Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SHORE BANCSHARES INC | tm2035321d1_8k.htm |

Exhibit 99.1

1 Investor Presentation November 2020

2 This investor presentation contains, and future oral and written statements of Shore Bancshares, Inc. (the “Company” or “SHBI ”) and its wholly - owned banking subsidiary, Shore united bank (the “Bank”), and its management may contain, statements about future events that constitute forward - looking statements within the m eaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements may be identified by references to a future period or periods or by the use of the words "believe, " "expect," "anticipate," "intend," "estimate," "assume," "will," should," "plan," and other similar terms or expressions. Forward - looking statements include, but are not limited to: (i) projections an d estimates of revenues, expenses, income or loss, earnings or loss per share, and other financial items, including our financial results for the third quarter of 2020, (ii) statements of plans, ob jec tives and expectations of the Company or its management, (iii) statements of future economic performance, and (iv) statements of assumptions underlying such statements. Forward - looking statements shoul d not be relied on because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of the Company and the Bank. These risks, unce rta inties and other factors may cause the actual results, performance, and achievements of the Company and the Bank to be materially different from the anticipated future results, performance or a chi evements expressed in, or implied by, the forward - looking statements. Factors that could cause such differences include, but are not limited to, local, regional, national and interna tio nal economic conditions, the extent of the impact of the COVID - 19 pandemic, including the impact of actions taken by governmental and regulatory authorities in response to such pandemic, such as the CARES Act and the programs established thereunder, and our participation in such programs, volatility of the financial markets, changes in interest rates, regulatory considerations , c ompetition and market expansion opportunities, changes in non - interest expenditures or in the anticipated benefits of such expenditures, the receipt of required regulatory approvals, changes in n on - performing assets and charge - offs, changes in tax laws, current or future litigation, regulatory examinations or other legal and/or regulatory actions, the impact of any tariffs, terrorist thr eat s and attacks, acts of war or threats thereof or other pandemics. Therefore, the Company can give no assurance that the results contemplated in the forward - looking statements will be realized. For more inf ormation about these factors, please see our reports filed with or furnished to the Securities and Exchange Commission (the “SEC”), including the Company’s most recent Annual Report on Form 10 - K and Quarterly Report on Form 10 - Q on file with the SEC, including the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results o f O perations." Any forward - looking statements contained in this investor presentation are made as of the date hereof, and the Company undertakes no duty, and specifically disclaims any duty , t o update or revise any such statements, whether as a result of new information, future events or otherwise, except as required by applicable law. This investor presentation has been prepared by the Company solely for informational purposes based on its own information, as well as information from public sources. Certain of the information contained herein may be derived from info rma tion provided by industry sources. The Company believes such information is accurate and that the sources from which it has been obtained are reliable. However, the Company has not inde pen dently verified such information and cannot guarantee the accuracy of such information. This investor presentation has been prepared to assist interested parties in making their own eva luation of the Company and does not purport to contain all of the information that may be relevant. In all cases, interested parties should conduct their own investigation and analysis of th e C ompany and the data set forth in the investor presentation and other information provided by or on behalf of the Company. This investor presentation is not an offer to sell securities and it is no t soliciting an offer to buy securities in any state where the offer or sale is not permitted. Neither the SEC nor any other regulatory body has appro ved or disapproved of the securities of the Company or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. Non - GAAP Financials This investor presentation includes certain non - GAAP financial measures intended to supplement, not substitute for, comparable G AAP measures and the Company’s reported results prepared in accordance with GAAP. Numbers in this presentation may not sum due to rounding. Disclaimer

3 Management Team * Reference Appendix section for biographies Name Title/Function Entity Years in Banking Years with Company Lloyd L. “Scott” Beatty, Jr. President and Chief Executive Officer SHBI, Bank 26 14 Edward C. Allen EVP and Chief Financial Officer SHBI, Bank 42 9 Donna J. Stevens EVP and Chief Operating Officer SHBI, Bank 40 22 Charles E. Ruch, Jr. EVP and Chief Credit Officer Bank 43 14 Michael T. Cavey EVP and Chief Lending Officer Bank 35 6 Totals 186 65

4 Financial Summary and Key Ratios Financial Ratio 12/31/19 YTD Ann. 9/30/20 Return on Average Assets 1.03% 0.96% Return on Average Equity 8.24% 7.99% Net Interest Margin 3.47% 3.35% Non - interest Income/Average Assets (1) 0.69% 0.62% Non - interest Expense/Average Assets (1) 2.52% 2.25% Efficiency Ratio (Non - GAAP) (2) 62.58% 59.26% Nonperforming Assets/Assets Excluding TDRs (3) 0.77% 0.46% Tangible Common Equity/Tangible Assets 11.24% 9.92% Return on Average Tangible Common Equity 9.43% 9.09% Total Assets: $ 1.8 billion Gross Loans: $ 1.4 billion Total Deposits: $ 1.6 billion Total Shareholders’ Equity: $ 198.9 million Tangible Common Equity: $ 179.5 million Shares Outstanding (10/31/20) 12,034,530 Headquarters: Easton, Maryland (1) Non - interest income and expense are annualized for comparative purposes (2) Non - interest expense (excluding amortizations of intangible assets) as a percentage of fully taxable net interest income and non interest income (3) Nonperforming assets (NPAs) include nonaccrual and 90 days past due and still accruing loans, accruing troubled debt restruct uri ngs and net other real estate and other assets owned Note: Financial information as of September 30, 2020

