Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - HOMEFED CORP | Financial_Report.xls |

| EX-23 - PWC CONSENT - HOMEFED CORP | hfcconsent23.htm |

| EX-31.2 - ERIN N. RUHE EXHIBIT 31.2 - HOMEFED CORP | ruheexhibit312.htm |

| EX-32.2 - ERIN N. RUHE EXHIBIT 32.2 - HOMEFED CORP | ruheexhibit322.htm |

| EX-32.1 - PAUL J. BORDEN EXHIBIT 32.1 - HOMEFED CORP | bordenexhibit321.htm |

| EX-31.1 - PAUL J. BORDEN EXHIBIT 31.1 - HOMEFED CORP | bordenexhibit311.htm |

| EX-21 - HOMEFED CORPORATION LIST OF SUBSIDIARIES - HOMEFED CORP | homefedcorporationexhibit21.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

[x]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2011

|

OR

|

[_]

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from ___________ to ___________

|

Commission file number: 1-10153

HOMEFED CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

33-0304982

|

|

(State or other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

1903 Wright Place, Suite 220

Carlsbad, California 92008

(760) 918-8200

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.01 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ]No [x]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ x ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statement incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K [x].

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer," "accelerated filer,” and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer x

|

|

Non-accelerated filer o

|

Smaller reporting company o

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12-b of the Exchange Act). Yes [ ] No [x]

Based on the average bid and asked prices of the Registrant’s Common Stock as published by the OTC Bulletin Board Service as of June 30, 2011, the aggregate market value of the Registrant’s Common Stock held by non-affiliates was approximately $92,000,000 on that date.

As of February 6, 2012, there were 7,879,500 outstanding shares of the Registrant’s Common Stock, par value $.01 per share.

DOCUMENTS INCORPORATED BY REFERENCE

None.

1

PART I

Item 1. Business.

THE COMPANY

Introduction

HomeFed Corporation (“HomeFed”) was incorporated in Delaware in 1988. As used herein, the term “Company” refers to HomeFed and its subsidiaries, except as the context may otherwise require. The Company is currently engaged, directly and through subsidiaries, in the investment in and development of residential real estate projects in California. The Company also investigates the acquisition of new real estate projects, both residential and commercial, within and outside California. However, no assurance can be given that the Company will find new investments providing a satisfactory return or, if found, that the Company will have access to the capital necessary to make new real estate investments. The executive office of the Company is located at 1903 Wright Place, Suite 220, Carlsbad, California 92008.

The Company’s current development projects consist of two master-planned communities located in San Diego County, California: San Elijo Hills, and a portion of the larger Otay Ranch planning area. The Company also owns the Rampage property, a 1,544 acre grape vineyard located in southern Madera County, California, which is not currently entitled for commercial or residential development. In addition, in January 2011, the Company acquired the Fanita Ranch property, a 2,600 acre parcel of vacant land located in Santee, California.

As the owner of development projects, the Company is responsible for the completion of a wide range of activities, including design engineering, grading raw land, constructing public infrastructure such as streets, utilities and public facilities, and finishing individual lots for home sites or other facilities. Prior to commencement of development, the Company may engage in incidental activities to maintain the value of the project; such activities are not treated as a separate operating segment. The Company develops and markets its communities in phases to allow itself the flexibility to sell finished lots to suit market conditions and to enable it to create stable and attractive neighborhoods. Consequently, at any particular time, the various phases of a project will be in different stages of land development and construction. In addition, from time to time the Company has received expressions of interest from buyers for multiple phases of a project, or the remaining undeveloped land of an entire project. The Company evaluates these proposals when it receives them, but no assurance can be given that the Company will sell all or any portion of its development projects in such a manner.

For any master-planned community, plans must be prepared that provide for infrastructure, neighborhoods, commercial and industrial areas, educational and other institutional or public facilities, adequate water supply, as well as open space, in compliance with regulations regarding reduction in emissions of greenhouse gasses. Once preliminary plans have been prepared, numerous governmental approvals, licenses, permits and agreements, referred to as “entitlements,” must be obtained before development and construction may commence. These often involve a number of different governmental jurisdictions and agencies, challenges through litigation, considerable risk and expense, and substantial delays. Unless and until the requisite entitlements are received and substantial work has been commenced in reliance upon such entitlements, a developer generally does not have full “vested rights” to develop a project, and as a result, allocation of acreage between developable and non-developable land may change. In addition, as a precondition to receipt of building-related permits, master-planned communities in California are typically required to pay impact and capacity fees, or to otherwise satisfy mitigation requirements.

Current Development Projects

San Elijo Hills

In 2002, the Company purchased from Leucadia National Corporation (together with its subsidiaries, “Leucadia”) all of the issued and outstanding shares of capital stock of CDS Holding Corporation (“CDS”), which through its majority-owned subsidiaries is the owner of the San Elijo Hills project (title is owned in fee simple). The San Elijo Hills project, a master-planned community located in the City of San Marcos in San Diego County, California, will be a community of approximately 3,500 homes and apartments, as well as a commercial and residential Towncenter. Since August 1998, the Company has been the development manager for this project, with responsibility for the overall management of the project, including, among other things, preserving existing entitlements and obtaining any additional entitlements required for the project, arranging financing for the project, coordinating marketing and sales activity, and acting as the construction manager. The development management agreement provides that the Company receive fees for the field overhead, management and marketing services it provides (“development management fees”), based on the revenues of the project. Through its ownership interest in CDS, the Company has an effective 68% indirect equity interest in the San Elijo Hills project, after considering noncontrolling interests held by former owners of the project before CDS acquired its interest. Before amounts are distributed to the noncontrolling shareholders, the Company has the right to receive repayment of any amounts advanced by it to the project and to receive a preferred return on any advances. For more information on the noncontrolling interests, see Note 5 of Notes to Consolidated Financial Statements.

2

Current Market Developments: Throughout much of the period that the Company has been developing the San Elijo Hills project, the Company’s sales efforts greatly benefited from a strong regional and national residential housing market. However, beginning in 2006, residential property sales volume, prices and new building starts declined significantly in many U.S. markets, including California and the greater San Diego region, which negatively affected sales and profits. The slowdown in residential sales was exacerbated by the turmoil in the mortgage lending and credit markets, which resulted in stricter lending standards and reduced liquidity for prospective home buyers. Sales of new homes and re-sales of existing homes declined substantially from the early years of the project’s development; based on information obtained from homebuilders and other public sources, the Company estimates that total home sales (both new and re-sales) at the San Elijo Hills project were approximately 236 in 2011 as compared to 860 in 2004. As of December 31, 2011, the San Elijo Hills project has sold 2,098 of its 2,364 single family lots and 1,070 of its 1,099 multi-family units.

Interest from homebuilders concerning the San Elijo project’s remaining single family lots and multi-family units has increased since late 2009, and the Company has been able to sell some single family lots and multi-family units at acceptable prices. Although these developments are encouraging, it is too soon to determine if the long slump in the housing market is coming to an end, or when the Company will be able to sell its remaining inventory. The Company has substantially completed development of all of its remaining residential single family lots at the San Elijo Hills project, many of which are “premium” lots which are expected to command premium prices if, and when, the market fully recovers. The Company believes that by exercising patience and waiting for market conditions to improve it can best maximize shareholder value with its remaining residential lot inventory. However, on an ongoing basis the Company evaluates the local real estate market and economic conditions in general, and updates its expectations of future market conditions as it continues to assess the best time to market its remaining residential lot inventory for sale.

