Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT - SELLAS Life Sciences Group, Inc. | gale-20140930xex321.htm |

| EX-31.2 - EXHIBIT - SELLAS Life Sciences Group, Inc. | gale-20140930xex312.htm |

| EX-31.1 - EXHIBIT - SELLAS Life Sciences Group, Inc. | gale-20140930xex311.htm |

| EX-10.1 - EXHIBIT - SELLAS Life Sciences Group, Inc. | gale-20140930xex101.htm |

| EXCEL - IDEA: XBRL DOCUMENT - SELLAS Life Sciences Group, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________

FORM 10-Q

________________________________

(Mark One)

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2014

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-33958

________________________________

Galena Biopharma, Inc.

(Exact name of registrant as specified in its charter)

________________________________

Delaware | 20-8099512 | |

(State of incorporation) | (I.R.S. Employer Identification No.) | |

4640 SW Macadam Ave., Suite 270, Portland, OR 97239

(Address of principal executive office) (Zip code)

Registrant’s telephone number: (855) 855-4253

________________________________

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter time that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer | o | Accelerated filer | ý | |||

Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | o | ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): o Yes ý No

As of October 31, 2014, Galena Biopharma, Inc. had outstanding 121,457,118 shares of common stock, $0.0001 par value per share, exclusive of treasury shares.

GALENA BIOPHARMA, INC.

FORM 10-Q — QUARTER ENDED SEPTEMBER 30, 2014

INDEX

Part No. | Item No. | Description | Page No. | ||

I | |||||

1 | |||||

2 | |||||

3 | |||||

4 | |||||

II | |||||

1 | Legal Proceedings | ||||

6 | |||||

EX-10.1 | |||||

EX-31.1 | |||||

EX-31.2 | |||||

EX-32.1 | |||||

1

PART I

ITEM 1. FINANCIAL STATEMENTS

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share and per share data)

September 30, 2014 | December 31, 2013 | ||||||

(Unaudited) | |||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 24,647 | $ | 47,787 | |||

Restricted cash | 200 | 200 | |||||

Accounts receivable | 1,435 | 3,683 | |||||

Inventories | 450 | 386 | |||||

Prepaid expenses | 1,789 | 1,399 | |||||

Total current assets | 28,521 | 53,455 | |||||

Equipment and furnishings, net | 589 | 665 | |||||

In-process research and development | 12,864 | 12,864 | |||||

Abstral rights, net | 14,714 | 14,979 | |||||

Zuplenz rights | 7,663 | — | |||||

GALE-401 rights | 9,155 | — | |||||

Goodwill | 5,898 | 5,898 | |||||

Deposits and other assets | 88 | 115 | |||||

Total assets | $ | 79,492 | $ | 87,976 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 3,360 | $ | 2,660 | |||

Accrued expenses and other current liabilities | 15,292 | 8,667 | |||||

Current maturities of capital lease obligations | 6 | 6 | |||||

Fair value of warrants potentially settleable in cash | 8,765 | 48,965 | |||||

Current portion of long-term debt | 4,163 | 2,149 | |||||

Total current liabilities | 31,586 | 62,447 | |||||

Capital lease obligations, net of current maturities | 17 | 26 | |||||

Deferred tax liability | 5,053 | 5,053 | |||||

Contingent purchase price consideration | 6,880 | 6,821 | |||||

Long-term debt, net of current portion | 5,097 | 7,743 | |||||

Total liabilities | 48,633 | 82,090 | |||||

Commitments and contingencies | |||||||

Stockholders’ equity: | |||||||

Preferred stock, $0.0001 par value; 5,000,000 shares authorized; no shares issued and outstanding | — | — | |||||

Common stock, $0.0001 par value; 200,000,000 shares authorized, 122,132,118 shares issued and 121,457,118 shares outstanding at September 30, 2014; 110,100,701 shares issued and 109,425,701 shares outstanding at December 31, 2013 | 11 | 10 | |||||

Additional paid-in capital | 242,222 | 188,600 | |||||

Accumulated deficit | (207,525 | ) | (178,875 | ) | |||

Less treasury shares at cost, 675,000 shares | (3,849 | ) | (3,849 | ) | |||

Total stockholders’ equity | 30,859 | 5,886 | |||||

Total liabilities and stockholders’ equity | $ | 79,492 | $ | 87,976 | |||

See accompanying notes to condensed consolidated financial statements.

2

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Amounts in thousands, except share and per share data)

(Unaudited)

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2014 | 2013 | 2014 | 2013 | ||||||||||||

Net revenue | $ | 1,620 | $ | 1,170 | $ | 6,124 | $ | 1,170 | |||||||

Costs and expenses: | |||||||||||||||

Cost of revenue (excluding amortization of certain acquired intangible assets) | 247 | 258 | 925 | 258 | |||||||||||

Research and development | 7,243 | 3,633 | 22,082 | 13,990 | |||||||||||

Selling, general, and administrative | 7,268 | 4,129 | 23,698 | 8,369 | |||||||||||

Amortization of certain acquired intangible assets | 70 | 43 | 259 | 43 | |||||||||||

Total costs and expenses | 14,828 | 8,063 | 46,964 | 22,660 | |||||||||||

Operating loss | (13,208 | ) | (6,893 | ) | (40,840 | ) | (21,490 | ) | |||||||

Non-operating income (expense): | |||||||||||||||

Change in fair value of warrants potentially settleable in cash | 6,735 | (1,614 | ) | 13,174 | (7,135 | ) | |||||||||

Interest income (expense), net | (297 | ) | (314 | ) | (925 | ) | (495 | ) | |||||||

Other income (expense) | 597 | 693 | (59 | ) | 881 | ||||||||||

Total non-operating income (expense), net | 7,035 | (1,235 | ) | 12,190 | (6,749 | ) | |||||||||

Loss before income taxes | (6,173 | ) | (8,128 | ) | (28,650 | ) | (28,239 | ) | |||||||

Income tax expense (benefit) | — | 1,159 | — | (62 | ) | ||||||||||

Net loss | $ | (6,173 | ) | $ | (9,287 | ) | $ | (28,650 | ) | $ | (28,177 | ) | |||

Net loss per common share: | |||||||||||||||

Basic and diluted net loss per share | $ | (0.05 | ) | $ | (0.11 | ) | $ | (0.24 | ) | $ | (0.33 | ) | |||

Weighted-average common shares outstanding: basic and diluted | 119,038,656 | 87,319,450 | 117,767,791 | 84,678,612 | |||||||||||

Comprehensive loss | |||||||||||||||

Net loss | $ | (6,173 | ) | $ | (9,287 | ) | $ | (28,650 | ) | $ | (28,177 | ) | |||

Reclassification of unrealized gain upon sale of marketable securities | — | (841 | ) | — | (1,636 | ) | |||||||||

Unrealized gain (loss) on marketable securities | — | (2,108 | ) | — | 1,795 | ||||||||||

Tax effect of reclassification of unrealized gain upon sale of marketable securities | — | 330 | — | 643 | |||||||||||

Tax effect of unrealized gain on marketable securities | — | 828 | — | (705 | ) | ||||||||||

Total comprehensive loss | $ | (6,173 | ) | $ | (11,078 | ) | $ | (28,650 | ) | $ | (28,080 | ) | |||

See accompanying notes to condensed consolidated financial statements.

3

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS' EQUITY

(Amounts in thousands, except share amounts)

(Unaudited)

Common Stock | Additional Paid-In Capital | Accumulated Deficit | Treasury Stock | Total | ||||||||||||||||||

Shares Issued | Amount | |||||||||||||||||||||

Balance at December 31, 2013 | 110,100,701 | $ | 10 | $ | 188,600 | $ | (178,875 | ) | $ | (3,849 | ) | $ | 5,886 | |||||||||

Issuance of common stock for milestone payment | 3,000,000 | — | 6,840 | — | — | 6,840 | ||||||||||||||||

Issuance of common stock upon exercise of warrants | 5,467,027 | 1 | 37,742 | — | — | 37,743 | ||||||||||||||||

Issuance of common stock in connection with employee stock purchase plan | 114,630 | — | 263 | — | — | 263 | ||||||||||||||||

Stock-based compensation for directors and employees | — | — | 4,297 | — | — | 4,297 | ||||||||||||||||

Stock-based compensation for services | — | — | 138 | — | — | 138 | ||||||||||||||||

Exercise of stock options | 3,449,760 | — | 4,342 | — | — | 4,342 | ||||||||||||||||

Net loss | — | — | — | (28,650 | ) | — | (28,650 | ) | ||||||||||||||

Balance at September 30, 2014 | 122,132,118 | $ | 11 | $ | 242,222 | $ | (207,525 | ) | $ | (3,849 | ) | $ | 30,859 | |||||||||

See accompanying notes to condensed consolidated financial statements.

