Attached files

| file | filename |

|---|---|

| EX-21 - SUBSIDIARIES - HAUPPAUGE DIGITAL INC | v169997_ex21.htm |

| EX-32 - CERTIFICATION OF CEO AND CFO PURSUANT TO SECTION 906 - HAUPPAUGE DIGITAL INC | v169997_ex32.htm |

| EX-23 - CONSENT OF BDO SEIDMAN, LLP - HAUPPAUGE DIGITAL INC | v169997_ex23.htm |

| EX-31.2 - CERTIFICATION OF CFO PURSUANT TO SECTION 302 - HAUPPAUGE DIGITAL INC | v169997_ex31-2.htm |

| EX-31.1 - CERTIFICATION OF CEO PURSUANT TO SECTION 302 - HAUPPAUGE DIGITAL INC | v169997_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-K

(Mark

One)

|

x

|

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

fiscal year ended September 30,

2009

OR

|

¨

|

TRANSITION REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

|

For the

transition period from

to

___________

Commission

file number 1-13550

HAUPPAUGE

DIGITAL INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

11-3227864

|

|

(State

or other jurisdiction of

|

(I.R.S

Employer

|

|

incorporation

or organization)

|

Identification

No.)

|

|

91 Cabot Court, Hauppauge, New

York

|

11788

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Issuer's

telephone number, including area code (631)

434-1600

Securities

registered pursuant to Section 12 (b) of the Act:

|

Title of each class

|

Name of each exchange on which

registered

|

|

Common

Stock, $.01 par value

|

The

NASDAQ Stock

Market

|

Securities

registered pursuant to Section 12 (g) of the Act:

None

(Title of

class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

|

|

¨

Yes

|

x

No

|

Indicate

by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Act.

|

|

¨

Yes

|

x

No

|

Indicate

by check mark whether the registrant (1) has filed all reports required to be

filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the

preceding twelve (12) months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing

requirements for the past ninety (90) days

|

|

x

Yes

|

¨

No

|

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files).

|

Yes

¨

|

No

¨

|

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant's knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10-K. x

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer or a smaller reporting company. See

the definitions of “large accelerated filer”, “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

|

¨

Large Accelerated Filer

|

¨

Accelerated Filer

|

|

¨

Non-Accelerated Filer

|

x

Smaller reporting company

|

|

(Do

not check box if smaller reporting company)

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule12b-2

of the Act).

|

|

¨

Yes

|

x

No

|

The

aggregate market value of the voting stock held by non-affiliates of the

registrant as of the close of business on March 31, 2009 was approximately

$9,326,800 based upon the last price reported on such date on the NASDAQ Global

Market. Non-affiliates include all stockholders other than officers, directors

and 5% stockholders of the registrant.

As of

December 23, 2009, the number of shares of Common Stock, $0.01 par value,

outstanding was 10,060,115.

DOCUMENTS INCORPORATED BY

REFERENCE

None.

PART

I

Special Note Regarding

Forward Looking Statements

This

Annual Report on Form 10-K contains forward-looking statements as that term is

defined in the federal securities laws. The events described in forward-looking

statements contained in this Annual Report on Form 10-K may not occur. Generally

these statements relate to business plans or strategies, projected or

anticipated benefits or other consequences of our plans or strategies, projected

or anticipated benefits from acquisitions to be made by us, or projections

involving anticipated revenues, earnings or other aspects of our operating

results. The words “may,” “will,” “expect,” “believe,” “anticipate,” “project,”

“plan,” “intend,” “estimate,” and “continue,” and their opposites and similar

expressions are intended to identify forward-looking statements. We caution you

that these statements are not guarantees of future performance or events and are

subject to a number of uncertainties, risks and other influences (including, but

not limited to, those set forth in “Item 1A–Risk Factors”), many of which are

beyond our control, that may influence the accuracy of the statements and the

projections upon which the statements are based. Any one or more of these

uncertainties, risks and other influences could materially affect our results of

operations and whether forward looking statements made by us ultimately prove to

be accurate. Our actual results, performance and achievements could differ

materially from those expressed or implied in these forward-looking statements.

We undertake no obligation to publicly update or revise any forward-looking

statements, whether from new information, future events or otherwise. All

cautionary statements made in this Annual Report on Form 10-K should be read as

being applicable to all related forward-looking statements wherever they

appear.

ITEM

1. BUSINESS

OVERVIEW

We are a

developer of analog and digital TV tuner and other products for the personal

computer market. Through our Hauppauge Computer Works, Inc., Hauppauge Digital

Europe Sarl and PCTV Systems Sarl subsidiaries, we design, develop, manufacture

and market analog, digital and other types of TV tuners and other devices that

allow PC users to watch television on a PC screen in a resizable window. Most of

our products also enable the recording of TV shows to a PC’s hard disk,

receiving of digital TV data transmissions, and the display of digital media

stored on a computer to a TV set via a home network. We were incorporated in

Delaware in August 1994 and are headquartered in Hauppauge, New York. We have

administrative offices in Luxembourg, Ireland and Singapore, sales offices in

Germany, London, Paris, The Netherlands, Sweden, Italy, Spain, Singapore, Taiwan

and California and research and development centers in Hauppauge, New York,

Braunschweig, Germany and Taipei,Taiwan.

2

ACQUISTION

OF PCTV ASSETS FROM AVID TECHNOLOGY, INC.

Effective

December 24, 2008, pursuant to an Asset Purchase Agreement, dated as of October

25, 2008, as amended by that certain Amendment No. 1 to the Asset Purchase

Agreement (the “Amendment”) (together with the Amendment, the “Asset Purchase

Agreement”), PCTV Systems Sarl, a Luxembourg company (“Buyer”) and a

wholly-owned subsidiary of ours, acquired certain assets and properties (the

“Acquired Assets”) of Avid Technology, Inc. (“Avid”), a Delaware corporation,

Pinnacle Systems, Inc., a California corporation (“Pinnacle”), Avid Technology

GmbH, a limited liability company organized under the laws of Germany, Avid

Development GmbH, a limited liability company organized under the laws of

Germany, and Avid Technology International BV, organized under the laws of the

Netherlands, (collectively, the “Sellers”). The purchase price was approximately

$5,000,000, and consisted of $2,238,000 payable in cash; $2,500,000 payable

pursuant to a Promissory Note, dated December 24, 2008, made payable by the

Buyer to Avid (the “Note”) and the assumption of certain liabilities. In

connection with the transaction, the Buyer or one or more of its affiliates are

employing certain employees and occupying certain facilities located in

Braunschweig, Germany. The Acquired Assets were used by the Sellers in the

business of, among other things, the development, manufacture and sale of TV

tuner devices for receiving over-the-air, satellite and/or cable television

signals that are used in conjunction with personal computers for personal

television viewing.

