Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PEGASYSTEMS INC | pega-20210603.htm |

© 2021 Pegasystems Inc. 2021 Investor Briefing Alan Trefler | Founder & CEO Peter Welburn | VP, Investor Relations Stephanie Louis | Sr. Director, Product Hayden Stafford | President, Global Client Engagement Ken Stillwell | COO & CFO June 3, 2021

© 2021 Pegasystems Inc. Financial Discussion Ken Stillwell | COO & CFO

3 Safe Harbor Statement Certain statements contained in this presentation may be construed as “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. The words expects, anticipates, intends, plans, believes, will, could, should, estimates, may, targets, strategies, intends to, projects, forecasts, guidance, likely, and usually or variations of such words and other similar expressions identify forward-looking statements, which speak only as of the date the statement was made and are based on current expectations and assumptions. Because such statements deal with future events, they are subject to various risks and uncertainties. Actual results for fiscal year 2021 and beyond could differ materially from the Company’s current expectations. Factors that could cause the Company’s results to differ materially from those expressed in forward-looking statements are contained in the Company’s press release announcing its Q1 2021 earnings, its Annual Report on Form 10-K for the year ended December 31, 2020 and other recent filings with the United States Securities and Exchange Commission. Investors are cautioned not to place undue reliance on such forward-looking statements and there are no assurances that the results contained in such statements will be achieved. Although subsequent events may cause our view to change, except as required by applicable law, we do not undertake and specifically disclaim any obligation to publicly update or revise these forward-looking statements whether as the result of new information, future events, or otherwise. The information in this presentation is not an offer or commitment by Pegasystems and does not create any legal obligation for Pegasystems, including to deliver any material, code, or functionality. The timing of the development and release of any features or functionality described about our products remains at our sole discretion. Non-GAAP Financial Measures This presentation includes non-GAAP financial measures. Our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures, and it should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. For a detailed explanation of the adjustments made to comparable GAAP measures, the reasons why management uses these measures, the usefulness of these measures, and the material limitations on the usefulness of these measures, see the disclosures included with the Company’s press release announcing its Q1 2021 financial results available on our investor relations website at http://www.pega.com/about/investors. This presentation does not include a reconciliation of certain forward-looking non-GAAP measures to the corresponding GAAP measure, as the reconciliation is not available without unreasonable efforts given the inherent difficulty in estimating components of the reconciliation on a multi-year basis.

Financial Outlook 4 Margin Expansion Opportunities Massive Market Opportunity High Growth, Recurring Model Transition to Cloud Underway

Pursuing a Massive Market Opportunity in Platform & CRM Source: IDC Software Tracker Forecast 2020H2 5 FY 21 $65B+ FY 25 $110B+

Digital Transformation (DX): Worldwide DX Software Spending vs Other 62021 2024 $100 $50 2022 $150 $200 2023 $0 $250 $300 $350 $400 $450 $500 $550 $600 $650 Non-DX Software DX Software Source: IDC, 2021 ($B)

Transition to Cloud Well Underway While Underlying Growth is Increasing 7 CLOUD TRANSITION TIMELINE TODAY 2017 2023 To… Recurring More Predictable Rule of 40 From… Perpetual Less Predictable Lower Growth & Margins

Transition to Cloud Underway: Key Growth Metrics 8 1. Annual Contract Value (ACV) Growth 2. Pega Cloud Bookings as a Percentage of New Business 3. Remaining Performance Obligation (RPO) – also known as Backlog

Transition to Cloud Underway: Focus on Total ACV Growth as Leading Indicator (in millions) 9 $400$100 $800$600$300$0 $750$700$200 $500 $850 $900 Pega Cloud (55% Growth) 31-Mar-21 $282$571 $182$52931-Mar-20 Client Cloud (8% Growth) $853 $711 20% ACV, as reported, represents the annualized value of our active contracts as of the measurement date. The contract's total value is divided by its duration in years to calculate ACV for term license and Pega Cloud contracts. Maintenance revenue for the quarter then ended is multiplied by four to calculate ACV for maintenance. Client Cloud ACV is composed of maintenance ACV and term license ACV. ACV is a performance measure that we believe provides useful information to our management and investors, particularly during our Cloud Transition. Reported amounts have not been adjusted for changes in foreign exchange rates. Foreign currency exchange rate changes contributed about 3% to total ACV growth in 2021.

