Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Cornerstone Building Brands, Inc. | a2016exhibit32_2.htm |

| EX-32.1 - EXHIBIT 32.1 - Cornerstone Building Brands, Inc. | a2016exhibit32_1.htm |

| EX-31.2 - EXHIBIT 31.2 - Cornerstone Building Brands, Inc. | a2016exhibit31_2.htm |

| EX-31.1 - EXHIBIT 31.1 - Cornerstone Building Brands, Inc. | a2016exhibit31_1.htm |

| EX-24.1 - EXHIBIT 24.1 - Cornerstone Building Brands, Inc. | a2016exhibit24_1.htm |

| EX-23.1 - EXHIBIT 23.1 - Cornerstone Building Brands, Inc. | a2016exhibit23_1.htm |

| EX-21.1 - EXHIBIT 21.1 - Cornerstone Building Brands, Inc. | a2016exhibit21_1.htm |

| EX-10.1 - EXHIBIT 10.1 - Cornerstone Building Brands, Inc. | a2016exhibit10_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

Form 10-K

__________________________

(Mark One) | |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended October 30, 2016

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number 1-14315

__________________________

NCI BUILDING SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

__________________________

Delaware | 76-0127701 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

10943 North Sam Houston Parkway West, Houston, TX | 77064 |

(Address of principal executive offices) | (zip code) |

Registrant’s telephone number, including area code: (281) 897-7788

__________________________

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $0.01 par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

__________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer ý |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).Yes o No ý

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant on May 1, 2016 was $418,251,380, which aggregate market value was calculated using the closing sales price reported by the New York Stock Exchange as of the last business day of the registrant’s most recently completed second fiscal quarter.

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

The number of shares of common stock of the registrant outstanding on December 28, 2016 was 70,875,084.

__________________________

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Part III of this Annual Report is incorporated by reference from the registrant’s definitive proxy statement for its 2017 annual meeting of shareholders to be filed with the Securities and Exchange Commission within 120 days of October 30, 2016.

TABLE OF CONTENTS

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

Item 16. | ||

i

FORWARD LOOKING STATEMENTS

This Annual Report includes statements concerning our expectations, beliefs, plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements that are not historical facts. These statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those expressed or implied by these statements. In some cases, our forward-looking statements can be identified by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,” “should,” “will” or other similar words. We have based our forward-looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions and projections about future events may and often do vary materially from actual results. Therefore, we cannot assure you that actual results will not differ materially from those expressed or implied by our forward-looking statements. Accordingly, investors are cautioned not to place undue reliance on any forward-looking information, including any earnings guidance, if applicable. Although we believe that the expectations reflected in the forward-looking statements are reasonable, these expectations and the related statements are subject to risks, uncertainties and other factors that could cause the actual results to differ materially from those projected. These risks, uncertainties and other factors include, but are not limited to:

• | industry cyclicality and seasonality and adverse weather conditions; |

• | challenging economic conditions affecting the nonresidential construction industry; |

• | volatility in the United States (“U.S.”) economy and abroad, generally, and in the credit markets; |

• | substantial indebtedness and our ability to incur substantially more indebtedness; |

• | our ability to generate significant cash flow required to service or refinance our existing debt, including the 8.25% senior notes due 2023, and obtain future financing; |

• | our ability to comply with the financial tests and covenants in our existing and future debt obligations; |

• | operational limitations or restrictions in connection with our debt; |

• | increases in interest rates; |

• | recognition of asset impairment charges; |

• | commodity price increases and/or limited availability of raw materials, including steel; |

• | our ability to make strategic acquisitions accretive to earnings; |

• | retention and replacement of key personnel; |

• | our ability to carry out our restructuring plans and to fully realize the expected cost savings; |

• | enforcement and obsolescence of intellectual property rights; |

• | fluctuations in customer demand; |

• | costs related to environmental clean-ups and liabilities; |

• | competitive activity and pricing pressure; |

• | increases in energy prices; |

• | volatility of the Company’s stock price; |

• | dilutive effect on the Company’s common stockholders of potential future sales of the Company’s Common Stock held by our sponsor; |

• | substantial governance and other rights held by our sponsor; |

• | breaches of our information system security measures and damage to our major information management systems; |

• | hazards that may cause personal injury or property damage, thereby subjecting us to liabilities and possible losses, which may not be covered by insurance; |

• | changes in laws or regulations, including the Dodd–Frank Act; |

1

• | costs and other effects of legal and administrative proceedings, settlements, investigations, claims and other matters; |

• | timing and amount of any stock repurchases; and |

• | other risks detailed under the caption “Risk Factors” in Item 1A of this report. |

A forward-looking statement may include a statement of the assumptions or bases underlying the forward-looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable. However, we caution you that assumed facts or bases almost always vary from actual results, and the differences between assumed facts or bases and actual results can be material, depending on the circumstances. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this report, including those described under the caption “Risk Factors” in Item 1A of this report. We expressly disclaim any obligations to release publicly any updates or revisions to these forward-looking statements to reflect any changes in our expectations unless the securities laws require us to do so.

2

PART I

Item 1. Business.

General

NCI Building Systems, Inc. (together with its subsidiaries, unless the context requires otherwise, the “Company,” “NCI,” “we,” “us” or “our”) is one of North America’s largest integrated manufacturers and marketers of metal products for the nonresidential construction industry. Of the approximate $224 billion nonresidential construction industry, we primarily serve the low-rise nonresidential construction market (five stories or less) which, according to Dodge Data & Analytics (“Dodge”), represented approximately 85% of the total nonresidential construction industry during our fiscal year 2016. Our broad range of products are used primarily in new construction and in repair and retrofit activities, mostly in North America.

We design, engineer, manufacture and market what we believe is one of the most comprehensive lines of metal components and engineered building systems in the industry, with a reputation for high quality and superior engineering and design. We go to market with well-recognized brands, which allow us to compete effectively within a broad range of end-user markets including industrial, commercial, institutional and agricultural. Our service versatility allows us to support the varying needs of our diverse customer base, which includes general contractors and sub-contractors, developers, manufacturers, distributors and a current network of approximately 3,200 authorized builders across North America in our engineered building systems segment, over 1,000 dealer partners for our insulated metal panel (“IMP”) products and approximately 5,500 architects. We also provide metal coil coating services for commercial and construction applications, servicing both internal and external customers.

As of October 30, 2016, we operated 41 manufacturing facilities located in the United States, Mexico, Canada and China, with additional sales and distribution offices throughout the United States and Canada. Our broad geographic footprint, along with our hub-and-spoke distribution system, allows us to efficiently supply a broad range of customers with high-quality customer service and reliable deliveries.

The Company was founded in 1984 and reincorporated in Delaware in 1991. In 1998, we acquired Metal Building Components, Inc. (“MBCI”) and doubled our revenue base. As a result of the acquisition of MBCI, we became the largest domestic manufacturer of nonresidential metal components. In 2006, we acquired Robertson-Ceco II Corporation (“RCC”) which operates the Ceco Building Systems, Star Building Systems and Robertson Building Systems divisions and is a leader in the metal buildings industry. The RCC acquisition created an organization with greater product and geographic diversification, a stronger customer base and a more extensive distribution network than either company had individually, prior to the acquisition.

Since 2011, we have executed on a strategy to become the leading provider of IMP products in North America through our acquisitions of Metl-Span LLC (‘‘Metl-Span’’) in 2012 and CENTRIA, a Pennsylvania general partnership (‘‘CENTRIA’’), in 2015. We believe the IMP market remains underpenetrated in North America. IMP products possess several physical and cost-effective attributes, such as energy efficiency, that make them compelling alternatives to competing building materials, in particular due to the adoption of stricter standards and codes by numerous states in the United States that are expected to increase the use of IMP products in construction projects. Given these factors, we believe that growth within the IMP market will continue to outpace the broader metal building sector and the nonresidential construction industry as a whole.

