Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Cornerstone Building Brands, Inc. | Financial_Report.xls |

| EX-31.1 - EX-31.1 - Cornerstone Building Brands, Inc. | d357936dex311.htm |

| EX-32.2 - EX-32.2 - Cornerstone Building Brands, Inc. | d357936dex322.htm |

| EX-32.1 - EX-32.1 - Cornerstone Building Brands, Inc. | d357936dex321.htm |

| EX-31.2 - EX-31.2 - Cornerstone Building Brands, Inc. | d357936dex312.htm |

| EX-10.6 - EX-10.6 - Cornerstone Building Brands, Inc. | d357936dex106.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended April 29, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-14315

NCI BUILDING SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 76-0127701 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 10943 N. Sam Houston Parkway W. Houston, TX |

77064 | |

| (Address of principal executive offices) | (Zip Code) | |

(281) 897-7788

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Common Stock, $.01 par value-20,347,925 shares as of May 29, 2012

Table of Contents

2

Table of Contents

| Item 1. | Unaudited Consolidated Financial Statements. |

NCI BUILDING SYSTEMS, INC.

(In thousands, except share data)

| April 29, 2012 |

October 30, 2011 |

|||||||

| (Unaudited) | ||||||||

| ASSETS |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 73,856 | $ | 78,982 | ||||

| Restricted cash |

–– | 2,836 | ||||||

| Accounts receivable, net |

83,051 | 95,381 | ||||||

| Inventories, net |

106,904 | 88,531 | ||||||

| Deferred income taxes |

19,313 | 20,405 | ||||||

| Income tax receivable |

1,591 | 1,272 | ||||||

| Investments in debt and equity securities, at market |

4,494 | 4,483 | ||||||

| Prepaid expenses and other |

18,820 | 14,847 | ||||||

| Assets held for sale |

4,875 | 4,874 | ||||||

|

|

|

|

|

|||||

| Total current assets |

312,904 | 311,611 | ||||||

|

|

|

|

|

|||||

| Property, plant and equipment, net |

211,346 | 208,514 | ||||||

| Goodwill |

5,200 | 5,200 | ||||||

| Intangible assets, net |

23,313 | 24,254 | ||||||

| Other assets |

9,898 | 11,575 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 562,661 | $ | 561,154 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ DEFICIT |

||||||||

| Current liabilities: |

||||||||

| Note payable |

$ | 1,648 | $ | 292 | ||||

| Accounts payable |

85,259 | 88,158 | ||||||

| Accrued compensation and benefits |

35,382 | 34,616 | ||||||

| Accrued interest |

340 | 1,309 | ||||||

| Other accrued expenses |

50,579 | 49,668 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

173,208 | 174,043 | ||||||

|

|

|

|

|

|||||

| Long-term debt |

128,499 | 130,699 | ||||||

| Deferred income taxes |

7,377 | 7,312 | ||||||

| Other long-term liabilities |

10,070 | 10,081 | ||||||

|

|

|

|

|

|||||

| Total long-term liabilities |

145,946 | 148,092 | ||||||

|

|

|

|

|

|||||

| Series B cumulative convertible participating preferred stock |

290,304 | 273,950 | ||||||

| Redeemable common stock |

–– | 759 | ||||||

| Stockholders’ deficit: |

||||||||

| Common stock, $.01 par value, 100,000,000 shares authorized; 20,350,479 and 19,954,323 shares issued at April 29, 2012 and October 30, 2011, respectively; 20,349,093 and 19,829,898 shares outstanding at April 29, 2012 and October 30, 2011, respectively |

924 | 924 | ||||||

| Additional paid-in capital |

222,774 | 237,244 | ||||||

| Accumulated deficit |

(264,987 | ) | (266,896 | ) | ||||

| Accumulated other comprehensive loss |

(5,501 | ) | (5,485 | ) | ||||

| Treasury stock, at cost (1,386 shares and 124,425 shares at April 29, 2012 and October 30, 2011, respectively) |

(7 | ) | (1,477 | ) | ||||

|

|

|

|

|

|||||

| Total stockholders’ deficit |

(46,797 | ) | (35,690 | ) | ||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ deficit |

$ | 562,661 | $ | 561,154 | ||||

|

|

|

|

|

|||||

See accompanying notes to consolidated financial statements.

3

Table of Contents

NCI BUILDING SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| Fiscal Three Months Ended | Fiscal Six Months Ended | |||||||||||||||

| April 29, 2012 |

May 1, 2011 |

April 29, 2012 |

May 1, 2011 |

|||||||||||||

| Sales |

$ | 250,231 | $ | 225,565 | $ | 493,834 | $ | 415,651 | ||||||||

| Cost of sales |

192,229 | 174,752 | 382,210 | 331,293 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Gross profit |

58,002 | 50,813 | 111,624 | 84,358 | ||||||||||||

| Engineering, selling, general and administrative expenses |

51,564 | 52,657 | 100,505 | 100,338 | ||||||||||||

| Acquisition-related costs |

1,494 | — | 1,890 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from operations |

4,944 | (1,844 | ) | 9,229 | (15,980 | ) | ||||||||||

| Interest income |

28 | 30 | 56 | 77 | ||||||||||||

| Interest expense |

(3,062 | ) | (3,900 | ) | (6,386 | ) | (8,124 | ) | ||||||||

| Other income, net |

353 | 699 | 379 | 1,278 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income taxes |

2,263 | (5,015 | ) | 3,278 | (22,749 | ) | ||||||||||

| Provision (benefit) for income taxes |

942 | (1,786 | ) | 1,368 | (6,795 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

$ | 1,321 | $ | (3,229 | ) | $ | 1,910 | $ | (15,954 | ) | ||||||

| Convertible preferred stock dividends and accretion |

9,744 | 6,260 | 16,352 | 12,490 | ||||||||||||

| Convertible preferred stock beneficial conversion feature |

7,858 | (240 | ) | 11,878 | 1,546 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss applicable to common shares |

$ | (16,281 | ) | $ | (9,249 | ) | $ | (26,320 | ) | $ | (29,990 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss per common share: |

||||||||||||||||

| Basic |

$ | (0.86 | ) | $ | (0.51 | ) | $ | (1.40 | ) | $ | (1.65 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | (0.86 | ) | $ | (0.51 | ) | $ | (1.40 | ) | $ | (1.65 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average number of common shares outstanding: |

||||||||||||||||

| Basic |

18,832 | 18,275 | 18,760 | 18,215 | ||||||||||||

| Diluted |

18,832 | 18,275 | 18,760 | 18,215 | ||||||||||||

See accompanying notes to consolidated financial statements.

4

Table of Contents

NCI BUILDING SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| Fiscal Six Months Ended | ||||||||

| April 29, 2012 |

May 1, 2011 |

|||||||

| Cash flows from operating activities: |

||||||||

| Net income (loss) |

$ | 1,910 | $ | (15,954 | ) | |||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

||||||||

| Depreciation and amortization |

14,427 | 16,850 | ||||||

| Share-based compensation expense |

4,093 | 3,357 | ||||||

| Loss on sale of property, plant and equipment |

13 | 11 | ||||||

| Provision for doubtful accounts |

(692 | ) | 690 | |||||

| Provision (benefit) from deferred income taxes |

1,147 | (6,978 | ) | |||||

| Changes in operating assets and liabilities, net of effect of acquisitions: |

||||||||

| Accounts receivable |

12,561 | 10,811 | ||||||

| Inventories |

(18,373 | ) | (26,176 | ) | ||||

| Income tax receivable |

169 | 15,702 | ||||||

| Prepaid expenses and other |

(2,972 | ) | (1,133 | ) | ||||

| Accounts payable |

(2,899 | ) | 3,907 | |||||

| Accrued expenses |

656 | 3,863 | ||||||

| Other, net |

(51 | ) | (408 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

9,989 | 4,542 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Capital expenditures |

(13,899 | ) | (8,070 | ) | ||||

| Proceeds from sale of property, plant and equipment |

37 | 143 | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(13,862 | ) | (7,927 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Decrease (increase) in restricted cash |

2,836 | (3 | ) | |||||

| Proceeds from ABL Facility |

— | 5 | ||||||

| Payments on ABL Facility |

— | (3 | ) | |||||

| Excess tax benefits from share-based compensation arrangements |

1 | 464 | ||||||

| Payments on term loan |

(2,200 | ) | (3,750 | ) | ||||

| Payments on note payable |

(403 | ) | (667 | ) | ||||

| Payment of financing costs |

(50 | ) | (75 | ) | ||||

| Payment of cash dividends on convertible preferred stock |

— | (11,039 | ) | |||||

| Purchase of treasury stock |

(1,510 | ) | (1,477 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in financing activities |

(1,326 | ) | (16,545 | ) | ||||

|

|

|

|

|

|||||

| Effect of exchange rate changes on cash and cash equivalents |

73 | (80 | ) | |||||

| Net decrease in cash and cash equivalents |

(5,126 | ) | (20,010 | ) | ||||

| Cash and cash equivalents at beginning of period |

78,982 | 77,419 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 73,856 | $ | 57,409 | ||||

|

|

|

|

|

|||||

See accompanying notes to consolidated financial statements.

