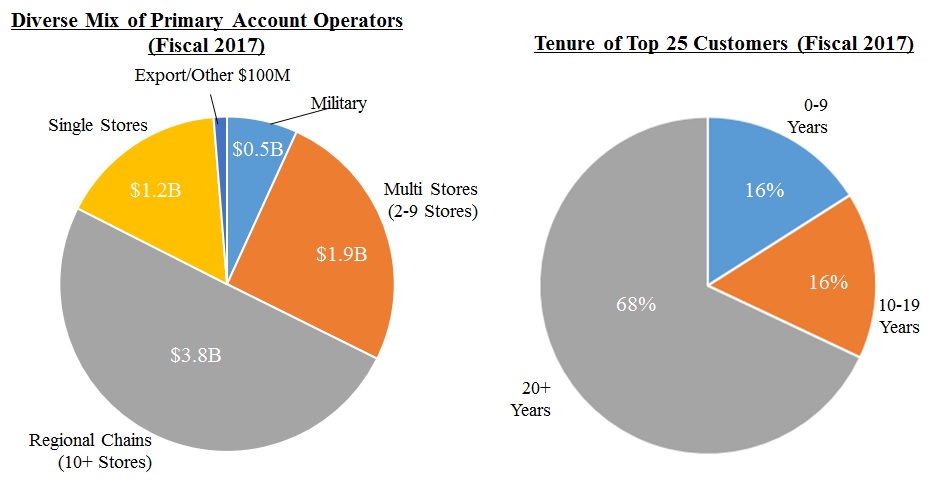

Supervalu organizes and operates its Wholesale segment through two geographic regions: East and West. As of February 25, 2017, the Wholesale network spans 40 states and Supervalu serves as primary grocery supplier to approximately 1,902 stores of wholesale customers, in addition to Supervalu’s own Retail stores, as well as serving as secondary grocery supplier to approximately 244 wholesale customer stores. Supervalu’s wholesale customers include single and multiple grocery store operators, regional chains and the military, many of whom are long tenured Supervalu customers. The following charts depict the composition of Supervalu’s wholesale customer mix and tenure of Supervalu’s top 25 customers by net sales:

3

Supervalu has established a network of strategically located distribution centers utilizing a multi-tiered logistics system. The network includes facilities that carry slow turn or fast turn groceries, perishables, general merchandise and home, health and beauty care products. As of February 25, 2017, the network is comprised of 18 distribution facilities, ten of which supply Supervalu’s own Retail stores in addition to stores of wholesale customers, and one distribution center dedicated to supplying the Shop ’n Save banner in the St. Louis, Missouri area. In March 2017, Supervalu acquired an additional distribution center in Harrisburg, Pennsylvania that has approximately 732 thousand square footage that will eventually replace the Lancaster, Pennsylvania facility that is owned by New Albertson’s, Inc. (“NAI”) and operated by Supervalu. Wholesale distribution sales to Supervalu’s own Retail stores are eliminated within the Wholesale segment in Supervalu’s financial statements. Deliveries to retail stores are made from Supervalu’s distribution centers by Company-owned trucks, third-party independent trucking companies or customer-owned trucks.

Supervalu offers wholesale customers a wide variety of food and non-food products, including national and regional brands, and Supervalu’s own extensive lines of private label products. Supervalu also offers a broad array of professional services that provide wholesale customers with cost-effective and scalable solutions. These services include pass-through programs in which vendors provide services directly to our wholesale customers, as well as services and solutions developed and provided directly by Supervalu. Supervalu’s services include retail store support, advertising, couponing, e-Commerce, network and data hosting solutions, training and certifications classes, as well as administrative back-office solutions. The sales and operating results for these services are included within Wholesale.

As a logistics provider, efficiency is an important customer service measure. Supervalu optimizes its facilities to implement leading warehouse technology, ranging from radio-frequency devices guiding selectors to mechanized facilities with completely automated order selection for dry groceries that help Supervalu deliver aisle-ready pallets to wholesale customers. The Wholesale segment also focuses on improving its supply chain to achieve labor and cost efficiencies.

Retail

Supervalu conducts its Retail operations through a total of 217 stores, as of February 25, 2017, primarily organized under five retail grocery banners of Cub Foods, Shoppers Food & Pharmacy, Shop ’n Save in the St. Louis market, Farm Fresh, Shop ’n Save in the east coast market and Hornbacher’s, plus two Rainbow stores. Retail stores provide an extensive grocery offering and, depending on size, a variety of additional products, including general merchandise, home, health and beauty care, and pharmacy, Supervalu’s Retail stores offer, national and regional brands as well as Supervalu’s own private label products. A typical Retail store carries approximately 14,000 to 21,000 core SKUs, depending on the retail banner, and ranges in size from approximately 40,000 to 60,000 square feet, varying by banner.

Supervalu believes its Retail banners have strong local and regional brand recognition in the markets in which they operate. Supervalu’s Retail operations are supplied by one dedicated distribution center and nine distribution centers that are part of the Wholesale segment providing wholesale distribution to both Supervalu’s Retail stores and stores of wholesale customers. Refer to Item 2—Properties for additional information regarding Retail stores by banner and the markets in which they operate.

Sale of Save-A-Lot

On December 5, 2016, Supervalu completed the sale of Supervalu’s Save-A-Lot business to SAL Acquisition Corp (f/k/a Smith Acquisition Corp), an affiliate of Onex Partners Managers LP, for a purchase price of $1,365 in cash, subject to customary closing adjustments that were estimated at the time of the sale to reduce the purchase price by approximately $61. The sale of Save-A-Lot was completed pursuant to the terms of the Agreement and Plan of Merger, dated as of October 16, 2016 (“SAL

4

Merger Agreement”), by and among SAL Acquisition Corp, SAL Merger Sub Corp (f/k/a Smith Merger Sub Corp), a newly formed wholly owned subsidiary of the SAL Acquisition Corp, Supervalu and Moran Foods, LLC, a wholly owned subsidiary of Supervalu prior to the sale. Concurrently with entering into the SAL Merger Agreement, Supervalu and Moran Foods also entered into a Separation Agreement (the “Separation Agreement”) pursuant to which, among other things, the assets and liabilities of the Save-A-Lot business were transferred to and assumed by Moran Foods, LLC prior to the completion of the sale. The assets, liabilities, operating results, and cash flows of Save-A-Lot have been presented separately as discontinued operations in the Consolidated Financial Statements for all periods presented.

Corporate

In connection with the completion of Supervalu’s sale of Save-A-Lot on December 5, 2016, Supervalu and Moran Foods entered into a Services Agreement whereby Supervalu is providing certain technical, human resources, finance and other operational services to Save-A-Lot for a term of five years, on the terms and subject to the conditions set forth therein. Moran Foods paid Supervalu $30 upon entry into the Services Agreement, which will be credited against fees due under the Services Agreement. The initial annual base charge under the Services Agreement is $30, subject to adjustments. Pursuant to this Services Agreement, Save-A-Lot may also request new services through the “change control” procedures described therein, and Supervalu may also agree to conduct non-recurring projects for Save-A-Lot pursuant to project orders.