The

principal amount due pursuant to the Note is payable in 12 equal monthly

installments of $208,333, with the first such payment due and payable on January

24, 2009. Interest on the outstanding principal amount of the Note is payable at

a rate equal to (i) from December 24, 2008 until the Maturity Date (as defined

in the Note), five percent (5%), (ii) from and after the Maturity Date, or

during the continuance of an Event of Default (as defined in the Note), at seven

percent (7%). Pursuant to the terms of the Note, the Buyer and its affiliates

are prohibited from (i) declaring or paying any cash dividend, or making a

distribution on, repurchasing, or redeeming, any class of stock or other equity

or ownership interest in the Buyer or its affiliates, (ii) selling, leasing,

transferring or otherwise disposing of any assets or property of the Buyer or

any of its affiliates, or attempting to or contracting to do so, other than (a)

the sale of inventory in the ordinary course of business and consistent with

past practice, (b) the granting of non-exclusive licenses of intellectual

property in the ordinary course of business and consistent with past practice

and (c) the sale, lease, transfer or disposition of any assets or property

(other than the Acquired Assets) with a value not to exceed $500,000 in the

aggregate, or (iii) dissolving or liquidating, or merging or consolidating with

any other entity, or acquiring all or substantially all of the stock or assets

of any other entity.

As of

September 30, 2009, three payments remained on the Note and the balance of the

Note was $625,045.

In

connection with the transactions contemplated by the Asset Purchase Agreement,

the Buyer, Hauppauge Digital Europe Sarl (“HDES”), and Hauppauge Computer Works,

Inc. (“HCW”), each a wholly-owned subsidiary of ours (collectively, the

“Subsidiaries”) and the Sellers entered into a Transition Services Agreement,

dated December 24, 2008 (the “TSA”), pursuant to which, among other things, the

parties agreed to provide each other with certain services relating to

infrastructure and systems, order processing and related matters and systems

transition and related matters (the “Services”), as set forth in detail in the

TSA. The fees for such Services are set forth in the TSA. The term of the TSA

shall be until the earlier to occur of (i) 18 months following the closing or

(ii) termination of the last of the Services to be provided pursuant to the TSA.

The TSA may be terminated by the Subsidiaries at any time upon thirty (30) days

prior written notice to the Sellers and may be terminated with respect to any

particular Service to be provided pursuant to the TSA upon ten (10) days prior

written notice to Seller.

The

Transition Services Agreement was terminated by the Subsidiaries as of April 30,

2009.

Further,

Avid, Avid Technology International BV (collectively, the “Consignor”), and HCW

and HDES (collectively, the “Consignee”) entered into an Inventory and Product

Return Agreement, dated December 24, 2008 (the “Inventory Agreement”). Pursuant

to the terms of the Inventory Agreement, the Consignor is obligated to deliver

the Consigned Inventory (as defined in the Inventory Agreement) to the Consignee

and the Consignee is obligated to, as applicable, fill orders from products held

as Consigned Inventory before filling any such orders with products or inventory

other than the Consigned Inventory. Upon the sale of Consigned Inventory by the

Consignee, the Consignee has agreed to pay the Consignor for such Consigned

Inventory as follows: (i) if Consignee sells Consigned Inventory for a price

equal to or greater than Consignor’s Cost (as defined in the Inventory

Agreement) for such Consigned Inventory, then Consignee has agreed to pay

Consignor an amount equal to one hundred percent (100%) of the Consignor Cost

for such Consigned Inventory; or (ii) if Consignee sells Consigned Inventory for

a price less than the Consignor Cost for such Consigned Inventory, then

Consignee has agreed to pay Consignor an amount equal to eighty percent (80%) of

the sales price for such Consigned Inventory. The term of the Inventory

Agreement expires 18 months from the date of execution.

3

In

connection with the transactions contemplated by the Asset Purchase Agreement,

Avid, Pinnacle and the Buyer also entered into an Intellectual Property License

Agreement, dated December 24, 2008 (the “IP Agreement”). Pursuant to the terms

of the IP Agreement, Avid and Pinnacle have granted the Buyer certain

irrevocable, personal, non-exclusive, worldwide, fully paid, royalty-free and

non-transferable licenses to certain copyrights and other intellectual property

rights owned by Avid, Pinnacle and their respective subsidiaries, subject to

certain termination provisions as set forth in the IP Agreement.

OUR

STRATEGY

Since our

entry into the PC video market in 1991, management believes that we have become

a leader in bringing TV content to PCs by focusing on five primary strategic

fronts:

|

|

·

|

innovating

and diversifying our products

|

|

|

·

|

introducing

new and desirable features in our

products

|

|

|

·

|

expanding

our domestic and international sales and distribution

channels

|

|

|

·

|

forging

strategic relationships with key industry

players

|

|

|

·

|

outsourcing

our production to contract

manufacturers

|

As more

people are looking to PCs for a total entertainment experience, we believe that

our products are able to enhance the capabilities of the PC to enable it to

become a one-stop integrated entertainment system. We feel our current products

and products we may introduce in the future have the potential to be ubiquitous

in PC-based home entertainment systems.

Our

engineering group works on updating our current products to add new and

innovative features that the marketplace seeks, while remaining vigilant in

keeping our manufacturing costs low and trying to ensure that our products are

compatible with new operating systems. This work is done in addition to our

research and development efforts in designing, planning and building new

products.

During

fiscal 2009 our engineering department introduced software support for all of

our WinTV-HVR and WinTV-NOVA products for use with the Microsoft Windows 7

operating system. In addition, we introduced new TV tuner products with the

WinTV-Ministick, the WinTV-Aero Stick, the WinTV-HVR-930 Triple mode TV tuner

stick, the PCTV Nano-stick 73e Ultimate, and the PCTV Picostick.

During

fiscal 2008 our engineering department introduced the HD PVR

High-Definition video

recorder, the WinTV-HVR-1950 and WinTV-HVR-2250 for the North American market

and theWinTV-HVR-2200, WinTV-HVR-900H and WinTV-NOVA-TD for the European

market.

All of

these products are designed to run under the Microsoft Windows 7 operating

system in addition to Microsoft Vista and Microsoft Windows XP. The products for

North America are designed to support the NTSC analog cable TV standard plus

over-the-air ATSC high definition TV and clear QAM digital cable

TV.

4

We

believe that strategic relationships with key suppliers, PC manufacturers,

technology providers, and internet and e-commerce solutions providers give us

important advantages in developing new technologies and marketing our products.

By jointly working with, and sharing our engineering expertise with a variety of

other companies, we seek to leverage our investment in research and development

and minimize time to market.

Our

domestic and international sales and marketing team cultivates a variety of

distribution channels comprised of computer and electronic retailers, computer

products distributors and PC manufacturers. Electronic retailers include retail

stores, web stores and third-party catalogs, both print and on-line, among

others. We work closely with our retailers to enhance sales through joint

advertising campaigns and promotions. We believe that developing our

international presence contributes to our strategic position, allowing us to

benefit from investments in product development, and more firmly establishing

our Hauppauge®, WinTV® and MediaMVP™ brand names in the international

marketplace. We currently have ten sales offices in countries outside of the

U.S.and a sales and R&D facility in Taiwan to service the growing Asian

market.

We seek

to maintain and improve our profit margins by, among other things, outsourcing

our production to contract manufacturers suited to accommodate the type and

volume of our needs. We also leverage international supplier relationships to

assist us in receiving competitive prices for the component parts we buy. We

believe this two-tiered approach allows us to be the lowest cost / highest

quality producer in our marketplace. This approach enables us to focus our human

and financial resources on developing, marketing and distributing our products.

Successfully engineering products to have low production costs and commonality

of parts along with the use of single platforms for multiple models are

additional important ways that we believe our design and build strategy

contributes to our financial performance.