The engineered building systems, metal components and metal coil coating businesses, and the construction industry in general, are seasonal in nature. Sales normally are lower in the first half of each fiscal year compared to the second half of each fiscal year because of unfavorable weather conditions for construction and typical business planning cycles affecting construction.

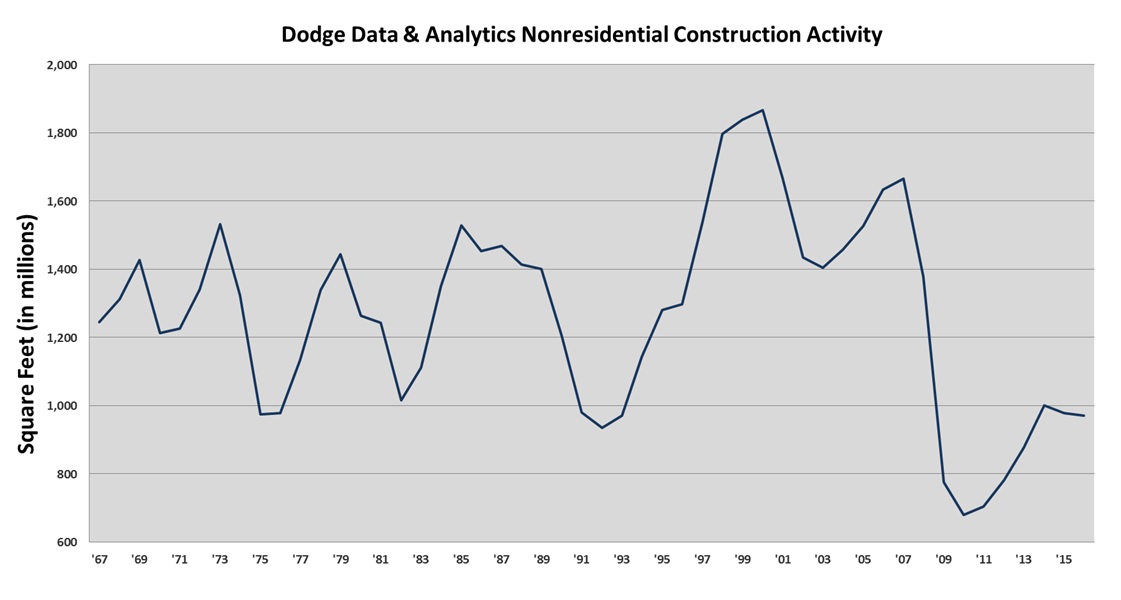

The nonresidential construction industry is highly sensitive to national and regional macroeconomic conditions. One of the primary challenges we face is that the United States economy is slowly recovering from a recession and a period of relatively low nonresidential construction activity, which began in the third quarter of 2008 and reduced demand for our products and adversely affected our business. In addition, the tightening of credit in financial markets over the same period adversely affected the ability of our customers to obtain financing for construction projects. As a result, we experienced a decrease in orders and cancellations of orders for our products. While economic growth has either resumed or remained flat, the nonresidential construction industry continues to be below previous cyclical troughs.

Current market estimates continue to show uneven activity across the nonresidential construction markets. According to Dodge, low-rise nonresidential construction starts, as measured in square feet and comprising buildings of up to five stories, were down as much as approximately 8% in our fiscal 2016 as compared to our fiscal 2015. However, Dodge typically revises initial reported figures, and we expect this metric will be revised upwards over time. Leading indicators for low-rise, nonresidential construction activity indicate positive momentum into fiscal 2017.

3

The leading indicators that we follow and that typically have the most meaningful correlation to nonresidential low-rise construction starts are the American Institute of Architects’ (“AIA”) Architecture Mixed Use Index, Dodge Residential single family starts and the Conference Board Leading Economic Index (“LEI”). Historically, there has been a very high correlation to the Dodge low-rise nonresidential starts when the three leading indicators are combined and then seasonally adjusted. The combined forward projection of these metrics, based on a 9 to 14-month historical lag for each metric, indicates low single digit growth for new low-rise nonresidential construction starts in fiscal 2017, with the majority of that growth occurring in the second half of our fiscal year.

On October 20, 2009, we completed a financial restructuring that resulted in a change of control of the Company. As part of the restructuring, Clayton, Dubilier & Rice Fund VIII, L.P. and CD&R Friends & Family Fund VIII, L.P. (together, the “CD&R Funds”), purchased an aggregate of 250,000 shares of a newly created class of our convertible preferred stock, designated the Series B Cumulative Convertible Participating Preferred Stock (the “Convertible Preferred Stock,” and shares thereof, the “Preferred Shares”), then representing approximately 68.4% of the voting power and Common Stock of the Company on an as-converted basis (the “Equity Investment”). On May 14, 2013, the CD&R Funds delivered a formal notice requesting the conversion of all of their Preferred Shares into shares of our Common Stock (the “Conversion”). In connection with the Conversion request, we issued the CD&R Funds 54,136,817 shares of our Common Stock, representing 72.4% of the Common Stock of the Company then outstanding. Under the terms of the Preferred Shares, no consideration was required to be paid by the CD&R Funds to the Company in connection with the Conversion of the Preferred Shares. As a result of the Conversion, the CD&R Funds no longer have rights to dividends or default dividends as specified in the Certificate of Designations for the Convertible Preferred Stock. The Conversion eliminated all the outstanding Convertible Preferred Stock and increased stockholders’ equity by nearly $620.0 million, returning our stockholders’ equity to a positive balance during fiscal 2013.

On May 2, 2012, we entered into an Amended Asset-Based Lending Facility (“Amended ABL Facility”) to (i) permit the acquisition of Metl-Span, the entry by the Company into the Credit Agreement and the incurrence of debt thereunder and the repayment of existing indebtedness under NCI’s existing Term Loan, (ii) increase the amount available for borrowing thereunder to $150 million (subject to a borrowing base), (iii) increase the amount available for letters of credit thereunder to $30 million, and (iv) extend the final maturity thereunder.

On June 22, 2012, we completed the acquisition of Metl-Span (the “Metl-Span Acquisition”) acquiring all of its outstanding membership interests for approximately $145.7 million in cash, which included $4.7 million of cash acquired. Upon the closing of the Metl-Span Acquisition, Metl-Span became a direct, wholly-owned subsidiary of NCI Group, Inc. Metl-Span’s operations are conducted through NCI Group, Inc. and its results are included in the results of our metal components segment. The Metl-Span Acquisition strengthened our position as a leading fully integrated supplier to the nonresidential building products industry in North America, providing our customers a comprehensive suite of building products.

On June 22, 2012, in connection with the Metl-Span Acquisition, the Company entered into a Credit Agreement (the “Credit Agreement”) among the Company, as Borrower, Credit Suisse AG, Cayman Islands Branch, as Administrative Agent and Collateral Agent and the lenders party thereto. The Credit Agreement provided for a term loan credit facility in an aggregate principal amount of $250.0 million. Proceeds from borrowings under the Credit Agreement were used, together with cash on hand, (i) to finance the Metl-Span Acquisition, (ii) to extinguish the existing amended and restated credit agreement, due April 2014 (the “Refinancing”), and (iii) to pay fees and expenses incurred in connection with the Metl-Span Acquisition and the Refinancing.

On June 24, 2013, the Company entered into Amendment No. 1 (the “Amendment”) to its existing Credit Agreement (the “Credit Agreement”), dated as of June 22, 2012, between NCI, as borrower, and Credit Suisse AG, Cayman Islands Branch, as administrative agent and collateral agent and the other financial institutions party thereto from time to time (the “Term Loan Facility”), primarily to extend the maturity date and reduce the interest rate applicable to all of the outstanding term loans under the Term Loan Facility.