Moran Foods may terminate the Services Agreement in the event of Supervalu’s material breach, if Supervalu breaches its non-compete obligations under the Merger Agreement, if Supervalu is acquired by a third party that engages in a Competing Business (as defined in the Merger Agreement) or in the event of Supervalu’s bankruptcy or insolvency, in each case, subject to certain limitations set forth in the Services Agreement. In addition, Moran Foods may terminate certain services or service categories if Supervalu commits a breach that is material to the service category or if Supervalu fails to meet certain minimum specified service levels, in each case, subject to certain limitations set forth in the Services Agreement. Supervalu may terminate the Services Agreement in the event of Moran Foods’ material breach, for Moran Foods’ failure to make timely payment, for certain legal or regulatory changes and in the event of Moran Foods’ bankruptcy or insolvency, in each case, subject to certain limitations set forth in the Services Agreement. The Services Agreement generally requires each party to indemnify the other party against third-party claims arising out of the performance of or the provision or receipt of services under the Services Agreement.

Supervalu provides back-office administrative support services under the transition services agreements (“TSA”) with NAI and Albertson’s LLC and is also providing services as needed to transition and wind down the TSA with NAI and Albertson’s LLC. Supervalu estimates that the complete transition and wind down of the TSA with NAI and Albertson’s LLC could take approximately two to three more years. In September 2016, NAI and Albertson’s LLC each notified Supervalu that it was again exercising its right to renew the term of their respective TSA for an additional year, which extended the expiration date of the NAI and Albertson’s LLC TSA to September 21, 2018, unless renewed again by notice given no later than September 21, 2017. The wind down of the TSA will result in the loss of significant revenue for Supervalu.

In connection with Haggen’s bankruptcy process, Haggen has now closed or sold all 164 of its stores. The transition and wind down of the Haggen transition services agreement occurred in the second quarter of fiscal 2017, with Supervalu now providing limited services in connection with the wind down of the Haggen estate.

Products

Supervalu offers a wide variety of nationally advertised brand name and private-label products, including grocery (both perishable and nonperishable), general merchandise, home, health and beauty care, and pharmacy, which are sold through Supervalu’s Wholesale segment to Wholesale customers and through Company-operated Retail stores to shoppers. Supervalu believes that it has adequate and alternative sources of supply for most of its purchased products.

The following table provides additional detail on the amounts and percentages of Net sales for each group of similar products sold in the Wholesale and Retail segments, and service agreement revenue discussed in “—Professional Services” in Corporate:

5

2017 (52 weeks) | 2016 (52 weeks) | 2015 (53 weeks) | ||||||||||||||||||

Wholesale: | ||||||||||||||||||||

Nonperishable grocery products(1) | $ | 5,579 | 45 | % | $ | 5,753 | 45 | % | $ | 5,939 | 45 | % | ||||||||

Perishable grocery products(2) | 1,969 | 16 | 2,025 | 16 | 2,099 | 16 | ||||||||||||||

Services to wholesale customers and other | 157 | 1 | 157 | 1 | 160 | 1 | ||||||||||||||

7,705 | 62 | % | 7,935 | 61 | % | 8,198 | 62 | % | ||||||||||||

Retail: | ||||||||||||||||||||

Nonperishable grocery products(1) | $ | 2,511 | 20 | % | $ | 2,607 | 20 | % | $ | 2,677 | 20 | % | ||||||||

Perishable grocery products(2) | 1,494 | 12 | 1,549 | 12 | 1,574 | 12 | ||||||||||||||

Pharmacy products | 500 | 4 | 511 | 4 | 510 | 4 | ||||||||||||||

Fuel | 55 | 1 | 67 | 1 | 83 | 1 | ||||||||||||||

Other | 36 | — | 35 | — | 40 | — | ||||||||||||||

4,596 | 37 | % | 4,769 | 37 | % | 4,884 | 37 | % | ||||||||||||

Corporate: | ||||||||||||||||||||

Service agreement revenue | $ | 179 | 1 | % | $ | 203 | 2 | % | $ | 195 | 1 | % | ||||||||

Net sales | $ | 12,480 | 100 | % | $ | 12,907 | 100 | % | $ | 13,277 | 100 | % | ||||||||

(1) | Includes such items as dry goods, dairy, frozen foods, beverages, general merchandise, home, health and beauty care and candy |

(2) | Includes such items as meat, produce, deli and bakery |

Private-Label Products

Supervalu’s private-label products are produced to Supervalu’s specification by many suppliers and compete in most categories. Private-label products include: the premium brands Culinary Circle® and Stockman & Dakota®, which offer unique, premium quality products in highly competitive categories; Wild Harvest®, which is free from over 100 undesirable ingredients; core brands Essential Everyday®, EQUALINE®, and category-specific brands Arctic Shores Seafood Company®, Baby Basics®, Farm Stand®, Stone Ridge Creamery® and Super Chill®, which provide shoppers quality national brand equivalent products at a competitive price; and the value brand Shopper’s Value®, which offers budget conscious consumers a quality alternative to national brands at substantial savings.

Trademarks

Supervalu offers Wholesale customers the opportunity to franchise a concept or license a service mark. These programs help our Wholesale customers compete by providing, as part of the franchise or license program, a complete business concept, group advertising, private-label products and other benefits. Supervalu is the franchisor or licensor of certain banner store service marks such as CUB FOODS, FESTIVAL FOODS, SENTRY, COUNTY MARKET, SHOP ’N SAVE, NEWMARKET, FOODLAND, JUBILEE and SUPERVALU. In conjunction with its licensing and franchise arrangements, Supervalu maintains wholesale distribution agreements with its licensees and franchisees, primarily under the Cub Foods, Festival Foods, Sentry and Rainbow banners.

Supervalu files a substantial number of its trademarks/service marks with the United States Patent and Trademark Office, including for many of its private-label product brands. U.S. trademark and service mark registrations are for a term of ten years, and renewable every ten years as long as the trademark is used in the regular course of trade. Supervalu considers certain of its trademarks and service marks to be of material importance to its Wholesale and Retail segments and actively defends and enforces such trademarks and service marks.

Working Capital

Normal operating fluctuations in working capital balances can result in changes to cash flow from operations presented in the Consolidated Statements of Cash Flows that are not necessarily indicative of long-term operating trends. Supervalu’s working capital needs are generally greater during the months leading up to high sales periods, such as the time period from prior to Thanksgiving through December. Supervalu typically finances these working capital needs with funds provided by operating activities and short-term borrowings. Inventories are managed primarily through demand forecasting and replenishing depleted inventories. There are no unusual industry practices or requirements relating to working capital.

6

Seasonality

Overall product sales are fairly balanced throughout the year, although demand for certain products of a seasonal nature may be influenced by holidays, changes in seasons or other annual events. Our first quarter consists of 16 weeks, while all of our other quarters consist of 12 weeks, and all of our quarters typically include a major holiday.

Competition

Wholesale and Retail each operate in a highly competitive environment.

Wholesale competes directly with a number of traditional and specialty grocery wholesalers and retailers that maintain or develop self-distribution systems. Supervalu believes it competes in this business on the basis of price, quality, assortment, schedule and reliability of deliveries and services, service fees and distribution facility locations.

