Attached files

Exhibit 10.1

EXECUTION VERSION

PURCHASE AND SALE AGREEMENT

This Purchase and Sale Agreement (this “Agreement”) is entered into this 19th day of October, 2015, by and among First States Investors 6000A, L.P. (“6000A Seller”), First States Investors 6000B, L.P. (“6000B Seller”), First States Investors 6000C, L.P. (“6000C Seller”) and First States Investors 6000D, L.P. (“6000D Seller”, and together with 6000A Seller, 6000B Seller and 6000C Seller, each, individually, and collectively “Seller”) and PONTUS NET LEASE ADVISORS, LLC, a Delaware limited liability company (“Purchaser”). In consideration of the mutual agreements herein set forth, the parties hereto, intending to be legally bound, agree as follows.

1. Defined Terms/Exhibits: Capitalized terms used in this Agreement shall, for purposes of this Agreement, have the meanings ascribed to such terms in this Section 1. Initial capitalized terms used in this Agreement and not defined in this Section 1 shall have the meanings ascribed to such terms elsewhere in this Agreement.

Additional Permitted Exceptions | The title exceptions listed on Exhibit J. |

Building | The building improvements located on the Land. |

Business Day | Each day of the week except Saturdays, Sundays and federal holidays. |

Contracts | The service contracts, maintenance agreements, or other agreements, and brokerage commission agreements affecting the Properties that will survive the Closing. |

Delinquent Rent | Means any of rent, additional rent or other amounts that, under the terms of the Leases, are to be paid by the Tenant for periods ending on or prior to the Closing Date, but which have not been received in good funds by Seller on or prior to the Closing Date. |

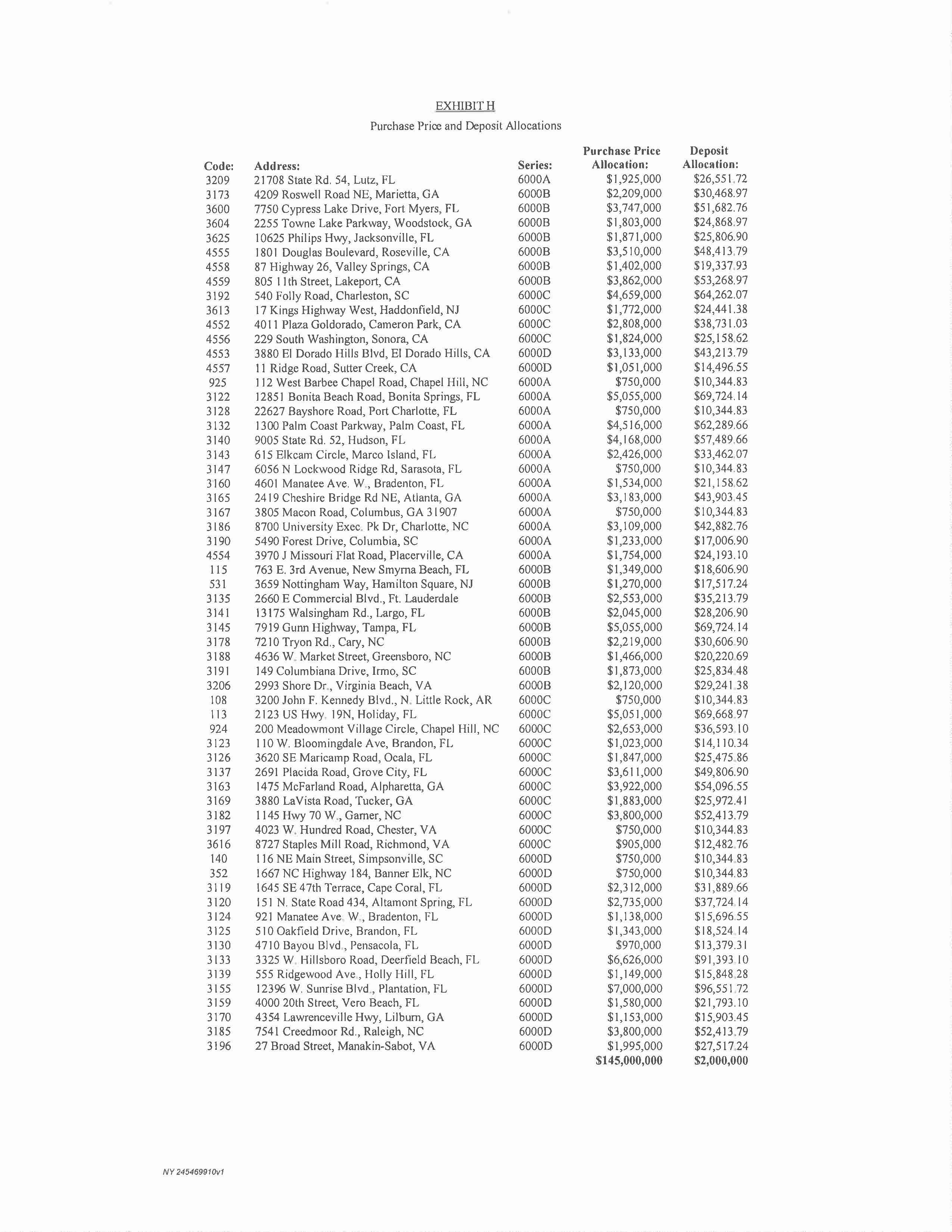

Deposit | $2,000,000.00, allocated among the Parcels as set forth on Exhibit H. |

Escrowee | First American Title Insurance Company 633 Third Avenue New York, NY 10017 Attention: Phillip Salomon Tel: (212) 551-9437 psalomon@firstam.com |

Exhibits | Exhibits A-1 – A-61 – Land Legal Description for each Parcel Exhibit B - Escrow Agreement Exhibit C-1 – C-61 – List of Leases for each Parcel |

Exhibit D-1 – Florida Form of Deed Exhibit D-2 – Georgia Form of Deed Exhibit D-3 – North Carolina Form of Deed Exhibit D-4 – South Carolina Form of Deed Exhibit D-5 – Arkansas Form of Deed Exhibit D-6 – California Form of Deed Exhibit D-7 – New Jersey Form of Deed Exhibit D-8 – Virginia Form of Deed Exhibit E-1 – List of Multi-Property Transfer Notice Tenants Exhibit E-2 – List of ROFO Tenants Exhibit F – Form of Tenant Estoppel Exhibit G – Form of Assignment of Leases Exhibit H – Allocation of Purchase Price and Deposit Among Parcels Exhibit I – Form of Title Affidavit Exhibits J – Additional Permitted Exceptions Exhibit K – List of Parcels by Address Exhibit L – Title Policy Responsibility Exhibit M – Form of Notice to Tenant(s) Exhibit N – List of Existing Loan Documents Exhibit O – Litigation and Condemnation Exhibit P-1 – Form of Multi-Property Transfer Notice Exhibit P-2 – Form of ROFO Notice | |

Existing Debt | Loans in the original principal amount of $110,394,000 evidenced by the Existing Loan Documents. |

Existing Loan Documents | The loan documents listed on Exhibit N. |

Existing Lender | Collectively, (i) Wells Fargo Bank, N.A. as Trustee for the Registered Holders of Banc of America Commercial Mortgage Inc, Commercial Mortgage Passthrough Certificates, Series 2008-LS1; and (ii) Wells Fargo Bank, N.A., as trustee for the registered holders of COMM Commercial Mortgage Trust 2007-C9, Commercial Mortgage Pass-Through Certificates, Series 2007-C9.Certificates, Series 2008-LS1; and (ii) Wells Fargo Bank, N.A., as trustee for the registered holders of COMM Commercial Mortgage Trust 2007-C9, Commercial Mortgage Pass-Through Certificates, Series 2007-C9. |

Fixtures | All equipment, fixtures and appliances of whatever nature which are (i) affixed to the Land or Improvements and (ii) owned by Seller. |

Improvements | The buildings, building pads, structures, improvements, and personal property erected or located on the Land, including, without limitation, the Building, all parking lots, walkways and other paved areas on the Land, any |

2

and all exterior shrubs, trees, plants and landscaping on the Land. | |

Land | The land more particularly described on Exhibits A-1 – A- 61 with respect to each Parcel. |

Leases | The leases described on Exhibits C-1 – C-61 with respect to the applicable Parcel. |

Parcels | Each of the parcels of Land described on Exhibit K. |

Person | Any individual, corporation, partnership, limited liability company, trust, unincorporated association, government, governmental authority, or other entity. |

Personal Property | The aggregate of the following: (i) Seller’s right, title and interest, if any, in any intangible property (including, without limitation, the Contracts, all licenses, plans, specifications, permits and warranties, guaranties, indemnities, and bonds), that (a) relate to any Property and (b) are assignable by Seller to Purchaser; (ii) Seller’s oil, gas, water, mineral rights and water rights, if any, that relate to any Property; (iii) all right, title and interest of Seller, if any, to any land lying in the bed of any street, alley or road (open or proposed) abutting any Property; and (iv) Seller’s damages, awards, claims and causes of action now or hereafter payable or assertable with respect to any Property by reason of any exercise of the power of eminent domain, any change in the grade of any street, road, highway, avenue or alley, or any damage, destruction, loss or removal of any of the foregoing, which (a) relate to any Property and (b) are assignable by Seller to Purchaser. |

