Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SELLAS Life Sciences Group, Inc. | gale-201508068xk.htm |

| EX-99.1 - EXHIBIT 99.1 - SELLAS Life Sciences Group, Inc. | gale-20150806ex991.htm |

Q2, 2015 EARNINGS

FORWARD LOOKING STATEMENT This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about target revenue from the sales of the Company’s products, the future expectations, plans and prospects for the development and commercialization of the Company's product candidates, including patient enrollment in our clinical trials, and are subject to a number of risks, uncertainties and assumptions, including those identified under “Risk Factors” in the Company’s most recently filed Annual Report on Form 10-K and Quarterly Report on Form 10-Q and in other filings the Company periodically makes with the SEC. Actual results may differ materially from those contemplated by these forward- looking statements. The Company does not undertake to update any of these forward-looking statements to reflect a change in its views or events or circumstances that occur after the date of this presentation. 2

EARNINGS CALL PARTICIPANTS Presenters Mark W. Schwartz, Ph.D. President and Chief Executive Officer Gavin Choy, PharmD Senior Vice President, Clinical Sciences and Operations Christopher Lento, MBA Senior Vice President, Commercial Operations Ryan Dunlap, CPA Vice President & Chief Financial Officer Other Participants Remy Bernarda, MBA SVP, Investor Relations & Corporate Communications Tom Knapp, Esq Interim General Counsel 3

Q2 Overview Mark W. Schwartz, Ph.D. President and Chief Executive Officer

2015 MILESTONES Commercial Report $8-10 million net revenue for 2014 Launch Zuplenz in the U.S. • Achieve $15-18 million net revenue in 2015 NeuVax™ Enroll N=700 into PRESENT trial Complete enrollment in Phase 3 PRESENT trial • PRESENT trial interim analysis (Q4,‘15/Q1,‘16) GALE-301 (FBP) Report Top-Line Phase 2a clinical data • Report 1-Year Phase 2a analysis GALE-401 (anagrelide CR) Report Top-Line efficacy and safety data • Report Final Phase 2 data 5

CLINICAL DEVELOPMENT Gavin Choy, PharmD Senior Vice President, Clinical Sciences and Operations 6

PHASE 3 PRESENT TRIAL PER SPA 1 2 3 4 Interim analysis by DSMB at n=70 events Endpoint DFS at n=141 events /36 months Dosing by Month + 1 booster dose every 6 months thereafter 5 6 Adjuvant breast cancer patients, randomized 1:1 Double blind Node positive HLA A2/A3+ HER2 IHC 1+/2+ Stratified by stage, type of surgery, hormone receptor, and menopausal status Enrollment complete: n=758 Patients Study Population + GM-CSF Placebo + GM-CSF 7 Prevention of Recurrence in Early-Stage, Node Positive Breast Cancer with Low to Intermediate Her2 Expression with NeuVax Treatment

NEUVAX CLINICAL DEVELOPMENT PROGRAMS Phase Treatment Indication Status Protocol Defined # of Patients 3 Single agent PRESENT Study Breast, 1+, 2+ Enrolled, 13 countries, ~140 centers 700 (enrolled 758) 2 Combination with Herceptin Breast, 1+, 2+ Enrolling, US only, 32 centers 300 2 Combination with Herceptin Breast, 3+ Enrolling, US only, 29 centers 100 2 Single agent Gastric, 1+, 2+, 3+ Planned, India sites only ~50 (anticipated) 8

Primary Endpoint DFS at 24 mos. Standard of Care: Standard Herceptin dosing every 3 weeks for 1 year + 1 booster dose every 6 months thereafter + Dosing to disease progression or 36 months 6 doses of NeuVax given every 3 weeks starting with third dose of Herceptin Secondary Endpoint DFS at 36 mos. 300 adjuvant breast cancer patients, randomized 1:1 Single blind (subject) Node positive or triple negative HLA A2/A3+ HLA A24/A26+ HER2 IHC 1+/2+ Stratified by nodal status and HER2 status Study Population NEUVAX+TRASTUZUMAB: HER2 1+/2+ PHASE 2 STUDY GM-CSF + GM-CSF 9