Principal competition for Supervalu’s Retail segment comes from traditional grocery retailers, including regional and national chains and independent grocery store operators, and non-traditional retailers, such as supercenters, membership warehouse clubs, specialty supermarkets, hard discount stores, dollar stores, online retailers, convenience stores, drug stores and restaurants. Supervalu’s ability to differentiate itself from its competitors and create an attractive value proposition for its customers is dependent upon a combination of price, quality, customer service, convenience, e-commerce offerings, assortment, in-stock levels, brand perception, store location and conditions, in-store marketing and merchandising and promotional strategies.

Supervalu believes that the success of its Wholesale and Retail segments is dependent upon the ability of its own stores, as well as the stores of wholesale customers it supplies, to compete successfully. Supervalu also competes to attract and maintain licensed and franchised operators to operate stores to which it provides wholesale distribution and services. This competition generally takes the form of alternative investment formats, such as a potential or existing licensee’s investment in fast food restaurants, dollar stores, specialty supermarkets, drug stores and other potential investments.

Recent and ongoing consolidation within the grocery industry has resulted in, and is expected to continue to result in, increased competition, including from some competitors that have greater financial, marketing and other resources than Supervalu.

Employees

As of February 25, 2017, Supervalu had approximately 29,000 employees. Approximately 16,000 employees are covered by 48 collective bargaining agreements. During fiscal 2017, twenty collective bargaining agreements covering approximately 9,200 employees were renegotiated. Also, three collective bargaining agreements covering approximately 140 employees have already expired without their terms being renegotiated. Negotiations are expected to continue with the bargaining units representing the employees subject to those expired agreements. During fiscal 2018, twenty-three collective bargaining agreements covering approximately 6,000 employees will expire. The majority of employees covered by these expiring collective bargaining agreements are located in Eastern markets. Supervalu is focused on ensuring competitive cost structures in each market in which it operates while meeting its employees’ needs for attractive wages and affordable healthcare and retirement benefits. Supervalu believes that it has generally good relations with its employees and with the labor unions that represent employees covered by collective bargaining agreements.

Where You Can Find More Information

Supervalu’s principal executive offices are located at 11840 Valley View Road, Eden Prairie, Minnesota 55344 (Telephone: 952-828-4000). Supervalu makes available free of charge at its Internet website (www.supervalu.com) its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (the “SEC”). Information on Supervalu’s website is not deemed to be incorporated by reference into this Annual Report on Form 10-K. Supervalu will also provide its SEC filings free of charge upon written request to Investor Relations, SUPERVALU INC., P.O. Box 990, Minneapolis, MN 55440.

7

EXECUTIVE OFFICERS OF SUPERVALU INC.

The following table provides certain information concerning the executive officers of Supervalu as of April 25, 2017.

Name | Age | Present Position | Calendar Year Elected to Present Position | Other Positions Recently Held with Supervalu | ||||

Mark Gross(1) | 54 | President and Chief Executive Officer | 2016 | |||||

Bruce H. Besanko(2) | 58 | Executive Vice President, Chief Operating Officer and Chief Financial Officer | 2016 | Executive Vice President, Chief Operating Officer, 2015-April 2016; Executive Vice President, Chief Financial Officer, 2013-2015 | ||||

Randy G. Burdick(3) | 59 | Executive Vice President, Chief Information Officer | 2013 | |||||

Anne M. Dament(4) | 50 | Senior Vice President, Retail, Merchandising and Marketing | 2017 | |||||

Susan S. Grafton(5) | 60 | Senior Vice President, Finance, and Chief Accounting Officer | 2016 | Executive Vice President, Chief Financial Officer, 2015-April 2016; Senior Vice President, Finance, and Chief Accounting Officer, 2014-2015 | ||||

Karla C. Robertson | 46 | Executive Vice President, General Counsel and Corporate Secretary | 2013 | Executive Vice President, Legal 2013; Vice President, Employment, Compensation and Benefits Law, 2012-2013; Director, Employment Law, 2011-2012; Senior Labor and Employment Counsel, 2009-2011 | ||||

Michael C. Stigers(6) | 58 | Executive Vice President, Wholesale | 2015 | President of Cub Foods, 2014-2015; President, Northern and Western Region of Wholesale, 2013-2014; President of Shaw’s, 2011-2013 | ||||

James W. Weidenheimer(7) | 58 | Executive Vice President, Corporate Development and Chief Innovation Officer | 2016 | |||||

Rob N. Woseth(8) | 46 | Executive Vice President, Chief Strategy Officer | 2013 | |||||

(1) | Mark Gross was appointed President and Chief Executive Officer in February 2016. Prior to joining Supervalu, Mr. Gross served since 2006 as President of Surry Investment Advisors LLC, an advisory firm that Mr. Gross founded to provide consulting services to grocery distributors and retailers with respect to strategic and operational matters. From 1997-2006, Mr. Gross held various positions at C&S Wholesale Grocers, including serving as Co-President of C&S’s overall operations from 2005-2006. Additionally, during his tenure with C&S, Mr. Gross served as Chief Financial Officer, General Counsel, and President of its affiliated retail grocery operations. |

(2) | Bruce H. Besanko was appointed Executive Vice President, Chief Operating Officer and Chief Financial Officer in April 2016. Prior to that, Mr. Besanko served as Executive Vice President, Chief Operating Officer from October 2015 to April 2016, and as Executive Vice President, Chief Financial Officer from August 2013 to October 2015. Prior to joining Supervalu, Mr. Besanko served as Executive Vice President and Chief Financial Officer since February 2009, and as Chief Administrative Officer since October 2009, for OfficeMax. Mr. Besanko previously served as Executive Vice President and Chief Financial Officer of Circuit City Stores, Inc. (“Circuit City”), a specialty retailer of consumer electronics and related services, from July 2007 to February 2009. Prior to that, Mr. Besanko served as Senior Vice President, Finance and Chief Financial Officer for The Yankee Candle Company, Inc., a designer, manufacturer, wholesaler and retailer of premium scented candles, since April 2005. On November 10, 2008, Circuit City and several of its subsidiaries filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the Eastern District of Virginia. Circuit City’s Chapter 11 plan of liquidation was confirmed by the Bankruptcy Court on September 14, 2010. |

(3) | Randy G. Burdick was appointed Executive Vice President, Chief Information Officer in March 2013. Prior to joining Supervalu, Mr. Burdick served as Executive Vice President and Chief Information Officer at OfficeMax from 2005-2013. |

(4) | Anne M. Dament was appointed Senior Vice President, Retail, Merchandising and Marketing in January 2017. Prior to joining Supervalu, Ms. Dament served as Senior Vice President, Merchandising at Target Corporation, a general merchandise retailer, from April 2015 to November 2016. Ms. Dament previously served as Vice President, Merchandising Solutions from 2009 to September 2012 and as Vice President, Services from September 2012 to April 2015 at PetSmart, Inc., a specialty retailer of services and solutions for pets. |

(5) | Susan S. Grafton was appointed Senior Vice President, Finance, and Chief Accounting Officer in April 2016. Prior to that, Ms. Grafton served as Executive Vice President, Chief Financial Officer from October 2015 to April 2016, and as Senior Vice President, Finance, and Chief Accounting Officer for Supervalu from February 2014 to October 2015. Prior to joining Supervalu, Ms. Grafton served as Senior Vice President, Controller and Chief Accounting Officer from 2011-2014 and as Vice President, Controller and Chief Accounting Officer from 2006-2011 at Best Buy Co., Inc., a retailer of consumer electronics and related products. |

(6) | Prior to joining Supervalu in 2011, Michael C. Stigers served as President of PW Supermarkets, Inc., an operator of retail grocery supermarkets, from 2006-2010 and as Chief Executive Officer in 2010. In April 2011, creditors filed a petition for involuntary bankruptcy against PW Supermarkets in U.S. Bankruptcy Court, Northern District of California to force PW Supermarkets into a |

8

Chapter 7 liquidation. The bankruptcy case was transferred to the Oakland Division in October 2014 and continues to be an active case in that court.

(7) | James W. Weidenheimer was appointed Executive Vice President, Corporate Development and Chief Innovation Officer in April 2016. Prior to joining Supervalu, Mr. Weidenheimer served as Senior Vice President of Corporate Development for C&S Wholesale Grocers from 2008 to January 2016, where Mr. Weidenheimer oversaw significant M&A activity and led the development of procurement and distribution outsourcing plans. From 1998 to 2008, Mr. Weidenheimer had operating responsibility for finance, treasury, procurement, facilities, internal audit, quality assurance and inventory control at C&S. |

(8) | Rob N. Woseth was appointed Executive Vice President, Chief Strategy Officer effective March 2013. Prior to joining Supervalu, Mr. Woseth served as Vice President Business Development and Strategy at Albertson’s LLC from 2006-2013. |

The term of office of each executive officer is from one annual meeting of the Board of Directors until the next annual meeting of Board of Directors or until a successor is elected. There are no family relationships between or among any of the executive officers of Supervalu.

ITEM 1A. RISK FACTORS

Various risks and uncertainties may affect Supervalu’s business. Any of the risks described below or elsewhere in this Annual Report on Form 10-K or Supervalu’s other SEC filings may have a material impact on Supervalu’s business, financial condition or results of operations.

Strategic and Operational Risks

Supervalu faces intense competition.

The grocery business is intensely competitive, and the recent and ongoing consolidation within the grocery industry is expected to result in increased competition, including from some competitors that have greater financial, marketing and other resources than Supervalu. The grocery industry is characterized by relatively small operating margins, and as competition in certain areas intensifies and as the industry continues to consolidate, Supervalu’s results of operations may be negatively impacted through a loss of sales and reductions in gross margins. See “Business—Competition” for a discussion of the competitive environment.

If Supervalu is unable to appropriately respond to competition and execute on its initiatives to improve the competitive position or profitability of Supervalu, and differentiate Supervalu’s offerings, Supervalu’s sales, financial condition and results of operations may be adversely affected.

Supervalu may engage in acquisitions and divestitures, and may encounter difficulties integrating acquired businesses or disposing divested businesses and may not realize the anticipated benefits of these acquisitions and divestitures.

Supervalu may engage in strategic transactions. Acquisitions and dispositions present significant challenges and risks relating to the integration of acquired businesses and the separation of disposed businesses. The risks include Supervalu’s due diligence reviews may not identify all of the material issues, Supervalu may incur unanticipated costs or expenses, and Supervalu may not be able to integrate acquisitions with its operations or separate divested businesses and related obligations from its operations as planned. Supervalu may also not realize the degree or timing of benefits or synergies it anticipates when it first enters into a transaction. There can be no assurances that Supervalu will manage acquisitions and dispositions successfully, that strategic opportunities will be available to Supervalu on acceptable terms or at all, or that Supervalu will be able to consummate desired transactions. Any of the foregoing could materially adversely affect Supervalu’s competitive position, financial condition, results of operations or cash flows.

On April 10, 2017, Supervalu entered into a definitive merger agreement to acquire Unified Grocers, Inc., a West Coast focused wholesale grocery and specialty distributor, in a transaction valued at approximately $375, comprised of approximately $114 in cash for 100% of the outstanding stock of Unified Grocers plus the assumption and pay-off of Unified Grocers’ net debt at closing, which was approximately $261 as of April 1, 2017. There are no purchase price adjustments for any changes in Unified Grocers’ net debt between signing and closing or otherwise. The process of consummating the proposed acquisition of Unified Grocers may be disruptive to Supervalu’s business operations and may distract Supervalu’s management team from their day-to-day responsibilities. The acquisition is subject to customary closing conditions, which may not be obtained or satisfied, and as a result and due to other factors outside Supervalu’s control, the acquisition may not be completed on the current terms or on the timing currently contemplated, or at all. There can also be no assurance the Supervalu will be able to successfully integrate Unified Grocers to achieve the operational efficiencies, including synergistic and other benefits of the proposed acquisition, or effectively retain key employees and maintain and grow customer relationships. Any of these risks or uncertainties, including the inability to complete the proposed acquisition in the time period and on the terms contemplated, could adversely affect Supervalu’s business, financial condition, results of operations or cash flows.

9

Supervalu’s Wholesale distribution business could be adversely affected if Supervalu is not able to affiliate new customers or retain existing customers, or if Supervalu’s Wholesale customers fail to perform.

The profitability of Supervalu’s Wholesale segment is dependent upon sufficient volume to support Supervalu’s operating infrastructure, which is dependent on the ability of Supervalu to attract new customers and retain existing customers. The inability to attract new customers or the loss of existing customers to a competing wholesaler or due to closure, vertical integration by an existing customer converting to self-distribution, or industry consolidation may negatively impact Supervalu’s sales and operating margins.

Supervalu’s success also relies in part on the financial success and cooperation of its Wholesale customers. These Wholesale customers manage their businesses independently, and therefore are responsible for the day-to-day operation of their stores. They may not experience an acceptable level of sales or profitability, and Supervalu’s revenues and gross margins could be negatively affected as a result. Supervalu may also need to extend credit to its Wholesale customers, including through loans, market support or guarantees, and while Supervalu seeks to obtain security interests and other credit support in connection with the financial accommodations Supervalu extends, such collateral may not be sufficient to cover its exposure. If sales trends or profitability worsen for Wholesale customers, their financial results may deteriorate, which could result in, among other things, lost business for Supervalu, delayed or reduced payments to Supervalu or defaults on payments or other liabilities owed by Wholesale customers to Supervalu, any of which could adversely impact Supervalu’s financial condition and results of operations as well as its ability to grow its Wholesale business. In this regard, Supervalu’s Wholesale customers are affected by the same economic conditions, including food deflation, and competition that Supervalu’s Retail segment is facing. The magnitude of these risks increases as the size of Supervalu’s Wholesale customers increases.

Failure to affiliate new customers and retain existing customers for Supervalu’s professional services, or the failure to perform the services as required, could adversely impact Supervalu’s results of operations.

Supervalu provides numerous services to its Wholesale customers to support the operation of their businesses and stores. Supervalu has been working to leverage its experience, infrastructure and investments to engage new customers and expand the scope of services received by existing customers. If Supervalu is unable to successfully implement this strategy, including differentiating the quality and breadth of Supervalu’s services to customers, in a highly competitive and consolidating environment, or if Supervalu is unable to perform the services up to the customers’ expectations, Supervalu’s results of operations could be adversely impacted.

