Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Cornerstone Building Brands, Inc. | v395937_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Cornerstone Building Brands, Inc. | v395937_ex99-1.htm |

| EX-99.2 - EXHIBIT 99.2 - Cornerstone Building Brands, Inc. | v395937_ex99-2.htm |

EXHIBIT 99.3

CENTRIA Acquisition FY14 Q4 Earnings release supplement December 9 , 2014

Cautionary Statement Regarding Forward Looking Statements Forward - Looking Statements This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The words such as "believe," "guidance," "potential," “anticipate,” “ plan,” "expect," "should," "will," "forecast" or similar expressions are intended to identify forward - looking statements in this press release. These forward - looking statements reflect our current expectations, assumptions and/or beliefs concerning future events. The Company has made every reasonable effort to ensure that the information, estimates, forecasts and assumptions on which these statements are based are current, reasonable, and complete. However, these forward - looking statements are subject to a number of risks and uncertainties that may cause the Company's actual performance to differ materially from that projected in such statements. Among the factors that could cause actual results to differ materially include, but are not limited to, our ability to integrate CENTRIA with our business or to realize the anticipated benefits of the acquisition of CENTRIA (the “Acquisition”), industry cyclicality and seasonality and adverse weather conditions; ability to service the Company's debt, including additional debt to finance the Acquisition ; fluctuations in customer demand and other patterns; raw material pricing and supply; competitive activity and pricing pressure; general economic conditions affecting the construction industry ; financial fluctuations in the U.S. and abroad; changes in laws or regulations; and the volatility of the Company's stock price. See also the “Risk Factors” in the Company's Annual Report on Form 10 - K for the fiscal year ended November 3, 2013, in the Company’s Quarterly Reports on Form 10 - Q for the quarterly period ended February 2, May 4 and August 3, 2014, and other reports we file with the SEC, which identify other important factors, though not necessarily all such factors, that could cause future outcomes to differ materially from those set forth in the forward - looking statements . NCI expressly disclaims any obligation to release publicly any updates or revisions to these forward - looking statements, whether as a result of new information, future events, or otherwise. 2 Basis of Presentation • “Combined” financial and operating information presented herein reflects the combined results of NCI and CENTRIA for the peri ods presented and does not necessarily reflect pro forma adjustments that would be required by a pro forma presentation prepared in accorda nce with the rules and regulations of the SEC or with GAAP. Actual results may differ materially. • Results for CENTRIA are for the trailing twelve month period ending 9/30/2014. These amounts represent preliminary estimates pr ovided by CENTRIA’s management which have not been audited or reviewed by CENTRIA’s external auditor . Actual results may differ materially. • This presentation also contains non - GAAP financial information such as EBITDA, Adjusted EBITDA and Combined Adjusted EBITDA. Ma nagement uses this information in its internal analysis of results and believes that the information may be informative to investors g aug ing the quality of the Company’s financial performance, identifying trends in our results and providing meaningful period to period comparisons. S ee additional information regarding these non - GAAP measures, including any required reconciliations to the most directly comparable financial measure calculated according to GAAP within this presentation. • This presentation also includes EBITDA of CENTRIA on a standalone basis for certain historical periods. CENTRIA has not histo ric ally prepared a calculation of Adjusted EBITDA comparable to Adjusted EBTIDA as reported by NCI. Therefore, CENTRIA’s historical EBTIDA inclu ded herein may not be comparable to Adjusted EBTIDA.

Transaction Overview On November 10, 2014 NCI Building Systems announced a definitive agreement to acquire CENTRIA, a leader in the design, engineering and manufacturing of architectural insulated metal panel (IMP) wall and roof systems and a provider of integrated coil coating services for the nonresidential construction industry Purchase Price Cash consideration of $245M Key Statistics CENTRIA LTM 9/30/2014 revenue of ~$230M and Adjusted EBITDA of ~$23M, before synergies Synergies Anticipated annual cost synergies of ~$6M; additional revenue synergy opportunities Structure Acquisition will be treated as an asset purchase, including a step - up of ~$200M that is expected to be deductible for tax purposes going forward Financing Transaction will be financed with new indebtedness ; financing commitment is in place Conditions Subject to customary closing conditions and regulatory clearance Anticipated Closing Q1 of FY 2015 3

