Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - VERDE RESOURCES, INC. | vrdr_ex322.htm |

| EX-32.1 - EX-32.1 - VERDE RESOURCES, INC. | vrdr_ex321.htm |

| EX-31.2 - EX-31.2 - VERDE RESOURCES, INC. | vrdr_ex312.htm |

| EX-31.1 - EX-31.1 - VERDE RESOURCES, INC. | vrdr_ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2020

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from [______] to [______]

Commission file number: 000-55276

| VERDE RESOURCES, INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

| 32-0457838 |

| (State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

|

|

|

|

| Block B-5, 20/F, Great Smart Tower, 230 Wanchai Rd, Wanchai, Hong Kong |

| N/A |

| (Address of principal executive offices) |

| (Zip Code) |

Registrant’s telephone number, including area code: (852) 2152-1223

Securities registered pursuant to Section 12(b) of the Act:

| Securities registered pursuant to Section 12(b) of the Act: Title of Each Class |

| Name of Each Exchange On Which Registered |

| N/A |

| N/A |

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 par value.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☒ No ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the last 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registration statement was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| (Do not check if a smaller reporting company) |

|

| |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold of $0.01 (or the average bid and asked price of such common equity) as of the last business day of the registrant’s most recently completed second fiscal quarter, being December 31, 2019, was $998,925.68.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

116,038,909 as of September 28, 2020

DOCUMENTS INCORPORATED BY REFERENCE

None.

| 2 |

Explanatory Note

On March 4, 2020, pursuant to Section 36 of the Securities Exchange Act of 1934, the Securities and Exchange Commission issued Release No. 34-88318 (the “Order”) granting exemptions to registrants subject to the reporting requirements of the Exchange Act Section 13(a) or 15(d) due to circumstances related to the coronavirus disease 2019 (COVID-19).

On October 13, 2020, Verde Resources, Inc. furnished a Current Report on Form 8-K to indicate its reliance on the Order in connection with the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2020.

The Company’s headquarters and operations are located in Hong Kong, SAR and Malaysia. Due to the ongoing outbreak of the COVID-19, the Hong Kong SAR and Malaysia government initiated travel restrictions and mandatory quarantines to control the spread of COVID-19 within Hong Kong, SAR China and Malaysia. First of all, these measurements taken by the government agents have delayed the Company's accounting department in obtaining and complying information which will be included in the Form 10-K. Secondly, it delayed the auditors to perform necessary audit procedures and complete audit report in a timely manner. As a result, the Company will be unable to file the Form 10-K by October 13, 2020.

The Company is herein filing the Form 10-K when all the required procedures and process were completed.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements involve risks and uncertainties, including, among other things, statements regarding our business strategy, future revenues and anticipated costs and expenses. Such forward-looking statements include, among others, those statements including the words “expects,” “anticipates,” “intends,” “believes” and similar language. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in the sections “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You should carefully review the risks described in this Annual Report on Form 10-K and in other documents we file from time to time with the Securities and Exchange Commission. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this report. We undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of this document.

Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements.

All references in this Form 10-K to the “Company,” “Verde,” “we,” “us” or “our” are to Verde Resources, Inc.

Overview

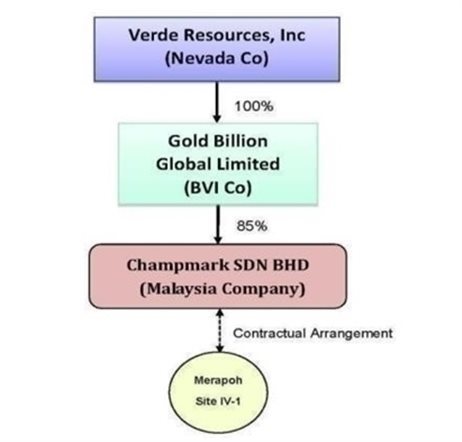

Verde Resources, Inc. (the “Company” or “VRDR”) was incorporated in the State of Nevada on April 22, 2010. The Company conducts business operations in Pahang Malaysia through Champmark Sdn Bhd (“CSB”), a privately limited liability company incorporated in Malaysia, which is a deemed subsidiary under the management control of our 100% subsidiary Gold Billion Global Limited (“GBL”), a company incorporated under the laws of the British Virgin Islands.

On October 25, 2013, we entered into an Assignment Agreement For the Assignment of Management Right in Merapoh Gold Mines in Malaysia (“Assignment Agreement”) with Federal Mining Resources Limited (“FMR”), a company incorporated under the laws of the British Virgin Islands.

FMR owns 85% equity interest in CSB, a privately limited liability company incorporated in Malaysia. CSB is the Mining Contractor of the Mining Lease for Site IV-1 at the Merapoh Gold Mine under the Contract for Work with MMC Corporation Berhad, the Permit Holder of the Mining Lease.

Under the terms of the Assignment Agreement, FMR has assigned its management rights of CSB’s mining operation in the Mining Lease to the Company, through its wholly-owned subsidiary Gold Billion Global Limited (“GBL”), in exchange for 80,000,000 shares of the Company’s common stock, which constituted 95.26% of our issued and outstanding capital stock as of and immediately after the consummation of the acquisition.

GBL was formed on February 7, 2013, by the Board of Directors of FMR to monitor the CSB operation. The acquisition of 100% of the issued and outstanding capital stock of GBL was agreed upon on October 18, 2013, and completed on October 25, 2013, subject to the approval of the Board of Directors and the audit of GBL.

On February 17, 2014, we entered into a Supplementary Agreement to the Assignment Agreement and completed a reverse acquisition of GBL pursuant to the Supplementary Agreement. As a result of the acquisition, the Company holds 100% equity interest in GBL and 85% variable interest in CSB. Our consolidated subsidiaries include GBL being our wholly-owned subsidiary and 85% of CSB being a variable interest entity (VIE) and deemed subsidiary of GBL. On April 1, 2014, GBL purchased 85% equity interest of CSB, and CSB became indirect subsidiary of the Company.

| 3 |

| Table of Contents |

Corporate History and Structure

Verde Resources, Inc. was incorporated on April 22, 2010, in the State of Nevada, U.S.A. The following persons were appointed to serve as directors and to assume the responsibilities of officers on October 17, 2013. Mr. Wu Ming Ding, as President and Director; Mr. Balakrishnan B S Muthu as Treasurer Chief Financial Officer, General Manager and Director; and Mr. Liang Wai Keen as Secretary. Mr. Wu and Mr. Muthu were added to the Board of Directors.

On April 1, 2014, the Board of Directors of Gold Billion Global Limited (“GBL”) notified Federal Mining Resources Limited (“FMR”) of the decision to exercise the right of option to purchase 85% equity interest of Champmark Sdn Bhd (“CSB”) under Management Agreement Section 3.2.4 dated July 1, 2013, between GBL and FMR. This acquisition was completed on April 1, 2014, with consideration of US$1, and GBL then became 85% shareholder of CSB.

