Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - HOMEFED CORP | c795-20151231xex321.htm |

| EX-23 - EX-23 - HOMEFED CORP | c795-20151231xex23.htm |

| EX-31.2 - EX-31.2 - HOMEFED CORP | c795-20151231xex312.htm |

| EX-21 - EX-21 - HOMEFED CORP | c795-20151231ex215201994.htm |

| EX-31.1 - EX-31.1 - HOMEFED CORP | c795-20151231xex311.htm |

| EX-32.2 - EX-32.2 - HOMEFED CORP | c795-20151231xex322.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[x]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

[_]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number: 1-10153

HOMEFED CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

Delaware |

33-0304982 |

|

(State or other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

1903 Wright Place, Suite 220

Carlsbad, California 92008

(760) 918-8200

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.01 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [x]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ x ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K [x].

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer," "accelerated filer,” and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

|

Large accelerated filer |

[ ] |

|

Accelerated filer |

[ x ] |

|

|

Non-accelerated filer |

[ ] |

|

Smaller reporting company |

[ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12-b of the Exchange Act). Yes [ ] No [x]

Based on the average bid and asked prices of the Registrant’s Common Stock as published by the OTC Bulletin Board Service as of June 30, 2015, the aggregate market value of the Registrant’s Common Stock held by non-affiliates was approximately $194,486,900 on that date.

As of February 5, 2016, there were 15,411,500 outstanding shares of the Registrant’s Common Stock, par value $.01 per share.

DOCUMENTS INCORPORATED BY REFERENCE: NONE

LOCATION OF EXHIBIT INDEX

The index of exhibits is contained in Part IV on page 41.

PART I

Item 1.Business.

Overview

HomeFed Corporation is a developer and owner of residential and mixed-use real estate projects in California, Virginia, South Carolina, Florida, Maine and New York. After many years in the entitlement process, the majority of our assets are now either operating real estate or entitled land ready for sale. We may also from time to time investigate and pursue the acquisition of new real estate projects, both residential and commercial.

This section should be read in conjunction with the consolidated financial statements and related footnote disclosures contained in this report and the information set forth under the heading, “Cautionary Statement for Forward-Looking Information” in Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Strategic Priorities

In 2016, our primary strategic priority is to optimize our asset in the Otay Ranch area by focusing on expediting development and maximizing revenue over the coming years. In addition, we intend to continue to focus on lot sales with maximization of revenue at the San Elijo Hills, Ashville Park, and Market Common projects while initiating sales at the SweetBay project. We also plan to strategically develop land and continue the entitlement process where these activities are ongoing.

Company Information

At December 31, 2015, we and our consolidated subsidiaries had 31 full-time employees. Our executive office is located at 1903 Wright Place, Suite 220, Carlsbad, California 92008. Our primary telephone number is (760) 918-8200 and our website address is www.homefedcorporation.com.

As used herein, the term “Company”, “HomeFed”, “we”, “us”, “our” or similar expressions refer to HomeFed Corporation, and our subsidiaries, except as the context otherwise may require.

Recent Transactions

During 2015, we completed the acquisition of approximately 1,600 acres in the Otay Ranch area of San Diego County, California for a cash purchase price of $150,000,000. The land that was purchased is contiguous with the 2,800 acres of land in the Otay Ranch area already owned by us. The purchase was funded in part from working capital and from proceeds of a private sale and issuance of 6.5% Senior Notes due 2018 in the amount of $125,000,000.

During 2014, we acquired substantially all of the real estate properties, operations and investments of Leucadia National Corporation (“Leucadia”) and approximately $14,000,000 of cash (including cash acquired as part of working capital) in exchange for 7.5 million newly issued unregistered shares of HomeFed common stock (the “Acquisition”). The Acquisition more than doubled the amount of our assets and common shareholders’ equity at that time. See Note 2 to our Consolidated Financial Statements.

Our Businesses

We currently operate in three reportable segments—real estate, farming and corporate. Our real estate operations, which represent the majority of our operations, consist of a variety of residential and commercial land development projects and other unimproved land, all in various stages of development, and retail and office operating properties. Real estate also includes the equity method investments in BRP Holding and BRP Hotel, all of which were acquired during 2014 in the Acquisition. Farming operations consist of the Rampage property, a project with which we are conducting farming activities during the lengthy entitlement and development process. Corporate primarily consists of interest income and overhead expenses.

Real Estate

As the owner of development projects, we are responsible for the completion of a wide range of activities, including design engineering, grading raw land, constructing public infrastructure such as streets, utilities and public facilities, and finishing individual lots for home sites or other facilities. Prior to commencement of development, we may engage in incidental activities to maintain the value of the project; such activities are not treated as a separate operating segment. We develop and market our communities in phases to allow ourselves the flexibility to sell finished lots to suit market conditions and to enable us to create stable and attractive neighborhoods. Consequently, at any particular time, the various phases of a project will be in different stages of land development and construction. In addition, from time to time we have received expressions of interest from buyers for multiple phases of a project,

2

or the remaining undeveloped land of an entire project. We evaluate these proposals when we receive them, but no assurance can be given that we will sell all or any portion of our development projects in such a manner.

For any master-planned community, plans must be prepared that provide for infrastructure, neighborhoods, commercial and industrial areas, educational and other institutional or public facilities, adequate water supply, as well as open space, in compliance with regulations regarding reduction in emissions of greenhouse gases, local growth ordinances, affordable housing, storm water permits and in California Title 24 (the “Cal Green” code). Once preliminary plans have been prepared, numerous governmental approvals, licenses, permits and agreements, referred to as “entitlements,” must be obtained before development and construction may commence. These often involve a number of different governmental jurisdictions and agencies, challenges through litigation, considerable risk and expense, and substantial delays. Unless and until the requisite entitlements are received and substantial work has been commenced in reliance upon such entitlements, a developer generally does not have full “vested rights” to develop a project, and as a result, allocation of acreage between developable and non-developable land may change. In addition, as a precondition to receipt of building-related permits, master-planned communities are typically required to pay impact and capacities fees, or to otherwise satisfy mitigation requirements.

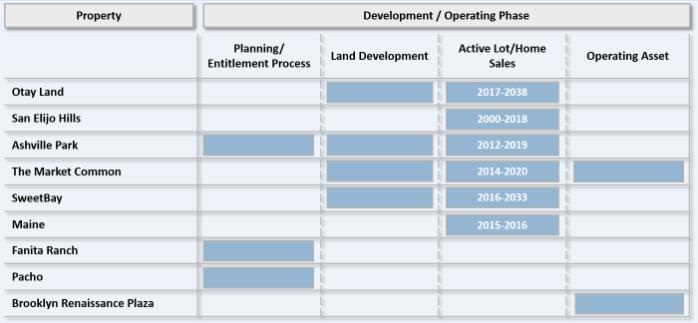

The following table summarizes the stages of development of our properties:

Otay Land

In October 1998, we acquired approximately 4,850 non-adjoining acres of land located within the larger 22,900 acre Otay Ranch master-planned community south of San Diego, California (title is owned in fee simple). The City of Chula Vista and the County of San Diego approved a General Development Plan (“GDP”) for the larger planning area in 1993.

