Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - CASCADE MICROTECH INC | Financial_Report.xls |

| EX-32.1 - EX-32.1 - CASCADE MICROTECH INC | d697159dex321.htm |

| EX-31.2 - EX-31.2 - CASCADE MICROTECH INC | d697159dex312.htm |

| EX-10.3 - EX-10.3 - CASCADE MICROTECH INC | d697159dex103.htm |

| EX-32.2 - EX-32.2 - CASCADE MICROTECH INC | d697159dex322.htm |

| EX-10.1 - EX-10.1 - CASCADE MICROTECH INC | d697159dex101.htm |

| EX-31.1 - EX-31.1 - CASCADE MICROTECH INC | d697159dex311.htm |

| 10-Q - 10-Q - CASCADE MICROTECH INC | d697159d10q.htm |

Exhibit 10.2

THIRD AMENDMENT TO LEASE

(Extension of Term)

THIS THIRD AMENDMENT TO LEASE (this “Third Amendment”) is dated as of the 23rd day of January, 2014, between NIMBUS CENTER LLC, a Delaware limited liability company (“Landlord”), and CASCADE MICROTECH, INC., an Oregon corporation (“Tenant”).

RECITALS

A. Landlord (as successor-in-interest to OR-Nimbus Corporate Center, L.L.C.) and Tenant are parties to a lease dated as of April 2, 1999 (the “Original Lease”), as amended by First Amendment dated as of January 10, 2007 (the “First Amendment”) and Second Amendment dated as of February 25, 2013 (the “Second Amendment”, and together with the Original Lease and First Amendment, collectively referred to herein as the “Lease”), pursuant to which Tenant leases from Landlord certain premises (the “Existing Premises”) consisting of the entire building (the “Building 6 Premises”) located at 9100 SW Gemini Drive, Beaverton, Oregon commonly known as Nimbus Building 6 (“Building 6”) and a portion of the building (the “Suite 9203B Premises”) located at 9203-9205 SW Nimbus Avenue, Beaverton, Oregon commonly known as Nimbus Building 9 (“Building 9”). Capitalized terms not otherwise defined herein shall have the meanings set forth in the Lease.

B. The Term expires on December 31, 2019.

C. Landlord and Tenant presently desire to amend the Lease to (i) confirm the Base Rent for the Building 6 Premises, (ii) and provide for certain other Lease modifications, all as more particularly set forth herein.

NOW, THEREFORE, in consideration of the foregoing, the parties hereto agree as follows:

1. Building 6 Base Rent. Tenant shall continue to pay Base Rent for the Building 6 Premises in the amount set forth in the Lease throughout December 31, 2014. Pursuant to the terms and conditions set forth in Paragraph 2 of the Second Amendment, Landlord and Tenant have agreed upon the Prevailing Market Rate for the Building 6 Premises. Effective as of January 1, 2015 and continuing thereafter during the Extension Term, Tenant shall pay Base Rent for the Building 6 Premises pursuant to the Lease in the following amounts:

| Period |

Annual Rate Per SF | Monthly Base Rent | ||||||

| 1/01/15 - 3/31/15 |

$ | 13.00 | $ | 63,718.42 | ||||

| 4/01/15 - 3/31/16 |

$ | 13.39 | $ | 65,629.97 | ||||

| 4/01/16 - 3/31/17 |

$ | 13.79 | $ | 67,590.54 | ||||

| 4/01/17 - 3/31/18 |

$ | 14.20 | $ | 69,600.12 | ||||

| 4/01/18 - 3/31/19 |

$ | 14.63 | $ | 71,707.73 | ||||

| 4/01/19 - 12/31/19 |

$ | 15.07 | $ | 73,864.35 | ||||

2. Building 6 Premises; Expenses and Taxes. Tenant shall continue to pay Tenant’s Proportionate Share of Operating Expenses with respect to the Building 6 Premises throughout the Term.

3. Landlord Work; Existing Premises. Tenant shall accept the Existing Premises in its as-is condition as of the date of this Third Amendment, and, except as provided in the Work Letter attached to the Second Amendment as Exhibit J, Landlord shall have no obligation to make or pay for any alterations, additions, improvements or renovations in or to the Existing Premises. Notwithstanding the foregoing, the parties agree that Tenant is permitted to perform certain improvements to the Building 6 Premises as described in the Work Letter attached to the Second Amendment as Exhibit J. In addition, Exhibit J-1 attached to the Second Amendment to Lease is hereby deleted in its entirety and replaced with Exhibit J-1 attached hereto.

