Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Cornerstone Building Brands, Inc. | q32016exhibit32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - Cornerstone Building Brands, Inc. | q32016exhibit32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - Cornerstone Building Brands, Inc. | q32016exhibit31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - Cornerstone Building Brands, Inc. | q32016exhibit31_1.htm |

| EX-10.4 - EXHIBIT 10.4 - Cornerstone Building Brands, Inc. | q32016exhibit10_4.htm |

| EX-10.3 - EXHIBIT 10.3 - Cornerstone Building Brands, Inc. | q32016exhibit10_3.htm |

| EX-10.2 - EXHIBIT 10.2 - Cornerstone Building Brands, Inc. | q32016exhibit10_2.htm |

| EX-10.1 - EXHIBIT 10.1 - Cornerstone Building Brands, Inc. | q32016exhibit10_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One) | |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended July 31, 2016

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-14315

NCI BUILDING SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

Delaware | 76-0127701 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

10943 North Sam Houston Parkway West Houston, TX | 77064 |

(Address of principal executive offices) | (Zip Code) |

(281) 897-7788

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ý |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes ý No

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Common Stock, $.01 par value - 71,230,961 shares as of August 25, 2016.

TABLE OF CONTENTS

PAGE | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 5. | ||

Item 6. | ||

i

PART I — FINANCIAL INFORMATION

Item 1. Unaudited Consolidated Financial Statements.

NCI BUILDING SYSTEMS, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

July 31, 2016 | November 1, 2015 | ||||||

(Unaudited) | |||||||

ASSETS | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 50,710 | $ | 99,662 | |||

Restricted cash | 726 | 682 | |||||

Accounts receivable, net | 175,387 | 166,800 | |||||

Inventories, net | 183,340 | 157,828 | |||||

Deferred income taxes | 31,404 | 27,390 | |||||

Prepaid expenses and other | 38,346 | 31,834 | |||||

Investments in debt and equity securities, at market | 5,885 | 5,890 | |||||

Assets held for sale | 4,256 | 6,261 | |||||

Total current assets | 490,054 | 496,347 | |||||

Property, plant and equipment, net | 244,347 | 257,892 | |||||

Goodwill | 158,106 | 158,026 | |||||

Intangible assets, net | 149,181 | 156,395 | |||||

Other assets | 10,131 | 11,069 | |||||

Total assets | $ | 1,051,819 | $ | 1,079,729 | |||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||

Current liabilities: | |||||||

Note payable | $ | 919 | $ | 513 | |||

Accounts payable | 146,417 | 145,917 | |||||

Accrued compensation and benefits | 65,919 | 62,200 | |||||

Accrued interest | 1,486 | 6,389 | |||||

Accrued income taxes | 5,374 | 9,296 | |||||

Other accrued expenses | 103,593 | 97,309 | |||||

Total current liabilities | 323,708 | 321,624 | |||||

Long-term debt, net | 414,147 | 444,147 | |||||

Deferred income taxes | 24,332 | 20,807 | |||||

Other long-term liabilities | 21,063 | 21,175 | |||||

Total long-term liabilities | 459,542 | 486,129 | |||||

Stockholders’ equity: | |||||||

Common stock, $.01 par value, 100,000,000 shares authorized; 71,545,242 and 74,529,750 shares issued at July 31, 2016 and November 1, 2015, respectively; 71,230,961 and 74,082,324 shares outstanding at July 31, 2016 and November 1, 2015, respectively | 715 | 745 | |||||

Additional paid-in capital | 600,538 | 640,767 | |||||

Accumulated deficit | (321,707 | ) | (353,733 | ) | |||

Accumulated other comprehensive loss, net | (8,330 | ) | (8,280 | ) | |||

Treasury stock, at cost (314,281 and 447,426 shares at July 31, 2016 and November 1, 2015, respectively) | (2,647 | ) | (7,523 | ) | |||

Total stockholders’ equity | 268,569 | 271,976 | |||||

Total liabilities and stockholders’ equity | $ | 1,051,819 | $ | 1,079,729 | |||

See accompanying notes to consolidated financial statements.

1

NCI BUILDING SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

Fiscal Three Months Ended | Fiscal Nine Months Ended | ||||||||||||||

July 31, 2016 | August 2, 2015 | July 31, 2016 | August 2, 2015 | ||||||||||||

Sales | $ | 462,353 | $ | 420,789 | $ | 1,204,614 | $ | 1,103,862 | |||||||

Cost of sales | 334,454 | 319,102 | 899,277 | 852,789 | |||||||||||

Fair value adjustment of acquired inventory | — | 1,000 | — | 2,358 | |||||||||||

Gain on sale of assets and asset recovery | (52 | ) | — | (1,704 | ) | — | |||||||||

Gross profit | 127,951 | 100,687 | 307,041 | 248,715 | |||||||||||

Engineering, selling, general and administrative expenses | 80,414 | 74,520 | 224,912 | 210,424 | |||||||||||

Intangible asset amortization | 2,405 | 5,338 | 7,226 | 11,206 | |||||||||||

Strategic development and acquisition related costs | 819 | 701 | 2,080 | 3,058 | |||||||||||

Restructuring and impairment charges | 778 | 750 | 3,437 | 3,695 | |||||||||||

Income from operations | 43,535 | 19,378 | 69,386 | 20,332 | |||||||||||

Interest income | 62 | 14 | 136 | 53 | |||||||||||

Interest expense | (7,747 | ) | (8,149 | ) | (23,460 | ) | (20,448 | ) | |||||||

Foreign exchange loss | (922 | ) | (610 | ) | (1,088 | ) | (2,021 | ) | |||||||

Gain from bargain purchase | — | — | 1,864 | — | |||||||||||

Other income, net | 414 | 107 | 476 | 439 | |||||||||||

Income (loss) before income taxes | 35,342 | 10,740 | 47,314 | (1,645 | ) | ||||||||||

Provision (benefit) from income taxes | 11,627 | 3,520 | 15,288 | (1,057 | ) | ||||||||||

Net income (loss) | $ | 23,715 | $ | 7,220 | $ | 32,026 | $ | (588 | ) | ||||||

Net income allocated to participating securities | (165 | ) | (60 | ) | (265 | ) | — | ||||||||

Net income (loss) applicable to common shares | $ | 23,550 | $ | 7,160 | $ | 31,761 | $ | (588 | ) | ||||||

Income (loss) per common share: | |||||||||||||||

Basic | $ | 0.32 | $ | 0.10 | $ | 0.44 | $ | (0.01 | ) | ||||||

Diluted | $ | 0.32 | $ | 0.10 | $ | 0.43 | $ | (0.01 | ) | ||||||

Weighted average number of common shares outstanding: | |||||||||||||||

Basic | 73,104 | 73,341 | 72,932 | 73,170 | |||||||||||

Diluted | 73,552 | 74,336 | 73,460 | 73,170 | |||||||||||

See accompanying notes to consolidated financial statements.

2

NCI BUILDING SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(In thousands)

(Unaudited)

Fiscal Three Months Ended | Fiscal Nine Months Ended | ||||||||||||||

July 31, 2016 | August 2, 2015 | July 31, 2016 | August 2, 2015 | ||||||||||||

Comprehensive income (loss): | |||||||||||||||

Net income (loss) | $ | 23,715 | $ | 7,220 | $ | 32,026 | $ | (588 | ) | ||||||

Other comprehensive income, net of tax: | |||||||||||||||

Foreign exchange translation losses and other, net of taxes(1) | (201 | ) | (431 | ) | (50 | ) | (431 | ) | |||||||

Other comprehensive loss | (201 | ) | (431 | ) | (50 | ) | (431 | ) | |||||||

Comprehensive income (loss) | $ | 23,514 | $ | 6,789 | $ | 31,976 | $ | (1,019 | ) | ||||||

(1) | Foreign exchange translation gains (losses) and other are presented net of taxes of $0 in both the three months ended July 31, 2016 and August 2, 2015, and $0 in both the nine months ended July 31, 2016 and August 2, 2015. |

See accompanying notes to consolidated financial statements.