5 Locations SHORE BANCSHARES Headquarters 18 E. Dover St. Easton, MD 21601 BANKING Shore United Bank 18 E. Dover St. Easton, MD 21601 877.758.1600 ShoreUnitedBank.com LOAN PRODUCTION OFFICES Shore United Bank 102 Sleepy Hollow, Unit 204 Middletown, DE 19709 9748 Stephen Decatur Highway, Unit 104 Ocean City, MD 21842 INVESTMENTS WYE Financial Partners 16 N. Washington Street Easton, MD 21601 1101 Maiden Choice Ln, Baltimore, MD 21229 410.763.8543 WyeFinancialPartners.com 27 Locations 22 Branches 2 Loan Production Offices 2 Investment Offices 1 Headquarters

6 Strategic Direction Market Expansion LPO’s and Strategic Branching Acquire Banks Contiguous to our Existing Markets Leverage Back Office Capability Additions to Staff Have Been Primarily Production Operating Strategy Drive Profitability Emphasis on Core Deposits & Cost of Funds Capitalize on New Market Opportunities Increase Referrals Diversify Loan Portfolio

7 Maryland Rank Share Branches Talbot 1 41.49% 4 Queen Anne’s 2 26.25% 5 Caroline 3 15.21% 2 Kent 5 8.92% 1 Dorchester 7 5.52% 1 Worcester 11 0.60% 1 Howard 14 0.39% 1 Baltimore 17 0.79% 2 Delaware Rank Share Branches Kent 6 5.22% 4 Virginia Accomack 6 1.55% 1 Selected SHBI Market Highlights Projected 2021 Median Household income for entire franchise is $90,160 in MD, $68,758 in DE, $79,124 in VA, vs. $67,761 for the US. Projected HH income increase (2021 - 2026) is 8.80% for MD, and 6.58% for DE, and 9.07% for VA. Projected 5 - year population growth rate (2021 - 2026) in overall market = 5.14% for MD, 4.09% for DE, and 7.48% for VA SHBI deposit market rank/share by county (2020):

8 Market Rank Local Rank Ticker Company Name City (HQ) HQ State Branches 2020 Total Deposits 2020 ($000) ’20 Market Share (%) 1 – BAC Bank of America Corp. Charlotte NC 40 8,014,169 19.5% 2 – MTB M&T Bank Corp. Buffalo NY 56 6,171,860 15.0% 3 – PNC PNC Financial Services Group Inc. Pittsburgh PA 60 4,844,815 11.8% 4 – TFC Truist Financial Corp. Charlotte NC 56 3,738,468 9.1% 5 – WFC Wells Fargo & Co. San Francisco CA 24 3,357,292 8.2% 6 1 SHBI Shore Bancshares Inc. Easton MD 22 1,508,703 3.7% 7 2 – Capital Funding Bancorp Inc. Baltimore MD 1 1,395,351 3.4% 8 3 HBMD Howard Bancorp Inc. Baltimore MD 8 1,296,142 3.1% 9 4 SASR Sandy Spring Bancorp Inc. Olney MD 5 1,092,088 2.7% 10 – FNB F.N.B. Corp. Pittsburgh PA 12 1,068,796 2.6% 11 – FULT Fulton Financial Corp. Lancaster PA 9 938,802 2.3% 12 – COF Capital One Financial McLean VA 4 869,396 2.1% 13 – WSFS WSFS Financial Corp. Wilmington DE 6 704,238 1.7% 14 5 – Rosedale Federal Savings and Loan Assoc. Baltimore MD 7 602,969 1.5% 15 6 – Calvin B. Taylor Bankshares Inc. Berlin MD 11 511,650 1.2% 16 7 BVFL BV Financial Inc. Baltimore MD 10 489,085 1.2% 17 8 – Queenstown Bank Queenstown MD 8 476,949 1.2% 18 9 – PSB Holding Corp. Preston MD 8 403,562 1.0% 19 – WSBC WesBanco. Inc Wheeling WV 7 374,974 0.9% 20 10 – Bank of Ocean City Ocean City MD 4 361,216 0.9% Other Market Participants (27) 69 2,953,737 7.2% Total 427 41,174,262 100.00 Deposit Market Share: SHBI Markets NOTE: SHBI Market defined as Maryland Counties of Kent, Queen Anne's, Talbot, Caroline, Dorchester, Baltimore, Howard, Wicom ico ; Kent County, Delaware; and Accomack County, VA. SOURCE: SNL Analysis as of June 30, 2020