Effective February 20, 2016, Mr. Wu Ming Ding resigned all of his positions as President and Director of the Company, with Mr. Balakrishnan B S Muthu being appointed President to fill the vacancy created. Effective February 20, 2016, Mr. Chen Ching was appointed Director of the Company and the entire Board of Directors now consists of Mr. Balakrishnan B S Muthu and Mr. Chen Ching.

Effective February 2, 2018, the Company’s Articles of Incorporation were amended to increase the authorized shares of the Company from 250,000,000 shares of common stock to 10,000,000,000 shares of common stock. A copy of the Certificate of Amendment was filed with the Nevada Secretary of State. The Form 8K announcing the increase of the authorized shares of the Company was filed with SEC on February 6, 2018.

The following diagram illustrates our current corporate structure:

According to ASC 810-05-08 A, CSB is a deemed subsidiary of GBL where GBL controls the Board of Directors of CSB, rights to receive future benefits and residual value, and obligation to absorb loss and finance for CSB. GBL has the power to direct the activities of CSB that most significantly impact CSB’s economic performance and the obligation to absorb losses of CSB that could potentially be significant to the CSB or the right to receive benefits from CSB that could potentially be significant to CSB. GBL is the primary beneficiary of CSB because GBL can direct the activities of CSB through the common directors and 85% shareholder FMR. Under 810-23-42, 43, it is determined that CSB is de-facto agent of the principal GBL and so GBL will consolidate CSB from July 1, 2013. On April 1, 2014, GBL purchased 85% equity interest of CSB, and CSB became indirect subsidiary of the Company.

| 4 |

| Table of Contents |

Contractual Arrangements

Our exploration and mining business is currently provided through contractual arrangements with CSB through our wholly-owned subsidiary GBL.

CSB, the VIE of GBL, sells gold minerals directly to the registered gold trading company in Malaysia. We have been and are expected to continue to be dependent on our VIE to operate our exploration and mining business. GBL has entered into contractual arrangements with its VIE, which enable us to exercise effective control over the VIE, receive substantially all of the economic benefits from the VIE, and have the option to purchase equity interests in the VIE.

On July 1, 2013, the Company’s subsidiary GBL entered into a series of agreements (“VIE agreements”) with FMR and details of the VIE agreements are as follows:

|

| 1. | Management Agreement, FMR entrusted the management rights of its subsidiary CSB to GBL that include: | |

|

|

|

| |

|

|

| i.) | management and administrative rights over the day-to-day business affairs of CSB and the mining operation at Site IV-1 of the Merapoh Gold Mine; |

|

|

| ii.) | final right for the appointment of members to the Board of Directors and the management team of CSB; |

|

|

| iii.) | act as principal of CSB; |

|

|

| iv.) | obligation to provide financial support to CSB; |

|

|

| v.) | option to purchase an equity interest in CSB; |

|

|

| vi.) | entitlement to future benefits and residual value of CSB; |

|

|

| vii.) | right to impose no dividend policy; |

|

|

| viii.) | human resources management. |

|

|

|

| |

|

| 2. | Debt Assignment, FMR assigned to GBL the sum of money in the amount of three hundred nine thousand three hundred thirty one dollars and ninety-two cents (US$ 309,331.92), now due to GBL from CSB under the financing obligation from the FMR to CSB. | |

With the above agreements, GBL demonstrates its ability to control CSB as the primary beneficiary and the operating results of the VIE was included in the condensed consolidated financial statements for the year ended June 30, 2014.

CSB holds the operating right to Merapoh Gold Mine (the “Mine”) with all regulatory and government operating licenses in Malaysia.

On April 1, 2014, GBL purchased 85% equity interest of CSB, and CSB became indirect subsidiary of the Company.

Stage of Operation

The Company does not own any title and/or concession right in any mines. The Company is undertaking natural mineral resource extraction management services.

The Company is in the process of negotiating with Malaysia state agency PKNP on a 2-year lease for a new mining location that is about 5 km from the current Merapoh mine site. For the period between January 2019 to December 2019, there was no production at the Merapoh Gold Mine. The objective of the Company is to improve the productivity at the new mine to ensure that the operation will be carried out effectively and efficiently at minimum cost.

| 5 |

| Table of Contents |

Current Mining Property and Location

Merapoh Gold Mine (the “Mine”)

The Merapoh Gold Mine is located in northern Pahang, with convenient road access through Kelantan directly to the mine site and is about 400 kilometers away from Kuala Lumpur. The Mine is located in the middle of Malaysia’s gold metallogenic belt. The central gold belt is the source of the majority of the gold deposits in the peninsula. It lies between the western and eastern tin belts and extends from Kelantan (Sungai Pergau, Sungai Galas) to Pahang (Merapoh, Kuala Lipis, Raub), Terengganu (Lubuk Mandi), Negri Sembilan and Johor (Gunung Ledang).

Mine Area:

Site IV-1 of the Merapoh Gold Mine consists of a mining area of 400 acres with mining lease.

Location and Access:

The Merapoh Gold Mine is about 280km from Kuala Lumpur, and 50km from Kuala Lipis, the former state capital of Pahang, accessible via secondary paved highways with a new major highway under construction expected to be completed in 2018/19. The geological coordinates of the mine are 101 ° 58 ′ , 4 ° 35 ′.

| 6 |

| Table of Contents |

Type of Claim:

Champmark Sdn Bhd, the subsidiary of Gold Billion Global Limited, is the Mining Contractor of the Mining Lease for Site IV-1 of the Merapoh Gold Mine under the Contract for Work with MMC Corporation Berhad, the Permit Holder of the Mining Lease.

Identifying Information of the Merapoh Gold Mine:

Mining Right:

Mining Lease No.: ML 08/2008

Operational Mining Scheme No.: JMG.PHG.(M) 38/2018/11 (Au)

Concession Period: From December 4, 2017 to December 3, 2019

Regional Geology:

The Malaysia Central Gold Belt runs along the entire backbone of Peninsular Malaysia, extending further to the north. It was formed between the Sibumasu block in the west and Manabor block in the east that runs along major mineral deposits in Thailand, Myanmar and China. The regional gold deposits were made of Epithermal deposits that formed in a series of volcanic environment, where the tensional fractures along the subduction zone allows the intrusion of mineral rich acidic magma within deep faults.