Since acquisition, we disposed of part of the land in several sales transactions and an eminent domain proceeding. After considering these dispositions, we own approximately 2,800 acres, of which the total developable area is approximately 700 acres, including approximately 170 acres of land designated as “Limited Development Area and Common Use Area.” The remaining approximately 2,100 acres are designated as various qualities of non-developable open space mitigation land. Under the GDP, 1.188 acres of open space mitigation land from within the Otay Ranch area must be dedicated to the government for each 1.0 acre of land that is developed, excluding land designated Limited Development Area and Common Use Area. We currently have substantially more mitigation land than we would need to develop our property at this project. This land could have value to other developers within the larger Otay Ranch development area or elsewhere, should such developers need to acquire additional mitigation land for their projects.

Although there is no specified time within which implementation of the GDP must be completed, it is expected that full development of the larger planning area will take many years. The GDP establishes land use goals, objectives and policies within the larger planning area. The GDP for the larger planning area contemplates home sites, a golf-oriented resort and residential community, commercial retail centers, a proposed university site and a network of infrastructure, including roads and highways, a public transportation system, park systems and schools. Any development within the larger Otay Ranch master-planned community must be consistent with the GDP.

In March 2015, we completed the acquisition of approximately 64 acres of land in the Otay Ranch area of San Diego County, California for a cash purchase price of $3,750,000. The land is entitled for 26 acres of industrial development and 62 single family

3

homes. On July 2, 2015, we completed the acquisition of approximately 1,600 acres in the Otay Ranch area of San Diego County, California for a cash purchase price of $150,000,000. In June 2015, we made a $1,000,000 option deposit for the Otay land that was applied to the purchase price on July 2, 2015. The land that was purchased is contiguous with the land we already owned and is entitled for approximately 2,640 single family lots, approximately 4,300 multi-family residential units and 40,000 square feet of commercial space. The purchased land includes approximately 30 acres of land designated for industrial and office space development and 700 acres of land designated for open space and preserve. The purchase was funded in part by our working capital and in part by the proceeds of the private offering, sale and issuance of the 6.5% Senior Notes in the amount of $125,000,000.

Our combined Otay Land project is now approved for approximately 13,050 residential units and 1.85 million square feet of commercial space. As part of the approval of entitlements related to the original Otay Land property, we made a $1,000,000 university endowment payment, and we dedicated a 50 acre parcel to the City of Chula Vista for the university. The Otay Land project is in the early stages of development; as a result, we do not expect any sales in 2016. In addition, actual land development will require additional permits which are in process. When development throughout the project occurs, it will be phased based on market conditions at the time of development and the progress of infrastructure improvements. Development is expected to begin in the first village of the project during the first quarter of 2016. In addition, we are currently in the process of negotiating contracts with homebuilders for approximately 900 lots within the first village. We are also negotiating with the local school districts regarding their school site needs given the future growth throughout the development project. We are anticipating revenues may be derived from this project in 2017. The ultimate development of this project is likely to take many years. For additional information concerning governmental and environmental matters, see “Government Regulation” and “Environmental Compliance” below.

A map indicating the location of the Chula Vista General Plan area in San Diego County and a more detailed map showing general information about our land within that General Plan area can be found on Otay Land Company's website at www.otaylandcompany.com.

San Elijo Hills

We own 85% of the San Elijo Hills project, a master-planned community located in the City of San Marcos in San Diego County, California, consisting of approximately 3,500 homes and apartments, as well as a commercial and residential Towncenter. Since August 1998, we have been the development manager for this project, with responsibility for the overall management of the project, including, among other things, preserving existing entitlements and obtaining any additional entitlements required for the project, arranging financing for the project, coordinating marketing and sales activity, and acting as the construction manager. The development management agreement provides that we receive fees for the field overhead, management and marketing services we provide (“development management fees”), based on the revenues of the project.

Throughout much of the period that we have been developing the San Elijo Hills project, our sales efforts greatly benefited from a strong regional and national residential housing market. However, beginning in 2006, residential property sales volume, prices and new building starts declined significantly in many U.S. markets, including California and the greater San Diego region, which negatively affected sales and profits. Interest from homebuilders concerning the San Elijo Hills project’s remaining single family lots and multi-family units has increased since late 2009, and we have been able to sell some single family lots and multi-family units at acceptable prices. We have substantially completed development of all of our remaining residential single family lots at the San Elijo Hills project, many of which are “premium” lots which are expected to command premium prices. We believe that by exercising patience, we can best maximize shareholder value with our remaining residential lot inventory.

As of December 31, 2015, the San Elijo Hills project has sold 2,281 of the 2,382 single family lots and 1,071 of the 1,081 multi-family units. In addition, the project has 37,800 square feet of commercial space in the Towncenter. The Towncenter includes multi-family residential units and commercial space, which are being constructed in phases. We have completed construction of the first phase of the Towncenter, which included 12 residential condominium units, all of which have been sold, and 11,000 square feet of commercial space, all of which has been leased. In the fourth quarter of 2015, we entered into a contract with a local developer to sell phase one and phase two of the Towncenter as well as a two acre site in the Towncenter previously designated as a church site for a purchase price of $6,400,000. The purchase is contingent on the buyer obtaining plan approval from the City of San Marcos, the timing of which is uncertain.

General information about the San Elijo Hills project can be found at www.sanelijohills.com.

Ashville Park

In February 2012, we acquired Ashville Park, a 450 acre master planned community located in Virginia Beach, Virginia, with 451 entitled single family lots, one of which is a visitors center for $17,350,000. The project is being developed in phases: the first phase, Village A, is a development of 91 finished lots, and the second phase, Village B, a 164 lot development. As of December 31, 2015, all lots in Village A and Village B were sold. During August 2015, we agreed to purchase 67 acres of land for $5,000,000 located adjacent to our Ashville Park project with the intention to entitle an additional 67 single family lots into the project. We placed a $200,000 refundable deposit and submitted the plans to the City of Virginia Beach. The purchase is contingent upon approval of the

4

67 lot entitlement into our project by City of Virginia Beach within 180 days from the effective date of the agreement. If approved, the remaining amount will not be due until the earliest of (i) the first lot closing of the additional 67 lots added to the entitlements or (ii) December 31, 2018.

We are currently processing plans and permits to begin development work in Village C, which is planned for 71 single family homes starting at 13,500 square feet, and 45 single family homes starting at 18,000 square feet. We are currently negotiating contracts with homebuilders for lots within Village C and, if permits are received before the end of the second quarter 2016, revenues are anticipated beginning in the fourth quarter 2016. The clubhouse and pool facility is anticipated to be completed during the first quarter 2016.

General information about the Ashville Park project can be found at www.ashvilleparkva.com.

Market Common

The Market Common is located in Myrtle Beach, South Carolina and was acquired in 2014 as part of the Acquisition. The project is a mixed-used retail, office and residential lifestyle center, including adjacent land for future commercial and residential development. The 114 acre mixed-use development is part of a larger 3,900 acre redevelopment of the Myrtle Beach Air Force Base that was closed in 1993. The Market Common includes a 346,580 square foot retail center, approximately 40,000 square feet of office space and 195 long term apartment units. The retail and office space, which opened in 2008, are currently 90% leased. The long term apartments are approximately 96% leased. Tenants in the retail center include: Barnes and Noble, PF Chang’s, Gordon Biersch, Anthropology, Chico’s, Piggly Wiggly, Pottery Barn, Victoria’s Secret and Grand 14 Cinema.

The balance of the residential land was entitled for up to 866 townhomes and 575 condominiums. Since 2008, several planning areas have been redesigned to include small single lot family homes into the master plan resulting in significantly less density. A local homebuilder has purchased and built approximately 340 townhome and single family homes. Final product design and density will likely change with market conditions.