PRODUCTS

Our

products fall under three product categories:

|

|

·

|

Analog

TV tuners

|

|

|

·

|

Digital

TV tuners, and combination analog plus digital TV tuner

products

|

|

|

·

|

Other

non-TV tuner products

|

See “Item

7- Management’s Discussion and Analysis of Financial Condition and Results of

Operations” and the Consolidated Financial Statements comprising part of this

Annual Report on Form 10-K for additional information relating to our operating

segments.

Analog TV

Tuners

Our

analog TV tuner products enable, among other things, a PC user to watch analog

cable TV in a resizable window on a PC. Although we continue selling analog TV

tuners in regions outside of the United States, we have stopped developing pure

analog TV tuners, concentrating our engineering resources on digital TV tuners

and combination analog and digital TV tuners, which is detailed in the section

entitled “Digital TV Tuners".

Our WinTV

analog TV tuner products include cable-ready TV tuners with automatic channel

scan and a video digitizer which allows the user to capture still and motion

video images. Some of our analog TV tuner products allow the user to listen to

FM radio, video-conference over the internet (with the addition of a camera or

camcorder), and control these functions with a handheld remote control. In

Europe, our WinTV® analog TV tuner products can be used to receive teletext data

broadcasts, which allow the reception of digital data that is transmitted along

with the “live” TV signal.

Some

WinTV analog TV tuner products are available as external devices which connect

to the PC through the USB port. The USB models are encased in an attractive case

making USB models freely portable from PC to PC and from one desktop, laptop or

notebook computer to another.

5

Our

WinTV-PVR TV recording products include all of the basic features of our analog

TV tuner products, such as TV on the PC screen, channel changing and volume

adjustment. They also add the ability to record TV shows to disk using a

built-in high quality hardware MPEG 2 encoder. This technology allows a typical

desktop computer system to record up to hundreds of hours of video to disk,

limited only by the size of the disk (or storage medium). In addition, the

WinTV-PVR user can pause a live TV show, and then resume watching the TV show at

a later time. The maximum amount of recording time and the maximum amount of

paused TV is dependent upon the hard disk space available on the

PC.

The

WinTV-PVR user can record a TV show to the hard disk using a TV scheduler and

then play the recording back, edit it, and record the show onto a CD-ROM or

DVD-ROM, using a CD or DVD writer, for playback on a home or portable DVD player

or on a PC. The user can re-size the window during viewing, recording or

playback. Our WinTV-PVR products also provide for instant replay and are

available in both internal and external USB models.

An added

feature to the WinTV-PVR-150, WinTV®-PVR-250, WinTV-PVR-500 and WinTV-PVR-USB2

is that they support Microsoft®’s Windows® XP Media Center Edition. Microsoft’s

Windows XP Media Center Edition integrates digital entertainment experiences

including “live” television, PVR, digital music, digital video, DVDs and

pictures. Users can pause, jump forward or watch “live” TV, record a program or

a whole series, and manage digital music, home movies, videos, photos and DVDs

on the PC. Users can also access and control this new entertainment device with

large, easy-to-use-on-screen menus and the Media Center Remote

Control.

We

provide Microsoft certified Media Center drivers for these products to PC

manufacturers and value added resellers for integration into their Windows XP

Media Center PC systems.

With the

global shift to digital TV broadcasts, the sales of our analog family products

have been declining and we expect this decline to continue during the transition

from analog to digital broadcasts.

Digital TV and Combination

Analog plus Digital TV Tuner Products

Our

digital TV tuner products enable, among other things, a PC user to watch digital

television in a resizable window on a PC or laptop screen. There are different

digital TV standards throughout the world, and we develop TV tuner products for

many of these digital TV formats. Examples of digital TV broadcasts we can

receive on our TV tuner products include: over-the-air high definition ATSC,

clear QAM and DVB-C digital cable, digital terrestrial DVB-T, digital satellite

DVB-S and DVB-S2. To support these digital TV formats, and as many of our

primary markets transition from analog to digital TV, we have been concentrating

our engineering resources on digital TV tuner products and have discontinued

development on analog only TV tuners.

We have a

line of external TV tuners called TV “sticks”. TV tuner “sticks” are small TV

tuners which connect to a PC, notebook or netbook computer through the USB port.

TV tuner “sticks’ are typically used for mobile PC users and others who want the

flexibility to simply insert a USB TV tuner and watch TV on their screen. The

small size and UPC plug-in capability are good for use in laptops while

traveling.

Our

WinTV-NOVA products are digital only TV tuners for PCs. They support the various

forms of digital TV and come in either an internal or external form

factor.

Our

WinTV-NOVA-T is a DVB-T digital terrestrial tuner for our European markets which

allows for the viewing of digital terrestrial TV and listening to digital radio

on a PC. The product also allows recording of digital TV and radio to a hard

drive. This product is available as either a PCI card or an external USB

device.

6

Our

WinTV-NOVA-T-500 is a dual tuner DVB-T tuner for our European markets which uses

“Diversity Technology” and allows for the viewing of digital terrestrial

programs while recording another program. The product also allows recording of

two digital TV programs simultaneously or watching one channel while recording

another.

Our

WinTV-NOVA-T-USB2 is an external high performance DVB-T digital TV tuner, with

dual tuners for recording of two digital TV programs simultaneously or watching

one channel while recording another.

Our

WinTV-NOVA-T TV tuner stick is a pocket sized external DVB-T tuner for our

European markets which allows for the viewing of digital terrestrial TV and the

listening of digital radio on a PC or laptop. The product also allows recording

of digital TV and radio to a hard drive. The product’s pocket size and UPC

plug-in capability is good for use in laptops while traveling.

Our

WinTV-NOVA-TD stick, introduced during fiscal 2008, is a pocket-sized external

DVB-T tuner for our European markets, employs “Diversity Technology” with the

use of two antennas to maximize the reception for the viewing of digital

terrestrial TV on a PC or laptop. The product also allows recording of digital

TV to a hard drive in high quality MPEG-2 format. The product’s pocket size and

UPC plug-in capability is good for use in laptops while traveling.

Our

WinTV-Aero stick is a small but powerful external DVB-T tuner with a built-in

telescoping antenna for our European markets which allows a user to watch and

record DVB-T digital TV programs. It has a compact design and was designed for

mobile laptop computers and compact netbook computers. The WinTV-Aero comes with

a remote control and has a built-in external connector which allows a user to

connect it to a rooftop TV antenna when the user is inside their home or office

building.

Our

WinTV-Ministick is a small and portable external DVB-T tuner for our European

markets which allows a user to watch and record digital TV programs on a

netbook, laptop or desktop computer. WinTV-Ministick comes with a remote control

and a portable digital TV antenna which allows a user to watch TV at home or

when they travel.

Our

WinTV-HVR products are combinations of both digital TV and analog TV tuners on

an internal TV tuner board or external USB TV tuner.

Our

WinTV-HVR-900 stick is a pocket sized external tuner for our European markets

which allows for the viewing of digital terrestrial and analog terrestrial TV on

a PC or laptop. Digital and analog programs can be recorded to a hard drive in

high quality MPEG-2 format.

Our

WinTV-HVR-930C stick is a triple mode external tuner for our European markets

which allows for the viewing of digital cable TV and radio, digital terrestrial

TV and radio and analog cable or analog terrestrial TV on a PC or laptop. This

product allows the recording of digital and analog programs to a hard drive in

high quality MPEG-2 format and includes a DVB-T antenna.

Our

WinTV-HVR-950Q stick is a pocket sized external tuner for our North American

markets which allows for the viewing of ATSC high definition TV and NTSC cable

TV on a PC or laptop. The product also allows recording of digital and analog

programs to a hard drive in high quality MPEG-2 format.

Our

WinTV-HVR-1100 and WinTV-HVR-1300 are PCI based tuners for our European markets,

which are designed to be installed inside a desktop PC. These TV tuners allow

the viewing of digital terrestrial and analog terrestrial TV on a PC screen, in

addition to listening to FM radio and DVB-T radio through a PC’s audio system.

These products also allow the recording of digital and analog programs to a hard

drive in high quality MPEG-2 format. The WinTV-HVR-1300 is the higher

performance of the two models, in that it includes a hardware MPEG-2 encoder for

recording analog TV directly to a PC’s hard disk.

7

Our

WinTV-HVR-1400 and WinTV-HVR-1500, introduced during fiscal 2007, are dual tuner

ExpressCard/54 cards designed for notebook computers with ExpressCard/54mm

expansion slots. These TV tuners are for analog and digital TV watching and

recording on laptop computers, and allow the recording of digital programs to a

hard drive in high quality MPEG-2 format and the recording of analog

programs.

Our

WinTV-HVR-1600, introduced during fiscal 2007, is a PCI combination analog and

digital TV tuner for our North American market. The WinTV-HVR-1600 is installed

in an internal PCI slot in a desktop PC and allows the watching and recording of

ATSC high definition TV and NTSC cable TV. The WinTV-HVR-1600 can record all

ATSC formats, including the 1080i format. The WinTV-HVR-1600 also supports

viewing and recording clear QAM digital cable TV channels and includes a remote

control and IR blaster which changes the channels on your satellite or cable TV

set top box.

Our

WinTV-HVR-1800, introduced during fiscal 2007, is a combination analog and

digital PCI Express TV tuner for our North American market. The WinTV-HVR-1800

allows the watching and recording of ATSC high definition TV, clear QAM digital

cable TV and NTSC analog cable TV on a PC.

Our

WinTV-HVR-3000 is a tri-mode PCI based TV tuner for our European markets. The

WinTV-HVR-3000 is installed in a desktop PC and allows watching and recording of

digital terrestrial (DVB-T), satellite (DVB-S) and analog cable TV, in addition

to the ability to listen to FM radio and DVB-T radio. When recording digital TV

programs, the original broadcast format is used which preserves the quality of

the recording.

Our

WinTV-HVR-4000 is a quad-format PCI based TV tuner for our European markets. It

is installed in a desktop PC and can be used to watch and record digital

terrestrial (DVB-T), digital satellite (DVB-S), high definition digital

satellite (DVB-S2) and analog cable TV, in addition to the ability to listen to

FM radio and DVB-T radio. When recording digital TV programs, the original

digital broadcast format is used which preserves the quality of the

recording.

Our

WinTV-NOVA-S is a low cost DVB-S tuner for our European markets which allows for

the viewing

of

satellite based digital programming on a PC. The product also allows for

recording and playback of digital TV, using the high quality MPEG-2 format, and

for listening to digital radio.

Our HD

PVR is a High-Definition video

recorder for making real-time compressed recordings at resolutions up to 1080i.

The HD PVR records component video from cable TV and satellite set top boxes.

With a built-in IR blaster, the HD PVR can automatically change TV channels for

scheduled recordings. The HD PVR recording format can be used to burn Blu-ray

DVD disks. The HD PVRs recording quality allows personal archival of high

definition TV programs from any component video HD set top box. The HD PVR also

has standard definition composite and S-Video inputs which allows you to record

your old home video tapes into an AVCHD format for creating Blu-ray DVD

recordings.

Our

WinTV-HVR-1950 is a high performance external USB based TV tuner for your PC or

laptop. The WinTV-HVR-1950 allows you to watch, pause and record analog cable

TV, clear QAM digital cable TV, or ATSC over-the-air digital TV at up to 1080i

resolution. The product comes with a remote control and IR blaster, and contains

a built-in hardware MPEG-2 encoder for use when recording analog

video.

Our

WinTV-HVR-2200 and WinTV-HVR-2250 products are dual tuner PCI Express based TV

tuners designed to be installed in a desktop PC. These PCI Express boards allow

a PC user to watch, pause or record two analog or digital TV programs at the

same time. A user can either watch one TV program while recording another or can

record two TV programs at once. With the WinTV-HVR-2250, a user in North America

can watch and record analog cable TV or high definition digital ATSC and clear

QAM digital cable TV. With the WinTV-HVR-2200, a user in Europe or Asia can

watch or record analog PAL TV or digital DVB-T TV. Both of these products allow

the recording of analog cable TV programs to a PC's hard disk with our built-in

high quality MPEG-2 hardware encoder.

8

PCTV

products

Our PCTV

products allow Windows or Macintosh users to view television programming on

their computers. Our PCTV line consists of a family of USB sticks with a small

and convenient form factor well-suited for use with laptops and PCI-based cards

more appropriate for desktop users, in addition to PCI cards for use in desktop

computers. PCTV products are positioned as our high end product offering. We

believe that the positioning of the PCTV product line will be complimentary to

our existing WinTV line and will broaden our product offerings.

Other Non-TV Tuner

Products

|

(i)

|

MediaMVP™

|

Our

MediaMVP™ is a Linux-based digital media device, and is one of a new class of PC

products which link TV sets and PCs. Media, such as music, digital pictures, and

digital videos, are transmitted from the PC, where they are stored, to the

MediaMVP™, where they are converted from a digital format into an analog format,

enabling playback on a TV connected to the MediaMVP™. MediaMVP™ was introduced

to the market in fiscal 2003, and the first shipments to customers were made at

the start of our 2004 fiscal year.

Our

MediaMVP™ enables a user to watch and listen to PC-based videos, music and

pictures on a TV set through a home network. The MediaMVP™ connects to TV sets

or home theater systems and, via an Ethernet network, plays back MP3 music,

MPEG-1 and MPEG-2 videos, and JPEG and GIF digital pictures that have been

recorded and stored on a PC. The MediaMVP™ decodes this media and then outputs

video through composite and S-Video connections for high quality video on TV

sets and high quality audio through stereo audio output connectors to TV sets or

home theater systems.

Our

MediaMVP™ also provides an on-TV-screen display of media directory listings. It

receives commands from the supplied remote control, and sends these commands to

the PC server. The TV menus are created on the PC server, sent over the Ethernet

LAN and displayed by the MediaMVP™’s browser. The MediaMVP™’s remote

control allows a user to pause, fast forward and rewind through videos, plus

pause music and picture shows. A user can adjust the audio volume from the

MediaMVP™’s remote control, avoiding the need to use the TV’s remote control.

The MediaMVP™ is available in a wired or wireless version.

|

(ii)

|

Video

Capture Products

|

Our

ImpactVCB Video Capture Board (“ImpactVCB”) is a low cost PCI board for high

performance access to digitized video. Designed for PC-based video conferencing

and video capture in industrial applications, the ImpactVCB features “live”

video-in-a-window, still image capture and drivers for Windows® 2000, Windows®

XP, Windows® NT and Windows® 98. There are third party drivers and applications

for use with the Linux operating system.

Our USB

Live is an easy way to watch video, grab images and video conference on the PC

with the addition of a camera. It plugs into the PC’s USB port for easy

installation and brings video into users’ PCs from their camcorder or VCR. Users

can create video movies, save still and motion video images onto their hard disk

with our software, and video conference over the internet with the addition of a

camera or camcorder.

9

|

|

(iii)

|

Software

Recording Products

|

Our

“Wing” software enables the user to record TV shows on a personal computer for

playback on the Sony Playstation Portable (PSP), Apple iPod and other portable

video players. Wing can also convert existing TV recordings to the PSP and iPod

formats. With the emergence and popularity of portable video players, our Wing

product provides an easy solution for recording live TV shows for playback on

these devices. This product had minimal sales during fiscal 2009.

|

|

(iv)

|

WinTV-CI

Common Interface Module

|

Our

WinTV-CI common interface module when coupled with a WinTV card, CAM and

SmartCard subscription allows the user to watch popular pay TV channels, such as

movies and sporting events, on a user’s WinTV application.

(v)

Xfones Wireless Headphones for PCs and Macs:

Our

Xfones wireless headphones allow users to listen to the audio produced by their

PC or Mac through a wireless over the ear headphone. The Xfone has the ability

to broadcast to more than one headphone allowing multiple users to listen to the

audio from their PC or Mac.

TECHNOLOGY

Analog TV

Technology

We have

developed four generations of products which convert analog video into digital

video since our first such product was introduced in 1991.

The first

generation of WinTV® products put the TV image on the PC screen using chroma

keying, requiring a dedicated “feature connector cable” between the WinTV® and

the VGA (video) board. Our initial customers were mostly professional PC users,

such as financial market professionals who needed to be able to view stock

market-related TV shows while spending many hours on their PCs, who found having

TV in a window on their desktop useful and entertaining.

In 1993,

we invented a technique called “smartlock”, which eliminated the need for the

“feature connector cable.” In 1994, we introduced the WinTV®-Celebrity

generation of TV tuner boards based on this smartlock technology, greatly

improving customer satisfaction. At the time, our CinemaPro series of WinTV®

boards then used smartlock and other techniques to further reduce cost and

improve performance.

In June

1996, we introduced the WinTV®-PCI line of TV tuner boards for PCs. These boards

were developed to eliminate the relatively expensive smartlock circuitry and

memory used on the WinTV®-Celebrity and CinemaPro products. The WinTV®-PCI used

a technique called “PCI Push” and was designed to be used in the then emerging

Intel® Pentium® market. These Pentium®-based PCs had a new type of system

expansion “bus”, called the PCI bus, which allowed data to be moved at a much

higher rate than the older ISA bus, which the previous WinTV® generations used.

The “PCI Push” technique moves the video image 30 times per second (in Europe

the image is moved 25 times per second) over the PCI bus. In addition to being

less expensive to manufacture, the WinTV®-PCI had higher digital video movie

capture performance than the previous generations, capturing video at up to 30

quarter screen frames per second. With this higher performance capture

capability, the WinTV®-PCI found new uses in video conferencing, video

surveillance and internet streaming video applications.

10

The

fourth generation analog TV tuners are the WinTV®-PVR models which were first

developed during fiscal 2000 and introduced to the market in early fiscal 2001.

The WinTV®-PVRs include both internal PCI and external USB TV tuners which are

designed to add the ability to record TV shows to a PC’s hard disk. The core

technology in the WinTV®-PVR products is a hardware MPEG encoder, which

compresses analog video from a TV tuner or external video source into an MPEG

format in real time. MPEG is the compression format used on DVDs and for the

transmission of digital TV. This MPEG encoder is a purchased chip, to which we

add our driver and application software to create the recording and program

pause functions. Our WinTV®2000 application was enhanced to add the functions

needed to record, pause and play back TV on a PC screen.

Digital TV

Technology

Our

WinTV®-D board, developed during the 1999 fiscal year and delivered to the

market in the beginning of fiscal 2000, was the first ATSC digital TV tuner for

the North American market which allowed PCs to receive, display and record

over-the-air digital TV signals. ATSC digital television is the digital TV

standard for North America which has replaced analog television in the United

States and Canada. In the U.S., all analog over-the-air television transmissions

have ceased as of June 19, 2009 and only digital TV transmissions will be

broadcast. Since our first ATSC digital TV tuner delivered in 2000, we have

introduced 8 new digital TV tuners for use in North America.

In fiscal

1999, we also introduced the WinTV®-DVB board for the European market. This

board brings European digital TV to PCs, and is based on the Digital Video

Broadcast standard. Both the WinTV®-D and the WinTV®-DVB have the ability to

receive special data broadcasts which some broadcasters may send along with the

digital TV signal, in addition to displaying digital TV in a resizable window.

Data broadcasts on digital TV are transmitted at several million bits per

second. Our proprietary software can decode and display some of these special

data broadcasts. We may work on standardized reception and display software, if

such broadcasts become standardized.

The

software to control the digital TV reception is based on our WinTV®-2000

software, which was developed during fiscal 1999 and has had a major update in

2006 and 2008. Over the two fiscal years ended September 30, 2009, we have

further developed the digital TV reception capabilities of our digital family of

products and as of September 30, 2009 we have 18 products for DVB-T terrestrial,

DVB-S and DVB-S2 satellite, ATSC and clear QAM digital TV reception. In

addition, there are seven PCTV products which allow digital TV to be watched on

a PC or notebook computer.

Our

MediaMVP™ is a device which allows TV recordings which are stored on a PC or

notebook computer to be viewed on a TV set. Based on the Linux operating system,

the MediaMVP™ works in a client/server system with a PC, communicating with the

PC ‘server’ and receiving digital media from the PC and displaying the media on

the TV set. The core technology to the MediaMVP™ comprises the configuration and

enhancements to the Linux operating system, the user interface displayed on the

TV set, and the technology to transmit digital media reliably over the local

area network. The MediaMVP™ is available in a wired or wireless

version.

RESEARCH

AND DEVELOPMENT

Our

development efforts are focused on extending the range and features of our

existing products and developing additional internal and externally attached TV

tuner products. We intend to develop more highly integrated versions of hardware

products to further improve performance and price points, and new versions of

software to add features, improve ease of use, and provide support for new

operating systems.

As of

September 30, 2009, we had three research and development operations: one based

in our Hauppauge, New York headquarters, one based in Taipei, Taiwan, ROC and

one in Braunschweig, Germany. The New York and Taiwan R&D operations are

aimed at extending the range and features of our digital/analog products,

developing additional externally attached TV products, additional

high-definition digital TV products and portable digital players. The

Braunschweig, Germany PCTV research and engineering facility is responsible for

the updating and enhancement of the current PCTV line in addition to developing

new PCTV products.

11

The

technology underlying our products and certain other products in the computer

industry, in general, is subject to rapid change, including the potential

introduction of new types of products and technologies, which may have a

material adverse impact upon our business. See, “Item 1A — Risk

Factors”.

We

maintain an ongoing research and development program. Our future success, of

which there can be no assurances, will depend, in part, on our ability to

respond quickly to technological advances by developing and introducing new

products, successfully incorporating such advances in existing products, and

obtaining licenses, patents, or other proprietary technologies to be used in

connection with new or existing products. We continue to invest in research and

development. We spent approximately $4,422,000 and $3,884,000 for research and

development expenses for the years ended September 30, 2009 and 2008,

respectively. There can be no assurance that our current and future research and

development will be successful or that we will be able to foresee, and respond

to, advances in technological developments and to successfully develop other

products. Additionally, there can be no assurances that the development of

technologies and products by competitors will not render our products or

technologies non-competitive or obsolete. See “Item 1A- Risk

Factors.”

