Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - CST BRANDS, INC. | exhibit101q12015.htm |

| EX-31.1 - EXHIBIT 31.1 - CST BRANDS, INC. | exhibit311.htm |

| EX-32.1 - EXHIBIT 32.1 - CST BRANDS, INC. | exhibit321.htm |

| EX-10.2 - EXHIBIT 10.2 - CST BRANDS, INC. | exhibit102q12015.htm |

| EX-32.2 - EXHIBIT 32.2 - CST BRANDS, INC. | exhibit322.htm |

| EXCEL - IDEA: XBRL DOCUMENT - CST BRANDS, INC. | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - CST BRANDS, INC. | exhibit312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10–Q

(Mark One) | |

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2015

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________ | |

Commission File No. 001-35743

CST BRANDS, INC.

(Exact name of registrant as specified in its charter)

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 46-1365950 (I.R.S. Employer Identification No.) | |

One Valero Way

Building D, Suite 200

San Antonio, Texas

(Address of Principal Executive Offices)

78249

(Zip Code)

(210) 692-5000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer þ | Accelerated filer o | Non-accelerated filer o (do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

As of May 6, 2015, there were 76,865,626 common shares outstanding.

TABLE OF CONTENTS

PAGE | |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CST BRANDS, INC.

CONSOLIDATED BALANCE SHEETS

(Millions of Dollars)

March 31, | December 31, | |||||||

2015 | 2014 | |||||||

ASSETS | (Unaudited) | |||||||

Current assets: | ||||||||

Cash (CrossAmerica: $5 and $15, respectively) | $ | 314 | $ | 368 | ||||

Accounts receivable, net of allowances of $1 and $1, at March 31, 2015 and December 31, 2014, respectively (CrossAmerica: $35 and $35, respectively) | 170 | 173 | ||||||

Inventories (CrossAmerica: $20 and $12, respectively) | 208 | 221 | ||||||

Deferred income taxes (CrossAmerica: $0 and $1, respectively) | 12 | 12 | ||||||

Prepaid expenses and other (CrossAmerica: $12 and $10, respectively) | 23 | 24 | ||||||

Total current assets | 727 | 798 | ||||||

Property and equipment, net (CrossAmerica: $582 and $482, respectively) | 2,046 | 1,957 | ||||||

Intangible assets, net (CrossAmerica: $367 and $370, respectively) | 481 | 486 | ||||||

Goodwill (CrossAmerica: $262 and $223, respectively) | 294 | 242 | ||||||

Deferred income taxes | 71 | 79 | ||||||

Other assets, net (CrossAmerica: $16 and $19, respectively) | 75 | 79 | ||||||

Total assets | $ | 3,694 | $ | 3,641 | ||||

LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

Current liabilities: | ||||||||

Current portion of debt and capital lease obligations (CrossAmerica: $8 and $29, respectively) | $ | 59 | $ | 77 | ||||

Accounts payable (CrossAmerica: $41 and $31, respectively) | 142 | 157 | ||||||

Accounts payable to Valero | 201 | 179 | ||||||

Accrued expenses (CrossAmerica: $17 and $21, respectively) | 77 | 79 | ||||||

Taxes other than income taxes (CrossAmerica: $12 and $10, respectively) | 35 | 37 | ||||||

Income taxes payable (CrossAmerica: $3 and $0, respectively) | 8 | 16 | ||||||

Deferred income taxes (CrossAmerica: $3 and $0, respectively) | 3 | — | ||||||

Dividends payable | 5 | 5 | ||||||

Total current liabilities | 530 | 550 | ||||||

Debt and capital lease obligations, less current portion (CrossAmerica: $398 and $261, respectively) | 1,352 | 1,227 | ||||||

Deferred income taxes (CrossAmerica: $58 and $38, respectively) | 186 | 150 | ||||||

Asset retirement obligations (CrossAmerica: $20 and $19, respectively) | 105 | 102 | ||||||

Other long-term liabilities (CrossAmerica: $16 and $16, respectively) | 56 | 57 | ||||||

Total liabilities | 2,229 | 2,086 | ||||||

Commitments and contingencies (Note 8) | ||||||||

Stockholders’ equity: | ||||||||

CST Brands, Inc. stockholders’ equity: | ||||||||

Common stock, 250,000,000 shares authorized at $0.01 par value; 77,739,779 and 77,674,450 shares issued as of March 31, 2015 and December 31, 2014, respectively | 1 | 1 | ||||||

Additional paid-in capital (APIC) | 474 | 488 | ||||||

Treasury stock, at cost: 863,189 and 512,714 common shares as of March 31, 2015 and December 31, 2014, respectively | (37 | ) | (22 | ) | ||||

Retained earnings | 279 | 269 | ||||||

Accumulated other comprehensive income (AOCI) | 25 | 77 | ||||||

Total CST Brands, Inc. stockholders’ equity | 742 | 813 | ||||||

Noncontrolling interest | 723 | 742 | ||||||

Total stockholders’ equity | 1,465 | 1,555 | ||||||

Total liabilities and stockholders’ equity | $ | 3,694 | $ | 3,641 | ||||

See Condensed Notes to Consolidated Financial Statements.

1

CST BRANDS, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Millions of Dollars, Except per Share Amounts)

(Unaudited)

Three Months Ended March 31, | ||||||||

2015 | 2014 | |||||||

Operating revenues(a) | $ | 2,670 | $ | 3,001 | ||||

Cost of sales(b) | 2,366 | 2,756 | ||||||

Gross profit | 304 | 245 | ||||||

Operating expenses: | ||||||||

Operating expenses | 184 | 164 | ||||||

General and administrative expenses | 50 | 25 | ||||||

Depreciation, amortization and accretion expense | 54 | 31 | ||||||

Total operating expenses | 288 | 220 | ||||||

Gain on sale of assets, net | 5 | — | ||||||

Operating income | 21 | 25 | ||||||

Other income, net | 2 | 1 | ||||||

Interest expense | (15 | ) | (10 | ) | ||||

Income before income tax expense | 8 | 16 | ||||||

Income tax expense | 2 | 5 | ||||||

Consolidated net income | 6 | 11 | ||||||

Net loss attributable to noncontrolling interest | (8 | ) | — | |||||

Net income attributable to CST stockholders | $ | 14 | $ | 11 | ||||

Earnings per common share | ||||||||

Basic earnings per common share | $ | 0.18 | $ | 0.14 | ||||

Weighted-average common shares outstanding (in thousands) | 76,896 | 75,397 | ||||||

Earnings per common share – assuming dilution | ||||||||

Diluted earnings per common share | $ | 0.18 | $ | 0.14 | ||||

Weighted-average common shares outstanding - assuming dilution (in thousands) | 77,242 | 75,494 | ||||||

Dividends per common share | $ | 0.06 | $ | 0.06 | ||||

Supplemental information: | ||||||||

(a) Includes excise taxes of: | $ | 470 | $ | 470 | ||||

(a) Includes income from rentals of: | $ | 12 | $ | — | ||||

(b) Includes expenses from rentals of: | $ | 4 | $ | — | ||||

See Condensed Notes to Consolidated Financial Statements.

2

CST BRANDS, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Millions of Dollars)

(Unaudited)

Three Months Ended March 31, | ||||||||

2015 | 2014 | |||||||

Consolidated net income | $ | 6 | $ | 11 | ||||

Other comprehensive income (loss): | ||||||||

Foreign currency translation adjustment | (52 | ) | (24 | ) | ||||

Other comprehensive income (loss) before income taxes | (52 | ) | (24 | ) | ||||

Income taxes related to items of other comprehensive income | — | — | ||||||

Other comprehensive income (loss) | (52 | ) | (24 | ) | ||||

Comprehensive income (loss) | (46 | ) | (13 | ) | ||||

Loss attributable to noncontrolling interests | (8 | ) | — | |||||

Comprehensive income (loss) attributable to CST stockholders | $ | (38 | ) | $ | (13 | ) | ||

See Condensed Notes to Consolidated Financial Statements.

3

CST BRANDS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Millions of Dollars)

(Unaudited)

Three Months Ended March 31, | ||||||||

2015 | 2014 | |||||||

Cash flows from operating activities: | ||||||||

Consolidated net income | $ | 6 | $ | 11 | ||||

Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

Stock-based compensation expense | 8 | 4 | ||||||

Depreciation, amortization and accretion expense | 54 | 31 | ||||||

Gain on the sale of assets, net | (5 | ) | — | |||||

Deferred income tax expense (benefit) | (11 | ) | (5 | ) | ||||

Changes in working capital, net of acquisitions | 16 | 3 | ||||||

Other operating activities, net | 2 | — | ||||||

Net cash provided by operating activities | 70 | 44 | ||||||

Cash flows from investing activities: | ||||||||

Capital expenditures | (50 | ) | (43 | ) | ||||

Proceeds from the sale of assets | 7 | — | ||||||

CST acquisitions, net of cash acquired | (20 | ) | — | |||||

CrossAmerica acquisitions, net of cash acquired | (126 | ) | — | |||||

Other investing activities, net | 9 | — | ||||||

Net cash used in investing activities | (180 | ) | (43 | ) | ||||

Cash flows from financing activities: | ||||||||

Proceeds under the CAPL revolving credit facility | 118 | — | ||||||

Payments on the CST term loan facility | (9 | ) | (7 | ) | ||||

Purchases of treasury shares | (14 | ) | — | |||||

Payments of capital lease obligations | (1 | ) | — | |||||

CST dividends paid | (5 | ) | (5 | ) | ||||

CrossAmerica distributions paid | (13 | ) | — | |||||

Net cash provided by (used in) financing activities | 76 | (12 | ) | |||||

Effect of foreign exchange rate changes on cash | (20 | ) | (2 | ) | ||||

Net decrease in cash | (54 | ) | (13 | ) | ||||

Cash at beginning of period | 368 | 378 | ||||||

Cash at end of period | $ | 314 | $ | 365 | ||||

See Condensed Notes to Consolidated Financial Statements.

