Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ESCALADE INC | Financial_Report.xls |

| EX-21 - EXHIBIT 21 - ESCALADE INC | ex_21.htm |

| EX-32.2 - EXHIBIT 32.2 - ESCALADE INC | ex32_2.htm |

| EX-23.2 - EXHIBIT 23.2 - ESCALADE INC | ex23_2.htm |

| EX-32.1 - EXHIBIT 32.1 - ESCALADE INC | ex32_1.htm |

| EX-31.1 - EXHIBIT 31.1 - ESCALADE INC | ex31_1.htm |

| EX-23.1 - EXHIBIT 23.1 - ESCALADE INC | ex23_1.htm |

| EX-31.2 - EXHIBIT 31.2 - ESCALADE INC | ex31_2.htm |

| EX-10.26 - EXHIBIT 10.26 - ESCALADE INC | ex10_26.htm |

| EX-10.27 - EXHIBIT 10.27 - ESCALADE INC | ex10_27.htm |

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2011

Or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission File Number 0-6966

ESCALADE, INCORPORATED

(Exact name of registrant as specified in its charter)

| Indiana | 13-2739290 | |

| (State of incorporation) | (I.R.S. EIN) | |

| 817 Maxwell Ave, Evansville, Indiana | 47711 | |

| (Address of Principal Executive Office) | (Zip Code) |

812-467-4449

(Registrant’s Telephone Number)

Securities registered pursuant to Section 12(b) of the Act

| Common Stock, No Par Value | The NASDAQ Stock Market LLC | |

| (Title of Class) | (Name of Exchange on Which Registered) |

Securities registered pursuant to section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See the definitions of “Large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] (do not check if a smaller reporting company) |

Smaller reporting company [X] |

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12 b-2 of the Exchange Act).

Yes [ ] No [X]

Aggregate market value of common stock held by nonaffiliates of the registrant as of July 9, 2011 based on the closing sale price as reported on the NASDAQ Global Market: $53,085,149

The number of shares of Registrant’s common stock (no par value) outstanding as of February 6, 2012: 12,891,757.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the registrant’s Proxy Statement relating to its annual meeting of stockholders scheduled to be held on April 27, 2012 are incorporated by reference into Part III of this Report.

| 1 |

Escalade, Incorporated and Subsidiaries

Table of Contents

| 2 |

General

Escalade, Incorporated (“Escalade” or “Company”) operates in two business segments: Sporting Goods and Information Security and Print Finishing (or “Martin Yale Group”). Escalade and its predecessors have more than 80 years of manufacturing and selling experience in these two industries.

The following table presents the percentages contributed to Escalade’s net sales by each of its business segments:

| 2011 | 2010 | 2009 | ||||||||||

| Sporting Goods | 72 | % | 71 | % | 66 | % | ||||||

| Information Security and Print Finishing | 28 | % | 29 | % | 34 | % | ||||||

| Total Net Sales | 100 | % | 100 | % | 100 | % | ||||||

For additional segment information, see Note 14 – Operating Segment and Geographic Information in the consolidated financial statements.

Sporting Goods

Headquartered in Evansville, Indiana, Escalade Sports manufactures, imports, and distributes widely recognized sporting goods brands in family recreation, fitness, training, and hunting products through traditional department stores, mass merchandise retailers, and sporting goods specific retailers. Escalade is the world’s largest producer of table tennis tables. Some of the Company’s most recognized brands include:

| Product Segment | Brand Names | |

| Archery | Bear Archery®, Trophy Ridge®, Whisker Biscuit® | |

| Table Tennis | STIGA®, Ping-Pong® | |

| Basketball Backboards and Goals | Goalrilla™, Goaliath®, Silverback® | |

| Play Systems | Woodplay®, Childlife® | |

| Fitness | The STEP®, USWeight™ | |

| Game Tables (Hockey and Soccer) | Harvard Game®, Atomic®, Accudart® | |

| Pool Tables and Accessories | Mosconi®, Mizerak® |

In 2011, the Company has one customer in the Sporting Goods segment, Dick’s Sporting Goods, which accounted for approximately 16% of total consolidated gross revenues.

Escalade Sports manufactures in the USA and Mexico and imports product from Asia, where the Company utilizes a number of contract manufacturers.

Certain products produced by Escalade Sports are subject to regulation by the Consumer Product Safety Commission. The Company believes it is in material compliance with all applicable regulations.

Information Security and Print Finishing

Martin Yale Group has increasingly expanded its focus on the information security requirements of larger corporate customers, governments, and strategic business partners. The Company is particularly focused on addressing information security issues including the decommissioning or destruction of data stored on optical, solid state, magnetic, and traditional media like paper to meet the increasingly strict security standards set by the National Security Administration, National Institute of Standards and Technology, Deutsches Institut fur Normung (German Institute for Standardization), the European Union, and many other governments and organizations around the world. Martin Yale Group continues to focus on the print finishing sector with a particular focus on digital print applications.

| 3 |

Martin Yale Group has a worldwide presence with manufacturing facilities in Indiana and Germany and joint venture manufacturing facilities in the Czech Republic and Taiwan. Martin Yale Group has sales offices in the USA, Germany, United Kingdom, France, Spain, China, Italy, South Africa and Sweden.

Martin Yale Group products include: shredders, disintegrators, degaussers, paper folders, letter openers, and paper cutters/trimmers. The key Martin Yale Group brands include martin yale®, intimus®, and papermonster®.

Martin Yale Group products and services are sold directly to end-users as well as through retailers, wholesalers, catalogs, specialty dealers, and business partners. No single Martin Yale Group customer accounted for more than 10% of Information Security and Print Finishing sales during 2011.

Marketing and Product Development

The Company makes a substantial investment in product development and brand marketing to differentiate its product line from its competition. Each operating segment conducts market research and development efforts to design products which satisfy existing and emerging consumer needs. On a consolidated basis, the Company incurred research and development costs of approximately $1.4 million, $1.9 million, and $2.0 million in 2011, 2010 and 2009, respectively.

The Company also makes investments in brand marketing to properly communicate the specific attributes and qualities of its products. The Company advertises directly to the consumer or end-user as well as through its retail partners in the form of advertising and other promotional allowances.

Competition

Escalade is subject to competition with various manufacturers in each product line produced or sold by Escalade. The Company is not aware of any other single company that is engaged in both the same industries as Escalade or that produces the same range of products as Escalade within such industries. Nonetheless, competition exists for many Escalade products within both the Sporting Goods and Information Security and Print Finishing industries. Some competitors are larger and have substantially greater resources than the Company. Escalade believes that its long-term success depends on its ability to strengthen its relationship with existing customers, attract new customers and develop new products that satisfy the quality and price requirements of Sporting Goods and Information Security and Print Finishing customers.

Licenses, Trademarks and Brand Names

The Company has an agreement and contract with STIGA Sports AB, a 50% owned joint venture, for the exclusive right and license to distribute and produce table tennis equipment under the brand name STIGA® for the United States and Canada. The Company also owns several registered trademarks and brand names including but not limited to Ping-Pong®, Bear Archery®, Goalrillaä, The Step®, and Wood Play® which are used in the Sporting Goods business segment and intimus® and papermonster® which are used in the Information Security and Print Finishing business segment.