5

Table of Contents

NCI BUILDING SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

APRIL 29, 2012

(Unaudited)

NOTE 1 — BASIS OF PRESENTATION

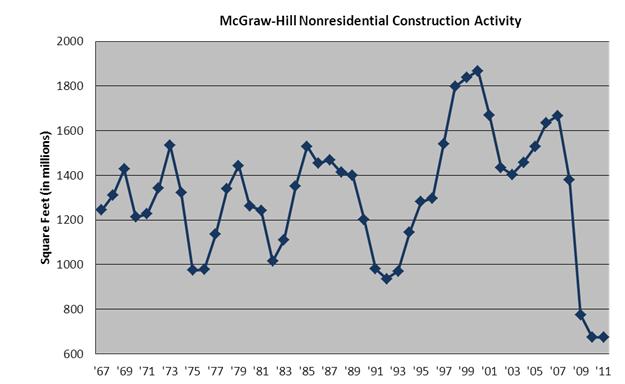

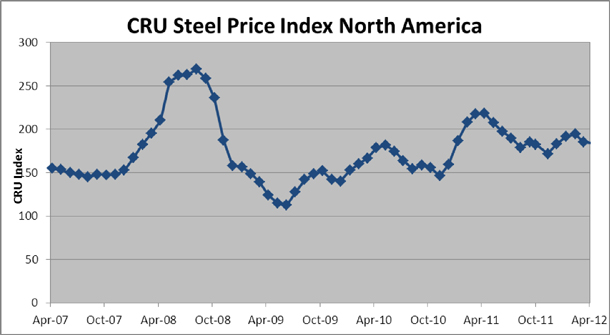

The accompanying unaudited consolidated financial statements for NCI Building Systems, Inc. (together with its subsidiaries, unless otherwise indicated, the “Company,” “we,” “us,” or “our”) have been prepared in accordance with generally accepted accounting principles for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, the unaudited consolidated financial statements included herein contain all adjustments necessary to fairly present our financial position, results of operations and cash flows for the periods indicated. Such adjustments, other than nonrecurring adjustments that have been separately disclosed, are of a normal, recurring nature. Operating results for the fiscal three and six month periods ended April 29, 2012 are not necessarily indicative of the results that may be expected for the fiscal year ending October 28, 2012. Our sales and earnings are subject to both seasonal and cyclical trends and are influenced by general economic conditions, interest rates, the price of steel relative to other building materials, the level of nonresidential construction activity, roof repair and retrofit demand and the availability and cost of financing for construction projects.

We use a four-four-five week calendar each quarter with our year end being on the Sunday closest to October 31. The year end for fiscal 2012 is October 28, 2012.

For further information, refer to the consolidated financial statements and footnotes thereto included in our Annual Report on Form 10-K for the fiscal year ended October 30, 2011 filed with the Securities and Exchange Commission (the “SEC”) on December 21, 2011.

NOTE 2 —ACCOUNTING PRONOUNCEMENTS

Adopted Accounting Pronouncements

In September 2011, the FASB issued ASU 2011-08, Intangibles—Goodwill and Other (Topic 350): Testing Goodwill for Impairment (“ASU 2011-08”), which gives companies the option to perform an annual qualitative assessment to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount and, in some cases, by-pass the two-step impairment test. Early adoption is permitted. Therefore, we have early adopted this ASU in our fiscal year ending October 28, 2012. The adoption of ASU 2011-08 did not have a material impact on our consolidated financial statements.

In May 2011, the FASB issued ASU 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs (“ASU 2011-04”). The amendments to this update provide a uniform framework for applying the principles of fair value measurement and include (i) amendments that clarify the Board’s intent about the application of existing fair value measurement and disclosure requirements and (ii) amendments that change a particular principle or requirement for measuring fair value or for disclosing information about fair value measurements. These amendments do not require additional fair value measurements. We adopted ASU 2011-04 in our second fiscal quarter ended April 29, 2012. The adoption of ASU 2011-04 did not have a material impact on our consolidated financial statements.

Recent Accounting Pronouncements

In June 2011, the FASB issued ASU 2011-05, Comprehensive Income (Topic 220): Presentation of Comprehensive Income (“ASU 2011-05”) which amends its guidance on the presentation of comprehensive income to increase the prominence of items reported in other comprehensive income. The new guidance requires that all components of comprehensive income in stockholders’ equity be presented either in a single continuous statement of comprehensive income or in two separate but consecutive statements. The guidance required entities to present reclassification adjustments out of accumulated other comprehensive income by component in both the statement in which net income is presented and the statement in which other comprehensive income is presented. In December 2011, the FASB issued ASU 2011-12, Comprehensive Income (Topic 220): Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items Out of Accumulated Other Comprehensive Income in Accounting Standards Update No. 2011-05 (“ASU 2011-12”) which indefinitely deferred the guidance related to the presentation on the face of the financial statements of the effects of reclassifications out of accumulated other comprehensive income on the components of net income and other comprehensive income. These amendments are to be applied retrospectively. We will adopt ASU 2011-05 and ASU 2011-12 in our first quarter of fiscal 2013 and we believe its adoption will not have any impact on our consolidated financial statements.

6

Table of Contents

NOTE 3 — RESTRICTED CASH

In prior year, we entered into a cash collateral agreement with our agent bank to secure letters of credit. The restricted cash was invested in a bank account securing our agent bank. As of April 29, 2012, we no longer had restricted cash as collateral related to our letters of credit because we utilized the ABL Facility to secure all our letters of credit. As of October 30, 2011, we had restricted cash in the amount of $2.8 million as collateral related to our $2.7 million of letters of credit for certain insurance policies, exclusive of letters of credit under our ABL Facility. Restricted cash was classified as a current asset as the underlying letters of credit were to expire within one year of the respective balance sheet date.

NOTE 4 — INVENTORIES

The components of inventory are as follows (in thousands):

| April 29, 2012 | October 30, 2011 | |||||||

| Raw materials |

$ | 76,511 | $ | 62,801 | ||||

| Work in process and finished goods |

30,393 | 25,730 | ||||||

|

|

|

|

|

|||||

| $ | 106,904 | $ | 88,531 | |||||

|

|

|

|

|

|||||

NOTE 5 — SHARE-BASED COMPENSATION

Our 2003 Long-Term Stock Incentive Plan (“Incentive Plan”) is an equity-based compensation plan that allows us to grant a variety of types of awards, including stock options, restricted stock, restricted stock units, stock appreciation rights, performance share awards, phantom stock awards and cash awards. As of April 29, 2012 and May 1, 2011, and for all periods presented, our share-based awards under this plan have consisted of restricted stock grants and stock option grants, none of which can be settled through cash payments. Both our stock options and restricted stock awards are subject only to vesting requirements based on continued employment at the end of a specified time period and typically vest over four years or earlier upon death, disability or a change of control. However, our annual restricted stock awards also vest upon retirement and, only in the case of certain special one-time restricted stock awards, a portion vest on termination without cause or for good reason, as defined by the agreements governing such awards.