4

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1. | DEFINITION OF TERMS, DESCRIPTION OF BUSINESS AND OTHER DISCLOSURES |

Definition of Terms

The following terms are used throughout this document to refer to the items indicated:

• | “CST” refers to CST Brands, Inc., a Delaware corporation, and, where appropriate in context, to one or more of CST’s subsidiaries without the inclusion or consolidation of the operations or subsidiaries of CrossAmerica Partners LP. CST includes CST’s ownership of 100% of the outstanding incentive distribution rights (“IDRs”) of CrossAmerica Partners LP and any common units of CrossAmerica Partners LP owned by CST, including those received as consideration for “asset drops” as defined in our Annual Report on Form 10-K (“Form 10-K”). |

• | We refer to CrossAmerica Partners LP, a Delaware limited partnership, and, where appropriate in context, to one or more of its subsidiaries, or all of them taken as a whole as “CrossAmerica.” |

• | “We,” “us,” “our” and “company” refer to the consolidated results and accounts of CST and CrossAmerica, or individually as the context implies. |

Description of Business

CST is a holding company and conducts substantially all of its operations through its subsidiaries. We were incorporated in Delaware in 2012, formed solely in contemplation of the separation and distribution (“spin-off”) of the retail business of Valero Energy Corporation (“Valero”) and, prior to May 1, 2013, had not commenced operations and had no material assets, liabilities or commitments.

On October 1, 2014, CST completed the purchase of 100% of the non-economic membership interests in Lehigh Gas GP LLC (the “General Partner”) and IDRs of Lehigh Gas Partners LP for $17 million in cash and approximately 2.0 million shares of CST common stock. After the purchase of the membership interest in its General Partner, the name of Lehigh Gas Partners LP was changed to CrossAmerica Partners LP. On January 1, 2015, CST sold (dropped down) a 5% limited partner equity interest in our U.S. Retail segment’s wholesale motor fuel supply business (“CST Fuel Supply”) to CrossAmerica in exchange for common units representing an approximate 6.1% limited partner interest in CrossAmerica. See footnote 2 for additional information.

We are a publicly traded corporation and CrossAmerica is a separate publicly traded Delaware master limited partnership primarily engaged in the wholesale distribution of motor fuel and the ownership and leasing of real estate used in the retail distribution of motor fuel. CST controls CrossAmerica’s General Partner and has the right to appoint all members of the Board of Directors of the General Partner. CrossAmerica is managed and operated by the Board of Directors and executive officers of the General Partner. Therefore, we control the operations and activities of CrossAmerica even though we do not have a controlling ownership of CrossAmerica’s outstanding limited partner units. As a result, under the guidance in ASC 810–Consolidation, CrossAmerica is a consolidated variable interest entity.

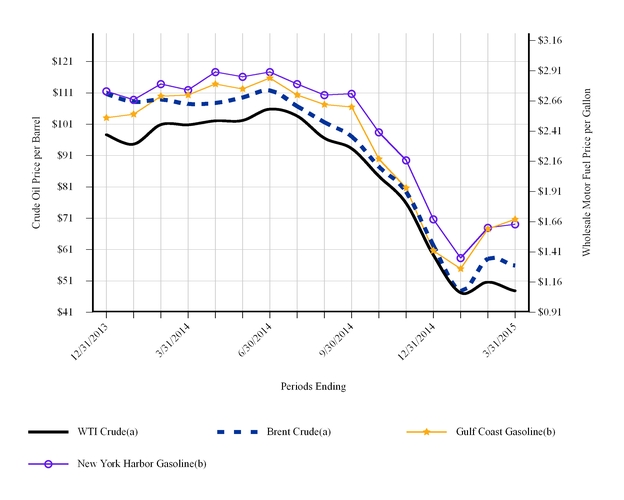

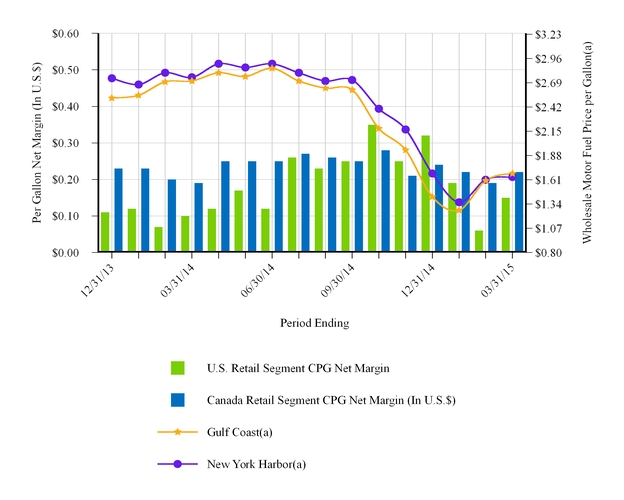

On a consolidated basis, we have three operating segments, U.S. Retail, Canadian Retail and CrossAmerica. The U.S. Retail, Canadian Retail and CrossAmerica segments are managed as individual strategic business units. Each segment experiences different operating income margins due to geographic supply and demand attributes, specific country and local regulatory environments, and are exposed to variability in gross profit from the volatility of crude oil prices.

Our U.S. Retail segment operations are substantially a company owned and operated convenience store business. We generate profit on motor fuel sales, convenience merchandise sales and other services (car wash, lottery, money orders, air/water/vacuum services, video and game rentals, and access to automated teller machines (“ATMs”)). Our retail sites are operated by company employees.

Our Canadian Retail segment includes company owned and operated convenience stores, commission agents, cardlocks and heating oil operations. We generate profit on motor fuel sales, and at our company owned and operated convenience stores, profit is also generated on convenience merchandise sales and other services (similar to our U.S. Retail segment). We use the term “retail site” as a general term to refer to convenience stores, commission agent sites or cardlocks.

CrossAmerica is engaged in the wholesale distribution of motor fuels and the ownership and leasing of real estate used in the retail distribution of motor fuels. Through recent acquisitions, CrossAmerica is also engaged in retail operations consisting of recently acquired convenience stores, which we currently classify as non-core. CrossAmerica’s operations are conducted entirely within the U.S.

5

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Recently Acquired Retail Sites

Our retail sites are classified into two categories: core and non-core. Core stores are retail sites that are fully integrated into our existing retail distribution network and are operated and managed by CST convenience store management personnel. These stores are included in our operating statistics under the label “core store.” Non-core stores are acquired sites that are under evaluation to determine whether they have the potential to be fully integrated into our core store operations with respect to convenience store size, location or market demands. We have a dedicated integration team that evaluates our newly acquired convenience stores and assesses their future potential. After evaluating the assets, the team makes a recommendation to classify the stores into the appropriate core or non-core category. We expect this evaluation to occur within twelve months of acquisition. All retail convenience stores we acquire through acquisition are first categorized as non-core to the consolidated results of CST. If these stores are not determined to be core stores, we believe these non-core stores are attractive candidates for conversion to third party dealers or eventual divestment. By converting non-core stores into dealers, we continue to benefit from motor fuel distribution volumes as well as rental income from lease or sublease arrangements.

Interim Financial Information

These unaudited financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X of the Securities Exchange Act of 1934, as amended. Accordingly, they do not include all of the information and notes required by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments considered necessary for a fair presentation have been included. All such adjustments are of a normal recurring nature unless disclosed otherwise. Management believes that the disclosures made are adequate to keep the information presented from being misleading. The financial statements contained herein should be read in conjunction with the consolidated and combined financial statements and notes thereto included in our Form 10-K for the year ended December 31, 2014. Financial information as of March 31, 2015 and for the three months ended March 31, 2015 and 2014 included in the condensed notes to the consolidated financial statements has been derived from our unaudited financial statements. Financial information as of December 31, 2014, has been derived from our audited financial statements and notes thereto as of that date.

Operating results for the three months ended March 31, 2015 are not necessarily indicative of the results that may be expected for the year ending December 31, 2015. Our business exhibits substantial seasonality due to our wholesale and retail sites being located in certain geographic areas that are affected by seasonal weather and temperature trends and associated changes in end customer activity behavior during different seasons. Historically, sales volumes and operating income have been highest in the second and third quarters (during the summer activity months) and lowest during the winter months.