Property | With respect to each Parcel, collectively, (i) the Land, (ii) the Improvements, (iii) the Fixtures, (iv) the Personal Property, (v) the tenements, hereditaments, appurtenances, rights of way, strips, gores, easements, rights and privileges in any way pertaining or beneficial to the Land or Improvements, including, without limitation, all easements, rights-of-way and other similar interests appertaining to the Land or the Improvements. |

Purchase Price | $145,000,000.00, allocated among the Properties as set forth on Exhibit H attached hereto. |

Purchaser's EIN | 45-5352197 |

3

Purchaser's Notice Address | c/o Pontus Capital 875 Prospect Street, Ste. 303 La Jolla, California 92037 Attention: Michael Press E-mail: mpress@pontuscapital.com With a required copy to: Seyfarth Shaw LLP 333 South Hope Street, Suite 3900 Los Angeles, California 90071 Attention: Dana Treister, Esq. E-mail: dtreister@seyfarth.com |

Rent | Shall mean fixed and minimum rents and all additional rents, escalation charges, maintenance charges, insurance charges, percentage rent, and all other amounts, charges and commissions payable by any Tenant under the Leases. |

Scheduled Closing Date | On or before 5:00 P.M. (EST) February 2, 2016. |

Seller's EIN | 6000A Seller: 20-8753875 6000B Seller: 20-8753929 6000C Seller: 20-8753992 6000D Seller: 20-8754042 |

Seller's Notice Addresses | c/o Gramercy Property Trust 521 Fifth Ave 30th Floor New York, New York 10175 Attention: Allan B. Rothschild E-mail: rothschild@gptreit.com With a required copy to: c/o KBS Capital Advisors LLC 620 Newport Center Drive Suite 1300 Newport Beach, California 92660 Attention: James Chiboucas, Esq. E-mail : jchiboucas@kbsrealty.com And to: c/o KBS Capital Advisors LLC |

4

620 Newport Center Drive Suite 1300 Newport Beach, California 92660 Attention: Jeff Waldvogel E-mail: jwaldvogel@kbs.com And with a required copy to: Greenberg Traurig, LLP 200 Park Avenue New York, New York 10166 Attention: Stephen L. Rabinowitz, Esq. E-mail: rabinowitzs@gtlaw.com | |

Transfer Tax | Any tax, levy, fee, charge or documentary stamp required to be paid or purchased in connection with the sales transaction contemplated hereunder or recordation of a deed. |

All Exhibits and other attachments hereto are incorporated herein by reference, and taken together with this Agreement, shall constitute a single agreement. All documents to be executed and delivered by Purchaser (and/or any of its affiliates) and/or Seller (and/or any of its affiliates) at or prior to the Closing as contemplated by this Agreement are collectively referred to herein as the “Transaction Documents.”

2. Sale-Purchase. For the Purchase Price and subject to the terms and conditions hereof, each Seller agrees to sell and convey to Purchaser, and Purchaser agrees to purchase and take from such Seller, all of such Seller’s right, title and interest in and to the Property owned by it.

3. Purchase Price. The Purchase Price for the Properties shall be payable by Purchaser as follows:

3.1 Deposit. The Deposit is payable by Purchaser to Escrowee by wire transfer of immediately available funds by not later than 5p.m. EST on a date which is within one (1) Business Day of the date of the full execution and delivery of this Agreement, to be held in escrow and disbursed by Escrowee pursuant to the provisions of that certain Escrow Agreement (the “Escrow Agreement”) of even date herewith among Seller, Purchaser and Escrowee, a copy of which is attached hereto as Exhibit B. Failure by Purchaser to timely pay the Deposit shall give Seller the immediate right to terminate this Agreement, without any notice or grace period. At Closing, the Deposit shall be credited to Purchaser on account of the Purchase Price. The Deposit shall be deposited by Escrowee in an interest-bearing account reasonably approved by Purchaser and Seller and all interest thereon shall be paid to the party who receives the Deposit and, at Closing, credited against the Purchase Price.

5

3.2 Cash Balance. Subject to adjustments and credits in accordance with Sections 3.3, 11 and 35 hereof and the other prorations and adjustments herein provided for, the balance of the Purchase Price (the “Cash Balance”), shall be payable by Purchaser at Closing by wire transfer in accordance with the provisions of this Agreement.

3.3 Defeasance of the Existing Debt.

3.3.1 Seller and Purchaser acknowledge and agree that Seller’s title to the Properties is encumbered by the Existing Debt, which is required to be defeased in connection with the sale of the Properties (the “Defeasance”). Seller will send notice of its intent to defease the Existing Debt to the Existing Lender not later than five (5) Business Days after the expiration of the Due Diligence Period. Seller and Purchaser shall use commercially reasonable efforts, and cooperate with one another in good faith, to satisfy the requirements of the Existing Loan Documents with respect to the Defeasance including, without limitation, by funding prior to the Closing Date amounts necessary to effect the Defeasance and delivering such documents as may be required to effect the Defeasance (the “Defeasance Documents”).

3.3.2 Purchaser and Seller agree that, in connection with the Defeasance of the Existing Debt, Seller shall be responsible for payment of all actual, out-of-pocket costs and expenses in connection with the Defeasance (such amount, less the amount of Purchaser’s and Seller’s attorneys’ fees, the “Defeasance Costs”). The parties estimate the Defeasance Costs to be $10,000,000.00 (the “Estimated Defeasance Expense”). The Defeasance Costs actually payable at Closing if the Closing occurs on the Scheduled Closing Date shall be referred to herein as the “Scheduled Defeasance Expense,” and the positive difference between the Estimated Defeasance Expense and the Scheduled Defeasance Expense shall be referred to herein as the “Purchaser Defeasance Credit.” In the event that the Closing occurs on the Scheduled Closing Date, Purchaser shall receive a credit at Closing equal to the Purchaser Defeasance Credit. In the event that Seller elects to extend the Scheduled Closing Date pursuant to Section 3.3.3, below, then Purchaser shall receive a credit at Closing equal to the Purchaser Defeasance Credit, plus any amount by which the Defeasance Costs actually payable at Closing (such amount, the “Actual Defeasance Expense”) are less than the Scheduled Defeasance Expense. In the event that Purchaser elects to extend the Scheduled Closing Date pursuant to Section 4.1, below, and the Actual Defeasance Expense exceeds the Scheduled Defeasance Expense, then Purchaser shall receive a credit at Closing equal to the Purchaser Defeasance Credit, less any amount by which the Actual Defeasance Expense exceeds the Scheduled Defeasance Expense; provided that if the Actual Defeasance Expense exceeds the Estimated Defeasance Expense, Purchaser shall pay the amount of such difference. In the event that Purchaser elects to extend the Scheduled Closing Date pursuant to Section 4.1, below, and the Actual Defeasance Expense is less than the Scheduled Defeasance Expense, then Purchaser shall receive a credit equal to the Purchaser Defeasance Credit, and Seller shall receive the benefit of any remaining reduction in Defeasance Costs.

3.3.3 Seller shall have the right, in its sole discretion, to extend the Scheduled Closing Date up to two (2) times for a period of thirty (30) days each, upon not less than three (3) Business Days’ prior written notice to Purchaser, in order to effectuate the completion of the defeasance closing process; any additional extensions other than as expressly set forth herein of the Scheduled Closing Date shall require Purchaser’s prior written consent, in

6

its sole and absolute discretion. Each of the parties acknowledges that, subject to the terms of the this Agreement, time is of the essence with respect to such party’s obligations to close under this Agreement and any failure of such party to close in accordance with the terms of this Agreement shall be a default by such party under this Agreement. Notwithstanding the foregoing, Seller, in its sole discretion, may elect to extend the Scheduled Closing Date if Purchaser has failed to satisfy Purchaser’s obligations under Section 12.2 as of the Scheduled Closing Date. Notwithstanding anything set forth in Section 3.3.2, if Seller elects to extend the Scheduled Closing Date in accordance with the preceding sentence, then the amount of any reduction in the Defeasance Costs between the Scheduled Closing Date and the Closing Date shall be credited to Seller (such amount, the “Seller Defeasance Credit”).

3.4 Personal Property. The parties agree that no value or any portion of the Purchase Price shall be attributable to the Personal Property conveyed pursuant to this Agreement.

3.5 Purchase Price Allocation. The Purchase Price and the Deposit are allocated among the Parcels as set forth on Exhibit H.