During the six month periods ended April 29, 2012 and May 1, 2011, we granted 92,832 and 121,669 stock options, respectively, and the weighted average grant-date fair value of options granted during fiscal 2012 and fiscal 2011 was $5.12 and $5.78, respectively.

The fair value of restricted stock awards classified as equity awards is based on the Company’s stock price as of the date of grant. During the six months ended April 29, 2012 and May 1, 2011, we granted restricted stock awards with a fair value of $6.8 million or 666,110 shares and $6.2 million or 515,053 shares, respectively.

NOTE 6 — LOSS PER COMMON SHARE

Basic loss per common share is computed by dividing net loss allocated to common shares by the weighted average number of common shares outstanding. Diluted income per common share, if applicable, considers the dilutive effect of common stock equivalents. The reconciliation of the numerator and denominator used for the computation of basic and diluted loss per common share is as follows (in thousands, except per share data):

| Fiscal Three Months Ended | Fiscal Six Months Ended | |||||||||||||||

| April 29, 2012 |

May 1, 2011 |

April 29, 2012 |

May 1, 2011 |

|||||||||||||

| Numerator for Basic and Diluted Loss Per Common Share Net loss allocated to common shares (1) |

$ | (16,281 | ) | $ | (9,249 | ) | $ | (26,320 | ) | $ | (29,990 | ) | ||||

| Denominator for Basic and Diluted Loss Per Common Share |

||||||||||||||||

| Weighted average common shares outstanding for basic and diluted loss per share |

18,832 | 18,275 | 18,760 | 18,215 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Basic and Diluted loss per common share |

$ | (0.86 | ) | $ | (0.51 | ) | $ | (1.40 | ) | $ | (1.65 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Participating securities consist of the holders of the Convertible Preferred Stock, as defined below, and the unvested restricted Common Stock related to our Incentive Plan. These participating securities do not have a contractual obligation to share in losses; therefore, no losses were allocated in any periods presented above. These participating securities will be allocated earnings when applicable. |

7

Table of Contents

We calculate earnings per share using the “two-class” method, whereby unvested share-based payment awards that contain non-forfeitable rights to dividends or dividend equivalents are “participating securities” and, therefore, these participating securities are treated as a separate class in computing earnings per share. The calculation of earnings per share for Common Stock presented here excludes the income, if any, attributable to the unvested restricted stock awards and our Series B Cumulative Convertible Participating Preferred Stock (“Convertible Preferred Stock,” and shares thereof, “Preferred Shares”) from the numerator and excludes the dilutive impact of those shares from the denominator. There was no income amount attributable to unvested restricted stock or Preferred Shares for the three and six month periods ended April 29, 2012 and May 1, 2011 as the restricted stock and Preferred Shares do not share in the net losses. However, in periods of net income allocated to common shares, a portion of this income will be allocable to the restricted stock and Preferred Shares. As of April 29, 2012 and October 30, 2011, the Preferred Shares were convertible into 48.9 million and 46.6 million shares of Common Stock, respectively.

For both the three and six month periods ended April 29, 2012 and May 1, 2011, all options and unvested restricted shares were anti-dilutive and, therefore, not included in the diluted loss per common share calculation.

NOTE 7 — WARRANTY

We sell weathertightness warranties to our customers for protection from leaks in our roofing systems related to weather. These warranties range from two years to 20 years. We sell two types of warranties, standard and Single Source™, and three grades of coverage for each. The type and grade of coverage determines the price to the customer. For standard warranties, our responsibility for leaks in a roofing system begins after 24 consecutive leak-free months. For Single Source™ warranties, the roofing system must pass our inspection before warranty coverage will be issued. Inspections are typically performed at three stages of the roofing project: (i) at the project start-up; (ii) at the project mid-point; and (iii) at the project completion. These inspections are included in the cost of the warranty. If the project requires or the customer requests additional inspections, those inspections are billed to the customer. Upon the sale of a warranty, we record the resulting revenue as deferred warranty revenue, which is included in other accrued expenses in our Consolidated Balance Sheets. We recognize deferred warranty revenue over the warranty coverage period in a manner that matches our estimated expenses relating to the warranty. Additionally, we maintain an accrued warranty at Robertson-Ceco II Corporation (“RCC”) in which the balance was $3.1 million at both April 29, 2012 and October 30, 2011. RCC’s accrued warranty programs have similar terms and characteristics to our other warranty programs although this warranty is not amortized in the same manner as our other warranty programs.

The following table represents the rollforward of our acquired accrued warranty obligation and deferred warranty revenue activity for each of the fiscal six months ended (in thousands):

| Fiscal Six Months Ended | ||||||||

| April 29, 2012 | May 1, 2011 | |||||||

| Beginning balance |

$ | 17,941 | $ | 16,977 | ||||

| Warranties sold |

1,479 | 1,411 | ||||||

| Revenue recognized |

(803 | ) | (769 | ) | ||||

| Costs incurred and other |

(109 | ) | (302 | ) | ||||

|

|

|

|

|

|||||

| Ending balance |

$ | 18,508 | $ | 17,317 | ||||

|

|

|

|

|

|||||

NOTE 8 — LONG-TERM DEBT AND NOTE PAYABLE

Debt is comprised of the following (in thousands):

| April 29, 2012 | October 30, 2011 | |||||||

| Amended Credit Agreement, due April 2014 (interest at 6.5% at April 29, 2012 and 8.0% at October 30, 2011) |

$ | 128,499 | $ | 130,699 | ||||

| Asset-Based Lending Facility, due April 2014 (interest at 4.75%) |

–– | — | ||||||

|

|

|

|

|

|||||

| 128,499 | 130,699 | |||||||

| Current portion of long-term debt |

— | — | ||||||

|

|

|

|

|

|||||

| Total long-term debt, less current portion |

$ | 128,499 | $ | 130,699 | ||||

|

|

|

|

|

|||||

8

Table of Contents

Amended Credit Agreement

On October 20, 2009, we entered into the Amended Credit Agreement (the “Amended Credit Agreement”), pursuant to which we repaid $143.3 million of the $293.3 million in principal amount of term loans outstanding under such credit agreement and modified the terms and maturity of the remaining $150.0 million balance. The terms of the term loan require quarterly principal payments in an amount equal to 0.25% of the principal amount of the term loan then outstanding as of the last day of each calendar quarter and a final payment of approximately $136.3 million at maturity on April 20, 2014. However, we have made mandatory and optional prepayments on the Amended Credit Agreement and these prepayments are allowed to be applied against the remaining required quarterly principal payments. As a result, we are not required to make any additional quarterly principal payments for the remaining term of the term loan, although we intend to continue to make voluntary prepayments.

The Company’s obligations under the Amended Credit Agreement and any interest rate protection agreements or other permitted hedging agreement entered into with any lender under the Amended Credit Agreement are irrevocably and unconditionally guaranteed on a joint and several basis by each direct and indirect domestic subsidiary of the Company (other than any domestic subsidiary that is a foreign subsidiary holding company or a subsidiary of a foreign subsidiary that is insignificant).

The obligations under the Amended Credit Agreement and under any permitted hedging agreement and the guarantees thereof are secured by (i) all of the capital stock and other equity interests of all direct domestic subsidiaries owned by the Company and the guarantors, (ii) up to 65% of the capital stock of certain direct foreign subsidiaries of the Company or any guarantor (it being understood that a foreign subsidiary holding company or a domestic subsidiary of a foreign subsidiary is considered a foreign subsidiary for these purposes) and (iii) substantially all other tangible and intangible assets owned by the Company and each guarantor, including liens on material real property, in each case to the extent permitted by applicable law. The liens securing the obligations under the Amended Credit Agreement, the permitted hedging agreements and the guarantees thereof are first in priority (as between the Amended Credit Agreement and the Asset-Based Lending Facility (the “ABL Facility”)) with respect to stock, material real property and assets other than accounts receivable, inventory, certain deposit accounts, associated intangibles and certain other specified assets of the Company and the guarantors. Such liens are second in priority (as between the Amended Credit Agreement and the ABL Facility) with respect to accounts receivable, inventory, associated intangibles and certain other specified assets of the Company and the guarantors.