Supervalu has significant service relationships with Albertson’s LLC, NAI and Save-A-Lot, and the wind-down of Supervalu’s relationship with Albertson’s LLC and NAI (and any future wind down of Save-A-Lot) could adversely impact Supervalu’s results of operations.

Supervalu has provided significant support services to Albertson’s since 2006 and to Save-A-Lot since Supervalu divested it in December 2016. Despite Supervalu believing that it met service expectations, Albertson’s has determined to wind down its services relationship with Supervalu after it acquired Safeway and now has access to these services from Safeway’s platform. Supervalu expects its services to Albertson’s to be fully wound down over the next approximately two to three years. Supervalu will lose a significant amount of revenue and corresponding operating earnings as a result of this wind down. Supervalu has been executing on its plan to reduce costs, grow its sales and enhance its margins over the past several years. These efforts have contributed to Supervalu's profitability, including the TSA. As the revenue Supervalu receives from the TSA continues to decline, Supervalu does not believe that it will be able to grow sales quickly enough or further eliminate costs or enhance margin to fully mitigate the lost revenue as the TSA unwinds. Failure to execute on Supervalu’s services offering and growth strategy, including making the necessary capital investments for that growth while managing additional cost reductions, could further adversely impact Supervalu’s results of operations. Supervalu’s results of operations could also be adversely impacted if Supervalu is not able to transition and wind down the Albertson’s services in the manner or timeline anticipated. Supervalu is working closely with Albertson’s on the wind down but the execution of that wind down is dependent on Albertson’s.

Supervalu’s large professional services agreements, including Supervalu’s agreement with Save-A-Lot, provide certain rights for the customers. The services agreement will typically include a fixed term but provide the customer certain termination rights, including in the event of Supervalu’s material breach, and may give the customer certain termination and monetary rights with respect to specified services or service categories in the event Supervalu does not perform to agreed-upon minimum levels of service. The services agreement will also generally require Supervalu to indemnify the customer against third-party claims arising out of the performance of the services under the agreement. Termination of services agreements, in whole or in part, and in particular the services agreement with Save-A-Lot and the wind-down of the services agreement with Albertson’s, could adversely affect Supervalu’s business or results of operations.

10

Supervalu’s inability to maintain or increase its operating margins could adversely affect its results of operations and the price of Supervalu’s stock.

As competition increases, the grocery industry consolidates and Supervalu attempts to affiliate larger Wholesale customers, Supervalu expects to continue to face pressure on its operating margins. If Supervalu is not able to continue to capture scale efficiencies and enhance its merchandise offerings, Supervalu may not be able to achieve its goals with respect to operating margins. In addition, if Supervalu does not continuously refine and improve its systems, Supervalu may not be able to increase sales, effectively manage inventory and procurement processes or effectively manage customer pricing plans. As a result, Supervalu’s operating margins may stagnate or decline, which could adversely affect the price of Supervalu’s stock.

Supervalu may not be able to grow or maintain its levels of identical store sales.

Supervalu has experienced negative identical store sales in its Retail operations in recent periods. A variety of factors affect identical store sales and profitability, including in-store performance, consumer tastes, competition, current economic conditions, pricing, deflation or inflation, and weather conditions, and many of these factors are beyond our control and can be difficult to predict in advance. If Supervalu’s identical store sales continue to decline or fail to meet market expectations, Supervalu’s results of operations could be adversely affected and the price of Supervalu’s stock could decline.

Supervalu’s indebtedness could decrease Supervalu’s financial and operational flexibility and Supervalu’s borrowing costs could increase.

Supervalu’s credit facilities contain covenants that limit Supervalu’s ability to acquire assets, dispose of assets and use the proceeds thereof, create liens on property, incur or prepay indebtedness and pay dividends, among other things and subject to certain exceptions. These covenants may affect Supervalu’s operating and financial flexibility and may require Supervalu to seek the consent of the lenders for certain transactions that Supervalu may wish to effect. There can be no assurances that Supervalu would be able to obtain such consent. There can also be no assurances that Supervalu will be able to refinance its existing indebtedness on similar terms. Tightening of credit, reduced liquidity or volatility in the capital markets could result in diminished availability of credit and higher costs of borrowing, making it more difficult for Supervalu to obtain or amend debt financing on favorable terms. Additionally, if Supervalu fails to comply with any of its covenants or other restrictions, the related indebtedness (and other unrelated indebtedness) could become due and payable prior to its stated maturity and Supervalu may not be able to repay the indebtedness that becomes due. A default under Supervalu’s debt instruments may also significantly affect Supervalu’s ability to obtain additional or alternative financing.

A significant portion of Supervalu’s debt portfolio has a variable interest rate component. Volatility in interest rates causes volatility in interest expense, potentially resulting in an adverse impact to earnings.

Increased healthcare, pension and other costs under Supervalu’s and multiemployer benefit plans, or failure to maintain satisfactory labor relations, could adversely affect Supervalu’s financial condition and results of operations.

Supervalu provides health, defined benefit pension, defined contribution and other postretirement benefits to many of its employees and the costs of such benefits continue to increase. The amount of any increase depends on a number of different factors, many of which are beyond Supervalu’s control. These factors include governmental regulations such as The Patient Protection and Affordable Care Act, which has resulted in changes to the U.S. healthcare system and imposes mandatory types of coverage, reporting and other requirements; return on assets held in plans; changes in actuarial valuations used to determine Supervalu’s benefit obligations for certain benefit plans, which require the use of significant estimates, including the discount rate, expected long-term rate of return on plan assets, mortality rates and the rates of increase in compensation and health care costs; and for multiemployer plans, the outcome of collective bargaining and actions taken by trustees who manage the plans. If Supervalu is unable to control these benefits and costs, Supervalu may experience increased operating costs, which may adversely affect Supervalu’s financial condition and results of operations.

Additionally, Company-sponsored plans and multiemployer pension plans are underfunded with the projected benefit obligations exceeding the fair value of those plans’ assets. Withdrawal liabilities from multiemployer plans could be material, and potential exposure to withdrawal liabilities could cause Supervalu to forgo business opportunities. Many of these plans have required rehabilitation plans or funding improvement plans, and Supervalu can give no assurances of the extent to which a rehabilitation plan or a funding improvement plan will improve the funded status of the plan. Supervalu expects that the unfunded liabilities of these plans will result in increased future payments by Supervalu and the other participating employers over the next few years. A significant increase to funding requirements could adversely affect Supervalu’s financial condition, results of operations or cash flows. The financial condition of these pension plans may also negatively impact Supervalu’s debt ratings, which may increase the cost of borrowing or adversely affect Supervalu’s ability to access one or more financial markets.

11

Supervalu is party to collective bargaining agreements that impose certain work rules and other restrictions on Supervalu that limit its flexibility in managing the business and cost structure. See “Business—Employees” for information about the collective bargaining agreements. There can be no assurance that Supervalu will be able to negotiate the terms of expiring or expired agreements in a manner acceptable to Supervalu. Therefore, potential increases in operating costs, reduced operational flexibility or work disruptions from labor disputes, strikes or picketing could disrupt Supervalu’s businesses and adversely affect Supervalu’s financial condition and results of operations. Certain of Supervalu’s operations have employees who are non-union, and while Supervalu believes its employee relations are strong, there can be no assurance that these operations will not experience pressure from labor unions or become the target of campaigns to unionize.