Pursuant to the Amendment, the maturity date of the $238 million of outstanding term loans (the “Initial Term Loans”) was extended and such loans were converted into a new tranche of term loans (the “Tranche B Term Loans”) that will mature on June 24, 2019 and, prior to such date, will amortize in nominal quarterly installments equal to one percent of the aggregate initial principal amount thereof per annum. Pursuant to the Amendment, the Tranche B Term Loans will bear interest at a floating rate measured by reference to, at NCI’s option, either (i) an adjusted LIBOR not less than 1.00% plus a borrowing margin of 3.25% per annum or (ii) an alternate base rate plus a borrowing margin of 2.25% per annum.

On January 6, 2014, NCI entered into an agreement with the CD&R Funds to repurchase 1.15 million shares of its Common Stock at a price per share equal to the price per share paid by the underwriters to the CD&R Funds in the underwritten offering (the “2014 Stock Repurchase”). The 2014 Stock Repurchase, which was completed at the same time as the 2014 Secondary Offering (as defined below), represented a private, non-underwritten transaction between NCI and the

4

CD&R Funds that was approved and recommended by the Affiliate Transactions Committee of NCI’s board of directors. Following completion of the 2014 Stock Repurchase, NCI canceled the shares repurchased from the CD&R Funds, resulting in a $19.7 million decrease in both additional paid-in capital and treasury stock.

On January 15, 2014, the CD&R Funds completed a registered underwritten offering, in which the CD&R Funds offered 8.5 million shares of Common Stock at a price to the public of $18.00 per share (the “2014 Secondary Offering”). The underwriters also exercised their option to purchase 1.275 million additional shares of Common Stock. The aggregate offering price for the 9.775 million shares sold in the 2014 Secondary Offering was approximately $167.6 million, net of underwriting discounts and commissions. The CD&R Funds received all of the proceeds from the 2014 Secondary Offering and no shares in the 2014 Secondary Offering were sold by NCI or any of its officers or directors (although certain of our directors are affiliated with the CD&R Funds).

On November 7, 2014, the Company, Steelbuilding.com, LLC (together with the Company, the “Guarantors”) and the Company’s subsidiaries NCI Group, Inc. and Robertson-Ceco II Corporation (each a “Borrower” and collectively, the “Borrowers”) entered into Amendment No. 3 to the Loan and Security Agreement (the “ABL Loan and Security Agreement”) among the Borrowers, the Guarantors, Wells Fargo Capital Finance, LLC, as administrative agent and co-collateral agent, Bank of America, N.A., as co-collateral agent and syndication agent, and certain other lenders under the ABL Loan and Security Agreement, in order to amend the ABL Loan and Security Agreement to (i) permit the acquisition of CENTRIA (“CENTRIA Acquisition”), (ii) permit the entry by the Company into documentation with respect to certain debt financing to be incurred in connection with the CENTRIA Acquisition and the incurrence of debt with respect thereto, (iii) extend the maturity date to June 24, 2019, (iv) decrease the applicable margin with respect to borrowings thereunder and (v) make certain other amendments and modifications to provide greater operational and financial flexibility.

On January 16, 2015, the Company issued $250.0 million in aggregate principal amount of 8.25% senior notes due 2023 (the “Notes”) to fund the CENTRIA Acquisition. Interest on the Notes accrues at the rate of 8.25% per annum and is payable semi-annually in arrears on January 15 and July 15. The Notes are guaranteed on a senior unsecured basis by all of the Company’s existing and future domestic subsidiaries that guarantee the Company’s obligations (including by reason of being a borrower under the senior secured asset-based revolving credit facility on a joint and several basis with the Company or a guarantor subsidiary) under the senior secured credit facilities. The Notes are unsecured senior indebtedness and rank equally in right of payment with all of the Company’s existing and future senior indebtedness and senior in right of payment to all of its future subordinated obligations. In addition, the Notes and guarantees are structurally subordinated to all existing and future indebtedness and other liabilities of the Company’s non-guarantor subsidiaries.

The Company may redeem the Notes at any time prior to January 15, 2018, at a price equal to 100% of the principal amount thereof, plus accrued and unpaid interest, if any, to the redemption date, plus the applicable make-whole premium. On or after January 15, 2018, the Company may redeem all or a part of the Notes at redemption prices (expressed as percentages of principal amount thereof) equal to 106.188% for the twelve-month period beginning on January 15, 2018, 104.125% for the twelve-month period beginning on January 15, 2019, 102.063% for the twelve-month period beginning on January 15, 2020 and 100.000% for the twelve-month period beginning on January 15, 2021 and at any time thereafter, plus accrued and unpaid interest, if any, to the applicable redemption date of the Notes. In addition, prior to January 15, 2018, the Company may redeem the Notes in an aggregate principal amount equal to up to 40.0% of the original aggregate principal amount of the Notes with funds in an equal aggregate amount not exceeding the aggregate proceeds of one or more equity offerings, at a redemption price of 108.250%, plus accrued and unpaid interest, if any, to the applicable redemption date of the Notes.

On July 18, 2016, the Company entered into an agreement with the CD&R Funds to repurchase 2.9 million shares of our Common Stock at a price per share equal to the price per share paid by the underwriters to the CD&R Funds in the underwritten offering (the “2016 Stock Repurchase”). The 2016 Stock Repurchase, which was completed concurrently with the 2016 Secondary Offering (as defined below), represented a private, non-underwritten transaction between the Company and the CD&R Funds that was approved and recommended by the Affiliate Transactions Committee of our board of directors. Following completion of the 2016 Stock Repurchase, the Company canceled the shares repurchased from the CD&R Funds, resulting in a $45.0 million decrease in both additional paid in capital and treasury stock. The 2016 Stock Repurchase was funded by the Company’s cash on hand.

On July 25, 2016, the CD&R Funds completed a registered underwritten offering, in which the CD&R Funds offered 9.0 million shares of our Common Stock at a price to the public of $16.15 per share (the “2016 Secondary Offering”). The underwriters also exercised their option to purchase 1.35 million additional shares of our Common Stock from the CD&R Funds. The aggregate offering price for the 10.35 million shares sold in the 2016 Secondary Offering was approximately $160.1 million, net of underwriting discounts and commissions. The CD&R Funds received all of the proceeds from the 2016 Secondary Offering and no shares in the 2016 Secondary Offering were sold by the Company or any of its officers or directors (although certain of our directors are affiliated with the CD&R Funds). In connection with the 2016 Secondary

5

Offering and 2016 Stock Repurchase, we incurred approximately $0.7 million in expenses, which were included in engineering, selling, general and administrative expenses in the consolidated statements of operations for the fiscal year ended October 30, 2016.

Our principal offices are located at 10943 North Sam Houston Parkway West, Houston, Texas 77064, and our telephone number is (281) 897-7788.

We file annual, quarterly and current reports and other information with the Securities and Exchange Commission (the “SEC”). Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, along with any amendments to those reports, are available free of charge at our corporate website at http://www.ncibuildingsystems.com as soon as practicable after such material is electronically filed with, or furnished to, the SEC. In addition, our website includes other items related to corporate governance matters, including our corporate governance guidelines, charters of various committees of our board of directors and the code of business conduct and ethics applicable to our employees, officers and directors. You may obtain copies of these documents, free of charge, from our corporate website. However, the information on our website is not incorporated by reference into this Form 10-K.