The Amended Credit Agreement contains a number of covenants that, among other things, limit or restrict our ability to dispose of assets, incur additional indebtedness, incur guarantee obligations, prepay other indebtedness, make dividends and other restricted payments, create liens, make investments, make acquisitions, engage in mergers, change the nature of our business and engage in certain transactions with affiliates.

The Amended Credit Agreement did not require financial covenants until October 30, 2011 (subject to prepayment deferrals as noted below), at which time our consolidated leverage ratio of net indebtedness to EBITDA was to be no more than 5 to 1. Net indebtedness is defined as consolidated debt less the lesser of unrestricted cash or $50 million. This ratio steps down by 0.25 each quarter until October 28, 2012 at which time the maximum ratio is 4 to 1. The ratio continues to step down by 0.125 each quarter until November 3, 2013 to a ratio of 3.5 to 1, which remains the maximum ratio for each fiscal quarter thereafter. We will, however, not be subject to this financial covenant with respect to a specified period if certain prepayments or repurchases of the term loans under the Amended Credit Agreement are made prior to the specified period. Based on our prepayments made through April 29, 2012, the leverage ratio covenant has been deferred until the third quarter of fiscal 2013. The prepayments that have been made can be applied to continuously defer covenant requirements and are not reduced unless the Company’s actual leverage ratios are above the maximum requirement for a given period. Although our Amended Credit Agreement did not require any financial covenant compliance, at April 29, 2012 and October 30, 2011, our consolidated leverage ratio as of those dates was 1.30 and 2.27, respectively.

Term loans under the Amended Credit Agreement may be repaid at any time, without premium or penalty but subject to customary LIBOR breakage costs. We also have the ability to repurchase a portion of the term loans under the Amended Credit Agreement, subject to certain terms and conditions set forth in the Amended Credit Agreement. In addition, the Amended Credit Agreement requires mandatory prepayment and reduction in an amount equal to:

| • | the net cash proceeds of (1) certain asset sales, (2) certain debt offerings and (3) certain insurance recovery and condemnation events; and |

| • | 50% of annual excess cash flow (as defined in the Amended Credit Agreement) for any fiscal year ended on or after October 31, 2010, unless a specified leverage ratio target is met. |

The Amended Credit Agreement limited our ability to pay cash dividends on or prior to October 31, 2010 after which time we were permitted to pay dividends in an amount not to exceed the available amount (as defined in the Amended Credit Agreement). The available amount is defined as the sum of 50% of the cumulative consolidated net income from August 2, 2009 to the end of the most

9

Table of Contents

recent fiscal quarter, plus net proceeds of property or assets received as capital contributions, less the sum of all dividends, payments or other distributions of such available amounts, in each case subject to certain adjustments and exceptions as specified in the Amended Credit Agreement. In the absence of accumulated earnings, cash dividends and other cash restricted payments are limited to $14.5 million in the aggregate during the term of the loan, of which we used $11.0 million as of April 29, 2012. Each quarterly dividend payment on the Convertible Preferred Stock cannot be split between cash and payment-in-kind.

The term loan under the Amended Credit Agreement bears interest, at our option, at either LIBOR or Base Rate plus an applicable margin. To date, we have selected LIBOR interest rates. Overdue amounts will bear interest at a rate that is 2% higher than the rate otherwise applicable. “Base Rate” is defined as the highest of (i) the Wells Fargo Bank, National Association prime rate, (ii) the overnight Federal Funds rate plus 0.5%, and (iii) 3%. “LIBOR” is defined as the applicable London interbank offered rate (not to be less than 2%) adjusted for reserves. The applicable margin until October 30, 2011 was 5.00% on Base Rate loans and 6.00% on LIBOR loans under the Amended Credit Agreement. Since October 30, 2011, the LIBOR-linked margin fluctuates based on our leverage ratio and shall be either 6% or 4.5%. Based on our leverage ratio at April 29, 2012, the applicable margin in the third quarter of fiscal 2012 will be 4.5%.

ABL Facility

On October 20, 2009, the subsidiaries of the Company, NCI Group, Inc. and RCC and the Company entered into the ABL Facility pursuant to a loan and security agreement that provided for a $125.0 million asset-based loan facility. The ABL Facility allows us an aggregate maximum borrowing of up to $125.0 million; however, the aggregate maximum borrowings are limited to $100.0 million under our Amended Credit Agreement. Borrowing availability under the ABL Facility is determined by a monthly borrowing base collateral calculation that is based on specified percentages of the value of qualified cash, eligible inventory and eligible accounts receivable, less certain reserves and subject to certain other adjustments. At April 29, 2012 and October 30, 2011, our excess availability under the ABL Facility was $83.9 million and $87.8 million, respectively. The ABL Facility has a maturity of April 20, 2014 and includes borrowing capacity of up to $25 million for letters of credit and up to $10 million for swingline borrowings. Under the ABL Facility, there were no amounts of borrowings outstanding at both April 29, 2012 and October 30, 2011. In addition, at April 29, 2012 and October 30, 2011, standby letters of credit totaling approximately $9.1 million and $6.4 million, respectively, were issued under the ABL Facility related to certain insurance policies.

On December 3, 2010, we finalized an amendment of our ABL Facility that reduces the unused commitment fee from 1% or 0.75% based on the average daily balance of loans and letters of credit obligations outstanding to an annual rate of 0.5%. The calculation is determined on the amount by which the maximum credit exceeds the average daily principal balance of outstanding loans and letter of credit obligations. Additional customary fees in connection with the ABL Facility also apply. In addition, the amendment reduced the effective interest rate on borrowings, if any, by nearly 40% or 175 basis points. It also relaxes the prohibitions against making restricted payments or paying cash dividends, including on the Convertible Preferred Stock, to allow, in the aggregate, up to $6.5 million of restricted payments or cash dividends each calendar quarter, provided (i) certain excess availability conditions or (ii) certain other excess availability conditions and a fixed charge coverage ratio under the ABL Facility are satisfied. However, these prohibitions are second to the cash restricted payment limitations on the Amended Credit Agreement discussed above.

The obligations of the borrowers under the ABL Facility are guaranteed by us and each direct and indirect domestic subsidiary of the Company (other than any domestic subsidiary that is a foreign subsidiary holding company or a subsidiary of a foreign subsidiary that is insignificant) that is not a borrower under the ABL Facility. Our obligations under certain specified bank products agreements are guaranteed by each borrower and each other direct and indirect domestic subsidiary of the Company and the other guarantors. These guarantees are made pursuant to a guarantee agreement, dated as of October 20, 2009, entered into by the Company and each other guarantor with Wells Fargo Foothill, LLC, as administrative agent.

The obligations under the ABL Facility and the guarantees thereof are secured by a first priority lien on our accounts receivable, inventory, certain deposit accounts, associated intangibles and certain other specified assets of the Company and a second priority lien on the assets securing the term loans under the Amended Credit Agreement on a first-lien basis.

The ABL Facility contains a number of covenants that, among other things, limit or restrict our ability to dispose of assets, incur additional indebtedness, incur guarantee obligations, engage in sale and leaseback transactions, prepay other indebtedness, modify organizational documents and certain other agreements, create restrictions affecting subsidiaries, make dividends and other restricted payments, create liens, make investments, make acquisitions, engage in mergers, change the nature of our business and engage in certain transactions with affiliates.

Under the ABL Facility, a “Dominion Event” occurs if either an event of default is continuing or excess availability falls below certain levels, during which period, and for certain periods thereafter, the administrative agent may apply all amounts in the Company’s, the borrowers’ and the other guarantors’ concentration accounts to the repayment of the loans outstanding under the ABL Facility, subject

10

Table of Contents

to the Intercreditor Agreement. In addition, during such Dominion Event, we are required to make mandatory payments on our ABL Facility upon the occurrence of certain events, including the sale of assets and the issuance of debt, in each case subject to certain limitations and conditions set forth in the ABL Facility.