Our effective income tax rates for the three months ended March 31, 2015 and 2014 were 24% and 33%, respectively. The effective tax rate differs from the federal statutory rate of 35% for 2015 primarily as a result of a valuation allowance benefit associated with the acquisition of CrossAmerica. As a limited partnership, CrossAmerica has not been subject to Federal and State income tax with the exception of its operations through certain corporate subsidiaries. CST’s effective tax rate, excluding CrossAmerica, was 35% for the three months ended March 31, 2015.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results and outcomes could differ from those estimates and assumptions. On an ongoing basis, management reviews its estimates based on currently available information. Changes in facts and circumstances could result in revised estimates and assumptions.

Significant Accounting Policies

There have been no material changes to the significant accounting policies described in our Form 10-K.

New Accounting Pronouncements

In February 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2015-02—Consolidation (Topic 810): Amendments to the Consolidation Analysis. This standard modifies existing consolidation guidance for reporting organizations that are required to evaluate whether they should consolidate certain legal entities, including limited partnerships and other similar entities. ASU 2015-02 is effective for fiscal years and interim periods within those years beginning after December 15, 2015, and requires either a full retrospective or a modified retrospective approach to adoption. Early adoption is also permitted. Management is currently evaluating this new guidance, including how it will apply the guidance at the date of adoption.

6

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

In April 2015, the FASB issued ASU 2015-03—Interest-Imputation of Interest (Subtopic 835-30), which requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. This guidance is effective January 1, 2016. Early adoption is permitted. The guidance is to be applied on a retrospective basis, wherein the balance sheet of each individual period presented should be adjusted to reflect the period-specific effects of applying the new guidance. Management has not yet determined which period the guidance will be adopted. If the guidance were applicable at March 31, 2015, other noncurrent assets and long-term debt would be lower by $15 million.

In May 2014, the FASB issued ASU 2014-09—Revenue from Contracts with Customers (Topic 606), which results in comprehensive new revenue accounting guidance, requires enhanced disclosures to help users of financial statements better understand the nature, amount, timing, and uncertainty of revenue that is recognized, and develops a common revenue standard under U.S. GAAP and International Financial Reporting Standards. Specifically, the core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods and services. This guidance is effective January 1, 2017. Early adoption is not permitted. The guidance can be applied either retrospectively to each prior reporting period presented, or as a cumulative-effect adjustment as of the date of adoption. Management is currently evaluating this new guidance, including how it will apply the guidance at the date of adoption.

Certain other new financial accounting pronouncements have become effective for our financial statements and the adoption of these pronouncements will not affect our financial position or results of operations, nor will they require any additional disclosures.

Concentration Risk

Valero supplied substantially all of the motor fuel purchased by our U.S. Retail and Canadian Retail segments for resale during all periods presented. During the three months ended March 31, 2015 and 2014 our U.S. Retail and Canadian Retail segments purchased $1.5 billion, and $2.4 billion, respectively, of motor fuel from Valero.

CrossAmerica purchases a substantial amount of motor fuel from three suppliers. For the three months ended March 31, 2015, CrossAmerica’s wholesale business purchased approximately 27%, 26% and 22% of its motor fuel from ExxonMobil, BP and Motiva, respectively. No other fuel suppliers accounted for 10% or more of CrossAmerica's fuel purchases in first quarter of 2015.

No customers are individually material to our U.S. Retail and Canadian Retail segment operations. For the three months ended March 31, 2015, CrossAmerica distributed approximately 17% of its total wholesale distribution volumes to Dunne Manning Stores LLC (formerly Lehigh Gas–Ohio, LLC (“LGO” or “affiliated dealer”)). LGO is an operator of retail sites that purchases a significant portion of its motor fuel from CrossAmerica on a wholesale basis and then re-sells motor fuel on a retail basis. For more information regarding transactions with LGO, see Note 7.

7

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 2. ACQUISITIONS AND DIVESTITURES

GP Purchase and IDR Purchase

During the first quarter of 2015, we updated the valuation of CrossAmerica, which resulted in adjustments to certain property and equipment, definite-lived intangibles, goodwill and related deferred tax effects as follows (in millions):

Preliminary Purchase Price Allocation | Fair Value Adjustments | Adjusted Purchase Price Allocation | ||||||||||

Current assets (excluding inventories) | $ | 74 | $ | — | $ | 74 | ||||||

Inventories | 14 | — | 14 | |||||||||

Property and equipment | 436 | 17 | 453 | |||||||||

Intangibles | 367 | (7 | ) | 360 | ||||||||

Goodwill | 213 | (7 | ) | 206 | ||||||||

Other assets | 18 | — | 18 | |||||||||

Current liabilities | (65 | ) | — | (65 | ) | |||||||

Long-term debt and capital leases | (236 | ) | — | (236 | ) | |||||||

Deferred tax liabilities | (33 | ) | — | (33 | ) | |||||||

Other liabilities | (17 | ) | — | (17 | ) | |||||||

Non-controlling interest | (771 | ) | (3 | ) | (774 | ) | ||||||

Total consideration | $ | — | $ | — | $ | — | ||||||

The adjustment to property and equipment resulted from obtaining additional information for the fair value determination for certain retail sites. The adjustment to intangibles resulted from revising our pro forma cash flow projections based on actual motor fuel gallons distributed for 2014 in the determination of fair value of motor fuel supply and distribution agreements. The adjustments to property and equipment and intangible assets resulted in an immaterial adjustment to previously recognized depreciation and amortization and was recorded in the first quarter of 2015.

We engaged a third party valuation services firm to assist in the calculation of the fair value of CrossAmerica’s assets and liabilities. The fair value of CrossAmerica was based on its enterprise value on the date of acquisition as principally determined by the closing price of its common units trading on the New York Stock Exchange, which resulted in a portion of the purchase price being allocated to goodwill.

Our pro forma results, assuming we acquired CrossAmerica on January 1, 2014, would have been (in millions):

Three Months Ended March 31, | |||

2014 | |||

Total revenues | $ | 3,483 | |

Net income attributable to CST stockholders | 11 | ||

Acquisition of Landmark Industries Stores (“Landmark”)

In January 2015, CST and CrossAmerica jointly purchased 22 convenience stores from Landmark. CrossAmerica purchased the real property of the 22 fee sites as well as certain wholesale fuel distribution assets for an initial payment of $44 million. CST purchased the personal property, working capital and the convenience store operations for an initial payment of $20 million. A final adjustment to the purchase price between CrossAmerica and CST was made related to the purchase of certain property so that the aggregate purchase price paid by CST is $23 million and the aggregate final purchase price paid by CrossAmerica is $41 million.

CrossAmerica leases the acquired real property to CST under triple net leases at a lease rate of 7.5% and CrossAmerica distributes wholesale fuel to CST under long term agreements with a fuel gross profit margin of approximately $0.05 per gallon.

8

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The fair values of Landmark’s assets on the date of acquisition with final fair value adjustments were as follows (in millions):

Current assets | $ | 4 | |

Property and equipment | 28 | ||

Other assets | 6 | ||

Goodwill | 26 | ||

Total consideration | $ | 64 | |

The fair value of property and equipment, which consisted of land, buildings, building improvements, USTs and other equipment, was based on a cost approach, with the fair value being estimated by reference to the replacement cost to obtain a substitute asset of comparable features and functionality, and is the amount a willing market participant would pay for such an asset, taking into consideration the asset condition as well as any physical deterioration, functional obsolescence, and/or economic obsolescence. The buildings and equipment are being depreciated on a straight-line basis, with estimated useful lives not to exceed 20 years for the buildings and 30 years for the underground storage tanks.

A substantial portion of the goodwill represents the value that would have been allocated to wholesale fuel distribution rights. However because the acquired wholesale fuel distribution rights relate to entities under common control, this identifiable intangible is not permitted under U.S. GAAP to be recognized and therefore the value has been allocated to goodwill.

Aggregate incremental revenues since the closing of the Landmark acquisition included in our statement of operations were $20 million for the three months ended March 31, 2015.

Acquisition of Erickson

In February 2015, CrossAmerica closed on the purchases of all of the outstanding capital stock of Erickson Oil Products, Inc. (“Erickson”) and separate purchases of certain related assets with an aggregate purchase price of $85 million, subject to certain post-closing adjustments. These transactions resulted in the acquisition of a total of 64 retail sites located in Minnesota, Michigan, Wisconsin and South Dakota. The convenience store operations of Erickson are classified as non-core in the CrossAmerica segment.

The following table summarizes the preliminary estimated fair values of the assets acquired and liabilities assumed at the acquisition date (in millions):

Current assets (excluding inventories) | $ | 4 | ||

Inventories | 8 | |||

Property and equipment | 72 | |||

Intangibles | 14 | |||

Goodwill | 33 | |||

Current liabilities | (20 | ) | ||

Deferred tax liabilities | (29 | ) | ||

Total consideration, net of cash acquired | $ | 82 | ||

The fair value of inventory was estimated at retail selling price less estimated costs to sell and a reasonable profit allowance for the selling effort.