Backlog and Seasonality

Sales are based primarily on standard purchase orders and in most cases orders are shipped within the same month received. Unshipped orders at the end of the fiscal year (backlog) were not material and therefore are not an indicator of future results. Increased diversity in product categories, such as playground and basketball, over the past few years has helped the Company achieve more evenly distributed revenues in Sporting Goods. The Company does not expect Sporting Goods sales to be seasonal in the future. Demand for Information Security and Print Finishing has not been seasonal and is not expected to be so in the future.

| 4 |

Employees

The number of employees at December 31, 2011 and December 25, 2010 for each business segment were as follows:

| 2011 | 2010 | |||||||

| Sporting Goods | ||||||||

| USA | 281 | 284 | ||||||

| Mexico | 105 | 98 | ||||||

| Asia | 6 | 8 | ||||||

| 392 | 390 | |||||||

| Information Security and Print Finishing | ||||||||

| USA | 90 | 89 | ||||||

| Europe | 126 | 121 | ||||||

| Asia | 10 | 8 | ||||||

| 226 | 218 | |||||||

| Total | 618 | 608 | ||||||

The I.U.E./C.W.A. (United Electrical Communication Workers of America, AFL-CIO) represents hourly rated employees at the Escalade Sports’ Evansville, Indiana distribution center. There are approximately 13 covered employees at December 31, 2011. A 3-year labor contract was negotiated and renewed in April 2009; the new agreement expires on April 30, 2012. Management believes it has satisfactory relations with its employees.

Sources of Supplies

Raw materials for Escalade’s various product lines consist of wood, steel, plastics, fiberglass and packaging. Escalade relies upon suppliers in various countries and upon various third party Asian manufacturers for certain of its game tables and non-security paper shredders. The Company believes that these sources will continue to provide adequate supplies as needed and that all other materials needed for the Company’s various operations are available in adequate quantities from a variety of domestic and foreign sources.

SEC Reports

The Company’s Internet site (www.escaladeinc.com) makes available free of charge to all interested parties the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and all amendments to those reports, as well as all other reports and schedules filed electronically with the Securities and Exchange Commission (the “Commission”), as soon as reasonably practicable after such material is electronically filed with or furnished to the Commission. Interested parties may also find reports, proxy and information statements and other information on issuers that file electronically with the Commission at the Commission’s Internet site (http://www.sec.gov).

Sales at Martin Yale Group increased but net loss grew in 2011 and net losses could continue to grow in 2012.

Overall sales in Information Security and Print Finishing increased, but net losses further declined. The increase in losses by our Martin Yale Group in 2011 over 2010 is due mainly to inefficiencies in bringing new products to the market, customer pricing pressures and high organizational costs. In addition, continued weakness in the global office products channel and the government sales channel primarily in the United States and the United Kingdom and prolonged economic weakness in Spain and certain other European countries continue to provide challenges. Sales in Information Security and Print Finishing may not continue to increase in 2012 and could decline. Improving profitability in the Information Security and Print Finishing segment will prove to be a challenge. The Company cannot provide any assurance that it will be able to maintain or increase sales levels in the future.

| 5 |

If the Company would lose significant customers in the future, the Company may have difficulty in replacing such lost revenues.

The Company has several large customers and historically has derived substantial revenues from those customers. The Company needs to continue to expand its customer base to minimize the effects of the loss of any single customer in the future. If sales to one or more significant customers would be lost or materially reduced, there can be no assurance that the Company will be able to replace such revenues, which losses could have a material adverse effect on the Company’s business, results of operations and financial condition.

Markets are highly competitive and the Company may not continue to compete successfully.

The market for sporting goods and information security and print finishing products is highly fragmented and intensely competitive. Escalade competes with a variety of regional, national and international manufacturers for customers, employees, products, services and other important aspects of the business. In Sporting Goods, the Company has historically sold a large percentage of its sporting goods products to mass merchandisers and has increasingly attempted to expand sales to specialty retailer and dealer markets. Similarly, the Company has traditionally sold information security and print finishing products to office products retailers, specialty machine dealers and government channels. In addition to competition for sales into those distribution channels, vendors also must compete in sporting goods with large format sporting goods stores, traditional sporting goods stores and chains, warehouse clubs, discount stores and department stores, and in information security and print finishing products with office supply superstores, computer and electronics superstores, contract stationers, and others. Competition from on-line retailers may also impact sales. Some of the current and potential competitors are larger than Escalade and have substantially greater financial resources that may be devoted to sourcing, promoting and selling their products, and may discount prices more heavily than the Company can afford.

If the Company is unable to predict or react to changes in consumer demand, it may lose customers and sales may decline.

Success depends in part on the ability to anticipate and respond in a timely manner to changing consumer demand and preferences regarding sporting goods and information security and print finishing products. Products must appeal to a broad range of consumers whose preferences cannot be predicted with certainty and are subject to change. The Company often makes commitments to manufacture products months in advance of the proposed delivery to customers. If Escalade misjudges the market for products, sales may decline significantly. The Company may have to take significant inventory markdowns on unpopular products that are overproduced and/or miss opportunities for other products that may rise in popularity, both of which could have a negative impact on profitability. A major shift in consumer demand away from sporting goods or information security and print finishing products could also have a material adverse effect on the Company’s business, results of operations and financial condition.

Quarterly operating results are subject to fluctuation.

Operating results have fluctuated from quarter to quarter in the past, and the Company expects that they will continue to do so in the future. Earnings may not recover to historical levels and may fall short of either a prior fiscal period or market expectations. Factors that could cause these quarterly fluctuations include the following: international, national and local general economic and market conditions; the size and growth of the overall Sporting Goods and Information Security and Print Finishing markets; intense competition among manufacturers, marketers, distributors and sellers of products; demographic changes; changes in consumer preferences; popularity of particular designs, categories of products and sports; seasonal demand for products; the size, timing and mix of purchases of products; fluctuations and difficulty in forecasting operating results; ability to sustain, manage or forecast growth and inventories; new product development and introduction; ability to secure and protect trademarks, patents and other intellectual property; performance and reliability of products; customer service; the loss of significant customers or suppliers; dependence on distributors; business disruptions; increased costs of freight and transportation to meet delivery deadlines; changes in business strategy or development plans; general risks associated with doing business outside the United States, including, without limitation: exchange rates, import duties, tariffs, quotas and political and economic instability; changes in government regulations; any liability and other claims asserted against the Company; ability to attract and retain qualified personnel; and other factors referenced or incorporated by reference in this Form 10-K and any other filings with the Securities and Exchange Commission.

| 6 |

Operating results may be impacted by changes in the economy that impact business and consumer spending.

In general, the Company’s sales depend on discretionary spending by consumers. The economic downturn experienced in both the United States and the global economy has resulted in reduced consumer demand and reduced selling price and adversely impacted sales. A continuance of this economic downturn could result in further declines in revenues and impair growth in 2012. Severely negative economic conditions could greatly impair the ability and willingness of consumers to buy products. Operating results are directly impacted by the health of the North American, European and Asian economies. Business and financial performance may be adversely affected by current and future economic conditions, including unemployment levels, energy costs, interest rates, recession, inflation, the impact of natural disasters and terrorist activities, and other matters that influence business and consumer spending.

If national and global financial markets do not improve, potential disruptions in the credit markets may adversely affect business, including the availability and cost of short-term funds for liquidity requirements and ability to meet long-term commitments, which could adversely affect results of operations, cash flows and financial condition.