The ABL Facility includes a minimum fixed charge coverage ratio of one to one, which will apply if we fail to maintain at least $15 million of minimum borrowing capacity. Although our ABL Facility did not require any financial covenant compliance, at April 29, 2012 and October 30, 2011, our fixed charge coverage ratio as of those dates, which is calculated on a trailing twelve month basis, was 3.44 to one and 0.37 to one, respectively.

Loans under the ABL Facility bear interest, at our option, as follows:

(1) Base Rate loans at the Base Rate plus a margin. The margin ranges from 1.50% to 2.00% depending on the quarterly average excess availability under such facility, and

(2) LIBOR loans at LIBOR plus a margin. The margin ranges from 2.50% to 3.00% depending on the quarterly average excess availability under such facility.

During an event of default, loans under the ABL Facility will bear interest at a rate that is 2% higher than the rate otherwise applicable. “Base Rate” is defined as the higher of the Wells Fargo Bank, N.A. prime rate and the overnight Federal Funds rate plus 0.5% and “LIBOR” is defined as the applicable London interbank offered rate adjusted for reserves.

Deferred Financing Costs

At April 29, 2012 and October 30, 2011, the unamortized balance in deferred financing costs was $9.2 million and $11.6 million, respectively.

Insurance Note Payable

The note payable is related to financed insurance premiums. As of April 29, 2012 and October 30, 2011, we had outstanding a note payable in the amount of $1.6 million and $0.3 million, respectively. Insurance premium financings are generally secured by the unearned premiums under such policies.

NOTE 9 — SERIES B CUMULATIVE CONVERTIBLE PARTICIPATING PREFERRED STOCK

The CD&R Equity Investment

On August 14, 2009, the Company entered into an Investment Agreement (as amended, the “Investment Agreement”), by and between the Company and Clayton, Dubilier & Rice Fund VIII, L.P. (“CD&R Fund VIII”), pursuant to which the Company agreed to issue and sell to CD&R Fund VIII, and CD&R Fund VIII agreed to purchase from the Company, for an aggregate purchase price of $250 million (less reimbursement to CD&R Fund VIII or direct payment to its service providers of up to $14.5 million in the aggregate of transaction expenses and a deal fee, paid to Clayton, Dubilier & Rice, Inc., the manager of CD&R Fund VIII, of $8.25 million), 250,000 shares of Convertible Preferred Stock. Pursuant to the Investment Agreement, on October 20, 2009 (the “Closing Date”), the Company issued and sold to CD&R Fund VIII and CD&R Friends & Family Fund VIII, L.P. (the “CD&R Funds”), and the CD&R Funds purchased from the Company, an aggregate of 250,000 Preferred Shares, representing approximately 39.2 million shares of Common Stock or 68.4% of the voting power and Common Stock of the Company on an as-converted basis as of the Closing Date (such purchase and sale, the “CD&R Equity Investment”). At April 29, 2012 and October 30, 2011, the CD&R Funds own 70.6% and 70.1%, respectively, of the voting power and Common Stock of the Company on an as-converted basis.

Certain Terms of the Convertible Preferred Stock

In connection with the consummation of the CD&R Equity Investment, on October 19, 2009 we filed the Certificate of Designations of the Convertible Preferred Stock (the “Certificate of Designations”), setting forth the terms, rights, powers, and preferences, and the qualifications, limitations and restrictions thereof, of the Convertible Preferred Stock.

Liquidation Value. Each Preferred Share has an initial liquidation preference of $1,000.

Rank. The Convertible Preferred Stock ranks senior as to dividend rights, redemption payments and rights upon liquidation to the Common Stock and each other class or series of our equity securities, whether currently issued or to be issued in the future, that by its terms ranks junior to the Convertible Preferred Stock, and junior to each class or series of equity securities of the Company, whether

11

Table of Contents

currently issued or issued in the future, that by its terms ranks senior to the Convertible Preferred Stock. The Company does not have any outstanding securities ranking senior to the Convertible Preferred Stock. Pursuant to the Certificate of Designations, the issuance of any senior securities of the Company requires the approval of the holders of the Convertible Preferred Stock.

Dividends. Dividends on the Convertible Preferred Stock are payable, on a cumulative daily basis, as and if declared by the board of directors, at a rate per annum of 12% of the sum of the liquidation preference of $1,000 per Preferred Share plus accrued and unpaid dividends thereon or at a rate per annum of 8% of the sum of the liquidation preference of $1,000 per Preferred Share plus any accrued and unpaid dividends thereon if paid in cash on the dividend payment date on which such dividends would otherwise compound. If dividends are not paid on the dividend payment date, either in cash or in kind, such dividends compound on the dividend payment date. Members of the board of directors who are not affiliated with the CD&R Funds have the right to choose whether such dividends are paid in cash or in-kind, subject to the conditions of the Amended Credit Agreement and ABL Facility. The Company’s Amended Credit Agreement restricts the payment of cash dividends to 50% of cumulative earnings beginning with the fourth quarter of 2009, and in the absence of accumulated earnings, cash dividends and other cash restricted payments are limited to $14.5 million in the aggregate during the term of the loan, of which we used $11.0 million as of April 29, 2012.

Each quarterly dividend payment on the Convertible Preferred Stock cannot be split between cash and payment-in-kind. The Company’s ABL Facility, among other potentially available baskets, permits the Company to pay cash dividends, including on the Convertible Preferred Stock, up to $6.5 million each calendar quarter, provided (i) certain excess availability conditions or (ii) certain other excess availability conditions and a fixed charge coverage ratio under the ABL Facility are satisfied.

If, at any time after the 30-month anniversary of the Closing Date of October 20, 2009 (i.e., April 20, 2012), the trading price of the Common Stock exceeds $12.75, which is 200% of the initial conversion price of the Convertible Preferred Stock ($6.3740, as adjusted for any stock dividends, splits, combinations or similar events), for each of 20 consecutive trading days (the “Dividend Rate Reduction Event”), the dividend rate (excluding any applicable adjustments as a result of a default) will become 0.00%. However, this does not preclude the payment of default dividends after the 30-month anniversary of the Closing Date. As a result of certain restrictions on dividend payments in the Company’s Amended Credit Agreement and ABL Facility, the dividends for each quarter of fiscal 2010 were paid in-kind, at a pro rata rate of 12% per annum. The dividends for the December 15, 2010 and March 15, 2011 dividend payments were paid in cash and the dividends for the June 15, 2011 dividend payment was paid in-kind at a pro rata rate of 12% per annum. As a result of the two Consent and Waiver Agreements (discussed below), the September 15, 2011 and December 15, 2011 dividend payments were paid in-kind, at a pro rata rate of 8% per annum. See Note 8—Long-term Debt and Note Payable for more information on our Amended Credit Agreement and ABL Facility.

At any time prior to the Dividend Rate Reduction Event, if dividends are not paid in cash on the applicable dividend payment date, the rate at which such dividends are payable will be at least 12% per annum. Therefore, the Company accrues dividends daily based on the 12% rate and if and when the Company determines the dividends will be paid at a different rate due to either cash payment on the applicable dividend payment date or obtaining a waiver, the Company will record a subsequent benefit of the excess 4% accrual upon our board’s declaration of such cash dividend and reverse the beneficial conversion feature charge associated with such accrual. However, we currently cannot pay dividends in cash because the Company’s Amended Credit Agreement currently restricts the payment of cash dividends to 50% of cumulative earnings beginning with the fourth quarter of 2009, and in the absence of accumulated earnings, cash dividends and other cash restricted payments are limited to $14.5 million in the aggregate during the term of the loan, of which we used $11.0 million as of April 29, 2012.

The dividend rate will increase by up to 6% per annum above the rates described in the preceding paragraphs upon and during certain defaults specified in the Certificate of Designations involving the Company’s failure to have a number of authorized and unissued shares of Common Stock reserved and available sufficient for the conversion of all outstanding Preferred Shares. The Company currently has sufficient authorized, unissued and reserved shares of Common Stock to effect the conversion.

On the dividend payment date, the Company has the right to choose whether dividends are paid in cash or in-kind. However, the first dividend payment which was scheduled to be paid on December 15, 2009 in the amount of $4.6 million was required to be paid in cash by the Certificate of Designations but could not be paid in cash based on the terms of the Company’s Amended Credit Agreement and ABL Facility which restricted the Company’s ability to pay cash dividends until the first quarter of fiscal 2011 and until October 20, 2010, respectively. As a result, the dividend for the period up to the December 15, 2009 dividend payment date compounded at a rate of 12% per annum. We currently cannot pay this dividend in cash because the Company’s Amended Credit Agreement restricts the payment of cash dividends to 50% of cumulative earnings beginning with the fourth quarter of 2009, and in the absence of accumulated earnings, cash dividends and other cash restricted payments are limited to $14.5 million in the aggregate during the term of the loan, of which the Company used $11.0 million as of April 29, 2012. Each quarterly dividend payment on the Convertible Preferred Stock cannot be split between cash and payment-in-kind.

12

Table of Contents

In addition to any dividends declared and paid as described in the preceding paragraphs, holders of the outstanding Preferred Shares also have the right to participate equally and ratably, on an as-converted basis, with the holders of shares of Common Stock in all cash dividends and distributions paid on the Common Stock.

On March 15, 2012, the Preferred Dividend Payment Committee of the board of directors declared and paid to the holders of Convertible Preferred Stock, the CD&R Funds, a dividend of 8,924.762 shares of Convertible Preferred Stock at a pro rata rate of 12% per annum for the period from December 16, 2011 to March 15, 2012.

On December 9, 2011, the Company entered into a Mutual Waiver and Consent with the CD&R Funds, under which (1) the CD&R Funds, as the holders of all of the Company’s issued and outstanding Convertible Preferred Stock, agreed to accept a paid-in-kind dividend on their Preferred Shares for the quarterly dividend payment period ended December 15, 2011 computed at the dividend rate of 8% per annum, rather than the dividend rate of 12% per annum provided for in the Certificate of Designations applicable to the Preferred Shares, and (2) the Company waived its right under the Stockholders Agreement with the CD&R Funds to issue up to $5 million of its capital stock without the consent of the CD&R Funds during the fiscal year ending October 28, 2012, subject to certain exceptions. The December 9, 2011 Mutual Waiver and Consent does not extend to dividends on the Convertible Preferred Stock accruing after December 15, 2011 or restrict our issuance of capital stock after October 28, 2012.

In view of the December 9, 2011 Mutual Waiver and Consent, the Preferred Dividend Payment Committee of the board of directors declared and directed the payment of the December 15, 2011 dividend on the Preferred Shares in-kind at the reduced rate of 8% per annum. As a result, a dividend of 5,833.4913 Preferred Shares was paid to the holders of Convertible Preferred Stock for the period from September 16, 2011 to December 15, 2011. As a result of accruing the dividend at the stated 12% rate, and subsequently paying the lower 8% rate, the Company recorded a dividend accrual reversal of $2.9 million in the first quarter of fiscal 2012 related to dividends accrued between September 16, 2011 and December 15, 2011. Similarly, the Company recorded a beneficial conversion feature reversal of $1.1 million in the first quarter of fiscal 2012 related to beneficial conversion feature charges between September 16, 2011 and December 15, 2011 associated with the dividend reduction.

On March 15, 2011, the Preferred Dividend Payment Committee of the board of directors declared and paid to the holders of Convertible Preferred Stock, the CD&R Funds, a $5.5 million cash dividend at a pro rata rate of 8% per annum. As a result of paying an 8% cash dividend, we recorded a dividend accrual reversal of $2.7 million in the second quarter of fiscal 2011 related to dividends accrued in excess of 8% between December 16, 2010 and March 15, 2011. In addition, we reversed the related beneficial conversion feature previously recorded of $8.2 million in the second quarter of fiscal 2011 related to the paid-in-kind dividends accrued between December 16, 2010 and March 15, 2011.

On December 15, 2010, the Preferred Dividend Payment Committee of the board of directors declared and paid to the holders of Convertible Preferred Stock, the CD&R Funds, a $5.55 million cash dividend at the rate of 8% per annum. As a result of paying an 8% cash dividend, we recorded a dividend accrual reversal of $2.5 million in the first quarter of fiscal 2011 related to dividends accrued in excess of 8% between September 16, 2010 and December 15, 2010. In addition, we reversed the related beneficial conversion feature previously recorded of $5.1 million in the first quarter of fiscal 2011 related to the paid-in-kind dividends accrued between September 16, 2010 and December 15, 2010.

Convertibility and Anti-Dilution Adjustments. To the extent that we have authorized but unissued shares of Common Stock, holders of Preferred Shares have the right, at any time and from time to time, at their option, to convert any or all of their Preferred Shares, in whole or in part, into fully paid and non-assessable shares of the Company’s Common Stock at the conversion price set forth in the Certificate of Designations. The number of shares of Common Stock into which a Preferred Share is convertible is determined by dividing the sum of the liquidation preference of $1,000 per Preferred Share and the accrued and unpaid dividends of such share as of the time of conversion by the conversion price in effect at the time of conversion.

The initial conversion price of the Convertible Preferred Stock was equal to $6.3740. The conversion price is subject to adjustment as set forth in the Certificate of Designations and is subject to customary anti-dilution adjustments, including stock dividends, splits, combinations or similar events and issuance of our Common Stock at a price below the then-current market price and, within the first three years after the Closing Date, issuances of our Common Stock below the then applicable conversion price.

Milestone Redemption Right. The Company has the right, at any time on or after the tenth anniversary of the Closing Date, to redeem in whole, but not in part, all then-issued and outstanding shares of Convertible Preferred Stock in accordance with the procedures set forth in the Certificate of Designations. Any holder of Convertible Preferred Stock has the right, at any time on or after the tenth anniversary of the Closing Date, to require that the Company redeem all, but not less than all, of its shares of Convertible Preferred Stock in accordance with the procedures set forth in the Certificate of Designations. In each case, such right (the “Milestone Redemption Right”), is exercisable at a redemption price for each Preferred Share equal to the sum of the liquidation preference of $1,000 per Preferred Share and the accrued and unpaid dividends of such share as of the time of redemption.

13

Table of Contents

Change of Control Redemption Right. Upon certain change of control events specified in the Certificate of Designations, including certain business combinations involving the Company and certain changes to the beneficial ownership of the voting power of the Company, so long as the CD&R Funds do not own 45% or more of the voting power of the Company and directors designated by the CD&R Funds are not entitled to cast a majority of the total number of votes that can be cast by the Company’s board of directors or by the directors constituting the quorum approving or recommending such change of control event, holders of Preferred Shares are able to require redemption by the Company, in whole but not in part, of the Convertible Preferred Stock (1) if redeemed after the fourth anniversary of the Closing Date, at a purchase price equal to the sum of the liquidation value of such Preferred Shares and the accrued and unpaid dividends thereon as of the redemption date or (2) if redeemed prior to the fourth anniversary of the Closing Date, at a purchase price equal to the sum of (a) the liquidation value of such Preferred Shares plus the accrued and unpaid dividends thereon as of the redemption date and (b) a make-whole premium equal to the net present value of the sum of all dividends that would otherwise be payable on and after the redemption date, to and including such fourth anniversary date, assuming that such dividends are paid in cash. In addition, upon change of control events pursuant to the Amended Credit Agreement or the ABL Facility, holders of Preferred Shares are able to require redemption by the Company, in whole but not in part, of the Convertible Preferred Stock, at a purchase price equal to 101% of the sum of the liquidation value of such Preferred Shares and the accrued and unpaid dividends thereon as of the redemption date.