Rock Formations and Mineralization:

Site IV-1 of the Merapoh Gold Mine covers an area of 400 acres with mineralization structure being Permian limestone dominating the South-East portion, felsic volcanic tuff in the Western portion of the area and intrusive dacite rock to the north-west of the area. Tectonic contact within the sheer zone of creates epithermal mineralization, forming a mineral rich vein along the contact zone. The mineralized zone is made of highly altered tuffacaous rock with abundant pyrite dissemination and a moderately spaced quartz vein.

Work Completed and Present Condition:

Lode gold exploration on Site IV-1 has commenced since 2011 and still in progress with both in-house drilling team and third party drilling services running in parallel to expedite data collection to generate a comprehensive JORC compliant gold reserve report.

Equipment, Infrastructure and Other Facilities of the Merapoh Gold Mine:

Parlongs

These are basic production plants and the processing method employed five high powered manual water guns, angled water buffering control and 5-lane carpeted sluice with lateral barriers. The processing capacity is between 40 - 45 tons per hour.

OPS 1

This is a modified production plant and the processing method employed four high powered manual water guns, tapered rotating screen scrubber, angled water flow buffering and 3-lane carpeted sluice with lateral barriers. The processing capacity is between 30 - 35 tons per hour.

GS 150

This is a non-self-propelled mobile production plant and the processing method employed fixed spray guns, 6m x 2m rotating screen scrubber, 6-lane carpeted sluice with lateral barriers and conveyer belt pebble dispenser. The processing capacity is between 25 - 30 tons per hour.

GS 120

This is a self-propelled mobile plant with concentrator and the processing method employed fixed spray guns, 4m x 3m rotating screen scrubber, fixed screen, conveyer belt pebble dispenser and triple concentrator processor. The processing capacity is between 15 - 20 tons per hour.

| 7 |

| Table of Contents |

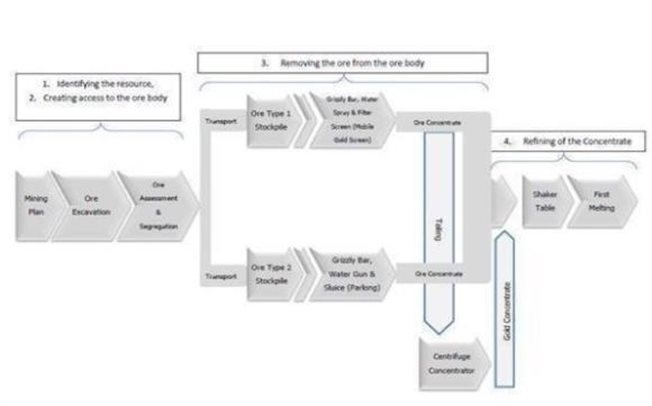

Description of Processing Facilities:

Process for removing ore concentrates from the ore body

| 1. | The ore body is transported to the treatment plants in vehicles capable of hauling huge, heavy loads. |

| 2. | The ore body is separated into Ore Type 1 Stockpile and Ore Type 2 Stockpile. |

| 3. | The monitor washes finer gold bearing material off larger rocks which is screened on an inclined coarse wire screen. |

| 4. | An excavator is used to turn over the rocks so wash is removed from all sides of the coarse material. |

| 5. | A monitor pushes the rock down the inclined coarse screen where the course is removed and stockpiled at the bottom. |

| 6. | Finer material passes through the mesh screen into the sluice system and runs over the sluice. |

| 7. | The carpets are removed and taken to refining facility for gold recovery. |

| 8. | A suction pipe recovers water of the fine tailings pond for use in the system. |

Refining of the concentrate

| 1. | The carpets holding concentrate from the sluice are brought to a shed in the camp site where the gold is refined. |

| 2. | The first stage of the refining is to wash the gold containing concentrate into large bins. This is pumped to a jig and shaking table. |

| 3. | Nuggets are handpicked from the coarse fraction and the fine fraction is amalgamated to remove the gold. After distillation, gold from the amalgam and the coarse are melted with flux and the gold is poured into small bars. |

Current State of Exploration:

As of the date of this report, the Merapoh Gold Mine property is without known reserves.

The Merapoh Gold Mine commenced exploratory operation in alluvia mining and achieved its first gold pour in July 2011. Through the years of operation, the Company has performed ongoing exercises to improve upon the matching of processing method with the types of ore in order to optimize cost to recovery ratio. In July 2013, production was outsourced to a reputable subcontractor, and developed a resource management system to match ore against processes to achieve the most cost efficient and highest recovery production procedure.

There was no gold ore extraction of the Merapoh Gold Mine and no gold concentrate sold for the twelve months ended June 30, 2020.

Our revenues have been derived from gold production from the Merapoh Gold Mine, but currently there is no production from that mine and we are not certain there will be production in the future. Management continues to search for mining opportunities to generate revenues in the future.

| 8 |

| Table of Contents |

Subcontractors

In an effort to enhance the efficiency of mine operations at the Merapoh Gold Mine, Champmark Sdn Bhd (“CSB”) entered into an Operation Term Sheet (“OTS”) agreement in July 2013 to outsource the exploitation works of alluvial gold resources at Site IV-1 of the Merapoh Gold Mine to a third party subcontractor Borneo Oil & Gas Corporation Sdn Bhd (“BOG”). However, BOG became the Company’s shareholder in January 29, 2014, and was no longer a third party subcontractor.

BOG has the experience and local knowledge in managing the exploitation of alluvial gold at the Merapoh Gold Mine. The Company currently intends to continue to outsource the exploitation of alluvial gold at our mine site to BOG as our third party subcontractor. The Company will provide necessary disclosure when any significant agreements have been made with the sub-contractor in the future.

Number of Employees

The Company had 1 employee during the year from July 1, 2019 to June 30, 2020.

Reports to Security Holders

The public may read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The Company files its reports electronically with the SEC. The SEC maintains an Internet site that contains reports, proxy and information statements, and other electronic information regarding New Media and filed with the SEC at http://www.sec.gov.

Change of Control

On October 25, 2013, the Company entered into an Assignment Agreement for the Assignment of Management Right (“AAMA”) in Merapoh Gold Mines in Malaysia with Federal Mining Resources Limited (“FMR”). Under the terms of the Agreement and relevant subsequent Supplemental Agreement, FMR assigned its management rights to the Company Board of Directors of FMR agreed to transfer 1 share common stock of Gold Billion Global Limited (“GBL”) which represented all shares of common stock of GBL owned by the Investor, and the Company’s Board of Directors agreed to issue 80,000,000 million shares of common stock in full value as consideration. At the time of closing under the AAMA, the Investor transferred 100% ownership of GBL shares to the Company, and the Company issued 80,000,000 million shares of common stock to the shareholders of FMR in exchange for the GBL Shares. The effect of the transaction was to make GBL and its deemed subsidiaries become wholly-owned and 85.00% owned subsidiaries of the Company, and to cause a change of control of GBL. Following the closing, there was a change of control in the Company.

