Attached files

Exhibit 10.12

AMENDMENT NO. 1

TO THE

ADVISORY AGREEMENT

This amendment no. 1 to the Advisory Agreement dated as of November 8, 2015 (the “Advisory Agreement”), between KBS Real Estate Investment Trust, Inc., a Maryland corporation (the “Company”), and KBS Capital Advisors LLC, a Delaware limited liability company (the “Advisor”), is entered as of August 9, 2016 (the “Amendment”). Capitalized terms used herein but not defined shall have the meaning set forth in the Advisory Agreement.

WHEREAS, upon the terms set forth in this Amendment, the Company and the Advisor have agreed to amend certain terms related to the Disposition Fee payable to the Advisor by the Company;

NOW, THEREFORE, in consideration of the mutual agreements and covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Company and the Advisor agree to amend the Advisory Agreement as follows:

1. | Disposition Fees. Section 8.03 of the Advisory Agreement is hereby amended and restated in its entirety as follows: |

8.03 Disposition Fees.

(i) Except as provided in Section 8.03(ii) hereof, if the Advisor or any of its Affiliates provide a substantial amount of services (as determined by the Conflicts Committee) in connection with a Sale, the Advisor or such Affiliate shall receive a fee at the closing (the “Disposition Fee”) equal to 1.0% of the Contract Sales Price; provided, however, that no Disposition Fee shall be payable to the Advisor for any Sale if such Sale involves the Company selling all or substantially all of its assets in one or more transactions designed to effectuate a business combination transaction (as opposed to a Company liquidation, in which case the Disposition Fee would be payable if the Advisor or an Affiliate provides a substantial amount of services as provided above). Any Disposition Fee payable under this Section 8.03 may be paid in addition to commissions paid to non-Affiliates, provided that the total commissions (including such Disposition Fee) paid to all Persons by the Company for each Sale shall not exceed an amount equal to the lesser of (i) 6.0% of the aggregate Contract Sales Price of each Property, Loan or other Permitted Investment or (ii) the Competitive Real Estate Commission for each Property, Loan or other Permitted Investment. Substantial assistance in connection with the Sale of a Property includes the Advisor’s preparation of an investment package for the Property (including a new investment analysis, rent rolls, tenant information regarding credit, a property title report, an environmental report, a structural report and exhibits) or such other substantial services performed by the Advisor in connection with a Sale.