3.5.1 Notwithstanding anything to the contrary herein, in the event that, pursuant to Section 5.1(e) or (f), Purchaser elects not to purchase one or more Properties, the Purchase Price shall be reduced proportionately in accordance with the price allocations set forth on Exhibit H, as the same may be re-allocated pursuant to Section 3.5.2, Escrowee shall promptly return to Purchaser the portion of the Deposit allocable to any such removed Properties, and this Agreement shall otherwise continue in full force and effect.

3.5.2 At all times after the Effective Date, Purchaser shall have the right, subject to Seller’s consent, not to be unreasonably withheld, to reallocate the prices attributable to each Property listed on Exhibit H, so long as the sum of the reallocated prices equals the total Purchase Price set forth above (as may be adjusted due to removal of Properties from those Properties being purchased by Purchaser); provided, however, that Purchaser shall have no right to reallocate any portion of the Purchase Price if (a) same is attributable to any Property occupied by a ROFO Tenant, (b) such reallocation would increase the liability of Seller in the aggregate for transfer or intangible property taxes in connection with the Closing or (c) such reallocation shall cause the Purchase Price allocated to any Property to be less than the net asset value reflected on Seller’s (or its parent company’s) financial records.

4. Closing.

4.1 Closing Date. “Closing” shall mean the consummation of each of the actions set forth below in this Section 4 and the satisfaction of each of the conditions specified in Section 12, or the waiver in writing of such action or condition by the party in whose favor such action or condition is intended. The Closing of the transaction contemplated by this Agreement (that is, the payment of the Purchase Price, the transfer of title to the Properties, and the satisfaction of all other terms and conditions of this Agreement, unless waived in writing by the party to whose benefit any condition runs) shall occur on the Scheduled Closing Date (as same may be extended by Seller in accordance with this Agreement; the date on which the Closing actually occurs is referred to herein as the “Closing Date”) in escrow through the Title

7

Company. Notwithstanding the foregoing, Purchaser shall have the right, in its sole and absolute discretion, to extend the Scheduled Closing Date for an aggregate period not to exceed five (5) Business Days upon two (2) Business Days’ notice to Seller and Escrowee.

4.2 Closing Documents.

4.2.1 Seller. At least one (1) Business Day prior to the Closing Date (or such earlier date as may be required to effect the Defeasance), each Seller shall execute and deliver with respect to each Parcel owned by such Seller:

4.2.1.1 to Escrowee, each of the following:

4.2.1.1.1 a deed in the form that is customary in the jurisdiction in which such Parcel is located, a form of which is set forth on Exhibits D-1 – D-8, or as modified to conform to such local custom;

4.2.1.1.2 a letter to each of the tenants (each, a “Tenant”) under the Leases, in the form of Exhibit M attached hereto;

4.2.1.1.3 a title affidavit in the form reasonably requested by the Title Company for the jurisdiction in which such Parcel is located set forth on Exhibits I-1 – I-8, with any revisions reasonable required by the Title Company to issue the applicable Title Policy in the form contemplated in this Agreement;

4.2.1.1.4 two (2) duly executed counterparts of an Assignment and Assumption of the Leases in the form of Exhibit G attached hereto (the “Assignment of Leases”);

4.2.1.1.5 copies of all Leases, certified by the applicable Seller as true and complete;

4.2.1.1.6 each Seller’s duly executed affidavit stating, under penalty of perjury, such Seller’s U.S. taxpayer identification number and that such Seller is not a foreign person within the meaning of Section 1445 of the Internal Revenue Code (and any similar affidavit that may be required under state law);

4.2.1.1.7 if required by the Title Company, documentation to establish to the Title Company’s reasonable satisfaction the due authorization of each Seller’s sale of the Properties owned by such Seller and each Seller’s delivery of the documents required to be delivered by such Seller pursuant to this Agreement;

4.2.1.1.8 all other documents reasonably required or customarily provided in order to complete the conveyance, transfer and assignment of the Properties to Purchaser pursuant to the terms of this Agreement, provided that such documents are consistent with the terms of this Agreement, and do not increase Seller’s monetary obligations hereunder or subject Seller to additional liability not otherwise specified in this Agreement;

8

4.2.1.1.9 the Tenant Estoppels in accordance with Section 7.4.7 hereof; and

4.2.1.1.10 the Defeasance Documents.

4.2.1.2 to Purchaser, each of the following:

4.2.1.2.1 any and all books, records, documentation or items constituting Intangible Personal Property in the possession or control of Seller or First States Management Corp. (“Seller’s Property Manager”) (it being understood that same may not be delivered, but may be left at the Properties or made available for pick-up by Purchaser at Seller’s offices) to the extent, and in the form, previously maintained by Seller or Seller’s Property Manager’s in the ordinary course of business; and

4.2.1.2.2 to the extent in the possession or control of Seller or Seller’s Property Manager (or its agents), all keys and passcards for the Properties, with identification of the lock to which each such item relates.

4.2.2 Purchaser. On the Closing Date (or such earlier date as may be required to effect the Defeasance), Purchaser shall deliver or cause to be delivered to Seller at Closing each of the following (duly executed by Purchaser, if applicable):

4.2.2.1 the Cash Balance;

4.2.2.2 two (2) duly executed counterparts of the Assignment of Leases;

4.2.2.3 any and all documents reasonably required or customarily provided from a purchaser by the Title Company in order to cause it to issue the owner’s title policy with liability in the full amount of the Purchase Price (the “Title Policy”); and

4.2.2.4 all other documents reasonably and customarily required in order to complete the conveyance, transfer and assignment of the Properties to Purchaser pursuant to the terms of this Agreement, provided that such documents are consistent with the terms of this Agreement, and do not increase Purchaser’s obligations hereunder or subject Purchaser to additional liability not otherwise contemplated by this Agreement.

4.2.3 Joint. On the Closing Date, Purchaser and Seller shall deliver to the other duly executed counterparts of (i) a closing statement (to be prepared by the Title Company or Seller and approved by Purchaser) and (ii) any transfer tax declarations, change of ownership forms or other similar instruments as may be required by law in the jurisdiction where the applicable Parcels are located.

5. Due Diligence Contingency.

5.1 Procedure.

9

(a) Purchaser shall have a period commencing on the Effective Date and ending at 5:00 p.m. (Pacific time) on December 18, 2015 (the “Contingency Approval Date; such period, the “Due Diligence Period”) within which to conduct, at its sole cost, risk and expense, any and all engineering, environmental, soils (excluding invasive testing and borings), economic, feasibility and other investigations, reviews, studies and tests of the Properties, their conditions, Tenants, Leases, financial conditions and prospects which Purchaser may, in Purchaser’s good faith discretion, deem necessary or helpful to determine whether or not the Properties are suitable for Purchaser’s intended use. Purchaser’s obligations under this Agreement shall be expressly conditional on Purchaser’s approval (in its sole but good faith discretion) of all such investigations, reviews, studies and tests relating to the Properties (collectively, “Due Diligence Investigations”).

(b) Purchaser shall notify Seller in writing (which written notice is referred to herein as “Purchaser’s Due Diligence Contingency Approval Notice”), on or before 5:00 p.m. (Pacific time) on the Contingency Approval Date, TIME BEING OF THE ESSENCE, if Purchaser has approved or disapproved its Due Diligence Investigations and if applicable, any Properties that Purchaser has elected to remove from the Properties being purchased pursuant to Section 5.1(e). In the event that Purchaser’s Due Diligence Contingency Approval Notice informs Seller that the Due Diligence Investigations are not approved by Purchaser (subject to the terms of Section 5.1(e)), which Purchaser may elect to do for any reason, or no reason at all, in Purchaser’s sole discretion, this Agreement shall terminate, Purchaser and Seller shall instruct the Escrowee to return the Deposit to Purchaser, and the parties hereto shall have no further obligations to the other hereunder, except as expressly provided in this Agreement. Purchaser’s failure to timely provide the Purchaser’s Due Diligence Contingency Approval Notice on or before the Contingency Approval Date shall without further notice from Seller to Purchaser be deemed to be the immediate and irrevocable approval of the Due Diligence Investigations.

(c) During the Due Diligence Period and prior to the Closing, Purchaser and its agents, engineers, surveyors, appraisers, auditors and other representatives (any of the foregoing, “Purchaser’s Agents”) shall have the right to enter upon the Parcels to inspect, examine, survey, obtain engineering inspections, test, appraise, and otherwise do that which, in the good faith opinion of Purchaser, is necessary or appropriate in connection with Purchaser’s purchase of the Properties. If requested in the written notice given by Purchaser to Seller pursuant to clause (d)(iii) below, Seller shall make reasonable efforts to cause a representative of Seller’s Property Manager to be available, at such times as requested in the notice, prior to the Closing to discuss with Purchaser matters relating to the Properties.