Estimates of future property available for sale, the timing of the sales, selling prices and future development costs are based upon current development plans for the project and will change based on the strength of the real estate market or other factors that are not within the control of the Company.

Sales Activity: The table below summarizes sales activity at the San Elijo Hills project during the last three years.

|

For the Year Ended December 31,

|

||||||||||||

|

2011

|

2010

|

2009

|

||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

Number of residential units sold (1)

|

93 | 192 | 32 | |||||||||

|

Aggregate sales proceeds from sales of residential

|

||||||||||||

|

units, net of closing costs

|

$ | 25,600 | $ | 35,600 | $ | 7,000 | ||||||

|

Aggregate proceeds from the sales of

|

||||||||||||

|

non-residential sites, net of closing costs (2)

|

$ | 1,950 | $ | - | $ | 1,950 | ||||||

|

Development management fees earned (3)

|

$ | 1,550 | $ | 2,050 | $ | 500 | ||||||

|

(1)

|

Units are comprised of single family lots, multi-family units and residential condominium units.

|

|

(2)

|

Reflects the sales of a daycare center and bank site in 2011 and reflects the sale of the visitor center in 2009.

|

|

(3)

|

Development management fees are intercompany payments, which are eliminated in consolidation and therefore not reflected in the Company’s consolidated statements of operations, but which are a source of liquidity for the parent company.

|

3

As of December 31, 2011, the remaining land at the San Elijo Hills project to be sold or leased consists of the following (including real estate under contract for sale):

|

Single family lots

|

266 | |||

|

Multi-family units

|

29 | |||

|

Square footage of commercial space

|

37,800 |

The Towncenter includes multi-family residential units and commercial space, which are being constructed in phases. The Company has completed construction of the first phase of the Towncenter, which included 12 residential condominium units and 11,000 square feet of commercial space. Eleven of the twelve condominium units have been sold, and all of the phase one retail spaces have been leased. The plan for phase two of the Towncenter has not yet been developed.

Since 1999, the San Elijo Hills project has carried $50,000,000 of general liability and professional liability insurance under a policy issued by the Lumbermens Mutual Group (“Lumbermens”), formerly known as the Kemper Insurance Companies. The policy covered a thirteen year term from the initial date of coverage, and the entire premium for the life of the policy was paid in 1999. This policy is specific to the San Elijo Hills project; the Company has general and professional liability insurance for other matters with different insurance companies.

Lumbermens has ceased underwriting operations and is operating under the administrative supervision of its insurance regulators. Although Lumbermens is not in receivership proceedings, it is operating under restrictive orders entered by insurance regulators. It is uncertain whether Lumbermens will have sufficient assets at such time, if ever, the Company makes a claim under the policy (the Company has not made any claims to date). In May 2004, the Company purchased an excess policy with another insurance carrier that provides up to $10,000,000 of coverage for general liability claims, but not professional liability claims, relating to homes sold through August 1, 2007. In July 2007, the Company purchased a new $1,000,000 primary insurance policy and $10,000,000 excess insurance policy that provides coverage for general liability claims, but not professional liability claims, relating to homes sold at the San Elijo Hills project from July 29, 2007 through August 1, 2011. During 2011, coverage under these policies was extended for homes sold through August 2012.

Otay Ranch

In October 1998, Otay Land Company, LLC (“Otay Land Company”) acquired approximately 4,850 non-adjoining acres of land located within the larger 22,900 acre Otay Ranch master-planned community south of San Diego, California (title is owned in fee simple). The City of Chula Vista and the County of San Diego approved a General Development Plan (“GDP”) for the larger planning area in 1993.

Since acquisition, Otay Land Company has disposed of part of its land in several sales transactions and an eminent domain proceeding. After considering these dispositions, Otay Land Company owns approximately 2,800 acres, of which the total developable area is approximately 700 acres, including approximately 170 acres of land designated as “Limited Development Area and Common Use Area.” The remaining approximately 2,100 acres are designated as various qualities of non-developable open space mitigation land. Under the GDP, 1.188 acres of open space mitigation land from within the Otay Ranch project must be dedicated to the government for each 1.0 acre of land that is developed, excluding land designated Limited Development Area and Common Use Area.

Although there is no specified time within which implementation of the GDP must be completed, it is expected that full development of the larger planning area will take many years. The GDP establishes land use goals, objectives and policies within the larger planning area. The GDP for the larger planning area contemplates home sites, a golf-oriented resort and residential community, commercial retail centers, a proposed university site and a network of infrastructure, including roads and highways, a public transportation system, park systems and schools. Any development within the larger Otay Ranch master-planned community must be consistent with the GDP. While the GDP can be amended, subject to approval by either or both the City of Chula Vista and the County of San Diego, Otay Land Company has certain vested and contractual rights, pursuant to a development agreement, that protect its development interests in Chula Vista, covering substantially all of its developable land. However, actual land development will require that further entitlements and approvals be obtained.

Some owners of development land have adequate or excess mitigation land, while other owners lack sufficient acreage of mitigation land to cover their inventory of development land. Otay Land Company currently has substantially more mitigation land than it would need to develop its property at this project. Based upon the GDP conditions, this land could have value to other developers within the larger Otay Ranch development area as their development progresses; however, this is partially dependent upon other parties with developable land fully developing their land. Should other owners choose not to develop their developable land, there will be an excess of mitigation land in Otay Ranch. In that event, Otay Land Company will have to find buyers for its mitigation land outside the Otay Ranch General Plan Area, which the Company believes it can do.

4

The Company continues to evaluate how to maximize the value of this investment while processing further entitlements on portions of its property. The Company has been working with the City of Chula Vista and other developers on a GDP amendment for the overall Otay Ranch area. In April 2008, the City of Chula Vista approved an agreement whereby the Company dedicated 50 acres of development land in the Otay Ranch project and 160 acres of open space land in the unincorporated area of San Diego County and committed to pay an endowment of $2,000,000 (of which $1,000,000 has been paid) to fund costs associated with establishing a higher education facility on the property. Subject to numerous public hearings and the discretionary action of the City Council, the City committed to allocate a maximum of 6,050 residential units and 1.8 million square feet of commercial development space to the Company’s project, and agreed to process its development applications by August 2011. The Company’s development applications have not as yet been approved; however, the Company continues to work with the City to obtain the approvals while retaining its rights to seek a refund of the endowment funds and a return of the land should the approvals ultimately not be received. If such applications are not approved and implemented, the City will be required to return to the Company the endowment funds and the dedicated land. The Company retains the right to withdraw these development applications if it determines, in its sole discretion, that it is economically infeasible or undesirable to continue with such applications.

During 2007, the San Diego Expressway Limited Partnership (“SDELP”) completed construction of a toll road designated as SR 125 through south San Diego County. This toll road runs along the western border of one of Otay Land Company’s land parcels and is a quarter mile east of another. The toll road was designed with one or more interchanges, which have yet to be built, on or adjacent to land parcels owned by the Company. When complete, these interchanges will significantly improve access to this area in the southern portion of Otay Ranch, which could increase the value of the Company’s land. Otay Land Company and other adjacent property owners will need to negotiate with the City of Chula Vista and SDELP regarding the construction timing and financing of interchanges that will provide access to SR 125.

