Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CST BRANDS, INC. | d517686d8k.htm |

Exhibit 99.1

CST Brands, Inc.

CST Brands, Inc.

Investor Presentation

April 2013 |

1

Safe Harbor Statement

Statements contained in this presentation that state the Company’s or

management’s expectations or predictions of the future are

forward–looking statements intended to be covered by the safe harbor

provisions of the Securities Act of 1933 and the Securities Exchange Act of

1934. The words “believe,” “expect,”

“should,”

“intends,”

“estimates,”

and other similar expressions identify

forward–looking statements. It is important to note that

actual results could

differ materially from those projected in such forward–looking statements.

For more information concerning factors that could cause actual

results

to

differ

from

those

expressed

or

forecasted,

see

Valero’s annual reports on

Form 10-K and quarterly reports on Form 10-Q, filed with the Securities and

Exchange Commission, and available on Valero’s website at

www.valero.com and CST Brand’s registration statement on Form 10 as

amended and filed with the Securities and Exchange Commission, and

available on the CST Brand’s website at www.cstbrands.com

|

Management

Presenters Kim Bowers

President & CEO

Clay Killinger

SVP & CFO

2 |

Overview

–

We are one of the largest independent retailers of transportation fuels and

convenience merchandise in North America

–

Nearly 1,900 sites in two geographic segments: Retail-U.S. and Retail-Canada

–

2012 revenues of $13.1 billion

–

Pro forma 2012 EBITDA

(1)

of $379 million

–

$455 million of capital expenditures over the past 4 years

•

Almost 60% of which relates to store remodels and sustaining activities

Retail –

U.S.

–

1,032 company-operated (COOP) fuel and convenience store sites

–

Sites located in the Southwest and Central U.S.

–

Targeting 15 New-to-Industry (“NTI”) sites in 2013

Retail –

Canada

–

848 retail sites

•

261 COOP fuel and convenience store sites

•

507 dealer/agent-operated sites (participate in fuel sales only)

•

80 unattended truck fuel sites (“Cardlock”

sites)

–

Sites located in the provinces of Eastern Canada, including Ontario

and Quebec

–

Targeting 8 NTI sites in 2013

Summary of Our Business

(1)

See Appendix for a full EBITDA definition and reconciliation.

Note:

Store count data as of December 31, 2012.

3 |

159

83

63

37

2

625

29

30

4

Large Scale and Geographic Diversity

Site data as of December 31, 2012.

CST Service Centers

San Antonio and Montreal

122

542

184

U.S.

Canada

Total

COOP

Dealer-Agent

& Cardlock

Owned

833

81%

187

72%

132

22%

1,152

Leased

199

19%

74

28%

455

78%

728

Total

1,032

100%

261

100%

587

100%

1,880

COOP

4 |

Our Family of

Brands Licensed Brands

Proprietary Brands

5 |

CST is a leading

C-store operator in attractive and growing markets in the

Southwestern U.S.

–

1,032 company-operated retail sites with

average store size of 2,200 sq ft

–

Averaged 5,083 gallons of fuel sold per

site per day in 2012

–

Averaged $17,841 in fuel sales per site per

day in 2012

–

Averaged $3,341 in merchandise sales per

site per day in 2012

Convenience-type merchandise include

tobacco products, beer, snacks,

beverages and fresh foods

–

Recent focus on food service and private

label programs drives improvement in

merchandise margins

•

Recent NTIs have a larger format, more

conducive to food service and other services

•

NTI’s 2012 average store size was 5,360 sq ft

6

Retail U.S. Segment Overview

Fuel Volume and Pro Forma Margin

Total COOP Inside Sales Breakdown

4,983

5,086

5,059

5,083

$0.109

$0.126

$0.131

$0.147

2009

2010

2011

2012

Note:

Margins are net of credit card fees, include LIFO and are adjusted for new

commercial agreements.

Margin ($ per gallon)

Note:

Margin includes retail distribution center.

Cigarettes

Food Service

Beverages

Alcohol

Other

36%

8%

23%

15%

18%

38%

8%

23%

14%

17%

36%

9%

23%

15%

17%

9%

32%

25%

16%

18%

$1,171m

$1,205m

$1,223m

$1,239m

Total:

2009

2012

2010

2011

(Gallons per site per day) |

Company operated

and dealer –

Consists of 768 sites selling fuel under the

Ultramar brand

•

261 company operated sites (fuel and merchandise)

•

507 retail sites that are dealer/agent operated

(fuel only)

•

Averaged 3,046 gallons of fuel sold per site per

day in 2012

•

Averaged $13,008 in fuel sales per site per day

in 2012

•

Averaged $2,743 in merchandise sales per site

per day in 2012

Cardlock

–

Consists of 80 Card-activated, self-service,

unattended stations that allow commercial,

trucking and governmental fleets to buy

transportation fuel 24 hours a day

•

Averaged 6,220 gallons of fuel sold per site per

day in 2012

•

Averaged $25,301 in fuel sales per site per day

in 2012

Heating Oil

–

One of the largest retail heating oil distributors in Eastern Canada

7

Retail Canada Segment Overview

Total COOP Inside Sales Breakdown

Fuel Volume and Pro Forma Margin

2009

2012

2010

2011

Total:

$240m

$261m

$257m

48%

10%

20%

11%

10%

50%

9%

19%

11%

11%

50%

9%

19%

11%

11%

9%

50%

19%

11%

11%

$201m

3,086

3,223

3,320

3,340

$0.195

$0.224

$0.259

$0.233

2009

2010

2011

2012

Note:

Margins are net of credit card fees, include LIFO and are adjusted for new

commercial agreements, includes Cardlock motor fuel sales.

Margin ($ per gallon)

(Gallons per site per day)

Cigarettes

Food Service

Beverages

Alcohol

Other |

Proven

Historical Financial Results and Conservative Capital Structure

Available liquidity of

$550 million

expected at spin-off

Investment Highlights

Significant Real Estate Ownership

Experienced and Deep

Management Team

Well Positioned for Growth

Stable Margins Through All Cycles

Exposure to Growing Markets

Robust and Growing Industry

6

5

1

2

3

4

81% of U.S. sites are owned and 72%

of Canadian COOP sites are owned

Impressive industry performance even

during recessions

Strong urban footprint in the U.S. and

Canadian markets with a

concentration in growing markets

Fuel margins are relatively stable on an

annual basis despite short-term volatility

Growth in food service and private label programs along

with efficient merchandise logistics drive margin growth. NTI

program drives growth in market share. Potential for

wholesale business and bolt-on acquisitions

The company is well positioned to be a leader in the sector

Customer.Service.Team.

7

Management team has an average of

27 years of relevant experience

8 |

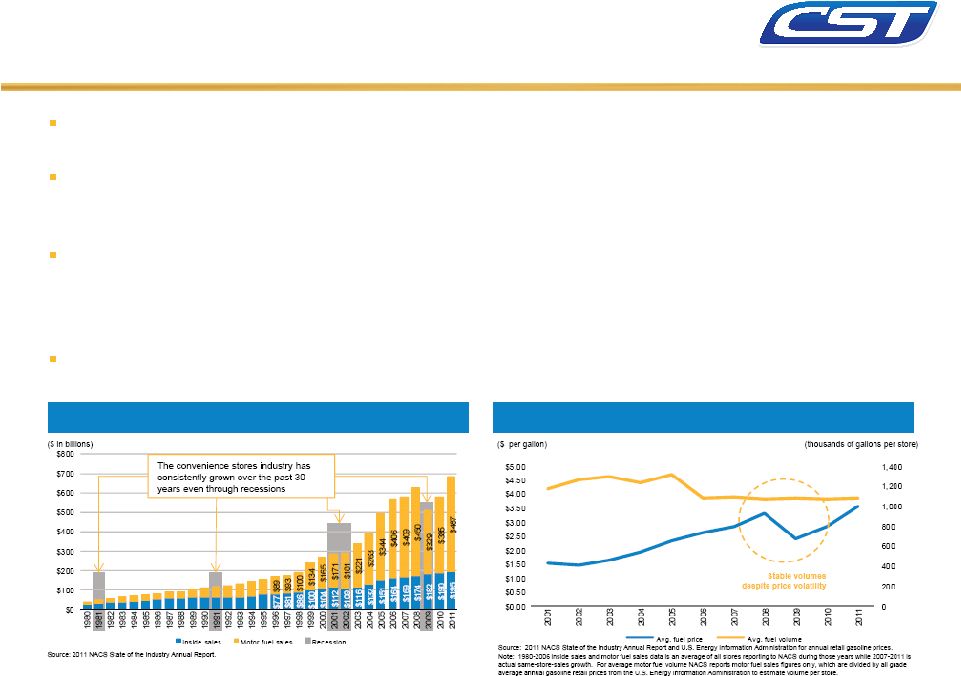

The convenience

store industry has demonstrated consistent growth through multiple economic cycles

Growth of non-fuel revenue is a key driver of increased profit

–

Merchandise and food sales

–

ATM access, car wash facilities and other services

Volatility in fuel prices does not necessarily translate into gross margin volatility

–

Fuel margins tend to have less volatility than fuel prices

–

Relatively stable fuel volumes despite volatile retail fuel prices

–

Fuel margins in Canada are stronger than U.S. due to market structure and regulation

Industry NTI stores are trending toward larger formats that produce higher EBITDA than

existing stores

Robust and Growing Industry

U.S. convenience store industry total sales

U.S. convenience store average fuel volume and fuel price

9 |

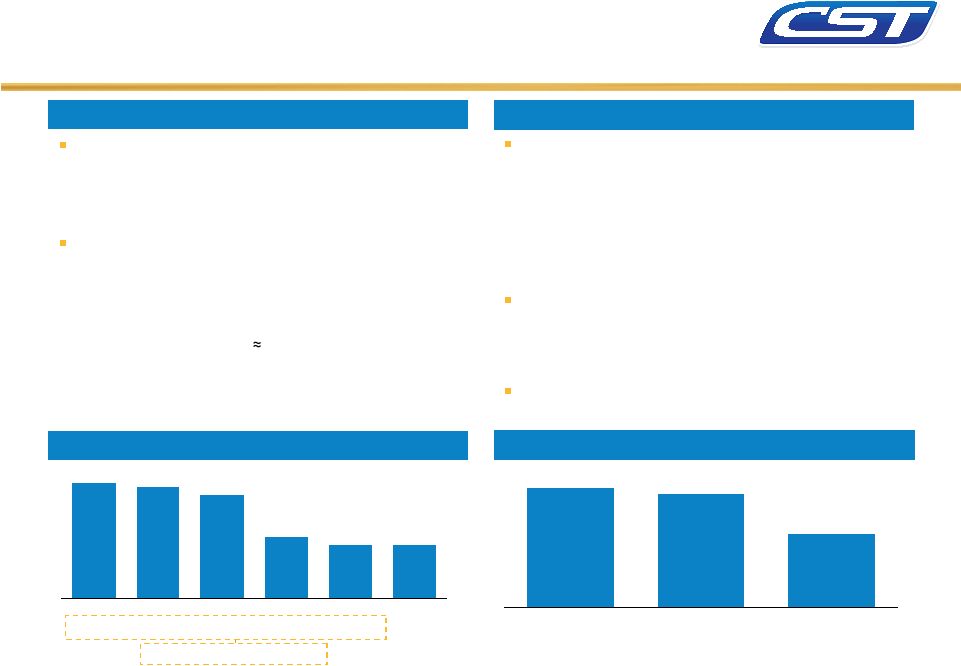

CST has

concentration in markets with strong population growth

–

Significant presence and deep knowledge of

markets in the Southwest

61% of CST’s U.S. stores are in Texas, which

has a robust economy and ideal

demographics for convenience stores

–

#1 in 2011 job growth

–

Unemployment rate

1% below national average

–

Benefitting from increased oil and gas industry

activity

Exposure to Growing Markets

U.S. Market

Canadian Market

Population Growth 2011–2021

(2)

Population Growth 2011–2021

(1)

86.1% of CST’s U.S. stores

(1)

Data from IHS Global Insight

(2)

Data from Ontario Population Projections Update, 2011–2036; Ontario Ministry

of Finance, Spring 2012 Institut de la statistique du Québec,

Perspectives démographiques du Québec et des régions,

2006-2056. 18.0%

17.0%

11.0%

Ottawa

Toronto (GTA)

Montreal (GMA)

CST maintains a leading position in the heavily

populated eastern provinces of Canada

–

78% of sites are located in Quebec and Ontario

–

Many of the provinces have market and regulatory

conditions that provide healthy margin support

–

Permit restrictions in these provinces provide barriers

to new-market entrants for convenience stores

A majority of company operated retail sites are

located in growing metropolitan areas

–

Urban markets are characterized by relatively low

volatility in fuel margins and high barriers to entry

Poised to leverage Ultramar’s “leading brand”

status as we expand in other growth markets

10

17.3%

16.7%

15.5%

9.1%

7.9%

7.8%

Texas

Arizona

Colorado

New Mexico

Wyoming

U.S. average

15.4%

6.1%

60.6%

0.4%

3.6% |

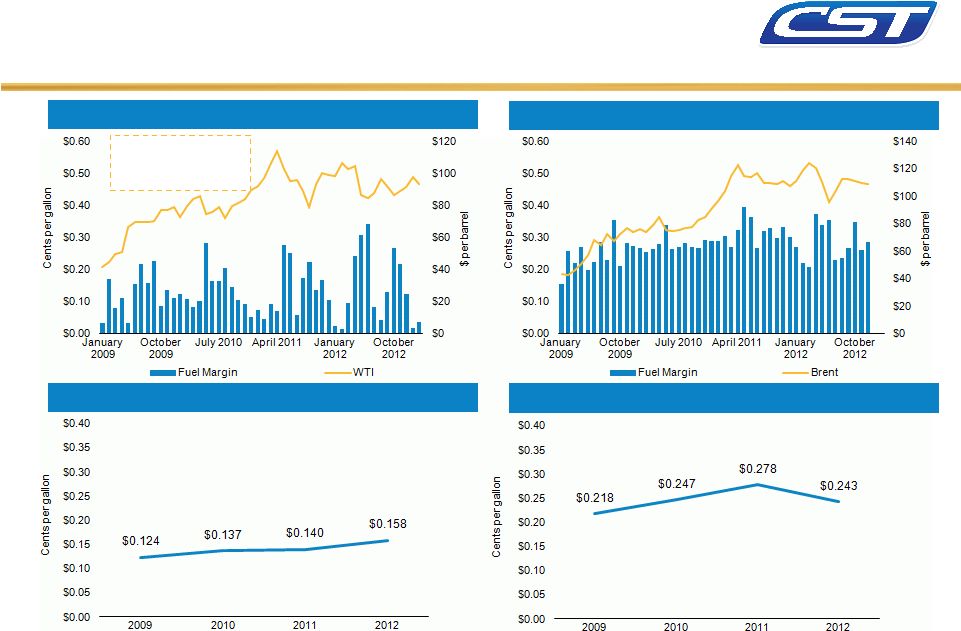

U.S. Reported

Annual Fuel Margins U.S. Monthly Fuel Margins

Canada Monthly Fuel Margins

Canada Reported Annual Fuel Margins

Stable Margins Through All Cycles

Note:

Not adjusted for new commercial agreements with VLO and are presented for price

trend comparisons. 11

Monthly margins are

volatile and correlated

to crude oil prices |

Well Positioned

for Growth Merchandise Growth Drivers in Place

Growing Food Service

Business

Significant growth opportunity

Grow immediate consummables /

snackable business

Growth through proprietary food

programs (breakfast and lunch

programs)

Growth through branded food programs

such as Subway and Country Style

Strong Core Categories

Continue to drive sales around core

categories

Leverage CST’s high customer counts to

build core category sales

Leverage CST’s network volumes to

achieve lower cost of goods

Private Label Program

Development

Provides gross profit growth

Delivers value to and increase loyalty

from consumers

Private label volume provides leverage

over national brands

Efficient Supply Chain

Strong relationship with distributors

Strong central merchandising group

that leverages technology to enhance

productivity and optimize costs

Increases store inventory turns

Significant benefits achieved through

our Texas distribution center

12 |

Well Positioned

for Growth NTI (New-To-Industry) Program

13

Overview

–

CAPEX program selects markets and

properties to invest in based on various

factors including competition, growth

potential, store concentration, traffic counts

and customer access, among others

–

CAPEX program is balanced between

redevelopment of existing owned properties

and NTIs

Retail –

U.S.

–

Anticipate completing 15 NTIs in 2013

(Completed 11 NTIs in 2012)

–

Have traditionally identified sites well

positioned within CST’s footprint

–

Focus for 2013 projects is key markets in

Texas

Retail –

Canada

–

Anticipate completing 8 NTIs in 2013

(Completed 5 NTIs in 2012)

–

Target markets are the Greater Toronto,

Ottawa and Montreal areas

Note:

3-Year NTI Average is for the period of 2009-2011.

|

Transformation

from a “fuel-centric” business to a retail business focused on

creating shareholder value

Participate in the convenience store consolidation

–

Continue to see consolidation in the industry

–

We will continue to explore and evaluate acquisition opportunities, but with an independent

retailer view

–

Our scale gives us the ability to integrate quickly

Wholesale Development

–

Opportunity as an independent company to have a dealer network

–

Utilize our expertise in Canada’s wholesale business to expand network

Well Positioned for Growth

New Opportunities as Independent Company

14 |

New fuel

pricing tools and analysis allow for more dynamic pricing –

Centralized pricing center in Canada provides the latest

competitive information to each retail store to optimize price

–

In US, making investments to utilize historic pricing information,

centralized approach, and LED store signage to respond quickly

to changing market dynamics

Internal store redesign highlights high margin offerings

and increased merchandise sales

–

Food service focus generates incremental revenue with above

average gross margins

–

Private label merchandise offerings increase gross margins and

provide consumers added value

Well Positioned for Growth

Focus on Fuel & Merchandise Margin

U.S. –

U.S. –

Legacy

Legacy

U.S. –

U.S. –

New

New

Canada –

Canada –

Legacy

Legacy

Canada –

Canada –

New

New

15 |

81%

72%

79%

52%

CST-US

CST-CAN

CST

Consolidated

Other Public

Retail Pure-plays

(1)

Leases typically include rent increases at

the rate of inflation or higher

–

Fixed costs increase every year as rent

increases

–

Leases eventually expire leaving the tenant

subject to renegotiation risk

Ownership mitigates impact of lease risks

–

No “rent creep”

–

Potential for long-term increase in value

–

No risk of losing best locations to lease

expirations

–

Provides flexibility of use

Significant Real Estate Ownership

A True Differentiator

% of COOP with CST Real Estate Ownership

Source:

Company data and public filings.

(1)

Includes Casey’s, Couche-Tard, Pantry and Susser

16 |

Kim Bowers,

President and Chief Executive Officer –

Kim

has

over

15

years

of

service

with

Valero,

having

served

as

its

Executive

Vice

President

and

General

Counsel

since

2007

until

her

promotion

to

her

current

position

in

January

2013.

Prior

to

joining

Valero

in

1997,

Kim

specialized

in

mergers

&

acquisitions

with

a

Fort

Worth,

Texas

based

law

firm.

Kim

holds

a

B.A.

in

Spanish

and

in

International

Studies

from

Miami

University

(Ohio),

an

M.A.

in

International

Relations

from

Baylor

University,

and

her

J.D.

from

the

University

of

Texas

School

of

Law.

Kim

is

a

2009

graduate

of

the

Stanford

Executive

Program.

Clay Killinger, Senior Vice President and Chief Financial Officer

–

Clay

has

over

11

years

of

service

with

Valero,

having

served

as

its

Senior

Vice

President

and

Controller

since

2007

until

his

promotion

to

his

current

position

in

January

2013.

Prior

to

that,

Clay

served

as

Vice

President

and

Controller

of

Valero

since

2003.

Prior

to

joining

Valero

in

2001,

Clay

was

a

partner

at

Arthur

Andersen

LLP,

with

service

there

from

1983

through

December

2001.

Clay

is

a

Certified

Public

Accountant,

with

his

B.B.A

in

Accounting

from

the

University

of

Texas

at

San

Antonio,

where

he

graduated

Summa

Cum

Laude.

Tony Bartys, Senior Vice President and Chief Operating Officer

–

Tony

has

over

27

years

of

experience

in

the

retail

and

fuel

marketing

businesses,

with

21

of

those

years

at

Valero

and

certain

of

its

predecessor

companies,

having

served

as

the

Vice

President

of

Retail

Operations

and

Marketing

for

Valero,

overseeing

all

U.S.

Retail

operations,

from

2001

until

his

promotion

to

his

current

position

in

January

2013.

Tony

has

a

B.A.

in

Accounting

from

the

University

of

West

Florida-Pensacola.

Prior

to

attending

University,

Tony

served

in

the

U.S.

Navy

as

a

submarine

Torpedoman

2nd

class

for

five

years.

Steve Motz, Senior Vice President and Chief Development Officer

–

Steve

has

30

years

of

service

with

Valero

and

certain

of

its

predecessor

companies,

having

served

as

the

Vice

President

of

Retail

Asset

Development

and

Administration

from

2003

until

his

promotion

to

his

current

position

in

January

2013.

Steve

has

had

several

areas

of

responsibilities

over

his

tenure

with

Valero,

including

15

years

as

part

of

the

Canadian

Retail

organization,

where

he

directed

the

launch

of

the

Canadian

company

operated

retail

business

and

led

the

efforts

to

rebrand

and

reposition

the

Ultramar

brand.

Steve

received

his

B.B.A.

from

Wilfrid

Laurier

University

(Waterloo,

Ontario).

Hal Adams, Senior Vice President of Marketing

–

Hal

has

over

25

years

with

Valero

retail

and

its

predecessor

companies,

having

served

as

the

Vice

President

of

Retail

Merchandising

from

January

2001

until

his

promotion

to

his

current

position

in

January

2013.

Hal

began

his

tenure

with

the

Company

as

a

store

associate

in

a

Stop

N

Go

store

in

Ventura,

California.

He

has

been

a

Store

Manager,

District

Representative,

Regional

Merchandiser

and

has

held

several

leadership

positions

in

the

store

merchandising

area

of

the

network

operation.

Hal

received

a

B.A.

in

Business

Economics

from

the

University

of

California,

Santa

Barbara

and

he

earned

his

M.B.A.

from

The

University

of

Texas

at

San

Antonio.

17

Experienced and Deep Management Team

Senior Executive Leadership |

Name

Title

Years of relevant

experience

Kim Bowers

President & Chief Executive Officer

22 years

Clay Killinger

SVP & Chief Financial Officer

30 years

Tony Bartys

SVP & Chief Operating Officer

27 years

Steve Motz

SVP & Chief Development Officer

30 years

Hal Adams

SVP of Marketing

27 years

Cindy Hill

SVP & General Counsel & Corporate Secretary

26 years

Henry Martinez

SVP of Human Resources

20 years

Christian Houle

SVP –

Canada

37 years

Stephane Trudel

VP –

Canada

22 years

James Maxey

VP & Chief Information Officer

26 years

Paul Clark

VP of Construction and Maintenance

25 years

Jeremy Bergeron

VP & Treasurer

20 years

Tammy Floyd

VP & Controller

19 years

Kevin Sheehan

VP of Internal Audit and Risk Management

32 years

Jeff Truman

VP, Regional Retail Operations

28 years

Pete Linton

VP, Regional Retail Operations

36 years

18

Experienced and Deep Management Team

Corporate Executive Leadership Team |

Financial

Overview Financial Overview |

Pro Forma Cash

Flow Return on Net Assets Historical Operating Revenue

Pro Forma Free Cash Flow

Historical Capital Expenditures

Source:

Company filings.

Note:

Please see Appendix for a reconciliation of non-GAAP metrics.

(1)

Peers include Casey’s, Pantry, Susser and Couche-Tard.

Proven Historical Financial Results

Consolidated

20 |

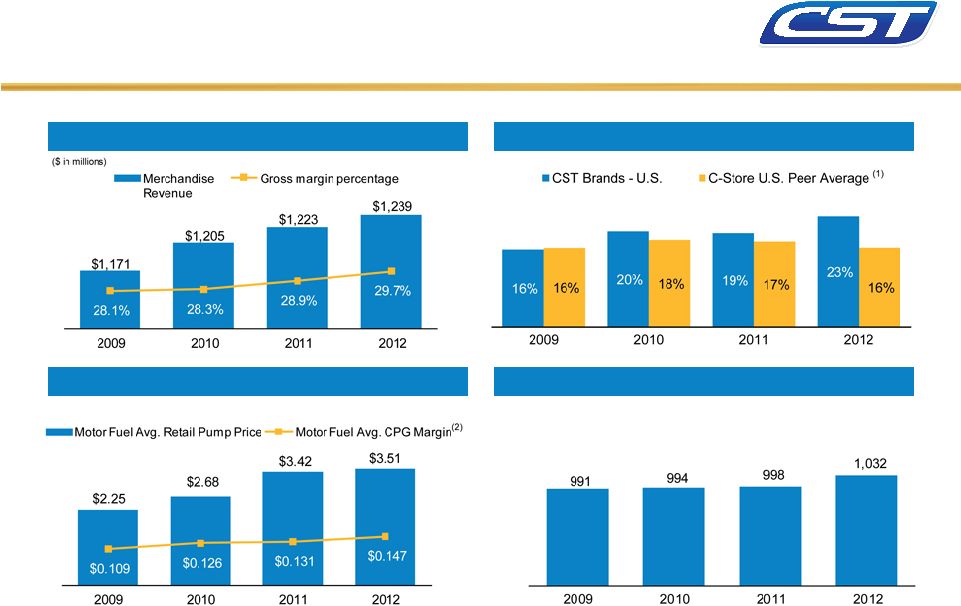

Merchandise

Revenue & Gross Margin Percentage Number of Site Locations

Motor Fuel Average CPG Margin & Pump Price

Source:

Company filings.

Note:

Please see Appendix for a reconciliation of non-GAAP metrics.

(1)

U.S. peers include Casey’s, Pantry, and Susser.

(2)

Margins are net of credit card fees, include LIFO and are adjusted for new

commercial agreements Pro Forma Cash Flow Return on Net Assets

Proven Historical Financial Results

U.S.

21 |

$201

$240

$261

$257

29.4%

30.0%

29.5%

29.2%

25.0%

27.0%

29.0%

31.0%

33.0%

35.0%

$0

$50

$100

$150

$200

$250

$300

2009

2010

2011

2012

Revenue

Gross margin percentage

Merchandise Revenue & Gross Margin Percentage

Number of Site Locations

Motor Fuel Average CPG Margin & Pump Price

($ in millions)

907

895

873

848

500

600

700

800

900

2009

2010

2011

2012

Pro Forma Cash Flow Return on Net Assets

Source:

Company filings.

Note:

Please see Appendix for a reconciliation of non-GAAP metrics.

(1)

Canadian peers include Couche-Tard.

(2)

Margins are net of credit card fees, include LIFO and are adjusted for new

commercial agreements Proven Historical Financial Results

Canada

22

$3.16

$3.84

$4.90

$4.95

$0.195

$0.224

$0.259

$0.233

–

$0.200

$0.400

$0.600

–

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

2009

2010

2011

2012

Motor Fuel Avg. Retail Pump Price

Motor Fuel Avg. CPG Margin

(2) |

At spin, CST

expects to issue $1.05 billion of debt with net

cash proceeds distributed to

Valero

Expected strong pro forma

liquidity of

$550 million

(1)

,

including approximately $200

million of cash generated from

“Net 10”

payment terms

2012 pro forma lease-adjusted

leverage

of

3.1x

debt-to-EBITDAR

(2)

2012 pro forma leverage of 2.8x

debt-to-EBITDA

(2)

CST

Valero

$500MM

5-Year

Term Loan

L + 1.75%

Bank facilities

Debt capital

markets

$300MM

Revolving

Credit

Facility

$550MM

10-Year

High Yield Bonds

Estimated at 5.50%

$500MM

$550MM

(1)

Includes ~$50 million in existing cash net of transaction expenses, $300 million of

revolver availability and $200 million in cash generated by net 10 day payment term from new supply agreements.

(2)

Please see Appendix for a reconciliation of EBITDA and EBITDAR.

Post spin capital structure

$1,050MM

23

Conservative Capital Structure

Key Highlights of Spin |

Total pro forma liquidity of

$550 million including

$300 million of revolver

availability

24

Conservative Capital Structure

Pro Forma Capitalization

($ in millions)

Sources

Uses

High yield notes

$550

Payment to VLO

$1,050

Term loan

500

Cash to balance sheet

184

New credit terms with VLO

(1)

200

Fees and expenses

16

Total sources

$1,250

Total uses

$1,250

($ in millions)

As of December 31, 2012

CST Brands

Actual

Transaction

Adj.

CST Brands

Pro Forma

Cash

and

equivalents

(2)

$61

$184

$245

Long-term debt:

New $300 million revolving credit facility

New term loan

$500

$500

New high yield notes

550

550

Total long-term debt

$1,050

$1,050

Total book equity

1,247

(777)

470

Total book capitalization

$1,247

$1,520

Credit statistics:

2012

Pro

forma

EBITDA

(3)

$379

Debt

/

2012

EBITDA

(3)

2.8x

Debt / Total book capitalization

69.1%

Net debt / Total book capitalization

53.0%

Lease adjusted credit statistics:

2012

Pro

forma

EBITDAR

(3)

$404

Adj. debt

(4)

/ 2012 EBITDAR

(3)

3.1x

Adj. debt

(4)

/ Total adj. book capitalization

(4)

72.7%

Adj. net debt

(4)

/ Total adj. book capitalization

(4)

58.4%

Source:

Company filings.

(1)

Cash from net 10 day payment term from new supply agreements.

(2)

Includes transaction adjustments related to the spin-off and cash to balance

sheet. (3)

Please see Appendix for a reconciliation of EBITDA and EBITDAR.

(4)

Debt

and

book

capitalization

have

been

adjusted

(increased)

by

8

times

2012

minimum

lease

rentals

of

$25

million,

or

$200

million. |

Liquidity

Management

Strong liquidity through committed credit facilities, with

$550 million

of liquidity expected

Access to capital markets

Projects are relatively quick to complete and discrete nature makes

growth CAPEX easy to adjust

Capital

Structure

Less than 3.5x Lease-adjusted Debt-to-EBITDAR

(1)

Long-term debt maturity profile: 5-year term loan and 10-year bonds

High proportion of owned real estate

Strong returns on

invested capital

Strong NTI performance

Cash flow return on net assets consistently above peers

(1)