Operating Segments

Operating segments are defined as components of an enterprise that engage in business activities and by which discrete financial information is available that is evaluated on a regular basis by the chief operating decision maker to make decisions about how to allocate resources to the segment and assess the performance of the segment. We have three operating segments: engineered building systems; metal components; and metal coil coating. All operating segments operate primarily in the nonresidential construction market. Sales and earnings are influenced by general economic conditions, the level of nonresidential construction activity, metal roof repair and retrofit demand and the availability and terms of financing available for construction. Our operating segments are vertically integrated and benefit from using similar basic raw materials. The metal coil coating segment consists of cleaning, treating, painting and slitting continuous steel coils before the steel is fabricated for use by construction and industrial users. The metal components segment products include metal roof and wall panels, doors, metal partitions, metal trim, IMP products and other related accessories. The engineered building systems segment includes the manufacturing of main frames, Long Bay® Systems and value-added engineering and drafting, which are typically not part of metal components or metal coil coating products or services. The manufacturing and distribution activities of our segments are effectively coupled through the use of our nationwide hub-and-spoke manufacturing and distribution system, which supports and enhances our vertical integration. The operating segments follow the same accounting policies used for our consolidated financial statements.

We evaluate a segment’s performance based primarily upon operating income before corporate expenses. Intersegment sales are recorded based on standard material costs plus a standard markup to cover labor and overhead and consist of: (i) hot-rolled, light gauge painted, and slit material and other services provided by the metal coil coating segment to both the metal components and engineered building systems segments; (ii) building components provided by the metal components segment to the engineered building systems segment; and (iii) structural framing provided by the engineered building systems segment to the metal components segment.

Corporate assets consist primarily of cash but also include deferred financing costs, deferred taxes and property, plant and equipment associated with our headquarters in Houston, Texas. These items (and income and expenses related to these items) are not allocated to the operating segments. Corporate unallocated expenses include share-based compensation expenses, and executive, legal, finance, tax, treasury, human resources, information technology, purchasing, marketing and corporate travel expenses. Additional unallocated amounts include interest income, interest expense, debt extinguishment costs and other (expense) income.

Our total sales, external sales, operating income and total assets attributable to these operating segments were as follows for the fiscal years indicated (in thousands):

6

2016 | % | 2015 | % | 2014 | % | |||||||||||||||

Total sales: | ||||||||||||||||||||

Engineered building systems | $ | 672,235 | 39.9 | $ | 667,166 | 42.7 | $ | 669,843 | 48.9 | |||||||||||

Metal components | 1,044,040 | 62.0 | 920,845 | 58.9 | 694,858 | 50.7 | ||||||||||||||

Metal coil coating | 247,736 | 14.7 | 231,732 | 14.8 | 246,582 | 18.0 | ||||||||||||||

Intersegment sales | (279,083 | ) | (16.6 | ) | (256,050 | ) | (16.4 | ) | (240,743 | ) | (17.6 | ) | ||||||||

Total net sales | $ | 1,684,928 | 100.0 | $ | 1,563,693 | 100.0 | $ | 1,370,540 | 100.0 | |||||||||||

External sales: | ||||||||||||||||||||

Engineered building systems | $ | 652,471 | 38.7 | $ | 647,881 | 41.4 | $ | 649,344 | 47.4 | |||||||||||

Metal components | 925,863 | 55.0 | 815,310 | 52.1 | 607,594 | 44.3 | ||||||||||||||

Metal coil coating | 106,594 | 6.3 | 100,502 | 6.5 | 113,602 | 8.3 | ||||||||||||||

Total net sales | $ | 1,684,928 | 100.0 | $ | 1,563,693 | 100.0 | $ | 1,370,540 | 100.0 | |||||||||||

Operating income: | ||||||||||||||||||||

Engineered building systems | $ | 62,046 | $ | 51,410 | $ | 32,525 | ||||||||||||||

Metal components | 102,495 | 50,541 | 33,306 | |||||||||||||||||

Metal coil coating | 25,289 | 19,080 | 23,982 | |||||||||||||||||

Corporate | (81,051 | ) | (64,200 | ) | (64,717 | ) | ||||||||||||||

Total operating income | $ | 108,779 | $ | 56,831 | $ | 25,096 | ||||||||||||||

Unallocated other expense | (29,815 | ) | (30,041 | ) | (12,421 | ) | ||||||||||||||

Income before income taxes | $ | 78,964 | $ | 26,790 | $ | 12,675 | ||||||||||||||

Total assets: | ||||||||||||||||||||

Engineered building systems | $ | 229,422 | 21.7 | $ | 218,646 | 20.3 | $ | 209,281 | 27.6 | |||||||||||

Metal components | 654,534 | 61.9 | 654,762 | 60.6 | 365,874 | 48.2 | ||||||||||||||

Metal coil coating | 87,194 | 8.2 | 81,456 | 7.5 | 84,519 | 11.1 | ||||||||||||||

Corporate | 87,146 | 8.2 | 124,865 | 11.6 | 99,009 | 13.1 | ||||||||||||||

$ | 1,058,296 | 100.0 | $ | 1,079,729 | 100.0 | $ | 758,683 | 100.0 | ||||||||||||

Engineered Building Systems.

Products. Engineered building systems consist of engineered structural members and panels that are fabricated and roll-formed in a factory. These systems are custom designed and engineered to meet project requirements and then shipped to a construction site complete and ready for assembly with no additional field welding required. Engineered building systems manufacturers design an integrated system that meets applicable building code and designated end use requirements. These systems consist of primary structural framing, secondary structural members (purlins and girts) and metal roof and wall systems or conventional wall materials manufactured by others, such as masonry and concrete tilt-up panels.

Engineered building systems typically consist of three systems:

Primary structural framing. Primary structural framing, fabricated from heavy-gauge plate steel, supports the secondary structural framing, roof, walls and all externally applied loads. Through the primary framing, the force of all applied loads is structurally transferred to the foundation.

Secondary structural framing. Secondary structural framing is designed to strengthen the primary structural framing and efficiently transfer applied loads from the roof and walls to the primary structural framing. Secondary structural framing consists of medium-gauge, roll-formed steel components called purlins and girts. Purlins are attached to the primary frame to support the roof. Girts are attached to the primary frame to support the walls.

Metal roof and wall systems. Metal roof and wall systems not only lock out the weather but may also contribute to the structural integrity of the overall building system. Roof and wall panels are fabricated from light-gauge, roll-formed steel in many architectural configurations.

Accessory components complete the engineered building system. These components include doors, windows, specialty trims, gutters and interior partitions.

The following characteristics of engineered building systems distinguish them from other methods of construction:

7

Shorter construction time. In many instances, it takes less time to construct an engineered building than other building types. In addition, because most of the work is done in the factory, the likelihood of weather interruptions is reduced.

More efficient material utilization. The larger engineered building systems manufacturers use computer-aided analysis and design to fabricate structural members with high strength-to-weight ratios, minimizing raw materials costs.

Lower construction costs. The in-plant manufacture of engineered building systems, coupled with automation, allows the substitution of less expensive factory labor for much of the skilled on-site construction labor otherwise required for traditional building methods.

Greater ease of expansion. Engineered building systems can be modified quickly and economically before, during or after the building is completed to accommodate all types of expansion. Typically, an engineered building system can be expanded by removing the end or side walls, erecting new framework and adding matching wall and roof panels.

Lower maintenance costs. Unlike wood, metal is not susceptible to deterioration from cracking, rotting or insect damage. Furthermore, factory-applied roof and siding panel coatings resist cracking, peeling, chipping, chalking and fading.

Environmentally friendly. Our buildings utilize between 30% and 60% recycled content and our roofing and siding utilize painted surfaces with high reflectance and emissivity, which help conserve energy and operating costs.

Manufacturing. As of October 30, 2016, we operated 8 facilities for manufacturing and distributing engineered building systems throughout the United States and in Monterrey, Mexico.

After we receive an order, our engineers design the engineered building system to meet the customer’s requirements and to satisfy applicable building codes and zoning requirements. To expedite this process, we use computer-aided design and engineering systems to generate engineering and erection drawings and a bill of materials for the manufacture of the engineered building system. From time to time, depending on our volume, we outsource portions of our drafting requirements to third parties.

Once the specifications and designs of the customer’s project have been finalized, the manufacturing of frames and other building systems begins at one of our frame manufacturing facilities. Fabrication of the primary structural framing consists of a process in which steel plates are punched and sheared and then routed through an automatic welding machine and sent through further fitting and welding processes. The secondary structural framing and the covering system are roll-formed steel products that are manufactured at our full manufacturing facilities as well as our components plants.

Upon completion of the manufacturing process, structural framing members and metal roof and wall systems are shipped to the job site for assembly. Since on-site construction is performed by an unaffiliated, independent general contractor, usually one of our authorized builders, we generally are not responsible for claims by end users or owners attributable to faulty on-site construction. The time elapsed between our receipt of an order and shipment of a completed building system has typically ranged from six to twelve weeks, although delivery varies depending on engineering and drafting requirements and the length of the permitting process.

Sales, Marketing and Customers. We are one of the largest domestic suppliers of engineered building systems. We design, engineer, manufacture and market engineered building systems and self-storage building systems for all nonresidential markets including commercial, industrial, agricultural, governmental and community.

Throughout the twentieth century, the applications of metal buildings have significantly evolved from small, portable structures that prospered during World War II into fully customizable building solutions spanning virtually every commercial low-rise end-use market.

We believe the cost of an engineered building system, excluding the cost of the land, generally represents approximately 15% to 20% of the total cost of constructing a building, which includes such elements as labor, plumbing, electricity, heating and air conditioning systems, installation and interior finish. Technological advances in products and materials, as well as significant improvements in engineering and design techniques, have led to the development of structural systems that are compatible with more traditional construction materials. Architects and designers now often combine an engineered building system with masonry, concrete, glass and wood exterior facades to meet the aesthetic requirements of end users while preserving the inherent characteristics of engineered building systems. As a result, the uses for engineered building systems now include office buildings, showrooms, retail shopping centers, banks, schools, places of worship, warehouses, factories, distribution centers, government buildings and community centers for which aesthetics and architectural features are important considerations of the end users. In addition, advances in our products such as insulated steel panel systems for roof and wall applications give buildings the desired balance of strength, thermal efficiency and aesthetic attractiveness.

8

We sell engineered building systems to builders, general contractors, developers and end users nationwide under the brand names “Metallic,” “Mid-West Steel,” “A & S,” “All American,” “Mesco,” “Star,” “Ceco,” “Robertson,” “Garco,” “Heritage” and “SteelBuilding.com.” We market engineered building systems through an in-house sales force to authorized builder networks of approximately 3,200 builders. We also sell engineered building systems via direct sale to owners and end users as well as through private label companies. In addition to a traditional business-to-business channel, we sell small custom-engineered metal buildings through two other consumer-oriented marketing channels targeting end-use purchasers and small general contractors. We sell through Heritage Building Systems (“Heritage”), which is a direct-response, phone-based sales organization, and Steelbuilding.com, which allows customers to design, price and buy small metal buildings online. During fiscal 2016, our largest customer for engineered building systems accounted for less than 1% of our total consolidated sales and external sales of our engineered building systems segment accounted for 38.7% of total consolidated sales for the fiscal year.

The majority of our sales of engineered building systems are made through our authorized builder networks. We enter into an authorized builder agreement with independent general contractors that market our products and services to users. These agreements generally grant the builder the non-exclusive right to market our products in a specified territory. Generally, the agreement is cancelable by either party with between 30 and 60 days’ notice. The agreement does not prohibit the builder from marketing engineered building systems of other manufacturers. In some cases, we may defray a portion of the builder’s advertising costs and provide volume purchasing and other pricing incentives to encourage those businesses to deal exclusively or principally with us. The builder is required to maintain a place of business in its designated territory, provide a sales organization, conduct periodic advertising programs and perform construction, warranty and other services for customers and potential customers. An authorized builder usually is hired by an end-user to erect an engineered building system on the customer’s site and provide general contracting, subcontracting and/or other services related to the completion of the project. We sell our products to the builder, which generally includes the price of the building as a part of its overall construction contract with its customer. We rely upon maintaining a satisfactory business relationship for continuing job orders from our authorized builders.

Metal Components.

Products. Metal components include metal roof and wall systems, metal partitions, metal trim, doors and other related accessories. These products are used in new construction and in repair and retrofit applications for industrial, commercial, institutional, agricultural and rural uses. Metal components are used in a wide variety of construction applications, including purlins and girts, roofing, standing seam roofing, walls, doors, trim and other parts of traditional buildings, as well as in architectural applications and engineered building systems. Although precise market data is limited, we estimate the metal components market, including roofing applications, to be a multi-billion dollar market. We believe that metal products have gained and continue to gain a greater share of new construction and repair and retrofit markets due to increasing acceptance and recognition of the benefits of metal products in building applications.

Our metal components consist of individual components, including secondary structural framing, metal roof and wall systems and associated metal trims. We sell directly to contractors or end users for use in the building industry, including the construction of metal buildings. We also stock and market metal component parts for use in the maintenance and repair of existing buildings. Specific component products we manufacture include metal roof and wall systems, purlins, girts, partitions, header panels and related trim and screws. We are continually developing and marketing new products such as our Soundwall™, Nu-Roof™ system and Energy Star cool roofing. We believe we offer the widest selection of metal components in the building industry. We custom produce purlins and girts for our customers and offer one of the widest selections of sizes and profiles in the United States. Metal roof and wall systems protect the rest of the structure and the contents of the building from the weather. They may also contribute to the structural integrity of the building.

Metal roofing systems have several advantages over conventional roofing systems, including the following:

Lower life cycle cost. The total cost over the life of metal roofing systems is lower than that of conventional roofing systems for both new construction and retrofit roofing. For new construction, the cost of installing metal roofing is greater than the cost of conventional roofing. However, the longer life and lower maintenance costs of metal roofing make the cost more attractive. For retrofit roofing, although installation costs are higher for metal roofing due to the need for a sloping support system, over time the lower ongoing costs more than offset the initial cost.

Increased longevity. Metal roofing systems generally last for a minimum of 20 years without requiring major maintenance or replacement. This compares to five to ten years for conventional roofs. The cost of leaks and roof failures associated with conventional roofing can be very high, including damage to building interiors and disruption of the functional usefulness of the building. Metal roofing prolongs the intervals between costly and time-consuming repair work.

9

Attractive aesthetics and design flexibility. Metal roofing systems allow architects and builders to integrate colors and geometric design into the roofing of new and existing buildings, providing an increasingly fashionable means of enhancing a building’s aesthetics. Conventional roofing material is generally tar paper or a gravel surface, and building designers tend to conceal roofs made with these materials.

Our metal roofing products are attractive and durable. We use standing seam roof technology to replace traditional built-up and single-ply roofs as well as to provide a distinctive look to new construction.

Manufacturing. As of October 30, 2016, we operated 27 facilities (25 in the United States, 1 in Canada and 1 in China) to manufacture metal components for the nonresidential construction industry, including 3 facilities for our door operations and 9 facilities for our IMP products.

Metal component products are roll-formed or fabricated at each plant using roll-formers and other metal working equipment. In roll-forming, pre-finished coils of steel are unwound and passed through a series of progressive forming rolls that form the steel into various profiles of medium-gauge structural shapes and light-gauge roof and wall panels.

Sales, Marketing and Customers. We are one of the largest domestic suppliers of metal components to the nonresidential building industry. We design, manufacture, sell and distribute one of the widest selections of components for a variety of new construction applications as well as for repair and retrofit uses.

We manufacture and design metal roofing systems for sales to regional metal building manufacturers, general contractors and subcontractors. We believe we have the broadest line of standing seam roofing products in the building industry. In addition, we have granted 21 non-exclusive, on-going license agreements to 18 companies, both domestic and international, relating to our standing seam roof technology.

These licenses, for a fee, are provided with MBCI’s technical know-how relating to the marketing, sales, testing, engineering, estimating, manufacture and installation of the licensed product. The licensees buy their own roll forming equipment to manufacture the roof panels and typically buy accessories for the licensed roof system from MBCI.

We estimate that metal roofing currently accounts for less than 10% of total roofing material volume. However, metal roofing accounts for a significant portion of the overall metal components market. As a result, we believe that significant opportunities exist for metal roofing, with its advantages over conventional roofing materials, to increase its overall share of this market.

One of our strategic objectives and a major part of our “green” initiative is to expand our IMP product lines, which are increasingly desirable because of their energy efficiency, noise reduction and aesthetic qualities. Our IMP product line manufacturing facilities in the United States, Canada and China provide the nonresidential building products market with cost-effective and energy efficient insulated metal wall and roof panels.

Our “green” initiative enables us to capitalize on increasing consumer preferences for environmentally-friendly construction. We believe this will allow us to further service the needs of our existing customer base and to gain new customers.

We sell metal components directly to regional manufacturers, contractors, subcontractors, distributors, lumberyards, cooperative buying groups and other customers under the brand names “MBCI”, “American Building Components” (“ABC”), “Eco-ficient”, “Metl-Span”, “CENTRIA” and “Metal Depots.” In addition to metal roofing systems, we manufacture roll-up doors and sell interior and exterior walk doors for use in the self-storage industry and metal and other buildings. Roll-up doors, interior and exterior doors, interior partitions and walls, header panels and trim are sold directly to contractors and other customers under the brand “Doors and Buildings Components” (“DBCI”). These components also are produced for integration into self-storage and engineered building systems sold by us. In addition to a traditional business-to-business channel, we sell components through Metal Depots, which has eight retail stores throughout the United States and specifically targets end-use consumers and small general contractors.

We market our components products primarily within six market segments: commercial/industrial, architectural, standing seam roof systems, agricultural, residential and cold storage. In addition, our IMP product lines service each of our six market segments. Customers include small, medium and large contractors, specialty roofers, regional fabricators, regional engineered building fabricators, post frame contractors, material resellers and end users. Commercial and industrial businesses, including self-storage, are heavy users of metal components and metal buildings systems. Standing seam roof and architectural customers have emerged as an important part of our customer base. As metal buildings become a more acceptable building alternative and aesthetics become an increasingly important consideration for end users of metal buildings, we believe that architects will participate more in the design and purchase decisions and will use metal components to a greater extent. Wood frame builders also purchase our metal components through distributors, lumberyards, cooperative buying groups and chain stores for various uses, including agricultural buildings.

10

Our metal components sales operations are organized into geographic regions. Each region is headed by a general sales manager supported by individual regional sales managers. Each local sales office is staffed by a direct sales force responsible for contacting customers and architects and a sales coordinator who supervises the sales process from the time the order is received until it is shipped and invoiced. The regional and local focus of our customers requires extensive knowledge of local business conditions. During fiscal 2016, our largest customer for metal components accounted for approximately 1% of our total consolidated sales and external sales of our metal components segment accounted for 55.0% of total consolidated sales for the fiscal year.

Metal Coil Coating.

Products. Metal coil coating consists of cleaning, treating and painting various flat-rolled metals, in coil form, as well as slitting and/or embossing the metal, before the metal is fabricated for use by various industrial users. Light gauge and heavy gauge metal coils that are painted, either for decorative or corrosion protection purposes, are utilized in the building industry by manufacturers of metal components and engineered building systems. In addition, these painted metal coils are utilized by manufacturers of other products, such as water heaters, lighting fixtures, ceiling grids, HVAC and appliances. We clean, treat and coat both heavy gauge (hot-rolled) and light gauge metal coils for our other operating segments and for third party customers, who utilize them in a variety of applications, including construction products, heating and air conditioning systems, water heaters, lighting fixtures, ceiling grids, office furniture, appliances and other products. We provide toll coating services under which the customer provides the metal coil and we provide only the coil coating process. We also provide a painted metal package under which we sell both the metal coil and the coil coating service together.

We believe that pre-painted metal coils provide manufacturers with a higher quality, environmentally cleaner and more cost-effective solution to operating their own in-house painting operations. Pre-painted metal coils also offer manufacturers the opportunity to produce a broader and more aesthetically pleasing range of products.

Manufacturing. As of October 30, 2016, we operated 6 metal coil coating facilities located in the United States. Two of our facilities coat hot-rolled, heavy gauge metal coils and four of our facilities coat light gauge metal coils.

Our coil coating processes have multiple stages. In the first stage, the metal surface is cleaned and a chemical pretreatment is applied. The pretreatment is designed to promote adhesion of the paint system and enhance the corrosion resistance of the metal. After the pretreatment stage, a paint system is roll-applied to the metal surface, then baked at a high temperature to cure the coating and achieve a set of physical properties that not only make the metal more attractive, but also allows it to be formed into a manufactured product, all while maintaining the integrity of the paint system so that it can endure the final end use requirements. After the coating system has been cured, the metal substrate is rewound into a finished metal coil and packaged for shipment. Slitting and embossing processes can also be performed on the finished coil in accordance with customer specifications, prior to shipment.

Sales, Marketing and Customers. We process metal coils to supply substantially all the coating requirements of our own metal components and engineered building systems operating segments. We also process metal coils to supply external customers in a number of different industries.

We market our metal coil coating products and processes under the brand names “Metal Coaters” and “Metal Prep”. Each of our metal coil coating facilities has an independent sales staff.

We sell our products and processes principally to original equipment manufacturer customers who utilize pre-painted metal, including other manufacturers of engineered building systems and metal components. Our customer base also includes steel mills, metal service centers and painted coil distributors who in-turn supply various manufacturers of engineered building systems, metal components, lighting fixtures, ceiling grids, water heaters, appliances and other manufactured products. During fiscal 2016, the largest customer of our metal coil coating segment accounted for less than 2% of our total consolidated sales and external sales of our metal coil coating segment represented 6.3% of total consolidated sales for the fiscal year.

Business Strategy

We intend to expand our business, enhance our market position and increase our sales and profitability by focusing on the implementation of a number of key initiatives that we believe will help us grow and reduce costs. Our current strategy focuses primarily on organic initiatives, but also considers the use of opportunistic acquisitions to achieve our growth objectives:

• | Corporate-Wide Initiatives. We will continue our focus on leveraging technology, automation and supply chain efficiencies to be one of the lowest cost producers, reduce ESG&A expenses and improve plant utilization through expanded use of our integrated business model and facility re-alignment. To further distinguish the value of our products and services, our manufacturing platform has been reorganized into a single, integrated organization, to rapidly incorporate the benefits of lean manufacturing best practices and efficiencies across all of our facilities. |

11

• | Engineered Building Systems Segment. We intend to enhance the performance of our differentiated brands by aligning our operations to achieve the best total value building solution, delivered complete and on-time, every time. We are focused on providing industry leading cycle times, service and quality, while improving customer satisfaction. |

• | Metal Components Segment. We intend to maintain our leading positions in these markets and seek opportunities to profitably expand our customer base by providing industry leading customer service. In addition, we intend to drive increased IMP sales through all commercial channels. |

• | Metal Coil Coating Segment. Through diversification of our external customer base and national footprint, we plan to grow non-construction sales as a supply chain partner to national manufacturers. We will continue to leverage efficiency improvements to be one of the lowest cost producers. |

Restructuring

We have developed plans to improve cost efficiency and optimize our combined manufacturing plant footprint considering our recent acquisitions and restructuring efforts. During the fiscal year ended October 30, 2016, we incurred severance related charges of $3.6 million associated with restructuring actions, including $1.0 million and $1.7 million in our engineered building systems segment and metal components segment, respectively, and the remaining amount of $0.9 million at corporate. These charges included severance related costs associated with the consolidation and closing of two manufacturing facilities in our metal components segment during fiscal 2016. We also incurred approximately $0.6 million of other costs associated with restructuring actions during fiscal 2016.

The Company believes that the successful execution of these plans in phases over the next 24 months will result in annual cost savings ranging between $30.0 million and $40.0 million when completed, of which between approximately $18.0 million and $28.0 million represents the aggregate expected incremental cost savings to be realized in fiscal years 2017 and 2018. We are currently unable to make a good faith determination of cost estimates, or range of cost estimates, for actions associated with these plans. Restructuring charges will be recorded for these plans as they become estimable and probable.

Raw Materials

The principal raw material used in manufacturing of our metal components and engineered building systems is steel which we purchase from multiple steel producers. Our various products are fabricated from steel produced by mills including bars, plates, structural shapes, hot-rolled coils and galvanized or Galvalume®-coated coils (Galvalume® is a registered trademark of BIEC International, Inc.).

Our raw materials on hand increased to $145.1 million at October 30, 2016 from $109.5 million at November 1, 2015 due to rising input costs and to support higher levels of business activity in fiscal 2016.

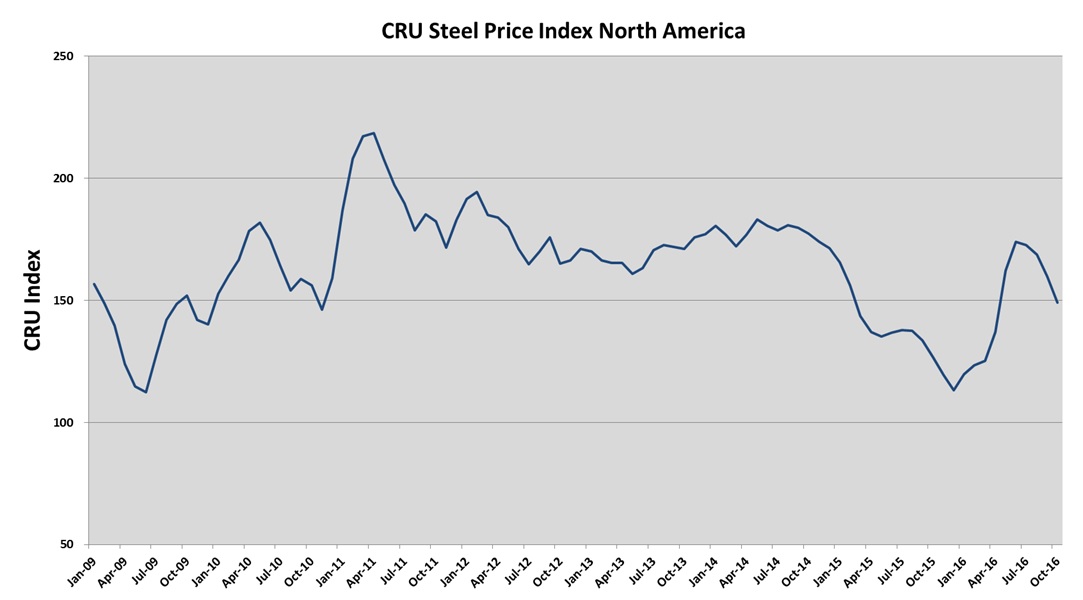

The price and supply of steel impacts our business. The steel industry is highly cyclical in nature, and steel prices have been volatile in recent years and may remain volatile in the future. Steel prices are influenced by numerous factors beyond our control, including general economic conditions domestically and internationally, currency fluctuations, the availability of raw materials, competition, labor costs, freight and transportation costs, production costs, import duties and other trade restrictions. We believe the CRU North American Steel Price Index, published by the CRU Group since 1994, reasonably depicts the volatility we have experienced in steel prices. See “Item 7A. Quantitative and Qualitative Disclosures About Market Risk — Steel Prices.” During fiscal 2016 and 2015, steel prices fluctuated due to market conditions ranging from a low point of 113 to a high point of 174 on the CRU Index in fiscal 2016 and from a low point of 127 to a high point of 174 on the CRU Index in fiscal 2015. Based on the cyclical nature of the steel industry, we expect steel prices will continue to be volatile.

Although we have the ability to purchase steel from a number of suppliers, a production cutback by one or more of our current suppliers could create challenges in meeting delivery schedules to our customers. Because we have periodically adjusted our contract prices, particularly in the engineered building systems segment, we have generally been able to pass increases in our raw material costs through to our customers. We normally do not maintain an inventory of steel in excess of our current production requirements. However, from time to time, we may purchase steel in advance of announced steel price increases. For additional information about the risks of our raw material supply and pricing, see “Item 1A. Risk Factors.”

Backlog

At October 30, 2016 and November 1, 2015, the total backlog of orders, primarily consisting of engineered building systems’ orders, for our products we believe to be firm was $515.8 million and $496.1 million, respectively. Job orders included in backlog are generally cancellable by customers at any time for any reason; however, cancellation charges may be assessed. Occasionally, orders in the backlog are not completed and shipped for reasons that include changes in the requirements of the customers and the inability of customers to obtain necessary financing or zoning variances. We anticipate that less than 19% of this backlog will extend beyond one year.

12

Competition

We and other manufacturers of metal components and engineered building systems compete in the building industry with all other alternative methods of building construction such as tilt-wall, concrete and wood, single-ply and built up, all of which may be perceived as more traditional, more aesthetically pleasing or having other advantages over our products. We compete with all manufacturers of building products, from small local firms to large national firms.

In addition, competition in the metal components and engineered building systems market of the building industry is intense. We believe it is based primarily on:

• | quality; |

• | service; |

• | on-time delivery; |

• | ability to provide added value in the design and engineering of buildings; |

• | price; |

• | speed of construction; and |

• | personal relationships with customers. |

We compete with a number of other manufacturers of metal components and engineered building systems for the building industry, ranging from small local firms to large national firms. Many of these competitors operate on a regional basis. We have two primary nationwide competitors in the engineered building systems market and three primary nationwide competitors in the metal components market. However, the metal components market is more fragmented than the engineered building systems market.

As of October 30, 2016, we operated 41 manufacturing facilities located in the United States, Mexico, Canada and China, with additional sales and distribution offices throughout the United States and Canada. These facilities are used primarily for the manufacturing of metal components and engineered building systems for the building industry. We believe this broad geographic distribution gives us an advantage over our metal components and engineered building systems competitors because major elements of a customer’s decision are the speed and cost of delivery from the manufacturing facility to the product’s ultimate destination. We operate a fleet of trucks to deliver our products to our customers in a more timely manner than most of our competitors.

We compete with a number of other providers of metal coil coating services to manufacturers of metal components and engineered building systems for the building industry, ranging from small local firms to large national firms. Most of these competitors operate on a regional basis. Competition in the metal coil coating industry is intense and is based primarily on quality, service, delivery and price.

Consolidation

Over the last several years, there has been a consolidation of competitors within the industries of the engineered building systems, metal components and metal coil coating segments, which include many small local and regional firms. We believe that these industries will continue to consolidate, driven by the needs of manufacturers to increase anticipated long-term manufacturing capacity, achieve greater process integration, add geographic diversity to meet customers’ product and delivery needs, improve production efficiency and manage costs. When beneficial to our long-term goals and strategy, we have sought to consolidate our business operations with other companies. The resulting synergies from these consolidation efforts have allowed us to reduce costs while continuing to serve our customers’ needs. For more information, see “Acquisitions” below.

In addition to the consolidation of competitors within the industries of the engineered building systems, metal components and metal coil coating segments, in recent years there has been consolidation between those industries and steel producers. Several of our competitors have been acquired by steel producers, and further similar acquisitions are possible. For a discussion of the possible effects on us of such consolidations, see “Item 1A. Risk Factors.”