(d) Purchaser’s rights of entry and inspection pursuant to this Section 5 shall be subject to the following: (i) such rights of entry and inspection shall be subject to the rights of Tenants under the Leases (including, without limitation, not unreasonably impeding the normal day-to-day business operations of the Properties); (ii) all inspections shall be during business hours on Business Days; (iii) no inspection shall be undertaken without at least three (3) days advance notice; provided, however, promptly following the Effective Date, Purchaser shall deliver to Seller a schedule indicating the date, time and name(s) of the individual(s) who will be conducting Due Diligence Investigations at each Property; (iv) no entry, inspection or investigation of any Property shall involve the taking

10

of samples or other physically invasive procedures without the prior written consent of Seller, which consent shall be in Seller’s sole discretion; (v) a representative of Seller shall be entitled to accompany Purchaser and its agents during any inspections; (vi) prior to any such entry or inspection, Purchaser shall deliver to Seller certificates reasonably satisfactory to Seller evidencing that Purchaser or Purchaser’s Agents carry and maintain (A) workmen’s compensation insurance, with statutory limits of coverage and (B) commercial general liability insurance (“CGL Insurance”), including a contractual liability endorsement, and personal injury liability coverage, which insurance shall be from an insurer reasonably acceptable to Seller, and in the case of the CGL Insurance (w) be primary and not contributing coverage, (x) have limits for bodily injury and death or damage to property of not less than $3,000,000 for any one occurrence, and (y) name Seller as an additional insured; and (vii) Purchaser shall not be entitled to interview any Tenant of any Property unless a representative of Seller shall have consented to, and is present during, any such interview; provided, however, that in the event that Purchaser shall have given Seller not less than three (3) Business Days’ written notice of its request to interview a Tenant of any Property, and Seller shall have failed to approve or deny such request within such three (3) Business Day’s period, then Seller shall be deemed to have consented to Purchaser interviewing such Tenant of such Property without Seller’s representative present at such interview; and (viii) all rights of entry and inspection shall be at Purchaser’s sole cost, risk and expense and Purchaser shall, at its sole cost, fully repair any damage to any Property caused by its inspections, tests or studies at such Property. Purchaser hereby indemnifies and agrees to defend and hold Seller and Seller Parties harmless from and against any claim for losses, liabilities, expenses, costs (including, without limitation, reasonable attorneys’ fees), damage or injuries suffered or incurred by any of Seller or Seller Parties arising out of, resulting from, relating to or in connection with or from (i) damage to property or injury to persons arising from any such inspection by Purchaser or Purchaser’s Agents and (ii) any breach of the provisions of this Section 5, or any liens filed against Seller or any Property in connection therewith. The provisions of this Section 5(d) shall survive the Closing or the termination of this Agreement.

(e) If, in the course of Purchaser’s Due Diligence Investigations, Purchaser discovers (i) a Material environmental condition at a Property, (ii) a Material structural defect in the Property or (iii) a Material title defect which is not a Permitted Encumbrance, in each case that Seller elects not to or is unable to cure, Purchaser may notify Seller in the Due Diligence Contingency Approval Notice that it has elected not to purchase the Property so affected, and the provisions of Section 3.5.1 shall apply thereto. For purposes of this Section 5.1(e), “Material” shall mean a condition, the cost of repair, remediation or correction of which (or, with respect to a title defect, the satisfaction of which) would reasonably be expected to be equal to or greater than twenty percent (20%) of the amount of the Purchase Price originally allocated to such Property (without giving effect to any reallocations pursuant to Section 3.5.2). Notwithstanding anything to the contrary contained in this Agreement, in no event may the Purchaser elect (without Seller’s prior written consent) to remove more than six (6) of the Properties in the aggregate from the Properties being purchased pursuant to this Section 5.1(e), together with Section 5.1(f).

(f) From and after the expiration of the Due Diligence Period, Purchaser may elect to remove a Property from the Properties being purchased by Purchaser hereunder by written notice to Seller (a “Removal Notice”), if any of the following occurs

11

with respect to the applicable Property: (i) Seller fails to obtain and deliver to Purchaser a Conforming Estoppel and SNDA from each Tenant of such Property as required by Section 7.4.7; (ii) a Material Breach occurs with respect to such Property that Seller has not cured in accordance with Section 7.2, provided Purchaser delivers a Removal Notice within two (2) Business Days of receipt of the Representation Notice; (iii) a Material (as defined in Section 5.1(e)) title condition shall arise that is a Seller’s Refused Objected Title Matter; or (iv) a Material Event occurs with respect to such Property and Seller fails to timely provide to Purchaser a Casualty Vitiation Notice, provided Purchaser delivers a Removal Notice within two (2) Business Days of the last date on which Seller is entitled to provide a Casualty Vitiation Notice. Notwithstanding anything to the contrary contained in this Agreement, except in connection with the removal of a Property in accordance with Section 35.3.2, in no event may the Purchaser elect to remove more than six (6) of the Properties being purchased, in the aggregate, pursuant to Section 5.1(e) and/or Section 5.1(f). The term “Material Breach” shall mean a breach of a representation or warranty that is reasonably likely to result in Purchaser (if it acquires the relevant Property) suffering actual damages in an amount equal to or greater than twenty percent (20%) of the amount of the Purchase Price originally allocated to such Property (without giving effect to any reallocations pursuant to Section 3.5.2). If Purchaser shall deliver a Removal Notice with respect to one or more Properties, Purchaser shall be entitled to a credit at Closing for Purchaser’s costs incurred in connection with its Due Diligence Investigations equal to $20,000 per Property for each Property listed in such Removal Notice.

5.2 Due Diligence Materials; Seller’s Books and Records. Within three (3) days after the Effective Date, Seller shall make available for review by Purchaser or its representatives at all times prior to the Closing (including during the Due Diligence Period) on a datasite (the “DataSite”), materials related to the Properties, which are in the actual possession of Seller, as Purchaser may reasonably request (collectively, the “Diligence Materials”); provided, that the foregoing obligation is not a Surviving Seller Representation and failure by Seller to provide any Diligence Materials shall not entitle Purchaser to seek specific performance or extend the Contingency Approval Date or the Scheduled Closing Date as a result thereof. Notwithstanding any provision of this Agreement to the contrary, the following books and records (the “Excluded Records”) shall not be subject to review by Purchaser (including under this Section 5.2): all proprietary, privileged or confidential documents of Seller (or any affiliate thereof) relating to (i) any financing of the Properties, (iii) any Seller or affiliate income or franchise tax returns, (iv) any appraisal or valuation of the Properties, (v) any internal financial analysis or projections, (vi) any marketing studies or reports, (vii) any credit analysis, (viii) any prior offers to purchase any Property, (ix) any other materials related to Seller’s investment structure for purchasing and holding the Properties which do not relate to matters reasonably relevant to ownership of the Properties or (x) any matters subject to attorney-client privilege.

6. Title.

6.1 Deliveries.

6.1.1 Prior to the Effective Date, Escrowee has issued and delivered to Purchaser, and Purchaser acknowledges receipt of, a commitment to insure title for the Properties, together with legible copies of all written covenants, restrictions, easements and agreements

12

which are listed as exceptions in Schedule B therein (collectively, the “Preliminary Title Commitment”).

6.1.2 Prior to the Effective Date, Seller has posted to the DataSite copies of the most current ALTA surveys affecting the Properties in the possession of Seller (“Existing Surveys”).

6.2 Approval.

6.2.1 Purchaser shall have until 5:00 p.m. (EST) on December 4, 2015 (the “Initial Title Review Date”) to review and approve or disapprove, by delivery of a written notice to Seller (the “Original Title Objection Notice”), the Preliminary Title Commitment, Existing Surveys and all supplements thereto obtained by Purchaser after the Effective Date but prior to the Initial Title Review Date, and all exceptions to title referred to therein (collectively, the “Initial Title and Survey Matters”). If Purchaser timely specifies any objectionable matters (“Objected Title Matters”) in the Original Title Objection Notice, Seller agrees to notify Purchaser in writing (“Seller’s Initial Notice”) no later than December 11, 2015 as to whether Seller will attempt to cure such defect(s) prior to the Closing. If Seller’s Initial Notice states that Seller refuses to cure such defect(s) (“Seller Refused Objected Title Matters”) prior to the Closing, Purchaser shall either (i) take title to the applicable Property “as is” with respect to the matters set forth in the Original Title Objection Notice, which shall be evidenced by the Purchaser’s approval of the Due Diligence Investigations in the Purchaser’s Due Diligence Contingency Approval Notice, (ii) in the event that Purchaser’s Due Diligence Contingency Approval Notice informs Seller that the Due Diligence Investigations are not approved by Purchaser, this Agreement shall terminate as set forth in Section 5.1(b), or (iii) if permitted by the terms of Section 5.1(e), elect to remove the applicable Property from the Properties being purchased. Purchaser unconditionally waives any right to object to (i) the Initial Title and Survey Matters known to exist at the expiration of the Due Diligence Period not objected to in the Original Title Objection Notice and (ii) any Seller Refused Objected Title Matters (which matters, collectively, shall hereinafter be referred to as the “Initial Permitted Exceptions”).