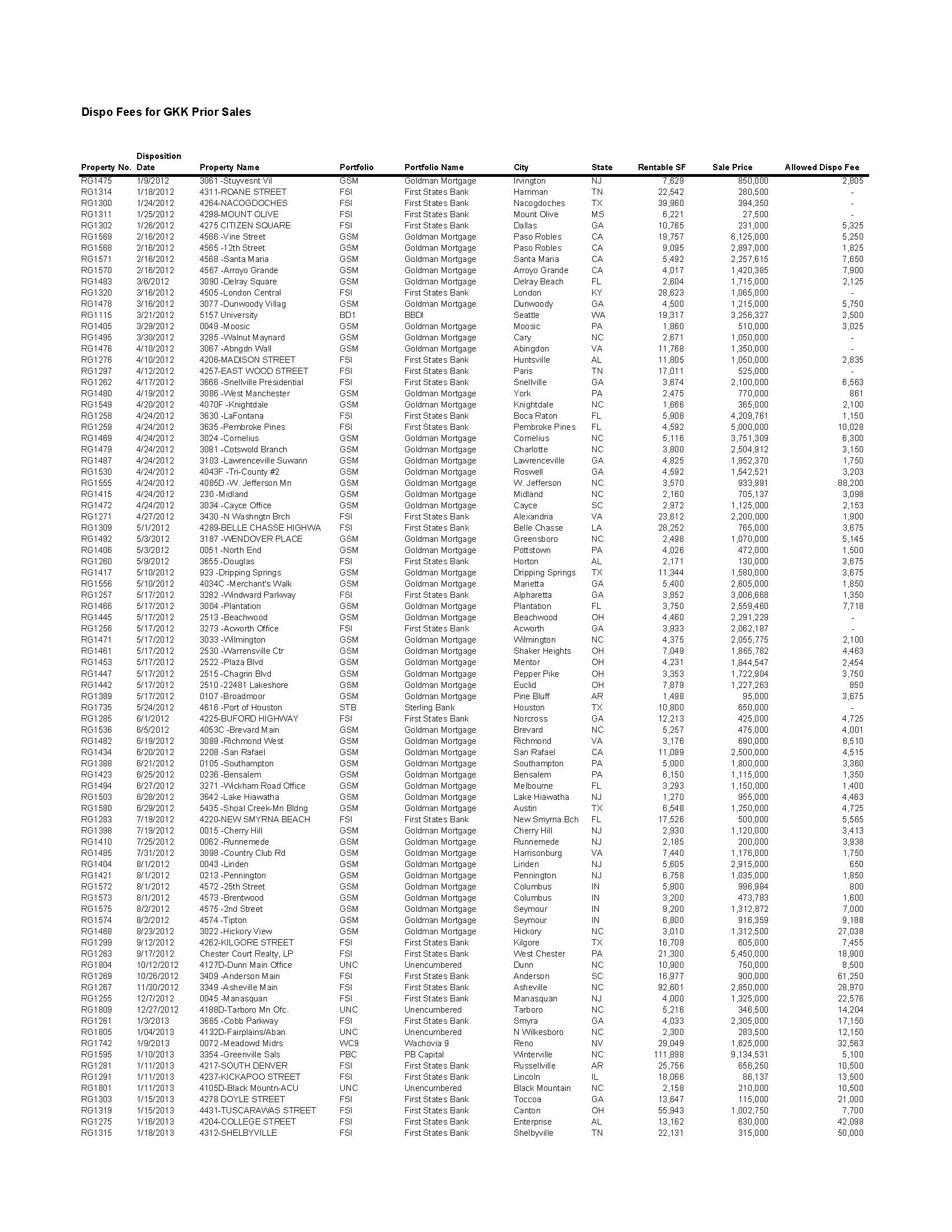

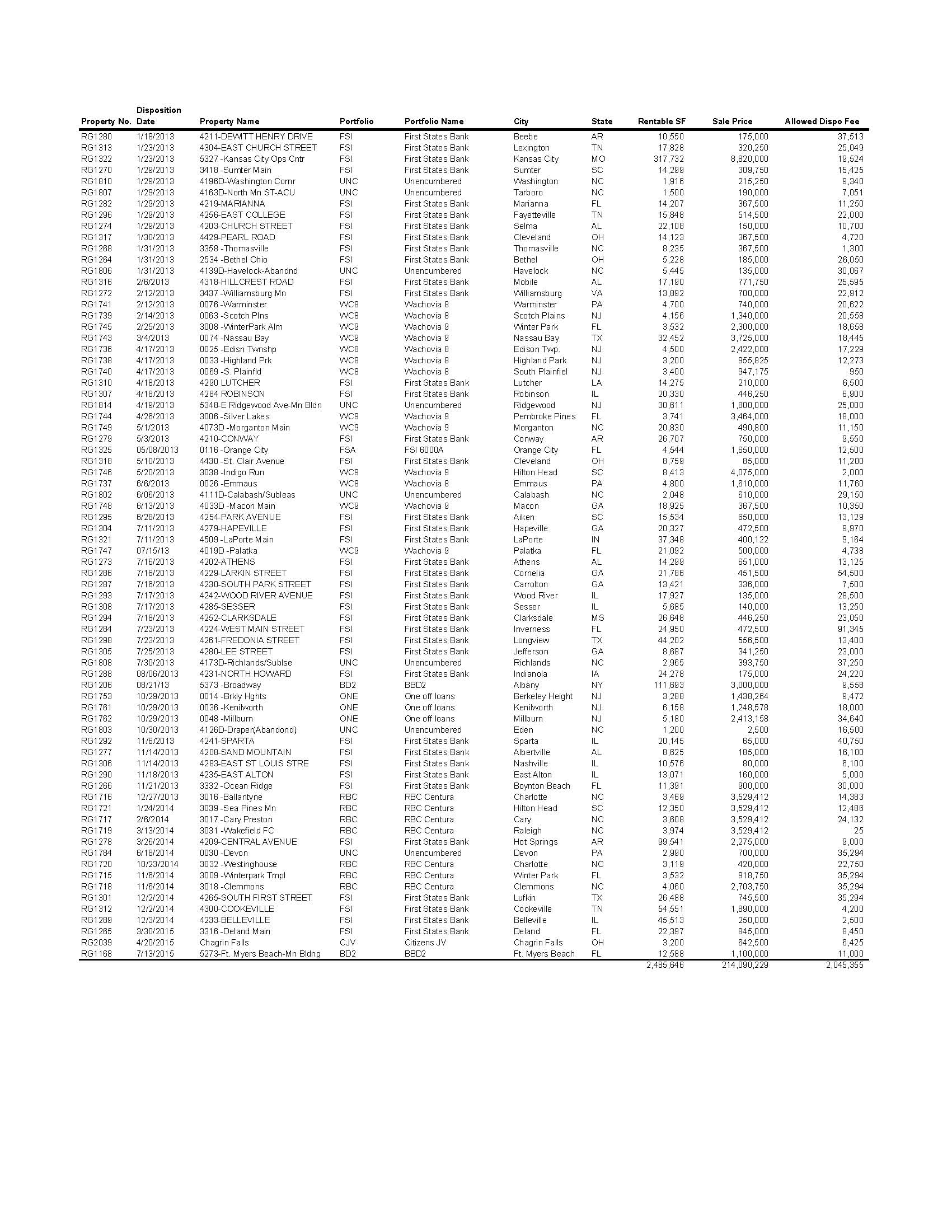

(ii) Notwithstanding the provisions of Section 8.03(i), with respect to Sales of the Properties that the Company indirectly received an ownership or leasehold interest in as a result of the Collateral Transfer and Settlement Agreement (the “Settlement Agreement”) with, among other parties, GKK Stars Acquisition LLC (the “GKK Properties”), that have been sold as of the date of this Amendment and for which no Disposition Fee has been paid, and which are listed on Attachment A hereto, the Conflicts Committee hereby determines that the Advisor

or its Affiliates provided a substantial amount of services in connection with the Sale of each such GKK Property listed on Attachment A and approves the payment to the Advisor of a disposition fee equal to 1.0% of the aggregate Contract Sales Price of the GKK Properties listed on Attachment A hereto.

2.Ratification; Effect on Advisory Agreement.

a. | Ratification. The Advisory Agreement, as amended hereby, shall remain in full force and effect and is hereby ratified and confirmed in all respects. |

b. | Effect on the Advisory Agreement. On and after the date hereof, each reference in the Advisory Agreement to “this Agreement,” “herein,” “hereof,” “hereunder,” or words of similar import shall mean and be a reference to the Advisory Agreement as amended hereby. |

Signature page follows.

IN WITNESS WHEREOF, the parties hereto have executed this Amendment as of the date and year first above written.

KBS REAL ESTATE INVESTMENT TRUST, INC.

By: | /s/ Charles J. Schreiber, Jr. |

Charles J. Schreiber, Jr., Chief Executive Officer

KBS CAPITAL ADVISORS LLC

By: | PBren Investments, L.P., a Manager |

By: | PBren Investments, LLC, as general partner |

By: | /s/ Peter M. Bren |

Peter M. Bren, Manager

By: | Schreiber Real Estate Investments, L.P., a Manager |

By: | Schreiber Investments, LLC, as general partner |

By: | /s/ Charles J. Schreiber, Jr. |

Charles J. Schreiber, Jr., Manager

EAST\126877173.2

Attachment A

EAST\126877173.2

EAST\126877173.2

EAST\126877173.2