The Transaction was accounted for as a “reverse merger,” since FMR owned a majority of the outstanding shares of VRDR’s common stock immediately following the execution of the transaction. The Company was deemed to be the accounting acquirer in the reverse merger. Consequently, the assets and liabilities and the historical operations that were reflected in the financial statements for periods prior to the transaction were those of the Company and its deemed subsidiaries, and were recorded at the historical cost basis of the Company. After completion of the transaction, the Company’s consolidated financial statements were include the assets and liabilities of the Company and its subsidiaries, the historical operations of the Company and its subsidiaries, and the operations of the Company and its subsidiaries from the closing date of the transaction.

| 9 |

| Table of Contents |

Risks Associated With Verde Resources, Inc.

We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Messrs. Balakrishnan Muthu, our current principal executive officer and financial officer, has extensive contacts and experience in the gold exploration and natural resource industry in Malaysia, and we are dependent upon his abilities and services to develop and market our business. He is responsible for overseeing all of our day-to-day business operations of our operating company, CSB, and its subsidiaries and VIEs, including the mining operations and negotiations for the sales of any gold concentrates extracted. We may not be able to retain the executive officers/managers for any given period of time. The loss of their services could have a material adverse effect upon our business operations, financial condition and results of operations. In addition, we must attract, recruit and retain a sizeable workforce of technically competent employees in Malaysia to run our mining operations. Our ability to effectively implement our proposed business strategies and expand our operations will depend upon the successful recruitment and retention of additional highly skilled and experienced management and other key personnel in Malaysia. If we cannot maintain highly experienced and skilled management teams, our business could fail and you could lose any investment you make in our shares.

Since our business consists of managing gold mining projects, the drop in the price of gold would negatively impact our asset values, cash flows, potential revenues and profits.

We plan to pursue opportunities in properties with gold mineralized material or reserves with exploration potential. Our potential future revenues are expected to be derived from the production and sale of gold from these properties, or from the sale of some of these properties. The value of any gold reserves or other mineralized materials, and the value of any potential mineral production will vary in direct proportion to changes in those mineral prices. The price of gold has fluctuated widely as a result of numerous factors beyond our control. The effect of these factors on the price of gold and other minerals, and therefore the economic viability of any of our projects, cannot accurately be predicted. Any drop in the price of gold and other minerals we may produce would negatively affect our asset values, cash flows and potential revenues and profits.

We may not be able to find commercially viable reserves.

Mineral exploration and development involve a high degree of risk and few properties that are explored are ultimately developed into producing mines. The reserve estimates, if any, are based only on prefeasibility studies that are inherited with the following drawbacks:

|

| - | Limited amount of drilling completed to date; |

|

| - | The process testing is limited to small pilot plants and bench scale testing; |

|

| - | Difficulty in obtaining expected metallurgical recoveries when scaling up to production scale from pilot plant scale; |

|

| - | Preliminary nature of the mine plans and processing concepts; |

|

| - | Preliminary nature of operating and capital cost estimates |

|

| - | Metallurgical flow sheets and recoveries still in development; |

|

| - | Limited history of prefeasibility studies that might be underestimating capital and operating costs. |

We cannot assure that any future mineral exploration and development activities will result in any discoveries of proven or probable reserves as defined by the SEC. Further, we cannot provide any assurance that, even if we discover commercial quantities of mineralization, a mineral property will be brought into commercial production. Development of our mineral property will follow only upon obtaining sufficient funding and satisfactory exploration results.

We may not be able to successfully compete with other mineral exploration and mining companies.

We compete with other mineral exploration and mining companies or individuals, including large, well established mining companies with substantial capabilities and financial resources in Malaysia, to research and acquire rights to mineral properties containing gold and other minerals. There is a limited supply of desirable mineral lands available for claim staking, lease or other acquisition in Malaysia. We do not know if we will be able to successfully acquire any prospective mineral properties against competitors with substantially greater financial resources than we have. If we cannot successfully acquire other mining properties to manage and explore and generally expand our business operations, our results of operations, financial condition and future revenues could be reduced and you could suffer a loss of any investment made in our shares.

Unless we increase our mining production or secure new sources, we may not be able to meet expenses and our business may fail

Our production of gold has steadily decreased over the past two years. This is a result of lower production of gold from our mine. Our revenues have been derived from gold production from the Merapoh Gold Mine, but currently there is no production from that mine and we are not certain there will be production in the future. We are also considering acquiring other mining properties to increase our overall production and income. However, if we are not successful in increasing production, either through new methods at our exiting mine, or by securing rights at other gold properties, we may not have sufficient revenues to maintain our business, and our business may fail.

| 10 |

| Table of Contents |

We are subject to the many risks of doing business internationally, including but not limited to the difficulty of enforcing liabilities in foreign jurisdictions.

We are a Nevada corporation and, as such, are subject to the jurisdiction of the State of Nevada and the United States courts for purposes of any lawsuit, action or proceeding by investors. An investor would have the ability to effect service of process in any action against the Company within the United States. In addition, we are registered as a foreign corporation doing business in Malaysia, and as such, are subject to the local laws of Malaysia governing an investors’ ability to bring actions in foreign courts and enforce liabilities against a foreign private issuer, or any person, based on U.S. federal securities laws.

Investors may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in Malaysia based upon U.S. laws, including the federal securities laws or other foreign laws against us or our management.

All of our current operations are conducted in Malaysia, and all of our directors and officers are nationals and residents of Malaysia and other foreign countries. All or substantially all of the assets of these persons are located outside the United States and in other foreign countries. As a result, it may not be possible to effect service of process within the United States or elsewhere outside Malaysia upon these persons. In addition, uncertainty exists as to whether the courts of Malaysia would recognize or enforce judgments of U.S. courts obtained against us or such officers and/or directors predicated upon the civil liability provisions of the securities laws of the United States or any state thereof, or be competent to hear original actions brought in Malaysia against us or such persons predicated upon the securities laws of the United States or any state thereof.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. In addition, we are required to maintain records that accurately and fairly represent our transactions and have an adequate system of internal accounting controls. Foreign companies, including some that may compete with us, are not subject to these prohibitions, and therefore may have a competitive advantage over us. Our executive officers and employees have not been subject to the United States Foreign Corrupt Practices Act prior to 2010. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

Mining risks and insurance could negatively effect on our profitability.