The fair value of property and equipment, which consisted of land, buildings and equipment, was based on a cost approach. The buildings and equipment are being depreciated on a straight-line basis, with estimated remaining useful lives of 15 years for the buildings and 5 to 10 years for equipment.

The $12 million fair value of the wholesale fuel distribution rights was based on an income approach, with the fair value estimated to be the present value of incremental after-tax cash flows attributable solely to the wholesale fuel distribution rights over their estimated remaining useful life, using probability-weighted cash flows and using discount rates considered appropriate given the inherent risks associated with this type of transaction. Management believes the level and timing of cash flows represent relevant market participant assumptions. The wholesale fuel distribution rights are being amortized on a straight-line basis over an estimated useful life of approximately 10 years.

Goodwill recorded is primarily attributable to the deferred tax liabilities arising from the application of purchase accounting.

9

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Aggregate incremental revenues since the closing of the Erickson acquisition included in our consolidated statement of operations were $34 million for the three months ended March 31, 2015.

Divestitures

During the three months ended March 31, 2015, CST closed on the sale of nine convenience stores and recognized a gain of $5 million in “Gain on sale of assets, net” on the consolidated statements of income. During the three months ended March 31, 2015, CrossAmerica recorded an immaterial gain on sale of assets.

Sale (“Drop Down”) of CST Wholesale Fuel Supply Equity Interests

In January 2015, we closed on the sale of a 5% limited partner equity interest in CST Fuel Supply to CrossAmerica in exchange for common units representing an approximate 6.1% limited partner interest in CrossAmerica. The value of the common units at closing was approximately $60 million. Because this transaction was between entities under common control, a gain on the sale of CST Fuel Supply is not reflected in our consolidated income statement and we eliminated our 6.1% limited partner interest from our consolidated balance sheet. The receipt of common units resulted in a credit to stockholders’ equity in the amount of $60 million. The excess of the purchase price paid by CrossAmerica over the carrying value recorded on CST’s balance sheet was recorded as a contribution from CrossAmerica.

See Note 7 for additional disclosures.

Note 3. INVENTORIES

Inventories consisted of the following (in millions):

March 31, | December 31, | |||||||

2015 | 2014 | |||||||

Convenience store merchandise (CrossAmerica: $13 and $7, respectively) | $ | 124 | $ | 128 | ||||

Motor fuel (CrossAmerica: $7 and $5, respectively) | 82 | 92 | ||||||

Supplies | 2 | 1 | ||||||

Inventories | $ | 208 | $ | 221 | ||||

The cost of convenience store merchandise and supplies is determined principally under the weighted-average cost method. We account for our motor fuel inventory in our U.S. Retail segment on the LIFO basis. As of March 31, 2015 and December 31, 2014, the replacement cost (market value) of our U.S. motor fuel inventories exceeded their LIFO carrying amounts by approximately $3 million and $2 million, respectively. We account for our motor fuel inventory in our Canadian Retail and CrossAmerica segments under the weighted-average cost method.

Note 4. PROPERTY AND EQUIPMENT

Property and equipment, net consisted of the following (in millions):

March 31, | December 31, | |||||||

2015 | 2014 | |||||||

Land (CrossAmerica: $196 and $154, respectively) | $ | 621 | $ | 580 | ||||

Buildings (CrossAmerica: $225 and $179, respectively) | 719 | 678 | ||||||

Equipment (CrossAmerica: $172 and $148, respectively) | 826 | 812 | ||||||

Leasehold improvements (CrossAmerica: $4 and $4, respectively) | 318 | 311 | ||||||

Other | 243 | 243 | ||||||

Construction in progress (CrossAmerica: $4 and $5, respectively) | 31 | 38 | ||||||

Property and equipment, at cost | 2,758 | 2,662 | ||||||

Accumulated depreciation (CrossAmerica: $19 and $8, respectively) | (712 | ) | (705 | ) | ||||

Property and equipment, net | $ | 2,046 | $ | 1,957 | ||||

Other in the table above consists primarily of the assets related to our asset retirement obligations and computer hardware and software.

10

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 5. INTANGIBLE ASSETS

Intangible assets consisted of the following (in millions):

March 31, 2015 | December 31, 2014 | ||||||||||||||||||||||

Gross Amount | Accumulated Amortization | Net Carrying Amount | Gross Amount | Accumulated Amortization | Net Carrying Amount | ||||||||||||||||||

US: | |||||||||||||||||||||||

Indefinite-lived intangible assets | $ | 91 | $ | — | $ | 91 | $ | 91 | $ | — | $ | 91 | |||||||||||

Other | 8 | (1 | ) | 7 | 7 | (1 | ) | 6 | |||||||||||||||

US total | 99 | (1 | ) | 98 | 98 | (1 | ) | 97 | |||||||||||||||

Canada: | |||||||||||||||||||||||

Customer lists | 97 | (81 | ) | 16 | 106 | (87 | ) | 19 | |||||||||||||||

Total US and Canada | 196 | (82 | ) | 114 | 204 | (88 | ) | 116 | |||||||||||||||

CrossAmerica: | |||||||||||||||||||||||

Wholesale fuel distribution rights | 215 | (13 | ) | 202 | 229 | (8 | ) | 221 | |||||||||||||||

Wholesale fuel supply agreements | 175 | (22 | ) | 153 | 155 | (17 | ) | 138 | |||||||||||||||

Below market leases | 11 | (3 | ) | 8 | 10 | (3 | ) | 7 | |||||||||||||||

Other | 6 | (2 | ) | 4 | 5 | (1 | ) | 4 | |||||||||||||||

Total CrossAmerica | 407 | (40 | ) | 367 | 399 | (29 | ) | 370 | |||||||||||||||

Consolidated total | $ | 603 | $ | (122 | ) | $ | 481 | $ | 603 | $ | (117 | ) | $ | 486 | |||||||||

Indefinite lived intangible assets, which consist primarily of the IDRs, are not amortized, but instead are tested for impairment at least annually, and tested for impairment more frequently if events and circumstances indicate that the IDRs might be impaired.

Our customer lists are located in our Canadian Retail segment and are amortized on a straight-line basis over their remaining life. As these assets are recorded in the local currency, Canadian dollars, historical gross carrying amounts are translated at each balance sheet date, resulting in changes to historical amounts presented.

11

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 6. DEBT

Our balances for long-term debt and capital leases are as follows (in millions):

March 31, | December 31, | |||||||

2015 | 2014 | |||||||

CST debt and capital leases:(a) | ||||||||

Revolving credit facility | $ | — | $ | — | ||||

Term loan due 2019 | 444 | 453 | ||||||

5.00% senior notes due 2023 | 550 | 550 | ||||||

Capital leases | 11 | 11 | ||||||

Total CST debt and capital leases | 1,005 | 1,014 | ||||||

CrossAmerica debt and capital leases:(b) | ||||||||

Revolving credit facility | 318 | 200 | ||||||

Other debt | 27 | 27 | ||||||

Capital leases | 61 | 63 | ||||||

Total CrossAmerica debt and capital leases | 406 | 290 | ||||||

Total consolidated debt and capital lease obligations outstanding | 1,411 | 1,304 | ||||||

Less current portion of CST | 51 | 48 | ||||||

Less current portion of CrossAmerica | 8 | 29 | ||||||

Consolidated debt and capital lease obligations, less current portion | $ | 1,352 | $ | 1,227 | ||||

(a) The assets of CST can only be used to settle the obligations of CST and creditors of CST have no recourse to the assets or general credit of CrossAmerica. CST has pledged its equity ownership in CrossAmerica to secure the CST Credit Facility.

(b) The assets of CrossAmerica can only be used to settle the obligations of CrossAmerica and creditors of CrossAmerica have no recourse to the assets or general credit of CST.

Financial Covenants and Interest Rate

The CST Credit Facility contains financial covenants consisting of (a) a maximum total lease adjusted leverage ratio set at not greater than 3.75 to 1.00, and (b) a minimum fixed charge coverage ratio set at not less than 1.30 to 1.00. As of March 31, 2015, CST’s lease adjusted leverage ratio and fixed charge coverage ratio were 2.32 to 1.00 and 2.60 to 1.00, respectively.

The CrossAmerica revolving credit facility requires CrossAmerica to maintain a total leverage ratio (as defined) for the most recently completed four fiscal quarters of less than or equal to 5.00 to 1.00 and a consolidated interest coverage ratio (as defined in the Credit Agreement) of greater than or equal to 2.75 to 1.00. As of March 31, 2015, CrossAmerica was in compliance with the covenants.

Outstanding borrowings under the CST term loan facility bear interest at the 30–day London Interbank Offered Rate (“LIBOR”) plus a margin of 1.50%. As of March 31, 2015, the interest rate was 1.68%. The majority of CrossAmerica’s outstanding borrowings under the revolving credit facility bear interest at LIBOR plus a margin of 3%, with the remaining borrowings at the prime rate plus a margin of 2%. CrossAmerica’s borrowings had a weighted-average rate of 3.50% as of March 31, 2015.