3

NCI BUILDING SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands, except share data)

(Unaudited)

Additional | Accumulated Other | ||||||||||||||||||||||||||||

Common Stock | Paid-In | Accumulated | Comprehensive | Treasury Stock | Stockholders’ | ||||||||||||||||||||||||

Shares | Amount | Capital | Deficit | Loss | Shares | Amount | Equity | ||||||||||||||||||||||

Balance, November 1, 2015 | 74,529,750 | $ | 745 | $ | 640,767 | $ | (353,733 | ) | $ | (8,280 | ) | (447,426 | ) | $ | (7,523 | ) | $ | 271,976 | |||||||||||

Treasury stock purchases | — | — | — | — | — | (4,128,786 | ) | (57,401 | ) | (57,401 | ) | ||||||||||||||||||

Retirement of treasury shares | (4,423,564 | ) | (44 | ) | (62,233 | ) | — | — | 4,423,564 | 62,277 | — | ||||||||||||||||||

Issuance of restricted stock | 80,837 | — | — | — | — | (161,633 | ) | — | — | ||||||||||||||||||||

Stock options exercised | 1,358,219 | 14 | 12,041 | — | — | — | — | 12,055 | |||||||||||||||||||||

Excess tax benefits from share-based compensation arrangements | — | — | 867 | — | — | — | — | 867 | |||||||||||||||||||||

Foreign exchange translation loss and other, net of taxes | — | — | — | — | (50 | ) | — | — | (50 | ) | |||||||||||||||||||

Deferred compensation obligation | — | — | 1,385 | — | — | — | — | 1,385 | |||||||||||||||||||||

Share-based compensation | — | — | 7,711 | — | — | — | — | 7,711 | |||||||||||||||||||||

Net income | — | — | — | 32,026 | — | — | — | 32,026 | |||||||||||||||||||||

Balance, July 31, 2016 | 71,545,242 | $ | 715 | $ | 600,538 | $ | (321,707 | ) | $ | (8,330 | ) | (314,281 | ) | $ | (2,647 | ) | $ | 268,569 | |||||||||||

See accompanying notes to consolidated financial statements.

4

NCI BUILDING SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Fiscal Nine Months Ended | |||||||

July 31, 2016 | August 2, 2015 | ||||||

Cash flows from operating activities: | |||||||

Net income (loss) | $ | 32,026 | $ | (588 | ) | ||

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |||||||

Depreciation and amortization | 32,107 | 38,038 | |||||

Deferred financing cost amortization | 1,431 | 1,006 | |||||

Share-based compensation expense | 7,711 | 7,702 | |||||

Gain from bargain purchase | (1,864 | ) | — | ||||

Gain on sale of assets and asset recovery | (1,704 | ) | (15 | ) | |||

Provision for (recovery of) doubtful accounts | 1,515 | (645 | ) | ||||

Provision for deferred income taxes | 1,573 | 5,625 | |||||

Excess tax benefits from share-based compensation arrangements | (867 | ) | (706 | ) | |||

Changes in operating assets and liabilities, net of effect of acquisitions: | |||||||

Accounts receivable | (10,102 | ) | 13,254 | ||||

Inventories | (25,309 | ) | (1,910 | ) | |||

Income taxes receivable | — | (2,634 | ) | ||||

Prepaid expenses and other | 1,150 | 1,071 | |||||

Accounts payable | 499 | 493 | |||||

Accrued expenses | 2,550 | (22,106 | ) | ||||

Other, net | (117 | ) | 6 | ||||

Net cash provided by operating activities | 40,599 | 38,591 | |||||

Cash flows from investing activities: | |||||||

Acquisitions, net of cash acquired | (4,343 | ) | (247,123 | ) | |||

Capital expenditures | (15,140 | ) | (15,330 | ) | |||

Proceeds from sale of property, plant and equipment | 5,479 | 28 | |||||

Net cash used in investing activities | (14,004 | ) | (262,425 | ) | |||

Cash flows from financing activities: | |||||||

Deposit of restricted cash | (44 | ) | — | ||||

Proceeds from stock options exercised | 12,055 | 354 | |||||

Issuance of debt | — | 250,000 | |||||

Payments on term loan | (30,000 | ) | (31,240 | ) | |||

Payments on note payable | (974 | ) | (1,103 | ) | |||

Payment of financing costs | — | (9,218 | ) | ||||

Excess tax benefits from share-based compensation arrangements | 867 | 706 | |||||

Purchases of treasury stock | (57,401 | ) | (3,273 | ) | |||

Net cash (used in) provided by financing activities | (75,497 | ) | 206,226 | ||||

Effect of exchange rate changes on cash and cash equivalents | (50 | ) | (766 | ) | |||

Net decrease in cash and cash equivalents | (48,952 | ) | (18,374 | ) | |||

Cash and cash equivalents at beginning of period | 99,662 | 66,651 | |||||

Cash and cash equivalents at end of period | $ | 50,710 | $ | 48,277 | |||

See accompanying notes to consolidated financial statements.

5

NCI BUILDING SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

July 31, 2016

(Unaudited)

NOTE 1 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

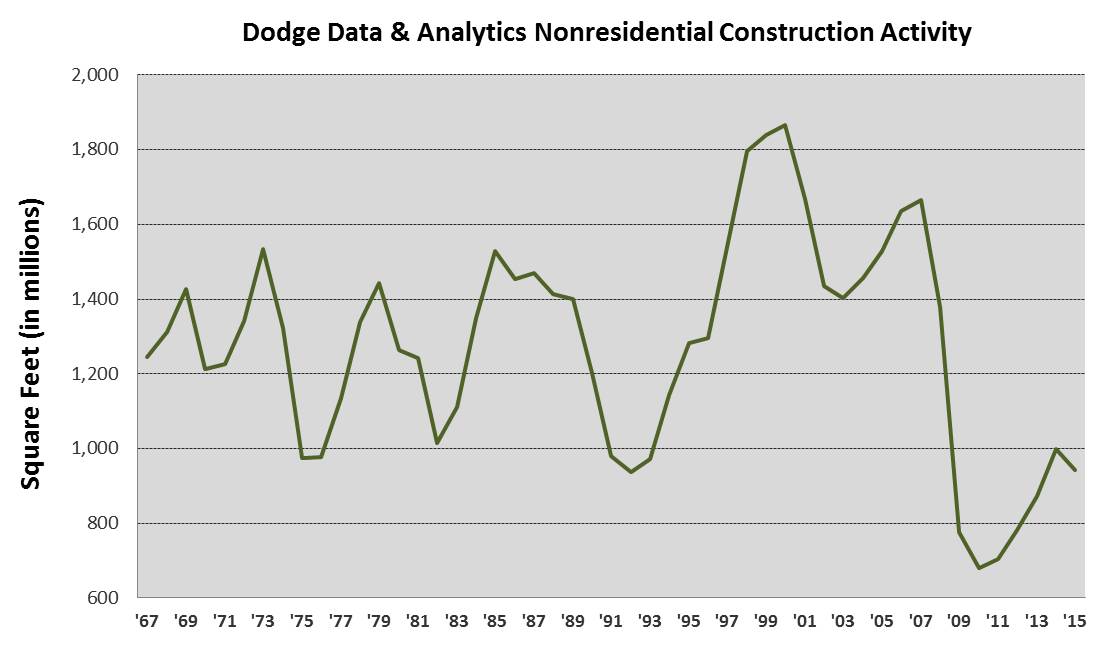

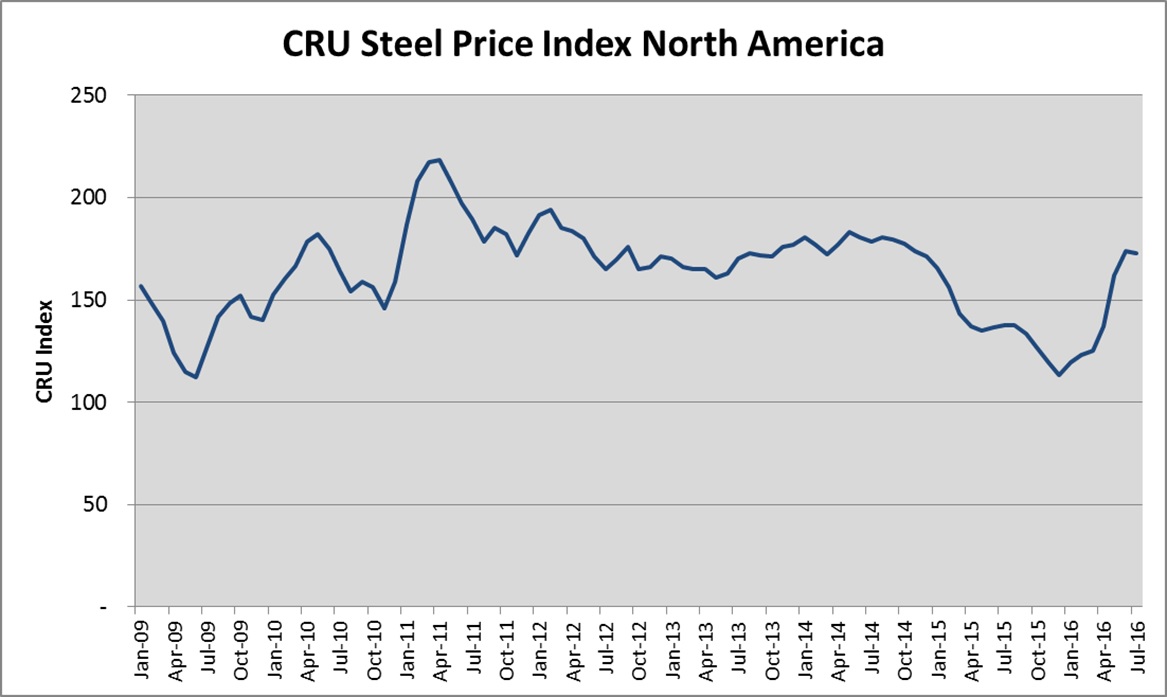

The accompanying unaudited consolidated financial statements for NCI Building Systems, Inc. (together with its subsidiaries, unless otherwise indicated, the “Company,” “NCI,” “we,” “us” or “our”) have been prepared in accordance with generally accepted accounting principles for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, the unaudited consolidated financial statements included herein contain all adjustments, which consist of normal recurring adjustments, necessary to fairly present our financial position, results of operations and cash flows for the periods indicated. Operating results for the fiscal three and nine month periods ended July 31, 2016 are not necessarily indicative of the results that may be expected for the fiscal year ending October 30, 2016. Our sales and earnings are subject to both seasonal and cyclical trends and are influenced by general economic conditions, interest rates, the price of steel relative to other building materials, the level of nonresidential construction activity, roof repair and retrofit demand and the availability and cost of financing for construction projects.