6.2.2 If exceptions to title appear on any update or continuation of the Preliminary Title Commitment (each a “Continuation”) first issued after the Contingency Approval Date which are neither Initial Permitted Exceptions nor Additional Permitted Exceptions, Purchaser shall notify Seller in writing (a “Subsequent Title Objection Notice”) thereof within the earlier of ten (10) Business Days after Purchaser receives such Continuation and the last Business Day prior to the Closing Date, TIME BEING OF THE ESSENCE. If Purchaser specifies any objectionable matters in the Subsequent Title Objection Notice, Seller agrees to notify Purchaser in writing (“Seller’s Subsequent Notice”) within ten (10) Business Days after its receipt of the Subsequent Title Objection Notice as to whether Seller will attempt to cure such defect(s) prior to the Closing. If Seller’s Notice states that Seller refuses to cure such defect(s) prior to the Closing, Purchaser shall have five (5) days after receipt of Seller’s Notice to notify Seller in writing of its election (the “Election Notice”) (i) to take title to the applicable Property “as is”(and all such title defects set forth in a Subsequent Title Objection Notice which Seller elects not to cure in the Seller’s Subsequent Notice are hereinafter, collectively, referred to as the “Subsequent Permitted Exceptions”; the Initial Permitted Exceptions, together with the Additional Permitted Exceptions and the Subsequent Permitted Exceptions, collectively,

13

hereinafter referred to as the “Permitted Exceptions”) and consummate the Closing of the Properties, (ii) if permitted by the terms of Section 5.1(f), deliver a Removal Notice, (iii) if Purchaser has removed six (6) of the Properties in the aggregate from the Properties being purchased pursuant to Section 5.1(e) and/or Section 5.1(f), to terminate this Agreement, or (iv) if the defect is a lien caused by Seller that can be cured by a monetary payment not in excess of Twenty-Five Thousand Dollars ($25,000.00) in the aggregate per Property, making such payment of Twenty-Five Thousand Dollars ($25,000.00) or less at the Closing and reducing by a like amount the cash due to Seller at the Closing. If Purchaser shall fail to deliver its Election Notice in the time prescribed above, Purchaser shall be deemed to have elected clause (i) above and the Closing shall take place on the Scheduled Closing Date (subject to any adjournment by Seller in accordance with this Agreement). If Seller’s Initial Notice or Seller’s Subsequent Notice provides that Seller shall attempt to cure any defects described therein prior to the Closing, but Seller fails to do so prior to the Closing (as the same may be adjourned by Seller pursuant to Section 6.2.3), Purchaser may at the Closing elect clauses (i), (ii), (iii) or (iv) as set forth above. Seller’s failure to cure any of Purchaser’s objections raised in the Original Title Objection Notice or the Subsequent Title Objection Notice shall not be a default on Seller’s part, but shall give Purchaser the rights set forth in clauses (i) through (iv) of this Section 6.2.2. In the event Purchaser elects to terminate this Agreement, the obligations of Seller to sell, and Purchaser to buy, the Properties as provided herein, and each of the parties’ obligations under this Agreement, except for those obligations hereunder which specifically survive such a termination, shall terminate. Upon termination of this Agreement by Purchaser pursuant to this Section 6.2.2, the Deposit and any interest thereon, shall be returned to Purchaser.

6.2.3 Notwithstanding anything to the contrary contained in Sections 6.2.1 or 6.2.2, if Purchaser gives the Original Title Objection Notice and the Subsequent Title Objection Notice within the time allowed, then Seller shall have the right, at its option, to defer the Scheduled Closing Date one or more times for a period not to exceed thirty (30) days in the aggregate, during which time Seller shall have the right, but not the obligation, to remove or otherwise resolve Purchaser’s objections contained in the Original Title Objection Notice or the Subsequent Title Objection Notice in accordance with Sections 6.2.1 and 6.2.2. Other than as required in Section 6.2 and in Section 12.1.2, nothing contained herein shall obligate Seller to expend any sums of money whatsoever in order to remove or otherwise resolve Purchaser’s objections contained in the Original Title Objection Notice or the Subsequent Title Objection Notice.

6.3 Conveyance of Title. At the Closing, the Properties shall be conveyed subject to the Permitted Exceptions and, for the avoidance of doubt, free and clear of any monetary liens, including liens related to the Existing Debt, other than liens related to property taxes not yet due and payable.

14

7. Seller’s Representations, Warranties and Covenants.

7.1 Seller’s Representations and Warranties. Each Seller represents and warrants to Purchaser as follows as of the Effective Date, which representations and warranties shall be effective, subject to Section 7.2, on the Closing Date:

(a) Such Seller is duly organized and validly existing under the laws of its state of formation. Such Seller owns the Properties set forth under such Seller’s name on Exhibit K and has the right, power and authority to enter into this Agreement and to convey such Properties in accordance with the terms and conditions of this Agreement, to engage in the transactions contemplated in this Agreement and to perform and observe the terms and provisions hereof.

(b) Such Seller has taken all necessary action to authorize the execution, delivery and performance of this Agreement and each Transaction Document to which such Seller is or shall be a party, and upon the execution and delivery of any Transaction Document to be delivered by such Seller on or prior to the Closing, this Agreement and such other Transaction Documents shall constitute the valid and binding obligation and agreement of such Seller, enforceable against such Seller in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws of general application affecting the rights and remedies of creditors. The individual(s) executing this Agreement and the documents contemplated hereby on behalf of such Seller have full power and authority to legally bind such Seller.

(c) Neither the execution, delivery or performance of this Agreement by such Seller, nor compliance with the terms and provisions hereof, will result in any breach of the terms, conditions or provisions of, or conflict with or constitute a default under, or result in the creation of any lien, charge or encumbrance upon the Properties or any portion thereof pursuant to the terms of any indenture, deed to secure debt, mortgage, deed of trust, note, evidence of indebtedness or any other agreement or instrument by which such Seller and/or the Properties are bound.

(d) Except as set forth on Exhibit O, to Seller’s actual knowledge, Seller has not received any written notice of (i) any pending or threatened suit, action or proceeding, which (A) if determined adversely to such Seller, materially and adversely affects the use or value of the Properties owned by such Seller or any portion thereof, or (B) questions the validity of this Agreement, any Transaction Document or any action taken or to be taken pursuant hereto, or (C) involves condemnation or eminent domain proceedings involving the Properties owned by such Seller or any portion thereof, or (ii) that there currently exists a Violation with respect to any Property.

(e) Neither such Seller nor, to Seller’s actual knowledge, any of such Seller’s respective constituents or affiliates nor any of their respective agents acting or benefiting in any capacity in connection with the sale of the Properties owned by such Seller is in violation of any laws relating to terrorism or money laundering, including but not limited to, Executive Order No. 13224 on Terrorist Financing, effective September 24, 2001 (the “Executive Order”), as amended from time to time, and the U.S. Bank Secrecy Act of 1970,

15

as amended by the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, and as otherwise amended from time to time (collectively, with the Executive Order, the “Anti-Terrorism Law”).

(f) Neither such Seller nor any of such Seller’s respective constituents or affiliates nor any of their respective agents acting or benefiting in any capacity in connection with the sale of the Properties owned by such Seller is a “Prohibited Person” under the Anti-Terrorism Law.

(g) Such Seller has not (A) made a general assignment for the\ benefit of creditors, (B) filed any voluntary petition in bankruptcy or suffered the filing of any involuntary petition by its creditors, (C) suffered the appointment of a receiver to take possession of all, or substantially all, of its assets, (D) suffered the attachment or other judicial seizure of all, or substantially all, of its assets, (E) admitted in writing its inability to pay its debts as they come due, or (F) made an offer of settlement, extension or composition to its creditors generally.

(h) Such Seller has not entered into any other agreement of sale for any of the Properties owned by such Seller with any party other than Purchaser.

(i) Seller has not entered into any leases applicable to the Property or other licenses, use agreements, or rights of third parties to possess any portion of the Property other than the Leases that have been disclosed to Purchaser as part of the Diligence Materials. To Seller’s knowledge, no tenant under the any of the Leases is in material default under the terms of their respective Lease. The current rent roll maintained by Seller, which will be delivered to Purchaser within three (3) Business Days after execution of this Agreement, is true and correct in all material respects.

(j) No consent, approval or other authorization of, or registration, declaration or filing with, any governmental authority or any third-party is required for the due execution and delivery of this Agreement and/or any of the documents to be executed by Seller hereunder, or for the performance by or the validity or enforceability thereof against Seller, other than the recording or filing for recordation of each deed.