The business of mining for gold is generally subject to a number of risks and hazards including environmental hazards, industrial accidents, labor disputes, unusual or unexpected geological conditions, pressures, cave-ins, changes in the regulatory environment, and natural phenomena such as inclement weather conditions, floods, blizzards and earthquakes. At the present time, we have in effect statutory required social insurance for all employees and mine workers. There is currently no other insurance in place for the mining site and management, and, even if we were to purchase additional insurance, we cannot be sure that such insurance would be available to us, or that we could afford the premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. In addition, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to companies in the mining industry on acceptable terms. We might also become subject to liability for pollution or other hazards which we may not be insured against, or which we may elect not to insure against, because of premium costs or other reasons. Any losses from any of these events may cause us to incur significant costs that could have a material adverse effect upon our financial performance and results of operations, which could negatively impact any investment you make in our shares.

If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected.

Malaysian companies may not always adopt a Western style of management and financial reporting concepts and practices, which includes strong corporate governance, internal controls and computer, financial and other control systems. In addition, we may have difficulty in hiring and retaining a sufficient number of qualified employees to work in Malaysia. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards for foreign subsidiaries. As a result, we may experience difficulties in implementing and maintaining adequate internal controls as required under Section 404 of the Sarbanes-Oxley Act of 2002. This could result in significant deficiencies or material weaknesses in our internal controls, which could impact the reliability of our financial statements and prevent us from complying with SEC rules and regulations and the requirements of the Sarbanes-Oxley Act of 2002. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting or disclosure of our public accounting firm’s attestation to or report on management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our common stock.

| 11 |

| Table of Contents |

Changes in interest rates could negatively impact our results of operations, stockholders’ equity (deficit) and fair value of net assets.

Our investment activities and credit guarantee activities expose us to interest rate and other market risks. Changes in interest rates, up or down, could adversely affect our net interest yield. Although the yield we earn on our assets and our funding costs tend to move in the same direction in response to changes in interest rates, either can rise or fall faster than the other, causing our net interest yield to expand or compress. For example, due to the timing of maturities or rate reset dates on variable-rate instruments, when interest rates rise, our funding costs may rise faster than the yield we earn on our assets. This rate change could cause our net interest yield to compress until the effect of the increase is fully reflected in asset yields. Changes in the slope of the yield curve could also reduce our net interest yield.

Interest rates can fluctuate for a number of reasons, including changes in the fiscal and monetary policies of the federal government and its agencies, such as the Federal Reserve. Federal Reserve policies directly and indirectly influence the yield on our interest-earning assets and the cost of our interest-bearing liabilities. The availability of derivative financial instruments (such as options and interest rate and foreign currency swaps) from acceptable counterparties of the types and in the quantities needed could also affect our ability to effectively manage the risks related to our investment funding. Our strategies and efforts to manage our exposures to these risks may not be effective in the future, which could negatively impact our results of operations and the price of our common stock.

We may be exposed to risks relating to management’s conclusion that our disclosure controls and procedures and internal controls over financial reporting are ineffective.

We do not have an independent audit committee and our Board of Directors may be unable to fulfill the functions of such a committee, which may compromise the management of our business. Our Board of Directors functions as our audit committee and is comprised of two directors, none of whom are considered to be “independent” in accordance with the requirements of Rule 10A-3 under the Securities Exchange Act of 1934. An independent audit committee plays a crucial role in the corporate governance process, assessment of the Company’s processes relating to its risks and control environment, oversight of financial reporting, and evaluation of internal and independent audit processes. The lack of an independent audit committee may prevent the Board of Directors from being independent in its judgments and decisions and its ability to pursue the committee’s responsibilities, which could compromise the management of our business.

If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected.

Malaysian companies may not always adopt a Western style of management and financial reporting concepts and practices, which includes strong corporate governance, internal controls and computer, financial and other control systems. In addition, we may have difficulty in hiring and retaining a sufficient number of qualified employees to work in Malaysia. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards for foreign subsidiaries. As a result, we may experience difficulties in implementing and maintaining adequate internal controls as required under Section 404 of the Sarbanes-Oxley Act of 2002. This could result in significant deficiencies or material weaknesses in our internal controls, which could impact the reliability of our financial statements and prevent us from complying with SEC rules and regulations and the requirements of the Sarbanes-Oxley Act of 2002. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting or disclosure of our public accounting firm’s attestation to or report on management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our common stock.

| 12 |

| Table of Contents |

The audit report included in our Annual Report was prepared by auditors who are not inspected by the Public Accounting Oversight Board (“PCAOB”) and as a result, our shareholders are deprived of the benefit of having PCAOB inspections.

The independent registered public accounting firm that issues the audit reports included in our annual reports filed with the SEC, as auditors of companies that are traded publicly in the United States and a firm registered with the Public Company Accounting Oversight Board (United States), or the “PCAOB”, is required by the laws of the United States to undergo regular inspections by the PCAOB to assess its compliance with the laws of the United States and professional standards. Because our auditors are located in Hong Kong SAR, a jurisdiction where the PCAOB is currently unable to conduct inspections without the approval of the Hong Kong authorities, our auditors are not currently inspected by the PCAOB.

Inspections of other firms that the PCAOB has conducted outside Hong Kong SAR have identified deficiencies in those firms’ audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. The inability of the PCAOB to conduct inspections in Hong Kong SAR prevents the PCAOB from regularly evaluating our auditor’s statements, audits and quality control procedures. As a result, investors may be deprived of the benefits of PCAOB inspections.

The inability of the PCAOB to conduct inspections of auditors in Hong Kong SAR makes it more difficult to evaluate the effectiveness of our auditor’s quality control and audit procedures as compared to auditors outside of Hong Kong SAR that are subject to PCAOB inspections. Investors may lose confidence in our reported financial information and procedures and the quality of our financial statements.

We may be exposed to risks relating to management’s conclusion that our disclosure controls and procedures and internal controls over financial reporting are ineffective.

We do not have an independent audit committee and our Board of Directors may be unable to fulfill the functions of such a committee, which may compromise the management of our business. Our Board of Directors functions as our audit committee and is comprised of two directors, none of whom are considered to be “independent” in accordance with the requirements of Rule 10A-3 under the Securities Exchange Act of 1934. An independent audit committee plays a crucial role in the corporate governance process, assessment of the Company’s processes relating to its risks and control environment, oversight of financial reporting, and evaluation of internal and independent audit processes. The lack of an independent audit committee may prevent the Board of Directors from being independent in its judgments and decisions and its ability to pursue the committee’s responsibilities, which could compromise the management of our business.

| 13 |

| Table of Contents |

Risks Associated with Our Common Stock

Our shares are defined as “penny stock.” The rules imposed on the sale of the shares may affect your ability to resell any shares you may purchase, if at all.

