Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Hyatt Hotels Corp | d8k.htm |

Exhibit 99.1 |

2

Forward-Looking Statements in this presentation, which are not historical facts, are

forward-looking statements within the meaning of the Private Securities Litigation Reform

Act of 1995. These statements include statements about our plans, strategies, occupancy and ADR

trends, market share, the number of properties we expect to open in the future, our expected capital

expenditures, depreciation and amortization expense and interest expense, estimates, financial

performance, prospects or future events and involve known and unknown risks that are difficult

to predict. As a result, our actual results, performance or achievements may differ materially from those expressed or

implied by these forward-looking statements. In some cases, you can identify forward-looking

statements by the use of words such as “may,” “could,” “expect,”

“intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” “likely,” “will,”

“would” and variations of these terms and similar expressions, or the negative

of these terms or similar expressions. Such forward-looking statements are necessarily

based upon estimates and assumptions that, while considered reasonable by us and our management, are

inherently uncertain. Factors that may cause actual results to differ materially from current

expectations include, among others, the depth and duration of the current economic downturn;

levels of spending in the business, travel and leisure industries as well as consumer

confidence; declines in occupancy and average daily rate; hostilities, including future terrorist

attacks, or fear of hostilities that affect travel; travel-related accidents; changes

in the tastes and preferences of our customers; relationships with associates and labor unions

and changes in labor law; the financial condition of, and our relationships with, third-party

property owners, franchisees and hospitality venture partners; if our third-party owners,

franchisees or development partners are unable to access the capital necessary to fund

current operations or implement our plans for growth; risk associated with potential acquisitions and

dispositions and the introduction of new brand concepts; changes in the competitive

environment in our industry and the markets where we operate; outcomes of legal proceedings;

changes in federal, state, local or foreign tax law; fluctuations in currency exchange rates; general volatility of the capital

markets; our ability to access the capital markets; and other risks discussed in the Company’s

filings with the U.S. Securities and Exchange Commission, including our Annual Report on

Form 10-K, which filings are available from the SEC. We caution you not to place undue

reliance on any forward-looking statements, which are made as of the date of this presentation. We undertake no obligation to

update publicly any of these forward-looking statements to reflect actual results, new information

or future events, changes in assumptions or changes in other factors affecting

forward-looking statements, except to the extent required by applicable laws. If we

update one or more forward-looking statements, no inference should be drawn that we will make

additional updates with respect to those or other forward-looking

statements.

In this presentation, management has referred to Adjusted EBITDA, which is not presented in accordance

with US GAAP. For our definition of Adjusted EBITDA and a reconciliation of

consolidated Adjusted EBITDA to EBITDA and a reconciliation of EBITDA to net income (loss)

attributable to Hyatt Hotels Corporation, please refer to Part I, Item 7 “Management’s Discussion and Analysis of Financial

Condition and Results of Operations – Results of Operations” of our Annual Report on Form

10-K for fiscal year 2009 or the information posted on the Investor Relations page of the

Company’s website, which can be accessed at http://www.hyatt.com and by selecting the

Investor Relations link located at the bottom of the

page.

|

3

Mission / Goal / Values

To

become the most preferred brand

in each segment that we serve for our

associates, guests and owners

foster a

common purpose and culture

within the Hyatt family through shared core values of

mutual respect, intellectual honesty and integrity,

humility, fun, creativity and innovation

We aim to

provide authentic hospitality

To

by making a difference in the lives of the people

we touch every day, including our

associates, guests and owners |

4

Key Highlights

Global footprint in key gateway cities provides a foundation

for expansion in high growth markets

Strategy of owning, managing and franchising properties

provides diversity of earnings streams and growth opportunities

Strong capital base and ability to support growth

Experienced management team

Premier brands and a long-term strategic focus on

brand preference |

5

Expanding Our Presence

in Attractive Markets

Increase market presence

Increase focus on franchising,

primarily in North America

Utilize our capital and asset base for

targeted growth

Improvement in the

Performance of Existing Hotels

Focus on associate engagement

Enhance operational efficiency

Enhance customer satisfaction

Increase revenue share of hotel in its

market

Renovate / re-invest in owned hotels

Strategy Drives Brand Preference and

Shareholder Value |

6

Portfolio of Brands

Note: Percentages based upon room/unit counts as of March 31, 2010

Select Service Upscale

(15%)