General information about The Market Common can be found at www.marketcommonmb.com.

SweetBay Project

The SweetBay Project is a 700 acre mixed use master planned community located in Panama City, Florida. The project is a bay front planned community with over five miles of shoreline at the site of the former Panama City-Bay County International Airport. SweetBay is entitled for up to 3,200 single family and multi-family units, 700,000 square feet of commercial space, a marina with approval for 117 wet slips and 240 dry docks, as well as an extensive trail system, neighborhood parks and the new site of University Park Charter Academy. The school opened in 2012 in cooperation with Florida State University-Panama City and has relocated to the renovated former airport terminal building which currently provides space for 330 full-time K thru 5 students, eventually expanding to 536 students. The enrollment of the school is oversubscribed; however future residents of SweetBay will have an enrollment preference for up to 50% of the available seats. For the 2015-2016 school year, 54 student seats have been reserved for residents of SweetBay. After the 2015-2016 school year, we may increase or decrease the number of reserved seats for SweetBay residents in an annual notice to the school prior to commencement of the following school year. The financial contribution for reserved student seats is an amount equal to the state funding per student as determined by the Bay County School District and the State of Florida.

The school has a $5,525,000 loan outstanding for which we have pledged 42 acres of our land as collateral; although we are not obligated to repay the loan should the school fail to do so, we could lose the land we have pledged as collateral.

Development has begun in the initial portion of Phase 1 of the community consisting of 32 single family lots, with 9 models and a welcome center anticipated to be open in the first quarter 2016 with revenue anticipated to begin in the fourth quarter 2016. When completed, Phase 1 will include up to 260 single family lots. Entitlements include a Development Agreement with a 30-year term that sets forth the obligations between SweetBay and Panama City, the local jurisdiction for project approvals. Panama City and Bay County are considered a recovering housing market, with SweetBay the first and only entitled master planned community of its size in its market area.

General information about the SweetBay project can be found at www.sweetbayfl.com.

Maine Projects

The Maine Projects, Northeast Point and miscellaneous small mixed use lots in Rockport, Maine, were acquired in 2014 as part of the Acquisition. These properties are located in mid-coast Maine near the town of Camden, which has traditionally been a summer vacation destination for affluent families from Boston, New York and elsewhere.

Northeast Point is an entitled 45 acre project subdivided into 12 oceanfront lots and one existing residence on Islesboro Island, a small island community that is accessed by ferry service from Lincolnville, Maine, just north of Camden, Maine. Islesboro is predominantly

5

a seasonal destination for affluent families, some of whom have been coming to the island for generations. We continued marketing the Northeast Point lots for sale in 2015 and believe that by exercising patience, we can best maximize shareholder value for this project.

The various lots in Rockport have been marketed for sale since the fourth quarter of 2015.

Fanita Ranch

In January 2011, we acquired in a foreclosure sale the Fanita Ranch property, a 2,600 acre parcel of vacant land located in Santee, California, for aggregate consideration of $12,350,000. The City of Santee is located at the intersection of SR125 and SR52 in East San Diego County, about a 30 minute drive from downtown San Diego. We acquired the property with the intention of completing the necessary entitlements to develop the property as a master-planned community. Fanita Ranch was approved for approximately 1,400 residential units. The project’s Environmental Impact Report (“EIR”) and development agreement with the City of Santee were approved in 2007.

During 2013, the existing project entitlements for the Fanita Ranch property were successfully challenged under the California Environmental Quality Act (“CEQA”) related to alleged defects in the EIR. As a result, the City of Santee decertified the project’s EIR and rescinded the project’s discretionary approvals pending City compliance with the court order. We continue to evaluate our options, which could include addressing the defects in the existing entitlements or submitting an entirely new plan for the project.

If we are successful in obtaining an approved EIR, the timing of which is uncertain, there are no assurances that real estate market conditions, or costs of construction, will allow the project to be profitably developed as currently planned. If successful, obtaining all the entitlements is expected to take years.

During 2015, we received approval from the City of Santee to amend the General Plan. We are preparing the project and General Plan EIRs and will then prepare a new master development plan which will be the basis for a future plan submittal or development application to the City of Santee. As a prerequisite for development, we are working in cooperation with the City of Santee to complete a habitat preserve plan, which will create an open space preserve required by state and federal regulations for the City of Santee to process and approve our development plans. In addition, we are working with the City to complete an important traffic study involving State Highway Route 52 from the City of Santee west to the intersection with State Highway 5.

Pacho Project (Wild Cherry Canyon)

The Pacho Project, a leasehold interest in six separate contiguous parcels totaling 2,369 acres of unentitled property located along the central California coast in San Luis Obispo County, California, was acquired in 2014 as part of the Acquisition. The property is located in the hills above San Luis Obispo Bay and Avila Beach and is near several recreational and tourist attractions including beaches, golf courses and wineries. The city of San Luis Obispo, home of the 18,000 student California Polytechnic State University, is located approximately 10 miles from the site.

We own a 90% controlling interest in the partnerships that are the lessees under a 99 year lease entered into on December 26, 1968 with an option to renew for an additional 99 years. The lessor is an affiliate of Pacific Gas & Electric, which owns the nearby Diablo Canyon Power Plant. The property is largely open space used for grazing and features slopes rising above Avila Bay offering spectacular panoramic views in all directions. We have begun the very lengthy and what we expect to be a difficult process to entitle the property for development purposes.

BRP Leasing

BRP Leasing is the indirect obligor under a lease through October 2018 of approximately 286,500 square feet of office space at Brooklyn Renaissance Plaza, substantially all of which has been sublet through October 2018. We expect that these subleases will provide positive annual cash flow, net of the underlying lease.

Brooklyn Renaissance Plaza

Brooklyn Renaissance Plaza is comprised of a 665 room hotel operated by Marriott, an approximate 850,000 square foot office building complex and an 888 space parking garage located in Brooklyn, New York. We own a 25.80% equity interest in the hotel and a 61.25% equity interest in the office building and garage.

The office building and garage are owned in partnership with New York City based Muss Development Corporation and the hotel in partnership with Muss Development Corporation and Marriott International. Brooklyn Renaissance Plaza was originally built in 1998; an additional hotel tower was completed in 2005. Tenants in the office building include, among others, the King’s County District Attorney’s Office, New York City Board of Education, the United States General Services Administration and the United Federation of Teachers. Certain tenants were the original anchors of the building and their leases were used to secure construction

6

financing for a significant portion of the office building in the form of self-amortizing New York City Industrial Revenue Bonds. The leases that serve as collateral to the bondholders expire in 2018 at which time the bonds will be fully paid off.

In addition to its equity interest, Marriott manages the hotel for an annual fee subject to the achievement of certain performance thresholds. The hotel is in the process of a major renovation of the restaurant, lobby, banquet facilities and rooms which began during the first quarter of 2015. The renovation is expected to be completed in the third quarter of 2016. During the renovation process, revenues will be adversely affected across all revenue categories. The hotel is also subject to a mortgage loan that matures in January 2017; at December 31, 2015, the outstanding amount of the loan was approximately $85,350,000.

Competition

Real estate development is a highly competitive business. There are numerous residential real estate developers and development projects operating in the same geographic areas in which we operate. Competition among real estate developers and development projects is determined by the location of the real estate, the market appeal of the development plan, and the developer’s ability to build, market and deliver project segments on a timely basis. Many of our competitors may have greater financial resources and/or access to cheaper capital than us. Residential developers sell to homebuilders, who compete based on location, price, market segmentation, product design and reputation.