9 Operating in Stable Mid - Atlantic Markets Source: US Bureau of Labor Statistics Rank State September 2020 Preliminary Unemployment Data Total Deposits (in thousands) Rank State September 2020 Preliminary Unemployment Data Total Deposits (in thousands) 1 Nebraska 3.5 27 Mississippi 7.1 2 South Dakota 4.1 28 Alaska 7.2 3 Vermont 4.2 28 Maryland 7.2 $1,433,083 4 North Dakota 4.4 30 Arkansas 7.3 5 Iowa 4.7 30 North Carolina 7.3 6 Missouri 4.9 32 Florida 7.6 7 Utah 5.0 33 Connecticut 7.8 8 South Carolina 5.1 33 Washington 7.8 9 Montana 5.3 USA 7.9 9 Oklahoma 5.3 35 Oregon 8.0 11 Wisconsin 5.4 36 Louisiana 8.1 12 Kentucky 5.6 36 Pennsylvania 8.1 13 Kansas 5.9 38 Delaware 8.2 $151,753 14 Minnesota 6.0 39 Texas 8.3 14 New Hampshire 6.0 40 Ohio 8.4 16 Idaho 6.1 41 Michigan 8.5 16 Maine 6.1 42 West Virginia 8.6 16 Wyoming 6.1 43 District of Columbia 8.7 19 Indiana 6.2 44 New Mexico 9.4 19 Virginia 6.2 $9,285 45 Massachusetts 9.6 21 Tennessee 6.3 46 New York 9.7 22 Colorado 6.4 47 Illinois 10.2 22 Georgia 6.4 48 Rhode Island 10.5 24 Alabama 6.6 49 California 11.0 25 Arizona 6.7 50 Nevada 12.6 25 New Jersey 6.7 51 Hawaii 15.1

10 Recent Developments PAYCHECK PROTECTION PROGRAM (PPP) Shore United Bank team responded quickly to identify impacted customers As of August 8, 2020 (end of program)1,525 loans were processed and 1,488 loans were funded for $126,670,423 22% of loans to new customers Funds are provided in the form of loans that will be fully forgiven when used for payroll costs, interest on mortgages, rent and utilities Loan payments deferred until forgiveness approved or up to 10 months after covered period ends and have a 2 or 5 - year maturity Size # of loans Funded % of total loans Balance as of 9/30/20 Under $150 thousand 1,306 88% $46,250,972 $150 – $350 thousand 108 7% $24,088,445 $350K and above 74 5% $56,331,006 Total 1,488 100% $126,670,423

11 Total Deposits ($M) Total Assets ($M) Total Gross Loans Held for Investment ($M) NCOs / Avg. Loans Targeted, Organic Balance Sheet Growth 1) Core deposits defined as total deposits less total CDs >$250,000 and brokered deposits (as of September 30, 2020) Source: S&P Global Market Intelligence; Company documents 997 $1,203 $1,212 $1,341 $1,594 Core 1 Total

12 Net Income from Continuing Operations ($M) ROAE from Continuing Operations ROAA from Continuing Operations NIM (FTE) Strong, Consistent Historical Profitability (1) Decline was due to Subordinated - debt issued in 3Q2020 of $25.0 million. Note: 2020Q3 metrics are YTD; Yellow dotted lines in 2018 denote results including proceeds received from sale on insurance s ubs idiary Source: S&P Global Market Intelligence; Company documents 2020Q2 2020Q1 2020Q3 (1)

13 Income Statement (Quarterly) Dollar Value in Thousands 9/30/2019 12/31/2019 3/31/2020 6/30/2020 9/30/2020 Interest and Fees on Loans $14,100 $14,043 $13,795 $13,945 $14,139 Other Interest Income 1,093 1,122 891 649 763 Interest Income 15,193 15,165 14,686 14,594 14,902 Interest on Deposits 2,288 2,287 2,059 1,556 1,470 Interest on Borrowings 225 114 109 7 149 Interest Expense 2,513 2,401 2,168 1,563 1,619 Net Interest Income 12,680 12,764 12,518 13,031 13,283 Provision for Loan Losses 200 200 350 1,000 1,500 Service Charges on Deposits 990 958 866 544 647 Trust and Investment Fee Income 383 382 375 363 381 Other Noninterest Income 1,156 1,354 1,111 1,862 1,553 Total Noninterest Income 2,529 2,694 2,352 2,769 2,581 Salaries, and Wages 3,853 4,002 4,296 2,130 4,143 Employee Benefits 1,299 1,662 1,722 1,535 1,489 Occupancy, Furniture and Equipment 960 988 1,015 949 1,068 Data Processing 972 989 1,044 1,037 1,114 Legal and Professional 495 568 634 553 447 Other Expenses 1,805 1,636 1,638 1,459 1,570 Total Noninterest Expense 9,384 9,845 10,349 7,663 9,831 Net Income Before Taxes 5,625 5,413 4,171 7,137 4,533 Provisions for Taxes 1,411 1,399 1,053 1,802 1,142 Net Income from Continuing Operations $4,214 $4,014 $3,118 $5,335 $3,391 (Loss) Income from Discontinued Operations (10) - - - - Gain on Sale of Insurance Agency - - - - - Income (Tax) Benefit Expense 2 - - - - Net Income (GAAP) $4,206 $4,014 $3,118 $5,335 $3,391 Note: Drop in Salaries and Wages from 2020Q1 to 2020Q2 is driven by the accounting treatment related to PPP loan origination whi ch requires the accounting effects to be accrued over the life of the loan Source: S&P Global Market Intelligence; Company documents

14 Dollar Value in Thousands Total Loan Balance as of 9/30/2020 Total Loans Modified as of 9/30/2020 Loans Modified to Interest Only Payments (6 months or less) Loans Modified to Payment Deferral (3 months) Percentage of Loans Modified Hospitality Industry $113,832,662 $4,659,324 -- $4,659,324 4.09% Non - Owner Occupied Retail Stores 101,303,762 -- -- -- -- Non - Owner Occupied Retail Stores Restaurant (Anchor) 11,172,703 -- -- -- -- Owner - Occupied Retail Stores 14,471,268 160,265 $160,265 -- 1.11% Owner – Occupied Restaurants 9,215,259 220,453 220,453 -- 2.39% Oil & Gas Industry – – – – – Other Commercial Loans 765,998,606 6,373,291 2,088,546 4,284,745 0.83% Total Commercial Loans $1,015,994,260 $11,413,333 $2,469,264 $8,944,069 1.12% Residential 1 – 4 Family Personal $231,546,461 – – – – Residential 1 – 4 Family Rentals 100,852,401 $1,072,622 $299,930 $772,692 $1.06% Home Equity Loans 46,608,827 – – – – Total Residential Real Estate Loans $379,007,689 $1,072,622 $299,930 $772,692 0.28% Consumer Loans $29,773,846 435,309 -- 435,309 1.46% Mortgage Warehouse Loans – – – – – Overdrafts and Other (811,115) – – – – Total Loans $1,423,964,680 $12,921,264 $2,769,194 $10,152,070 0.91% Note: Financial Information as of September 30, 2020 Loan Balances Modified due to COVID - 19

15 (Dollar Value in Thousands) As of September 30, 2020 Loan Type Balance % of Total Construction $106,040 7.4% 1 - 4 family residential 14,877 Other 91,163 Residential Real Estate 442,140 31.1% Secured by 1 - 4 family - revolving 49,860 Secured by 1 - 4 family - closed end 347,698 Secured by multifamily residential 44,582 Commercial Real Estate 620,426 43.6% Secured by farmland 32,513 Secured by owner - occupied 188,054 Secured by hotel 113,833 Secured by non - owner retail 112,476 Secured by other 173,550 Restaurant 9,215 0.6% Secured by owner 9,215 Commercial 218,596 15.4% Commercial and industrial loans 91,926 PPP Loans (SBA) 126,670 Consumer 27,548 1.9% Auto 21,263 Other 6,285 Total $1,423,965 100.0% Concentrations as a percentage of total capital as of 9 /30 /20 : CRE Concentration Ratio = 291.2% Construction Concentration Ratio = 56.0% Commercial 15.4% Consumer 1.9% Construction 7.4% Residential Real Estate 31.1% Commercial Real Estate 43.6% Loan Portfolio $1,424.0mm Restaurants 0.6%

16 100% of the portfolio was pass rated Geographically, there is a concentration in hotels based at the beach in Ocean City, MD which has rebounded nicely due to opening back up in June of 2020 20 Hospitality loans comprise of Hotels, Motels and Inns, which make up $113.8mm or 8.0% of the total loan portfolio as of September 30, 2020 $4.7 million, or 4% of the loans have secured a payment modification as of September 30, 2020. 61% weighted average LTV Independent , 39.2M, 34% Choice , $11.1 M, 10% Hilton , 31.7 M, 28% IHG , $11.2 M, 10% Best Western , $3.7 M, 3% Mariott , $16.9 M, 15% MD Beaches , 7 Chesapeake Bay Region , 7 Salisbury, MD , 1 Baltimore, MD , 2 Harrington, DE , 1 DE Beaches , 1 Murell's Inlet, SC , 1 Hospitality Loans Hotel by Geography Hotel by Flag

17 MD/DE Beaches Chesapeake Bay Region Myrtle Beach Area

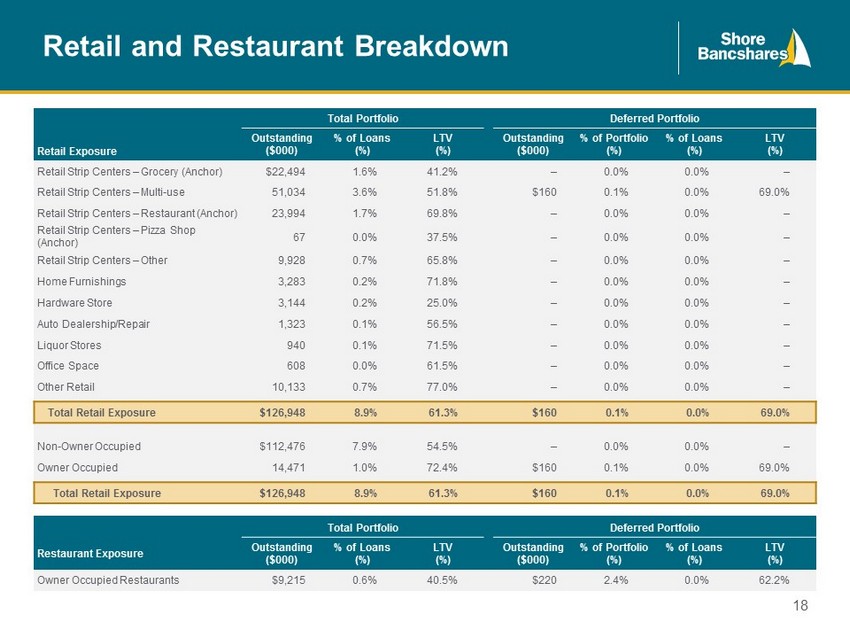

18 Retail and Restaurant Breakdown Total Portfolio Deferred Portfolio Retail Exposure Outstanding ($000) % of Loans (%) LTV (%) Outstanding ($000) % of Portfolio (%) % of Loans (%) LTV (%) Retail Strip Centers – Grocery (Anchor) $22,494 1.6% 41.2% – 0.0% 0.0% – Retail Strip Centers – Multi - use 51,034 3.6% 51.8% $160 0.1% 0.0% 69.0% Retail Strip Centers – Restaurant (Anchor) 23,994 1.7% 69.8% – 0.0% 0.0% – Retail Strip Centers – Pizza Shop (Anchor) 67 0.0% 37.5% – 0.0% 0.0% – Retail Strip Centers – Other 9,928 0.7% 65.8% – 0.0% 0.0% – Home Furnishings 3,283 0.2% 71.8% – 0.0% 0.0% – Hardware Store 3,144 0.2% 25.0% – 0.0% 0.0% – Auto Dealership/Repair 1,323 0.1% 56.5% – 0.0% 0.0% – Liquor Stores 940 0.1% 71.5% – 0.0% 0.0% – Office Space 608 0.0% 61.5% – 0.0% 0.0% – Other Retail 10,133 0.7% 77.0% – 0.0% 0.0% – Total Retail Exposure $126,948 8.9% 61.3% $160 0.1% 0.0% 69.0% Non - Owner Occupied $112,476 7.9% 54.5% – 0.0% 0.0% – Owner Occupied 14,471 1.0% 72.4% $160 0.1% 0.0% 69.0% Total Retail Exposure $126,948 8.9% 61.3% $160 0.1% 0.0% 69.0% Total Portfolio Deferred Portfolio Restaurant Exposure Outstanding ($000) % of Loans (%) LTV (%) Outstanding ($000) % of Portfolio (%) % of Loans (%) LTV (%) Owner Occupied Restaurants $9,215 0.6% 40.5% $220 2.4% 0.0% 62.2%

19 $1,814,038 $11,296,397 $88,193,327 $250,000 or less $250,000 - $1mm Over $1 mm $101.3mm Non - Owner Occupied Retail Stores Non - owner occupied retail store loans comprise of $101.3 mm or 7.1% of the total loan portfolio as of September 30, 2020 There were no payment modifications as of September 30, 2020 in this portfolio 59.8% weighted average LTV 94% of the portfolio was pass rated Retail Exposure by Loan Size

20 $2,396,765 $7,344,121 $4,730,383 $250,000 or less $250,000 - $1 mm Over $1mm $14.5mm Owner Occupied Retail Stores Owner occupied retail store loans comprise of $14.5 million or 1.0% of the total loan portfolio as of September 30, 2020 $160 thousand, or 1.1% of the loans have secured a payment modification as of September 30, 2020 74% weighted average LTV 82% of the portfolio was pass rated Retail Exposure by Loan Size

21 $1,789,000 $6,023,259 $1,403,000 $250,000 or less $250,000 - $1mm Over $1 mm $9.2 mm Restaurants 100% of the portfolio was pass rated Owner occupied restaurant loans comprise of $9.2 mm or 0.6% of the total loan portfolio as of September 30, 2020 $220 thousand, or 2.4% of the loans have secured a payment modification as of September 30, 2020 21.6% have been supported by PPP Loans and qualify for additional SBA assistance. 99% have carry - out or drive - thru functionality and have since re - opened according to State and Local Government guidelines 40.5% weighted average LTV Restaurant Exposure by Loan Size