Luxury

(4%)

Select Service Extended Stay

(3%)

Vacation Ownership / Residential

(2%)

Upper Upscale

(76%) |

7

Distribution Overview

Hyatt /

Hyatt Regency

71,277

58%

Grand Hyatt

21,567

17%

Hyatt Place

19,055

15%

Hyatt

Residential

1,337

1%

Hyatt Vacation

Ownership

962

1%

Andaz

912

1%

Summerfield

Suites

4,213

3%

Park Hyatt

4,729

4%

Total Rooms by Brand

Total Room Portfolio Mix

Rooms

By

Region

Owned &

Leased

28,315

23%

Managed

64,468

52%

Franchised

17,224

14%

Unconsolidated

Hospitality Venture

11,746

9%

Residential

Property

1,337

1%

Vacation

Ownership

962

1%

Note: Room/unit counts as of March 31, 2010

1

Excludes Timeshare and Residences

We have 124,052 rooms/units in our worldwide portfolio

North

America

71%

ASPAC

17%

EAME

7%

Southwest

Asia

3%

Other

Americas

2%

1 |

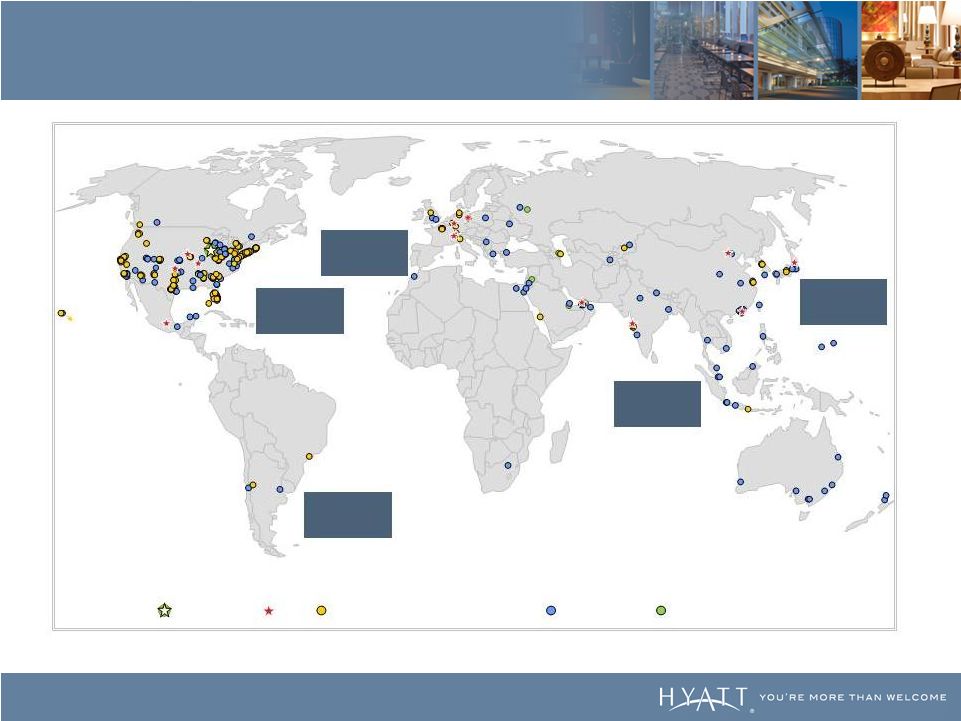

8

We Have a Global Footprint

Note:

Property counts as of March 31, 2010

Europe / Middle

East / Africa

Subtotal: 36

North America

Subtotal: 323

Latin America

Subtotal: 7

Southwest Asia

Subtotal: 16

Asia Pacific

Subtotal: 52

Offices

Managed and Franchised

Global Headquarters

Owned, Leased and Unconsolidated Hospitality Ventures

Vacation Ownership and Residential |

9

$628M

$708M

$687M

$406M

Attractive Business Model

Adjusted

EBITDA

2006

2007

2009

2008

2009

Adjusted

EBITDA

($406mm)