Government Regulation

The residential real estate development industry is subject to substantial environmental, building, construction, zoning and real estate regulations that are imposed by various federal, state and local authorities. In developing a community, we must obtain the approval of numerous government agencies regarding such matters as permitted land uses, housing density, the installation of utility services (such as water, sewer, gas, electric, telephone and cable television) and the dedication of acreage for open space, parks, schools and other community purposes. Regulations affect homebuilding by specifying, among other things, the type and quality of building materials that must be used, certain aspects of land use and building design and the manner in which homebuilders may conduct their sales, operations, and overall relationships with potential home buyers. Furthermore, changes in prevailing local circumstances or applicable laws may require additional approvals, or modifications of approvals previously obtained.

Timing of the initiation and completion of development projects depends upon receipt of necessary authorizations and approvals. Because of the provisional nature of these approvals and the concerns of various environmental and public interest groups, the approval process can be delayed by withdrawals or modifications of preliminary approvals and by litigation and appeals challenging development rights. Our ability to develop projects could be delayed or prevented due to litigation challenging previously obtained governmental approvals. We may also be subject to periodic delays or may be precluded entirely from developing in certain communities due to building moratoriums or "slow-growth" or "no-growth" initiatives that could be implemented in the future. Such delays could adversely affect our ability to complete our projects, significantly increase the costs of doing so, or drive potential customers to purchase competitors’ products.

Environmental Compliance

Environmental laws may cause us to incur substantial compliance, mitigation and other costs, may restrict or prohibit development in certain areas and may delay completion of our development projects. Delays arising from compliance with environmental laws and regulations could adversely affect our ability to complete our projects and significantly increase development costs.

Under various federal, state and local environmental laws, an owner or operator of real property may become liable for the costs of the investigation, removal and remediation of hazardous or toxic substances at that property. These laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the presence of the hazardous or toxic substances. In addition to remediation actions brought by federal, state and local agencies, the presence of hazardous substances on a property could result in personal injury, contribution or other claims by private parties. We have not received any claim or notification from any private party or governmental authority concerning environmental conditions at any of our properties.

As more fully discussed in the Annual Report on Form 10-K for the year ended December 31, 2013, upon receipt of required approvals, we commenced remediation activities on approximately 30 acres of undeveloped land owned by Flat Rock Land Company, LLC (“Flat Rock”), a subsidiary of Otay Land Company, LLC (“Otay”). The remediation activities were completed in February 2013. We received final approval of the remediation from the County of San Diego Department of Environmental Health in June 2013. Otay and Flat Rock commenced a lawsuit in California Superior Court seeking compensation from the parties who Otay and Flat Rock believe are responsible for the contamination of the property. In February 2015, the court denied us any recovery. We have filed an appeal of this decision; however, we can give no assurances that any appeal will be successful.

7

Farming

The Rampage Property is a 1,544 acre grape vineyard located in southern Madera County, California. Although this property is not currently entitled for residential development, it is located in a growing residential area northwest of Fresno, California. We purchased this land with the intention of obtaining the necessary entitlements to develop the property as a master-planned community, including meeting requirements with respect to adequate water supply. The entitlement and development process for the Rampage property is taking many years. In the interim, we have been conducting farming activities at the vineyard and, starting in 2010, have been generating positive cash flows from selling grapes.

During 2014, we purchased 95 acres of land adjacent to the Rampage property, which has been planted as an almond orchard. We have also converted approximately 200 acres of grape vineyard to expand the almond orchard. We expect to produce our first almond harvest in fall 2017 but will not experience full production until 2019.

Corporate

Corporate primarily consists of investment income and overhead expenses. Corporate amounts are not allocated to the operating units. The principal assets of the corporate segment are cash and cash equivalents.

Financial Information about Segments

Our reportable segments consist of the consolidated operating units identified above. Equity method investments include equity interests in other entities that we account for under the equity method of accounting and are not consolidated. Financial information regarding our reportable segments is contained in Note 17, Segment Information, in our consolidated financial statements.

Available Information

The Securities Exchange Commission (the “SEC”) maintains an internet site that contains reports, proxy or other information statements regarding issuers that file electronically with the SEC at www.sec.gov. The following documents and reports are available on or through our website as soon as reasonably practicable after we electronically file such material with, or furnish to, the SEC as applicable:

• Code of Business Practice;

• Reportable waivers, if any, from our Code of Business Practice by our executive officers;

• Charter of the Audit Committee of the Board of Directors;

• Annual reports on Form 10-K;

• Quarterly reports on Form 10-Q;

• Current reports on Form 8-K;

• Beneficial ownership reports on Forms 3, 4 and 5; and

• Any amendments to the above-mentioned documents and reports.

Shareholders may also obtain a printed copy of any of these documents or reports free of charge by sending a request to HomeFed Corporation, Investor Relations, 1903 Wright Place, Suite 220, Carlsbad, California 92008 or by calling (760) 918-8200.

Item 1A.Risk Factors.

Our business is subject to a number of risks. You should carefully consider the following risk factors, together with all of the other information included or incorporated by reference in this report, before you decide whether to purchase our common stock. The risks set out below are not the only risks we face. If any of the following risks occur, our business, financial condition and results of operations could be materially adversely affected. In such case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Our results of operations and financial condition are greatly affected by the performance of the real estate industry. The real estate development industry has historically been subject to up and down cycles driven by numerous market and economic factors, both national and local, beyond the control of the real estate developer. Because of the effect these factors have on real estate values, it is difficult to predict with certainty when future sales will occur or what the sales price will be.

Changes in mortgage interest rate levels could impact demand for housing. Our business is dependent upon the availability and cost of mortgage financing for potential homebuyers. Any significant increase in the prevailing low mortgage interest rate environment or decrease in available credit could reduce consumer demand for housing, and result in fewer home sales or lower sale prices.

Turmoil in the mortgage lending market has adversely affected our results in the past and could negatively impact our results in the future. The residential real estate development industry is dependent upon the availability of financing for both homebuilders

8

and homebuyers. Turmoil in the credit markets that began in 2008 resulted in a tightening of credit standards for residential and commercial mortgages and significantly reduced liquidity, adversely affecting the ability of homebuilders and homebuyers to obtain financing, which in turn adversely impacted our ability to sell lots. Although available liquidity in the mortgage lending market has improved since 2008, significant reductions in mortgage lending liquidity in the future would adversely affect our business.

Our financial results are dependent on the economic strength of the regions in which we own property. Significant increases in local unemployment and cost of living, including increases in residential property taxes, or concerns about the financial condition of the municipalities in which we have properties, could adversely affect consumer demand for our housing projects and negatively impact our financial results.

Residential property sales volume, prices and new building starts have declined significantly in many U.S. markets, which have negatively affected sales and profits. A worsening of current economic conditions could cause a decline in estimated future cash flows expected to be generated from our real estate projects, potentially resulting in impairment charges for real estate assets. When reviewing real estate assets for impairment, the most significant assumption made to determine estimated future cash flows is the estimated future selling prices of our real estate assets. If current conditions worsen and/or if we lower our estimate of future selling prices, impairment charges could be recorded.