10 11% Pega Cloud Bookings Other Bookings* ~55% ~60%-75% FY23 TargetFY16 FY21 Year to Date *Other bookings equals the sum of perpetual and term new license bookings. Transition to Cloud Underway: Growing Pega Cloud as a Percentage of New Business

11 $252 $312 $240 $174 3/31/2020 3/31/2021 $564M $414M 36% Pega Cloud RPO/Backlog Remaining Performance Obligation (RPO) /Backlog is Growing Pega Cloud RPO/Backlog up 36%, Total RPO/Backlog Up 30% ($ in millions) $544 $321 $433 3/31/2020 $436 3/31/2021 $754M $980M+30% Total RPO/Backlog >1 Year ≤1 Year >1 Year ≤1 Year

20% ACV Growth ACV is the Best Indicator of Growth During the Cloud Transition 12 $73 Q1 18 Q2 20 $529 $421 $82 $98 $439 $634M $433 $211 Q2 18 $571 Q3 18 $460 Q4 18 $129 $477$462 Q1 19 $232 Q1 20 $136 $146 Q2 19 $488 Q3 19 $169 $524 Q4 19 $182 $515M Q1 21 $527 $738M $545 Q3 20 $568 $267 $110 $282 $853M $494M $537M $570M Q4 20 $613M $693M $711M $777M $835M $591M Q1 2021 Growth vs Q1 2020 Total ACV: 20% Pega Cloud ACV: 55% Client Cloud ACV: 8% Pega Cloud Client Cloud Source: Company filings ($M) ACV, as reported, represents the annualized value of our active contracts as of the measurement date. The contract's total value is divided by its duration in years to calculate ACV for term license and Pega Cloud contracts. Maintenance revenue for the quarter then ended is multiplied by four to calculate ACV for maintenance. Client Cloud ACV is composed of maintenance ACV and term license ACV. ACV is a performance measure that we believe provides useful information to our management and investors, particularly during our Cloud Transition. Reported amounts have not been adjusted for changes in foreign exchange rates. Foreign currency exchange rate changes contributed about 3% to total ACV growth in 2021.

Pega Cloud ACV Growth: Fastest Growing ACV Segment 13 $249M $270M $293M $304M $151M $190M $231M $264M $64M $110M $169M $267M $0M $50M $100M $150M $200M $250M $300M $350M 20192017 20202018 Client Cloud 12% CAGR Maintenance – 7% CAGR Term License – 20% CAGR Pega Cloud – 60% CAGR