Our shares are defined as a “penny stock” under the Securities and Exchange Act of 1934, and rules of the Commission. The Exchange Act and such penny stock rules generally impose additional sales practice and disclosure requirements on broker-dealers who sell our securities to persons other than certain accredited investors who are, generally, institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 jointly with spouse, or in transactions not recommended by the broker-dealer. For transactions covered by the penny stock rules, a broker-dealer must make a suitability determination for each purchaser and receive the purchaser’s written agreement prior to the sale. In addition, the broker-dealer must make certain mandated disclosures in penny stock transactions, including the actual sale or purchase price and actual bid and offer quotations, the compensation to be received by the broker-dealer and certain associated persons, and deliver certain disclosures required by the Commission. Consequently, the penny stock rules may affect the ability of broker-dealers to make a market in or trade our common stock, and may also affect your ability to resell any shares you may purchase.

Market for penny stock has suffered in recent years from patterns of fraud and abuse

Stockholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

|

| • | Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; |

|

| • | Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; |

|

| • | Boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced salespersons; |

|

| • | Excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and, |

|

| • | The wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequential investor losses. |

Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

Inability and unlikelihood to pay dividends

To date, we have not paid, nor do we intend to pay in the foreseeable future, dividends on our common stock, even if we become profitable. Earnings, if any, are expected to be used to advance our activities and for general corporate purposes, rather than to make distributions to stockholders. Prospective investors will likely need to rely on an increase in the price of Company stock to profit from his or her investment. There are no guarantees that any market for our common stock will ever develop or that the price of our stock will ever increase.

Since we are not in a financial position to pay dividends on our common stock and future dividends are not presently being contemplated, investors are advised that return on investment in our common stock is restricted to an appreciation in the share price. The potential or likelihood of an increase in share price is questionable at best.

Item 1B. Unresolved Staff Comments.

None.

| 14 |

| Table of Contents |

We do not currently own any properties.

On October 25, 2013, we entered into an Assignment Agreement For the Assignment of Management Right in Merapoh Gold Mines in Malaysia (“Assignment Agreement”) with Federal Mining Resources Limited (“FMR”), a company incorporated under the laws of the British Virgin Islands.

FMR owns 85% equity interest in Champmark Sdn Bhd (“CSB”), a privately limited liability company incorporated in Malaysia. CSB is the Mining Contractor of the Mining Lease for Site IV-1 at the Merapoh Gold Mine under the Contract for Work with MMC Corporation Berhad, the Permit Holder of the Mining Lease.

As at June 30, 2020, the property and equipment owned by CSB are summarized, at net book values as follows:

| Land and Building |

| $ | 1 |

|

| Plant and Machinery |

| $ | - |

|

| Office equipment |

| $ | - |

|

| Project equipment |

| $ | - |

|

| Computer |

| $ | 704 |

|

| Motor Vehicle |

| $ | - |

|

|

|

| $ | 705 |

|

None

Item 4. Mine Safety Disclosures.

Pursuant to Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“ Dodd-Frank Act “), issuers that are operators, or that have a subsidiary that is an operator, of a coal or other mine in the United States are required to disclose in their periodic and annual reports filed with the SEC information regarding specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities under the regulation of the Federal Mine Safety and Health Act of 1977. The Company did not have any mines in the United States during the year ended June 30, 2020.

| 15 |

| Table of Contents |

Market Information

Our common stock is now quoted on the OTCQB, under the symbol “VRDR”. Our stock was approved for quotation on the OTCBB on September 26, 2012. However, the Company’s common stock did not begin active trading until October, 2013.

The following table sets forth the high and low bid prices for our common stock per quarter as reported by the OTCBB since trading began October 7, 2013, based on our fiscal year end June 30, 2020 These prices represent quotations between dealers without adjustment for retail mark-up, markdown or commission, and may not represent actual transactions.

| Fiscal Quarter Ended |

| High |

|

| Low |

| ||

|

|

|

|

|

|

|

| ||

| June 30, 2019 |

| $ | 0.10 |

|

| $ | 0.022 |

|

| September 30, 2019 |

| $ | 0.038 |

|

| $ | 0.0055 |

|

| December 31, 2019 |

| $ | 0.015 |

|

| $ | 0.0055 |

|

| March 31, 2020 |

| $ | 0.012 |

|

| $ | 0.01 |

|

| June 30, 2020 |

| $ | 0.013 |

|

| $ | 0.0021 |

|

As of September 28, 2020, we had 54 shareholders of record of our common stock and 116,038,909 shares issued and outstanding.

Dividend Policy

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our board of directors.

Equity Compensation Plan Information

None.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

We did not sell any equity securities which were not registered under the Securities Act during the year ended June 30, 2020, that were not otherwise disclosed on our quarterly reports on Form 10-Q or our current reports on Form 8-K filed during the fiscal year ended June 30, 2020 except the following transaction.:

On June 15, 2020, the Company issued a total of 1,000,000 common shares for US$12,000 at US$0.012 per share, of which 50,000 common shares to each of the twenty non-US shareholders.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fiscal year ended June 30, 2020.

Item 6. Selected Financial Data.

As a “smaller reporting company,” we are not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion should be read in conjunction with our audited financial statements and the related notes that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this annual report, particularly in the section entitled “Risk Factors” of this annual report.

Our audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

| 16 |

| Table of Contents |

Results of Operations

We have generated $12,036 and $0 revenues for the year ended June 30, 2019 and 2020, respectively, and have recorded a gross loss of $11,105 and $0 for the year ended June 30, 2019 and 2020. We have incurred $162,886 and $309,402 in operating expenses through June 30, 2019 and June 30, 2020. We have other income $302,724 and $0 for the year ended June 30, 2019 and 2020.

The following table provides selected financial data about our company for the year ended June 30, 2020 and June 30, 2019.

| Statement of Operation |

| June 30, 2020 |

|

| June 30, 2019 |

|

| Change |

| |||

|

|

| Amount |

|

| Amount |

|

| % |

| |||

|

|

|

|

|

|

|

|

|

|

| |||

| Revenue |

| $ | - |

|

| $ | 12,036 |

|

|

| (100 | ) |

| Cost of revenue |

| $ | - |

|

| $ | 23,141 |

|

|

| (100 | ) |

| Gross Loss |

| $ | - |

|

| $ | 11,105 |

|

|

| (100 | ) |

| Operating Expenses |

| $ | 309,402 |

|

| $ | 162,886 |

|

|

| 90 |

|

| Other Income |

| $ | - |

|

| $ | 302,724 |

|

|

| (100 | ) |

The revenue derived from the sales of gold mineral to customers in Malaysia. The decrease of revenue for the year ended June 30, 2020 was mainly due to a decrease in gold production and gold sales during the period. The decrease of cost of revenue was mainly due to a decrease of gold mineral production. Operating expenses comprised mainly of salaries, office costs, legal and professional fees and travelling expenses. The increase in operating expenses for the period was mainly due to the weakness of average rate for MYR:USD as mentioned above, and an under provision of professional fees for last year. The decrease of other income was mainly due to the gains on disposal of the property and equipment for last year were not presented in this year.

Plan of Operation

Our Industry and Principal Markets

The report by BMI Research states that global gold mine output growth will pick up in the next few years, supported by higher gold prices and solid projects in key countries. BMI Research forecasts global gold production to increase from 105moz in 2018 to 125moz by 2026, averaging 2.3% annual growth. While a steady pace of growth, this represents a slight deceleration in growth rate compared with the previous eight-year average of 3.1%.

Subcontractor

In an effort to enhance the efficiency of mine operations at the Merapoh Gold Mine, Champmark Sdn Bhd (“CSB”) entered into an Operation Term Sheet (“OTS”) agreement in July 2013, to outsource the exploitation works of alluvial gold resources at Site IV-1 of the Merapoh Gold Mine to a third party subcontractor Borneo Oil & Gas Corporation Sdn Bhd (“BOG”).

BOG has the experience and local knowledge in managing the exploitation of alluvial gold at the Merapoh Gold Mine. The Company currently intends to continue to outsource the exploitation of alluvial gold at our mine site to BOG as our third party subcontractor. The Company will provide necessary disclosure when any significant agreements have been made with the sub-contractor in the future.

BOG became the Company’s shareholder in January 29, 2014, and was no longer a third party subcontractor.

Expansion Plans

The Company is in the process of negotiating with Malaysia state agency PKNP on a 2-year lease for a new mining location that is about 5 km from the current Merapoh mine site. The leasing premium has been paid but the mining lease certificate will only be issued upon clearance from the Malaysia Forest Department, which is expected in late 2020 subject to review on COVID-19 “Movement Control Order” by the Malaysian government.

The Company believes that there are excellent growth opportunities for its business outside Malaysia. We are constantly exploring for potential acquisition of mining projects in other parts of the world.

| 17 |

| Table of Contents |

As our business is affected by the fluctuations of gold prices, the Company intends to diversify its product line by acquiring mining projects with potential for different mineral resources other than gold. We continue to hold discussions with other mining companies for potential collaboration to carry out exploration and exploitation works on other mineral resources in Southeast Asia regions. Apart from the mining industry, the Company is taking steps to look into investment opportunities in the non-mining areas that include the bioenergy industry and the food & beverage sector.

Limited Operating History; Need for Additional Capital

There is limited historical financial information about us upon which to base an evaluation of our performance. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources, possible delays in the exploration of our properties, and possible cost overruns due to price and cost increases in services.

We have no assurance that future financing will be available to us on acceptable terms. If financing is not available on satisfactory terms, we may be unable to continue, develop or expand our operations. Equity financing could result in additional dilution to existing shareholders.

Liquidity and Capital Resources

The following table provides selected cash flow data about our company for the year ended June 30, 2020 and 2019.

| Cash Flow Date |

| June 30, 2020 |

|

| June 30, 2019 |

| ||

|

|

|

|

|

|

|

| ||

| Net (Loss) / Profit from operation |

| $ | (309,402 | ) |

| $ | 128,733 |

|

| Net Cash (Used) / Generated from operating activities |

| $ | (213,763 | ) |

| $ | 40,702 |

|

| Net Cash Used from investing activities |

| $ | (828 | ) |

| $ | - |

|

| Net Cash Generated/(Used) from financing activities |

| $ | 11,810 |

|

| $ | (2,411 | ) |

For the year ended June 30, 2020, the Company had incurred net loss from operation of $309,402 which posted a negative impact to the company’s cash flow. The reconciliation on non-cash items such as depreciation and amortization provides positive impact on cash.

In the operation analysis, the net cash provided by operating activities decreased from $40,702 to ($213,763) for the years ended June 30, 2019 and 2020, respectively. The operation loss of $309,402 was partially offset by the noncash expenses such as $126 in depreciation and $6,055 in amortization. In the operating assets and liabilities, the net increase in current assets, such as deposits was $23,245 whereas the net increase in current liabilities, such as accrued liabilities, other payables, advanced from sub-contractor & related parties was $112,703, which provided $107,639 positive cash flow effect to offset the $309,402 loss in operation. The final result of the cash flow from operating activities was $213,763 negative cash flow effect.

In the investing cash flow analysis, there was $828 negative cash flow for acquisition of plant and equipment for the year ended June 30, 2020.

In financing analysis, $12,000 proceeds from the issuance of common stock offset by $190 repayments of bank loans end up with a positive cash flow of $11,810 for the year ended June 30, 2020, compared to $2,411 repaid to the bank for the year ended June 30, 2019. The overall cash flow effect was positive.

The net decrease in exchange rate effect of $216,146 also provided positive cash flow effect. The cash and cash equivalents at the end of June 30, 2020, was increased by $13,365 with $24,027 as ending balance.

The cash flow situation will not allow for operations in the coming next 12 months by self-generated cash provided from operating activities. The Company needs to increase cash flow supplies with a long term plan until the Company makes sustainable profits and has a positive cash flow. Otherwise, loans from related parties may be a temporary solution, although we have no written loan agreements. There is no guarantee that we will be able to secure adequate financing. If we fail to secure sufficient funds, our business activities may be curtailed, or we may cease to operate.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures, or capital resources that is material to investors.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

| 18 |

| Table of Contents |

Item 8. Financial Statements and Supplementary Data

INDEX TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2020

|

|

| Page |

|

|

|

|

|

|

|

| F-1 |

| |

|

|

|

|

|

|

| F-2 |

| |

|

|

|

|

|

|

| F-3 |

| |

|

|

|

|

|

| Consolidated Statements of Changes in Shareholders’ Equity (Deficit) |

| F-4 |

|

|

|

|

|

|

|

| F-5 |

| |

|

|

|

|

|

|

| F-6 |

|

| 19 |

| Table of Contents |

|

中正達會計師事務所 Centurion ZD CPA & Co. Certified Public Accountants (Practising)

Unit 1304, 13/F., Two Harbourfront, 22 Tak Fung Street, Hunghom, Hong Kong 香港紅磡德豐街22號海濱廣場二期13樓1304室 Tel : (852) 2126 2388 Fax: (852) 2122 9078 |

| To: | The board of directors and stockholders of |

|

| Verde Resources, Inc. (“the Company”) |

Report of Independent Registered Public Accounting Firm

Opinion of the Financial Statements

We have audited the accompanying consolidated balance sheets of Verde Resources, Inc. and its subsidiaries (the “Company”) as of June 30, 2020 and 2019, and the related consolidated statements of operations, changes in stockholders’ deficit and cash flows for each of the years in the two-year period ended June 30, 2020. The Company’s management is responsible for these financial statements. In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Company as of June 30, 2020 and 2019, and the consolidated results of its operations and its cash flows for each of the years in the two-year period ended June 30, 2020, in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 14 to the consolidated financial statements, the Company had a working capital deficiency and accumulated deficit from recurring net losses as of June 30, 2020. All these factors raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also discussed in Note 14 to the consolidated financial statements. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s consolidated financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ Centurion ZD CPA & Co.