Note 7. RELATED-PARTY TRANSACTIONS

We consider transactions with CrossAmerica to be with a related-party and account for the transactions as entities under common control.

Rent and Purchased Motor Fuel

CrossAmerica leases certain retail sites and sells motor fuel to the U.S. Retail segment under fuel distribution agreements and lease agreement having initial 10-year terms. The fuel distribution agreements provide CrossAmerica with a fixed wholesale mark-up per gallon and the lease agreement is a triple net lease with lease rates of 7.5%. The U.S. Retail segment incurred rent expense on these retail sites of $1 million and purchased approximately 17 million gallons of motor fuel from CrossAmerica during the three months ended March 31, 2015. Amounts payable to CrossAmerica totaled $4 million and $3 million at March 31, 2015 and December 31, 2014, respectively.

12

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Sale of CST Fuel Supply Equity Interests

We accounted for the sale of equity interests in CST Fuel Supply to CrossAmerica based on the carrying value recorded on our balance sheet, which amounted to $0.4 million at the date of acquisition. The excess of the purchase price paid by CrossAmerica over the carrying value on our balance sheet was recorded as a credit to stockholders’ equity in the amount of $60 million.

CST records the monthly distributions to CrossAmerica in cost of sales, which is eliminated upon consolidation of CrossAmerica.

CST distributed $1 million to CrossAmerica during the three months ended March 31, 2015 related to its equity ownership interests in CST Fuel Supply.

Amended and Restated Omnibus Agreement

We entered into an Amended and Restated Omnibus Agreement, dated October 1, 2014, by and among CrossAmerica, the General Partner, DMI, CST, LGO and Joseph V. Topper, Jr. (the “Amended Omnibus Agreement”), which amends and restates the Original Omnibus Agreement, which was executed in connection with CrossAmerica’s initial public offering on October 30, 2012. The current fee under the Amended Omnibus Agreement for the management services provided by CST to CrossAmerica is $643,000 per month, plus a variable rate based on the wholesale motor fuel gallons distributed by CrossAmerica. For the three months ended March 31, 2015, CST billed CrossAmerica $2 million for the fixed fee, $1 million for the variable fee and allocated $2 million in non-cash stock-based compensation and incentive compensation. CST and CrossAmerica have the right to negotiate the amount of the management fee on an annual basis, or more often as circumstances require.

IDR and Common Unit Distributions

CST received distributions of $1 million related to its investment in CrossAmerica’s IDRs and common units during the three months ended March 31, 2015.

CrossAmerica Transactions with LGO

LGO is an entity affiliated with Joseph V. Topper, Jr., a member of our Board of Directors. LGO is an operator of retail motor fuel stations that purchases all of its motor fuel requirements from CrossAmerica on a wholesale basis. LGO leases certain retail sites from CrossAmerica in accordance with a master lease agreement between LGO and CrossAmerica.

Revenues from fuel sales and rental income from LGO were as follows (in millions):

Three Months Ended March 31, | ||||

2015 | ||||

Revenues from fuel sales to LGO | $ | 70 | ||

Rental income from LGO | $ | 5 | ||

Fuel is sold to LGO at CrossAmerica’s cost plus a fixed mark-up per gallon. Receivables from LGO totaled $10 million at March 31, 2015 and December 31, 2014.

Note 8. COMMITMENTS AND CONTINGENCIES

We are from time to time party to various lawsuits, claims and other legal proceedings that arise in the ordinary course of business. These actions typically seek, among other things, compensation for alleged personal injury, breach of contract and/or property damages, environmental damages, employment-related claims and damages, punitive damages, civil penalties or other losses, or injunctive or declaratory relief. With respect to all such lawsuits, claims and proceedings, we record a reserve when it is probable that a liability has been incurred and the amount of loss can be reasonably estimated. In addition, we disclose matters for which management believes a material loss is at least reasonably possible. Except as otherwise stated below, none of these proceedings, separately or in the aggregate, are expected to have a material adverse effect on our consolidated financial position, results of operations or cash flows. In all instances, management has assessed the matter based on current information and made a judgment concerning its potential outcome, giving due consideration to the nature of the claim, the amount and nature of damages sought and the probability of success. Management’s judgment may prove materially inaccurate, and such judgment is made subject to the known uncertainties of litigation.

UST Fund Reimbursement Litigation-CST

On October 30, 2013, the State of Colorado filed a lawsuit against Valero and CST and several of their subsidiaries and affiliates claiming that, prior to the spin-off, Valero and its former retail subsidiaries filed claims with and recovered funds from Colorado’s

13

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Underground Storage Tank Fund and failed to disclose the existence of and/or recoveries from insurance policies, which are alleged to have provided coverage for these same remediation activities. Without admitting any responsibility, CST reached a settlement with the state of all claims against it for an immaterial amount resulting in the dismissal, with prejudice, of all claims against the CST entities. CST believes that the amounts paid in settlement and in defense of this litigation are covered by available insurance and has made demands on its insurers for these amounts.

Note 9. FAIR VALUE MEASUREMENTS

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (exit price). U.S. GAAP specifies a three-level hierarchy that is used when measuring and disclosing fair value. The fair value hierarchy gives the highest priority to quoted prices available in active markets (i.e., observable inputs) and the lowest priority to data lacking transparency (i.e., unobservable inputs). An instrument’s categorization within the fair value hierarchy is based on the lowest level of significant input to its valuation. The following is a description of the three hierarchy levels.

Level 1—Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities. Active markets are considered to be those in which transactions for the assets or liabilities occur in sufficient frequency and volume to provide pricing information on an ongoing basis.

Level 2—Quoted prices in markets that are not active, or inputs which are observable, either directly or indirectly, for substantially the full term of the asset or liability. This category includes quoted prices for similar assets or liabilities in active markets and quoted prices for identical or similar assets or liabilities in inactive markets.

Level 3—Unobservable inputs are not corroborated by market data. This category is comprised of financial and non-financial assets and liabilities whose fair value is estimated based on internally developed models or methodologies using significant inputs that are generally less readily observable from objective sources.

Transfers into or out of any hierarchy level are recognized at the end of the reporting period in which the transfers occurred. There were no transfers between any levels in 2015 or 2014.

Financial Instruments

The aggregate fair value and carrying amount of the CST senior notes and term loan at March 31, 2015 and December 31, 2014 were $1.0 billion. The fair value of the CST term loan approximates its carrying value due to the frequency with which interest rates are reset. The fair value of the CST senior notes is determined primarily using quoted prices of over the counter traded securities. These quoted prices are considered Level 1 inputs.

The fair value of CrossAmerica’s revolving credit facility approximated its carrying values of $318 million as of March 31, 2015 and $200 million as of December 31, 2014 due to the frequency with which interest rates are reset based on changes in prevailing interest rates.

Note 10. EQUITY

CST Treasury Stock

For the three months ended March 31, 2015 we purchased 334,584 of our common shares for a total purchase price of $14 million as part of our publicly announced share repurchase program. We have also withheld 15,891 shares of our common stock with a total fair value of $1 million in connection with withholding taxes related to the exercise of stock options, the vesting of restricted stock and the vesting of restricted stock units.

CST Dividends

We have paid regular quarterly cash dividends of $0.0625 per CST common share each quarter, commencing with the quarter ended September 30, 2013. The timing, declaration, amount and payment of future dividends to stockholders will fall within the discretion of our Board of Directors. Our indebtedness also restricts our ability to pay dividends. As such, there can be no assurance we will continue to pay dividends in the future.

Quarterly dividend activity was as follows:

Quarter Ended | Record Date | Payment Date | Cash Distribution (per share) | Cash Distribution (in millions) | ||||||||

March 31, 2015 | March 31, 2015 | April 15, 2015 | $ | 0.0625 | $ | 5 | ||||||

14

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

CrossAmerica Distributions

CrossAmerica’s quarterly distribution paid in the first quarter of 2015 (related to the fourth quarter of 2014) was $0.5425 per CrossAmerica common unit, or $13 million. During the first quarter of 2015, CrossAmerica distributed $170,000 to us with respect to the IDRs.

Comprehensive Income

Comprehensive income for a period encompasses net income and all other changes in equity other than from transactions with our stockholders. Foreign currency translation adjustments are the only component of our accumulated other comprehensive income. Our other comprehensive income or loss before reclassifications results from changes in the value of foreign currencies (the Canadian dollar) in relation to the U.S. dollar. Changes in foreign currency translation adjustments were as follows for the three months ended March 31, 2015 and 2014 (in millions):

Three Months Ended March 31, | ||||||||

2015 | 2014 | |||||||

Balance at the beginning of the period | $ | 77 | $ | 133 | ||||

Other comprehensive (loss) income before reclassifications | (52 | ) | (24 | ) | ||||

Amounts reclassified from other comprehensive income | — | — | ||||||

Net other comprehensive (loss) income | (52 | ) | (24 | ) | ||||

Balance at the end of the period | $ | 25 | $ | 109 | ||||

Note 11. STOCK-BASED COMPENSATION

Overview

Compensation expense for our stock-based compensation plans is based on the fair value of the awards granted and is recognized in income on a straight-line basis over the requisite service period of each vesting tranche. We record stock-based compensation as a component of operating expenses and general and administrative expenses in the consolidated statements of income.