In the event of a merger or other business combination resulting in a change of control in which the holders of shares of our Common Stock receive cash or securities of an unaffiliated entity as consideration for such shares, if the holder of Preferred Shares does not exercise the change of control redemption right described in the paragraph above or is not entitled to the change of control redemption right in connection with such event, such holder will be entitled to receive, pursuant to such merger or business combination, the consideration such holder would have received for its Preferred Shares had it converted such shares immediately prior to the merger or business combination transaction. In the event of a merger or other business combination not resulting in a change of control in which the holders of shares of our Common Stock receive cash or securities of an unaffiliated entity as consideration for such shares, holders of Convertible Preferred Stock shall have the option to exchange their Preferred Shares for shares of the surviving entity’s capital stock having terms, preferences, rights, privileges and powers no less favorable than the terms, preferences, rights, privileges and powers under the Certificate of Designations.

Vote. Holders of Preferred Shares generally are entitled to vote with the holders of the shares of our Common Stock on all matters submitted for a vote of holders of shares of the Company’s Common Stock (voting together with the holders of shares of our Common Stock as one class) and are entitled to a number of votes equal to the number of shares of Common Stock issuable upon conversion of such holder’s Preferred Shares (without any limitations based on our authorized but unissued shares of the Company’s Common Stock) as of the applicable record date for the determination of stockholders entitled to vote on such matters.

Certain matters require the approval of the holders of a majority of the outstanding Preferred Shares, voting as a separate class, including (1) amendments or modifications to the Company’s Certificate of Incorporation, by-laws or the Certificate of Designations, that would adversely affect the terms or the powers, preferences, rights or privileges of the Convertible Preferred Stock, (2) authorization, creation, increase in the authorized amount of, or issuance of any class or series of senior securities or any security convertible into, or exchangeable or exercisable for, shares of senior securities and (3) any increase or decrease in the authorized number of Preferred Shares or the issuance of additional Preferred Shares.

In addition, in the event that the Company fails to fulfill its obligations to redeem the Convertible Preferred Stock in accordance with the terms of the Certificate of Designations following the exercise of the Milestone Redemption Right or change of control redemption rights described above, until such failure is remedied, certain additional actions of the Company shall require the approval of the holders of a majority of the outstanding Preferred Shares, voting as a separate class, including the adoption of an annual budget, the hiring and firing, or the changing of the compensation, of executive officers and the commitment, resolution or agreement to effect any business combination.

Restriction on Dividends on Junior Securities. The Company is prohibited from (i) paying any dividend with respect to our Common Stock or other junior securities, except for ordinary cash dividends in which the Convertible Preferred Stock participates and which are declared, paid or set aside after the base dividend rate for the Convertible Preferred Stock has been reduced to 0.00% as described above and dividends payable solely in shares of our Common Stock or other junior securities, or (ii) repurchasing or redeeming any shares of our Common Stock or other junior securities, unless, in each case, we have sufficient access to lawful funds immediately following such action such that we would be legally permitted to redeem in full all Preferred Shares then outstanding.

Accounting for Convertible Preferred Stock

The Convertible Preferred Stock balance and changes in the carrying amount of the Convertible Preferred Stock are as follows (in thousands):

14

Table of Contents

| Dividends and Accretion |

Convertible Preferred Stock |

|||||||

| Balance as of October 30, 2011 |

$ | 273,950 | ||||||

| Accretion |

688 | |||||||

| Accrued paid-in-kind dividends(1) |

8,837 | |||||||

| Reversal of additional 4% accrued dividends(2) |

(2,917 | ) | ||||||

|

|

|

|||||||

| Subtotal |

6,608 | |||||||

|

|

|

|||||||

| Balance as of January 29, 2012 |

$ | 280,558 | ||||||

| Accretion |

688 | |||||||

| Accrued paid-in-kind dividends(1) |

9,057 | |||||||

|

|

|

|||||||

| Subtotal |

9,745 | |||||||

|

|

|

|||||||

| Balance as of April 29, 2012 |

$ | 290,303 | ||||||

|

|

|

|||||||

| (1) | Dividends are accrued at the 12% rate on a daily basis until the dividend payment date. |

| (2) | The reversal of the additional 4% accrued dividends relates to the period from September 16, 2011 to December 15, 2011. |

In accordance with ASC Topic 815, Derivatives and Hedging, and ASC Topic 480, Distinguishing Liabilities from Equity, we classified the Convertible Preferred Stock as mezzanine equity because the Convertible Preferred Stock (1) can be settled in cash or shares of our Common Stock, (2) contains change of control rights allowing for early redemption, and (3) contains Milestone Redemption Rights which allow the Convertible Preferred Stock to remain outstanding without a stated maturity date.

In addition, the Certificate of Designations, which is the underlying contract of the Convertible Preferred Stock, includes features that are required to be bifurcated and recorded at fair value. We classified the Convertible Preferred Stock as an equity host contract because of (1) the voting rights, (2) the participating dividends on Common Stock and mandatory, cumulative preferred stock dividends, and (3) the Milestone Redemption Right which allows the Convertible Preferred Stock to remain outstanding without a stated maturity date. We then determined that the conditions resulting in the application of the default dividend rate are not clearly and closely related to this equity host contract and we bifurcated and separately recorded these features at fair value. As of both April 29, 2012 and October 30, 2011, the fair value carrying amount of the embedded derivative was $0.1 million.

Because the dividends accrue and accumulate on a daily basis and the amount payable upon redemption of the Convertible Preferred Stock is the liquidation preference plus accrued and unpaid dividends, accrued dividends are recorded into Convertible Preferred Stock.

In accordance with ASC Subtopic 470-20, Debt with Conversion and Other Options, the Convertible Preferred Stock contains a beneficial conversion feature because it was issued with an initial conversion price of $6.3740 and the closing stock price per share of Common Stock just prior to the execution of the CD&R Equity Investment was $12.55. The intrinsic value of the beneficial conversion feature cannot exceed the issuance proceeds of the Convertible Preferred Stock less the cash paid for the deal fee paid to the CD&R Funds manager in connection with the CD&R Equity Investment, and thus was $241.4 million as of October 20, 2009. At April 29, 2012 and October 30, 2011, all of the potentially 48.9 million and 46.6 million shares of Common Stock, respectively, issuable upon conversion of the Preferred Shares, which includes paid-in-kind dividends, were authorized and unissued.

As of April 29, 2012 and October 30, 2011, the Preferred Shares were convertible into 48.9 million and 46.6 million shares of Common Stock, respectively, at an initial conversion price of $6.3740. The Company recorded a $7.9 million and $8.0 million beneficial conversion feature charge, prior to any applicable reversal, in the three month periods ended April 29, 2012 and May 1, 2011, respectively, and $11.9 million and $14.9 million beneficial conversion feature charge, prior to any applicable reversal, in the six month periods ended April 29, 2012 and May 1, 2011, respectively, related to dividends that have accrued and are convertible into shares of Common Stock. As a result of accruing dividends at the stated 12% rate, and subsequently paying the lower 8% rate agreed to in the Mutual Waiver and Consent, we recorded a beneficial conversion feature reversal of $1.1 million in the first quarter of fiscal 2012 related to beneficial conversion feature charges between September 16, 2011 and December 15, 2011 associated with the dividend reduction. As a result of paying an 8% cash dividend in the second quarter of fiscal 2011, we reversed the related beneficial conversion feature previously recorded of $8.2 million in the second quarter of fiscal 2011 related to beneficial conversion feature charges between December 16, 2010 and March 15, 2011. As a result of paying an 8% cash dividend in the first quarter of fiscal 2011, we reversed the related beneficial conversion feature previously recorded of $5.1 million in the first quarter of fiscal 2011 related to beneficial conversion feature charges between September 16, 2010 and December 15, 2010. The Company’s policy is to recognize beneficial conversion feature charges on paid-in-kind dividends based on a daily dividend recognition and the daily closing stock price of our Common Stock.