Significant design and processing will be required to fully entitle the Company’s property in Otay Ranch before development and sale of the finished neighborhoods to builders can begin, and there can be no assurance that the Company will be successful in receiving the entitlements necessary for any future development. If or when development does occur, it will likely be phased based on market conditions at the time of development and the progress of infrastructure improvements. As a result, the Company is unable to predict when revenues will be derived from this project. The ultimate development of projects of this type is subject to significant governmental and environmental regulation and approval and is likely to take many years. For additional information concerning governmental and environmental matters, see “Government Regulation” and “Environmental Compliance” below.

A map indicating the location of the Chula Vista General Plan area in San Diego County and a more detailed map showing general information about the Company's land within that General Plan area can be found on Otay Land Company's website at www.otaylandcompany.com.

Other Projects

Rampage Property

The Company owns a 1,544 acre grape vineyard located in southern Madera County, California (title is owned in fee simple) that was purchased in 1993. Although this property is not currently entitled for residential development, it is located in a growing residential area northwest of Fresno, California. The Company purchased this land with the intention of obtaining the necessary entitlements to develop the property as a master-planned community, including meeting requirements with respect to adequate water supply. In California, laws require that any large size residential community have sufficient water supplies to meet the water demands of the project for a period of 20 years. A preliminary site plan for development of the Rampage property showed that the land would support a master-planned community, but even if all entitlements are received, the build out and sale of homes will take many years. The entitlement process takes several years and no assurance can be given that such entitlements will be obtained, or that that future market conditions will support development of the Rampage property into a master-planned community. In the interim, the Company has been conducting farming activities at the vineyard and, starting in 2010, has been generating positive cash flows from selling grapes.

The Company is reevaluating its plans for the Rampage property. During 2011, the Company engaged a real estate brokerage firm to sell the Rampage property but the Company did not receive any offers it found acceptable. While a sale of the property in the future is possible, the Company continues to conduct farming activities while it explores possible development as a master-planned community. For the years ended December 31, 2011, 2010 and 2009, farming revenues from the Rampage property were $6,000,000, $3,950,000 and $1,950,000, respectively, and farming expenses were $2,850,000, $2,700,000 and $3,150,000, respectively.

5

Fanita Ranch

In January 2011, the Company acquired in a foreclosure sale the Fanita Ranch property, a 2,600 acre parcel of vacant land located in Santee, California. The aggregate purchase price of $12,350,000 consisted of cash consideration of $11,000,000 and the assumption of certain payables. The City of Santee is located at the intersection of SR125 and SR52 in East San Diego County, about a 30 minute drive from downtown San Diego. Fanita Ranch is a master-planned community that is approved for approximately 1,400 residential units. The project’s Environmental Impact Report (“EIR”) and development agreement with the City of Santee were approved in 2007.

The existing project entitlements are currently being challenged under the California Environmental Quality Act (“CEQA”) related to purported issues with the EIR. The Company and the City of Santee are defending these EIR challenges; however, this process may take several years to resolve and the Company may not ultimately be successful.

If the Company successfully resolves the EIR challenges, there are no assurances that real estate market conditions, or costs of construction, will allow the project to be profitably developed as currently planned. The Company acquired the property with the intention of completing the necessary entitlements to develop the property as a master-planned community, although there can be no assurance that the Company will be successful in these efforts. If successful, obtaining all the entitlements is expected to take several years.

Competition

Real estate development is a highly competitive business. There are numerous residential real estate developers and development projects operating in the same geographic area in which the Company operates. Competition among real estate developers and development projects is determined by the location of the real estate, the market appeal of the development plan, and the developer’s ability to build, market and deliver project segments on a timely basis. Many of the Company’s competitors may have greater financial resources and/or access to cheaper capital than the Company. Residential developers sell to homebuilders, who compete based on location, price, market segmentation, product design and reputation.

Government Regulation

The residential real estate development industry is subject to substantial environmental, building, construction, zoning and real estate regulations that are imposed by various federal, state and local authorities. In developing a community, the Company must obtain the approval of numerous government agencies regarding such matters as permitted land uses, housing density, the installation of utility services (such as water, sewer, gas, electric, telephone and cable television) and the dedication of acreage for open space, parks, schools and other community purposes. Regulations affect homebuilding by specifying, among other things, the type and quality of building materials that must be used, certain aspects of land use and building design and the manner in which homebuilders may conduct their sales, operations, and overall relationships with potential home buyers. Furthermore, changes in prevailing local circumstances or applicable laws may require additional approvals, or modifications of approvals previously obtained.

Timing of the initiation and completion of development projects depends upon receipt of necessary authorizations and approvals. Because of the provisional nature of these approvals and the concerns of various environmental and public interest groups, the approval process can be delayed by withdrawals or modifications of preliminary approvals and by litigation and appeals challenging development rights. The ability of the Company to develop projects could be delayed or prevented due to litigation challenging previously obtained governmental approvals. The Company may also be subject to periodic delays or may be precluded entirely from developing in certain communities due to building moratoriums or "slow-growth" or "no-growth" initiatives that could be implemented in the future. Such delays could adversely affect the Company’s ability to complete its projects, significantly increase the costs of doing so or drive potential customers to purchase competitors’ products.

Environmental Compliance

Environmental laws may cause the Company to incur substantial compliance, mitigation and other costs, may restrict or prohibit development in certain areas and may delay completion of the Company’s development projects. Delays arising from compliance with environmental laws and regulations could adversely affect the Company’s ability to complete its projects and significantly increase development costs.

Under various federal, state and local environmental laws, an owner or operator of real property may become liable for the costs of the investigation, removal and remediation of hazardous or toxic substances at that property. These laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the presence of the hazardous or toxic substances. In addition to remediation actions brought by federal, state and local agencies, the presence of hazardous substances on a property could result in personal injury, contribution or other claims by private parties. We have not received any claim or notification from any private party or governmental authority concerning environmental conditions at any of our properties other than as disclosed below.

6

The Company obtained a preliminary remediation study concerning approximately 30 acres of undeveloped land in the Otay Ranch master-planned community that is owned by a subsidiary of Otay Land Company, Flat Rock Land Company, LLC (“Flat Rock”). Flat Rock owns approximately 260 acres of the Company’s total holdings in the Otay Ranch area, including 100 developable acres. The need for remediation results from activities conducted on the land prior to Otay Land Company’s ownership. Based upon the preliminary findings of this study, in 2002 the Company estimated that the cost to implement the most likely remediation alternative would be approximately $11,150,000, and accrued that amount as an operating expense. The estimated liability was neither discounted nor reduced for claims for recovery from previous owners and users of the land who may be liable, and may increase or decrease based upon the actual extent and nature of the remediation required, the type of remedial process approved, the expenses of the regulatory process, inflation and other items. During 2004, the Company increased its estimate of remediation costs by approximately $1,300,000, primarily due to increases in site investigation and remediation costs, and during 2003 by approximately $250,000, primarily for consulting costs. The liability is reduced for payments related to the development of a remediation plan, onsite testing and legal and other expenses. The Company periodically examines, and when appropriate, adjusts its liability to reflect its current best estimate; however, no assurance can be given that the actual amount of environmental liability will not exceed the amount of reserves for this matter or that it will not have a material adverse effect on the Company’s financial position, results of operations or cash flows. At December 31, 2011, the liability for environmental remediation was $8,950,000.

During 2003, Otay Land Company developed a Site investigation plan, which the San Diego Department of Environmental Health (“DEH”) approved, to determine the nature and extent of contamination on the property. In January 2004, the California Environmental Protection Agency designated DEH as the lead overseeing agency for site investigation and eventual remediation. Flat Rock then selected an environmental consultant to implement the investigation plan, which has been conducted under the San Diego County Voluntary Cleanup Program under the oversight of DEH, in full compliance with the federal National Contingency Plan (“NCP”) and State of California Health and Safety Code. In 2005, Flat Rock completed the site investigation, which was subsequently approved by DEH. Flat Rock submitted a Remedial Investigation and Feasibility Study (“RI/FS”) to DEH for review and approval; DEH requested State Department of Toxic Substances Control assistance in its review of the RI/FS, specifically with respect to human health and ecological risk assessment for the Site. Following the completion of human health and ecological risk assessment activities, further site assessment and characterization, and continued evaluation of remedial alternatives for final clean up of the Site, all of which was conducted in a manner consistent with the NCP, Flat Rock received regulatory approval with respect to the RI/FS. Flat Rock is now working with DEH and other regulatory agencies on a Draft Remedial Action Plan (“RAP”) for eventual approval and selection of a final remedy for the Site. The RAP will be subject to public comment prior to approval and implementation of the final DEH-approved remedy. Prior to approval, the RAP will also be subject to California Environmental Quality Act (“CEQA”) requirements, with input and direction provided by the County of San Diego and City of Chula Vista, among others. In summary, Flat Rock continues to work with DEH and other agencies to conduct the investigation and eventual cleanup of the Site in compliance with the NCP and State and local requirements. The Company is unable to predict with certainty when the remediation will commence and there is no regulatory requirement to commence remediation by a fixed date.

Otay Land Company and Flat Rock commenced a lawsuit in the U.S. District Court for the Southern District of California seeking compensation from the parties who Otay Land Company and Flat Rock believe are responsible for the contamination of the property. On July 20, 2006, the District Court dismissed the federal environmental law claims and refused to retain jurisdiction on the related state law claims. The District Court also awarded allowable costs to the defendants and against Otay Land Company and Flat Rock in the total sum of approximately $272,000. Otay Land Company and Flat Rock immediately filed an action in the Superior Court for the State of California, County of San Diego asserting all related state law claims against the same parties to preserve those claims while seeking appellate review of the District Court’s rulings on the merits of the case and the award of costs. The state court action was stayed by the Superior Court pending the decisions on the federal appeals. On appeal, the U.S. Court of Appeals for the Ninth Circuit declined to address the District Court’s grounds for its dismissal of the federal environmental law claims, and instead vacated the District Court’s decision and directed the dismissal of the lawsuit on the grounds that the federal environmental law claims were not yet ripe for judicial review. As to the cost appeal, the Ninth Circuit found the District Court had decided the cost based upon the wrong standard of review and remanded the matter back to the District Court. That court decided the costs issue again under a different standard, but found the same costs were still allowed. Otay Land Company and Flat Rock have again appealed the $272,000 cost award to the Ninth Circuit. Briefing was completed and the Ninth Circuit heard oral argument in October of 2011. The parties are awaiting the decision of the Ninth Circuit at this time on the cost appeal.

Once the Ninth Circuit’s decision dismissing the federal environmental claims became final, rather than re-file in Federal Court, the Company elected to pursue only the state law claims in California Superior Court seeking recovery of the Company’s damages associated with the investigation and anticipated future costs associated with the eventual remediation of the contamination. The stay has been lifted by the Superior Court. All defendants thereafter filed motions for summary judgment, all of which were denied by the Court in January 2012. A trial date has not yet been set, but the Company anticipates trial will commence in the latter part of 2012. The Company has not reduced its estimated liability for environmental remediation based upon any potential recoveries from these parties. The Company can give no assurances that this lawsuit will be successful, that it will not be liable for the defense costs awarded to date or that it will be able to recover any of the costs incurred in investigating and/or remediating the contamination.

7

Employees

At December 31, 2011, the Company and its consolidated subsidiaries had 13 full-time employees.

Investor Information

The Company is subject to the informational requirements of the Securities Exchange Act of 1934 (the “Exchange Act”). Accordingly, the Company files periodic reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”). Such reports, proxy statements and other information may be obtained by visiting the Public Reference Room of the SEC at 100 F Street, N.E., Washington, D.C. 20549 or by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding the Company and other issuers that file electronically.

The Company’s website is http://www.homefedcorporation.com. The Company also makes available through its website without charge its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after such reports are filed with or furnished to the SEC.

Cautionary Statement for Forward-Looking Information

Statements included in this Report may contain forward-looking statements. Such statements may relate, but are not limited, to projections of revenues, income or loss, development expenditures, plans for growth and future operations, competition and regulation, as well as assumptions relating to the foregoing. Such forward-looking statements are made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are inherently subject to risks and uncertainties, many of which cannot be predicted or quantified. When used in this Report, the words “will ” “could,” “estimates,” “expects,” “anticipates,” “believes,” “plans,” “intends” and variations of such words and similar expressions are intended to identify forward-looking statements that involve risks and uncertainties. Future events and actual results could differ materially from those set forth in, contemplated by or underlying the forward-looking statements.

Factors that could cause actual results to differ materially from any results projected, forecasted, estimated or budgeted or may materially and adversely affect the Company’s actual results include, but are not limited to, those set forth in Item 1A. Risk Factors and elsewhere in this Report and in the Company’s other public filings with the SEC.

Undue reliance should not be placed on these forward-looking statements, which are applicable only as of the date hereof. The Company undertakes no obligation to revise or update these forward-looking statements to reflect events or circumstances that arise after the date of this Report or to reflect the occurrence of unanticipated events.

Item 1A. Risk Factors.

Our business is subject to a number of risks. You should carefully consider the following risk factors, together with all of the other information included or incorporated by reference in this Report, before you decide whether to purchase our common stock. The risks set out below are not the only risks we face. If any of the following risks occur, our business, financial condition and results of operations could be materially adversely affected. In such case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Our results of operations and financial condition are greatly affected by the performance of the real estate industry. The real estate development industry has historically been subject to up and down cycles driven by numerous market and economic factors, both national and local, beyond the control of the real estate developer. Because of the effect these factors have on real estate values, it is difficult to predict with certainty when future sales will occur or what the sales price will be.

Changes in mortgage interest rate levels could impact demand for housing. Our business is dependent upon the availability and cost of mortgage financing for potential homebuyers. Any significant increase in the prevailing low mortgage interest rate environment or decrease in available credit could reduce consumer demand for housing, and result in fewer home sales or lower sale prices.

8

Recent turmoil in the mortgage lending market has adversely affected our results and will continue to negatively impact our results in the future. The residential real estate development industry is dependent upon the availability of financing for both homebuilders and homebuyers. The recent turmoil in the credit markets has resulted in a tightening of credit standards for residential and commercial mortgages and significantly reduced liquidity, which has adversely affected the ability of homebuilders and homebuyers to obtain financing, which in turn has adversely impacted our ability to sell lots.

Our business is currently concentrated in Southern California, specifically in the San Diego area. As a result, our financial results are dependent on the economic strength of that region. Significant increases in local unemployment and cost of living, including increases in residential property taxes, or concerns about the financial condition of the municipalities in which the Company has properties, could adversely affect consumer demand for our housing projects and negatively impact our financial results.

Residential property sales volume, prices and new building starts have declined significantly in many U.S. markets, including California and the greater San Diego region, which have negatively affected sales and profits. A worsening of current economic conditions could cause a decline in estimated future cash flows expected to be generated from the Company’s real estate projects, potentially resulting in impairment charges for real estate assets. When reviewing real estate assets for impairment, the most significant assumption made to determine estimated future cash flows is the estimated future selling prices of the Company’s real estate assets. If current conditions worsen and/or if the Company lowers its estimate of future selling prices, impairment charges could be recorded.

Changes in domestic laws and government regulations or in the implementation and/or enforcement of government rules and regulations may delay our projects or increase our costs. Our plans for development projects require numerous government approvals, licenses, permits and agreements, which we must obtain before we can begin development and construction. Our negotiations with local authorities often result in requirements for us to incur development expenses related to improvements for roads, sewers or other common areas that are both inside and outside of our project area. The approval process can be delayed by withdrawals or modifications of preliminary approvals, by litigation and appeals challenging development rights and by changes in prevailing local circumstances or applicable laws that may require additional approvals. Regulatory requirements may delay the start or completion of our projects and/or increase our costs.

Demographic changes in the U.S. generally and California in particular could reduce the demand for housing. If the current trend of population increases in California were not to continue, or in the event of any significant reductions in employment, demand for real estate in California may decline from current levels.

Increases in real estate taxes and other local government fees could adversely affect our results. Increases in real estate taxes and other government fees may make it more expensive to own the properties that we are currently developing, which would increase our carrying costs of owning the properties.

Significant competition from other real estate developers and homebuilders could adversely affect our results. Many of our competitors may have advantages over us, such as more favorable locations which may provide better schools and easier access to roads and shopping, or amenities that we may not offer, as well as greater financial resources and/or access to cheaper capital. In addition, the downturn in the real estate markets nationwide could result in an influx of lower-priced lots and homes coming onto the market, as competitors need to address their individual liquidity needs. Lower-priced homes and lots would increase the competition the Company faces, and could adversely affect our ability to sell lots and/or pricing.

Delays in construction schedules and cost overruns could adversely affect us. Any material delays could adversely affect our ability to complete our projects, significantly increasing the costs of doing so, or drive potential customers to purchase competitors’ products.

Increased costs for land, materials and for labor could adversely affect us. If these costs increase, it will increase the costs of completing our projects; if we are not able to recoup these increased costs, our results of operations would be adversely affected.

Imposition of limitations on our ability to develop our properties resulting from condemnations, environmental laws and regulations and developments in or new applications thereof could increase our costs and delay our projects. When we acquire our projects, our estimate of future profits and cash flows is derived from our estimates of future selling prices and development costs, less acquisition costs. Subsequent to acquisition, if environmental laws or other regulations change resulting in additional unanticipated costs, future profitability and cash flows could be reduced, and impairment charges might have to be recorded.

9

Property in California is at risk from earthquakes, fires and other natural disasters. Damage to any of our properties, whether by natural disasters, including earthquakes, and fires or otherwise, may either delay or preclude our ability to develop and sell our properties, or affect the price at which we may sell such properties.

Under California law we could be liable for some construction defects in structures we build or that are built on land that we develop. California law imposes some liabilities on developers of land on which homes are built as well as on builders. Future construction defect litigation could be based on a strict liability theory based on our involvement in the project or it could be related to infrastructure improvements or grading, even if we are not building homes ourselves.

We may not be able to insure certain risks economically. We may experience economic harm if any damage to our properties is not covered by insurance. We cannot be certain that we will be able to insure all risks that we desire to insure economically or that all of our insurers will be financially viable if we make a claim.

Shortages of adequate water resources and reliable energy sources in the areas where we own real estate projects could adversely affect the value of our properties or restrict us from commencing development. If we are unable to obtain adequate water resources and reliable energy sources for our development projects, development of the projects might be delayed, resulting in reduced profitability and cash flows.

The actual cost of environmental liabilities concerning land owned in San Diego County, California could exceed the amount we reserved for such matter. If the actual cost of the environmental remediation for land owned by Flat Rock is more than amounts reserved for additional expenses will have to be recorded.

Opposition from local community or political groups with respect to construction or development at a particular site could increase development costs.

We may not be able to generate sufficient taxable income to fully realize our net deferred tax asset. If we are unable to generate sufficient taxable income to fully realize our net deferred tax asset the valuation allowance would have to be increased resulting in reduced profitability.

Significant influence over our affairs may be exercised by our principal stockholders. As of February 6, 2012, the significant stockholders of our Company are Leucadia (approximately 31.4% beneficial ownership), our Chairman, Joseph S. Steinberg (approximately 9.4% beneficial ownership, including ownership by trusts for the benefit of his respective family members, but excluding Mr. Steinberg's private charitable foundation) and one of our directors, Ian M. Cumming (approximately 7.7% beneficial ownership, including ownership by certain family members, but excluding Mr. Cumming's charitable foundation). Mr. Steinberg is also President, a director and a significant stockholder of Leucadia. Mr. Cumming is also Chairman of the Board, a director and a significant stockholder of Leucadia. Accordingly, Leucadia and Messrs. Steinberg and Cumming could exert significant influence over all matters requiring approval by our stockholders, including the election or removal of directors and the approval of mergers or other business combination transactions.

Our common stock is subject to transfer restrictions. We and certain of our subsidiaries have net operating loss carryforwards (“NOLs”) and other tax attributes, the amount and availability of which are subject to certain qualifications, limitations and uncertainties. In order to reduce the possibility that certain changes in ownership could result in limitations on the use of the tax attributes, our certificate of incorporation contains provisions that generally restrict the ability of a person or entity from acquiring ownership (including through attribution under the tax law) of 5% or more of our common stock and the ability of persons or entities now owning 5% or more of our common stock from acquiring additional common stock. The restriction will remain until the earliest of (a) December 31, 2028, (b) the repeal of Section 382 of the Internal Revenue Code (or any comparable successor provision) and (c) the beginning of our taxable year to which these tax attributes may no longer be carried forward. The restriction may be waived by our board of directors. Stockholders are advised to carefully monitor their ownership of our common stock and consult their own legal advisors and/or us to determine whether their ownership of our common stock approaches the proscribed level.

Our common stock is not traded on NASDAQ or listed on any securities exchange. Prices for our common stock are quoted on the Over-the-Counter (OTC) Bulletin Board. Securities whose prices are quoted on the OTC Bulletin Board do not enjoy the same liquidity as securities that trade on a recognized market or securities exchange. As a result, stockholders may find it more difficult to dispose of or obtain accurate quotations as to the market value of the securities.

10

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

At December 31, 2011, the Company is the developer of three real estate properties, San Elijo Hills, the Otay Land Company project and Fanita Ranch, and owns the Rampage property, all of which are described under Item 1. Business. Real estate had an aggregate book value of approximately $92,650,000 at December 31, 2011.

The Company leases 11,364 square feet for its corporate headquarters which is located at 1903 Wright Place, Suite 220, Carlsbad, California 92008. The Company rents office space at its corporate headquarters to Leucadia for an annual rent of $12,000, payable monthly.

Item 3. Legal Proceedings.

From time to time the Company and its subsidiaries may be parties to legal proceedings that are considered to be either ordinary, routine litigation, incidental to its business or not material to the Company’s consolidated financial position or liquidity.

As previously disclosed, on June 25, 2009, a lawsuit was filed against the Company, its President and certain affiliates of the Company by a minority stockholder of CDS Devco, Inc. (“Devco”), a subsidiary of the Company.

The action, entitled Walter E. Wolf v. Paul J. Borden, CDS Devco, Inc., CDS Holding, Inc., San Elijo Ranch, Inc. and HomeFed Corporation was filed in the Superior Court of the State of California for the County of San Diego. The complaint alleges breach of fiduciary duty, fraud, breach of contract and intentional interference with contract in connection with the Company's relationship with its majority-owned subsidiary, San Elijo Ranch, Inc.

The complaint alleges that the plaintiff should have received additional distributions from Devco, and that Devco should have received additional distributions from San Elijo Ranch, Inc. The action seeks recovery of unspecified monetary damages, declaratory relief, an accounting and such other relief as the court may award.

In March 2010, the Court dismissed certain of the plaintiff’s claims and on April 11, 2011, the Court granted summary judgment in favor of all defendants on all remaining claims. Judgment was entered in favor of the Company and all of its officers and affiliates on May 26, 2011. On July 22, 2011, the plaintiff served a notice of appeal. The Company believes that the judgment should be affirmed on appeal and will continue to vigorously defend itself.

Item 4. Mine Safety Disclosures.

Not applicable.

11

PART II

|

Item 5.

|

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

The Company’s common stock is traded in the over-the-counter market under the symbol “HOFD.” The Company’s common stock is not listed on any stock exchange, and price information for the common stock is not regularly quoted on any automated quotation system.

The following table sets forth, for the calendar periods indicated, the high and low bid price of the Company’s common stock, as published by the National Association of Securities Dealers OTC Bulletin Board Service.

|

High

|

Low

|

|||||||

|

2010

|

||||||||

|

First Quarter

|

$ | 33.00 | $ | 18.25 | ||||

|

Second Quarter

|

27.98 | 21.00 | ||||||

|

Third Quarter

|

25.00 | 20.05 | ||||||

|

Fourth Quarter

|

25.00 | 20.38 | ||||||

|

2011

|

||||||||

|

First Quarter

|

$ | 30.00 | $ | 21.80 | ||||

|

Second Quarter

|

28.50 | 21.53 | ||||||

|

Third Quarter

|

23.00 | 18.00 | ||||||

|

Fourth Quarter

|

20.75 | 18.25 | ||||||

|

2012

|

||||||||

|

First quarter (through February 6, 2012)

|

$ | 20.20 | $ | 18.26 | ||||

The over-the-counter quotations reflect inter-dealer prices, without retail mark up, markdown or commission, and may not represent actual transactions. On February 6, 2012, the closing bid price for the Company’s common stock was $20.09 per share. As of that date, there were 569 stockholders of record. No dividends were paid during 2011 or 2010.

The Company does not currently meet certain requirements for listing on a national securities exchange or inclusion on the Nasdaq Stock Market.

The Company and certain of its subsidiaries have NOLs and other tax attributes, the amount and availability of which are subject to certain qualifications, limitations and uncertainties. In order to reduce the possibility that certain changes in ownership could result in limitations on the use of its tax attributes, the Company's certificate of incorporation contains provisions which generally restrict the ability of a person or entity from acquiring ownership (including through attribution under the tax law) of five percent or more of the common stock and the ability of persons or entities now owning five percent or more of the common stock from acquiring additional common stock. The restrictions will remain in effect until the earliest of (a) December 31, 2028, (b) the repeal of Section 382 of the Internal Revenue Code (or any comparable successor provision) and (c) the beginning of a taxable year of the Company to which certain tax benefits may no longer be carried forward.

The transfer agent for the Company’s common stock is American Stock Transfer & Trust Company, 59 Maiden Lane, New York, New York 10038.

In July 2004, the Board of Directors approved the repurchase of up to 500,000 shares of the Company’s common stock. In October 2008, the Company purchased 394,931 shares of the Company’s common stock for approximately $5,900,000 in a private transaction with an unrelated party. In March 2009, the Company purchased 478 shares of the Company’s common stock in an open market transaction in accordance with the Company’s repurchase plan. After considering these transactions, the Company can repurchase up to 104,591 common shares without board approval. Repurchased shares would be available for, among other things, use in connection with the Company’s stock option plan. The shares may be purchased from time to time, subject to prevailing market conditions, in the open market, in privately negotiated transactions or otherwise. Any such purchases may be commenced or suspended at any time without prior notice.

12

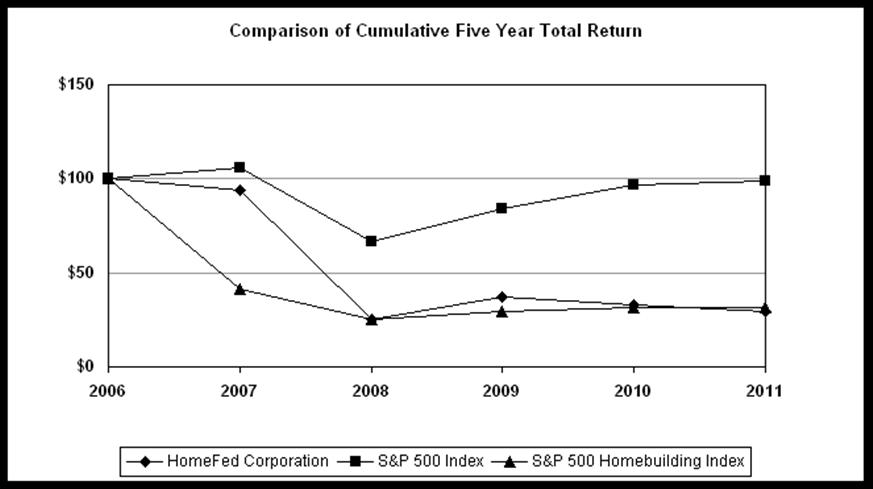

Stockholder Return Performance Graph

Set forth below is a graph comparing the cumulative total stockholder return on the Company’s common stock against the cumulative total return of the Standard & Poor’s 500 Stock Index and the Standard & Poor’s Homebuilding-500 Index for the period commencing December 31, 2006 to December 31, 2011. Index data was furnished by Standard & Poor’s Capital IQ. The graph assumes that $100 was invested on December 31, 2006 in each of our common stock, the S&P 500 Index and the S&P 500 Homebuilding Index and that all dividends were reinvested.

|

INDEXED RETURNS

|

||||||||||||||||||||||||

|

Base

|

Years Ending

|

|||||||||||||||||||||||

|

Period

|

||||||||||||||||||||||||

|

Company / Index

|

Dec06

|

Dec07

|

Dec08

|

Dec09

|

Dec10

|

Dec11

|

||||||||||||||||||

|

HomeFed Corporation

|

100 | 93.94 | 25.00 | 37.12 | 33.03 | 29.39 | ||||||||||||||||||

|

S&P 500 Index

|

100 | 105.49 | 66.46 | 84.05 | 96.71 | 98.76 | ||||||||||||||||||

|

S&P 500 Homebuilding Index

|

100 | 41.11 | 25.11 | 29.72 | 31.52 | 31.53 | ||||||||||||||||||

Item 6. Selected Financial Data.

The following selected financial data have been summarized from the Company’s consolidated financial statements and are qualified in their entirety by reference to, and should be read in conjunction with, such consolidated financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations, contained in Item 7 of this Report.

13

|

Year Ended December 31,

|

||||||||||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||

|

(In thousands, except per share amounts)

|

||||||||||||||||||||

|

SELECTED INCOME STATEMENT DATA:

|

||||||||||||||||||||

|

Revenues (a)

|

$ | 34,141 | $ | 40,367 | $ | 16,933 | $ | 12,157 | $ | 24,631 | ||||||||||

|

Expenses (a)

|

24,058 | 33,450 | 14,569 | 18,418 | 18,196 | |||||||||||||||

|

Net income (loss) (b) (c)

|

6,097 | 4,420 | 2,794 | (10,455 | ) | 8,520 | ||||||||||||||

|

Net income (loss) attributable to HomeFed

|

||||||||||||||||||||

|

Corporation common shareholders (b) (c)

|

4,491 | 3,529 | 2,807 | (9,927 | ) | 6,820 | ||||||||||||||

|

Basic earnings (loss) per share (b) (c)

|

$ | 0.57 | $ | 0.45 | $ | 0.36 | $ | (1.21 | ) | $ | 0.82 | |||||||||

|

Diluted earnings (loss) per share (b) (c)

|

$ | 0.57 | $ | 0.45 | $ | 0.36 | $ | (1.21 | ) | $ | 0.82 | |||||||||

|

At December 31,

|

||||||||||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||

|

(In thousands, except per share amounts)

|

||||||||||||||||||||

|

SELECTED BALANCE SHEET DATA:

|

||||||||||||||||||||

|

Cash and cash equivalents

|

$ | 40,820 | $ | 43,788 | $ | 9,127 | $ | 16,353 | $ | 10,574 | ||||||||||

|

Investments

|

43,297 | 38,287 | 57,038 | 57,735 | 95,940 | |||||||||||||||

|

Real estate

|

92,626 | 87,909 | 104,273 | 98,544 | 88,200 | |||||||||||||||

|

Total assets

|

188,753 | 184,510 | 185,704 | 190,397 | 219,255 | |||||||||||||||

|

Notes payable

|

– | – | 7,834 | 8,218 | 8,953 | |||||||||||||||

|

HomeFed Corporation shareholders’ equity

|

157,706 | 152,995 | 149,313 | 146,419 | 162,117 | |||||||||||||||

|

Shares outstanding

|

7,880 | 7,880 | 7,880 | 7,880 | 8,274 | |||||||||||||||

|

Book value per share (d)

|

$ | 20.01 | $ | 19.42 | $ | 18.95 | $ | 18.58 | $ | 19.59 | ||||||||||

|

Cash dividend per share

|

$ | – | $ | – | $ | – | $ | – | $ | – | ||||||||||

|

|

|

(a)

|

Prior period amounts have been reclassified to conform to the current year presentation of rental income, farming revenues and expenses.

|

|

(b)

|

For the years ended December 31, 2010 and 2008, the Company recorded provisions for impairment losses on real estate of $5,400,000 and $4,150,000, respectively.

|

|

(c)

|

For the year ended December 31, 2008, the Company increased its deferred tax valuation allowance by recording an increase to its income tax provision of $9,100,000.

|

|

(d)

|

Excludes noncontrolling interest.

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The purpose of this section is to discuss and analyze the Company’s consolidated financial condition, liquidity and capital resources and results of operations. This analysis should be read in conjunction with the consolidated financial statements, related footnote disclosures and “Cautionary Statements for Forward-Looking Information,” which appear elsewhere in this Report.

Liquidity and Capital Resources

During 2011 and 2010, net cash of $13,000,000 and $23,700,000, respectively, was provided by operating activities, principally from the proceeds from the sale of real estate at the San Elijo Hills project and sales of bulk grapes. The Company used net cash for operating activities of $8,950,000 for the years ended December 31, 2009, principally for real estate improvement expenditures at the San Elijo Hills project and for the payment of general and administrative expenses and federal and state income tax payments. The Company’s ability to generate positive cash flows from operating activities is dependent upon the amount and timing of real estate sales, principally at the San Elijo Hills project. Information about the remaining real estate to be sold at the San Elijo Hills project is provided below. Because of the nature of its real estate projects, the Company does not expect operating cash flows will be consistent from year to year.

Throughout much of the period that the Company has been developing the San Elijo Hills project, the Company’s sales efforts greatly benefited from a strong regional and national residential housing market. However, beginning in 2006, residential property sales volume, prices and new building starts declined significantly in many U.S. markets, including California and the greater San Diego region, which negatively affected sales and profits. The slowdown in residential sales was exacerbated by the turmoil in the mortgage lending and credit markets, which resulted in stricter lending standards and reduced liquidity for prospective home buyers. Sales of new homes and re-sales of existing homes declined substantially from the early years of the project’s development; based on information obtained from homebuilders and other public sources, the Company estimates that total home sales (both new and re-sales) at the San Elijo Hills project were approximately 236 in 2011 as compared to 860 in 2004.

14

Interest from homebuilders concerning the San Elijo project’s remaining single family lots and multi-family units has increased since late 2009, and the Company has been able to sell some single family lots and multi-family units at acceptable prices. Although these developments are encouraging, it is too soon to determine if the long slump in the housing market is coming to an end, or when the Company will be able to sell its remaining inventory. The Company has substantially completed development of all of its remaining residential single family lots at the San Elijo Hills project, many of which are “premium” lots which are expected to command premium prices if, and when, the market fully recovers. The Company believes that by exercising patience and waiting for market conditions to improve it can best maximize shareholder value with its remaining residential lot inventory. However, on an ongoing basis the Company evaluates the local real estate market and economic conditions in general, and updates its expectations of future market conditions as it continues to assess the best time to market its remaining residential lot inventory for sale.

HomeFed’s principal sources of funds are cash and cash equivalents and investments, proceeds from the sale of real estate, proceeds from sales of bulk grapes, rental income primarily from the San Elijo Hills Towncenter, fee income from the San Elijo Hills project, dividends and tax sharing payments from its subsidiaries and borrowings from or repayment of advances by its subsidiaries. As of December 31, 2011, the Company had consolidated cash and cash equivalents and marketable securities aggregating $84,100,000, substantially all of which was held by the parent company and available to be used without restriction.