10 NEUVAX+TRASTUZUMAB: HER2 3+ DoD STUDY

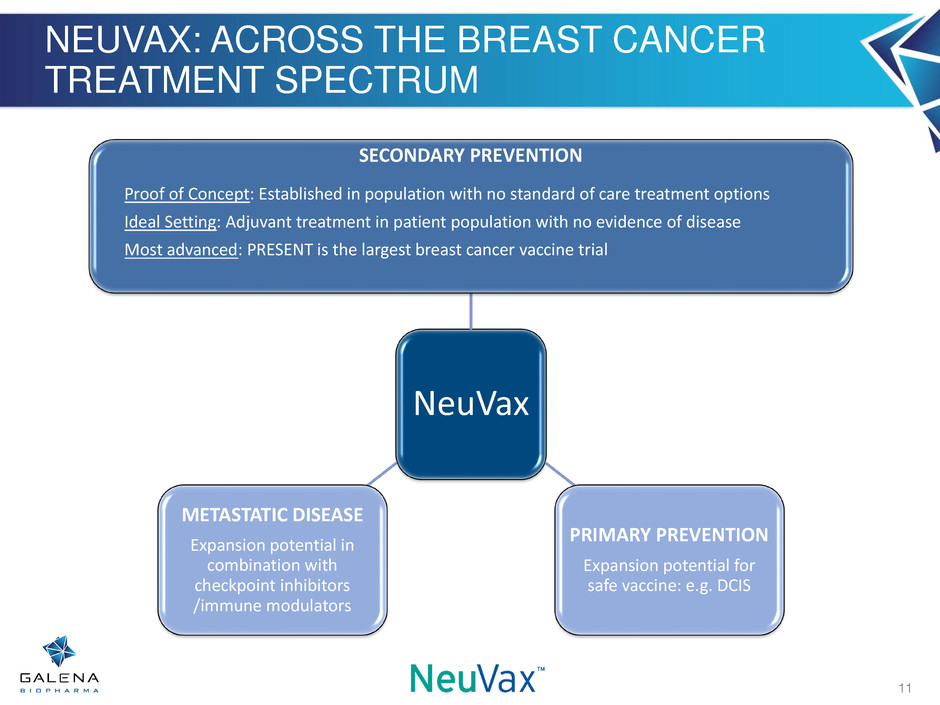

NEUVAX: ACROSS THE BREAST CANCER TREATMENT SPECTRUM NeuVax SECONDARY PREVENTION Proof of Concept: Established in population with no standard of care treatment options Ideal Setting: Adjuvant treatment in patient population with no evidence of disease Most advanced: PRESENT is the largest breast cancer vaccine trial PRIMARY PREVENTION Expansion potential for safe vaccine: e.g. DCIS METASTATIC DISEASE Expansion potential in combination with checkpoint inhibitors /immune modulators 11

GALE-301: FOLATE BINDING PROTEIN (FBP) 12 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% Vaccine Control % of Subj e ct s Recurrence 24.0% 13.3% Source: U.S. Ovarian Cancer http://seer.cancer.gov/statfacts/html/ovary.html Targeted cancer immunotherapy FBP is over-expressed (20-80 fold) in >90% of ovarian and endometrial cancers FBP has very limited tissue distribution and expression in non-malignant tissue making it an ideal immunotherapy target Current treatments are generic • Carboplatin and paclitaxel • High recurrence rate Most patients relapse with poor prognosis