Owned

and

Leased

Operating

Margin

23%

25%

26%

18%

2006

2007

2009

2008

50%

12%

13%

25%

Owned & Leased

North America Management

& Franchising

International Management &

Franchising

Unconsolidated Hospitality

Ventures

1

3

2

Represents 2009 Actual Adjusted EBITDA. Effective January 1, 2010, our Park Hyatt and Andaz branded

hotels are managed and reported geographically by the respective North American or international management and

franchising segment consistent with our brands. As a result of this change we are reporting the

operating results for the Park Hyatt and Andaz branded hotels located in North America in the North American management and

franchising segment for the year ended December 31, 2009. Corporate and other EBITDA of ($79) million

not included in percent breakdown. Owned and leased operating margin is defined as the margin on

owned and leased hotel results calculated as the difference between owned and leased hotels revenue and owned and leased hotels expense as reflected on

our consolidated statements of income (loss).

For our definition of Adjusted EBITDA and a reconciliation of consolidated Adjusted EBITDA to EBITDA

and a reconciliation of EBITDA to its most directly comparable GAAP measure, net income (loss) attributable to Hyatt

Hotels Corporation, see Part I, Item 7 “Management’s Discussion and Analysis of Financial

Condition and Results of Operations – Results of Operations” of our Annual Report on Form 10-K for fiscal year 2009 or the

information posted on the Investor Relations website, which can be accessed at

http://www.hyatt.com and by selecting the Investor Relations link located at the bottom of the page.

1

2

3 |

10

Owned / Venture Hotels in Key

Gateway Cities

Chicago, IL

Park Hyatt Chicago

198 Rooms

Mumbai, India

Grand Hyatt Mumbai

547 Rooms

Grand Hyatt New York

1,311 Rooms

New York, NY

Seoul, Korea

Grand Hyatt Seoul

601 Rooms

São Paulo, Brazil

Grand Hyatt São Paulo

466 Rooms

Hyatt at Olive 8

346 Rooms

Seattle, WA

Andaz West Hollywood

238 Rooms

Los Angeles, CA

Park Hyatt Washington

216 Rooms

Washington,

D.C.

Paris, France

Park

Hyatt

Paris

-

Vendôme

167 Rooms

Zurich,

Switzerland

Park Hyatt Zurich

142 Rooms |

11

Recent and Near-Term Hotel Openings

Provide Entry Into New Markets

Chennai, India

Hyatt Regency Chennai

325 Rooms

4Q 2010

154th Hyatt Place

92 Rooms

2Q 2010

Santa Fe, NM

Broomfield, CO

34th Summerfield Suites

123 Rooms

2Q 2010

Shenzhen, China

Grand Hyatt Shenzhen

491 Rooms

4Q 2009

Grand Hyatt Macau

791 Rooms

4Q 2009

Macau, China

New York, NY

Andaz Fifth Avenue

184 Rooms

3Q 2010

Andaz Wall Street

253 Rooms

1Q 2010

Abu Dhabi, UAE

Hyatt at Capital Gate, Abu Dhabi

190 Rooms

3Q 2010

Carlsbad, CA

Park Hyatt Aviara

Resort

329 Rooms

2Q 2010 |

12

Expand into under-penetrated / underrepresented markets

As of December 31, 2009, substantiated by 120 executed

contracts (over 27,000 rooms)

55% international properties (70% of rooms)

Approximately 10 new countries and several new markets

Openings

Opened 30 new hotels in 2009 (removed 8 hotels)

Expect to open 25+ hotels in 2010

Expect to update prospective expansion information annually

Expansion Opportunities |

13

$1.3 billion of cash and cash equivalents and undrawn borrowing

capacity of another $1.4 billion

One of the highest credit ratings among lodging peers with

modest current debt levels and significant liquidity

No significant near-term maturities ($143 million through 2012)

Strong Capital Base

Note: Balance sheet information as of March 31, 2010

|

14

Experienced Management Team

Over 80,000 associates in 45 countries

GM’s have an average tenure of more than 21 years

Executive team has an average of 27 years of experience

Tom Pritzker, Executive Chairman of Hyatt’s Board of Directors, continues

a legacy of strategic leadership and innovation

|

15

Financial Highlights

Operating leverage is significant

Focus on operating margins for our existing portfolio and on returns

on capital for the business overall

Continued efforts to expand in key gateway cities and

emerging markets

Strong balance sheet / liquidity |