For further information, refer to the consolidated financial statements and footnotes thereto included in our Annual Report on Form 10-K for the fiscal year ended November 1, 2015 filed with the Securities and Exchange Commission (the “SEC”) on December 22, 2015.

Reporting Periods

We use a four-four-five week calendar each quarter with our fiscal year end being on the Sunday closest to October 31. The year end for fiscal 2016 is October 30, 2016.

Insurance Recoveries

Involuntary conversions result from the loss of an asset because of an unforeseen event (e.g., destruction due to fire). Some of these events are insurable and result in property damage insurance recovery. Amounts the Company receives from insurance carriers are net of any deductibles related to the covered event. The Company records a receivable from insurance to the extent it recognizes a loss from an involuntary conversion event and the likelihood of recovering such loss is deemed probable at the balance sheet date. To the extent that any of the Company’s insurance claim receivables are later determined not probable of recovery (e.g., due to new information), such amounts are expensed. The Company recognizes gains on involuntary conversions when the amount received from insurers exceeds the net book value of the impaired asset(s). In addition, the Company does not recognize a gain related to insurance recoveries until the contingency related to such proceeds has been resolved, through either receipt of a non-refundable cash payment from the insurers or by execution of a binding settlement agreement with the insurers that clearly states that a non-refundable payment will be made. To the extent that an asset is rebuilt or new assets are acquired, the associated expenditures are capitalized, as appropriate, in the consolidated balance sheets and presented as capital expenditures in the Company’s consolidated statements of cash flows. With respect to business interruption insurance claims, the Company recognizes income only when non-refundable cash proceeds are received from insurers, which are presented in the Company’s consolidated statements of operations as a component of gross profit or operating income and in the consolidated statements of cash flows as an operating activity.

In June 2016, the Company experienced a fire at a facility in the metal components segment. We estimated that fixed assets with a net book value of approximately $6.7 million were impaired as a result of the fire. We recorded an insurance receivable of $6.7 million on the consolidated balance sheet in prepaid and other assets as an offset to the estimated loss on involuntary conversion of the fixed assets as of July 31, 2016, as we determined the insurance recovery was probable. We subsequently received cash proceeds from insurers in August 2016 in full satisfaction of the insurance receivable.

6

NOTE 2 — ACQUISITIONS

Fiscal 2016 acquisition

On November 3, 2015, we acquired manufacturing operations in Hamilton, Ontario, Canada for cash consideration of $2.2 million, net of post-closing working capital adjustments. This business allows us to service customers more competitively within the Canadian and Northeastern United States insulated metal panel (“IMP”) markets. Because the business was acquired from a seller in connection with a divestment required by a regulatory authority, the fair value of net assets acquired exceeded the purchase consideration by $1.9 million, which was recorded as a non-taxable gain from bargain purchase in the unaudited consolidated statements of operations during the first quarter of fiscal 2016.

The fair values of the assets acquired and liabilities assumed as part of this acquisition as of November 3, 2015, as determined in accordance with ASC Topic 805, were as follows (in thousands):

November 3, 2015 | ||||

Current assets | $ | 307 | ||

Property, plant and equipment | 4,810 | |||

Assets acquired | 5,117 | |||

Current liabilities assumed | 380 | |||

Fair value of net assets acquired | 4,737 | |||

Total cash consideration transferred | 2,201 | |||

Deferred tax liabilities | 672 | |||

Gain from bargain purchase | $ | (1,864 | ) | |

The results of operations for this business are included in our metal components segment. Pro forma financial information and other disclosures for this acquisition have not been presented as it was not material to the Company’s financial position or reported results.

Fiscal 2015 acquisition

On January 16, 2015, NCI Group, Inc., a wholly-owned subsidiary of the Company, and Steelbuilding.com, LLC, a wholly owned subsidiary of NCI Group, Inc., completed the acquisition of CENTRIA (the “CENTRIA Acquisition”), a Pennsylvania general partnership (“CENTRIA”), pursuant to the terms of the Interest Purchase Agreement, dated November 7, 2014 (“Interest Purchase Agreement”) with SMST Management Corp., a Pennsylvania corporation, Riverfront Capital Fund, a Pennsylvania limited partnership, and CENTRIA. NCI acquired all of the general partnership interests of CENTRIA in exchange for $255.8 million in cash, including cash acquired of $8.7 million. The purchase price was subject to a post-closing adjustment to net working capital as provided in the Interest Purchase Agreement, which we settled during the first quarter of fiscal 2016 for additional cash consideration of approximately $2.1 million payable to the seller, which approximated the amount we previously accrued. The purchase price was funded through the issuance of $250.0 million of new indebtedness. See Note 12 — Long-Term Debt and Note Payable. CENTRIA is now an indirect, wholly-owned subsidiary of NCI.

Accordingly, the results of CENTRIA’s operations from January 16, 2015 are included in our consolidated financial statements. For the nine months ended July 31, 2016 and the period from January 16, 2015 to August 2, 2015, CENTRIA contributed revenue of $170.2 million and $121.1 million and operating income (loss) of $8.4 million and $(3.7) million, respectively. CENTRIA is a leader in the design, engineering and manufacturing of architectural IMP wall and roof systems and a provider of integrated coil coating services for the nonresidential construction industry. CENTRIA operates four production facilities in the United States and a manufacturing facility in China.

We report on a fiscal year that ends on the Sunday closest to October 31. CENTRIA previously reported on a calendar year that ended December 31. In accordance with ASC Topic 805, the unaudited pro forma financial information presented below for the nine month period ended August 2, 2015 assumes the acquisition was completed on November 4, 2013, the first day of fiscal year 2014.

This unaudited pro forma financial information does not necessarily represent what would have occurred if the transaction had taken place on the date presented and should not be taken as representative of our future consolidated results of operations. The unaudited pro forma financial information includes adjustments for interest expense to match the new capital structure, amortization expense for identified intangibles, and depreciation expense based on the fair value and estimated lives of acquired property, plant and equipment. In addition, acquisition related costs and $16.1 million of transaction costs incurred by the seller

7

are excluded from the unaudited pro forma financial information. The pro forma information does not reflect any expected synergies or expense reductions that may result from the acquisition.

The following table shows our unaudited financial information and unaudited pro forma financial information for the nine month periods ended July 31, 2016 and August 2, 2015, respectively (in thousands, except per share amounts):

(Unaudited) | Pro Forma (Unaudited) | ||||||

Fiscal Nine Months Ended | |||||||

July 31, 2016 | August 2, 2015 | ||||||

Sales | $ | 1,204,614 | $ | 1,148,348 | |||

Net income applicable to common shares | 31,761 | 785 | |||||

Income per common share: | |||||||

Basic | $ | 0.44 | $ | 0.01 | |||

Diluted | $ | 0.43 | $ | 0.01 | |||

The following table summarizes the fair values of the assets acquired and liabilities assumed as part of the CENTRIA Acquisition as of January 16, 2015 as determined in accordance with ASC Topic 805. The fair value of all assets acquired and liabilities assumed were finalized during the first quarter of fiscal 2016, including certain contingent assets and liabilities and the post-closing working capital adjustment, which did not result in any material adjustments during the first quarter of fiscal 2016. As we continue to integrate CENTRIA into our existing operations, we may identify integration charges that would be required to be recognized.

(In thousands) | January 16, 2015 | |||

Cash | $ | 8,718 | ||

Current assets, excluding cash | 74,725 | |||

Property, plant and equipment | 34,127 | |||

Intangible assets | 128,280 | |||

Assets acquired | 245,850 | |||

Current liabilities | 61,869 | |||

Other long-term liabilities | 8,893 | |||

Liabilities assumed | 70,762 | |||

Fair value of net assets acquired | 175,088 | |||

Total cash consideration transferred | 257,927 | |||

Goodwill | $ | 82,839 | ||

The amount allocated to intangible assets was attributed to the following categories (in thousands):

Useful Lives | |||||

Backlog | $ | 8,400 | 9 months | ||

Trade names | 13,980 | 15 years | |||

Customer lists and relationships | 105,900 | 20 years | |||

$ | 128,280 | ||||

These intangible assets are amortized on a straight-line basis, which is presented in intangible asset amortization in our consolidated statements of operations. The backlog intangible asset was fully amortized during fiscal 2015. We also recorded a step-up in inventory fair value of approximately $2.4 million in fiscal 2015, which was recognized as an expense in fair value adjustment of acquired inventory in our consolidated statements of operations upon the sale of the related inventory.