Transaction Rationale • Strengthens NCI’s position as a leader in the North American insulated metal panel (IMP) market • Management has not yet determined in which segment or segments the results of the CENTRIA business will be included following the acquisition • Management estimates that, for NCI’s fiscal 2014, combined panel product sales by the Metl - Span and CENTRIA businesses would have contributed approximately $381M of revenue (with an estimated Adjusted EBITDA margin of approximately 10 %) on a combined basis for NCI’s fiscal 2014 • Complements existing IMP offering in cold storage and commercial and industrial applications by expanding capabilities into the high - end architectural panel market with a well - recognized brand • Enables NCI to expand into serving mid - and high - rise non - residential applications • Accelerates NCI’s architectural panel expansion initiative • Existing, longstanding partnerships with leading architects that specify CENTRIA’s innovative product offerings in the early design phase • Insulated panel market in North America has potential to grow faster than the overall market • North American IMP market remains underpenetrated (~ 4 %). Management believes the penetration rate in Europe is approximately 5x the penetration rate in North America • Overall non - residential market still has significant runway for recovery (2014E non - res starts in square footage are ~29% below long - term average and ~17% below the average of the previous five cyclical troughs) • Adds complementary, proprietary coating capabilities for niche customer segments not currently served by NCI • Significant earnings upside potential from synergies, as well as any market rebound • Cost synergies estimated at ~$6M, with additional revenue synergy opportunities • C urrent CENTRIA Adj. EBITDA is ~$23M for the twelve months ended 9/30/2014, and is well below historical peak of $ 41M (CY 2009) • Meaningful near - term cash and earnings benefits • Tax step - up is expected to generate ongoing deductions that reduce effective tax rate and benefit cash flow 4

IMP Market and Potential – Increased IMP Penetration 1,144 1,404 1,666 1,379 776 680 704 780 870 915 1,289 600 800 1,000 1,200 1,400 1,600 1,800 2,000 '67 '68 '69 '70 '71 '72 '73 '74 '75 '76 '77 '78 '79 '80 '81 '82 '83 '84 '85 '86 '87 '88 '89 '90 '91 '92 '93 '94 '95 '96 '97 '98 '99 '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 Data updated as of December 4, 2014 Nonresidential Construction Activity – Historical and Forecast Volume for Square Feet North America Projected Wall Market Growth • CENTRIA specializes in high - end architectural and C&I applications. Management believes there is a significant opportunity to convert curtain wall, precast, EIFS/stucco, and brick projects to high - end IMPs • The IMP penetration rate in North America is only ~ 4 %. Management believes the IMP penetration rate in Europe is approximately 5x that of North America, implying significant runway for increased penetration Source: M anagement estimate based on industry information Square Feet (in millions) Source: McGraw - Hill 5 2014 2019 Total Wall CAGR 4.9% IMP CAGR 7.2%

CENTRIA: A Leader in Innovation

CENTRIA Business Overview • CENTRIA is a leading North American manufacturer of architectural foam and single skin panels for the commercial, institutional and industrial markets • LTM 9/30/2014 Revenue and Adj. EBITDA of $ 230 million and $ 23 million, respectively • HQ in Moon Township, PA; 720 employees • Business consists of 3 primary product offerings: • Insulated metal panels (~40% of LTM 9/30/2014 revenue) • Single skin profiles and other accessories (~22%) • Specialty coil coating (~38%) • Sells through proprietary network of ~100 dealers, with substantial sales and marketing efforts targeted towards architects • Relationships with 1,200+ architects who specify CENTRIA products into designs and plans • Targets a wide range of end markets • Operates 4 U.S. manufacturing facilities and a new plant recently opened in Shanghai: • Frankfort , KY – Single skin architectural &industrial panels; Metal composite panel line • Sheridan , AR – Architectural & industrial foam panel lines; Custom fabrication equipment & painting • Ambridge , PA – Paint , embossing, and coil to coil lines • Cambridge, OH – Paint , embossing, and coil to coil lines • Shanghai, China – Rockwool panel line; Single skin architectural profiles • Operates international sales offices in Dubai, the U.K., Singapore and several cities in China LTM 9/30/2014 Revenue by Product (1) 2013 Bookings by End Market (Arch. Panels) (1) Components 22% IMP 40% Coaters 38% Amusement 7% Power 5% Healthcare 22% Education 16% Manufacturing 14% Misc Non - Res 12% Govt. Service 8% Offices/Banks 8% Other 8% (1) Allocations approximate 7