We recognized stock-based compensation expense as follows (in millions):

Three Months Ended March 31, | ||||||||

2015 | 2014 | |||||||

Stock-based compensation related to CST | $ | 5 | $ | 4 | ||||

Stock-based compensation related to CrossAmerica | 3 | — | ||||||

Total stock-based compensation expense | $ | 8 | $ | 4 | ||||

In the first quarter of 2015, we recognized $4 million of stock-based compensation expense, and in the first quarter of 2014, we recognized $2 million of stock-based compensation expense, related to stock-based awards granted to employees who were retirement eligible at the date of grant.

CST Stock-Based Awards

Grants of stock-based awards occurred in the first quarter of 2015 and consisted of:

Number of Shares | Weighted-Avg Grant-Date Fair Value | ||||||

Stock options | 687,099 | $ | 10.79 | ||||

Restricted stock (granted to Board of Directors) | 22,820 | $ | 41.41 | ||||

Restricted stock units (granted principally to employees) | 124,112 | $ | 41.44 | ||||

15

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The stock options and restricted stock units granted become exercisable in equal increments on the first, second and third anniversaries of their date of grant, and expire on the tenth anniversary of their date of grant. The restricted stock awards vest in full on the first anniversary of their date of grant and participate in dividends. Exercise prices of the stock options are equal to the market value of the common stock on the date of grant. The weighted average exercise price of the stock options granted was $41.44 per share.

Approximately 142,000 of the CST stock based awards were granted to certain employees of CST for services rendered on behalf of CrossAmerica and the expense associated with the awards was charged to CrossAmerica. These stock based awards had a total fair value of $2 million on the date of grant.

CrossAmerica Unit-Based Awards

CrossAmerica’s unit-based compensation expense for the three months ended March 31, 2015 and 2014 was $3 million and $1 million, respectively.

Grants of unit-based awards occurred in the first quarter of 2015 and consisted of:

Number of Securities | Weighted-Avg Grant-Date Fair Value | ||||||

Phantom units | 35,814 | $ | 33.95 | ||||

Profits interests | 34,728 | $ | 33.95 | ||||

These awards were fully vested on the date of grant. Previously issued awards generally vest in equal increments on the first, second and third anniversaries of their date of grant. It is the intent of CrossAmerica to settle the phantom units upon vesting by issuing common units and to settle the profits interests upon conversion by the grantee by issuing common units. However, the awards may be settled in cash at the discretion of the board of directors of the General Partner.

Since CrossAmerica grants awards to employees of CST, and since the grants may be settled in cash, unvested phantom units and vested and unvested profits interests receive fair value accounting treatment. As such, they are measured at fair value at each balance sheet reporting date and the cumulative compensation cost recognized is classified as a liability, which is included in accrued expenses and other current liabilities on the consolidated balance sheet. The balance of the accrual at March 31, 2015 and December 31, 2014 totaled $2 million and $5 million, respectively.

Awards to CrossAmerica Officers

In April 2015, in connection with his appointment as President of CrossAmerica, CrossAmerica granted 4,077 phantom units to Jeremy Bergeron with a fair value of $0.1 million. This award will vest in equal increments on the first, second and third anniversaries of the date of grant. This award was accompanied by tandem distribution equivalent rights that entitle the holder to cash payments equal to the amount of distributions authorized to be paid to the holders of common units.

Additionally, in April 2015, in connection with an executive retention agreement, CST granted 7,902 restricted stock units with a fair value of $0.4 million to Dave Hrinak, the Executive Vice President and COO of CrossAmerica. One third of this award will vest on October 1, 2015, and the remaining awards will vest in equal increments on the first and second anniversaries of that date. The awards will receive dividend equivalent payments.

Awards to Members of the Board of Directors of CrossAmerica

In 2014, CrossAmerica granted 6,141 phantom units to the non-employee members of the board of directors of the General Partner as a portion of director compensation, which will vest on November 10, 2015.

The fair value of these awards at March 31, 2015, including previously issued fully vested profits interests that have not been converted into common units, was $1 million. Compensation expense was not significant for the three months ended March 31, 2015 and 2014.

16

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 12. EARNINGS PER COMMON SHARE

Earnings per common share are computed after adjustment for net income or loss attributable to noncontrolling interest. Therefore, all earnings per common share information solely relates to CST common stockholders.

Earnings per common share were computed as follows (in millions, except shares outstanding, common equivalent shares and per share amounts):

Three Months Ended March 31, | ||||||||||||||||

2015 | 2014 | |||||||||||||||

Restricted Shares and Units | Common Stock | Restricted Shares and Units | Common Stock | |||||||||||||

Earnings per common share: | ||||||||||||||||

Net income attributable to CST stockholders | $ | 14 | $ | 11 | ||||||||||||

Less dividends declared: | ||||||||||||||||

Common stock | 5 | 5 | ||||||||||||||

Undistributed earnings | $ | 9 | $ | 6 | ||||||||||||

Weighted-average common shares outstanding (in thousands) | 331 | 76,896 | — | 75,397 | ||||||||||||

Earnings per common share | ||||||||||||||||

Distributed earnings | $ | 0.06 | $ | 0.06 | $ | — | $ | 0.06 | ||||||||

Undistributed earnings | 0.12 | 0.12 | — | 0.08 | ||||||||||||

Total earnings per common share | $ | 0.18 | $ | 0.18 | $ | — | $ | 0.14 | ||||||||

Three Months Ended March 31, | ||||||||||||

2015 | 2014 | |||||||||||

Restricted Shares and Units | Common Stock | Restricted Shares and Units | Common Stock | |||||||||

Earnings per common share - assuming dilution: | ||||||||||||

Net income attributable to CST stockholders | $ | 14 | $ | 11 | ||||||||

Weighted-average common shares outstanding (in thousands) | 76,896 | 75,397 | ||||||||||

Common equivalent shares: | ||||||||||||

Stock options (in thousands) | 136 | — | ||||||||||

Restricted stock (in thousands) | 113 | 97 | ||||||||||

Restricted stock units (in thousands) | 97 | — | ||||||||||

Weighted-average common shares outstanding - assuming dilution (in thousands) | 77,242 | 75,494 | ||||||||||

Earnings per common share - assuming dilution | $ | 0.18 | $ | 0.14 | ||||||||

17

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The table below presents securities that have been excluded from the computation of diluted earnings per share because they would have been anti-dilutive for the periods presented:

Three Months Ended March 31, | ||||||

2015 | 2014 | |||||

Weighted-average anti-dilutive options (in thousands) | 107 | 23 | ||||

Note 13. SEGMENT INFORMATION

Our operations include (i) the sale of motor fuel to end-users at convenience stores, commission agents and cardlocks, (ii) the sale of convenience merchandise items and services at convenience stores, (iii) the sale of heating oil to residential customers and heating oil and motor fuel to small commercial customers, and (iv) the wholesale distribution of motor fuel and the ownership and leasing of real estate used in the retail distribution of motor fuel.

We have three reportable segments: U.S. Retail, Canadian Retail and CrossAmerica. The U.S. Retail, Canadian Retail and CrossAmerica segments are managed as individual strategic business units. Each segment experiences different operating income margins due to certain unique operating characteristics, geographic supply and demand attributes, specific country and local regulatory environments, and are exposed to variability in gross profit from the volatility of crude oil prices. Operating revenues from our heating oil business were less than 6% of our operating revenues for three months ended March 31, 2015 and 2014 and have been included within the Canadian Retail segment information.

Results that are not included in our reportable segments are included in the corporate category, which consist primarily of general and administrative costs. Management evaluates the performance of our CrossAmerica segment without considering the effects of the “step-up” of CrossAmerica’s historical account balances to fair value required under ASC 805—Business Combinations. As a result, we have included a fair value column to reconcile to our consolidated results. The elimination column represents wholesale fuel supplied to our U.S. Retail segment from CrossAmerica.