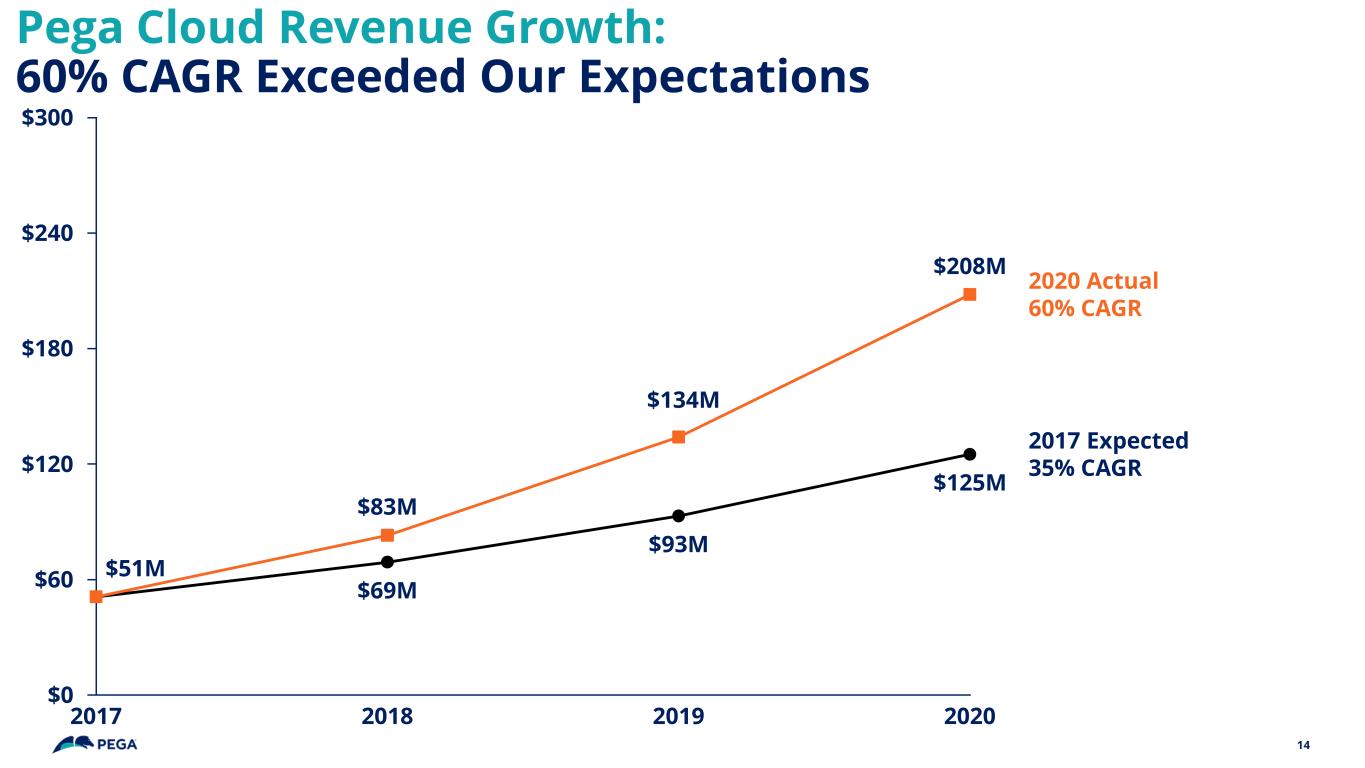

Pega Cloud Revenue Growth: 60% CAGR Exceeded Our Expectations 14 $120 2017 $180 $300 2018 20202019 $60 $0 $240 $69M $51M $83M $93M $134M $125M $208M 2017 Expected 35% CAGR 2020 Actual 60% CAGR

Margin Expansion Opportunities: Cloud Margin Pega Cloud Margins Improve with Scale 15 $0 $50 $100 $150 $200 $250 20182017 2019 2020 $51M $83M $134M $208M +60% Three-Year Pega Cloud Revenue % Change 55% 2020 53% 20192017 2018 51% 63% 67% Q121 75% Target Pega Cloud Gross Margins

16 -10% -5% 0% 5% 10% 15% 20% 25% 4% 11% Year 0 Year 3 -8% 2% Year 4Year 1 Year 2 16% 22% Year 5 Competitor’s Growth Example Competitor’s Journey: Revenue Growth During a Cloud Transition

17 -10% -5% 0% 5% 10% 15% 20% 25% -8% 4% Year 1 11% 17% 0% Competitor’s Growth Year 0 2% Year 2 2% 12% Year 3 16% Year 4 22% Year 5 Pega’s Revenue Growth Example Competitor’s Journey vs Pega: Pega’s Growth During Its Cloud Transition vs Competitor

18 3.7 3.0 4.9 6.5 7.0 7.2 9.2 12.5 0.0 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0 Year 3Year 0 Year 5Year 1 Year 4Year 2 Year 6 Year 7 EV/Rev Example Competitor’s Journey: EV*/Rev Multiple Expansion During a Cloud Transition *Enterprise Value = Market Capitalization + Total Debt – Total Cash Perpetual Go-to-Market Cloud Go-to-Market

Financial Outlook & Model 19 What does this mean? • Near-term: − Continued complicated & awkward revenue optics − Focus on Total ACV growth as leading indicator − Pega Cloud backlog growth as a confirming metric • Longer-term: − Increasingly predictable revenue and cash flows

Revenue and Margin Growth Key Growth Metrics: Longer-Term 20 ACV Growth Free Cash Flow (FCF) Margin* Rule of 40 * Free Cash Flow Margin (FCF) = Cash Flow from Operations Less Investments in Property, Plant, and Equipment Divided by Total Revenue

21 2018 Investor Day Presentation – “Rule of 40” Slide

22 Path to “Rule of 40” ~21%-23% ~15% ~45% ~72%-75% 2023 Update Free Cash Flow Margin Old

What Does this All Mean? Strive to build a growing, recurring business to drive increased value 23 • Capitalizing on high-growth markets • Continuing our technology leadership • Increasing sales capacity • Driving ACV growth • Leveraging Cloud Choice differentiation • Balancing growth & margin • “Rule of 40” Sustain higher growth Through transition to recurring While driving margin leverage To drive shareholder value © Pegasystems Inc. With a view towards: