Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - PEGASYSTEMS INC | d521822dex32.htm |

| EX-31.2 - EX-31.2 - PEGASYSTEMS INC | d521822dex312.htm |

| EX-31.1 - EX-31.1 - PEGASYSTEMS INC | d521822dex311.htm |

| EX-23.1 - EX-23.1 - PEGASYSTEMS INC | d521822dex231.htm |

| EX-21.1 - EX-21.1 - PEGASYSTEMS INC | d521822dex211.htm |

| EX-10.1 - EX-10.1 - PEGASYSTEMS INC | d521822dex101.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 |

For the fiscal year ended December 31, 2017

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 |

Commission File No. 1-11859

PEGASYSTEMS INC.

(Exact name of Registrant as specified in its charter)

| Massachusetts | 04-2787865 | |

| (State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification No.)

| |

| One Rogers Street, Cambridge, MA | 02142-1209 | |

| (Address of principal executive offices) | (zip code) |

(617) 374-9600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $0.01 par value per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging company,” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the Registrant’s common stock held by non-affiliates, based upon the closing price of the Registrant’s common stock on the NASDAQ Global Select Market of $58.35, on June 30, 2017 was approximately $2.2 billion.

There were 78,099,419 shares of the Registrant’s common stock, $0.01 par value per share, outstanding on February 14, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement related to its 2018 annual meeting of stockholders to be filed subsequently are incorporated by reference into Part III of this report.

Table of Contents

PEGASYSTEMS INC.

ANNUAL REPORT ON FORM 10-K

2

Table of Contents

PART I

Forward-looking statements

This Annual Report on Form 10-K (“Annual Report”), including without limitation, Item 1. “Business”, Item 1A. “Risk Factors”. Item 5. “Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities” and Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains or incorporates forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. We claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 for all forward-looking statements. In addition, other written or oral statements that constitute forward-looking statements may be made by us or on our behalf. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “could,” “estimate,” “may,” “target,” “strategy,” “is intended to,” “project,” “guidance,” “likely,” “usually,” or variations of such words and similar expressions are intended to identify such forward-looking statements. These forward-looking statements are based on current expectations, estimates, forecasts, and projections about the industry and markets in which we operate, and management’s beliefs and assumptions. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions that are difficult to predict. These statements include, among other things, statements regarding:

| • | our future financial performance and business plans; |

| • | the adequacy of our liquidity and capital resources; |

| • | the continued payment of our quarterly dividends; |

| • | the timing of revenue recognition under license and cloud arrangements; |

| • | the expected benefits to our clients and potential clients of our product and service offerings; |

| • | the growth of our business and revenues and our expectations about the factors that influence our success and trends in our business; |

| • | our expectation that revenue will continue to shift from perpetual licenses towards term licenses and cloud arrangements; |

| • | our international operations providing a significant portion of our total revenues; |

| • | our backlog of license, maintenance, cloud, and services agreements and the timing of future cash receipts from committed license and cloud arrangements; |

| • | our belief that our acquisitions should allow us to grow and continue to make investments in research and development; |

| • | our expectation that research and development expenses and sales and marketing expenses will continue to increase in absolute dollar values and may increase as a percentage of revenues; |

| • | our expectations regarding the impact of recent accounting pronouncements on our consolidated financial statements; |

| • | our beliefs regarding the impact of the Tax Cuts and Jobs Act (the “Tax Reform Act”), including its impact on income tax expense and deferred tax assets; |

| • | our beliefs that our net deferred tax assets will be realized in the foreseeable future, that we have adequately provided under U.S. generally accepted accounting principles for uncertain tax benefits, and that the undistributed earnings of our foreign subsidiaries are considered permanently reinvested; and |

| • | exposure to foreign currency exchange rates and continued realization of gains or losses with respect to our foreign currency exposures. |

3

Table of Contents

Factors that could cause our actual results to differ from those expressed in forward-looking statements include, but are not limited to, those identified in Item 1A. “Risk Factors” of this Annual Report.

Except as required by law, we have no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or risks. New information, future events or risks may cause actual results to differ materially from future results expressed or implied by such forward-looking statements.

| ITEM 1. | BUSINESS |

Our Business

We develop, market, license, and support software applications for customer engagement and digital process automation, in addition to licensing our Pega® Platform application development product for clients that wish to build and extend their own applications. We are helping our clients accelerate digital transformation, by realizing high customer engagement and achieving operational excellence, and leveraging our artificial intelligence (AI) and Robotics technology. Our cloud-architecture customer engagement and digital process automation applications—built on our unified Pega Platform—empower businesses with comprehensive no-code tools to design, extend, and scale their enterprise applications to meet strategic business needs.

To grow our business, we intend to:

| • | Grow market share by developing and delivering market-leading applications for marketing, sales, service, and operations that can work together seamlessly with maximum differentiation and minimal customization; |

| • | Execute new-market growth initiatives, further expanding coverage within the Global 3000; and |

| • | Continue to scale our digital platform and invest in awareness marketing to support the way today’s clients want to buy. |

Whether or not we are successful depends, in part, on our ability to:

| • | Successfully execute our marketing and sales strategies; |

| • | Appropriately manage our expenses as we grow our organization; |

| • | Effectively develop new products and enhance our existing product; and |

| • | Successfully incorporate acquired technologies into our customer relationship management (“CRM”) applications and unified Pega Platform. |

4

Table of Contents

Our Products

The Pega Platform and applications help connect enterprises to their customers in real-time across channels, streamline business operations, and adapt to meet changing requirements.

Our applications and platform intersect with and encompass several software markets, including:

| • | Customer Relationship Management (“CRM”), |

| • | Business Process Management (“BPM”) and Digital Process Automation (“DPA”), |

| • | Robotic Process Automation (“RPA”), |

| • | Business Rules Management Systems (“BRMS”), |

| • | Dynamic Case Management (“DCM”), |

| • | Decision Management, including Predictive and Adaptive analytics, |

| • | No-code and low-code application development platforms, including Mobile Application Development Platforms (“MADP”), and |

| • | Vertical Specific Software (“VSS”) market of industry solutions and packaged applications. |

5

Table of Contents

Customer engagement

Our omni-channel customer engagement applications are designed to maximize the lifetime value of customers and help reduce the costs of serving customers while ensuring a consistent, unified, and personalized customer experience. At the center of our customer engagement-or CRM-applications is the Customer Decision Hub, our real-time AI engine, which leads the industry in its ability to predict a customer’s behavior and recommend the “Next-best-action” to take across channels in real-time.

| • | The Pega® Marketing application is designed to enable enterprises to improve customer acquisition and experiences across inbound, outbound, and paid media channels. It incorporates AI in the form of predictive and machine-learning analytics, as well as business rules, and executes these decisions in real-time to evaluate the context of each customer interaction and dynamically deliver the most relevant action, offer, content, and channel. |

| • | The Pega® Sales Automation application automates and manages the entire sales process, from prospecting to product fulfillment. Our software allows enterprises to capture best practices, and leverages AI to guide sales teams through the sales and customer onboarding processes. |

| • | The Pega® Customer Service application is designed to anticipate customer needs, connect customers to the right people and systems, and automate or intelligently guide customer interactions, to rapidly and continuously evolve the customer service experience and to allow enterprises to deliver consistent interactions across channels and improve employee productivity. The application consists of a contact center desktop, case management for customer service, chat, knowledge management, mobile field service, omni-channel self-service, AI-powered virtual assistants, and industry-specific processes and data models. |

Digital process automation

Pegasystems offers industry-specific software applications built on the Pega Platform. These applications provide businesses with robust capabilities to automate industry-specific business processes. As they are built on the Pega Platform, these applications deliver flexibility beyond traditional, “off the shelf” products. Our applications allow our clients to offer differentiated service and value to their customers. The Pega Platform empowers organizations to implement new processes quickly, refine customer experiences, bring new offerings to market, and provide customized or specialized automated processing.

Our capabilities

Real-time, Omni-channel AI

AI has been around for many years, in many forms, yet only in the past decade businesses have started experiencing its practical applications fueled by the new abundance of data to power decisions and ever-increasing customer expectations. Our CRM and other applications built on the Pega platform, leverage predictive and adaptive analytics to deliver more personalized customer experiences and maximize business objectives. The Pega Customer Decision Hub®, a centralized, always-on “brain” unleashes the power of predictive analytics, machine learning, and real-time decisioning across our clients’ data, systems, and touchpoints—orchestrating engagement on and across customer interactions channels.

End-to-end robotic automation

Pega brings together Robotic Automation capabilities-for both human-assisted robotic desktop automation and unattended robotic process automation-with our unified BPM, and case management capabilities. This gives our applications and platform the ability to automate both customer-facing processes and back-office operational processes from “end-to-end,” connecting across organizational and system silos to seamlessly and efficiently connect customers and employees to outcomes.

6

Table of Contents

Journey-centric rapid delivery

Our CRM and DPA solutions are designed to improve targeted customer outcomes, quickly and with out-of-the-box functionality that connects enterprise data and systems to customer experience channels. From there, organizations can scale, one customer journey-at-a-time, to realize greater value while delivering increasingly consistent and personalized customer experiences.

Software that writes your software

Our approach bypasses the error-prone and time-consuming process of manually translating requirements into code. Users design software in no-code visual models that reflect the needs of the business. The software application is created and optimized automatically and directly from the model, helping to close the costly gap between vision and execution. Changes to the code are made by changing the model, and application documentation is generated directly from the model. The Pega Platform is standards-based and can leverage a client’s existing technology to create new business applications that cross technology silos and bridge front and back-office.

Unified future-proof platform

Pega offers a unified digital process automation platform, combining robotics, process automation, and case management together in a unified architecture. We build in powerful decision analytics, designed to allow our clients to automate any process while working faster and smarter. Our no-code architecture is designed to empower organizations to scale across all dimensions of their business, including product lines, departments, and geographies, by reusing components and avoiding the traditional method of deploying multiple CRM and BPM instances that lead to even more silos and disjointed customer experiences.

Cloud choice

Pega Cloud® Services allow clients to develop, test, and deploy, on an accelerated basis, our CRM applications and Pega Platform using a secure, flexible internet-based infrastructure. Pega Cloud provides production, development, and testing (“Dev/Test”) services to accelerate the development and deployment of Pega applications and the Pega Platform. This allows our clients to minimize infrastructure cost while focusing on core revenue generating competencies.

Additionally, the Pega Platform and CRM applications are deployable on other cloud architectures, including client or partner-managed clouds. This cloud choice gives our clients the ability to select, and change as needed, the best cloud architecture for the security, data access, speed-to-market, and budget requirements of each application they deploy.

Our Services and Support

We offer services and support through our Global Customer Success group, our Global Customer Support group, and our Pega® Academy training services group. We also use third-party contractors to assist us in providing these services.

Global Customer Success

Our Global Customer Success group combines our sales and Pega consulting groups and provides guidance and implementation services to our clients and partners on how to best apply our technology and develop strong implementation expertise.

Global Customer Support

Our Global Customer Support group oversees technical support of our products and Pega Cloud. Support services include managing the online support community, proactive problem prevention through information and knowledge sharing, and problem tracking, prioritization, escalation, diagnosis, and resolution.

7

Table of Contents

PegaAcademy—Training Services

The success of our sales strategy for repeat sales to target clients depends on our ability to train a large number of partners and clients to implement our technology.

We offer training for our staff, clients, and partners through the following means:

| • | Instructor-led training is offered at our regional training facilities in the Americas, the United Kingdom (the “U.K.”), Asia Pacific, and at third-party facilities in numerous other locations, including client sites. |

| • | Online training is a convenient way to learn our software anytime, anywhere. We expect online training to continue to help expand the number of trained and certified experts globally. |

We have also partnered with universities to offer Pega courseware as part of the student curriculum, taught by Pega instructors and university professors to expand our ecosystem.

Our Partners

We collaborate with global systems integrators and technology consulting firms that provide consulting services to our clients. Strategic partnerships with technology consulting firms and systems integrators are important to our sales efforts because they influence buying decisions, help us to identify sales opportunities, and complement our software with their domain expertise and services capabilities. These partners may deliver strategic business planning, consulting, project management, and implementation services to our clients.

Currently, our partners include well-respected, major firms such as Accenture PLC, Atos SE, Capgemini SA, Cognizant Technology Solutions Corporation, EY, Infosys Limited, PwC, Tata Consultancy Services Limited, Tech Mahindra Limited, Virtusa Corporation, and Wipro Limited.

Our Markets

Target Clients

Our target clients are industry-leading Global 3000 organizations and government agencies that require applications to differentiate themselves in the markets they serve. This is achieved by increasing business agility, driving growth, improving productivity, attracting and retaining customers, and reducing risk. We deliver applications tailored to our clients’ specific industry needs. We also enable enterprise transformation initiatives by providing an application development platform that digitizes end-to-end processes and allows for multi-channel customer interactions, all enhanced by Pega Next-Best-Action analytics.

Our clients represent a number of industries including:

| • | Financial Services—Financial services organizations rely on software to market, onboard, cross-sell, retain, and service their customers as well as automate the operations that support these customer interactions. Our customer service, sales and new account onboarding, Know Your Customer (“KYC”), marketing, collections, and dispute management applications allow clients to be responsive to changing business requirements. |

| • | Healthcare—Healthcare organizations seek software that integrates their front and back-offices and helps them deliver personalized care and customer service while reducing cost, automating processes, and increasing operational efficiency. Our applications allow healthcare clients to address sales, service, operations, financial, administrative, and coverage requirements of healthcare consumerism and reform. |

| • | Manufacturing and high tech—Manufacturers worldwide are transforming their businesses to better engage customers and suppliers, as well as to directly manage product performance throughout the product life-cycle. Our manufacturing applications address customer service and field service; manage warranties, recalls, repairs, and returns; improve the performance of direct sales forces; and extend existing enterprise resource planning system capabilities. |

8

Table of Contents

| • | Communications and media—Communications and media organizations need to address high levels of customer churn, growing pressure to increase revenue, and an ability to respond quickly to changing market conditions. Our applications enable organizations to reshape the way they engage with customers and increase customer lifetime value throughout the customer lifecycle by delivering omni-channel, personalized customer journeys. Our applications are designed to solve the most critical business issues from acquiring more customers at higher margin, increasing cross-sell/up-sell, improving the efficiency and effectiveness of customer service, and streamlining sales and quoting. |

| • | Insurance—Insurance companies, whether competing globally or nationally, need software to automate the key activities of distribution management, quoting, underwriting, claims, and policy servicing. Insurers are also becoming increasingly sensitive to ways to improve customer service and the overall customer experience. Our applications for insurance carriers are designed to help increase business value by delivering customer-focused experiences and personalized interactions that help drive higher sales, lower expense ratios, and mitigate risk. |

| • | Government—Government agencies need to modernize legacy systems and processes to meet the growing demands for improved constituent service, lower costs, reduced fraud, and greater levels of transparency. Our applications deliver advanced capabilities to help streamline operations and optimize service delivery through an agile, omni-channel approach. |

| • | Consumer Services—Organizations that provide services to a range of consumers in industries such as airlines/transportation, utilities, consumer-focused internet companies, retail, and hospitality and entertainment. Our marketing, customer service, and sales applications allow these organizations to personalize their customer engagement to acquire more customers, drive revenue through cross-sell/up-sell, and increase service efficiency while increasing customer satisfaction. |

| • | Life Sciences—Life sciences organizations are looking for solutions to improve customer engagement as well as increase efficiencies and transparency across the product development life-cycle. Our customer engagement, clinical, and pharmacovigilance applications are designed to deliver customer engagement, safety and risk management, and regulatory transparency. |

We also offer software to a broad range of other types of companies and industries. For example, we license our applications and platform to clients in travel, transportation, retail, and other services.

Competition

The markets for our offerings are intensely competitive, rapidly changing, and highly fragmented, as current competitors expand their product offerings and new companies enter the market.

We encounter competition from:

| • | CRM application vendors; |

| • | BPM vendors, including no-code and low-code application development platforms, and service-oriented architecture middleware vendors; |

| • | Case management vendors; |

| • | Decision management, data science and AI vendors, as well as vendors of solutions that leverage decision making and data science in managing customer relationships and marketing; |

| • | Robotic automation and workforce intelligence software providers; |

| • | Companies that provide application specific software for the financial services, healthcare, insurance, and other specific markets; |

| • | Mobile application platform vendors; |

9

Table of Contents

| • | Co-browsing software providers; |

| • | Social listening, text analytics, and natural language processing vendors; |

| • | Professional service organizations that develop their own products or create custom software in conjunction with rendering consulting services; and |

| • | Clients’ in-house information technology departments, which may seek to modify their existing systems or develop their own proprietary systems. |

Competitors vary in size, scope and breadth of the products and services they offer and include some of the largest companies in the world, such as Salesforce.com, Microsoft Corporation, Oracle Corporation, SAP SE, and International Business Machines Corporation (IBM).

We have been most successful competing for clients whose businesses are characterized by a high degree of change, complexity, or regulation. We believe the principal competitive factors within our market include:

| • | Product adaptability, scalability, functionality, and performance; |

| • | Proven success in delivering cost-savings and efficiency improvements; |

| • | Proven success in enabling improved customer interactions; |

| • | Ease-of-use for developers, business units, and end-users; |

| • | Timely development and introduction of new products and product enhancements; |

| • | Establishment of a significant base of reference clients; |

| • | Ability to integrate with other products and technologies; |

| • | Customer service and support; |

| • | Product price; |

| • | Vendor reputation; and |

| • | Relationships with systems integrators. |

We believe we are competitively differentiated as our unified Pega Platform is designed to allow both client business and IT staff, using a single, intuitive user interface, to build and evolve enterprise applications in a fraction of the time it would take with disjointed architectures and tools offered by our competitors. In addition, our applications, built on the Pega Platform, provide the same level of flexibility and ability to adapt to our clients’ needs. We believe we compete favorably due to our expertise in our target industries and our long-standing client relationships. We believe we compete less favorably on the basis of some of these factors with respect to our larger competitors, many of which have greater sales, marketing, and financial resources, more extensive geographical presence, and greater name recognition than we do. In addition, we may be at a disadvantage with respect to our ability to provide expertise outside our target industries. See “Risk Factors—The market for our offerings is intensely and increasingly competitive, rapidly changing, and highly fragmented.” in Item 1A of this Annual Report.

Intellectual Property

We rely primarily on a combination of copyright, patent, trademark, and trade secrets laws, as well as confidentiality and intellectual property agreements to protect our proprietary rights. We have obtained patents relating to our system architecture and products in strategic global markets. We enter into confidentiality, intellectual property ownership, and license agreements with our employees, partners, clients, and other third parties. We also control access to and ownership of software, services, documentation, and other proprietary information as means to protect our proprietary rights.

10

Table of Contents

Sales and Marketing

We sell our software and services primarily through a direct sales force. In addition, strategic partnerships with management consulting firms and major systems integrators are important to our sales efforts because they influence buying decisions, help us identify sales opportunities, and complement our software and services with their domain expertise and consulting capabilities. We also partner with technology providers and application developers.

To support our sales efforts, we conduct a broad range of marketing programs, including awareness advertising, client and industry-targeted solution campaigns, trade shows, including our PegaWorld® user conference, solution seminars and webinars, industry analyst and press relations, Web and digital marketing, community development, social media, and other direct and indirect marketing efforts. Our consulting staff, business partners, and other third parties also conduct joint and separate marketing campaigns that generate sales leads.

Sales by Geography

See Note 17, “Geographic Information and Major Clients,” included in Item 8 and “Risk Factors—We face risks from operations and clients based outside of the U.S.” in Item 1A of this Annual Report.

Research and Development

Our development organization is responsible for product architecture, core technology development, product testing, and quality assurance. Our product development priority is to continue expanding the capabilities of our technology. We intend to maintain and extend the support of our existing applications, and we may choose to invest in additional strategic applications which incorporate the latest business innovations. We also intend to maintain and extend the support of popular hardware platforms, operating systems, databases, and connectivity options to facilitate easy and rapid deployment in diverse IT infrastructures. Our goal with all of our products is to enhance product capabilities, ease of implementation, long-term flexibility, and the ability to provide improved client service.

During 2017, 2016, and 2015, research and development expenses were approximately $162.9 million, $145.5 million, and $126.4 million, respectively. See Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report. We expect that we will continue to commit significant resources to our product research and development in the future to maintain our leadership position.

Employees

As of January 31, 2018 we had 4,237 employees worldwide, of which 1,768 were based in North America, 834 were based in Europe, and 1,635 were based in Asia Pacific.

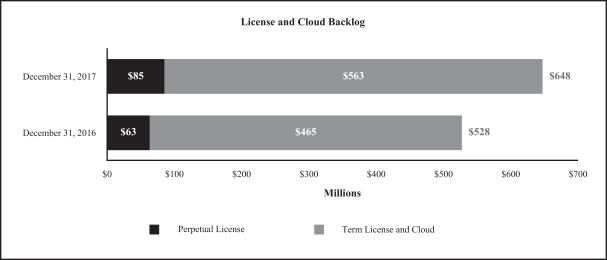

Backlog

As of December 31, 2017, we had software license, maintenance, cloud, and services agreements with clients not yet recognized in revenue (“backlog”) of approximately $850.3 million. As of December 31, 2016, we had approximately $707.8 million in backlog.

Under some of these agreements, we must fulfill certain conditions prior to recognizing revenue, and there can be no assurance when, if ever, we will be able to satisfy all such conditions in each instance. Additionally, some backlog amounts may not be recognized as revenue in future periods as a result of the adoption of the new revenue recognition standard (“ASC 606”) effective January 1, 2018. See Note 2. “Significant Accounting Polices” in Item 8 of this Annual Report.

11

Table of Contents

Backlog may vary in any given period depending on the amount and timing of when arrangements are executed, as well as the mix between perpetual license, term license, and cloud arrangements. See Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report for a discussion on license and cloud backlog, which excludes future revenue from maintenance and service arrangements.

Available Information

Pegasystems Inc. was incorporated in Massachusetts in 1983. Our stock is traded on the NASDAQ Global Select Market under the symbol PEGA. Our website is located at www.pega.com and our investor relations website is located at www.pega.com/about/investors.

We make available our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, and amendments to these reports, free of charge through our website (www.pega.com) as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the Securities and Exchange Commission (“SEC”). We also make available on our website reports filed by our executive officers and Directors on Forms 3, 4, and 5 regarding their ownership of our securities. Our Code of Conduct, and any amendments to our Code of Conduct, are also available on our website at www.pega.com/about/leadership on the “Governance” tab.

The SEC maintains a website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov.

| ITEM 1A. | RISK FACTORS |

The risks and uncertainties described below are not the only ones facing us. Other events that we do not currently anticipate or that we currently deem immaterial also may affect our results of operations, cash flows and financial condition.

Factors relating to our financial results

We may not be able to achieve the key elements of our strategy and grow our business as anticipated.

We currently intend to grow our business by pursuing strategic initiatives. Key elements of our strategy include continuing to grow our market share by developing and delivering robust applications for marketing, sales automation, customer service, and operations that can work together seamlessly with maximum differentiation and minimal customization, offering versatility in our Pega Platform and application deployment and licensing options to meet the specific needs of our clients, growing our network of partner alliances, and developing the talent and organizational structure capable of supporting our revenue and earnings growth targets. We may not be able to achieve one or more of our key initiatives. Our success depends on our ability to appropriately manage our expenses as we grow our organization; successfully execute our marketing and sales strategies; successfully incorporate acquired technologies into our unified Pega Platform; and develop new products or product enhancements. If we are not able to execute on these actions, our business may not grow as we anticipated, and our operating results could be adversely affected.

Security of our systems and of global client data is a growing challenge on many fronts. Cyber-attacks and security breaches may expose us to significant legal and financial liabilities.

Our cloud offering provides Pega Platform environments that are provisioned, monitored, and maintained for individual clients to create and deploy Pega-based applications using an Internet-based infrastructure. These services involve the storage and transmission of clients’ data and potential proprietary information. Security breaches could expose us and our clients to a risk of loss or misuse of this information. Any security breach

12

Table of Contents

could result in a loss of confidence in the security of our services, damage our reputation, disrupt our business, lead to legal liability, and negatively impact our future sales. High-profile security breaches at other companies have increased in recent years, and security industry experts and government officials have warned about the risks of hackers and cyber-attackers targeting information technology products and businesses. Threats to IT security can take a variety of forms. Individual hackers, groups of hackers, and sophisticated organizations including state-sponsored organizations or nation-states themselves, may take steps that pose threats to our clients and to our IT structure.

Our security measures, and those of our clients, may be breached as a result of third-party actions, or that of employees, consultants, or others, including intentional misconduct by computer hackers, system error, human error, technical flaws in our products, or otherwise. The techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until launched against a target. While we have invested in the protection of our data and systems and of our clients’ data to reduce these risks, there can be no assurance that our efforts will prevent breaches. We carry data breach insurance coverage to mitigate the financial impact of potential legal liability, though this may prove insufficient in the event of a breach.

Our cloud offering involves the hosting of clients’ applications on the servers of third-party technology providers. We also rely on third-party systems and technology including encryption, virtualized infrastructure and support, and we employ a shared security model with our clients and our third-party technology providers. Because we do not control the configuration of Pega applications by our clients, the transmissions between our clients and our third-party technology providers, the processing of data on the servers at third-party technology providers, or the internal controls maintained by our clients and third-party technology providers that could prevent unauthorized access or provide appropriate data encryption, we cannot fully ensure the complete integrity or security of such transmissions processing, or controls. In addition, privacy, security, and data transmission concerns in some parts of the world may inhibit demand for our cloud offering or lead to requirements to provide our products or services in configurations that may increase the cost of serving such markets.

In order to defend against security threats, we need to continuously engineer products and services with enhanced security and reliability features; improve the deployment of software updates to address security vulnerabilities; apply technologies which mitigate the risk of attacks; and maintain a digital security infrastructure that protects the integrity of our network, products, and services. The cost of these steps could negatively impact our operating margins.

The timing of our license and cloud revenue is difficult to predict accurately, which may cause our operating results to vary considerably.

A change in the number or size of high value license and cloud arrangements, or a change in the mix between perpetual licenses, term licenses, and cloud arrangements can cause our revenues to fluctuate materially between periods.

Factors which may influence the predictability of our license and cloud revenue include:

| • | changes in client budgets and decision-making processes that could affect both the timing and size of transactions; |

| • | deferral of license revenue to future periods due to the timing of the execution of an agreement or our ability to deliver the products or services; |

| • | changes in our business model; and/or |

| • | our ability to execute on our marketing and sales strategies. |

We budget for our selling and marketing, product development, and other expenses based upon anticipated future bookings and revenue. If the timing or amount of revenue fails to meet our expectations in a given period,

13

Table of Contents

our financial performance is likely to be adversely affected because only a small portion of our expenses vary with revenue. Other factors which may cause our operating results to vary considerably include changes in foreign currency exchange rates, income tax effects, and the impact of new accounting pronouncements.

As a result, period-to-period comparisons of our operating results are not necessarily meaningful and should not be relied upon to predict future performance. If our revenues and operating results do not meet the expectations of our investors or securities analysts or fall below guidance we may provide to the market or due to other factors discussed elsewhere in this section, the price of our common stock may decline.

The number of our license and cloud arrangements has been increasing, and we may not be able to sustain this growth unless we and our partners can provide sufficient high quality consulting, training, and maintenance resources to enable our clients to realize significant business value from our software.

Our clients typically request consulting and training to assist them in implementing our license and cloud offerings. Our clients also purchase maintenance on our perpetual and term licenses. As a result, an increase in the number of license and cloud arrangements is likely to increase demand for consulting, training, and maintenance related to our offerings. Given that the number of our license and cloud arrangements has been increasing, we will need to provide our clients with more consulting, training, and maintenance to enable our clients to realize significant business value from our software. We have been increasing our partner and client enablement through training to create an expanded ecosystem of people that are skilled in the implementation of our products. However, if we and our partners are unable to provide sufficient high quality consulting, training, or maintenance resources to our clients, our clients may not realize sufficient business value from our offerings to justify follow-on sales, which could impact our future financial performance. In addition, the investments required to meet the increased demand for our consulting services could strain our ability to deliver our consulting engagements at desired levels of profitability, thereby impacting our overall profitability and financial results.

We frequently enter into a series of license or cloud arrangements that are each focused on a specific purpose or area of operations. If we are not successful in obtaining follow-on business from these clients, our financial performance could be adversely affected.

Once a client has realized the value of our software, we work with the client to identify opportunities for follow-on sales. However, we may not be successful in demonstrating this value to some clients, for reasons relating to the performance of our products, the quality of the services and support provided by our partners and us, or external reasons. Also, some of our smaller clients may have limited additional sales opportunities available. For any of these clients, we may not obtain follow-on sales or the follow-on sales may be delayed, and our future revenue could be limited. This could lower the total value of all transactions and adversely affect our financial performance.

Our consulting revenue is dependent to a significant extent on closing new license transactions with clients.

We derive a substantial portion of our consulting revenue from implementations of new licenses and cloud arrangements led by our consulting staff and where we provide consulting for partner-led and client-led implementation efforts. Accordingly, if we do not continue to close more license and cloud arrangements transactions with our clients, we may be unable to maintain or grow our consulting revenue, which could have an adverse effect on our results of operations.

Our financial results may be adversely affected if we are required to change certain estimates, judgments, and/or positions relative to our income and other taxes.

In the ordinary course of conducting our global business enterprise, we cannot be certain of the ultimate tax outcome related to many transactions and calculations. Some of these uncertainties arise as a consequence of

14

Table of Contents

positions we have taken regarding valuation of deferred tax assets, transfer pricing for transactions with our subsidiaries, and potential challenges to nexus and tax credit estimates. We estimate our exposure to unfavorable outcomes related to these uncertainties and estimate the probability of such outcomes. Future realization of our deferred tax assets ultimately depends on the existence of sufficient taxable income within the available carryback or carryforward periods. We record a valuation allowance to reduce our deferred tax assets to an amount we believe is more likely than not to be realized. If our taxable income is not consistent with our expectations or the timing of income is not within the applicable carryforward period, we may be required to establish a valuation allowance on all or a portion of these deferred tax assets. Changes in our valuation allowance impact our income tax expense in the period of adjustment. Although we believe our estimates are reasonable, no assurance can be given that the final tax outcome of these matters or our current estimates regarding these matters will not be different from what is reflected in our historical income tax provisions, returns, and accruals. Such differences, or changes in estimates relating to potential differences, could have a material impact, unfavorable or favorable, on our income tax provisions and effective tax rate, require us to change the recorded value of deferred tax assets, and adversely affect our financial results. Our effective tax rate may also be adversely affected by changes in the mix of taxable income derived by jurisdictions with varied statutory tax rates, changes in tax laws, regulations and interpretations, changes to the financial accounting rules for income taxes and assessments, and any interest or penalties, by taxing authorities.

We are also subject to non-income taxes such as payroll, sales and use, value-added, net worth, property, and goods and services taxes in the U.S. and in various foreign jurisdictions. We are regularly under audit by tax authorities with respect to these non-income taxes and may have exposure to additional non-income tax liabilities which could have an adverse effect on our results of operations and financial condition.

Uncertainties in the interpretation and application of the Tax Reform Act could materially affect our tax obligations and effective tax rate.

On December 22, 2017, the President of the United States signed into law the Tax Reform Act, which significantly changed the U.S. tax code. The U.S. Department of the Treasury has broad authority to issue regulations and interpretive guidance that may significantly affect the application of the Tax Reform Act. The Tax Reform Act requires complex computations not previously required under U.S. tax law. As such, the application of accounting guidance for such items is currently uncertain. Further, compliance with the Tax Reform Act and the accounting for such provisions require accumulation of information not previously required or regularly gathered. As a result, we have recognized provisional tax impacts of the Tax Reform Act in our financial statements. As additional regulatory guidance is issued by the U.S. Department of the Treasury, the Internal Revenue Service, and/or state taxing authorities, as accounting treatment is clarified, and as we perform additional analysis on the application of the law, the final amounts may differ from our current provisional amounts.

If it became necessary to repatriate any of our foreign cash balances to the United States, we may be subject to increased income taxes, other restrictions, and limitations.

As of December 31, 2017, approximately $87.3 million of our cash and cash equivalents was held in our foreign subsidiaries. If we are unable to reinvest this cash outside of the U.S., we may have to repatriate some of our foreign cash to the U.S. which would increase our income tax liability. If it became necessary to repatriate these funds, we may be required to pay U.S. state and local taxes, as well as foreign taxes, upon repatriation. We consider the earnings of our foreign subsidiaries to be permanently reinvested and, as a result, U.S. state, U.S. local and foreign taxes on such earnings have not been provided. It is impractical to estimate the amount of U.S. state, U.S. local and foreign tax we would have to pay upon repatriation due to the complexity of the income tax laws and the effects of the Tax Reform Act and other factors.

15

Table of Contents

We are investing heavily in sales and marketing, research and development, and support in anticipation of a continued increase in license and cloud arrangements, and we may experience decreased profitability or losses if we do not continue to increase the value of our license and cloud arrangements to balance our growth in expenses.

We have been expanding our sales and marketing capacity to meet increasing demand for our software and to broaden our market coverage by hiring additional sales and marketing personnel. We anticipate that we will need to provide our clients with more maintenance support as a result of this increase in demand, and also have been hiring additional personnel in this area. We continue to invest significantly in research and development to expand and improve the Pega Platform and applications. These investments have resulted in increased fixed costs that do not vary with the level of revenue. If the increased demand for our offerings does not continue, we could experience decreased profitability or losses as a result of these increased fixed costs. Conversely, if we are unable to hire sales and marketing personnel to meet future demand or research and development personnel to enhance our current or develop new products, we may not be able to achieve our sales and profitability targets.

We will need to acquire or develop new products, evolve existing ones, address any defects or errors, and adapt to technology changes.

Technical developments, client requirements, programming languages, and industry standards change frequently in our markets. As a result, success in current markets and new markets will depend upon our ability to enhance current products, address any product defects or errors, acquire or develop and introduce new products that meet client needs, keep pace with technology changes, respond to competitive products, and achieve market acceptance. Product development requires substantial investments for research, refinement, and testing. We may not have sufficient resources to make necessary product development investments. We may experience technical or other difficulties that will delay or prevent the successful development, introduction, or implementation of new or enhanced products. We may also experience technical or other difficulties in the integration of acquired technologies into our existing platform and applications. Inability to introduce or implement new or enhanced products in a timely manner could result in loss of market share if competitors are able to provide solutions to meet client needs before we do, give rise to unanticipated expenses related to further development or modification of acquired technologies, and adversely affect future financial performance.

The market for our offerings is intensely and increasingly competitive, rapidly changing, and highly fragmented.

We compete in the CRM (which includes marketing, sales, and customer service), BPM, case management, decision management, robotic automation, co-browsing, social engagement, and mobile application development platform software markets, as well as in markets for the vertical applications we provide (e.g. Pega® KYC for Financial Services, Pega® Underwriting for Insurance). These markets are intensely competitive, rapidly changing, and highly fragmented, as current competitors expand their product offerings and new companies enter the market.

We encounter significant competition from other technology vendors, as well as clients’ internal information systems departments, that seek to modify their existing systems or develop their own proprietary systems, and professional service organizations that develop their own products or create custom software in conjunction with rendering consulting services. Competition for market share and pressure to reduce prices and make sales concessions are likely to increase. Many of our competitors, such as IBM, Oracle, and Salesforce, have far greater resources than we do and may be able to respond more quickly and efficiently to new or emerging technologies, programming languages, or standards, or to changes in client requirements or preferences. Competitors may also be able to devote greater managerial and financial resources to develop, promote, and distribute products and to provide related consulting and training services. There can be no assurance that we will be able to compete successfully against current or future competitors or that the competitive pressures faced by us will not materially adversely affect our business, operating results, and financial condition. See “Competition” in Item 1 “Business” of this Annual Report.

16

Table of Contents

The continued uncertainties in the global economy may negatively impact our sales to, and the collection of receivables from, our clients.

Our sales to, and our collection of receivables from, our clients may be impacted by adverse changes in global economic conditions. The U.S. and other key international economies have experienced cyclical downturns from time to time during which economic activity has been impacted by falling demand for goods and services, restricted credit, poor liquidity, reduced corporate profitability, volatility in credit, equity, and foreign exchange markets, bankruptcies, and economic uncertainty. These changes in global economic conditions could impact the ability and willingness of our clients to make investments in technology, which in turn may delay or reduce the purchases of our software and services. These factors could also impact the ability and willingness of these clients to pay their trade obligations and honor their contractual commitments. These clients may also become subject to increasingly restrictive regulatory requirements, which could limit or delay their ability to proceed with technology purchases and may result in longer sales cycles, increased price competition, and reductions in sales of our products and services. The financial uncertainties facing many of our clients and the industries in which they operate could negatively impact our business, operating results, and financial condition.

We have historically sold to the financial services, healthcare, insurance, and communications markets, and rapid changes or consolidation in these markets could affect the level of demand for our products.

We have historically derived a significant portion of our revenue from clients in the financial services, healthcare, insurance, and communications markets, and sales to these markets are important for our future growth. Competitive pressures, industry consolidation, decreasing operating margins, regulatory changes, and privacy concerns affect the financial condition of our clients and their willingness to buy. In addition, clients’ purchasing patterns in these industries for large technology projects are somewhat discretionary. The financial services and insurance markets continue to undergo intense domestic and international consolidation, and consolidation has increased in the healthcare and communications markets. Consolidation may interrupt normal buying behaviors and increase the volatility of our operating results. In recent years, several of our clients have been merged or consolidated, and we expect this to continue in the near future. Future mergers or consolidations may cause a decline in revenues and adversely affect our future financial performance. All of these factors affect the level of demand for our products from clients in these industries, and could adversely affect our business, operating results, and financial condition.

We rely on certain third-party relationships.

We have a number of relationships with third parties that are significant to our sales, marketing and support activities, and to product development efforts, including hosting facilities for our cloud offering. We rely on software and hardware vendors, large system integrators, and technology consulting firms to provide marketing and sales opportunities for our direct sales force and to strengthen our products through the use of industry-standard tools and utilities. We also have relationships with third parties that distribute our products. There can be no assurance that these companies, many of which have far greater financial and marketing resources than we do, will not develop or market offerings that compete with ours in the future or will not otherwise end or limit their relationships with us. Further, the use of third-party hosting facilities requires us to rely on the functionality and availability of the third parties’ services, as well as their data security as it is provided by such third parties, which despite our due diligence may be or become less than adequate.

We face risks from operations and clients based outside of the U.S.

Sales to clients based outside of the U.S. represent an average of 44% of our total revenue over the last three fiscal years. We market our products and services to clients based outside of the U.S. including clients based in Canada, Europe, Latin America, Asia, and Australia. We have established offices in the Americas, Europe (including Russia and Turkey), Asia (including India), and Australia. We believe that growth will necessitate expanded international operations, requiring increased managerial attention and costs. We anticipate hiring

17

Table of Contents

additional personnel to accommodate international growth, and we may also enter into agreements with local distributors, representatives, or resellers. If we are unable to do one or more of these things in a timely and effective manner, the growth, if any, of our foreign operations may be restricted, and our business, operating results, and financial condition could be materially and adversely affected.

In addition, we may not be able to maintain or increase international market demand for our offerings. Additional risks inherent in our international business activities generally include:

| • | laws and business practices favoring local competitors; |

| • | compliance with multiple, conflicting, and changing governmental laws and regulations, including employment, tax, privacy and data privacy and protection, and increased tariffs and other trade barriers; |

| • | the costs of localizing offerings for local markets, including translation into foreign languages and associated expenses; |

| • | longer payment cycles and credit and collectability risk on our foreign trade receivables; |

| • | economic and political uncertainty around the world, such as the United Kingdom’s referendum in June 2016 in which voters approved an exit from the European Union, commonly referred to as “Brexit”; |

| • | difficulties in enforcing contractual and intellectual property rights; |

| • | heightened fraud and anti-bribery awareness risks; |

| • | treatment of revenue from international sources and changes to tax codes, including being subject to foreign tax laws, being liable for paying withholding income or other taxes in foreign jurisdictions, and other potentially adverse tax consequences (including restrictions on repatriating earnings and the threat of “double taxation”); |

| • | managing our international operations, including increased accounting, internal control, and compliance expenses; |

| • | heightened risks of political and economic instability; and |

| • | foreign currency exchange rate fluctuations and controls. |

There can be no assurance that one or more of these factors will not have a material adverse effect on our international operations, and, consequently, on our business, operating results, and financial condition.

We are exposed to fluctuations in currency exchange rates that could negatively impact our financial results and cash flows.

Because a significant portion of our business is conducted outside the U.S., we face exposure to adverse movements in foreign currency exchange rates. Our international sales are usually denominated in foreign currencies. The operating expenses of our foreign operations are also primarily denominated in foreign currencies, which partially offset our foreign currency exposure on our international sales. Our results of operations and cash flows are subject to fluctuations due to changes in foreign currency exchange rates, particularly changes in the U.S. dollar, the Euro, and the Australian dollar relative to the British Pound. These exposures may change over time as business practices evolve, and they could have a material adverse impact on our financial results and cash flows. In the past we have used, but do not currently use, foreign currency forward contracts (“forward contracts”) to hedge our exposure to changes in foreign currency exchange rates associated with our foreign currency denominated cash, accounts receivable, and intercompany receivables and payables held by our U.S. parent company and its U.K. subsidiary. We may in the future again enter into hedging contracts if we feel that it is appropriate. We do not enter into any hedging contracts for trading or speculative purposes. Our realized gain or loss with respect to foreign currency fluctuations will generally depend on the size

18

Table of Contents

and type of cross-currency exposures that we enter into; the currency exchange rates associated with these exposures and changes in those rates; whether we have entered into forward contracts to offset these exposures; and other factors. All of these factors could materially impact our operating results, financial condition, and cash flows.

Factors relating to our internal operations and potential liabilities

We depend on a number of key personnel, and must be able to attract and retain qualified personnel in the future.

The business is dependent on key, highly skilled technical, managerial, consulting, sales, and marketing personnel, including our Chief Executive Officer who is also our founder and majority stockholder. The loss of key personnel could be disruptive to our operations and adversely affect financial performance. We do not have any significant key-man life insurance on any officers or employees and do not plan to obtain any. Our success will depend in large part on the ability to attract and retain qualified personnel, and rapidly replace and develop new management. The number of potential employees who have the extensive knowledge needed to develop, sell, and maintain our offerings is limited, and competition for their services is intense, and there can be no assurance that we will be able to attract and retain such personnel. If we are unable to do so, our business, operating results, and financial condition could be materially adversely affected.

The acquisition of other businesses and technologies may present new risks.

We have undertaken acquisitions in the past, and we continue to evaluate and consider other potential strategic transactions, including domestic and international acquisitions of businesses, technologies, services, products, and other assets. These acquisitions, if undertaken, may involve significant new risks and uncertainties, including distraction of management attention away from our current business operations, insufficient new revenue to offset expenses, inadequate return on capital, integration challenges, new regulatory and/or legal requirements, new third-party intellectual property infringement claims related to the acquired technology and/or services, dilution of shareholder value, cross border legal issues, and issues not discovered in our due diligence process. No assurance can be given that such acquisitions will be successful and will not adversely affect our profitability or operations.

We may experience significant errors or security flaws in our product and services, and could face privacy, product liability, and/or warranty claims as a result.

Despite quality testing prior to its release, our software frequently contains errors or security flaws, especially when first introduced or when new versions are released. Errors in our software could affect its ability to work with hardware or other software, or could delay the development or release of new products or new versions of our software. Additionally, the detection and correction of any security flaws can be time consuming and costly. Errors or security flaws in our software could result in the inadvertent disclosure of confidential information or personal data relating to our clients, employees, or third parties. Software errors and security flaws in our products or services could expose us to privacy, product liability, and/or warranty claims as well as harm our reputation, which could impact our future sales of products and services. Typically, we enter into license agreements that contain provisions intended to limit the nature and extent of our risk of product liability and warranty claims. There is a risk that a court might interpret these terms in a limited way or could hold part or all of these terms to be unenforceable. Also, there is a risk that these contract terms might not bind a party other than the direct client. Furthermore, some of our licenses with our clients are governed by non-U.S. law, and there is a risk that foreign law might give us less or different protection. Although we have not experienced any material product liability claims to date, a product liability suit or action claiming a breach of warranty, whether or not meritorious, could result in substantial costs and a diversion of management’s attention and our resources.

19

Table of Contents

We face risks related to intellectual property claims or appropriation of our intellectual property rights.

We rely primarily on a combination of copyright, trademark, and trade secrets laws, as well as intellectual property and confidentiality agreements to protect our proprietary rights. We also try to control access to and distribution of our technologies and other proprietary information. We have obtained patents in strategically important global markets relating to the architecture of our systems. We cannot assure that such patents will not be challenged, invalidated, or circumvented or that rights granted thereunder or the claims contained therein will provide us with competitive advantages. Moreover, despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our software or to obtain the use of information that we regard as proprietary. Although we generally enter into intellectual property and confidentiality agreements with our employees and strategic partners, despite our efforts our former employees may seek employment with our business partners, clients, or competitors, and there can be no assurance that the confidential nature of our proprietary information will be maintained. In addition, the laws of some foreign countries do not protect our proprietary rights to as great an extent as do the laws of the U.S. There can be no assurance that our means of protecting our proprietary rights will be adequate or that our competitors will not independently develop similar technology.

Other companies or individuals have obtained proprietary rights covering a variety of designs, processes, and systems. There can be no assurance that third parties, including clients, will not claim infringement by us with respect to current or future products. Although we attempt to limit the amount and type of our contractual liability for infringement of the proprietary rights of third parties, and also assert ownership of work product and intellectual property rights as appropriate, there are often exceptions, and limitations may not be applicable and enforceable in all cases. Even if limitations are found to be applicable and enforceable, our liability to our clients for these types of claims could be material given the size of certain of our transactions. We expect that software product developers will increasingly be subject to infringement claims as the number of products and competitors in our industry segment grows and the functionality of products in different industry segments overlaps. Any such claims, with or without merit, could be time-consuming, result in costly litigation, cause product shipment and delivery delays, require us to enter into royalty or licensing agreements, or be precluded from making and selling the infringing software, if such proprietary rights are found to be valid. Royalty or licensing agreements, if required, may not be available on terms acceptable to us or at all, which could have a material adverse effect upon our business, operating results, and financial condition.

We are subject to increasingly complex and burdensome U.S. and foreign laws and regulations, and any failure to comply with these laws and regulations could subject us to, among other things, penalties and legal expenses that could harm our reputation or have a material adverse effect on our business, financial condition and results of operations.

We are subject to extensive federal, state, and foreign laws and regulations, including but not limited to the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act, data privacy and security laws, and similar laws and regulations. The Foreign Corrupt Practices Act, the U.K. Bribery Act, and similar foreign anti-bribery laws generally prohibit companies and their intermediaries from making improper payments for the purpose of obtaining or retaining business. Similar laws and regulations exist in many other countries throughout the world in which we do or intend to do business. Data privacy laws and regulations in Europe, Australia, Latin America and elsewhere are undergoing rapid transformation towards increased restrictions. For example, in October 2015, the European Court of Justice invalidated the U.S.-EU Safe Harbor framework that had been in place since 2000, which allowed companies to meet certain European legal requirements for the transfer of personal data from the European Economic Area to the United States. In April 2016, the European Parliament adopted the General Data Protection Regulation (“GDPR”). The GDPR has a two-year phase-in period, with an effective date of May 25, 2018 and extends the scope of European privacy laws to any entity which controls or processes personal data of E.U. residents in connection with the offer of goods or services or the monitoring of behavior. Complying with the GDPR and other emerging and changing requirements may cause us to incur substantial costs or require us to change our business practices.

20

Table of Contents

We have developed and implemented a compliance program based on what we believe are current best practices, including the background checking of our current partners and prospective clients and partners, but we cannot guarantee that we, our employees, our consultants, our partners, or our contractors are or will be in compliance with all federal, state, and foreign regulations, particularly as we expand our operations outside of the U.S. If we or our representatives fail to comply with any of these laws or regulations, a range of fines, penalties, and/or other sanctions could be imposed on us, which could have a material adverse effect on our business, financial condition, and results of operations. Even if we are determined not to have violated these laws, government investigations into these issues typically require the expenditure of significant resources and generate negative publicity, which could also have an adverse effect on our business, financial condition, and results of operations. In addition, regulation of data privacy and security laws is increasing worldwide, including various restrictions on cross-border access or transfer of data, including personal data of our employees, our clients, and customers of our clients. Compliance with such regulations may increase our costs and there is a risk of enforcement of such laws resulting in damage to our brand as well as financial penalties and potential loss of business, which could be significant.

We face risks related to outages, data losses, and disruptions of our online services if we fail to maintain an adequate operations infrastructure.

The increasing user traffic for our cloud offering demands more computing power. It requires that we maintain an Internet connectivity infrastructure that is robust and reliable within competitive and regulatory constraints that continue to evolve. Inefficiencies or operational failures, including temporary or permanent loss of client data, power outages, or telecommunications infrastructure outages, by us or our third party service providers could diminish the quality of our user experience resulting in contractual liability, claims by clients and other third parties, damage to our reputation, loss of current and potential clients, and harm to our operating results and financial condition.

Our implementation of significant modifications to our enterprise resource planning (“ERP”) system may adversely affect our business and results of operations or the effectiveness of internal control over financial reporting.

During 2016, we implemented the billing and revenue recognition modules in our existing ERP system. The new revenue recognition module was implemented to facilitate the preparation of our financial statements under both the current revenue recognition guidance under Accounting Standards Codification 985-605, Software—Revenue Recognition and the new guidance under Accounting Standard Update No. 2014-09, “Revenue from Contracts with Customers (Topic 606)”. See Note 2, “Significant Accounting Policies—New accounting pronouncements,” included in Item 8 of this Annual Report for further discussion of new guidance. Implementations of a project of this size and complexity involve risks inherent in the conversion to a new computer system, including loss of information and potential disruption of normal operations. The implementation was completed in the fourth quarter of 2016; however, post-implementation support activities are still ongoing. Our business and results of operations may be adversely affected if we experience operating problems with the new system that result in increased costs to correct post-implementation issues identified. Additionally, if the new system and the associated process changes do not give rise to the benefits that we expect, or if the new system does not operate as intended, it could adversely affect our financial reporting systems and processes, our ability to produce timely and accurate financial reports, and/or the effectiveness of internal control over financial reporting. We have assessed, and continue to monitor, our processes and procedures as a result of the implementation, as well as the impact on our internal controls over financial reporting.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

21

Table of Contents

| ITEM 2. | PROPERTIES |

Our principal administrative, sales, marketing, support, and research and development operations are located in Cambridge, Massachusetts in an approximately 185,000 square foot leased facility. Our lease expires in 2023, subject to our option to extend for two additional five-year periods. A significant portion of our research and development is conducted in Hyderabad, India in an approximately 238,000 square foot leased facility. Our Hyderabad facility is subject to two leases which expire in 2019 and 2020 and are subject to our option to extend for two additional five-year periods.

We also lease space for smaller offices in the Americas, Europe, and the Asia Pacific under leases that expire at various dates through 2022. We periodically evaluate the adequacy of existing facilities and we believe that additional or alternative space will be available as needed in the future on commercially reasonable terms.

See Note 12 “Commitments and Contingencies,” in Item 8 of this Annual Report for more information about our lease commitments.

| ITEM 3. | LEGAL PROCEEDINGS |

None.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

22

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our common stock is quoted on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “PEGA.” The following table sets forth the range of high and low sales prices of our common stock on NASDAQ for each quarter in 2017 and 2016:

| Common Stock Price | ||||||||||||||||

| 2017 | 2016 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter |

$ | 45.20 | $ | 35.50 | $ | 27.19 | $ | 20.62 | ||||||||

| Second Quarter |

$ | 63.65 | $ | 43.00 | $ | 29.00 | $ | 24.32 | ||||||||

| Third Quarter |

$ | 62.35 | $ | 52.00 | $ | 29.61 | $ | 25.02 | ||||||||