7.2 Changes. For purposes of Section 7.1, a representation or warranty shall not be deemed to have been breached if the representation or warranty is not true and correct in all material respects as of the Closing Date by reason of changed facts or circumstances arising after the Effective Date which did not arise by reason of a breach of any covenant made by Seller under this Agreement; provided that Seller will notify Purchaser promptly after learning that such changed facts or circumstances exist. Seller shall have the right to cure any misrepresentation or breach of a representation or warranty, or any representation or warranty that is no longer true due to a changed fact or circumstance, and shall be entitled to a reasonable adjournment of the Closing (not to exceed thirty (30) days) for the purpose of such cure. Seller reserves the right, at its sole discretion, at any time during such period to notify Purchaser that it no longer elects to endeavor to effect any such cure (the “Representation Notice”) in which event Purchaser shall have two (2) Business Days from Purchaser’s receipt of the Representation Notice in which to notify Seller of its election as provided in the next succeeding sentence. If

16

Seller is unable or elects not to so cure any such change, misrepresentation or breach, then Purchaser, as its sole remedy for any and all such materially untrue, inaccurate or incorrect original representations or warranties, shall elect either (i) to waive such misrepresentations or breaches of representations or warranties and consummate the transaction without any reduction of or credit against the Purchase Price; (ii) to terminate this Agreement by notice given to Seller within such two (2) Business Day period, in which event this Agreement shall terminate, the Deposit and all interest thereon, if any, shall be returned to Purchaser, and neither party shall have any further liability to the other hereunder, except as may otherwise be expressly provided herein; (iii) deliver a Removal Notice pursuant to (and subject to the limitations contained in) Section 5.1(f); or (iv) if discovered by Purchaser after the Closing, with respect to the Properties purchased by Purchaser and to which the breach of a representation or warranty applies, to recover actual damages resulting from Seller’s breach of its representations or warranties set forth herein.

7.3 Knowledge Parties. Whenever a representation in this Agreement is qualified by the phrase “to Seller’s knowledge”, or by words of similar import, the accuracy of such representation shall be based solely on the actual (as opposed to constructive or imputed) knowledge of Jeff Waldvogle, an individual (the “Designated Representative”) employed by a direct or indirect owner of Seller with the most knowledge regarding the applicable representations, without independent investigation or inquiry of any kind and without any duty to make any such investigation or inquiry. Purchaser acknowledges that the Designated Representative is named solely for the purpose of defining the scope of Seller’s knowledge and not for the purpose of imposing any liability on or creating any duties running from the Designated Representative to Purchaser and Purchaser agrees that the Designated Representative shall not have any liability under this Agreement or in connection with the transactions contemplated hereby.

7.4 Seller’s Covenants and Agreements.

7.4.1 Leasing Arrangements. During the pendency of this Agreement, Seller will not enter into any new lease affecting any Property or materially amend or modify any Lease or approve any assignment or sublease (to the extent Seller’s approval is required under the Lease in question) without Purchaser’s prior written consent, in its reasonable discretion, in each instance, unless an assignment or sublease is pursuant to a lease that provides (or is subject to prevailing law that requires) Seller’s consent is not to be unreasonably withheld or delayed or conditioned, in which case Purchaser may grant such consent if it has no reasonable ground to withhold such consent.

7.4.2 New Contracts. During the pendency of this Agreement, Seller will not enter into any contract, or modify, amend, renew or extend any existing Contract to which Seller is a party that will be an obligation affecting any Property or any part thereof subsequent to the Closing without Purchaser’s prior written consent, in its sole discretion, in each instance, other than any agreements, modifications or amendments required by existing agreements or reasonably necessary for health or safety purposes, and which are cancelable by Seller on thirty (30) days’ or less notice without penalty or premium.

17

7.4.3 Operation of Property. During the pendency of this Agreement, Seller shall continue to operate the Properties consistent with Seller’s past practices.

7.4.4 Insurance. During the pendency of this Agreement, Seller shall, at its expense, continue to maintain the insurance policies covering the Improvements which are currently in force and effect; provided that Seller may make such reasonable modifications to such policies as it deems necessary.

7.4.5 Information. As and when Seller receives or discovers any action, notices, correspondences, information or documentation required to be delivered to Purchaser under this Agreement or that otherwise contains information that is material to one or more of the Properties, it will promptly deliver same to Purchaser.

7.4.6 Encumbrances. Seller shall not further encumber any Property or any part thereof, or convey, lease or transfer any interest therein (or permit the encumbrance, conveyance, lease or transfer thereof) without Purchaser’s prior written consent.

7.4.7 Estoppel Certificates and SNDAs.

7.4.7.1 Seller shall endeavor in good faith to obtain from each of the Tenants under the Leases and deliver to Purchaser (i) a subordination, non-disturbance and attornment agreement (each, an “SNDA” and collectively, the “SNDAs”) in a commercially reasonable form to be delivered by Purchaser to Seller within a reasonable period of time after the Effective Date, and (ii) an estoppel certificate (each, a “Tenant Estoppel” and, collectively, the “Tenant Estoppels”). The Tenant Estoppels shall be (any of the following, an “Acceptable Estoppel Form”) (i) either (1) substantially in the form attached hereto as Exhibit F, it being agreed that the inclusion of qualifications as to knowledge shall not cause a Tenant Estoppel to be non-compliant, or (2) on such other form as may be provided by the Tenant, provided that it certifies in all material respects the matters contained in Exhibit F; or (ii) in the event that a Tenant’s Lease provides for the form or content of a Tenant Estoppel that such Tenant is required to deliver, then in such form or contain only those matters as an estoppel is required to address pursuant to such Tenant’s Lease without giving effect to any requirement regarding “additional information reasonably requested by the lessor” or words of similar import. A Tenant Estoppel, which is delivered in any Acceptable Estoppel Form and confirms the applicable matters contained in such Acceptable Estoppel Form in all material respects is referred to herein as a “Conforming Estoppel”. Without limiting the generality of the foregoing sentence, a Tenant Estoppel shall be a Conforming Estoppel notwithstanding that the Tenant Estoppel may contain (alone or in combination with other matters) claims that are based on (1) facts disclosed to Purchaser in the DataSite, or (2) an assertion by a Tenant that there are liquidated amounts due from Seller to such Tenant allocable to periods prior to the Closing and which are not disputed by Seller in good faith and which Seller has agreed to pay. Notwithstanding anything to the contrary in this Section 7.4.7, Purchaser shall have the right, at its option, to accept a Tenant Estoppel which is not a Conforming Estoppel.

7.4.7.2 It shall be a condition precedent to Purchaser’s obligation to close on each particular Property that Seller shall have delivered to Purchaser, at least five (5) Business Days prior to the Closing, Conforming Estoppels and SNDAs from the Tenants at

18

each of the Properties (collectively, the “Required Tenants”); it being understood and agreed that Seller shall have no obligation to make any payments or provide any financial accommodations to any Tenant or commence any litigation in connection with obtaining such Tenant Estoppels or SNDAs. In the event that Seller fails to obtain and deliver to Purchaser Conforming Estoppels and/or SNDAS from the Required Tenants of any particular Property or Properties by the Closing Date, then Purchaser may, if permitted by Section 5.1(f), deliver a Removal Notice with respect to the applicable Property.

7.4.7.3 Notwithstanding anything to the contrary in this Agreement, failure of Seller to obtain the Tenant Estoppels or the SNDAs shall not constitute a Seller default under this Agreement.

8. Purchaser’s Representations and Warranties and Covenants.

8.1 Purchaser Representations and Warranties. Purchaser represents and warrants to Seller as follows as of the Effective Date, which representations and warranties shall be effective as of the Effective Date and, subject to Section 8.2, on the Closing Date.

(a) Purchaser is duly organized and validly existing under the laws of Purchaser’s state of formation. Purchaser has the right, power and authority to enter into this Agreement and to purchase the Properties in accordance with the terms and conditions of this Agreement, to engage in the transactions contemplated in this Agreement and to perform and observe the terms and provisions hereof. This representation shall survive the Closing or the termination of this Agreement.

(b) Purchaser has taken all necessary action to authorize the execution, delivery and performance of this Agreement, and upon the execution and delivery of any document to be delivered by Purchaser on or prior to the Closing, this Agreement and such document shall constitute the valid and binding obligation and agreement of Purchaser, enforceable against Purchaser in accordance with its terms, except as enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws of general application affecting the rights and remedies of creditors. This representation shall survive the Closing or the termination of this Agreement.

(c) Neither the execution, delivery or performance of this Agreement by Purchaser, nor compliance with the terms and provisions hereof, will result in any breach of the terms, conditions or provisions of, or conflict with or constitute a default under the terms of any indenture, deed to secure debt, mortgage, deed of trust, note, evidence of indebtedness or any other agreement or instrument by which Purchaser is bound.

(d) Purchaser has not (i) made a general assignment for the benefit of creditors, (ii) filed any voluntary petition in bankruptcy or suffered the filing of any involuntary petition by Purchaser’s creditors, (iii) suffered the appointment of a receiver to take possession of all, or substantially all, of Purchaser’s assets, (iv) suffered the attachment or other judicial seizure of all, or substantially all, of Purchaser’s assets, (v) admitted in writing its inability to pay its debts as they come due, or (vi) made an offer of settlement, extension or composition to its creditors generally.

19

(e) Neither Purchaser nor any of Purchaser’s respective constituents or affiliates nor any of their respective agents acting or benefiting in any capacity in connection with the purchase of the Properties is in violation of any laws relating to terrorism or money laundering, including but not limited to, the Anti-Terrorism Law.