The excess of the purchase price over the fair values of assets acquired and liabilities assumed was allocated to goodwill. The intention of this transaction was to strengthen our position as a fully integrated supplier to the nonresidential building products industry, by enhancing our existing portfolio of cold storage and commercial and industrial solutions, expanding our capabilities into high-end insulated metal panels and contributing specialty continuous metal coil coating capabilities. We believe the transaction will result in revenue synergies to our existing businesses, as well as improvements in supply chain efficiency, including alignment of purchase terms and pricing optimization. We include the results of CENTRIA in the metal components segment. Goodwill of $73.6 million and $9.1 million was recorded in our metal components segment and engineered building systems segment,

8

respectively, based on expected synergies pertaining to these segments from the CENTRIA Acquisition. Additionally, because CENTRIA was treated as a partnership for tax purposes, the tax basis of the acquired assets and liabilities has been adjusted to their fair value and goodwill will be deductible for tax purposes.

NOTE 3 — ACCOUNTING PRONOUNCEMENTS

Adopted Accounting Pronouncements

In April 2014, the FASB issued ASU 2014-08, Presentation of Financial Statements (Topic 205) and Property, Plant, and Equipment (Topic 360): Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity. ASU 2014-08 changes the requirement for reporting discontinued operations. A disposal of a component of an entity or a group of components of an entity will be required to be reported in discontinued operations if the disposal represents a strategic shift that has or will have a major effect on an entity’s operations and financial results when the entity or group of components of an entity meets the criteria to be classified as held for sale or when it is disposed of by sale or other than by sale. The update also requires additional disclosures about discontinued operations, a disposal of an individually significant component of an entity that does not qualify for discontinued operations presentation in the financial statements, and an entity’s significant continuing involvement with a discontinued operation. We adopted ASU 2014-08 prospectively in our first quarter in fiscal 2016. The adoption of ASU 2014-08 did not have a material impact on our consolidated financial statements.

Recent Accounting Pronouncements

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606). ASU 2014-09 supersedes the revenue recognition requirements in ASC Topic 605, Revenue Recognition, and most industry-specific guidance. The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The FASB has also issued ASUs 2016-08 and 2016-10 to clarify guidance with respect to principal versus agent considerations, the identification of performance obligations, and licensing. These ASUs are effective for our fiscal year ending November 3, 2019, including interim periods within that fiscal year, and will be adopted using either a full or modified retrospective approach. We are currently assessing the potential effects of these changes to our consolidated financial statements.

In June 2014, the FASB issued ASU 2014-12, Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period. ASU 2014-12 requires that a performance target that affects vesting and could be achieved after the requisite service period be treated as a performance condition. A reporting entity should apply existing guidance in FASB Accounting Standards Codification 718, Compensation — Stock Compensation, as it relates to such awards. ASU 2014-12 is effective for our first quarter in fiscal 2017, with early adoption permitted. We do not expect that the adoption of this guidance will have a material impact on our consolidated financial statements.

In January 2015, the FASB issued ASU 2015-01, Income Statement — Extraordinary and Unusual Items (Subtopic 225-20): Simplifying Income Statement Presentation by Eliminating the Concept of Extraordinary Items. ASU 2015-01 eliminates from U.S. GAAP the concept of extraordinary items. The guidance is effective for our fiscal year ending October 29, 2017, including interim periods within that fiscal year. A reporting entity may apply the amendments prospectively. We do not expect that the adoption of this guidance will have a material impact on our consolidated financial statements.

In April 2015, the FASB issued ASU 2015-03, Interest - Imputation of Interest (Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs. ASU 2015-03 requires debt issuance costs related to a recognized debt liability be presented on the balance sheet as a direct deduction from the carrying amount of the related debt liability instead of being presented as a separate asset. In circumstances where the costs are incurred before the debt liability is recorded, the costs will be reported on the balance sheet as an asset until the debt liability is recorded. Debt disclosures will include the face amount of the debt liability and the effective interest rate. The update requires retrospective application and is effective for our fiscal year ending October 29, 2017, including interim periods within that fiscal year. In August 2015, FASB issued ASU 2015-15, Interest - Imputation of Interest (Subtopic 835-30) - Presentation and Subsequent Measurement of Debt Issuance Costs Associated with Line-of-Credit Arrangements (Amendments to SEC Paragraphs Pursuant to Staff Announcement at June 18, 2015 EITF Meeting), to provide further clarification to ASU 2015-03 as it relates to the presentation and subsequent measurement of debt issuance costs associated with line of credit arrangements. Upon adoption of this guidance, we expect to reclassify approximately $8 million in deferred financing costs as a reduction of the carrying amount of the debt liability.

In April 2015, the FASB issued ASU 2015-05, Intangibles — Goodwill and Other — Internal-Use Software (Subtopic 350-40): Customer’s Accounting for Fees Paid in a Cloud Computing Arrangement. ASU 2015-05 provides guidance to customers about whether a cloud computing arrangement includes a software license. If a cloud computing arrangement includes a software license,

9

the guidance specifies that the customer should account for the software license element of the arrangement consistent with the acquisition of other software licenses. ASU 2015-05 further specifies that the customer should account for a cloud computing arrangement as a service contract if the arrangement does not include a software license. The guidance is effective for our fiscal year ending October 29, 2017, including interim periods within that fiscal year. We are currently assessing the impact of this guidance on our consolidated financial statements.

In July 2015, the FASB issues ASU 2015-11, Inventory (Topic 330): Simplifying the Measurement of Inventory. ASU 2015-11 requires that inventory that has historically been measured using first-in, first-out (FIFO) or average cost method should now be measured at the lower of cost and net realizable value. The update requires prospective application and is effective for our fiscal year ending October 28, 2018, including interim periods within that fiscal year. We do not expect that the adoption of this guidance will have a material impact on our consolidated financial statements.

In November 2015, the FASB issued ASU 2015-17, Balance Sheet Classification of Deferred Taxes. ASU 2015-17 requires all deferred tax assets and liabilities to be presented on the balance sheet as noncurrent. ASU 2015-17 is effective for our fiscal year ending October 28, 2018, including interim periods within that fiscal year. Upon adoption, we will present the net deferred tax assets as noncurrent and reclassify any current deferred tax assets and liabilities in our consolidated financial position on a retrospective basis.

In February 2016, the FASB issued ASU 2016-02, Leases, which will require lessees to record most leases on the balance sheet and modifies the classification criteria and accounting for sales-type leases and direct financing leases for lessors. ASU 2016-02 is effective for our fiscal year ending November 1, 2020, including interim periods within that fiscal year. The guidance requires entities to use a modified retrospective approach for leases that exist or are entered into after the beginning of the earliest comparative period in the financial statements. We are evaluating the impact that the adoption of this guidance will have on our consolidated financial statements.

In March 2016, the FASB issued ASU 2016-09, Improvements to Employee Share-Based Payment Accounting, which is intended to simplify certain aspects of the accounting for share-based payment award transactions, including income tax effects when awards vest or settle, repurchase of employees’ shares to satisfy statutory tax withholding obligations, an option to account for forfeitures as they occur, and classification of certain amounts on the statement of cash flows. ASU 2016-09 is effective for our fiscal year ending October 28, 2018, including interim periods within that fiscal year. We are evaluating the impact that the adoption of this ASU will have on our consolidated financial statements.

In June 2016, the FASB issued ASU 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. This ASU requires an entity to measure all expected credit losses for financial assets, including trade receivables, held at the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts. Entities will now incorporate forward-looking information based on expected losses to estimate credit losses. ASU 2016-13 is effective for our fiscal year ending October 31, 2021, including interim periods within that fiscal year. We are evaluating the impact that the adoption of this ASU will have on our consolidated financial position, result of operations and cash flows.

NOTE 4 —RESTRUCTURING AND ASSET IMPAIRMENTS

As part of the plans developed in the fourth quarter of fiscal 2015 to improve cost efficiency and optimize our combined manufacturing footprint, given the Company’s recent acquisitions and restructuring efforts, we incurred severance related costs of $0.8 million, including $0.1 million and $0.3 million in the engineered building systems segment and metal components segment, respectively, during the three months ended July 31, 2016. For the nine months ended July 31, 2016, we incurred severance related costs of $3.4 million, including $0.8 million and $1.2 million in the engineered building systems segment and metal components segment, respectively, and the remaining amount at corporate.

The following table summarizes our restructuring plan costs and charges related to the restructuring plans during the three and nine months ended July 31, 2016 (in thousands), which are recorded in restructuring and impairment charges in the Company’s consolidated statements of operations:

10

Fiscal Three Months Ended | Fiscal Nine Months Ended | ||||||||||||||

July 31, 2016 | July 31, 2016 | Cost Incurred To Date (since inception) | Remaining Anticipated Cost | Total Anticipated Cost | |||||||||||

General severance | $ | 725 | $ | 2,658 | $ | 6,545 | * | * | |||||||

Plant closing severance | 53 | 149 | 1,724 | * | * | ||||||||||

Asset impairments | — | — | 5,844 | * | * | ||||||||||

Other restructuring costs | — | 630 | 630 | * | * | ||||||||||

Total restructuring costs | $ | 778 | $ | 3,437 | $ | 14,743 | * | * | |||||||

* | We expect to fully execute our plans in phases over the next 6 months to 24 months and estimate that we will incur future additional restructuring charges associated with these plans. We are unable at this time to make a good faith determination of cost estimates, or ranges of cost estimates, associated with future phases of these plans. |

The following table summarizes our severance liability and cash payments made pursuant to the restructuring plans from inception through July 31, 2016 (in thousands):

General Severance | Plant Closing Severance | Total | |||||||||

Balance at November 2, 2014 | $ | — | $ | — | $ | — | |||||

Costs incurred | 3,887 | 1,575 | 5,462 | ||||||||

Cash payments | (2,941 | ) | (1,575 | ) | (4,516 | ) | |||||

Accrued severance(1) | 739 | — | 739 | ||||||||

Balance at November 1, 2015 | $ | 1,685 | $ | — | $ | 1,685 | |||||

Costs incurred(1) | 1,997 | 149 | 2,146 | ||||||||

Cash payments | (3,390 | ) | (149 | ) | (3,539 | ) | |||||

Balance at July 31, 2016 | $ | 292 | $ | — | $ | 292 | |||||

(1) | During the second and fourth quarters of fiscal 2015, we entered into transition and separation agreements with certain executive officers. Each terminated executive officer was entitled to severance benefit payments issuable in two installments. The termination benefits were measured initially at the separation dates based on the fair value of the liability as of the termination date and were recognized ratably over the future service period. Costs incurred during the nine months ended July 31, 2016 exclude $0.7 million of amortization expense associated with these termination benefits. |

NOTE 5 — RESTRICTED CASH

We have entered into a cash collateral agreement with PNC Bank to backstop existing CENTRIA letters of credit until they expire. The restricted cash is held in a bank account with PNC Bank as the secured party. As of July 31, 2016, we had restricted cash in the amount of approximately $0.7 million as collateral related to our letters of credit for international projects with CENTRIA, exclusive of letters of credit under our Amended ABL Facility. See Note 12 — Long-Term Debt and Note Payable for more information on the material terms of our Amended ABL Facility. Restricted cash as of July 31, 2016 is classified as current as the underlying letters of credit expire within one year of the respective balance sheet date. Any renewal or replacement of the CENTRIA letters of credit is expected to occur under our Amended ABL Facility.

11

NOTE 6 — INVENTORIES

The components of inventory are as follows (in thousands):

July 31, 2016 | November 1, 2015 | ||||||

Raw materials | $ | 135,812 | $ | 109,455 | |||

Work in process and finished goods | 47,528 | 48,373 | |||||

Inventories, net | $ | 183,340 | $ | 157,828 | |||

NOTE 7 — ASSETS HELD FOR SALE

We record assets held for sale at the lower of the carrying value or fair value less costs to sell. The following criteria are used to determine if property is held for sale: (i) management has the authority and commits to a plan to sell the property; (ii) the property is available for immediate sale in its present condition; (iii) there is an active program to locate a buyer and the plan to sell the property has been initiated; (iv) the sale of the property is probable within one year; (v) the property is being actively marketed at a reasonable sale price relative to its current fair value; and (vi) it is unlikely that the plan to sell will be withdrawn or that significant changes to the plan will be made.

In determining the fair value of the assets less cost to sell, we consider factors including current sales prices for comparable assets in the area, recent market analysis studies, appraisals and any recent legitimate offers. If the estimated fair value less cost to sell of an asset is less than its current carrying value, the asset is written down to its estimated fair value less cost to sell. During the third quarter of fiscal 2016, we reclassified $1.6 million from property, plant and equipment to assets held for sale for a facility in our engineering building systems segment that met the held for sale criteria. The total carrying value of assets held for sale (primarily representing idled facilities in our engineered building systems segment) was $4.3 million and $6.3 million as of July 31, 2016 and November 1, 2015, respectively. All of these assets continued to be actively marketed for sale at July 31, 2016.

During the nine months ended July 31, 2016, we sold certain idled facilities in our engineered building systems segment, along with related equipment, which previously had been classified as held for sale. In connection with the sales of these assets, during the three and nine months ended July 31, 2016, we received net cash proceeds of $0.8 million and $5.5 million, respectively, and recognized net gains of $0.1 million and $1.7 million, respectively, which are included in gain on sale of assets and asset recovery in the unaudited consolidated statements of operations.

Due to uncertainties in the estimation process, it is reasonably possible that actual results could differ from the estimates used in our historical analysis. Our assumptions about property sales prices require significant judgment because the current market is highly sensitive to changes in economic conditions. We calculated the estimated fair values of assets held for sale based on current market conditions and assumptions made by management, which may differ from actual results and may result in impairments if market conditions deteriorate.

NOTE 8 — SHARE-BASED COMPENSATION

Restricted Stock and Performance Awards

Our 2003 Long-Term Stock Incentive Plan (“Incentive Plan”) is an equity-based compensation plan that allows us to grant a variety of types of awards, including stock options, restricted stock, restricted stock units, stock appreciation rights, performance share units (“PSUs”), phantom stock awards, long-term incentive awards with performance conditions (“Performance Share Awards”) and cash awards. As of July 31, 2016, and for all periods presented, our share-based awards under this plan have consisted of restricted stock grants, PSUs and stock option grants, none of which can be settled through cash payments, and Performance Share Awards. Both our stock options and restricted stock awards are subject only to vesting requirements based on continued employment at the end of a specified time period and typically vest in annual increments over one to four years or earlier upon death, disability or a change of control. However, our annual restricted stock awards issued prior to December 15, 2013 also vest upon attainment of age 65 and, only in the case of certain special one-time restricted stock awards, a portion vest on termination without cause or for good reason, as defined by the agreements governing such awards. Restricted stock awards issued after December 15, 2013 do not vest upon attainment of age 65, as provided by the agreements governing such awards. The vesting of our Performance Share Awards is described below.

In December 2015, we granted long-term incentive awards, with a three-year performance period, to our senior executives (“2015 Executive Awards”). 40% of the value of the long-term incentive awards consists of time-based restricted stock units and 60% of the value of the award consists of PSUs. The restricted stock units are time-vesting based on continued employment, with

12

one-third of the restricted stock units vesting on each of the first, second and third anniversaries of the grant date. The PSUs vest based on the achievement of performance goals and continued employment at the end of the three-year performance period. The PSU performance goals are based on three metrics: (1) cumulative free cash flow (weighted 40%); (2) cumulative earnings per share (weighted 40%); and (3) total shareholder return (weighted 20%), in each case during the performance period. The number of shares that may be received upon the vesting of the PSUs will depend upon the satisfaction of the performance goals, up to a maximum of 200% of the target number of the PSUs. The PSUs vest pro rata if an executive’s employment terminates prior to the end of the performance period due to death, disability, or termination by NCI without cause or by the executive for good reason. If an executive’s employment terminates for any other reason prior to the end of the performance period, all outstanding unvested PSUs, whether earned or unearned, will be forfeited and cancelled. If a change in control of NCI occurs prior to the end of the performance period, the PSU payout will be calculated and paid assuming that the maximum benefit had been achieved. If an executive’s employment terminates due to death or disability while any of the restricted stock units are unvested, then all of the executive’s unvested restricted stock units will become vested. If an executive’s employment is terminated for any other reason, the executive’s unvested restricted stock units will be forfeited. If a change in control of NCI occurs prior to the end of the performance period, the restricted stock units fully vest.

The fair value of the 2015 Executive Awards is based on the Company’s stock price as of the grant date. A portion of the compensation cost of the 2015 Executive Awards is based on the probable outcome of the performance conditions associated with the respective shares, as determined by management. During the nine months ended July 31, 2016 and August 2, 2015, we granted PSUs with a fair value of approximately $5.2 million and $3.7 million, respectively.

The fair value of restricted stock units classified as equity awards is based on the Company’s stock price as of the date of grant. During the nine months ended July 31, 2016 and August 2, 2015, we granted time-based restricted stock units with a fair value of $4.2 million, representing 328,780 shares, and $6.6 million, representing 389,323 shares, respectively.

Also, in December 2015, we granted Performance Cash and Share Awards to certain key employees that will be paid 50% in cash and 50% in stock (“2015 Key Employee Awards”). The amount of cash and number of shares that may be received upon the vesting of these awards will be based on the achievement of free cash flow and earnings per share targets over a three-year performance period. The 2015 Key Employee Awards vest three years from the grant date and will be earned based on the performance against the pre-established targets for the requisite service period. A key employee’s awards also vest in full upon death, disability or a change of control, and a pro-rated portion of the key employee’s awards may vest on termination without cause or after reaching normal retirement age prior to the vesting date, as defined by the agreements governing such awards. The fair value of the 2015 Key Employee Awards is based on the Company’s stock price as of the grant date. Compensation cost is recorded based on the probable outcome of the performance conditions associated with the shares, as determined by management. During the nine months ended July 31, 2016 and August 2, 2015, we granted awards to key employees with an equity fair value of $2.4 million and $1.5 million and a cash value of $2.1 million and $1.7 million, respectively.