4

GALENA BIOPHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(Unaudited)

For the Nine Months Ended September 30, | |||||||

2014 | 2013 | ||||||

Cash flows from operating activities: | |||||||

Net loss | $ | (28,650 | ) | $ | (28,177 | ) | |

Adjustment to reconcile net loss to net cash used in operating activities: | |||||||

Depreciation and amortization expense | 665 | 168 | |||||

Gain on sale of marketable securities | — | (1,392 | ) | ||||

Deferred taxes | — | (63 | ) | ||||

Non-cash stock-based compensation | 4,435 | 1,344 | |||||

Change in fair value of common stock warrants | (13,174 | ) | 7,135 | ||||

Change in fair value of contingent consideration | 59 | 559 | |||||

Changes in operating assets and liabilities: | |||||||

Accounts receivable | 2,248 | (1,543 | ) | ||||

Inventories | (64 | ) | (425 | ) | |||

Prepaid expenses and other assets | (363 | ) | 68 | ||||

Accounts payable | 700 | (86 | ) | ||||

Accrued expenses and other current liabilities | 2,018 | 1,975 | |||||

Net cash used in operating activities | (32,126 | ) | (20,437 | ) | |||

Cash flows from investing activities: | |||||||

Change in restricted cash | — | 1 | |||||

Cash paid for acquisition of Abstral rights | — | (10,075 | ) | ||||

Cash paid for acquisition of Zuplenz rights | (3,056 | ) | — | ||||

Cash paid for acquisition of GALE-401 rights | (2,315 | ) | — | ||||

Proceeds from sale of marketable securities | — | 1,392 | |||||

Cash paid for purchase of equipment and furnishings | (48 | ) | (554 | ) | |||

Net cash used in investing activities | (5,419 | ) | (9,236 | ) | |||

Cash flows from financing activities: | |||||||

Net proceeds from issuance of common stock | — | 37,520 | |||||

Net proceeds from exercise of stock options | 4,342 | 9 | |||||

Proceeds from exercise of warrants | 10,717 | 820 | |||||

Proceeds from common stock issued in connection with ESPP | 263 | 69 | |||||

Net proceeds from issuance of long-term debt | — | 9,865 | |||||

Principle payments on long-term debt | (908 | ) | — | ||||

Repayments of capital lease obligations | (9 | ) | (21 | ) | |||

Net cash provided by financing activities | 14,405 | 48,262 | |||||

Net decrease in cash and cash equivalents | (23,140 | ) | 18,589 | ||||

Cash and cash equivalents at the beginning of period | 47,787 | 32,807 | |||||

Cash and cash equivalents at end of period | $ | 24,647 | $ | 51,396 | |||

Supplemental disclosure of cash flow information: | |||||||

Cash received during the periods for interest | $ | 13 | $ | 13 | |||

Cash paid during the periods for interest | $ | 632 | $ | 195 | |||

Supplemental disclosure of non-cash investing and financing activities: | |||||||

Future payment for Abstral rights included in accrued expenses | $ | — | $ | 5,000 | |||

Future obligations for Zuplenz rights included in accrued expenses | $ | 4,607 | $ | — | |||

Fair value of warrants issued in connection with common stock recorded as cost of equity | $ | — | $ | 8,238 | |||

Reclassification of warrant liabilities upon exercise | $ | 27,026 | $ | 2,070 | |||

Common stock issued in settlement of contingent purchase price consideration | $ | — | $ | 1,000 | |||

Change in fair value of marketable securities | $ | — | $ | 1,551 | |||

5

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Business and Basis of Presentation

Overview

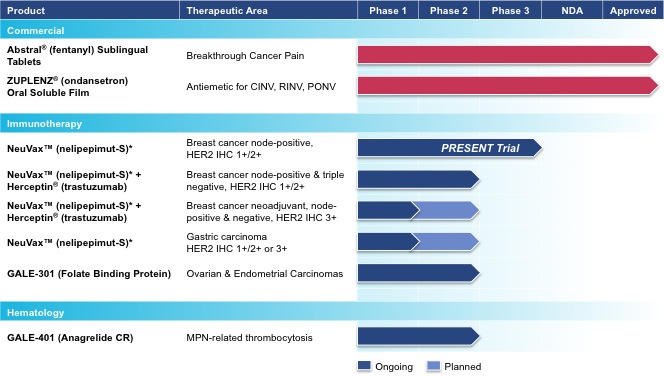

Galena Biopharma, Inc. (“we,” “us,” “our,” “Galena” or the “company”) is a biopharmaceutical company developing and commercializing innovative, targeted oncology therapeutics that address major medical needs across the full spectrum of cancer care. Galena’s development portfolio ranges from mid- to late-stage clinical assets, including an immunotherapy program led by NeuVax™ (nelipepimut-S) currently in an international, Phase 3 clinical trial. The Company’s commercial drugs include Abstral® (fentanyl) Sublingual Tablets and Zuplenz® (ondansetron) Oral Soluble Film. Collectively, Galena’s clinical and commercial strategy focuses on identifying and advancing therapeutic opportunities to improve cancer care, from direct treatment of the disease to the reduction of its debilitating side-effects.

Developing Novel Cancer Immunotherapies

Galena is developing peptide vaccine cancer immunotherapies, which address major patient populations of cancer survivors to prevent recurrence of their cancers. These therapies work by harnessing the patient’s own immune system to seek out and attack residual cancer cells and micro-metastases. Our peptide vaccines are delivered with the immune adjuvant, recombinant human granulocyte macrophage-colony stimulating factor (rhGM-CSF).

Our lead immunotherapy product candidate, NeuVaxTM (nelipepimut-S) is the immunodominant nonapeptide derived from the extracellular domain of the HER2 protein, a well-established target for therapeutic intervention in breast and gastric carcinomas. Despite having no evidence of disease following standard of care therapy, many patients will still relapse. Increased presence of circulating tumor cells (CTCs) may be an indicator of decreased Disease Free Survival (DFS) and Overall Survival (OS), suggesting a dormancy of isolated micrometastases that over time may lead to recurrence. The nelipepimut sequence stimulates specific cytotoxic T lymphocytes (CTLs) following binding to HLA-A2 or A3 molecules on antigen presenting cells (APC) to elicit a specific and potentially robust killer CD8+ CTL response. These activated specific CTLs recognize, neutralize and destroy, through cell lysis, HER2 expressing cancer cells, including occult cancer cells and micrometastatic foci. The nelipepimut immune response can also generate CTLs to other immunogenic peptides through inter- and intra-antigenic epitope spreading. We currently have four ongoing or planned trials with NeuVax:

• | Phase 3 Ongoing: Our international, randomized, multicenter, double-blind Phase 3 PRESENT (Prevention of Recurrence in Early-Stage, Node-Positive Breast Cancer with Low-to-Intermediate HER2 Expression with NeuVax Treatment) study is enrolling HER2 1+ and 2+ node positive breast cancer patients who have no evidence of disease following their standard of care treatment. The trial is being run under a Special Protocol Assessment (SPA) granted by the U.S. Food and Drug Administration (FDA). Additional information on the study can be found at www.neuvax.com. |

• | Phase 2b Ongoing: A randomized, multicenter, investigator-sponsored, 300 patient Phase 2b clinical trial is currently enrolling HER2 1+ and 2+, node positive, and high-risk node negative patients to study NeuVax in combination with Herceptin® (trastuzumab; Genentech/Roche) in the adjuvant setting. |

• | Phase 2 Planned: A randomized, multicenter, prospective, single-blinded, placebo controlled investigator-sponsored Phase 2 trial is expected to initiate in 2014 to study NeuVax in combination with Herceptin. The trial will enroll 100 patients with a diagnosis of HER2 3+ or HER2 gene-amplified breast cancer who are HLA A2+ or HLA A3+ and are determined to be at high-risk for recurrence. |