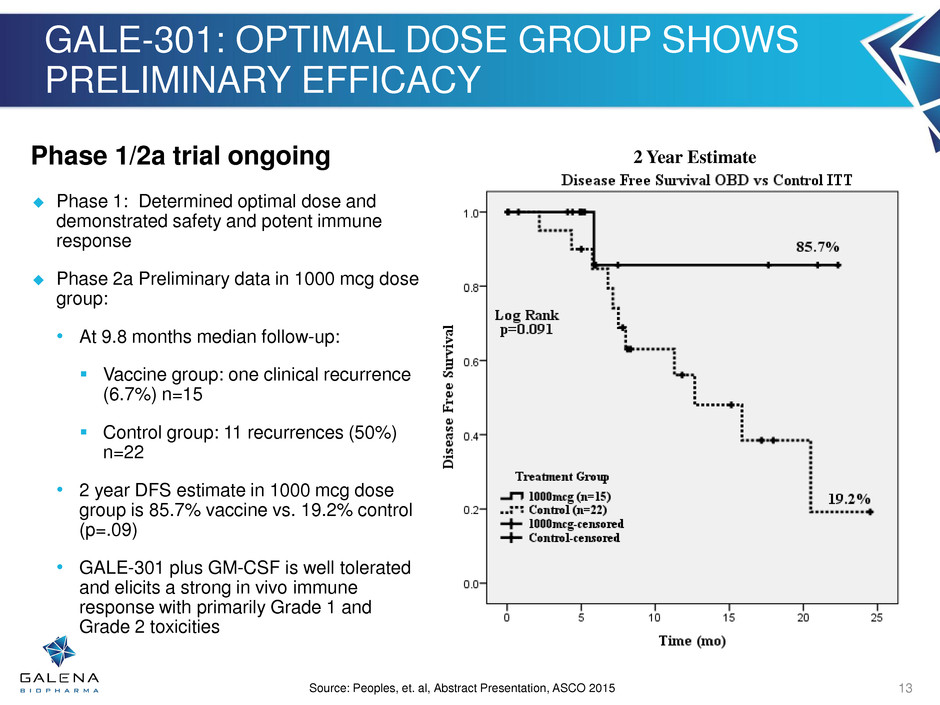

GALE-301: OPTIMAL DOSE GROUP SHOWS PRELIMINARY EFFICACY 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% Vaccine Control % of Subj e ct s Recurrence 24.0% 13.3% Source: Peoples, et. al, Abstract Presentation, ASCO 2015 13 Phase 1/2a trial ongoing Phase 1: Determined optimal dose and demonstrated safety and potent immune response Phase 2a Preliminary data in 1000 mcg dose group: • At 9.8 months median follow-up: Vaccine group: one clinical recurrence (6.7%) n=15 Control group: 11 recurrences (50%) n=22 • 2 year DFS estimate in 1000 mcg dose group is 85.7% vaccine vs. 19.2% control (p=.09) • GALE-301 plus GM-CSF is well tolerated and elicits a strong in vivo immune response with primarily Grade 1 and Grade 2 toxicities 2 Year Estimate

GALE-401: PHASE 2 PILOT STUDY PRELIMINARY RESULTS 14 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% Vaccine Control % of Subj e ct s Recurrence 24.0% 13.3% Source: EHA 2015 Poster Presentation, Verstovsek et al. Well tolerated with primarily Grade 1 and 2 toxicities in n=16/18 Efficacy compares favorably to historical anagrelide IR • Platelet response: ORR = 78% (14/18) CR = 39% (7/18) PR = 39% (7/18) Median time to response was 5 weeks (range, 3–10) Median duration of response has not yet been reached Figure 2. Platelet Response 1 8 15 22 29 36 43 50 57 64 71 78 85 99 113 127 141 155 169 197 225 18 18 18 18 18 18 15 14 14 14 13 13 13 13 13 13 12 12 11 11 11 1.0 1.4 1.8 1.9 2.0 2.2 2.4 2.5 2.4 2.2 2.0 2.1 2.1 1.9 1.8 1.9 2.0 1.9 1.8 1.9 1.8 Study Days N= Avg. daily dose 0 200 400 600 800 1000 1200 1400 Mean Platelet Count (± SD) Pl a tel e t Co u nt (x 1 0 9 /L ) Figure 2. Platelet Response 1 8 15 22 29 36 43 50 57 64 71 78 85 99 113 127 141 155 169 197 225 18 18 18 18 18 18 15 14 14 14 13 13 13 13 13 13 12 12 11 11 11 1.0 1.4 1.8 1.9 2.0 2.2 2.4 2.5 2.4 2.2 2.0 2.1 2.1 1.9 1.8 1.9 2.0 1.9 1.8 1.9 1.8 Study Days N= Avg. daily dose 0 200 400 600 800 1000 1200 1400 Mean Platelet Count (± SD) P la te le t C o u n t (x 1 0 9 /L ) Figure 2. Platelet Response 1 8 15 22 29 36 43 50 57 64 71 78 85 99 113 127 141 155 169 197 225 18 18 18 18 18 18 15 14 14 14 13 13 13 13 13 13 12 12 11 11 11 1.0 1.4 1.8 1.9 2.0 2.2 2.4 2.5 2.4 2.2 2.0 2.1 2.1 1.9 1.8 1.9 2.0 1.9 1.8 1.9 1.8 Study Days N= Avg. daily dose 0 200 400 600 800 1000 1200 1400 Mean Platelet Count (± SD) P la te le t C o u n t (x 1 0 9 /L ) Figure 2. Platelet Response 1 8 15 22 29 36 43 50 57 64 71 78 85 99 113 127 141 155 169 197 225 18 18 18 18 18 18 15 14 14 14 13 13 13 13 13 13 12 12 11 11 11 1.0 1.4 1.8 1.9 2.0 2.2 2.4 2.5 2.4 2.2 2.0 2.1 2.1 1.9 1.8 1.9 2.0 1.9 1.8 1.9 1.8 Study Days N= Avg. daily dose 0 200 400 600 800 1000 1200 1400 Mean Platelet Count (± SD) P la te le t C o u n t (x 1 0 9 /L )