Supervalu’s success depends in part on the retention of its executive officers and key management, and its ability to hire and retain key personnel.

Supervalu’s success depends on the experience, performance and skills of its executive officers, senior management and other key employees. Competition for skilled and experienced personnel is intense, and Supervalu’s future success will also depend on its ability to attract and retain qualified personnel. Failure to attract and retain qualified personnel could have an adverse effect on Supervalu’s operations. There can be no assurance that Supervalu’s executive succession planning, retention or hiring efforts will be successful.

Disruptions to Supervalu’s or third-party information technology systems, including cyber-attacks and security breaches, and the costs of maintaining secure and effective information technology systems could negatively affect Supervalu’s business and results of operations.

The efficient operation of Supervalu’s businesses is highly dependent on computer hardware and software systems, including customized information technology systems. Additionally, Supervalu’s businesses increasingly involve the receipt, storage and transmission of sensitive data, including personal information about Supervalu’s customers and employees and proprietary business information of Supervalu and its customers and vendors. Supervalu also shares information with vendors. Information systems are vulnerable to not functioning as designed and to disruptions and security breaches by computer hackers and cyber terrorists.

In fiscal 2015, Supervalu experienced separate criminal intrusions into the portion of its computer network that processes payment card transactions for some of its owned and franchised retail food stores, including some of the associated stand-alone liquor stores. Supervalu has incurred and expects to incur costs and expenses related to these intrusions, and may also be adversely affected by claims from customers, financial institutions, payment card brands, Albertson’s LLC and NAI for stores owned and operated by them that experienced related criminal intrusions, stockholders and others and by costly inquiries or enforcement actions on the part of regulatory authorities.

Despite Supervalu continuing to take actions to strengthen the security of its information technology systems, these measures and technology may not adequately anticipate or prevent security breaches in the future or Supervalu may not be able to timely implement these measures and technology. Cyber-attacks are rapidly evolving and becoming increasingly sophisticated and difficult to detect. The failure to promptly detect, determine the extent of and appropriately respond to and contain a significant data security attack or breach of the systems of Supervalu or any third party systems used by Supervalu could have a material adverse impact on Supervalu’s business, financial condition and results of operations. Supervalu could also lose credibility with its customers and suffer damage to its reputation and future sales, including through negative publicity and social media. In addition, the unavailability of the information systems or failure of these systems or software to perform as anticipated for any reason and any inability to respond to, or recover from, such an event, could disrupt Supervalu’s business, impact Supervalu’s customers and could result in decreased performance, increased overhead costs and increased risk for liability, causing Supervalu’s business and results of operations to suffer.

As a merchant that accepts debit and credit cards for payment, Supervalu is subject to the Payment Card Industry Data Security Standard (“PCI DSS”), issued by the PCI Council. Additionally, Supervalu is subject to PCI DSS as a service provider, which is a business entity that is not a payment brand directly involved in the processing, storage, or transmission of cardholder data. PCI DSS contains compliance guidelines and standards with regard to Supervalu’s security surrounding the physical and electronic storage, processing and transmission of individual cardholder data. By accepting debit cards for payment, Supervalu is also subject to compliance with American National Standards Institute data encryption standards and payment network security operating guidelines. The cost of complying with stricter privacy and information security laws, standards and guidelines, including evolving PCI DSS standards, and developing, maintaining and upgrading technology systems to address future advances in technology, could be significant and Supervalu could experience problems and interruptions associated with the implementation of new or upgraded systems and technology or with maintenance or adequate support of existing systems. Failure to comply with such laws, standards and guidelines, or payment card industry standards such as accepting Europay,

12

MasterCard, and Visa (EMV) transactions, could have a material adverse impact on Supervalu’s business, financial condition and results of operations.

Changes in the military commissary system or decreases in governmental funding could negatively impact the sales and operating performance of Supervalu’s military business.

Supervalu’s Wholesale segment sells and distributes grocery products to military commissaries and exchanges in the United States. The commissary system is experiencing material changes as the Defense Commissary Agency (“DeCA”) looks to reduce the level of governmental funding required for the system, including to lower prices from suppliers and to offer its own private label products. The military food distribution industry already has narrow operating margins making economies of scale critical for distributors. These changes could have an adverse impact on the sales and operating performance of Supervalu’s military business. Additionally, Supervalu’s military business faces competition from large national and regional food distributors as well as smaller food distributors, and the military commissaries and exchanges face competition from low-cost retailers.

Supervalu’s insurance and self-insurance programs may not be adequate to cover future claims.

Supervalu uses a combination of insurance and self-insurance to provide for potential liabilities for workers’ compensation, automobile and general liability, director and officer liability, property risk, cyber and privacy risks and employee healthcare benefits. Supervalu estimates the liabilities and required reserves associated with the risks retained by Supervalu. Any such estimates and actuarial projection of losses is subject to a degree of variability. Among the causes of this variability are changes in benefit levels, medical fee schedules, medical utilization guidelines, vocation rehabilitation and apportionment and unpredictable external factors affecting inflation rates, discount rates, rising health care costs, litigation trends, legal interpretations, benefit level changes and actual claim settlement patterns. If the number or severity of claims for which Supervalu is self-insured increases, or Supervalu is required to accrue or pay additional amounts because the claims prove to be more severe than Supervalu’s original assessments, Supervalu’s financial condition and results of operations may be adversely affected.

Impairment charges for long-lived assets or goodwill may adversely affect Supervalu’s financial condition and results of operations.

Supervalu monitors the recoverability of its long-lived assets such as buildings and equipment and evaluates their carrying value for impairment whenever events or changes in circumstances indicate that the carrying amount of such assets may not be fully recoverable. Supervalu annually reviews goodwill to determine if impairment has occurred. Additionally, interim reviews are performed whenever events or changes in circumstances indicate that impairment may have occurred. If the testing performed indicates that impairment has occurred, Supervalu is required to record a non-cash impairment charge for the difference between the carrying value of the long-lived assets or goodwill and the fair value of long-lived assets and the implied fair value of the goodwill, respectively, in the period the determination is made. The testing of long-lived assets and goodwill for impairment requires Supervalu to make estimates that are subject to significant variability about its future revenue, profitability, cash flows, fair value of assets and liabilities, weighted average cost of capital, as well as other assumptions. Changes in these estimates, or changes in actual performance compared with these estimates, may affect the fair value of long-lived assets or goodwill, which may result in an impairment charge.

Supervalu cannot accurately predict the amount or timing of any impairment of assets. Should the value of long-lived assets or goodwill become impaired, Supervalu’s financial condition and results of operations may be adversely affected.

Supervalu’s stock price is subject to market and other conditions and may be volatile.