22 Restaurants Map

23 Dollar Values in Thousands 9/30/2019 12/31/2019 9/30/2020 Non - performing Assets Nonaccrual Loans $12,530 $10,590 $6,966 90+ or More Days Past Due 712 1,326 1,373 Other Real Estate Owned 74 74 38 Total Non - Performing Assets $13,316 $11,990 $8,377 Performing TDRs $7,588 $7,501 $7,267 Total NPAs + TDRs $20,904 $19,491 $15,644 NPAs / Assets (%) 0.85 0.77 0.46 NPAs + TDRS / Assets (%) 1.34 1.25 0.86 Reserves Loan Loss Reserve $10,438 $10,507 $12,777 Reserves / Gross Loans (%) 0.85 (1) 0.84 (1) 0.90 (1) Reserves / Legacy Loans (%)` 0.91 (2) 0.90 (2) 0.94 (2) Reserves / Gross Loans (%) 0.85 0.84 (3) 0.98 (3) Reserves / NPLs (%) 83.30 99.22 183.42 Reserves / NPLs+TDRs (%) 49.93 53.91 81.67 Net Charge - offs Net Charge - Offs $405 $536 $580 Credit Quality Statistics 1) Includes mark on purchased loans from Northwest 2) Excludes mark on purchased loans from Northwest 3) Excludes PPP loans

24 (Dollars in thousands) Amortized Cost Gross Unrealized Gains/(Losses) Estimated Fair Value Available - for - sale securities: September 30, 2020 U.S. Government Agencies $24,661 $(29) $24,632 Mortgage - backed 112,068 2,649 114,717 Total $136,729 $2,620 $139,349 Held - to - maturity securities: U.S Government Agencies $1,195 40 1,235 States and Political Subdivisions 400 1 401 Other Debt Securities 18,579 39 18,618 Total $20,174 $80 $20,254 Equity Securities 1,333 63 1,396 Total Securities $158,236 $160,999 Average Yield 2.14% Average Duration 2.8 Years Securities Portfolio

25 (Dollar Value in Thousands) September 30, 2020 Deposit Type Balance % of Total Average Rate (%) Noninterest Bearing Demand 465,304 29.2 0.00 Interest Bearing Demand 411,743 25.8 0.30 Money Market & Savings 442,684 27.8 0.29 CDs $100,000 or more 126,704 7.9 1.78 Other Time 147,686 9.3 1.52 Total Deposits 1,594,121 100.0 0.47 Total Cost of Interest - Bearing Deposits 0.66 Total Cost of Funds (Including Borrowings) 0.49 Noninterest Bearing Demand 29.2% Interest Bearing Demand 25.8% Money Market & Savings 27.8% CDs $100k or more 7.9% Other Time 9.3% $1.594 mm Attractive Deposit Base Deposit Type

26 Yield Table – 9/30/20 YTD with and without excess liquidity As reported YTD 9/30/2020 Without $100k in excess liquidity YTD 9/30/2020 (Dollars in thousands) Average Balance Interest Yield/rate Average Balance Interest Yield/rate Earnings assets Loans $1,348,362 $41,987 4.16% $1,348,362 $41,987 4.16% Investment securities Taxable 124,487 2,087 2.24 84,487 1,417 2.24 Interest - bearing deposits 81,125 216 0.36 21,125 57 0.36 Total earning assets 1,553,974 44,290 3.81% 1,453,974 43,461 3.99% Cash and due from banks 18,302 18,302 Other assets 91,642 91,642 Allowance for credit losses (11,042) (11,042) Total assets $1,652,876 $1,552,876 Interest - bearing liabilities Interest - bearing deposits 1,023,813 5,086 0.66 1,023,813 5,086 0.66 Securities sold under retail repurchase agreements 1,613 4 0.33 1,613 4 0.33 Advances from FHLB - long - term 5,255 113 2.87 5,255 113 2.87 Subordinated debt 3,310 148 5.97 3,310 148 5.97 Total interest - bearing liabilities 1,033,991 5,351 0.69% 1,033,991 5,351 0.69% Noninterest - bearing deposits 410,702 310,702 Accrued expenses and other liabilities 10,088 10,088 Stockholders’ equity 198,095 198,095 Total liabilities and stockholders’ equity $1,652,876 $1,552,876 Net interest spread $38,939 3.12% $38,110 3.30% Net interest margin 3.35% 3.50%

27 Strong Capital and Asset Growth 11.93% 12.32% 10.38% 11.13% 11.24% 9.92% 0% 2% 4% 6% 8% 10% 12% 14% $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 2015 2016 2017 2018 2019 2020Q3 Total Assets TCE/TA

28 Capital Ratios (Bank Only) 9.79% 10.64% 10.07% 11.84% 13.00% 13.31% 11.84% 13.00% 13.31% 12.73% 13.87% 14.30% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% YE 2018 YE 2019 9/30/2020 Tier 1 Leverage Ratio Common Equity Tier 1 Tier 1 Risk-Based Capital Ratio2 Total Risk-Based Capital Ratio

29 Compelling Investment Considerations Excellent Cost of Funds Strategic plan positioned for organic growth and acquisitions Focused on creating sustainable competitive advantages Strengthened noninterest revenue sources Driving a sales culture with both a commercial and retail focus while maintaining our credit discipline

30 APPENDIX Appendix

31 SHBI Management Team Talent, depth, unique skills Lloyd L. “Scott” Beatty, Jr ., 68, CPA, President & CEO of Shore Bancshares, Inc. since June 2013, Director of SHBI since December 2000, Director of Shore United Bank (formerly the Talbot Bank and CNB) since 1992. COO from 2006 until 2012 and named President and CO O in 2012. Formerly COO, private equity firm Darby Overseas Investments. Formerly Managing Partner of public accounting firm. Edward C. Allen , 72, Executive Vice President & Chief Financial Officer Shore Bancshares, Inc. and of Shore United Bank since June 2016 . Prior to that he was President & CEO of CNB, a Shore Bancshares affiliate for two years. Mr. Allen is a career banker with 40 years experience in community banks. Donna J. Stevens , 58, Executive Vice President & Chief Operating Officer of Shore Bancshares, Inc. since July 2015 and Shore United Bank since July 2016. She has been employed by the Company in various officer capacities since 1997, including Senior Vice President, and Senior Operations and Compliance Officer of CNB. Ms. Stevens is a graduate of Maryland Banking School and ABA Stonier Graduate Scho ol of Banking. Charles E. Ruch Jr. , 61, Executive Vice President and Chief Credit Officer of Shore United Bank (formerly CNB) since 2010 and joined CNB in 2006. Entered banking in 1977, holding various retail positions from teller to core manager through the 1980s with Equitable Ban k. Joined AB&T as a commercial lender in 1987 and was AB&T’s Senior Commercial Lender for 10 years. Graduated from the University of Ma ryl and in 1983. Michael T. Cavey , 63 , Executive Vice President and Chief Lending Officer of Shore United Bank (formerly the Talbot Bank) joined the bank in 2014 as a Senior Vice President and Commercial Sales Manager. Prior to his employment in 2014 with The Talbot Bank, Mr. Cavey wo rked for Howard Bank as a Senior Vice President and Regional Executive for Howard and Anne Arundel Counties for five years. Prior to his position at Howard Bank, Mr. Cavey held a Senior Vice President and Commercial Team Leader positions at Sandy Spring Bank and M& T Bank. Mr. Cavey received his Bachelor of Science degree from Duke University. Jennifer M. Joseph ; 52 , Executive Vice President and Chief Retail Officer of Shore United Bank since November 2016. Prior to her employment, Mrs. Joseph served as the Market Executive of PNC Bank, N.A. from 2011 to 2015. Mrs. Joseph entered into banking in 1986, holding various retail and lending positions, including Business Banking Sales Manager. She is a graduate of ABA Stonier Grad uat e School of Banking and CBA Graduate School of Retail Bank Management. W. David Morse , 59, Executive Vice President and Legal Counsel of Shore Bancshares, Inc. and Shore United Bank (formerly the Talbot Bank) has served as Secretary and General Counsel for the Company since 2008. He began employment with Talbot Bank in 1991. He received his Juris Doctorate from the University of Baltimore and his Bachelor of Arts degree from High Point College, NC.

32 Dollar Values in Thousands 2016 2017 2018 2019 9/30/2020 Assets Cash and Cash Equivalents $75,938 $31,820 $67,225 $94,971 $156,462 Available for Sale Securities 163,902 196,955 154,432 122,791 139,349 Other Securities 1,650 3,735 7,745 5,532 25,196 Total Cash & Securities 248,194 238,757 235,445 232,080 321,007 Loans Held for Sale – – – – – Total Loans Held for Investment 871,525 1,093,514 1,195,355 1,248,654 1,423,965 Loan Loss Reserve (8,726) (9,781) (10,343) (10,507) (12,777) Total Net Loans Held for Investment 862,799 1,083,733 1,185,012 1,238,147 1,411,188 Goodwill and Other Intangibles 13,010 21,241 20,375 19,770 19,362 Total Other Assets 33,791 48,335 41,022 69,164 76,615 Total Assets 1,160,271 $1,393,860 $1,483,076 $1,559,235 $1,828,172 Liabilities Deposits $997,489 $1,202,781 $1,212,341 $1,341,334 $1,594,121 FHLB Borrowings – 15,662 74,989 15,000 – Senior Debt 3,203 21,734 75,812 21,018 – Subordinated Debt – – – – 24,399 Other Liabilities 5,280 5,609 11,738 4,081 10,771 Total Liabilities 1,005,972 $1,230,124 $1,299,891 $1,366,433 $1,629,291 Equity Total Equity $154,299 $163,736 $183,185 $192,802 $198,881 Total Liabilities & Shareholder's Equity $1,160,271 $1,393,860 $1,483,076 $1,559,235 $1,828,172 Consolidated Historical Balance Sheet Source: S&P Global Market Intelligence