The Company expects that its cash and cash equivalents and marketable securities classified as available for sale, together with the other sources described above, will be sufficient for both its short and long term liquidity needs. Residential sales at the San Elijo Hills project are expected to be a source of funds to the Company in the future; however, the amount and timing is uncertain due to current market conditions. The Company is not relying on receipt of funds from Otay Land Company for the foreseeable future, since the timing of sales of undeveloped property, development activity and sales of developable and undevelopable property cannot be predicted with any certainty. However, with the possible exception of the environmental remediation matter discussed below, Otay Land Company is not expected to require material funds in the short term, and long term needs will not be determined until a development plan is established. Property development expenditures at the Rampage project, if any, are not expected to be significant for the next few years. In the interim, the Company has been conducting farming activities at the vineyard and has been generating positive cash flows from selling grapes since 2010. Except as disclosed herein, the Company is not committed to acquire any new real estate projects, but it believes it has sufficient liquidity to take advantage of appropriate acquisition opportunities if they are presented.

During 2011, the Company closed on the sale of two neighborhoods in the San Elijo Hills project consisting of 91 single family lots for aggregate sales proceeds of $24,750,000, net of closing costs. In addition, the Company sold a Towncenter commercial lot to a bank for cash proceeds of $1,400,000 and sold a Towncenter commercial lot to a daycare operator for cash proceeds of $550,000 during 2011. The Company also sold two condominium units in the San Elijo Hills Towncenter for aggregate cash proceeds of $850,000, net of closing costs. As of December 31, 2011, the Company had completed all required improvements to these and previously sold properties.

As of December 31, 2011, the remaining land at the San Elijo Hills project to be sold or leased consists of the following (including real estate under contract for sale):

|

Single family lots

|

266 | |||

|

Multi-family units

|

29 | |||

|

Square footage of commercial space

|

37,800 |

As of February 6, 2012, the Company has entered into an agreement to sell an aggregate of 18 single family residential lots to a homebuilder for aggregate cash proceeds of $3,350,000, for which it has received non-refundable option deposits totaling $350,000 during the year ended December 31, 2011. These option payments are non-refundable if the Company fulfills its obligations under the agreement, and will be applied to reduce the amount due from the purchaser at closing. Although this agreement is binding on the purchasers, should the Company fulfill its obligations under the agreement within the specified timeframes and the purchasers decide not to close, the Company’s recourse will be primarily limited to retaining the option payments.

The Towncenter includes multi-family residential units and commercial space, which are being constructed in phases. The Company has completed construction of the first phase of the Towncenter, which includes 12 residential condominium units and 11,000 square feet of commercial space. Eleven of the twelve condominium units have been sold, and all of the phase one retail spaces have been leased. The plan for phase two of the Towncenter has not yet been developed.

15

Estimates of future property available for sale, the timing of the sales, selling prices and future development costs are based upon current development plans for the project and will change based on the strength of the real estate market or other factors that are not within the control of the Company.

Since 1999, the San Elijo Hills project has carried $50,000,000 of general liability and professional liability insurance under a policy issued by Lumbermens. The policy covered a thirteen year term from the initial date of coverage, and the entire premium for the life of the policy was paid in 1999. This policy is specific to the San Elijo Hills project; the Company has general and professional liability insurance for other matters with different insurance companies. To date, the Company has not made any claims under the policy.

Lumbermens has ceased underwriting operations and has submitted a voluntary run-off plan to its insurance regulators. Although Lumbermens is not in receivership proceedings, it is operating under orders entered by insurance regulators. It is uncertain whether Lumbermens will have sufficient assets at such time, if ever, the Company makes a claim under the policy (the Company has not made any claims to date). In May 2004, the Company purchased an excess policy with another insurance carrier that provides up to $10,000,000 of coverage for general liability claims, but not professional liability claims, relating to homes sold through August 1, 2007. In July 2007, the Company purchased a new $1,000,000 primary insurance policy and $10,000,000 excess insurance policy that provides coverage for general liability claims, but not professional liability claims, relating to homes sold at the San Elijo Hills project from July 29, 2007 through August 1, 2011. During 2011, coverage under these policies was extended for homes sold through August 2012.

In January 2011, the Company acquired in a foreclosure sale the Fanita Ranch property, a 2,600 acre parcel of vacant land located in Santee, California. The aggregate purchase price of $12,350,000 consisted of cash consideration of $11,000,000 and the assumption of certain payables. Fanita Ranch is approved for approximately 1,400 residential units. The Company acquired the property with the intention of completing the necessary entitlements to develop the property as a master-planned community, although there can be no assurance that the Company will be successful in these efforts. If successful, obtaining all the entitlements is expected to take several years.

In February 2012, the Company acquired approximately 450 acres of land in Virginia Beach, Virginia for cash consideration of $17,000,000 excluding closing costs. The project is entitled for 455 single family lots, of which 91 are finished lots that can be sold immediately without any further development. The Company is currently preparing its sales and development plan for the property.

In July 2004, the Board of Directors approved the repurchase of up to 500,000 shares of the Company’s common stock, representing approximately 6% of the Company’s outstanding stock. Repurchased shares would be available for, among other things, use in connection with the Company’s stock option plan. The shares may be purchased from time to time, subject to prevailing market conditions, in the open market, in privately negotiated transactions or otherwise. Any such purchases may be commenced or suspended at any time without prior notice. The Company has purchased 395,409 shares to date, principally in 2008.

As indicated in the table below, at December 31, 2011, the Company’s contractual cash obligations consisted solely of its operating lease, which net of sublease income totaled $650,000.

|

Payments Due by Period (in thousands)

|

||||||||||||||||||||

|

Contractual Obligations

|

Total Amounts Committed

|

Less Than 1 Year

|

1-3 Years

|

4-5 Years

|

After 5

Years

|

|||||||||||||||

|

Operating lease, net of sublease income

|

$ | 650 | $ | 400 | $ | 250 | $ | - | $ | - | ||||||||||

As of December 31, 2011, the Company had NOLs of $17,600,000 available to reduce its future federal income tax liabilities and $32,400,000 of alternative minimum tax credit carryovers. The federal NOLs are not available to reduce federal alternative minimum taxable income, which is currently taxed at the rate of 20%. As a result, the Company expects to pay federal income tax at a rate of 20% during future periods. For more information, see Note 9 of Notes to Consolidated Financial Statements.

16

Off-Balance Sheet Arrangements

The Company is required to obtain infrastructure improvement bonds primarily for the benefit of the City of San Marcos prior to the beginning of lot construction work and warranty bonds upon completion of such improvements at the San Elijo Hills project. These bonds provide funds primarily to the City in the event the Company is unable or unwilling to complete certain infrastructure improvements in the San Elijo Hills project. Leucadia is contractually obligated to obtain these bonds on behalf of CDS and its subsidiaries pursuant to the terms of agreements entered into when CDS was acquired by the Company. CDS is responsible for paying all third party fees related to obtaining the bonds. Should the City or others draw on the bonds for any reason, certain of the Company’s subsidiaries would be obligated to reimburse Leucadia for the amount drawn. As of December 31, 2011, the amount of outstanding bonds was approximately $1,200,000, none of which has been drawn upon.

Results of Operations

Critical Accounting Estimates

The Company’s discussion and analysis of its financial condition and results of operations are based upon its consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”). The preparation of these financial statements requires the Company to make estimates and assumptions that affect the reported amounts in the financial statements and disclosures of contingent assets and liabilities. On an on-going basis, the Company evaluates all of these estimates and assumptions. Actual results could differ from those estimates.