PRODUCTION

AND SUPPLIERS

We design

the hardware for most models of the WinTV, PCTV and MediaMVP products, and also

write the operating software to be used in conjunction with many versions of the

Microsoft Windows operating system, including Windows 7 and Windows

Vista.

During

fiscal 2009, we sub-contracted the manufacturing and assembly of most of these

products to six independent third parties at facilities in various Asian

countries. We monitor and test the quality of the completed products at any one

of our facilities in the U.S. (Hauppauge, New York), Singapore or Ireland before

packaging the products and shipping them to our customers. We also buy some

models of TV tuner products, such as the WinTV-Nova-T, some models of WinTV-HVR,

WinTV-CI module and XFones from other unrelated third party companies, add

Hauppauge software and sell under our name or on a private label

basis.

Most of

the PCTV products sold by Hauppauge in 2009 were manufactured and assembled by

Avid prior to the PCTV acquisition. They are provided to Hauppauge by Avid as

part of the PCTV Inventory and Product Return Agreement. “See Item 1.

Acquisition of PCTV Assets from Avid Technology, Inc. ” Of the PCTV products not

provided by Avid, we sub-contracted the manufacturing and assembly to two

independent third parties. These two contract manufacturers, both located in

Asia, were previous used by Avid for the manufacturing of PCTV

products.

Certain

component parts, such as TV tuners, video decoder chips and software compression

chips, plus certain assembled products, such as the WinTV-HVR stick products

that are essential to our business, are available from a single source or

limited sources. Other essential component parts that are generally available

from multiple sources may be obtained by us from only a single source or limited

sources because of pricing concerns. See “Item 1A-Risk Factors.”

Components

are subject to industry-wide availability and pricing pressures. Any

availability limitations, interruption in supplies, or price increases could

have a material adverse effect on our business, operating results and financial

condition. In addition, our new products may initially utilize custom components

obtained from only one source. See “Item 1A-Risk Factors.” We typically attempt

to evaluate and qualify additional suppliers for these components.

Where a

product utilizes a new component, initial capacity constraints of the supplier

of that component may exist until such time as the supplier's yields have

matured.

12

Components

are normally acquired through purchase orders, either issued by us or by our

contract manufacturers, typically covering our requirements for a 60-120 day

period from the date of issue. Purchased assembled products are normally covered

by longer term purchase orders. Our principal suppliers of component parts are

Dibcom S.A., NXP Semiconductors and Conexant Systems.

If the

supply of a key component, or a purchased assembled product, were to be delayed

or curtailed, or in the event a key manufacturing vendor delays shipment of

completed products to us or our contract manufacturer, our ability to ship

products in desired quantities, and in a timely manner, will be adversely

affected. Our business, operating results and financial condition will likely be

adversely affected, depending on the time required to obtain sufficient

quantities from the original source or, if possible, to identify and obtain

sufficient quantities from an alternative source. See “Item 1A-Risk Factors.” We

attempt to mitigate these potential risks by working closely with our key

suppliers on product introduction plans, strategic inventories, coordinated

product introductions, and internal and external manufacturing schedules and

levels.

We have,

from time to time, experienced significant price increases and limited

availability of certain components. Similar occurrences in the future could have

a material adverse effect on our business, operating results and financial

condition. See “Item 1A-Risk Factors.”

During

fiscal 2009 and 2008, all WinTV, PCTV and MediaMVP manufacturing was performed

by six unrelated contract manufacturers in Asia. Product design specifications

are provided by our engineering team to ensure proper assembly. Contract

manufacturing is primarily done on a consignment basis, in which we provide all

the significant component parts and we pay for assembly charges and for certain

additional parts for each board produced. Some products are purchased on a

turnkey basis, in which all components and labor are provided by the

manufacturer, and the manufacturing price includes parts and assembly costs. We

monitor the quality of the finished product produced by our contract

manufacturers. As of September 30, 2009, we had six qualified contract

manufacturers located in Malaysia, Indonesia, Taiwan and China, who are capable

of producing our products to our standards. If demand were to increase

dramatically, we believe additional production could be absorbed by these

qualified contract manufacturers. For fiscal 2009 and 2008 we did not engage any

contract manufacturers in Europe or North America.

CUSTOMER

SERVICE AND TECHNICAL SUPPORT

We

maintain customer service and technical support departments in our Hauppauge,

New York headquarters, as well as in the U.K., Germany, France, Italy,

Scandinavia, Taiwan and in Singapore. Technical support is provided to help with

installation problems or pre-sale and post-sale questions on our products, while

customer service provides repair service in accordance with our warranty policy

free of charge for product that is within the warranty period. During fiscal

2009 customer support and technical support for PCTV products was absorbed into

the existing Hauppauge customer support and technical support

infrastructure.

CUSTOMERS

AND MARKETS

We

primarily market our products to the personal computer market, including both

Microsoft Windows and Apple Macintosh based systems. To reach this market, we

sell to a network of computer retailers in the U.S., Europe and Asia and through

computer products distributors and manufacturers. To attract new users to our

products, from time to time we run special promotions and participate in

cooperative advertising with computer retailers. We actively participate in

trade shows to educate and train key computer retail marketing personnel. Most

of our sales and marketing budget is aimed at the consumer

market.

13

Apart

from the typical home user, we also target business users. One example of a

business application is in the securities brokerage industry where our product

is primarily used to display financial TV shows in a window on a broker’s PC

screen while the PC continues to receive financial information. We have sold our

WinTV® products on a direct corporate sales basis to two large financial

services information providers for incorporation into their workstations, and

several independent financial institutions. This market segment is typically

project-based.

We also

offer our products to PC manufacturers that either embed a WinTV® product in a

PC that they sell, or sell the WinTV® as an accessory to the PC.

Sales Channels for Our

Products

We

primarily sell through a sales channel which consist of retailers, PC

manufacturers and distributors. We have no exclusive distributors and retailers.

For fiscal 2009, we had one customer, D&H Distributing, that accounted for

approximately 12% of our net sales. For fiscal 2008, we had one customer, Hon

Hai Precision Industry Co. LTD, that accounted for approximately 16% of our

sales.

Our PCTV

products are offered as our high end line and are sold through similar retail

and distribution channels as our WinTV products.

Marketing and

Sales

We market

our products both domestically and internationally through our sales offices in

the U.S. (New York and California), Germany, the United Kingdom, France, Taiwan

and Singapore, plus through independent sales representative offices in the

Netherlands, Spain, Scandinavia, Poland and Italy. For the fiscal years ended

September 30, 2009 and 2008, approximately 48% of our net sales were made within

the U.S., while approximately 52% were made outside the United

States.

More

information on our geographic segments can be obtained from “Item 7-Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” and

the notes to the “Consolidated Financial Statements” which comprise part of this

Annual Report on Form 10-K.

From time

to time, we advertise our products in a number of consumer computer magazines.

We also participate in retailers’ market promotion programs, such as store

circulars and promotions and retail store displays. These in-store promotional

programs, magazine advertisements, plus a public relations program aimed at

editors of key PC computer magazines and an active website on the internet, are

the principal means of getting our product introduced to end users. Our sales in

computer retail stores are closely related to the effectiveness of these

programs, along with the technical capabilities of the products. We also list

our products in catalogs of various mail order companies and attend trade

shows.