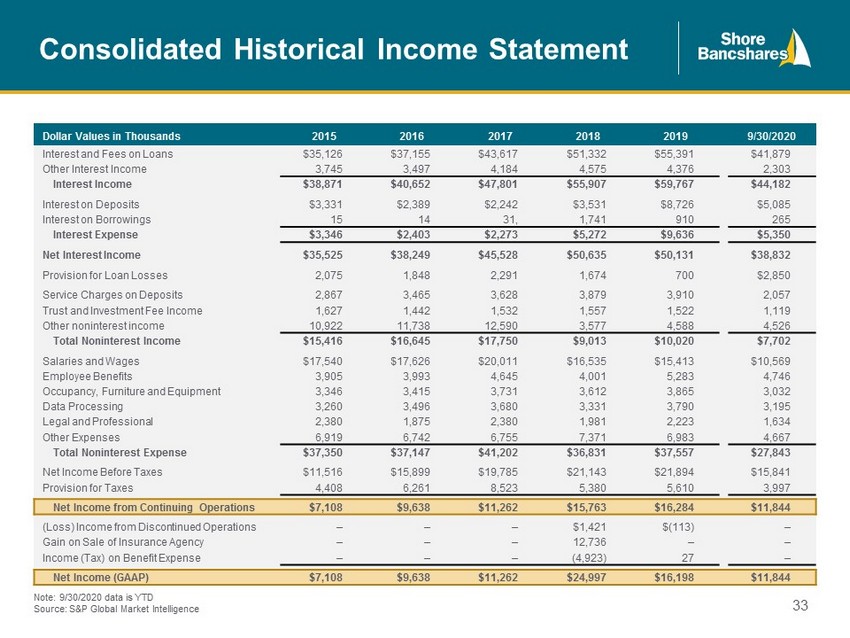

33 Consolidated Historical Income Statement Note: 9/30/2020 data is YTD Source: S&P Global Market Intelligence Dollar Values in Thousands 2015 2016 2017 2018 2019 9/30/2020 Interest and Fees on Loans $35,126 $37,155 $43,617 $51,332 $55,391 $41,879 Other Interest Income 3,745 3,497 4,184 4,575 4,376 2,303 Interest Income $38,871 $40,652 $47,801 $55,907 $59,767 $44,182 Interest on Deposits $3,331 $2,389 $2,242 $3,531 $8,726 $5,085 Interest on Borrowings 15 14 31, 1,741 910 265 Interest Expense $3,346 $2,403 $2,273 $5,272 $9,636 $5,350 Net Interest Income $35,525 $38,249 $45,528 $50,635 $50,131 $38,832 Provision for Loan Losses 2,075 1,848 2,291 1,674 700 $2,850 Service Charges on Deposits 2,867 3,465 3,628 3,879 3,910 2,057 Trust and Investment Fee Income 1,627 1,442 1,532 1,557 1,522 1,119 Other noninterest income 10,922 11,738 12,590 3,577 4,588 4,526 Total Noninterest Income $15,416 $16,645 $17,750 $9,013 $10,020 $7,702 Salaries and Wages $17,540 $17,626 $20,011 $16,535 $15,413 $10,569 Employee Benefits 3,905 3,993 4,645 4,001 5,283 4,746 Occupancy, Furniture and Equipment 3,346 3,415 3,731 3,612 3,865 3,032 Data Processing 3,260 3,496 3,680 3,331 3,790 3,195 Legal and Professional 2,380 1,875 2,380 1,981 2,223 1,634 Other Expenses 6,919 6,742 6,755 7,371 6,983 4,667 Total Noninterest Expense $37,350 $37,147 $41,202 $36,831 $37,557 $27,843 Net Income Before Taxes $11,516 $15,899 $19,785 $21,143 $21,894 $15,841 Provision for Taxes 4,408 6,261 8,523 5,380 5,610 3,997 Net Income from Continuing Operations $7,108 $9,638 $11,262 $15,763 $16,284 $11,844 (Loss) Income from Discontinued Operations – – – $1,421 $(113) – Gain on Sale of Insurance Agency – – – 12,736 – – Income (Tax) on Benefit Expense – – – (4,923) 27 – Net Income (GAAP) $7,108 $9,638 $11,262 $24,997 $16,198 $11,844