• | Phase 2 Planned: In January 2014, we partnered NeuVax with Dr. Reddy’s in India for the commercialization of NeuVax in that region. Per the agreement, Dr. Reddy’s is responsible for running a Phase 2 gastric cancer trial of NeuVax in India that is expected to initiate in early 2015. |

6

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Our second peptide immunotherapy product candidate, GALE-301 (Folate Binding Protein, or “FBP”), is derived from a protein that is over-expressed (20-80 fold) in more than 90% of ovarian and endometrial cancers. GALE-301 is an immunogenic peptide(s) combined with rhGM-CSF that can stimulate CTLs to recognize and destroy FBP-expressing cancer cells. GALE-301 is currently in a Phase 2 trial in ovarian and endometrial cancer. Ovarian cancer is the eleventh most common cancer among women and the fifth leading cause of cancer related death among women, and the deadliest of all gynecological cancers. Initial results from the GALE-301 Phase 1 trial indicate that the agent is capable of generating a strong immune response to the FBP peptide(s), while the initial clinical data has indicated a trend in the reduction of recurrences. Top line data from the Phase 2a trial is expected to be available in the summer of 2015.

Expanding into Hematology

Our third product candidate, GALE-401 (anagrelide controlled release (CR)) was acquired on January 12, 2014. GALE-401 contains the active ingredient anagrelide, an FDA-approved product, which has been in use since the late 1990s for the treatment of patients with myeloproliferative neoplasms to lower abnormally elevated platelet levels. GALE-401 is a reformulated, controlled release version of anagrelide that is currently only given as an immediate release (IR) version. Multiple Phase 1 studies in approximately 90 healthy subjects have shown the drug to be effective at lowering platelet levels while reducing side effects. Based on a regulatory meeting with the FDA, Galena believes a 505(b)(2) regulatory filing is an acceptable pathway for GALE-401 development, with the reference drug Agrylin® (anagrelide; Shire Pharmaceuticals). GALE-401 is currently in a Phase 2 proof of concept trial expected to enroll approximately 20 patients for the treatment of thrombocytosis, or elevated platelet counts in patients with myeloproliferative neoplasms including polycythemia vera, chronic myelognenous leukemia, and essential thrombocythemia.

In the future, we may pursue selective strategic alliances and acquisitions of other cancer treatments to complement or add to our existing cancer product pipeline.

Commercial Capabilities

Galena has established an oncology commercial portfolio to support its development pipeline in a number of key strategic areas in the United States.

Our first commercial product, Abstral® (fentanyl) Sublingual Tablets, is approved for the treatment of breakthrough cancer pain (BTcP) which affects an estimated 40%-80% of all cancer patients. Abstral is approved by the FDA, as a sublingual (under the tongue) tablet for the management of breakthrough pain in patients with cancer, 18 years of age and older, who are already receiving, and who are tolerant to, opioid therapy for their persistent baseline cancer pain. The Abstral formulation delivers the analgesic power and increased bioavailability of micronized fentanyl in a sublingual tablet which is designed to dissolve under the tongue in seconds and provide relief of breakthrough pain within minutes. Abstral is a transmucosal immediate release fentanyl (TIRF) product with product class oversight by the TIRF Risk Evaluation and Mitigation Strategy (REMS) access program. Galena manufactures and markets Abstral in the United States through its commercial organization.

In July 2014 we expanded our commercial portfolio through the licensing of our second product, Zuplenz® (ondansetron) Oral Soluble Film, from MonoSol Rx, LLC (MonoSol”). Zuplenz is approved by the FDA in adult patients for the prevention of highly and moderately emetogenic chemotherapy-induced nausea and vomiting (CINV), radiotherapy-induced nausea and vomiting (RINV), and post-operative nausea and vomiting (PONV). Zuplenz is also approved in pediatric patients treated with moderately emetogenic CINV. Nausea and vomiting are two of the most common side-effects experienced by patients receiving chemotherapy or radiation, as well as post-surgery patients. It is estimated that up to 90% of chemotherapy and up to 80% of radiotherapy patients will experience CINV and RINV, respectively.

7

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Zuplenz utilizes MonoSol’s proprietary PharmFilm® technology, an oral soluble film that dissolves on the tongue in less than thirty seconds. Zuplenz eliminates the burden of swallowing pills during periods of emesis, may be advantageous for patients with oral irritation, and may increase patient adherence and the patient's ability to keep the medication down without vomiting. The active pharmaceutical ingredient in Zuplenz, ondansetron, belongs to a class of medications called serotonin 5-HT3 receptor antagonists and works by blocking the action of serotonin, a natural substance that may cause nausea and vomiting. Ondansetron is the most widely prescribed drug in this class of anti-emetics, and used broadly across the oncology spectrum. MonoSol will exclusively manufacture Zuplenz for sale by Galena in the United States through its commercial organization.

Basis of Presentation and Significant Accounting Policies

The accompanying consolidated financial statements included herein have been prepared by Galena pursuant to the rules and regulations of the Securities and Exchange Commission (SEC). Unless the context otherwise indicates, references in these notes to the “company,” “we,” “us” or “our” refer (i) to Galena, our wholly owned subsidiary, Apthera, Inc., or “Apthera,” and our wholly owned subsidiary, Mills Pharmaceuticals, Inc. or "Mills."

Uses of Estimates in Preparation of Financial Statements — The preparation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ materially from those estimates.

Principles of Consolidation — The consolidated financial statements include the accounts of Galena and its wholly owned subsidiaries. All material intercompany accounts have been eliminated in consolidation.

Reclassifications — Certain prior year amounts have been reclassified to conform to current year presentation. These reclassifications had no effect on net loss per share.

Cash and Cash Equivalents — The company considers all highly liquid debt instruments with an original maturity of 90 days or less to be cash equivalents. Cash equivalents consist primarily of amounts invested in money market accounts and demand deposits.

Restricted Cash — Restricted cash consists of certificates of deposit on hand with the company’s financial institutions as collateral for its corporate credit cards.

Fair Value of Financial Instruments — The carrying amounts reported in the balance sheet for cash equivalents, marketable securities, accounts receivable, accounts payable, and capital leases approximate their fair values due to their short-term nature and market rates of interest.

Accounts Receivable - The company maintains credit limits for all customers based upon several factors, including but not limited to financial condition and stability, payment history, published credit reports and use of credit references. Management performs analysis to evaluate accounts receivables to ensure recorded amounts reflect estimated net realizable value.

Inventories — Inventories are stated at the lower of cost or market value and are determined using the first-in, first-out ("FIFO") method. Inventories consist of Abstral work-in-process and finished goods. The company has entered into manufacturing and supply agreements for the manufacture and packing of Abstral finished goods. As of September 30, 2014, the company had inventories of $450,000, consisting of $232,000 of work-in-process and $218,000 of finished goods. As of December 31, 2013, the company had inventories of $386,000 consisting of $270,000 of work-in-process and $116,000 of finished goods.

Equipment and Furnishings — Equipment and furnishings are stated at cost and depreciated using the straight-line method based on the estimated useful lives (generally three to five years) of the related assets.

8

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Goodwill and Intangible Assets — Goodwill and indefinite-lived intangible assets are not amortized but are tested annually for impairment at the reporting unit level, or more frequently if events and circumstances indicate impairment may have occurred. Factors the company considers important that could trigger an interim review for impairment include, but are not limited to, the following:

•Significant changes in the manner of its use of acquired assets or the strategy for its overall business;

•Significant negative industry or economic trends;

•Significant decline in stock price for a sustained period; and

•Significant decline in market capitalization relative to net book value.

Goodwill and other intangible assets with indefinite lives are evaluated for impairment first by a qualitative assessment to determine the likelihood of impairment. If it is determined that impairment is more likely than not, the company will then proceed to the two step impairment test. The first step is to compare the fair value of the reporting unit to the carrying amount of the reporting unit (the “First Step”). If the carrying amount exceeds the fair value, a second step must be followed to calculate impairment (the “Second Step”). Otherwise, if the fair value of the reporting unit exceeds the carrying amount, the goodwill is not considered to be impaired as of the measurement date. In its review of the carrying value of the goodwill for its single reporting unit and its indefinite-lived intangible assets, the company determines fair values of its goodwill using the market approach, and its indefinite-lived intangible assets using the income approach.