The following table reflects activity related to our reportable segments (in millions):

U.S. Retail | Canada Retail | CrossAmerica | Corporate | Eliminations | Fair value adjustments | Consolidated | ||||||||||||||||||||||

Three months ended March 31, 2015: | ||||||||||||||||||||||||||||

Operating revenues | $ | 1,362 | $ | 853 | 455 | $ | — | $ | — | $ | — | $ | 2,670 | |||||||||||||||

Intersegment revenues | — | — | 30 | — | (30 | ) | — | — | ||||||||||||||||||||

Gross profit | 176 | 93 | 35 | — | — | — | 304 | |||||||||||||||||||||

Depreciation, amortization and accretion expense | 24 | 9 | 12 | — | — | 9 | 54 | |||||||||||||||||||||

Operating income (loss) | 42 | 28 | 10 | (50 | ) | — | (9 | ) | 21 | |||||||||||||||||||

Total expenditures for long-lived assets (including acquisitions) | 66 | 4 | 126 | — | — | — | 196 | |||||||||||||||||||||

Three months ended March 31, 2014: | ||||||||||||||||||||||||||||

Operating revenues from external customers | $ | 1,799 | $ | 1,202 | $ | — | $ | — | $ | — | $ | — | $ | 3,001 | ||||||||||||||

Gross profit | 151 | 94 | — | — | — | — | 245 | |||||||||||||||||||||

Depreciation, amortization and accretion expense | 22 | 9 | — | — | — | — | 31 | |||||||||||||||||||||

Operating income (loss) | 24 | 26 | — | (25 | ) | — | — | 25 | ||||||||||||||||||||

Total expenditures for long-lived assets (including acquisitions) | 36 | 7 | — | — | — | — | 43 | |||||||||||||||||||||

18

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 14. SUPPLEMENTAL CASH FLOW INFORMATION

In order to determine net cash provided by operating activities, net income is adjusted by, among other things, changes in current assets and current liabilities as follows (in millions):

Three Months Ended March 31, | ||||||||

2015 | 2014 | |||||||

Decrease (increase): | ||||||||

Receivables, net | $ | (1 | ) | $ | (60 | ) | ||

Inventories | 18 | 20 | ||||||

Deferred income taxes | (1 | ) | — | |||||

Prepaid expenses and other | 5 | (2 | ) | |||||

Increase (decrease): | ||||||||

Accounts payable | (19 | ) | (5 | ) | ||||

Accounts payable to Valero | 28 | 41 | ||||||

Accrued expenses | — | 8 | ||||||

Taxes other than income taxes | (5 | ) | 3 | |||||

Income taxes payable | (9 | ) | (2 | ) | ||||

Changes in working capital | $ | 16 | $ | 3 | ||||

The above changes in current assets and current liabilities may differ from changes between amounts reflected in the applicable balance sheets for the respective periods for the following reasons:

• | acquisitions, including the consolidation of CrossAmerica; |

• | amounts accrued for capital expenditures are reflected in investing activities when such amounts are paid; and |

• | certain differences between balance sheet changes and the changes reflected above result from translating foreign currency denominated amounts at the applicable exchange rates as of each balance sheet date. |

Cash flows related to interest were as follows (in millions):

Three Months Ended March 31, | ||||||||

2015 | 2014 | |||||||

Interest paid in excess of amount capitalized | $ | 6 | $ | 3 | ||||

There were no significant non-cash investing or financing activities for the three months ended March 31, 2015.

Note 15. TERMINATION BENEFITS

CST accrued $4 million of severance and benefit costs in 2015 related to certain CST employees who were officers of CrossAmerica officers who have terminated their employment. Such costs are included in general and administrative expenses.

As a result of the continued integration of certain processes and systems of our recently acquired businesses, CrossAmerica committed to a workforce reduction affecting certain employees of CrossAmerica or its affiliates for which the expected completion date is December 31, 2015. CrossAmerica is recognizing $2 million of estimated cost of severance and other benefits ratably over the required service period.

In addition, at December 31, 2014, CrossAmerica had a $2 million accrual for severance and benefit costs related to certain officers who terminated their employment.

19

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

A rollforward of our liability for severance and other termination benefits is as follows (in millions):

Balance at December 31, 2014 | $ | 2 | ||

Provision for termination benefits (included in general and administrative expenses) | 4 | |||

Termination benefits paid | — | |||

Balance at March 31, 2015 | $ | 6 | ||

Note 16. GUARANTOR SUBSIDIARIES

CST’s 100% owned, domestic subsidiaries (the “Guarantor Subsidiaries”) fully and unconditionally guarantee, on a joint and several basis, CST’s 5% senior notes. CrossAmerica is not a guarantor under CST’s 5% senior notes. The following consolidating schedules present financial information on a consolidated basis in conformity with the SEC’s Regulation S-X Rule 3-10(f):

20

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

CONSOLIDATING BALANCE SHEETS

(Millions of Dollars)

March 31, 2015 | |||||||||||||||||||||||||||||||

Parent Company | Guarantor Subsidiaries | Non-Guarantor Subsidiaries | CST Eliminations | Total CST | CrossAmerica | Eliminations | Total Consolidated | ||||||||||||||||||||||||

US | Canada | ||||||||||||||||||||||||||||||

ASSETS | |||||||||||||||||||||||||||||||

Current assets: | |||||||||||||||||||||||||||||||

Cash | $ | — | $ | 111 | $ | 198 | $ | — | $ | 309 | $ | 5 | $ | — | $ | 314 | |||||||||||||||

Receivables, net | — | 60 | 75 | — | 135 | 39 | (4 | ) | 170 | ||||||||||||||||||||||

Inventories | — | 128 | 60 | — | 188 | 20 | — | 208 | |||||||||||||||||||||||

Deferred income taxes | — | 12 | — | — | 12 | — | — | 12 | |||||||||||||||||||||||

Prepaid expenses and other | — | 6 | 5 | — | 11 | 12 | — | 23 | |||||||||||||||||||||||

Total current assets | — | 317 | 338 | — | 655 | 76 | (4 | ) | 727 | ||||||||||||||||||||||

Property and equipment, at cost | — | 1,672 | 485 | — | 2,157 | 601 | — | 2,758 | |||||||||||||||||||||||

Accumulated depreciation | — | (529 | ) | (164 | ) | — | (693 | ) | (19 | ) | — | (712 | ) | ||||||||||||||||||

Property and equipment, net | — | 1,143 | 321 | — | 1,464 | 582 | — | 2,046 | |||||||||||||||||||||||

Intangible assets, net | — | 98 | 16 | — | 114 | 367 | — | 481 | |||||||||||||||||||||||

Goodwill | — | 32 | — | — | 32 | 262 | — | 294 | |||||||||||||||||||||||

Investment in subsidiaries | 2,063 | — | — | (2,063 | ) | — | — | — | — | ||||||||||||||||||||||

Investment in CrossAmerica | — | 59 | — | — | 59 | — | (59 | ) | — | ||||||||||||||||||||||

Deferred income taxes | — | — | 71 | — | 71 | — | — | 71 | |||||||||||||||||||||||

Other assets, net | 30 | 24 | 5 | — | 59 | 16 | — | 75 | |||||||||||||||||||||||

Total assets | $ | 2,093 | $ | 1,673 | $ | 751 | $ | (2,063 | ) | $ | 2,454 | $ | 1,303 | $ | (63 | ) | $ | 3,694 | |||||||||||||

Historical amounts for CrossAmerica were adjusted to their fair values as a result of the GP Purchase discussed in Note 2. These adjustments were as follows as of March 31, 2015: | |||||||||||||||||||||||||||||||

Property and equipment, net | $ | 104 | |||||||||||||||||||||||||||||

Intangibles, net | 279 | ||||||||||||||||||||||||||||||

Goodwill | 176 | ||||||||||||||||||||||||||||||

21

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2015 | |||||||||||||||||||||||||||||||

Parent Company | Guarantor Subsidiaries | Non-Guarantor Subsidiaries | CST Eliminations | Total CST | CrossAmerica | Eliminations | Total Consolidated | ||||||||||||||||||||||||

US | Canada | ||||||||||||||||||||||||||||||

LIABILITIES AND STOCKHOLERS’ EQUITY | |||||||||||||||||||||||||||||||

Current liabilities: | |||||||||||||||||||||||||||||||

Current portion of debt and capital lease obligations | $ | 50 | $ | 1 | $ | — | $ | — | $ | 51 | $ | 8 | $ | — | $ | 59 | |||||||||||||||

Accounts payable | — | 67 | 34 | — | 101 | 45 | (4 | ) | 142 | ||||||||||||||||||||||

Accounts payable to Valero | (1 | ) | 121 | 81 | — | 201 | — | — | 201 | ||||||||||||||||||||||

Accrued expenses | 12 | 32 | 16 | — | 60 | 17 | — | 77 | |||||||||||||||||||||||

Taxes other than income taxes | — | 22 | 1 | — | 23 | 12 | — | 35 | |||||||||||||||||||||||

Income taxes payable | — | 3 | 2 | — | 5 | 3 | — | 8 | |||||||||||||||||||||||

Deferred income taxes | — | — | — | — | — | 3 | — | 3 | |||||||||||||||||||||||

Dividends payable | 5 | — | — | — | 5 | — | — | 5 | |||||||||||||||||||||||

Total current liabilities | 66 | 246 | 134 | — | 446 | 88 | (4 | ) | 530 | ||||||||||||||||||||||

Debt and capital lease obligations, less current portion | 943 | 7 | 4 | — | 954 | 398 | — | 1,352 | |||||||||||||||||||||||

Deferred income taxes | — | 128 | — | — | 128 | 58 | — | 186 | |||||||||||||||||||||||

Intercompany payables (receivables) | 268 | (269 | ) | 1 | — | — | — | — | — | ||||||||||||||||||||||