The market price of Supervalu’s common stock may fluctuate significantly in response to a number of factors. These factors, some of which may be beyond Supervalu’s control, include the perceived prospects and actual operating results of Supervalu’s business; changes in estimates of Supervalu’s operating results by analysts, investors or Supervalu; trading activity by our large stockholders; trading activity by sophisticated algorithms (high-frequency trading); Supervalu’s actual operating results relative to such estimates or expectations; actions or announcements by Supervalu or its competitors; litigation and judicial decisions; legislative or regulatory actions; and changes in general economic or market conditions. In addition, the stock market in general has from time to time experienced extreme price and volume fluctuations. These market fluctuations could reduce the market price of Supervalu’s common stock for reasons unrelated to Supervalu’s operating performance.

13

Economic Risks

Changes in commodity prices, including due to deflation or inflation, or worsening economic conditions could adversely impact Supervalu’s financial condition and operating results.

Prices for the commodities and supplies that Supervalu purchases can be volatile. Supervalu has more recently experienced continued deflation in commodities that it purchases for resale. Decreases in these input costs have caused Supervalu to lower its prices and thereby reduce its revenues and gross margins. Continued deflation could adversely affect Supervalu’s operating results. Additionally, Supervalu’s operations are dependent on the availability of energy and fuel to store and transport products. While Supervalu has entered into contracts to purchase fuel, electricity and natural gas at fixed prices to satisfy a portion of its expected needs, an increase in these costs could adversely affect Supervalu’s results of operations. Supervalu has also invested in semitrailer trucks powered by compressed natural gas, which operations are subject to risks of defects, malfunctions and other damages.

The vast majority of Supervalu’s operations and customers are located in the United States, making its results highly dependent on U.S. economic conditions including consumer confidence and spending habits. Further, a significant portion of Supervalu’s total sales for its Retail operations is derived from stores located in Minnesota, Missouri and the Washington D.C./Baltimore market, resulting in further dependence on local economic conditions in these states. There can be no assurance that Supervalu will be able to identify and respond effectively to changing economic conditions and trends. Additionally, these economic conditions can increase Supervalu’s cost of sales and selling, general and administrative expenses, and otherwise adversely affect Supervalu’s results of operations.

Severe weather and natural disasters may harm Supervalu’s business.

Severe weather conditions and natural disasters in areas in which Supervalu or its customers operate or from which Supervalu obtains products may adversely affect Supervalu’s financial condition and results of operations, including as a result of physical damage to Supervalu’s properties, closure of one or more of Supervalu’s or its customers’ stores, offices or distribution facilities, lack of an adequate work force in a market, temporary disruption in the supply of products, disruption in the transport of goods, delays in the delivery of goods to distribution centers or stores, a reduction in customer volume and a reduction in the availability of products. In addition, adverse climate conditions and adverse weather patterns, such as drought or flood, that impact growing conditions and the quantity and quality of crops yielded by food producers may adversely affect the availability or cost of certain products within the grocery supply chain.

Disruption to Supervalu’s supply chain and distribution network could have an adverse impact on Supervalu’s sales and results of operations.

Supervalu’s sales and operating results could be adversely impacted if Supervalu is not able to provide goods and services to Supervalu and its customers in a timely and cost-effective manner. Factors that may disrupt Supervalu’s ability to maintain an uninterrupted supply chain and distribution network include adverse climate conditions, product recalls, crop conditions, availability of key commodities, regulatory actions, disruptions in technology, political or financial instability of suppliers, performance by outsourced service providers, transportation interruptions, labor supply or stoppages or vendor defaults or disputes, as well as other risk factors mentioned herein, any of which could also have an adverse effect on Supervalu’s sales and operating results.

Legal and Regulatory Risks

Supervalu’s businesses are subject to laws and governmental regulations that could adversely impact Supervalu’s financial condition and results of operations.

Supervalu’s businesses are subject to various federal, state and local laws, regulations and administrative practices that require Supervalu to comply with numerous provisions regulating areas such as environmental, health and sanitation standards, food safety, marketing of natural or organically produced food, facilities, pharmacies, equal employment opportunity, public accessibility, employee benefits, wages and hours worked and licensing for the sale of food, drugs and alcoholic beverages, among others. For example:

Environmental, Health and Safety: Supervalu’s operations are subject to extensive and increasingly stringent laws and regulations pertaining to the protection of the environment, including those relating to the discharge of materials into the environment, the disposal of food by-products, the handling, treatment and disposal of wastes, maintenance of refrigeration systems and remediation of soil and groundwater contamination. Compliance with existing or changing environmental and safety requirements, including more stringent limitations imposed or expected to be imposed in recently renewed or soon-to-be renewed environmental permits, may require capital expenditures.

14

Food Safety: There is increasing governmental scrutiny, regulations and public awareness regarding food quality and food and drug safety. Supervalu may be adversely affected if consumers lose confidence in the safety and quality of Supervalu’s food and drug products. Any events that give rise to actual or potential food contamination, drug contamination or food-borne illness or injury, or events that give rise to claims that Supervalu’s products are not of the quality or composition claimed to be, may result in product liability claims from individuals, consumers and governmental agencies, penalties and enforcement actions from government agencies, a loss of consumer confidence, harm to Supervalu’s reputation and could cause production and delivery disruptions, which may adversely affect Supervalu’s financial condition and results of operations. It may be necessary for Supervalu to recall unsafe, contaminated or defective products or Supervalu may recall products that it determines do not satisfy its quality standards. Recall costs and product liability claims can be material. While Supervalu generally seeks contractual indemnification and insurance coverage from its suppliers, it might not be able to recover these significant costs from its suppliers.

Pharmacy: Supervalu is required to meet various security and operating standards and comply with the Controlled Substances Act and its accompanying regulations governing the sale, marketing, packaging, holding, record keeping and distribution of controlled substances. During the past several years, the United States health care industry has been subject to an increase in governmental regulation and audits at both the federal and state levels. For example, see Note 15—Commitments, Contingencies and Off-Balance Sheet Arrangements in Part II, Item 8 of this Annual Report on Form 10-K under the caption “Legal Proceedings” for a discussion of the administrative subpoena issued to Supervalu by the DEA requesting, among other things, information on Supervalu’s pharmacy policies and procedures generally as well as the production of documents that are required to be kept and maintained by Supervalu pursuant to the Controlled Substances Act and its implementing regulations. Additionally, the Patient Protection and Affordable Care Act made several significant changes to Medicaid rebates and to reimbursement. One of these changes was to revise the definition of the Average Manufacturer Price, a pricing element common to most payment formulas, and the reimbursement formula for multi-source (i.e., generic) drugs. This change will affect Supervalu’s reimbursement. In addition, the Patient Protection and Affordable Care Act made other changes that affect the coverage and plan designs that are or will be provided by many of Supervalu’s health plan clients, including the requirement for health insurers to meet a minimum medical loss ratio to avoid having to pay rebates to enrollees. These Patient Protection and Affordable Care Act changes may not affect Supervalu’s business directly, but they could indirectly impact Supervalu’s services and/or business practices.

Wage Rates and Paid Leave: Changes in federal or state minimum wage and overtime laws or employee paid leave laws could cause Supervalu to incur additional wage costs, which could adversely affect Supervalu’s operating margins.