Please see Appendix for a reconciliation of EBITDAR. Debt has been increased by 8 times 2012

minimum lease rentals of $25 million, or $200 million. 25

Conservative Capital Structure

Financial Strategy / Expectations |

Investment

Highlights Proven Historical Financial Results

and Conservative Capital Structure

Available liquidity of

$550 million

expected at spin-off

Significant Real Estate Ownership

Experienced and Deep

Management Team

Well Positioned for Growth

Stable Margins Through All Cycles

Exposure to Growing Markets

Robust and Growing Industry

6

5

1

2

3

4

81% of U.S. sites are owned and 72%

of Canadian COOP sites are owned

Impressive industry performance even

during recessions

Strong urban footprint in the U.S. and

Canadian markets with a

concentration in growing markets

Fuel margins are relatively stable on an

annual basis despite short-term volatility

Growth in food service and private label programs along

with efficient merchandise logistics drive margin growth. NTI

program drives growth in market share. Potential for

wholesale business and bolt-on acquisitions

The company is well positioned to be a leader in the sector

Customer.Service.Team.

7

Management team has an average of

27 years of relevant experience

26 |

Appendix

Appendix |

28

(1)

Represents minimum rent expense and excludes contingent rent.

Reconciliation of Net Income to

EBITDA and EBITDAR

U.S.

Canada

Consol.

U.S.

Canada

Consol.

U.S.

Canada

Consol.

U.S.

Canada

Consol.

Historical Net Income, as reported

$78

$68

$146

$100

$93

$193

$101

$113

$214

$127

$83

$210

Depreciation and

amortization expense

71

30

101

72

33

105

76

37

113

78

37

115

Asset Impairment Loss

8

5

13

2

3

5

2

1

3

-

-

-

Interest Expense, net

1

-

1

1

-

1

1

-

1

1

-

1

Income Tax expense

45

31

76

57

40

97

59

44

103

75

30

105

EBITDA, as reported

$203

$134

$337

$232

$169

$401

$239

$195

$434

$281

$150

$431

Rent

(1)

25

25

25

25

EBITDAR

$362

$426

$459

$456

EBITDA, as reported

$203

$134

$337

$232

$169

$401

$239

$195

$434

$281

$150

$431

Estimated Commercial Agreement Adj.

(26)

(25)

(51)

(20)

(24)

(44)

(18)

(21)

(39)

(21)

(11)

(32)

Estimated Administrative Expense Adj.

(19)

(1)

(20)

(19)

(1)

(20)

(19)

(1)

(20)

(19)

(1)

(20)

Pro Forma EBITDA

$158

$108

266

$193

$144

337

$202

$173

375

$241

$138

379

Rent

25

25

25

25

Pro Forma EBITDAR

$291

$362

$400

$404

2009

2010

2011

2012 |

29

Cash Flow Return on Net Assets

(1)

Includes current maturities of Capital Lease obligations.

2009

2010

2011

2012

U.S. Retail:

Pro Forma EBITDA

$158

$193

$202

$241

Total assets

1,067

1,065

1,133

1,153

Less: Current Liabilities

(1)

(80)

(88)

(84)

(96)

Add: Current Maturities of Debt & Capital Leases

1

1

1

1

Net assets

$988

$978

$1,050

$1,058

Return on Net Assets -

U.S. Retail

16%

20%

19%

23%

Canadian Retail:

Pro Forma EBITDA

$108

$144

$173

$138

Total assets

513

556

558

556

Less: Current Liabilities

(97)

(127)

(128)

(132)

Add: Current Maturities of Debt & Capital Leases

–

–

–

–

Net assets

$416

$429

$430

$424

Return on Net Assets -

Canadian Retail

26%

34%

40%

33%

CST Brands Consolidated:

Pro Forma EBITDA

$266

$337

$375

$379

Total assets

1,580

1,621

1,691

1,709

Less: Current Liabilities

(1)

(177)

(215)

(212)

(228)

Add: Current Maturities of Debt & Capital Leases

1

1

1

1

Net assets

$1,404

$1,407

$1,480

$1,482

Return on Net Assets -

CST Brands

19%

24%

25%

26%

Year Ended December 31, |

30

Reconciliation of Free Cash Flow

Year Ended December 31,

2009

2010

2011

2012

Cash Provided by Operating Activities

$262

$323

$308

$364

Consolidated Commercial Agreement Adjustments

(51)

(44)

(39)

(32)

Consolidated Administrative Expense Adjustments

(20)

(20)

(20)

(20)

Pro Forma Cash Provided by Operating Activities

$191

$259

$249

$312

Less Sustaining Capital Expenditures

(43)

(65)

(83)

(72)

Pro Forma Free Cash Flow

$148

$194

$166

$240 |