Attached files

| file | filename |

|---|---|

| 8-K - 8-K COWEN INDUSTRIALS CONFERENCE - WORTHINGTON INDUSTRIES INC | wor-8k_20210211.htm |

Worthington Industries Joe Hayek – Chief Financial Officer 42nd Annual Aerospace/Defense & Industrials Conference February 11, 2021

Worthington Industries wishes to take advantage of the Safe Harbor provisions included in the Private Securities Litigation Reform Act of 1995 (the “Act"). Statements by the Company which are not historical information constitute "forward looking statements" within the meaning of the Act. All forward-looking statements are subject to risks and uncertainties which could cause actual results to differ from those projected. Factors that could cause actual results to differ materially include risks, uncertainties and impacts described from time to time in the Company's filings with the Securities and Exchange Commission, including those related to COVID-19 and the various actions taken in connection therewith, which could also heighten other risks. 2 Safe harbor statement

Vision To Be the Transformative Partner for our customers, a Positive Force in our communities and earn exceptional returns 3

Domestic leader in flat rolled steel processing Global leader in pressure cylinders Consumer Products Industrial Products Domestic leader in suspension ceiling solutions (WAVE) Market-leading joint ventures serving building product & automotive end-markets LTM Financial Metrics (Q2 FY2021): Sales:$2,810 million Adj. EBITDA: $317 million Corporate Credit Ratings: BBB / Baa3 7,500 employees & 4,500 customers; 51 facilities in 7 countries Primarily non-union facilities Employee, customer, supplier and investor-centered philosophy 4 Net sales of $2.8 billion ltM 11/30/20

Long history of keeping employees safe, practicing good citizenship and protecting the environment Corporate Citizenship & sustainability Fiscal Year 2020 Highlights For more information on our Corporate Citizenship & Sustainability efforts, please see our first annual Corporate Citizenship & Sustainability Report located on the “Governance” page of our Investor Relations website at ir.WorthingtonIndustries.com 5

Largest purchaser of flat roll steel behind automakers 6 Manufactured 83MM Cylinders & Accessories (FY20) Sold in 90+ Countries FORTUNE Most Admired Companies in Metals Industry three times FORTUNE 100 Best Companies to Work For in America four times Best Place to Work in IT by Computerworld 2017-2020 Partner-Level Supplier 2013-2019 and Supplier Hall of Fame by John Deere Military Friendly® Employer by VIQTORY 2016-2021 Top Workplace by Columbus CEO from 2013-2020 TWB Company named a General Motors Supplier of the Year 2019 FCA Supplier of the Year 2020 in the category of raw materials

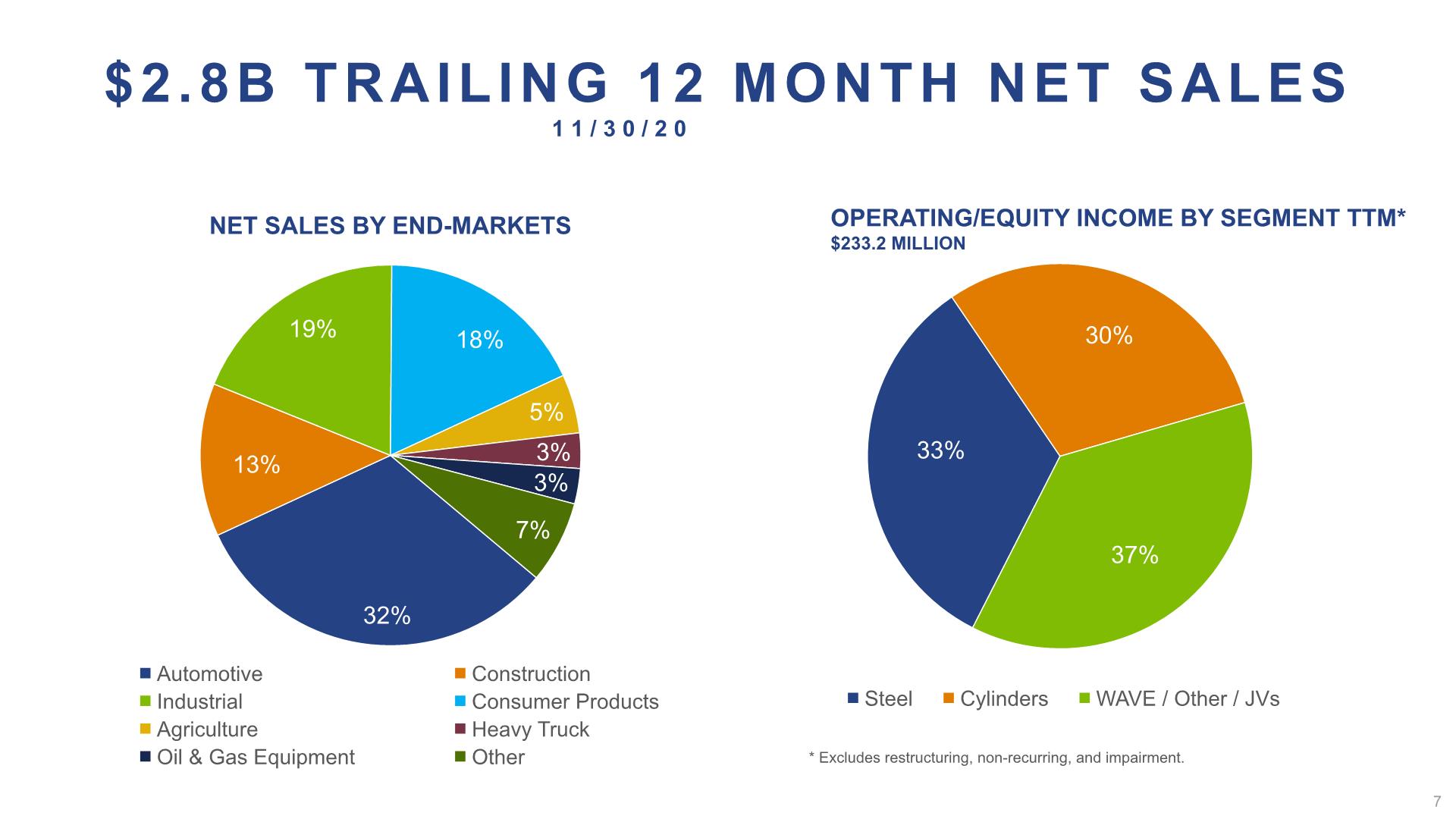

Net Sales by End-Markets $2.8B Trailing 12 Month Net Sales 11/30/20 Operating/Equity Income by Segment TTM* $233.2 million * Excludes restructuring, non-recurring, and impairment. 7