(f) Neither Purchaser nor any of Purchaser’s respective constituents or affiliates nor any of their respective agents acting or benefiting in any capacity in connection with the purchase of the Properties is a “Prohibited Person” under the Anti-Terrorism Law.

8.2 Purchaser shall promptly notify Seller of any event or circumstance which makes any representation or warranty by Purchaser under this Agreement incomplete, inaccurate or incorrect in any material respect.

9. Condition of Property. Except as otherwise specifically provided in this Agreement, Seller makes no representation, promise or guaranty with respect to the accuracy or completeness of any due diligence materials and/or Property information provided to Purchaser under this Agreement, the condition or character of any Property (including, without limitation, the subsoil condition thereof) or the use or uses to which any Property may be put. Purchaser acknowledges that Purchaser has the right to make the examinations and investigations described in this Agreement, and except for reliance upon Seller’s express representations, warranties and covenants set forth in this Agreement, that Purchaser is relying on this right in order to satisfy itself as to the character, condition and operation of the Properties. Purchaser further acknowledges that (i) except as otherwise specifically provided in this Agreement, Purchaser will be purchasing the Properties on the basis of its examination and investigation and not in reliance on any representation or warranty of Seller or any agent, employee or representative of Seller (not expressly contained in this Agreement) and (ii) the Properties are being sold in “AS IS, WHERE IS” condition “WITH ALL FAULTS.”

10. Compliance with Laws. Subject to the provisions of this Agreement, the Properties are sold and in the event of a Closing hereunder, Purchaser shall accept same, subject to any and all violations of law, rules, regulations, ordinances, orders, or requirements noted or issued by any Federal, state, county, municipal, or other department or government agency having jurisdiction against or affecting the Properties whenever noted or issued (collectively, “Violations”) and any conditions which could give rise to any Violations. Seller shall have no obligation to cure or remove any Violations. If any notice or communication with respect to any Violation is received by Seller after the date of this Agreement, Seller shall promptly notify Purchaser in writing.

11. Apportionments at Closing; Transfer Taxes; Closing Costs.

11.1 Apportionments. The following charges, pro-rations and apportionments shall be made on a per diem basis between Purchaser and Seller at Closing as of 12:01 A.M. (EST) on the Closing Date on the basis of a 365-day year, with Purchaser deemed the owner of the applicable Property on the entire Closing Date:

11.1.1 Rent, Income.

20

(a) All Rent collected under the Leases (including all prepaid Rent previously collected by Seller) shall be prorated as of the Closing Date and be adjusted against the Purchase Price on the basis of a schedule which shall be prepared by Seller and approved by Purchaser prior to the Closing. Purchaser shall receive at the Closing a credit for all security deposits held or controlled by Seller under the Leases, for Purchaser’s pro rata share of the Rent and all other payments payable for the month of the Closing and for all other Rent and other amounts that apply to periods from and after the Closing, but which were actually received by Seller prior to the Closing.

(b) Delinquent Rent shall not be accrued or prorated at the Closing. Any Delinquent Rent that is paid within sixty (60) days after the Closing Date shall, subject to the terms below, be paid to Seller and, if Delinquent Rent is received by Purchaser, Purchaser shall pay the Delinquent Rent to Seller promptly after collection by Purchaser; provided, however, that all Rent collected after the Closing Date shall be applied (i) first, to the month in which the Closing occurs, prorated between Seller and Purchaser as provided above in subsection (a); (ii) next, to Purchaser, for application to all Rents due and owing after the date of the Closing; (iii) next, to Seller, for application to all Rents due and owing for the period prior to the month in which the Closing occurs; and (iv) last, the balance thereof to Purchaser. Seller shall deliver to Purchaser any Rents Seller receives after the Closing for allocation by Purchaser pursuant to this subsection (b).

(c) If any Property is affected by any assessment imposed by any governmental authority which is or may become payable in annual installments, then, to the extent required under the Leases, Seller shall pay the unpaid installments of any such assessment which are due and payable on or before the Closing Date, and Purchaser shall assume full responsibility for the payment of all installments which become due and payable after the Closing Date. Notwithstanding the foregoing, any assessments which are payable by the Tenants under the Leases directly to the applicable authority shall not be apportioned hereunder, and Purchaser shall look solely to the Tenant responsible therefore for the payment of the same.

11.2 Adjustment. If at any time following the Closing Date, the amount of an item listed or prorated in Section 11 shall prove to be incorrect (whether as a result of an error in calculation or lack of complete and accurate information as of the Closing), the party in whose favor the error was made shall promptly pay to the other party the sum necessary to correct such error upon receipt of reasonable proof of such error, provided that notice of such error. The provisions of this Section 11.1.3 shall survive the Closing indefinitely and not be merged therein. All prorations shall be made based on the number of calendar days in such year or month, as the case may be.

11.3 Transfer Tax/Documentary Stamps. Seller shall pay all Transfer Taxes and intangible property taxes imposed in connection with the Closing and recording of each deed (excluding recording fees).

11.4 Closing Costs.

21

(a) Except as otherwise set forth in Section 3.3 hereof, Seller shall pay at Closing:

(i) | all recording fees due on recording of corrective instruments, if any; |

(ii) | all recording fees due on Deeds, to the extent paid by Seller in accordance with local custom; |

(iii) | all Transfer Taxes and intangible property taxes; |

(iv) | Seller’s attorney’s fees and costs; |

(v) | title insurance premiums for standard owner’s Title Policies (but not extended coverage or any endorsements required by Purchaser or its lender), as indicated on Exhibit L; |

(vi) | any Defeasance Costs allocated to Seller and the Purchaser Defeasance Credit, if any in accordance with Section 3.3; and |

(vii) | one-half of all escrow fees charged by Escrowee, if any. All costs and expenses to be paid by Seller at the Closing shall be disbursed from the balance of the Purchase Price payable by Purchaser at the Closing and shall reduce the net cash payable to Seller. |

(b) Except as otherwise set forth in Section 3.3 hereof, Purchaser shall pay at or prior to the Closing:

(i) | all recording fees due on each Deed, to the extent customarily paid by purchasers in accordance with local custom where the applicable Properties are located; |

(ii) | all recording fees due on recording of corrective instruments, if any, to the extent customarily paid by purchasers of real property in the jurisdictions where the Properties are located; |

(iii) | all title insurance premiums for the Title Policies for the Properties, as indicated on Exhibit L, and all premiums for extended coverage and all endorsements to any Title Policy; |

(iv) | the cost of any survey obtained by Purchaser; |

(v) | all costs and expenses of any financing of Purchaser’s acquisition of the Properties (including, without limitation, all intangible taxes, documentary stamp taxes and recording and filing fees due on any financing document, and lender’s attorneys’ fees and expenses); |

(vi) | Purchaser’s attorney’s fees and costs; |

22

(vii) | the Seller Defeasance Credit, if any, in accordance with Section 3.3.3; and |

(viii) | one-half of all escrow fees charged by Escrowee, if any. |

(c) All other closing costs shall be allocated in accordance with local custom in the jurisdiction in which the particular Property is located.

12. Conditions Precedent.

12.1 Purchaser’s Conditions Precedent. The obligations of Purchaser under this Agreement are contingent upon the satisfaction (or written waiver by Purchaser) of each and all of the following conditions precedent on or before the Closing Date:

12.1.1 Representations. Each and every representation and warranty of Seller set forth in this Agreement shall be true, complete and correct in all material respects as of the Closing Date, subject to the provisions of Section 7.2 or waived by Purchaser.

12.1.2 Title Policy. The Title Company shall be irrevocably committed to issue a Title Policy (subject only to the Permitted Exceptions) with respect to each Property at and as of the Closing in accordance with Section 6.2 hereof.

12.1.3 Seller Authority. Seller shall have provided evidence satisfactory to the Title Company that all necessary corporate, partnership, trust and limited liability company authority and approvals have been issued and obtained from Seller.

12.1.4 Tenant Estoppels and SNDAs. Seller shall have delivered to Purchaser Conforming Estoppels and executed SNDAs from the Required Tenants.

12.1.5 ROFO. The Multiple-Property Transfer Notices (as defined in Section 35.2) shall have been delivered to the Multiple-Property Transfer Notice Tenants (as defined in Section 35.1). The ROFO Notices (as defined in Section 35.3.1) shall have been delivered to the ROFO Tenants (as defined in Section 35.1). With respect to any particular Property encumbered by a Lease with a ROFO Tenant, and not excluded from the Properties to be conveyed to Purchaser pursuant to the terms of this Agreement, the applicable ROFO Tenant shall have waived its Purchase Right (and Seller shall deliver to Purchaser a copy of the written waiver actually received by Seller from any ROFO Tenant, if any) or the time period under the applicable Lease for the Tenant to exercise such Purchase Right shall have expired.

12.1.6 Defeasance. The Defeasance shall have been effected or shall be effected simultaneously with the Closing resulting in all existing liens associated with the Existing Debt to be released.