COMMERCIAL: ABSTRAL® Christopher Lento Senior Vice President, Commercial Operations 15

GROSS REVENUE vs. NET REVENUE (Since Acquisition) 16

17 PAID TRANSACTIONS vs. QUANTITY DISPENSED (April 2014 to June 2015)

18 AVERAGE TRANSACTION PRICE (April 2014 to June 2015)

SALES BY SPECIALTY (2015 YTD) 19 Oncology Includes Medical Oncology Radiation Oncology Palliative Care Source: Galena REMS Data

COMMERCIAL: ZUPLENZ® Christopher Lento Senior Vice President, Commercial Operations 20

INTRODUCING ZUPLENZ® 21 Source: Image taken from Zuplenz.com

COMMERCIAL OPPORTUNITY 22 Delivers the trusted efficacy and safety of ondansetron Convenient oral soluble film eliminates the burden of swallowing pills during periods of emesis Does not require water ideal in cases of oral irritation Pleasant peppermint flavor, no gritty aftertaste

GALENA COMMERCIAL TEAM: PROMOTION/TARGETING MIX • ZUPLENZ (PONV) • ABSTRAL (BTcP) • ZUPLENZ (PONV) • ABSTRAL (BTcP) • ZUPLENZ (RINV/PONV) • ABSTRAL (BTcP) • ZUPLENZ (CINV) Medical Oncologists Radiation & Surgical Oncologists Non- Oncology Specialties Pain Specialists (oncology patients) 23

24 Source: Image taken from galenapatientservices.com

FINANCE Ryan Dunlap, CPA Vice President & CFO 25

ABSTRAL NET REVENUE 26

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS (in 000s)(unaudited) 27 June 30, 2015 Net revenue $ 3,382 Costs and expenses: Cost of revenue (excluding amortization of certain acquired intangible assets) 468 Research and development 7,290 Selling, general, and administrative 6,451 Amortization of certain acquired intangible assets 442 Total costs and expenses 14,651 Operating loss (11,269) Non-operating income (expense): Change in fair value of warrants potentially settleable in cash (4,267) Interest income (expense), net (207) Other income (expense) 83 otal non-operating income (expense), net (4,391) Three Months Ended June 30, 2014 $ 2,331 347 8,069 9,600 98 18,114 (15,783) (3,353) (314) (491) (4,158) Net loss (15,660)$ Net loss per common share: Basic and diluted net loss per share (0.10)$ Weighted average common shares outstanding: basic and diluted 161,383,398 (19,941)$ (0.17)$ 118,083,988

Q2 2015 CASH ROLL-FORWARD 28 Confidential Information (000s rounded) Beginning Cash, April 1, 2015 $52,860 Financing Activities $5,280 Operating Burn ($11,900) Debt Service ($1,000) Ending Cash, March 31, 2015 $45,280

THANK YOU Mark W. Schwartz, Ph.D. President and Chief Executive Officer 29