Centurion ZD CPA & Co.

We have served as the Company’s auditor since 2014.

Hong Kong, China

October 22, 2020

| F-1 |

| Table of Contents |

Consolidated Balance Sheets

|

|

| As at June 30, |

|

| As at June 30, |

| ||

|

|

| 2020 |

|

| 2019 |

| ||

| ASSETS |

|

|

|

|

|

| ||

| Current Assets |

|

|

|

|

|

| ||

| Cash and cash equivalents |

| $ | 24,027 |

|

| $ | 10,662 |

|

| Amount due from related parties |

|

| - |

|

|

| - |

|

| Inventories |

|

| - |

|

|

| - |

|

| Other deposit & prepayment |

|

| 17,837 |

|

|

| 974 |

|

| Total Current Assets |

| $ | 41,864 |

|

| $ | 11,636 |

|

| Long Term Assets |

|

|

|

|

|

|

|

|

| Property, plant and equipment |

| $ | 705 |

|

| $ | 1 |

|

| Total Long Term Assets |

| $ | 705 |

|

| $ | 1 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL ASSETS |

| $ | 42,569 |

|

| $ | 11,637 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

| $ | 1,507,258 |

|

| $ | 1,563,102 |

|

| Advanced from related parties |

|

| 655,920 |

|

|

| 592,683 |

|

| Accrual and other payables |

|

| 172,409 |

|

|

| 76,490 |

|

| Taxation payable |

|

| - |

|

|

| - |

|

| Loans from banks |

|

| - |

|

|

| 193 |

|

| Total Current Liabilities |

| $ | 2,335,587 |

|

| $ | 2,232,468 |

|

| Long term Liabilities |

|

|

|

|

|

|

|

|

| Loans from banks (non-current) |

| $ | - |

|

| $ | - |

|

| Total Long Term Liabilities |

| $ | - |

|

| $ | - |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES |

| $ | 2,335,587 |

|

| $ | 2,232,468 |

|

|

|

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

| Preferred stock, par value $0.001, 50,000,000 shares authorized, none issued and outstanding |

|

| - |

|

|

| - |

|

| Common stock, par value $0.001, 10,000,000,000 shares authorized, 116,038,909 & 115,038,909 shares issued and outstanding as of June 30, 2020 & June 30, 2019 respectively |

| $ | 116,039 |

|

| $ | 115,039 |

|

| Additional paid-in capital |

|

| 2,427,243 |

|

|

| 2,416,243 |

|

| Accumulated deficit |

|

| (5,138,406 | ) |

|

| (4,839,749 | ) |

| Accumulated other comprehensive income(loss) |

|

| 839,818 |

|

|

| 614,603 |

|

| Non-controlled interest |

|

| (537,712 | ) |

|

| (526,967 | ) |

| Total Stockholders’ Deficit |

| $ | (2,293,018 | ) |

| $ | (2,220,831 | ) |

|

|

|

|

|

|

|

|

|

|

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT |

| $ | 42,569 |

|

| $ | 11,637 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| F-2 |

| Table of Contents |

Consolidated Statements of Operations

|

|

| For the year |

|

| For the year |

| ||

|

|

| Ended |

|

| Ended |

| ||

|

|

| June 30, 2020 |

|

| June 30, 2019 |

| ||

|

|

|

|

|

|

|

| ||

| REVENUES |

|

|

|

|

|

| ||

| Revenue |

| $ | - |

|

| $ | 12,036 |

|

| Cost of revenue |

|

| - |

|

|

| (23,141 | ) |

| Gross loss |

|

| - |

|

|

| (11,105 | ) |

|

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

| Selling, general & administrative expenses |

|

| (309,402 | ) |

|

| (162,886 | ) |

| LOSS FROM OPERATIONS |

| $ | (309,402 | ) |

| $ | (173,991 | ) |

|

|

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE) |

|

| - |

|

|

| 302,724 |

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME (LOSS) BEFORE INCOME TAX |

| $ | (309,402 | ) |

| $ | 128,733 |

|

|

|

|

|

|

|

|

|

|

|

| Provision of Income Tax |

|

| - |

|

|

| - |

|

| NET INCOME (LOSS) |

| $ | (309,402 | ) |

| $ | 128,733 |

|

|

|

|

|

|

|

|

|

|

|

| Non-controlled interest |

|

| 10,745 |

|

|

| (34,471 | ) |

| Net profit (loss) contributed to the group |

|

| (298,657 | ) |

|

| 94,262 |

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation gain |

| $ | 225,215 |

|

| $ | 65,896 |

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive (loss) income |

| $ | (73,442 | ) |

| $ | 160,158 |

|

|

|

|

|

|

|

|

|

|

|

| Basic and Diluted (Loss) Earnings per Common Share |

| $ | (0.0026 | ) |

| $ | 0.0008 |

|

|

|

|

|

|

|

|

|

|

|

| Weighted Average Number of Common Shares Outstanding |

|

| 115,082,625 |

|

|

| 115,038,909 |

|

The accompanying notes are an integral part of these consolidated financial statements.

| F-3 |

| Table of Contents |

Statement of Changes in Stockholders’ Equity (Deficit)

|

|

| Common Shares |

|

| Additional Paid-In |

|

| Accumulated |

|

| Non-Controlling |

|

| Accumulated Other Comprehensive |

|

|

|

| ||||||||||

|

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Interest |

|

| Income (Loss) |

|

| Total |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

| Balance - June 30, 2018 |

|

| 115,038,909 |

|

| $ | 115,039 |

|

| $ | 2,416,243 |

|

| $ | (4,934,011 | ) |

| $ | (561,438 | ) |

| $ | 548,707 |

|

| $ | (2,415,460 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net profit for the period |

|

| - |

|

|

| - |

|

|

| - |

|

|

| 94,262 |

|

|

| 34,471 |

|

|

| - |

|

|

| 128,733 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation gain |

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| - |

|

|

| 65,896 |

|

|

| 65,896 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance - June 30, 2019 |

|

| 115,038,909 |

|

| $ | 115,039 |

|

| $ | 2,416,243 |

|

| $ | (4,839,749 | ) |

| $ | (526,967 | ) |

| $ | 614,603 |

|

| $ | (2,220,831 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares issued |

|

| 1,000,000 |

|

|

| 1,000 |

|

|

| 11,000 |

|

|

| - |

|

|

| - |