12.2 Seller’s Conditions Precedent. The obligations of Seller under this Agreement are contingent upon the satisfaction (or written waiver by Seller) of each and all of the following conditions precedent on or before the Closing Date:

23

12.2.1 Payment of Purchase Price and Other Amounts. Purchaser shall have paid or tendered payment of the Purchase Price, as adjusted as provided herein, and the Seller Defeasance Credit (if any) pursuant to the terms hereof.

12.2.2 Representations. Each and every representation and warranty of Purchaser set forth in Section 8.1 above shall be true, complete and correct in all material respects as of the Closing Date, subject to the provisions of Section 8.2.

12.2.3 No Default. Purchaser shall have performed in full all of its obligations to be performed hereunder at or prior to the Closing, unless cured by the Closing.

12.2.4 No Litigation. There shall be no litigation, suit, action or other proceeding pending or threatened which, if successful, would have a material adverse effect on Purchaser’s ability or authority to perform its (or their) obligations under this Agreement or the Transaction Documents.

12.2.5 Purchaser’s Authority. Purchaser shall have provided evidence satisfactory to the Title Company that all necessary corporate, partnership, trust and limited liability company authority and approvals have been issued and obtained from Purchaser.

12.2.6 Defeasance. The Defeasance shall have been effected or shall be effected simultaneously with the Closing.

13. Time of the Essence. Time wherever specified herein for satisfaction of conditions or performance of obligations of Purchaser is of the essence of this Agreement.

14. Possession and Condition. Subject to the express provisions of this Agreement, it is understood and agreed that the Properties are being purchased by Purchaser in their present physical “as is” condition. At the Closing, Seller shall transfer to Purchaser possession of each Property in substantially the same condition such Property is in on the date hereof, reasonable wear and tear excepted and subject to the terms and conditions of Sections 16 and 17 hereof.

15. PURCHASER’S DEFAULT. IF PURCHASER SHALL DEFAULT HEREUNDER OR SHALL FAIL OR REFUSE TO PERFORM ITS OBLIGATOINS IN ACCORDANCE WITH THIS AGREEMENT, SELLER’S SOLE AND EXCLUSIVE REMEDY SHALL BE TO TERMINATE THIS AGREEMENT BY WRITTEN NOTICE TO ESCROWEE AND PURCHASER, AND UPON SUCH TERMINATION, ESCROWEE SHALL IMMEDIATELY DELIVER THE DEPOSIT AND ALL INTEREST THEREON TO SELLER AS FULL COMPENSATION AND LIQUIDATED DAMAGES; PROVIDED, HOWEVER, THAT SUCH TERMINATION SHALL NOT LIMIT SELLER’S RIGHTS TO

24

RECEIVE REIMBURSEMENT FOR ATTORNEYS' FEES UNDER TI-US AGREEEMENT IN CONNECTION WITH AN ACTION TO RECOVER THE DEPOSIT, NOR WAIVE OR AFFECT PURCHASER'S AND SELLER'S INDEMNITY OBLIGATIONS UNDER THIS AGREEMENT WHICH EXPRESSLY SURVIVE THE TERMINATION OF THIS AGREEMENT. IN CONNECTION WITH THE FOREGOING, THE PARTIES RECOGNIZE THAT IN THE EVENT THE CLOSING SHALL NOT OCCUR ON ACCOUNT OF THE DEFAULT OF PURCHASER, SELLER SHALL INCUR EXPENSES AND LOSSES IN CONNECTION WITH THE TRANSACTION CONTEMPLATED BY THIS AGREEMENT AND THAT IT IS EXTREMELY DIFFICULT AND IMPRACTICAL TO ASCERTAIN THE EXTENT OF DETRIMENT TO SELLER CAUSED BY SUCH BREACH BY PURCHASER AND THE FAILURE OF THE CONSUMMATION OF THE TRANSACTION CONTEMPLATED BY THIS AGREEMENT OR THE AMOUNT OF COMPENSATION SELLER SHOULD RECEIVE AS OF RESULT OF SUCH PURCHASER DEFAULT.

/s/ JW | /s/ MKP |

SELLER'S INITIALS | PURCHASER'S INITIALS |

16. Seller's Default

In the event Seller shall be unable to perform its obligation to convey the Properties, or any particular Properties, in accordance with the terms of this Agreement (other than by reason of Seller's Willful Default), Purchaser, at its sale option and as its sole and exclusive remedy, may terminate this Agreement by written notice to Escrowee and Seller, and upon such termination, Escrowee shall refund to Purchaser the Deposit, together with all interest thereon, if any, and neither party shall thereafter have any further right or obligation hereunder, other than the surviving obligations expressly provided for herein. "Seller's Willful Default" shall mean Seller' s willful refusal to perform its obligation to convey the Properties to Purchaser in accordance with the terms of this Agreement (as opposed to the failure of a condition listed in Section 12.1), provided: (1) the reasons for such refusal do not include conditions beyond Seller's control or the non-conformance of title with the conditions described in Section 6.2; and (2) Purchaser has satisfied all conditions required to be satisfied by it under this Agreement (other than the delivery to escrow of the funds required to close the purchase contemplated herein), is not otherwise in default under this Agreement, and is ready, willing and able to perform all of its obligations under this Agreement and to deliver the Purchase Price clue Seller under this Agreement and the Seller Defeasance Credit (if any), as adjusted by the Defeasance Difference Amount (if any) (without tender thereof being required) . In the event of Seller's Willful Default , Purchaser, at its sole option and as its sale and exclusive remedy, may either (a) terminate this Agreement by written notice to Escrowee and Seller, and upon such termination, (i) Escrowee shall refund to Purchaser the Deposit, together with all interest thereon, if any, (ii) Seller shall refund to Purchaser its costs incurred in connection with Purchaser's Due Diligence Investigations in the amount of $20 ,000 per Property, and (iii) Purchaser shall receive from Seller liquidated damages of $2,000,000.00 (which tile parties agree is fair compensation), and neither party shall thereafter have any further right or obligation hereunder, other than the surviving obligations expressly provided for herein; or (b) within forty-five (45) days after any

25

rights of Purchaser arise due to a Seller’s Default, bring an action in equity against Seller for specific performance. In no event may Purchaser bring an action against Seller for damages or seek any remedy (whether or not in an action at law or in equity) against Seller on account of a Seller’s default prior to the Closing that could require Seller to pay any monies to Purchaser whether characterized as damages or otherwise, except as expressly set forth herein.

17. Casualty Loss and Condemnation.

If, prior to the Closing, all or any portion of any Property is (i) taken or rendered unusable for its current purpose or reasonably inaccessible by eminent domain, (ii) subject of a pending or threatened taking which has not been consummated (clauses (i) and (ii) referred to herein as “Condemnation”, or (iii) destroyed by fire or other casualty (“Casualty Event”) (any of Condemnation or Casualty Event, an “Interruption Event”), then Seller shall so notify Purchaser of such fact or facts in writing, and:

17.1 Material Event. If an Interruption Event (a) would result (in Purchaser’s reasonable opinion) in Restoration Costs in excess of twenty percent (20%) of the portion of the Purchase Price allocated to the affected Property or (b) in the event of a Condemnation, would prevent public access to the Property or result in any material and adverse loss of parking at the Property (which is defined as the loss of use of twenty percent (20%) or more of the Property’s parking stalls), or (c) would entitle the Tenant at the Property, if any, to terminate its Lease (any such event is referred to herein as a “Material Event”), then Purchaser shall have the option to notify Seller that Purchaser desires to remove the Property affected by the Interruption Event from the Properties being purchased by Purchaser; provided, however, if Purchaser elects to remove one or more Properties from the Properties being purchased in accordance with this Section 17.1, as a result of a Casualty Event, Seller may, at its option, by written notice to Purchaser (the “Casualty Vitiation Notice”) within five (5) days after Seller’s receipt of written notice from Purchaser exercising such termination or removal right, notify Purchaser that it intends to repair the damage caused by such Casualty Event at its sole cost and expense if the Material Event is reasonably capable of being cured by Seller, in which case Seller may, upon such notice, postpone the Closing with respect to the applicable Properties for a period of time reasonably necessary, but not to exceed ninety (90) days in the aggregate, to make such repairs. In the event that Purchaser elects to remove one or more Properties as a result of a Material Event and Seller does not or cannot deliver to Purchaser the Casualty Vitiation Notice within five (5) days after Seller’s receipt of written notice from Purchaser exercising such termination right, Purchaser may deliver a Removal Notice pursuant to Section 5.1(f). “Restoration Costs” means the sum of (i) all costs required or necessary to fully restore all damage to the Property, including all parking facilities and amenities (in the case of a Casualty Event), to its condition prior to such Casualty Event or provide for a fully restored and functioning Property (including all parking facilities and amenities) (in the case of a Condemnation) (with the area of loss limited only to the area so condemned)) and (ii) all rental loss and rental abatement to be suffered in connection with the Material Event in question; and

17.2 Non-Material Event.