During the nine month periods ended July 31, 2016 and August 2, 2015, we also granted 28,535 and 10,543 stock options, respectively. The grant date fair value of options granted during the nine month periods ended July 31, 2016 and August 2, 2015 was $5.38 and $7.91, respectively. The Company received cash proceeds of $10.7 million and $12.1 million from exercises of 1,202,885 and 1,358,219 stock options during the three and nine month periods ended July 31, 2016, respectively.

During the nine month periods ended July 31, 2016 and August 2, 2015, we recorded share-based compensation expense for all awards of $7.7 million and $7.7 million, respectively.

Deferred Compensation

On February 26, 2016, the Company amended its Deferred Compensation Plan (“Plan”), with an effective date of January 31, 2016, to require that amounts deferred into the Company Stock Fund remain invested in the Company Stock Fund until distribution. In accordance with the terms of the Plan, the deferred compensation obligation related to the Company’s stock may only be settled by the delivery of a fixed number of the Company’s common shares held on the participant’s behalf. As a result, we have a deferred compensation obligation of $1.4 million related to the Company Stock Fund that is recorded within equity in additional paid-in capital on the consolidated balance sheet as of July 31, 2016. Subsequent changes in the fair value of the deferred compensation obligation classified within equity are not recognized. Additionally, the Company currently holds 144,857 shares in treasury shares, relating to deferred, vested 2012 PSU awards, until participants are eligible to receive benefits under the terms of the plan.

13

NOTE 9 — EARNINGS (LOSS) PER COMMON SHARE

Basic earnings (loss) per common share is computed by dividing net income (loss) allocated to common shares by the weighted average number of common shares outstanding. Diluted earnings per common share, if applicable, considers the dilutive effect of common stock equivalents. The reconciliation of the numerator and denominator used for the computation of basic and diluted earnings (loss) per common share is as follows (in thousands, except per share data):

Fiscal Three Months Ended | Fiscal Nine Months Ended | ||||||||||||||

July 31, 2016 | August 2, 2015 | July 31, 2016 | August 2, 2015 | ||||||||||||

Numerator for Basic and Diluted Income (Loss) Per Common Share | |||||||||||||||

Net income (loss) | $ | 23,715 | $ | 7,220 | $ | 32,026 | $ | (588 | ) | ||||||

Less: Net income applicable to participating securities | (165 | ) | (60 | ) | (265 | ) | — | ||||||||

Net income (loss) applicable to common shares | $ | 23,550 | $ | 7,160 | $ | 31,761 | $ | (588 | ) | ||||||

Denominator for Basic and Diluted Income (Loss) Per Common Share | |||||||||||||||

Weighted average basic number of common shares outstanding | 73,104 | 73,341 | 72,932 | 73,170 | |||||||||||

Common stock equivalents: | |||||||||||||||

Employee stock options | 441 | 650 | 528 | — | |||||||||||

PSUs and Performance Share Awards | 7 | 345 | — | — | |||||||||||

Weighted average diluted number of common shares outstanding | 73,552 | 74,336 | 73,460 | 73,170 | |||||||||||

Basic income (loss) per common share | $ | 0.32 | $ | 0.10 | $ | 0.44 | $ | (0.01 | ) | ||||||

Diluted income (loss) per common share | $ | 0.32 | $ | 0.10 | $ | 0.43 | $ | (0.01 | ) | ||||||

We calculate earnings (loss) per share using the “two-class” method, whereby unvested share-based payment awards that contain nonforfeitable rights to dividends or dividend equivalents are “participating securities” and, therefore, are treated as a separate class in computing earnings (loss) per share. Participating securities consist of unvested restricted stock units related to our Incentive Plan. For the three and nine month periods ended July 31, 2016 and the three month period ended August 2, 2015, undistributed earnings attributable to participating securities were approximately $0.2 million, $0.3 million and $0.1 million, respectively. There was no amount attributable to participating securities for the nine month period ended August 2, 2015, as the participating securities do not contractually share in net losses.

For the three and nine month periods ended July 31, 2016, all PSUs and Performance Share Awards that are contingent upon the achievement of performance targets as described in Note 8 were excluded from the diluted income per common share calculation as the performance targets were not met as of July 31, 2016. Additionally, for the nine month period ended July 31, 2016, the number of weighted average options and Performance Share Awards that were not included in the diluted earnings per share calculations because the effect would have been anti-dilutive represented approximately 0.1 million shares.

NOTE 10 — WARRANTY

We sell weathertightness warranties to our customers for protection from leaks in our roofing systems related to weather. These warranties range from 2 years to 20 years. We sell two types of warranties, standard and Single Source™, and three grades of coverage for each. The type and grade of coverage determines the price to the customer. For standard warranties, our responsibility for leaks in a roofing system begins after 24 consecutive leak-free months. For Single Source™ warranties, the roofing system must pass our inspection before warranty coverage will be issued. Inspections are typically performed at three stages of the roofing project: (i) at the project start-up; (ii) at the project mid-point; and (iii) at the project completion. These inspections are included in the cost of the warranty. If the project requires or the customer requests additional inspections, those inspections are billed to the customer. Upon the sale of a warranty, we record the resulting revenue as deferred revenue, which is included in other accrued expenses on our consolidated balance sheets.

The following table represents the rollforward of our accrued warranty obligation and deferred warranty revenue activity for each of the fiscal nine months ended (in thousands):

14

Fiscal Nine Months Ended | |||||||

July 31, 2016 | August 2, 2015 | ||||||

Beginning balance | $ | 25,669 | $ | 23,685 | |||

Warranties sold | 2,606 | 2,022 | |||||

Revenue recognized | (2,415 | ) | (2,025 | ) | |||

Other(1) | — | 1,609 | |||||

Ending balance | $ | 25,860 | $ | 25,291 | |||

(1) | Represents the fair value of accrued warranty obligations in the amount of $1.6 million assumed in the CENTRIA Acquisition. CENTRIA offers weathertightness warranties to certain customers. Weathertightness warranties are offered in various configurations for time periods from 5 to 20 years, prorated or non-prorated and on either a dollar limit or no dollar limit basis, as required by the buyer. These warranties are available only if certain conditions, some of which relate to installation, are met. |

NOTE 11 — DEFINED BENEFIT PLANS

RCC Pension Plan — With the acquisition of Robertson-Ceco II Corporation (“RCC”) on April 7, 2006, we assumed a defined benefit plan (the “RCC Pension Plan”). Benefits under the RCC Pension Plan are primarily based on years of service and the employee’s compensation. The RCC Pension Plan is frozen and, therefore, employees do not accrue additional service benefits. Plan assets of the RCC Pension Plan are invested in broadly diversified portfolios of government obligations, mutual funds, stocks, bonds, fixed income securities and master limited partnerships.

CENTRIA Benefit Plans — As a result of the CENTRIA Acquisition on January 16, 2015, we assumed noncontributory defined benefit plans covering certain hourly employees (the “CENTRIA Benefit Plans”) and are closed to new participants. Benefits under the CENTRIA Benefit Plans are calculated based on fixed amounts for each year of service rendered, although benefits accruals for one of the plans previously ceased. Plan assets of the CENTRIA Benefit Plans are invested in broadly diversified portfolios of equity mutual funds, international equity mutual funds, bonds, mortgages and other funds. CENTRIA also sponsors postretirement medical and life insurance plans that cover certain of its employees and their spouses (the “OPEB Plans”).