Asset retirement obligations | — | 69 | 16 | — | 85 | 20 | — | 105 | |||||||||||||||||||||||

Other long-term liabilities | 16 | 10 | 14 | — | 40 | 16 | — | 56 | |||||||||||||||||||||||

Total liabilities | 1,293 | 191 | 169 | — | 1,653 | 580 | (4 | ) | 2,229 | ||||||||||||||||||||||

Commitments and contingencies | |||||||||||||||||||||||||||||||

Stockholders’ equity: | |||||||||||||||||||||||||||||||

Common stock | 1 | — | — | — | 1 | — | — | 1 | |||||||||||||||||||||||

APIC | 533 | 1,214 | 460 | (1,674 | ) | 533 | — | (59 | ) | 474 | |||||||||||||||||||||

Treasury stock | (37 | ) | — | — | — | (37 | ) | — | — | (37 | ) | ||||||||||||||||||||

Retained earnings | 278 | 268 | 122 | (389 | ) | 279 | — | — | 279 | ||||||||||||||||||||||

AOCI | 25 | — | — | — | 25 | — | — | 25 | |||||||||||||||||||||||

Noncontrolling interest | — | — | — | — | — | 723 | — | 723 | |||||||||||||||||||||||

Total stockholders’ equity | 800 | 1,482 | 582 | (2,063 | ) | 801 | 723 | (59 | ) | 1,465 | |||||||||||||||||||||

Total liabilities and stockholders’ equity | $ | 2,093 | $ | 1,673 | $ | 751 | $ | (2,063 | ) | $ | 2,454 | $ | 1,303 | $ | (63 | ) | $ | 3,694 | |||||||||||||

Deferred taxes and noncontrolling interest for CrossAmerica include $13 million and $546 million, respectively, related to the fair value adjustments to CrossAmerica’s net assets as a result of the GP Purchase discussed in Note 2.

22

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

CONSOLIDATING BALANCE SHEETS

(Millions of Dollars)

December 31, 2014 | |||||||||||||||||||||||||||||||

Parent Company | Guarantor Subsidiaries | Non-Guarantor Subsidiaries | CST Eliminations | Total CST | CrossAmerica | Eliminations | Total Consolidated | ||||||||||||||||||||||||

US | Canada | ||||||||||||||||||||||||||||||

ASSETS | |||||||||||||||||||||||||||||||

Current assets: | |||||||||||||||||||||||||||||||

Cash | $ | — | $ | 148 | $ | 205 | $ | — | $ | 353 | $ | 15 | $ | — | $ | 368 | |||||||||||||||

Receivables, net | 3 | 62 | 73 | — | 138 | 38 | (3 | ) | 173 | ||||||||||||||||||||||

Inventories | — | 144 | 65 | — | 209 | 12 | — | 221 | |||||||||||||||||||||||

Deferred income taxes | — | 11 | — | — | 11 | 1 | — | 12 | |||||||||||||||||||||||

Prepaid expenses and other | — | 9 | 5 | — | 14 | 10 | — | 24 | |||||||||||||||||||||||

Total current assets | 3 | 374 | 348 | — | 725 | 76 | (3 | ) | 798 | ||||||||||||||||||||||

Property and equipment, at cost | 1 | 1,647 | 524 | — | 2,172 | 490 | — | 2,662 | |||||||||||||||||||||||

Accumulated depreciation | — | (527 | ) | (170 | ) | — | (697 | ) | (8 | ) | — | (705 | ) | ||||||||||||||||||

Property and equipment, net | 1 | 1,120 | 354 | — | 1,475 | 482 | — | 1,957 | |||||||||||||||||||||||

Intangible assets, net | — | 97 | 19 | — | 116 | 370 | — | 486 | |||||||||||||||||||||||

Goodwill | — | 19 | — | — | 19 | 223 | — | 242 | |||||||||||||||||||||||

Investment in subsidiaries | 2,029 | — | — | (2,029 | ) | — | — | — | — | ||||||||||||||||||||||

Deferred income taxes | — | — | 79 | — | 79 | — | — | 79 | |||||||||||||||||||||||

Other assets, net | 30 | 25 | 5 | — | 60 | 19 | — | 79 | |||||||||||||||||||||||

Total assets | $ | 2,063 | $ | 1,635 | $ | 805 | $ | (2,029 | ) | $ | 2,474 | $ | 1,170 | $ | (3 | ) | $ | 3,641 | |||||||||||||

Historical amounts for CrossAmerica were adjusted to their fair values as a result of the GP Purchase discussed in the Form 10-K for the year ended December 31, 2014. These adjustments were as follows: | |||||||||||||||||||||||||||||||

Property and equipment, net | $ | 90 | |||||||||||||||||||||||||||||

Intangibles, net | 292 | ||||||||||||||||||||||||||||||

Goodwill | 183 | ||||||||||||||||||||||||||||||

23

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2014 | |||||||||||||||||||||||||||||||

Parent Company | Guarantor Subsidiaries | Non-Guarantor Subsidiaries | CST Eliminations | Total CST | CrossAmerica | Eliminations | Total Consolidated | ||||||||||||||||||||||||

US | Canada | ||||||||||||||||||||||||||||||

LIABILITIES AND STOCKHOLERS’ EQUITY | |||||||||||||||||||||||||||||||

Current liabilities: | |||||||||||||||||||||||||||||||

Current portion of debt and capital lease obligations | $ | 47 | $ | 1 | $ | — | $ | — | $ | 48 | $ | 29 | $ | — | $ | 77 | |||||||||||||||

Accounts payable | 3 | 76 | 47 | — | 126 | 34 | (3 | ) | 157 | ||||||||||||||||||||||

Accounts payable to Valero | — | 104 | 75 | — | 179 | — | — | 179 | |||||||||||||||||||||||

Accrued expenses | 4 | 40 | 14 | — | 58 | 21 | — | 79 | |||||||||||||||||||||||

Taxes other than income taxes | — | 27 | — | — | 27 | 10 | — | 37 | |||||||||||||||||||||||

Income taxes payable | — | 1 | 15 | — | 16 | — | — | 16 | |||||||||||||||||||||||

Dividends payable | 5 | — | — | — | 5 | — | — | 5 | |||||||||||||||||||||||

Total current liabilities | 59 | 249 | 151 | — | 459 | 94 | (3 | ) | 550 | ||||||||||||||||||||||

Debt and capital lease obligations, less current portion | 956 | 6 | 4 | — | 966 | 261 | — | 1,227 | |||||||||||||||||||||||

Deferred income taxes | — | 112 | — | — | 112 | 38 | — | 150 | |||||||||||||||||||||||

Intercompany payables (receivables) | 220 | (221 | ) | 1 | — | — | — | — | — | ||||||||||||||||||||||

Asset retirement obligations | — | 66 | 17 | — | 83 | 19 | — | 102 | |||||||||||||||||||||||

Other long-term liabilities | 15 | 10 | 16 | — | 41 | 16 | — | 57 | |||||||||||||||||||||||

Total liabilities | 1,250 | 222 | 189 | — | 1,661 | 428 | (3 | ) | 2,086 | ||||||||||||||||||||||

Commitments and contingencies | |||||||||||||||||||||||||||||||

Stockholders’ equity: | |||||||||||||||||||||||||||||||

Common stock | 1 | — | — | — | 1 | — | — | 1 | |||||||||||||||||||||||

APIC | 488 | 1,154 | 502 | (1,656 | ) | 488 | — | — | 488 | ||||||||||||||||||||||

Treasury stock | (22 | ) | — | — | — | (22 | ) | — | — | (22 | ) | ||||||||||||||||||||

Retained earnings | 269 | 259 | 114 | (373 | ) | 269 | — | — | 269 | ||||||||||||||||||||||

AOCI | 77 | — | — | — | 77 | — | — | 77 | |||||||||||||||||||||||

Noncontrolling interest | — | — | — | — | — | 742 | — | 742 | |||||||||||||||||||||||

Total stockholders’ equity | 813 | 1,413 | 616 | (2,029 | ) | 813 | 742 | — | 1,555 | ||||||||||||||||||||||

Total liabilities and stockholders’ equity | $ | 2,063 | $ | 1,635 | $ | 805 | $ | (2,029 | ) | $ | 2,474 | $ | 1,170 | $ | (3 | ) | $ | 3,641 | |||||||||||||

Deferred taxes and noncontrolling interest for CrossAmerica include $14 million and $551 million, respectively, related to the fair value adjustments to CrossAmerica’s net assets as a result of the GP Purchase discussed in Form 10-K for the year ended December 31, 2014.

24

CST BRANDS, INC.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

CONSOLIDATING STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(Millions of Dollars)

March 31, 2015 | |||||||||||||||||||||||||||||||

Parent Company | Guarantor Subsidiaries | Non-Guarantor Subsidiaries | CST Eliminations | Total CST | CrossAmerica | Eliminations | Total Consolidated | ||||||||||||||||||||||||

US | Canada | ||||||||||||||||||||||||||||||