We intend

to absorb the marketing and sales of our PCTV line into our existing sales and

marketing structure. It is anticipated that our existing sales personnel will

handle the generating of sales orders and the PCTV line will follow marketing

and advertising programs that are similar to our WinTV programs.

We

currently have fifteen sales people located in Europe, two sales people in the

Far East and two sales people in the U.S., located in New York and California.

In addition to our sales people we also utilize the services of 7 manufacturer

representatives in the United States and 12 manufacturer representatives in

Europe.

See “Item

7-Management’s Discussion and Analysis of Financial Condition and Results of

Operations” with reference to a discussion on the impact seasonality has on our

sales.

14

FOREIGN

CURRENCY FLUCTUATIONS

For each

of the fiscal years ended September 30, 2009 and 2008, at least 40% of our sales

were generated by our European subsidiary and were invoiced and collected in

local currency, which is primarily the Euro. On the supply side, since we

predominantly deal with North American and Asian suppliers and contract

manufacturers, approximately 95% of the our inventory required to support our

European sales is purchased and paid in U.S. Dollars.

The

combination of sales billed in Euros supported by inventory purchased in U.S.

Dollars results in an absence of a natural local currency hedge. Consequently,

our financial results are subject to market risks resulting from the

fluctuations in the Euro to U.S. Dollar exchange rates.

See “Item

1A-Risk Factors” and “Item 7-Management’s Discussion and Analysis of Financial

Condition and Results of Operations.”

COMPETITION

Our

business is subject to significant competition. Competition exists from larger

companies that possess substantially greater technical, financial, human, sales

and marketing resources than we do. The dynamics of competition in this market

involve short product life cycles, declining selling prices, evolving industry

standards and frequent new product introductions. We compete against companies

such as ATI Technologies Inc., a division of Advanced Micro Devices, Inc. and a

number of Asian and European companies. Our MediaMVP™ product competes in the

consumer electronics market, where competition comes from Sony Corporation.,

Toshiba Corporation, Cisco Systems, Inc. and others.

We

believe that competition from new entrants into our market will increase as the

market for television in a PC expands. There can be no assurance that we will

not experience increased competition in the future. Such increased competition

may have a material adverse affect on our ability to successfully market our

products. Competition is expected to remain intense and, as a result, we may

lose some of our market share to our competitors. Further, we believe that the

market for our products will continue to be price competitive and thus we could

continue to experience lower selling prices, lower gross profit margins and

reduced profitability levels for such products than in the past. “Item 1A-Risk

Factors”.

Though

management believes that the delivery of TV via the internet will become more

popular in the future, we believe that TV delivered via cable, broadcast or

satellite will continue to dominate the way consumers watch live television.

Since our products connect directly to cable, broadcast and satellite tuners, we

view our products as the preferred way to watch and record TV on the

PC.

PATENTS,

COPYRIGHTS AND TRADEMARKS

With the

proliferation of new products and rapidly changing technology, there is a

significant volume of patents and other intellectual property rights held by

third parties with regard to our market. There are a number of companies that

hold patents for various aspects of the technologies incorporated in some of the

PC and TV industries' standards. Given the nature of our products and

development efforts, there are risks that claims associated with such patents or

intellectual property rights could be asserted by third parties against us. We

expect that parties seeking to gain competitive advantages will increase their

efforts to enforce any patent or intellectual property rights that they may

have. The holders of patents from which we may have not obtained licenses may

take the position that we are required to obtain a license from

them.

15

If a

patent holder refuses to offer such a license or offers such a license on terms

unacceptable to us, there is a risk of incurring substantial litigation or

settlement costs regardless of the merits of the allegations or which party

eventually prevails. If we do not prevail in a litigation suit, we may be

required to pay significant damages and/or cease sales and production of

infringing products and accordingly, may incur significant defense costs.

Additionally, we may need to attempt to design around a given technology,

although there can be no assurances that this would be possible or

economical.

We

currently use technology licensed from third parties in certain products. Our

business, financial condition and operating results could be adversely affected

by a number of factors relating to these third-party technologies,

including:

|

|

·

|

failure

by a licensor to accurately develop, timely introduce, promote or support

the technology

|

|

|

·

|

delays

in shipment of products

|

|

|

·

|

excess

customer support or product return costs due to problems with licensed

technology and

|

|

|

·

|

termination

of our relationship with such

licensors

|

We may

not be able to adequately protect our intellectual property through patent,

copyright, trademark and other means of protection. If we fail to adequately

protect our intellectual property, our intellectual property rights may be

misappropriated by others, invalidated or challenged, and our competitors could

duplicate our technology or may otherwise limit any competitive technological

advantage we may have. Due to the rapid pace of technological change, we believe

our success is likely to depend more upon continued innovation, technical

expertise, marketing skills and customer support and service rather than upon

legal protection of our proprietary rights. However, we intend to aggressively

assert our intellectual property rights when necessary.

Even

though we independently develop most of our products and copyright the operating

software which our products use, our success will depend, in a large part, on

our ability to innovate, obtain or license patents, protect trade secrets and

operate without infringing on the proprietary rights of others. We maintain

copyrights on certain of our designs and software programs, but currently we

have no patent on the WinTV® board or other products.

The

trademarks “Hauppauge®”, “SoftPVR®”, “HardPVR®” , “MediaMVP®” and "WinTV®" have

been registered with the United States Patent and Trademark Office.

See “Item

1A-Risk Factors” and “Item 7-Management’s Discussion and Analysis of Financial

Condition and Results of Operations.”

EMPLOYEES

As of

September 30, 2009, we employed 169 people domestically and internationally,

including our executive officers, all of whom are employed on a full-time basis,

and none of whom are represented by a union.

Included

in the 169 employees are 25 employees located in Braunschweig, Germany,

primarily consisting of engineers and product support personnel, formerly

employed by Avid Technology, Inc., whom we hired to support our PCTV

operations.

CORPORATE

STRUCTURE

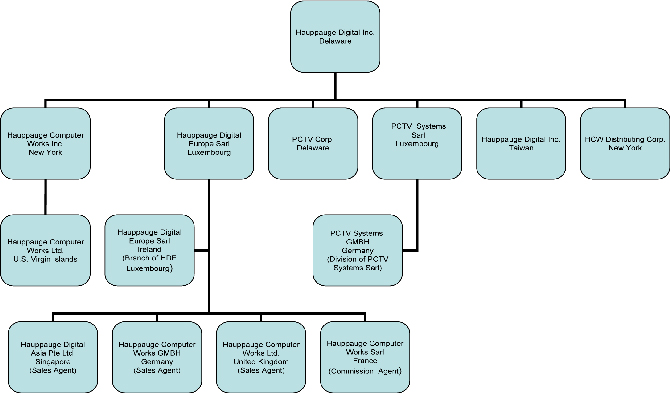

Hauppauge

Digital Inc. was incorporated in the state of Delaware on August 2, 1994. Listed

below is a chart depicting our corporate structure.