4. Suites 9225 and 9215 Must Take Space.

a. Paragraph 4.c. of the Second Amendment shall be deleted in its entirety and replaced with the following:

“c. Base Rent; Operating Expenses. Tenant’s obligation to pay Base Rent and Tenant’s Proportionate Share of Operating Expenses for the Suites 9225 and 9215 Must Take Space pursuant to the Lease shall commence as of the date (the “Suites 9225 and 9215 Must Take Space Rent Commencement Date”) that is the earlier to occur of (i) 90 days following the Suites 9225 and 9215 Must Take Space Commencement Date or (ii) the date Tenant shall commence the conduct of business in the Suites 9225 and 9215 Must Take Space or any portion thereof. From and after the

1

Suites 9225 and 9215 Must Take Space Rent Commencement Date, and for the balance of the Term, Tenant shall pay Base Rent for the Suites 9225 and 9215 Must Take Space pursuant to the Lease in the following amounts:

| Period |

Annual Rate Per SF | Monthly Base Rent | ||||||

| Suites 9225 and 9215 Must Take Space Rent Commencement Date - 3/31/15 |

$ | 13.00 | $ | 9,871.33 | ||||

| 4/01/15 - 3/31/16 |

$ | 13.39 | $ | 10,167.47 | ||||

| 4/01/16 - 3/31/17 |

$ | 13.79 | $ | 10,471.21 | ||||

| 4/01/17 - 3/31/18 |

$ | 14.20 | $ | 10,782.53 | ||||

| 4/01/18 - 3/31/19 |

$ | 14.63 | $ | 11,109.05 | ||||

| 4/01/19 - 12/31/19 |

$ | 15.07 | $ | 11,443.15 | ” | |||

5. Suites 9225 and 9215 Work Letter. Exhibit D to the Second Amendment is hereby deleted in its entirety and replaced with Exhibit D attached hereto.

6. Suite 9205 Must Take Space.

a. Paragraphs 5.a. and 5.c of the Second Amendment shall be deleted in their entirety and replaced with the following”

“a. Suite 9205 Must Take Space. Effective as of the Suite 9205 Must Take Space Commencement Date (as defined below), and continuing for the balance of the Term as applicable to the Premises and any extension thereof, the space consisting of 3,634 rentable square feet on the first (1st) floor of Nimbus Building 9, as shown on the demising plan attached hereto as Exhibit E (the “Suite 9205 Must Take Space”) shall be added to the premises covered by the Lease. Commencing on the Suite 9205 Must Take Space Commencement Date, all references in the Lease to the “Premises” shall be deemed to include the Suite 9205 Must Take Space. All terms, covenants and conditions of the Lease applicable to the Premises, as modified hereunder, shall apply to the Suite 9205 Must Take Space, except as expressly set forth in this Paragraph 5.

The “Suite 9205 Must Take Space Commencement Date” shall mean the date on which Landlord shall deliver the Suite 9205 Must Take Space to Tenant in the condition required by Paragraph 5.b. below. The scheduled Suite 9205 Must Take Space Commencement Date is April 1, 2014. The parties agree that the Suite 9205 Must Take Space Commencement Date will not occur prior to April 1, 2014 unless agreed to in writing by Landlord and Tenant. If Landlord is unable to deliver possession of the Suite 9205 Must Take Space to Tenant on or before such scheduled Suite 9205 Must Take Space Commencement Date for any reason whatsoever, neither the Lease nor Tenant’s obligation to lease the Suite 9205 Must Take Space hereunder shall be void or voidable, nor shall any such delay in delivery of possession of the Suite 9205 Must Take Space operate to extend the Term with respect to the Suite 9205 Must Take Space or the balance of the Premises, or amend the Suite 9205 Must Take Space Rent Commencement Date (as defined below) or Tenant’s other obligations with respect to the Suite 9205 Must Take Space or under the Lease. If Landlord is unable to deliver possession of the Suite 9205 Must Take Space to Tenant by November 1, 2014, Landlord shall not incur any liability under the Lease, but Tenant shall have the right to terminate Tenant’s obligation to lease the Suite 9205 Must Take Space by providing Landlord with written notice on or before November 15, 2014. So long as Tenant is not in default under the Lease, during the period commencing on the date of this Second Amendment and ending on the earlier of (i) Tenant’s delivery to Landlord of Tenant’s termination notice pursuant to the terms of this Paragraph 5.a. or (ii) the Suite 9205 Take Space Commencement Date, Landlord shall not enter into any new lease or amend an existing lease which term or extension term extends beyond April 1, 2014.”

“c. Base Rent; Operating Expenses. Tenant’s obligation to pay Base Rent and Tenant’s Proportionate Share of Operating Expenses for the Suite 9205 Must Take Space pursuant to the Lease shall commence as of the date (the “Suite 9205 Must Take Space Rent Commencement Date”) that is the earlier to occur of (i) 90 days following the Suite 9205 Must Take Space Commencement Date or (ii) the date Tenant shall commence the conduct of business in the Suite 9205 Must Take Space or any portion thereof. From and after the Suite 9205 Must Take Space Rent Commencement Date, and for the balance of the Term, Tenant shall pay Base Rent for the Suite 9205 Must Take Space pursuant to the Lease in the following amounts:

| Period |

Annual Rate Per SF | Monthly Base Rent | ||||||

| Suite 9205 Must Take Space Rent Commencement Date -3/31/15 |

$ | 13.00 | $ | 3,936.83 | ||||

| 4/01/15 - 3/31/16 |

$ | 13.39 | $ | 4,054.94 | ||||

| 4/01/16 - 3/31/17 |

$ | 13.79 | $ | 4,176.07 | ||||

| 4/01/17 - 3/31/18 |

$ | 14.20 | $ | 4,300.23 | ||||

| 4/01/18 - 3/31/19 |

$ | 14.63 | $ | 4,430.45 | ||||

| 4/01/19 - 12/31/19 |

$ | 15.07 | $ | 4,563.70 | ” | |||

2

7. Suite 9500 Must Take Space. Paragraph 6.c. of the Second Amendment shall be deleted in its entirety and replaced with the following:

“c. Base Rent; Operating Expenses. Tenant’s obligation to pay Base Rent and Tenant’s Proportionate Share of Operating Expenses for the Suite 9500 Must Take Space pursuant to the Lease shall commence as of the date (the “Suite 9500 Must Take Space Rent Commencement Date”) that is the earlier to occur of (i) 90 days following the Suite 9500 Must Take Space Commencement Date or (ii) the date Tenant shall commence the conduct of business in the Suite 9500 Must Take Space or any portion thereof. From and after the Suite 9500 Must Take Space Rent Commencement Date, and for the balance of the Term, Tenant shall pay Base Rent for the Suites 9225 and 9215 Must Take Space pursuant to the Lease in the following amounts:

| Period |

Annual Rate Per SF | Monthly Base Rent | ||||||

| Suite 9500 Must Take Space Rent Commencement Date - 3/31/15 |

$ | 13.00 | $ | 13,187.42 | ||||

| 4/01/15 - 3/31/16 |

$ | 13.39 | $ | 13,583.04 | ||||

| 4/01/16 - 3/31/17 |

$ | 13.79 | $ | 13,988.81 | ||||

| 4/01/17 - 3/31/18 |

$ | 14.20 | $ | 14,404.72 | ||||

| 4/01/18 - 3/31/19 |

$ | 14.63 | $ | 14,840.92 | ||||

| 4/01/19 - 12/31/19 |

$ | 15.07 | $ | 15,278.26 | ” | |||

8. Renewal Option. The Renewal Option set forth in Section 6 of the First Amendment, as amended by Paragraph 9 of the Second Amendment shall continue in full force and effect through the Term.

9. Supplemental HVAC Units. Tenant may, upon written consent from Landlord, install supplemental HVAC units (the “Supplemental HVAC Units”) outside the Premises in a location selected by Landlord in Landlord’s sole discretion; provided, however, Landlord agrees that the location selected by Landlord will be within the area set forth in Exhibit A attached hereto. In the event Tenant installs the Supplemental HVAC Units, Tenant shall be solely responsible for obtaining all necessary governmental and regulatory approvals and for the cost of installing, repairing, maintaining and replacing such Supplemental HVAC Units. Tenant shall also be required to remove the Supplemental HVAC Units upon the expiration of the Term and for restoring the area where the Supplemental HVAC Units were installed to the area’s pre-existing condition.

10. Roof Top HVAC Units.

a. Notwithstanding anything to the contrary contained in the Lease, including but not limited to Article 11 of the Lease, Tenant, at its sole cost and expense, shall perform all maintenance and repairs to all roof top HVAC units serving the Premises (including any existing and new HVAC units located in Buildings 6 and 9). Without limiting the foregoing, Tenant shall enter into, and maintain in effect throughout the Term, an HVAC maintenance contract with respect to all roof top HVAC units serving the Premises, in form and substance reasonably approved in writing by Landlord, with a contractor reasonably approved in writing by Landlord, which contract shall require, among other things, that maintenance be performed on such HVAC system not less than once every 6 months. To the extent Landlord is not reimbursed by insurance proceeds, Tenant shall reimburse Landlord for the cost of repairing damage to the Building caused by the acts of Tenant, Tenant Related Parties and their respective contractors and vendors in connection with such HVAC maintenance and repairs. If Tenant fails to make any repairs to the roof top HVAC units serving the Premises for more than 15 days after notice from Landlord (although notice shall not be required in an emergency), Landlord may make the repairs, and, within 30 days after demand, Tenant shall pay the reasonable cost of the repairs, together with an administrative charge in an amount equal to 5% of the cost of the repairs.

b. Notwithstanding the foregoing, if the roof top HVAC system serving the Premises needs to be replaced (rather than merely maintained or repaired), Landlord shall perform such replacement at

3

Landlord’s sole cost and expense. Except as otherwise expressly set forth herein, neither Base Rent nor Additional Rent will be reduced, nor will Landlord be liable, for loss or injury to or interference with Tenant’s property, profits or business arising from or in connection with Landlord’s performance of its obligations under this section.

11. Real Estate Brokers. Tenant represents and warrants that it has negotiated this Amendment directly with Shorenstein Realty Services, L.P., on behalf of Landlord, and Cresa Portland, LLC, on behalf of Tenant (collectively, the “Brokers”), and Tenant has not authorized or employed, or acted by implication to authorize or to employ, any other real estate broker or salesman to act for Tenant in connection with this Third Amendment. Tenant shall indemnify, defend and hold Landlord harmless from and against any and all claims by any real estate broker or salesman other than the Brokers for a commission, finder’s fee or other compensation as a result of Tenant’s entering into this Amendment.

12. No Offer. Submission of this instrument for examination and signature by Tenant does not constitute an offer to amend the Lease or a reservation of or option to amend the Lease, and this instrument is not effective as a lease amendment or otherwise until executed and delivered by both Landlord and Tenant.

13. Authority. If Tenant is a corporation, partnership, trust, association or other entity, Tenant and each person executing this Third Amendment on behalf of Tenant, hereby covenants and warrants that (a) Tenant is duly incorporated or otherwise established or formed and validly existing under the laws of its state of incorporation, establishment or formation, (b) Tenant has and is duly qualified to do business in the state in which the Building is located, (c) Tenant has full corporate, partnership, trust, association or other appropriate power and authority to enter into this Third Amendment and to perform all Tenant’s obligations under the Lease, as amended by this Third Amendment, and (d) each person (and all of the persons if more than one signs) signing this Third Amendment on behalf of Tenant is duly and validly authorized to do so.

14. Lease in Full Force and Effect. Except as provided above, the Lease is unmodified hereby and remains in full force and effect.

IN WITNESS WHEREOF, the parties have executed this Third Amendment as of the date and year first above written.

| LANDLORD: | TENANT: | |||||||||

| NIMBUS CENTER LLC, | CASCADE MICROTECH, INC., | |||||||||

| a Delaware limited liability company | an Oregon corporation | |||||||||

| By: | /s/ Greg Meyer |

By: | /s/ Jeff Killian | |||||||

| Name: | Greg Meyer |

Name: | Jeff Killian | |||||||

| Title: | Vice President |

Title: | Chief Financial Officer | |||||||

4

EXHIBIT D

Suites 9225 and 9215 Work Letter

This Exhibit (the “Suites 9225 and 9215 Work Letter”) is attached to and made a part of the Second Amendment to Lease (the “Second Amendment”) by and between NIMBUS CENTER LLC, a Delaware limited liability company (“Landlord”), and CASCADE MICROTECH, INC., an Oregon corporation (“Tenant”), for space in the building located at 9100 SW Gemini Drive, Beaverton, Oregon commonly known as Nimbus Building 6. Capitalized terms used but not defined herein shall have the meanings set forth in the Amendment.

1. Tenant, following the Suites 9225 and 9215 Must Take Space Commencement Date, shall have the right to perform alterations and improvements to the Suites 9225 and 9215 Must Take Space (the “Suites 9225 and 9215 Tenant Improvements”). Notwithstanding the foregoing, Tenant and its contractors shall not have the right to perform the Suites 9225 and 9215 Tenant Improvements unless and until Tenant has complied with all of the terms and conditions of Section 9 of the Original Lease, including, without limitation, approval by Landlord of the final plans for the Suites 9225 and 9215 Tenant Improvements and the contractors to be retained by Tenant to perform such Suites 9225 and 9215 Tenant Improvements. Tenant shall be responsible for all elements of the design of Tenant’s plans (including, without limitation, compliance with laws, functionality of design, the structural integrity of the design, the configuration of the Premises and the placement of Tenant’s furniture, appliances and equipment), and Landlord’s approval of Tenant’s plans shall in no event relieve Tenant of the responsibility for such design. Landlord’s approval of final plans for the Suites 9225 and 9215 Tenant Improvements and the contractors to perform the Tenant Improvements shall not be unreasonably withheld, conditioned or delayed. The parties agree that Landlord’s approval of the general contractor to perform the Suites 9225 and 9215 Tenant Improvements shall not be considered to be unreasonably withheld if any such general contractor (i) does not have trade references reasonably acceptable to Landlord, (ii) does not maintain insurance as required pursuant to the terms of the Lease, (iii) does not have the ability to be bonded for the work, or (iv) is not licensed as a contractor in the state/municipality in which the Premises is located. Tenant acknowledges the foregoing is not intended to be an exhaustive list of the reasons why Landlord may reasonably withhold its consent to a general contractor. In the event that the Suites 9225 and 9215 Tenant Improvements includes the removal of any demising walls, Landlord agrees that Tenant shall not be obligated to restore the demising walls at the end of the Term.

2. Landlord agrees to contribute the sum of: (i) $159,460.00 (i.e., $17.50 per rentable square foot of Suite 9225 and $17.50 per rentable square foot of Suite 9215) plus (ii) $251,208.00 to be applied toward the cost of the Suites 9225 and 9215 Tenant Improvements (the “Suites 9225 and 9215 Allowance”). The Suites 9225 and 9215 Allowance shall be paid to Tenant in 1 disbursement within 30 days after completion of the Suites 9225 and 9215 Tenant Improvements and Landlord’s receipt of the following documentation: (i) general contractor and architect’s (if an architect is required) completion affidavits, (ii) full and final waivers of lien, (iii) receipted bills covering all labor and materials expended and used, (iv) as-built plans of the Suites 9225 and 9215 Tenant Improvements, and (v) the certification of Tenant and its architect (if an architect is required) that the Suites 9225 and 9215 Tenant Improvements have been installed in a good and workmanlike manner in accordance with the approved plans, and in accordance with applicable Laws. Notwithstanding anything herein to the contrary, Landlord shall not be obligated to disburse any portion of the Suites 9225 and 9215 Allowance during the continuance of an uncured default under the Lease, and Landlord’s obligation to disburse shall only resume when and if such default is cured.

3. Unless utilized for the Existing Premises Tenant Improvements, Suite 9205 Tenant Improvements or the 9500 Tenant Improvements pursuant to Section 4 below, any portion of the Suites 9225 and 9215 Allowance which exceeds the cost of the Suites 9225 and 9215 Tenant Improvements or is otherwise remaining after December 31, 2014 shall accrue to the sole benefit of Landlord, it being agreed that Tenant shall not be entitled to any credit, offset, abatement or payment with respect thereto. In addition, if the Suites 9225 and 9215 Allowance is utilized for the Existing Premises Tenant Improvements, Suite 9205 Tenant Improvements or the 9500 Tenant Improvements pursuant to Section 4 below, any portion of the Suites 9225 and 9215 Allowance which has been moved and is still remaining after June 30, 2015 shall accrue to the sole benefit of Landlord. In the event the cost of the Suites 9225 and 9215 Tenant Improvements exceeds the Suites 9225 and 9215 Allowance, Tenant shall pay all such excess costs after the full amount of the Suites 9225 and 9215 Allowance has been disbursed hereunder directly to Tenant’s contractor or subcontractor or suppliers involved and shall furnish to Landlord copies of receipted invoices therefor and such waivers of lien rights as Landlord may reasonably require.

4. In no event shall the Suites 9225 and 9215 Allowance be used for the purchase of equipment, furniture or other items of personal property of Tenant. Tenant shall be responsible for all applicable state sales or use taxes, if any, payable in connection with the Suites 9225 and 9215 Tenant Improvements and/or Suites 9225 and 9215 Allowance. Notwithstanding anything to the contrary contained herein, Tenant shall be permitted to use any outstanding portion of the Suites 9225 and 9215 Allowance toward the Existing Premises Tenant Improvements, Suite 9205 Tenant Improvements and the Suite 9500 Tenant Improvements; provided that Tenant must provide Landlord with a monthly accounting and six (6) month forecast for the use of each of the Existing Premises Allowance, Suite 9225 and 9215 Allowance, Suite 9205 Allowance, and the Suite 9500 Allowance so that Landlord can properly account for the use and outstanding amount of each respective allowance.