If internal funds are not available from operations, the Company may be required to rely on the banking credit and equity markets to meet financial commitments and short-term liquidity needs. Disruptions in the capital and credit markets could adversely affect the Company’s ability to borrow pursuant to its Credit Agreement with JP Morgan Chase Bank, N.A. (Chase) or to borrow from other financial institutions. Access to funds under the Credit Agreement or pursuant to arrangements with other financial institutions is dependent on Chase’s or other financial institutions’ ability to meet funding commitments. Financial institutions, including Chase, may not be able to meet their funding commitments if they experience shortages of capital and liquidity or if they experience high volumes of borrowing requests from other borrowers within a short period of time. There can be no assurance that the Company would be able to replace its current Credit Agreement on favorable terms, if at all, in the event that replacement would become necessary or desirable.

Longer term disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives or failures of significant financial institutions could adversely affect access to the liquidity needed for business. Any disruption could require the Company to take measures to conserve cash until the markets stabilize or until alternative credit arrangements or other funding for our business needs can be arranged. Such measures could include deferring capital expenditures and reducing or eliminating future share repurchases, dividend payments or other discretionary uses of cash.

Current financial conditions in the United States and globally may have significant effects on customers and suppliers that would result in material adverse effects on business, operating results and stock price.

Current financial conditions in the United States and globally and concern that the worldwide economy may enter into a prolonged recessionary period may materially adversely affect customers’ access to capital or willingness to spend capital on products and/or their levels of cash liquidity with which to pay for products that they will order or have already ordered from the Company. In addition, current financial conditions may materially adversely affect suppliers’ access to capital and liquidity with which to maintain their inventories, production levels and/or product quality could cause them to raise prices, lower production levels or result in their ceasing operations. Continuing adverse economic conditions in the Company’s markets would also likely negatively impact business, which could result in: (1) reduced demand for products; (2) increased price competition for products; (3) increased risk of excess or obsolete inventories; (4) increased risk of collectability of cash from customers; (5) increased risk in potential reserves for doubtful accounts and write-offs of accounts receivable; (6) reduced revenues; and (7) higher operating costs as a percentage of revenues.

| 7 |

All of the foregoing potential consequences of current financial conditions are difficult to forecast and mitigate. As a consequence, operating results for a particular period are difficult to predict, and, therefore, prior results are not necessarily indicative of future results to be expected in future periods. Any of the foregoing effects could have a material adverse effect on the Company’s business, results of operations and financial condition and could adversely affect stock price.

Negative economic conditions could prevent the Company from accurately forecasting demand for its products which could adversely affect its operating results or market share.

The current negative economic conditions and market instability in the United States and globally makes it increasingly difficult for the Company, customers and suppliers to accurately forecast future product demand trends, which could cause the Company to produce excess products that can increase inventory carrying costs and result in obsolete inventory. Alternatively, this forecasting difficulty could cause a shortage of products, or materials used in products, that could result in an inability to satisfy demand for products and a loss of market share.

The Company may pursue strategic acquisitions, which could have an adverse impact on its business.

In the past, the Company has made acquisitions of complementary companies or businesses, which have been part of the strategic plan and may continue to pursue acquisitions in the future from time to time. Acquisitions may result in difficulties in assimilating acquired companies, and may result in the diversion of capital and management’s attention from other business issues and opportunities. The Company may not be able to successfully integrate operations that it acquires, including personnel, financial systems, distribution, and operating procedures. If the Company fails to successfully integrate acquisitions, the Company’s business could suffer. In addition, the integration of any acquired business, and its financial results, may adversely affect operating results. Escalade will consider acquisitions in the future, but the Company currently does not have any agreements with respect to any such acquisitions.

Growth may strain resources, which could adversely affect the Company’s business and financial performance.

Both the Sporting Goods and Information Security and Print Finishing businesses have grown in the past through strategic acquisitions. Growth places additional demands on management and operational systems. If the Company is not successful in continuing to support operational and financial systems, expanding the management team and increasing and effectively managing customers and suppliers, growth may result in operational inefficiencies and ineffective management of the Company’s business, which could adversely affect its business and financial performance.

The Company’s ability to expand business will be dependent upon the availability of adequate capital.

The rate of expansion will also depend on the availability of adequate capital, which in turn will depend in large part on cash flow generated by the business and the availability of equity and debt capital. Escalade can make no assurances that it will be able to obtain equity or debt capital on acceptable terms or at all, especially considering the current disruptions in the credit markets.

Failure to improve operational efficiency and reduce administrative costs could have a material adverse effect on the Company’s liquidity, financial position and results of operations.

The Company’s ability to improve profit margins is largely dependent on the success of on-going initiatives to streamline infrastructure, improve operational efficiency and the reduction of administrative costs in certain segments of the Company. Failure to continue to implement these initiatives successfully, or the failure of such initiatives to result in improved profitability, could have a material adverse effect on the Company’s liquidity, results of operations and financial position.

| 8 |

The Company’s business may be adversely affected by the actions of and risks associated with third-party suppliers.

The raw materials that the Company purchases for manufacturing operations and many of the products that it sells are sourced from a wide variety of third-party suppliers. The Company cannot control the supply, design, function or cost of many of the products that are offered for sale and are dependent on the availability and pricing of key materials and products. Disruptions in the availability of raw materials used in production of these products may adversely affect sales and result in customer dissatisfaction. In addition, global sourcing of many of the products sold is an important factor in the Company’s financial performance. The ability to find qualified suppliers and to access products in a timely and efficient manner is a significant challenge, especially with respect to goods sourced outside the United States. Political instability, financial instability of suppliers, merchandise quality issues, trade restrictions, tariffs, currency exchange rates, transport capacity and costs, inflation and other factors relating to foreign trade are beyond the Company’s control.

Historically, instability in the political and economic environments of the countries in which the Company or its suppliers obtain products and raw materials has not had a material adverse effect on operations. However, the Company cannot predict the effect that future changes in economic or political conditions in such foreign countries may have on operations. In the event of disruptions or delays in supply due to economic or political conditions in foreign countries, such disruptions or delays could adversely affect results of operations unless and until alternative supply arrangements could be made. In addition, products and materials purchased from alternative sources may be of lesser quality or more expensive than the products and materials currently purchased abroad.

Deterioration in relationships with suppliers or in the financial condition of suppliers could adversely affect liquidity, results of operations and financial position.

Access to materials, parts and supplies is dependent upon close relationships with suppliers and the ability to purchase products from the principal suppliers on competitive terms. The Company does not enter into long-term supply contracts with these suppliers, and has no current plans to do so in the future. These suppliers are not required to sell to the Company and are free to change the prices and other terms. Any deterioration or change in the relationships with or in the financial condition of the Company’s significant suppliers could have an adverse impact on its ability to procure materials and parts necessary to produce products for sale and distribution. If any of the significant suppliers terminated or significantly curtailed its relationship with the Company or ceased operations, the Company would be forced to expand relationships with other suppliers, seek out new relationships with new suppliers or risk a loss in market share due to diminished product offerings and availability. Any change in one or more of these suppliers’ willingness or ability to continue to supply the Company with their products could have an adverse impact on the Company’s liquidity, results of operations and financial position.

Escalade may be subject to product warranty claims that require the replacement or repair of the product sold. Such warranty claims could adversely affect Escalade’s financial position and relationships with its customers.

The Company manufactures and/or distributes a variety of products in both its Sporting Goods and Information Security and Print Finishing business segments. From time to time, such products may contain manufacturing defects or design flaws that are not detected prior to sale, particularly as to new product introductions or upon design changes to existing products. The failure to identify and correct manufacturing defects and product design issues prior to the sale of those products could result in product warranty claims that result in costs to replace or repair any such defective products. Because many of the Company’s products are sold to retailers for broad consumer distribution and/or to customers who buy in large quantities, the costs associated with product warranty claims could have a material adverse effect on the Company’s results of operations and financial position. Product warranty claims also could cause customer dissatisfaction that may have a material adverse effect on the Company’s reputation and on the Company’s relationships with its customers, which may result in lost or reduced sales.

Escalade may be subject to product liability claims and the Company’s insurance may not be sufficient to cover damages related to those claims.

The Company may be subject to lawsuits resulting from injuries associated with the use of sporting goods equipment and information security and print finishing products that it sells. The Company may incur losses relating to these claims or the defense of these claims. There is a risk that claims or liabilities will exceed the Company’s insurance coverage. In addition, the Company may be unable to retain adequate liability insurance in the future. Further, the Company is subject to regulation by the Consumer Product Safety Commission and similar state regulatory agencies. If the Company fails to comply with government and industry safety standards, it may be subject to claims, lawsuits, fines, product recalls and adverse publicity that could have a material adverse effect on the Company’s business, results of operations and financial condition.

| 9 |

Intellectual property rights are valuable, and any inability to protect them could reduce the value of products.

The Company obtains patents, trademarks and copyrights for intellectual property, which represent important assets to the Company. If the Company fails to adequately protect intellectual property through patents, trademarks and copyrights, its intellectual property rights may be misappropriated by others, invalidated or challenged, and our competitors could duplicate the Company’s products or may otherwise limit any competitive design or manufacturing advantages. The Company believes that success is likely to depend upon continued innovation, technical expertise, marketing skills and customer support and services rather than on legal protection of intellectual property rights. However, the Company intends to aggressively assert its intellectual property rights when necessary.

The Company is subject to risks associated with laws and regulations related to health, safety and environmental protection.

Products, and the production and distribution of products, are subject to a variety of laws and regulations relating to health, safety and environmental protection. Laws and regulations relating to health, safety and environmental protection have been passed in several jurisdictions in which the Company operates in the United States and abroad. Although the Company does not anticipate any material adverse effects based on the nature of operations and the thrust of such laws, there is no assurance such existing laws or future laws will not have a material adverse effect on the Company’s business, results of operations and financial condition.

International operations expose the Company to the unique risks inherent in foreign operations.

The Company has operations in Mexico, Europe, S. Africa and Asia. Foreign operations encounter risks similar to those faced by U.S. operations, as well as risks inherent in foreign operations, such as local customs and regulatory constraints, control over product quality and content, foreign trade policies, competitive conditions, foreign currency fluctuations and unstable political and economic conditions. The Company’s international operations headquartered in Germany and its business relationships in Asia further increase its exposure to these foreign operating risks, which could have an adverse impact on the Company’s international income and worldwide profitability.

The Company could be adversely affected by changes in currency exchange rates and/or the value of the United States dollar.

The Company is exposed to risks related to the effects of changes in foreign currency exchange rates and the value of the United States dollar. Changes in currency exchange rates and the value of the United States dollar can have a significant impact on earnings from international operations. While the Company carefully watches fluctuations in currency exchange rates, these types of changes can have material adverse effects on the Company’s business, results of operations and financial condition.

Failure to improve and maintain the quality of internal controls over financial reporting could materially and adversely affect the ability to provide timely and accurate financial information, which could harm the Company’s reputation and share price.

Management is responsible for establishing and maintaining adequate internal controls over financial reporting for the Company to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with generally accepted accounting principles. Management cannot be certain that weaknesses and deficiencies in internal controls will not arise or be identified or that the Company will be able to correct and maintain adequate controls over financial processes and reporting in the future. Any failure to maintain adequate controls or to adequately implement required new or improved controls could harm operating results or cause failure to meet reporting obligations in a timely and accurate manner. Ineffective internal controls over financial reporting could also cause investors to lose confidence in reported financial information, which could adversely affect the trading price of the Company’s common stock.

| 10 |

Disclosure controls and procedures are designed to provide reasonable assurance of achieving their objectives. However, management, including the Chief Executive Officer and Chief Financial Officer, does not expect that disclosure controls and procedures will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected.

Failure to effectively implement the Company’s global integrated information system could cause incorrect information or delays in getting information which could adversely affect the performance of the Company.

The Company converted its Enterprise Risk Planning (ERP) system from the Oracle E-Business suite to Epicor at its Martin Yale North America location at the beginning of 2011 and at its Escalade Sports North Carolina location at the beginning of 2012. The Company is in the process of converting its legacy system in Germany to Epicor during the second quarter of 2012. The Company intends to complete the conversion of its remaining sites over the next two years. There can be no assurance the Company will have the necessary funds or the staff to fully avail itself of the control features inherent in the system design. Without such utility, the Company management is faced with cumbersome and time consuming efforts to manually consolidate its financial information.

The preparation of the Company’s financial statements requires the use of estimates that may vary from actual results.

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make significant estimates that may affect financial statements. Due to the inherent nature of making estimates, actual results may vary substantially from such estimates, which could materially adversely affect the Company’s business, results of operations and financial condition. For more information on the Company’s critical accounting estimates, please see the Critical Accounting Estimates section of this Form 10-K.

Changes in accounting standards could impact reported earnings and financial condition.

The accounting standard setters, including the Financial Accounting Standards Board, the International Accounting Standards Board, the Securities and Exchange Commission and the Public Company Accounting Oversight Board, periodically change the financial accounting and reporting standards that govern the preparation of the Company’s consolidated financial statements. These changes can be hard to predict and apply and can materially affect how the Company records and reports its financial condition and results of operations. In some cases, the Company could be required to apply a new or revised standard retrospectively, which may result in the restatement of prior period financial statements.

Effective tax rate may fluctuate.

The Company is a multi-national, multi-channel provider of sporting goods and information security and print finishing products. As a result, the Company’s effective tax rate is derived from a combination of applicable tax rates in the various countries, states and other jurisdictions in which the Company operates. The effective tax rate may be lower or higher than its tax rates have been in the past due to numerous factors, including the sources of income, any agreement with taxing authorities in various jurisdictions, the tax filing positions taken in various jurisdictions and changes in the political environment in the jurisdictions in which the Company operates. The Company bases estimates of an effective tax rate at any given point in time upon a calculated mix of the tax rates applicable to the Company and to estimates of the amount of business likely to be done in any given jurisdiction. The loss of one or more agreements with taxing jurisdictions, a change in the mix of business from year to year and from country to country, changes in rules related to accounting for income taxes, changes in tax laws and any of the multiple jurisdictions in which the Company operates, or adverse outcomes from tax audits that the Company may be subject to in any of the jurisdictions in which the Company operates, could result in an unfavorable change in the effective tax rate which could have an adverse effect on the Company’s business and results of operations.

| 11 |

The market price of Escalade’s common stock is likely to be highly volatile as the stock market in general can be highly volatile.

The public trading of Escalade’s common stock is based on many factors, which could cause fluctuation in the Company’s stock price. These factors may include, among other things:

| · | General economic and market conditions; | |

| · | Actual or anticipated variations in quarterly operating results; | |

| · | Lack of research coverage by securities analysts; | |

| · | Relatively low market capitalization resulting in low trading volume in the Company’s stock; | |

| · | If securities analysts provide coverage, our inability to meet or exceed securities analysts’ estimates or expectations; | |

| · | Conditions or trends in the Company’s industries; | |

| · | Changes in the market valuations of other companies in the Company’s industries; | |

| · | Announcements by the Company or the Company’s competitors of significant acquisitions, strategic partnerships, divestitures, joint ventures or other strategic initiatives; | |

| · | Capital commitments; | |

| · | Additions or departures of key personnel; | |

| · | Sales and repurchases of the Company’s common stock; and | |

| · | The ability to maintain listing of the Company’s common stock on the NASDAQ Global Market. |

Many of these factors are beyond the Company’s control. These factors may cause the market price of the Company’s common stock to decline, regardless of operating performance.

Information security may be compromised.

Through sales and marketing activities, the Company collects and stores certain information that customers provide to purchase products or services or otherwise communicate and interact with the Company. Despite instituted safeguards for the protection of such information, the Company cannot be certain that all of its systems are entirely free from vulnerability to attack. Computer hackers may attempt to penetrate the Company’s network security and, if successful, misappropriate confidential customer or business information. In addition, an employee, a contractor or other third party with whom the Company does business may attempt to circumvent the Company’s security measures in order to obtain such information or inadvertently cause a breach involving such information. Loss of customer or business information could disrupt operations, damage the Company’s reputation, and expose the Company to claims from customers, financial institutions, payment card associations and other persons, any of which could have an adverse effect on the Company’s business, results of operations and financial condition. In addition, compliance with tougher privacy and information security laws and standards may result in significant expense due to increased investment in technology and the development of new operational processes.

Terrorist attacks or acts of war may seriously harm the Company’s business.

Among the chief uncertainties facing the nation and the world and, as a result, the business is the instability and conflict in the Middle East. Obviously, no one can predict with certainty what the overall economic impact will be as a result of these circumstances. Terrorist attacks may cause damage or disruption to the Company, employees, facilities and customers, which could significantly impact net sales, costs and expenses and financial condition. The potential for future terrorist attacks, the national and international responses to terrorist attacks, and other acts of war and hostility may cause greater uncertainty and cause business to suffer in ways the Company currently cannot predict.

| 12 |

These risks are not exhaustive.

Other sections of this Form 10-K may include additional factors which could adversely impact the Company’s business and financial performance. Moreover, the Company operates in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for management to predict all risk factors, nor can the Company assess the impact of all factors on business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results.

ITEM 1B—UNRESOLVED STAFF COMMENTS

None.

At December 31, 2011, the Company operated from the following locations:

| Location | Square Footage | Owned or Leased | Use | |||

| Sporting Goods | ||||||

| Evansville, Indiana, USA | 359,000 | Owned | Distribution; sales and marketing; administration | |||

| Olney, Illinois, USA | 108,500 | Leased | Manufacturing and distribution | |||

| Gainesville, Florida, USA | 154,200 | Owned | Manufacturing and distribution | |||

| Rosarito, Mexico | 66,500 | Owned | Manufacturing and distribution | |||

| Rosarito, Mexico | 108,200 | Leased | Manufacturing | |||

| Raleigh, N. Carolina, USA | 69,800 | Leased | Manufacturing and distribution | |||

| Jacksonville, Florida, USA | 2,500 | Leased | Sales and marketing | |||

| Shanghai, China | 650 | Leased | Sales and sourcing | |||

| Information Security and Print Finishing | ||||||

| Wabash, Indiana, USA | 141,000 | Owned | Manufacturing and distribution; sales and marketing; administration | |||

| Markdorf, Germany | 70,300 | Owned | Manufacturing and distribution; sales and marketing; administration | |||

| Paris, France | 1,335 | Leased | Distribution; sales and marketing | |||

| Crawley, UK | 8,300 | Leased | Sales and marketing | |||

| Barcelona, Spain | 8,600 | Leased | Distribution; sales and marketing | |||

| Johannesburg, South Africa | 4,800 | Leased | Distribution; sales and marketing | |||

| Sollentuna, Sweden | 400 | Leased | Sales and marketing | |||

| Beijing, China | 12,911 | Leased | Sales and marketing |

At the end of 2010, the Company had one idle facility in Reynosa, Mexico. The sale of the Reynosa facility was completed in 2011. The Company believes that its remaining facilities are in satisfactory and suitable condition for their respective operations. The Company also believes that it is in material compliance with all applicable environmental regulations and is not subject to any proceeding by any federal, state or local authorities regarding such matters. The Company provides regular maintenance and service on its plants and machinery as required.

| 13 |

The Company is involved in litigation arising in the normal course of its business, but the Company does not believe that the disposition or ultimate resolution of such claims or lawsuits will have a material adverse affect on the business or financial condition of the Company.

The Company is not aware of any probable or levied penalties against the Company relating to the American Jobs Creation Act.

ITEM 4—MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5—MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company’s common stock is traded under the symbol “ESCA” on the NASDAQ Global Market. The following table sets forth, for the calendar periods indicated, the high and low sales prices of the Common Stock as reported by the NASDAQ Global Market:

| Prices | High | Low | ||||||

| 2011 | ||||||||

| Fourth quarter ended December 31, 2011 | $ | 5.60 | $ | 4.26 | ||||

| Third quarter ended October 1, 2011 | 6.22 | 4.30 | ||||||

| Second quarter ended July 9, 2011 | 6.43 | 5.00 | ||||||

| First quarter ended March 19, 2011 | 7.10 | 5.30 | ||||||

| 2010 | ||||||||

| Fourth quarter ended December 25, 2010 | $ | 6.65 | $ | 4.27 | ||||

| Third quarter ended October 2, 2010 | 5.80 | 4.14 | ||||||

| Second quarter ended July 10, 2010 | 5.52 | 2.46 | ||||||

| First quarter ended March 20, 2010 | 3.00 | 2.21 | ||||||

| 2009 | ||||||||

| Fourth quarter ended December 26, 2009 | $ | 3.07 | $ | 1.96 | ||||

| Third quarter ended October 3, 2009 | 3.44 | 0.72 | ||||||

| Second quarter ended July 11, 2009 | 1.48 | 0.43 | ||||||

| First quarter ended March 21, 2009 | 1.15 | 0.30 | ||||||

The closing market price on February 6, 2012 was $4.88 per share.

Depending on profitability and cash flows from operations, the Board of Directors issues dividends. Based on the Company’s 2010 performance, the Board declared a dividend in 2010 of $0.10 per share. As a result of the 2011 performance, the Board declared a dividend in August 2011 of $0.25 per share, and in November 2011 of $0.07 per share. Dividends issued/declared during 2010 and 2011 are as follows:

| Record Date | Payment Date | Amount per Common Share | ||

| November 22, 2010 | December 6, 2010 | $0.10 | ||

| August 25, 2011 | September 2, 2011 | $0.25 | ||

| December 22, 2011 | January 5, 2012 | $0.07 |

| 14 |

There were approximately 186 holders of record of the Company’s Common Stock at February 9, 2012. The approximate number of stockholders, including those held by depository companies for certain beneficial owners, was 1,250.

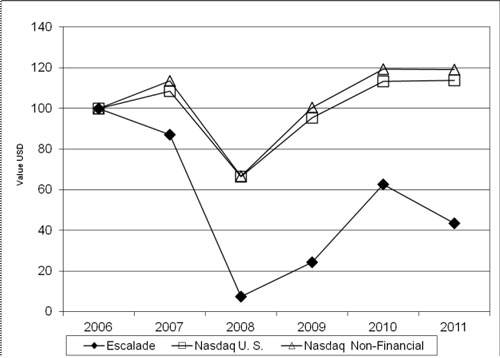

SHAREHOLDER RETURN PERFORMANCE GRAPH

Set forth below is a line graph comparing the yearly percentage change in the cumulative total shareholder return on the Company’s common stock with that of the cumulative total return on the NASDAQ US Stock Market Index and the NASDAQ Non-Financial Stocks Index for the five year period ended December 31, 2011. The following information is based on an investment of $100, on December 31, 2006, in the Company’s common stock, the NASDAQ US Stock Market Index and the NASDAQ Non-Financial Stocks Index, with dividends reinvested.

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |||||||||||||||||||

| Escalade Common Stock | 100 | 87 | 7 | 24 | 63 | 43 | ||||||||||||||||||

| NASDAQ US Stock Index | 100 | 108 | 66 | 95 | 113 | 114 | ||||||||||||||||||

| NASDAQ Non-Financial Stock Index | 100 | 113 | 67 | 101 | 119 | 119 | ||||||||||||||||||

The above performance graph does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other Company filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates the performance graph by reference therein.

| 15 |

ISSUER PURCHASES OF EQUITY SECURITIES

| Period | (a) Total Number of Shares (or Units) Purchased | (b) Average Price Paid per Share (or Unit) | (c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs | (d) Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs |

| Share purchases prior to 10/01/2011 under the current repurchase program. | 982,916 | $8.84 | 982,916 | $ 2,273,939 |

Fourth quarter purchases: |

||||

| 10/02/2011 – 10/29/2011 | None | None | None | No Change |

| 10/30/2011 – 11/26/2011 | None | None | None | No Change |

| 11/27/2011 – 12/31/2011 | None | None | None | No Change |

| Total share purchases under the current program | 982,916 | $8.84 | 982,916 | $2,273,939 |

The Company has one stock repurchase program which was established in February 2003 by the Board of Directors and which initially authorized management to expend up to $3,000,000 to repurchase shares on the open market as well as in private negotiated transactions. In each of February 2005 and 2006, August 2007 and February 2008 the Board of Directors increased the remaining balance on this plan to its original level of $3,000,000. The repurchase plan has no termination date and there have been no share repurchases that were not part of a publicly announced program.

ITEM 6—SELECTED FINANCIAL DATA

(In thousands, except per share data)

| At and For Years Ended | December 31, 2011 | December 25, 2010 | December 26, 2009 | December 27, 2008 | December 29, 2007 | |||||||||||||||

| Income Statement Data | ||||||||||||||||||||

| Net revenue | ||||||||||||||||||||

| Sporting Goods | $ | 96,971 | $ | 85,815 | $ | 76,807 | $ | 98,039 | $ | 129,788 | ||||||||||

| Information Security and Print Finishing | 37,279 | 34,841 | 39,192 | 50,647 | 55,788 | |||||||||||||||

| Total net sales | 134,250 | 120,656 | 115,999 | 148,686 | 185,576 | |||||||||||||||

| Net income (loss) | 4,441 | 6,059 | 1,657 | (7,496 | ) | 9,255 | ||||||||||||||

| Weighted-average shares | 12,849 | 12,726 | 12,632 | 12,684 | 12,901 | |||||||||||||||

| Per Share Data | ||||||||||||||||||||

| Basic earnings (loss) per share | $ | 0.35 | $ | 0.48 | $ | 0.13 | $ | (0.59 | ) | $ | 0.72 | |||||||||

| Cash dividends | $ | 0.32 | $ | 0.10 | $ | — | $ | 0.25 | $ | 0.22 | ||||||||||

| Balance Sheet Data | ||||||||||||||||||||

| Working capital | 29,496 | 24,132 | 9,688 | 4,842 | 31,442 | |||||||||||||||

| Total assets | 130,115 | 127,553 | 127,238 | 147,701 | 152,016 | |||||||||||||||

| Short-term bank debt | 16,947 | 11,407 | 27,644 | 46,525 | 13,033 | |||||||||||||||

| Long-term bank debt | 5,000 | 7,500 | — | — | 19,135 | |||||||||||||||

| Total stockholders’ equity | 87,565 | 87,030 | 82,764 | 78,790 | 91,742 | |||||||||||||||

| 16 |

Fiscal year 2011 was positively impacted by increased sales in the Sporting Goods and Information Security and Print Finishing segments. Net income was negatively impacted by the accelerated write-off of the Oracle ERP system, which reduced net income by $2.7 million.

Fiscal year 2010 was positively impacted by increased sales in the Sporting Goods segment, as well as continued efforts at cost reduction, and improved margins resulting from higher sales volumes.

Fiscal year 2009 was positively impacted by significant cost reductions and consolidation of certain manufacturing and distributions facilities.

Fiscal year 2008 was negatively impacted by loss of sales to Sears, a major sporting goods retailer, impairment of certain long-lived assets and a general economic downturn.

Fiscal year 2007 was positively impacted by the sale of rights to license potential future intellectual property.

ITEM 7—MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following section should be read in conjunction with Item 1: Business; Item 1A: Risk Factors; Item 6: Selected Financial Data; and Item 8: Financial Statements and Supplementary Data.

Forward-Looking Statements

This report contains forward-looking statements relating to present or future trends or factors that are subject to risks and uncertainties. These risks include, but are not limited to, the impact of competitive products and pricing, product demand and market acceptance, new product development, the continuation and development of key customer and supplier relationships, Escalade’s ability to control costs, general economic conditions, fluctuation in operating results, changes in the securities market, Escalade’s ability to obtain financing and to maintain compliance with the terms of such financing and other risks detailed from time to time in Escalade’s filings with the Securities and Exchange Commission. Escalade’s future financial performance could differ materially from the expectations of management contained herein. Escalade undertakes no obligation to release revisions to these forward-looking statements after the date of this report.

Overview

Escalade, Incorporated (“Escalade” or “Company”) manufactures and distributes products for two industries: Sporting Goods and Information Security and Print Finishing. Sporting Goods has expanded its product offerings to include team training products. Information Security and Print Finishing has increasingly focused its strategy on expanding the security segment of its business to assist businesses and governments with their high security needs for handling sensitive customer, employee and business documents and information, in addition to Martin Yale’s traditional product offerings.

Within these industries the Company has successfully built a market presence in niche markets. This strategy is heavily dependent on expanding the customer base, barriers to entry, brand recognition and excellent customer service. A key strategic advantage is the Company’s established relationships with major customers that allow the Company to bring new products to market in a cost effective manner while maintaining a diversified product line and wide customer base. In addition to strategic customer relations, the Company has substantial manufacturing and import experience that enable it to be a low cost supplier.

| 17 |

A majority of the Company’s products are in markets that are currently experiencing low growth rates. Where the Company enjoys a commanding market position, such as table tennis tables in the Sporting Goods segment and paper folding machines in the Information Security and Print Finishing segment, revenue growth is expected to be roughly equal to general growth/decline in the economy. However, in markets that are fragmented and where the Company is not the dominant leader, such as archery in the Sporting Goods segment and data security shredders in the Information Security and Print Finishing segment, the Company anticipates growth. To enhance internal growth, the Company has a strategy of acquiring companies or product lines that complement or expand the Company’s existing product lines. A key objective is the acquisition of product lines with barriers to entry that the Company can take to market through its established distribution channels or through new market channels. Significant synergies are achieved through assimilation of acquired product lines into the existing company structure. Management believes that key indicators in measuring the success of this strategy are revenue growth, earnings growth and the expansion of channels of distribution. The following table sets forth the annual percentage change in revenues and net income (loss) over the past three years:

| 2011 | 2010 | 2009 | ||||||||||

| Net revenue | ||||||||||||

| Sporting Goods | 13.0 | % | 11.7 | % | -21.7 | % | ||||||

| Information Security and Print Finishing | 7.0 | % | -11.1 | % | -22.6 | % | ||||||

| Total | 11.3 | % | 4.0 | % | -22.0 | % | ||||||

| Net income | -26.7 | % | 265.6 | % | 122.1 | % | ||||||

Without the accelerated depreciation expense on the replaced ERP system, net income in 2011 would have increased by 19.5%.

Results of Operations

The following schedule sets forth certain consolidated statement of operations data as a percentage of net revenue for the periods indicated:

| 2011 | 2010 | 2009 | ||||||||||

| Net revenue | 100.0 | % | 100.0 | % | 100.0 | % | ||||||

| Cost of products sold | 68.9 | % | 69.2 | % | 70.9 | % | ||||||

| Gross margin | 31.1 | % | 30.8 | % | 29.1 | % | ||||||

| Selling, administrative and general expenses | 26.8 | % | 22.9 | % | 25.4 | % | ||||||

| Amortization | 1.2 | % | 1.1 | % | 2.0 | % | ||||||

| Operating income | 3.1 | % | 6.8 | % | 1.7 | % | ||||||

Without the accelerated depreciation expense on the replaced ERP system, selling, administrative and general expenses would have been 23.5% and operating income would have been 6.4%.

Consolidated Revenue and Gross Margin

Sales growth across most sales channels of the Sporting Goods segment resulted in an overall increase of 13.0% in Sporting Goods net revenues for 2011 compared to 2010. Revenues from the Information Security and Print Finishing business increased 7.0% in 2011 compared to 2010. Approximately 1% of the increase in Information Security and Print Finishing revenue is due to changes in foreign exchange rates.

The overall gross margin in 2011 was slightly higher than 2010. The Company experienced some stability in manufacturing costs and some variances in product mix that resulted in margins slightly improved from prior year. Gross margins were up approximately 1% in the Sporting Goods segment and down approximately 1% in the Information Security and Print Finishing segment. Decreases in gross margin in the Information Security and Print Finishing segment were due to manufacturing inefficiencies experienced in new product offerings.

| 18 |

Consolidated Selling, General and Administrative Expenses

Consolidated selling, general and administrative expenses (“SG&A”) were $35.9 million in 2011 compared to $27.7 million in 2010, an increase of $8.2 million or 29.7%. In 2011, the Company began accelerating depreciation expense related to the replacement of its Oracle ERP system. Accelerated depreciation expense for the year of $4.4 million is included in SG&A. Without the additional depreciation expense, SG&A would have been $31.5 million, an increase of $3.8 million or 13.8%. SG&A as a percent of sales is 26.8% in 2011 compared with 22.9% in 2010. Without the effects of the accelerated depreciation, SG&A as a percent of sales would have been 23.5% in 2011.

Other Income

Other income increased in 2011 compared to 2010 due almost exclusively to increased profitability from the Stiga Sports, AB joint venture. Income from the non-marketable equity investments was $3.3 million in 2011 compared with $2.0 million in 2010.

Provision for Income Taxes

The effective income tax rate in 2011 was slightly higher relative to 2010 primarily due to valuation allowances on net operating losses generated in the European subsidiaries. The effective tax rate for 2011 was 35.4% compared to 33.2% and 36.4% in 2010 and 2009 respectively. In addition, in 2010, the Company benefitted from a favorable audit settlement. The Company expects its future effective tax rates to approximate the effective tax rate achieved in 2011.

Sporting Goods

Net revenues, operating income, and net income for the Sporting Goods business segment for the three years ended December 31, 2011 were as follows:

| In Thousands | 2011 | 2010 | 2009 | |||||||||

| Net revenue | $ | 96,971 | $ | 85,815 | $ | 76,807 | ||||||

| Operating income | 10,802 | 9,171 | 4,610 | |||||||||

| Net income | 5,817 | 4,601 | 1,273 | |||||||||

Net revenue increased 13.0% in 2011 compared to 2010 with growth coming from most sales channels in the Sporting Goods segment. The Company continues to aggressively pursue opportunities to increase revenue through introduction of new products, expansion of product distribution, and increased investment in consumer marketing. Sales channels are predominately mass market retail customers, specialty retailers, and dealers.

Gross margin and profitability increased in 2011 compared with 2010. The gross margin ratio in 2011 improved to 28.2% compared to 27.2% in the prior year. The improvement is due to continued focus on production efficiencies and better factory absorption resulting from increased sales volume. As a result, operating income as a percentage of net revenue increased to 11.1% in 2011 compared to 10.7% in 2010. Management anticipates that with additional sales growth in 2012, improvements in operating income will continue. Net income for 2011 increased from 2010 due primarily to increased revenue.

Information Security and Print Finishing

Net revenue, operating income, and net income (loss) for the Information Security and Print Finishing business segment for the three years ended December 31, 2011 were as follows:

| In Thousands | 2011 | 2010 | 2009 | |||||||||

| Net revenue | $ | 37,279 | $ | 34,841 | $ | 39,192 | ||||||

| Operating income | 71 | 926 | 1,780 | |||||||||

| Net income (loss) | (921 | ) | (187 | ) | 1,077 | |||||||

Sales in the Information Security and Print Finishing business increased 7.0% in 2011 compared to 2010 primarily due to a specialty product sold to one customer. The Company has widened its product range to promote its opportunities in the information security and print finishing markets. Excluding the effect of changes in foreign exchange rates, 2011 sales were up 4.5% from 2010. Sales are direct to end users, including government agencies, as well as through office products retailers, wholesalers, specialty dealers, and business partners.

| 19 |

Profitability in the Information Security and Print Finishing segment decreased in 2011 as evidenced by the ratio of operating income to net revenues which declined to 0.2% in 2011 compared to 2.7% in 2010. The primary reasons for this decline in profitability are under-absorbed factory variances due to low sales and inefficiencies incurred on new product offerings. Management anticipates increased sales due to a broadening of the product portfolio, enhanced focus on sales opportunities and improved manufacturing efficiencies in 2012 will help improve operating income.

Financial Condition and Liquidity

The current ratio, a basic measure of liquidity (current assets divided by current liabilities), increased to 1.9 in 2011 from 1.8 in 2010. The primary reason for the increase in current ratio is an increase in inventory partially offset by an increase in current debt. Inventory levels increased to $29.0 million in 2011 compared with $22.9 million in 2010. Total current and long-term debt increased to $21.9 million up from $18.9 million in 2010.

The Company’s generation of cash was principally a result of increased profits resulting from stronger sales mostly offset by increases in inventory levels and the distribution of shareholder dividends. The Company declared $4.1 million in dividends in 2011. Of the declared dividends, $3.2 million were paid in 2011. Total bank debt for the year increased by $3.0 million. Total bank debt as a percentage of stockholders equity increased to 25.1% in 2011, up from 21.7% in 2010.

In 2012, the Company expects capital expenditures to be approximately $4.0 million which includes $1.1 million to complete implementation of its integrated information system at its Sporting Goods locations. The Company fully depreciated the remaining book value of its Oracle ERP system in 2011. This acceleration of depreciation resulted in additional pre-tax expense of $4.4 million, ($2.7 million net of tax) in 2011.

The Company’s working capital requirements are primarily funded through cash flows from operations and revolving credit agreements with its bank. During 2011, the Company’s maximum borrowings under its primary revolving credit lines totaled $26.4 million compared to $27.6 million in 2010. Total notes payable as of the end of fiscal 2011 was $21.9 million compared with $18.9 million at the end of fiscal 2010. The overall effective interest rate in 2011 was 2.9% which was reduced from the effective rate of 4.6% in 2010. The lower interest rate is a result of improved interest rate terms and lower debt capacity. The Company’s Credit Agreement with JPMorgan Chase Bank, N.A. matures as of July 31, 2013. The Company also maintains a multicurrency overdraft facility with its bank. The total amount outstanding under the overdraft facility at the end of fiscal 2011 was $2.2 million compared with $1.6 million at the end of fiscal 2010.

The Company has a long standing relationship with its lender and has met all financial covenants under the new agreement which was last amended as of April 14, 2011. The amended terms of the agreement extends the maturity date for repayment from May 31, 2012 to July 31, 2013 and provides for more favorable interest rates terms. As mentioned above, the Company increased its bank debt in 2011 by approximately 16.0% to $21.9 million.

The Company expects improvements in its overall sales levels for fiscal year 2012, above those experienced in 2011, as a result of new product offerings and expanded customer base. The Company believes that cash generated from its projected 2012 operations and the commitment of borrowings from its primary lender will provide it with sufficient cash flows for its operations.

It is possible that if the economic conditions deteriorate, this could have adverse effects on the Company’s ability to operate profitably during fiscal year 2012. To the extent that occurs, management intends to pursue additional cost reductions and to continue realigning its infrastructure in an effort to match the Company’s overhead and cost structure with the sales level dictated by current market conditions.

| 20 |

New Accounting Pronouncements

Refer to Note 1 to the consolidated financial statements under the sub-heading “New Accounting Pronouncements”.

Off Balance Sheet Financing Arrangements

The Company has no financing arrangements that are not recorded on the Company’s balance sheet.

Contractual Obligations

The following schedule summarizes the Company’s contractual obligations as of December 31, 2011:

| Amounts in thousands | Payments Due by Period | |||||||||||||||||||

| Contractual Obligations | Total | Less than 1 year | 1 –3 years | 3 – 5 years | More than 5 years | |||||||||||||||

| Debt | $ | 19,700 | $ | 14,700 | $ | 4,000 | $ | 1,000 | $ | — | ||||||||||

| Overdraft facility | 2,247 | 2,247 | — | — | — | |||||||||||||||

| Future interest payments (1) | 975 | 705 | 240 | 30 | — | |||||||||||||||

| Operating leases | 3,216 | 1,099 | 1,386 | 731 | — | |||||||||||||||

| Minimum payments under royalty and license agreements | 2,755 | 530 | 725 | 750 | 750 | |||||||||||||||

| Total | $ | 28,893 | $ | 19,281 | $ | 6,351 | $ | 2,511 | $ | 750 | ||||||||||

Notes:

(1) Assumes that the Company will not increase borrowings under its long-term credit agreements and that the effective interest rate experienced in 2011 of 2.9% will continue for the life of the agreements.

Critical Accounting Estimates

The methods, estimates and judgments used in applying the Company’s accounting policies have a significant impact on the results reported in its financial statements. Some of these accounting policies require difficult and subjective judgments, often as a result of the need to make estimates of matters that are inherently uncertain. The most critical accounting estimates are described below and in the Notes to the Consolidated Financial Statements.

Product Warranty

The Company provides limited warranties on certain of its products for varying periods. Generally, the warranty periods range from 90 days to one year. However, some products carry extended warranties of seven-year, ten-year, and lifetime warranties. The Company records an accrued liability and expense for estimated future warranty claims based upon historical experience and management’s estimate of the level of future claims. Changes in the estimated amounts recognized in prior years are recorded as an adjustment to the accrued liability and expensed in the current year. To the extent there are product defects in current products that are unknown to management and do not fall within historical defect rates, the product warranty reserve could be understated and the Company could be required to accrue additional product warranty costs thus negatively affecting gross margin.

Inventory Valuation Reserves

The Company evaluates inventory for obsolescence and excess quantities based on demand forecasts over specified time frames, usually one year. The demand forecast is based on historical usage, sales forecasts and current as well as anticipated market conditions. All amounts in excess of the demand forecast are deemed to be potentially excess or obsolete and a reserve is established based on the anticipated net realizable value. To the extent that demand forecasts are greater than actual demand and the Company fails to reduce manufacturing output accordingly, the Company could be required to record additional inventory reserves which would have a negative impact on gross margin.

| 21 |

Allowance for Doubtful Accounts

The Company provides an allowance for doubtful accounts based upon a review of outstanding receivables, historical collection information and existing economic conditions. Accounts receivable are ordinarily due between 30 and 60 days after the issuance of the invoice. Accounts are considered delinquent when more than 90 days past due. Delinquent receivables are reserved or written off based on individual credit evaluation and specific circumstances of the customer. To the extent that actual bad debt losses exceed the allowance recorded by the Company, additional reserves would be required which would increase selling, general and administrative costs.

Customer Allowances

Customer allowances are common practice in the industries in which the Company operates. These agreements are typically in the form of advertising subsidies, volume rebates and catalog allowances and are accounted for as a reduction to gross sales. The Company reviews such allowances on an ongoing basis and accruals are adjusted, if necessary, as additional information becomes available.

Impairment of Goodwill

The Company annually tests as of the last day of its fiscal year for impairment of goodwill in accordance with guidance in FASB ASC 350, Intangibles – Goodwill and Other. Management determined the assumptions and inputs utilized in the evaluation of the fair value of the Company’s two separate reporting units, discussed below. The first phase of the goodwill impairment test requires that the fair value of the applicable reporting unit be compared with its recorded value. The Company establishes fair value by using an income approach or a combination of a market approach and an income approach. The market approach uses the guideline-companies method to estimate the fair value of a reporting unit based on reported sales of publicly-held entities engaged in the same or a similar business as the reporting unit. The income approach uses the discounted cash flow method to estimate the fair value of a reporting unit by calculating the present value of the expected future cash flows of the reporting unit. The discount rate is based on a weighted average cost of capital determined using publicly-available interest rate information on the valuation date and data regarding equity, size and country-specific risk premiums/decrements compiled and published by a commercial source. The Company uses assumptions about expected future operating performance in determining estimates of those cash flows, which may differ from actual cash flows.

If the implied fair value of a reporting unit is less than the recorded value of net assets, management performs a phase-two analysis that allocates the fair value of the reporting unit calculated in phase one to the specific tangible and intangible assets and liabilities of the reporting unit and results in an implied fair value of goodwill. Goodwill is reduced by any shortfall of implied goodwill to its current carrying value.