Changes in domestic laws and government regulations or in the implementation and/or enforcement of government rules and regulations may delay our projects or increase our costs. Our plans for development projects require numerous government approvals, licenses, permits and agreements, which we must obtain before we can begin development and construction. Our negotiations with local authorities often result in requirements for us to incur development expenses related to improvements for roads, sewers or other common areas that are both inside and outside of our project area. The approval process can be delayed by withdrawals or modifications of preliminary approvals, by litigation and appeals challenging development rights and by changes in prevailing local circumstances or applicable laws that may require additional approvals. Regulatory requirements may delay the start or completion of our projects and/or increase our costs.

Demographic changes in the U.S. generally and California in particular could reduce the demand for housing. If the current trend of population increases in California were not to continue, or in the event of any significant reductions in employment, demand for real estate in California may decline from current levels.

Increases in real estate taxes and other local government fees could adversely affect our results. Increases in real estate taxes and other government fees may make it more expensive to own the properties that we are currently developing, which would increase our carrying costs of owning the properties.

Significant competition from other real estate developers and homebuilders could adversely affect our results. Many of our competitors may have advantages over us, such as more favorable locations which may provide better schools and easier access to roads and shopping, or amenities that we may not offer, as well as greater financial resources and/or access to cheaper capital. In addition, the downturn in the real estate markets nationwide could result in an influx of lower-priced lots and homes coming onto the market, as competitors need to address their individual liquidity needs. Lower-priced homes and lots would increase the competition we face, and could adversely affect our ability to sell lots and/or pricing.

Delays in construction schedules and cost overruns could adversely affect us. Any material delays could adversely affect our ability to complete our projects, significantly increasing the costs of doing so, or drive potential customers to purchase competitors’ products.

Increased costs for land, materials and for labor could adversely affect us. If these costs increase, it will increase the costs of completing our projects; if we are not able to recoup these increased costs, our results of operations would be adversely affected.

Imposition of limitations on our ability to develop our properties resulting from condemnations, environmental laws and regulations and developments in or new applications thereof could increase our costs and delay our projects. When we acquire our projects, our estimate of future profits and cash flows is derived from our estimates of future selling prices and development costs, less acquisition costs. Subsequent to acquisition, if environmental laws or other regulations change resulting in additional unanticipated costs, future profitability and cash flows could be reduced, and impairment charges might have to be recorded.

Our properties may be at risk from natural disasters beyond our control. Damage to any of our properties, whether by natural disasters, including earthquakes, hurricanes and fires or otherwise, may either delay or preclude our ability to develop and sell our properties, or affect the price at which we may sell such properties.

Under state law we could be liable for some construction defects in structures we build or that are built on land that we develop. State law imposes some liabilities on developers of land on which homes are built as well as on builders. Future construction defect litigation could be based on a strict liability theory based on our involvement in the project or it could be related to infrastructure improvements or grading, even if we are not building homes ourselves.

9

We may not be able to insure certain risks economically. We may experience economic harm if any damage to our properties is not covered by insurance or if our insurance is insufficient or unavailable. We cannot be certain that we will be able to insure all risks that we desire to insure economically or that all of our insurers will be financially viable if we make a claim.

Shortages of adequate water resources and reliable energy sources in the areas where we own real estate projects could adversely affect the value of our properties or restrict us from commencing development. If we are unable to obtain adequate water resources and reliable energy sources for our development projects, development of the projects might be delayed, resulting in reduced profitability and cash flows.

Opposition from local community, political or environmental groups with respect to construction or development at a particular site could increase development costs. At acquisition, the Fanita Ranch property had an approved EIR and development agreement. However, the projects existing entitlements have been challenged, some of which have been successful, resulting in us incurring legal expenses to defend our entitlements and being required to reimburse legal and other costs incurred by the plaintiffs. Further challenges to our entitlements at any of our projects are possible, which would result in increased legal fees, development costs and/or delays in development.

We own or have economic interests in real estate investments in California, Florida, Maine, New York, South Carolina and Virginia. As a result, our financial results are dependent on the economic strength of various regions within the U.S. Significant adverse changes in local economic conditions in areas where we own or are developing real estate projects, or concerns about the financial condition of the municipalities in which we have properties, could adversely affect the value of our projects and negatively impact our financial results.

Significant influence over our affairs may be exercised by our principal stockholders who could impact our business. As of February 5, 2016, Leucadia is the beneficial owner of an aggregate of 9,974,226 shares of our common stock or approximately 65% of our common stock outstanding. In addition, our other significant stockholders include our Chairman, Joseph S. Steinberg (approximately 4.8% beneficial ownership, including ownership by trusts for the benefit of his respective family members, but excluding Mr. Steinberg's private charitable foundation) who is also Chairman, a director and a significant stockholder of Leucadia. Pursuant to a stockholders agreement with the Company, Leucadia has agreed that to the extent its ownership of shares of our common stock exceeds 45% of the outstanding voting securities of the Company, Leucadia will limit its vote to no more than 45% of the total outstanding voting securities voting on any matter, assuming all of the total outstanding voting securities not owned by Leucadia vote on such matter. This concentration of equity ownership may delay or prevent a change in control of our Company and may make some transactions more difficult without the support of Leucadia. In addition, the interests of our significant stockholders may not always coincide with the interests of other stockholders.

We may not realize anticipated benefits of the acquisition of Leucadia’s real estate assets and investments and we face uncertainties with respect to our significantly expanded business. The acquisition is subject to numerous risks and uncertainties including:

|

|

· |

|

The failure to realize the anticipated benefits of the transaction; |

|

|

· |

|

The inability to manage the acquired assets effectively; |

|

|

· |

|

The disruption of our current ongoing business activity and distraction of management from ongoing business concerns; and |

|

|

· |

|

The potential for unknown costs associated with the acquired assets. |

The acquisition has resulted in a significant change in the composition of our assets. Consequently, our financial condition and results of operations may be affected by factors different from those affecting our financial condition and results of operations historically. In addition, we face risks and uncertainties integrating controls and systems, the failure of which to integrate could adversely affect our business and prospects.

Our common stock is subject to transfer restrictions. We and certain of our subsidiaries have certain tax attributes, the amount and availability of which are subject to certain qualifications, limitations and uncertainties. In order to reduce the possibility that certain changes in ownership could result in limitations on the use of the tax attributes, our certificate of incorporation contains provisions that generally restrict the ability of a person or entity from acquiring ownership (including through attribution under the tax law) of 5% or more of our common stock and the ability of persons or entities now owning 5% or more of our common stock from acquiring additional common stock. The restriction will remain until the earliest of (a) December 31, 2028, (b) the repeal of Section 382 of the Internal Revenue Code (or any comparable successor provision) and (c) the beginning of our taxable year to which these tax attributes may no longer be carried forward. The restriction may be waived by our board of directors. Stockholders are advised to carefully monitor their ownership of our common stock and consult their own legal advisors and/or us to determine whether their ownership of our common stock approaches the proscribed level.

10

Our common stock is not traded on NASDAQ or listed on any securities exchange. Prices for our common stock are quoted on the Over-the-Counter (OTC) Bulletin Board. Securities whose prices are quoted on the OTC Bulletin Board do not have the same liquidity as securities that trade on a recognized market or securities exchange. As a result, stockholders may find it more difficult to dispose of or obtain accurate quotations as to the market value of the securities.

We may not be able to finance our development projects and related business activities. There is no assurance that if desirable or required we will be able to obtain the financing needed to develop our properties. Financing may depend on our financial condition, the creditworthiness of our projects and the availability of credit based on both market and economic conditions.