The following table sets forth the components of the net periodic benefit cost, before tax, and funding contributions, for the periods indicated (in thousands):

Fiscal Three Months Ended July 31, 2016 | Fiscal Three Months Ended August 2, 2015 | ||||||||||||||||||||||||||||||

RCC Pension Plan | CENTRIA Benefit Plans | OPEB Plans | Total | RCC Pension Plan | CENTRIA Benefit Plans | OPEB Plans | Total | ||||||||||||||||||||||||

Service cost | $ | — | $ | 34 | $ | 8 | $ | 42 | $ | — | $ | 42 | $ | 8 | $ | 50 | |||||||||||||||

Interest cost | 450 | 139 | 65 | 654 | 483 | 165 | 80 | 728 | |||||||||||||||||||||||

Expected return on assets | (475 | ) | (270 | ) | — | (745 | ) | (551 | ) | (311 | ) | — | (862 | ) | |||||||||||||||||

Prior service cost amortization | (2 | ) | — | — | (2 | ) | (2 | ) | — | — | (2 | ) | |||||||||||||||||||

Unrecognized net loss | 292 | — | — | 292 | 361 | — | — | 361 | |||||||||||||||||||||||

Net periodic pension cost | $ | 265 | $ | (97 | ) | $ | 73 | $ | 241 | $ | 291 | $ | (104 | ) | $ | 88 | $ | 275 | |||||||||||||

Funding contributions | $ | 234 | $ | 160 | $ | — | $ | 394 | $ | 260 | $ | 160 | $ | — | $ | 420 | |||||||||||||||

15

Fiscal Nine Months Ended July 31, 2016 | Fiscal Nine Months Ended August 2, 2015 | ||||||||||||||||||||||||||||||

RCC Pension Plan | CENTRIA Benefit Plans | OPEB Plans | Total | RCC Pension Plan | CENTRIA Benefit Plans | OPEB Plans | Total | ||||||||||||||||||||||||

Service cost | $ | — | $ | 103 | $ | 25 | $ | 128 | $ | — | $ | 79 | $ | 15 | $ | 94 | |||||||||||||||

Interest cost | 1,350 | 416 | 196 | 1,962 | 1,450 | 307 | 149 | 1,906 | |||||||||||||||||||||||

Expected return on assets | (1,426 | ) | (809 | ) | — | (2,235 | ) | (1,653 | ) | (577 | ) | — | (2,230 | ) | |||||||||||||||||

Prior service cost amortization | (7 | ) | — | — | (7 | ) | (7 | ) | — | — | (7 | ) | |||||||||||||||||||

Unrecognized net loss | 877 | — | — | 877 | 1,082 | — | — | 1,082 | |||||||||||||||||||||||

Net periodic pension cost | $ | 794 | $ | (290 | ) | $ | 221 | $ | 725 | $ | 872 | $ | (191 | ) | $ | 164 | $ | 845 | |||||||||||||

Funding contributions | $ | 679 | $ | 480 | $ | — | $ | 1,159 | $ | 755 | $ | 320 | $ | — | $ | 1,075 | |||||||||||||||

We expect to contribute an additional $0.4 million and $0.2 million to the RCC Pension Plan and the CENTRIA Benefit Plans, respectively, for the remainder of fiscal 2016. Currently, our policy is to fund the CENTRIA Benefit Plans and OPEB Plans as required by minimum funding standards of the Internal Revenue Code. The contributions to the OPEB Plans by retirees vary from none to 25% of the total premium cost.

In addition to the CENTRIA Benefit Plans, CENTRIA contributes to a multi-employer plan, Steelworkers Pension Trust. The current contract expires on June 1, 2019. The minimum required annual contribution to this plan is $0.3 million. If we were to withdraw our participation from this multi-employer plan, we would have a complete withdrawal liability of approximately $0.7 million.

NOTE 12 — LONG-TERM DEBT AND NOTE PAYABLE

Debt is comprised of the following (in thousands):

July 31, 2016 | November 1, 2015 | ||||||

Credit Agreement, due June 2019 (variable interest, at 4.25% on July 31, 2016 and November 1, 2015) | $ | 164,147 | $ | 194,147 | |||

8.25% senior notes, due January 2023 | 250,000 | 250,000 | |||||

Amended Asset-Based lending facility, due June 2019 (interest at 4.25% on July 31, 2016 and 4.00% on November 1, 2015) | — | — | |||||

Current portion of long-term debt | — | — | |||||

Total long-term debt, net | $ | 414,147 | $ | 444,147 | |||

8.25% Senior Notes Due January 2023

The Company’s $250.0 million in aggregate principal amount of 8.25% senior notes due 2023 (the “Notes”) bear interest at 8.25% per annum and will mature on January 15, 2023. Interest is payable semi-annually in arrears on January 15 and July 15 of each year.

The Company may redeem the Notes at any time prior to January 15, 2018, at a price equal to 100% of the principal amount thereof, plus accrued and unpaid interest, if any, to the redemption date, plus the applicable make-whole premium. On or after January 15, 2018, the Company may redeem all or a part of the Notes at redemption prices (expressed as percentages of principal amount thereof) set forth below, plus accrued and unpaid interest, if any, to the applicable redemption date of the Notes, if redeemed during the 12-month period beginning on January 15 of the year as follows:

16

Year | Percentage | |

2018 | 106.188% | |

2019 | 104.125% | |

2020 | 102.063% | |

2021 and thereafter | 100.000% | |

In addition, prior to January 15, 2018, the Company may redeem the Notes in an aggregate principal amount of up to 40.0% of the original aggregate principal amount of the Notes with funds in an equal aggregate amount not exceeding the aggregate proceeds of one or more equity offerings, at a redemption price of 108.250%, plus accrued and unpaid interest, if any, to the applicable redemption date of the Notes.

Credit Agreement

The Company’s Credit Agreement provided for a term loan credit facility (“Term Loan”) in an original aggregate principal amount of $250.0 million. The Credit Agreement will mature on June 24, 2019. The Term Loan amortizes in nominal quarterly installments equal to one percent of the aggregate initial principal amount thereof per annum. The Term Loan will bear interest at a floating rate measured by reference to, at the Company’s option, either (i) an adjusted LIBOR not less than 1.00% plus a borrowing margin of 3.25% per annum or (ii) an alternate base rate plus a borrowing margin of 2.25% per annum. At both July 31, 2016 and November 1, 2015, the interest rate on the Term Loan was 4.25%.

During the three and nine month periods ended July 31, 2016, the Company made voluntary prepayments of $10.0 million and $30.0 million, respectively, on the outstanding principal amount of the Term Loan.

Amended ABL Facility

The Company’s Asset-Based Lending Facility (“Amended ABL Facility”) provides for revolving loans of up to $150.0 million (subject to a borrowing base) and letters of credit of up to $30.0 million. Borrowing availability under the Amended ABL Facility is determined by a monthly borrowing base collateral calculation that is based on specified percentages of the value of qualified cash, eligible inventory and eligible accounts receivable, less certain reserves and subject to certain other adjustments. At July 31, 2016 and November 1, 2015, the Company’s excess availability under the Amended ABL Facility was $140.9 million and $131.0 million, respectively. At both July 31, 2016 and November 1, 2015, the Company had no revolving loans outstanding under the Amended ABL Facility. In addition, at July 31, 2016 and November 1, 2015, standby letters of credit related to certain insurance policies totaling approximately $9.1 million and $8.7 million, respectively, were outstanding but undrawn under the Amended ABL Facility. The Amended ABL Facility will mature on June 24, 2019.

The Amended ABL Facility includes a minimum fixed charge coverage ratio of one to one, which will apply if we fail to maintain a specified minimum borrowing capacity. The minimum level of borrowing capacity as of July 31, 2016 and November 1, 2015 was $21.1 million and $19.7 million, respectively. Although the Amended ABL Facility did not require any financial covenant compliance, at July 31, 2016 and November 1, 2015, NCI’s fixed charge coverage ratio as of those dates, which is calculated on a trailing twelve month basis, was 2.78:1.00 and 3.54:1.00, respectively. These ratios include the pro forma impact of the CENTRIA Acquisition.

Loans under the Amended ABL Facility bear interest, at NCI’s option, as follows:

(1) | Base Rate loans at the Base Rate plus a margin. The margin ranges from 0.75% to 1.25% depending on the quarterly average excess availability under such facility, and |

(2) | LIBOR loans at LIBOR plus a margin. The margin ranges from 1.75% to 2.25% depending on the quarterly average excess availability under such facility. |

An unused commitment fee is paid monthly on the Amended ABL Facility at an annual rate of 0.50% based on the amount by which the maximum credit exceeds the average daily principal balance of outstanding loans and letter of credit obligations. Additional customary fees in connection with the Amended ABL Facility also apply.

For additional information on the Notes, Credit Agreement and the Amended ABL Facility, including guarantees and security, see our Annual Report on Form 10-K for the fiscal year ended November 1, 2015.

17

Debt Covenants

The Company’s outstanding debt agreements contain a number of covenants that, among other things, limit or restrict the ability of the Company and its subsidiaries to dispose of assets, make acquisitions and engage in mergers. As of July 31, 2016, the Company was in compliance with all covenants that were in effect on such date. For additional information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended November 1, 2015.

Deferred Financing Costs

At July 31, 2016 and November 1, 2015, the unamortized balance in deferred financing costs related to the Notes, Credit Agreement and Amended ABL Facility was $9.6 million and $11.1 million, respectively.

Insurance Note Payable

As of July 31, 2016 and November 1, 2015, the Company had an outstanding note payable in the amount of $0.9 million and $0.5 million, respectively, related to financed insurance premiums. Insurance premium financings are generally secured by the unearned premiums under such policies.

NOTE 13 — EQUITY INVESTMENT

On August 14, 2009, the Company entered into an Investment Agreement (as amended, the “Investment Agreement”), by and between the Company and Clayton, Dubilier & Rice Fund VIII, L.P. (“CD&R Fund VIII”). In connection with the Investment Agreement, the CD&R Fund VIII and the Clayton, Dubilier & Rice Friends & Family Fund VIII, L.P. (collectively, the “CD&R Funds”) purchased convertible preferred stock, which was later converted to shares of our common stock on May 14, 2013. Also, on October 20, 2009, the Company entered into a Stockholders Agreement with the CD&R Funds.