Acquisitions

We have a history of making acquisitions within our industry, and we regularly evaluate growth opportunities both through acquisitions and internal investment. We believe that there remain opportunities for growth through consolidation in the metal buildings and components segments, and our goal is to continue to grow organically and through opportunistic strategic acquisitions.

13

Consistent with our growth strategy, we frequently engage in discussions with potential sellers regarding the possible purchase by us of businesses, assets and operations that are strategic and complementary to our existing operations. Such assets and operations include engineered building systems and metal components, but may also include assets that are closely related to, or intertwined with, these business lines, and enable us to leverage our asset base, knowledge base and skill sets. Such acquisition efforts may involve participation by us in processes that have been made public, involve a number of potential buyers and are commonly referred to as “auction” processes, as well as situations in which we believe we are the only party or one of the very limited number of potential buyers in negotiations with the potential seller. These acquisition efforts often involve assets that, if acquired, would have a material effect on our financial condition and results of operations.

We also evaluate from time to time possible dispositions of assets or businesses when such assets or businesses are no longer core to our operations and do not fit into our long-term strategy.

The Credit Agreement and the Notes contain a number of covenants that, among other things, limit or restrict the ability of the Company and its subsidiaries to dispose of assets, make acquisitions and engage in mergers. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Debt.”

Environmental Matters

The operation of our business is subject to stringent and complex laws and regulations pertaining to health, safety and the environment. As an owner or operator of manufacturing facilities, we must comply with these laws and regulations at the federal, state and local levels. These laws and regulations can restrict or impact our business activities in many ways, such as:

• | requiring investigative or remedial action to mitigate or control certain environmental conditions that may have been caused by our operations or practices, or historically caused by former owners or operators at properties we have acquired; or |

• | enjoining or restricting the operations of facilities found to be out of compliance with environmental laws and regulations, permits or other legal authorizations issued pursuant to such laws or regulations. |

The trend in environmental regulation is to place more restrictions and requirements on activities that potentially impact human health and welfare or the environment. As a result, there can be no assurance as to the amount or timing of future expenditures for environmental compliance or corrective action, and actual future expenditures may differ from what we presently anticipate. However, we strategically anticipate future regulatory requirements that might be imposed and plan accordingly to meet and maintain compliance with such environmental laws and regulations. We do so with the goal of minimizing the associated costs of compliance while not intruding on our ability to comply.

Failure to comply with environmental laws and regulations may trigger a variety of administrative, civil or criminal enforcement measures, including the assessment of monetary penalties, the imposition of investigative or remedial requirements, the issuance of orders enjoining or limiting current or future operations, or the denial or revocation of permits or other legal authorizations. Certain environmental statutes impose strict, joint and several liability for costs required to clean up and restore sites where hazardous substances or industrial wastes have been mismanaged or otherwise released. Moreover, neighboring landowners or other third parties may file claims for personal injury and property damage allegedly caused by the release of substances or contaminants into the environment.

We do not believe that compliance with federal, state or local environmental laws and regulations will have a material adverse effect on our business, financial position or results of operations. In addition, we believe that the various environmental compliance activities we are presently engaged in are not expected to materially interrupt or diminish our operational ability to manufacture our products. We cannot assure, however, that future events, such as changes in existing laws, the promulgation of new laws, or the development or discovery of new facts or conditions related to our operations will not cause us to incur significant costs.

The following are representative environmental and safety requirements relating to our business:

Air Emissions. Our operations are subject to the federal Clean Air Act Amendments of 1990, or CAAA, and comparable state laws and regulations. These laws and regulations govern emissions of air pollutants from industrial stationary sources (including our manufacturing facilities) and impose various permitting, monitoring, record keeping and reporting requirements. Such laws and regulations may require us to: obtain pre-approval for the construction or modification of applicable projects or facility changes that have the potential to produce new or increased air emissions; obtain and comply with operating permits that limit air emissions or certain operational parameters; or employ best available emission control technologies to minimize or destruct emissions from our facilities.

Our failure to comply with these requirements could subject us to monetary penalties, injunctions, restrictions on operations, and potential administrative, civil or criminal enforcement actions. We may be required to incur certain capital

14

expenditures in the future for air pollution control equipment in conjunction with obtaining and complying with pre-construction authorizations or operating permits for air emissions. We do not believe that our operations will be materially adversely affected by such requirements.

Greenhouse Gases. More stringent laws and regulations relating to climate change and greenhouse gases, or GHGs, may be adopted in the future and could cause us to incur additional operating costs or reduced demand for our products. On December 15, 2009, the federal Environmental Protection Agency, or EPA, published its findings that emissions of carbon dioxide, methane, and other GHGs present an endangerment to public health, the economy and the environment because emissions of such gases contribute to the warming of the earth’s atmosphere and other climate changes. These findings allowed the EPA to adopt and implement regulations that would restrict emissions of GHGs under existing provisions of the federal CAAA.

The EPA adopted regulations that would require a reduction in emissions of GHGs and could trigger permit review for GHGs produced from certain industrial stationary sources. In June 2010, the EPA adopted the Prevention of Significant Deterioration (“PSD”) and Title V Greenhouse Gas Tailoring Rule, which phases in permitting requirements for stationary sources of GHGs beginning January 2, 2011. This rule “tailors” these permitting programs to apply to certain significant stationary sources of GHG emissions in using a multistep process, with the largest sources first subjected to permitting. In June 2014, the Supreme Court restricted applicability of the Tailoring Rule to GHG-emitting stationary sources that also emit conventional non-GHG National Ambient Air Quality Standard criteria pollutants at levels greater than PSD and Title V threshold amounts.

Several North American state and multi-state climate change initiatives are either actively assessing, or have already implemented, measures to reduce GHG emissions, primarily through the development of emission source performance standards, GHG tracking systems and GHG emission cap-and-trade programs. These programs typically require major sources of GHGs to acquire and surrender emission allowances and offsets, with the number of allowances available for purchase incrementally reduced each year until an overall GHG emission reduction goal is achieved.

In October 2011, the California Air Resources Board adopted a cap-and-trade program that will require the state to reduce GHG emissions to 1990-levels by 2020. This program, along with mandatory GHG reporting and other complementary measures, was authorized by the California Global Warming Solutions Act (AB 32) of 2006. Effective January 1, 2013, cap-and-trade regulations applied to all major industrial sources and electricity generators, and expanded in 2015 to cover the distributors of transportation fuels, natural gas and other fuels. The amount of allowances available to these sources is set to decline by about three percent each year through 2020 as the cap is lowered and emissions are reduced.

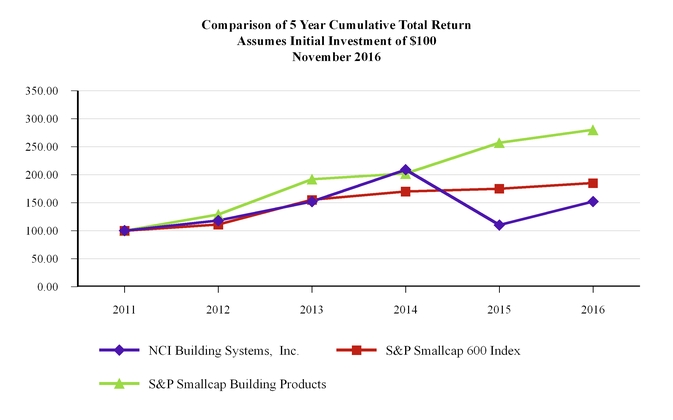

Although it is not possible to accurately predict how new GHG legislation or regulations would impact our business, any new federal, regional or state restrictions on emissions of carbon dioxide or other GHGs that may be imposed in areas where we conduct business could result in increased compliance costs or additional operating restrictions on our facilities, raw material and energy suppliers, the transportation and distribution of our products, and our customers. Such restrictions could potentially make our products more expensive and thus reduce their demand, which could have a material adverse effect on our business.