The terms of our indebtedness contain various covenants that could limit our business activities. The terms of our indebtedness contain, and our future indebtedness may contain, various restrictive covenants that limit our management’s discretion in operating our business. In particular, the indenture dated June 30, 2015, among us, our domestic wholly-owned subsidiaries and Wilmington Trust, N.A., as trustee (the “Indenture”) governing our 6.5% Senior Notes with an aggregate principal amount of $125,000,000 due 2018 contains certain covenants, among other things, that restrict our and our subsidiary guarantors’ ability to incur, issue, assume or guarantee certain indebtedness; issue shares of disqualified or preferred stock; incur liens; pay dividends on equity; or consummate certain asset sales or affiliate transactions. We cannot assure you that we will be able to satisfy any of these covenants in the future or that we will be able to pursue our new business strategies within the constraints of these restrictive covenants in our Indenture. Additionally, the Indenture contains certain customary events of default, including failure to comply with the covenants contained therein, which may result in the acceleration of the maturity of the Notes.

Our ability to comply with our covenants under the Indenture may be affected by events beyond our control. Examples of such events beyond our control include prevailing economic, financial and industry conditions. The breach of our covenants could result in an event of default under our Indenture. Such breach could result in the acceleration of all amounts borrowed thereunder and cause them to become due and payable, together with accrued interest. Alternative sources of financing may not be available to us under these circumstances or available on attractive terms. We may incur other indebtedness in the future that may contain financial or other covenants more restrictive than those applicable to the Indenture.

Our ability to access our cash may be affected by adverse events relating to our banks that may be beyond our control. Our cash accounts are not insured or otherwise protected. Should the bank holding our cash deposits become insolvent, or if we are otherwise unable to withdraw funds, we could lose the cash on deposit with that particular bank or trust company.

As we enter into the homebuilding market, we will face increased exposure to the fluctuations in the housing market. Reduction in demand may adversely affect our results. Demand for our homes will be subject to fluctuations, often due to factors outside of our control. Cancellations of agreements for the sale of homes or the ability of home buyers to obtain suitable financing to consummate the home purchases could also impact our results. Further, a reduction in home sales may impair our ability to recoup development costs or force us to absorb additional costs in connection with the engagement of the builder and its subcontractors to build homes.

We will rely on builders who will hire subcontractors to construct our homes. The failure of the builders and their subcontractors to properly construct our homes may be costly. The builders will engage subcontractors to perform the actual construction of our homes. Despite the builders’ quality control efforts, we may discover that the subcontractors are engaging in improper construction practices. The occurrence of such events could require us to repair the homes in accordance with our standards and as required by law. The cost of satisfying our legal obligations in these instances may be significant, and we may be unable to recover the cost of repair from the builders, subcontractors, suppliers and insurers.

Product liability claims and litigation and warranty claims that arise in the ordinary course of business may be costly, which could adversely affect our business. As we enter the homebuilding market, we may be subject to increased exposure to construction defect and home warranty claims that commonly arise in the ordinary course of business and can be costly. In addition, the costs of insuring against construction defect and product liability claims are high, and the amount of coverage offered by insurance companies is currently limited. There can be no assurance that this coverage will not be further restricted and become more costly. If the limits or coverages of our current and former insurance programs prove inadequate, or we are not able to obtain adequate or reasonably priced, insurance against these types of claims in the future, we may experience losses that could negatively impact our financial results.

Item 1B. Unresolved Staff Comments.

Not applicable.

11

Item 2. Properties.

At December 31, 2015, we are the developer of various real estate properties, all of which are described under Item 1. Business under our Real Estate segment disclosure. Our real estate had an aggregate book value of approximately $345,050,000 at December 31, 2015.

We lease 8,944 square feet for our corporate headquarters which is located at 1903 Wright Place, Suite 220, Carlsbad, California 92008. We rent office space at our corporate headquarters to Leucadia for an annual rent of $12,000, payable monthly.

At the San Elijo Hills project, we have a lease in place at the Towncenter through December 31, 2016 for a monthly rent of $2,500.

BRP Leasing leases 286,500 square feet of office space at Brooklyn Renaissance Plaza, substantially all of which has been sublet through October 2018.

Item 3. Legal Proceedings.

From time to time, we and our subsidiaries may be parties to legal proceedings that are considered to be either ordinary, routine litigation, incidental to our business or not material to our consolidated financial position or liquidity. We do not believe that the ultimate resolution of any such matters will materially affect our consolidated financial position, consolidated results of operations or liquidity.

Item 4. Mine Safety Disclosures.

Not applicable.

12

PART II

Item 5.Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is traded in the over-the-counter market under the symbol “HOFD.” Our common stock is not listed on any stock exchange, and price information for the common stock is not regularly quoted on any automated quotation system. We do not currently meet certain requirements for listing on a national securities exchange or inclusion on the Nasdaq Stock Market.

The following table sets forth, for the two most recently completed fiscal years indicated, the high and low bid price of our common stock, as published by the National Association of Securities Dealers OTC Bulletin Board Service.

|

High |

Low |

||

|

|

|

|

|

|

2014 |

|

|

|

|

First Quarter |

$48.60 |

|

$35.50 |

|

Second Quarter |

57.00 |

|

47.00 |

|

Third Quarter |

57.00 |

|

50.00 |

|

Fourth Quarter |

52.25 |

|

44.75 |

|

|

|

|

|

|

2015 |

|

|

|

|

First Quarter |

$47.25 |

|

$42.45 |

|

Second Quarter |

49.85 |

|

45.25 |

|

Third Quarter |

47.95 |

|

40.51 |

|

Fourth Quarter |

45.50 |

|

34.00 |

|

|

|

|

|

|

2016 |

|

|

|

|

First quarter (through February 5, 2016) |

$36.50 |

|

$32.50 |

The over-the-counter quotations reflect inter-dealer prices, without retail mark up, markdown or commission, and may not represent actual transactions. On February 5, 2016, the closing bid price for our common stock was $35.00 per share. As of that date, there were 408 stockholders of record. No dividends were paid during 2015 or 2014 to HomeFed common shareholders. We do not have a regular dividend policy and whether or not to pay dividends is subject to the discretion of our Board of Directors.

During the second quarter of 2015, dividends of $22,000,000 were declared and distributed by our subsidiary that owns the San Elijo Hills project, of which $3,300,000 was paid to the noncontrolling interests in the San Elijo Hills project, and the balance was transferred to HomeFed Corporation. The dividends retained by us did not increase the amount of consolidated liquidity reflected on our consolidated balance sheet; however, they did increase the liquidity of HomeFed Corporation.

We and certain of our subsidiaries have tax attributes, and the amount and availability of which are subject to certain qualifications, limitations and uncertainties. In order to reduce the possibility that certain changes in ownership could result in limitations on the use of our tax attributes, our certificate of incorporation contains provisions which generally restrict the ability of a person or entity from acquiring ownership (including through attribution under the tax law) of five percent or more of the common stock and the ability of persons or entities now owning five percent or more of the common stock from acquiring additional common stock. The restrictions will remain in effect until the earliest of (a) December 31, 2028, (b) the repeal of Section 382 of the Internal Revenue Code (or any comparable successor provision) and (c) the beginning of our taxable year to which certain tax benefits may no longer be carried forward.

The transfer agent for our common stock is American Stock Transfer & Trust Company, 59 Maiden Lane, New York, New York 10038.