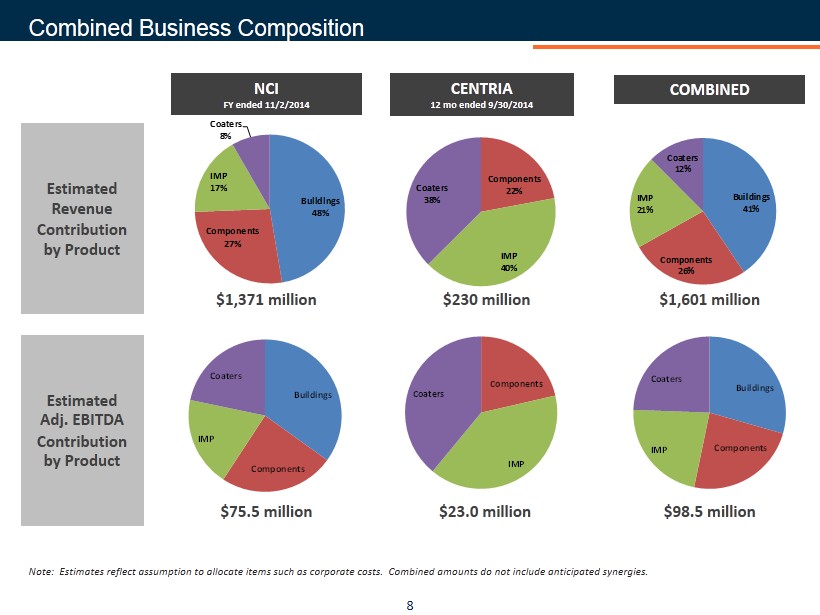

Combined Business Composition NCI FY ended 11/2/2014 CENTRIA 12 mo ended 9/30/2014 COMBINED Estimated Revenue Contribution by Product Estimated Adj. EBITDA Contribution by Product $1,371 million $230 million $1,601 million $75.5 million $23.0 million $98.5 million Note: Estimates reflect assumption to allocate items such as corporate costs. Combined amounts do not include anticipated s yne rgies. 8 Buildings Components IMP Coaters Components IMP Coaters Buildings Components IMP Coaters Buildings 48% Components 27% IMP 17% Coaters 8% Components 22% IMP 40% Coaters 38% Buildings 41% Components 26% IMP 21% Coaters 12%

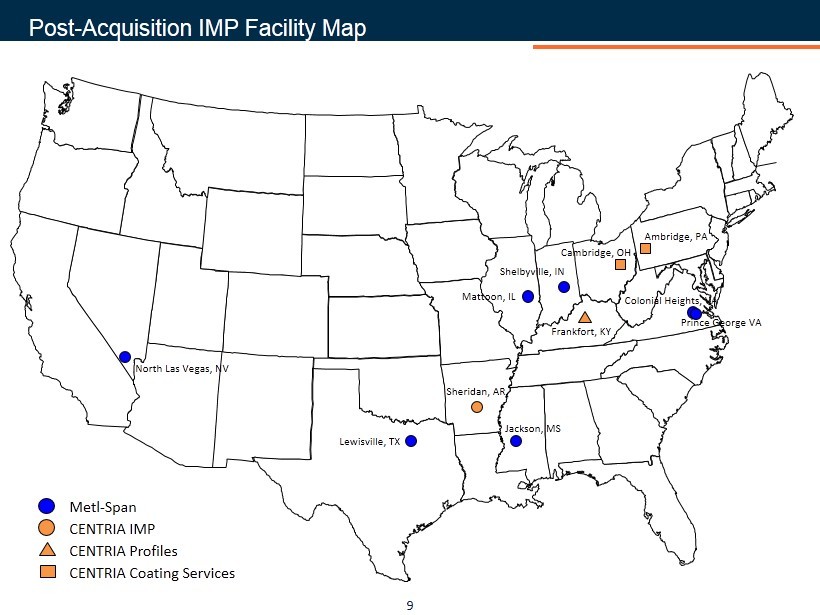

Post - Acquisition IMP Facility Map North Las Vegas, NV Mattoon, IL Sheridan, AR Jackson, MS Lewisville, TX Colonial Heights, VA Prince George VA Shelbyville, IN Frankfort, KY Cambridge, OH Ambridge, PA CENTRIA IMP Metl - Span CENTRIA Profiles CENTRIA Coating Services 9

Combined Balance Sheet 10 ($ in millions) NCI FY2014 Cumulative net Leverage Combined with CENTRIA LTM 9/30/2014 Cumulative net Leverage (combined) Cash 66.7 59.2 Existing ABL - - Existing 1st lien term loan 235.4 235.4 Total first lien debt 235.4 2.2x 235.4 1.8x New indebtedness - 250.0 Total debt 235.4 2.2x 485.4 4.3x LTM 11/2/2014 Adjusted EBITDA 75.5 98.5

Adjusted EBITDA Reconciliation 11 NCI and Centria Adjusted EBITDA Reconciliation ($ in millions) (Unaudited) NCI CENTRIA Fiscal Year Ended Trailing 12 Months November 2, September 30, 2014 2014 Combined Net income (loss) 11.2$ 18.1$ 29.2$ Add: Depreciation and amortization 35.9 4.7 40.7 Consolidated interest expense, net 12.3 0.1 12.4 Provision (benefit) for income taxes 1.5 0.1 1.6 Gain on insurance recovery (1.3) - (1.3) Secondary offering costs 0.7 - 0.7 Strategic development costs 5.0 - 5.0 Non-cash charges: Share-based compensation 10.2 - 10.2 Adjusted EBITDA 75.5$ 23.0$ 98.5$ CENTRIA Year Ended December 31, 2009 Net income (loss) 36.2$ Add: Depreciation and amortization 4.6 Consolidated interest expense, net 0.4 Provision (benefit) for income taxes 0.1 EBITDA 41.3$

NCI Building Systems, Inc. 10943 North Sam Houston Parkway West Houston, Texas 77064 www.ncibuildingsystems.com