Intangible assets not considered indefinite-lived are reviewed for impairment when facts or circumstances suggest that the carrying value of these assets may not be recoverable. The company’s policy is to identify and record impairment losses, if necessary, on intangible assets when events and circumstances indicate that the assets might be impaired and the undiscounted cash flows estimated to be generated by those assets are less than the carrying amounts.

The company performed its review for impairment using the qualitative assessment for both goodwill and indefinite-lived intangible assets, as well as assets not considered to be indefinite-lived, and has determined that there has been no impairment to these assets as of September 30, 2014.

Revenue Recognition - The company recognizes revenue from the sale of Abstral. Revenue is recognized when (i) persuasive evidence of an arrangement exists, (ii) delivery has occurred and title has passed, (iii) the price is fixed or determinable and (iv) collectability is reasonably assured.

We sell Abstral product in the United States to wholesale pharmaceutical distributors and retail pharmacies, or our "customers," subject to rights of return. We recognize Abstral product sales at the time title transfers to our customer, and provide allowances for estimated future product returns, prompt pay discounts, wholesaler discounts, rebates, chargebacks, patient assistance program benefits and other deductions as needed. The company is required to make significant judgments and estimates in determining some of these allowances. If actual results differ from its estimates, the company will be required to make adjustments to these allowances in the future.

Returns - The company estimates future returns based on historical return information, as well as information regarding prescription information and sell-through trends, in relation to the estimated amount of product in the sales channels and product expiration dates. The allowance for returns is recorded as a reduction to revenue in the period in which the revenue is recognized, with a corresponding allowance against accounts receivable.

Prompt Pay Discounts - As an incentive for prompt payment, the company offers a cash discount to customers, which is generally 2% of gross sales. The company expects that all customers will comply with the contractual terms to earn the discount. The company records prompt pay discounts as a reduction to revenue in the period in which the revenue is recognized, with a corresponding allowance against accounts receivable.

9

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Wholesaler Discounts - The company offers discounts on sales to wholesalers and distributors based on contractually determined rates. The company accrues the discount as a reduction of receivables due from the wholesalers upon shipment to the respective wholesale distributors and retail pharmacies and recognizes the discount as a reduction of revenue in the same period the related revenue is recognized.

Rebates - The company participates in certain rebate programs, which provide discounted prescriptions to members of certain managed care organizations, group purchasing organizations and specialty pharmacies. Under these rebate programs, the company pays the rebates generally two to three months after the end of the quarter in which prescriptions subject to the rebate are filled. The company estimates and accrues these rebates based on current contract prices, historical and estimated future percentages of product sold to qualifying member pharmacies and estimated levels of inventory in the distribution channel. Rebates are recognized as a reduction to revenue in the period that the related revenue is recognized, with a corresponding liability in accrued expenses and other current liabilities.

Chargebacks - The company provides discounts primarily to authorized users of the Federal Supply Schedule (FSS) of the General Services Administration under an FSS contract negotiated by the Department of Veterans Affairs and various organizations under Medicaid or Medicare contracts and regulations. These entities purchase products from the wholesale distributors at a discounted price, and the wholesale distributors then charge back to the company the difference between the current retail price and the price the entity paid for the product. The company estimates and accrues chargebacks based on estimated wholesaler inventory levels, current contract prices and historic chargeback activity. Chargebacks are recognized as a reduction of revenue in the period the related revenue is recognized, with a corresponding allowance against accounts receivable.

Patient Assistance Programs - The company offers discount card programs to patients for Abstral in which patients receive discounts on their Abstral prescriptions that are reimbursed by the company. The company estimates the total amount that will be recognized based on a percentage of actual redemption applied to inventory in the distribution and retail channel and recognizes the discount as a reduction of revenue and as an other current liability (see Note 4) in the same period the related revenue is recognized.

Acquisitions and In-Licensing — For all in-licensed products and technologies, we perform an analysis to determine whether we hold a variable interest or a controlling financial interest in a variable interest entity. On the basis of our interpretations and conclusions, we determine whether the acquisition falls under the purview of variable interest entity accounting and if so, consider the necessity to consolidate the acquisition. As of September 30, 2014, we determined there were no variable interest entities required to be consolidated.

We also perform an analysis to determine if the assets and liabilities acquired in an acquisition qualify as a "business." The excess of the purchase price over the fair value of the net assets acquired can only be recognized as goodwill in a business combination.

Contingent Purchase Price Consideration — Contingent consideration in business combinations is recorded at the estimated fair value as of the acquisition date. The fair value of the contingent consideration is re-measured at each reporting period with any adjustments in fair value included in our consolidated statement of comprehensive loss.

Patents and Patent Application Costs — Although the company believes that its patents and underlying technology have continuing value, the amount of future benefits to be derived from the patents is uncertain. Patent costs are, therefore, expensed as incurred.

Share-based Compensation — The company follows the provisions of the FASB ASC Topic 718, “Compensation — Stock Compensation” (“ASC 718”), which requires the measurement and recognition of compensation expense for all stock-based payment awards made to employees, non-employee directors, and consultants, including stock options and warrants. Stock compensation expense based on the grant date fair value estimated in accordance with the provisions of ASC 718 is recognized as an expense over the requisite service period.

10

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

For stock options and warrants granted as consideration for services rendered by non-employees, the company recognizes compensation expense in accordance with the requirements of FASB ASC Topic 505-50 (“ASC 505-50”), “ Equity Based Payments to Non- Employees.” Non-employee option and warrant grants that do not vest immediately upon grant are recorded as an expense over the vesting period. At the end of each financial reporting period prior to vesting, the value of these options and warrants, as calculated using the Black-Scholes option-pricing model, is re-measured using the fair value of the company’s common stock and the non-cash compensation recognized during the period is adjusted accordingly. Since the fair market value of options and warrants granted to non-employees is subject to change in the future, the amount of the future compensation expense will include fair value re-measurements until the stock options are fully vested.

Research and Development Expenses — Research and development costs are expensed as incurred. Included in research and development costs are wages, benefits and other operating costs, facilities, supplies, external services and overhead related to our research and development departments, and clinical trial expenses.

Clinical trial expenses include direct costs associated with contract research organizations (CROs), as well as patient-related costs at sites at which our trials are being conducted.

Direct costs associated with our CROs are generally payable on a time and materials basis, or when certain enrollment and monitoring milestones are achieved. Expense related to a milestone is recognized in the period in which the milestone is achieved or in which we determine that it is more likely than not that it will be achieved.

The invoicing from clinical trial sites can lag several months. We accrue these site costs based on our estimate of upfront set-up costs upon the screening of the first patient at each site, and the patient related costs based on our knowledge of patient enrollment status at each site.

Income Taxes — The company recognizes liabilities or assets for the deferred tax consequences of temporary differences between the tax basis of assets or liabilities and their reported amounts in the financial statements in accordance with FASB ASC 740-10, “Accounting for Income Taxes” (“ASC 740-10”). These temporary differences will result in taxable or deductible amounts in future years when the reported amounts of the assets or liabilities are recovered or settled. ASC 740-10 requires that a valuation allowance be established when management determines that it is more likely than not that all or a portion of a deferred asset will not be realized. The company evaluates the realizability of its net deferred income tax assets and valuation allowances as necessary, at least on an annual basis. During this evaluation, the company reviews its forecasts of income in conjunction with other positive and negative evidence surrounding the realizability of its deferred income tax assets to determine if a valuation allowance is required. Adjustments to the valuation allowance will increase or decrease the company’s income tax provision or benefit. The recognition and measurement of benefits related to the company’s tax positions requires significant judgment, as uncertainties often exist with respect to new laws, new interpretations of existing laws, and rulings by taxing authorities. Differences between actual results and the company’s assumptions or changes in the company’s assumptions in future periods are recorded in the period they become known.

There was no income tax expense or benefit for the three and nine months ended September 30, 2014. For the three months ended September 30, 2013, we recognized income tax expense of $1,159,000. This expense offsets the tax impact related to the unrealized loss on our marketable securities, which is presented as other comprehensive income, net of tax, on our condensed consolidated statement of comprehensive loss. For the nine months ended September 30, 2013, we recognized an income tax benefit of 62,000, which offset the tax impact related to the unrealized gain on our marketable securities. We continue to maintain a full valuation allowance against our net deferred tax assets.