In July 2004, the Board of Directors approved the repurchase of up to 500,000 shares of our common stock. As of December 31, 2015, 104,591 common shares remain available for repurchase under this program. The shares may be purchased from time to time, subject to prevailing market conditions, in the open market, in privately negotiated transactions or otherwise. Any such purchases may be commenced or suspended at any time without prior notice.

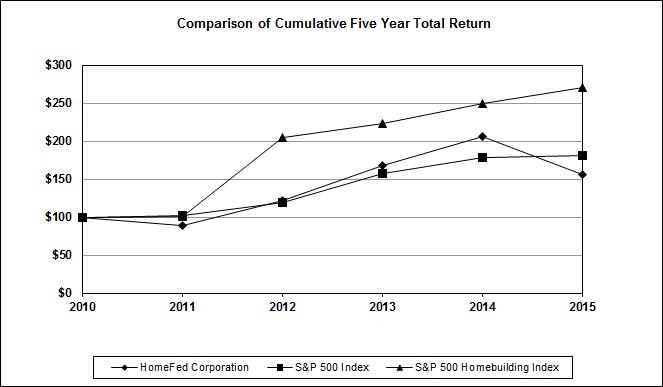

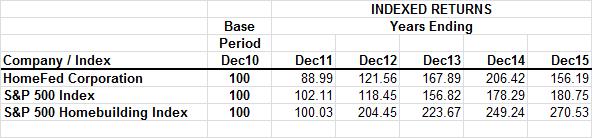

Stockholder Return Performance Graph

Set forth below is a graph comparing the cumulative total stockholder return on our common stock against the cumulative total return of the Standard & Poor’s 500 Stock Index and the Standard & Poor’s Homebuilding-500 Index for the period commencing December 31, 2010 to December 31, 2015. Index data was furnished by Standard & Poor’s Capital IQ. The graph assumes that $100 was

13

invested on December 31, 2010 in each of our common stock, the S&P 500 Index and the S&P 500 Homebuilding Index and that all dividends were reinvested.

Item 6. Selected Financial Data.

The following selected financial data have been summarized from our consolidated financial statements and are qualified in their entirety by reference to, and should be read in conjunction with, such consolidated financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations, contained in Item 7 of this Report. Consolidated operations are reflected from the date of acquisition, which for the Acquisition was March 28, 2014.

|

Year Ended December 31, |

|||||

|

2015 |

2014 |

2013 |

2012 |

2011 |

|

|

(In thousands, except per share amounts) |

|||||

|

SELECTED INCOME STATEMENT DATA: |

|||||

|

Revenues |

$69,538 | $59,505 | $56,804 | $35,849 | $34,255 |

|

Expenses |

61,257 | 54,066 | 38,491 | 24,444 | 24,172 |

|

Net income (a) |

6,503 | 4,732 | 12,704 | 7,432 | 6,097 |

|

Net income attributable to HomeFed |

|

|

|

|

|

|

Corporation common shareholders (a) |

5,835 | 3,886 | 11,268 | 6,022 | 4,491 |

|

Basic earnings per share (a) |

$0.38 | $0.29 | $1.43 | $0.76 | $0.57 |

|

Diluted earnings per share (a) |

$0.38 | $0.29 | $1.43 | $0.76 | $0.57 |

14

|

At December 31, |

||||||

|

2015 |

2014 |

2013 |

2012 |

2011 |

||

|

(In thousands, except per share amounts) |

||||||

|

SELECTED BALANCE SHEET DATA: |

||||||

|

Cash and cash equivalents |

$66,676 | $61,495 | $57,306 | $22,987 | $40,820 | |

|

Investments available for sale |

- |

35,898 | 31,896 | 36,390 | 43,297 | |

|

Real estate held for development |

301,683 | 143,301 | 103,465 | 116,537 | 88,817 | |

|

Real estate held for investment, net |

43,347 | 45,184 | 3,607 | 3,708 | 3,809 | |

|

Total assets |

555,311 | 433,189 | 204,402 | 189,409 | 188,753 | |

|

HomeFed Corporation shareholders’ equity |

406,381 | 399,895 | 179,835 | 168,380 | 157,706 | |

|

Shares outstanding |

15,408 | 15,388 | 7,880 | 7,880 | 7,880 | |

|

Book value per share (b) |

$26.37 | $25.99 | $22.82 |

$21.37 |

$20.01 | |

|

(a) |

After taking into consideration our 2015 results of operations, we determined that tax credits can be applied to our 2015 taxable income which results in our valuation allowance exceeding our deferred tax assets related to minimum tax credits. As a result, $1,550,000 of the deferred tax valuation allowance was reduced as a credit to income tax expense during 2015. For the years ended December 31, 2014, 2013 and 2012, we decreased our deferred tax valuation allowance by recording a decrease to our income tax provision of $900,000, $1,350,000 and $750,000, respectively. |

|

(b) |

Excludes noncontrolling interest. |

Item 7.Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The purpose of this section is to discuss and analyze our consolidated financial condition, liquidity and capital resources and results of operations. This analysis should be read in conjunction with the consolidated financial statements, related footnote disclosures and the following “Cautionary Statements for Forward-Looking Information.”

Cautionary Statement for Forward-Looking Information

Statements included in this report may contain forward-looking statements. Such statements may relate, but are not limited, to projections of revenues, income or loss, development expenditures, plans for growth and future operations, competition and regulation, as well as assumptions relating to the foregoing. Such forward-looking statements are made pursuant to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are inherently subject to risks and uncertainties, many of which cannot be predicted or quantified. When used in this report, the words “will,” “could,” “estimates,” “expects,” “anticipates,” “believes,” “plans,” “intends” and variations of such words and similar expressions are intended to identify forward-looking statements that involve risks and uncertainties. Future events and actual results could differ materially from those set forth in, contemplated by or underlying the forward-looking statements.

Factors that could cause actual results to differ materially from any results projected, forecasted, estimated or budgeted or may materially and adversely affect our actual results include, but are not limited to, those set forth in Item 1A. Risk Factors and elsewhere in this report and in our other public filings with the SEC.

Undue reliance should not be placed on these forward-looking statements, which are applicable only as of the date hereof. We undertake no obligation to revise or update these forward-looking statements to reflect events or circumstances that arise after the date of this report or to reflect the occurrence of unanticipated events.

2014 Acquisition

On February 28, 2014, we entered into an agreement with Leucadia pursuant to which we agreed to purchase substantially all of Leucadia’s real estate properties and operations, its membership interests in Brooklyn Renaissance Holding Company LLC (“BRP Holding”) and Brooklyn Renaissance Hotel LLC (“BRP Hotel,” and collectively with BRP Holding, “Brooklyn Renaissance Plaza”), and cash of approximately $14,000,000 (including cash acquired as part of working capital of $1,500,000) in exchange for 7,500,000 newly issued unregistered HomeFed common shares (the “Acquisition”). On March 28, 2014, we completed the initial closing of the Acquisition, which consisted of (i) all of the assets to be acquired except for a portion of Leucadia’s membership interest in BRP Holding, and (ii) cash of approximately $14,000,000 (including cash acquired as part of working capital of $1,500,000). At the initial closing, we issued to Leucadia 6,986,337 shares of our unregistered common stock. During September 2014, we acquired the balance of Leucadia’s membership interest in BRP Holding in exchange for 513,663 additional shares of our unregistered common stock.