5. This Exhibit shall not be deemed applicable to any additional space added to the Premises at any time or from time to time, whether by any options under the Lease or otherwise, or to any portion of the original Premises or any additions to the Premises in the event of a renewal or extension of the original term of the Lease, whether by any options under the Lease or otherwise, unless expressly so provided in the Lease or any amendment or supplement to the Lease.

EXHIBIT J-1

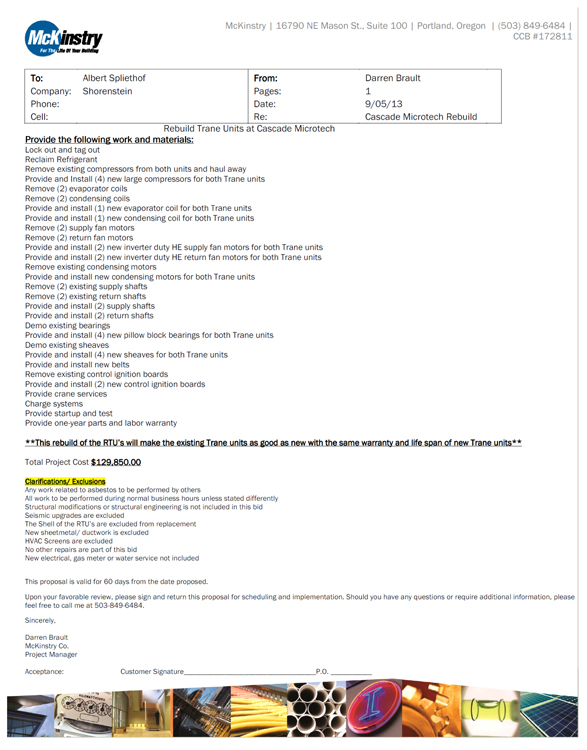

McKinstry | 16790 NE Mason St., Suite 100 | Portland, Oregon | (503) 849-6484 |

CCB #172811

McKinstry

For The Life Of Your Building

To: Albert Spliethof

Company: Shorenstein Phone:

Cell:

From: Darren Brault

Pages: 1

Date: 9/05/13

Re: Cascade Microtech Rebuild

Rebuild Trane Units at Cascade Microtech

Provide the following work and materials:

Lock out and tag out

Reclaim Refrigerant

Remove existing compressors from both units and haul away Provide and Install (4) new large compressors for both Trane units Remove (2) evaporator coils

Remove (2) condensing coils

Provide and install (1) new evaporator coil for both Trane units

Provide and install (1) new condensing coil for both Trane units Remove (2) supply fan motors

Remove (2) return fan motors

Provide and install (2) new inverter duty HE supply fan motors for both Trane units Provide and install (2) new inverter duty HE return fan motors for both Trane units Remove

existing condensing motors

Provide and install new condensing motors for both Trane units

Remove (2) existing supply shafts Remove (2) existing return shafts Provide and install (2) supply shafts Provide and install (2) return shafts Demo existing bearings

Provide and install (4) new pillow block bearings for both Trane units

Demo existing sheaves

Provide and install (4) new sheaves for both Trane units

Provide and install

new belts

Remove existing control ignition boards

Provide and install (2) new

control ignition boards

Provide crane services

Charge systems

Provide startup and test

Provide one-year parts and labor warranty

**This rebuild of the RTU’s will make the existing Trane units as good as new with the same warranty and life span of new Trane units**

Total Project Cost $129,850.00

Clarifications/ Exclusions

Any work related to asbestos to be performed by others

All work to be performed during normal

business hours unless stated differently Structural modifications or structural engineering is not included in this bid Seismic upgrades are excluded

The Shell of

the RTU’s are excluded from replacement

New sheetmetal/ ductwork is excluded

HVAC Screens are excluded

No other repairs are part of this bid

New electrical, gas meter or water service not included

This proposal is valid for 60 days

from the date proposed.

Upon your favorable review, please sign and return this proposal for scheduling and implementation. Should you have any questions or

require additional information, please feel free to call me at 503-849-6484.

Sincerely,

Darren Brault

McKinstry Co.

Project Manager

Acceptance:

Customer Signature

P.O.