15

Table of Contents

The Company’s aggregate liquidation preference plus accrued dividends of the Convertible Preferred Stock at April 29, 2012 and October 30, 2011 are as follows (in thousands):

| April 29, 2012 |

October 30, 2011 |

|||||||

| Liquidation preference |

$ | 301,459 | $ | 286,701 | ||||

| Accrued dividends |

10,320 | 10,102 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 311,779 | $ | 296,803 | ||||

|

|

|

|

|

|||||

At April 29, 2012 and October 30, 2011, we had 301,459 and 286,701 Preferred Shares outstanding.

NOTE 10 — FAIR VALUE OF FINANCIAL INSTRUMENTS AND FAIR VALUE MEASUREMENTS

Fair Value of Financial Instruments

The carrying amounts of cash, restricted cash, trade accounts receivable and accounts payable approximate fair value as of April 29, 2012 and October 30, 2011 because of the relatively short maturity of these instruments. The fair values of the remaining financial instruments not currently recognized at fair value on our Consolidated Balance Sheets at the respective fiscal period ends were (in thousands):

| April 29, 2012 | October 30, 2011 | |||||||||||||||

| Carrying Amount |

Fair Value | Carrying Amount |

Fair Value | |||||||||||||

| Amended Credit Agreement |

$ | 128,499 | $ | 127,857 | $ | 130,699 | $ | 127,106 | ||||||||

The fair value of the Amended Credit Agreement was based on recent trading activities of comparable market instruments which are level 2 inputs.

Fair Value Measurements

ASC Subtopic 820-10, Fair Value Measurements and Disclosures, requires us to use valuation techniques to measure fair value that maximize the use of observable inputs and minimize the use of unobservable inputs. These inputs are prioritized as follows:

Level 1: Observable inputs such as quoted prices for identical assets or liabilities in active markets.

Level 2: Other inputs that are observable directly or indirectly, such as quoted prices for similar assets or liabilities or market-corroborated inputs.

Level 3: Unobservable inputs for which there is little or no market data and which require us to develop our own assumptions about how market participants would price the assets or liabilities.

The following is a description of the valuation methodologies used for assets and liabilities measured at fair value. There have been no changes in the methodologies used at April 29, 2012 and October 30, 2011.

Money market: Money market funds have original maturities of three months or less. The original cost of these assets approximates fair value due to their short-term maturity.

Mutual funds: Mutual funds are valued at the closing price reported in the active market in which the mutual fund is traded.

Stocks, options and ETF’s: Stocks, options and ETF’s are valued at the closing price reported in the active market in which the fund is traded.

Foreign currency contracts: The fair value of the foreign currency derivatives are based on a market approach and take into consideration current foreign currency exchange rates and current creditworthiness of us or the counterparty, as applicable.

16

Table of Contents

Assets held for sale: Assets held for sale are valued based on current market conditions, prices of similar assets in similar condition and expected proceeds from the sale of the assets.

Deferred compensation plan liability: Deferred compensation plan liability is comprised of phantom investments in the deferred compensation plan and is valued at the closing price reported in the active market in which the money market, mutual fund or NCI stock phantom investments are traded.

Embedded derivative: The embedded derivative value is based on an income approach in which we used a probability-weighted discounted cash flow model and assigned probabilities for each qualified default event.

The following table summarizes information regarding our financial assets and liabilities that are measured at fair value on a recurring basis as of April 29, 2012, segregated by level of the valuation inputs within the fair value hierarchy utilized to measure fair value (in thousands):

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets: |

||||||||||||||||

| Money market |

$ | 10,000 | $ | — | $ | — | $ | 10,000 | ||||||||

| Short-term investments in deferred compensation plan(1): |

||||||||||||||||

| Money market |

240 | — | — | 240 | ||||||||||||

| Mutual funds — Growth |

630 | — | — | 630 | ||||||||||||

| Mutual funds — Blend |

1,900 | — | — | 1,900 | ||||||||||||

| Mutual funds — Foreign blend |

664 | — | — | 664 | ||||||||||||

| Mutual funds — Fixed income |

— | 556 | — | 556 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total short-term investments in deferred compensation plan |

3,434 | 556 | — | 3,990 | ||||||||||||

| Other investments: |

||||||||||||||||

| Cash |

55 | — | — | 55 | ||||||||||||

| Stocks, options and ETF’s |

373 | — | — | 373 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other investments |

428 | — | — | 428 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

$ | 13,862 | $ | 556 | $ | — | $ | 14,418 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities: |

||||||||||||||||

| Deferred compensation plan liability |

$ | (4,208 | ) | $ | — | $ | — | $ | (4,208 | ) | ||||||

| Foreign currency contracts |

— | (21 | ) | — | (21 | ) | ||||||||||

| Embedded derivative |

— | — | (68 | ) | (68 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total liabilities |

$ | (4,208 | ) | $ | (21 | ) | $ | (68 | ) | $ | (4,297 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Unrealized holding gains (losses) for the three months ended April 29, 2012 and May 1, 2011 were $0.2 million and $0.2 million, respectively. Unrealized holding gains (losses) for the six months ended April 29, 2012 and May 1, 2011 were $0.2 million and $0.3 million, respectively. These unrealized holding gains (losses) are primarily offset by changes in the deferred compensation plan liability. |

The following table summarizes information regarding our financial assets that are measured at fair value on a nonrecurring basis as of April 29, 2012, segregated by level of the valuation inputs within the fair value hierarchy utilized to measure fair value (in thousands):

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets: |

||||||||||||||||

| Assets held for sale(1) |

$ | — | $ | — | $ | 2,500 | 2,500 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

$ | — | $ | — | $ | 2,500 | $ | 2,500 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (1) | Certain assets held for sale are valued at fair value and are measured at fair value on a nonrecurring basis. Assets held for sale are reported at fair value, if, on an individual basis, the fair value of the asset is less than cost. The fair value of assets held for sale is estimated using Level 3 inputs, such as broker quotes for like-kind assets or other market indications of a potential selling value which approximates fair value. As of April 29, 2012, the fair value of one asset group held for sale exceeded that asset group’s cost and carrying value. Accordingly, that asset group held for sale has been excluded from the table as of April 29, 2012. |

17

Table of Contents

The following table summarizes information regarding our financial assets and liabilities that are measured at fair value on a recurring basis as of October 30, 2011, segregated by level of the valuation inputs within the fair value hierarchy utilized to measure fair value (in thousands):

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets: |

||||||||||||||||

| Money market |

$ | 12,837 | $ | — | $ | — | $ | 12,837 | ||||||||

| Short-term investments in deferred compensation plan(1): |

||||||||||||||||

| Money market |

$ | 149 | $ | — | $ | — | $ | 149 | ||||||||

| Mutual funds — Growth |

682 | — | — | 682 | ||||||||||||

| Mutual funds — Blend |

1,798 | — | — | 1,798 | ||||||||||||

| Mutual funds — Foreign blend |

743 | — | — | 743 | ||||||||||||

| Mutual funds — Fixed income |

— | 638 | — | 638 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total short-term investments in deferred compensation plan |

$ | 3,372 | $ | 638 | $ | — | $ | 4,010 | ||||||||

| Other investments: |

||||||||||||||||

| Cash |

45 | — | — | 45 | ||||||||||||

| Stocks, options and ETF’s |

429 | — | — | 429 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other investments |

474 | — | — | 474 | ||||||||||||

| Foreign currency contracts |

— | 42 | — | 42 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total assets |

$ | 16,683 | $ | 680 | $ | — | $ | 17,363 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities: |

||||||||||||||||

| Deferred compensation plan liability |

$ | — | $ | (4,077 | ) | $ | — | $ | (4,077 | ) | ||||||

| Embedded derivative |

— | — | (79 | ) | (79 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total liabilities |

$ | — | $ | (4,077 | ) | $ | (79 | ) | $ | (4,156 | ) | |||||

|

|

|

|

|

|

|

|

|

|||||||||

The following table summarizes information regarding our financial assets that are measured at fair value on a nonrecurring basis as of October 30, 2011, segregated by level of the valuation inputs within the fair value hierarchy utilized to measure fair value (in thousands):