Concentrations of Credit Risk — Financial instruments that potentially subject the company to significant concentrations of credit risk consist principally of cash and cash equivalents. The company maintains cash balances in several accounts with two banks, which at times are in excess of federally insured limits. As of September 30, 2014, the company’s cash equivalents were invested in money market mutual funds. The company’s investment policy does not allow investment in any debt securities rated less than “investment grade” by national ratings services. The company has not experienced any losses on its deposits of cash and cash equivalents. The company maintains significant cash and cash equivalents at two financial institutions that are in excess of federally insured limits.

11

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Comprehensive Loss — Comprehensive loss consists of our net loss and other comprehensive income related to the unrealized gain (loss), net of tax, on our marketable securities, which are classified as available-for-sale. The value of the marketable securities held by the company at September 30, 2013 was approximately $5,786,000, based on quoted market prices of the securities. The company fully liquidated its position in marketable securities during the year ended December 31, 2013, and held no marketable securities as of September 30, 2014.

2. Business Combinations

On July 17, 2014 the Company entered into a definitive license and supply agreement with MonoSol Rx, LLC (MonoSol) for the U.S. commercial rights to Zuplenz® (ondansetron) Oral Soluble Film (Zuplenz), an FDA approved product. The transaction was accounted for as a business combination under the acquisition method of accounting based on Accounting Standards Codification 805, "Business Combinations." Accordingly, the assets acquired and liabilities assumed were recorded at fair value. As of the issuance date of the condensed consolidated financial statements for the quarter ended September 30, 2014, the Company had not finalized the valuation of the acquired assets and liabilities for the transaction.

The following table summarizes the purchase price consideration and allocation of purchase price:

Total Acquisition Date Fair Value | ||||

Purchase price consideration: | ||||

Cash and cash equivalents | $ | 3,056 | ||

Common stock | 2,482 | |||

Liabilities assumed: | ||||

Contingent consideration | 741 | |||

Credit memos for expiring channel inventory | 1,384 | |||

Total consideration | $ | 7,663 | ||

Asset acquired: | ||||

Zuplenz rights | $ | 7,663 | ||

Goodwill | — | |||

Fair value of assets acquired | $ | 7,663 | ||

The above contingent consideration represents a risk adjusted net present value relating to cash payments on achievement of certain milestones.

3. Fair Value Measurements

The company follows ASC 820, “Fair Value Measurements and Disclosures,” (“ASC 820”) for the company’s financial assets and liabilities that are re-measured and reported at fair value at each reporting period, and are re-measured and reported at fair value at least annually using a fair value hierarchy that is broken down into three levels. Level inputs are defined as follows:

Level 1 — quoted prices in active markets for identical assets or liabilities.

Level 2 — other significant observable inputs for the assets or liabilities through corroboration with market data at the measurement date.

Level 3 — significant unobservable inputs that reflect management’s best estimate of what market participants would use to price the assets or liabilities at the measurement date.

12

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

The company categorized its cash equivalents as Level 1. The valuations for Level 1 were determined based on a “market approach” using quoted prices in active markets for identical assets. Valuation of these assets does not require a significant degree of judgment. The company categorized its warrants potentially settleable in cash as Level 2 inputs. The warrants are measured at market value on a recurring basis and are being marked to market each quarter-end until they are completely settled. The warrants are valued using an appropriate pricing model, using assumptions consistent with our application of ASC 718. The contingent purchase price consideration is categorized as Level 3 inputs and is measured at its estimated fair value on a recurring basis and is adjusted at each quarter-end until it is completely settled. The contingent purchase price consideration is valued based on the expected timing of milestones, the expected probability of success for each milestone and discount rates based on a corporate debt interest rate index publicly issued.

The following tables present information about our assets and liabilities measured at fair value on a recurring basis in the condensed consolidated balance sheets (in thousands):

Description | September 30, 2014 | Quoted Prices In Active Markets (Level 1) | Significant Other Observable Inputs (Level 2) | Unobservable Inputs (Level 3) | |||||||||||

Assets: | |||||||||||||||

Cash equivalents | $ | 20,332 | $ | 20,332 | $ | — | $ | — | |||||||

Total assets measured and recorded at fair value | $ | 20,332 | $ | 20,332 | $ | — | $ | — | |||||||

Liabilities: | |||||||||||||||

Warrants potentially settleable in cash | $ | 8,765 | $ | — | $ | 8,765 | $ | — | |||||||

Contingent purchase price consideration | 6,880 | — | — | 6,880 | |||||||||||

Total liabilities measured and recorded at fair value | $ | 15,645 | $ | — | $ | 8,765 | $ | 6,880 | |||||||

Description | December 31, 2013 | Quoted Prices In Active Markets (Level 1) | Significant Other Observable Inputs (Level 2) | Unobservable Inputs (Level 3) | |||||||||||

Assets: | |||||||||||||||

Cash equivalents | $ | 42,349 | $ | 42,349 | $ | — | $ | — | |||||||

Total assets measured and recorded at fair value | $ | 42,349 | $ | 42,349 | $ | — | $ | — | |||||||

Liabilities: | |||||||||||||||

Warrants potentially settleable in cash | $ | 48,965 | $ | — | $ | 48,965 | $ | — | |||||||

Contingent purchase price consideration | 6,821 | — | — | 6,821 | |||||||||||

Total liabilities measured and recorded at fair value | $ | 55,786 | $ | — | $ | 48,965 | $ | 6,821 | |||||||

The company did not transfer any financial instruments into or out of Level 3 classification during the nine months ended September 30, 2014 or 2013. A reconciliation of the beginning and ending Level 3 liabilities for the nine months ended September 30, 2014 is as follows (in thousands):

Fair Value Measurements Using Significant Unobservable Inputs (Level 3) | |||

Balance, January 1, 2014 | $ | 6,821 | |

Change in the estimated fair value of the contingent purchase price consideration | 59 | ||

Balance at September 30, 2014 | $ | 6,880 | |

13

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

The fair value of the contingent purchase price consideration is measured at the end of each reporting period using Level 3 inputs in a probability-weighted, discounted cash-outflow model. The significant unobservable assumptions include the probability of achieving each milestone, the date we expect to reach the milestone, and a determination of present value factors used to discount future expected cash outflows.

4. Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities consist of the following (in thousands):

September 30, 2014 | December 31, 2013 | ||||||

Clinical trial costs | $ | 5,601 | $ | 3,109 | |||

Zuplenz milestone payments | 3,222 | — | |||||

Credit memos for expiring Zuplenz channel inventory | 1,384 | — | |||||

Patient assistance programs and rebates | 1,969 | 2,618 | |||||

Compensation and related benefits | 1,946 | 1,999 | |||||

Professional fees | 919 | 713 | |||||

Royalties | 188 | 158 | |||||

Interest expense | 63 | 70 | |||||

Accrued expenses and other current liabilities | $ | 15,292 | $ | 8,667 | |||

5. Long-term Debt

On May 8, 2013 we entered into a loan and security agreement with Oxford Finance LLC, as collateral agent, and related lenders under which we borrowed the first tranche of $10 million (the "Loan"). The Loan payment terms include 12 months of interest-only payments at the fixed coupon rate of 8.45%, followed by 30 months of amortization of principal and interest until maturity in November 2016. In connection with the Loan, we paid the lender a 1% cash facility fee and a 5.5% cash final payment and granted to the lenders seven-year warrants to purchase up to 182,186 shares of our common stock at an exercise price of $2.47, which equaled a 20-day average market price of our common stock prior to the date of the grant.

6. Legal Proceedings, Commitments and Contingencies

Legal Proceedings

Earlier this year, several purported shareholder derivative complaints were filed against our company, as nominal defendant, and certain of our officers and directors in the Circuit Court of Oregon for the County of Multnomah, the United States District Court for the District of Oregon and the Delaware Court of Chancery. On April 11, 2014, the Oregon federal derivative cases were consolidated into one action, In re Galena Biopharma, Inc. Derivative Litig., Nos. 3:14-cv-382, 3:14-cv-514, 3:14-cv-516 (D. Or.). On July 21, 2014, the Oregon state derivative cases were consolidated into one action, Fagin v. Ahn, et al., No. 140202384; Zhang v. Hillsberg, et al., No. 140403987 (Or. Cir. Ct.). On July 22, 2014, all of the Delaware derivative complaints were consolidated into one action, the matter of In re Galena Biopharma, Inc. Stockholder Derivative Litigation, Consolidated C.A. No. 9715-VCN (Del. Ch.). The various complaints allege, among other things, breaches of fiduciary duties and abuse of control by the officers and directors in connection with public statements purportedly issued by us or on our behalf and sales of our common stock by our officers and directors in January and February of this year.

Also, five purported securities class action complaints filed in the United States District Court for the District of Oregon have been consolidated into a single action, In re Galena Biopharma, Inc. Securities Litig., No. 3:14-cv-367 (D. Or.), and a lead plaintiff has been appointed. On October 31, 2014, the lead plaintiff filed a consolidated amended complaint, which alleges, among other things, that certain of our officers and directors violated the federal securities laws by making materially false and misleading statements and omissions in press releases and in filings with the SEC arising out of the same circumstances that are the subject of the derivative actions described above.

14

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

We intend to vigorously defend against the foregoing complaints. Based on the very early stage of the litigation, it is not possible to estimate the amount or range of possible loss that might result from an adverse judgment or a settlement of these matters.

In March and April 2014, we received demands (“220 Demands”) pursuant to Section 220 of the Delaware General Corporation Law (“Section 220”) from five purported stockholders of our company to inspect certain of our books and records. Under Delaware law, a stockholder may bring an action to enforce a 220 Demand that has been rejected.

On March 18, 2014, one of the derivative lawsuit shareholders commenced an action (the “220 Action”) against us in the Delaware Court of Chancery under Section 220 (Fuhs v. Galena Biopharma, Inc., No. 9457-ML (Del. Ch.)). In the 220 Action, the plaintiff seeks to inspect our books and records described in his 220 Demand. The 220 Action was stayed prior to trial, and the shareholder has now filed a derivative complaint in the Delaware Court of Chancery. Nevertheless, we intend to vigorously defend against the 220 Action until it is dismissed.

At September 30, 2014, no material liabilities with respect to the foregoing claims have been recorded in our consolidated financial statements. We have notified our insurance carriers of the claims, and the insurers have responded by requesting additional information and by reserving their rights under the policies, including the rights to deny coverage under various policy exclusions.

We are aware that the SEC is investigating certain matters relating to the use of certain outside investor-relations professionals by us and other public companies. We have been in contact with the SEC staff through our counsel and are cooperating with the investigation.

Commitments

On January 12, 2014, we acquired exclusive worldwide license to develop and commercialize GALE‑401 (anagrelide CR), a patented, controlled-release formulation of anagrelide, through our acquisition of Mills Pharmaceuticals, LLC (“Mills”) under a unit purchase agreement. Under the terms of the unit purchase agreement, we made an up-front cash payment of $2 million to the former Mills owners and also agreed to make additional contingent payments to the former owners upon the achievement of certain development milestones relating to GALE‑401, including 2,000,000 shares of our common stock upon initiating the first clinical trial of GALE‑401 in patients with essential thrombocythemia, or “ET,” and an additional 2,000,000 shares upon initiating a Phase 3 clinical study of GALE‑401. The number of shares issuable upon the milestones is subject to increase based on a formula specified in the purchase agreement, up to a maximum of 3,000,000 shares for each milestone, in the event the five‑day average trailing closing price of our common stock (the “Average Price”) is less than $4.84 at the time the applicable milestone is achieved. Similarly, the number of shares issuable upon achievement of the milestones is subject to decrease based on such formula if the Average Price exceeds $6.84 at the time of achievement of the applicable milestone.

We achieved the milestone relating to the initiation of the first clinical trial of GALE-401 in the third quarter of 2014 and issued 3,000,000 shares of common stock to the former owners, the maximum under the unit purchase agreement as our five-day average trailing close price of our common stock was less than the low end of the collar of $4.84. We will record as an addition to the GALE-401 intangible asset the fair value of the shares delivered in payment of each milestone under the Mills unit purchase agreement. The addition to the intangible asset for the fair value of the shares will increase our additional paid-in capital by the same amount, less the par value of the milestone shares. As a result of the achievement of the initiation of the first clinical trial of GALE-401, we recorded an addition to GALE-401 asset and additional paid in capital in the amount of $6.8 million, or the fair value of the shares issued. The milestone payments will have no effect on our net loss.

On July 17, 2014, we entered into a definitive license and supply agreement with MonoSol Rx, LLC (MonoSol) for the U.S. commercial rights to Zuplenz® (ondansetron) Oral Soluble Film, an FDA approved product for the prevention of highly and moderately emetogenic chemotherapy-induced nausea and vomiting (CINV), radiotherapy-induced nausea and vomiting (RINV), and post-operative nausea and vomiting (PONV). Refer to Note 12 for details of the transaction.

7. Stockholders’ Equity

Preferred Stock — The company has authorized up to 5,000,000 shares of preferred stock, $0.0001 par value per share, for issuance. The preferred stock will have such rights, preferences, privileges and restrictions, including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences, as shall be determined by the company’s board of directors upon its issuance. To date, the company has not issued any preferred shares.

Common Stock — The company has authorized up to 200,000,000 shares of common stock, $0.0001 par value per share, for issuance.

September 2013 Underwritten Public Offering - On September 18, 2013 the company closed an underwritten public offering of 17,500,000 units at a price to the public of $2.00 per unit for gross proceeds of $35 million (the "September 2013 Offering"). Each unit consists of one share of common stock, and a warrant to purchase 0.35 of a share of common stock at an exercise price of $2.50 per share. The September 2013 Offering included an over-allotment option for the underwriters to purchase an additional 2,625,000 shares of common stock and/or warrants up to 918,750 shares of common stock. On September 23, 2013, the underwriters exercised their over-allotment option in full. The additional gross proceeds to the company as a result of the full exercise of the over-allotment option were approximately $5.2 million. The total net proceeds of the September 2013 offering, including the exercise of the over-allotment option, were $37.5 million, after deducting underwriting discounts and commissions and offering expenses payable by the company.

Shares of common stock for future issuance are reserved for as follows (in thousands):

As of September 30, 2014 | ||

Warrants outstanding | 8,540 | |

Stock options outstanding | 8,994 | |

Options reserved for future issuance under the Company’s 2007 Incentive Plan | 2,484 | |

Shares reserved for future issuance under the Employee Stock Purchase Plan | 642 | |

Total reserved for future issuance | 20,660 | |

8. Warrants

The following is a summary of warrant activity for the six months ended September 30, 2014 (in thousands):

September 2013 Warrants | December 2012 Warrants | April 2011 Warrants | March 2011 Warrants | March 2010 Warrants | August 2009 Warrants | Consultant and Oxford Warrants | Total | ||||||||||||||||

Outstanding, January 1, 2014 | 6,442 | 4,917 | 1,158 | 176 | 290 | 978 | 889 | 14,850 | |||||||||||||||

Granted | — | — | — | — | — | — | 300 | 300 | |||||||||||||||

Exercised | (2,469 | ) | (1,886 | ) | (543 | ) | — | (265 | ) | (62 | ) | (469 | ) | (5,694 | ) | ||||||||

Outstanding, September 30, 2014 | 3,973 | 3,031 | 615 | 176 | 25 | — | 720 | 8,540 | |||||||||||||||

Expiration | September 2018 | December 2017 | April 2017 | March 2016 | March 2016 | August 2014 | Varies 2014-2020 | ||||||||||||||||

Warrants consist of warrants potentially settleable in cash, which are liability-classified warrants, and equity-classified warrants.

15

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Warrants classified as liabilities

Liability-classified warrants consist of warrants to purchase common stock issued in connection with equity financings in September 2013, December 2012, April 2011, March 2011, March 2010 and August 2009. These warrants are potentially settleable in cash and were determined not to be indexed to our common stock.

The estimated fair value of outstanding warrants accounted for as liabilities is determined at each balance sheet date. Any decrease or increase in the estimated fair value of the warrant liability since the most recent balance sheet date is recorded in the condensed consolidated statement of comprehensive loss as other income (expense). The fair value of the warrants is estimated using an appropriate pricing model with the following inputs:

As of September 30, 2014 | |||||||||||||||||||

September 2013 Warrants | December 2012 Warrants | April 2011 Warrants | March 2011 Warrants | March 2010 Warrants | |||||||||||||||

Strike price | $ | 2.50 | $ | 1.90 | $ | 0.65 | $ | 0.65 | $ | 2.15 | |||||||||

Expected term (years) | 3.97 | 3.23 | 2.56 | 1.43 | 1.49 | ||||||||||||||

Volatility % | 74.39 | % | 76.97 | % | 78.24 | % | 79.41 | % | 79.03 | % | |||||||||

Risk-free rate % | 1.41 | % | 1.15 | % | 0.85 | % | 0.32 | % | 0.35 | % | |||||||||

As of December 31, 2013 | |||||||||||||||||||||||

September 2013 Warrants | December 2012 Warrants | April 2011 Warrants | March 2011 Warrants | March 2010 Warrants | August 2009 Warrants | ||||||||||||||||||

Strike price | $ | 2.50 | $ | 1.90 | $ | 0.65 | $ | 0.65 | $ | 2.15 | $ | 4.50 | |||||||||||

Expected term (years) | 4.72 | 3.98 | 3.31 | 2.18 | 2.24 | 0.59 | |||||||||||||||||

Volatility % | 71.97 | % | 71.38 | % | 71.71 | % | 73.45 | % | 73.36 | % | 66.85 | % | |||||||||||

Risk-free rate % | 1.61 | % | 1.25 | % | 0.93 | % | 0.45 | % | 0.47 | % | 0.11 | % | |||||||||||

The expected volatility assumptions are based on the company's implied volatility in combination with the implied volatilities of similar publicly traded entities. The expected life assumption is based on the remaining contractual terms of the warrants. The risk-free rate is based on the zero coupon rates in effect at the time of valuation. The dividend yield used in the pricing model is zero, because the company has no present intention to pay cash dividends.

The changes in fair value of the warrant liability for the nine months ended September 30, 2014 were as follows (in thousands):

September 2013 Warrants | December 2012 Warrants | April 2011 Warrants | March 2011 Warrants | March 2010 Warrants | August 2009 Warrants | Total | |||||||||||||||||||||

Warrant liability, January 1, 2014 | $ | 22,950 | $ | 18,060 | $ | 5,069 | $ | 763 | $ | 945 | $ | 1,178 | $ | 48,965 | |||||||||||||

Fair value of warrants exercised | (12,713 | ) | (10,086 | ) | (2,906 | ) | — | (1,159 | ) | (162 | ) | (27,026 | ) | ||||||||||||||

Change in fair value of warrants | (6,066 | ) | (4,605 | ) | (1,214 | ) | (505 | ) | 232 | (1,016 | ) | (13,174 | ) | ||||||||||||||

Warrant liability, September 30, 2014 | $ | 4,171 | $ | 3,369 | $ | 949 | $ | 258 | $ | 18 | $ | — | $ | 8,765 | |||||||||||||

16

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

Warrants classified as equity

Equity-classified warrants consist of warrants issued in connection with consulting services provided to us. Additionally, on May 8, 2013 as a part of our Loan financing, we granted Oxford Financial LLC warrants to purchase up to 182,186 shares of common stock at an exercise price of $2.47, which equaled to the 20-day average market price of our common stock prior to the date of the grant. The warrants were valued using the Black Scholes model as described in Note 8, below. The fair value assumptions for the grant included a volatility of 75.34%, expected term of seven years, risk free rate of 1.20%, and a dividend rate of 0.00%. The fair value of the warrants granted was $1.93 per share. These warrants are recorded in equity at fair value upon issuance, and not as liabilities, and are not subject to adjustment to fair value in subsequent reporting periods.

9. Stock-Based Compensation

Options to Purchase Shares of Common Stock — The company follows the provisions ASC 718, which requires the measurement and recognition of compensation expense for all share-based payment awards made to employees, non-employee directors, including employee stock options. Stock compensation expense based on the grant date fair value estimated in accordance with the provisions of ASC 718 is recognized as an expense over the requisite service period.

For stock options and warrants granted in consideration for services rendered by non-employees, the company recognizes compensation expense in accordance with the requirements of ASC Topic 505-50. Non-employee option and warrant grants that do not vest immediately upon grant are recorded as an expense over the vesting period. At the end of each financial reporting period prior to vesting, the value of these options and warrants, as calculated using the Black-Scholes option-pricing model, is re-measured using the fair value of the company’s common stock and the non-cash compensation recognized during the period is adjusted accordingly. Since the fair market value of options and warrants granted to non-employees is subject to change in the future, the amount of the future compensation expense will include fair value re-measurements until the stock options and warrants are fully vested.

The following table summarizes the components of stock-based compensation expense in the condensed consolidated statements of comprehensive loss for the three months and nine months ended September 30, 2014 and 2013, respectively (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2014 | 2013 | 2014 | 2013 | ||||||||||||

Research and development | $ | 92 | $ | 133 | $ | 439 | $ | 391 | |||||||

Selling, general, and administrative | 1,208 | 328 | 3,997 | 953 | |||||||||||

Total stock-based compensation | $ | 1,300 | $ | 461 | $ | 4,436 | $ | 1,344 | |||||||

The company uses the Black-Scholes option-pricing model and the following weighted-average assumptions to determine the fair value of all its stock options granted:

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||

2014 | 2013 | 2014 | 2013 | ||||||||

Risk free interest rate | 2.02 | % | — | % | 2.02 | % | 1.25 | % | |||

Volatility | 79.10 | % | — | % | 79.47 | % | 77.66 | % | |||

Expected lives (years) | 6.12 | 0 | 6.15 | 6.25 | |||||||

Expected dividend yield | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | |||

The weighted-average fair value of options granted during the three months and nine months ended September 30, 2014 was $1.78 per share and $1.79 per share, respectively.

17

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

The company’s expected common stock price volatility assumption is based upon the company's own implied volatility in combination with the implied volatility of a basket of comparable companies. The expected life assumptions for employee grants were based upon the simplified method provided for under ASC 718-10, which averages the contractual term of the company’s options of ten years with the average vesting term of four years for an average of six years. The expected life assumptions for non-employees were based upon the contractual term of the option. The dividend yield assumption is zero, because the company has never paid cash dividends and presently has no intention to do so. The risk-free interest rate used for each grant was also based upon prevailing short-term interest rates. The company has estimated an annualized forfeiture rate of 15% for options granted to its employees, 8% for options granted to senior management and zero for non-employee directors. The company will record additional expense if the actual forfeitures are lower than estimated and will record a recovery of prior expense if the actual forfeiture rates are higher than estimated.

As of September 30, 2014, there was $5,389,000 of unrecognized compensation cost related to outstanding options that is expected to be recognized as a component of the company’s operating expenses over a weighted-average period of 2.67 years.

As of September 30, 2014, an aggregate of 16,500,000 shares of common stock were reserved for issuance under the company’s 2007 Incentive Plan, including 8,994,000 shares subject to outstanding common stock options granted under the plan and 2,484,000 shares available for future grants. The administrator of the plan determines the times when an option may become exercisable. Vesting periods of options granted to date have not exceeded four years. The options will expire, unless previously exercised, no later than ten years from the grant date.

The following table summarizes option activity of the company:

Total Number of Shares (In Thousands) | Weighted Average Exercise Price | Aggregate Intrinsic Value (In Thousands) | ||||||||

Outstanding at January 1, 2014 | 13,159 | $ | 2.73 | $ | — | |||||

Granted | 1,235 | 2.57 | — | |||||||

Exercised | (3,608 | ) | 1.31 | 13,429 | ||||||

Cancelled | (1,792 | ) | 2.42 | 562 | ||||||

Outstanding at September 30, 2014 | 8,994 | $ | 3.34 | $ | 1,551 | |||||

Options exercisable at September 30, 2014 | 5,225 | $ | 3.68 | $ | 1,088 | |||||

The aggregate intrinsic values of outstanding and exercisable options at September 30, 2014 were calculated based on the closing price of the company’s common stock as reported on The NASDAQ Capital Market on September 30, 2014 of $2.06 per share. The aggregate intrinsic value equals the positive difference between the closing fair market value of the company’s common stock and the exercise price of the underlying options.

Note 10. Other Income (Expense)

Other income (expense) is summarized as follows (in thousands):

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2014 | 2013 | 2014 | 2013 | ||||||||||||

Realized gain on sale of marketable securities | $ | — | $ | 814 | $ | — | $ | 1,392 | |||||||

Change in fair value of the contingent purchase price liability | 597 | (172 | ) | (59 | ) | (559 | ) | ||||||||

Miscellaneous other income (expense) | — | 51 | — | 48 | |||||||||||

Total other income (expense) | $ | 597 | $ | 693 | $ | (59 | ) | $ | 881 | ||||||

18

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

11. Net Loss Per Share

The company accounts for and discloses net loss per common share in accordance with FASB ASC Topic 260 “Earnings per Share.” Basic net loss per common share is computed by dividing net loss attributable to common stockholders by the weighted-average number of common shares outstanding. Diluted net loss per common share is computed by dividing net loss attributable to common stockholders by the weighted-average number of common shares that would have been outstanding during the period assuming the issuance of common shares for all potential dilutive common shares outstanding. Potential common shares consist of shares issuable upon the exercise of stock options and warrants.

The following table sets forth the potentially dilutive common shares excluded from the calculation of net loss per common share because their inclusion would be anti-dilutive (in thousands):

Three and Nine Months Ended September 30, | |||||

2014 | 2013 | ||||

Warrants to purchase common stock | 8,540 | 18,903 | |||

Options to purchase common stock | 8,994 | 9,928 | |||

Total | 17,534 | 28,831 | |||

12. License Agreements

As part of its business, the company enters into licensing agreements with third parties that often require milestone and royalty payments based on the progress of the licensed assets through development and commercial stages. Milestone payments may be required, for example, upon approval of the product for marketing by a regulatory agency, and the company may be required to make royalty payments based upon a percentage of net sales of the product. The expenditures required under these arrangements in any period may be material and are likely to fluctuate from period to period.

These arrangements sometimes permit the company to unilaterally terminate development of the product and thereby avoid future contingent payments; however, the company is unlikely to cease development if the compound successfully achieves clinical testing objectives.

In conjunction with the acquisition of NeuVaxTM, the company acquired rights and assumed obligations under a license agreement among Apthera and The University of Texas M. D. Anderson Cancer Center (“MDACC”) and The Henry M. Jackson Foundation for the Advancement of Military Medicine, Inc. (“HJF”) which grants exclusive worldwide rights to a U.S. patent covering the nelipepimut-S peptide and several U.S. and foreign patents and patent applications covering methods of using the peptide as a vaccine. Under the terms of this license, we are required to pay an annual maintenance fee of $200,000, a milestone payment of $200,000 upon commencing the Phase 3 PRESENT trial of NeuVax and other clinical milestone payments, as well as royalty payments based on sales of NeuVax or other therapeutic products developed from the licensed technologies.

On March 18, 2013, we acquired Abstral® (fentanyl) Sublingual Tablets for sale and distribution in the United States from Orexo AB (ORX.ST), an emerging specialty pharmaceutical company based in Sweden. Abstral has been approved by the U.S. Food and Drug Administration (FDA) and is a transmucosal immediate-release fentanyl (TIRF) product.

Under our agreement with Orexo, we assumed responsibility for the U.S. commercialization of Abstral and for all regulatory and reporting matters in the U.S. We also agreed to establish and maintain through 2015 a specified minimum commercial field force to market, sell and distribute Abstral and to use commercially reasonable efforts to reach the specified sales milestones. Orexo is entitled to reacquire the U.S. rights to Abstral from us for no consideration if we breach our obligations to establish and maintain the requisite sales force throughout the marketing period. We expect to maintain our sales efforts beyond this date. We officially launched U.S. commercial sales of Abstral in October 2013.

19

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

In exchange for the U.S. rights to Abstral, (1) we paid Orexo $10 million upfront, and a $5 million milestone payment in cash in October 2013 upon the approval by the FDA of a specified U.S. manufacturer of Abstral; and (2) we agreed to pay to Orexo: (a) three one-time future cash milestone payments based on our net sales of Abstral; and (b) a low double-digit royalty on future net sales. No further milestone or royalty payments will be due after the date on which all claims of the last remaining licensed patents expire (currently 2019) or become invalidated by a governmental agency.

On January 12, 2014, we acquired worldwide rights to anagrelide controlled release (CR) formulation, which we renamed GALE-401, through our acquisition of Mills Pharmaceuticals, LLC ("Mills") (see Note 5), and Mills became a wholly owned subsidiary. GALE-401 contains the active ingredient anagrelide, an FDA-approved product that has been in use since the late 1990s for the treatment of essential thrombocythemia (ET). Mills holds an exclusive license to develop and commercialize anagrelide CR formulation, pursuant to a license agreement with BioVascular, Inc. Under the terms of the license agreement, Mills has agreed to pay BioVascular, Inc. a mid-to-low single digit royalty on net revenue from the sale of licensed products as well as future cash milestone payments based on the achievement of specified regulatory milestones. Mills is also responsible for patent prosecution and maintenance.

On July 17, 2014, we entered into a definitive license and supply agreement with MonoSol Rx, LLC (MonoSol) for the U.S. commercial rights to Zuplenz® (ondansetron) Oral Soluble Film, an FDA approved product for the prevention of highly and moderately emetogenic chemotherapy-induced nausea and vomiting (CINV), radiotherapy-induced nausea and vomiting (RINV), and post-operative nausea and vomiting (PONV). In exchange for the U.S. rights to Zuplenz, in connection with the effectiveness of the license and transfer to us of the New Drug Application (NDA) for Zuplenz, we will pay MonoSol a total of $5 million in cash and shares of our common stock. In addition to these payments, we will pay MonoSol $0.5 million upon the earlier of (a) the occurrence of a specified managed care milestone and (b) December 31, 2014, (ii) $0.25 million within 30 days after MonoSol’s payment of applicable fees relating to the notice of allowance by the United States Patent and Trademark Office of a U.S. patent with composition claims covering Zuplenz that extend beyond 2028, (iii) future cash milestone payments based on our achievement of specified “net sales” of Zuplenz, and (iv) a double-digit royalty on future “net sales.”

Under the terms of the license agreement, we assumed responsibility for the commercialization of Zuplenz and for all regulatory and reporting matters in the U.S. We also agreed in the license and supply agreement to use our best commercial efforts to begin commercializing Zuplenz in the U.S. on or before December 31, 2014 in accordance with a joint commercialization plan to be established by the company and MonoSol. We also agreed that, until net sales of Zuplenz exceed a specified minimum amount or a competing product has been approved by the FDA and is placed into the market for sale, we will maintain a specified minimum number of field sales force personnel on specified terms.

Under the license and supply agreement, MonoSol has the exclusive right to supply all of our requirements for Zuplenz, subject to certain conditions.

13. Significant Customers and Concentration of Credit Risk

The company is engaged in the business of developing and commercializing pharmaceutical products. As of September 30, 2014, the company had one active commercial product, Abstral, available in six dosing strengths, and all sales reported are in the United States.

Sales to the following customers represented 10% or more of net revenue during at least one of the periods are presented as follows:

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||

Customer | 2014 | 2013 | 2014 | 2013 | ||||||||

Customer A | 40 | % | 8 | % | 44 | % | 8 | % | ||||

Customer B | — | % | 64 | % | 16 | % | 64 | % | ||||

Customer C | 27 | % | 17 | % | 14 | % | 17 | % | ||||

Customer D | 11 | % | — | % | 5 | % | — | % | ||||

Customer E | 14 | % | 6 | % | 10 | % | 6 | % | ||||

20

GALENA BIOPHARMA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS - Continued

(Unaudited)

The following customers represented 10% or more of total accounts receivable as of at least one of the balance sheet dates presented:

September 30, 2014 | December 31, 2013 | |||||

Customer | (Unaudited) | |||||

Customer A | 39 | % | 25 | % | ||

Customer B | 8 | % | 11 | % | ||

Customer C | 25 | % | 1 | % | ||

Customer D | 10 | % | — | % | ||

Customer E | 12 | % | 54 | % | ||

21