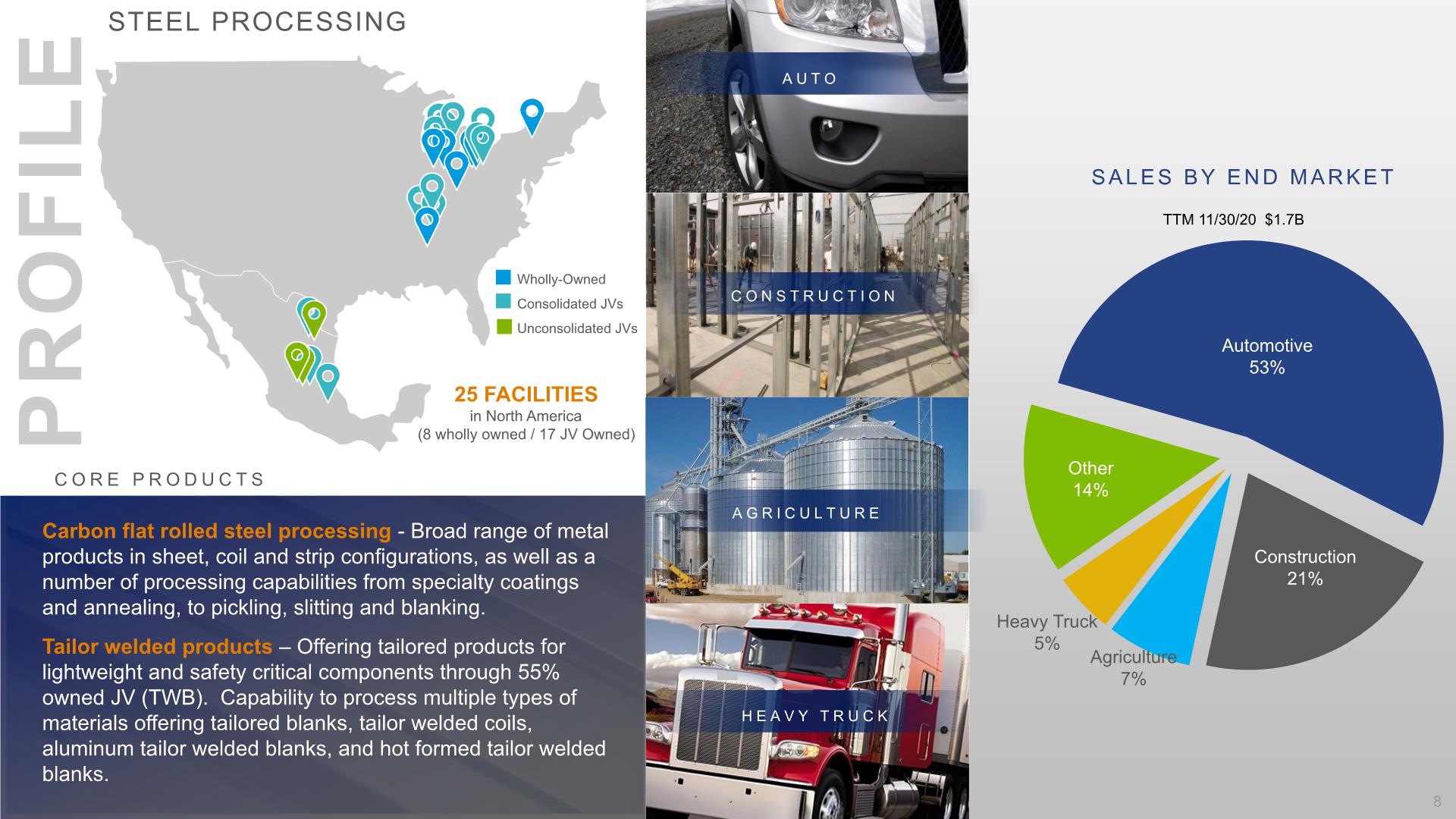

Sales By End Market TTM 11/30/20 $1.7B AUTO CORE PRODUCTS Profile STEEL PROCESSING AGRICULTURE HEAVY TRUCK Carbon flat rolled steel processing - Broad range of metal products in sheet, coil and strip configurations, as well as a number of processing capabilities from specialty coatings and annealing, to pickling, slitting and blanking. Tailor welded products – Offering tailored products for lightweight and safety critical components through 55% owned JV (TWB). Capability to process multiple types of materials offering tailored blanks, tailor welded coils, aluminum tailor welded blanks, and hot formed tailor welded blanks. 8 25 facilities in North America (8 wholly owned / 17 JV Owned)

Profile Sales By SBU Industrial Products - Broad line of pressure cylinders and tanks for industrial gas storage and transportation Consumer Products – Market-leading brands with products for outdoor living, niche tools, and water system solutions. TTM 11/30/20 $1.1B CORE PRODUCTS PRESSURE CYLINDERS 9 15 facilities in North America and Europe

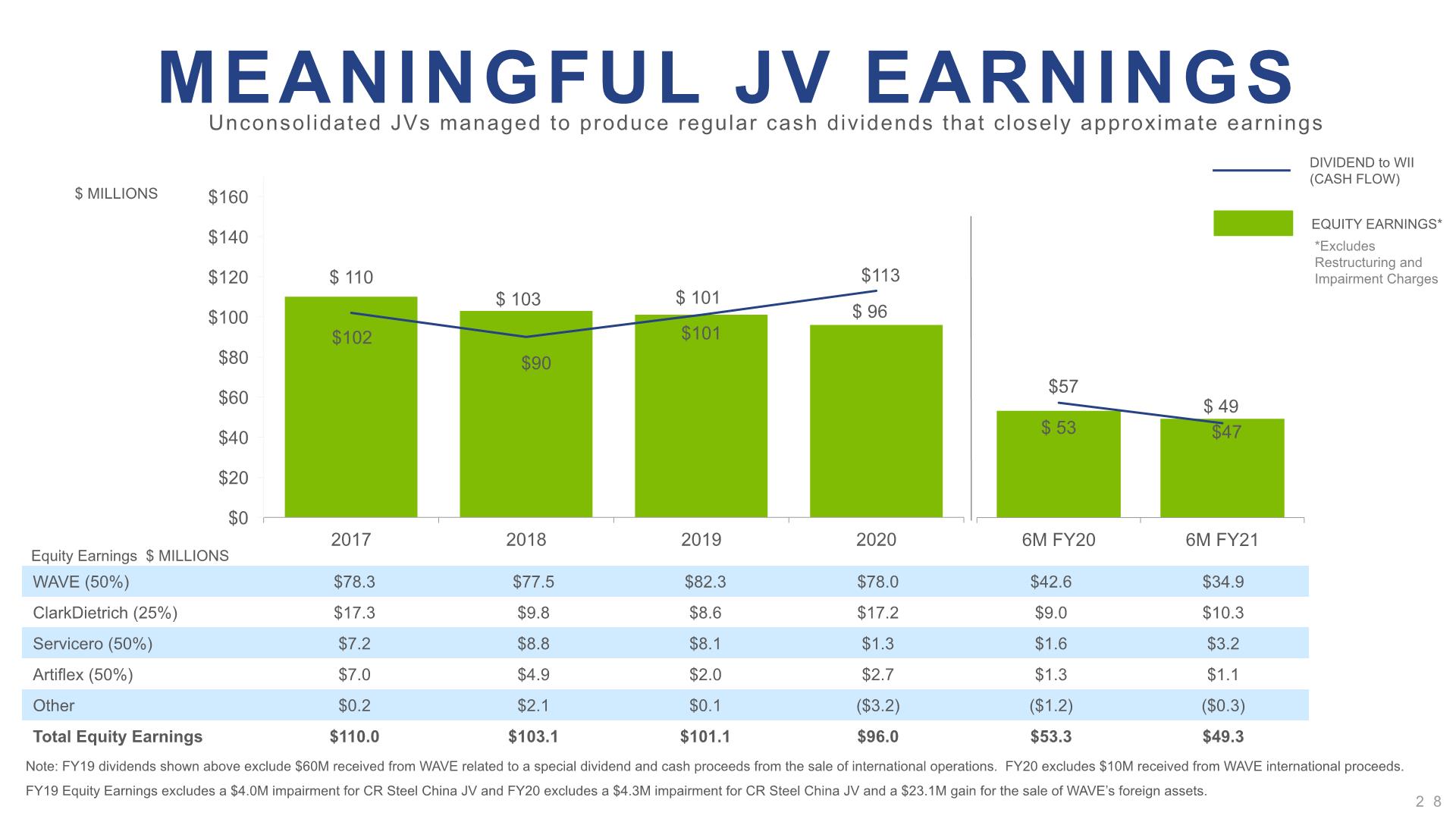

Profile Contribution to WI Equity Income ($M) MARKETS CORE PRODUCTS 5.9% CAGR Sustainable revenue and EBITDA growth with creative fabricated architectural metal components, focusing on superior customer value, industry leading manufacturing, and talent development resulting in low cost construction and enterprise efficiencies Over $850M in dividends paid to Worthington in past 10 years since start of FY 2011 WAVE (50% JV) 10 6 facilities in North America * FY20 excludes the $23.1M gain related to the sale of WAVE’s foreign assets

Successful JV portfolio built with trusted partners who help make a business better versus the alternative of going solo JVs managed to produce regular cash dividends that closely approximate earnings Successful Joint Ventures Serving building product and automotive end markets Over $1.0B in dividends received from JVs in past 10 years since start of FY 2011 11

Growth Strategy Working together using technology, analytics and automation enables us to deliver… Successful innovation, transformation, and acquisitions that drive value for customers and earn exceptional returns for our shareholders. All with Our Philosophy at the center. 12

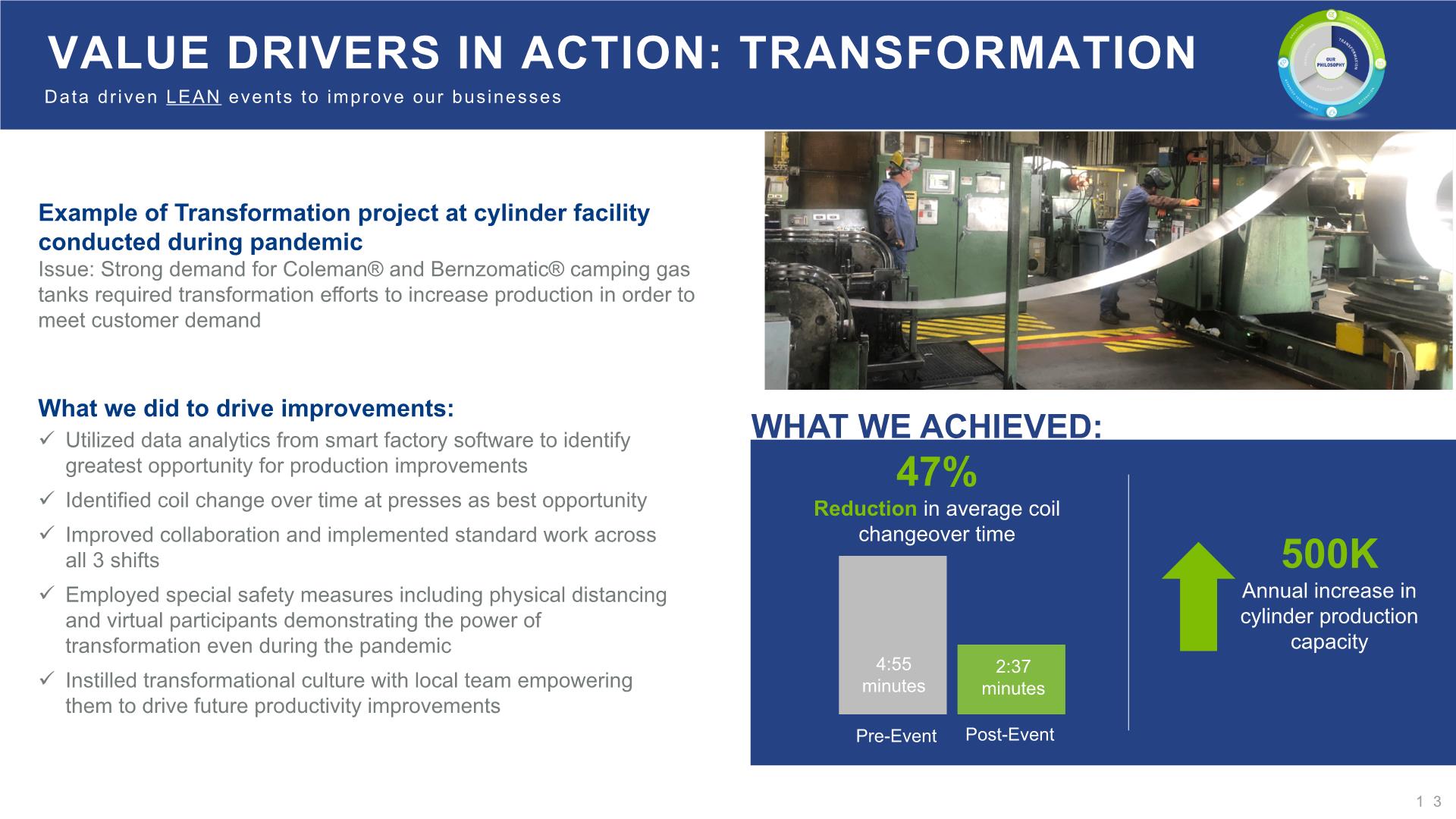

Example of Transformation project at cylinder facility conducted during pandemic Issue: Strong demand for Coleman® and Bernzomatic® camping gas tanks required transformation efforts to increase production in order to meet customer demand What we did to drive improvements: Utilized data analytics from smart factory software to identify greatest opportunity for production improvements Identified coil change over time at presses as best opportunity Improved collaboration and implemented standard work across all 3 shifts Employed special safety measures including physical distancing and virtual participants demonstrating the power of transformation even during the pandemic Instilled transformational culture with local team empowering them to drive future productivity improvements 13 What we achieved: 47% Reduction in average coil changeover time 500K Annual increase in cylinder production capacity 4:55 minutes 2:37 minutes Pre-Event Post-Event Value drivers in action: Transformation Data driven LEAN events to improve our businesses

Fuel Gauge for camping cylinders Smartlid™ Integrated monitoring solution Check fuel levels to avoid running out Available at Walmart Check propane levels remotely for home & industrial heating Comfort Carry™ Propane Tank Easier to handle, more attractive tank Available at U-Haul Value drivers in action: innovation Focused effort has resulted in a growing pipeline of new products

CLEAN CANNABIS extraction cylinder Meets need for a cleaner alternative to carbon steel Max9 Bundle™ Holds 25% more industrial gas than traditional bundle fourtis® Type IV PROPANE cylinder Heating & cooking indoors globally Lightweight & fully recyclable Value drivers in action: innovation Focused effort has resulted in a growing pipeline of new products

Armstrong VidaShield UV24 Air Purification System Value drivers in action: innovation Focused effort has resulted in a growing pipeline of new products

17 Value drivers in action: M&A Acquired General Tools & Instruments on January 29, 2021 which complements our existing strong brands in consumer products and expands our reach in niche tools and outdoor living Investment Thesis Market leader for feature-rich, specialized tools – Over 1,200 products Complements existing consumer brands; Expands product offering in niche tools and outdoor living Deepens relationships with long-term blue chip customers including big box retailers and online sales Proven new product development process with demonstrated agility and speed to market Management team with expertise in managing a global supply chain will continue to run the business Solid platform ripe for growth through innovation, new product development and bolt-on acquisitions Attractive financial returns $115 million purchase price $68.2 million in revenue, $15.2 million Adjusted EBITDA (CY20) Financed with existing cash

18 Additional q3 Transactions that will improve our Financial performance and strengthen liquidity … Divested Oil & Gas Equipment business Exited non-core, loss-making operations in January 2021 Received nominal consideration at closing with the opportunity for additional consideration in the future Retained real-estate assets in Bremen, OH and Tulsa, OK PTEC Pressure Technology Acquisition Acquired German valve and component company in January 2021 for $10.8 million Adds products adjacent to core pressure cylinders business, providing more comprehensive systems for the storage, transport and use of alternative fuels like hydrogen and compressed natural gas Monetized Nikola Corp (NKLA) Investment Exited NKLA investment in January 2021 generating pre-tax cash proceeds of $146.6 million on remaining shares Cumulative pre-tax cash proceeds of $634.4 million realized in fiscal 2021

Financial goals Grow EBITDA & free cash flow every year 10%+ return on capital Raise margins Reduce earnings volatility Balanced capital allocation Modest leverage / ample liquidity (investment grade) Rigorous capital discipline 19

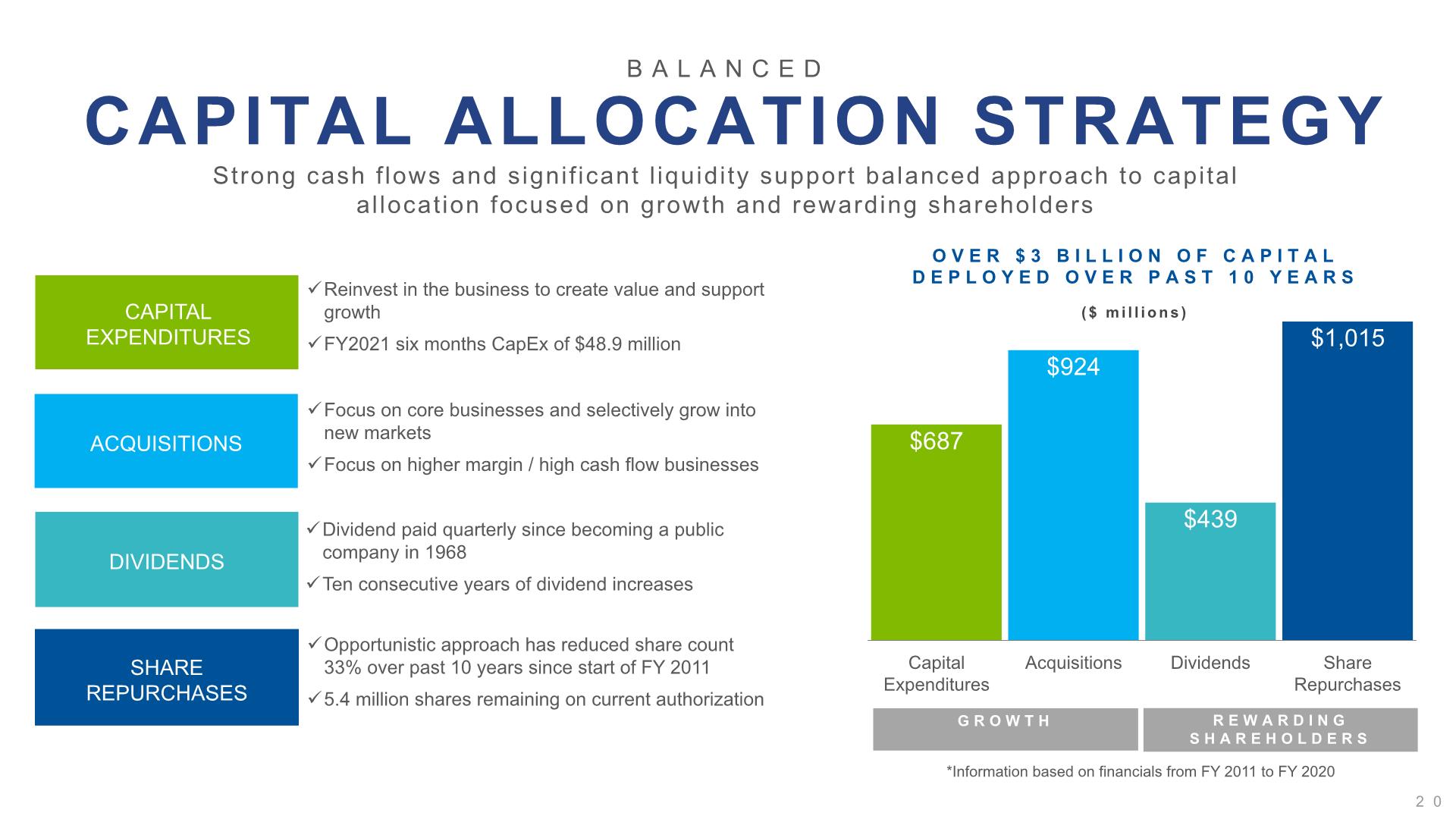

Balanced CAPITAL ALLOCATION STRATEGY Strong cash flows and significant liquidity support balanced approach to capital allocation focused on growth and rewarding shareholders Reinvest in the business to create value and support growth FY2021 six months CapEx of $48.9 million Focus on core businesses and selectively grow into new markets Focus on higher margin / high cash flow businesses Dividend paid quarterly since becoming a public company in 1968 Ten consecutive years of dividend increases Opportunistic approach has reduced share count 33% over past 10 years since start of FY 2011 5.4 million shares remaining on current authorization over $3 billion of capital deployed over past 10 years ($ millions) Growth Rewarding Shareholders *Information based on financials from FY 2011 to FY 2020 20

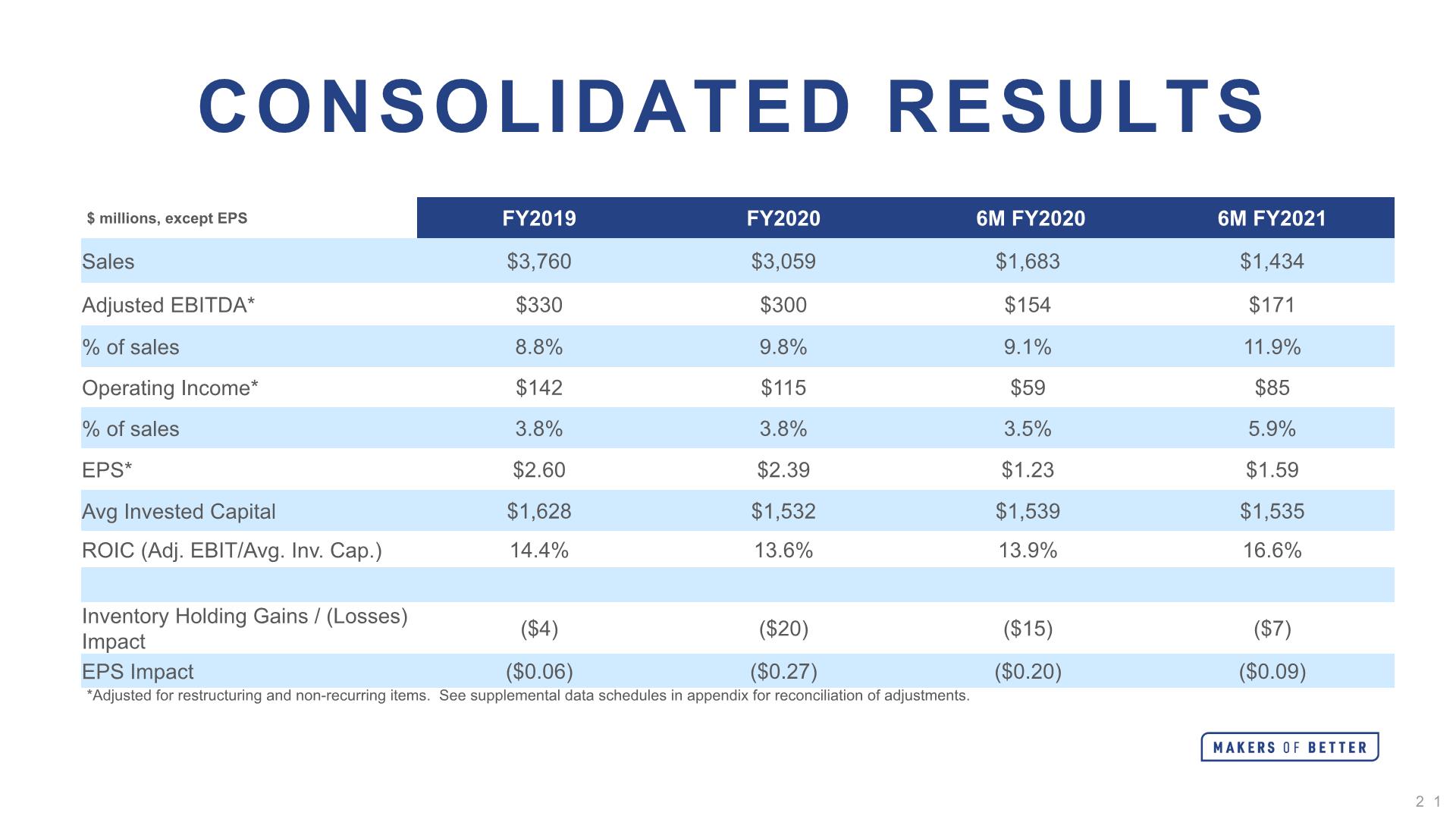

Consolidated Results *Adjusted for restructuring and non-recurring items. See supplemental data schedules in appendix for reconciliation of adjustments. 21

Key investment highlights Growth strategy focused on value drivers of innovation, transformation and acquisition to enhance margins Solid free cash flow and ample liquidity to execute on strategy Rigorous capital discipline focused on high cash flow investments Balanced approach to capital allocation focused on investing for growth and rewarding shareholders 22 Worthington offers an attractive investment opportunity

SUPPLEMENTAL DATA 23

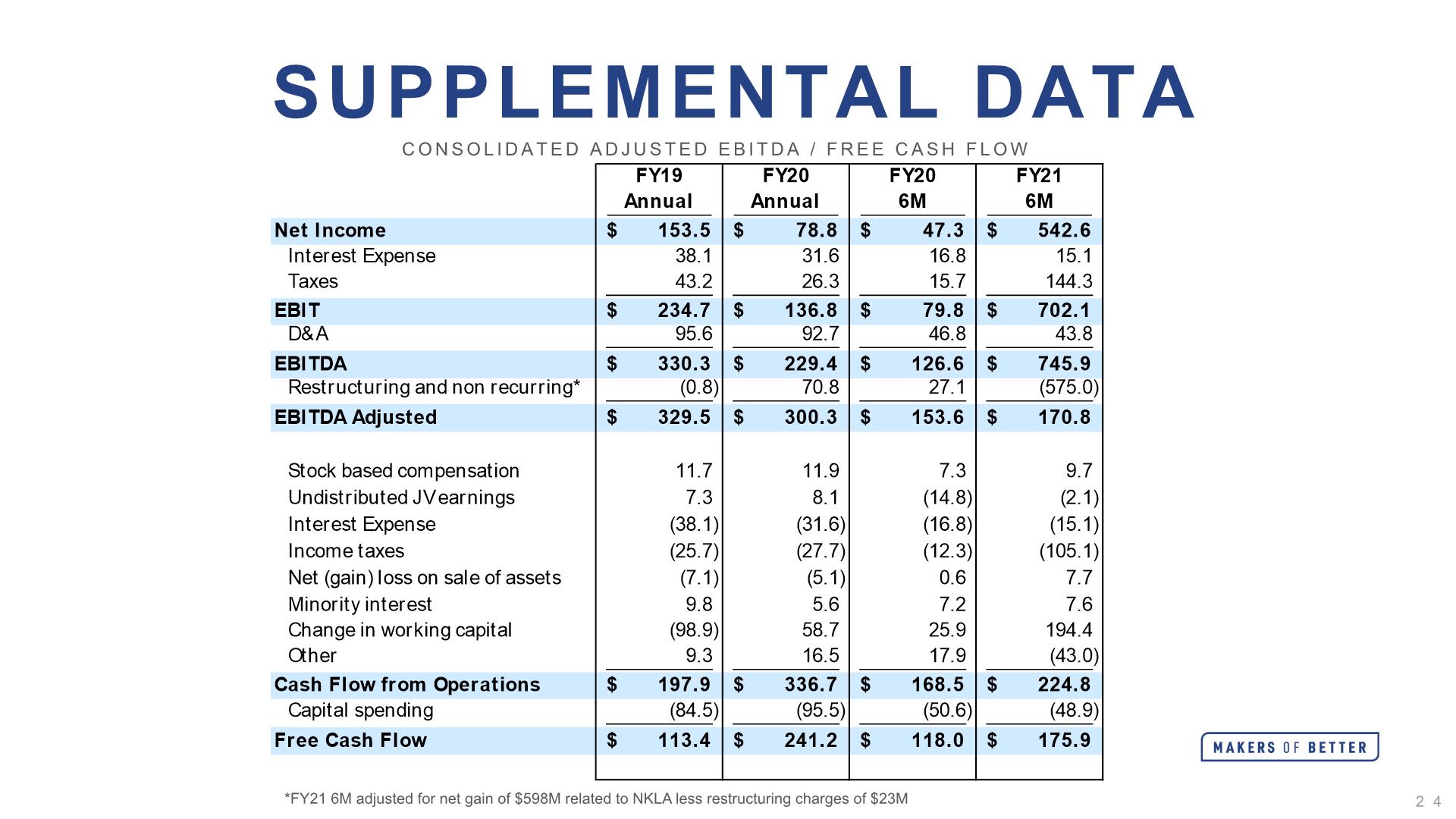

Supplemental Data Consolidated Adjusted EBITDA / Free Cash Flow 24 *FY21 6M adjusted for net gain of $598M related to NKLA less restructuring charges of $23M

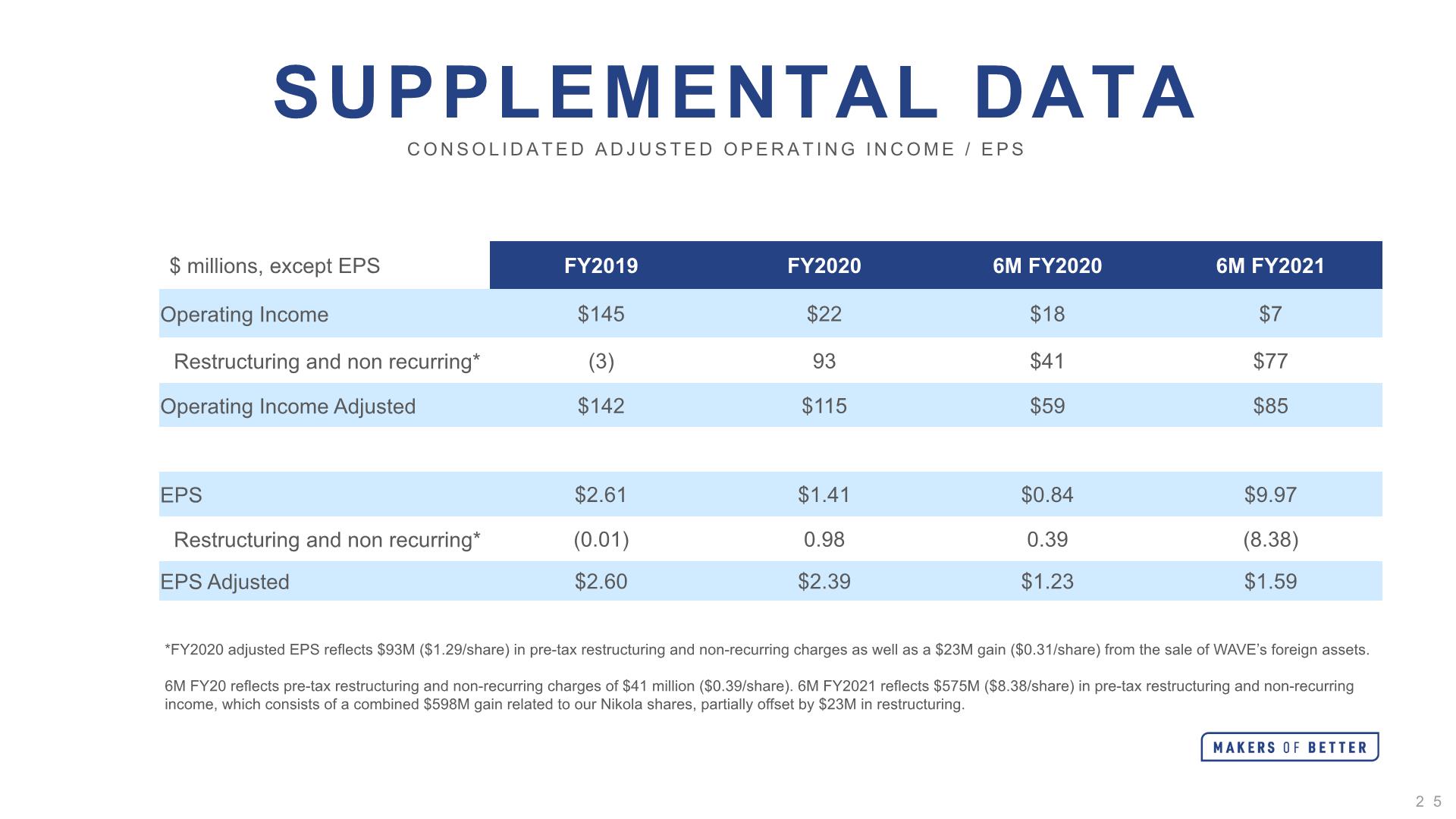

Supplemental Data Consolidated Adjusted Operating Income / EPS *FY2020 adjusted EPS reflects $93M ($1.29/share) in pre-tax restructuring and non-recurring charges as well as a $23M gain ($0.31/share) from the sale of WAVE’s foreign assets. 6M FY20 reflects pre-tax restructuring and non-recurring charges of $41 million ($0.39/share). 6M FY2021 reflects $575M ($8.38/share) in pre-tax restructuring and non-recurring income, which consists of a combined $598M gain related to our Nikola shares, partially offset by $23M in restructuring. 25

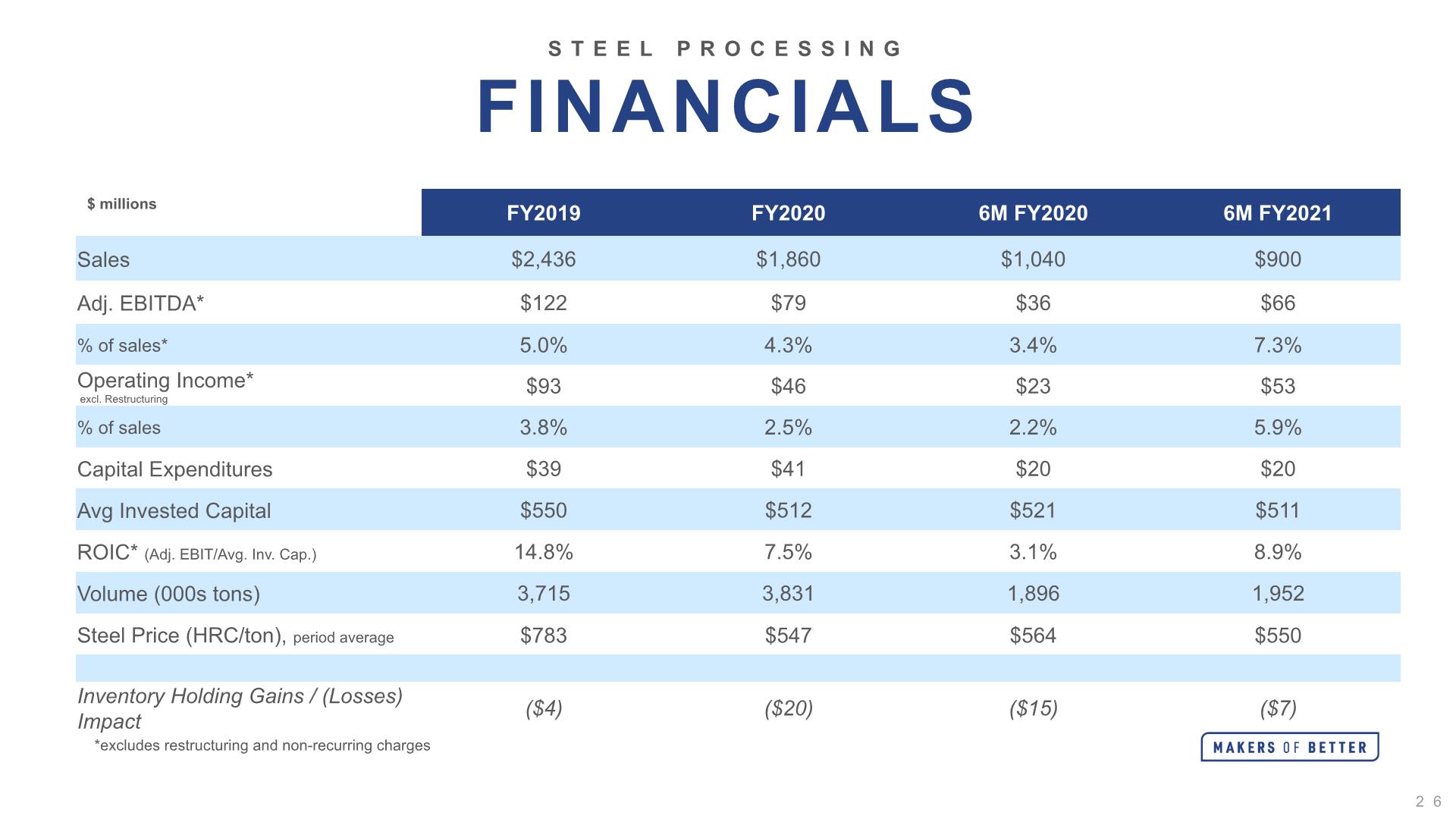

STEEL PROCESSING Financials *excludes restructuring and non-recurring charges 26

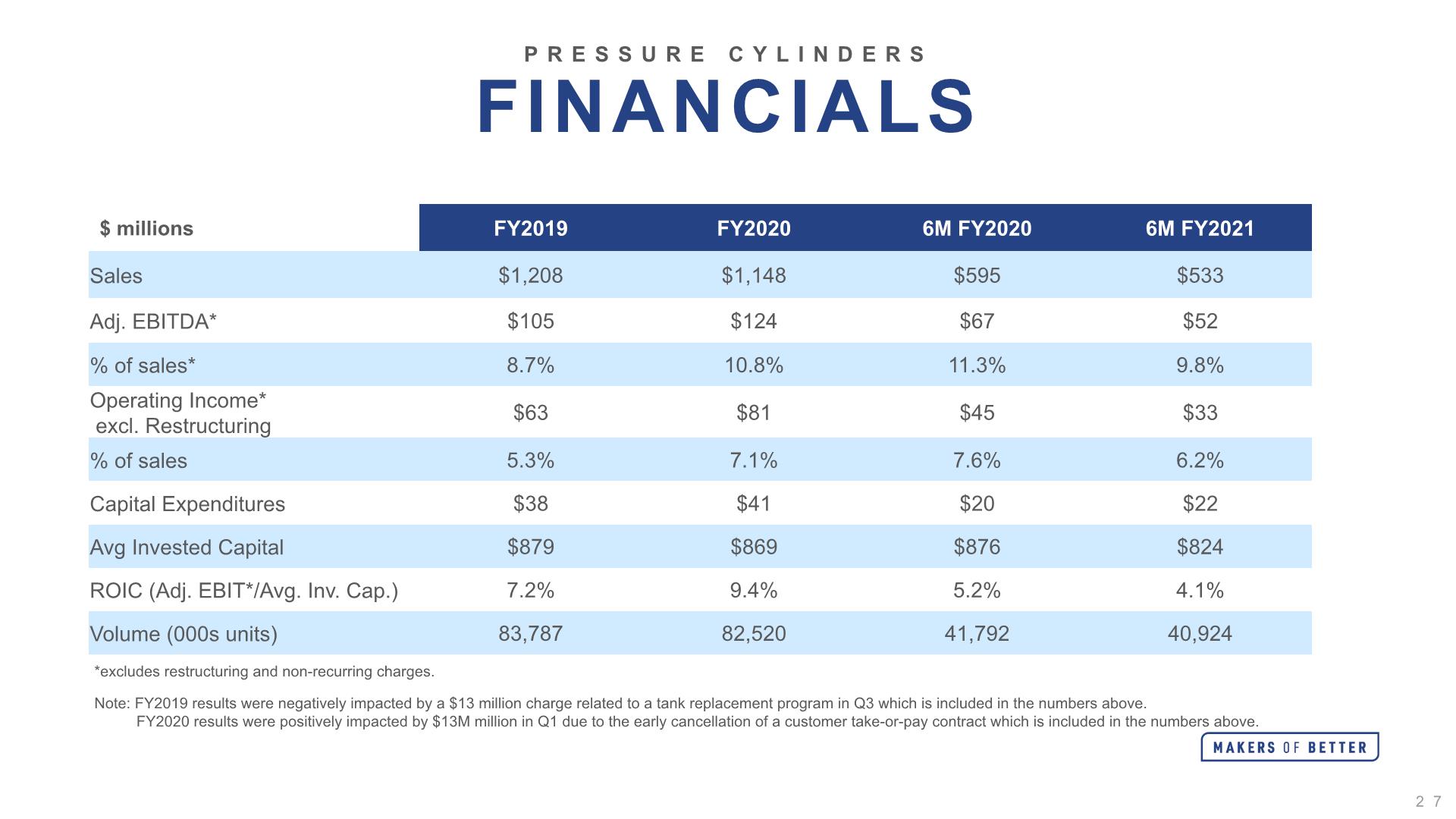

Pressure Cylinders Financials *excludes restructuring and non-recurring charges. Note: FY2019 results were negatively impacted by a $13 million charge related to a tank replacement program in Q3 which is included in the numbers above. FY2020 results were positively impacted by $13M million in Q1 due to the early cancellation of a customer take-or-pay contract which is included in the numbers above. 27

*Excludes Restructuring and Impairment Charges DIVIDEND to WII (CASH FLOW) EQUITY EARNINGS* Equity Earnings $ MILLIONS Note: FY19 dividends shown above exclude $60M received from WAVE related to a special dividend and cash proceeds from the sale of international operations. FY20 excludes $10M received from WAVE international proceeds. FY19 Equity Earnings excludes a $4.0M impairment for CR Steel China JV and FY20 excludes a $4.3M impairment for CR Steel China JV and a $23.1M gain for the sale of WAVE’s foreign assets. $ MILLIONS Unconsolidated JVs managed to produce regular cash dividends that closely approximate earnings Meaningful JV Earnings 28

Safe Harbor Statement Worthington Industries wishes to take advantage of the Safe Harbor provisions included in the Private Securities Litigation Reform Act of 1995 (the “Act"). Statements by the Company which are not historical information constitute "forward looking statements" within the meaning of the Act. All forward-looking statements are subject to risks and uncertainties which could cause actual results to differ from those projected. Factors that could cause actual results to differ materially include risks, uncertainties and impacts described from time to time in the Company's filings with the Securities and Exchange Commission, including those related to COVID-19 and the various actions taken in connection therewith, which could also heighten other risks. 614.840.4663 Marcus.Rogier@WorthingtonIndustries.com CONTACT 29