On July 25, 2016, the CD&R Funds completed a registered underwritten offering, in which the CD&R Funds offered 9.0 million shares of our common stock at a price to the public of $16.15 per share (the “Secondary Offering”). The underwriters also exercised their option to purchase 1.35 million additional shares of our common stock from the CD&R Funds. The aggregate offering price for the 10.35 million shares sold in the Secondary Offering was approximately $160.1 million, net of underwriting discounts and commissions. The CD&R Funds received all of the proceeds from the Secondary Offering and no shares in the Secondary Offering were sold by the Company or any of its officers or directors (although certain of our directors are affiliated with the CD&R Funds). As disclosed in Note 14, concurrent with the Secondary Offering, the Company repurchased approximately 2.9 million shares from the CD&R Funds. In connection with the Secondary Offering and Stock Repurchase (defined below), we incurred approximately $0.7 million in expenses, which were included in engineering, selling, general and administrative expenses in the unaudited consolidated statement of operations for the three and nine months ended July 31, 2016.

At July 31, 2016 and November 1, 2015, the CD&R Funds owned approximately 42.0% and 58.4%, respectively, of the outstanding shares of our common stock. See “Transactions with Related Persons” in our Proxy Statement on Schedule 14A, as filed with the SEC on January 27, 2016, for a description of the rights held by the CD&R Funds under the terms and conditions of the Investment Agreement and the Stockholders Agreement.

NOTE 14 — STOCK REPURCHASE PROGRAM

In January 2016, our board of directors authorized a stock repurchase program for up to an aggregate of $50.0 million of the Company’s outstanding common stock. In July 2016, our board of directors authorized the stock repurchase program to be increased for up to an aggregate of $56.3 million of the Company’s outstanding common stock.

On July 18, 2016, the Company entered into an agreement with the CD&R Funds to repurchase approximately 2.9 million shares of our common stock at the price per share equal to the price per share paid by the underwriters to the CD&R Funds in the Secondary Offering (the “Stock Repurchase”). The Stock Repurchase represented a private, non-underwritten transaction between the Company and the CD&R Funds that was approved and recommended by the Affiliate Transactions Committee of our board of directors. The closing of the Stock Repurchase occurred on July 25, 2016 concurrently with the closing of the Secondary Offering. Following completion of the Stock Repurchase, the Company canceled the shares repurchased from the CD&R Funds, resulting in a $45.0 million decrease in both additional paid in capital and treasury stock. The Stock Repurchase was funded by the Company’s cash on hand.

18

During the three and nine months ended July 31, 2016, we repurchased approximately 2.9 million shares for $45.0 million and 4.0 million shares for $56.3 million, respectively, under the stock repurchase program. Following the Stock Repurchase, the Company has repurchased the maximum amount authorized under the stock repurchase program. Approximately 0.1 million shares remain authorized for repurchase under a previous program. The previously authorized program has no time limit on its duration, but our Credit Agreement, Amended ABL Facility, and Notes apply certain limitations on our repurchase of shares of our common stock. The timing and method of any repurchases, which will depend on a variety of factors, including market conditions, are subject to results of operations, financial conditions, cash requirements and other factors, and may be suspended or discontinued at any time. In addition to the common stock repurchased during the three and nine months ended July 31, 2016 under our stock repurchase programs, we also withheld shares of restricted stock to satisfy minimum tax withholding obligations arising in connection with the vesting of restricted stock units, which are included in treasury stock purchases in the consolidated statements of stockholders’ equity.

NOTE 15 — FAIR VALUE OF FINANCIAL INSTRUMENTS AND FAIR VALUE MEASUREMENTS

Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, restricted cash, trade accounts receivable and accounts payable approximate fair value as of July 31, 2016 and November 1, 2015 because of the relatively short maturity of these instruments. The fair values of the remaining financial instruments not currently recognized at fair value on our consolidated balance sheets at the respective fiscal period ends were (in thousands):

July 31, 2016 | November 1, 2015 | ||||||||||||||

Carrying Amount | Fair Value | Carrying Amount | Fair Value | ||||||||||||

Credit Agreement, due June 2019 | $ | 164,147 | $ | 163,737 | $ | 194,147 | $ | 193,662 | |||||||

8.25% senior notes, due January 2023 | 250,000 | 272,500 | 250,000 | 263,750 | |||||||||||

The fair values of the Credit Agreement and the Notes were based on recent trading activities of comparable market instruments which are level 2 inputs.

Fair Value Measurements

ASC Subtopic 820-10, Fair Value Measurements and Disclosures, requires us to use valuation techniques to measure fair value that maximize the use of observable inputs and minimize the use of unobservable inputs. These inputs are prioritized as follows:

Level 1: Observable inputs such as quoted prices for identical assets or liabilities in active markets.

Level 2: Other inputs that are observable directly or indirectly, such as quoted prices for similar assets or liabilities or market-corroborated inputs.

Level 3: Unobservable inputs for which there is little or no market data and which require us to develop our own assumptions about how market participants would price the assets or liabilities.

The following is a description of the valuation methodologies used for assets and liabilities measured at fair value. There have been no changes in the methodologies used at July 31, 2016 and November 1, 2015

Money market: Money market funds have original maturities of three months or less. The original cost of these assets approximates fair value due to their short-term maturity.

Mutual funds: Mutual funds are valued at the closing price reported in the active market in which the mutual fund is traded.

Assets held for sale: Assets held for sale are valued based on current market conditions, prices of similar assets in similar condition and expected proceeds from the sale of the assets.

Deferred compensation plan liability: Deferred compensation plan liability is comprised of phantom investments in the deferred compensation plan and is valued at the closing price reported in the active market in which the money market or mutual fund is traded.

19

The following table summarizes information regarding our financial assets and liabilities that are measured at fair value on a recurring basis as of July 31, 2016, segregated by the level of the valuation inputs within the fair value hierarchy utilized to measure fair value (in thousands):

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Assets: | |||||||||||||||

Short-term investments in deferred compensation plan(1): | |||||||||||||||

Money market | $ | 483 | $ | — | $ | — | $ | 483 | |||||||

Mutual funds – Growth | 795 | — | — | 795 | |||||||||||

Mutual funds – Blend | 3,170 | — | — | 3,170 | |||||||||||

Mutual funds – Foreign blend | 725 | — | — | 725 | |||||||||||

Mutual funds – Fixed income | — | 712 | — | 712 | |||||||||||

Total short-term investments in deferred compensation plan | 5,173 | 712 | — | 5,885 | |||||||||||

Total assets | $ | 5,173 | $ | 712 | $ | — | $ | 5,885 | |||||||

Liabilities: | |||||||||||||||

Deferred compensation plan liability | $ | — | $ | 3,813 | $ | — | $ | 3,813 | |||||||

Total liabilities | $ | — | $ | 3,813 | $ | — | $ | 3,813 | |||||||

(1) | Unrealized holding gains for the three months ended July 31, 2016 and August 2, 2015 were $0.3 million and insignificant, respectively. Unrealized holding gains for the nine months ended July 31, 2016 and August 2, 2015 were $0.1 million and $0.1 million, respectively. These unrealized holding gains were primarily offset by changes in the deferred compensation plan liability. |

The following table summarizes information regarding our financial assets and liabilities that are measured at fair value on a recurring basis as of November 1, 2015, segregated by level of the valuation inputs within the fair value hierarchy utilized to measure fair value (in thousands):

Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Assets: | |||||||||||||||

Short-term investments in deferred compensation plan(1): | |||||||||||||||

Money market | $ | 744 | $ | — | $ | — | $ | 744 | |||||||

Mutual funds – Growth | 764 | — | — | 764 | |||||||||||

Mutual funds – Blend | 2,984 | — | — | 2,984 | |||||||||||

Mutual funds – Foreign blend | 724 | — | — | 724 | |||||||||||

Mutual funds – Fixed income | — | 673 | — | 673 | |||||||||||

Total short-term investments in deferred compensation plan | $ | 5,216 | $ | 673 | $ | — | $ | 5,889 | |||||||

Total assets | $ | 5,216 | $ | 673 | $ | — | $ | 5,889 | |||||||

Liabilities: | |||||||||||||||

Deferred compensation plan liability | $ | — | $ | 5,164 | $ | — | $ | 5,164 | |||||||

Total liabilities | $ | — | $ | 5,164 | $ | — | $ | 5,164 | |||||||

(1) | Unrealized holding gain for the fiscal year ended November 1, 2015 was insignificant. This unrealized holding gain was primarily offset by changes in the deferred compensation plan liability. |

The following table summarizes information regarding our financial assets that are measured at fair value on a nonrecurring basis as of July 31, 2016 and November 1, 2015 (in thousands):

Level 3 | |||||||

July 31, 2016 | November 1, 2015 | ||||||

Assets: | |||||||

Assets held for sale(1) | $ | — | $ | 2,280 | |||

Total assets | $ | — | $ | 2,280 | |||

20