16

Corporate

Organization Chart

Hauppauge

Digital Inc. is the parent holding company. Our subsidiaries function as

follows:

Hauppauge

Computer Works, Inc., incorporated in New York, is our United States operating

company. It has locations in Hauppauge, New York and Danville, California. The

Hauppauge, New York location functions as our company headquarters and houses

the executive offices and is responsible for some or all of the following

functions:

|

|

·

|

Sales

|

|

|

·

|

Technical

Support

|

|

|

·

|

Research

and development

|

|

|

·

|

Warehousing

and shipping

|

|

|

·

|

Finance

and Administrative

|

|

|

·

|

Inventory

planning and forecasting

|

Hauppauge

Digital Europe Sarl (“HDE”), incorporated in Luxembourg, is our European

subsidiary. It has the following

wholly-owned subsidiaries:

|

|

·

|

Hauppauge

Digital Asia Pte Ltd. (incorporated in

Singapore)

|

|

|

·

|

Hauppauge

Computer Works, GMBH (incorporated in

Germany)

|

|

|

·

|

Hauppauge

Computed Works Ltd. (incorporated in the United

Kingdom)

|

|

|

·

|

Hauppauge

Computer Works Sarl (incorporated in

France)

|

The

subsidiaries of HDE listed above function as sales and commission agents, and

are primarily responsible for some or all of the following

functions:

17

|

|

·

|

Directing

and overseeing European sales, marketing and promotional

efforts

|

|

|

·

|

Procuring

sales and servicing customers

|

|

|

·

|

Sales

administration

|

|

|

·

|

Technical

support

|

|

|

·

|

Product

and material procurement support

|

|

|

·

|

Contract

manufacturer and production support

|

Hauppauge

Digital Europe Sarl also has a branch office in Blanchardstown, Ireland, which

functions as our European distribution center and is responsible for some or all

of our following functions:

|

|

·

|

Warehousing

of product

|

|

|

·

|

Shipment

of product

|

|

|

·

|

Repair

center

|

|

|

·

|

European

logistics center

|

Hauppauge

Digital Inc. Taiwan was incorporated during fiscal 2004 in Taiwan, ROC and is

responsible for some or all of the following functions:

|

|

·

|

Sales

administration for Asia and China

|

|

|

·

|

Research

and development activities

|

PCTV

Systems Sarl (Luxembourg) is a wholly owned subsidiary of Hauppauge Digital Inc.

This subsidiary was created to be the holding company of certain assets and

properties acquired from Avid Technology, Inc., Pinnacle Systems, Inc., Avid

Technology GmbH, Avid Development GmbH and Avid Technology International BV.

PCTV Systems GMBH is a division of PCTV Systems Sarl, Luxembourg. Located in

Germany, PCTV Systems GMBH is responsible for PCTV research and

development.

Hauppauge

Computer Works, Inc. is in turn the holding company of a foreign sales

corporation, Hauppauge Computer Works, Ltd, (incorporated in the U.S. Virgin

Islands).

HCW

Distributing Corp., incorporated in New York, is an inactive

company.

Our

executive offices are located at 91 Cabot Court, Hauppauge, New York 11788, and

our telephone number at that address is (631) 434-1600. Our internet address is

http://www.hauppauge.com.

ITEM

1A. RISK FACTORS

Our

operating results and financial condition are subject to various risks and

uncertainties, including those described below, that could materially adversely

affect our business, operating results and financial condition, any of which

could negatively affect the trading price of our Common Stock. Because of the

following factors, as well as other variables affecting our business, operating

results and financial condition, past performance may not be a reliable

indicator of future performance, and historical trends should not be used to

anticipate results or trends for future periods.

If TV technology for the PC, or our

implementation of this technology, is not accepted, we will not be able to

sustain or expand our business.

Our

future success depends on the growing use and acceptance of TV and video

applications for PCs. The market for these applications is still evolving, and

may not develop to the extent necessary to enable us to further expand our

business. We have invested, and continue to invest, significant time and

resources in the development of new products for this market.

18

Our:

|

|

·

|

dependence

on sales of TV and video products for the

PC

|

|

|

·

|

lack

of market diversification

|

|

|

·

|

concentration

on the North American and European market for the majority of our

sales

|

|

|

·

|

potential

inability to remain ahead of the development of competing

technologies

|

could

each have a material adverse effect on our business, operating results and

financial condition if we are unable to address any of the factors listed

above.

We

rely upon sales of a small number of product lines, and the failure of any one

product line to be successful in the market could substantially reduce our

sales.

We

currently rely upon sales from our existing product lines of internal and

external products to generate a majority of our sales. While we continue to

develop additional products within these and other product lines, there can be

no assurance that we will be successful in doing so. Consequently, if the

existing or future products are not successful, sales could decline

substantially, which would have a material adverse effect on our business,

operating results and financial condition.

We

rely heavily on the success of retailers, dealers and PC manufacturers to

market, sell and distribute our products. If these channels are not effective in

distributing our products, our sales could be reduced.

These

retailers, dealers and PC manufacturers may not effectively promote or market

our products or they may experience financial difficulties and even close

operations. Our sales channels are not contractually obligated to sell our

products, and they typically sell on an “as needed” basis. Therefore, they may,

at any time:

|

|

·

|

refuse

to promote our products

|

|

|

·

|

discontinue

the use of our products in favor of a competitor's

product

|

Also,

with a distribution channel standing between us and the actual end user, we may

not be able to accurately gauge current demand and anticipate future demand for

our products. For example, retailers, dealers and PC manufacturers may place

large initial orders for a new product just to keep their stores and products

stocked with the newest TV tuners and not because there is a significant demand

for them.

We

operate in a highly competitive market, and many of our competitors have much

greater resources, which may make it difficult for us to remain

competitive.

Our

business is subject to significant competition. Competition exists from larger

companies that possess substantially greater technical, financial, human, sales

and marketing resources than we do. The dynamics of competition in this market

involve short product life cycles, declining selling prices, evolving industry

standards and frequent new product introductions. We compete against companies

such as ATI Technologies Inc., a division of Advanced Micro Devices, Inc., and a

number of Asian and European companies. Our MediaMVP™ product competes in the

consumer electronics market, where competition comes from Sony Corporation,

Toshiba Corporation, Cisco Systems, Inc. and others.

19

We

believe that competition from new entrants will increase as the market for

digital video in a PC expands. There can be no assurance that we will not

experience increased competition in the future. Such increased competition may

have a material adverse affect on our ability to successfully market our

products. Competition is expected to remain intense and, as a result, we may

lose some of our market share to our competitors. Further, we believe that the

market for our products will continue to be price competitive and thus we could

continue to experience lower selling prices, lower gross profit margins and

reduced profitability levels for such products than in the past.

Rapid

technological changes and short product life cycles in our industry and the

availability of new products, services and technologies could harm our

business.

The

technology underlying our products and other products in the computer industry,

in general, is subject to rapid change, including the potential introduction of

new types of products, services and technologies, which may have a material

adverse impact upon our business, operating results and financial condition. The

pervasive availability of new products, services (including internet services)

and technologies may have a material adverse impact upon our business, operating

results and financial condition. We will need to maintain an ongoing research

and development program, and our potential future success, of which there can be

no assurances, will depend, in part, on our ability to respond quickly to

technological advances by developing and introducing new products, successfully

incorporating such advances in existing products, and obtaining licenses,

patents, or other proprietary technologies to be used in connection with new or

existing products. We expended approximately $4,422,000 and $3,884,000 for

research and development expenses for the fiscal years ended September 30, 2009

and 2008, respectively. There can be no assurance that our research and

development will be successful or that we will be able to foresee and respond to