Foreign Operations: Supervalu’s supplier base includes domestic and foreign suppliers. Accordingly, political or financial instability in these foreign countries, changes in U.S. and foreign relationships, laws and regulations affecting the importation and taxation of goods, including duties, tariffs and quotas, or changes in the enforcement of those laws and regulations could adversely impact Supervalu’s financial condition and results of operations. In addition, Supervalu is required to comply with laws and regulations governing ethical, anti-bribery and similar business practices such as the Foreign Correct Practices Act. Additionally, foreign currency exchange rates and fluctuations may have an effect on our future costs or on future cash flows from our foreign operations, and could adversely affect our financial condition and results of operations.

Failure to comply with government laws and regulations or make capital expenditures required to maintain compliance with governmental laws and regulations may adversely impact Supervalu’s business operations and prospects for future growth and its ability to participate in federal and state healthcare programs and may also result in monetary liabilities, claims, fines, penalties or other sanctions and may adversely affect Supervalu’s business, financial condition and operating results. Supervalu cannot predict the nature of future laws, regulations, interpretations or applications, nor can Supervalu determine the effect that additional governmental regulations or administrative orders, when and if promulgated, or disparate federal, state and local regulatory schemes would have on Supervalu’s future business.

Supervalu’s businesses may become subject to legal proceedings that may adversely affect Supervalu’s financial condition and results of operations.

Supervalu’s businesses are subject to the risk of legal proceedings by employees, unions, consumers, customers, suppliers, stockholders, debt holders, governmental agencies or others through private actions, class actions, administrative proceedings, regulatory actions or other litigation or proceeding. The outcome of litigation, particularly class action lawsuits and regulatory actions, is difficult to assess or quantify. Plaintiffs in these types of lawsuits may seek recovery of very large amounts, and the magnitude of the potential loss relating to such lawsuits may remain unknown for substantial periods of time. The cost to defend future litigation may be significant. There may also be adverse publicity associated with litigation that may decrease consumer confidence in Supervalu’s businesses, regardless of whether the allegations are valid or whether Supervalu is ultimately found liable. As a result, litigation may adversely affect Supervalu’s financial condition and results of operations. See also “Item 3 Legal Proceedings” below.

15

Efforts to reduce pharmacy reimbursement levels and alter health care financing practices may adversely affect Supervalu’s results of operations.

The continued efforts of health maintenance organizations, managed care organizations, pharmacy benefit managers, government entities and other third party payors to reduce prescription drug costs and pharmacy reimbursement rates may impact Supervalu’s profitability. In particular, increased utilization of generic pharmaceuticals (which normally yield a higher gross profit rate than equivalent brand named drugs) has resulted in pressure to decrease reimbursement payments to Supervalu’s pharmacies for generic drugs, causing a reduction in Supervalu’s generic profit rate. Additionally, there has been significant consolidation within the generic manufacturing industry, and it is possible that this and other external factors may enhance the ability of manufacturers to sustain or increase pricing of generic pharmaceuticals and diminish Supervalu’s ability to negotiate reduced acquisition costs. The increase in preferred pharmacy networks has also had a negative impact on pharmacy reimbursement rates. Any inability to offset increased costs or to modify Supervalu’s activities to lessen the impact could have an adverse effect on Supervalu’s results of operations.

Supervalu may be unable to adequately protect its intellectual property rights, which could harm Supervalu’s business.

Supervalu relies on a combination of trademark, trade secret, copyright and domain name law and internal procedures and nondisclosure agreements to protect its intellectual property. Supervalu believes its trademarks, private label products and domain names are valuable assets. However, Supervalu’s intellectual property rights may not be sufficient to distinguish Supervalu’s products and services from those of its competitors and to provide Supervalu with a competitive advantage. From time to time, third parties may use names, logos and slogans similar to Supervalu’s, may apply to register trademarks or domain names similar to Supervalu’s, and may infringe or otherwise violate Supervalu’s intellectual property rights. Supervalu’s intellectual property rights may not be successfully asserted against such third parties or may be invalidated, circumvented or challenged. Asserting or defending Supervalu’s intellectual property rights could be time consuming and costly and could distract management’s attention and resources. If Supervalu is unable to prevent its competitors from using names, logos, slogans and domain names similar to Supervalu’s, consumer confusion could result, the perception of Supervalu’s brands and products could be negatively affected, and Supervalu’s sales and profitability could suffer as a result. In addition, if Supervalu’s Wholesale customers receive negative publicity or fail to maintain the quality of the goods and services used in connection with Supervalu’s trademarks, Supervalu’s rights to, and the value of, its trademarks could potentially be harmed. Failure to protect Supervalu’s proprietary information could also have an adverse effect on its business.

Supervalu may also be subject to claims that its activities or the products it sells infringe, misappropriate or otherwise violate the intellectual property rights of others. Any such claims can be time consuming and costly to defend and may distract management’s attention and resources, even if the claims are without merit, and may prevent Supervalu from using its trademarks in certain geographies or in connection with certain products and services, any of which could have an adverse effect on Supervalu’s business.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Supervalu’s properties are in good condition, well maintained and suitable to carry on its business. Substantially all of Supervalu’s owned and ground-leased real estate are subject to mortgages to secure Supervalu’s credit facilities. Additional information on Supervalu’s properties can be found in Part I, Item 1 of this Annual Report on Form 10-K.

Distribution Centers

Supervalu operates and manages its distribution centers by geographic region. The following table is a summary of Supervalu’s distribution centers as of February 25, 2017. In March 2017, Supervalu acquired an additional distribution center in Harrisburg, Pennsylvania that has approximately 732 thousand square feet that will eventually replace the Lancaster, Pennsylvania facility that is owned by NAI and operated by Supervalu.

16

Distribution Center | Wholesale Region | Owned Square Footage (Approximate in thousands) | Leased Square Footage (Approximate in thousands) | Total Square Footage (Approximate in thousands) | |||||||

Hopkins, MN | West | 1,847 | — | 1,847 | |||||||

Lancaster, PA | East | — | — | 1,559 | |||||||

Mechanicsville, VA | East | 1,192 | — | 1,192 | |||||||

Champaign, IL | West | 893 | — | 893 | |||||||

Green Bay, WI | West | 433 | 448 | 881 | |||||||

Fort Wayne, IN | West | 856 | — | 856 | |||||||

Quincy, FL | East | 787 | — | 787 | |||||||

Pittsburgh, PA | East | 771 | — | 771 | |||||||

Tacoma, WA | West | 683 | — | 683 | |||||||

Anniston, AL | East | 456 | 105 | 561 | |||||||

St. Louis, MO(1) | n/a | 547 | — | 547 | |||||||

Indianola, MS | East | 540 | — | 540 | |||||||

Stevens Point, WI | West | 431 | — | 431 | |||||||

Fargo, ND | West | 324 | — | 324 | |||||||

Oglesby, IL | West | 321 | — | 321 | |||||||

Billings, MT | West | 239 | — | 239 | |||||||

Anniston, AL | East | 231 | — | 231 | |||||||

Bismarck, ND | West | 210 | — | 210 | |||||||

West Newell, IL | West | 174 | — | 174 | |||||||

Total | 10,935 | 553 | 13,047 | ||||||||

(1) | St. Louis, MO distribution center is dedicated to providing products to the Shop ’n Save retail stores in the St. Louis, Missouri market. |

Retail Stores