The Acquisition was accounted for using the acquisition method of accounting. The aggregate purchase price of approximately $215,700,000 (or approximately $29 per our common share included in the consideration) was based on the fair value of the assets and liabilities acquired in the transaction. The transaction more than doubled the amount of our assets and common shareholders’ equity. Except for a 90% partnership interest in each of Pacho Limited Partnership and San Luis Bay Limited Partnership, and the membership interests in Brooklyn Renaissance Plaza, we acquired 100% of the equity interests of each of the real estate entities. All

15

of the newly acquired entities are consolidated by us, except for the membership interests in Brooklyn Renaissance Plaza, which are accounted for under the equity method of accounting. We did not assume any debt or liabilities in the transaction other than liabilities incurred in the normal course of business.

Results of Operations

We have three reportable segments—real estate, farming and corporate. Real estate operations consist of a variety of residential land development projects and commercial properties and other unimproved land, all in various stages of development. Real estate also includes the equity method investments in BRP Holding and BRP Hotel, all of which were acquired during 2014 in the Acquisition. Farming operations consist of the Rampage property which includes an operating grape vineyard and an almond orchard. Corporate primarily consists of investment income and overhead expenses. Corporate amounts are not allocated to the operating units.

Certain information concerning our segments for the years ended 2015, 2014 and 2013 is presented in the following table. Consolidated operations are reflected from the date of acquisition, which for the Acquisition was March 28, 2014.

|

2015 |

2014 |

2013 |

||||||

|

(in thousands) |

||||||||

|

Revenues: |

||||||||

|

Real estate |

$ |

64,484 |

$ |

54,294 |

$ |

51,738 | ||

|

Farming |

5,042 | 5,199 | 5,054 | |||||

|

Corporate |

12 | 12 | 12 | |||||

|

Total consolidated revenues |

$ |

69,538 |

$ |

59,505 |

$ |

56,804 | ||

|

Income (loss) from continuing operations before income |

||||||||

|

taxes and noncontrolling interest: |

||||||||

|

Real estate |

$ |

16,137 |

$ |

14,470 |

$ |

24,822 | ||

|

Farming |

1,242 | 1,719 | 1,899 | |||||

|

Corporate |

(8,620) | (9,974) | (7,519) | |||||

|

Total consolidated income from continuing operations |

||||||||

|

before income taxes and noncontrolling interest |

$ |

8,759 |

$ |

6,215 |

$ |

19,202 | ||

As a result of the Acquisition, the newly acquired entities were consolidated for the twelve months ended December 31, 2015 versus only approximately nine months of activity during 2014. General and administrative expenses of the newly acquired entities increased $250,000 primarily related to marketing expenses (principally SweetBay), and depreciation and amortization increased by $250,000 as a result of this difference.

As a result of the Acquisition, general and administrative expenses increased by $1,450,000 in 2014 as compared to 2013 due to the size, complexity and location of the newly acquired real estate projects. Salaries expense increased by $400,000 (due to increase in headcount), professional fees also increased by $400,000 (primarily at the Maine and Pacho projects), legal expenses increased by $300,000, travel expenses increased by $250,000 (reflects that all of the acquired projects are located outside the state of California, which is the location of our headquarters) and insurance expense increased by $100,000.

As a result of the Acquisition, depreciation and amortization also increased by $3,600,000 in 2014 as compared to 2013 due to the amortization of acquired intangibles as well as adjustments to depreciation expense to account for the difference between the fair value of the acquired assets and their historical cost.

Real Estate

Otay Land Project:

There were no sales of real estate at the Otay Land project during 2015, 2014 and 2013.

During 2013, Otay and Flat Rock received $750,000 relating to the lawsuit against multiple parties for environmental contamination of the property.

General and administrative expenses decreased by $800,000 in 2015 compared to 2014 and decreased by $750,000 in 2014 compared to 2013 due to decreased legal activity pertaining to Otay Land Company and Flat Rock Land Company’s lawsuit related to the environmental contamination of the property. In 2015, professional fees declined by $100,000 due to general fluctuation in business activity at the project.

16

San Elijo Hills Project:

For the three years ended December 31, we have closed on sales of real estate as follows:

|

|

2015 |

|

2014 |

|

2013 |

|||

|

Number of units sold: |

|

|

|

|

|

|

|

|

|

Single family lots |

|

44 |

|

|

23 |

|

|

86 |

|

Multi-family lots |

|

- |

|

|

- |

|

|

- |

|

Residential condominium units |

|

- |

|

|

- |

|

|

1 |

|

Single family homes |

|

- |

|

|

10 |

|

|

- |

|

Purchase price, net of closing costs: |

|

|

|

|

|

|

|

|

|

Single family lots |

$ |

23,200,000 |

$ |

9,200,000 |

$ |

32,500,000 | ||

|

Multi-family lots |

$ |

- |

$ |

- |

$ |

- |

||

|

Residential condominium units |

$ |

- |

$ |

- |

$ |

700,000 | ||

|

Single family homes |

$ |

- |

$ |

15,350,000 |

$ |

- |

||

|

School lot sale |

$ |

- |

$ |

- |

$ |

5,800,000 | ||

Revenues recognized at closing were $22,000,000, $24,400,000 and $37,850,000 for 2015, 2014 and 2013, respectively. Since we are obligated to complete certain improvements to the lots sold, a portion of the revenue from sales of real estate is deferred, and is recognized as revenues upon the completion of the required improvements to the property, including costs related to common areas, under the percentage of completion method of accounting. Revenues include previously deferred amounts of $80,000, $1,150,000 and $200,000, respectively, for 2015, 2014 and 2013.

Revenues from sales of real estate at the San Elijo Hills project also include amounts recognized pursuant to revenue or profit sharing with homebuilders of $1,800,000 for the year ended December 31, 2014.

We recorded co-op marketing and advertising fee revenue of approximately $450,000, $800,000 and $950,000 for the years ended December 31, 2015, 2014 and 2013, respectively. We record these fees pursuant to contractual agreements, which is generally when builders sell homes based upon a fixed percentage of the homes’ selling price.

During 2015, 2014 and 2013, cost of sales of real estate aggregated $11,900,000, $14,500,000 and $15,200,000, respectively. Cost of sales was recognized in the same proportion to the amount of revenue recognized under the percentage of completion method of accounting.

General and administrative expenses held steady in 2015 as compared to 2014 resulting from a slight decrease in marketing expenses due to less available inventory to sell, mostly offset by a slight rise in legal expenses related to increased activity to settle the trademark litigation.

General and administrative expenses decreased during 2014 as compared to 2013 due to decreased legal activity related to trademark and general matters of $250,000, the settlement of a legal dispute with a neighboring land owner during 2013 for $100,000 and onsite security of $90,000 that was no longer necessary in 2014.

Ashville Park:

For the three years ended December 31, we have closed on sales of real estate as follows:

|

2015 |

2014 |

2013 |

||||||

|

Number of units sold: |

|

|

|

|

|

|

|

|

|

Single family lots- Village A |

|

- |

|

|

15 |

|

|

22 |

|

Single family lots- Village B |

|

37 |

|

|

37 |

|

|

90 |

|

Purchase price, net of closing costs: |

|

|

|

|

|

|

|

|

|

Single family lots- Village A |

$ |

- |

$ |

2,500,000 |

$ |

3,900,000 | ||

|

Single family lots- Village B |

$ |

5,200,000 |

$ |

4,450,000 |

$ |

9,000,000 | ||